Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MRC GLOBAL INC. | d180797d8k.htm |

Investor Presentation May 2016 Exhibit 99.1

Forward Looking Statements and Non-GAAP Disclaimer This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Words such as “will,” “expect,” “expected”, “looking forward”, “guidance” and similar expressions are intended to identify forward-looking statements. Statements about the company’s business, including its strategy, the impact of changes in oil prices and customer spending, its industry, the company’s future profitability, the company’s guidance on its sales, adjusted EBITDA, adjusted gross profit, tax rate, capital expenditures and cash flow, the company’s expectations regarding the pay down of its debt, growth in the company’s various markets and the company’s expectations, beliefs, plans, strategies, objectives, prospects and assumptions are not guarantees of future performance. These statements are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, most of which are difficult to predict and many of which are beyond our control, including the factors described in the company’s SEC filings that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. For a discussion of key risk factors, please see the risk factors disclosed in the company’s SEC filings, which are available on the SEC’s website at www.sec.gov and on the company’s website, www.mrcglobal.com. Our filings and other important information are also available on the Investor Relations page of our website at www.mrcglobal.com. Undue reliance should not be placed on the company’s forward-looking statements. Although forward-looking statements reflect the company’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause the company’s actual results, performance or achievements or future events to differ materially from anticipated future results, performance or achievements or future events expressed or implied by such forward-looking statements. The company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except to the extent required by law.

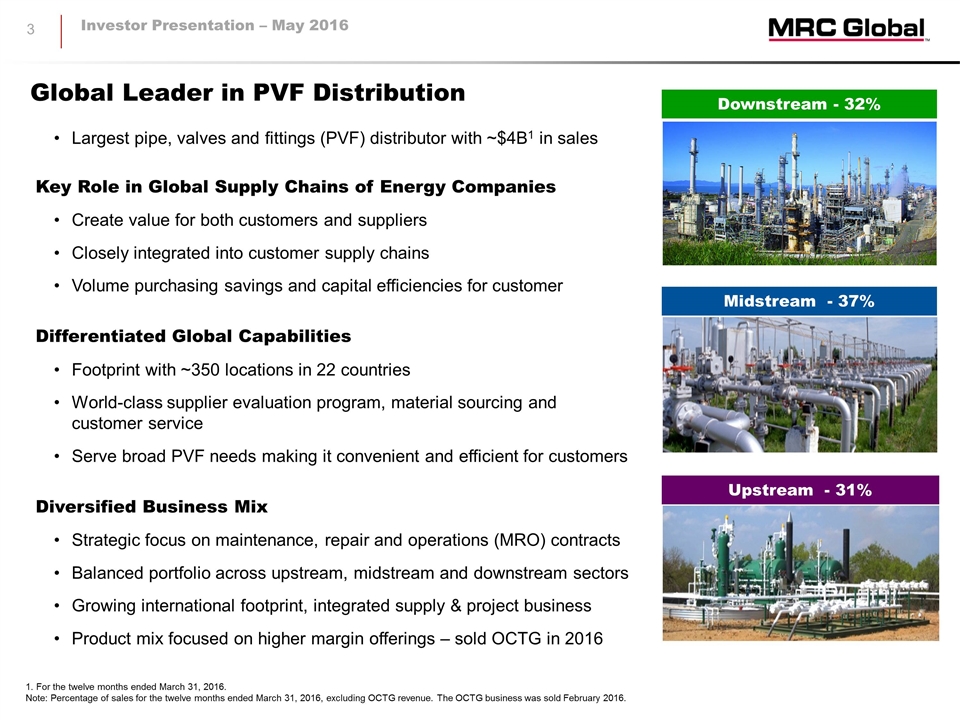

Projects 28% U.S. 75% Largest pipe, valves and fittings (PVF) distributor with ~$4B1 in sales Key Role in Global Supply Chains of Energy Companies Create value for both customers and suppliers Closely integrated into customer supply chains Volume purchasing savings and capital efficiencies for customer Differentiated Global Capabilities Footprint with ~350 locations in 22 countries World-class supplier evaluation program, material sourcing and customer service Serve broad PVF needs making it convenient and efficient for customers Diversified Business Mix Strategic focus on maintenance, repair and operations (MRO) contracts Balanced portfolio across upstream, midstream and downstream sectors Growing international footprint, integrated supply & project business Product mix focused on higher margin offerings – sold OCTG in 2016 Global Leader in PVF Distribution 1. For the twelve months ended March 31, 2016. Note: Percentage of sales for the twelve months ended March 31, 2016, excluding OCTG revenue. The OCTG business was sold February 2016. Downstream - 32% Midstream - 37% Upstream - 31%

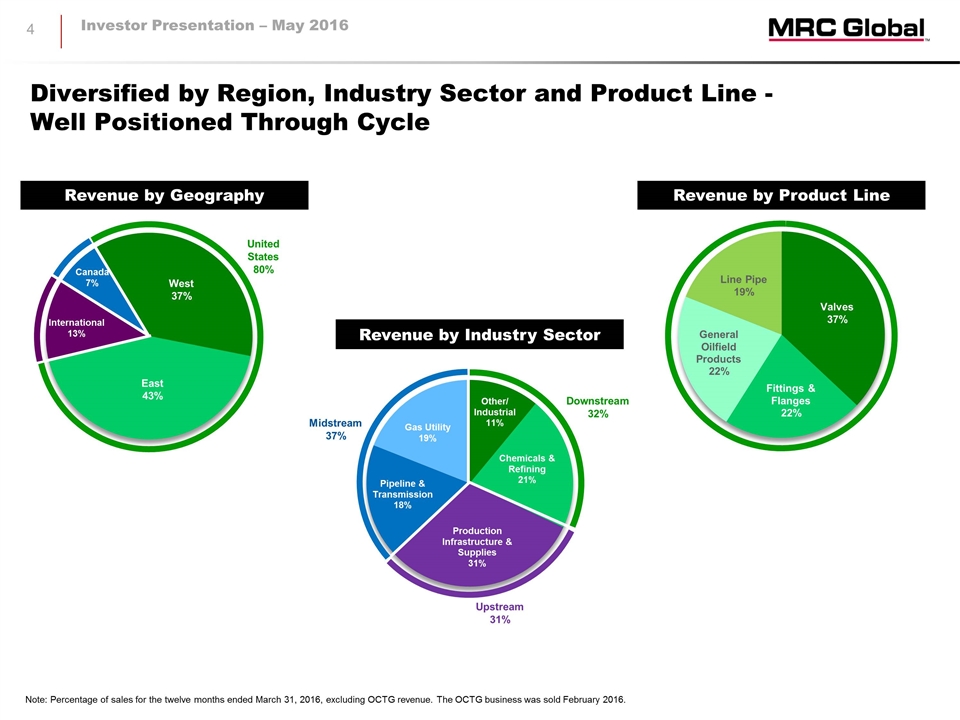

Revenue by Product Line Note: Percentage of sales for the twelve months ended March 31, 2016, excluding OCTG revenue. The OCTG business was sold February 2016. Revenue by Geography Revenue by Industry Sector United States 80% Diversified by Region, Industry Sector and Product Line - Well Positioned Through Cycle Chemical 9% Transmission 17% Refining 9% Other / Industrial 9% Downstream 32% Upstream 31% Midstream 37%

