Attached files

| file | filename |

|---|---|

| EX-2.2 - EXHIBIT 2.2 - CENTRAL VALLEY COMMUNITY BANCORP | sierravista_-xfinalxreorga.htm |

| 8-K - 8-K - CENTRAL VALLEY COMMUNITY BANCORP | shortstopmergerform8-k.htm |

FOR IMMEDIATE RELEASE

CONTACT: Debbie Nalchajian-Cohen

(559) 222-1322 or (559) 281-1312 cell

Gary D. Gall, Sierra Vista Bank

(916) 850-1590

CENTRAL VALLEY COMMUNITY BANCORP

TO ACQUIRE SIERRA VISTA BANK

FRESNO and SACRAMENTO, CALIFORNIA…April 29, 2016… Central Valley Community Bancorp (Company, together with its wholly owned subsidiary, Central Valley Community Bank (Bank)) (NASDAQ: CVCY), a bank holding company headquartered in Fresno, California, and Sierra Vista Bank (OTCBB: SVBA), headquartered in Folsom, California, jointly announced today that a definitive merger agreement has been signed by both parties. Under the terms of the agreement, Sierra Vista Bank, with three full service branches located in Folsom and Fair Oaks (Sacramento County), and Cameron Park (El Dorado County), will merge with Central Valley Community Bank. The transaction is subject to customary closing conditions, including regulatory approvals and Sierra Vista Bank shareholder approval. The Central Valley Community Bancorp and Sierra Vista Bank Boards of Directors have approved the transaction, which is expected to close in the fourth quarter of 2016.

As more fully described in the definitive merger agreement and investor presentation attached, Sierra Vista Bank shareholders will be entitled to receive cash and shares of Central Valley Community Bancorp stock, subject to certain adjustments described in the definitive merger agreement including if options or warrants are exercised prior to close. Sierra Vista Bank shareholders may elect to receive cash, Central Valley Community Bancorp stock, or a combination of both, subject to proration. Based on the closing price of Central Valley Community Bancorp on Thursday, April 28, 2016, the transaction, including redemption of certain outstanding Sierra Vista Bank securities immediately prior to the closing, would have a value of $24.0 million, or $5.22 per Sierra Vista Bank common share. However, the deal value will fluctuate with changes in Central Valley Community Bancorp’s stock price through the closing date.

-more-

Central Valley Community Bancorp - Page 2

The Central Valley Community Bancorp Board of Directors and the Central Valley Community Bank Executive Management team, led by James M. Ford, President and CEO, will continue to lead the combined team of professional bankers. Gary D. Gall, President, CEO and Director of Sierra Vista Bank, will join Central Valley Community Bancorp’s Board of Directors upon completion of the acquisition. This merger with Sierra Vista Bank will become the fourth acquisition for Central Valley Community Bancorp, which acquired Visalia Community Bank on July 1, 2013, Service 1st Bancorp and its subsidiary Service 1st Bank on November 12, 2008, and Bank of Madera County on January 1, 2005.

As of March 31, 2016, on a pro forma consolidated basis with Sierra Vista Bank, Central Valley Community Bancorp would have had approximately $1.5 billion in total assets, with 23 branches throughout California’s San Joaquin Valley.

“Sierra Vista Bank’s community banking culture, leadership and dedication to supporting small businesses and the greater Sacramento region mirrors the values that Central Valley Community Bank has lived by for the past 36 years. Once completed, the merger will complete another step in our long-term strategy to increase our northern Valley presence which began 14 years ago in Sacramento County’s Gold River business community,” stated James M. Ford, President and CEO of Central Valley Community Bancorp and Central Valley Community Bank.

“By combining our two great banks we believe our growth will enhance opportunities for businesses, customers, employees, the community and our Bank,” concluded Ford.

“Sierra Vista Bank was founded nine years ago with the goal to bring true community banking to the Folsom area by offering a financial partnership for small businesses and to help grow the local economy. Merging with Central Valley Community Bank will allow our customers and other small businesses within the region to grow and expand with a banking partner whose values and dedication to businesses, customer service and the community so closely match our own,” stated Gary Gall, President and CEO of Sierra Vista Bank.

“Central Valley Community Bank has grown profitably and sensibly over the past three decades. Their quality business reputation, character and leadership are well-known within the financial industry. More importantly, their team of banking professionals, like ours, live, work and actively serve their community by investing their time, financial expertise and business advocacy to help each region thrive,” concluded Gall.

