Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Four Corners Property Trust, Inc. | d182099d8k.htm |

| EX-99.1 - PRESS RELEASE - Four Corners Property Trust, Inc. | d182099dex991.htm |

Exhibit 99.2

Supplemental Financial & Operating Information

Quarter Ended

March 31, 2016

Four Corners, headquartered in Mill Valley, CA, is an independent company primarily engaged in the acquisition and leasing of restaurant properties. Four Corners will seek to grow its portfolio by acquiring additional real estate to lease, on a triple net basis, for use in the restaurant and related food services industry. As of March 31, 2016, Four Corners’ portfolio consists of 424 restaurant properties located in 44 states. The properties are 100% occupied with 418 properties leased to Darden Restaurants under long-term, triple net leases with a weighted average remaining lease term of approximately 14.3 years and an estimated portfolio weighted average EBITDAR to Lease Rent coverage of 4.2x. The remaining six properties are owned and ground leased properties operated by a taxable REIT subsidiary of Four Corners under a franchise agreement with LongHorn Steakhouse.

Table of Contents

| Non-GAAP Definitions |

3 | |||

| Consolidated Balance Sheets |

5 | |||

| Consolidated Statements of Operations |

6 | |||

| FFO and AFFO Statement |

7 | |||

| Diversification by Brand |

8 | |||

| Diversification by Geography |

9 | |||

| Lease Expirations |

10 | |||

2

Non-GAAP Definitions and Cautionary Note Regarding Forward-Looking Statements:

This document includes certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs and therefore may not be comparable. The non-GAAP measures should not be considered an alternative to net income as an indicator of our performance and should be considered only a supplement to net income, and to cash flows from operating, investing or financing activities as a measure of profitability and/or liquidity, computed in accordance with GAAP.

Funds From Operations (“FFO”) is a supplemental measure of our performance which should be considered along with, but not as an alternative to, net income and cash provided by operating activities as a measure of operating performance and liquidity. We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”). FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property and undepreciated land and impairment write-downs of depreciable real estate, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. We also omit the tax impact of non-FFO producing activities from FFO determined in accordance with the NAREIT definition.

Our management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We offer this measure because we recognize that FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. FFO is a non-GAAP measure and should not be considered a measure of liquidity including our ability to pay dividends or make distributions. In addition, our calculations of FFO are not necessarily comparable to FFO as calculated by other REITs that do not use the same definition or implementation guidelines or interpret the standards differently from us. Investors in our securities should not rely on these measures as a substitute for any GAAP measure, including net income.

Adjusted Funds From Operations “AFFO” is a non-GAAP measure that is used as a supplemental operating measure specifically for comparing year over year ability to fund dividend distribution from operating activities. AFFO is used by us as a basis to address our ability to fund our dividend payments. We calculate adjusted funds from operations by adding to or subtracting from FFO:

| 1. | Transaction costs incurred in connection with the acquisition of real estate investments |

| 2. | Non-cash stock-based compensation expense |

| 3. | Amortization of deferred financing costs |

| 4. | Other non-cash interest expense |

| 5. | Non-real estate depreciation |

| 6. | Merger, restructuring and other related costs |

| 7. | Impairment charges |

| 8. | Amortization of capitalized leasing costs |

| 9. | Straight-line rent revenue adjustment |

3

| 10. | Amortization of above and below market leases |

| 11. | Debt extinguishment gains and losses |

| 12. | Recurring capital expenditures and tenant improvements |

AFFO is not intended to represent cash flow from operations for the period, and is only intended to provide an additional measure of performance by adjusting the effect of certain items noted above included in FFO. AFFO is a widely reported measure by other REITs; however, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs.

EBITDAR represents earnings before interest, taxes, depreciation, amortization and rent. Calculated as EBITDA plus rental expense.

EBITDAR to Lease Rent coverage is calculated by dividing our reporting tenants’ trailing 12-month EBITDAR by annual contractual rent.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding the Company’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance; and expectations regarding the making of distributions and the payment of dividends. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of the Company’s public disclosure obligations, the Company expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and the Company can give no assurance that its expectations or the events described will occur as described. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements. Factors that could have a material adverse effect on the Company’s operations and future prospects or that could cause actual results to differ materially from the Company’s expectations are included in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 22, 2016.

