Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - Investors Bancorp, Inc. | d187764dex21.htm |

| 8-K - FORM 8-K - Investors Bancorp, Inc. | d187764d8k.htm |

| EX-99.1 - EX-99.1 - Investors Bancorp, Inc. | d187764dex991.htm |

| Exhibit 99.2

|

Acquisition of

May 4, 2016

|

|

Forward Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Investors Bancorp, Inc. and The Bank of Princeton, including future financial and operating results, cost savings and accretion to reported earnings that may be realized from the merger; (ii) Investors Bancorp, Inc.‘s and The Bank of Princeton’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. These forward-looking statements are based upon the current beliefs and expectations of Investors Bancorp, Inc.‘s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other ex pectations expressed in the forward-looking statements: (1) the businesses of Investors Bancorp, Inc. and The Bank of Princeton may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of The Bank of Princeton may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) difficulties associated with achieving expected future financial results; (10) competition from other financial services companies in Investors Bancorp, Inc.‘s and The Bank of Princeton’s markets; and (11) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Investors Bancorp, Inc.‘s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available at the SEC’s Internet site

(www.sec.gov) and The Bank of Princeton’s reports filed with the FDIC and available at the FDIC’s Internet site (www.fdic.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Investors Bancorp, Inc. or The Bank of Princeton or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Investors Bancorp, Inc. does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

| 2 |

|

2 |

|

|

Forward Looking Statements (cont’d)

Important Additional Information

This communication is being made in respect of the proposed merger transaction involving Investors Bancorp, Inc. and The Bank of Princeton. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

In connection with the proposed transaction, Investors Bancorp, Inc. intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement of The Bank of Princeton and a prospectus of Investors Bancorp, Inc., and each party will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/ prospectus will also be sent to The Bank of Princeton stockholders seeking any required stockholder approvals. Before making any voting or investment decision, investors and security holders of The Bank of Princeton are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction.

The documents filed by Investors Bancorp, Inc. with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. The documents filed by The Bank of Princeton filed with the FDIC may be obtained free of charge at the FDIC’s website at www.fdic.gov. In addition, the documents filed by Investors Bancorp, Inc. may be obtained free of charge at its website at www.myinvestorsbank.com or by contacting Investors Bancorp, Inc., 101 JFK Parkway, Short Hills, New Jersey 07078, Attention: Marianne Wade, telephone (973) 924-5100 and the documents filed by The Bank of Princeton may be obtained free of charge at The Bank of Princeton’s website at www.thebankofprinceton.com or by contacting The Bank of Princeton, 183 Bayard Lane, Princeton, New Jersey 08540, Attention: Edward Dietzler, telephone (609) 454-0717.

The Bank of Princeton and its directors, executive officers, and certain other persons may be deemed to be participants in the solicitation of proxies from The Bank of Princeton’s stockholders in favor of the approval of the merger. Information about the directors and executive officers of The Bank of Princeton and their ownership of its common stock is set forth in the proxy statement for The Bank of Princeton’s 2016 annual meeting of stockholders, as previously filed with the FDIC on April 15, 2016. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the proxy statement/prospectus when they become available.

3 3

|

|

Transaction Highlights

High quality community bank with demonstrated growth, consistent profitability and solid asset quality

Gain additional scale in Investors Bank’s Central and Southern New Jersey markets, which Investors Bank entered via its acquisition of

Roma Bank (2013)

Expansion into the Greater Princeton (Mercer County) and Philadelphia, PA markets

Strategic – Greater Princeton is one of the more attractive commercial banking markets given a favorable competitive environment (limited

Rationale number of regional bank competitors) and a less cyclical industry base (e.g. education, healthcare, government)

– Branches located in some of the wealthier counties in New Jersey: $77K of median household income1 vs. $72K for New Jersey and

$56K nationally

Adds seasoned lending team with strong commercial relationships throughout the Central New Jersey and Philadelphia markets

Leverages excess capital through an attractively priced, low execution risk transaction

The Bank of Princeton (“TBOP”) was founded in 2007 and has 10 branches in Central New Jersey and 3 in Philadelphia 2

