Exhibit 99.1

Table of Contents

|

|

|

|

|

| TO OUR MEMBERS |

|

|

2 |

|

|

|

| A Reliable Dividend |

|

|

3 |

|

|

|

| STRENGTH |

|

|

5 |

|

|

|

| Strength of Our Business |

|

|

6 |

|

|

|

| Financial Highlights |

|

|

8 |

|

|

|

| STABILITY |

|

|

9 |

|

|

|

| Board of Directors |

|

|

10 |

|

|

|

| Executive Leadership |

|

|

11 |

|

|

|

| A Nation of Local Lenders |

|

|

12 |

|

|

|

| 25 Years of Opening Doors for Affordable Housing |

|

|

14 |

|

|

|

| Affordable Housing Advisory Council |

|

|

14 |

|

|

|

| NJ Family Achieves Homeownership with the First Home Clubsm |

|

|

15 |

|

|

|

| Our Employees Give Back |

|

|

16 |

|

|

|

| SUSTAINABILITY |

|

|

17 |

|

|

|

| Initiatives to Further Develop Business |

|

|

18 |

|

|

|

| FHLBNY Officers |

|

|

20 |

|

1

To Our Members

Throughout 2015, the Federal Home Loan Bank of New York (FHLBNY) demonstrated our ability to identify, respond

to and overcome challenges. We faced continued volatility in the markets, a flurry of unprecedented prepayment activity, several significant member mergers, a shift in the advances activity of some of our top borrowers and increased competition from

various sources. And yet, 2015 was another successful year for our franchise. We performed well throughout the year, provided a consistent and attractive quarterly dividend, developed innovative products and policies to enhance the value of

membership and served as a steady and reliable partner for our members. Our continued success stems from the “strength, stability and sustainability” of our franchise, three areas on which

we focused in 2015.

The true strength of our franchise comes from two sources: our members and our people. Our members are well-managed, conservative

lending institutions with a strong knowledge of their customers and their territory. Ours is a diverse membership, spanning institutions that operate in the global arena to those which are centralized in a single town, all bound together by a common

focus on a brighter, more vibrant future for the communities they serve. In 2015, we added 11 new members and expanded our membership to include property and casualty insurance companies, further diversifying our cooperative.

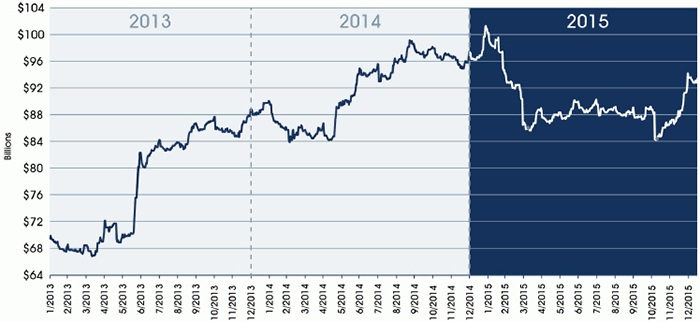

It is our members’ use of advances that drives our performance. We closed 2015 with the second-highest level of advances in the Federal Home Loan Bank

System with $93.9 billion flowing through communities across New Jersey, New York, Puerto Rico and the U.S. Virgin Islands. We are an Advances Bank, and our model is based on providing a daily source of funding for our members. But the performance

of our advances book was particularly notable in 2015

because of the volatility we experienced related to heightened prepayment activity and completed or announced

large member mergers throughout the year. In total, due to a combination of mergers, balance sheet restructurings and responses to regulatory requirements, a small number of members – including six of our top 10 borrowers at year-end 2014

– decreased their borrowings by approximately $20 billion in 2015. However, these declines were largely offset by a wide range of members that increased advances during the year. This activity was driven by long-tenured members, but we also

experienced significant interest from first-time and returning borrowers. At the end of the year, three of our top ten borrowers were not among the top ten borrowers at year-end 2014. This reflects just how important the diversity of our membership

is to our cooperative and how all of our members contribute to our success.

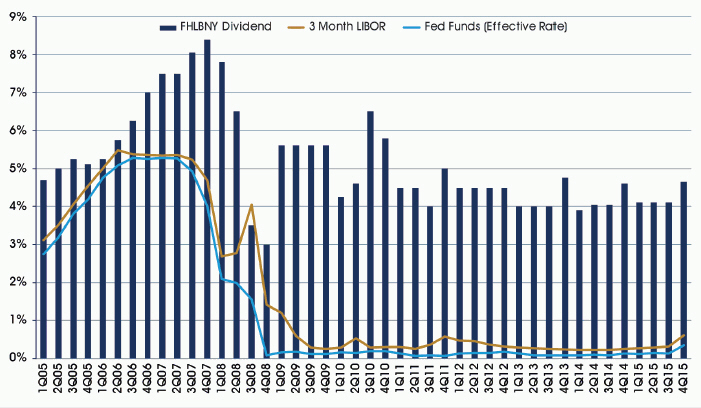

In 2015, this success translated into net income of $414.8 million, an

increase of $99.9 million, or 31.7 percent, from net income of $314.9 million for 2014. Prepayment activity helped drive these results, which is reflected in the significant increase in net income during the fourth quarter, when we earned $168.4

million, an increase of $91.4 million from the same period in 2014. However, our results were consistently strong throughout 2015, as made evident in our quarterly dividend. In each of the first three quarters of 2015, we paid a 4.10 percent

dividend to our members, before increasing this dividend to 4.65 percent in the fourth quarter – distributing more than $225 million in dividends to our members from our 2015 income. We believe a dividend that is fair, reasonable and consistent

is part of the reliability we provide to our members.

