Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Mylan II B.V. | d184592dex312.htm |

| EX-31.1 - EX-31.1 - Mylan II B.V. | d184592dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 1)

| þ | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2015

OR

| ¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number 333-199861

MYLAN N.V.

(Exact name of registrant as specified in its charter)

| The Netherlands | 98-1189497 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England

(Address of principal executive offices)

+44 (0) 1707 853 000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on Which Registered: | |

| Ordinary shares, nominal value €0.01 | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer |

x |

Accelerated filer |

¨ | |||

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the outstanding ordinary shares, nominal value €0.01, of the registrant other than shares held by persons who may be deemed affiliates of the registrant, as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $33,063,308,366.

The number of ordinary shares outstanding, nominal value €0.01, of the registrant as of April 27, 2016 was 508,342,710.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, originally filed on February 16, 2016 (the “Original Filing”). We are filing this Amendment to include the information required by Part III and not included in the Original Filing, as we do not intend to file a definitive proxy statement for an annual general meeting of stockholders within 120 days of the end of our fiscal year ended December 31, 2015. In addition, in connection with the filing of this Amendment and pursuant to the rules of the Securities and Exchange Commission (the “SEC”), we are including with this Amendment new certifications of our principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

As used in this Amendment, unless the context requires otherwise, the “Company,” “Mylan,” “our,” and “we” mean Mylan N.V. and its consolidated subsidiaries, “NASDAQ” means The NASDAQ Stock Market, and “U.S. GAAP” means accounting principles generally accepted in the United States of America.

On February 27, 2015 (the “Closing Date”), Mylan N.V. completed the acquisition (the “EPD Transaction”) of Mylan Inc. and Abbott Laboratories’ (“Abbott”) non-U.S. developed markets specialty and branded generics business (the “EPD Business”). In connection with this transaction, Mylan Inc. and the EPD Business were reorganized under Mylan N.V., a new public company organized in the Netherlands. On February 18, 2015, the Office of Chief Counsel of the Division of Corporation Finance of the Securities and Exchange Commission issued a no-action letter to Mylan Inc. and Mylan N.V. that included its views that the Merger constituted a “succession” for purposes of Rule 12g-3(a) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and that Mylan N.V., as successor to Mylan Inc., is deemed a large accelerated filer for purposes of Exchange Act Rule 12b-2. For purposes of this Amendment, references to the Company for periods prior to the Closing Date refer to Mylan Inc. and its consolidated subsidiaries.

Forward-Looking Statements

This Amendment contains “forward-looking statements.” These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, statements about the proposed acquisition of Meda AB (publ.) (“Meda”) by Mylan (the “Meda Transaction”), Mylan’s related public offer to the shareholders of Meda to acquire all of the outstanding shares of Meda (the “Offer”), the EPD Transaction, the benefits and synergies of the EPD Transaction and the Meda Transaction, future opportunities for Mylan, Meda, or the combined company and products, and any other statements regarding Mylan’s, Meda’s, or the combined company’s future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competition, and other expectations and targets for future periods. These may often be identified by the use of words such as “will,” “may,” “could,” “should,” “would,” “project,” “believe,” “anticipate,” “expect,” “plan,” “estimate,” “forecast,” “potential,” “intend,” “continue,” “target” and variations of these words or comparable words. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: uncertainties related to the Meda Transaction, including as to the timing of the Meda Transaction, uncertainties as to whether Mylan will be able to complete the Meda Transaction, the possibility that competing offers will be made, the possibility that certain conditions to the completion of the Offer will not be satisfied, and the possibility that Mylan will be unable to obtain regulatory approvals for the Meda Transaction or be required, as a condition to obtaining regulatory approvals, to accept conditions that could reduce the anticipated benefits of the Meda Transaction; the ability to meet expectations regarding the accounting and tax treatments of the EPD Transaction and the Meda Transaction; changes in relevant tax and other laws, including but not limited to changes in the U.S. tax code and

Table of Contents

healthcare and pharmaceutical laws and regulations in the U.S. and abroad; the integration of the EPD Business and Meda being more difficult, time-consuming, or costly than expected; operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients, or suppliers) being greater than expected following the EPD Transaction and the Meda Transaction; the retention of certain key employees of the EPD Business and Meda being difficult; the possibility that Mylan may be unable to achieve expected synergies and operating efficiencies in connection with the EPD Transaction and the Meda Transaction within the expected time-frames or at all and to successfully integrate the EPD Business and Meda; expected or targeted future financial and operating performance and results; the capacity to bring new products to market, including but not limited to where Mylan uses its business judgment and decides to manufacture, market, and/or sell products, directly or through third parties, notwithstanding the fact that allegations of patent infringement(s) have not been finally resolved by the courts (i.e., an “at-risk launch”); any regulatory, legal, or other impediments to Mylan’s ability to bring new products to market; success of clinical trials and Mylan’s ability to execute on new product opportunities; any changes in or difficulties with our inventory of, and our ability to manufacture and distribute, the EpiPen® Auto-Injector to meet anticipated demand; the scope, timing, and outcome of any ongoing legal proceedings and the impact of any such proceedings on financial condition, results of operations, and/or cash flows; the ability to protect intellectual property and preserve intellectual property rights; the effect of any changes in customer and supplier relationships and customer purchasing patterns; the ability to attract and retain key personnel; changes in third-party relationships; the impact of competition; changes in the economic and financial conditions of the businesses of Mylan, Meda, or the combined company; the inherent challenges, risks, and costs in identifying, acquiring, and integrating complementary or strategic acquisitions of other companies, products, or assets and in achieving anticipated synergies; uncertainties and matters beyond the control of management; and inherent uncertainties involved in the estimates and judgments used in the preparation of financial statements, and the providing of estimates of financial measures, in accordance with U.S. GAAP and related standards or on an adjusted basis. For more detailed information on the risks and uncertainties associated with Mylan’s business activities, see the risks described in the Original Filing and our other filings with the SEC. These risks and uncertainties also include those risks and uncertainties that are discussed in the offer document that has been filed with the Swedish Financial Supervisory Authority (“SFSA”) and will be published by Mylan upon approval by the SFSA (the “Offer Document”), the Registration Statement on Form S-4 filed with the SEC on April 11, 2016 (as amended from time to time, the “Registration Statement”) and the EU Prospectus that has been filed with the Netherlands Authority for the Financial Markets (“AFM”) and will be published by Mylan upon approval by the AFM (the “EU Prospectus”). You can access Mylan’s filings with the SEC through the SEC website at www.sec.gov, and Mylan strongly encourages you to do so. Mylan undertakes no obligation to update any statements herein for revisions or changes after the filing date of this Amendment.

Additional Information

In connection with the Offer, the Offer Document has been filed with the SFSA and will be published by Mylan upon approval by the SFSA. In addition, Mylan has filed certain materials with the SEC, including, among other materials, the Registration Statement. The EU Prospectus has been filed with the AFM and will be published by Mylan upon approval by the AFM. This Amendment is not intended to be, and is not, a substitute for such documents or for any other document that Mylan may file with the SFSA, the SEC, the AFM or any other competent EU authority in connection with the Offer. INVESTORS AND SECURITYHOLDERS OF MEDA ARE URGED TO READ ANY DOCUMENTS FILED WITH THE SFSA, THE SEC AND THE AFM OR ANY OTHER COMPETENT EU AUTHORITY CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING AN INVESTMENT DECISION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MYLAN, MEDA AND THE OFFER. Such documents are or upon publication will be available free of charge through the website maintained by the SEC at www.sec.gov, on Mylan’s website at medatransaction.mylan.com or, to the extent filed with the AFM, through the website maintained by the AFM at www.afm.nl, or by directing a request to Mylan at +1 724-514-1813 or investor.relations@mylan.com. Any materials filed by Mylan with the SFSA, the SEC, the AFM or any other competent EU authority that are required to be mailed to Meda shareholders will also be mailed to such shareholders.

