Attached files

| file | filename |

|---|---|

| EX-10.1 - FIRST AMENDMENT AND INCREMENTAL TERM LOAN AGREEMENT - RAYONIER INC | ex101firstamendmentandincr.htm |

| EX-99.2 - PRESS RELEASE - RAYONIER INC | exhibit992projectolympusan.htm |

| EX-10.2 - 2016 GUARANTEE AGREEMENT - RAYONIER INC | ex102guaranteeagreement-in.htm |

| 8-K - FORM 8-K - RAYONIER INC | a8-kshellmay2016projectoly.htm |

Pacific Northwest Portfolio Repositioning: Acquisition / Disposition / Financing Supplemental Materials | May 2016

Safe Harbor Statement 1 Certain statements in this presentation regarding anticipated financial outcomes including Rayonier’s earnings guidance, if any, business and market conditions, outlook, expected dividend rate, Rayonier’s business strategies, including expected harvest schedules, timberland acquisitions and sales of non-strategic timberlands, the anticipated benefits of Rayonier’s business strategies, and other similar statements relating to Rayonier’s future events, developments or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “project,” “anticipate” and other similar language. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. While management believes that these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. The following important factors, among others, could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document: the cyclical and competitive nature of the industries in which we operate; fluctuations in demand for, or supply of, our forest products and real estate offerings; entry of new competitors into our markets; changes in global economic conditions and world events, including political changes in particular regions or countries; fluctuations in demand for our products in Asia, and especially China; various lawsuits relating to matters arising out of our previously announced internal review and the restatement of our consolidated financial statements; the uncertainties of potential impacts of climate-related initiatives; the cost and availability of third party logging and trucking services; the geographic concentration of a significant portion of our timberland; our ability to identify, finance and complete timberland acquisitions; changes in environmental laws and regulations, timber harvesting, del ineation of wetlands, and endangered species, that may restrict or adversely impact our ability to conduct our business, or increase the cost of doing so; adverse weather conditions, natural disasters and other catastrophic events such as hurricanes, wind storms and wildfires, which can adversely affect our timberlands and the production, distribution and availability of our products; interest rate and currency movements; our capacity to incur additional debt, and any decision we may make to do so; changes in tariffs, taxes or treaties relating to the import and export of our products or those of our competitors; changes in key management and personnel; our ability to meet all necessary legal requirements to continue to qualify as a real estate investment trust (“REIT”) and changes in tax laws that could adversely affect tax treatment of our specific businesses or reduce the benefits associated with REIT status. Specifically with respect to our Real Estate business, the following important factors, among others, could cause actual results to differ materially from those expressed in forward-looking statements that may have been made in this document: the cyclical nature of the real estate business generally, including fluctuations in demand for both entitled and unentitled property; a delayed or weak recovery in the housing market; the lengthy, uncertain and costly process associated with the ownership, entitlement and development of real estate, especially in Florida, which also may be affected by changes in law, policy and political factors beyond our control; the potential for legal challenges to entitlements and permits in connection with our properties; unexpected delays in the entry into or closing of real estate transactions; the existence of competing developers and communities in the markets in which we own property; the pace of development and the rate and timing of absorption of existing entitled property in the markets in which we own property; changes in the demographics affecting projected population growth and migration to the Southeastern U.S.; changes in environmental laws and regulations, including laws regarding water withdrawal and management and delineation of wetlands, that may restrict or adversely impact our ability to sell or develop properties; the cost of the development of property generally, including the cost of property taxes, labor and construction materials; the timing of construction and availability of public infrastructure; and the availability of financing for real estate development and mortgage loans. For additional factors that could impact future results, please see Item 1A – Risk Factors in the Company’s most recent Annual Report on Form 10-K and similar discussions included other reports that we subsequently file with the Securities and Exchange Commission (the “SEC”). Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward- looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent reports filed with the SEC.