Central Valley Community Bancorp trades on the NASDAQ stock exchange under the symbol CVCY and as of March 31, 2016 has reported assets of over $1.2 billion. Central Valley Community Bank, headquartered in Fresno, California, was founded in 1979 and is the sole subsidiary of Central

-more-

Central Valley Community Bancorp - Page 3

Valley Community Bancorp. Central Valley Community Bank operates 20 full service offices in Clovis, Exeter, Fresno, Kerman, Lodi, Madera, Merced, Modesto, Oakhurst, Prather, Sacramento, Stockton, Tracy, and Visalia, California. Additionally, the Bank operates Commercial Real Estate Lending, SBA Lending and Agribusiness Lending Departments. Central Valley Investment Services are provided by Investment Centers of America, Inc.

Members of Central Valley Community Bancorp’s and the Bank’s Board of Directors are: Daniel J. Doyle (Chairman), Daniel N. Cunningham (Lead Independent Director), Edwin S. Darden, Jr., F. T. “Tommy” Elliott, IV, James M. Ford, Steven D. McDonald, Louis McMurray, William S. Smittcamp, and Joseph B. Weirick. Wanda L. Rogers and Sidney B. Cox are Founding Directors Emeriti. More information about Central Valley Community Bancorp and Central Valley Community Bank can be found at www.cvcb.com. Also, visit Central Valley Community Bank on Twitter and Facebook.

Sierra Vista Bank, headquartered in Folsom, California, reported assets of $156,117,000 as of March 31, 2016. Sierra Vista Bank, founded in 2007, operates three full service branch offices in Folsom, Cameron Park and Fair Oaks. Additional information about Sierra Vista Bank can be found at www.sierravistabank.com.

Central Valley Community Bancorp received a fairness opinion from Keefe, Bruyette & Woods, Inc., and Downey Brand LLP served as legal advisor. Sierra Vista Bank received advisory service and a fairness opinion from Sandler O’Neill + Partners, LP, and its legal counsel was Manatt, Phelps & Phillips, LLP.

###

ATTACHMENTS:

• | Investor Presentation - Acquisition of Sierra Vista Bank |

• | Central Valley Community Bancorp logo |

Forward-looking Statements- Certain matters discussed in this press release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained herein that are not historical facts, such as statements regarding the Company’s current business strategy and the Company’s plans for future development and operations, are based upon current expectations. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates, a decline in economic conditions at the international, national or local level on the Company’s results of operations, the Company’s ability to continue its internal growth at historical rates, the Company’s ability to maintain its net interest

-more-

Central Valley Community Bancorp - Page 4

margin, and the quality of the Company’s earning assets; (3) changes in the regulatory environment; (4) fluctuations in the real estate market; (5) changes in business conditions and inflation; (6) changes in securities markets; (7) the risk that the merger might, for any reason, not occur, and (8) the other risks set forth in the Company’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2015. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company.

Central Valley Community Bancorp will file a registration statement with the SEC, including a proxy statement/prospectus and other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. After it is filed with the SEC, the proxy statement/prospectus will be available for free, both on the SEC website (http://www.sec.gov) and from Central Valley Community Bancorp and Sierra Vista Bank.

Investor Presentation Acquisition of Sierra Vista Bank April 29, 2016

Forward-Looking Statements 2 Certain matters discussed in this press release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained herein that are not historical facts, such as statements regarding the Company’s current business strategy and the Company’s plans for future development and operations, are based upon current expectations. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates, a decline in economic conditions at the international, national or local level on the Company’s results of operations, the Company’s ability to continue its internal growth at historical rates, the Company’s ability to maintain its net interest margin, and the quality of the Company’s earning assets; (3) changes in the regulatory environment; (4) fluctuations in the real estate market; (5) changes in business conditions and inflation; (6) changes in securities markets; (7) the risk that the merger might, for any reason, not occur, and (8) the other risks set forth in the Company’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2015. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company. Central Valley Community Bancorp will file a registration statement with the SEC, including a proxy statement/prospectus and other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. After it is filed with the SEC, the proxy statement/prospectus will be available for free, both on the SEC website (http://www.sec.gov) and from Central Valley Community Bancorp and Sierra Vista Bank. All statements contained herein that are not historical facts or descriptions of terms of the merger agreement are based upon current expectations and estimates that have been made in good faith. Items set forth in forward-looking statements, or projecting future outcomes, are not guarantees of performance. All such items of information are subject to certain risks, uncertainties and assumptions, including those that will be identified in the registration statement and joint proxy statement/prospectus under which securities will be offered in the merger. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those presented herein. Many of the factors that will determine future results and values are beyond the Company’s ability to control or predict.