About The Financial Highlights

Bank of – Balance Sheet: $1.0 billion assets, $842 million loans, $820 million deposits, 1.1% NPAs / Assets

Princeton

– Profitability: 2015: 1.12% ROAA, 13.0% ROAE, 3.89% NIM | Q1 2016: 1.08% ROAA, 11.9% ROAE, 3.90% NIM

– Historical Growth: since 1Q 2011, grown assets at an average of 15%, loans at 22% and net income at 35% 3

Transaction multiples: 1.50x tangible book value per share, 13.0x LTM EPS

– 6% or $0.04 accretive to 2017 earnings per share

Transaction

Economics – 2% or $0.19 dilutive to tangible book value per share, with projected earnback of approximately 3.5 years using the “crossover”

method (5 years when dividing TBV per share dilution by 2017 EPS accretion)

– Estimated internal rate of return (IRR) of greater than 15%

– Does not materially limit ability to repurchase stock

(1) Weighted average by county deposits.

4 (2) Philadelphia branches operate as MoreBank, a division of The Bank of Princeton.

(3) 5-year compound annual growth rate (CAGR).

|

|

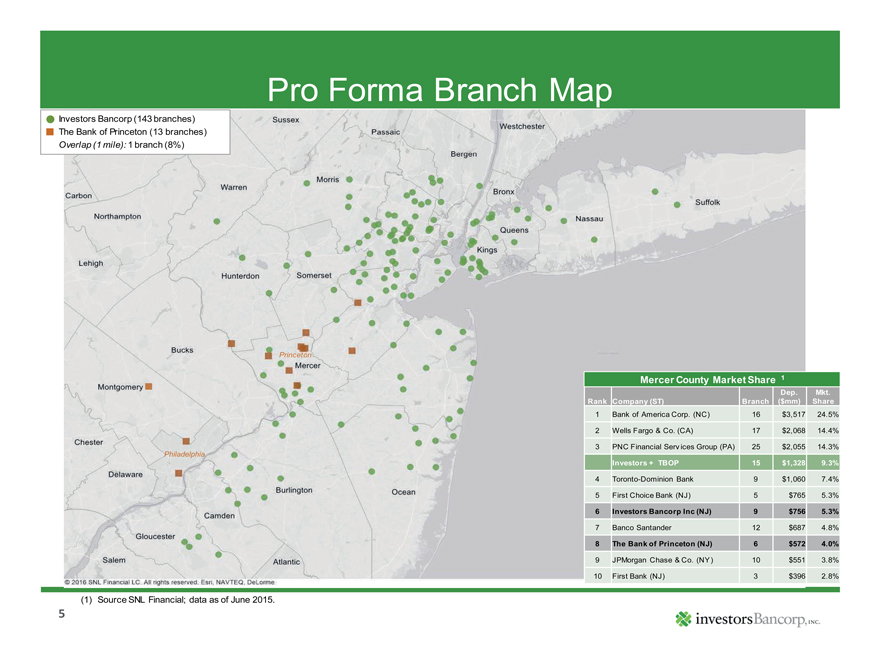

Pro Forma Branch Map

Investors Bancorp (143 branches)

The Bank of Princeton (13 branches)

Overlap (1 mile): 1 branch (8%)

Princeton

Mercer County Market Share 1

Dep. Mkt.

Rank Company (ST) Branch ($mm) Share

1 Bank of America Corp. (NC) 16 $3,517 24.5%

2 Wells Fargo & Co. (CA) 17 $2,068 14.4%

3 PNC Financial Services Group (PA) 25 $2,055 14.3%

Philadelphia

Investors + TBOP 15 $1,328 9.3%

4 Toronto-Dominion Bank 9 $1,060 7.4%

5 First Choice Bank (NJ) 5 $765 5.3%

6 Investors Bancorp Inc (NJ) 9 $756 5.3%

7 Banco Santander 12 $687 4.8%

8 The Bank of Princeton (NJ) 6 $572 4.0%

9 JPMorgan Chase & Co. (NY) 10 $551 3.8%

10 First Bank (NJ) 3 $396 2.8%

(1) Source SNL Financial; data as of June 2015.

