Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PORTLAND GENERAL ELECTRIC CO /OR/ | form8-kfor20160331pressrel.htm |

| EX-99.1 - PRESS RELEASE - PORTLAND GENERAL ELECTRIC CO /OR/ | exhibit99120160331pressrel.htm |

Earnings Conference Call First Quarter 2016 Exhibit 99.2

Cautionary Statement Information Current as of April 29, 2016 Except as expressly noted, the information in this presentation is current as of April 29, 2016 — the date on which PGE filed its Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update the presentation, except as may be required by law. Forward-Looking Statements Statements in this presentation that relate to future plans, objectives, expectations, performance, events and the like may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding earnings guidance; statements regarding future load, hydro conditions and operating and maintenance costs; statements concerning implementation of the company’s integrated resource plan; statements concerning future compliance with regulations limiting emissions from generation facilities and the costs to achieve such compliance; as well as other statements containing words such as “anticipates,” “believes,” “intends,” “estimates,” “promises,” “expects,” “should,” “conditioned upon,” and similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including reductions in demand for electricity; the sale of excess energy during periods of low demand or low wholesale market prices; operational risks relating to the company’s generation facilities, including hydro conditions, wind conditions, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; failure to complete capital projects on schedule or within budget, or the abandonment of capital projects, which could result in the company’s inability to recover project costs; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy markets conditions, which could affect the availability and cost of purchased power and fuel; changes in capital market conditions, which could affect the availability and cost of capital and result in delay or cancellation of capital projects; the outcome of various legal and regulatory proceedings; and general economic and financial market conditions. As a result, actual results may differ materially from those projected in the forward-looking statements. All forward-looking statements included in this press release are based on information available to the company on the date hereof and such statements speak only as of the date hereof. The company assumes no obligation to update any such forward-looking statement. Prospective investors should also review the risks and uncertainties listed in the company’s most recent annual report on form 10-K and the company’s reports on forms 8- K and 10-Q filed with the United States Securities and Exchange Commission, including management’s discussion and analysis of financial condition and results of operations and the risks described therein from time to time. 2

Leadership Presenting Today Jim Lobdell Senior VP of Finance, CFO & Treasurer Jim Piro President & CEO 3 On Today’s Call ▪ Financial performance ▪ Operational update ▪ Economy and customers ▪ Carty update ▪ Accelerated renewable RFP ▪ Oregon Clean Electricity Plan ▪ 2016 Integrated Resource Plan (IRP) ▪ Financial update ▪ Guidance ▪ Dividend increase

NI in millions Q1 2015 Q1 2016 Net Income $50 $61 Diluted EPS $0.62 $0.68 2015 EPS $2.04 2016E EPS $2.05 - $2.20 Q2 Q3 First Quarter 2016 Earnings Results 4 Q2-Q4: $1.37 - $1.52 Q1 Q2 Q3 Q4 Q1

Accomplishments and Operational Update 5

Economic Update 6 (1) State of Oregon Employment Department (2) Bloomberg’s Economic Evaluation of States, February 2016 (3) Net of approximately 1.5% of energy efficiency, excluding one large paper customer and adjusting for Leap Year ▪ Oregon reached a record low unemployment rate in March of 4.5 percent and 3.9 percent for PGE's operating area, beating the national rate of 5.0 percent(1). ▪ Oregon led the U.S. with the best performing economy last year(2). ▪ Portland strengthening its position as epicenter of global sportswear business. ▪ Average customer count increased approximately 1.3 percent over the past year. ▪ Weather-adjusted 2016 load growth forecast of approximately 1 percent(3).