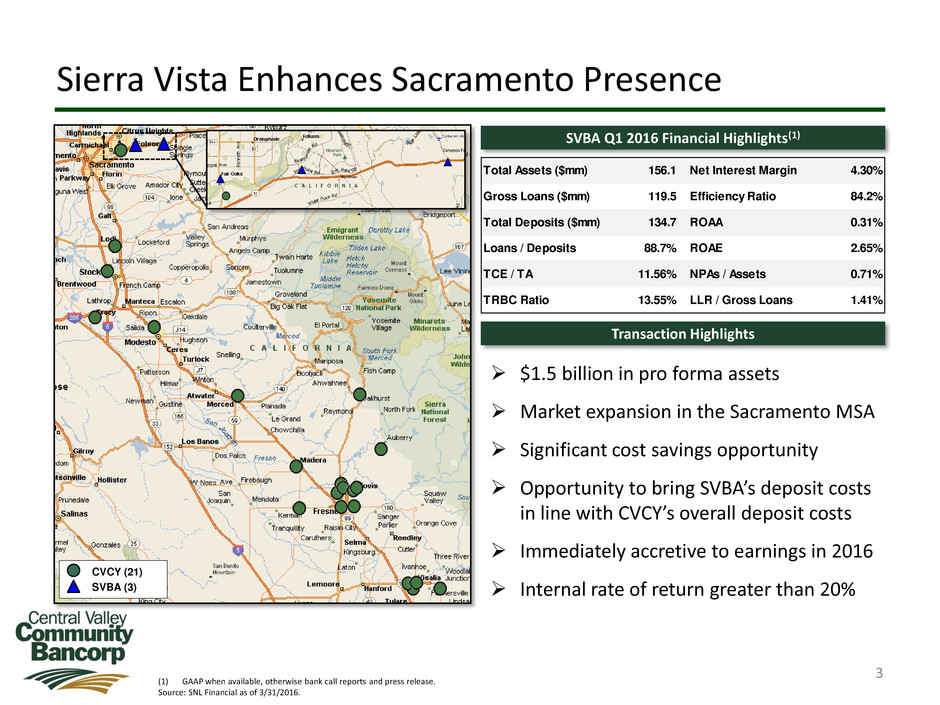

Total Assets ($mm) 156.1 Net Interest Margin 4.30% Gross Loans ($mm) 119.5 Efficiency Ratio 84.2% Total Deposits ($mm) 134.7 ROAA 0.31% Loans / Deposits 88.7% ROAE 2.65% TCE / TA 11.56% NPAs / Assets 0.71% TRBC Ratio 13.55% LLR / Gross Loans 1.41% Sierra Vista Enhances Sacramento Presence 3 (1) GAAP when available, otherwise bank call reports and press release. Source: SNL Financial as of 3/31/2016. SVBA Q1 2016 Financial Highlights(1) Transaction Highlights $1.5 billion in pro forma assets Market expansion in the Sacramento MSA Significant cost savings opportunity Opportunity to bring SVBA’s deposit costs in line with CVCY’s overall deposit costs Immediately accretive to earnings in 2016 Internal rate of return greater than 20% • CVCY (21) SVBA (3)

