Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NN INC | d186427dex991.htm |

| 8-K - FORM 8-K - NN INC | d186427d8k.htm |

Exhibit 99.2

|

|

First Quarter 2016 Earnings Release

May 4, 2016

|

|

Forward Looking Statements

Forward Looking Statement: With the exception of the historical information contained in this presentation, the matters described herein contain forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.— number of risks and uncertainties that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector, competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues, availability of raw materials, currency and other risks associated with international trade, the Company’s dependence on certain major customers, and other risk factors and cautionary statements listed from time to time in the Company’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on 10-K for the fiscal year ended December 31, 2015.

With respect to any non-GAAP financial measures included in the following presentation, the accompanying information required by SEC Regulation G can be found at the back of this presentation or in the “Investor Relations” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Disclaimer: NN disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

www.nninc.com

| 2 |

|

|

|

First Quarter

|

|

Highlights of 1st Quarter 2016

Sales of $212.2M

PEP acquisition contributed $56.0M

Adjusted Earnings Per Share of $0.27 above the midpoint of our guidance

Adjusted EBITDA of $35.6M at the top of our guidance range

Adjusted Operating Margins increased 220 bps compared to Q1 2015, exceeding our guidance range

Free Cash Flow ahead of expectations

www.nninc.com

| 4 |

|

|

|

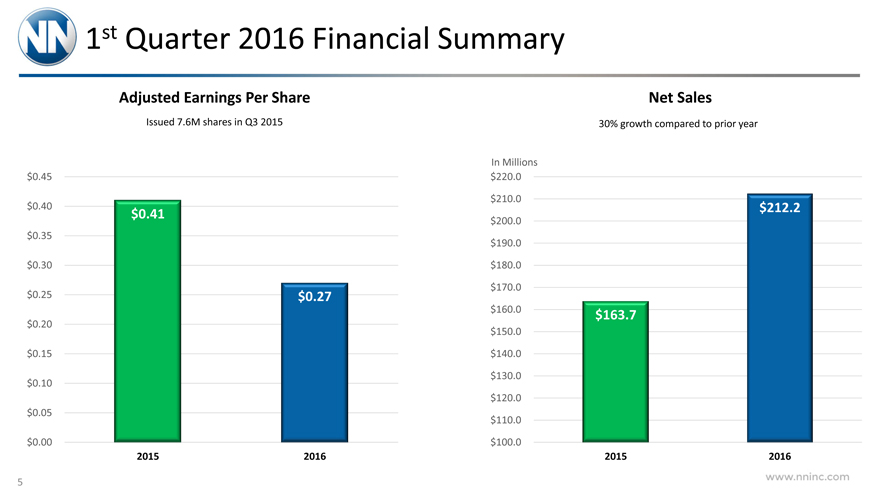

1st Quarter 2016 Financial Summary

Adjusted Earnings Per Share Net Sales

Issued 7.6M shares in Q3 2015 30% growth compared to prior year

In Millions

| $0.45 |

|

$ 220.0 |

$ 210.0

| $0.40 |

|

$ 212.2 |

$ 0.41 $ 200.0

$0.35

$ 190.0

| $0.30 |

|

$ 180.0 |

$ 170.0

| $0.25 |

|

$0.27 |

$ 160.0 $163.7

$0.20

$ 150.0

| $0.15 |

|

$ 140.0 |

$ 130.0

$0.10

$ 120.0

$0.05

$ 110.0

| $0.00 |

|

$ 100.0 |

2015 2016 2015 2016

www.nninc.com

| 5 |

|

|

|

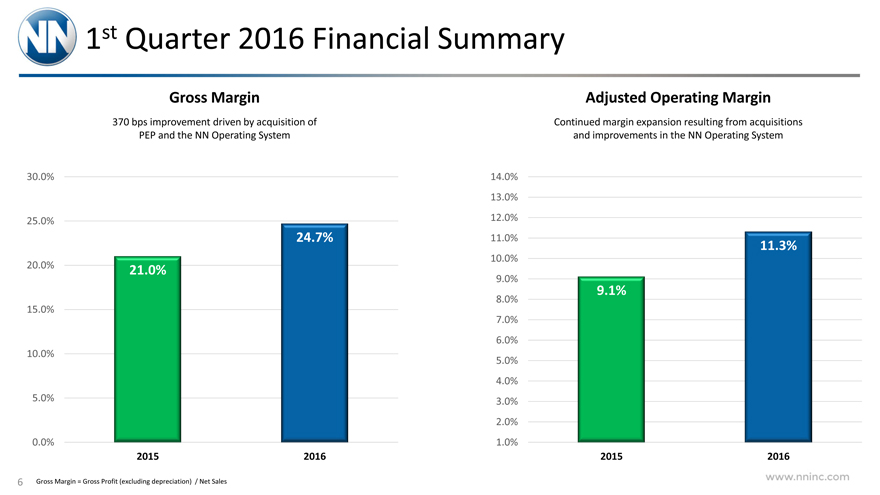

1st Quarter 2016 Financial Summary

Gross Margin Adjusted Operating Margin

370 bps improvement driven by acquisition of Continued margin expansion resulting from acquisitions