New Generation: Baseload Resource 7 Carty Generating Station, a 440 MW natural gas baseload plant under construction near Boardman, OR ▪ March 9, 2016: Sureties denied full liability under the performance bond ▪ March 23, 2016: PGE filed a lawsuit against sureties for breach of contract damages ▪ April 15, 2016: Sureties filed a motion to stay the proceedings, alleging PGE claims should be addressed in the arbitration proceeding initiated by Abengoa. ▪ Systems required for first fire are being completed ▪ First fire scheduled for beginning of June Capital costs, including AFDC, approved in 2016 GRC: $514M Total estimated cost, including AFDC, for completion(1): $635-$670M(1) Deadline for plant-in-service in 2016 GRC: July 31, 2016 Current targeted date for plant-in-service: July 31, 2016 (1) Total estimated cost does not consider any amounts received from sureties under the performance bond. Carty Project Update

Request For Proposal for Renewables ▪ Accelerated renewable RFP process intended to capture available renewable resource tax benefits for customers ▪ Participation of Independent Evaluator ▪ Project size up to approximately 175 aMW to help meet Oregon's 2020 and a portion of the 2025 Renewable Portfolio Standard ▪ Types of projects to be considered: ▪ Asset-Ownership Options ▪ Purchase Power Agreements ▪ Accelerated RFP contingent on OPUC approval Potential Accelerated RFP Process Timeline: Key Elements 8 Tax extender timeline for Production and Investment Tax Credits:

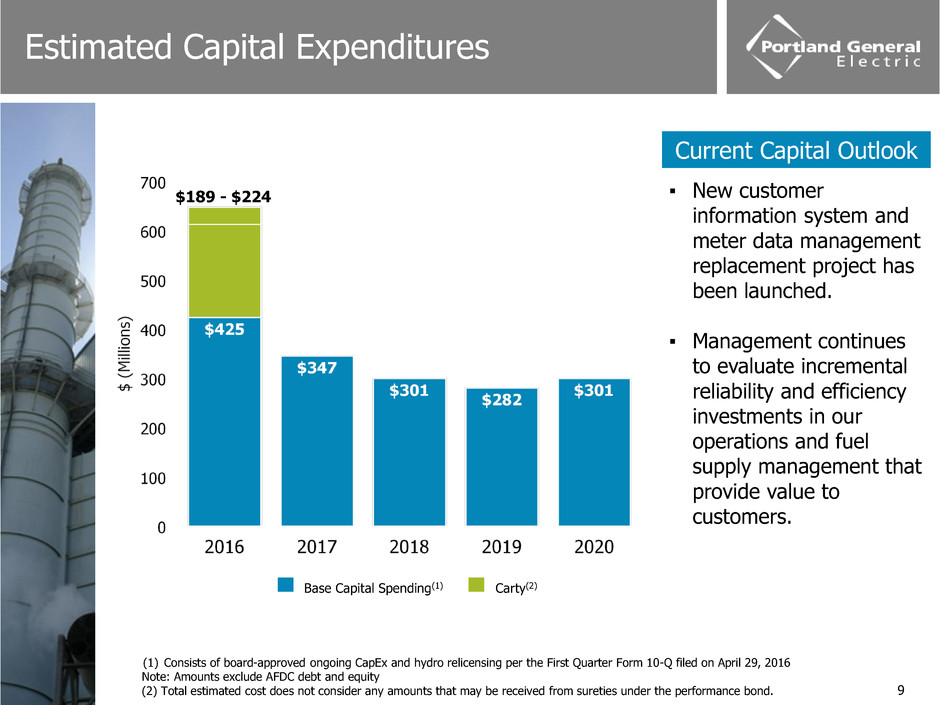

Estimated Capital Expenditures 9 (1) Consists of board-approved ongoing CapEx and hydro relicensing per the First Quarter Form 10-Q filed on April 29, 2016 Note: Amounts exclude AFDC debt and equity (2) Total estimated cost does not consider any amounts that may be received from sureties under the performance bond. Current Capital Outlook ▪ New customer information system and meter data management replacement project has been launched. ▪ Management continues to evaluate incremental reliability and efficiency investments in our operations and fuel supply management that provide value to customers. $189 - $224 Base Capital Spending(1) Carty(2)

