Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIAA FSB Holdings, Inc. | form8-kforeverbankinvestor.htm |

EVERBANK FINANCIAL CORP INVESTOR PRESENTATION May 2016

2 EVERBANK OVERVIEW CORPORATE OVERVIEW • Nationwide banking and lending franchise • Cohesive, experienced management team • Disciplined risk management culture with strong credit performance • 21 consecutive years of profitability • Headquartered in Jacksonville, FL • IPO in May 2012 FINANCIAL SUMMARY(1) TOTAL ASSETS & DEPOSITS ($BN) (1) As of 3/31/16. Market data and price performance as of 5/2/2016. A reconciliation of non-GAAP financial measures can be found in the appendix. MAY 2016 INVESTOR PRESENTATION Assets $26.6bn Loans & Leases, Held for Investment $22.8bn Deposits $19.0bn Tangible Common Equity per Common Share $13.23 Stock Price $15.05 Market Cap $1.9bn Ticker (NYSE) EVER $23.3 $26.6 1Q15 1Q16 Total Assets $16.1 $19.0 1Q15 1Q16 Total Deposits 14% 18%

3 Note: A reconciliation of non-GAAP financial measures can be found in the appendix. BALANCE SHEET ($MM) INCOME STATEMENT ($MM) KEY METRICS FINANCIAL OVERVIEW - 1Q 2016 Total revenue 204$ Net interest income, net of provision 165 Noninterest income 30 Noninterest expense 149 Net income allocated to common shareholders 25 GAAP EPS, diluted 0.20$ Adjusted net income allocated to common shareholders 40 Adjusted EPS, diluted 0.32$ Tangible common equity per common share 13.23$ Net interest margin 2.82% Tier 1 leverage ratio (bank) 8.2% Total risk-based capital ratio (bank) 12.9% Common equity tier 1 ratio (consolidated Basel III) 9.9% Cash and cash equivalents 601$ Total investment securities 840 Loans HFS 1,138 Loans and leases HFI, net 22,673 Total assets 26,641 Total deposits 18,996 Tot liabilities 24,785 Total shareholders' equity 1,856 MAY 2016 INVESTOR PRESENTATION

$3.10 $3.60 $4.08 $4.81 $5.39 $6.96 $8.54 $10.65 $10.12 $10.30 $11.57 $12.51 $13.36 $13.23 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1Q16 SOLID LONG TERM FINANCIAL PERFORMANCE ADJUSTED EARNINGS PER SHARE(1) (1) Represents adjusted diluted earnings per common share from continuing operations for 2007-1Q16; 2003-2006 represents GAAP basic earnings per common share from continuing operations. Calculated using adjusted net income attributable to the Company from continuing operations for 2010-1Q16; No material items gave rise to material adjustments prior to the year ended December 31, 2010; 2012 adjusted EPS calculation includes $4.5mm and $1.1mm cash dividends paid to Series A and Series B Preferred shareholders in Q1 and Q2, respectively; a reconciliation of non-GAAP financial measures can be found in the appendix. (2) Represents tangible common equity per share including accumulated other comprehensive loss. A reconciliation of non-GAAP financial measures can be found in the appendix. (3) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property accounted for under ASC 310-30 because we expect to fully collect the carrying value of such loans and foreclosed property. A reconciliation of non-GAAP financial measures can be found in the appendix. TANGIBLE COMMON EQUITY PER SHARE(2) ADJUSTED RETURN ON AVERAGE EQUITY ADJUSTED NPA / TOTAL ASSETS(3) 4 $0.42 $0.53 $0.63 $0.74 $0.66 $0.41 $0.78 $1.28 $1.11 $1.27 $1.11 $1.13 $1.22 $0.32 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1Q16 14.3% 15.4% 16.3% 16.5% 13.1% 7.4% 11.5% 14.0% 10.7% 12.4% 9.9% 9.2% 9.3% 9.3% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1Q16 EverBank $5-25bn Banks 0.66% 2.01% 2.73% 2.11% 1.86% 1.08% 0.65% 0.46% 0.53% 0.53% 2007 2008 2009 2010 2011 2012 2013 2014 2015 1Q16 MAY 2016 INVESTOR PRESENTATION