PEP and the NN Operating System and improvements in the NN Operating System

| 30.0% |

|

14.0% |

13.0%

| 25.0% |

|

12.0% |

| 24.7% |

|

11.0% 11.3% |

10.0%

| 20.0% |

|

21.0% |

9.0%

9.1%

8.0%

15.0%

7.0%

6.0%

10.0%

5.0%

4.0%

| 5.0% |

|

3.0% |

2.0%

| 0.0% |

|

1.0% |

2015 2016 2015 2016

Gross Margin = Gross Profit (excluding depreciation) / Net Sales

www.nninc.com

| 6 |

|

|

|

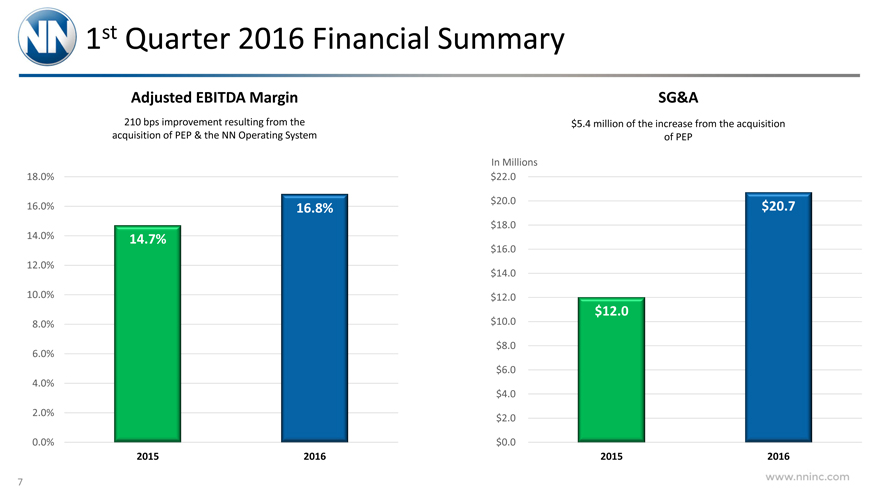

1st Quarter 2016 Financial Summary

Adjusted EBITDA Margin SG&A

210 bps improvement resulting from the $5.4 million of the increase from the acquisition