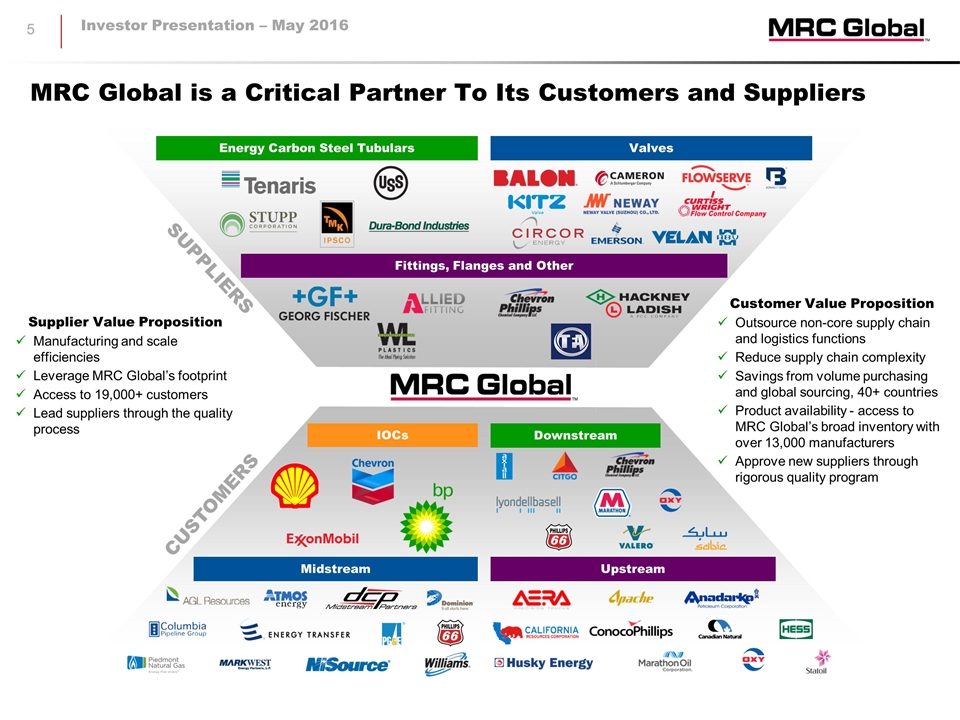

MRC Global is a Critical Partner To Its Customers and Suppliers CUSTOMERS SUPPLIERS Energy Carbon Steel Tubulars Valves Fittings, Flanges and Other IOCs Downstream Midstream Upstream Supplier Value Proposition Manufacturing and scale efficiencies Leverage MRC Global’s footprint Access to 19,000+ customers Lead suppliers through the quality process Customer Value Proposition Outsource non-core supply chain and logistics functions Reduce supply chain complexity Savings from volume purchasing and global sourcing, 40+ countries Product availability - access to MRC Global’s broad inventory with over 13,000 manufacturers Approve new suppliers through rigorous quality program

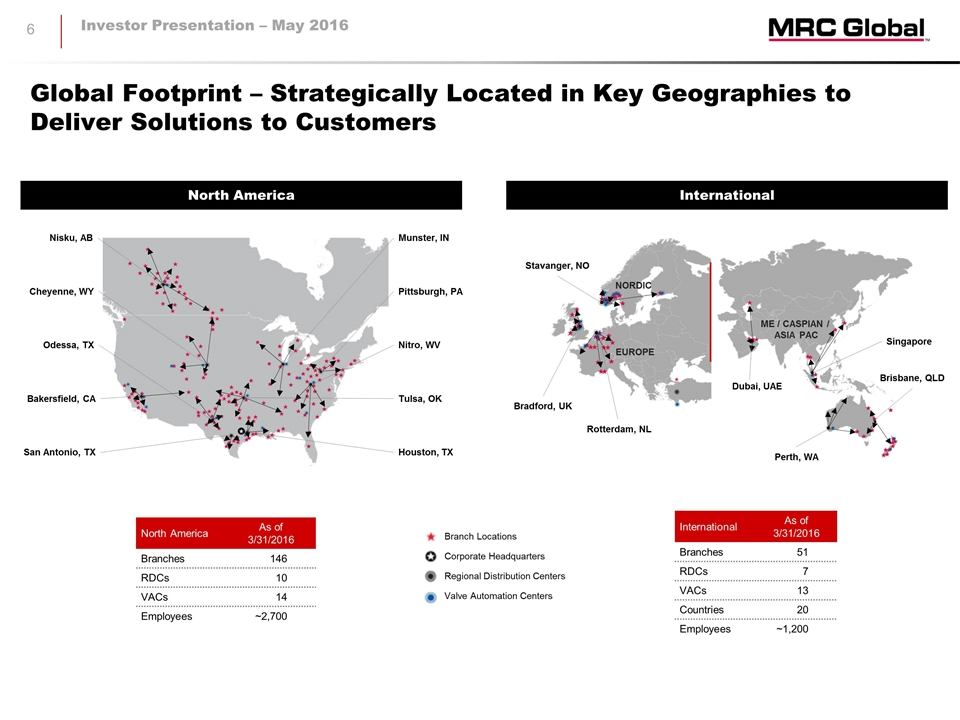

International North America Global Footprint – Strategically Located in Key Geographies to Deliver Solutions to Customers Nisku, AB Cheyenne, WY Odessa, TX Bakersfield, CA San Antonio, TX North America As of 3/31/2016 Branches 146 RDCs 10 VACs 14 Employees ~2,700 Munster, IN Nitro, WV Tulsa, OK Pittsburgh, PA Houston, TX Corporate Headquarters Regional Distribution Centers Valve Automation Centers Branch Locations EUROPE NORDIC Perth, WA Rotterdam, NL International As of 3/31/2016 Branches 51 RDCs 7 VACs 13 Countries 20 Employees ~1,200 Stavanger, NO Bradford, UK Brisbane, QLD Singapore Dubai, UAE ME / CASPIAN / ASIA PAC