SUPERIOR LONG-TERM CREDIT PERFORMANCE NPLs / LOANS (%)(1) 5 NPAs / ASSETS (%)(1) TRAILING TWELVE MONTHS TOTAL NET CHARGE OFFS / AVERAGE TOTAL LOANS (1) Metric represents adjusted non-performing loans (assets) as a percentage of total loans (assets). Numerator excludes government-insured pool buyout loans 90 days or more past due still accruing and loans (assets) accounted for under ASC 310-30. (2) SNL Financial. U.S. Publicly-traded banks with $10-30bn in total assets as of 12/31/2015. (3) SNL Financial. Average of all (currently active, defunct and/or acquired) banks with $1-30 billion in total assets as of 4Q 2004. EverBank Average of Banks $10-$30bn Assets (2) (3) 0.97 0.89 1.07 0.61 0.56 0.44 0.45 0.41 0.37 0.42 0.56 0.53 0.54 2.86 2.59 2.45 2.27 2.18 2.04 1.93 1.77 1.62 1.54 1.48 1.44 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 0.99 0.92 1.01 0.65 0.62 0.51 0.50 0.46 0.40 0.44 0.55 0.53 0.53 2.30 2.09 1.98 1.86 1.76 1.65 1.56 1.43 1.31 1.27 1.22 1.17 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 4Q04 2Q05 4Q05 2Q06 4Q06 2Q07 4Q07 2Q08 4Q08 2Q09 4Q09 2Q10 4Q10 2Q11 4Q11 2Q12 4Q12 2Q13 4Q13 2Q14 4Q14 2Q15 4Q15 EverBank $1-30bn Banks MAY 2016 INVESTOR PRESENTATION

6 BANKING FRANCHISE OVERVIEW CORE CONSUMER CLIENT CORE COMMERCIAL CLIENT RESIDENTIAL LENDING CONSUMER LENDING WEALTH MANAGEMENT CONSUMER DEPOSITS COMMERCIAL AND CRE LENDING EQUIPMENT AND LENDER FINANCE WAREHOUSE LENDING BUSINESS BANKING EverBank offers a full suite of lending and deposit products to consumer and commercial clients through multiple channels nationwide ASSET BASED LENDING DELIVERY CHANNELS NATIONWIDE NETWORK MOBILE / TABLET ONLINE CONTACT CENTER ATM Diversified, nationwide business model Attractive client base Strong asset origination capabilities Branch-light, omni- channel distribution Enhanced digital banking products and services MAY 2016 INVESTOR PRESENTATION

