Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - HARVEST NATURAL RESOURCES, INC. | c289-20151231xex31_1.htm |

| EX-31.2 - EX-31.2 - HARVEST NATURAL RESOURCES, INC. | c289-20151231xex31_2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

[ X ]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No.: 1-10762

HARVEST NATURAL RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

77-0196707 |

||

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

||

|

1177 Enclave Parkway, Suite 300 |

|

||

|

Houston, Texas |

77077 |

||

|

(Address of principal executive offices) |

(Zip Code) |

||

Registrant's telephone number, including area code: (281) 899-5700

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Common Stock, $.01 Par Value |

NYSE |

Securities registered pursuant to Section 12(g) of the Act: Preferred Share Purchase Rights

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No X

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large Accelerated Filer Accelerated Filer X Non-Accelerated Filer Smaller Reporting Company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2015 was: $72,142,875.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practical date. Class: Common Stock, par value $0.01 per share, on April 25, 2016, shares outstanding: 51,415,164.

DOCUMENTS INCORPORATED BY REFERENCE

None.

HARVEST NATURAL RESOURCES, INC.

FORM 10-K/A

|

Part III |

Page |

|

Item 10.Directors, Executive Officers and Corporate Governance |

1 |

| 6 | |

| 23 | |

|

Item 13.Certain Relationships and Related Transactions, and Director Independence |

25 |

| 26 | |

|

Part IV |

|

| 26 | |

|

|

|

EXPLANATORY NOTE

The purpose of this Amendment No. 1 on Form 10-K/A (“Amended Report”) is to amend Part III, Items 10 through 14 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the Securities and Exchange Commission (the “SEC”) on March 29, 2016 (the “2015 10-K”), to include information previously omitted from the 2015 10-K in reliance on General Instruction G to Form 10-K, which provides that registrants may incorporate by reference certain information from a definitive proxy statement filed with the SEC within 120 days after the end of the fiscal year. The Company’s definitive proxy statement will not be filed within 120 days after the end of the Company’s 2015 fiscal year.

As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amended Report under Item 15 of Part IV hereof.

Except as stated herein, the Company has not modified or updated disclosures presented in the 2015 10-K in this Amended Report. Accordingly, this Amended Report does not reflect events occurring after the filing of our 2015 10-K or modify or update those disclosures, including the exhibits to the 2015 10-K, affected by subsequent events. As such, our 2015 10-K continues to speak as of March 29, 2016 (the date it was filed with the SEC). Accordingly, this Amended Report should be read in conjunction with the 2015 10-K and our other reports filed with the SEC subsequent to the filing of our 2015 10-K, including any amendments to those filings.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

BOARD OF DIRECTORS

The Company’s Board is comprised of seven members:

Stephen D. Chesebro’

Appointed Director in October 2000

Age 74

Mr. Chesebro’ has served as the Chairman of the Board of the Company since 2001. From December 1998 until he retired in 1999, he served as President and Chief Executive Officer of PennzEnergy, the independent oil and gas exploration and production company that was formerly a business unit of Pennzoil Company. From February 1997 to December 1997, Mr. Chesebro’ served as Group Vice President – Oil and Gas and from December 1997 until December 1998 he served as President and Chief Operating Officer of Pennzoil Company, an integrated oil and gas company. From 1993 to 1996, Mr. Chesebro’ was Chairman and Chief Executive Officer of Tenneco Energy. Tenneco Energy was part of Tenneco, Inc., a worldwide corporation that owned diversified holdings in six major industries. Mr. Chesebro’ is an advisory director to Preng & Associates, an executive search consulting firm. In 1964, Mr. Chesebro’ graduated from the Colorado School of Mines. He was awarded the school’s Distinguished Achievement Medal in 1991 and received his honorary doctorate from the institution in 1998. He currently serves on the school’s visiting committee for petroleum engineering, and is a member of the Colorado School of Mines Foundation Board of Governors. In 1994, Mr. Chesebro’ was the first American awarded the H. E. Jones London Medal by the Institution of Gas Engineers, a British professional association.

Oswaldo Cisneros

Appointed Director in June 2015

Age 75

Mr. Cisneros started his career in the soft drink industry in 1961 and served as the president of Pepsi Cola Venezuela until 1996, when the Cisneros Group undertook a strategic alliance with the Coca Cola Company. Mr. Cisneros also served as the president of Telcel Celular, C.A., a partner of Bellsouth International. Mr. Cisneros currently serves as president and is a shareholder of the following companies: Corporación Digitel, a telecom company, Maritime Contractors de Venezuela, an oil drilling services company, Fabrica Nacional de Vidrios, a glass bottle manufacturer, and Central Azucarero Portuguesa, a sugar mill factory. Mr. Cisneros received a degree in Business Administration from Babson College, USA, in 1961.

- 1 -

Francisco D’Agostino

Appointed Director in June 2015

Age 41

From 1996 to 1999, Mr. D’Agostino was vice president - Finance of Dayco Holding Corp, his family’s real estate management and construction company. From 2000 to 2010, he served as director and president of Grupo Empresarial Alfa-Caracas, Venezula, a real estate management and construction company. Since 2000 he has served as director and vice president of Private Banking at Banco Occidentel de Descuento – Caracas, Venezuela, and since 2007 he has also served as president of D’Agostino & Company, Ltd., a financial advisory and investment firm. In 2008, he founded and has served as president of Element Capital Group – Panama City, Panama, an asset management firm. Mr. D’Agostino is a director of Dayco Telecom-Venezuela, a Venezuelan internet company; BancAmerica – Dominican Republic, a commercial bank; and Fundacion Dayco – Caracas, a Venezuelan family charitable foundation. Mr. D’Agostino graduated from Boston College with a Bachelor of Science in Economics and Finance.

Elected Director in May 2005

Age 56

Mr. Edmiston was elected President and Chief Executive Officer of Harvest Natural Resources, Inc. on October 1, 2005. He joined the Company as Executive Vice President and Chief Operating Officer on September 1, 2004. Prior to joining Harvest, Mr. Edmiston was with Conoco and ConocoPhillips for 22 years in various management positions including President, Dubai Petroleum Company (2002-2004), a ConocoPhillips affiliate company in the United Arab Emirates and General Manager, Petrozuata, C.A., in Puerto La Cruz, Venezuela (1999-2001). Prior to 1999, Mr. Edmiston also served as Vice President and General Manager of Conoco Russia and then as Asset Manager of Conoco’s South Texas Lobo Trend gas operations. On March 27, 2014, Mr. Edmiston was appointed to the board of Sonde Resources Corp. He earned a Bachelor of Science degree in Petroleum Engineering from the Texas Tech University and a Masters of Business Administration from the Fuqua School of Business at Duke University. Mr. Edmiston was inducted into the Petroleum Engineering Academy and was recognized as a Distinguished Engineer by the Texas Tech College of Engineering in 2009. Mr. Edmiston is a Member of the Society of Petroleum Engineers.

Robert E. Irelan

Appointed Director in February 2008

Age 69

Mr. Irelan has over 45 years of experience in the oil and gas industry. He retired from Occidental Petroleum as Executive Vice President of Worldwide Operations in April 2004, having started there in 1998. Prior to Occidental Petroleum, Mr. Irelan held various positions at Conoco, Inc., from 1967 until 1998. Upon his retirement he opened his own company, Naleri Investments LLC. He also partnered in several entrepreneurial ventures including Rapid Retail Solutions LLC, BISS Product Development LLC and All About Baby LLC. Mr. Irelan earned his Professional Engineering degree in Petroleum Engineering from Colorado School of Mines. He also has advanced studies in Mineral Economics. He was awarded the Distinguished Achievement Award from the school in 1998.