Table of Contents

Reconciliation of Non-GAAP Financial Measures

This Amendment includes the presentation and discussion of certain financial information that differs from what is reported under U.S. GAAP. These non-GAAP financial measures, including, but not limited to, adjusted diluted earnings per share, adjusted EBITDA, adjusted free cash flow, total adjusted revenues, constant currency third party net sales, constant currency adjusted third party net sales, adjusted third party net sales, cash return on invested capital excluding goodwill, cash return on operating invested capital, and cash return on invested capital are presented in order to supplement investors’ and other readers’ understanding and assessment of Mylan’s financial performance. Management uses these measures internally for forecasting, budgeting, measuring its operating performance, and incentive-based awards. In addition, primarily due to acquisitions, Mylan believes that an evaluation of its ongoing operations (and comparisons of its current operations with historical and future operations) would be difficult if the disclosure of its financial results were limited to financial measures prepared only in accordance with U.S. GAAP. In addition, Mylan believes that including EBITDA and supplemental adjustments applied in presenting adjusted EBITDA pursuant to our debt agreements is appropriate to provide additional information to investors to demonstrate Mylan’s ability to comply with financial debt covenants (which are calculated using a measure similar to adjusted EBITDA) and assess Mylan’s ability to incur additional indebtedness. We also report sales performance using the non-GAAP financial measure of “constant currency” sales and adjusted sales. This measure provides information on the change in net sales assuming that foreign currency exchange rates had not changed between the prior and current period. The comparisons presented as constant currency rates reflect comparative local currency sales at the prior year’s foreign exchange rates. We routinely evaluate our third party net sales performance at constant currency so that sales results can be viewed without the impact of foreign currency exchange rates, thereby facilitating a period-to-period comparison of our operational activities, and we believe that this presentation also provides useful information to investors for the same reason. Appendix A to this Amendment contains reconciliations of such non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures. Investors and other readers are encouraged to review the related U.S. GAAP financial measures and the reconciliations of the non-GAAP measures to their most directly comparable U.S. GAAP measures set forth in Appendix A, and investors and other readers should consider non-GAAP measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with U.S. GAAP.

Table of Contents

MYLAN N.V.

For the Year Ended December 31, 2015

| Page | ||||||

| PART III | ||||||

| ITEM 10. |

1 | |||||

| ITEM 11. |

Executive Compensation | 12 | ||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 51 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence | 54 | ||||

| ITEM 14. |

Principal Accounting Fees and Services | 56 | ||||

| PART IV | ||||||

| ITEM 15. |

Exhibits | 57 | ||||

| 58 | ||||||

| Appendix A — Reconciliation of Non-GAAP Measures (Unaudited) |

||||||

Table of Contents

PART III

| ITEM 10. | Directors, Executive Officers and Corporate Governance |

Executive Officers

Certain information concerning our Code of Ethics that applies to our Principal Executive Officer, Principal Financial Officer and Corporate Controller is contained in Item 10 of Part III of the Original Filing and is also included below.

The names, ages, and positions of Mylan’s executive officers as of April 29, 2016, are as follows:

| Heather Bresch |

46 |

Chief Executive Officer (principal executive officer) | ||

| Rajiv Malik |

55 |

President | ||

| Anthony Mauro |

43 |

Chief Commercial Officer | ||

| Robert J. Coury |

55 |

Executive Chairman |

Each executive officer listed above was an executive officer of Mylan Inc. on the Closing Date and became an executive officer of Mylan N.V. on such date in connection with the EPD Transaction.

Ms. Bresch and Messrs. Coury and Malik are all also members of Mylan’s Board of Directors (the “Mylan Board”) and a discussion of their respective business experience and other relevant biographical information is provided under “Mylan Board” below.

Mr. Mauro has served as Chief Commercial Officer since January 4, 2016. Prior to that date, Mr. Mauro served as President, North America of Mylan since January 1, 2012. He served as President of Mylan Pharmaceuticals Inc. from 2009 through February 2013. In his 20 years at Mylan, Mr. Mauro has held roles of increasing responsibility, including Chief Operating Officer for Mylan Pharmaceuticals ULC in Canada and Vice President of Strategic Development, North America, and Vice President of Sales, North America for Mylan.

Pursuant to Mylan’s Rules for the Board of Directors of Mylan N.V. (the “Board Rules”), the Mylan Board appoints the Chief Executive Officer and may appoint, or delegate authority to the Chairman or the Chief Executive Officer to appoint, a President, a Chief Financial Officer, a Chief Legal Officer, a Secretary, and any other officers of Mylan as the Mylan Board, the Chairman, or the Chief Executive Officer may desire. Each officer appointed by the Mylan Board, or appointed by the Chairman or the Chief Executive Officer, holds office until his or her successor shall have been appointed, or until his or her death, resignation, or removal. Officers of Mylan who are appointed by the Mylan Board can be removed by the Mylan Board, and the Mylan Board may delegate to the Chairman or the Chief Executive Officer the right to remove any officer the Chairman or the Chief Executive Officer has appointed (but not any officer directly appointed by the Mylan Board). A copy of the Board Rules is available on Mylan’s website at http://www.mylan.com/company/corporate-governance or in print to shareholders upon request, addressed to Mylan N.V.’s Corporate Secretary at Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England.

Mylan Board

The Mylan Board consists of 13 directors, each of whom is either an executive director or a non-executive director pursuant to applicable Dutch law. Executive directors are responsible for the daily management and operation of the Company and non-executive directors are responsible for overseeing and monitoring the performance of the executive directors. Currently, Ms. Bresch and Mr. Malik are executive directors while the other directors listed below are non-executive directors. Consistent with established Dutch law and the Company’s articles of association, executive directors and non-executive directors are appointed by the general meeting from a binding nomination proposed by the Mylan Board. If appointed, each director’s term begins at the general meeting at which he or she is appointed and, unless such director resigns or is suspended or dismissed at an earlier date, his or her term of office lapses immediately after the next annual general meeting held after his or her appointment.

1

Table of Contents

| Name |

Age# | Other Positions with Mylan and Principal Occupation |

Has | |||

| Heather Bresch^ |

46 |

Chief Executive Officer |

2011 | |||

| Wendy Cameron |

56 |

Director and Co-Owner, Cam Land LLC |

2002 | |||

| Hon. Robert J. Cindrich |

72 |

President, Cindrich Consulting; Counsel, Schnader |

||||

| Harrison Segal & Lewis |

2011 | |||||

| Robert J. Coury |

55 |

Executive Chairman |

2002 | |||

| JoEllen Lyons Dillon |

52 |

Executive Vice President, Chief Legal Officer, and |

||||

| Corporate Secretary, The ExOne Company |

2014 | |||||

| Neil Dimick, C.P.A.* |

66 |

Retired Executive Vice President and Chief Financial |

||||

| Officer, AmerisourceBergen Corporation |

2005 | |||||

| Melina Higgins |

48 |

Retired Partner and Managing Director, Goldman |

||||

| Sachs |

2013 | |||||

| Douglas J. Leech, C.P.A.* |

61 |

Founder and Principal, DLJ Advisors |

2000 | |||

| Rajiv Malik^ |

55 |

President |

2013 | |||

| Joseph C. Maroon, M.D. |

75 |

Professor, Heindl Scholar in Neuroscience, and Vice Chairman of the Department of Neurosurgery for the University of Pittsburgh Medical Center; Neurosurgeon for the Pittsburgh Steelers |

2003 | |||

| Mark W. Parrish |

60 |

Chairman and Chief Executive Officer, Trident USA |

||||

| Health Services |

2009 | |||||

| Rodney L. Piatt, C.P.A.* |

63 |

Lead Independent Director and Vice Chairman; President and Owner, Horizon Properties Group, |

||||

| LLC; CEO, Lincoln Manufacturing Inc. |

2004 | |||||

| Randall L. (Pete) Vanderveen, Ph.D., R.Ph. |

65 |

Professor of Pharmaceutical Policy and Economics, Senior Adviser to the Leonard D. Schaeffer Center of Health Policy and Economics, Director of the Margaret and John Biles Center for Leadership, and Senior Adviser to the Dean for Advancement, School of Pharmacy, University of Southern California |