5

|

|

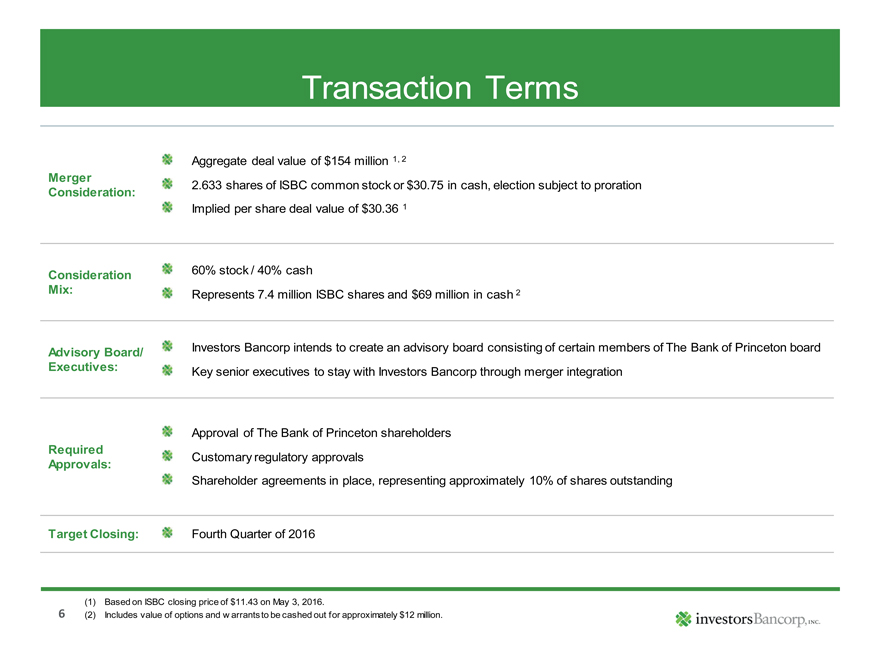

Transaction Terms

Aggregate deal value of $154 million 1, 2

Merger

Consideration: 2.633 shares of ISBC common stock or $30.75 in cash, election subject to proration

Implied per share deal value of $30.36 1

Consideration 60% stock / 40% cash

Mix: Represents 7.4 million ISBC shares and $69 million in cash 2

Advisory Board/ Investors Bancorp intends to create an advisory board consisting of certain members of The Bank of Princeton board

Executives: Key senior executives to stay with Investors Bancorp through merger integration

Approval of The Bank of Princeton shareholders

Required

Approvals: Customary regulatory approvals

Shareholder agreements in place, representing approximately 10% of shares outstanding

Target Closing: Fourth Quarter of 2016

(1) Based on ISBC closing price of $11.43 on May 3, 2016.

6 (2) Includes value of options and warrants to be cashed out for approximately $12 million.