Overview of Transactions 2 Menasha Acquisition Rayonier teamed with Forest Investment Associates (“FIA”) to acquire Menasha Forest Products Corporation (“Menasha”), a privately held timberland REIT, from Campbell Global Menasha owns ~132,000 acres of high quality timberlands in Oregon and Washington Following a distribution of assets expected to occur in the second quarter, Rayonier will end up with fee ownership of ~61,000 acres located in Oregon and Washington for total consideration of ~$263 million – Rayonier and FIA will have no continuing interest in or relationship with the assets of the other party Rayonier’s ownership is more heavily weighted with mature, merchantable timber, while FIA’s ownership is more heavily weighted with pre-merchantable timber Washington Disposition In a separate transaction, Rayonier closed on the sale of ~55,000 acres in Washington from Rayonier’s existing Pacific Northwest portfolio to FIA for ~$130 million The Washington disposition is comprised primarily of pre-merchantable timber Rayonier used the proceeds from this disposition to fund part of the purchase price for the Menasha acquisition Incremental Term Loan Concurrent with the acquisition and disposition, Rayonier entered into an incremental term loan agreement with a syndicate of Farm Credit institutions to provide a 10-year, $300 million term loan Proceeds from the term loan will be used to fund the net purchase price of the Menasha acquisition (~$133 million), to repay amounts outstanding under the Company’s revolver (~$105 million) and for general corporate purposes Weighted average interest rate on the term loan is expected to be ~2.6% net of estimated patronage payments – $200 million swapped to fixed at net rate of 2.9%; $100 million floating at net rate of L + 1.33%

3 Location Asset Quality Optionality Value Creation Financial Profile Located in competitive log markets with favorable supply / demand tension Increases exposure to strong domestic markets in Pacific Northwest Complements RYN’s age-class distribution, improves sustainable yield (1) Significantly increases mix of Douglas-fir and improves overall site index Fee simple ownership with no wood supply agreement encumbrances Dispersion of parcels across strong domestic markets improves operational flexibility Potential operational synergies from age-class optimization Competitive log markets fit RYN’s log / stumpage sales program well More mature age-class profile improves near-term harvest and cash flow Diversifies cash flow profile; increases contribution from Pacific Northwest segment The Menasha acquisition is a strong fit with Rayonier’s key acquisition criteria. Menasha Acquisition – Strategic Rationale (1) “Sustainable yield” is defined in the Company’s latest report on Form 10-K.

Pro Forma Pacific Northwest Ownership Map 4 The Menasha acquisition significantly expands Rayonier’s footprint in attractive log markets in Oregon and Washington. Washington Oregon

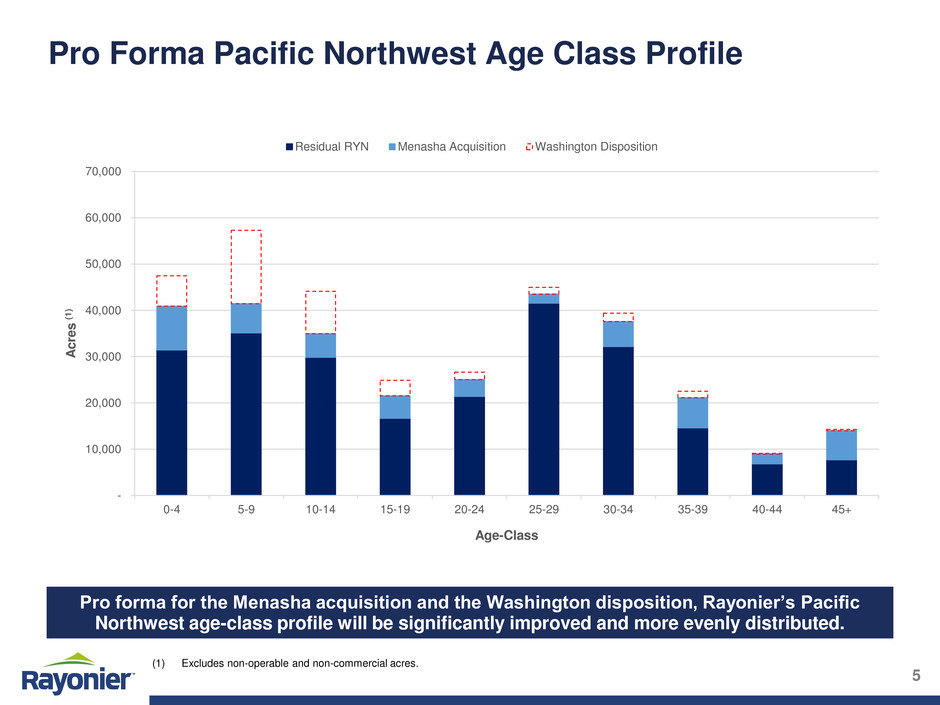

Pro Forma Pacific Northwest Age Class Profile 5 Pro forma for the Menasha acquisition and the Washington disposition, Rayonier’s Pacific Northwest age-class profile will be significantly improved and more evenly distributed. (1) Excludes non-operable and non-commercial acres. - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 0-4 5-9 10-14 15-19 20-24 25-29 30-34 35-39 40-44 45+ Ac res (1) Age-Class Residual RYN Menasha Acquisition Washington Disposition

