Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - InvenTrust Properties Corp. | d193395d8k.htm |

Exhibit 99.1

Dear Stockholder,

I am writing today to provide you with the results of our most recent estimated share value process as well as give you an update on other corporate activities. Since our prior estimated share value was announced over a year ago, the InvenTrust portfolio of assets has been significantly transformed. We have acquired and sold over $960 million in properties. We completed the disposition of 22 non-core assets through the spin-off of Highlands REIT, Inc. Finally, we are looking forward to completing our previously announced student housing platform sale, which is expected to close in mid-to-late June.

On May 6, 2016, our Board of Directors established an updated estimated share value of $3.14 per share for our common stock as of May 1, 2016. The change in value is mainly attributable to the following factors provided below:

| Share Value(1) | ||||

| February 4, 2015 Share Value |

$ | 4.00 | ||

|

|

|

|||

| Same Store Strategic Retail(2)(3) |

0.02 | |||

| Strategic Retail Acquisitions(2) |

0.55 | |||

|

|

|

|||

| Total Strategic Retail(2) |

0.57 | |||

|

|

|

|||

| Same-Store University House(4) |

0.03 | |||

| University House Acquisitions |

0.23 | |||

|

|

|

|||

| Total University House(5) |

0.26 | |||

|

|

|

|||

| Non-Strategic Retail(6) |

(0.09 | ) | ||

| Non-Strategic Retail Dispositions(6) |

(0.25 | ) | ||

|

|

|

|||

| Total Non-Strategic Retail(6) |

(0.34 | ) | ||

|

|

|

|||

| Other Non-Core Properties(7) |

(0.01 | ) | ||

| Other Non-Core Dispositions |

(0.06 | ) | ||

| Non-Core Properties included in Highlands REIT, Inc(8) |

(0.05 | ) | ||

| Spin-Off of Highlands REIT, Inc.(9) |

(0.36 | ) | ||

| Sacramento Railyards(10) |

(0.07 | ) | ||

|

|

|

|||

| Total Non-Core |

(0.55 | ) | ||

|

|

|

|||

| Xenia Hotels & Resorts, Inc. Shares owned by InvenTrust |

(0.03 | ) | ||

| Other Marketable Securities |

(0.07 | ) | ||

| Cash |

(0.12 | ) | ||

|

|

|

|||

| Total Cash and Marketable Securities |

(0.22 | ) | ||

|

|

|

|||

| Corporate Debt (Line of Credit and Term Loan) |

(0.44 | ) | ||

|

|

|

|||

| Estimated Transaction Costs, Closing Costs and Contingencies Related to Dispositions of Student Housing Platform |

(0.10 | ) | ||

| Estimated Transaction Costs, Closing Costs and Contingencies Related to Disposition of Certain Non-Strategic Properties |

(0.04 | ) | ||

|

|

|

|||

| Total Estimated Closing Costs, Transaction Fees and Contingencies |

(0.14 | ) | ||

|

|

|

|||

| May 1, 2016 Company Estimated Per Share Value |

$ | 3.14 | ||

|

|

|

|||

Chart Footnotes:

| (1) | Per share value reflects, to the extent applicable, property-level debt. |

| (2) | “Strategic Retail” includes (a) wholly owned Strategic Retail properties (considered as “Retail” in Real Globe’s report) and (b) properties owned by IAGM Retail Fund I, LLC (“IAGM”), the Company’s joint venture with PGGM Private Real Estate Fund (considered as “Joint Ventures” in Real Globe’s report). For the joint venture properties described in (b), this table only includes the per share value attributed to the Company based on its percentage ownership. |

| (3) | “Same Store” refers to assets included in both the February 4, 2015 estimate of per share value and the May 1, 2016 estimate of per share value and excludes any dispositions and acquisitions between February 4, 2015 and May 1, 2016. If ownership of the IAGM assets were 100%, the same store increase in per share value would be $0.03. |

| (4) | “Same Store” refers to assets included in both the February 4, 2015 estimate of per share value and the May 1, 2016 estimate of per share value and excludes any dispositions and acquisitions between February 4, 2015 and May 1, 2016. |

| (5) | Reflects the properties included in the Company’s disposition of the student housing platform. These are considered as “Student Housing” in Real Globe’s report. |

| (6) | Considered as “Retail” in Real Globe’s report. |

| (7) | Includes (a) Wilmar bank branch (considered as “Retail” in Real Globe’s report), (b) Worldgate Plaza (considered as “Non-Core” in Real Globe’s report), (c) CDH CDO LLC and Concord Debt Holdings LLC (considered as “Joint Ventures” in Real Globe’s report) and (d) an additional student housing property not included in the Company’s disposition of the student housing platform (considered as “Student Housing” in Real Globe’s report). |