|

|

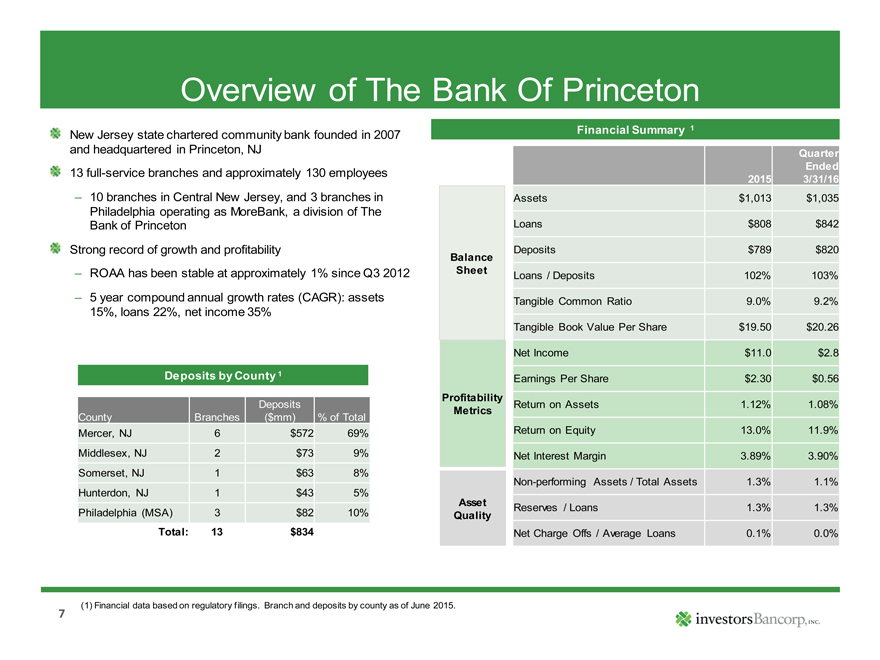

Overview of The Bank Of Princeton

New Jersey state chartered community bank founded in 2007 Financial Summary 1

and headquartered in Princeton, NJ Quarter

13 full-service branches and approximately 130 employees Ended

2015 3/31/16

– 10 branches in Central New Jersey, and 3 branches in Assets $1,013 $1,035

Philadelphia operating as MoreBank, a division of The

Bank of Princeton Loans $808 $842

Strong record of growth and profitability Deposits $789 $820

Balance

– ROAA has been stable at approximately 1% since Q3 2012 Sheet Loans / Deposits 102% 103%

– 5 year compound annual growth rates (CAGR): assets Tangible Common Ratio 9.0% 9.2%

15%, loans 22%, net income 35%

Tangible Book Value Per Share $19.50 $20.26

Net Income $11.0 $2.8

Deposits by County 1 Earnings Per Share $2.30 $0.56

Profitability

Deposits Return on Assets 1.12% 1.08%

County Branches ($mm) % of Total Metrics

Mercer, NJ 6 $572 69% Return on Equity 13.0% 11.9%

Middlesex, NJ 2 $73 9% Net Interest Margin 3.89% 3.90%

Somerset, NJ 1 $63 8%

Non-performing Assets / Total Assets 1.3% 1.1%

Hunterdon, NJ 1 $43 5%

Asset Reserves / Loans 1.3% 1.3%

Philadelphia (MSA) 3 $82 10% Quality

Total: 13 $834 Net Charge Offs / Average Loans 0.1% 0.0%

(1) Financial data based on regulatory filings. Branch and deposits by county as of June 2015.