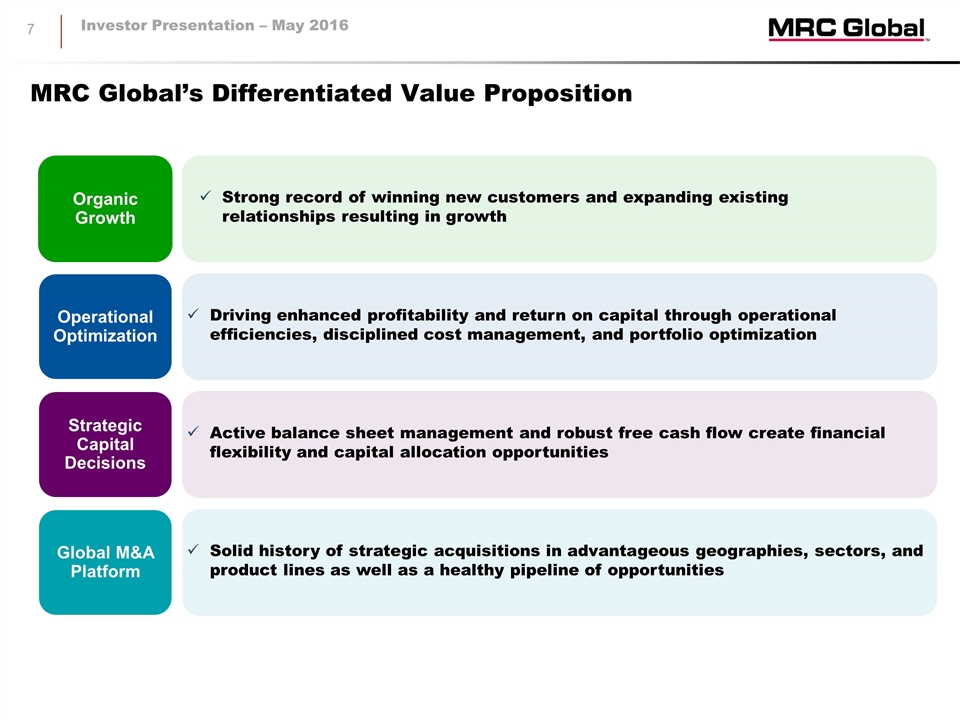

MRC Global’s Differentiated Value Proposition Organic Growth Operational Optimization Strategic Capital Decisions Global M&A Platform Strong record of winning new customers and expanding existing relationships resulting in growth Driving enhanced profitability and return on capital through operational efficiencies, disciplined cost management, and portfolio optimization Active balance sheet management and robust free cash flow create financial flexibility and capital allocation opportunities Solid history of strategic acquisitions in advantageous geographies, sectors, and product lines as well as a healthy pipeline of opportunities

Strong Record of Customer Contract Wins and Renewals – Yields Growth Opportunities Existing MRO Contract Customers Expand sales by adding scope, cross-selling products, project activity, and continued account penetration Approximately 50% of sales are from our top 25 customers New MRO Contract Customers Capitalize on MRC Global’s superior customer service and broad offering to win additional MRO contracts “Next 75” Customers Drive share with targeted growth accounts through focused sales efforts and exceptional customer service Continue to Expand the Integrated Supply Business Over $750 million in revenue and growing Gas distribution $400 million Refining & Upstream $350 million Customer Geography Term BASF North America 3 Years The Chemours Company U.S. 5 Years Chevron Gulf of Mexico U.S. Evergreen Shell Australia 5 Years Statoil Norway Project Marathon Oil U.S. 5 Years California Resources U.S. 3 Years TECO Energy U.S. 5 Years SABIC U.S., Europe & Saudi Arabia 5 Years Phillips 66 U.S. & Europe 5 Years Marathon Petroleum U.S. 3 Years Canadian Natural Resources Canada 3 Years Selected Recent Contract Wins and Renewals

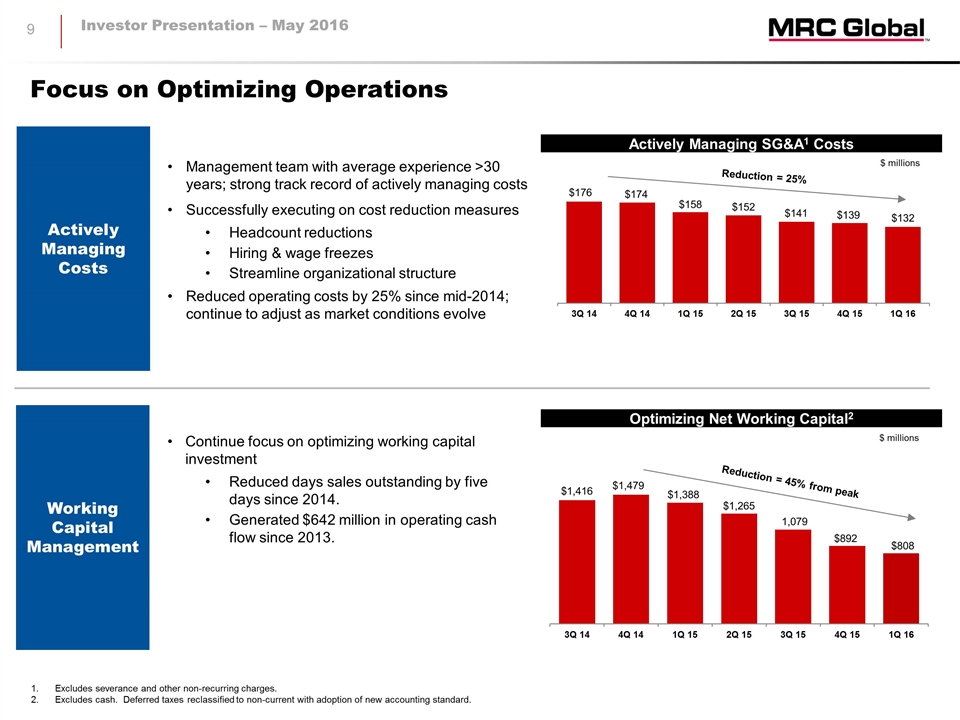

Actively Managing Costs Working Capital Management Focus on Optimizing Operations Continue focus on optimizing working capital investment Reduced days sales outstanding by five days since 2014. Generated $642 million in operating cash flow since 2013. Management team with average experience >30 years; strong track record of actively managing costs Successfully executing on cost reduction measures Headcount reductions Hiring & wage freezes Streamline organizational structure Reduced operating costs by 25% since mid-2014; continue to adjust as market conditions evolve Excludes severance and other non-recurring charges. Excludes cash. Deferred taxes reclassified to non-current with adoption of new accounting standard. Reduction = 25% Reduction = 45% from peak Actively Managing SG&A1 Costs Optimizing Net Working Capital2 $ millions $ millions

