Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Q1 EARNINGS RELEASE, SUPPLEMENT & SLIDES - KAR Auction Services, Inc. | form8-kxearningsreleasesup.htm |

| EX-99.1 - EXHIBIT 99.1 - EARNINGS RELEASE - KAR Auction Services, Inc. | exhibit991-q12016earningsr.htm |

| EX-99.2 - EXHIBIT 99.2 - EARNINGS RELEASE SUPPLEMENT - KAR Auction Services, Inc. | exhibit992-q12016ersupplem.htm |

Q1 2016 Earnings Slides May 3, 2016

Forward-Looking Statements This presentation includes forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. Many of these risk factors are outside of the company’s control, and as such, they involve risks which are not currently known to the company that could cause actual results to differ materially from forecasted results. Factors that could cause or contribute to such differences include those matters disclosed in the company’s Securities and Exchange Commission filings. The forward-looking statements in this document are made as of the date hereof and the company does not undertake to update its forward-looking statements. 2

First Quarter 2016 Highlights Summary Revenue: +18% Adjusted EBITDA: +17% Operating Adjusted EPS: +17% ADESA Revenue: +22% Volume: +17% Physical volume: +12% Online only volume: +33% Adjusted EBITDA: +35% IAA Revenue: +13% Volume: +14% AFC Revenue: +11% Loan transaction units: +10% Managed receivables of $1.7 billion; +26% 3