Edgard Leal

Appointed Director in June 2015

Age 74

Since 2005 Mr. Leal has served as a director of Leal, Leal & Associados, an advisory service to Venezuelan companies and investor groups, and as managing director of Asesorias y Servicios Gaspetro, C.A., an advisory services company. From 1998 to 2006, Mr. Leal was Senior Associate of Cambridge Energy Research Associates, providing advisory services to Latin American oil and gas companies. From 1980 to 2003, he was a director of Shipowners Mutual Protection and Indemnity, an insurance company. From 1998 to 2001, he was vice president of Banco Caracas, a private section bank in Venezuela. From 1994 to 1998, he was president of Centro de Aralisis y Negociacion – Internacional, C.A., providing advisory services to banks and other financial institutions in Venezuela. From 1975 to 1994, he served as a director, president of Bariven and a managing director of Petroleos de Venezuela (PDVSA), managing the centralized finances for PDVSA. From 1989 to 1990, Mr. Leal was the Commissioner of the President of Venezuela, negotiating foreign commercial bank debt with international banks. From 1969 to 1975, he was a Vice President of CitiBank, managing its credit and public sector lending in Venezuela. From 1966 to 1975, Mr. Leal represented the Government of Venezuela in the Economic Commission of the Organization of Petroleum-Exporting Countries; from 1963 to 1966 he served as Assistant to the Minister Counselor for Petroleum Affairs in the Embassy of Venezuela in the United States, conducting discussions with the U.S. Department of Energy on the U.S. Oil Import Program. Mr. Leal received a Bachelor of Arts degree in Economics from Rollins College in 1962 and a Master of Arts degree in Economics from Catholic University of America in 1966.

- 2 -

Patrick M. Murray

Appointed Director in October 2000

Age 73

In 2007, Mr. Murray retired from Dresser, Inc. He had been the Chairman of the Board and Chief Executive Officer since 2004. Dresser, Inc. is an energy infrastructure and oilfield products and services company. From 2000 until becoming Chairman of the Board, Mr. Murray served as President and Chief Executive Officer of Dresser, Inc. Mr. Murray was President of Halliburton Company’s Dresser Equipment Group, Inc.; Vice President, Strategic Initiatives of Dresser Industries, Inc.; and Vice President, Operations of Dresser, Inc. from 1996 to 2000. Mr. Murray has also served as the President of Sperry-Sun Drilling Services from 1988 through 1996. Mr. Murray joined NL Industries in 1973 as a Systems Application Consultant and served in a variety of increasingly senior management positions. Mr. Murray is on the board of the World Affairs Council of Dallas Fort Worth. He is on the board of advisors for the Maguire Energy Institute at the Edwin L. Cox School of Business, Southern Methodist University, and a member of the Board of Regents of Seton Hall University. Mr. Murray holds a B.S. degree in Accounting and a Master of Business Administration from Seton Hall University. He served for two years in the U.S. Army as a commissioned officer.

- 3 -

The following table provides information regarding each of our executive officers.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Age |

|

Position |

|

James A. Edmiston * |

|

56 |

|

President and Chief Executive Officer |

|

Stephen C. Haynes |

|

59 |

|

Vice President, Finance, Chief Financial Officer and Treasurer |

|

Keith L. Head |

|

58 |

|

Vice President, General Counsel and Corporate Secretary |

|

Karl L. Nesselrode |

|

58 |

|

Vice President, Engineering & Business Development |

|

Robert Speirs |

|

60 |

|

Senior Vice President, Eastern Operations |

* See Mr. Edmiston’s biography on page 2.

Stephen C. Haynes has served as our Vice President, Finance, Chief Financial Officer and Treasurer since May 19, 2008. Mr. Haynes performed various financial consulting engagements from January 1, 2008 until his appointment with Harvest. Previously, he served as Chief Financial Officer for Cygnus Oil and Gas Corporation for the period February 1, 2006 through December 31, 2007. Before joining Cygnus, Mr. Haynes was the Corporate Controller with Carrizo Oil and Gas for the period January 1, 2005 through January 31, 2006. Mr. Haynes served as an independent consultant from March 2001 through the end of 2004. From March 1990 through December 2000, Mr. Haynes served in a series of increasing responsibilities in international managerial and executive positions with British Gas, culminating in his appointment as Vice President-Finance of Atlantic LNG, a joint venture of British Gas and several industry partners in Trinidad and Tobago. Mr. Haynes is a Certified Public Accountant, holds a Master of Business Administration degree with a concentration in Finance from the University of Houston and a Bachelor of Business Administration degree in Accounting from Sam Houston State University. He also attended the Executive Development Program at Harvard University.

Keith L. Head has served as our Vice President, General Counsel and Corporate Secretary since May 7, 2007. He joined Texas Eastern upon graduation from law school and remained with the same organization through mergers with Panhandle Eastern, Duke Energy Corporation and Cinergy Corp. Mr. Head held various business development positions with Duke Energy Corporation from 1995 to 2001. His corporate development work included the identification, evaluation and negotiation of acquisitions in Latin America, North America and the United Kingdom. Mr. Head was Senior Vice President and General Counsel at Duke Energy North America from 2001 to 2004 and Associate General Counsel of Duke Energy Corporation from 2004 through December 2006. After leaving Duke Energy, Mr. Head joined Harvest in May 2007. He is a board member of the Houston chapter of The General Counsel Forum and formerly served as president of the board for the Texas Accountants and Lawyers for the Arts. Mr. Head holds a Bachelor of Science degree in Business Administration from the University of North Carolina. He received both a Juris Doctorate and Masters in Business Administration from the University of Texas in 1983.

Karl L. Nesselrode has served as Vice President, Engineering and Business Development of the Company since November 17, 2003. From August 9, 2007 to August 2, 2010, he accepted a long-term secondment to Petrodelta as its Operations and Technical Manager while remaining an officer of Harvest. From February 2002 until November 2003, Mr. Nesselrode was President of Reserve Insights, LLC, a strategy and management consulting company for oil and gas. He was employed with Anadarko Petroleum Corporation as Manager Minerals and Special Projects from July 2000 to February 2002. Mr. Nesselrode served in various managerial positions with Union Pacific Resources Company from August 1979 to July 2000. Mr. Nesselrode earned a Bachelor of Science in Petroleum Engineering from the University of Tulsa in 1979 and completed Harvard Business School Program for Management Development in 1995.

Robert Speirs has served as Senior Vice President, Eastern Operations since July of 2011. Prior to his promotion, his title had been Vice President, Eastern Operations since December 6, 2007. He joined Harvest in June 2006 as President and General Manager, Russia. Previously Mr. Speirs was President of Marathon Petroleum Russia and General Director of their wholly-owned subsidiary, KhantyMansciskNefte Gas Geologia from March 2004 through May 2006. Prior to joining Marathon, Mr. Speirs was Executive Vice President of YUKOS EP responsible for engineering and construction from June 2001. During both these periods, Mr. Speirs spent considerable time in West Siberia where he oversaw substantial increases in production at both companies. From November 1997 until March 2001, Mr. Speirs resided in Jakarta where he served as President of Premier Oil Indonesia. During this period, Premier was active in all phases of the Upstream business, culminating in the commissioning of the West Natuna Gas Project. Prior to 1997, Mr. Speirs was with Conoco for 21 years in various leadership positions in the US, UK, Russia, Indonesia, Singapore and Dubai, UAE. Mr. Speirs earned a Bachelor of Science degree with Honors in Engineering Science from the University of Edinburgh. He also attended the Executive Management Program at INSEAD.