acquisition of PEP & the NN Operating System of PEP

In Millions

| 18.0% |

|

$22.0 |

| 16.0% |

|

16.8% $20.0 $20.7 |

$18.0

| 14.0% |

|

14.7% |

$16.0

12.0%

$14.0

| 10.0% |

|

$12.0 |

$12.0

| 8.0% |

|

$10.0 |

$8.0

6.0%

$6.0

4.0%

$4.0

| 2.0% |

|

$2.0 |

| 0.0% |

|

$0.0 |

2015 2016 2015 2016

www.nninc.com

| 7 |

|

|

|

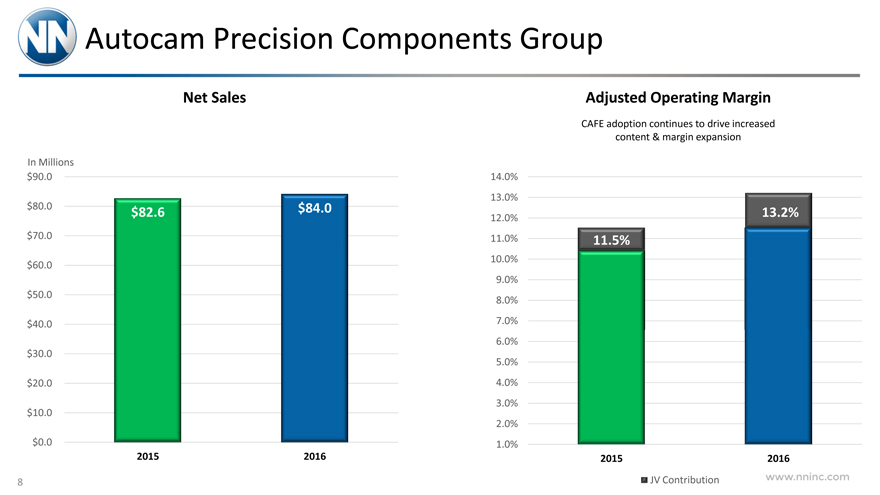

Autocam Precision Components Group

Net Sales Adjusted Operating Margin

CAFE adoption continues to drive increased

content & margin expansion

In Millions

| $90.0 |

|

14.0% |

13.0%

| $80.0 |

|

$82.6 $84.0 13.2% |

12.0%

| $70.0 |

|

11.0% 11.5% |

| $60.0 |

|

10.0% |

9.0%

| $50.0 |

|

8.0% |

| $40.0 |

|

7.0% |

6.0%

$30.0

5.0%

| $20.0 |

|

4.0% |

3.0%

$10.0

2.0%

| $0.0 |

|

1.0% |

2015 2016 2015 2016

JV Contribution

www.nninc.com

| 8 |

|

|

|

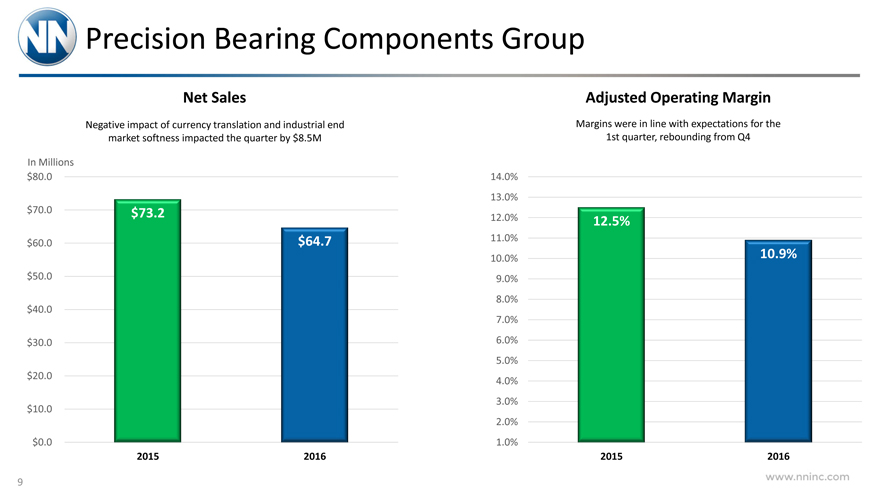

Precision Bearing Components Group

Net Sales Adjusted Operating Margin

Negative impact of currency translation and industrial end Margins were in line with expectations for the

