Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Imprivata Inc | impr-ex311_7.htm |

| EX-31.2 - EX-31.2 - Imprivata Inc | impr-ex312_6.htm |

| EX-10.1 - EX-10.1 - Imprivata Inc | impr-ex101_151.htm |

| 10-Q - 10-Q - Imprivata Inc | impr-10q_20160331.htm |

| EX-32.1 - EX-32.1 - Imprivata Inc | impr-ex321_8.htm |

Exhibit 10.2

Brookfield

Imprivata, Inc.

Monadnock Building

685 Market Street

|

|

BASIC LEASE PROVISIONS |

|

1 |

|

|

|

|

|

|

|

|

2. |

|

PROJECT |

|

2 |

|

|

|

|

|

|

|

3. |

|

TERM |

|

4 |

|

|

|

|

|

|

|

4. |

|

RENT |

|

5 |

|

|

|

|

|

|

|

5. |

|

USE & OCCUPANCY |

|

7 |

|

|

|

|

|

|

|

6. |

|

SERVICES & UTILITIES |

|

8 |

|

|

|

|

|

|

|

7. |

|

REPAIRS |

|

10 |

|

|

|

|

|

|

|

8. |

|

ALTERATIONS |

|

10 |

|

|

|

|

|

|

|

9. |

|

INSURANCE |

|

12 |

|

|

|

|

|

|

|

10. |

|

DAMAGE OR DESTRUCTION |

|

13 |

|

|

|

|

|

|

|

11. |

|

INDEMNITY |

|

14 |

|

|

|

|

|

|

|

12. |

|

CONDEMNATION |

|

14 |

|

|

|

|

|

|

|

13. |

|

TENANT TRANSFERS |

|

15 |

|

|

|

|

|

|

|

14. |

|

LANDLORD TRANSFERS |

|

16 |

|

|

|

|

|

|

|

15. |

|

DEFAULT AND REMEDIES |

|

17 |

|

|

|

|

|

|

|

16. |

|

LETTER OF CREDIT; FINANCIAL STATEMENTS |

|

19 |

|

|

|

|

|

|

|

17. |

|

MISCELLANEOUS |

|

20 |

|

|

|

|

|

|

|

18. |

|

BROKERS |

|

22 |

|

|

|

|

|

|

|

|

TENANT’S SECURITY SYSTEM |

|

22 |

List of Exhibits

EXHIBIT A – LOCATION OF PREMISES

EXHIBIT B – RULES & REGULATIONS

EXHIBIT C – NOTICE OF LEASE TERM

EXHIBIT D – WORK LETTER

i

|

A |

|

|

|

L |

|

|

|

Additional Construction Allowance |

|

D-4 |

|

Land |

|

3 |

|

Additional Insured |

|

13 |

|

Landlord |

|

1 |

|

Additional Rent |

|

5 |

|

Landlord Delay |

|

D-2 |

|

Affiliates |

|

15 |

|

Landlord’s Compliance Work |

|

D-1 |

|

Alterations |

|

11 |

|

Landlord’s Contractor |

|

D-3 |

|

Amortization Rate |

|

7 |

|

Landlord’s Representative |

|

D-1 |

|

As-Built Drawings |

|

D-3 |

|

Landlord’s Security System |

|

24 |

|

B |

|

|

|

Landlord’s Work |

|

D-1 |

|

Bank |

|

20 |

|

Late Charge |

|

8 |

|

Base Building |

|

3 |

|

LC Amount |

|

1 |

|

Base Rent |

|

1 |

|

LC Expiration Date |

|

21 |

|

Base year |

|

1 |

|

Lease |

|

1 |

|

Bid Summary |

|

D-3 |

|

Leasehold Improvements |

|

3 |

|

Billing Address |

|

2 |

|

Letter of Credit |

|

20 |

|

Brokers |

|

2 |

|

Liability Limit |

|

2 |

|

Building |

|

1 |

|

M |

|

|

|

Building Standard |

|

4 |

|

Mandated Expenses |

. |

6 |

|

Building Structure |

|

3 |

|

Mechanical Systems |

|

3 |

|

Business Hours |

|

2 |

|

Month |

|

4 |

|

C |

|

|

|

N |

|

|

|

Change Order |

|

D-2 |

|

NLT |

|

4 |

|

Claims |

|

15 |

|

Notice Addresses |

|

1 |

|

Commencement Date |

|

4 |

|

P |

|

|

|

Common Areas |

|

3 |

|

Permitted Transferee |

|

16 |

|

Comparison year |

|

5 |

|

Premises |

|

1 |

|

Construction Allowance |

|

2 |

|

Project |

|

3 |

|

Construction Drawings |

|

D-2 |

|

Q |

|

|

|

Construction Schedule |

|

D-1 |

|

Quality Expenses |

|

6 |

|

Cost-Saving Expenses |

|

6 |

|

R |

|

|

|

D |

|

|

|

REIT |

|

II |

|

Dale |

|

1 |

|

Relocation Notice |

|

22 |

|

Default |

|

19 |

|

Renovations |

|

12 |

|

Default Rate |

|

20 |

|

Rent |

|

7 |

|

Design Problem |

|

11 |

|

Repair Estimate |

|

14 |

|

E |

|

|

|

Replacement Premises |

|

22 |

|

Encumbrance |

|

18 |

|

Retention |

|

D-3 |

|

Estimated Additional Rent |

|

7 |

|

RSF |

|

4 |

|

Expenses |

|

5 |

|

S |

|

|

|

Expiration Date |

|

4 |

|

Scheduled Commencement Date |

|

1 |

|

F |

|

|

|

Scheduled Term |

|

1 |

|

Force Majeure |

|

20 |

|

Service Provider |

|

11 |

|

Force Majeure Delay |

|

D-2 |

|

Space Plans |

|

D-2 |

|

H |

|

|

|

Standard Services |

|

9 |

|

Hazardous Materials |

|

8 |

|

Substantially Complete |

|

D-5 |

|

Holdover |

|

4 |

|

Successor Landlord |

|

18 |

|

Holidays |

|

2 |

|

T |

|

|

|

HVAC |

|

9 |

|

Taking |

|

16 |

|

I |

|

|

|

Taxes |

|

5 |

|

Interruption Estimate |

|

14 |

|

Telecommunication Services |

|

10 |

|

|

|

|

|

Tenant |

|

1 |

ii

|

|

D-1 |

|

Transferee |

|

16 |

|

|

Tenant’s Architect |

|

D-2 |

|

U |

|

|

|

Tenant’s Personal Property |

|

4 |

|

Untenantable |

|

14 |

|

Tenant’s Personnel |

|

D-3 |

|

Use |

|

1 |

|

Tenant’s Representative. |

|

D-1 |

|

USF |

|

4 |

|

Tenant’s Security System |

|

24 |

|

W |

|

|

|

Tenants Share |

|

1 |

|

Work Costs |

|

D-4 |

|

Tenant’s Wiring |

|

10 |

|

Y |

|

|

|

Tenant’s Work |

|

D-3 |

|

Year |

|

4 |

|

Term |

|

4 |

|

|

|

|

|

Transfer |

|

16 |

|

|

|

|

iii

Landlord and Tenant enter into this Lease (“Lease”) as of the Date on the following terms, covenants, conditions; and provisions:

