Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | a2q16form8-kcoverpage.htm |

Associated Banc-Corp Investor Presentation SECOND QUARTER 2016 Exhibit 99.1

FORWARD-LOOKING STATEMENTS Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” “outlook” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference. 1

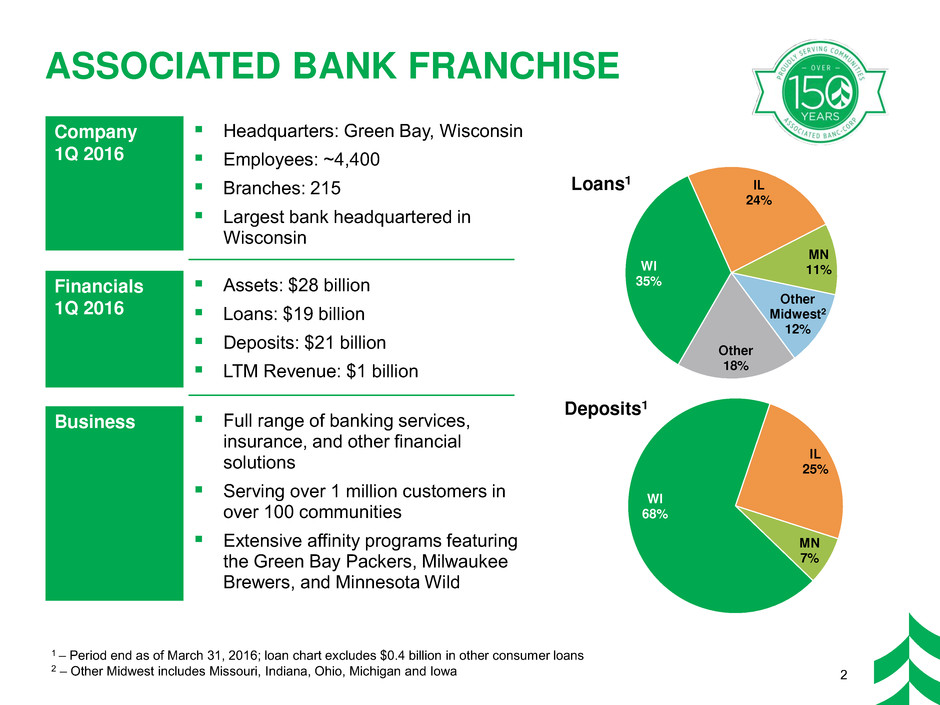

WI 35% IL 24% MN 11% Other Midwest2 12% Other 18% Loans1 ASSOCIATED BANK FRANCHISE Company 1Q 2016 Headquarters: Green Bay, Wisconsin Employees: ~4,400 Branches: 215 Largest bank headquartered in Wisconsin Financials 1Q 2016 Assets: $28 billion Loans: $19 billion Deposits: $21 billion LTM Revenue: $1 billion Business Full range of banking services, insurance, and other financial solutions Serving over 1 million customers in over 100 communities Extensive affinity programs featuring the Green Bay Packers, Milwaukee Brewers, and Minnesota Wild 1 – Period end as of March 31, 2016; loan chart excludes $0.4 billion in other consumer loans 2 – Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa 2 WI 68% IL 25% MN 7% 1861 Deposits1

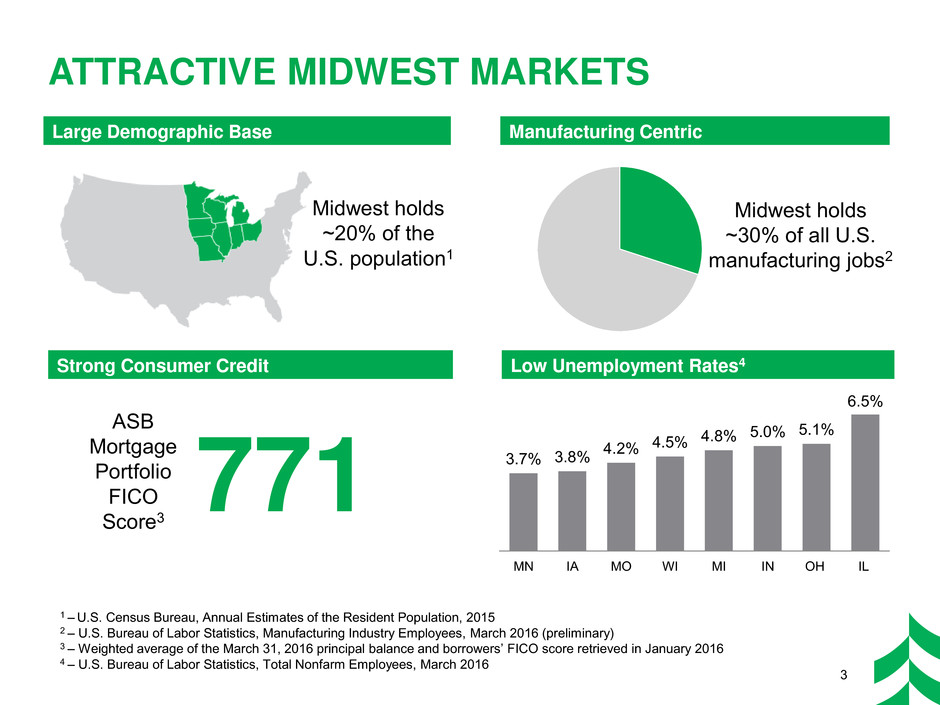

ASB Mortgage Portfolio FICO Score3 ATTRACTIVE MIDWEST MARKETS 3.7% 3.8% 4.2% 4.5% 4.8% 5.0% 5.1% 6.5% MN IA MO WI MI IN OH IL Midwest holds ~30% of all U.S. manufacturing jobs2 1 – U.S. Census Bureau, Annual Estimates of the Resident Population, 2015 2 – U.S. Bureau of Labor Statistics, Manufacturing Industry Employees, March 2016 (preliminary) 3 – Weighted average of the March 31, 2016 principal balance and borrowers’ FICO score retrieved in January 2016 4 – U.S. Bureau of Labor Statistics, Total Nonfarm Employees, March 2016 Midwest holds ~20% of the U.S. population1 Large Demographic Base Manufacturing Centric Strong Consumer Credit Low Unemployment Rates4 3 771