Net Change in Operable Acres by Age Class 6 The Menasha acquisition increases Rayonier’s volume of mature, merchantable timber, while the Washington disposition reduces its volume of pre-merchantable timber. (1) Excludes non-operable and non-commercial acres. (12,000) (10,000) (8,000) (6,000) (4,000) (2,000) - 2,000 4,000 6,000 8,000 0-4 5-9 10-14 15-19 20-24 25-29 30-34 35-39 40-44 45+ Ch an ge in Ac res (1) Age-Class

Pro Forma Pacific Northwest Harvest Profile 7 Sustainable Yield (1) – Legacy to Pro Forma Bridge 5-Year Avg. Harvest – Legacy to Pro Forma Bridge (1) “Sustainable yield” is defined in the Company’s latest report on Form 10-K. The acquisition of well-stocked, productive timberland coupled with the disposition of predominantly pre-merchantable timberland is expected to increase both near-term harvest and long-term sustainable yield. 25 38 165 178 0 20 40 60 80 100 120 140 160 180 200 Legacy Disposition Acquisition Pro Forma 9 40 130 161 0 20 40 60 80 100 120 140 160 180 200 Legacy Disposition Acquisition Pro Forma (MMBF) (MMBF)

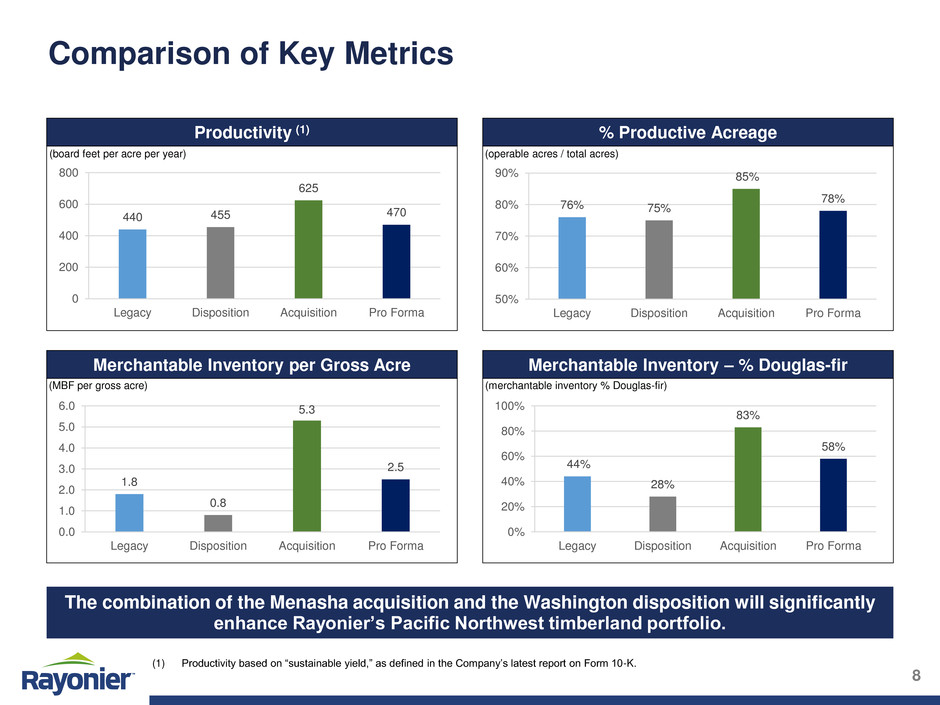

Comparison of Key Metrics 8 Productivity (1) Merchantable Inventory per Gross Acre Merchantable Inventory – % Douglas-fir % Productive Acreage (board feet per acre per year) (operable acres / total acres) (MBF per gross acre) (merchantable inventory % Douglas-fir) The combination of the Menasha acquisition and the Washington disposition will significantly enhance Rayonier’s Pacific Northwest timberland portfolio. 76% 75% 85% 78% 50% 60% 70% 80% 90% Legacy Disposition Acquisition Pro Forma (1) Productivity based on “sustainable yield,” as defined in the Company’s latest report on Form 10-K. 1.8 0.8 5.3 2.5 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Legacy Disposition Acquisition Pro Forma 440 455 625 470 0 200 400 600 800 Legacy Disposition Acquisition Pro Forma 44% 28% 83% 58% 0% 20% 40% 60 80% 1 0% Legacy Disp sition Acquisition Pro Forma