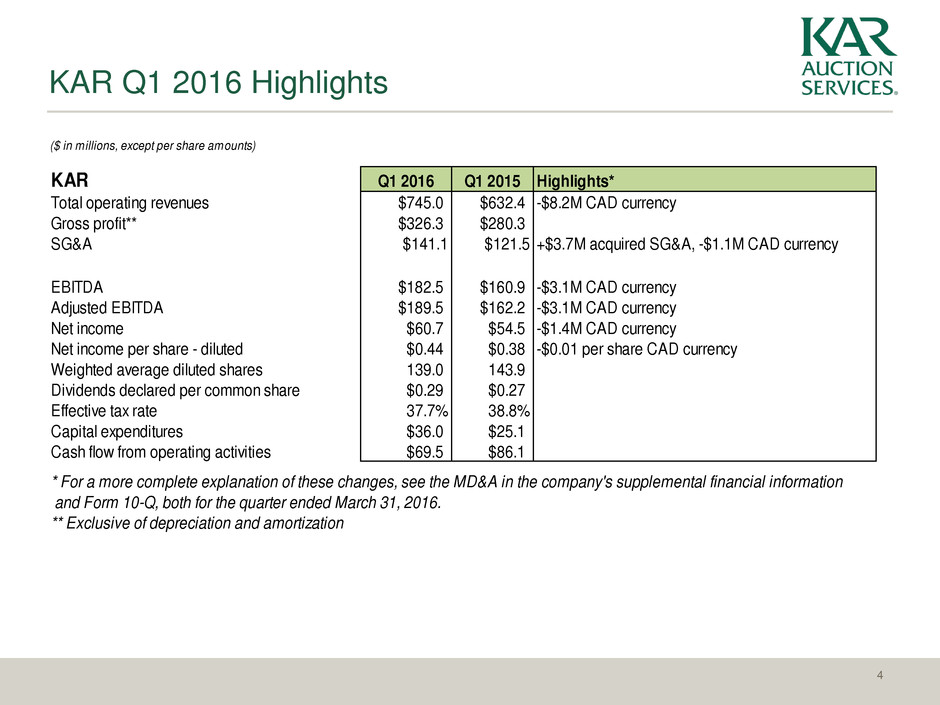

KAR Q1 2016 Highlights 4 ($ in millions, except per share amounts) KAR Q1 2016 Q1 2015 Highlights* Total operating revenues $745.0 $632.4 -$8.2M CAD currency Gross profit** $326.3 $280.3 SG&A $141.1 $121.5 +$3.7M acquired SG&A, -$1.1M CAD currency EBITDA $182.5 $160.9 -$3.1M CAD currency Adjusted EBITDA $189.5 $162.2 -$3.1M CAD currency Net income $60.7 $54.5 -$1.4M CAD currency Net income per share - diluted $0.44 $0.38 -$0.01 per share CAD currency Weighted average diluted shares 139.0 143.9 Dividends declared per common share $0.29 $0.27 Effective tax rate 37.7% 38.8% Capital expenditures $36.0 $25.1 Cash flow from operating activities $69.5 $86.1 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended March 31, 2016. ** Exclusive of depreciation and amortization

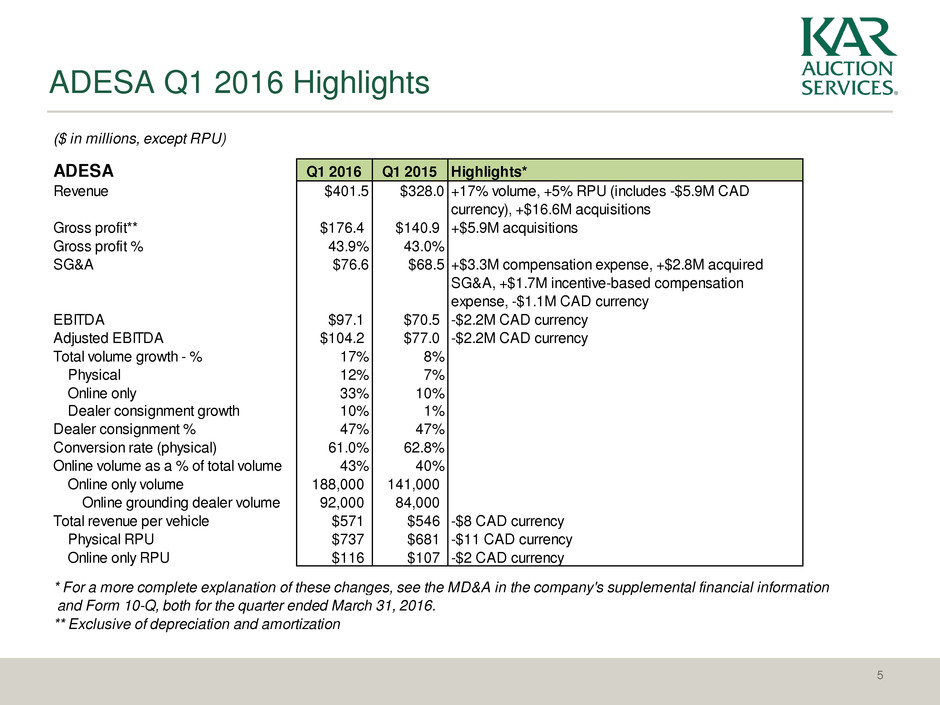

ADESA Q1 2016 Highlights 5 ($ in millions, except RPU) ADESA Q1 2016 Q1 2015 Highlights* Revenue $401.5 $328.0 +17% volume, +5% RPU (includes -$5.9M CAD currency), +$16.6M acquisitions Gross profit** $176.4 $140.9 +$5.9M acquisitions Gross profit % 43.9% 43.0% SG&A $76.6 $68.5 +$3.3M compensation expense, +$2.8M acquired SG&A, +$1.7M incentive-based compensation expense, -$1.1M CAD currency EBITDA $97.1 $70.5 -$2.2M CAD currency Adjusted EBITDA $104.2 $77.0 -$2.2M CAD currency Total volume growth - % 17% 8% Physical 12% 7% Online only 33% 10% Dealer consignment growth 10% 1% Dealer consignment % 47% 47% Conversion rate (physical) 61.0% 62.8% Online volume as a % of total volume 43% 40% Online only volume 188,000 141,000 Online grounding dealer volume 92,000 84,000 Total revenue per vehicle $571 $546 -$8 CAD currency Physical RPU $737 $681 -$11 CAD currency Online only RPU $116 $107 -$2 CAD currency * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended March 31, 2016. ** Exclusive of depreciation and amortization