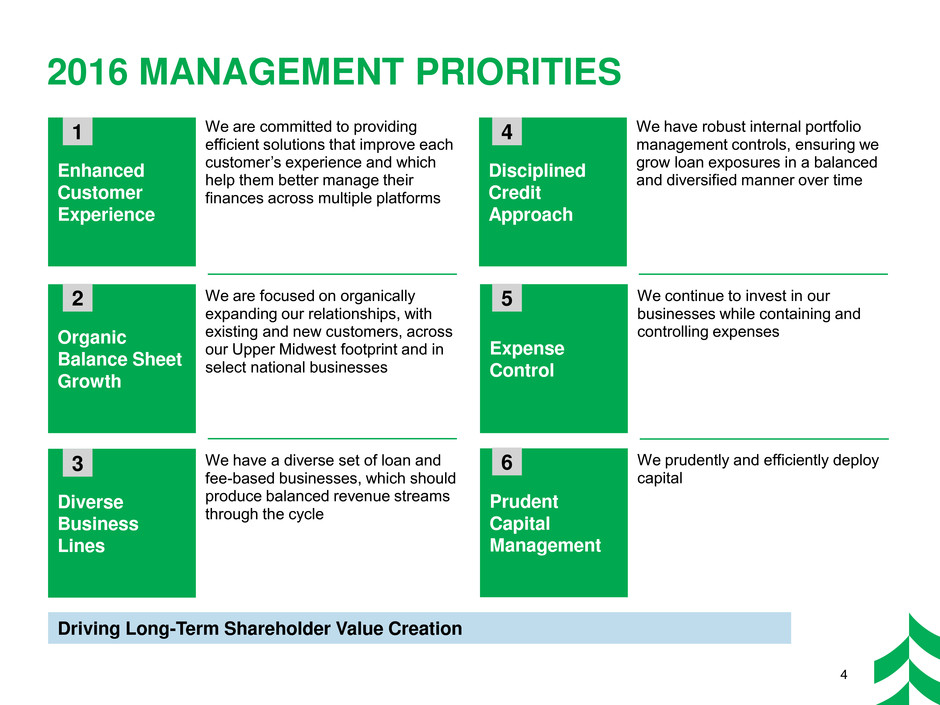

2016 MANAGEMENT PRIORITIES 4 Driving Long-Term Shareholder Value Creation Enhanced Customer Experience We are committed to providing efficient solutions that improve each customer’s experience and which help them better manage their finances across multiple platforms Organic Balance Sheet Growth We are focused on organically expanding our relationships, with existing and new customers, across our Upper Midwest footprint and in select national businesses Diverse Business Lines We have a diverse set of loan and fee-based businesses, which should produce balanced revenue streams through the cycle Disciplined Credit Approach We have robust internal portfolio management controls, ensuring we grow loan exposures in a balanced and diversified manner over time Expense Control We continue to invest in our businesses while containing and controlling expenses Prudent Capital Management We prudently and efficiently deploy capital 1 2 3 4 5 6

FIRST QUARTER UPDATE 5 Net income available to common equity of $40 million, or $0.27 per common share Enhanced Customer Experience Improving branch customer satisfaction trends 90% of consumer customers were completely satisfied with their branch experience in the first quarter Organic Balance Sheet Growth Average loans were up $380 million, or 2% in the first quarter Total commercial lending accounted for 85% of average loan growth Diverse Business Lines Recognized record insurance commissions of $21 million in the first quarter Expanded REIT lending Disciplined Credit Approach Increased the allowance related to the oil and gas portfolio to 6.5% Solid credit quality trends outside of the oil and gas portfolio Expense Control Costs were down $2 million from the fourth quarter and flat year over year Efficiency ratio improved to 67% in the first quarter Prudent Capital Management Returned 90% of first quarter’s net income to shareholders through share repurchases and dividends

Changing customer behavior has driven our continued investment in digital platforms EVOLVING DELIVERY MODEL 6 Jan 12 Mar 16 Jan 12 Mar 16 Jan 12 Mar 16 Jan 12 Mar 16 Branch – Deposit and Withdrawal Activity Check Processing ATM – Deposit and Withdrawal Activity ACH and Wire Activity

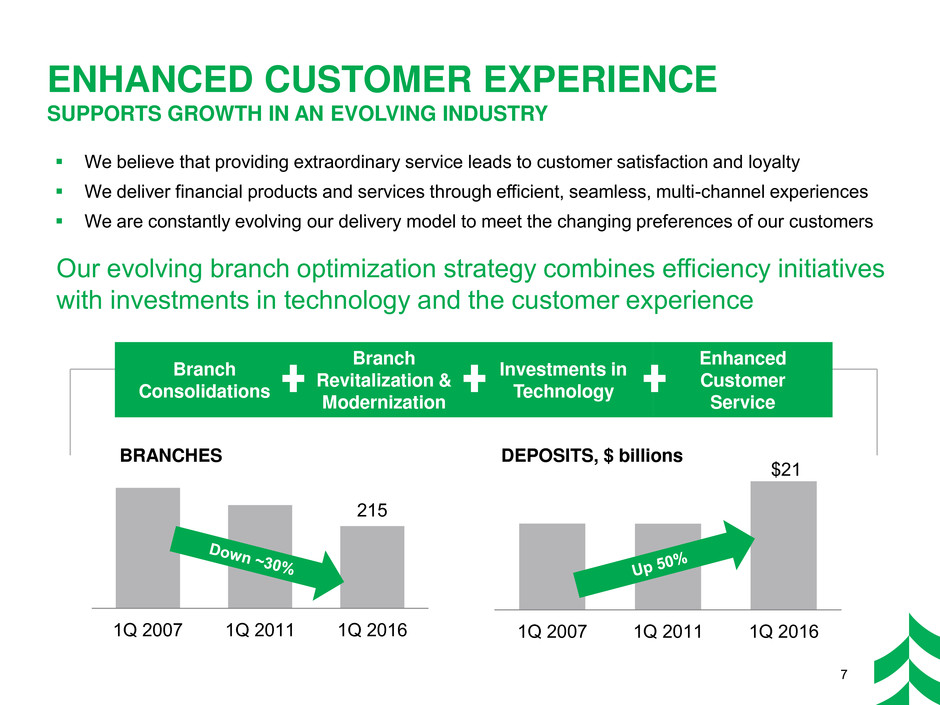

ENHANCED CUSTOMER EXPERIENCE SUPPORTS GROWTH IN AN EVOLVING INDUSTRY 7 Branch Consolidations Branch Revitalization & Modernization Investments in Technology Enhanced Customer Service 215 1Q 2007 1Q 2011 1Q 2016 $21 1Q 2007 1Q 2011 1Q 2016 BRANCHES DEPOSITS, $ billions We believe that providing extraordinary service leads to customer satisfaction and loyalty We deliver financial products and services through efficient, seamless, multi-channel experiences We are constantly evolving our delivery model to meet the changing preferences of our customers Our evolving branch optimization strategy combines efficiency initiatives with investments in technology and the customer experience

$1.9 $1.6 $1.5 $1.5 $1.4 $4.4 $4.6 $4.7 $5.2 $5.9 $3.2 $3.6 $3.9 $4.1 $4.5 $4.8 $5.6 $6.1 $7.0 $7.1 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Home Equity & Other Consumer Residential Mortgage Commercial Real Estate Commercial & Business $15.4 $14.3 $16.2 $17.8 $18.9 8 Cumulative Change +$4.6 billion, 32% +$2.3 billion, +47% +$1.3 billion, +40% +$1.6 billion, +36% ($0.5 billion), (27%) ORGANIC LOAN GROWTH (AVERAGE BALANCES, $ IN BILLIONS)