|

1. |

BASIC LEASE PROVISIONS |

|

|

1.1 |

Basic Lease Definitions. |

In this Lease, the following defined terms have the meanings indicated. |

|

|

|

|

|

|

|

(a) |

Date: |

March 31, 2016 |

|

|

|

|

|

|

|

(b) |

Landlord: |

BOP 685 Market LLC, a Delaware limited liability company. |

|

|

|

|

|

|

|

(c) |

Tenant: |

Imprivata, Inc., a Delaware corporation |

|

|

|

|

|

|

|

(d) |

Building: |

685 Market Street, San Francisco, California, deemed to contain: |

|

|

|

|

203,161 RSF |

|

|

|

|

|

|

|

(e) |

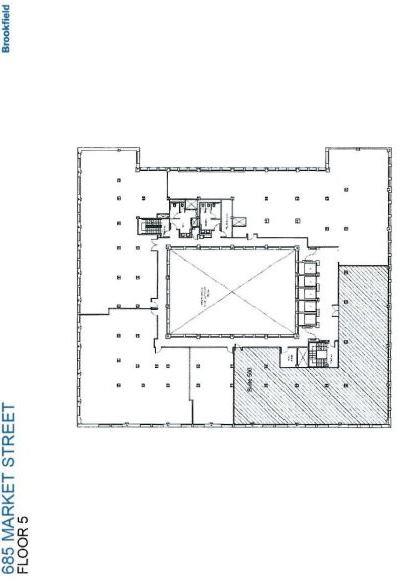

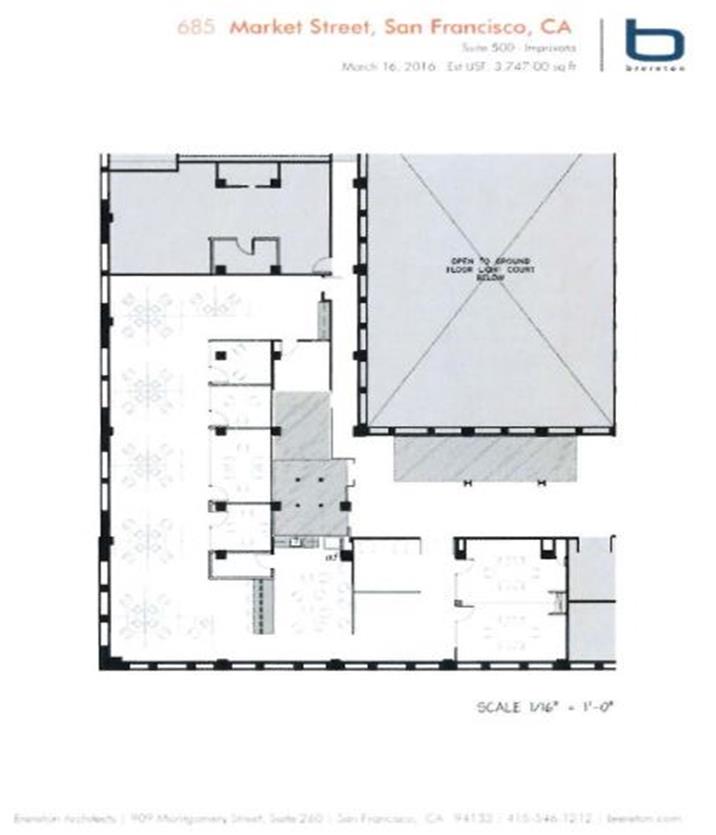

Premises: |

Suite 500 (identified on Exhibit A), located in the Building and deemed to contain: |

|

|

|

|

5,029 RSF |

|

|

|

|

|

|

|

(f) |

Use: |

General administrative non-governmental office use consistent with that of a first-class office building. |

|

|

|

|

|

|

|

(g) |

Scheduled Term: |

85 Months |

|

|

|

|

|

|

|

(h) |

Scheduled |

June 1, 2016. |

|

|

|

Commencement Date: |

|

|

|

|

|

|

|

|

(i) |

Base Rent: |

The following amounts, payable in accordance with Article 4: |

|

Period |

Annual Rate |

Annual Base Rent |

Monthly Base Rent |

|

Months 1 to 12 |

$75.00 |

$377,175.00 |

$31,431.25 |

|

Months 13 to 24 |

$77.25 |

$388,490.28 |

$32,374.19 |

|

Months 25 to 36 |

$79.57 |

$400,157.52 |

$33,346.46 |

|

Months 37 to 48 |

$81.96 |

$412,176.84 |

$34,348.07 |

|

Months 49 to 60 |

$84.42 |

$424,548.24 |

$35,379.02 |

|

Months 61 to 72 |

$86.95 |

$437,271.60 |

$36,439.30 |

|

Months 73 to·84 |

$89.56 |

$450,397.20 |

$37,533.10 |

|

Month 85 |

$92.25 |

$463,925.28 |

$38,660.44 |

Notwithstanding the foregoing, and provided that Tenant is not then in Default of this Lease (with all applicable notices having been given and cure periods having expired), Landlord will excuse Tenant from the payment of Base Rent, only, otherwise payable during Month 1 of the initial Term.

|

|

(j) |

Tenant’s Share: |

2.48% |

|

|

|

|

|

|

|

(k) |

Base Year: |

The calendar year 2016 |

|

|

|

|

|

|

|

(l) |

LC Amount: |

$270,623.08. Such LC Amount shall be periodically subject to reduction and subject to conversion in accordance with Article 16 of this Lease. |

|

|

|||

|

|

|

|

|

|

|

(m) |

Notice Address: |

For each party, the following address(es): |

1

|

|

To Landlord |

To Tenant |

|

|

BOP 685 Market, LLC |

Imprivata, Inc. |

|

|

685 Market Street, Suite 520 |

10 Maguire Rd. |

|

|

San Francisco, California 94105 |

Lexington, MA 02421 |

|

|

Attn: General Manager |

Attn: Kelliann McCabe |

|

|

|

|

|

|

with a copy to: |

|

|

|

|

|

|

|

Brookfield Properties Management |

|

|

|

601 S. Figueroa Street, Suite 2200 |

|

|

|

Los Angeles, California 90017 |

|

|

|

Attn: VP, Regional Counsel |

|

|

|

(n) |

Billing Address: |

For each party, the following address: |

|

|

For Landlord |

For Tenant |

|

|

|

Via U.S. Mail |

Imprivata, Inc. |

|

|

|

BOP 685 Market LLC |

10 Maguire Rd. |

|

|

|

PO Box 62905 |

Lexington, MA 02421 |

|

|

|

Baltimore, MD 21264-2905 |

Attn: Kelliann McCabe |

|

|

|

|

Email: payables@imprivata.com |

|

|

|

Via Overnight Courier |

|

|

|

|

BOP 685 Market LLC |

|

|

|

|

Box# 62905 |

|

|

|

|

1800 Washington Boulevard |

|

|

|

|

Baltimore, MD 21230 |

|

|

|

|

|

|

|

|

|

Via Electronic Transfer |

|

|

|

|

Bank: |

Manufacturers & Traders |

|

|

|

|

Trust Co. |

|

|

|

Acct. Name: |

BOP 685 Market LLC |

|

|

|

Acct. No.: |

9859352131 |

|

|

|

ABA No.: |

022000046 |

|

|

|

Ref: |

Invoice # |

|

|

|

(o) |

Brokers: |

Brookfield Properties Management (CA) Inc. and Jones Lang LaSalle Brokerage Inc. (for Landlord); and T3 Advisors (for Tenant). |

|

|

|

|

|

|

|

(p) |

Liability Limit |

A minimum combined single limit of liability of at least $1,000,000 per occurrence and a general aggregate limit of at least $2,000,000, and in addition, excess liability insurance on a following form basis, with overall limits of at least $5,000,000. |

|

|

|

|

|

|

|

(q) |

Construction Allowance: |

$377,175.00 (i.e., $75.00 per RSF of the Premises) for the payment of Work Costs in accordance with the Work Letter attached to this Lease as Exhibit D. |

|

|

|

|

. |

|

|

(r) |

Business Hours: |

From 7:00 a.m. to 6:00 p.m., Monday through Friday, except for the days observed for: New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, Christmas Day and, at Landlord’s discretion, other locally or nationally recognized holidays that are observed by other buildings of comparable class in the locale of the Building (“Holidays”). |

|

2. |

PROJECT |

2.1 Project. The Land, Building, and Common Areas (as defined in §1 and below) are collectively referred to as the “Project.” As of the Date, the Project is commonly known as “The Monadnock Building.”

2.2 Land. “Land” means the real property on which the Building and Common Areas are located, including casements and other rights that benefit or encumber the real property. Landlord’s interest in the Land may be in fee or a leasehold. The Land may be expanded or reduced after the Date.

2

2.3 Base Building. “Base Building” means the Building Structure and Mechanical Systems, collectively, defined as follows:

|

|

(a) |

Building Structure. “Building Structure” means the structural components in the Building, including foundations, floor and ceiling slabs, roofs, exterior walls, exterior glass and mullions, columns, beams, shafts, and emergency stairwells. The Building Structure excludes the Leasehold Improvements (and similar improvements to other premises) and the Mechanical Systems. |

|

|

(b) |

Mechanical Systems. “Mechanical Systems” means the mechanical, electronic, physical or informational systems generally serving the Building or Common Areas, including the sprinkler, plumbing, heating, ventilating, air conditioning, lighting, communications, security, drainage, sewage, waste disposal, vertical transportation, and fire/life safety systems. |

2.4 Common Areas. Tenant will have a non-exclusive right to use the Common Areas subject to the terms of this Lease. “Common Areas” means those interior and exterior common and public areas on the Land (and appurtenant easements) and in the Building designated by Landlord for the non-exclusive use by Tenant in common with Landlord, other tenants and occupants, and their employees, agents and invitees.