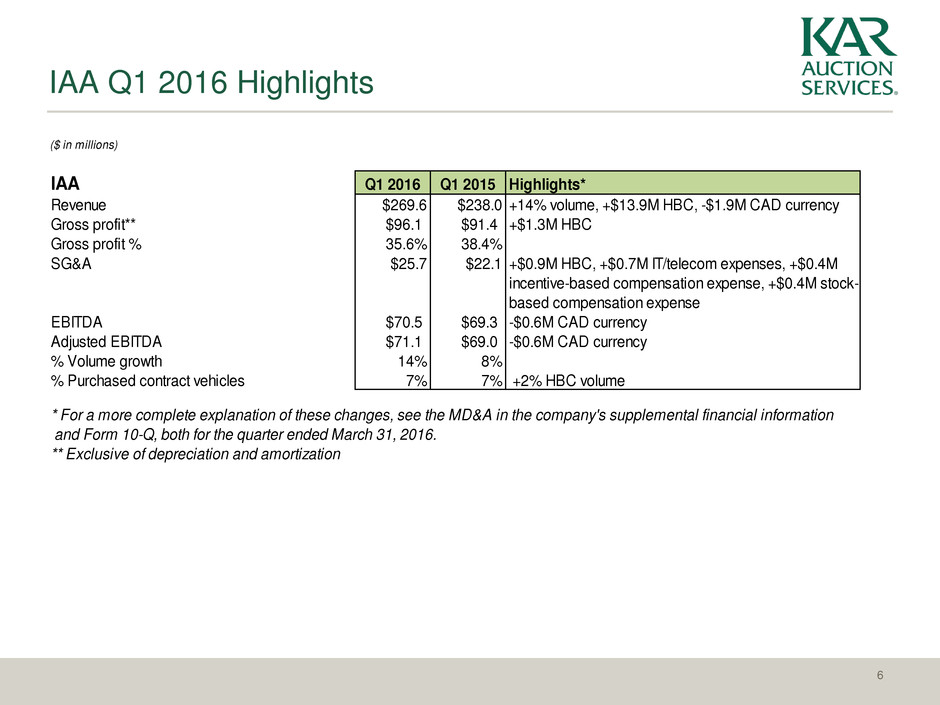

IAA Q1 2016 Highlights 6 ($ in millions) IAA Q1 2016 Q1 2015 Highlights* Revenue $269.6 $238.0 +14% volume, +$13.9M HBC, -$1.9M CAD currency Gross profit** $96.1 $91.4 +$1.3M HBC Gross profit % 35.6% 38.4% SG&A $25.7 $22.1 +$0.9M HBC, +$0.7M IT/telecom expenses, +$0.4M incentive-based compensation expense, +$0.4M stock- based compensation expense EBITDA $70.5 $69.3 -$0.6M CAD currency Adjusted EBITDA $71.1 $69.0 -$0.6M CAD currency % Volume growth 14% 8% % Purchased contract vehicles 7% 7% +2% HBC volume * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended March 31, 2016. ** Exclusive of depreciation and amortization