$2.5 $2.0 $1.7 $1.6 $1.6 $1.0 $1.1 $1.2 $1.3 $1.4 $2.1 $2.8 $2.8 $3.2 $3.2 $3.7 $4.2 $4.2 $4.3 $5.0 $5.7 $7.0 $7.2 $8.7 $9.4 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Time deposits Savings deposits Interest-bearing demand deposits Noninterest-bearing demand deposits Money market deposits ORGANIC DEPOSIT GROWTH (AVERAGE BALANCES, $ IN BILLIONS) Cumulative Change +$5.6 billion, 37% $3.7 billion, +66% +$1.3 billion, +36% +$1.1 billion, +52% +$0.3 billion, +33% ($0.9 billion), (37%) 9 $15.0 $17.1 $17.0 $19.1 $20.6

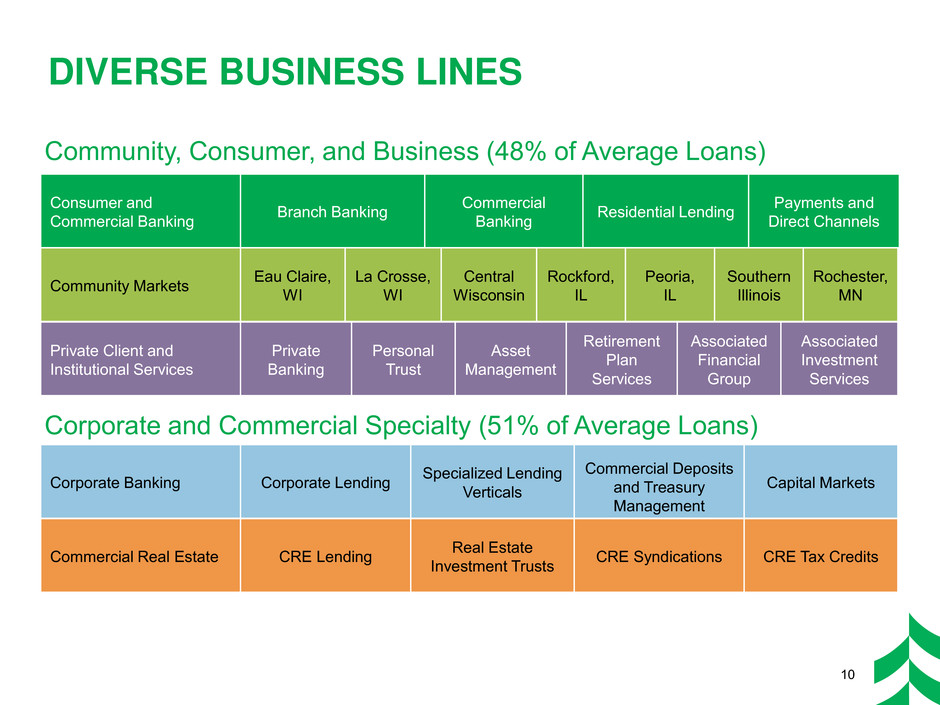

Community, Consumer, and Business (48% of Average Loans) Corporate and Commercial Specialty (51% of Average Loans) Consumer and Commercial Banking Branch Banking Commercial Banking Residential Lending Payments and Direct Channels Community Markets Eau Claire, WI La Crosse, WI Central Wisconsin Rockford, IL Peoria, IL Southern Illinois Rochester, MN Private Client and Institutional Services Private Banking Personal Trust Asset Management Retirement Plan Services Associated Financial Group Associated Investment Services Corporate Banking Corporate Lending Specialized Lending Verticals Commercial Deposits and Treasury Management Capital Markets Commercial Real Estate CRE Lending Real Estate Investment Trusts CRE Syndications CRE Tax Credits DIVERSE BUSINESS LINES 10

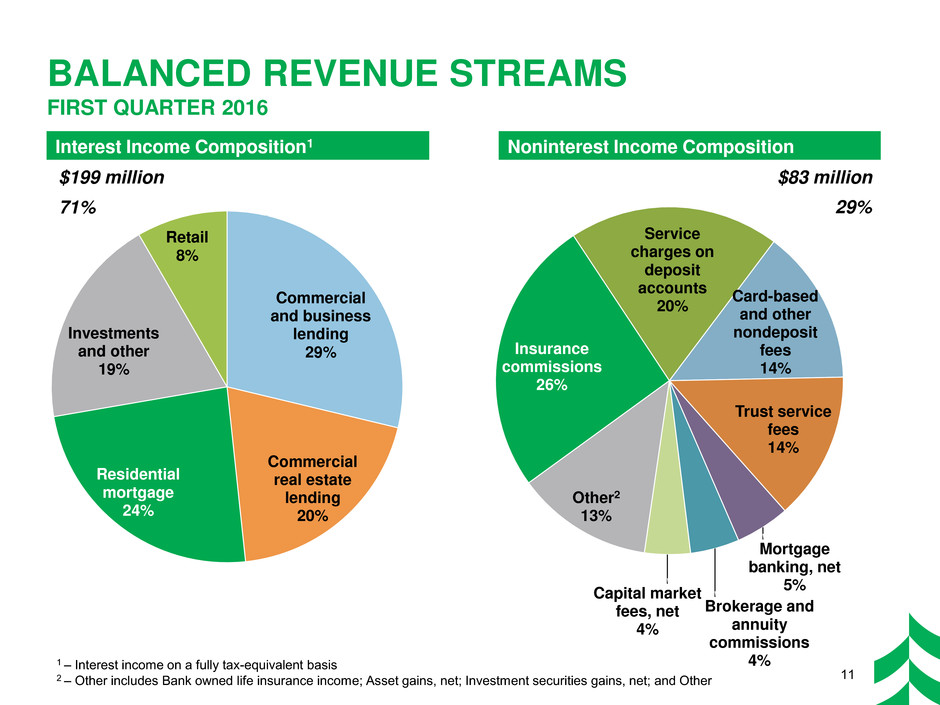

Insurance commissions 26% Service charges on deposit accounts 20% Card-based and other nondeposit fees 14% Trust service fees 14% Mortgage banking, net 5% Brokerage and annuity commissions 4% Capital market fees, net 4% Other2 13% Commercial and business lending 29% Commercial real estate lending 20% Residential mortgage 24% Investments and other 19% Retail 8% BALANCED REVENUE STREAMS FIRST QUARTER 2016 1 – Interest income on a fully tax-equivalent basis 2 – Other includes Bank owned life insurance income; Asset gains, net; Investment securities gains, net; and Other 11 $199 million 71% $83 million 29% Interest Income Composition1 Noninterest Income Composition