The Federal Home Loan Bank System also performed well throughout 2015, with income

2

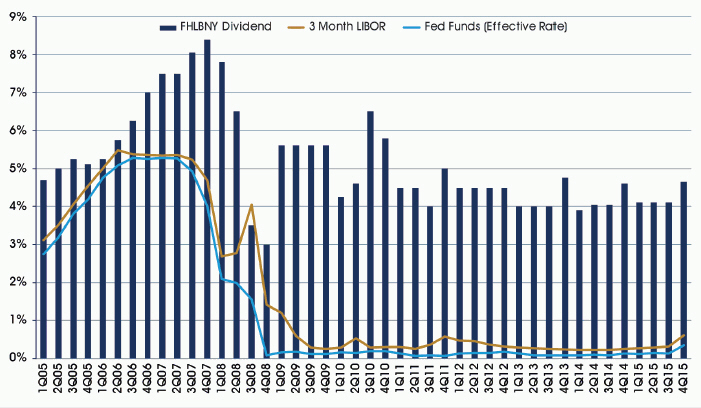

FHLBNY Dividend History - 2005-2015

Our dividends have been reliable and exceeded market reference rates.

Please note: Dividends as shown for each quarter were paid out in the following quarter. Although FHLBNY capital

stock has been high-performing and has had a very competitive dividend rate for an extended period of time, the dividend rate is not guaranteed, and as such, it may fluctuate in the future.

of $2.9 billion, a record for the System and an increase of 27 percent from 2014. Each of the 11 Federal Home

Loan Banks reported positive earnings for the year. And, most importantly, System-wide advances grew by 11 percent during the year, finishing 2015 with $634 billion in funding across the United States.

The Federal Home Loan Bank System’s performance in 2015 represents the third straight year of double-digit advances growth System-wide. It is also

reflective of the stability that we strive to promote within our own cooperative. That stability begins with our people. On average, our employees have nine years of experience

working with our franchise; our team here includes 99 employees with more than 10 years of service to the

cooperative, and 33 employees with more than 20 years of service. Combined, our Executive Leadership has more than 200 years of service to the Federal Home Loan Bank System. All of that experience builds and strengthens a culture wherein our 273

dedicated employees come to work each day with a focus on meeting the needs of our members and acting on our mission. This focus is supplemented by our knowledgeable and active Board of Directors, which is comprised of leaders in the community

banking industry and independent directors who bring an extraordinary range of professional

3

experience and vast expertise relevant to our mission and operations. The guidance management receives from the

Board continues to help the FHLBNY perform well.

Our stability is also reflected within the support we provide to our members every day. In 2015, we

celebrated the 20th anniversary of our First Home Clubsm, a program we developed on our own that has since served as a model for similar programs across the Federal Home Loan Bank System. This

past year also marked the 25th anniversary of making our first Affordable Housing Program grants in 1990. In the years that have passed, the Affordable Housing Program has become a trusted source of funding for affordable housing partners across the

region and a key tool our members employ to make a significant, positive and lasting difference in their communities. That these programs have existed and operated at such a high level – and that they are funded directly from our earnings

– is reflective of the stability of our franchise.

With our substantial earnings and steady dividend, our strength and stability was on display in

2015. But we also worked towards ensuring that this strength and stability is sustainable. Throughout 2015, we took steps to better identify and respond to member needs through innovation. In March 2015, we created our Products & Services

Committee, a group representing various functions from across the FHLBNY, which has helped us develop more

innovative ways to support our members as they navigate the changing economic environment. In April, and then

again in the fourth quarter, we launched a set of well-received Advance Specials, which offered reduced rates on some of our longer-term advance products. In October, we enhanced our Advance Modification Program. And in December, we enhanced our

prepayment methodology with the creation of an advance prepayment Rebate Program, the first of its kind in the Federal Home Loan Bank System.

All of this

was done against the backdrop of the year-long development of the FHLBNY’s 2016-2018 Strategic Plan. The effort to develop this three-year plan was led by the Board’s Strategic Planning Committee and the FHLBNY’s internal Strategic

Planning Team, drawing on the knowledge and expertise of employees from every function of the FHLBNY. In following this strategy, we remain focused on being a balanced provider of liquidity to members in all operating environments. And we remain

committed to the principles that guide us: the decisions we make that benefit our cooperative, uphold our integrity, support our communities and advance our people.

Throughout 2015, our focus on enhancing member value is what drove our success. Our well-defined strategy, our diverse membership, our dedicated people and

our meaningful mission positions our cooperative for the future. The strength, stability and sustainability of our cooperative are all part of the value of membership at the FHLBNY.

|

|

|

|

|

|

|

|

|

Michael M. Horn

Chairman |

|

|

|

José R. González President

and CEO |

4

Our strong business model is built on a diverse membership base, all bound by a common focus on a brighter,

more vibrant future for the communities we serve.