Clean Electricity and Coal Transition Plan Key Elements ▪ Increases the renewable portfolio standard to 50 percent in 2040. ▪ Transitions Oregon off coal-fired generation by 2035. ▪ Includes PTCs in power costs, beginning with AUT filing for 2017. ▪ Reaffirms state’s commitment to energy- efficiency programs. ▪ Encourages transportation electrification. ▪ Increases access to solar energy for more Oregonians. ▪ Flexibility to achieve goals while working with the Oregon Public Utility Commission. 10

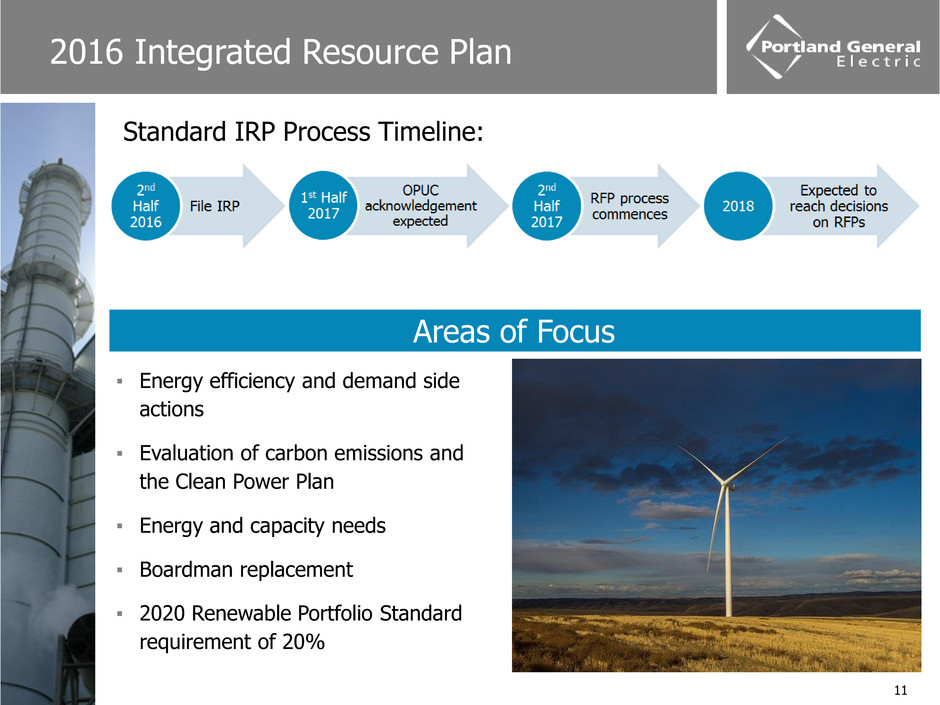

2016 Integrated Resource Plan Areas of Focus ▪ Energy efficiency and demand side actions ▪ Evaluation of carbon emissions and the Clean Power Plan ▪ Energy and capacity needs ▪ Boardman replacement ▪ 2020 Renewable Portfolio Standard requirement of 20% 11 Standard IRP Process Timeline:

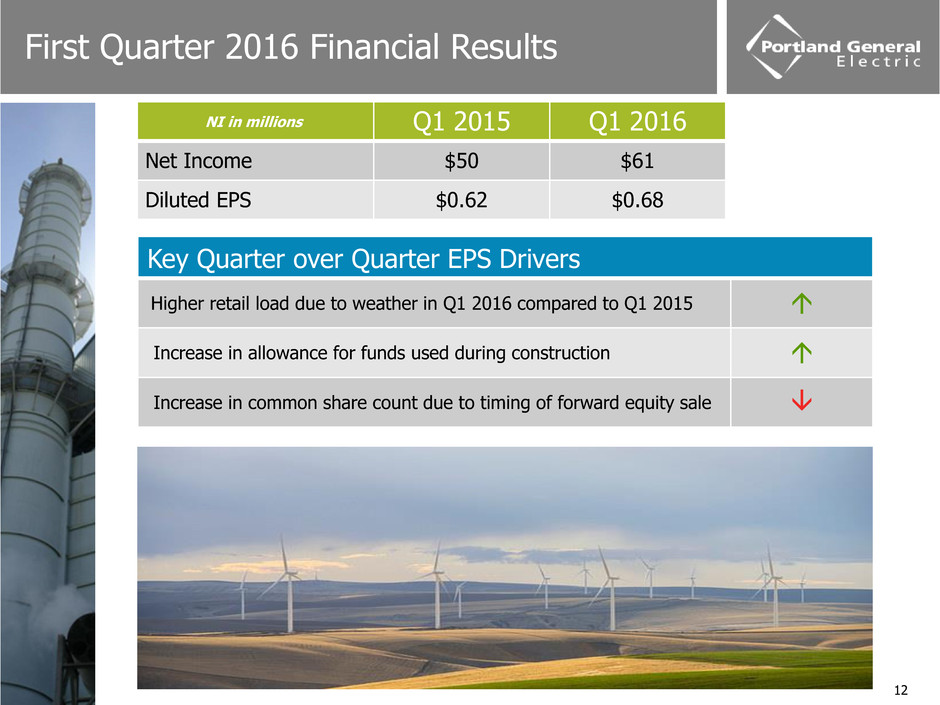

First Quarter 2016 Financial Results NI in millions Q1 2015 Q1 2016 Net Income $50 $61 Diluted EPS $0.62 $0.68 Key Quarter over Quarter EPS Drivers Higher retail load due to weather in Q1 2016 compared to Q1 2015 Increase in allowance for funds used during construction Increase in common share count due to timing of forward equity sale 12

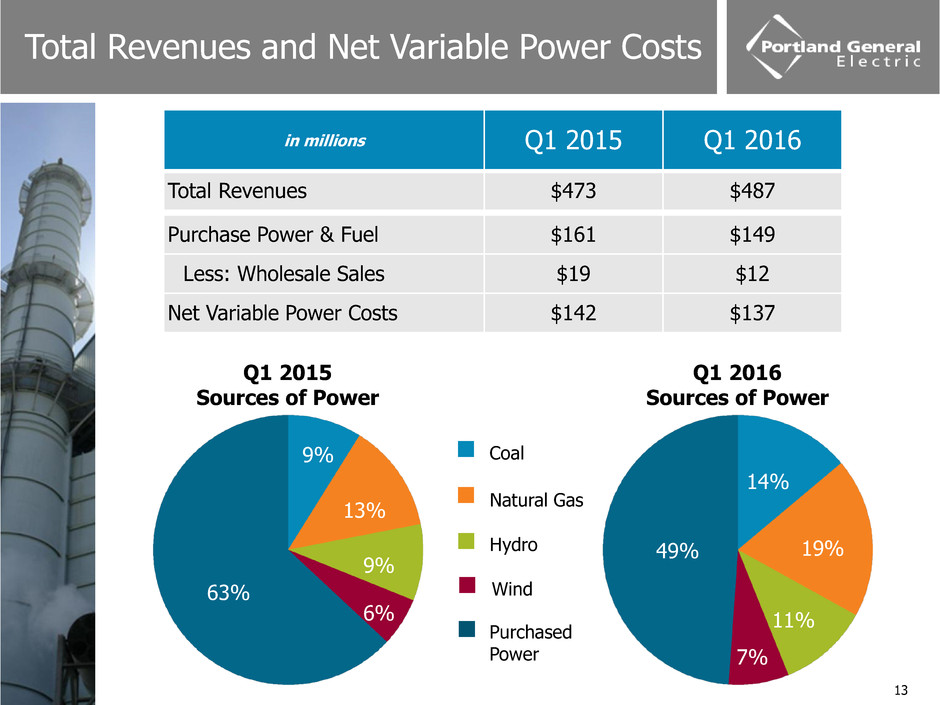

Purchase Power & Fuel $161 $149 Less: Wholesale Sales $19 $12 Net Variable Power Costs $142 $137 Total Revenues and Net Variable Power Costs Q1 2015 Sources of Power Q1 2016 Sources of Power in millions Q1 2015 Q1 2016 Total Revenues $473 $487 63% 9% 9% 13% 6% 49% 14% 11% 19% Coal Natural Gas Hydro Wind Purchased Power 7% 13