2002 |

| ^ | Refers to an executive director. All other directors listed above are non-executive directors. |

| * | C.P.A. distinctions refer to “inactive” status. |

| # | Ages as of April 29, 2016 |

| ** | Includes service as director of Mylan Inc. and Mylan N.V. Each director listed above was a director of Mylan Inc. on the Closing Date and became a director of Mylan N.V. on such date in connection with the EPD Transaction. |

Heather Bresch. Ms. Bresch has served as Mylan’s Chief Executive Officer (“CEO”) since January 1, 2012. Throughout her 24-year career with Mylan, Ms. Bresch has held roles of increasing responsibility in more than 15 functional areas. Prior to becoming CEO, Ms. Bresch was Mylan’s President commencing in July 2009 and was responsible for the day-to-day operations of the Company. Before that, she served as Mylan’s Chief Operating Officer and Chief Integration Officer from October 2007 to July 2009, leading the successful integration of two transformational international acquisitions – Matrix Laboratories Limited (n/k/a Mylan Laboratories Limited) and Merck KGaA’s generics and specialty pharmaceuticals businesses. Under Ms. Bresch’s leadership, Mylan has continued to expand its portfolio and geographic reach, acquiring Abbott Laboratories’ non-U.S. developed markets specialty and branded generics business, the female healthcare business of Famy Care Ltd., and India-based Agila Specialties, a global leader in injectable products and an innovative respiratory technology platform; partnering on portfolios of biologic and insulin products; entering new commercial markets such as India and Brazil; and expanding its leadership in the treatment of HIV/AIDS

2

Table of Contents

through the distribution of novel testing devices. During her career, Ms. Bresch has championed initiatives aimed at improving product quality and removing barriers to patient access to medicine. Ms. Bresch’s qualifications to serve on the Mylan Board include, among others, her extensive industry, policy, and leadership experience and abilities, as well as her strategic vision, judgment and unique and in-depth knowledge about the Company.

Wendy Cameron. Ms. Cameron has served as Co-Owner and Director of Cam Land LLC, a harness racing business in Washington, Pennsylvania, since January 2003. From 1981 to 1998, she was Vice President, Divisional Sales & Governmental Affairs, Cameron Coca-Cola Bottling Company, Inc. Ms. Cameron served as Chairman of the Washington Hospital Board of Trustees and of the Washington Hospital Executive Committee until she stepped down in 2012. She was a member of the hospital’s Board of Trustees from 1997 through 2012 and a member of the Washington Hospital Foundation Board from 1993 through 2012. In addition to being a business owner and having held an executive position with one of the nation’s largest bottlers for nearly 20 years, Ms. Cameron has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Ms. Cameron’s qualifications to serve on the Mylan Board include, among others, this experience, as well as her independence, business experience, leadership, and judgment.

Hon. Robert J. Cindrich. Since February 2011, Judge Cindrich has been serving as the President of Cindrich Consulting, LLC, a business and healthcare consulting company that advises clients on corporate governance, compliance, and business strategies, and from October 1, 2013 through January 31, 2014 he served as Interim General Counsel for United States Steel Corporation (NYSE: X). Judge Cindrich joined Schnader Harrison Segal & Lewis (“Schnader”), a law firm, as legal counsel in April 2013 and took a temporary leave of absence on October 1, 2013 to join United States Steel as Interim General Counsel, returning to Schnader after his time at United States Steel. In May 2012, he joined the Board of Directors of Allscripts Healthcare Solutions, Inc. (NASDAQ: MDRX), which provides healthcare information technology solutions, where he served until April 2015. From 2011 through 2012, Judge Cindrich served as a senior advisor to the Office of the President of the University of Pittsburgh Medical Center (“UPMC”), an integrated global health enterprise. From 2004 through 2010, Judge Cindrich was a Senior Vice President and the Chief Legal Officer of UPMC. From 1994 through January 2004, Judge Cindrich served as a judge on the United States District Court for the Western District of Pennsylvania. Prior to that appointment, he was active as an attorney in both government and private practice, including positions as the U.S. Attorney for the Western District of Pennsylvania and as the Allegheny County Assistant Public Defender and Assistant District Attorney. Judge Cindrich’s qualifications to serve on the Mylan Board include, among others, his extensive legal and leadership experience and judgment, as well as his independence, and in-depth knowledge of the healthcare industry.

Robert J. Coury. Robert J. Coury has been the Executive Chairman of Mylan and the Mylan Board since January 2012. Under his visionary leadership, Mylan transformed from the third largest generics pharmaceutical company in the U.S. into one of the largest pharmaceutical companies in the world, earning spots in both the S&P 500 and, prior to the Company’s reincorporation outside of the U.S. in 2015, the Fortune 500. Mr. Coury was first elected to the Mylan Board in February 2002, having served since 1995 as a strategic advisor to the Company. He became the Mylan Board’s Vice Chairman shortly after his election and served as CEO of the Company from September 2002 until January 2012.

Since 2007, Mr. Coury has led the Company through a series of transactions totaling approximately $15 billion, which transformed the Company into a global powerhouse within the highly competitive pharmaceutical industry. In 2007, Mylan purchased India-based Matrix Laboratories, a major producer of active pharmaceutical ingredients, and the generics business of Europe-based Merck KGaA. Subsequent acquisitions under Mr. Coury’s leadership further expanded the Company into new therapeutic categories and greatly enhanced its geographic and commercial footprint. For instance, in 2010, Mylan acquired Bioniche Pharma, an injectables business in Ireland, and in 2012, Mylan acquired India-based Agila Specialties, a global injectables company. Most recently, the Company completed its acquisition of Abbott Laboratories’ non-U.S. developed markets specialty and branded generics business.

3

Table of Contents

As a result of this period of expansion, the Company now has in place a high quality foundation supporting Mylan’s mission of providing the world’s 7 billion people with access to high quality medicine.

Before assuming his current role in 2012, Mr. Coury also executed a successful executive leadership transition after cultivating and developing a powerful leadership team. Grooming executive talent from within and recruiting dynamic leaders from outside the Company were both key components of the Company’s past, current and future growth strategies.

Prior to Mylan, Mr. Coury was the principal of Coury Consulting, a boutique business advisory firm he formed in 1989, and The Coury Financial Group, a successful financial and estate planning firm, which he founded in 1984. Mr. Coury earned a Bachelor of Science degree in industrial engineering from the University of Pittsburgh. He has served as a member of the University of Southern California President’s Leadership Council since 2014.

Mr. Coury’s qualifications to serve on the Mylan Board include, among others, his prior business experience, his in-depth knowledge of the industry, the Company, its businesses, and management, and his leadership experience as the Company’s CEO, as well as his judgment, strategic vision, and service and leadership as Vice Chairman and then Chairman of the Mylan Board for more than ten years – the most transformational and successful time in the Company’s history.

JoEllen Lyons Dillon. Ms. Dillon has served as Chief Legal Officer and Corporate Secretary of The ExOne Company (NASDAQ: XONE), a global provider of three-dimensional printing machines, since March 2013, and as Executive Vice President since December 2014. Previously, she was a legal consultant on ExOne’s initial public offering. Prior to that experience, Ms. Dillon was a partner with Reed Smith LLP, a law firm, from 2002 until 2011. She had previously been at the law firm Buchanan Ingersoll & Rooney PC from 1988 until 2002, where she became a partner in 1997. Ms. Dillon is the former Chair, and currently serves as the Audit Committee Chair of, the Allegheny District chapter of the National Multiple Sclerosis Society. Ms. Dillon’s qualifications to serve on the Mylan Board include, among others, this experience, as well as her independence, judgment, and substantial legal and leadership experience.