market softness impacted the quarter by $8.5M 1st quarter, rebounding from Q4

In Millions

| $80.0 |

|

14.0% |

13.0%

| $70.0 |

|

$73.2 12.0% 12.5% |

| $60.0 |

|

$64.7 11.0% |

| 10.0% |

|

10.9% |

| $50.0 |

|

9.0% |

8.0%

$40.0

7.0%

| $30.0 |

|

6.0% |

5.0%

| $20.0 |

|

4.0% |

3.0%

$10.0

2.0%

| $0.0 |

|

1.0% |

2015 2016 2015 2016

www.nninc.com

9

|

|

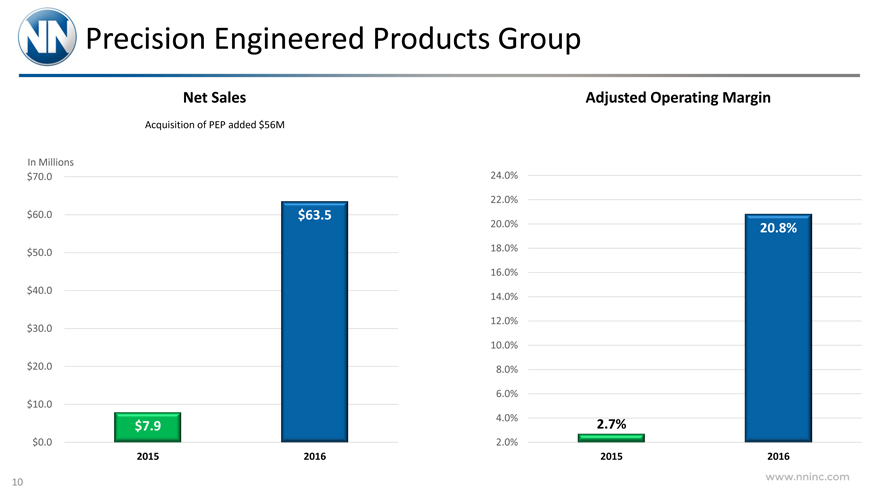

Precision Engineered Products Group

Net Sales Adjusted Operating Margin

Acquisition of PEP added $56M

In Millions

| $70.0 |

|

24.0% |

22.0%

| $60.0 |

|

$63.5 |

| 20.0% |

|

20.8% |

| $50.0 |

|

18.0% |

16.0%

| $40.0 |

|

14.0% |

12.0%

$30.0

10.0%

| $20.0 |

|

8.0% |

6.0%

$10.0

4.0%

| $7.9 |

|

2.7% |

| $0.0 |

|

2.0% |

2015 2016 2015 2016

www.nninc.com

10

|

|

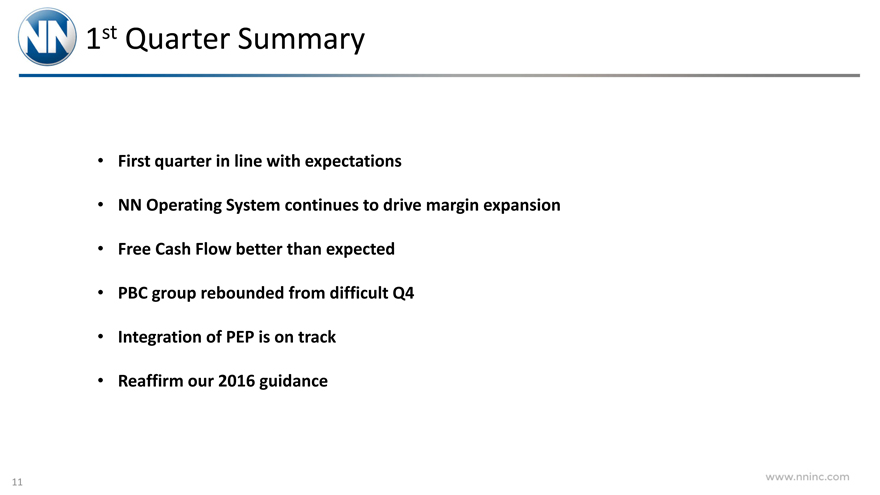

1st Quarter Summary

First quarter in line with expectations

NN Operating System continues to drive margin expansion Free Cash Flow better than expected PBC group rebounded from difficult Q4 Integration of PEP is on track Reaffirm our 2016 guidance