5

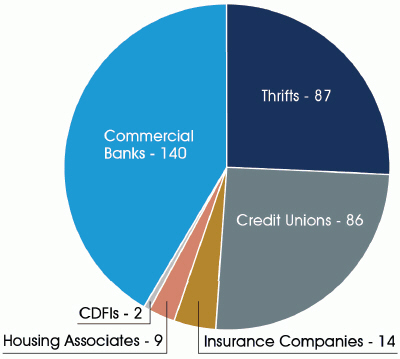

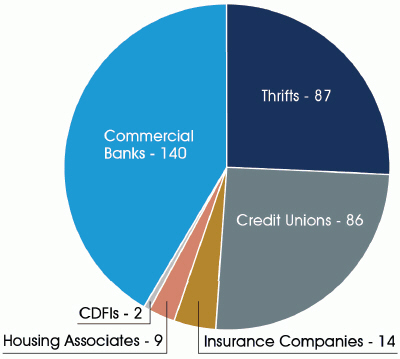

Member Composition by Type

2015 New Members

|

|

|

|

|

|

|

|

|

| NEW MEMBER |

|

|

|

|

|

STATE |

| American Home Assurance Company |

|

New York |

| ARBC Insurance Company, LLC |

|

New Jersey |

| Belmont Insurance Company |

|

New York |

| Cantor Real Estate Insurance Company, LLC |

|

New Jersey |

| Genesee Valley Federal Credit Union |

|

New York |

| Nassau Educators Federal Credit Union |

|

New York |

| Quontic Bank |

|

New York |

| Savoy Bank |

|

New York |

| Selective Insurance Company of America |

|

New Jersey |

| Selective Insurance Company of New York |

|

New York |

| Teachers Insurance and Annuity Association of America |

|

New York |

6

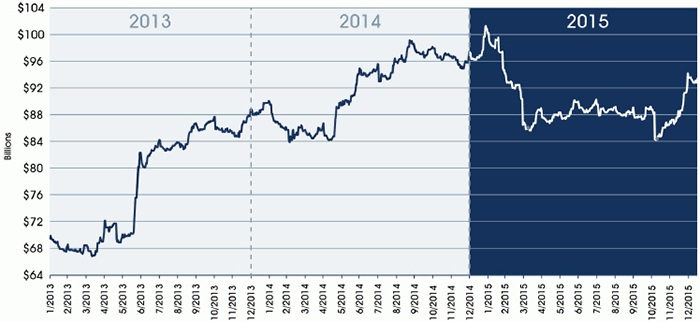

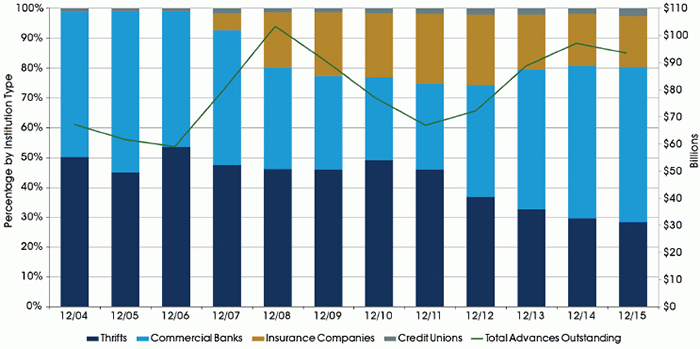

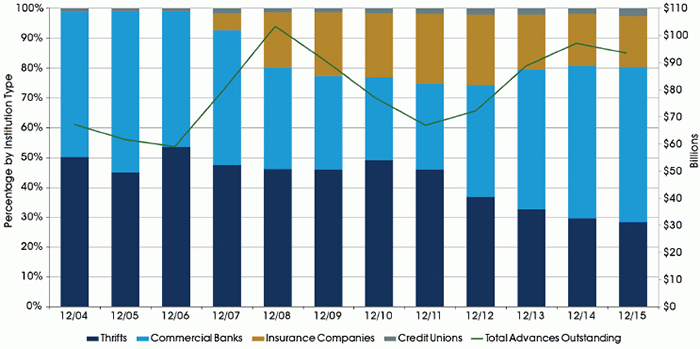

Total Advances Outstanding

Diversity of Borrowers by Member Type & Advances Outstanding

Note: At December 31, 2015, advances made to our nine housing associate members totaled $5.7

million.

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in millions) |

|

2015 |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Selected Balances at Year-End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

123,248 |

|

|

$ |

132,825 |

|

|

$ |

128,333 |

|

|

$ |

102,989 |

|

|

$ |

97,662 |

|

| Advances |

|

|

93,874 |

|

|

|

98,797 |

|

|

|

90,765 |

|

|

|

75,888 |

|

|

|

70,864 |

|

| Investments |

|

|

26,167 |

|

|

|

25,201 |

|

|

|

20,084 |

|

|

|

17,459 |

|

|

|

14,236 |

|

| Mortgage Loans |

|

|

2,524 |

|

|

|

2,129 |

|

|

|

1,928 |

|

|

|

1,843 |

|

|

|

1,408 |

|

| Capital Stock |

|

|

5,585 |

|

|

|

5,580 |

|

|

|

5,571 |

|

|

|

4,797 |

|

|

|

4,491 |

|

| Retained Earnings |

|

|

1,270 |

|

|

|

1,083 |

|

|

|

999 |

|

|

|

894 |

|

|

|

746 |

|

| Annual Operating Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Income |

|

$ |

554 |

|

|

$ |

444 |

|

|

$ |

421 |

|

|

$ |

467 |

|

|

$ |

509 |

|

| Net Income |

|

|

415 |

|

|

|

315 |

|

|

|

305 |

|

|

|

361 |

|

|

|

245 |

|

| Dividends Paid |

|

|

228 |

|

|

|

231 |

|

|

|

200 |

|

|

|

213 |

|

|

|

210 |

|

| Dividend Rate |

|

|

4.22 |

% |

|

|

4.19 |

% |

|

|

4.12 |

% |

|

|

4.63 |

% |

|

|

4.70 |

% |

| Performance Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on Average Equity |