2.5 Premises. Landlord leases to Tenant the Premises subject to the terms of this Lease. Except as provided elsewhere in this Lease, by taking possession of the Premises Tenant accepts the Premises in its “as is” condition and with all faults, and the Premises is deemed in good order, condition, and repair. The Premises includes the Leasehold Improvements and excludes certain areas, facilities and systems, as follows:

|

|

(a) |

Leasehold Improvements. “Leasehold Improvements” means all non-structural improvements in the Premises or exclusively serving the Premises, and any structural improvements to the Building made to accommodate Tenant’s particular use of the Premises. The Leasehold Improvements may exist in the Premises as of the Date, or be installed by Landlord or Tenant under this Lease at the cost of either party. The Leasehold Improvements include: (1) interior walls and partitions (including those surrounding structural columns entirely or partly within the Premises); (2) the interior one-half of walls that separate the Premises from adjacent areas designated for leasing; (3) the interior drywall on exterior structural walls, and walls that separate the Premises from the Common Areas; (4) stairways and stairwells connecting parts of the Premises on different floors, except those required for emergency exiting; (5) the frames, casements, doors, windows and openings installed in or on the improvements described in the foregoing clauses (1) through (4), or that provide entry/exit to/from the Premises; (6) all hardware, fixtures, cabinetry, railings, paneling, woodwork and finishes in the Premises or that are installed in or on the improvements described in the foregoing clauses (1) through (5); (7) if any part of the Premises is on the ground floor, the ground floor exterior windows (including mullions, frames and glass); (8) integrated ceiling systems (including grid, panels and lighting); (9) carpeting and other floor finishes; (10) kitchen, rest room, laboratory or other similar facilities that exclusively serve the Premises (including plumbing fixtures, toilets, sinks and built-in appliances); and (11) the sprinkler, plumbing, heating, ventilating, air conditioning, electrical, metering, lighting, communications, security, drainage, sewage, waste disposal, vertical transportation, fire/life safety, and other mechanical, electronic, physical or informational systems that exclusively serve the Premises, including the parts of each system that are connected to the Mechanical Systems from the common point of distribution for each system to and throughout the Premises. The Leasehold Improvements exclude Tenant’s Personal Property (defined below). |

|

|

(b) |

Exclusions from the Premises. The Premises does not include: (1) any areas above the finished ceiling or integrated ceiling systems, or below the finished floor coverings that are not part of the Leasehold Improvements, (2) janitor’s closets, (3) stairways and stairwells to be used for emergency exiting or as Common Areas, (4) rooms for Mechanical Systems or connection of telecommunication equipment, (5) vertical transportation shafts, (6) vertical or horizontal shafts, risers, chases, flues or ducts, and (7) any casements or rights to natural light, air or view. |

2.6 Building Standard. “Building Standard” means the minimum or exclusive type, brand, quality or quantity of materials Landlord designates for use in the Building from time to time.

2.7 Tenant’s Personal Property. “Tenant’s Personal Property” means those trade fixtures, furnishings, equipment, work product, inventory, stock-in-trade and other personal property of Tenant that are not permanently affixed to the Project in a way that they become a part of the Project and will not, if removed, cause material damage to the Premises.

2.8 Area. “RSF” means rentable square feet or rentable square foot, as the context may require. “USF” means usable square feet or usable square foot, as the context may require.

2.9 Access Inspection Status. Pursuant to Section 1938 of the California Civil Code, Landlord hereby advises Tenant that the Premises, as delivered to Tenant, the Building and Project have not undergone an inspection by a Certified Access Specialist (“CASp”).

3

3.1 Term. “Term” means the period that begins on the Commencement Date and ends on the Expiration Date, subject to renewal, extension, or earlier termination as may be further provided in this Lease. “Month” means a full calendar month of the Term. “Year” means a full calendar year in which all or a part of the Term occurs.

|

|

(a) |

Commencement Date. “Commencement Date” means that date which is the earlier of: |

|

|

(1) |

The date that Tenant first conducts business in any part of the Premises; or |

|

|

(2) |

The date that Landlord tenders the Premises to Tenant with Landlord’s Work substantially complete or that earlier date that Landlord would have tendered possession of the Premises to Tenant with Landlord’s Work substantially complete but for Tenant Delay (as defined in the Work Letter attached to this Lease as Exhibit D). |

|

|

(b) |

Expiration Date. “Expiration Date” means the date that is the Scheduled Term (plus that many additional days required for the Expiration Date to be the last day of a Month) after the Commencement Date. |

|

|

(c) |

Early Occupancy. Except as set forth in the Work Letter, Tenant may not enter the Premises for any purpose until Landlord tenders the Premises to Tenant. If Tenant conducts business in any part of the Premises before the Scheduled Commencement Date, Tenant will pay Base Rent for that period at the rate for the first Month that Base Rent is due, without discount or excuse. |

|

|

(d) |

Late Occupancy. If Landlord fails to tender possession of the Premises to Tenant by the Scheduled Commencement Date, Landlord will not be in default of this Lease, but Tenant shall have no obligation to pay Rent until the Commencement Date where such delay is not the result of a Tenant Delay. |

|

|

(e) |

Confirmation of Term. Landlord shall notify Tenant of the Commencement Date using a Notice of Lease Term (“NLT”) in the form attached to this Lease as Exhibit C. Unless Tenant reasonably objects, Tenant shall execute and deliver to Landlord the NLT within 10 business days after its receipt, but Tenant’s failure to do so will not reduce Tenant’s obligations or Landlord’s rights under this Lease. |

3.2 Holdover. If Tenant keeps possession of the Premises after the Expiration Date (or earlier termination of this Lease) without Landlord’s prior written consent (a “Holdover”), which may be withheld in its sole discretion, then in addition to the remedies available elsewhere under this Lease or by law, Tenant will be a tenant-at-sufferance and must comply with all of Tenant’s obligations under this Lease (including the payment of Additional Rent), except that for each Month of Holdover Tenant will pay 150% of the Base Rent payable for the last Month of the Term (or that would have been payable but for abatement or excuse), without prorating for any partial Month of Holdover, plus Additional Rent for such period. Tenant shall indemnify and defend Landlord from and against all claims and damages, both consequential and direct, that Landlord suffers due to Tenant’s failure to return possession of the Premises to Landlord at the end of the Term. Landlord’s deposit of Tenant’s Holdover payment will not constitute Landlord’s consent to a Holdover, or create or renew any tenancy.

3.3 Condition on Expiration.

|

|

(a) |

Return of the Premises. At the end of the Term, Tenant will return possession of the Premises to Landlord vacant, free of Tenant’s Personal Property, in broom-clean condition, and with all Leasehold Improvements in in the condition delivered to Tenant (excepting ordinary wear and tear and casualty), except that Landlord may require Tenant, by notice at least 10 days before the expiration of the Term, to remove (and restore the Premises damaged by removal): |

|

|

(1) |

All Tenant’s Wiring; and |

|

|

(2) |

Any item of Leasehold Improvements or Alterations (other than Tenant’s Wiring) if either: |

|

|

(A) |

When Landlord consented to the installation of the improvement, Landlord reserved Landlord’s right to have Tenant remove the improvement at the end of the Term; or |

|

|

(B) |

Tenant failed to obtain Landlord’s written consent under §8.1(a) for an item of Alterations to become part of the Premises. |

|

|

(b) |

Correction by Landlord. If Tenant fails to return possession of the Premises to Landlord in the condition required under (a), then Tenant shall reimburse Landlord for the costs incurred by Landlord to put the Premises in the condition required under (a), plus Landlord’s standard administration fee. |

|

|

(c) |

Abandoned Property. Tenant’s Personal Property left behind in the Premises after the end of the Term will be considered abandoned and Landlord may move, store, retain, or dispose of these items at Tenant’s cost, including Landlord’s standard administration fee. |

4

4.1 Base Rent. Tenant shall prepay 1 Month’s installment of Base Rent (without any abatement) by the Date (i.e., $31,431.25), to be applied against Base Rent first due under this Lease. During the Term, Tenant shall pay all other Base Rent in advance, in equal Monthly installments, on the 1st of each Month. Base Rent for any partial Month will be prorated based on a 30-day month.