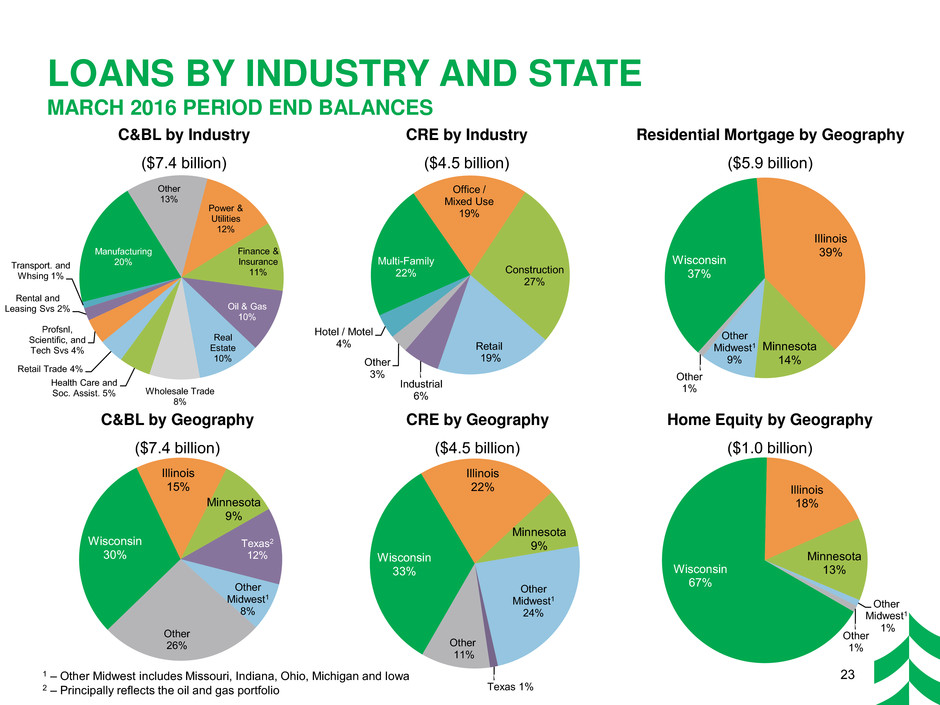

DISCIPLINED CREDIT APPROACH INTERNAL PORTFOLIO MANAGEMENT LEADS TO PURPOSEFUL DIVERSIFICATION 12 Asset Class Geography Industry / Property 30-40% 38% 25-35% 24% 30-40% 38% Target 1Q 2016 average Commercial & Business CRE Consumer Focused on growth within our Upper Midwest footprint, and select national specialty businesses and markets Industry and property type caps ensure granular diversification Balanced portfolio of Commercial and Business, Commercial Real Estate and Consumer credit 31% 42% 17% 36% 9% 14% 14% 7% 8% 21% 1% Total Commercial Consumer WI IL MN Other Midwest Texas Other 12% 81% 13% 8% 6% 7% 7% 3% 1% Total Commercial Consumer Residential mortgage Manufacturing Utilities Health Care Transportation/warehouse Home equity Multi-Family Retail 1 – Excludes $0.4 billion in other consumer loans 2 – Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa 1 2 See slide 23 for complete industry and property detail.

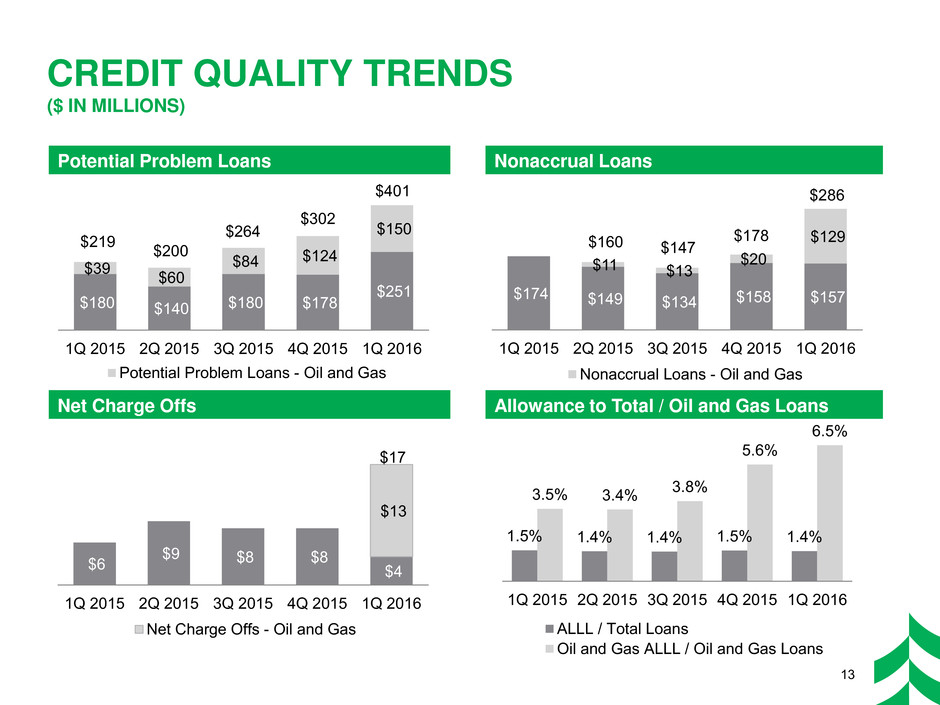

CREDIT QUALITY TRENDS ($ IN MILLIONS) $180 $140 $180 $178 $251 $39 $60 $84 $124 $150 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Potential Problem Loans - Oil and Gas $174 $149 $134 $158 $157 $11 $13 $20 $129 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Nonaccrual Loans - Oil and Gas Potential Problem Loans Nonaccrual Loans $6 $9 $8 $8 $4 $13 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Net Charge Offs - Oil and Gas Net Charge Offs Allowance to Total / Oil and Gas Loans 1.5% 1.4% 1.4% 1.5% 1.4% 3.5% 3.4% 3.8% 5.6% 6.5% 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 ALLL / Total Loans Oil and Gas ALLL / Oil and Gas Loans 13 $219 $200 $264 $302 $401 $160 $147 $178 $286 $17