7

|

|

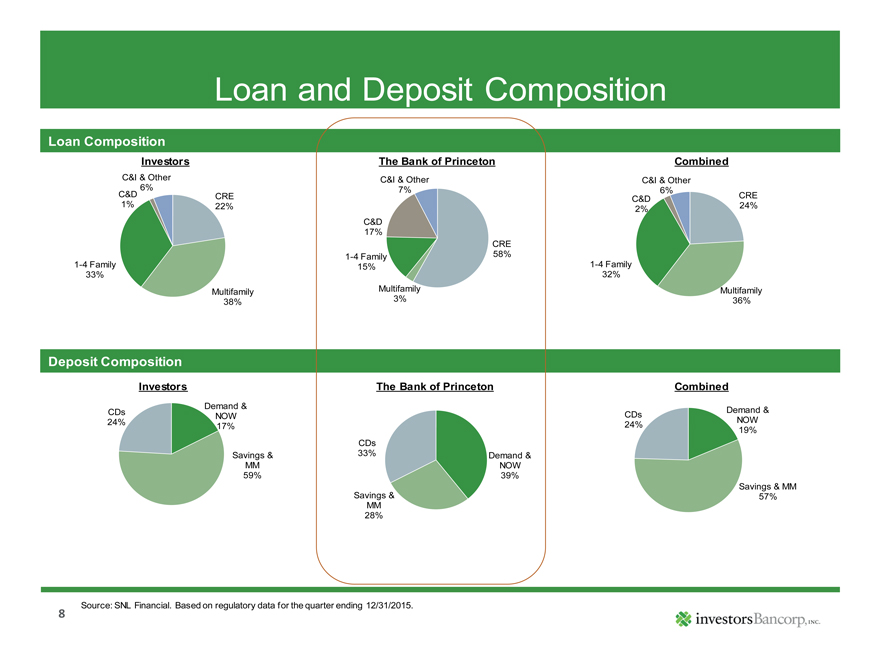

Loan and Deposit Composition

Loan Composition

Investors The Bank of Princeton Combined

C&I & Other C&I & Other C&I & Other

6% 7% 6%

C&D CRE C&D CRE

1% 22% 2% 24%

C&D

17%

CRE

1-4 Family 58%

1-4 Family 15% 1-4 Family

33% 32%

Multifamily Multifamily Multifamily

38% 3% 36%

Yield: 4.13% Yield: 5.25% Yield: 4.18%

Loans: $16,888 million Loans: $811 million Loans: $17,699 million

Deposit Composition

Investors The Bank of Princeton Combined

Demand &

CDs NOW CDs Demand &

24% 17% 24% NOW

19%

CDs

Savings & 33% Demand &

MM NOW

59% 39%

Savings & MM

Savings & 57%

MM

28%

Cost: 0.58% Cost: 0.79% Cost: 0.59%

Deposits: $14,182 million Deposits: $789 million Deposits: $14,971 million

Source: SNL Financial. Based on regulatory data for the quarter ending 12/31/2015.

8

|

|

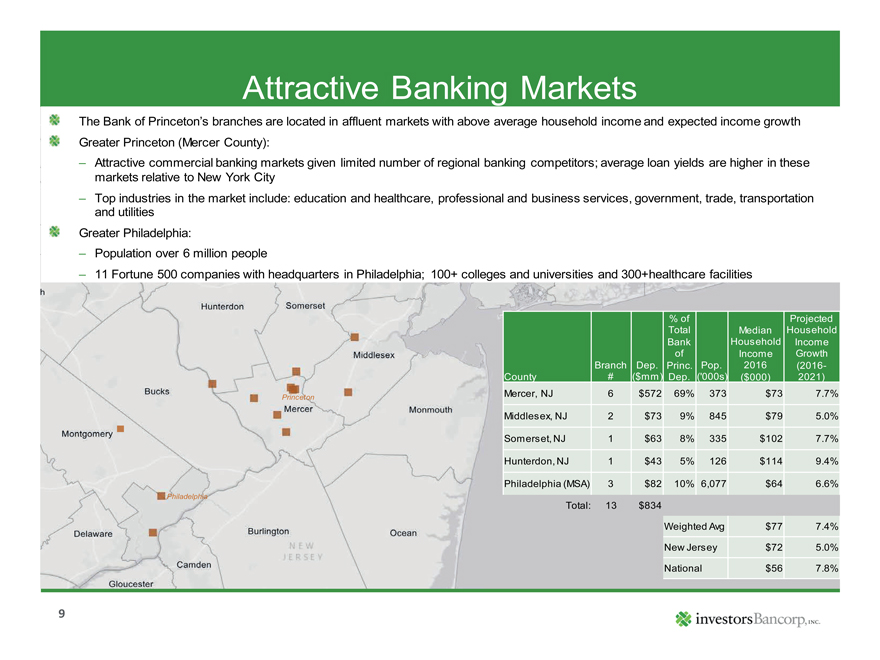

Attractive Banking Markets

The Bank of Princeton’s branches are located in affluent markets with above average household income and expected income grow th

Greater Princeton (Mercer County):

– Attractive commercial banking markets given limited number of regional banking competitors; average loan yields are higher in these

markets relative to New York City

– Top industries in the market include: education and healthcare, professional and business services, government, trade, transportation

and utilities

Greater Philadelphia:

– Population over 6 million people

– 11 Fortune 500 companies with headquarters in Philadelphia; 100+ colleges and universities and 300+healthcare facilities

% of Projected

Total Median Household

Bank Household Income

of Income Growth

Branch Dep. Princ. Pop. 2016 (2016-

County # ($mm) Dep. (‘000s) ($000) 2021)