|

|

6.61 |

% |

|

|

4.88 |

% |

|

|

5.22 |

% |

|

|

6.88 |

% |

|

|

4.83 |

% |

| Return on Average Assets |

|

|

0.34 |

% |

|

|

0.25 |

% |

|

|

0.27 |

% |

|

|

0.35 |

% |

|

|

0.24 |

% |

| Average Equity to Average Asset |

|

|

5.14 |

% |

|

|

5.13 |

% |

|

|

5.18 |

% |

|

|

5.10 |

% |

|

|

5.01 |

% |

| Net Interest Margin |

|

|

0.46 |

% |

|

|

0.36 |

% |

|

|

0.38 |

% |

|

|

0.46 |

% |

|

|

0.51 |

% |

The Federal Home Loan Bank of New York’s 2015 annual report on Form 10-K, as filed with the Securities and Exchange

Commission, contains additional information about the FHLBNY’s financial performance. The report is available on the FHLBNY’s public website, www.fhlbny.com, under the “About Us” tab; select “Investor Relations,” and

under the right-hand column labeled “Financial Reports.”

8

The experience and dedication of our people, the consistent performance of our cooperative and our System,

and the daily availability of our funding and products all create the stability that our members rely on.

9

Our Board of Directors is comprised of community banking industry leaders and independent directors

who bring an extraordinary range of professional experience and vast expertise relevant to our mission and operations.

|

| STANDING, LEFT TO RIGHT |

| Rev. DeForest B. Soaries, Jr. * |

| Senior Pastor | First Baptist Church of Lincoln Gardens, Somerset, New Jersey |

|

| Vincent F. Palagiano + |

| Chairman & CEO | The Dime Savings Bank of Williamsburgh, Brooklyn, New

York |

|

| Joseph J. Melone (retired) * |

| Chairman Emeritus | The Equitable Companies, New York, New York |

|

| Carlos J. Vázquez + |

| CFO & Executive Vice President | Banco Popular de Puerto Rico, San Juan, Puerto

Rico |

|

| C. Cathleen Raffaeli * |

| President & Managing Director | The Hamilton White Group, Stamford,

Connecticut |

|

| Richard S. Mroz * |

| President | New Jersey Board of Public Utilities, Trenton, New Jersey |

|

| Thomas L. Hoy + |

| Chairman | Glens Falls National Bank & Trust Company, Glens Falls, New

York |

|

| Kevin Cummings + |

| President & CEO | Investors Bank, Short Hills, New Jersey |

|

| Larry E. Thompson * |

| Vice Chairman | The Depository Trust & Clearing Corporation (DTCC) |

|

| Monte N. Redman + |

| President & CEO | Astoria Bank, Lake Success, New York |

|

|

|

| David J. Nasca + |

| President & CEO | Evans Bank, N.A., Hamburg, New York |

|

| Gerald H. Lipkin + |

| Chairman, President & CEO | Valley National Bank, Wayne, New Jersey |

|

| Christopher P. Martin + |

| President & CEO | The Provident Bank, Jersey City, New Jersey |

|

| Anne Evans Estabrook *# |

| Owner & CEO | Elberon Development Co., Cranford, New Jersey |

|

| SEATED, LEFT TO RIGHT |

|

| John R. Buran + |

| President & CEO | Flushing Savings Bank, Lake Success, New York |

|

| James W. Fulmer - Vice Chairman + |

| Chairman | The Bank of Castile, Batavia, New York |

|

| Michael M. Horn - Chairman * |

| Partner | McCarter & English, LLP, Newark, New Jersey |

|

| Jay M. Ford + |

| President & CEO | Crest Savings Bank, Wildwood, New Jersey |

|

| Rev. Edwin C. Reed *# |

| President & CEO | GGT Development, LLC, Jamaica Estates, New York |

|

|

|

| * Independent Director | # Public Interest Director | + Member Director |

10

Combined, our Executive

Leadership has more than

200 years of service to the Federal Home Loan Bank System.