4.2 Additional Rent. Tenant’s obligation to pay Taxes and Expenses under this §4.2 is referred to in this Lease as “Additional Rent.”

|

|

(a) |

Taxes. For each full or partial Year after the Base Year in which the Term occurs (each, a “Comparison Year”), Tenant shall pay as in the manner described below the Tenant’s Share of the amount that Taxes for the Comparison Year exceed Taxes for Ute Base Year. “Taxes” means the total costs incurred by Landlord for: (1) real and personal property taxes and assessments (including ad valorem and special assessments) levied on the Project and Landlord’s personal property used in connection with the Project; (2) taxes on rents or other income derived from the Building; (3) capital and place-of-business taxes; (4) taxes, assessments or fees in lieu of the taxes described in the foregoing clauses (1) through (3); and (5) the reasonable costs incurred to reduce the taxes described in the foregoing clauses (1) through (4). Taxes excludes net income taxes, documentary transfer taxes and taxes paid by Tenant under §4.3 (and any other tenant of the Building with a similar lease obligation). |

|

|

(b) |

Expenses. For each Comparison Year, Tenant shall pay in the manner described below the Tenant’s Share of the amount that Expenses for the Comparison Year exceed Expenses for the Base Year. “Expenses” means the total costs incurred by Landlord to operate, manage, administer, equip, secure, protect, repair, replace, refurbish, clean, maintain, decorate and inspect the Project, including a fee to manage the Project of 3% of the gross revenue of the Project. Expenses that vary with occupancy will be calculated as if the Building is 100% occupied and operating, with all utilities and services being provided to all tenants. |

|

|

(1) |

Expenses include: |

|

|

(A) |

Standard Services provided under §6.1; |

|

|

(B) |

Repairs and maintenance performed under §7.2; |

|

|

(C) |

Insurance maintained under §9.2 {including deductibles paid; provided, however, any deductibles in excess of $100,000 shall be amortized over a term of 10 years at an annual interest rate equal to the Amortization Rate (defined below), and the amortized costs thereof, but not in excess of $1.00 per RSF of the Building shall be included in Expenses in any Year); |

|

|

(D) |

Wages, salaries, and benefits of personnel of Landlord or its Affiliates to the extent they render services to the Project (including, without limitation, property accounting, technical services, and information technology services); |

|

|

(E) |

Costs of operating the Project management office (including reasonable rent); |

|

|

(F) |

Amortization installments of costs that are required to be capitalized and are incurred: |

|

|

(i) |

To comply with insurance requirements or laws enacted after the Commencement Date (“Mandated Expenses”); |

|

|

(ii) |

With the reasonable expectation of reducing Expenses or the rate of increase in Expenses (“Cost-Saving Expenses”); or |

|

|

(iii) |

That are reasonably calculated to improve or maintain the safety or health of Project occupants (“Quality Expenses”). |

|

|

(2) |

Expenses exclude: |

|

|

(A) |

Taxes; |

|

|

(B) |

Mortgage payments (principal and interest), and ground lease rent; |

|

|

(C) |

Commissions, advertising costs, attorney’s fees, and costs of improvements in connection with leasing space in the Building; |

|

|

(D) |

Costs reimbursed by insurance proceeds; |

|

|

(E) |

Depreciation; |

|

|

(F) |

Except for the costs identified in §4.2(b)(1)(F), costs required to be capitalized according to sound real estate accounting and management principles, consistently applied; |

5

|

|

(H) |

Costs to maintain and operate the entity that is Landlord (as opposed to operation and maintenance of the Project); |

|

|

(I) |

In the Base Year, only, installments of costs amortized under subsection (c)(1) and (c)(2) of this §4.2, unless such costs are included in Expenses in Lease Years subsequent to the Base Year, |

|

|

(J) |

The costs of utilities and services: |

|

|

(i) |

Set forth in subsections (4) and (9) of §6.l (a) that are provided to the Premises and to other tenanted premises in the Building, regardless of whether such Standard Services are subject to direct payment by Tenant or such other tenants of the Building pursuant to §6.2 or any similar lease provision; and |

|

|

(ii) |

Otherwise reimbursed by Tenant pursuant to §6.3, or by other tenants of the Building pursuant to any similar provision of their respective leases (and not as part of Additional Rent, or any similar lease provision for the sharing of Building costs); |

|

|

(K) |

Costs incurred by Landlord to comply with notices of violation of applicable Jaws, including the Americans With Disabilities Act, as amended, when such notices are for conditions existing prior to the Commencement Date that would have been a violation of applicable laws existing as of the Commencement Date; and |

|

|

(L) |

Penalties, fines, and associated legal expenses incurred by Landlord due to the violation by Landlord or any other tenant of the Building (other than Tenant) of applicable laws |

|

|

(c) |

Amortization and Accounting Principles. |

|

|

(1) |

Each item of Mandated Expenses and Quality Expenses will be fully amortized in equal annual installments, with interest on the principal balance at Amortization Rate, over the number of years that Landlord projects the item of Expenses will be productive for its intended use, without replacement, but properly repaired and maintained. |

|

|

(2) |

Each item of Cost-Saving Expenses will be fully amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over the number of years that Landlord reasonably estimates for the present value of the projected savings in Expenses (discounted at the Amortization Rate) to equal the cost. |

|

|

(3) |

Any item of Expenses of significant cost that is not required to be capitalized but is unexpected or does not typically recur may, in Landlord’s discretion, be amortized in equal annual installments, with interest on the principal balance at the Amortization Rate, over a number of years determined by Landlord. |

|

|

(4) |

“Amortization Rate” means the greater of (A) prime rate of Citibank, N.A. (or a comparable financial institution selected by Landlord) in effect as of the last day of the year in which the costs were incurred, plus 3%, or (B) the actual cost incurred by Landlord for financing. |

|

|

(5) |

Landlord may allocate Expenses and Taxes for the Project to various components of the Project on an equitable basis, or as required by any reciprocal easement agreement or common interest association agreement affecting the Project. |

|

|

(6) |

Subject to the specific provisions of this Article 4, Landlord will use sound real estate accounting and management principles, consistently applied, to determine Additional Rent. |

|

|

(d) |

Estimates. Landlord will reasonably estimate Additional Rent for each Comparison Year (“Estimated Additional Rent”). During each Comparison Year, Tenant will pay the Estimated Additional Rent in advance, in equal Monthly installments, on the first day of each Month of the Comparison Year. Landlord may reasonably revise the Estimated Additional Rent during a Comparison Year and the Monthly installments of Estimated Additional Rent for the remainder of the Comparison Year will be increased or decreased accordingly. Until Landlord provides Tenant with the Estimated Additional Rent for a Comparison Year, Tenant will continue to pay the Estimated Additional Rent for the prior Comparison Year. |

6

4.3 Tenant’s Taxes. Upon demand, Tenant will reimburse Landlord for taxes paid by Landlord, other than net income taxes, on (a) Tenant’s Personal Property, (b) Rent, (c) Tenant’s occupancy of the Premises, or (d) this Lease. If Tenant cannot lawfully reimburse Landlord for these taxes, then the Base Rent will be increased to yield to Landlord the same amount after these taxes were imposed as Landlord would have received before these taxes were imposed.

4.4 Terms of Payment. “Rent” means all amounts payable by Tenant under this Lease and the exhibits, including Base Rent and Additional Rent. If a time for payment of an item of Rent is not specified in this Lease, then Tenant will pay Rent within 30 days after receipt of Landlord’s statement or invoice. Unless otherwise provided in this Lease, Tenant shall pay Rent without notice, demand, deduction, abatement, or setoff, in lawful U.S. currency, at Landlord’s Billing Address. Landlord will send invoices payable by Tenant to Tenant’s Billing Address; however, neither Landlord’s failure to send an invoice nor Tenant’s failure to receive an invoice for Base Rent (and installments of Estimated Additional Rent) will relieve Tenant of its obligation to timely pay Base Rent (and installments of Estimated Additional Rent). Any partial payment of Rent by Tenant will be considered a payment on account. No endorsement or statement on any Rent check or any letter accompanying Rent will be deemed an accord and satisfaction, affect Landlord’s right to collect the full Rent due, or require Landlord to apply any payment to any Rent other than Rent earliest due. No payment by Tenant to Landlord will be deemed to extend the Term or render any notice, pending suit or judgment ineffective. By notice to the other, each party may change its Billing Address.