Neil Dimick, C.P.A.* Currently retired, Mr. Dimick previously served as Executive Vice President and Chief Financial Officer of AmerisourceBergen Corporation (NYSE: ABC), a wholesale distributor of pharmaceuticals, from 2001 to 2002. From 1992 to 2001, he was Senior Executive Vice President and Chief Financial Officer of Bergen Brunswig Corporation, a wholesale drug distributor. Prior to that experience, Mr. Dimick served as a partner with Deloitte & Touche LLP (“Deloitte”) for eight years. Mr. Dimick also serves on the Boards of Directors of WebMD Health Corp. (NASDAQ: WBMD), Alliance HealthCare Services, Inc. (NASDAQ: AIQ), and Resources Connection, Inc. (NASDAQ: RECN). Mr. Dimick also served on the Boards of Directors of Thoratec Corporation from 2003 to October 2015, at which time it was purchased by St. Jude Medical, Inc., and HLTH Corporation from 2002 to 2009, at which time it was merged into WebMD Health Corp. Mr. Dimick has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Mr. Dimick’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, substantial industry experience, judgment, business and accounting background, and judgment.

Melina Higgins. Currently retired, Ms. Higgins held senior roles of increasing responsibility at The Goldman Sachs Group, Inc. (NYSE: GS), including Partner and Managing Director, during her nearly 20-year career at the firm from 1989 to 1992 and 1994 to 2010. During her tenure at Goldman Sachs, Ms. Higgins served as a member of the Investment Committee of the Principal Investment Area, which oversaw and approved global private equity and private debt investments and was one of the largest alternative asset managers in the world. She also served as head of the Americas and as co-chairperson of the Investment Advisory Committee for the GS Mezzanine Partners funds, which managed over $30 billion of assets and were global leaders in their industry. Ms. Higgins also serves on the Women’s Leadership Board of Harvard University’s John F. Kennedy School of

4

Table of Contents

Government. In September 2013, Ms. Higgins joined the Board of Directors of Genworth Financial Inc. (NYSE: GNW), an insurance company. In January 2016, Ms. Higgins became non-executive Chairman of Antares Midco Inc., a private company that provides financing solutions for middle-market, private equity-backed transactions. Ms. Higgins’ qualifications to serve on the Mylan Board include, among others, her independence, broad experience in finance, and judgment.

Douglas J. Leech, C.P.A.* Mr. Leech is the founder and principal of DLJ Advisors. From 1999 to 2011, he was Founder, Chairman, President and Chief Executive Officer of Centra Bank, Inc. and Centra Financial Holdings, Inc., prior to which he was Chief Executive Officer, President of the southeast region, and Chief Operating Officer of Huntington National Bank. Mr. Leech also served on the Board of Directors of United Bankshares, Inc. (NASDAQ: UBSI) from 2011 to 2015. Mr. Leech’s public accounting, audit, and professional experience has provided him financial and business expertise and leadership experience. In addition, Mr. Leech has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Mr. Leech’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, years of business experience, and judgment.

Rajiv Malik. Mr. Malik has served as Mylan’s President since January 1, 2012. Previously, Mr. Malik held various senior roles at Mylan, including Executive Vice President and Chief Operating Officer from July 2009 to December 2012, and Head of Global Technical Operations from January 2007 to July 2009. In addition to his oversight of day-to-day operations of the Company as President, Mr. Malik has been instrumental in identifying, evaluating, and executing on significant business development opportunities, expanding and optimizing Mylan’s product portfolio, and leveraging Mylan’s global research and development capabilities, among other important contributions. Previously, he served as Chief Executive Officer of Matrix Laboratories Limited (n/k/a Mylan Laboratories Limited) from July 2005 to June 2008. Prior to joining Matrix, he served as Head of Global Development and Registrations for Sandoz GmbH from September 2003 to July 2005. Prior to joining Sandoz, Mr. Malik was Head of Global Regulatory Affairs and Head of Pharma Research for Ranbaxy from October 1999 to September 2003. Mr. Malik’s qualifications to serve on the Mylan Board include, among others, his extensive industry and leadership experience, his understanding of the Asia-Pacific region and other growth markets, and his knowledge about the Company and judgment.

Joseph C. Maroon, M.D. Dr. Maroon is Professor, Heindl Scholar in Neuroscience and Vice Chairman of the Department of Neurosurgery, UPMC, and has held other positions at UPMC since 1998. He also has served as the team neurosurgeon for the Pittsburgh Steelers since 1981. From 1995 to 1998, Dr. Maroon was Professor and Chairman of the Department of Surgery at Allegheny General Hospital, and from 1984 to 1999 he was Professor and Chairman of the Department of Neurosurgery at Allegheny General Hospital. Dr. Maroon has earned numerous awards for his contributions to neurosurgery from various national and international neurological societies throughout his career, and patients travel from all over the world to seek his care. In addition, Dr. Maroon has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Dr. Maroon’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, exceptional medical and leadership experience, and judgment.

Mark W. Parrish. Mr. Parrish has served as Chairman and Chief Executive Officer of TridentUSA Health Services, a provider of mobile X-ray and laboratory services to the long-term care industry, since 2008. Since January 2013, Mr. Parrish has also served on the Board of Directors of Omnicell, Inc. (NASDAQ: OMCL), a company that specializes in healthcare technology. Mr. Parrish also serves on the Boards of Directors of Silvergate Pharmaceuticals, a private company that develops and commercializes pediatric medications, and GSMS, a private company that specializes in meeting unique labeling and sizing needs for its customers and pharmaceutical packaging, serialization, and distribution. From 2001 to 2007, Mr. Parrish held management roles of increasing responsibility with Cardinal Health Inc. (NYSE: CAH) and its affiliates, including Chief Executive Officer of Healthcare Supply Chain Services for Cardinal Health from 2006 to 2007. Mr. Parrish also serves as President of the International Federation of Pharmaceutical Wholesalers, an association of pharmaceutical

5

Table of Contents

wholesalers and pharmaceutical supply chain service companies, and senior adviser to Frazier Healthcare Ventures, a healthcare oriented growth equity firm. Mr. Parrish’s qualifications to serve on the Mylan Board include, among others, his independence, extensive industry, business, and leadership experience, knowledge of the healthcare industry, and judgment.

Rodney L. Piatt, C.P.A.* Mr. Piatt is the Lead Independent Director and has served as Vice Chairman of the Mylan Board since May 2009. Since 1996, he has also been President and owner of Horizon Properties Group, LLC, a real estate and development company. Since 2003, Mr. Piatt has also served as Chief Executive Officer and Director of Lincoln Manufacturing Inc., a steel and coal manufacturing company. Mr. Piatt is also on the Board of Directors of AccuTrex Products, Inc., a private company that manufactures a wide range of custom products for diverse and demanding industries throughout the world. Mr. Piatt brings extensive experience to the Mylan Board as an auditor and a successful business owner. In addition, Mr. Piatt has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Mr. Piatt’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, financial and business expertise, leadership experience, and judgment.

Randall L. (Pete) Vanderveen, Ph.D., R.Ph. Dr. Vanderveen is currently Professor of Pharmaceutical Policy and Economics, Senior Adviser to the Leonard D. Schaeffer Center of Health Policy and Economics, Director of the Margaret and John Biles Center for Leadership, and Senior Adviser to the Dean for Advancement at the School of Pharmacy, University of Southern California in Los Angeles, California. Dr. Vanderveen previously served as Dean, Professor and John Stauffer Decanal Chair of the USC School of Pharmacy from 2005 to 2015 where he was named “Outstanding Pharmacy Dean in the Nation” in 2013 by the American Pharmacist Association. From 1998 to 2005, he served as Dean and Professor of Pharmacy of the School of Pharmacy and the Graduate School of Pharmaceutical Sciences at Duquesne University, before which he was Assistant Dean at Oregon State University from 1988 to 1998. Dr. Vanderveen has an extensive pharmaceutical and academic background. In addition, Dr. Vanderveen has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Dr. Vanderveen’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, pharmaceutical and leadership experience, and judgment.

| * | C.P.A. distinctions refer to “inactive” status. |

Meetings of the Mylan Board

The Mylan Board met seven times in 2015, including three meetings of Mylan N.V. (after the Closing Date) and four meetings of Mylan Inc. (prior to the Closing Date). In addition to meetings of the Mylan Board, directors attended meetings of individual Mylan Board committees of which they were members. Each of the directors attended at least 75% of the Mylan Board meetings and meetings of Mylan Board committees of which they were a member during the periods for which they served. Twelve members of the Mylan Board attended Mylan’s extraordinary general meeting on August 28, 2015, which constituted the Company’s 2015 annual meeting of shareholders for the purposes of compliance with NASDAQ listing standards.