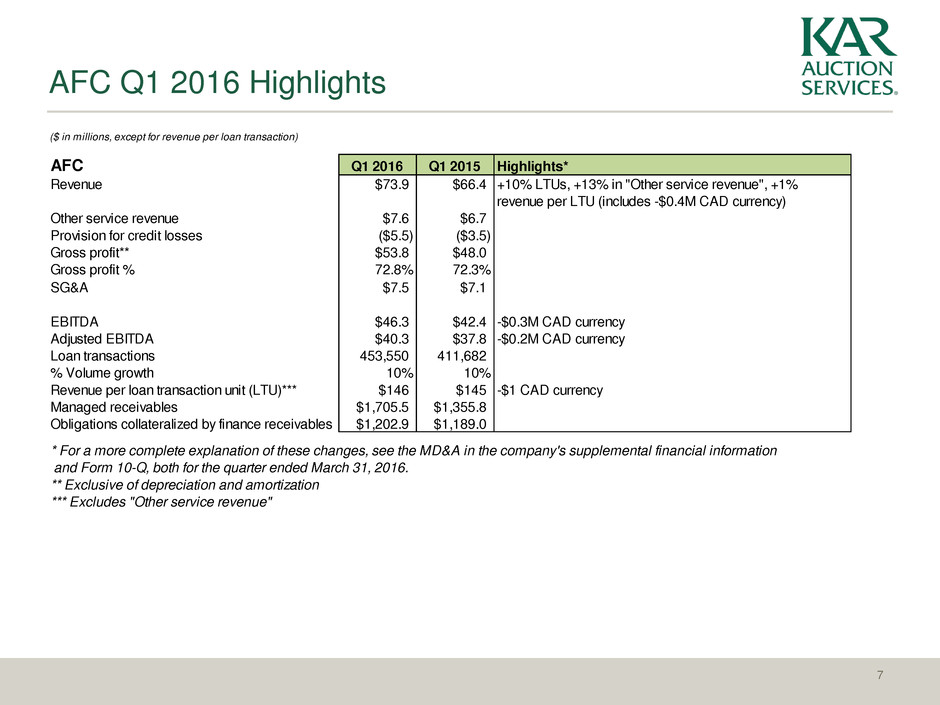

($ in millions, except for revenue per loan transaction) AFC Q1 2016 Q1 2015 Highlights* Revenue $73.9 $66.4 +10% LTUs, +13% in "Other service revenue", +1% revenue per LTU (includes -$0.4M CAD currency) Other service revenue $7.6 $6.7 Provision for credit losses ($5.5) ($3.5) Gross profit** $53.8 $48.0 Gross profit % 72.8% 72.3% SG&A $7.5 $7.1 EBITDA $46.3 $42.4 -$0.3M CAD currency Adjusted EBITDA $40.3 $37.8 -$0.2M CAD currency Loan transactions 453,550 411,682 % Volume growth 10% 10% Revenue per loan transaction unit (LTU)*** $146 $145 -$1 CAD currency Managed receivables $1,705.5 $1,355.8 Obligations collateralized by finance receivables $1,202.9 $1,189.0 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended March 31, 2016. ** Exclusive of depreciation and amortization *** Excludes "Other service revenue" AFC Q1 2016 Highlights 7