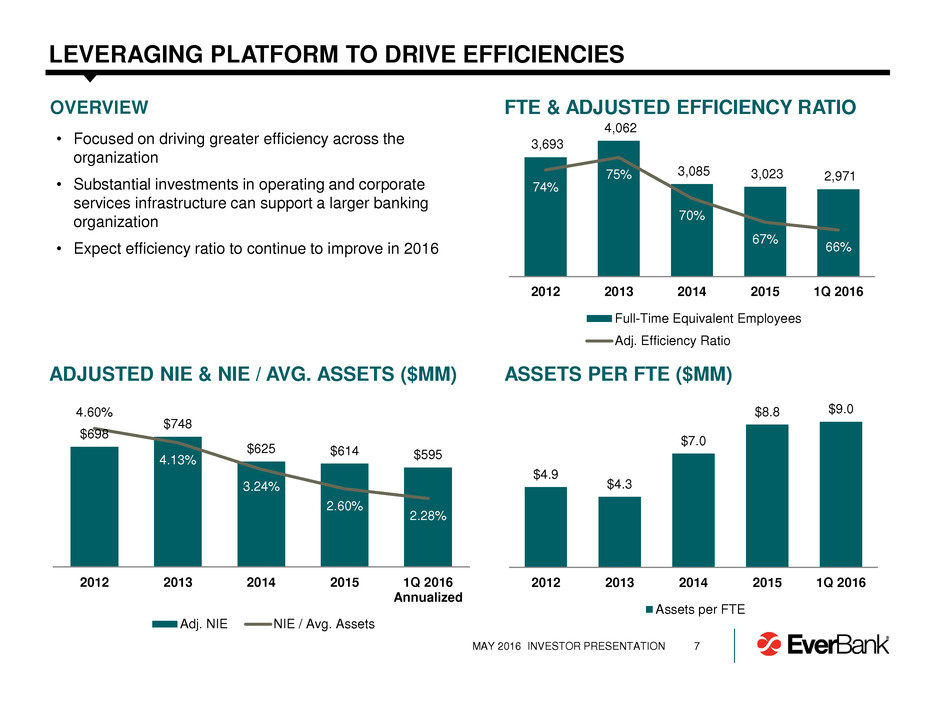

7 LEVERAGING PLATFORM TO DRIVE EFFICIENCIES FTE & ADJUSTED EFFICIENCY RATIO ADJUSTED NIE & NIE / AVG. ASSETS ($MM) ASSETS PER FTE ($MM) OVERVIEW • Focused on driving greater efficiency across the organization • Substantial investments in operating and corporate services infrastructure can support a larger banking organization • Expect efficiency ratio to continue to improve in 2016 $698 $748 $625 $614 $595 4.60% 4.13% 3.24% 2.60% 2.28% 2012 2013 2014 2015 1Q 2016 Annualized Adj. NIE NIE / Avg. Assets 3,693 4,062 3,085 3,023 2,971 74% 75% 70% 67% 66% 2012 2013 2014 2015 1Q 2016 Full-Time Equivalent Employees Adj. Efficiency Ratio $4.9 $4.3 $7.0 $8.8 $9.0 2012 2013 2014 2015 1Q 2016 Assets per FTE MAY 2016 INVESTOR PRESENTATION

(1) For the quarter ended March 31, 2016 $1.6 $2.0 $2.6 $3.6 $0.7 $0.8 $1.9 $3.5 $3.6 $0.7 $11.3 $12.8 $11.0 $13.1 $2.5 2012 2013 2014 2015 1Q 2016 Commercial HFI Residential HFI Loans Sold 8 STRONG ORGANIC ORIGINATIONS TOTAL ORIGINATIONS ($BN) RETAINED ORIGINATIONS(1) 56% Retained 79% Sold EverBank sells or retains assets to optimize risk-adjusted returns while managing balance sheet concentrations and capital levels Jumbo residential mortgage & HELOC 52% CRE and other commercial 11% Lender & warehouse finance 10% Business credit 5% Equipment finance receivables 22% MAY 2016 INVESTOR PRESENTATION

(1) As of March 31, 2016 9 DIVERSIFIED LOAN PORTFOLIO LOANS HFI PORTFOLIO MIX(1) EverBank’s loan portfolio is diversified between consumer and commercial segments LOANS HFI PORTFOLIO ($BN) $6.9 $7.2 $10.1 $12.2 $12.6 $5.6 $6.1 $7.7 $10.0 $10.2 $12.5 $13.3 $17.8 $22.2 $22.8 2012 2013 2014 2015 1Q 2016 Residential 32% Gov't. insured pool buyouts 19% HELOC and other 4% CRE and other commercial 17% Mortgage warehouse finance 11% Lender finance 6% Equipment finance receivables 11% MAY 2016 INVESTOR PRESENTATION

(1) As of December 31, 2015 (2) As of March 31, 2016 OVERVIEW DEPOSIT FRANCHISE DEPOSIT COMPOSITION(2) DEPOSITS BY REGION(1) 10 TOTAL DEPOSITS ($BN) • Branch-light model well positioned to capitalize on industry trends • Core, mass-affluent consumer clients nationwide who utilize transaction-oriented features such as online bill pay and mobile deposit • Commercial balance growth driven by attractive value proposition • Proven ability to tailor deposit growth with asset growth Mid-Atlantic / Northeast 33% Southeast 31% Midwest 14% West 14% Southwest 8% AK/HI/Other 0% $11.6 $11.4 $12.6 $14.1 $14.7 $1.5 $1.8 $3.0 $4.2 $4.3 $13.1 $13.3 $15.5 $18.2 $19.0 2012 2013 2014 2015 1Q 2016 Consumer Commercial Noninterest bearing demand 8% Interest bearing demand 19% Savings and Money Market 36% Global Markets 4% Time 33% MAY 2016 INVESTOR PRESENTATION