- 4 -

CORPORATE GOVERNANCE

Audit Committee

Our Board of Directors has established a standing audit committee (the “Audit Committee”). The Audit Committee operates pursuant to a written charter. The charter is accessible in the Corporate Governance section of our website (http://www.harvestnr.com).

From January 1, 2015 until June 19, 2015, our audit committee consisted of Patrick M. Murray as Chairman, Igor Effimoff, H. H. Hardee and J. Michael Stinson. On June 19, 2015, in connection with a financing involving CT Energy Holding SRL, the Company’s Board of Directors accepted the resignations of Dr. Effimoff, Mr. Hardee and Mr. Stinson and appointed Mr. Oswaldo Cisneros, Mr. Francisco D’Agostino and Mr. Edgard Leal as Board members, effective the same date. The Board determined that Mr. Leal is independent for the purposes of the NYSE and its own internal policies. Effective as of June 30, 2015, the audit committee of the Board is comprised of Mr. Murray as Chairman, Mr. Leal and Mr. Robert Irelan.

The Audit Committee assists the Board in its oversight of our accounting and financial reporting policies and practices; the integrity of our financial statements; the independent registered public accounting firm’s qualifications, independence and objectivity; the performance of our internal audit function and our independent registered public accounting firm; and our compliance with legal and regulatory requirements.

The Audit Committee acts as a liaison between our independent registered public accounting firm and the Board, and it has the sole authority to appoint or replace the independent registered public accounting firm and to approve any non-audit relationship with the independent registered public accounting firm. Our internal audit function and the independent registered public accounting firm report directly to the Audit Committee.

Our Audit Committee has established procedures for our employees or consultants to make a confidential, anonymous complaint or raise a concern over accounting, internal accounting controls or auditing matters concerning us or any of our companies and is responsible for the proper implementation of such procedures. The Audit Committee is also responsible for understanding and assessing our processes and policies for communications with stockholders, institutional investors, analysts and brokers.

The Audit Committee has access to our records and employees, and has the sole authority to retain independent legal, accounting or other advisors for committee matters. We will provide appropriate funding for the payment of the independent registered public accounting firm and any advisors employed by the Audit Committee.

The Audit Committee makes regular reports to the Board. Each year the Audit Committee assesses the adequacy of its charter and conducts a self-assessment review to determine its effectiveness.

The Board has determined that each member of the Audit Committee meets the independence standards of the Securities and Exchange Commission’s (“SEC”) requirements, the rules of the New York Stock Exchange and the Company Guidelines for Corporate Governance. No member of the Audit Committee serves on the audit committee of more than three public companies. The Board has further determined that each member of the Audit Committee is financially literate and that Mr. Murray qualifies as an audit committee financial expert, as defined in Item 407(d)(5) of SEC Regulation S-K. Information on the relevant experience of Mr. Murray is set forth in “Board of Directors” above.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, (“Section 16(a)”) requires our directors, executive officers and beneficial holders of more than 10 percent of our common stock to file reports with the SEC regarding their ownership and changes in ownership of our stock. Based solely upon our review of SEC Forms 3, 4 and 5 and any amendments thereto furnished to us, to our knowledge, during fiscal year 2015, our officers, directors and 10 percent stockholders complied with all Section 16(a) filing requirements. In making this statement, we have relied upon the written representations of our directors and officers.

Code of Ethics

The Board has adopted a Code of Business Conduct and Ethics, which applies to all of our directors, officers and employees. The Board last amended the Code of Business Conduct and Ethics in December 2014. The Board has not granted any waivers to the Code of Business Conduct and Ethics.

The Guidelines for Corporate Governance, the Code of Business Conduct and Ethics and the charters of all the Board committees are accessible on our website under the Corporate Governance section at http://www.harvestnr.com. Any amendments to or waivers of the Code of Conduct and Business Ethics will also be posted on our website.

- 5 -

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The Company’s Compensation Discussion and Analysis explains the key elements of our executive compensation program for our President and Chief Executive Officer and our other named executive officers whose 2015 compensation is in the Executive Compensation Tables starting on page 15.

|

· |

James A. Edmiston, President and Chief Executive Officer (CEO); |

|

· |

Stephen C. Haynes, Vice President, Finance, Chief Financial Officer and Treasurer; |

|

· |

Robert Speirs, Senior Vice President, Eastern Operations; |

|

· |

Karl L. Nesselrode, Vice President, Engineering & Business Development; and |

|

· |

Keith L. Head, Vice President, General Counsel and Corporate Secretary. |

Executive Summary

Our Company focuses on acquiring exploration, development, and producing properties in proven and active hydrocarbon systems. We hold interests in the Bolivarian Republic of Venezuela (“Venezuela”) and exploration acreage offshore Gabon. We operate from our Houston, Texas headquarters with an office in Venezuela, and a field office in Port Gentil, Gabon.

Performance Highlights

2015 held many challenges for the Company. Among the accomplishments were:

|

· |

In June of 2015, we entered into a securities purchase agreement with CT Energy Holdings SRL to sell certain securities including a senior secured non-convertible note, a senior secured note convertible into our common stock and a warrant to purchase additional shares of common stock. This agreement provided for essential liquidity of the Company and the opportunity to restructure our interest in Petrodelta, S.A. (“Petrodelta”). |

|

· |

Our shareholders overwhelming approved the above securities purchase agreement with over 95% approval of shareholders who voted. |

|

· |

We negotiated and signed a non-binding term sheet with PDVSA that sets forth a framework for definitive agreements for the restructuring of the management and operations of Petrodelta. |

|

· |

We secured the approval of a four billion Venezuelan Bolivar loan to Petrodelta by CT Energia Holding Ltd. which would stabilize its balance sheet and eliminate exchange rate differences. |

|

· |

We completed 3D processing in Gabon which has significantly enhanced our prospect inventory. |

|

· |

We negotiated an optional two-year extension to the Dussafu exploration term in Gabon. |

|

· |

We completed the sale of Budong Budong, liquidated the Indonesian Branch of Harvest Far East and closed the Singapore office. |

|

· |

We reduced general overhead expenses 36 percent from year-end 2014 to year-end 2015. |

Compensation Highlights

|

· |

For the second year, no salary increases were given during the annual review process due to the continuing financial considerations. |

|

· |

As of March 2016, all executive salaries have been deferred until resolution or improvement of the Company’s financial situation. |

- 6 -

|

· |

Annual cash incentive awards for executive officers for 2015 performance have been deferred until resolution or improvement of the Company’s financial situation. |

|

· |

Long-term incentive awards were granted, consisting of approximately 30 percent restricted stock units and 70 percent stock options. |

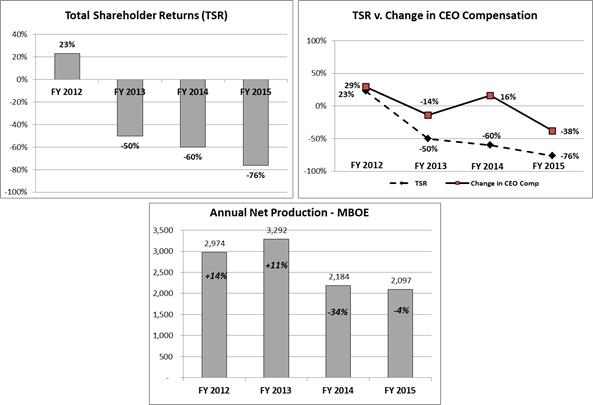

The following graphs highlight the Company results for 2015:

The Human Resources Committee (the “Committee”) of the Board of Directors has the discretion to exercise their judgment in weighing the achievement of specific performance measures. For 2015, it again considered total shareholder return (“TSR”), reserves, social responsibility/governance and safety as well as strategic individual objectives for the named executive officers. TSR was down 76%. We calculate TSR as current year-end closing share price minus prior year closing share price divided by prior year closing share price. Annual net production of Petrodelta, net to our ownership interest, in 2015 was down 4% over the prior year in Petrodelta. There were no Foreign Corrupt Practices Act (“FCPA”) incidents in 2015, and the Company was accident-free in 2015.