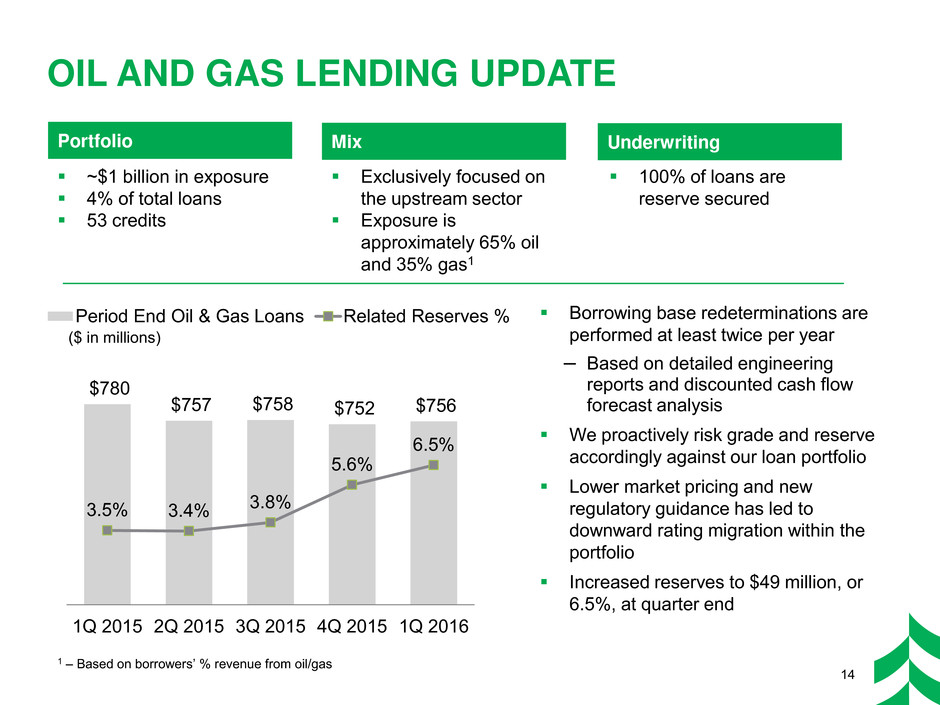

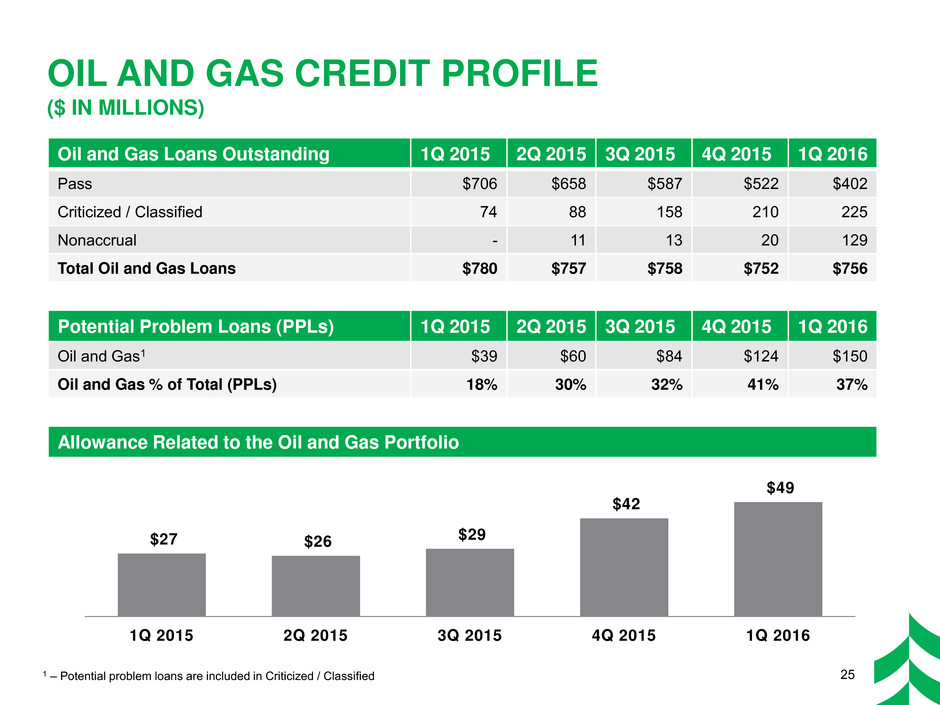

OIL AND GAS LENDING UPDATE $780 $757 $758 $752 $756 3.5% 3.4% 3.8% 5.6% 6.5% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% $500 $550 $600 $650 $700 $750 $800 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Period End Oil & Gas Loans Related Reserves % ($ in millions) Borrowing base redeterminations are performed at least twice per year ‒ Based on detailed engineering reports and discounted cash flow forecast analysis We proactively risk grade and reserve accordingly against our loan portfolio Lower market pricing and new regulatory guidance has led to downward rating migration within the portfolio Increased reserves to $49 million, or 6.5%, at quarter end 1 – Based on borrowers’ % revenue from oil/gas 14 Mix Portfolio Underwriting ~$1 billion in exposure 4% of total loans 53 credits Exclusively focused on the upstream sector Exposure is approximately 65% oil and 35% gas1 100% of loans are reserve secured

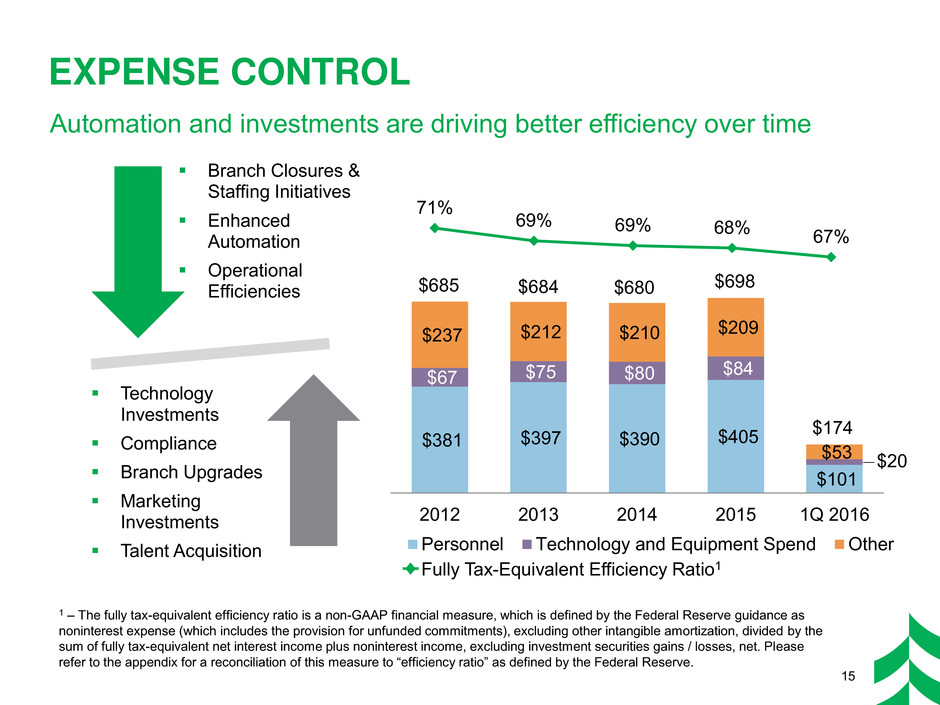

Branch Closures & Staffing Initiatives Enhanced Automation Operational Efficiencies Technology Investments Compliance Branch Upgrades Marketing Investments Talent Acquisition 71% 69% 69% 68% 67% $381 $397 $390 $405 $101 $67 $75 $80 $84 $20 $237 $212 $210 $209 $53 2012 2013 2014 2015 1Q 2016 Personnel Technology and Equipment Spend Other Fully Tax-Equivalent Efficiency Ratio1 1 – The fully tax-equivalent efficiency ratio is a non-GAAP financial measure, which is defined by the Federal Reserve guidance as noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Please refer to the appendix for a reconciliation of this measure to “efficiency ratio” as defined by the Federal Reserve. $685 $684 $680 $174 EXPENSE CONTROL 15 $698 Automation and investments are driving better efficiency over time