4

Consolidating Balance Sheet

March 31, 2016

(Unaudited)

(In thousands, except shares and per share data)

| Real Estate Operations |

Restaurant Operations |

Elimination | Consolidated FCPT |

|||||||||||||

| ASSETS | ||||||||||||||||

| Real estate investments: |

||||||||||||||||

| Land |

$ | 401,751 | $ | 3,061 | $ | — | $ | 404,812 | ||||||||

| Buildings, equipment and improvements |

978,916 | 13,507 | $ | — | 992,423 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total real estate investments |

1,380,667 | 16,568 | — | 1,397,235 | ||||||||||||

| Less: accumulated depreciation |

(568,291 | ) | (5,435 | ) | — | (573,726 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total real estate investments, net |

812,376 | 11,133 | — | 823,509 | ||||||||||||

| Cash and cash equivalents |

34,645 | 1,443 | — | 36,088 | ||||||||||||

| Deferred rent |

4,095 | — | — | 4,095 | ||||||||||||

| Other assets |

601 | 380 | — | 981 | ||||||||||||

| Investment in subsidiary |

10,953 | — | (10,953 | ) | — | |||||||||||

| Intercompany receivable |

22 | — | (22 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

$ | 862,692 | $ | 12,956 | $ | (10,975 | ) | $ | 864,673 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||||

| Liabilities: |

||||||||||||||||

| Notes payable, net of deferred financing costs |

$ | 392,700 | $ | — | $ | — | $ | 392,700 | ||||||||

| Derivative liabilities |

7,151 | — | — | 7,151 | ||||||||||||

| Deferred rental revenue |

7,866 | — | — | 7,866 | ||||||||||||

| Deferred tax liability |

225 | — | — | 225 | ||||||||||||

| Dividends payable |

14,509 | — | — | 14,509 | ||||||||||||

| Other liabilities |

2,949 | 2,069 | — | 5,018 | ||||||||||||

| Intercompany payable |

— | 22 | (22 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

425,400 | 2,091 | (22 | ) | 427,469 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Stockholders’ equity: |

||||||||||||||||

| Preferred stock |

— | — | — | — | ||||||||||||

| Common stock |

6 | — | — | 6 | ||||||||||||

| Additional paid-in capital |

437,017 | 10,953 | (10,953 | ) | 437,017 | |||||||||||

| Accumulated other comprehensive loss |

(6,774 | ) | — | — | (6,774 | ) | ||||||||||

| Cumulative distributions to shareholders |

(92,585 | ) | — | — | (92,585 | ) | ||||||||||

| Retained earnings |

99,628 | (88 | ) | — | 99,540 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total stockholders’ equity |

437,292 | 10,865 | (10,953 | ) | 437,204 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities and Stockholders’ Equity |

$ | 862,692 | $ | 12,956 | $ | (10,975 | ) | $ | 864,673 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

5

Consolidated and Combined Statements of Operations

Three Months Ended March 31, 2016 and 2015

(Unaudited)

(In thousands, except shares and per share data)

| Three Months Ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Revenues: |

||||||||

| Rental income |

$ | 26,252 | $ | — | ||||

| Restaurant revenues |

4,859 | 4,890 | ||||||

|

|

|

|

|

|||||

| Total revenues |

31,111 | 4,890 | ||||||

| Operating expenses: |

||||||||

| General and administrative |

3,317 | — | ||||||

| Depreciation and amortization |

5,187 | 212 | ||||||

| Restaurant expenses |

4,698 | 4,513 | ||||||

| Interest expense |

4,182 | — | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

17,384 | 4,725 | ||||||

|

|

|

|

|

|||||

| Income before provision for income taxes |

13,727 | 165 | ||||||

| Benefit from (provision for) income taxes |

80,556 | (19 | ) | |||||

|

|

|

|

|

|||||

| Net Income |

$ | 94,283 | $ | 146 | ||||

|

|

|

|

|

|||||

| Basic net income per share |

$ | 1.58 | N/A | |||||

| Diluted net income per share |

$ | 1.57 | N/A | |||||

| Regular dividends declared per common share |

$ | 0.2425 | N/A | |||||

| Weighted-average shares outstanding: |

||||||||

| Basic (1) |

59,827,808 | N/A | ||||||

| Diluted (1) |

59,863,804 | N/A | ||||||

| (1) | Includes 17,085,566 shares issued on March 2, 2016 as part of our Earnings and Profits distribution to satisfy REIT requirements. For financial reporting purposes, these shares were assumed to be issued on January 1, 2016. |