Non-management members of the Mylan Board met in executive session from time to time during 2015. As noted, Rodney L. Piatt, the Vice Chairman of the Mylan Board, is the Lead Independent Director and presides at such executive sessions.

Mylan Board Committees

The standing committees of the Mylan Board include the Audit Committee, the Compensation Committee, the Compliance Committee, the Executive Committee, the Finance Committee, the Governance and Nominating Committee, and the Science and Technology Committee. Each committee operates pursuant to a written charter.

6

Table of Contents

The table below provides the current membership and 2015 meeting information for the noted Mylan Board committees of Mylan. The 2015 meeting information includes meetings of Mylan N.V. (after the Closing Date) and meetings of Mylan Inc. (prior to the Closing Date).

| Director |

Audit | Compensation | Compliance | Executive | Finance | Governance and Nominating |

Science and Technology | |||||||

| Heather Bresch |

X | |||||||||||||

| Wendy Cameron (1) |

C | X | ||||||||||||

| Hon. Robert J. Cindrich |

X | X | X | |||||||||||

| Robert J. Coury |

C | |||||||||||||

| JoEllen Lyons Dillon |

X | |||||||||||||

| Neil Dimick |

C | X | X | X | ||||||||||

| Melina Higgins |

X | C | ||||||||||||

| Douglas J. Leech |

X | X | C | |||||||||||

| Rajiv Malik |

X | |||||||||||||

| Joseph C. Maroon, M.D. |

X | X | C | |||||||||||

| Mark W. Parrish |

X | C | X | |||||||||||

| Rodney L. Piatt (1) |

X | X | X | X | ||||||||||

| Randall L. (Pete) Vanderveen, Ph.D., R.Ph. | X | X | ||||||||||||

| Meetings during 2015 |

5 | 7 | 4 | 7 | 2 | 3 | 1 |

| (1) | Mr. Piatt served as the Chair of the Compensation Committee until October 27, 2015, at which time Ms. Cameron was appointed Chair of the Compensation Committee. |

C = Chair

X = Member

Copies of the committee charters of Mylan are available on Mylan’s website at http://www.mylan.com/company/corporate-governance or in print to shareholders upon request, addressed to Mylan N.V.’s Corporate Secretary at Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England.

Audit Committee and Audit Committee Financial Expert

The Audit Committee’s responsibilities include, among others: the appointment (other than the independent auditor of annual accounts prepared in accordance with Dutch law), compensation, retention, oversight, and replacement of the Company’s independent registered public accounting firm; approving the scope, procedures and fees for the proposed audit for the current year and reviewing the scope, conduct and findings of any financial or internal control-related audit performed by the independent registered public accounting firm; reviewing the organization, responsibilities, plans and resources of the internal audit function; reviewing with management both the Company’s financial statements and management’s assessment of the Company’s internal control over financial reporting; reviewing, including reviewing and discussing with management (including the Company’s internal audit function) and the independent registered public accounting firm, as appropriate, the Company’s processes and procedures with respect to risk assessment and risk management; and reviewing, approving, ratifying or rejecting “transactions” between the Company and “related persons” (each as defined in Item 404 of Regulation S-K). All of the members of the Audit Committee are independent directors, as required by and as defined in the audit committee independence standards of the SEC and the applicable NASDAQ listing standards. The Mylan Board has determined that each of the Audit Committee members — Mr. Dimick, Ms. Higgins, Mr. Leech, and Mr. Piatt — is an “audit committee financial expert,” as that term is defined in the rules of the SEC. The Mylan Board has also approved Mr. Dimick’s concurrent service on the audit committees of more than two other public companies.

7

Table of Contents

Compensation Committee

The Compensation Committee’s responsibilities include, among others: reviewing and recommending to the non-executive, independent (in accordance with the NASDAQ listing standards) members of the Mylan Board corporate goals and objectives relevant to the Executive Chairman’s, CEO’s, and other executive directors’ compensation, evaluating such individual’s performance, and determining (with respect to the CEO’s and other executive directors’ compensation) and providing recommendations to the non-executive, independent members of the Mylan Board with respect to such individual’s compensation based on these evaluations. In making such recommendations, the Compensation Committee may consider pay for performance, alignment with long-term shareholder interests, promotion of Company strategic goals, maintenance of the appropriate level of fixed and at-risk compensation, remaining competitive with companies within the Company’s peer group, internal pay equity, an executive’s leadership and mentoring skills and contributions, talent management, the executive’s contributions to establishment or execution of corporate strategy, retention, and recognition of individual performance and contributions, and/or any other factors determined by the Mylan Board or the Compensation Committee to be in the interests of the Company. The Compensation Committee also exercises oversight of, and provides recommendations to the Mylan Board as appropriate regarding, the compensation of the other executive officers of the Company and applicable compensation programs and incentive compensation plans, as well as the compensation of independent directors. All of the members of the Compensation Committee are independent directors as defined in the applicable NASDAQ listing standards.

Compliance Committee

The Compliance Committee oversees the Chief Compliance Officer’s implementation of the Company’s Corporate Compliance Program and, as appropriate, makes recommendations to the Mylan Board with respect to the formulation or re-formulation of, and the implementation, maintenance, and monitoring of, the Company’s Corporate Compliance Program and Code of Business Conduct and Ethics as may be modified, supplemented or replaced from time to time, designed to support and promote compliance with corporate policies and legal rules and regulations. All of the members of the Compliance Committee are independent directors as defined in the NASDAQ listing standards.

Executive Committee

The Executive Committee exercises those powers of the Mylan Board not otherwise limited by a resolution of the Mylan Board or by law.

Finance Committee

The Finance Committee advises the Mylan Board with respect to, and by discharging the duties and responsibilities delegated to it by the Mylan Board in respect of, material financial matters and transactions of the Company including, but not limited to: reviewing and overseeing material mergers, acquisitions, and combinations with other companies; swaps and other derivatives transactions; the establishment of credit facilities; potential financings with commercial lenders; and the issuance and repurchase of the Company’s debt, equity, hybrid or other securities. All of the members of the Finance Committee are independent directors as defined in the applicable NASDAQ listing standards.

Governance and Nominating Committee

The Governance and Nominating Committee advises the Mylan Board with respect to corporate governance matters as well as the nomination or re-nomination of director candidates and its responsibilities also include overseeing both the Mylan Board’s review and consideration of shareholder recommendations for director candidates and the Mylan Board’s annual self-evaluation. Additionally, the Governance and Nominating Committee oversees director orientation and Mylan Board continuing education programs and makes

8

Table of Contents

recommendations to the Mylan Board with respect to the annual evaluation of independence of each director and, as needed, the appointment of directors to committees of the Mylan Board and the appointment of a chair of each committee. All of the members of the Governance and Nominating Committee are independent directors as defined in the applicable NASDAQ listing standards.

Science and Technology Committee

The Science and Technology Committee serves as a sounding board as requested by management and, at the Mylan Board’s request, reviews the Company’s research and development strategy and portfolio from time to time from a scientific and technological perspective.

Consideration of Director Nominees

Consistent with established Dutch law and the Company’s articles of association, executive directors and non-executive directors are appointed by the general meeting from a binding nomination proposed by the Mylan Board. The proposed candidate specified in a binding nomination shall be appointed provided that the requisite quorum is present or represented at the annual general meeting, unless the nomination is overruled by the general meeting voting against the appointment of the candidate by a resolution adopted with a majority of at least two-thirds of the votes cast, representing more than half of the issued share capital. In such event, the Mylan Board may propose a new binding nomination to be submitted at a subsequent general meeting.