|

|

|

| STANDING, LEFT TO RIGHT |

|

SEATED, LEFT TO RIGHT |

| Eric Amig |

|

John Edelen |

| Senior Vice President & Head of Bank Relations |

|

Senior Vice President & Chief Risk Officer |

|

|

| Phil Scott |

|

Kevin Neylan |

| Senior Vice President & Chief Capital Markets Officer |

|

Senior Vice President & Chief Financial Officer |

|

|

| Melody Feinberg |

|

José R. González |

| Senior Vice President & Deputy Chief Risk Officer |

|

President & Chief Executive Officer |

|

|

| Paul Héroux |

|

Bob Fusco |

| Senior Vice President & Chief Bank Operations Officer |

|

Senior Vice President, Chief Information Officer & Head of Enterprise Services |

| Adam Goldstein |

|

|

| Senior Vice President & Chief Business Officer |

|

|

|

|

| Edwin Artuz |

|

|

| Senior Vice President & Head of Corporate Services & |

|

|

| Director of the Office of Minority and Women Inclusion |

|

|

|

|

| Stephen Angelo |

|

|

| Senior Vice President & Chief Audit Officer |

|

|

|

|

| Jonathan West |

|

|

| Senior Vice President & Chief Legal Officer |

|

|

11

|

|

|

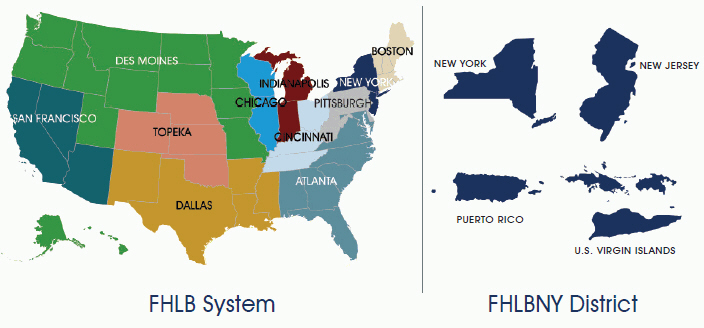

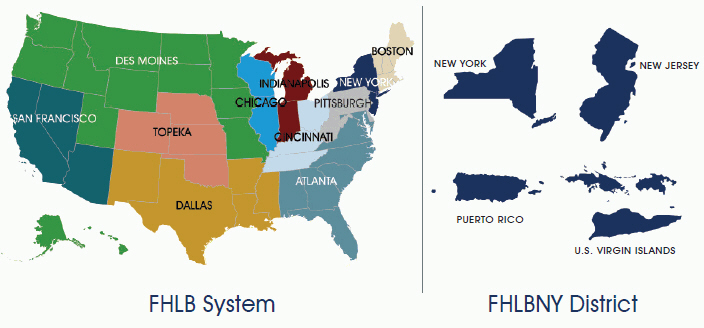

| A Nation of Local Lenders |

|

|

Our broad membership reflects the different types and sizes of institutions that drive housing opportunity in our region.

Their use of our advances strengthens our cooperative and ensures that our funding is put to work in communities across New Jersey, New York, Puerto Rico and the U.S. Virgin Islands every day.

| |

• |

|

Government Sponsored Enterprise created by Congress in 1932 as a result of the Great Depression and its effects on the housing market |

| |

• |

|

Primary business is extending credit to banks, thrifts, credit unions, insurance companies and community development financial institutions |

| |

• |

|

Eleven Federal Home Loan Banks across the United States all registered with the SEC and regulated by the Federal Housing Finance Agency |

| |

• |

|

Each Federal Home Loan Bank is an independent cooperative, owned by its members, who purchase stock in the cooperative |

| |

• |

|

The total System-wide membership as of December 31, 2015 was 7,238 institutions |

| |

• |

|

The total Advances to members System-wide as of December 31, 2015 was $634 billion |

| |

• |

|

System-wide in 2014, $89.5 million was awarded in homeownership set-aside funds; since 1995, a total of $775 million has been awarded in set-aside programs |

12

FHLBNY’S STRATEGIC MISSION & VISION

Our mission and vision have tremendous relevance in today’s business environment.

Although challenges lie ahead, the FHLBNY is well-positioned for the future

as we evolve from a strong base.

The mission of the Federal Home Loan Bank of New York is to advance housing opportunity and

local community development by supporting members in serving their markets.

To be a balanced provider of liquidity to members in all operating environments.

| |

• |

|

Balanced: The FHLBNY provides members with competitively priced products while considering the risks of providing those products and the financial return requirements of the cooperative. |

| |

• |

|

Provider of liquidity: The FHLBNY will maintain a focus on advances but also continue to evaluate other ways of providing liquidity to members. |

| |

• |

|

Members: The FHLBNY will serve all eligible banks, thrifts, credit unions, insurance companies, housing associates and CDFIs regardless of size or scale. |

| |

• |

|

All operating environments: The FHLBNY aims to be a reliable source of liquidity for members in all markets and conditions. |

GUIDING PRINCIPLES

Each and every day, we make decisions that act on our mission by following the principles that guide us. These principles are:

13

|

|

|

| 25 Years of Opening Doors for Affordable Housing |

|

|

The FHLBNY’s Community Investment Programs help our members create opportunities to strengthen the communities they serve.

Our Affordable Housing Program and First Home Clubsm are funded directly from our earnings, which means that as we consistently perform well, we are consistently able to do good: since 1990, we

have awarded more than half a billion dollars in grants to help create or preserve 64,860 homes. In 2015, we marked the 25th anniversary of the Affordable Housing Program and the 20th anniversary of the First Home Club.

|

|

|

|

|

| AHP Performance Statistics |

|

|

|

FHC Performance Statistics |

| (Program totals as of 12/31/15) |

|

|

|

(Program totals as of 12/31/15) |

|

|

|

| • Projects approved: 1,443 |

|

|

|

• Households enrolled: 35,195 |

|

|

|

| • Units created: 64,860 |

|

|

|

• Closings: 11,063 |

|

|

|

| • Subsidies approved: $517,071,757 |

|

|

|

• Subsidies funded: $78,372,650 |

AFFORDABLE HOUSING ADVISORY COUNCIL

CHAIR

Peter Elkowitz

President & CEO

Long Island Housing Partnership, Inc.