4.5 Late Payment. If Landlord does not receive all or part of any item of Rent when due, then Tenant shall pay Landlord 5% of the overdue Rent, plus interest on the unpaid Rent at the Default Rate from the date due until paid (collectively, a “Late Charge”) as Rent. Tenant agrees that the Late Charge is not a penalty, and will compensate Landlord for costs not contemplated under this Lease that are impracticable or extremely difficult to fix. Landlord’s acceptance of a Late Charge does not waive any applicable Tenant’s Default. Notwithstanding the foregoing, Landlord will waive a Late Charge otherwise due from Tenant if:

|

|

(a) |

Tenant notifies Landlord in writing of Tenant’s claim for waiver of the Late Charge within 30 days after Tenant’s receipt of Landlord’s invoice for the Late Charge; |

|

|

(b) |

Tenant has neither incurred a Late Charge nor received a waiver of a Late Charge in the 12 consecutive Months before the due date of the late payment; |

|

|

(c) |

Tenant is not in Default; and |

|

|

(d) |

Tenant has paid Landlord the overdue amount. |

|

5. |

USE & OCCUPANCY |

5.1 Use. Tenant shall use and occupy the Premises only for the Use. Landlord does not represent or warrant that the Project is suitable for the conduct of Tenant’s particular business.

5.2 Compliance with Laws and Directives.

|

|

(a) |

Tenant’s Compliance. Subject to the remaining terms of this Lease, Tenant shall comply at Tenant’s expense with all laws and reasonable directives of Landlord’s insurers concerning: |

|

|

(1) |

The Leasehold Improvements and Alterations, |

|

|

(2) |

Tenant’s use or occupancy of the Premises, |

|

|

(3) |

Tenant’s employer/employee obligations, |

|

|

(4) |

A condition created by Tenant, its Affiliates or their contractors or invitees, |

|

|

(5) |

Tenant’s failure to comply with this Lease, |

7

|

|

(7) |

Any chemical wastes, contaminants, pollutants or substances that are hazardous, toxic, infectious, flammable or dangerous, or regulated by any local, state or federal statute, rule, regulation or ordinance for the protection of health or the environment (“Hazardous Materials”) that are introduced to the Project, handled or disposed, by Tenant or its Affiliates, or any of their contractors; provided, however, that this Section 5.2(a) shall not require Tenant to correct construction defects in Landlord’s Work or effectuate capital improvements or repairs (other than with respect to the Leasehold Improvements and/or Tenant’s Alterations). |

|

|

(b) |

Landlord’s Compliance. The cost of Landlord’s compliance with laws or directives of Landlord’s insurers concerning the Project, other than those that are Tenant’s obligation under subsection (a), will be included in Expenses to the extent allowed under §4.2. |

5.3 Occupancy. Tenant shall not interfere with Building services or other tenants’ rights to quietly enjoy their respective premises or the Common Areas. Tenant shall not make or continue a nuisance, including any objectionable odor, noise, fire hazard, vibration, or wireless or electromagnetic transmission. Tenant will not maintain any Leasehold Improvements or use the Premises in a way that increases the cost of insurance required under §9.2, or requires insurance in addition to the coverage required under §9.2.

5.4 OFAC Certification. Tenant represents that: (a) Tenant is not now and has never been listed or named as a Blocked Person, or (b) Tenant is not now and has never been acting directly or indirectly for, or on behalf of, any Blocked Person. “Blocked Person” means any person, group, entity or nation designated by the United States Treasury Department as a terrorist or a “Specially Designated National and Blocked Person,” or that is a banned or blocked person, entity, nation under any law, order, rule or regulation that is enforced or administered by the Office of Foreign Assets Control.

|

6. |

SERVICES & UTILITIES |

6.1 Standard Services.

|

|

(a) |

Standard Services Defined. “Standard Services” means: |

|

|

(1) |

Condenser water for the operation of heating, ventilation and air-conditioning (“HVAC”) equipment serving the Premises during Business Hours, to the extent reasonably required to comfortably use and occupy the Premises. |

|

|

(2) |

HVAC during Business hours to the extent reasonably required to comfortably use and occupy the interior Common Areas; |

|

|

(3) |

Tempered water from the public utility for use in Common Areas rest rooms, and for use in customary kitchen facilities that may be in the Premises; |

|

|

(4) |

Subject to §6.2, janitorial services to the Premises and interior Common Areas 5 days a week, except Holidays, to the extent customarily provided in office buildings in the San Francisco financial district and SOMA submarkets which are comparable in quality, location and prestige to the Building; |

|

|

(5) |

Access to the Premises (by at least 1 passenger elevator if not on the ground floor) 24 hours a day, 365 days per year; |

|

|

(6) |

Replacement of, and Labor to replace, fluorescent tubes and ballasts in Building Standard light fixtures in the Premises and in the Common Areas; |

|

|

(7) |

Building access control services; |

|

|

(8) |

Electricity from Landlord’s selected provider(s) for Common Areas lighting; and |

|

|

(9) |

Subject to §6.2, electricity from Landlord’s selected provider(s) for the provision of the following in and to the Premises: |

|

|

(A) |

Lighting, |

|

|

(B) |

Convenience outlets for the operation of customary office equipment, and |

|

|

(C) |

The operation of HVAC equipment; |

provided, however, that the connected load for the uses under subsections (A) and (B) will not exceed 6 watts per USF of the Premises.

8

|

|

will be included in Expenses. Landlord is not responsible for any inability to provide Standard Services due to either: a concentration of personnel or equipment in the Premises in excess of that customary for the general administrative office use; or Tenant’s use of equipment in the Premises that is not customary office equipment or has special cooling requirements. |

6.2 Direct Charge for Electricity and Janitorial Services. Tenant will pay as Rent the costs incurred by Landlord to provide those Standard Services set forth in subsections (4) and (9) of §6.1(a) subject to the following:

|

|

(a) |

Tenant’s total consumption of electricity in the Premises, including lighting, convenience outlets, and HVAC units, will be separately metered with Building Standard meters to be installed and maintained at Tenant’s cost and expense (and which will constitute part of the Leasehold Improvements and may be included as a Work Cost pursuant to the Work Letter). Landlord may, but will not be required to, install an energy management and billing system to read such meters and determine the cost incurred by Landlord of Tenant’s electrical usage (which system will be part of the Mechanical System) based upon any or all of the following, as applicable: (i) the actual cost per kilowatt to which Landlord is subject to charge by the utility providing service to the Building, as determined by Landlord’s energy management and billing system. |

|

|

(b) |

The charge to Tenant for janitorial services provided to Tenant as a part of Standard Services will be the product of (i) the USF of the Premises, and (ii) the cost per USF of janitorial services provided to tenanted premises of the Building as part of Standard Services (as opposed to costs incurred with respect to the Common Areas, which will be included in Expenses). |

6.3 Additional Services. Landlord will provide utilities and services in excess of the Standard Services subject to the following:

|

|

(a) |

HVAC. If Tenant requests condenser water for HVAC service to the Premises during non-Business Hours, Tenant will pay as Rent Landlord’s scheduled rate for this service. |

|

|

(b) |

Lighting. Landlord may elect to furnish non-Building Standard lamps, bulbs, ballasts, and starters that are part of the Leasehold improvements for purchase by Tenant at Landlord’s cost, plus Landlord’s standard administration fee. Landlord will install such items at Landlord’s scheduled rate for this service. |

|

|

(c) |

Other Utilities and Services. Tenant will pay as Rent the actual cost of utilities or services (other than those directly charged pursuant to §6.2, or delineated in subsections (a) and (b) of this §6.1) either used by Tenant or provided at Tenant’s request in excess of that provided as part of the Standard Services, plus Landlord’s standard administration fee. Tenant’s excess consumption may be estimated by Landlord unless either Landlord requires or Tenant elects to install Building Standard meters to measure Tenant’s consumption. |

|

|

(d) |

Additional Systems and Metering. Landlord may require Tenant, at Tenant’s expense, to upgrade or modify existing Mechanical Systems serving the Premises or the Leasehold Improvements to the extent necessary to meet Tenant’s excess requirements, including installation of Building Standard meters in addition to those meters required under §6.2(a) to measure the same. |