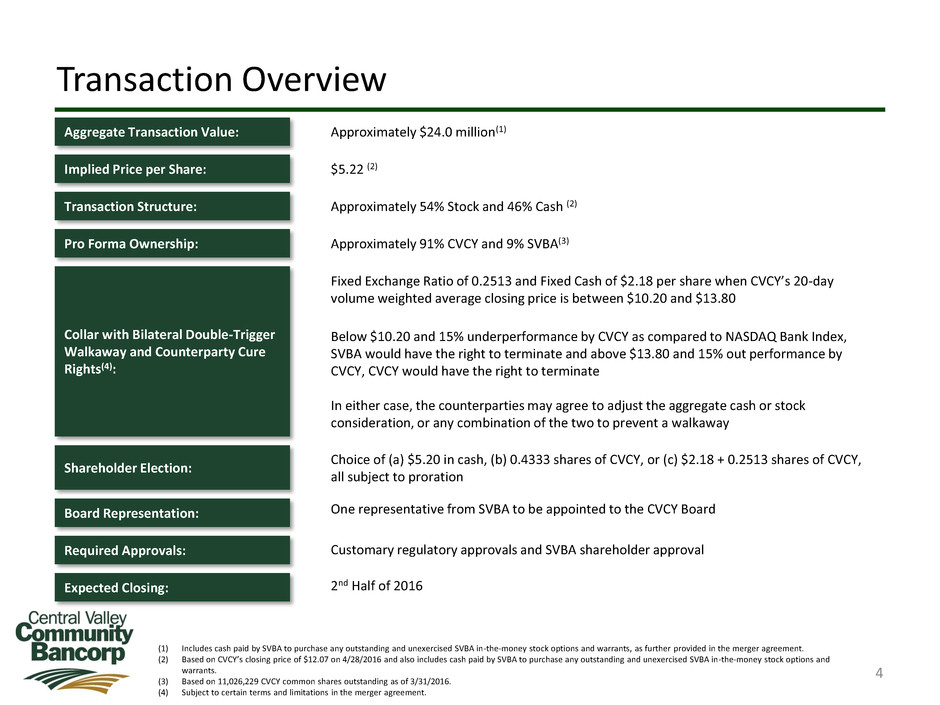

Transaction Overview 4 (1) Includes cash paid by SVBA to purchase any outstanding and unexercised SVBA in-the-money stock options and warrants, as further provided in the merger agreement. (2) Based on CVCY’s closing price of $12.07 on 4/28/2016 and also includes cash paid by SVBA to purchase any outstanding and unexercised SVBA in-the-money stock options and warrants. (3) Based on 11,026,229 CVCY common shares outstanding as of 3/31/2016. (4) Subject to certain terms and limitations in the merger agreement. Aggregate Transaction Value: Implied Price per Share: Transaction Structure: Required Approvals: Expected Closing: Approximately $24.0 million(1) $5.22 (2) Approximately 54% Stock and 46% Cash (2) Customary regulatory approvals and SVBA shareholder approval 2nd Half of 2016 Pro Forma Ownership: Collar with Bilateral Double-Trigger Walkaway and Counterparty Cure Rights(4): Board Representation: Fixed Exchange Ratio of 0.2513 and Fixed Cash of $2.18 per share when CVCY’s 20-day volume weighted average closing price is between $10.20 and $13.80 Below $10.20 and 15% underperformance by CVCY as compared to NASDAQ Bank Index, SVBA would have the right to terminate and above $13.80 and 15% out performance by CVCY, CVCY would have the right to terminate In either case, the counterparties may agree to adjust the aggregate cash or stock consideration, or any combination of the two to prevent a walkaway One representative from SVBA to be appointed to the CVCY Board Approximately 91% CVCY and 9% SVBA(3) Shareholder Election: Choice of (a) $5.20 in cash, (b) 0.4333 shares of CVCY, or (c) $2.18 + 0.2513 shares of CVCY, all subject to proration