www.nninc.com

11

|

|

Guidance

|

|

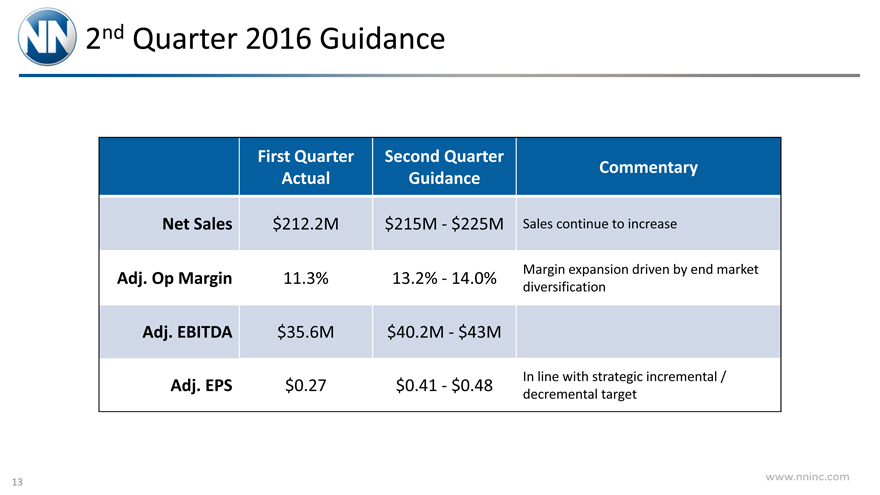

2nd Quarter 2016 Guidance

First Quarter Second Quarter

Commentary

Actual Guidance

Net Sales $212.2M $215M—$225M Sales continue to increase

Adj. Op Margin 11.3% 13.2%—14.0% Margin expansion driven by end market

diversification

Adj. EBITDA $35.6M $40.2M—$43M

Adj. EPS $0.27 $0.41—$0.48 In line with strategic incremental /

decremental target

www.nninc.com

13

|

|

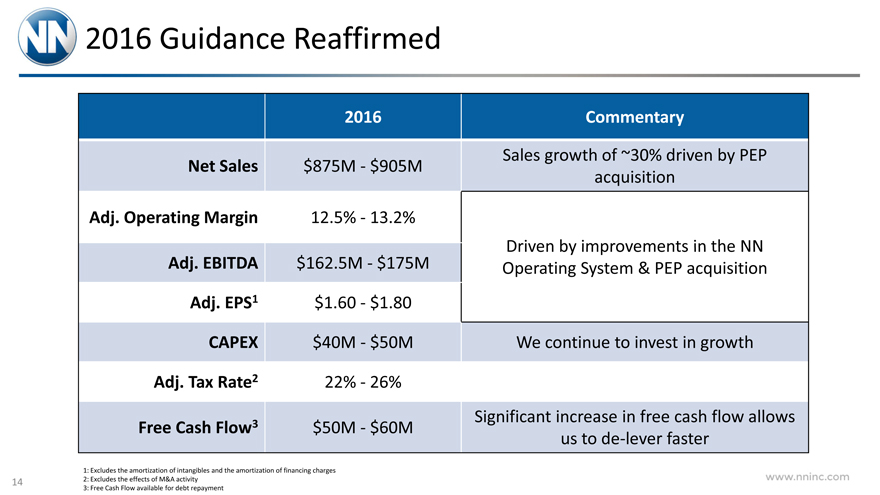

2016 Guidance Reaffirmed

2016 Commentary

Sales growth of ~30% driven by PEP

Net Sales $875M—$905M

acquisition

Adj. Operating Margin 12.5%—13.2%

Driven by improvements in the NN

Adj. EBITDA $162.5M—$175M Operating System & PEP acquisition

Adj. EPS1 $1.60—$1.80

CAPEX $40M—$50M We continue to invest in growth

Adj. Tax Rate2 22%—26%

Free Cash Flow3 $50M—$60M Significant increase in free cash flow allows

us to de-lever faster

1: Excludes the amortization of intangibles and the amortization of financing charges

2: Excludes the effects of M&A activity

3: Free Cash Flow available for debt repayment

www.nninc.com

14

|

|

Reconciliation Tables

|

|

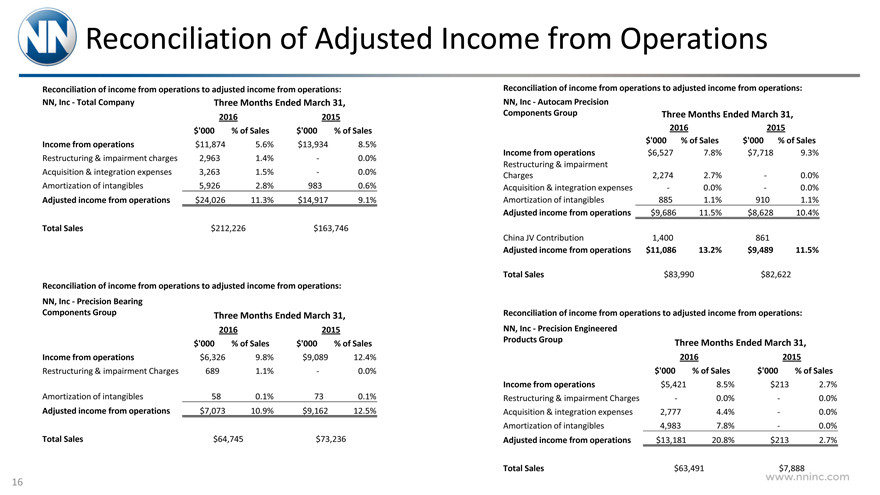

Reconciliation of Adjusted Income from Operations

Reconciliation of income from operations to adjusted income from operations:

NN, Inc—Total Company Three Months Ended March 31,

2016 2015

$‘000% of Sales $‘000% of Sales

Income from operations $11,874 5.6% $13,934 8.5%

Restructuring & impairment charges 2,963 1.4%—0.0%

Acquisition & integration expenses 3,263 1.5%—0.0%

Amortization of intangibles 5,926 2.8% 983 0.6%

Adjusted income from operations $24,026 11.3% $14,917 9.1%

Total Sales $212,226 $163,746

Reconciliation of income from operations to adjusted income from operations:

NN, Inc—Precision Bearing

Components Group Three Months Ended March 31,

2016 2015

$‘000% of Sales $‘000% of Sales

Income from operations $6,326 9.8% $9,089 12.4%

Restructuring & impairment Charges 689 1.1%—0.0%

Amortization of intangibles 58 0.1% 73 0.1%

Adjusted income from operations $7,073 10.9% $9,162 12.5%

Total Sales $64,745 $73,236

Reconciliation of income from operations to adjusted income from operations:

NN, Inc—Autocam Precision

Components Group Three Months Ended March 31,

2016 2015

$‘000 % of Sales $‘000 % of Sales

Income from operations $6,527 7.8% $7,718 9.3%

Restructuring & impairment

Charges 2,274 2.7%—0.0%

Acquisition & integration expenses—0.0%—0.0%

Amortization of intangibles 885 1.1% 910 1.1%

Adjusted income from operations $9,686 11.5% $8,628 10.4%

China JV Contribution 1,400 861

Adjusted income from operations $11,086 13.2% $9,489 11.5%

Total Sales $83,990 $82,622

Reconciliation of income from operations to adjusted income from operations:

NN, Inc—Precision Engineered

Products Group Three Months Ended March 31,

2016 2015

$‘000% of Sales $‘000% of Sales

Income from operations $5,421 8.5% $213 2.7%

Restructuring & impairment Charges—0.0%—0.0%

Acquisition & integration expenses 2,777 4.4%—0.0%

Amortization of intangibles 4,983 7.8%—0.0%

Adjusted income from operations $13,181 20.8% $213 2.7%

Total Sales $63,491 $7,888

www.nninc.com

16

|

|

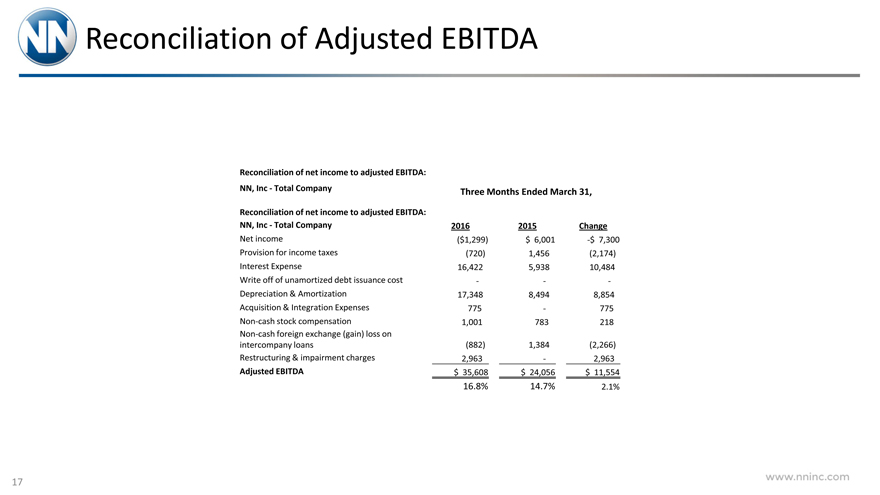

Reconciliation of Adjusted EBITDA

Reconciliation of net income to adjusted EBITDA:

NN, Inc—Total Company Three Months Ended March 31,

Reconciliation of net income to adjusted EBITDA:

NN, Inc—Total Company 2016 2015 Change

Net income($1,299) $ 6,001 -$ 7,300

Provision for income taxes(720) 1,456(2,174)

Interest Expense 16,422 5,938 10,484

Write off of unamortized debt issuance cost — -

Depreciation & Amortization 17,348 8,494 8,854

Acquisition & Integration Expenses 775—775

Non-cash stock compensation 1,001 783 218

Non-cash foreign exchange (gain) loss on

intercompany loans(882) 1,384(2,266)

Restructuring & impairment charges 2,963—2,963

Adjusted EBITDA $ 35,608 $ 24,056 $ 11,554

| 16.8% |

|

14.7% 2.1% |

www.nninc.com

17

|

|

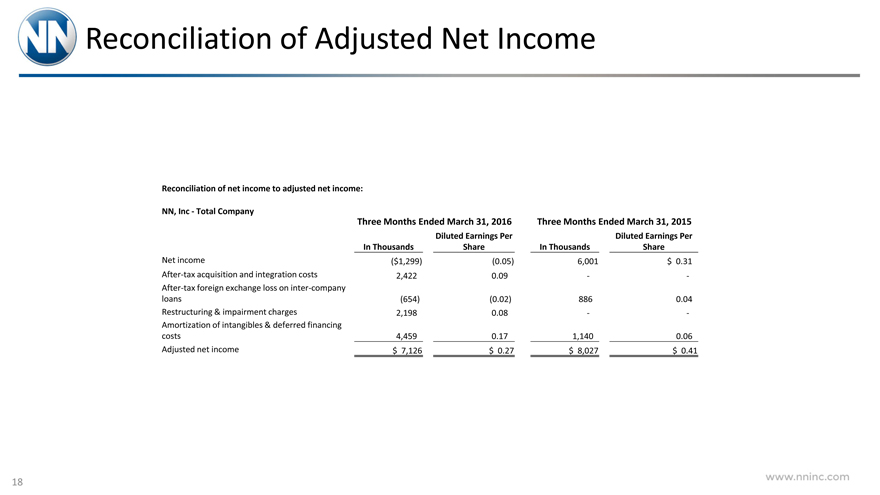

Reconciliation of Adjusted Net Income

Reconciliation of net income to adjusted net income:

NN, Inc—Total Company

Three Months Ended March 31, 2016 Three Months Ended March 31, 2015

Diluted Earnings Per Diluted Earnings Per

In Thousands Share In Thousands Share

Net income($1,299)(0.05) 6,001 $ 0.31

After-tax acquisition and integration costs 2,422 0.09 —

After-tax foreign exchange loss on inter-company

loans(654)(0.02) 886 0.04

Restructuring & impairment charges 2,198 0.08 —

Amortization of intangibles & deferred financing

costs 4,459 0.17 1,140 0.06

Adjusted net income $ 7,126 $ 0.27 $ 8,027 $ 0.41

www.nninc.com

18

|

|

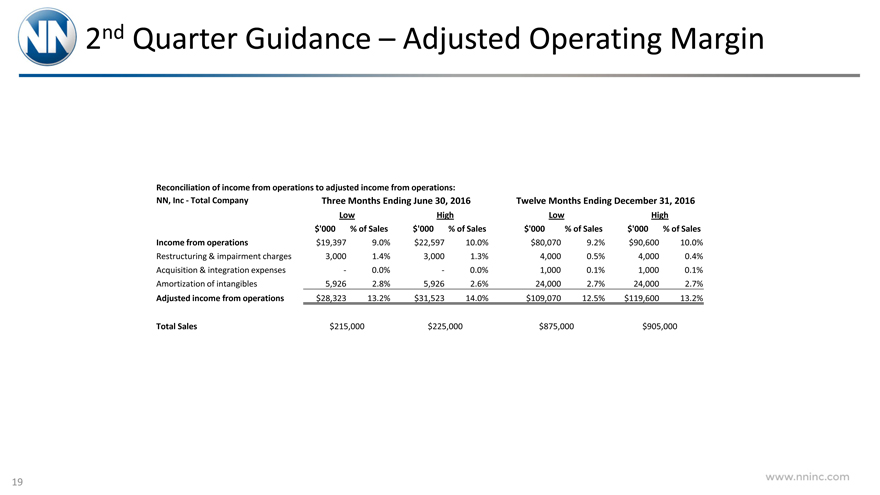

2nd Quarter Guidance – Adjusted Operating Margin

Reconciliation of income from operations to adjusted income from operations:

NN, Inc—Total Company Three Months Ending June 30, 2016 Twelve Months Ending December 31, 2016

Low High Low High

$‘000% of Sales $‘000% of Sales $‘000% of Sales $‘000% of Sales

Income from operations $19,397 9.0% $22,597 10.0% $80,070 9.2% $90,600 10.0%

Restructuring & impairment charges 3,000 1.4% 3,000 1.3% 4,000 0.5% 4,000 0.4%

Acquisition & integration expenses—0.0%—0.0% 1,000 0.1% 1,000 0.1%

Amortization of intangibles 5,926 2.8% 5,926 2.6% 24,000 2.7% 24,000 2.7%

Adjusted income from operations $28,323 13.2% $31,523 14.0% $109,070 12.5% $119,600 13.2%

Total Sales $215,000 $225,000 $875,000 $905,000

www.nninc.com

19

|

|

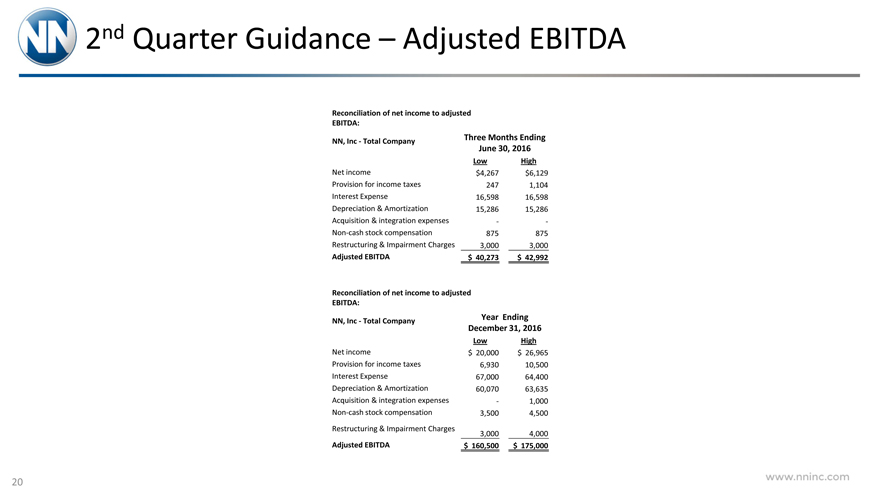

2nd Quarter Guidance – Adjusted EBITDA

Reconciliation of net income to adjusted

EBITDA:

NN, Inc—Total Company Three Months Ending

June 30, 2016

Low High

Net income $4,267 $6,129

Provision for income taxes 247 1,104

Interest Expense 16,598 16,598

Depreciation & Amortization 15,286 15,286

Acquisition & integration expenses —

Non-cash stock compensation 875 875

Restructuring & Impairment Charges 3,000 3,000

Adjusted EBITDA $ 40,273 $ 42,992

Reconciliation of net income to adjusted

EBITDA:

NN, Inc—Total Company Year Ending

December 31, 2016

Low High

Net income $ 20,000 $ 26,965

Provision for income taxes 6,930 10,500

Interest Expense 67,000 64,400

Depreciation & Amortization 60,070 63,635

Acquisition & integration expenses—1,000

Non-cash stock compensation 3,500 4,500

Restructuring & Impairment Charges

3,000 4,000

Adjusted EBITDA $ 160,500 $ 175,000

www.nninc.com

20

|

|

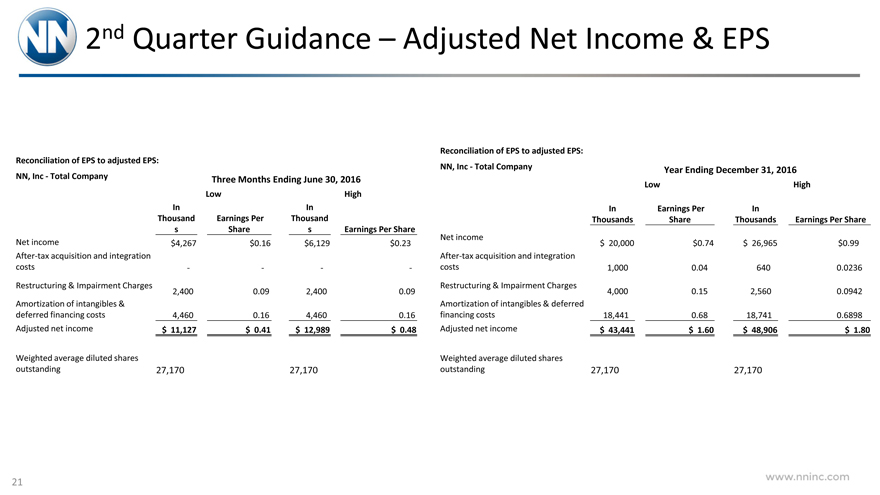

2nd Quarter Guidance – Adjusted Net Income & EPS

Reconciliation of EPS to adjusted EPS:

NN, Inc—Total Company Three Months Ending June 30, 2016

Low High

In In

Thousand Earnings Per Thousand

s Share s Earnings Per Share

Net income $4,267 $0.16 $6,129 $0.23

After-tax acquisition and integration

costs — —

Restructuring & Impairment Charges

2,400 0.09 2,400 0.09

Amortization of intangibles &

deferred financing costs 4,460 0.16 4,460 0.16

Adjusted net income $ 11,127 $0.41 $ 12,989 $0.48

Weighted average diluted shares

outstanding 27,170 27,170

Reconciliation of EPS to adjusted EPS:

NN, Inc—Total Company Year Ending December 31, 2016

Low High

In Earnings Per In

Thousands Share Thousands Earnings Per Share

Net income

$ 20,000 $0.74 $ 26,965 $0.99

After-tax acquisition and integration

costs 1,000 0.04 640 0.0236

Restructuring & Impairment Charges

4,000 0.15 2,560 0.0942

Amortization of intangibles & deferred

financing costs 18,441 0.68 18,741 0.6898

Adjusted net income $ 43,441 $1.60 $ 48,906 $1.80

Weighted average diluted shares

outstanding 27,170 27,170

www.nninc.com

21

|

|

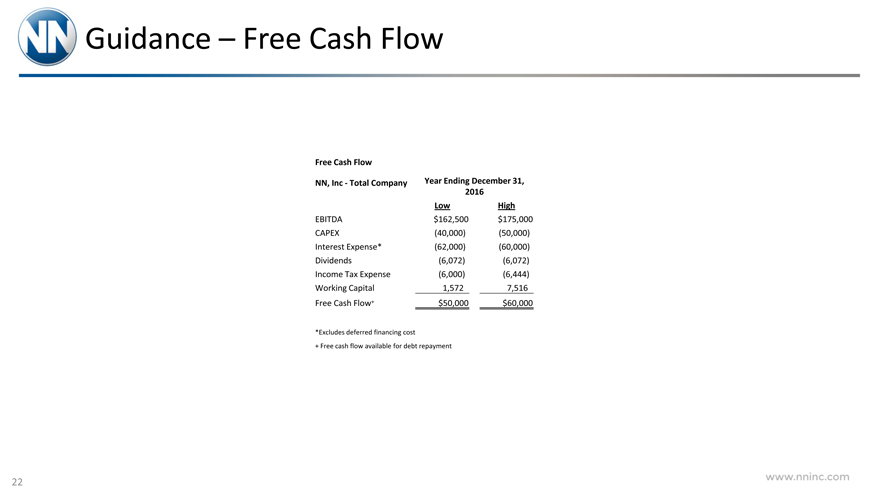

Guidance – Free Cash Flow

Free Cash Flow

NN, Inc—Total Company Year Ending December 31,

2016

Low High

EBITDA $162,500 $175,000

CAPEX(40,000)(50,000)

Interest Expense*(62,000)(60,000)

Dividends(6,072)(6,072)

Income Tax Expense(6,000)(6,444)

Working Capital 1,572 7,516

Free Cash Flow+ $50,000 $60,000

*Excludes deferred financing cost

+ Free cash flow available for debt repayment

www.nninc.com

22