ATTRACTIVE DEPOSIT BASE LOYAL CUSTOMERS WITH GROWING BALANCES (1) Average account balance for non-CD bank accounts existing at each point in time, shown from initial year end to December 31, 2015. 11 Average Balance of Accounts Existing at Each Period(1) $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2007 2008 2009 2010 2011 2012 2013 2014 MAY 2016 INVESTOR PRESENTATION

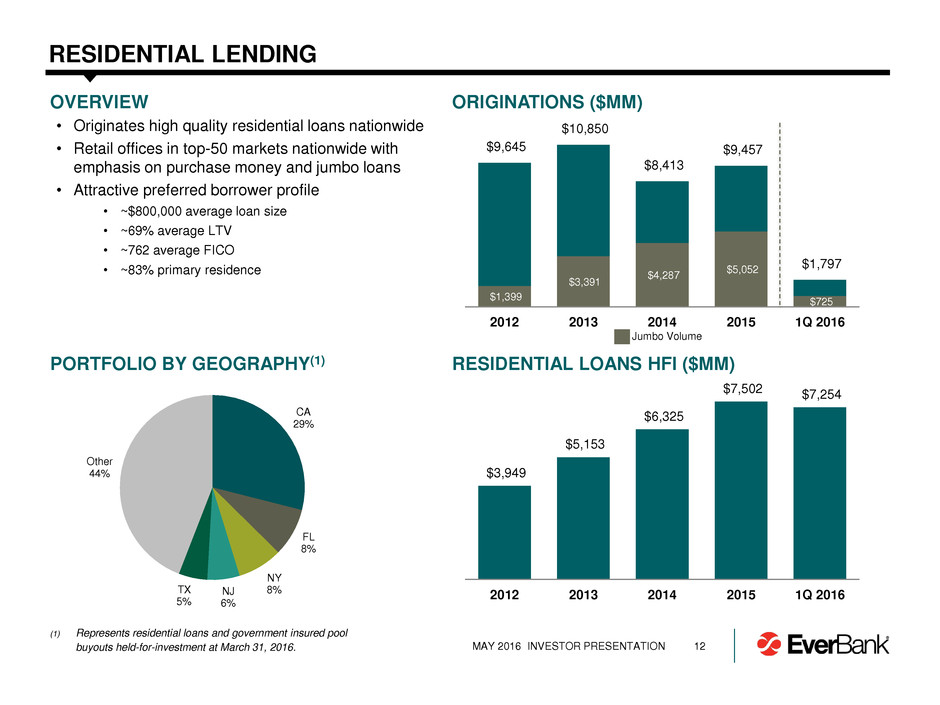

CA 29% FL 8% NY 8% NJ 6% TX 5% Other 44% (1) Represents residential loans and government insured pool buyouts held-for-investment at March 31, 2016. $1,399 $3,391 $4,287 $5,052 $725 $9,645 $10,850 $8,413 $9,457 $1,797 2012 2013 2014 2015 1Q 2016 RESIDENTIAL LENDING OVERVIEW ORIGINATIONS ($MM) RESIDENTIAL LOANS HFI ($MM) • Originates high quality residential loans nationwide • Retail offices in top-50 markets nationwide with emphasis on purchase money and jumbo loans • Attractive preferred borrower profile • ~$800,000 average loan size • ~69% average LTV • ~762 average FICO • ~83% primary residence PORTFOLIO BY GEOGRAPHY(1) 12 $3,949 $5,153 $6,325 $7,502 $7,254 2012 2013 2014 2015 1Q 2016 Jumbo Volume MAY 2016 INVESTOR PRESENTATION

GOVERNMENT-INSURED LOAN PORTFOLIO OVERVIEW GOV’T INSURED POOL BUYOUTS HFI ($MM) 13 • Short duration asset with stable, predictable cash flows • Attractive risk-return profile in a period of sustained low rates • Consists of loans that are insured or guaranteed by one of several federal government agencies • Allowance related to these loans is low due to limited / no loss exposure • Extensive historical performance, program and oversight knowledge $2,759 $1,892 $3,595 $4,215 $4,396 22% 14% 20% 19% 19% 0% 5% 10% 15% 20% 25% $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2012 2013 2014 2015 1Q 2016 EoP Balance % of Loans and Leases HFI MAY 2016 INVESTOR PRESENTATION