The Governance and Nominating Committee will consider for nomination by the Mylan Board potential director candidates properly recommended by shareholders, subject to the discretion of the Mylan Board and to Mylan’s articles of association. In considering candidates recommended by shareholders, the Governance and Nominating Committee will take into consideration, among other matters, the needs of the Mylan Board and Mylan and the qualifications of the candidate, including, among other things, those traits, abilities, and experiences set forth in Mylan’s Corporate Governance Principles. Any submission to the Governance and Nominating Committee of a recommended candidate for consideration must include, among other information, the name of the recommending shareholder and evidence of such person’s ownership of Mylan shares, and the name of the recommended candidate, his or her resume or a statement of his or her principal occupation or employment, and the recommended candidate’s signed consent to be named as a director if recommended by the Governance and Nominating Committee and nominated by the Mylan Board. Any shareholder recommendations for director must be sent to Mylan’s Corporate Secretary at Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England, not later than 120 days prior to the anniversary date of Mylan’s most recent annual general meeting of shareholders.

Board Education

From time-to-time, the Mylan Board or individual Mylan Board members participate in director educational programs.

Mylan Board Leadership Structure

The Mylan Board elects one of its own members as the Chairman of the Mylan Board. Mr. Coury has served as the Chairman of the Board of Mylan Inc. and now Mylan N.V. since being elected in May 2009. Based on significant interaction and experience with Mr. Coury, the independent directors on the Mylan Board continue to believe that Mr. Coury’s highly collaborative relationship with the independent directors, including the Lead Independent Director, his extensive knowledge of the industry, Mylan’s management, businesses and global platform, and the opportunities and challenges anticipated in the future, as well as his proven leadership abilities, vision, and insight, and the continued outstanding performance of the Company, make him the ideal person to lead the Mylan Board. Mr. Coury previously served as CEO of the Company from September 2002 to January 2012.

9

Table of Contents

In his capacity as Executive Chairman, Mr. Coury’s primary responsibilities include providing overall leadership and strategic direction of the Company; providing guidance to the CEO and senior management; coordinating the activities of the Mylan Board; overseeing talent management; communicating with shareholders and other stakeholders; strategic business development; and mergers and acquisitions.

Effective January 1, 2012, the Mylan Board implemented an enhanced management structure, again electing Mr. Coury as Executive Chairman of the Mylan Board (as described above) and appointing Ms. Bresch as CEO and Mr. Malik as President, among other changes described in previous public filings.

In connection with this enhanced management structure implemented in 2012, the Mylan Board also appointed Mr. Piatt as Lead Independent Director based on, among other factors, Mr. Piatt’s independence, outstanding contributions as a director of the Company, excellent business judgment, and recognized leadership abilities. The Mylan Board believes that this appointment only further enhanced the Mylan Board’s already strong independent oversight of the Company. As Lead Independent Director, Mr. Piatt presides at executive sessions of the independent directors, and he has the authority to call meetings of the independent directors. He also serves on the Executive Committee of the Mylan Board. In addition, the Chairman, in consultation with the Lead Independent Director, as applicable, determines the information sent to the Mylan Board, the meeting agendas, and meeting schedules to assure that there is sufficient time for discussion of agenda items. The Lead Independent Director in turn is charged with separately approving information sent to the Mylan Board, its meeting agendas, and its meeting schedules. He also serves as the contact person for stakeholders wishing to communicate with the Mylan Board and as a liaison between the Chairman and independent directors.

As of 2012, in her role as CEO, Ms. Bresch’s primary responsibilities include the day-to-day running and oversight of the Company’s global operations, business, and functions; executing on and overseeing implementation of strategies developed or approved by the Mylan Board; continued oversight of process and operational enhancements; and continued implementation of a blueprint for an organizational design to help ensure the sustainability of our success into the future.

The Mylan Board strongly believes, and the Company’s short- and long-term performance demonstrates, that the current Mylan Board and management structures continue to prove to be ideal for Mylan, and that it has produced outstanding results for shareholders and has benefited the interests of other stakeholders, as illustrated on pages 12 to 23 of this Amendment. We believe that the Company and its stakeholders have benefited, and continue to benefit, from the respective leadership, judgment, vision, experience – and performance – of the existing Mylan Board and management structure, and that the Executive Chairman, Mr. Coury, the CEO, Ms. Bresch, and the President, Mr. Malik, all share a vision for the Company that is consistent with the Mylan Board’s philosophy.

This determination is based on, among other factors, senior management’s demonstrated leadership abilities; the performance of the Company; the Mylan Board’s deep and unique knowledge of the complexity, size, and dramatic growth of the Company, the Company’s businesses, operations, vision, and strategies; the respective talents and capabilities of our fellow directors and management; and the opportunities and challenges anticipated in the future.

Our governance structure also provides effective independent oversight by the Mylan Board in the following additional ways:

| • | ten of the thirteen members of the Mylan Board are independent; |

| • | the Mylan Board has established robust Corporate Governance Principles; |

| • | the Audit, Compensation, Compliance, Finance and Governance and Nominating Committees are all composed entirely of independent directors (as defined in the applicable NASDAQ listing standards); |

10

Table of Contents

| • | the independent directors on the Mylan Board and its committees receive extensive information and input from management and external advisors, engage in detailed discussion and analysis regarding matters brought before them (including in executive session), and consistently and actively engage in the development and approval of significant corporate strategies; |

| • | the Mylan Board and its committees have unrestricted access to management; |

| • | the Mylan Board and its committees (other than the Science and Technology Committee) can retain, at their discretion and at Company expense, any advisors they deem necessary with respect to any matter brought before the Mylan Board or any of its committees (the Science and Technology Committee retains advisors in consultation with the Executive Chairman and the Lead Independent Director); |

| • | the Mylan Board and its committees are intimately familiar with the business and management of the Company and collectively met 36 times in 2015, including 24 times after the Closing Date; and |

| • | in 2015, the Mylan Board held five executive sessions of non-management members while its committees collectively held 16 executive sessions. |

Board of Directors Risk Oversight

The Mylan Board’s Audit Committee is primarily responsible for overseeing the Company’s risk management processes on behalf of the full Mylan Board. The Audit Committee focuses on financial reporting risk and oversight of the internal audit function. It receives reports from management at least quarterly regarding, among other matters, the Company’s assessment of risks and the adequacy and effectiveness of internal controls. The Audit Committee also receives reports from management addressing risks impacting the day-to-day operations of the Company. Mylan’s internal audit function meets with the Audit Committee on at least a quarterly basis to discuss potential risk or control issues. The Audit Committee reports regularly to the full Mylan Board, which also considers the Company’s risk profile. The full Mylan Board focuses on the most significant risks facing the Company and the Company’s general risk management strategy, and also seeks to ensure that risks undertaken by the Company are consistent with the Mylan Board’s risk management expectations. While the Mylan Board oversees the Company’s overall risk management strategy, management is responsible for the day-to-day risk management processes. We believe this division of responsibility continues to remain a highly effective approach for addressing the risks facing the Company and that the Mylan Board’s leadership structure supports this approach.

In addition, the Compensation Committee is responsible for overseeing the Company’s compensation risks as discussed further beginning on page 30 of this Amendment under “Consideration of Risk in Company Compensation Policies.”

Also, the Compliance Committee is responsible for overseeing the Company’s corporate compliance program and related policies and controls.

Code of Ethics; Corporate Governance Principles; Code of Business Conduct and Ethics

The Mylan Board has adopted a Code of Ethics that applies to our Principal Executive Officer, Principal Financial Officer, and Corporate Controller (“Code of Ethics”). The Mylan Board also has adopted Corporate Governance Principles as well as a Code of Business Conduct and Ethics applicable to all directors, officers, and employees.