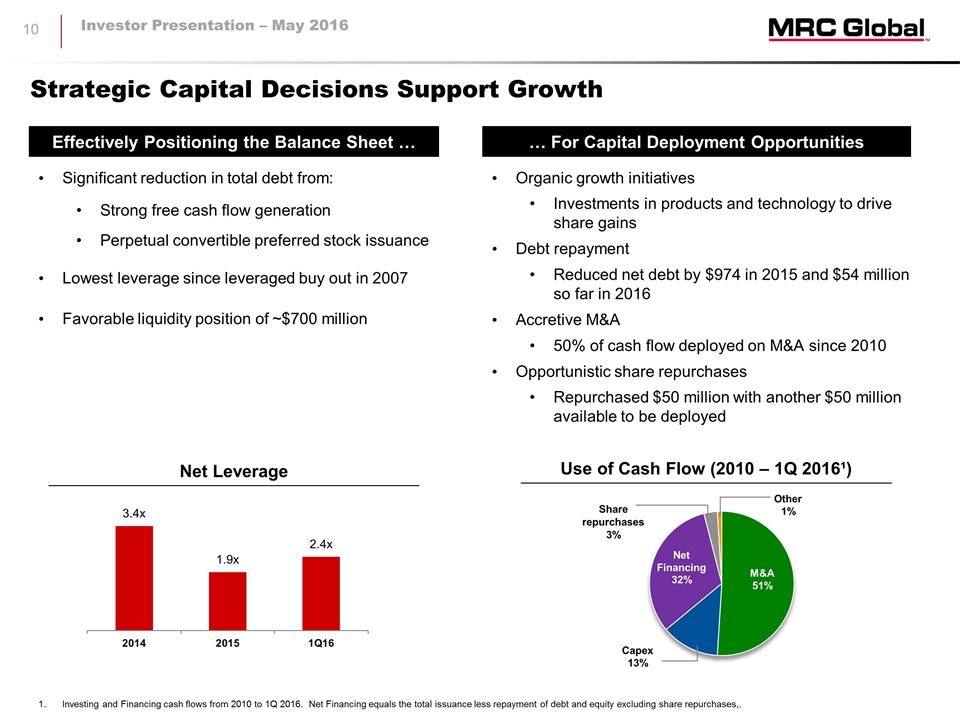

Strategic Capital Decisions Support Growth Investing and Financing cash flows from 2010 to 1Q 2016. Net Financing equals the total issuance less repayment of debt and equity excluding share repurchases,. Effectively Positioning the Balance Sheet … Significant reduction in total debt from: Strong free cash flow generation Perpetual convertible preferred stock issuance Lowest leverage since leveraged buy out in 2007 Favorable liquidity position of ~$700 million … For Capital Deployment Opportunities Organic growth initiatives Investments in products and technology to drive share gains Debt repayment Reduced net debt by $974 in 2015 and $54 million so far in 2016 Accretive M&A 50% of cash flow deployed on M&A since 2010 Opportunistic share repurchases Repurchased $50 million with another $50 million available to be deployed Use of Cash Flow (2010 – 1Q 2016¹) Net Leverage

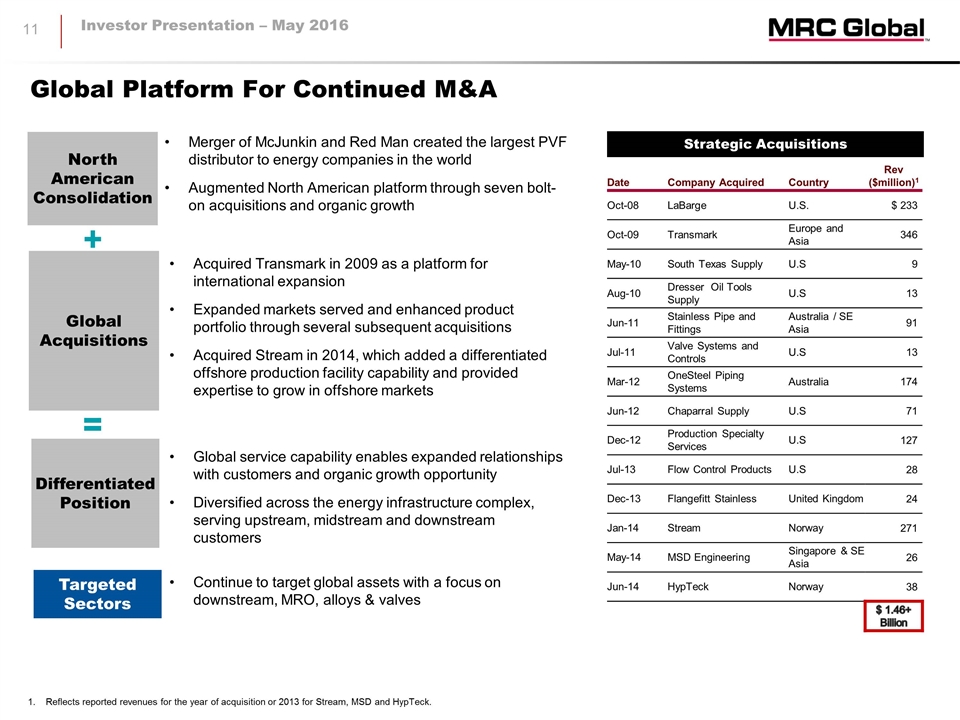

Date Company Acquired Country Rev ($million)1 Oct-08 LaBarge U.S. $ 233 Oct-09 Transmark Europe and Asia 346 May-10 South Texas Supply U.S 9 Aug-10 Dresser Oil Tools Supply U.S 13 Jun-11 Stainless Pipe and Fittings Australia / SE Asia 91 Jul-11 Valve Systems and Controls U.S 13 Mar-12 OneSteel Piping Systems Australia 174 Jun-12 Chaparral Supply U.S 71 Dec-12 Production Specialty Services U.S 127 Jul-13 Flow Control Products U.S 28 Dec-13 Flangefitt Stainless United Kingdom 24 Jan-14 Stream Norway 271 May-14 MSD Engineering Singapore & SE Asia 26 Jun-14 HypTeck Norway 38 $ 1.46+ Billion Reflects reported revenues for the year of acquisition or 2013 for Stream, MSD and HypTeck. Strategic Acquisitions Global Platform For Continued M&A North American Consolidation Global Acquisitions Differentiated Position Merger of McJunkin and Red Man created the largest PVF distributor to energy companies in the world Augmented North American platform through seven bolt-on acquisitions and organic growth Acquired Transmark in 2009 as a platform for international expansion Expanded markets served and enhanced product portfolio through several subsequent acquisitions Acquired Stream in 2014, which added a differentiated offshore production facility capability and provided expertise to grow in offshore markets Global service capability enables expanded relationships with customers and organic growth opportunity Diversified across the energy infrastructure complex, serving upstream, midstream and downstream customers Targeted Sectors Continue to target global assets with a focus on downstream, MRO, alloys & valves