Compensation Philosophy

Our compensation philosophy is to offer a competitive total compensation package to enable us to attract, motivate and retain key executives. Our compensation objectives include:

|

· |

Offering total compensation that is competitive with a select peer group; |

|

· |

Providing annual cash incentive awards that take into account performance factors weighted by both corporate and individual goals; |

|

· |

Aligning the interest of executive officers and directors with stockholder value creation by providing significant equity based long-term incentives. |

- 7 -

The Committee oversees the development and execution of our compensation program. The Committee annually reviews our compensation philosophy and tests its ability to promote meeting the objectives stated above. The Committee recommends compensation for the named executive officers, short-term cash bonuses, long-term cash and non-cash compensation, and submits its recommendations to the Board of Directors for approval. Three independent directors comprise the Committee. The Committee meets as needed, but no less than quarterly to review compensation and benefit programs with management. It subsequently approves any changes. Our Human Resources, Accounting and Legal Department employees handle the day-to-day design and administration of employee compensation and benefit programs available to our employees.

Say-on-Pay Results

We hold our Say-on-Pay vote every other year. At our September 9, 2015 annual stockholders meeting, Harvest received support for our compensation program with approval from approximately 76.5% of the stockholders who voted. The Committee considered this support when contemplating potential changes to the Company’s compensation.

Setting Executive Compensation

Our compensation program consists of base salary, annual performance-based incentive awards, long-term incentives and personal benefits. Base salary and annual performance based incentive awards are cash-based. Long-term incentives typically consist of stock options, stock appreciation rights, restricted stock units and/or restricted stock awards. The Committee reviews the compensation recommendations from the CEO and our independent consultants’ advice on competitive trends regarding base salary, annual incentive awards and long-term incentives. The Committee exercises its collective judgment in establishing executive compensation based on performance, compensation history and market information. The recommendations are then made to the full Board of Directors for its approval.

The Role of the Compensation Consultant; Compensation Consultant Independence

In 2015, the Committee again engaged Frost Human Resource Consulting (“Frost HR Consulting”) as the Committee’s independent compensation consultant, to benchmark our executive officer compensation levels with similar positions in our industry peer group. The Committee reviews the relationship annually for any conflicts of interest. To ensure Frost HR Consulting’s independence:

|

· |

The Committee directly retained and has the authority to terminate Frost HR Consulting. |

|

· |

Frost HR Consulting reports directly to the Committee and its Chairperson. |

|

· |

Frost HR Consulting meets regularly in executive sessions with the Committee. |

|

· |

Frost HR Consulting has direct access to all members of the Committee during and between meetings. |

|

· |

Interactions between Frost HR Consulting and management generally are limited to data gathering and discussions regarding information which has or will be presented to the Committee. |

|

· |

Frost HR Consulting has procedures in place to prevent conflicts of interest. |

|

· |

Frost HR Consulting does not have any business or personal relationship with any member of management or the Committee. |

|

· |

Frost HR Consulting consultants do not own any of our stock. |

Peer Group and Compensation Surveys

The Committee considered market information from 2014 and 2015 compensation surveys and peer company proxy statements in determining compensation for each of the executive officers. The Committee reviews proxy statement data from a peer group of companies. The surveys used for benchmarking included:

|

· |

Economic Research Institute 2015 Executive Compensation Assessor |

|

· |

William M. Mercer 2014 Energy Industry Compensation Survey |

The Committee reviews the composition of the peer group and the compensation paid at these companies, as well as their corporate performance and other comparative factors in determining the appropriate compensation levels for our executives. No company in our peer group shares our unique risk profile, which is a function of our portfolio of producing assets and exploratory prospects as well as the regulatory and political environments in which we operate. Therefore, the Committee uses its judgment and business experience in addition to the peer group data in determining executive compensation.

- 8 -

The Committee selects peer companies for their shared similarities, including a common industry oil exploration focus, assets, market capitalization and enterprise value, among other factors. Revenue at the peer companies range from $11.5 million to $1148.3 million.

|

Carrizo Oil and Gas Inc. |

Halcón Resources, LLC |

|

Contango Oil and Gas Inc.* |

PDC Energy Inc. |

|

FX Energy, Inc. |

PetroQuest Energy, Inc. |

|

Gastar Exploration Ltd. |

VAALCO Energy, Inc. |

|

Gran Tierra Energy, Inc.* |

Yuma Energy, Inc.* |

|

Gulfport Energy, Corp. |

ZaZa Energy Corp. |

|

* New in 2015 |

Frost HR Consulting typically benchmarks the 25th, 50th and 75th percentiles for the data sources mentioned above to provide the Committee with an understanding of competitive pay practices. These surveys, equally weighted with the proxy data, consider each element of compensation and are collectively referred to as the “market data” throughout this Compensation Discussion and Analysis. Frost HR Consulting also provides the Committee with advice on equity incentive compensation trends, including types and value of awards being used by other public companies.

The Role of the Executives in Human Resources Committee Meetings

The Committee invites our CEO, the Vice President, Administration and Human Resources and the Vice President, General Counsel and Corporate Secretary to attend its meetings. The Vice President, Administration and Human Resources acts as the Committee Secretary and provides reports on plan administration and human resources policies and programs. The Vice President, General Counsel and Corporate Secretary provides legal advice on human resource matters. The CEO makes recommendations with respect to specific compensation decisions. The Committee, without management present, regularly meets in executive session and with its compensation consultant to review executive compensation matters including market data as well as peer group information.

The CEO makes recommendations to the Committee on performance evaluations, base salary changes, and both equity and annual incentive based compensation for executive officers and senior management (other than the CEO). From time to time, the CEO and members of management are invited to participate in Committee meetings to provide information regarding our strategic objectives, financial performance and recommendations regarding compensation plans. Management may be asked to prepare information for any Committee meeting. Depending on the agenda for a particular meeting, these materials may include:

|

· |

reports on our strategic objectives; |

|

· |

financial reports; |

|

· |

reports on achievement of individual and corporate performance objectives; |

|

· |

information regarding compensation programs and compensation levels for executive officers, directors and other employees at peer companies; |

|

· |

information on the total compensation of the executive officers, including base salary, cash incentives, equity awards, and other compensation, and any amounts payable to the executive officers upon voluntary or involuntary termination, or following a severance with or without a change in control; and |

|

· |

information regarding all annual and equity incentive based compensation, and health and welfare plans. |

Executive Compensation Components

Our compensation program components are designed to reward executive officers’ contributions, while considering our specific operating situation and how they manage this situation consistent with our strategy. Factors considered in compensating our executives include individual experience, skill sets that are required for multi-national oil and gas operations and their proven record of performance. The principal components of compensation and their purposes for executive officers are:

- 9 -

|

|

|

|

|

|

|

|

|

|

|

|

|

Element |

|

Form of Compensation |

|

Purpose |

|

Base salary |

|

Cash |

|

Provide competitive, fixed compensation to attract and retain executive talent |

|

Annual performance based incentive awards |

|

Cash |

|

Create strong financial incentive for achieving financial and strategic successes |

|

Long-term incentive compensation |

|

Stock Options, Stock Appreciation Rights (SARs), Restricted Stock Units (RSU) and Restricted Stock Grants |

|

Provides alignment between executive and shareholder interests by rewarding executives for performance based on appreciation in the Company's share price and retains executives |

|

Personal benefits |

|

Eligibility to participate in plans extends to all employees |

|

Broad-based employee benefits for health and welfare and retirement |

Base Salary

We pay base salaries to our executive officers to compensate them for specific job responsibilities during the calendar year. In determining base salaries for our executive officers, the Committee considers market and competitive benchmark data for the executive’s level of responsibility targeting between the 50th and 75th percentile of executive officers in comparable companies, with variation based on individual executive skill sets. Compared to 2015 market data, our base salaries were between 91% and 110% of the target market median.