| (8) | Represents the decline in per share value since February 4, 2015 of the properties included in the Highlands REIT, Inc. portfolio. |

| (9) | On April 28, 2016, we completed the spin-off of our previously wholly-owned subsidiary, Highlands REIT, Inc. |

| (10) | Considered as “Land Development” in Real Globe’s report. |

In establishing the estimated per share value, the Board determined that it was appropriate to deduct estimated closing costs, transaction fees and contingencies related to the planned disposition of certain non-strategic properties contemplated pursuant to the Company’s strategic plan. However, such costs may be higher or lower than the level estimated by the Company. A detailed explanation of the valuation method and process used to estimate our new per share value is available in our Current Report on Form 8-K filed with the SEC on May 9, 2016. We encourage you to read the filing in its entirety.

We recognize that there are a number of items in the chart on the previous page. Here are a few takeaways:

| • | The execution of our strategy did add value to our student housing and our strategic retail platforms. |

| • | Our non-strategic retail assets experienced a rise in capitalization rates (a decline in value), which supports our capital rotation strategy to sell these assets and invest in retail properties in premier locations within our target markets. |

| • | The expected dilution caused by the portfolio transformation has reduced the share value related to these assets. We believe that the activities related to these assets will continue to have a dilutive effect on the share value until we have completed our portfolio rotation strategy, which is expected over the next 24 months. |

| • | The assets included in the Highlands spin-off declined in value from the February 2015 estimated share value; this valuation reduction was in addition to any value related to Highlands’ assets. |

| • | The value of our marketable securities, including the shares in Xenia Hotels & Resorts, Inc. that InvenTrust still owns, declined since our last valuation. |

While a reduction in our estimated share value is disappointing to our investors, our Board and the management team, we continue to believe that the execution of our strategy will drive long-term value in the future. We remain dedicated to becoming a pure-play retail asset class company with a simplified and focused portfolio strategy.

InvenTrust in 2016: Enhancing Value as a Pure-Play Retail REIT

So what is next for InvenTrust? As we move onto our next chapter, we are witnessing critical changes in the retail real estate environment. Consumers continue to spend more time online, but retailers are embracing a “bricks and clicks,” or omni-channel, business model. Even e-commerce retailers are finding that having a physical presence is critical to their success. As consumers and their families demand quicker and healthier dining options, we are witnessing a rapid increase in fresh prepared offerings from our grocery tenants and new, cutting-edge, healthy restaurant concepts. As millennials look for an atmosphere of community, retailers want to be in open-air centers that bring a sense of local character and drive shopper engagement. We believe that these are all opportunities for InvenTrust to focus upon and drive value in our go-forward retail focused strategy.

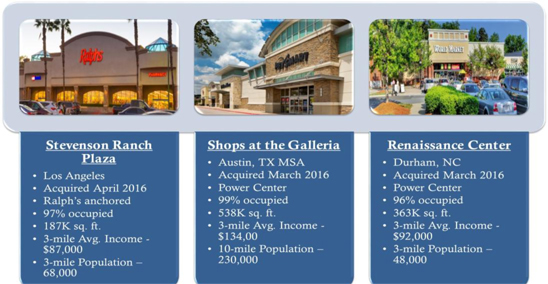

It’s an exciting and innovative time to be in retail real estate, but as always there is one constant: Location matters. At InvenTrust, our focus is to own and operate retail properties in premier locations in high job and population growth markets and our recent acquisitions shown below match this thesis. This dynamic combination drives demand for space from all retailers resulting in improved occupancy for our properties and enhanced rental income growth, with the ultimate objective of delivering value for our stockholders.

Fellow stockholders, there is no denying InvenTrust’s long history and complex investment story. Since our inception, InvenTrust (which was, at that time, known as Inland American Real Estate Trust, Inc.) assembled a $12 billion portfolio of assets with a focus on the credit quality of tenants and length of their lease term. The majority of our assets were purchased prior to 2009 (before the economic downturn) and were in disparate geographic markets and various asset classes. This investment thesis was consistent with our original stated investment charter but is markedly different than our more focused, pure-play retail strategy that we are currently executing. We believe our pure-play retail strategy in high-growth target markets will maximize value for our stockholders and there is already early evidence of success with the increased value in our Strategic Retail Portfolio that is indicated in our new estimated share value calculation chart on the first page.