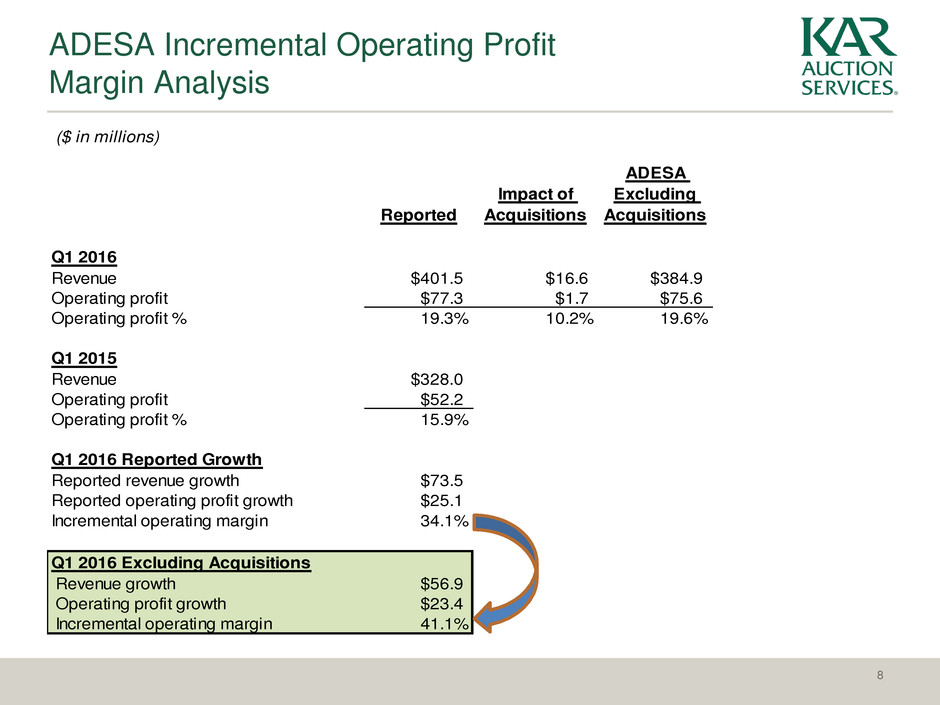

ADESA Incremental Operating Profit Margin Analysis 8 ($ in millions) Reported Impact of Acquisitions ADESA Excluding Acquisitions Q1 2016 Revenue $401.5 $16.6 $384.9 Operating profit $77.3 $1.7 $75.6 Operating profit % 19.3% 10.2% 19.6% Q1 2015 Revenue $328.0 Operating profit $52.2 Operating profit % 15.9% Q1 2016 Reported Growth Reported revenue growth $73.5 Reported operating profit growth $25.1 Incremental operating margin 34.1% Q1 2016 Excluding Acquisitions Revenue growth $56.9 Operating profit growth $23.4 Incremental operating margin 41.1%

Appendix

EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in the company's senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by the company’s creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the company’s performance. EBITDA and Adjusted EBITDA have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies. Non-GAAP Financial Measures 10