Based on our current financial situation, the Committee did not recommend salary increases in 2016 for the CEO and the other named executive officers. In March 2014, the CEO and other named executive officers received an average salary increase of 3%.

|

|

|||||||||||||||

|

Base Salary-Annualized |

Edmiston |

Speirs |

Haynes |

Nesselrode |

Head |

||||||||||

|

2014 |

$ |

588,000 |

$ |

370,000 |

$ |

314,000 |

$ |

289,000 |

$ |

283,000 | |||||

|

2015 |

$ |

588,000 |

$ |

370,000 |

$ |

314,000 |

$ |

289,000 |

$ |

283,000 | |||||

|

2016 |

$ |

588,000 |

$ |

370,000 |

$ |

314,000 |

$ |

289,000 |

$ |

283,000 | |||||

Annual Performance-Based Incentive Awards (Bonus)

Each year, in addition to individual performance objectives, the Committee establishes Company performance measures for determining annual incentive awards as follows:

|

· |

Total Shareholder Return (weight 60%) |

|

· |

Reserve Additions/Production/Estimated Market Value (EMV) (weight 30%) |

|

· |

Social Responsibility and Governance (including safety) (weight 10%) |

These measures and their weightings are reviewed and modified, if appropriate, in light of changing Company priorities and strategic objectives. The corporate targets and weightings are recommended by the CEO and reviewed and approved by the Committee. The Committee focuses on these corporate goals in evaluating Company performance for the purpose of compensation. Individual performance results of the named executive officers are measured and assessed by the CEO.

Among these corporate goals, total shareholder return was weighted at 60%. The Company realized a total shareholder return of negative 76%, due in part to declining oil prices. This total shareholder return places Harvest in the 3rd quartile among its peer group.

Reserves/Production/Estimated Market Value (EMV) was weighted at 30%. Production decreased by approximately 4% over 2014 at Petrodelta, our Venezuelan affiliate.

Social Responsibility and Governance was weighted at 10% and is used at the discretion of the Committee in deciding the final corporate rating. As expected, there were no violations of our FCPA and Ethics and Business Conduct policies and the Company was accident-free in 2015.

- 10 -

Individual performance and operational results were combined with the Company performance results and weighted equally to determine each executive’s final annual incentive award. Target award levels for annual incentives are set at 100% of base salary for the CEO and 60% of base salary for the other named executive officers. For 2015 performance, the CEO and the other named executive officer’s individual awards were eligible for 65% of their bonus targets. However, these bonuses have been deferred and will not be paid until the outcome of the sale of Gabon and/or resolution of the sale of Petrodelta.

Long-Term Incentive Compensation

Long-term incentive awards have been granted under our 2001, 2004, 2006 and 2010 Long Term Incentive Plans (“LTIPs”), and the awards are granted to our executive officers to align their personal financial interests with our stockholders. The LTIPs include provisions for stock options, stock appreciation rights (SARs), restricted stock, restricted stock units and cash awards.

Our policy on stock awards is focused on determining the right mix of retention and ownership requirements to drive and motivate our executive officers’ behavior consistent with long-term interests of stockholders. The Committee is the administrator of our LTIPs and, subject to Board of Director approval, has full power to determine the size of awards to our executives, to determine the terms and conditions of grants in a manner consistent with the LTIPs, and to amend the terms and conditions of any outstanding award.

The CEO presents individual stock award recommendations for executive officers to the Committee, and after review and discussion the Committee submits their recommendation to the Board of Directors for approval. The Committee’s policy is to grant awards on the date the Board of Directors approves them. Stock options, stock appreciation rights, restricted stock and/or restricted stock units will be granted once each calendar year on a predetermined date or at the effective date of a new hire or promotion, but not within six months of a previous award to the same individual. The price of options and the value of a restricted stock award issued to a new employee will be set at the closing price on the employee’s effective start date. The price of options and the value of a restricted stock award issued to an employee as a result of a promotion will be set at the closing price on the effective date of that promotion. Under no circumstances will a grant date be set retroactively.

The Board of Directors has adopted stock retention guidelines as an additional means to promote ownership of stock by executive officers and directors. The guidelines apply to any award of restricted stock or options to purchase our stock granted to executive officers and directors after February 2004. Under these guidelines, an executive officer or director must retain at least 50 percent of the shares of restricted stock for at least three years after the restriction lapses. Consequences for failure to adhere to these guidelines shall be determined by the Committee in its discretion including, without limitation, actions with respect to future compensation, and future grants of stock options or restricted stock and performance measures. Under our Insider Trading Policy, executive officers and directors are strictly prohibited from speculative trading including short sales and buying or selling puts or calls on the Company’s securities.

We believe the Company should have the ability to recover compensation paid to executive officers and key employees under certain circumstances. On May 20, 2010, our stockholders approved the 2010 Long-Term Incentive Plan (the “2010 Plan”). This 2010 Plan allows us to recover any award which the Company deems was not warranted after any restatement of corporate performance.

The long-term incentive awards for 2015 included stock options, stock appreciation rights and restricted stock units. Stock appreciation rights can be settled as cash or equity. This mix provides upside potential with the stock options/SARs and a more stable award in the form of restricted stock units. Of the total award value, 70 percent was allocated to options and SARs and 30 percent to restricted stock units based on available shares. As of April 30, 2016, the total shares available for grant under the LTIPs approved by our stockholders are as follows:

|

|

|

|

|

|

|

|

|

Total available for grant as options |

|

102,000 |

|

Total available for grants as restricted stock or options |

|

6,999 |

Personal Benefits

Our executive officers are covered under the same health and welfare and retirement plans, including our 401(k) plan, as all employees. The executive officers also receive supplemental life insurance to cover the risks of extensive travel required in conducting our global business. We pay 100 percent of all premiums for the following benefits for employees and their eligible dependents:

|

· |

All employees are entitled to a medical benefit with unlimited maximum lifetime benefits, with an annual out-of-pocket deductible of $3,125 per individual and $9,375 per family. |

|

· |

Life and accidental death and dismemberment (“AD&D”) insurance equal to two times annual salary with a minimum of $200,000 and a cap of $300,000 (or $400,000 with evidence of insurability). Also, there is additional coverage equal to five times annual salary ($1.0 million maximum) while traveling outside their home country on Company business. |

|

· |

Long-term disability benefits provide a monthly benefit of 60 percent of base salary up to a maximum of $10,000 per month. |

- 11 -

|

· |

Participation in our Statutory Profit Sharing Plan 401(k). Eligibility is effective the first day of the month following the date of hire. We use a safe harbor matching formula for Company contributions (dollar for dollar match up to 3 percent of pay, $0.50 for every dollar on the next 2 percent of pay subject to the statutory maximum salary limits). Participant and Company contributions are 100 percent vested from the date of contribution. At termination of employment, employees are eligible to receive their account balance in a lump sum. |

|

· |

All employees and their dependents receive annual dental and vision care benefits of $1,500 and $250, respectively, per employee and dependents. |

We do not offer a pension plan or a non-qualified deferred compensation plan for executive officers or employees. In 2015, we did not offer perquisites to executive officers or other employees. We offer relocation and foreign service premiums to employees serving in an international location. The amount of the premium will vary depending upon the living conditions, political situation and general safety conditions of the international location. Expatriate employees are also provided housing and utilities allowances where applicable. They also receive a cost of living allowance to cover the differential between normal living expenses in the host and home countries, and will continue to participate in the employee benefit plans available to home country employees.