Princeton Mercer, NJ 6 $572 69% 373 $73 7.7%

Middlesex, NJ 2 $73 9% 845 $79 5.0%

Somerset, NJ 1 $63 8% 335 $102 7.7%

Hunterdon, NJ 1 $43 5% 126 $114 9.4%

Philadelphia (MSA) 3 $82 10% 6,077 $64 6.6%

Philadelphia

Total: 13 $834

Weighted Avg $77 7.4%

New Jersey $72 5.0%

National $56 7.8%

9

|

|

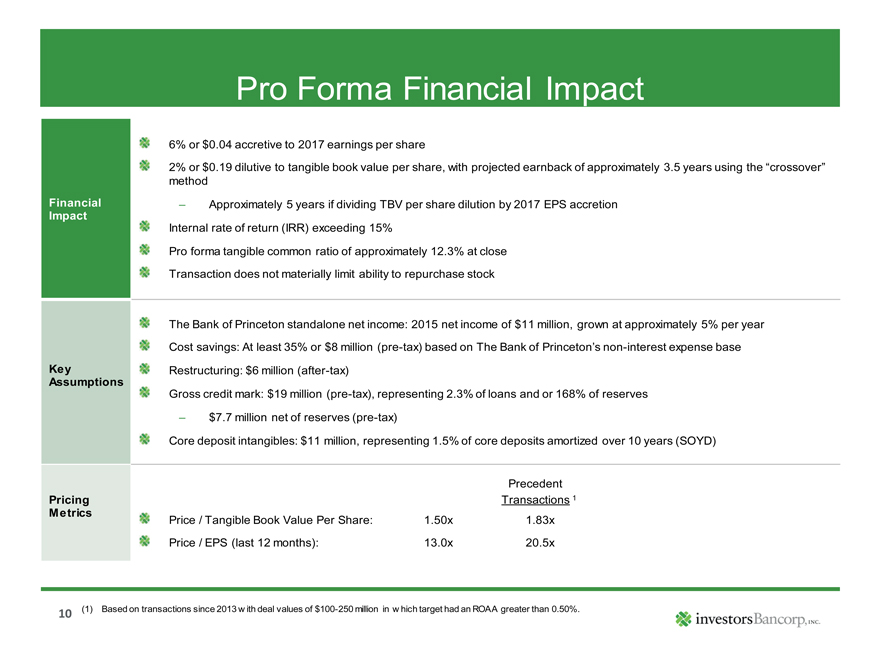

Pro Forma Financial Impact

6% or $0.04 accretive to 2017 earnings per share

2% or $0.19 dilutive to tangible book value per share, with projected earnback of approximately 3.5 years using the “crossover”

method

Financial – Approximately 5 years if dividing TBV per share dilution by 2017 EPS accretion

Impact

Internal rate of return (IRR) exceeding 15%

Pro forma tangible common ratio of approximately 12.3% at close

Transaction does not materially limit ability to repurchase stock

The Bank of Princeton standalone net income: 2015 net income of $11 million, grown at approximately 5% per year

Cost savings: At least 35% or $8 million (pre -tax) based on The Bank of Princeton’s non-interest expense base

Key Restructuring: $6 million (after-tax)

Assumptions

Gross credit mark: $19 million (pre-tax), representing 2.3% of loans and or 168% of reserves

– $7.7 million net of reserves (pre-tax)

Core deposit intangibles: $11 million, representing 1.5% of core deposits amortized over 10 years (SOYD)

Precedent

Pricing Transactions 1

Metrics Price / Tangible Book Value Per Share: 1.50x 1.83x

Price / EPS (last 12 months): 13.0x 20.5x

10 (1) Based on transactions since 2013 with deal values of $100-250 million in which target had an ROAA greater than 0.50%.

|

|

Summary

The Bank of Princeton is a high quality community bank with demonstrated strong growth, consistent profitability and clean asset

quality

Provides additional scale in Investors Bank’s current markets with expansion into attractive Greater Princeton and Philadelphia

markets

Financially compelling transaction producing 6% EPS accretion, 2% tangible book value per share dilution and a reasonable TBV

earnback period

Attractive transaction multiples of 1.5x tangible book value per share and 13x last 12 months EPS for a higher quality commun ity

bank

Low risk, value creating use of excess capital

11

|

|

investorsBancorp, INC.