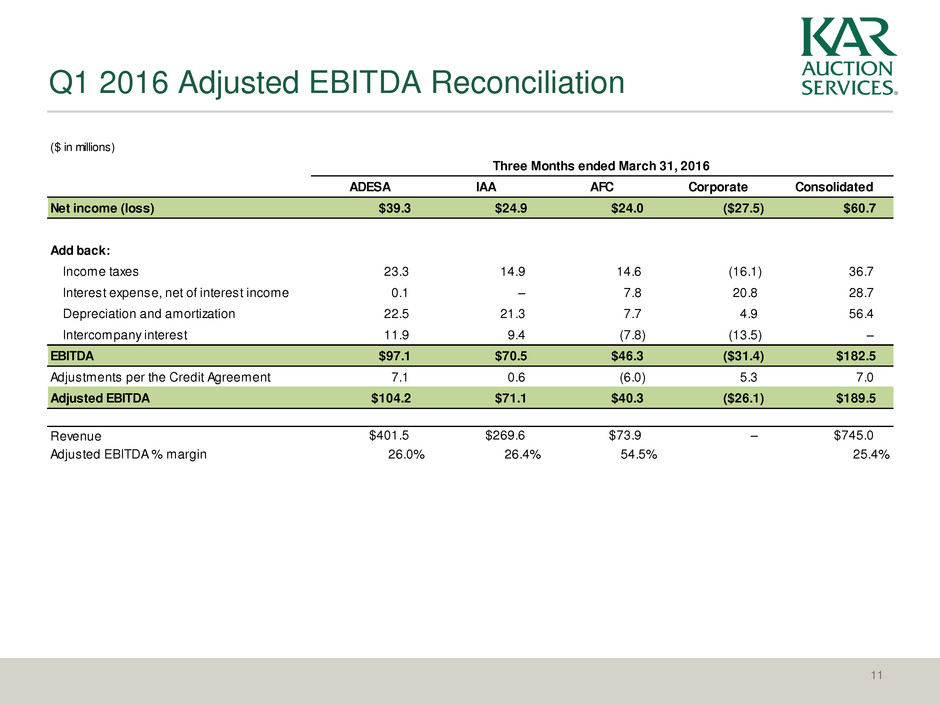

11 Q1 2016 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended March 31, 2016 ADESA IAA AFC Corporate Consolidated Net income (loss) $39.3 $24.9 $24.0 ($27.5) $60.7 Add back: Income taxes 23.3 14.9 14.6 (16.1) 36.7 Interest expense, net of interest income 0.1 – 7.8 20.8 28.7 Depreciation and amortization 22.5 21.3 7.7 4.9 56.4 Intercompany interest 11.9 9.4 (7.8) (13.5) – EBITDA $97.1 $70.5 $46.3 ($31.4) $182.5 Adjustments per the Credit Agreement 7.1 0.6 (6.0) 5.3 7.0 Adjusted EBITDA $104.2 $71.1 $40.3 ($26.1) $189.5 Revenue $401.5 $269.6 $73.9 – $745.0 Adjusted EBITDA % margin 26.0% 26.4% 54.5% 25.4%

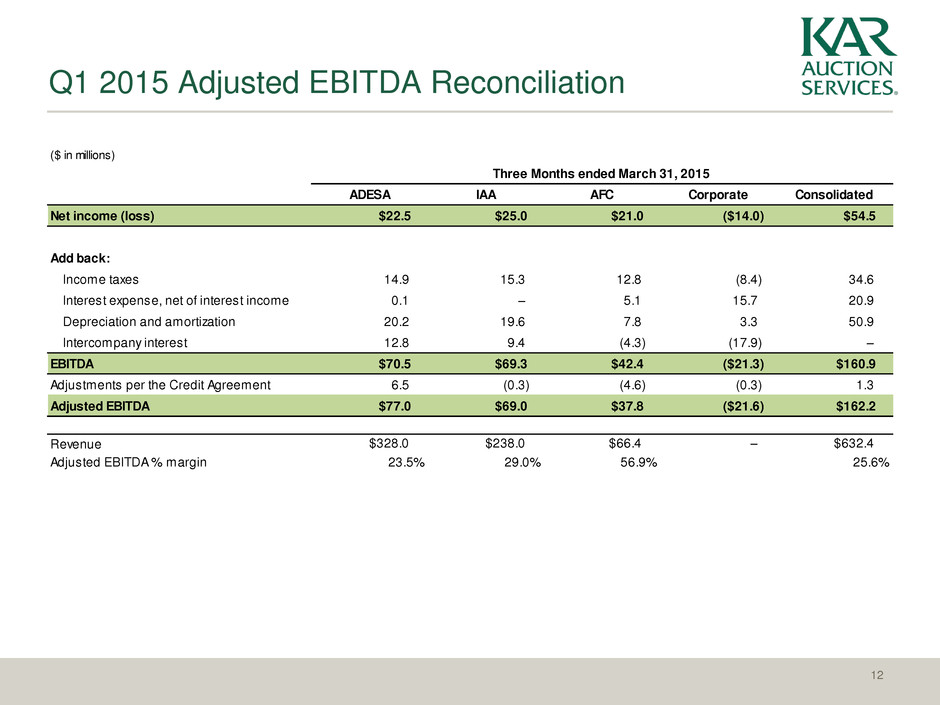

12 Q1 2015 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended March 31, 2015 ADESA IAA AFC Corporate Consolidated Net income (loss) $22.5 $25.0 $21.0 ($14.0) $54.5 Add back: Income taxes 14.9 15.3 12.8 (8.4) 34.6 Interest expense, net of interest income 0.1 – 5.1 15.7 20.9 Depreciation and amortization 20.2 19.6 7.8 3.3 50.9 Intercompany interest 12.8 9.4 (4.3) (17.9) – EBITDA $70.5 $69.3 $42.4 ($21.3) $160.9 Adjustments per the Credit Agreement 6.5 (0.3) (4.6) (0.3) 1.3 Adjusted EBITDA $77.0 $69.0 $37.8 ($21.6) $162.2 Revenue $328.0 $238.0 $66.4 – $632.4 Adjusted EBITDA % margin 23.5% 29.0% 56.9% 25.6%