Total Direct Compensation

Executive Compensation Compared to Market Data

Compared to 2015 market data, total direct compensation ranged between 45th and 52nd percentile of the target market for all named executive officers. In 2015, actual compensation fell at the following percentiles:

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 Actual Compensation in Relationship to 2014 Actual Peer Market Data |

|

CEO |

|

Other Named Executive Officers |

|

Base Salary |

|

54th Percentile |

|

42nd to 47th percentile |

|

Actual Total Cash |

|

46th Percentile |

|

42nd to 47th percentile |

|

Actual Total Direct Compensation |

|

57th Percentile |

|

44th to 55th percentile |

Tax and Accounting Implications of Executive Compensation

Deductibility of Executive Compensation

As part of its role, the Committee reviews and considers the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code of 1986 which imposes a limit of $1.0 million on the amount that a publicly-held corporation may deduct in any year for the compensation paid or accrued with respect to its named executive officers unless the compensation is performance based. None of our executive officers currently receives compensation exceeding the limits imposed by Section 162(m). While we cannot predict with certainty how executive compensation might be affected in the future by Section 162(m) or applicable tax regulations issued, we may attempt to preserve the tax deductibility of all executive compensation while maintaining our executive compensation program as described in this discussion and analysis.

Employment Agreements

We have entered into Executive Employment Agreements with our current named executive officers: Messrs. Edmiston, Haynes, Speirs, Nesselrode and Head. The contracts have an initial term that automatically extends for one year upon each anniversary unless a one-year notice not to extend is given to the executive. The current terms of the employment agreements are through May 31, 2016.

- 12 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entitlements based on terms in Executive Agreements if we terminate the employment without cause or notice (not related to Change of Control) OR the executive terminates employment for good reason |

|

Edmiston |

|

Haynes |

|

Speirs |

|

Nesselrode |

|

Head |

|

A lump sum amount equal to a certain multiple of base salary |

|

3 times |

|

2 times |

|

2 times |

|

2 times |

|

2 times |

|

An amount equal to a certain number of years times the maximum annual employer contributions made under our 401(k) plan |

|

3 years |

|

2 years |

|

2 years |

|

2 years |

|

2 years |

|

Vesting of all stock options and SARs |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Vesting of all restricted stock awards and RSUs |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Reimbursement of Outplacement Services |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Restrictions on ability to compete with our company after termination of employment |

|

2 years |

|

2 years |

|

2 years |

|

2 years |

|

2 years |

See the table titled “Potential Payments under Termination or Change of Control” for details on the above information.

The Committee believes the termination payment included in these employment agreements is needed to attract and retain the executives necessary to achieve our business objectives. However, the Committee also believes termination payments should not be guaranteed. Accordingly, a termination payment will not be paid if a termination occurs after notice and lapse of the notice period to terminate the employment agreement. Also, a termination payment will not be made if the executive officer resigns other than for good reason. Good reason under the employment contracts includes: (1) a material breach of the employment agreement by the Company; (2) failure to maintain or reelect the executive officer to his position; (3) a significant reduction of the executive officer’s duties, position or responsibilities; (4) a substantial reduction, without good business reasons, of the facilities and perquisites available to the executive officer; (5) a reduction by the Company of the executive officer’s monthly base salary; (6) failure of the Company to continue the executive officer’s participation in any bonus, incentive, profit sharing, performance, savings, retirement or pension policy, plan, program or arrangement on substantially the same or better basis relative to other participants; or (7) the relocation of the executive officer more than fifty miles from the location of the Company’s principal office.

Change of Control

Since it is in our best interest to retain during uncertain times executive officers who will act in the best interests of the stockholders without concern for personal outcome, our Executive Employment Agreements provide benefits in the event of loss of employment for employees in good standing due to a change of control. Change of control is defined as the acquisition of 50 percent or more of our voting stock, the cessation of the incumbent board of directors to constitute a majority of the board of directors, or, in certain circumstances, the reorganization, merger, or sale or disposition of at least 50 percent of our assets where we are not the surviving entity. Change of control severance benefits apply to terminations taking place between 240 days before a change of control and 730 days after a change of control.

- 13 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entitlements based on terms in Executive Agreements if we terminate the employment without cause or notice related to a Change of Control |

|

Edmiston |

|

Haynes |

|

Speirs |

|

Nesselrode |

|

Head |

|

A lump sum amount equal to a certain multiple of base salary |

|

3 times |

|

2 times |

|

2 times |

|

2 times |

|

2 times |

|

A lump sum amount equal to a certain multiple of the highest annual bonus over the past 3 years or target bonus, whichever is higher |

|

3 times |

|

2 times |

|

2 times |

|

2 times |

|

2 times |

|

An amount equal to a certain number of years times the maximum annual employer contributions made under our 401(k) plan |

|

3 years |

|

2 years |

|

2 years |

|

2 years |

|

2 years |

|

Continuation of accident, life, disability, dental and health benefits for a certain number of years |

|

3 years |

|

2 years |

|

2 years |

|

2 years |

|

2 years |

|

Excise tax reimbursement and gross up on the reimbursement |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Vesting of all stock options and SARs |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Vesting of all restricted stock awards and RSUs |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Reimbursement of outplacement services |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Yes |

|

Restrictions on ability to compete with our company after termination of employment |

|

2 years |

|

2 years |

|

2 years |

|

2 years |

|

2 years |

The change of control benefits in the employment agreements contain a double trigger in that both a change of control must occur and the executive officer must be terminated without cause or resign for good reason within a specified period of time after the change of control. The Committee believes that the double trigger avoids unnecessarily rewarding an executive officer when a change of control occurs and the executive officer’s status is not changed as a result. However, because of the significant uncertainty that can arise during a period of a potential or actual change of control, the Committee has provided greater benefits to the executive officer in the event of a termination resulting from a change of control. Change of control benefits are detailed in the “Potential Payments under Termination or Change of Control” table in the Compensation of Executive Officers section.

HUMAN RESOURCES COMMITTEE REPORT

The Human Resources Committee has reviewed and discussed with management the Compensation Discussion and Analysis filed in this document. Based on such review and discussions, the Human Resources Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Amended Report.