6.4 Telecommunication Services. Tenant will contract directly with third party providers and will be solely responsible for paying for all telephone, data transmission, video and other telecommunication services (“Telecommunication Services”) subject to the following:

|

|

(a) |

Providers. Each Telecommunication Services provider that does not already provide service to the Building shall be subject to Landlord’s approval, which Landlord may withhold in Landlord’s sole discretion. Without liability to Tenant, the license of any Telecommunication Services provider servicing the Building may be terminated under the terms of the license, or not renewed upon the expiration of the license. |

|

|

(b) |

Tenant’s Wiring. Landlord may, in its sole discretion, designate the location of all wires, cables, fibers, equipment, and connections (“Tenant’s Wiring”) for Tenant’s Telecommunication Services, restrict and control access to telephone cabinets and rooms. Tenant may not use or access the Base Building, Common Areas or roof for Tenant’s Wiring without Landlord’s prior written consent, which Landlord may withhold in Landlord’s sole discretion. Tenant’s Wiring will be subject to removal in accordance with §3.3. |

|

|

(c) |

No Beneficiaries. This §6.4 is solely for Tenant’s benefit, and no one else shall be considered a beneficiary of these provisions. |

6.5 Special Circumstances. Without breaching this Lease or creating any liability on the part of Landlord, Landlord may interrupt, limit or discontinue any utility or services Landlord provides under this Article 6 under any of the following circumstances: (a) without notice, in an emergency; (b) with reasonable notice, to comply with laws; (c) with reasonable notice, to conform to

9

voluntary government or industry guidelines; (d) with reasonable advance notice, to repair and maintain the Project under §7.2 (including scheduled annual Building-wide shutdowns; or (e) with reasonable notice, to modify, perform Renovations or improve the Project under §8.2. If as a result of any interruption, limitation or discontinuance of any utility or services under clause (c), (d) or (e) of this §6.5, the Premises are Untenantable (as defined in §10.1(a)) and Tenant does not actually use all or part of the Premises as a result thereof, then Tenant’s Rent will be abated to the same extent as if Untenantable due to damage or destruction, in the manner of and subject to the provisions of §10.2.

6.6 REIT Compliance. If Landlord or any affiliate of Landlord has elected to qualify as a real estate investment trust (“REIT”), any service required or permitted to be performed by Landlord pursuant to this Lease, the charge or cost of which may be treated as impermissible tenant service income under the laws governing a REIT, may be performed by an independent contractor of Landlord, Landlord’s property manager, or a taxable REIT subsidiary that is affiliated with either Landlord or Landlord’s property manager (each, a “Service Provider”). If Tenant is subject to a charge under this Lease for any such service, then at Landlord’s direction Tenant will pay the charge for such service either to Landlord for further payment to the Service Provider or directly to the Service Provider and, in either case (a) Landlord will credit such payment against any charge for such service made by Landlord to Tenant under this Lease, and (b) Tenant’s payment of the Service Provider will not relieve Landlord from any obligation under the Lease concerning the provisions of such services.

|

7. |

REPAIRS |

7.1 Tenant’s Repairs. Except as provided in Articles 10 and 12 and subject to Article 11, during the Term Tenant shall, at Tenant’s cost, repair, maintain and replace, if necessary, the Leasehold Improvements and keep the Premises in the condition delivered to Tenant, subject to ordinary wear and tear and casualty. Tenant’s work under this §7.l must be (a) approved by Landlord before commencement, (b) supervised by Landlord at Tenant’s cost, if Landlord so reasonably requires, (c) performed in compliance with laws and Building rules and regulations, and (d) performed lien free and in a first-class manner with materials of at least Building Standard.

7.2 Landlord’s Repairs. Except as provided in Articles 10 and 12, during the Term Landlord shall repair, maintain and replace, if necessary, all parts of the Project that are not Tenant’s responsibility under §7.1, or any other tenant’s responsibility under their respective lease, and otherwise keep the Project in good order and condition according to the standards prevailing for comparable office buildings in the area in which the Building is located. Except in an emergency, Landlord will use commercially reasonable efforts to avoid disrupting the Use of the Premises in performing Landlord’s duties under this §7.2; however, Landlord will not be required to employ premium labor to perform any of Landlord’s duties under this §7.2. Tenant may not repair or maintain the Project on Landlord’s behalf or offset any Rent for any repair or maintenance of the Project that is undertaken by Tenant.

|

8. |

ALTERATIONS |

8.1 Alterations by Tenant. “Alterations” means any modifications, additions, or improvements to the Premises or Leasehold Improvements made by Tenant during the Term, including modifications to the Base Building or Common Areas required by law as a condition of performing the work. Alterations do not include work performed under a Work Letter that is part of this Lease. Alterations are made at Tenant’s sole cost and expense, subject to the following:

|

|

(a) |

Consent Required. All Alterations that cost in excess of $20,000.00 or require a building permit from the applicable governmental agency shall require Landlord’s prior written consent; and if Landlord’s consent is not required pursuant to foregoing, then Tenant must submit written notice to Landlord of any such Alteration no less than 10 business days prior to the commencement of such Alteration. If a Design Problem exists, Landlord may withhold its consent in Landlord’s sole discretion; otherwise, Landlord will not unreasonably withhold, condition or delay its consent. Unless Tenant at the time of installation obtains Landlord’s prior written consent to remove the Alterations, then such Alterations will become part of the Premises to be tendered to Landlord on termination of the Lease. Landlord may require Tenant to remove Alterations and restore the Premises under §3.3 upon termination of this Lease if the Alterations are not customary Alterations for the Use and, if consent is required, Landlord requires such removal as a condition of Landlord’s consent. |

|

|

(b) |

Design Problem Defined. “Design Problem” means a condition that results, or will result, from work proposed, being performed or that has been completed that either: |

|

|

(1) |

Does not comply with laws; |

|

|

(2) |

Does not meet or exceed the Building Standard; |

|

|

(3) |

Exceeds the capacity, adversely affects, is incompatible with, or impairs Landlord’s ability to maintain, operate, alter, modify, or improve the Base Building; |

|

|

(4) |

Affects the exterior appearance of the Building or Common Areas; |

10

|

|

(6) |

Costs more to demolish than Building Standard improvements; |

|

|

(7) |

Violates any insurance regulations or standards for a fire-resistive office building; |

|

|

(8) |

Locates any equipment, Tenant’s Wiring or Tenant’s Personal Property on the roof of the Building, in Common Areas or in telecommunication or electrical closets, except for connections of Tenant’s Wiring to service provided by Telecommunications Services providers; or |

|

|

(9) |

Causes a “work of visual art” (as defined in the Visual Artists Rights Act of 1990) to be incorporated into or made a part of the Building. |

|

|

(c) |

Performance of Alterations. Alterations shall be performed by Tenant in a good and workman-like manner according to plans and specifications approved by Landlord, if applicable. All Alterations shall comply with law and insurance requirements. Landlord’s designated contractors must perform Alterations affecting the Base Building or Mechanical Systems; and, all other work will be performed by qualified contractors that meet Landlord’s insurance requirements and are otherwise approved by Landlord. Promptly after completing Alterations, if applicable, Tenant will deliver to Landlord “as-built” CADD plans, proof of payment, a copy of the recorded notice of completion, and all unconditional lien releases. |

|

|

(d) |

Bonding. If requested by Landlord, before commencing Alterations requiring consent Tenant shall at Tenant’s cost obtain bonds, or deposit with Landlord other security acceptable to Landlord for the payment and completion of the Alterations. These bonds or other security shall be in form and amount acceptable to Landlord. |

|

|

(e) |

Alterations Fee. Tenant shall pay Landlord as Rent 3% of the total construction costs of the Alterations that are not cosmetic Alterations to cover review of Tenant’s plans and construction coordination by Landlord’s employees. In addition, Tenant shall reimburse Landlord for the actual cost that Landlord reasonably incurs to have engineers, architects, or other professional consultants review Tenant’s plans and work in progress, or inspect the completed Alterations. |

8.2 Renovations. Landlord may modify, renovate, or improve the Project, including the granting of rights to other tenants to modify, renovate, or improve their respective premises and Common Areas serving their premises (“Renovations”) as Landlord deems appropriate; provided, that Renovations may not materially adversely impair Tenant’s access to the Premises from the Common Areas on a permanent basis and Landlord shall use commercially reasonable efforts to avoid disrupting Tenant’s Use of the Premises during Business Hours. Renovations may include demolishing or removing improvements, erecting scaffolding or other necessary structures, screening, limiting access to portions of the Project (or all of the Project, if required for safety reasons), and performing work that creates noise, dust, or debris. Provided that Landlord uses commercially reasonable efforts not to interfere with the conduct of business in the Premises for the Use during Business Hours, the performance of Renovations will not constitute a constructive eviction. Except as expressly provided elsewhere in this Lease, Renovations will not entitle Tenant to any abatement of Rent or damages for interference with Tenant’s business or the loss of use of any or all of the Premises. Landlord shall use commercially reasonable efforts to do the work permitted pursuant to this Section in a manner that will minimize, to the extent commercially practicable, the disruption of Tenant’s business in the Premises.