Sources & Uses / Pro Forma Capitalization 9 Pro forma for the transactions, Rayonier will maintain a strong credit profile. ($ in millions) Sources Uses New Term Loan $300.0 Menasha Acquisition $263.3 Washington Disposition 129.5 Repay Revolving Credit Facility 105.0 Transaction Costs & Transfer Taxes 5.0 Increase in Cash 56.2 Total Sources $429.5 Total Uses $429.5 New Menasha Washington Revolver / Pro Forma 3/31/2016 Term Loan Acquisition Disposition Other (1) 3/31/2016 Senior Notes due 2022 $325.0 – – – – $325.0 Term Loan due 2024 350.0 – – – – 350.0 New Term Loan due 2026 – 300.0 – – – 300.0 Revolving Credit Facility due 2020 105.0 – – – (105.0) – Other 92.8 – – – – 92.8 Total Debt $872.8 $1,067.8 (–) Cash & Equivalents 76.2 300.0 (263.3) 129.5 (110.0) 132.4 Net Debt $796.6 $935.4 Equity Market Capitalization (2) 3,029.1 – – – – 3,029.1 Net Debt / Enterprise Value (3) 20.8% – – – – 23.6% (1) Includes repayment of revolving credit facility and transaction costs. (2) Based on share price of $24.68 as of 4/29/16 and common shares outstanding of 122.7 million as of 2/19/16 per most recent report on Form 10-K. (3) Enterprise Value based on Equity Market Capitalization plus Net Debt.

10 Pro Forma Debt Structure & Maturity Profile Pro Forma Debt Profile ($ in millions) Pro Forma Maturity Profile ($ in millions) Highlights Average interest rate of 3.2% 88% fixed rate debt Average maturity of nearly 8 years Highlights Well staggered maturity profile Nearest significant maturity in 2022 No significant stacked maturities Pro forma for the transactions, Rayonier will have a very attractive debt structure and maturity profile. $12 $43 – – $15 – $325 – $350 – $300 $23 – $50 $100 $150 $200 $250 $300 $350 $400 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027+ Balance @ Interest Annual Years to 3/31/2016 Rate Interest % Fixed Maturity Senior Notes due 2022 $325.0 3.75% $12.2 100.0% 5.9 Term Loan due 2024 350.0 3.33% 11.7 100.0% 8.3 New Term Loan due 2026 (1) 300.0 2.55% 7.6 66.7% 10.0 Mortgage Notes due 2017 42.5 4.35% 1.9 100.0% 1.3 Revolving Credit Facility due 2020 (2) – 1.70% 0.4 – 4.3 Solid Waste Bond due 2020 15.0 1.70% 0.3 – 4.0 NZ Working Capital Facility due 2016 12.2 3.20% 0.4 – 0.2 NZ Shareholder Loan (3) 23.1 NA NA NA NA Total / Weighted Avg. $1,067.8 3.22% $34.3 87.8% 7.6 (1) Assumes fixed rate portion of 2.93%, f loating rate portion of L + 1.33% (net of patronage), and LIBOR of 0.45%. (2) Interest on revolver represents unused facility fee of 0.175%. (3) Minority share of New Zealand shareholder loan; does not represent third-party indebtedness.

Pacific Northwest Portfolio Repositioning – Key Takeaways 11 Transactions achieve many of Rayonier’s key objectives: Upgrades asset quality Accretive to cash available for distribution (CAD)(1) Increases Adjusted EBITDA(1) / cash flow from sustainable harvesting activities Demonstrates capital allocation flexibility Rayonier was able to achieve these results through: Creative acquisition structure; co-investor with complementary investment objectives Opportunistic acquisition funding through capital redeployment and attractive long-term debt Key financial highlights include: Average annual Adjusted EBITDA(1) estimated to increase by ~$11 million over next five years Average annual CAD(1) estimated to increase by ~$7 million over next five years Strong pro forma capital structure with Net Debt / Enterprise Value(2) of ~24% The Menasha acquisition and the Washington disposition demonstrate Rayonier’s commitment to disciplined and opportunistic capital allocation. (1) “Adjusted EBITDA” and “cash available for distribution (CAD)” are defined in the Company’s latest report on Form 10-K. (2) Based on share price of $24.68 as of 4/29/16 and common shares outstanding of 122.7 million as of 2/19/16 per most recent report on Form 10-K.