R. E. Irelan, Committee Chairman

Edgard A. Leal

Patrick M. Murray

- 14 -

COMPENSATION OF EXECUTIVE OFFICERS

The following table summarizes the compensation of the Company’s named executive officers for the three most recently completed fiscal years ended December 31, 2015, 2014 and 2013.

|

|

|||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

|

Non-Equity |

||||||||||||||||||||||

|

|

Stock |

Option |

Incentive Plan |

All Other |

|||||||||||||||||||

|

Name and Principal |

Bonus |

Awards |

Awards |

Compensation |

Compensation |

||||||||||||||||||

|

Position |

Year |

Salary ($) |

($) (1) |

($) (2) |

($) (3) |

($) (4) |

($) (5) |

Total ($) |

|||||||||||||||

|

|

|||||||||||||||||||||||

|

James A. Edmiston |

2015 |

$ |

610,616 |

$ |

382,200 |

$ |

285,000 |

$ |

554,440 |

$ |

214,550 |

$ |

20,008 |

$ |

2,066,814 | ||||||||

|

President and Chief |

2014 |

584,539 | 382,200 |

— |

769,230 | 966,280 | 19,724 | 2,721,973 | |||||||||||||||

|

Executive Officer |

2013 |

566,154 | 399,000 | 115,200 | 1,117,719 | 125,580 | 18,149 | 2,341,802 | |||||||||||||||

|

|

|||||||||||||||||||||||

|

Stephen C. Haynes |

2015 |

$ |

326,077 |

$ |

122,460 |

$ |

95,190 |

$ |

193,735 |

$ |

63,315 |

$ |

17,255 |

$ |

818,032 | ||||||||

|

Vice President, Finance, |

2014 |

312,269 | 122,460 |

— |

249,480 | 314,160 | 17,423 | 1,015,792 | |||||||||||||||

|

Chief Financial Officer |

2013 |

303,077 | 128,100 | 33,600 | 320,633 | 35,490 | 18,923 | 839,823 | |||||||||||||||

|

and Treasurer |

|||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

Robert Speirs |

2015 |

$ |

370,000 |

$ |

144,300 |

$ |

112,290 |

$ |

228,218 |

$ |

74,592 |

$ |

488,912 |

$ |

1,418,312 | ||||||||

|

Senior Vice President |

2014 |

368,333 | 144,300 |

— |

294,030 | 371,280 | 537,459 | 1,715,402 | |||||||||||||||

|

Eastern Operations |

2013 |

357,500 | 151,200 | 38,400 | 377,567 | 43,680 | 385,363 | 1,353,710 | |||||||||||||||

|

|

|||||||||||||||||||||||

|

Karl L. Nesselrode |

2015 |

$ |

300,116 |

$ |

112,710 |

$ |

87,780 |

$ |

178,416 |

$ |

58,264 |

$ |

18,594 |

$ |

755,880 | ||||||||

|

Vice President |

2014 |

287,269 | 112,710 |

— |

228,690 | 290,360 | 18,323 | 937,352 | |||||||||||||||

|

Engineering and |

2013 |

278,077 | 117,600 | 33,600 | 293,663 | 32,760 | 17,898 | 773,598 | |||||||||||||||

|

Business Development |

|||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

Keith L. Head |

2015 |

$ |

293,885 |

$ |

110,370 |

$ |

86,070 |

$ |

174,570 |

$ |

57,090 |

$ |

14,183 |

$ |

736,168 | ||||||||

|

Vice President |

2014 |

281,462 | 110,370 |

— |

225,720 | 285,600 | 14,036 | 917,188 | |||||||||||||||

|

General Counsel |

2013 |

273,077 | 115,500 | 33,600 | 287,670 | 32,760 | 20,368 | 762,975 | |||||||||||||||

|

|

|||||||||||||||||||||||

|

Notes: |

|||||||||||||||||||||||

|

1. Harvest pays bonuses one year in arrears but reflects the bonus in the table above in the year to which it related. Bonuses related to 2013 were paid February 28, |

|||||||||||||||||||||||

|

2014 and are reflected in the schedule above as 2013 bonuses. Bonuses related to 2014 were paid June 25, 2015 and are reflected in the schedule above as 2014 |

|||||||||||||||||||||||

|

bonuses. Bonuses related to 2015 were approved on March 15, 2016 but have been deferred until our current financial situation is resolved and are reflected in the |

|||||||||||||||||||||||

|

above schedule as 2015 bonuses. |

|||||||||||||||||||||||

|

2. In 2015, Harvest issued restricted stock units to employees and the named executive officers. The fair value of each restricted stock unit ("RSU") was estimated |

|||||||||||||||||||||||

|

on the date of grant using a Monte Carlo simulation since the RSU's were also subject to a market condition. These RSUs will not become exercisable until the first |

|||||||||||||||||||||||

|

day on which the volume weighted average price of the common stock over any 30-day period, commencing on or after the award date, equals or exceeds $2.50 per |

|||||||||||||||||||||||

|

share (“VWAP condition”) in addition to the required three year cliff vesting period. The Monte Carlo simulation includes this VWAP condition and uses |

|||||||||||||||||||||||

|

assumptions for the risk-free interest rate of 2.27%, volatility of 80%, term of 10 years and a 0% dividend yield. |

|||||||||||||||||||||||

|

3. In 2015, the fair value of each stock option was estimated on the date of grant using a Monte Carlo simulation since the options were also subject to a market |

|||||||||||||||||||||||

|

condition. These options will not become exercisable until the first day on which the volume weighted average price of the common stock over any 30-day period, |

|||||||||||||||||||||||

|

commencing on or after the award date, equals or exceeds $2.50 per share (“VWAP condition”) in addition to the ratable vesting over a three year period. The Monte |

|||||||||||||||||||||||

|

Carlo simulation includes this VWAP condition and uses assumptions for the risk-free interest rate of 1.7%, volatility of 100%, exercise price of $1.13 and a 0% |

|||||||||||||||||||||||

|

dividend yield. A suboptimal exercise factor determines the expected term of the options. The Monte Carlo simulation assumed a suboptimal exercise factor of 2.5 |

|||||||||||||||||||||||

|

meaning that exercise is generally expected to occur when the share price reaches 2.5 times the award’s exercise price. The resulting weighted average term was 4.7 |

|||||||||||||||||||||||

|

years. A forfeiture rate of 1.1% was assumed in calculating the value of the options. |

|||||||||||||||||||||||

|

4. In 2015, Harvest issued stock appreciation rights ("SARs"). The fair value of each SAR was estimated on the date of grant using a Monte Carlo simulation since |

|||||||||||||||||||||||

|

the SARs were also subject to a market condition. These SARs will not become exercisable until the first day on which the volume weighted average price of the |

|||||||||||||||||||||||

|

common stock over any 30-day period, commencing on or after the award date, equals or exceeds $2.50 per share (“VWAP condition”) in addition to the ratable vesting |

|||||||||||||||||||||||

|

over a three year period. The Monte Carlo simulation includes this VWAP condition and uses assumptions for the risk-free interest rate of 1.7%, volatility of 105%, |

|||||||||||||||||||||||

|

exercise price of $1.13 and a 0% dividend yield. A suboptimal exercise factor determines the expected term of the options. The Monte Carlo simulation assumed a |

|||||||||||||||||||||||

|

suboptimal exercise factor of 2.5 meaning that exercise is generally expected to occur when the share price reaches 2.5 times the award’s exercise price. The resulting |

|||||||||||||||||||||||

|

weighted average term was 4.6 years. A forfeiture rate of 0.7% was assumed in calculating the value of the SARs. |

|||||||||||||||||||||||

|

The SARs can be settled in cash or equity. Currently, no plan has been approved by the shareholders for equity settlement and Harvest is recording the liability and |