Hauppauge, New

York (2015)

VICE CHAIR

Bernell Grier1

Chief Executive Officer

Neighborhood Housing Services of

New York City

New York, New York (2015)

Notes:

Terms expire on December 31 of years indicated

1Resigned October 2015

Deborah Boatright

Regional Director

NeighborWorks America / Northeast

Region

New York, New York (2017)

Susan Cotner

Executive Director

Affordable Housing

Partnership

Albany Community Land Trust

Albany, New York (2017)

Robert Di Vincent

Executive Director

West New York Housing Authority

West New York, New Jersey (2017)

Melody

Federico

Chief Real Estate Officer

NewBridge

Services, Inc.

Pequannock, New Jersey (2016)

Tyrone Garrett

Executive Director

Long Branch Housing Authority

Long Branch, New Jersey

(2017)

Daniel Kelly

President

Community Quest

Egg Harbor Township, New Jersey (2016)

Colin McKnight

Deputy Director

New York State Rural Housing Coalition

Albany, New York (2017)

Carrie Michel-Wynne

Director of Housing

YWCA of

Rochester & Monroe County

Rochester, New York (2016)

Faith Moore

Executive Director

Orange County Rural Development Advisory Council

Walden, New York (2016)

Maria Rodriguez-Collazo

Director of Housing Programs

PathStone

Corporation

Ponce, Puerto Rico (2016)

Gary

van Nostrand

President/Chief Executive Officer

SERV Behavioral Health System, Inc.

Ewing, New Jersey

(2015)

14

NJ

Family Achieves Homeownership with the First Home Clubsm

It is our belief that the stability that homeownership provides can create a foundation that leads to stronger

communities, increased civic engagement and improved educational achievement for children. Our First Home Club was developed with the aim of improving homeownership opportunities across our District. In 2015, we marked the 20th anniversary of the First Home Club, which we developed on our own to meet a need that we saw in the communities our cooperative serves: too often, down payments and closing costs were acting as

barriers to homeownership for otherwise qualified borrowers. In establishing the First Home Club, we created a non-competitive set-aside of our Affordable Housing Program to provide down payment and closing cost assistance through matching grants.

We now offer grants of up to $7,500, matching $4 for each $1 saved in a dedicated account to an eligible first-time homebuyer purchasing a home and obtaining a mortgage through one of our members. Also available is an additional $500 toward the

defrayment of non-profit housing agency counseling costs.

In 2015, the First Home Club ushered in 1,845 new homeowners, including Bradley and Rebecca

Barlow,

who closed on their new home in West Milford, New Jersey in July 2015. The Barlows were renting a one-bedroom

condo and saving towards their first home when, in September 2014, their mortgage representative at Investors Bank suggested they enroll in the First Home Club. The First Home Club requires participants to complete a homebuyer counseling program,

which the Barlows considered to be one of the benefits of the First Home Club. The couple attended courses at the Central Jersey Housing Resource Center, where they received information on the issues involved in mortgage financing and owning a home.

In July 2015, the Barlows achieved their goal of homeownership, which has provided the key benefits of more space and a backyard for their growing family.

In the 20 years since the program’s first dollar was matched, we have made more than $78 million in grants to help more than 11,000 households, just like

the Barlows, achieve the dream of homeownership. And with more than 6,000 households currently participating in the First Home Club, we know that this program will continue to succeed for decades to come.

15

|

|

|

| Our Employees Give Back

Over $17,000 Raised and Hundreds Served

In addition to the charitable contribution funds and grants the FHLBNY provides to support communities, our employees also join together to make a personal

difference across our District. In 2015, they demonstrated their dedication by adopting the theme of “Let’s Give Back” for all employee events. Throughout the year, employees volunteered their time, money and hard work to help support

a broad range of community services and programs. Their collaborative efforts raised

more than $17,000 in support – a number that reflects FHLBNY employees’ heartfelt dedication to building a connection to the community, while strengthening the culture of the cooperative at the same time. |

|

|

|

|

|

|

|

| HABITAT FOR HUMANITY Charity: Habitat for

Humanity Bergen |

|

Employees Helped in the Final Rebuild Stage of Super Storm Sandy Projects |

|

Helped Rebuild Five Homes (Serving 18 Family Members) in Little Ferry, NJ |

|

|

|

| MAKING STRIDES AGAINST BREAST CANCER WALK

Charity: American Cancer Society |

|

Employees, Friends & Family Walked; Employees Bankwide Donated in Support |

|

$8,000 Total Raised (Includes FHLBNY Matching) |

|

|

|

| MISSION BACKPACK Charity: Graham

Windham |

|

FHLBNY Donated Backpacks; Employees Donated Supplies, Then Filled & Distributed Backpacks |

|

100 Foster Kids Served at Graham Windham’s Back to School Fair in Prospect Park |

|

|

|

| THE RELIEF BUS Charity: New York City

Relief |

|

Employees Partnered with NYC Relief to Give Out Food & Supply Kits to NYC’s Homeless |

|

Served 300 of NYC’s Homeless |

|

|

|

| COAT DRIVE Charity: New York

Cares |

|

Joined NY Cares to Collect & Donate Coats |

|

30 Coats Donated to the Homeless |

|

|

|

| FAMILY PICNIC OLYMPICS Charity: Special

Olympics New Jersey |

|

Funds Raised from Guest Tickets, Silent Auction & Other Events |

|

$6,630 Total Raised (Includes FHLBNY Matching) |

|

|

|

| GOLF OUTING Charity: Ronald McDonald

House New York |

|

Proceeds Collected from Employee & Guest Registrations |

|

$1,150 Raised for Pediatric Cancer Patients & their Families |

|

|

|

| PAINTFEST Charity: Foundation for

Hospital Art |

|

Employees Painted Three Murals for Donation (NY & NJ offices) |

|

Served Brookdale Family Care Center (Brooklyn, NY) & Hope for the Warriors (Annandale, VA) |

|

|

|

| DONATE FOR DENIM Charities:

Candlelighters NYC, NAMI (National Alliance of Mental Illness) |

|

Donated $5 Each Day to Wear Jeans on Select Days |

|

$1,410 Total Raised (to date) |

16

For more than 80 years, the FHLBNY has been a reliable partner for our members. We continue to strengthen

our business model while focusing on innovative ways to identify and respond to member needs to ensure that we remain a trusted partner for the next eight decades.

17

|

|

|

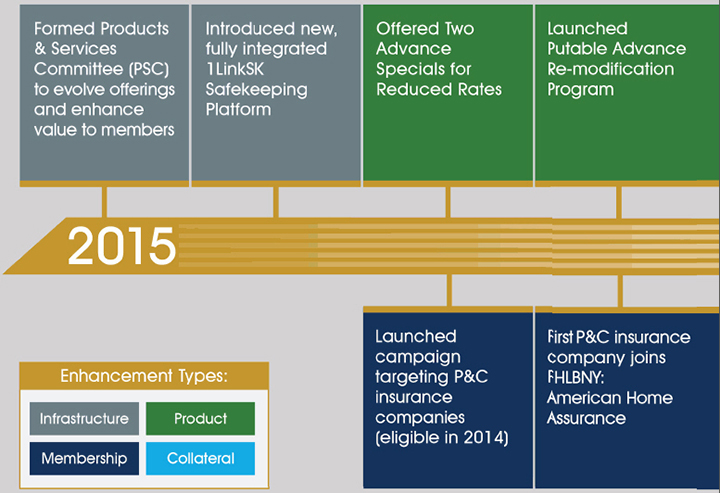

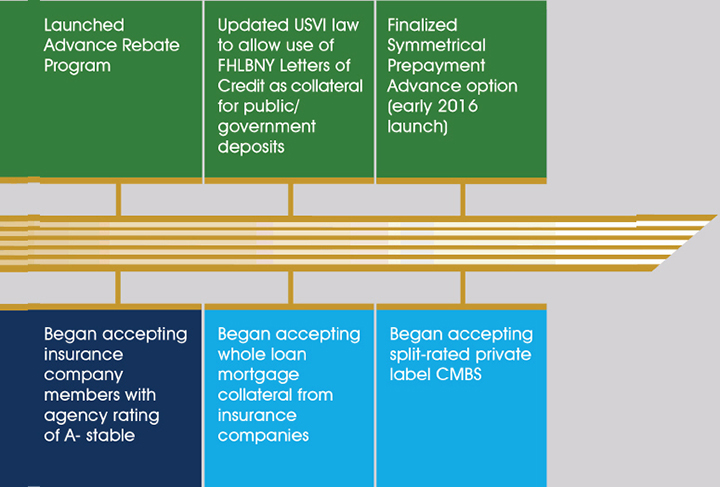

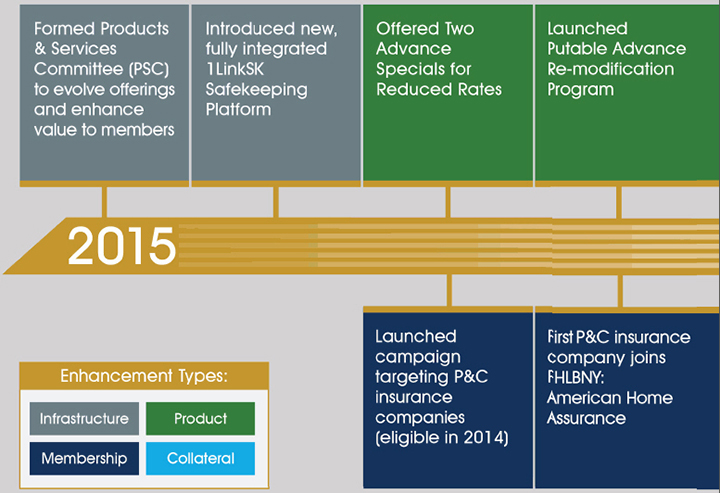

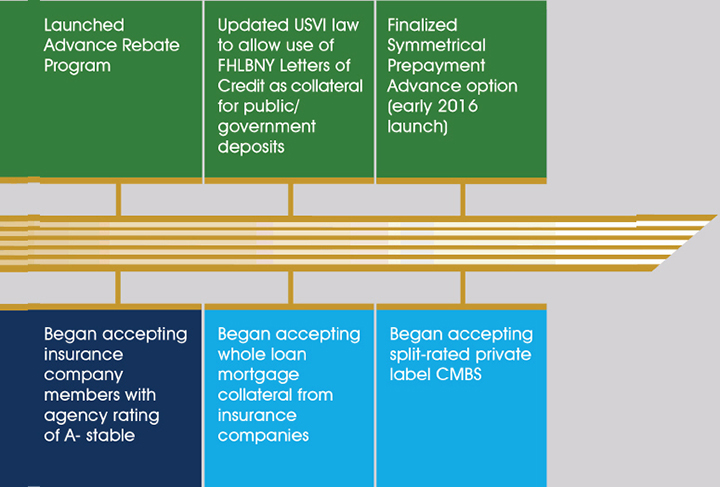

| Initiatives to Further Develop Business: 2015 — A Year of Enhancements |

18

In an effort to serve the evolving needs of our members, the FHLBNY continued to add value to the cooperative

though innovation and flexibility. In 2015, we worked with legislators and regulatory entities to expand eligibility for our well-performing Letter of Credit Program; improved infrastructure to better respond to member needs; developed new products

and enhancements to broaden funding options offered; and made changes to our collateral eligibility requirements to maximize member borrowing capacity.