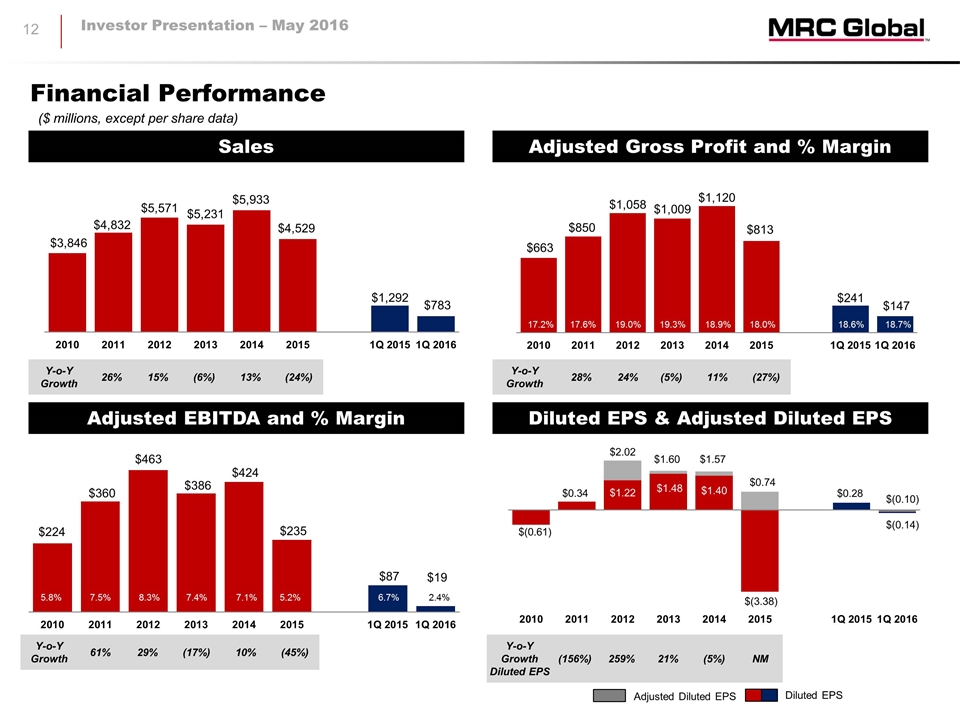

Y-o-Y Growth 61% 29% (17%) 10% (45%) Y-o-Y Growth 28% 24% (5%) 11% (27%) Sales Adjusted Gross Profit and % Margin Adjusted EBITDA and % Margin 7.0% 8.5% ($ millions, except per share data) 5.8% 7.5% 8.3% 7.4% 7.1% 5.2% 6.7% 2.4% Diluted EPS & Adjusted Diluted EPS 17.2% 17.6% 19.0% 19.3% 18.9% 18.0% 18.6% 18.7% Financial Performance Adjusted Diluted EPS Diluted EPS Y-o-Y Growth 26% 15% (6%) 13% (24%) Y-o-Y Growth Diluted EPS (156%) 259% 21% (5%) NM

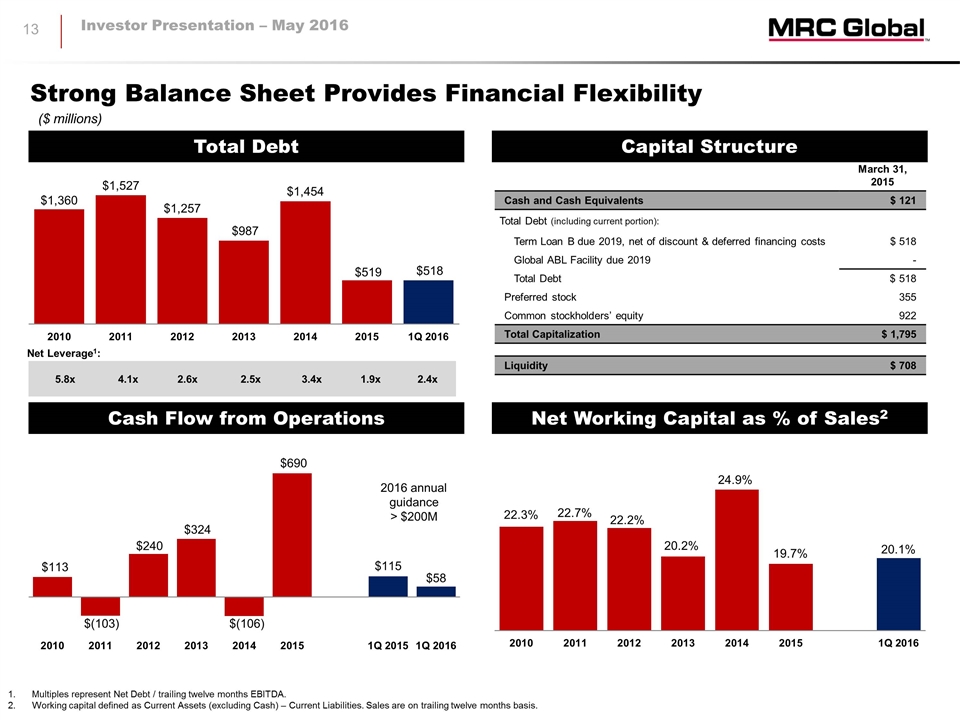

Total Debt Capital Structure Cash Flow from Operations Net Working Capital as % of Sales2 ($ millions) March 31, 2015 Cash and Cash Equivalents $ 121 Total Debt (including current portion): Term Loan B due 2019, net of discount & deferred financing costs $ 518 Global ABL Facility due 2019 - Total Debt $ 518 Preferred stock 355 Common stockholders’ equity 922 Total Capitalization $ 1,795 Liquidity $ 708 Strong Balance Sheet Provides Financial Flexibility Multiples represent Net Debt / trailing twelve months EBITDA. Working capital defined as Current Assets (excluding Cash) – Current Liabilities. Sales are on trailing twelve months basis. Y-o-Y Growth 30.8% 13.1% (9.0%) 39.7% (39.7%) 5.8x 4.1x 2.6x 2.5x 3.4x 1.9x 2.4x Net Leverage1: 2016 annual guidance > $200M