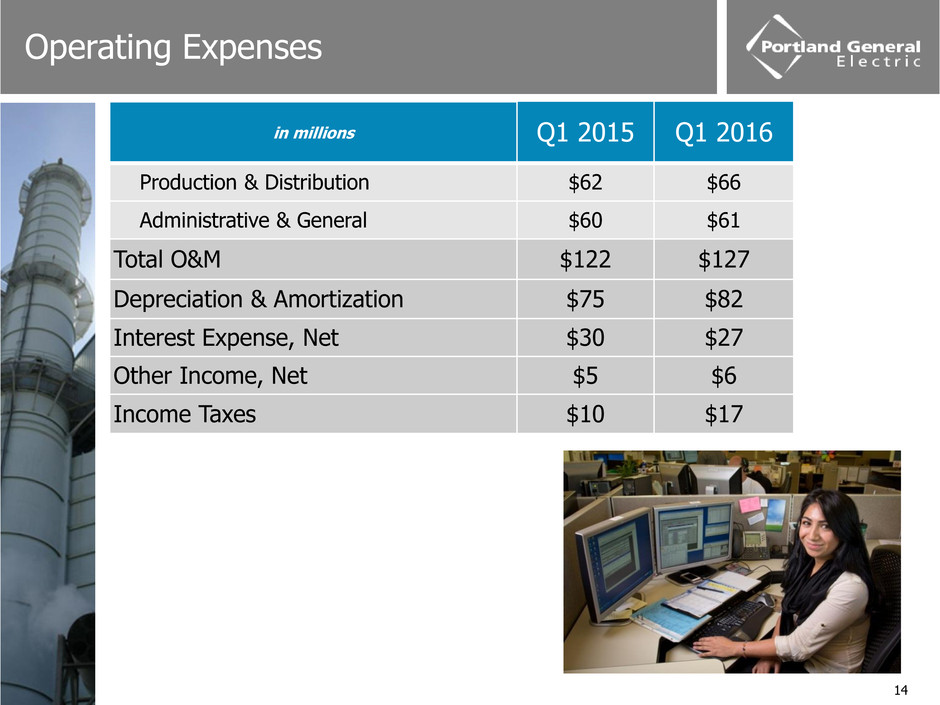

Operating Expenses in millions Q1 2015 Q1 2016 Production & Distribution $62 $66 Administrative & General $60 $61 Total O&M $122 $127 Depreciation & Amortization $75 $82 Interest Expense, Net $30 $27 Other Income, Net $5 $6 Income Taxes $10 $17 14

Liquidity and Financing 15 2016 Financing Activity Q1 2016 Q2 2016 Q3 2016 Q4 2016 First Mortgage Bonds $140 million issued May issue $100 million $133 million redeemed Bank Loan Planning to issue $200 million Senior Secured Senior Unsecured Outlook S&P A- BBB Stable Moody’s A1 A3 Stable Total Liquidity as of 3/31/2016 (in millions) Credit Facilities $ 660 Commercial Paper $ — Letters of Credit $ (111 ) Cash $ 4 Available $ 553

▪ Retail delivery growth of approximately 1%, weather-adjusted and excluding one large paper company; ▪ Average hydro conditions for the remainder of the year; ▪ Wind generation for the remainder of the year based on 5 years of historic levels or forecast studies when historical data is not available; ▪ Normal thermal plant operations; ▪ Operating and maintenance costs between $515 and $535 million; ▪ Depreciation and amortization expense between $315 and $325 million; and ▪ Carty Generating Station in service by July 31, 2016 Guidance 16 2016 EPS Guidance: $2.05-$2.20

2016 Key Initiatives 1. Maintain high level of operational excellence 2. Complete construction of Carty Generating Station 3. Pursue an accelerated renewables RFP 4. Complete and file the 2016 Integrated Resource Plan 17