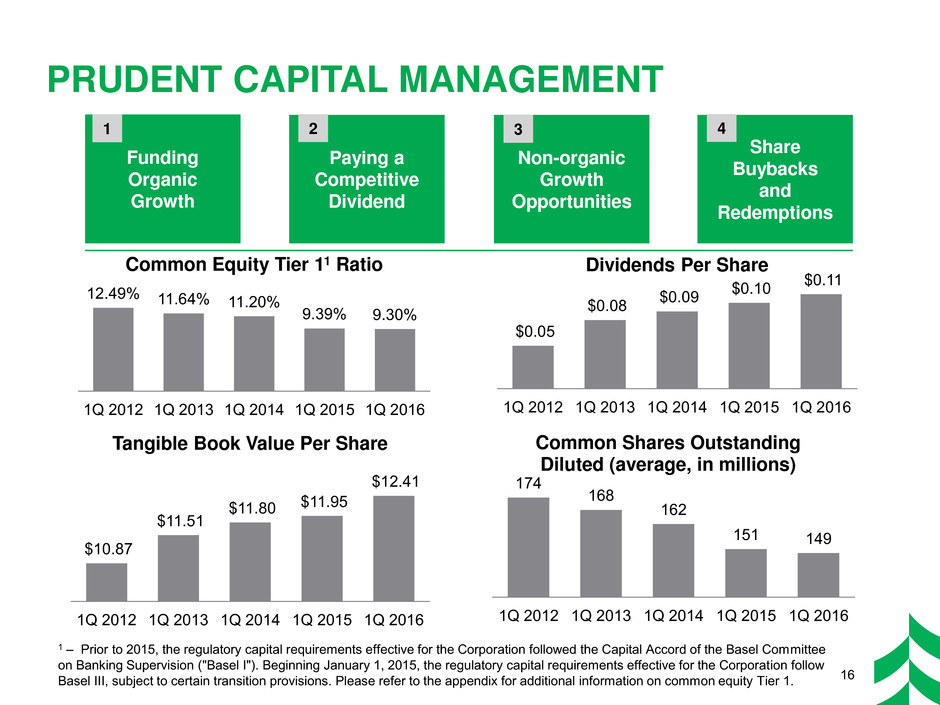

PRUDENT CAPITAL MANAGEMENT 16 Funding Organic Growth Paying a Competitive Dividend Non-organic Growth Opportunities Share Buybacks and Redemptions 174 168 162 151 149 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Common Shares Outstanding Diluted (average, in millions) $0.05 $0.08 $0.09 $0.10 $0.11 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Dividends Per Share 12.49% 11.64% 11.20% 9.39% 9.30% 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Common Equity Tier 11 Ratio $10.87 $11.51 $11.80 $11.95 $12.41 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Tangible Book Value Per Share 1 2 3 4 1 – Prior to 2015, the regulatory capital requirements effective for the Corporation followed the Capital Accord of the Basel Committee on Banking Supervision ("Basel I"). Beginning January 1, 2015, the regulatory capital requirements effective for the Corporation follow Basel III, subject to certain transition provisions. Please refer to the appendix for additional information on common equity Tier 1.

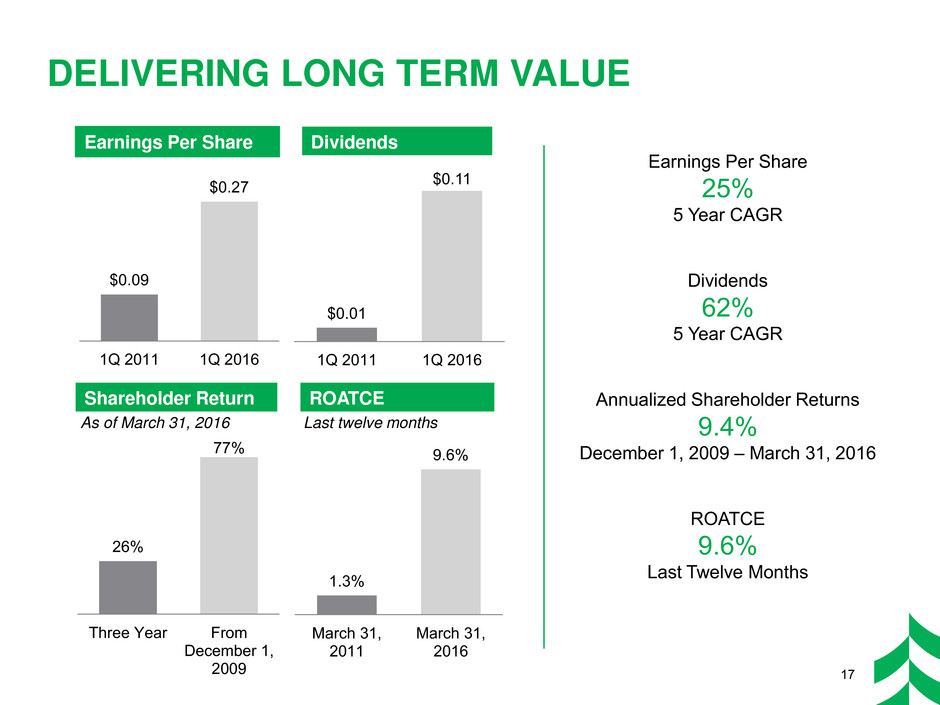

Earnings Per Share 25% 5 Year CAGR Dividends 62% 5 Year CAGR Annualized Shareholder Returns 9.4% December 1, 2009 – March 31, 2016 ROATCE 9.6% Last Twelve Months DELIVERING LONG TERM VALUE 17 1.3% 9.6% March 31, 2011 March 31, 2016 $0.01 $0.11 1Q 2011 1Q 2016 Earnings Per Share Dividends $0.09 $0.27 1Q 2011 1Q 2016 26% 77% Three Year From December 1, 2009 Shareholder Return ROATCE Last twelve months As of March 31, 2016

2016 OUTLOOK 18 High single digit annual average loan growth Maintain Loan to Deposit ratio under 100% In the absence of Federal Reserve action to raise rates, NIM to dip into the 2.75% to 2.80% range Approximately flat to prior year, excluding investment securities gains NONINTEREST EXPENSE Approximately flat to prior year Continue to follow stated corporate priorities for capital deployment Dependent on loan growth and changes in risk grade or other indications of credit quality BALANCE SHEET NET INTEREST MARGIN NONINTEREST INCOME CAPITAL PROVISION oninterest Expense Balance Sheet et Interest argin oninterest ncome apital rovision