Market Leader in PVF Distribution, Serving Critical Function to the Energy Industry Diversified Across Sectors, Regions and Customers Differentiated Global Platform Creates Customer Value Counter-cyclical Cash Flow and Strong Balance Sheet Organic Growth Potential from Existing Business, Supported by Long-term Secular Growth from Global Energy Demand Proven History of Driving Continuous Productivity Improvements to Deliver Industry Leading Margins Industry Consolidator with Proven Success in Acquiring and Integrating Businesses World-Class Management Team with Significant Distribution and Energy Experience Compelling Long-Term Investment

Appendix

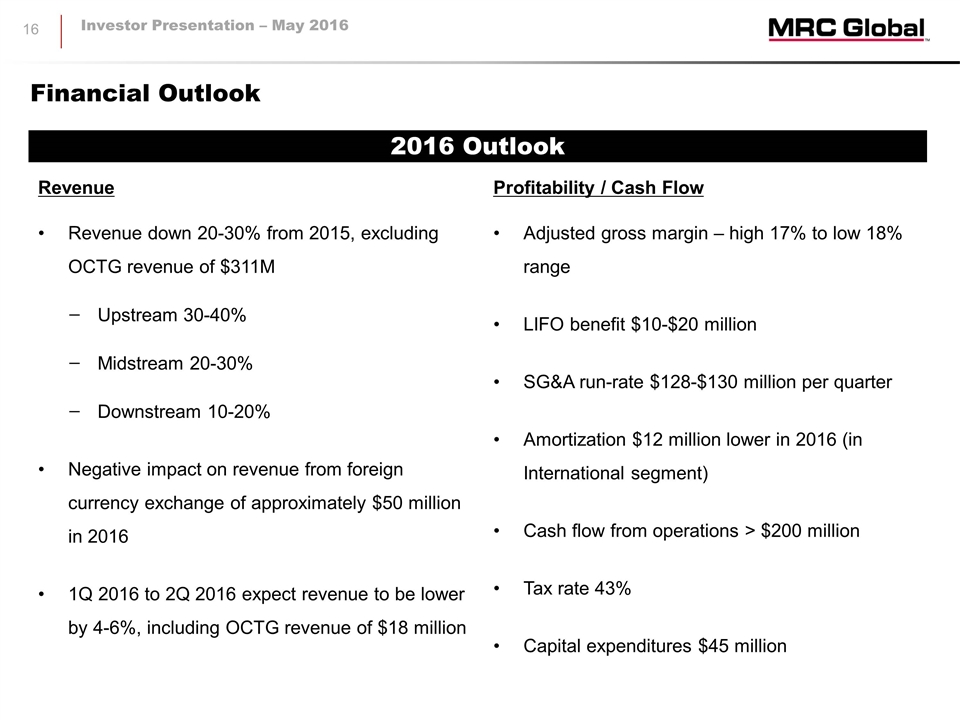

Financial Outlook Revenue Revenue down 20-30% from 2015, excluding OCTG revenue of $311M Upstream 30-40% Midstream 20-30% Downstream 10-20% Negative impact on revenue from foreign currency exchange of approximately $50 million in 2016 1Q 2016 to 2Q 2016 expect revenue to be lower by 4-6%, including OCTG revenue of $18 million 2016 Outlook Profitability / Cash Flow Adjusted gross margin – high 17% to low 18% range LIFO benefit $10-$20 million SG&A run-rate $128-$130 million per quarter Amortization $12 million lower in 2016 (in International segment) Cash flow from operations > $200 million Tax rate 43% Capital expenditures $45 million

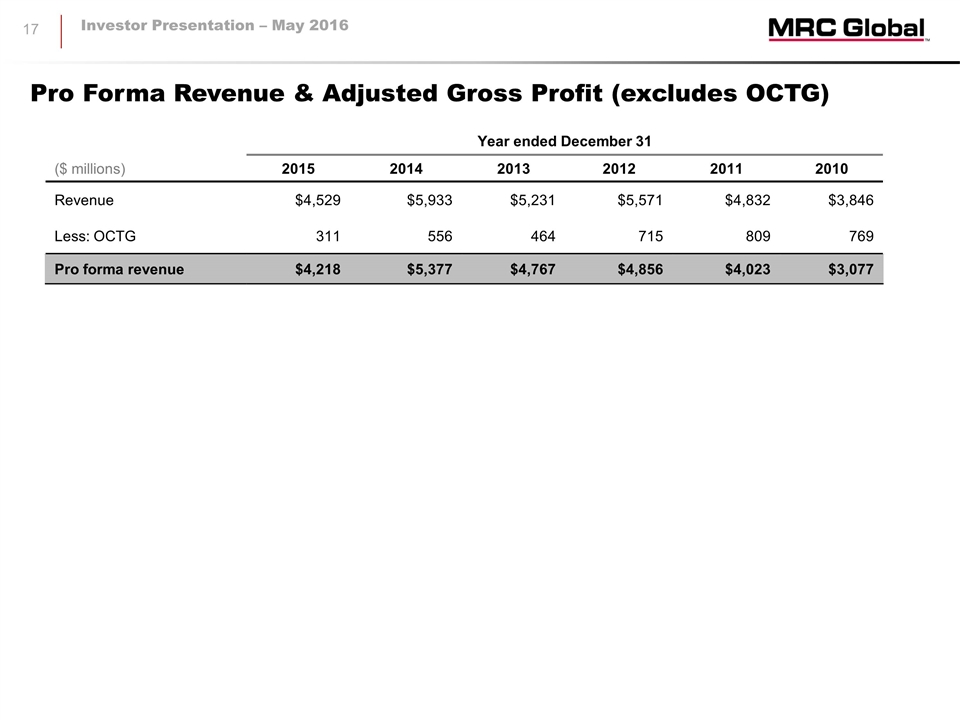

Pro Forma Revenue & Adjusted Gross Profit (excludes OCTG) Year ended December 31 ($ millions) 2015 2014 2013 2012 2011 2010 Revenue $4,529 $5,933 $5,231 $5,571 $4,832 $3,846 Less: OCTG 311 556 464 715 809 769 Pro forma revenue $4,218 $5,377 $4,767 $4,856 $4,023 $3,077