6

FFO and AFFO Statement

Three Months Ended March 31, 2016

(Unaudited)

(In thousands, except shares and per share data)

| Three Months Ended March 31, 2016 |

||||

| Funds from operations (FFO): |

||||

| Net income attributable to stockholders in accordance with GAAP |

$ | 94,283 | ||

| Depreciation and amortization |

5,187 | |||

| Deferred tax benefit from REIT election |

(80,409 | ) | ||

|

|

|

|||

| FFO (as defined by NAREIT) |

$ | 19,061 | ||

|

|

|

|||

| Real estate acquisition costs |

— | |||

| Non-cash stock-based compensation |

317 | |||

| Non-cash amortization of deferred financing costs |

398 | |||

| Other non-cash interest expense |

380 | |||

| Straight-line rent |

(2,595 | ) | ||

|

|

|

|||

| Adjusted funds from operations (AFFO) |

$ | 17,561 | ||

|

|

|

|||

| Fully diluted shares outstanding |

59,863,804 | |||

| FFO per diluted share |

$ | 0.32 | ||

| AFFO per diluted share |

$ | 0.29 | ||

7

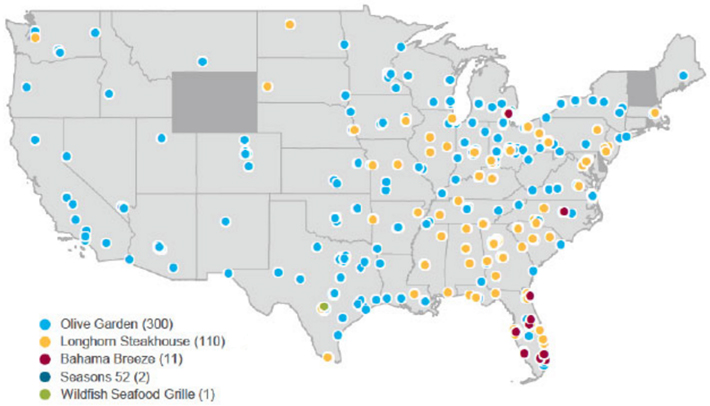

Leased Portfolio Diversification by Brand

| Q1 2016 Activity |

Brand |

Number of Four Corners Properties |

Total Square Feet (000s) |

Annual Cash Base Rent ($000s) |

Percentage of Total Annualized Base Rent |

Avg. Rent Per Square Foot ($) |

Q1 2016 EBITDAR Coverage1 |

Avg. Lease Term Before Renewals (Yrs) |

Number of Renewal Periods | |||||||||||||||||||||||

| Existing properties |

||||||||||||||||||||||||||||||||

| Olive Garden |

300 | 2,565 | $ | 70,144 | 74.3 | % | $ | 27 | 4.4x | 14.6 | Typically 5 | |||||||||||||||||||||

| Longhorn SteakHouse |

104 | 579 | 18,757 | 19.9 | % | 32 | 3.8x | 13.6 | Typically 5 | |||||||||||||||||||||||

| Bahama Breeze |

11 | 116 | 4,471 | 4.8 | % | 39 | 3.8x | 12.7 | Typically 5 | |||||||||||||||||||||||

| Seasons 52 |

2 | 18 | 699 | 0.7 | % | 39 | 3.4x | 14.1 | Typically 5 | |||||||||||||||||||||||

| Wildfish Seafood |

1 | 9 | 318 | 0.3 | % | 35 | 3.9x | 12.6 | Typically 5 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Properties acquired by location |

||||||||||||||||||||||||||||||||

| No acquisitions in Q1 2016 |

— | — | — | — | — | — | — | N/A | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Properties sold by location |

||||||||||||||||||||||||||||||||

| No sales in Q1 2016 |

— | — | — | — | — | — | — | N/A | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Lease terminations by location |

||||||||||||||||||||||||||||||||

| No terminations in Q1 2016 |

— | — | — | — | — | — | — | N/A | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total/Weighted Avg. |