8.3 Liens and Disputes. With respect to Alterations undertaken by Tenant, Tenant will keep title to the Land and Building free of any liens concerning the Leasehold Improvements (other than with respect to Landlord’s Work pursuant to the Work Letter), Alterations, or Tenant’s Personal Property, and will promptly take whatever action is required to have any of these liens released and removed of record (including, as necessary, posting a bond or other deposit). To the extent legally permitted, each contract and subcontract for Alterations will provide that no lien attaches to or may be claimed against the Project. Tenant will indemnify Landlord for costs that Landlord reasonably incurs because of Tenant’s violation of this §8.3.

11

9.1 Tenant’s Insurance.

|

|

(a) |

Tenant’s Coverage. Before taking possession of the Premises for any purpose (including construction of Tenant Improvements, if any) and during the Term, Tenant will provide and keep in force the following coverage: |

|

|

(1) |

Commercial general liability insurance insuring Tenant’s use and occupancy of the Premises and use of the Common Areas, and covering personal and bodily injury, death, and damage to others’ property of not less than the Liability Limit. Each of these policies shall include cross liability and severability of interests clauses, and be written on an occurrence, and not claims-made, basis. Each of these policies shall name Landlord, the Building property manager, each secured lender, and any other party reasonably designated by Landlord as an additional insured (“Additional Insured”). |

|

|

(2) |

All risk property insurance (including standard extended coverage endorsement perils, leakage from fire protective devices, and other water damage) covering the full replacement cost of the Leasehold improvements and Tenant’s Personal Property. Each of these policies shall name Landlord and each Additional Insured an additional insured to the extent of their interest in the Leasehold Improvements. Each of these policies shall include a provision or endorsement in which the insurer waives its right of subrogation against Landlord and each Additional Insured. |

|

|

(3) |

Insurance covering the perils described in (2) for Tenant’s loss of income or insurable gross profits with a limit not less than Tenant’s annual Rent. Each of these policies shall include a provision or endorsement in which the insurer waives its right of subrogation against Landlord and each Additional Insured. |

|

|

(4) |

If any boiler or machinery is operated in the Premises, boiler and machinery insurance. |

|

|

(5) |

Insurance required by law, including workers’ compensation insurance. |

|

|

(6) |

Employers liability insurance with limits not less than $1 million. |

|

|

(7) |

Commercial automobile liability insurance covering all owned, hired, and non-owned vehicles with a combined single limit of not less than $1 million for each accident or person. |

|

|

(8) |

Insurance covering the Leasehold Improvements and Tenant’s Personal Property against loss or damage due to earthquake or difference in condition; provided, however, that Tenant may elect to self-insure this coverage. If Tenant does not elect to self-insure this coverage, then each of these policies shall name Landlord and each Additional Insured an additional insured to the extent of their interest in the Leasehold Improvements. |

|

|

(b) |

Insurers and Terms. Each policy required under (a) shall be written with insurance companies that are licensed to do business in the state in which the Building is located and have a rating of not less than A and a Financial Size Class of at least VIII by A.M. Best Company. The proceeds of policies providing coverage under subsection (a)(2) of this §9.1 will be payable to Landlord, Tenant and each Encumbrance holder as their interests may appear. Tenant will cooperate with Landlord in collecting any insurance proceeds that may be due in the event of loss, and Tenant will execute and deliver to Landlord proofs of loss and any other instruments that Landlord may require to recover such insurance proceeds. |

|

|

(c) |

Proof of Insurance. At least 10 days prior to the Commencement Date, and throughout the Term, Tenant will provide Landlord with certificates of insurance establishing that the coverage required under subsection (a) is in effect. Tenant will provide replacement certificates before any policy expires that the expiring policy has been renewed or replaced. |

9.2 Landlord’s Insurance.

|

|

(a) |

Landlord’s Coverage. During the Term, Landlord will provide and keep in force the following coverage: |

|

|

(1) |

Commercial general liability insurance. |

|

|

(2) |

All risk insurance (including standard extended coverage endorsement perils, leakage from fire protective devices, and other water damage) covering the Project improvements (excepting the Leasehold Improvements to be insured by Tenant). Each of these policies shall include a provision or endorsement in which the insurer waives its right of subrogation against Tenant. |

|

|

(3) |

Insurance covering the perils described in (2) for Landlord’s loss of rental income or insurable gross profits. Each of these policies shall include a provision or endorsement in which the insurer waives its right of subrogation against Tenant. |

|

|

(4) |

Boiler and machinery insurance. |

|

|

(5) |

Other insurance that Landlord elects to maintain. |

12

|

|

(b) |

Terms. Each of the policies required under (a) will have those limits, deductibles, retentions and other terms that Landlord prudently determines. |

|

10. |

DAMAGE OR DESTRUCTION |

10.1 Damage and Repair. If all or any part of the Project is damaged by fire or other casualty, then the parties will proceed as follows:

|

|

(a) |

Landlord’s Estimates. Landlord will assess the damage to the Project (but not the Leasehold Improvements) and notify Tenant of Landlord’s reasonable estimate of the time required to substantially complete repairs and restoration of the Project (“Repair Estimate”) within 30 days after the date of the casualty. Landlord will also estimate the time that all or a portion of the Premises will be Untenantable (“Interruption Estimate”) within 30 days after the date of the casualty. “Untenantable” means that the Premises are not reasonably accessible or are unfit for the Use. Within 30 days after the later of the casualty, issuance of the Repair Estimate, issuance of the Interruption Estimate, or receipt of any denial of coverage or reservation of rights from Landlord’s insurer, each party may terminate the Lease by written notice to the other on the following conditions: |

|

|

(1) |

Landlord may elect to terminate this Lease if either: |

|

|

(A) |

The Repair Estimate exceeds 180 days, or |

|

|

(B) |

The damage or destruction occurs in the last 12 Months of the Term and the Repair Estimate exceeds 20% of the remaining Term; or |

|

|

(C) |

The repair and restoration is not fully covered by insurance maintained or required to be maintained by Landlord (subject only to those deductibles or retentions Landlord elected to maintain) or Landlord’s insurer denies coverage. |

|

|

(2) |

Tenant may elect to terminate this Lease if either (i) the Interruption Estimate exceeds 180 days, or (ii) the damage or destruction occurs in the last 12 Months of the Term and the Interruption Estimate exceeds 20% of the remaining Term. |

|

|

(b) |

Repairs. If neither party terminates the Lease under (a), then the Lease shall remain in full force and effect and the parties will proceed as follows: |

|

|

(1) |

Landlord will repair and restore the Project (but not Leasehold Improvements) to the condition existing prior to such damage, except for modifications required by law. Landlord will perform such work reasonably promptly, subject to delay for loss adjustment, delay caused by Tenant and Force Majeure. |

|

|

(2) |

Tenant will repair and restore the Leasehold Improvements reasonably promptly to the condition existing prior to such damage, but not less than then current Building Standards, except for modifications required by law. |

|

|

(3) |

Tenant may not terminate this Lease if the actual time to perform the repairs and restoration exceeds the Repair Estimate, or the actual interruption exceeds the Interruption Estimate. Notwithstanding the foregoing, if(A) either the actual time to perform the repairs and restoration to the Base Building and Leasehold Improvements exceeds the Repair Estimate by more than 60 days, or the actual interruption exceeds the Interruption Estimate by more than 60 days (each such period to be extended by any delay caused by Tenant), and (B) the total time which the Premises will be Untenantable will exceed 180 days, then Tenant may terminate this Lease upon 30 days’ prior written notice to Landlord; provided, however, that if the repairs and restoration are completed within said 30 day period, then this Lease will not be so terminated and will continue in full force and effect. |

10.2 Rent Abatement. If as a result of the damage or destruction under §10.1 all or any part of the Premises becomes Untenantable and Tenant does not actually use the Untenantable part of the Premises, then Tenant’s Base Rent and Additional Rent for the Untenantable part of the Premises that Tenant does not actually use will be abated until the Untenantable part of the Premises becomes tenantable; however, Tenant will not be entitled to abatement of Base Rent and Additional Rent after that date (a) Landlord repairs and restores the Project to the extent necessary for Tenant to reasonably access and use the Premises for the Use, and (b) repair and restoration of the Leasehold Improvements would have been substantially complete if Tenant had performed its obligations under §10.1 (b )(2) diligently and in coordination with Landlord’s work. Tenant’s sole remedies against Landlord for damage or destruction of any part of the Project is abatement of Base Rent and Additional Rent under this §10.2 and/or termination of the Lease as provided in §10.1, and Landlord will not be liable to Tenant for any other amount, including damages to Tenant’s Personal Property, consequential damages, actual or constructive eviction, or abatement of any other item of Rent.