Use of Net Proceeds from Student Housing Transaction & Future Distributions

As we move closer to the completion of the student housing transaction, the Board of InvenTrust continues to evaluate potential uses of the proceeds from the student housing sale. The Board is currently exploring the following options:

| • | Using the capital to invest in premier retail multi-tenant assets in our target markets with high job and population growth; |

| • | Reducing debt and enhancing our capital structure; and/or |

| • | A share buyback to provide stockholders an opportunity to liquidate their investment. |

The Board is also currently evaluating the realignment of our distribution rate to reflect the change in our asset base from the Highlands spin and the pending student housing sale. The Board will evaluate what size distribution can be supported from the remaining InvenTrust portfolio. When the Board sets the new distribution rate it will consider a number of factors, including:

| • | The reduced size of our remaining portfolio; |

| • | The dilution caused by the acquisition and dispositions of our assets as we execute our pure-play retail strategy; |

| • | Yield or cash flow produced by newly acquired properties; and |

| • | Cash flow produced by the current portfolio of assets, including joint venture operations. |

We expect that a new distribution rate will be determined and announced after the closing of the student housing sale expected in late June and will become effective for the third quarter distribution in October.

Estimated Share Value Methodology

In order to arrive at our estimated share value, our Board engaged Real Globe Advisors, LLC, an independent third-party valuation firm, to value InvenTrust’s real estate and calculate a range of estimated values. To estimate our per share value, Real Globe utilized the “net asset value” or “NAV” method which is based on the fair value of real estate, real estate related investments and all other assets, less the fair value of total liabilities, and also included an estimate of the transaction fees, closing costs and contingencies the Company is expected to incur pursuant to its executed stock purchase agreement entered into in connection with the sale of its student housing platform. The estimated transaction fees, closing costs and contingencies were provided to Real Globe by the Company; however, there are no assurances that such costs will be incurred at the level estimated.

The fair value estimate of the real estate assets is equal to the sum of its individual real estate values. Generally, Real Globe estimated the value of the Company’s wholly-owned core and non-core real estate and real estate-related assets, using a discounted cash flow approach of projected net operating income, less capital expenditures, for each property, for the ten-year hold period ending April 30, 2026, and applying a market supported discount rate and capitalization rate. For all other assets, including cash, other current assets, joint ventures, land developments, and marketable securities, fair value was determined separately. Real Globe also estimated the fair value of the Company’s long-term debt obligations, including the current liabilities, by comparing market interest rates to the contract rates on the Company’s long-term debt and discounting to present value the difference in future payments. The NAV valuation method is the same method utilized by Real Globe and the Company last year.

We believe that the NAV method used to estimate the per share value of our common stock is the methodology most commonly used by non-listed REITs to estimate per share value. The estimated value of our real estate assets reflected above does not necessarily represent the value we would receive or accept if the assets were marketed for sale. The market for commercial real estate can fluctuate and values are expected to change in the future. Further, the estimated per share value of the Company’s common stock does not reflect a liquidity discount for the fact that the shares are not currently traded on a national securities exchange, a discount for the non-assumability or prepayment obligations associated with certain of the Company’s loans and other costs that may be incurred, including any costs of sale of its assets.

Our estimated per share value does not reflect “enterprise value” which may include an adjustment for:

| • | the large size of our portfolio given that some buyers may be willing to pay more for a large portfolio than they are willing to pay for each property in the portfolio separately; |

| • | any other intangible value associated with a going concern; or |

| • | the possibility that our shares could trade at a premium or a discount to net asset value if we listed our shares on a national securities exchange. |

We have provided a detailed explanation of the valuation method and process used to estimate the new per share value in our Current Report on Form 8-K filed with the SEC on May 9, 2016. We encourage you to read the filing in its entirety.

To our more than 170,000 stockholders, we are committed to working diligently to successfully maximize value for all of you. I look forward to updating you on our further achievements throughout the year. As always please feel free to contact us with any questions at 855-377-0510 or investorrelations@inventrustproperties.com.

Sincerely,

INVENTRUST PROPERTIES CORP.

Thomas P. McGuinness

President, CEO

Forward-Looking Statements in this letter, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, plans or predictions of the future and are typically identified by words such as “believe,” “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. These statements include, without limitation, statements concerning our estimated per share NAV, assumptions made in determining estimated per share NAV; statements about our plans and strategies and future events, including the sale of the student housing platform; the anticipated timing to close the University House transaction; the retail strategy; and possible uses of the proceeds from the University House transaction, among other things. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain and involve known and unknown risks that are difficult to predict. Certain factors that may cause actual results to differ materially from current expectations are listed from time to time in our Securities and Exchange Commission reports, including, but not limited to, the most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission. InvenTrust intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this letter. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.