• Originate commercial real estate loans for the acquisition and refinancing of stabilized CRE for owner users, investors and developers nationwide • Loans backed by single-tenant, multi-tenant and multi-family properties in top-100 markets nationwide • Business re-launched in 2013 after integration of Business Property Lending acquisition • Diversified loan portfolio by both geography and property type COMMERCIAL REAL ESTATE LENDING PORTFOLIO BY PROPERTY TYPE(1) PORTFOLIO BY GEOGRAPHY(1) OVERVIEW Industrial 7% Medical 7% Multifamily 24% Office 21% Retail 23% Warehouse 11% Other 7% CA 14% FL 11% TX 9% IL 7% NC 6% Other 53% LOAN PORTFOLIO ($MM) $3,190 $3,464 $3,744 $3,615 2013 2014 2015 1Q 2016 (1) Represents single-tenant and multi-tenant. Excludes Bank of Florida acquired loans. As of March 31, 2016. 14 $607 $857 $1,172 $149 2013 2014 2015 1Q 2016 LOANS HFI ORIGINATIONS MAY 2016 INVESTOR PRESENTATION

$775 $1,317 $1,282 $300 $372 $272 $510 $55 2013 2014 2015 1Q 2016 TX 12% CA 11% FL 10% NY 7% NJ 6% Other 54% COMMERCIAL FINANCE • Equipment finance (EF) originates equipment leases and loans nationwide through relationships with over 800 equipment manufacturers, distributors and dealers • Entered into the business through Tygris acquisition in 2010 • Lender finance provides revolving and term credit facilities secured by equipment and receivables to specialty finance companies • $15-$50mm transaction sizes • Diversified across multiple industries LEASE / LOAN PORTFOLIO ($MM) EF PORTFOLIO BY GEOGRAPHY(1) OVERVIEW EF PORTFOLIO BY PRODUCT(1) Healthcare 29% Office Products 19% Capital Equipment 11% Specialty vehicle 10% Information Technology 10% Construction 9% Other 13% 15 LOANS HFI ORIGINATIONS $355 $1,238 $2,032 $2,401 $2,401 $593 $762 $1,280 $1,300 2013 2014 2015 1Q 2016 $1,831 $2,794 $3,681 $1,147 $1,588 $1,792 Equipment Finance Lender Finance (1) As of March 31, 2016 $3,701 MAY 2016 INVESTOR PRESENTATION

APPENDIX

NON-GAAP RECONCILIATIONS QUARTERLY ADJUSTED NET INCOME 17 MAY 2016 INVESTOR PRESENTATION March 31, December 31, September 30, June 30, March 31, (dollars and shares in thousands) 2016 2015 2015 2015 2015 Net income 27,924$ 45,146$ 29,583$ 41,567$ 14,230$ Transaction and non-recurring regulatory related expense, net of tax (43) (1,849) (784) 3,745 1,498 Increase (decrease) in Bank of Florida non-accretable discount, net of tax (14) - (51) 159 (967) MSR impairment (recovery), net of tax 13,976 (55) 2,758 (9,751) 26,879 Restructuring cost, net of tax 438 2,219 (222) 10,667 - OTTI credit losses on investment securities (Volcker Rule), net of tax - - - - - Adjusted net income 42,281$ 45,461$ 31,284$ 46,387$ 41,640$ Adjusted net income allocated to preferred stock 2,531 2,531 2,532 2,531 2,531 Adjusted net income allocated to common shareholders 39,750$ 42,930$ 28,752$ 43,856$ 39,109$ Adjusted net earnings per common share, diluted 0.32$ 0.34$ 0.23$ 0.35$ 0.31$ Weighted average common shares outstanding, diluted 126,045 126,980 127,099 126,523 126,037 Three Months Ended