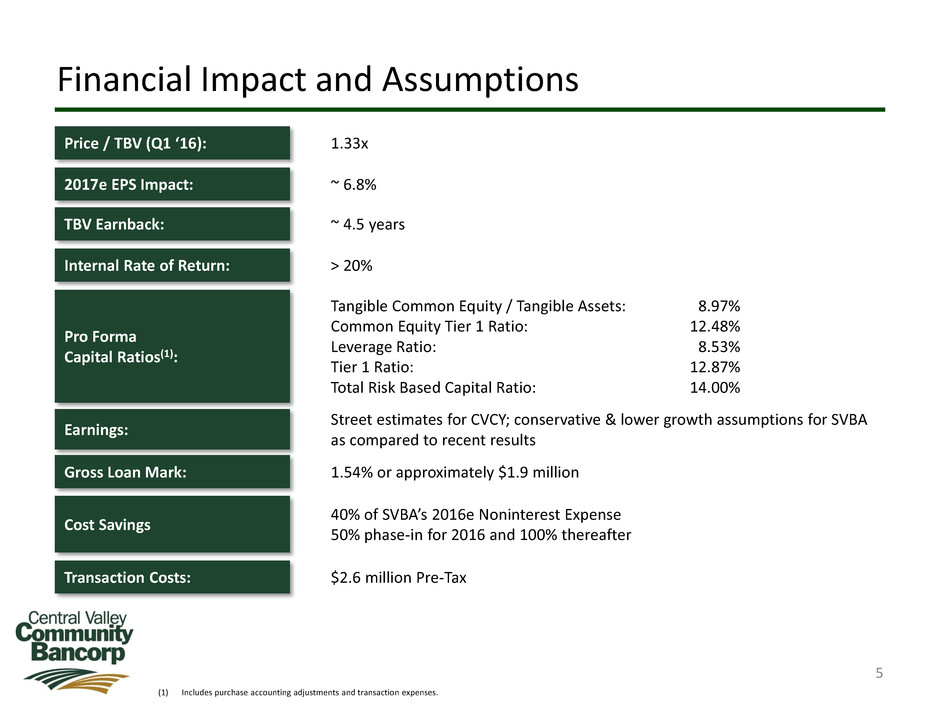

Financial Impact and Assumptions 5 (1) Includes purchase accounting adjustments and transaction expenses. Price / TBV (Q1 ‘16): 2017e EPS Impact: TBV Earnback: Internal Rate of Return: 1.33x ~ 6.8% ~ 4.5 years > 20% Pro Forma Capital Ratios(1): Gross Loan Mark: Cost Savings Earnings: Tangible Common Equity / Tangible Assets: 8.97% Common Equity Tier 1 Ratio: 12.48% Leverage Ratio: 8.53% Tier 1 Ratio: 12.87% Total Risk Based Capital Ratio: 14.00% 1.54% or approximately $1.9 million 40% of SVBA’s 2016e Noninterest Expense 50% phase-in for 2016 and 100% thereafter Street estimates for CVCY; conservative & lower growth assumptions for SVBA as compared to recent results Transaction Costs: $2.6 million Pre-Tax