APPENDIX

2.89% 2.83% 2.82% 2.82% 2.81% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $- $4 $8 $12 $16 $20 $24 $28 $32 $36 $40 $44 $48 $52 $56 $60 $64 $68 $72 $76 $80 $84 $88 $92 $96 $100 $104 $108 $112 $116 $120 $124 $128 $132 $136 $140 $144 $148 $152 $156 $160 $164 $168 $172 $176 $180 3.20% 3.15% 3.13% 3.14% 3.16% 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 $140 $144 $148 $153 $157 $161 $165 $169 $174 $178 Yield on Interest-earning Assets Net Interest Income & Net Interest Margin 3.46% 3.38% 3.38% 3.37% 3.41% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% $140 $144 $148 $153 $157 $161 $165 $169 $174 $178 Total Interest-earning Yield $165 $165 $170 $169 $171 $3 $1 $1 $2 $1 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Interest Recoveries, Prepayment Fees, & Deferred Fees Net Interest Income Net of Interest Recoveries, Prepayment Fees, & Deferred Fees NET INTEREST INCOME AND MARGIN TRENDS ($ in millions) Net Interest Margin 0.21% 0.21% 0.22% 0.22% 0.30% 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Interest-bearing Deposit Costs Other Funding Costs 0.40% 0.40% 0.40% 0.45% $166 Total Loan Yield $171 0.41% $171 $168 $172 Cost of Interest-bearing Liabilities 20

$7 $10 $7 $8 $4 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 NONINTEREST INCOME TRENDS ($ IN MILLIONS) $9 $10 $9 $12 $14 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Mortgage Banking (net) Income $64 $66 $64 $63 $65 $16 $20 $16 $20 $18 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Mortgage Banking (net) and Other Noninterest Income Fee-based Revenue Other Noninterest Income2 1 – Fee-based Revenue = A non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees, insurance commissions, and brokerage and annuity commissions 2 – Other Noninterest Income = Total noninterest income minus mortgage banking (net) income minus fee-based revenue $80 $86 $80 $83 1 Insurance Commissions $20 $20 $18 $18 $21 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 $83 21

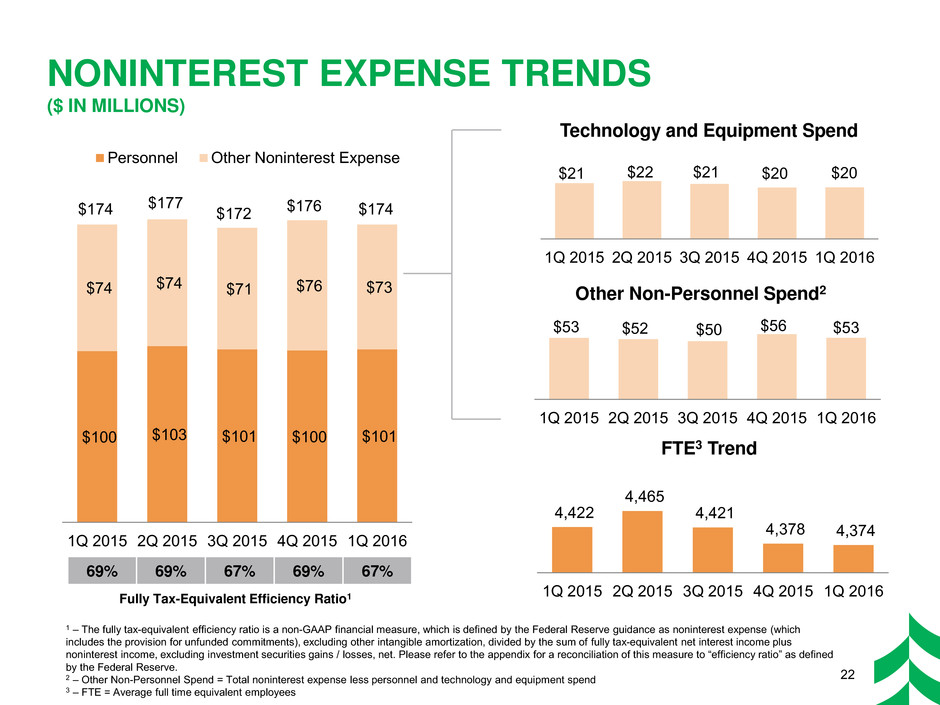

$21 $22 $21 $20 $20 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 NONINTEREST EXPENSE TRENDS ($ IN MILLIONS) $53 $52 $50 $56 $53 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Technology and Equipment Spend Other Non-Personnel Spend2 1 – The fully tax-equivalent efficiency ratio is a non-GAAP financial measure, which is defined by the Federal Reserve guidance as noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Please refer to the appendix for a reconciliation of this measure to “efficiency ratio” as defined by the Federal Reserve. 2 – Other Non-Personnel Spend = Total noninterest expense less personnel and technology and equipment spend 3 – FTE = Average full time equivalent employees Fully Tax-Equivalent Efficiency Ratio1 $100 $103 $101 $100 $101 $74 $74 $71 $76 $73 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Personnel Other Noninterest Expense FTE3 Trend $174 $177 $172 $176 $174 4,422 4,465 4,421 4,378 4,374 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 69% 69% 67% 69% 67% 22

C&BL by Geography CRE by Geography Home Equity by Geography ($7.4 billion) ($4.5 billion) ($1.0 billion) C&BL by Industry CRE by Industry Residential Mortgage by Geography ($7.4 billion) ($4.5 billion) ($5.9 billion) Manufacturing 20% Other 13% Power & Utilities 12% Oil & Gas 10% Finance & Insurance 11% Real Estate 10% Wholesale Trade 8% Health Care and Soc. Assist. 5% Retail Trade 4% Profsnl, Scientific, and Tech Svs 4% Rental and Leasing Svs 2% Transport. and Whsing 1% Wisconsin 30% Illinois 15% Minnesota 9% Texas2 12% Other Midwest1 8% Other 26% Wisconsin 33% Illinois 22% Minnesota 9% Other Midwest1 24% Texas 1% Other 11% Wisconsin 37% Illinois 39% Minnesota 14% Other Midwest1 9% Other 1% Wisconsin 67% Illinois 18% Minnesota 13% Other Midwest1 1% Other 1% 1 – Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa 2 – Principally reflects the oil and gas portfolio LOANS BY INDUSTRY AND STATE MARCH 2016 PERIOD END BALANCES 23 Multi-Family 22% Office / Mixed Use 19% Construction 27% Retail 19% Industrial 6% Other 3% Hotel / Motel 4%

Permian 20% East Texas North Louisiana Arkansas 16% Mid-Continent (primarily OK & KS) 15% South Texas & EagleFord 13% Rockies 8% Marcellus Utica Appalachia 8% Gulf Coast 7% Gulf Shallow 5% Bakken 2% Other (Onshore Lower 48) 6% OIL AND GAS PORTFOLIO BY GEOGRAPHY MARCH 2016 PERIOD END ESTIMATED EXPOSURE 24 Permian 20% South TX & EagleFord 13% East TX North LA AR 16% Rockies 8% Mid-Continent 15%