NON-GAAP RECONCILIATIONS ANNUAL ADJUSTED NET INCOME1 (1) No material items gave rise to adjustments prior to the year ended December 31, 2010. 18 (dollars and shares in thousands) 2015 2014 2013 2012 2011 2010 GAAP net income from continuing operations $ 130,526 $ 148,082 $ 136,740 $ 74,042 $ 52,729 $ 188,900 Bargain purchase gain on Tygris transaction, net of tax - - - - - (68,056) Gain on sale of investment securities due to portfolio repositioning, net of tax - - - - - (12,337) Gain on repuchase of trust preferred securities, net of tax - - - - (2,910) (3,556) Transaction expense and non-recurring regulatory related expense, net of tax 2,610 6,462 48,477 23,088 16,831 5,984 Loss on early extinguishment of acquired debt, net of tax - - - - - 6,411 Decrease in fair value of Tygris indemnification asset, net of tax - - - - 5,382 13,654 Inc. (Dec.) in Bank of Florida non-accretable discount, net of tax (859) 727 (95) 3,195 3,007 3,837 Impact of change in ALLL methodology, net of tax - - - - 1,178 - Adoption of TDR guidance and policy change, net of tax - - - 3,709 6,225 - MSR impairment, net of tax 19,831 (4,967) (58,870) 39,375 24,462 - Tax expense (benefit) related to revaluation of ygris NUBIL, net of tax - - - - 691 (7,840) Restructuring cost, net of tax 12,664 466 19,332 - - - OTTI credit losses on investment securities (Volcker Rule), net of tax - 425 2,045 - - - Adjusted net income 164,772$ 151,195$ 147,629$ 143,409$ 107,595$ 126,997$ Adjusted net income allocated to preferred stock 10,125 10,125 10,125 9,283 22,211 31,619 Adjusted net income allocated to common shareholders 154,647$ 141,070$ 137,504$ 134,126$ 85,384$ 95,378$ Adjusted net earnings per common share, diluted 1.22$ 1.13$ 1.11$ 1.27$ 1.11$ 1.28$ MAY 2016 INVESTOR PRESENTATION

NON-GAAP RECONCILIATIONS ADJUSTED EFFICIENCY RATIO 19 MAY 2016 INVESTOR PRESENTATION March 31, December 31, September 30, June 30, March 31, (dollars in thousands) 2016 2015 2015 2015 2015 Net interest income 173,781$ 175,040$ 168,840$ 169,025$ 155,438$ Noninterest income 29,753 57,850 41,195 83,814 32,521 Total revenue 203,534 232,890 210,035 252,839 187,959 Adjustment items (pre-tax): MSR impairment (recovery) 22,542 (89) 4,450 (15,727) 43,352 Restructuring cost - 160 - 96 - Adjusted total revenue 226,076$ 232,961$ 214,485$ 237,208$ 231,311$ oninterest expense 149,430 152,861 151,506 177,968$ 156,042$ djustment items (pre-tax): Transaction expense and non-recurring regulatory related expense 69 2,981 1,264 (6,041) (2,417) Restructuring cost (706) (3,419) 360 (17,108) - Adjusted noninterest expense 148,793$ 152,423$ 153,130$ 154,819$ 153,625$ GAAP efficiency ratio 73% 66% 72% 70% 83% Adjusted efficiency ratio 66% 65% 71% 65% 66% Three Months Ended

NON-GAAP RECONCILIATIONS ADJUSTED EFFICIENCY RATIO 20 December 31, December 31, December 31, December 31, (dollars in thousands) 2015 2014 2013 2012 Net interest income 668$ 565$ 559$ 514$ Noninterest income 215 337 519 370 Total revenue 884 902 1,078 884 Adjustments (pre-tax): MSR impairment (recovery) 32 (8) (95) 64 Restructuring cost 0 (2) 6 - OTTI losses on securities (Volker Rule) - 1 3 - Adjusted total revenue 916$ 892$ 993$ 947$ oninterest expense 638$ 639$ 848 736 djustment items (pre-tax): Transaction expense and non-recurring regulatory related expense (4) (10) (78) (37) Restructuring cost (20) (3) (22) - Adjusted noninterest expense 614$ 625$ 748$ 698$ GAAP efficiency ratio 72% 71% 79% 83% Adjusted efficiency ratio 67% 70% 75% 74% Year Ended MAY 2016 INVESTOR PRESENTATION