Copies of the Code of Ethics, the Corporate Governance Principles, and the Code of Business Conduct and Ethics for Mylan N.V. are posted on Mylan N.V.’s website at http://www.mylan.com/company/corporate-governance. Copies of the Code of Ethics, the Corporate Governance Principles, and the Code of Business Conduct and Ethics for Mylan N.V. are also available in print to shareholders upon request, addressed to Mylan N.V.’s Corporate Secretary at Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England. Mylan N.V. intends to post any amendments to and waivers from the Code of Ethics on its website as identified above.

11

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires all directors and certain executive officers and persons who own more than 10% of a registered class of Mylan’s equity securities to file with the SEC within specified due dates reports of ownership and reports of changes of ownership of Mylan ordinary shares and our other equity securities. These persons are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. Based on reports and written representations furnished to us by these persons, we believe that all Mylan directors and relevant executive officers complied with these filing requirements during 2015.

| ITEM 11. | Executive Compensation |

Executive Compensation for 2015

Compensation Discussion and Analysis

Executive Summary

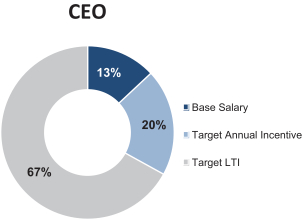

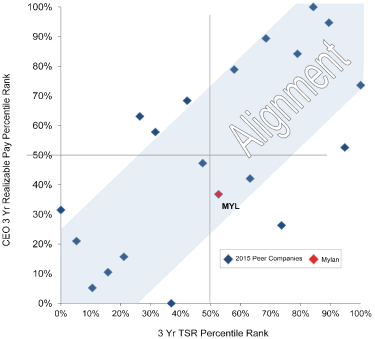

The Mylan Board has structured Mylan’s executive compensation programs to create a maximum “return on executive leadership.” Our compensation program is designed to incentivize continued excellence in execution against our long-stated strategy to create a leading, robust, sustainable company, as well as deliver outstanding performance and shareholder value creation over the short- and long-term, and align compensation with performance and shareholder and other stakeholder interests.

As outlined below, Mylan has successfully executed on its clearly articulated strategy, delivering superior long-term shareholder value and continuing to invest in initiatives designed to continue this track record of long-term growth and value creation in the future, all while also meeting and exceeding annual financial and performance targets.

Mylan has long believed that development of, and consistent execution against, a clear and coherent long-term strategy approved by the Mylan Board and executed by senior management is critical to the Company’s success and its ability to consistently create value for shareholders and other stakeholders. Mylan has developed an exceptional global operating and commercial platform and industry-leading product portfolio; attracted and retained highly-talented and motivated leaders to the organization; identified strategic drivers of organic growth and effectively executed against these key growth drivers; and identified exciting external opportunities to further enhance the business and accelerate the Company’s long-term growth trajectory. In pursuing external opportunities, we seek to differentiate the Company by acquiring assets that deliver not only short-term financial benefit, but which also will deliver sustainable long-term value for our business, shareholders and other stakeholders.

Since the beginning of 2015, we have had extensive discussions with holders of over 80% of Mylan’s ordinary shares on a variety of topics. As part of Mylan’s shareholder outreach and engagement, shareholders have consistently communicated to the Mylan Board and senior management that they too believe in the critical importance of focusing on sustainable long-term value creation.

The Mylan Board believes that the success of Mylan’s long-term strategy and the Company’s exceptional financial and operational performance over the past decade clearly reflects the dedication and talents of our employees around the world — and demonstrates the effectiveness of our compensation programs in incentivizing performance and aligning compensation with shareholder and other stakeholder interests.

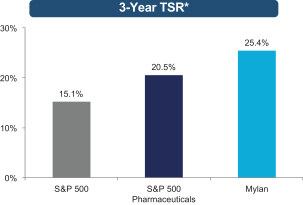

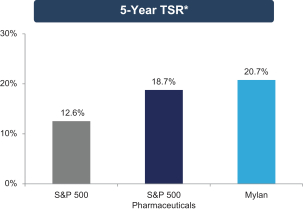

The Mylan Board also believes that the outstanding long-term growth of Mylan — including the exceptional 25.4% and 20.7% total shareholder return (“TSR”) over the past three and five years, respectively, each of which significantly exceeded the S&P 500 Index and S&P 500 Pharmaceutical Index results over those

12

Table of Contents

periods — is directly related to the effectiveness and the robustness of our compensation program, as well as the talents of Mylan’s global workforce and the extraordinary vision, commitment, and leadership of Mylan’s senior management team.

And the Company’s performance in 2015 again set records to the benefit of shareholders and other stakeholders, with a record high in adjusted diluted earnings per share (“adjusted diluted EPS”) of $4.30, total adjusted revenues of $9.45 billion, and adjusted EBITDA of $3.01 billion (U.S. GAAP diluted earnings per share were $1.70, U.S. GAAP total revenues were $9.43 billion, and U.S. GAAP net earnings attributable to Mylan N.V. ordinary shareholders were $847.6 million in 2015).

Our senior leadership team is led by Mr. Coury, Ms. Bresch, and Mr. Malik. Together, Mr. Coury, Ms. Bresch, Mr. Malik, and the Mylan Board have successfully developed and executed on a vision and strategy to position Mylan as a global leader in its industry and significantly enhance Mylan’s long-term growth prospects.

In addition to creating extraordinary long-term shareholder value over the last three and five years (and longer), Mylan has also delivered exceptional results for other stakeholders, including customers, patients, employees, and the broader community.

Named Executive Officers for 2015

Mylan’s named executive officers (“NEOs”) for 2015 were:

| Heather Bresch |

Chief Executive Officer | |

| John D. Sheehan, C.P.A (1) |

Former EVP and Chief Financial Officer | |

| Rajiv Malik |

President | |

| Anthony Mauro |

Chief Commercial Officer | |

| Robert J. Coury |

Executive Chairman |

| (1) |

Mr. Sheehan retired effective April 1, 2016. |

Outstanding 2015 and Long-Term Financial and Operational Performance

2015 represented yet another remarkable year for Mylan on many fronts, not the least of which was our continued outstanding execution on the Mylan Board’s long-standing strategy and vision. We made progress against the key pillars of this strategy by further strengthening our exceptional and differentiated global operating platform; continuing to diversify our product portfolio, which is already one of the industry’s broadest; and further building out our powerful commercial infrastructure. We also continued to position the company for long-term growth through significant investment in our organic growth drivers, which we complemented by executing on value-creating, strategic acquisitions and other business development opportunities.

Outstanding 2015 Financial Results

In addition to our continued focus on building a long-term sustainable business, we did not take our eye off the ball with regard to the Company’s day-to-day core business and short-term execution, as our financial results for 2015 clearly demonstrate.

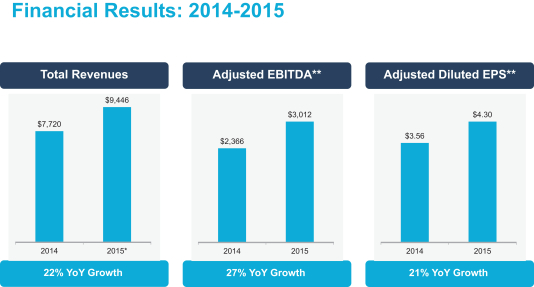

In 2015, we delivered total adjusted revenues of nearly $9.45 billion, adjusted EBITDA of $3.01 billion, and adjusted diluted EPS of $4.30, an increase of 22%, 27%, and 21%, respectively, compared to our very strong performance in 2014 (U.S. GAAP total revenues were $9.43 billion, U.S. GAAP net earnings attributable to Mylan N.V. ordinary shareholders were $847.6 million, and U.S. GAAP diluted earnings per share were $1.70 in 2015, an increase of 22%, decrease of 9%, and decrease of 27%, respectively). All of our regions and businesses contributed to this strong growth, and we achieved it despite strong foreign-currency headwinds.