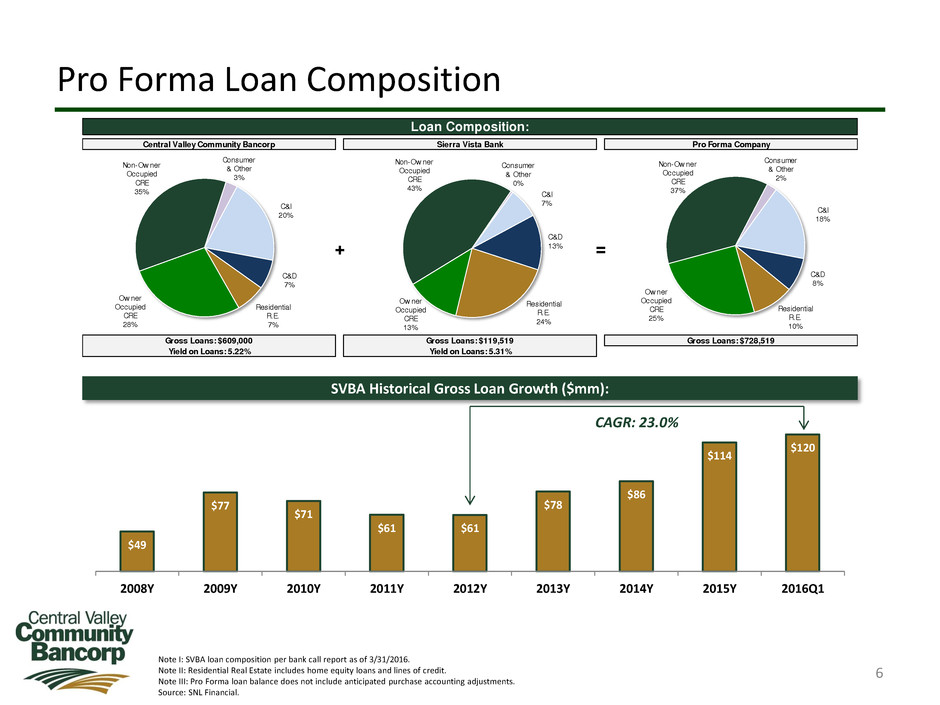

Pro Forma Loan Composition 6 Note I: SVBA loan composition per bank call report as of 3/31/2016. Note II: Residential Real Estate includes home equity loans and lines of credit. Note III: Pro Forma loan balance does not include anticipated purchase accounting adjustments. Source: SNL Financial. $49 $77 $71 $61 $61 $78 $86 $114 $120 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Q1 CAGR: 23.0% SVBA Historical Gross Loan Growth ($mm): + = Loan Composition: Central Valley Community Bancorp Sierra Vista Bank Pro Forma Company Gross Loans: $609,000 Yield on Loans: 5.22% Gross Loans: $119,519 Yield on Loans: 5.31% Gross Loans: $728,519 C&I 20% C&D 7% Residential R.E. 7% Ow ner Occupied CRE 28% Non-Ow ner Occupied CRE 35% Consumer & Other 3% C&I 7% C&D 13% Residential R.E. 24% Ow ner Occupied CRE 13% Non-Ow ner Occupied CRE 43% Consumer & Other 0% C&I 18% C&D 8% Residential R.E. 10% Ow ner Occupied CRE 25% Non-Ow ner Occupied CRE 37% Consumer & Other 2%

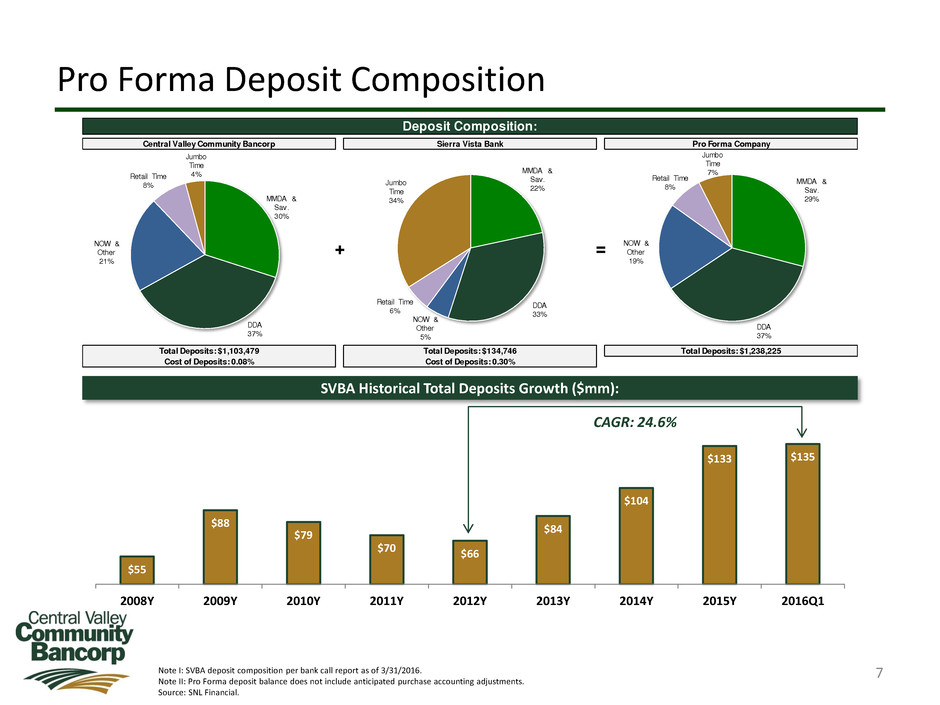

Pro Forma Deposit Composition 7 Note I: SVBA deposit composition per bank call report as of 3/31/2016. Note II: Pro Forma deposit balance does not include anticipated purchase accounting adjustments. Source: SNL Financial. $55 $88 $79 $70 $66 $84 $104 $133 $135 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Q1 CAGR: 24.6% SVBA Historical Total Deposits Growth ($mm): + = Deposit Composition: Central Valley Community Bancorp Sierra Vista Bank Pro Forma Company Total Deposits: $1,238,225Total Deposits: $1,103,479 Cost of Deposits: 0.08% Total Deposits: $134,746 Cost of Deposits: .30% MMDA & Sav. 30% DDA 37% NOW & Other 21% Retail Time 8% Jumbo Time 4% MMDA & Sav. 22% DDA 33% NOW & Other 5% Retail Time 6% Jumbo Time 34% MMDA & Sav. 29% DDA 37% NOW & Other 19% Retail Time 8% Jumbo Time 7%