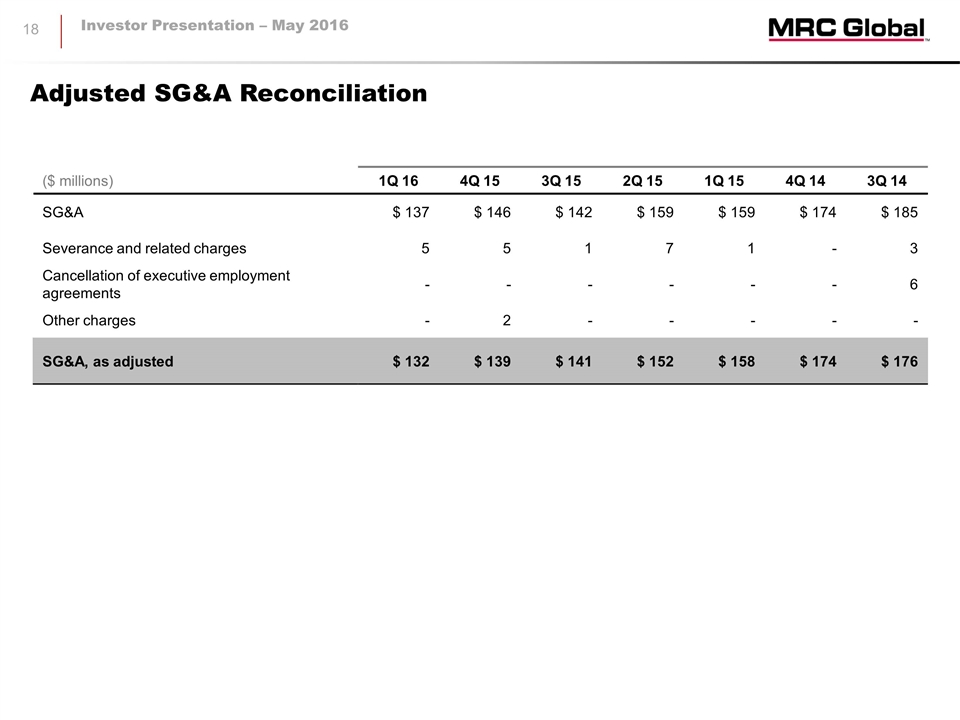

Adjusted SG&A Reconciliation ($ millions) 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 SG&A $ 137 $ 146 $ 142 $ 159 $ 159 $ 174 $ 185 Severance and related charges 5 5 1 7 1 - 3 Cancellation of executive employment agreements - - - - - - 6 Other charges - 2 - - - - - SG&A, as adjusted $ 132 $ 139 $ 141 $ 152 $ 158 $ 174 $ 176

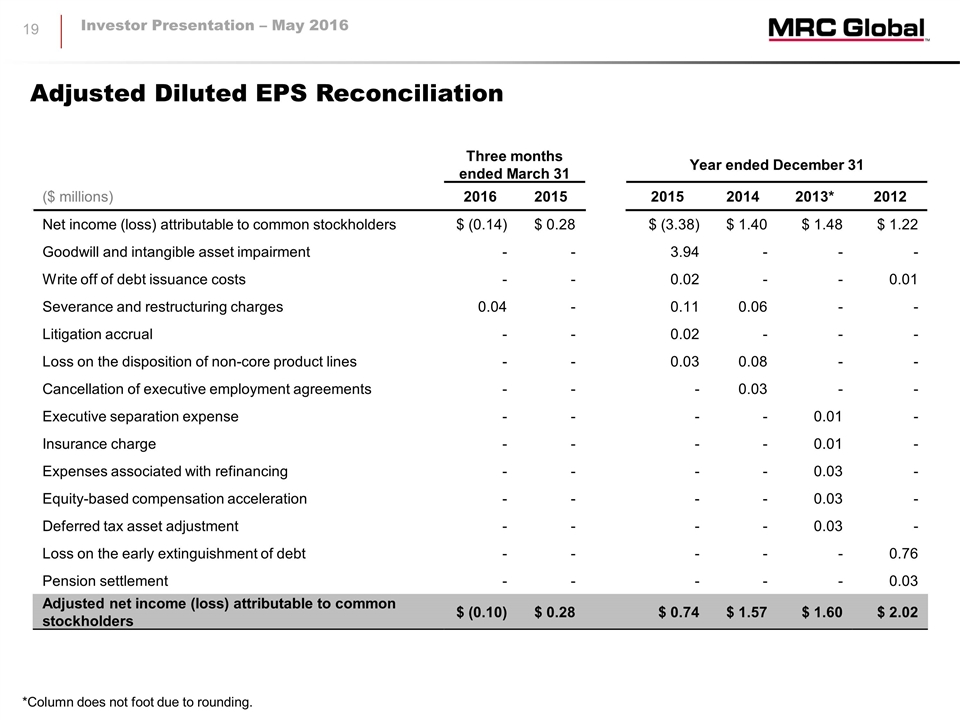

Adjusted Diluted EPS Reconciliation Three months ended March 31 Year ended December 31 ($ millions) 2016 2015 2015 2014 2013* 2012 Net income (loss) attributable to common stockholders $ (0.14) $ 0.28 $ (3.38) $ 1.40 $ 1.48 $ 1.22 Goodwill and intangible asset impairment - - 3.94 - - - Write off of debt issuance costs - - 0.02 - - 0.01 Severance and restructuring charges 0.04 - 0.11 0.06 - - Litigation accrual - - 0.02 - - - Loss on the disposition of non-core product lines - - 0.03 0.08 - - Cancellation of executive employment agreements - - - 0.03 - - Executive separation expense - - - - 0.01 - Insurance charge - - - - 0.01 - Expenses associated with refinancing - - - - 0.03 - Equity-based compensation acceleration - - - - 0.03 - Deferred tax asset adjustment - - - - 0.03 - Loss on the early extinguishment of debt - - - - - 0.76 Pension settlement - - - - - 0.03 Adjusted net income (loss) attributable to common stockholders $ (0.10) $ 0.28 $ 0.74 $ 1.57 $ 1.60 $ 2.02 *Column does not foot due to rounding.