13

Table of Contents

$ million except per share amount

* 2015 represents Total Adjusted Revenues. See Appendix A for a reconciliation to the most comparable GAAP measure

** See Appendix A for a reconciliation to the most comparable GAAP measures

For 2015, U.S. GAAP total revenues were $9,429 million. For 2014 and 2015, U.S. GAAP net earnings attributable to Mylan N.V. ordinary shareholders were $929.4 million and $847.6 million, respectively (down 9% year-over-year). For 2014 and 2015, U.S. GAAP diluted earnings per share were $2.34 and $1.70, respectively (down 27% year-over-year).

Continued Outstanding Performance in Regions and Segments

In our North America generics segment, third party net sales totaled $3.9 billion, a 16% increase compared to 2014. Growth came mainly from sales of new products, and to a lesser extent, from the EPD Business. Also contributing were higher volumes on existing products, partially offset by lower pricing.

In Europe, adjusted third party net sales totaled $2.2 billion in 2015, a year-over-year constant currency increase of 67% on an adjusted basis (U.S. GAAP third party net sales for Europe totaled $2.2 billion, a year-over-year increase of 49%). Growth came primarily from sales generated by the EPD Business and, to a lesser extent, from new products. Higher volumes on existing products, mainly in France and Italy, were offset by lower pricing throughout the region.

In the Rest of World, third party net sales totaled $2.1 billion, a year-over-year increase of 38% on a constant currency basis (a year-over-year increase of 27% for U.S. GAAP third party net sales). The growth came from the EPD Business; new product launches primarily in Australia and Japan; and higher volumes in India – predominately of antiretroviral medications. Increases were offset somewhat by lower pricing in the region.

Our Specialty business delivered revenues of $1.2 billion in 2015, an increase of 1% compared to 2014, driven by the continued strong performance of EpiPen® Auto-Injector, as well as strong sales of Perforomist and ULTIVA, which increased by double-digit percentage points from the prior year.

It is noteworthy that our EPD Business grew 2% year over year on a constant currency basis, demonstrating again our ability to take a declining business and drive growth ahead of our expectations.

This strong performance and continued dedication to operational excellence and execution allowed us to deliver a record year with respect to adjusted free cash flow, which more than doubled over the prior year (U.S. GAAP net cash provided by operating activities increased 98%). Specifically, we realized approximately $1.85 billion of adjusted free cash flow in 2015.

14

Table of Contents

In addition, continuing our commitment to strong balance sheet management, the Company maintained its investment grade rating from Standard & Poor’s and Moody’s, the two principal ratings agencies. As a result of maintaining a strong balance sheet and having an investment grade rating, we were able to reduce our cost of borrowing in 2015, providing additional financial flexibility.

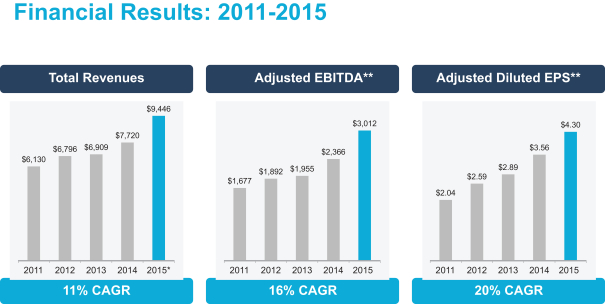

Outstanding Long-Term Financial Results

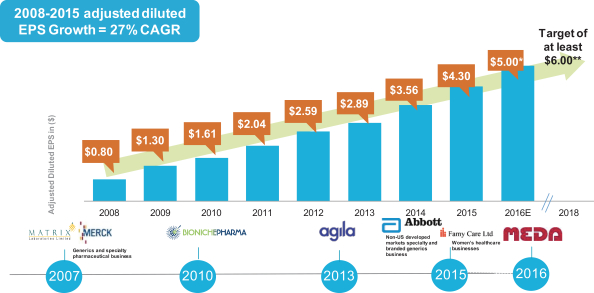

As shown in the tables below, our consistent execution and strong performance in 2015 continued a long-term track record of exceptional business execution, delivering superior financial results for shareholders, and contributing to a long-term compound annual growth rate (“CAGR”) in adjusted diluted EPS of 27% since 2008.

Adjusted diluted EPS is a non-GAAP financial measure. See Appendix for reconciliation of adjusted diluted EPS to the most directly comparable GAAP measure

* Midpoint of 2018 guidance range

** Stated 2018 target, this is a long-term only and does not represent company guidance

U.S. GAAP diluted earnings per share in 2008 were $(1.10), 2009 were $0.30, 2010 were $0.68, 2011 were $1.22, 2012 were $1.52, 2013 were $1.58, 2014 were $2.34, and 2015 were $1.70. The midpoint of forecasted U.S. GAAP diluted earnings per share for 2016 is $2.41.

15

Table of Contents

$ million except per share amounts

* 2015 represents Total Adjusted Revenues. See Appendix A for a reconciliation to the most comparable GAAP measure.

** See Appendix A for a reconciliation to the most comparable GAAP measures.

For 2015, U.S. GAAP total revenues were $9,429 million. U.S. GAAP net earnings attributable to Mylan N.V. ordinary shareholders were $536.8 million in 2011, $640.9 million in 2012, $623.7 million in 2013, $929.4 million in 2014, and $847.6 million in 2015 (12% CAGR). U.S. GAAP diluted earnings per share were $1.22 in 2011, $1.52 in 2012, $1.58 in 2013, $2.34 in 2014, and $1.70 in 2015 (9% CAGR).

Our track record of excellence in business execution and outstanding performance is further demonstrated by the long-term shareholder value creation that our exceptional team has achieved. As shown below, Mylan’s TSR over the last three and five years has significantly outperformed both the S&P 500 Index and the S&P 500 Pharmaceuticals Index.

| * | TSR data is from Bloomberg and reflects total return (including price appreciation and reinvested dividends) as of December 31, 2015. |

16

Table of Contents

| * | TSR data is from Bloomberg and reflects total return (including price appreciation and reinvested dividends) as of December 31, 2015. |

In addition to outstanding long-term shareholder value creation, we have also generated exceptional returns on our invested capital. In 2015, cash return on operating invested capital, cash return on invested capital excluding goodwill, and cash return on total invested capital were 52%, 22%, and 15%, respectively, continuing our outstanding long-term performance in those areas as well (see Appendix A for a reconciliation to the most directly comparable U.S. GAAP measure).

Strengthening and Expanding our Exceptional and Differentiated Global Platform and Portfolio

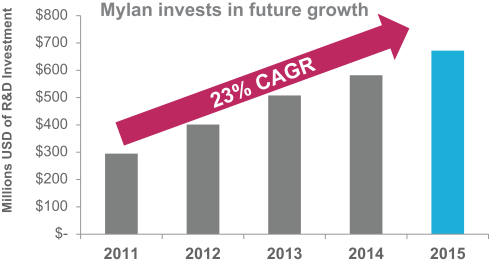

Mylan has earned a well-deserved reputation for innovation within the generics and specialty pharmaceuticals spaces. Our executive leadership team, together with Mylan’s outstanding workforce, has a track record of successfully developing and bringing to market products that are difficult to formulate or manufacture – to which the many innovative companies that have made Mylan a partner of choice can attest. To remain at the industry’s forefront, we continue to invest heavily in research and development and in strengthening our already-powerful manufacturing and commercial infrastructure.

17

Table of Contents

As a result of this R&D investment, in 2015, we submitted 167 regulatory applications to bring new high-quality medicines to market around the world. Currently, we have 270 new drug applications pending U.S. Food and Drug Administration approval, representing $101.6 billion in annual brand sales, according to IMS Health. Fifty of these pending Abbreviated New Drug Applications are potential first-to-file opportunities, representing $35.8 billion in annual brand sales for the twelve months ending June 30, 2015, according to IMS Health. Globally, we have more than 4,100 new product submissions pending regulatory approval around the world, up from 2,100 just two and a half years ago.

Commercially, our portfolio of marketed products rose from more than 1,300 to more than 1,400 and our commercial footprint expanded from approximately 140 countries and territories to approximately 165.

Advancement of Strategic Organic Growth Drivers