If you have any questions, comments or feedback regarding our suite of products, programs and services, please contact

your Calling Officer at (212) 441-6700.

19

|

|

|

| FHLBNY Officers

(January 1 through December 31, 2015) |

|

|

José R. González

President & CEO

SENIOR VICE PRESIDENTS

Eric Amig

Head of Bank Relations

Stephen Angelo

Chief Audit Officer

Edwin Artuz

Head of Corporate Services & Director of the Office of Minority & Women Inclusion

Steve Christatos

Director, Compliance

John Edelen

Chief Risk Officer

Melody Feinberg

Deputy Chief Risk Officer

Bob Fusco

Chief Information Officer & Head of

Enterprise Services

Adam Goldstein

Chief

Business Officer

Paul Héroux

Chief Bank

Operations Officer & Community Investment Officer

Kevin Neylan

Chief Financial Officer

Philip Scott

Chief Capital Markets Officer

Jonathan West

Chief Legal Officer

VICE PRESIDENTS

Backer Ali

Controller

James Bernard*

Director, Member Services Operations

Sean Borde

Director, Project Management Office

John Brandon

Senior Manager,

Business Research &

Development

Kenneth Brothers

Director,

Information Security Office

Muriel Brunken

Senior Manager, Acquired Member Assets

Judy Chiu

Senior Manager, Derivatives Accounting

& Operations

Officer

Joseph Creighton*

Senior Manager,

Portfolio Officer & Acquired Member Assets Controller

Mark Dankenbrink

Senior Manager, Financial Audits

Bernard DeSiena

Senior Manager, Application Services

Thomas

Doyle*

Director, Acquired Member Assets

Brian

Finnegan

Assistant Corporate Secretary

Paul

Friend

General Counsel

Bryan Gallagher

Director, Collateral Valuation & Analysis

Joseph Gallo*

Community Investment Officer

Robert Havanki*

Director, Business Technology

Rodger Hicks

Director, Technical Services

Susan Isquith

Director, Credit Risk Management

Maureen Kalena

Calling Officer

Claudia Kim

Director, Management Reporting

Phillip Mack

Manager, Credit & Collateral Risk

Analytics

Gregory Marposon

Financial Risk

Walter Moran

Director, Facilities Services

Sandra Napoleon*

Senior Manager, Quality

Assurance

Alfred O’Connell

Calling Officer

Deborah Palladino

Director, Collateral

Analytical Services

Diahann Rothstein

Director,

Investment & Portfolio Management

Edward Samson

Senior Manager, Reporting

Thomas Settino

Director, Sales

Rei Shinozuka

Director, Strategic, Operational,

& Model Risk

Management

Candice Soldano

Director,

Marketing & Corporate Events

Louis Solimine

Director, Funding & Derivatives/ Treasurer

Alexies Sornoza

Calling Officer

Mildred Tse-Gonzalez

Director, Human Resources

Michael Volpe

Director, Member Services Operations

Barbara Way

Assistant General Counsel

ASSISTANT VICE PRESIDENTS

Jessey Abraham

Compliance Officer

Mary Alvarez

Residential Loan Review Officer

Beth Bentley

Affordable Housing Officer -

Senior Community Investment Analyst

James Boyle

Senior Manager, Operational Risk

Erika Buglione

Manager, Quality Assurance

Christine Campbell

Manager, Electronic Payments

Michael Desiderio

Senior Manager, Credit Services

Joseph Garofalo

Risk Management Audit Manager

Sekar Gopinathan

Architectural Services Manager

Sheharyar Hasan

Manager, Investment & Portfolio Management

Mimi

Hur

Financial/Operational Audit Manager

Jason Kannenberg

Senior Manager,

Network Storage & Security

Services

Ahmet Kargi

Senior Manager,

Systems & Operations Services

Eugene Khesin

Trader Analyst

Kenneth Knight

Commercial Loan Review Officer

Kristen Lalama

Senior Credit Risk Officer

Christina Levatino

Senior Manager,

Information Technology Audit

Anthony Merli

Credit/Capital Markets Audit Manager

Ching Ngai

Manager, Financial Reporting

Bruce Petersel

Accounting Policy Officer

Frederick Puorro

Senior Credit Risk Officer

Angel Santos

Calling Officer

Anthony Scalzo

Custody & Pledging Services

Officer

Eric Shumsky

Senior Manager,

Systems & Support Services

Alberto Suarez

Risk Reporting Manager

Eric Suber

Senior Manager, Database Services

Catherine Sze

Manager, Management Reporting

Benjamin Tan

Assistant Treasurer

Kimberly Whitenack

Model Validation Manager

Brian Wiedl

Manager, Records & Continuity Services

20