NON-GAAP RECONCILIATIONS NON-PERFORMING ASSETS (NPAs) (1) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans accounted for under ASC 310-30 because we expect to fully collect the carrying value of such loans. 21 MAY 2016 INVESTOR PRESENTATION March 31, December 31, September 30, June 30, March 31, (dollars in thousands) 2016 2015 2015 2015 2015 Total non-accrual loans and leases 128,416$ 124,877$ 123,975$ 89,168$ 74,860$ Accruing loans 90 days or more past due - - - - - Total non-performing loans (NPL) 128,416 124,877 123,975 89,168 74,860 Other real estate owned (OREO) 14,072 17,253 15,491 16,826 17,588 Total non-performing assets (NPA) 142,488 142,130 139,466 105,994 92,448 Troubled debt restructurings (TDR) less than 90 days past due 15,814 16,425 16,558 14,693 15,251 Total NPA and TDR (1) 158,302$ 158,555$ 156,024$ 120,687$ 107,699$ Total NPA and TDR 158,302$ 158,555$ 156,024$ 120,687$ 107,699$ Government-insured 90 days or more past due still accruing 3,255,744 3,199,978 2,814,506 2,901,184 2,662,619 Loans accounted for under ASC 310-30: 90 days or more past due 4,858 5,148 4,871 4,571 5,165 Total regulatory NPA and TDR 3,418,904$ 3,363,681$ 2,975,401$ 3,026,442$ 2,775,483$ Adjusted credit quality ratios excluding government-insured loans and loans accounted for under ASC 310-30: (1) NPA to total assets 0.53% 0.53% 0.55% 0.44% 0.40% Credit quality ratios including government-insured loans and loans accounted for under ASC 310-30: NPA to total assets 12.77% 12.58% 11.73% 12.49% 11.82%

NON-GAAP RECONCILIATIONS NON-PERFORMING ASSETS (NPAs) (1) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property accounted for under ASC 310-30 because we expect to fully collect the carrying value of such loans and foreclosed property. 22 December 31, December 31, December 31, December 31, December 31, December 31, December 31, December 31, December 31, (dollars in thousands) 2015 2014 2013 2012 2011 2010 2009 2008 2007 Total non-accrual loans and leases 124,877$ 76,983$ 85,910$ 156,629$ 193,478$ 213,838$ 194,951$ 123,240$ 31,770$ Accruing loans 90 days or more past due - - - - 6,673 1,754 1,362 104 - Total non-performing loans (NPL) 124,877 76,983 85,910 156,629 200,151 215,592 196,313 123,344 31,770 Other real estate owned (OREO) 17,253 22,509 29,034 40,492 42,664 37,450 24,087 18,010 4,821 Total non-performing assets (NPA) 142,130 99,492 114,944 197,121 242,815 253,042 220,400 141,354 36,591 Troubled debt restructurings (TDR) less than 90 days past due 16,425 13,634 76,913 90,094 92,628 70,173 95,482 48,768 275 Total NPA and TDR (1) 158,555$ 113,126$ 191,857$ 287,215$ 335,443$ 323,215$ 315,882$ 190,122$ 36,866$ Total NPA and TDR 158,555$ 113,126$ 191,857$ 287,215$ 335,443$ 323,215$ 315,882$ 190,122$ 36,866$ Government-insured 90 days or more past due still accruing 3,199,978 2,646,415 1,039,541 1,729,877 1,570,787 553,341 589,842 428,630 236,455 Loans accounted for under ASC 310-30: 90 days or more past due 5,148 8,448 10,083 79,984 149,743 195,425 - - - OREO - - - 16,528 19,456 19,166 - - - Total regulatory NPA and TDR 3,363,681$ 2,767,989$ 1,241,481$ 2,113,604$ 2,075,429$ 1,091,147$ 905,724$ 618,752$ 273,321$ Adjusted credit quality ratios excluding government-insured loans and loans accounted for under ASC 310-30:(1) NPA to total assets 0.53% 0.46% 0.65% 1.08% 1.86% 2.11% 2.73% 2.01% 0.66% Credit quality ratios including government-insured loans and loans accounted for under ASC 310-30: NPA to total assets 12.58% 12.74% 6.60% 11.09% 15.20% 8.50% 10.05% 8.09% 4.94% MAY 2016 INVESTOR PRESENTATION

