Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - VECTOR GROUP LTD | newvalleyfactsheetmay.htm |

| EX-99.1 - EXHIBIT 99.1 - VECTOR GROUP LTD | vgrinvestorpresentationm.htm |

| 8-K - 8-K - VECTOR GROUP LTD | may2016factsheet.htm |

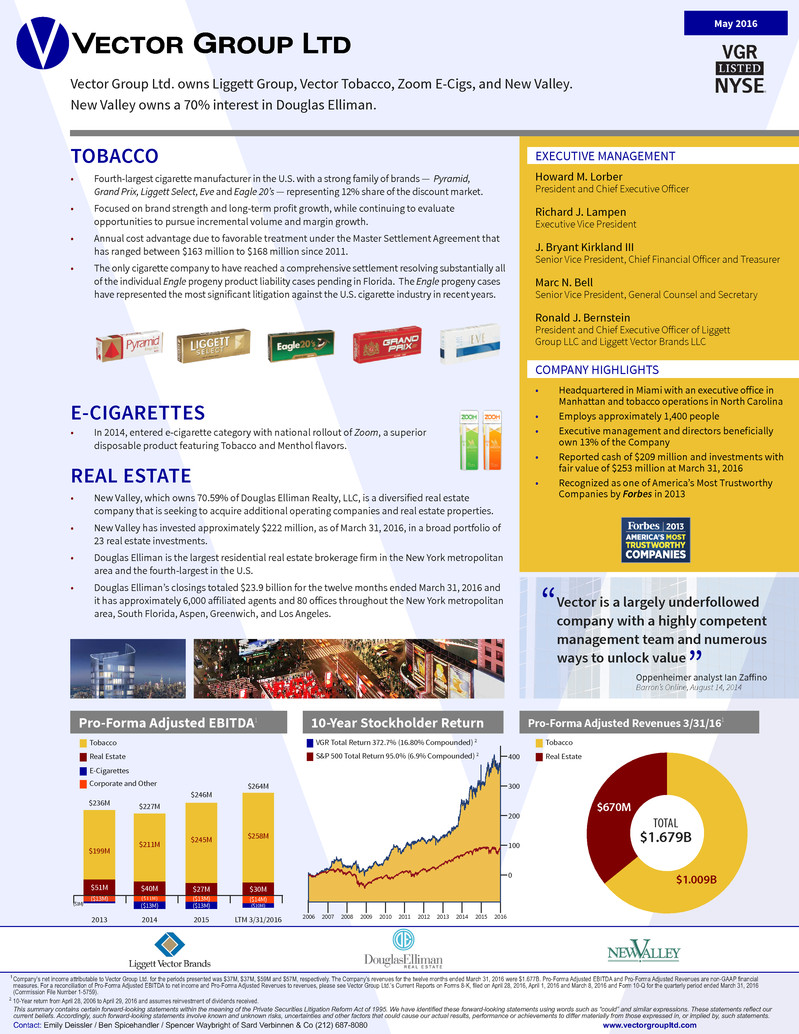

($13M) Vector Group Ltd. owns Liggett Group, Vector Tobacco, Zoom E-Cigs, and New Valley. New Valley owns a 70% interest in Douglas Elliman. Pro-Forma Adjusted Revenues 3/31/161 EXECUTIVE MANAGEMENT Howard M. Lorber President and Chief Executive Officer Richard J. Lampen Executive Vice President J. Bryant Kirkland III Senior Vice President, Chief Financial Officer and Treasurer Marc N. Bell Senior Vice President, General Counsel and Secretary Ronald J. Bernstein President and Chief Executive Officer of Liggett Group LLC and Liggett Vector Brands LLC • New Valley, which owns 70.59% of Douglas Elliman Realty, LLC, is a diversified real estate company that is seeking to acquire additional operating companies and real estate properties. • New Valley has invested approximately $222 million, as of March 31, 2016, in a broad portfolio of 23 real estate investments. • Douglas Elliman is the largest residential real estate brokerage firm in the New York metropolitan area and the fourth-largest in the U.S. • Douglas Elliman’s closings totaled $23.9 billion for the twelve months ended March 31, 2016 and it has approximately 6,000 affiliated agents and 80 offices throughout the New York metropolitan area, South Florida, Aspen, Greenwich, and Los Angeles. 10-Year Stockholder Return TOBACCO REAL ESTATE Real Estate Tobacco This summary contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We have identified these forward-looking statements using words such as “could” and similar expressions. These statements reflect our current beliefs. Accordingly, such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause our actual results, performance or achievements to differ materially from those expressed in, or implied by, such statements. • Fourth-largest cigarette manufacturer in the U.S. with a strong family of brands — Pyramid, Grand Prix, Liggett Select, Eve and Eagle 20’s — representing 12% share of the discount market. • Focused on brand strength and long-term profit growth, while continuing to evaluate opportunities to pursue incremental volume and margin growth. • Annual cost advantage due to favorable treatment under the Master Settlement Agreement that has ranged between $163 million to $168 million since 2011. • The only cigarette company to have reached a comprehensive settlement resolving substantially all of the individual Engle progeny product liability cases pending in Florida. The Engle progeny cases have represented the most significant litigation against the U.S. cigarette industry in recent years. COMPANY HIGHLIGHTS • Headquartered in Miami with an executive office in Manhattan and tobacco operations in North Carolina • Employs approximately 1,400 people • Executive management and directors beneficially own 13% of the Company • Reported cash of $209 million and investments with fair value of $253 million at March 31, 2016 • Recognized as one of America’s Most Trustworthy Companies by Forbes in 2013 • In 2014, entered e-cigarette category with national rollout of Zoom, a superior disposable product featuring Tobacco and Menthol flavors. E-CIGARETTES Real Estate Tobacco Corporate and Other $1.009B $670M TOTAL $1.679B Vector is a largely underfollowed company with a highly competent management team and numerous ways to unlock value “ “ Barron’s Online, August 14, 2014 Oppenheimer analyst Ian Zaffino 2 10-Year return from April 28, 2006 to April 29, 2016 and assumes reinvestment of dividends received. Company’s net income attributable to Vector Group Ltd. for the periods presented was $37M, $37M, $59M and $57M, respectively. The Company’s revenues for the twelve months ended March 31, 2016 were $1.677B. Pro-Forma Adjusted EBITDA and Pro-Forma Adjusted Revenues are non-GAAP financial measures. For a reconciliation of Pro-Forma Adjusted EBITDA to net income and Pro-Forma Adjusted Revenues to revenues, please see Vector Group Ltd.’s Current Reports on Forms 8-K, filed on April 28, 2016, April 1, 2016 and March 8, 2016 and Form 10-Q for the quarterly period ended March 31, 2016 (Commission File Number 1-5759). 1 Pro-Forma Adjusted EBITDA1 Contact: Emily Deissler / Ben Spicehandler / Spencer Waybright of Sard Verbinnen & Co (212) 687-8080 VGR Total Return 372.7% (16.80% Compounded) 2 S&P 500 Total Return 95.0% (6.9% Compounded) 2 www.vectorgroupltd.com May 2016 E-Cigarettes LTM 3/31/2016 $258M $30M ($14M) $264M ($10M) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 100 0 300 200 400 2013 $199M $51M $236M ($1M) 2014 $211M $40M ($11M) $227M 2015 $245M $27M ($13M) $246M ($13M)($13M)