OIL AND GAS CREDIT PROFILE ($ IN MILLIONS) Oil and Gas Loans Outstanding 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Pass $706 $658 $587 $522 $402 Criticized / Classified 74 88 158 210 225 Nonaccrual - 11 13 20 129 Total Oil and Gas Loans $780 $757 $758 $752 $756 Potential Problem Loans (PPLs) 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 Oil and Gas1 $39 $60 $84 $124 $150 Oil and Gas % of Total (PPLs) 18% 30% 32% 41% 37% Allowance Related to the Oil and Gas Portfolio 25 $27 $26 $29 $42 $49 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 1 – Potential problem loans are included in Criticized / Classified

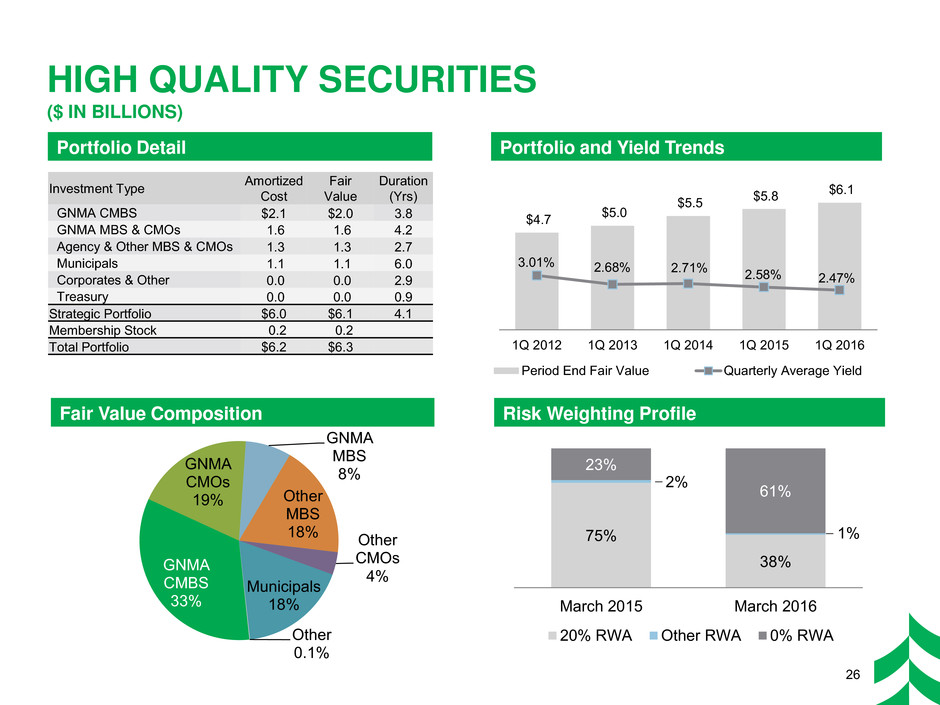

75% 38% 2% 1% 23% 61% March 2015 March 2016 20% RWA Other RWA 0% RWA HIGH QUALITY SECURITIES ($ IN BILLIONS) 26 $4.7 $5.0 $5.5 $5.8 $6.1 3.01% 2.68% 2.71% 2.58% 2.47% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $- $0.01 0.$ 20.0. $ 3 0.0. 4$0. 0.5 0.$ 0.6 0.$0.7 $0.8 0.$ 9 0.$1.0 1. 1.1$ 1.1.2 $1. 31. $1.4 1.$ 5 1.$ 6 1. 71.$1. 8 1.$1. 91. $2.0 2. $2.1 2.$2. 2 2.$ 3 2. 4$ 2.5 2.$2. 62. 2.$ 7 2. $ 82.2. 9 $2. 3.0$ 3.1 $ 3.3.2 $3.3 3.3. $ 4 3.3. $ 53. 6$ 3.3. 7$3. 8 3.$3. 93. $4.0 4. 4.$ 1 4.4.2 $4. 34.$ 4.4 $4. 5 4.$ 6 4. $4.74. $ 84.4. 4.9$ 4. 5.0$ 5.1 $5. 2 $5.3 5.5. $ 4 5.$ 5 5.5. 6$5. 5.7 5.$ 5.85. $ 9 5. $6.0 6. $ 1 6.6.2$ 6. 36.$ 6.4 6.$6. 56. 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Period End Fair Value Quarterly Average Yield Investment Type Amortized Cost Fair Value Duration (Yrs) GNMA CMBS $2.1 $2.0 3.8 GNMA MBS & CMOs 1.6 1.6 4.2 Agency & Other MBS & CMOs 1.3 1.3 2.7 Municipals 1.1 1.1 6.0 Corporates & Other 0.0 0.0 2.9 Treasury 0.0 0.0 0.9 Strategic Portfolio $6.0 $6.1 4.1 Membership Stock 0.2 0.2 Total Portfolio $6.2 $6.3 GNMA CMBS 33% GNMA CMOs 19% GNMA MBS 8% Other MBS 18% Other CMOs 4% Municipals 18% Other 0.1% Fair Value Composition Risk Weighting Profile Portfolio Detail Portfolio and Yield Trends

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS 27 Tangible Common Equity and Common Equity Tier 1 Reconciliation, ($ in millions) 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 Common equity $2,838 $2,873 $2,840 $2,823 $2,862 Goodwill and other intangible assets (948) (944) (939) (987) (989) Tangible common equity 1,890 1,929 1,901 1,836 1,873 Less: Accumulated other comprehensive (income) loss (65) (43) 11 (25) (2) Less: Deferred tax assets / deferred tax liabilities, net (5) (5) - 27 32 Common equity Tier 1 $1,820 $1,881 $1,912 $1,838 $1,903 Common equity Tier 1, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of our capital with the capital of other financial services companies. Management uses common equity Tier 1, along with other capital measures, to assess and monitor our capital position. Beginning January 1, 2015, common equity Tier 1 follows Basel III and is defined as common stock and related surplus, net of treasury stock, plus retained earnings. Prior to 2015, common equity Tier 1 follows Basel I and is defined as Tier 1 capital excluding qualifying perpetual preferred stock and qualifying trust preferred securities. Efficiency Ratio Reconciliation 2012 2013 2014 2015 1Q 2016 Federal Reserve efficiency ratio 72.62% 70.97% 70.26% 69.90% 69.01% Fully tax-equivalent adjustment (1.62) (1.46) (1.36) (1.42) (1.37) Other intangible amortization (0.44) (0.42) (0.38) (0.30) (0.20) Fully tax-equivalent efficiency ratio 70.56% 69.09% 68.52% 68.18% 67.44% The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Management believes the fully tax-equivalent efficiency ratio, which adjusts net interest income for the tax-favored status of certain loans and investment securities, to be the preferred industry measurement as it enhances the comparability of net interest income arising from taxable and tax-exempt sources.