DISCLAIMER THIS PRESENTATION HAS BEEN PREPARED BY EVERBANK FINANCIAL CORP ("EVERBANK" OR THE “COMPANY”) SOLELY FOR INFORMATIONAL PURPOSES BASED ON ITS OWN INFORMATION, AS WELL AS INFORMATION FROM PUBLIC SOURCES. THIS PRESENTATION HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF EVERBANK AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE RELEVANT. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF EVERBANK AND THE DATA SET FORTH IN THIS PRESENTATION AND OTHER INFORMATION PROVIDED BY OR ON BEHALF OF EVERBANK. EXCEPT AS OTHERWISE INDICATED, THIS PRESENTATION SPEAKS AS OF THE DATE HEREOF. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE WILL BE NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF. CERTAIN OF THE INFORMATION CONTAINED HEREIN MAY HAVE BEEN DERIVED FROM INFORMATION PROVIDED BY INDUSTRY SOURCES. EVERBANK BELIEVES THAT SUCH INFORMATION IS ACCURATE AND THAT THE SOURCES FROM WHICH IT HAS BEEN OBTAINED ARE RELIABLE. EVERBANK CANNOT GUARANTEE THE ACCURACY OF SUCH INFORMATION, HOWEVER, AND HAS NOT INDEPENDENTLY VERIFIED SUCH INFORMATION. THIS PRESENTATION MAY CONTAIN CERTAIN FORWARD-LOOKING STATEMENTS AS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, AND SUCH STATEMENTS ARE INTENDED TO BE COVERED BY THE SAFE HARBOR PROVIDED BY THE SAME. WORDS SUCH AS “OUTLOOK,” “BELIEVES,” “EXPECTS,” “POTENTIAL,” “CONTINUES,” “MAY,” “WILL,” “COULD,” “SHOULD,” “SEEKS,” “APPROXIMATELY,” “PREDICTS,” “INTENDS,” “PLANS,” “ESTIMATES,” “ANTICIPATES” OR THE NEGATIVE VERSION OF THOSE WORDS OR OTHER COMPARABLE WORDS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL FACTS, AND ARE BASED ON CURRENT EXPECTATIONS, ESTIMATES AND PROJECTIONS ABOUT THE COMPANY’S INDUSTRY, MANAGEMENT’S BELIEFS AND CERTAIN ASSUMPTIONS MADE BY MANAGEMENT, MANY OF WHICH, BY THEIR NATURE, ARE INHERENTLY UNCERTAIN AND BEYOND THE COMPANY’S CONTROL. ACCORDINGLY, YOU ARE CAUTIONED THAT ANY SUCH FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT. ALTHOUGH THE COMPANY BELIEVES THAT THE EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE AS OF THE DATE MADE, EXPECTATIONS MAY PROVE TO HAVE BEEN MATERIALLY DIFFERENT FROM THE RESULTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. UNLESS OTHERWISE REQUIRED BY LAW, EVERBANK ALSO DISCLAIMS ANY OBLIGATION TO UPDATE ITS VIEW OF ANY SUCH RISKS OR UNCERTAINTIES OR TO ANNOUNCE PUBLICLY THE RESULT OF ANY REVISIONS TO THE FORWARD-LOOKING STATEMENTS MADE IN THIS PRESENTATION. INTERESTED PARTIES SHOULD NOT PLACE UNDUE RELIANCE ON ANY FORWARD-LOOKING STATEMENT AND SHOULD CONSIDER THE UNCERTAINTIES AND RISKS DISCUSSED UNDER THE HEADINGS “RISK FACTORS” AND “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” IN EVERBANK’S ANNUAL REPORT ON FORM 10-K, QUARTERLY REPORTS ON FORM 10-Q AND IN OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. 23 MAY 2016 INVESTOR PRESENTATION