|||||||||||||||||||||||

|

expense associated with the awards based on the fair value of the awards. |

|||||||||||||||||||||||

|

|

|||||||||||||||||||||||

|

(5) See table below: |

|||||||||||||||||||||||

- 15 -

|

|

|||||||||||||||||||||||||||||||

|

|

Foreign |

||||||||||||||||||||||||||||||

|

|

Group |

Company |

Housing and |

Cost of |

Foreign |

||||||||||||||||||||||||||

|

Name and Principal |

Term |

401(K) |

Living |

Living |

Vacation |

Transportation |

Service |

Foreign |

|||||||||||||||||||||||

|

Position |

Year |

Life |

Match |

Expense |

Adjustment |

Allowance |

Allowance |

Premium |

Taxes |

Total ($) |

|||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

James A. Edmiston |

2015 |

$ |

9,408 |

$ |

10,600 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

20,008 | ||||||||||||

|

President and Chief |

2014 |

9,324 | 10,400 |

— |

— |

— |

— |

— |

— |

19,724 | |||||||||||||||||||||

|

Executive Officer |

2013 |

7,949 | 10,200 |

— |

— |

— |

— |

— |

— |

18,149 | |||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

Stephen C. Haynes |

2015 |

$ |

6,655 |

$ |

10,600 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

17,255 | ||||||||||||

|

Vice President, Finance |

2014 |

7,023 | 10,400 |

— |

— |

— |

— |

— |

— |

17,423 | |||||||||||||||||||||

|

Chief Financial Officer |

2013 |

8,723 | 10,200 |

— |

— |

— |

— |

— |

— |

18,923 | |||||||||||||||||||||

|

and Treasurer |

|||||||||||||||||||||||||||||||

|

Robert Speirs |

2015 |

$ |

1,980 |

$ |

— |

$ |

156,325 |

$ |

83,464 |

$ |

44,281 |

$ |

33,661 |

$ |

28,500 |

$ |

140,701 |

$ |

488,912 | ||||||||||||

|

Senior Vice President |

2014 |

1,290 |

— |

173,840 | 93,600 | 45,714 | 33,661 | 28,500 | 160,854 | 537,459 | |||||||||||||||||||||

|

Eastern Operations |

2013 |

1,290 |

— |

175,242 | 93,894 | 48,276 | 34,000 | 28,500 | 4,161 | 385,363 | |||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

Karl L. Nesselrode |

2015 |

$ |

7,994 |

$ |

10,600 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

18,594 | ||||||||||||

|

Vice President |

2014 |

7,923 | 10,400 |

— |

— |

— |

— |

— |

— |

18,323 | |||||||||||||||||||||

|

Engineering and |

2013 |

7,698 | 10,200 |

— |

— |

— |

— |

— |

— |

17,898 | |||||||||||||||||||||

|

Business Development |

|||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

Keith L. Head |

2015 |

$ |

3,583 |

$ |

10,600 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

14,183 | ||||||||||||

|

Vice President |

2014 |

3,636 | 10,400 |

— |

— |

— |

— |

— |

— |

14,036 | |||||||||||||||||||||

|

General Counsel |

2013 |

10,168 | 10,200 |

— |

— |

— |

— |

— |

— |

20,368 | |||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

The following table shows information concerning options to purchase our common stock granted to each of our named executive officers during 2015.

|

|

|||||||||||||

|

|

All Other Stock |

All Other Option |

Exercise or |

Grant Date |

|||||||||

|

|

Awards: Number |

Awards: Number |

Base Price |

Fair Value of |

|||||||||

|

|

of Shares of |

of Securities |

Of Option |

Stock Based |

|||||||||

|

|

Grant |

Stock or Units |

Underlying Options |

Awards |

Awards |

||||||||

|

Name |

Date |

(#) |

(#) |

($/Sh) |

($) |

||||||||

|

James A. Edmiston |

7/22/2015 |

269,000 |

$ |

1.13 |

$ |

204,440 |

|||||||

|

|

12/9/2015 |

1,000,000 |

1.13 |

350,000 |

|||||||||

|

|

12/9/2015 |

500,000 |

285,000 |

||||||||||

|

Stephen Haynes |

7/22/2015 |

90,000 |

$ |

1.13 |

$ |

68,400 |

|||||||

|

|

12/9/2015 |

358,099 |

1.13 |

125,335 |

|||||||||

|

|

12/9/2015 |

167,000 |

95,190 |

||||||||||

|

Robert Speirs |

7/22/2015 |

106,000 |

$ |

1.13 |

$ |

80,560 |

|||||||

|

|

12/9/2015 |

421,879 |

1.13 |

147,658 |

|||||||||

|

|

12/9/2015 |

197,000 |

112,290 |

||||||||||

|

Karl Nesselrode |

7/22/2015 |

83,000 |

$ |

1.13 |

$ |

63,080 |

|||||||

|

|

12/9/2015 |

329,531 |

1.13 |

115,336 |

|||||||||

|

|

12/9/2015 |

154,000 |

87,780 |

||||||||||

|

Keith L. Head |

7/22/2015 |

81,000 |

$ |

1.13 |

$ |

61,560 |

|||||||

|

|

12/9/2015 |

322,887 |

1.13 |

113,010 |

|||||||||

|

|

12/9/2015 |

151,000 |

86,070 |

||||||||||

Notes:

|

1) |

Options granted July 22, 2015 vest 1/3 each year over a three year period. |

|

2) |

Options granted December 9, 2015 vest 1/3 on July 22, 2016, 1/3 on July 22, 2017 and 1/3 on July 22, 2018 |

|

3) |

Harvest granted options representing 4,375,201 shares to employees in 2015. |

|

4) |

All employee grants awarded in 2015 are subject to an additional vesting condition of a 30-day volume weighted average closing price of $2.50/share (VWAP condition). The shares do not vest unless VWAP condition is met. |

- 16 -

Outstanding Equity Awards at Fiscal Year End

The following table shows information concerning outstanding equity awards as of December 31, 2015 held by the named executive officers.

|

|

Option Awards |

Stock Awards |

||||||||||||||||||

|

|

Equity Incentive |

Market |

Equity Incentive |

Equity Incentive |

||||||||||||||||

|

|

Plan Number |

Number of |

Value of |

Plan Awards: |

Plan Awards: |

|||||||||||||||

|

|

of Securities |

Shares or |

Shares or |

Number of |

Market or Payout |

|||||||||||||||

|

|

Number of Securities |

Underlying |

Units of |

Units of |

Unearned |

Value of Unearned |

||||||||||||||

|

|

Underlying Unexercised |

Unexercised |

Option |

Stock |

Stock That |

Shares, Units or |

Shares, Units or |

|||||||||||||

|

|

Options |

Unearned |

Exercise |

Option |

That Have |

Have Not |

Other Rights That |

Other Rights That |

||||||||||||

|

|

(#) |

Options |

Price |

Expiration |

Not Vested |

Vested (1) |

Have Not Vested |

Have Not Vested |

||||||||||||

|

Name |

Exercisable |

Unexercisable |

(#) |

($) |

Date |

(#) |

($) |

(#) |

($) |

|||||||||||

|

James A. Edmiston |

17,000 |

— |

$ |

9.605 |

3/2/2016 |

|||||||||||||||

|

|

24,334 |

— |

$ |

9.605 |

3/2/2016 |

|||||||||||||||

|

|

65,000 |

— |

$ |

4.595 |

6/18/2016 |

|||||||||||||||

|

|

114,200 |

— |

$ |

11.190 |

5/20/2016 |

|||||||||||||||

|

|

130,000 |

— |

$ |

5.120 |

5/17/2017 |

|||||||||||||||

|

|

248,667 | 124,333 |

$ |

4.800 |

7/17/2018 |

24,000 | 10,320 | |||||||||||||

|

|

86,333 | 172,667 |

$ |

4.760 |

5/21/2019 |

|||||||||||||||

|

|

1,269,000 |

$ |

1.130 |

7/22/2020 |

500,000 | 215,000 | ||||||||||||||

|

|

||||||||||||||||||||

|

Stephen Haynes |

12,000 |

— |

$ |

4.595 |

6/18/2016 |

|||||||||||||||

|

|

51,100 |

— |

$ |

11.190 |

5/20/2016 |