13

11.1 Claims. “Claims” means any and all liabilities, losses, claims, demands, damages or expenses that are suffered or incurred by a party, including attorneys’ fees reasonably incurred by that party in the defense or enforcement of the rights of that party.

11.2 Landlord’s Waivers and Tenant’s Indemnity.

|

|

(a) |

Landlord’s Waivers. Landlord waives any Claims against Tenant and its Affiliates for perils insured or required to be insured by Landlord under subsections (2) and (3) of §9.2(a), except to the extent caused by the willful misconduct of Tenant or its Affiliates but in no case will Tenant be liable for any special or consequential damages (including interruption of business, loss of income, or loss of opportunity). |

|

|

(b) |

Tenant’s Indemnity. Unless waived by Landlord under (a), Tenant will indemnify and defend Landlord and its Affiliates and hold each of them harmless from and against Claims arising from: |

|

|

(1) |

Any accident or occurrence in the Premises, except to the extent caused by Landlord’s or its Affiliates’ or contractors’ negligent or willful misconduct; |

|

|

(2) |

Tenant’s or its Affiliates’ or its contractors’ negligence or willful misconduct; or |

|

|

(3) |

Any claim for commission or other compensation by any person other than the Brokers for services rendered to Tenant in procuring this Lease. |

11.3 Tenant’s Waivers and Landlord’s Indemnity,

|

|

(a) |

Tenant’s Waivers. Tenant waives any Claims against Landlord and its Affiliates for: |

|

|

(1) |

Any peril insured or required to be insured by Tenant under subsections (2), (3) and (8) of §9.1(a), except to the extent caused by the willful misconduct of Landlord or its Affiliates, but in no case will Landlord be liable for any special or consequential damages (including interruption of business, loss of income, or loss of opportunity); or |

|

|

(2) |

Damage caused by any public utility, public work, other tenants or occupants of the Project, or persons other than Landlord or its Affiliates or contractors; or |

|

|

(b) |

Landlord’s Indemnity. Unless waived by Tenant under (a), Landlord will indemnify and defend Tenant and its Affiliates and hold each of them harmless from and against Claims arising from: |

|

|

(1) |

Landlord’s or its Affiliates’ or contractors’ negligence or willful misconduct; or |

|

|

(2) |

Any claim for commission or other compensation by any person other than the Brokers for services rendered to Landlord in procuring this Lease. |

11.4 Affiliates Defined. “Affiliates” means with respect to a party (a) that party’s partners, co-members and joint venturers, (b) each corporation or other entity that is a parent or subsidiary of that party, (c) each corporation or other entity that is controlled by or under common control of a parent of such party, and (d) the directors, officers, employees and agents of that party and each person or entity described in subsections (a) through (c) of this §11.4.

11.5 Survival of Waivers and Indemnities. Landlord’s and Tenant’s waivers and indemnities under §11.2 and §11.3 will survive the expiration or early termination of this Lease.

|

12. |

CONDEMNATION |

12.1 Taking. “Taking” means acquiring of all or part of the Project for any public or quasi-public use by exercise of a right of eminent domain or under any other law, or any sale in lieu thereof. If a Taking occurs:

|

|

(a) |

Total Taking. If because of a Taking substantially all of the Premises is untenantable for substantially all of the remaining Term, then the Lease terminates on the date of the Taking. |

14

|

|

(1) |

Landlord may terminate the Lease upon 60 days prior written notice to Tenant if Landlord reasonably determines that it is uneconomical to restore or alter the Premises to be tenantable. |

|

|

(2) |

Tenant may terminate the Lease upon 60 days prior written notice to Landlord if the Taking causes more than 20% of the Premises to be Untenantable for the remainder of the Term and Tenant cannot reasonably operate Tenant business for the Use in the remaining Premises. |

|

|

(c) |

If the Lease is not terminated under (a) or (b), the Rent payable by Tenant will be reduced for the term of the Taking based upon the RSF Premises rendered Untenantable by the Taking and that Tenant does not actually use. |

12.2 Awards. Landlord is entitled to the entire award for any claim for a taking of any interest in this Lease or the Project, without deduction or offset for Tenant’s estate or interest; however, Tenant may make a claim for relocation expenses and damages to Tenant’s Personal Property and business to the extent that Tenant’s claim does not reduce Landlord’s award.

|

13. |

TENANT TRANSFERS |

13.1 Terms Defined.

|

|

(a) |

Transfer Defined. “Transfer” means any: |

|

|

(1) |

Sublease of all or part of the Premises, or assignment, mortgage, hypothecation or other conveyance of an interest in this Lease; |

|

|

(2) |

Use of the Premises by anyone other than Tenant with Tenant’s consent; |

|

|

(3) |

Transfer of 51 % or more of Tenant’s assets, shares (excepting shares transferred in the normal course of public trading), membership interests, partnership interests or other ownership interests; or |

|

|

(4) |

Transfer of control of Tenant, subject to §13.3.(a) herein below. |

|

|

(b) |

Transferee Defined. “Transferee” means a party to whom a Transfer is proposed to be made or actually made in accordance with the provisions of this Lease. |

13.2 Prohibited Transfers. Tenant may not enter into a Transfer or other agreement to use or occupy the Premises that provides for rent or other compensation based in whole or in part on the net income or profits from the business operated in the Premises. Tenant may not enter into a Transfer if the proposed Transferee is directly or indirectly related to the Landlord under §856, et seq. of the Internal Revenue Code of 1986 (as amended). Any such Transfers shall be considered null, void and of no force or effect.

13.3 Consent Not Required. Tenant may effect a Transfer to a Permitted Transferee (defined below) without Landlord’s prior consent and without application of §13.5, below, but with notice to Landlord given not later than the Permitted Transferee’s occupancy. “Permitted Transferee” means any person or entity that:

|

|

(a) |

Either (1) controls, is controlled by, or is under common control with Tenant (for purposes hereof, “control” shall mean ownership of not less than 50% of all of the voting stock or legal and equitable interest in the entity in question), (2) results from the merger or consolidation of Tenant, or (3) acquires all or substantially all of the stock and/or assets of Tenant as a going concern; |

|

|

(b) |

Has a tangible net worth immediately following the Transfer not less than Tenant’s tangible net worth preceding the Transfer; |

|

|

(e) |

Will not, by occupying the Premises, cause Landlord to breach any other lease or other agreement affecting the Project; and |

|

|

(d) |

Is not named or listed as a Blocked Person. |

13.4 Consent Required. Each proposed Transfer, other than any Transfer prohibited under § 13.2 or permitted under § 13.3, requires Landlord’s prior consent, in which case the parties will proceed as follows:

|

|

(a) |

Tenant’s Notice. Tenant shall notify Landlord at least 30 days prior to the proposed Transfer of the name and address of the proposed Transferee and the proposed use of the Premises, and include in the notice the Transfer documents and copies of the proposed Transferee’s balance sheet and income statement for the most recent complete fiscal year. |

15

|

|

(b) |

Landlord’s Rights. Within 30 days after receipt of Tenant’s complete notice, Landlord may either: |

|

|

(1) |

If the proposed Transfer is either an assignment of this Lease a sublease of all of the Premises or any part of the Premises that will be separately demised and have its own entrance from the Common Areas and for substantially all of the remaining Term of the Lease, terminate this Lease as of the proposed Transfer date; provided, however, that there shall be no termination if Tenant rescinds its request within 5 days after receipt of Landlord’s election to terminate; or |

|

|

(2) |

Consent or deny consent to the proposed Transfer, provided that consent will not be unreasonably withheld if: |

|

|

(A) |

The proposed Transferee, in Landlord’s reasonable opinion, has the financial capacity to meet its obligations under the proposed Transfer; |

|

|

(B) |

The proposed use is consistent with the Use and will not cause Landlord to be in breach of any lease or other agreement affecting the Project; |

|

|

(C) |