418 | 3,287 | $ | 94,389 | 100.0 | % | $ | 29 | 4.2x | 14.3 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Footnotes:

| (1) | Q1 2016 EBITDAR Coverage reflects the ratio of EBITDAR to cash rent paid to Four Corners Property Trust. EBITDAR is defined as earnings before interest, income taxes, depreciation, amortization, and rent. |

8

Leased Portfolio Diversification by State

| State |

# of Properties |

% of Annual Base Rent |

||||||

| FL |

46 | 13.6 | % | |||||

| TX |

42 | 11.2 | % | |||||

| GA |

40 | 8.4 | % | |||||

| OH |

32 | 6.7 | % | |||||

| MI |

16 | 3.5 | % | |||||

| TN |

14 | 3.0 | % | |||||

| IN |

13 | 2.6 | % | |||||

| PA |

13 | 3.2 | % | |||||

| NC |

12 | 2.7 | % | |||||

| VA |

12 | 2.5 | % | |||||

| IL |

11 | 2.2 | % | |||||

| CA |

10 | 3.3 | % | |||||

| MD |

10 | 2.3 | % | |||||

| AL |

9 | 1.9 | % | |||||

| IA |

9 | 1.8 | % | |||||

| KY |

9 | 2.0 | % | |||||

| NY |

9 | 2.3 | % | |||||

| AZ |

8 | 1.9 | % | |||||

| MN |

8 | 1.8 | % | |||||

| SC |

8 | 2.0 | % | |||||

| WI |

8 | 1.8 | % | |||||

| AR |

7 | 1.4 | % | |||||

| CO |

6 | 1.5 | % | |||||

| LA |

6 | 1.3 | % | |||||

| MO |

6 | 1.1 | % | |||||

| MS |

6 | 1.3 | % | |||||

| NV |

6 | 1.9 | % | |||||

| OK |

6 | 1.4 | % | |||||

| KS |

5 | 1.4 | % | |||||

| WV |

5 | 1.3 | % | |||||

| 14 states |

26 | 6.7 | % | |||||

|

|

|

|

|

|||||

| Total |

418 | 100.0 | % | |||||

|

|

|

|

|

|||||

9

Lease Expirations

| Leases Expiring In: |

Number of Properties |

Expiring Annual Rent ($ in thousands) |

Total Square Footage (in thousands) |

Percent of Total Expiring Annual Rent |

||||||||||||

| 2016 |

— | — | — | 0 | % | |||||||||||

| 2017 |

— | — | — | 0 | % | |||||||||||

| 2018 |

— | — | — | 0 | % | |||||||||||

| 2019 |

— | — | — | 0 | % | |||||||||||

| 2020 |

— | — | — | 0 | % | |||||||||||

| 2021 |

— | — | — | 0 | % | |||||||||||

| 2022 |

— | — | — | 0 | % | |||||||||||

| 2023 |

— | — | — | 0 | % | |||||||||||

| 2024 |

— | — | — | 0 | % | |||||||||||

| 2025 |

— | — | — | 0 | % | |||||||||||

| 2026 |

— | — | — | 0 | % | |||||||||||

| 2027 |

70 | $ | 15,626 | 516 | 17 | % | ||||||||||

| 2028 |

70 | 16,159 | 518 | 17 | % | |||||||||||

| 2029 |

68 | 15,440 | 534 | 16 | % | |||||||||||

| 2030 |

67 | 14,498 | 518 | 15 | % | |||||||||||

| 2031 |

59 | 13,064 | 477 | 14 | % | |||||||||||

| 2032 |

41 | 9,639 | 351 | 10 | % | |||||||||||

| 2033 |

43 | 9,963 | 374 | 11 | % | |||||||||||

| Vacant |

— | — | — | 0 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Properties |

418 | $ | 94,389 | 3,287 | 100 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

10