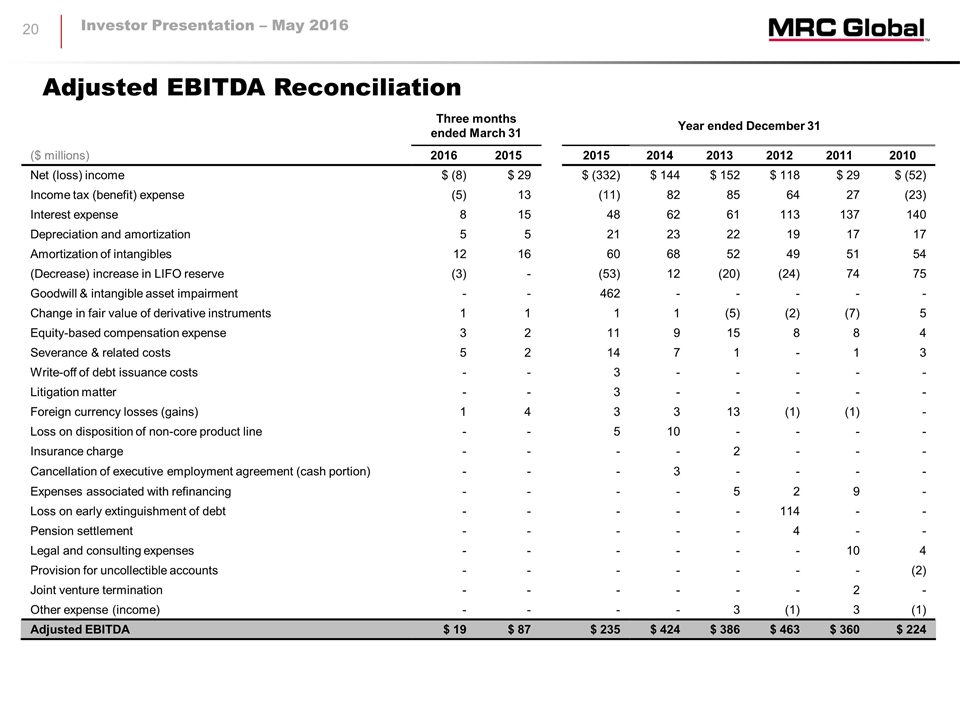

Adjusted EBITDA Reconciliation Three months ended March 31 Year ended December 31 ($ millions) 2016 2015 2015 2014 2013 2012 2011 2010 Net (loss) income $ (8) $ 29 $ (332) $ 144 $ 152 $ 118 $ 29 $ (52) Income tax (benefit) expense (5) 13 (11) 82 85 64 27 (23) Interest expense 8 15 48 62 61 113 137 140 Depreciation and amortization 5 5 21 23 22 19 17 17 Amortization of intangibles 12 16 60 68 52 49 51 54 (Decrease) increase in LIFO reserve (3) - (53) 12 (20) (24) 74 75 Goodwill & intangible asset impairment - - 462 - - - - - Change in fair value of derivative instruments 1 1 1 1 (5) (2) (7) 5 Equity-based compensation expense 3 2 11 9 15 8 8 4 Severance & related costs 5 2 14 7 1 - 1 3 Write-off of debt issuance costs - - 3 - - - - - Litigation matter - - 3 - - - - - Foreign currency losses (gains) 1 4 3 3 13 (1) (1) - Loss on disposition of non-core product line - - 5 10 - - - - Insurance charge - - - - 2 - - - Cancellation of executive employment agreement (cash portion) - - - 3 - - - - Expenses associated with refinancing - - - - 5 2 9 - Loss on early extinguishment of debt - - - - - 114 - - Pension settlement - - - - - 4 - - Legal and consulting expenses - - - - - - 10 4 Provision for uncollectible accounts - - - - - - - (2) Joint venture termination - - - - - - 2 - Other expense (income) - - - - 3 (1) 3 (1) Adjusted EBITDA $ 19 $ 87 $ 235 $ 424 $ 386 $ 463 $ 360 $ 224

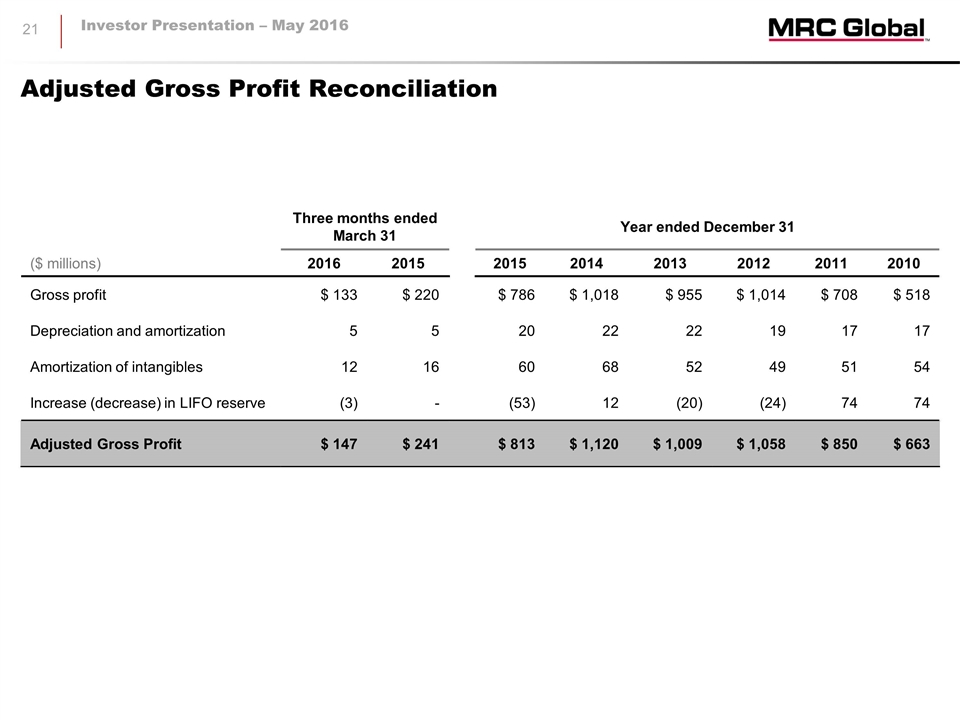

Adjusted Gross Profit Reconciliation Three months ended March 31 Year ended December 31 ($ millions) 2016 2015 2015 2014 2013 2012 2011 2010 Gross profit $ 133 $ 220 $ 786 $ 1,018 $ 955 $ 1,014 $ 708 $ 518 Depreciation and amortization 5 5 20 22 22 19 17 17 Amortization of intangibles 12 16 60 68 52 49 51 54 Increase (decrease) in LIFO reserve (3) - (53) 12 (20) (24) 74 74 Adjusted Gross Profit $ 147 $ 241 $ 813 $ 1,120 $ 1,009 $ 1,058 $ 850 $ 663