Attached files

| file | filename |

|---|---|

| EX-31.1 - PRINCIPAL EXECUTIVE OFFICER CERTIFICATION - Tumi Holdings, Inc. | exhibit311.htm |

| EX-31.2 - PRINCIPAL FINANCIAL OFFICER CERTIFICATION - Tumi Holdings, Inc. | exhibit312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________

FORM 10-K/A

(Amendment No.1)

_______________________________________________________

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35495

_______________________________________________________

Tumi Holdings, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________

Delaware | 04-3799139 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1001 Durham Ave., South Plainfield, NJ | 07080 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (908) 756-4400

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.01 Par Value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

_______________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the outstanding shares of common stock held by non-affiliates of Tumi Holdings, Inc. at June 28, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was $1,223,970,905 based on the closing price on the New York Stock Exchange on that date. For purposes of the foregoing calculation only, all directors and officers of the registrant and persons or entities that control, are controlled by, or are under common control of the registrant have been deemed affiliates.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | February 25, 2016 | |

Common Stock, $0.01 Par Value | 67,394,756 shares | |

EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the U.S. Securities and Exchange Commission (“SEC”) on February 25, 2016 (the “Original Filing”), solely for the purpose of including the information required by Part III (Items 10, 11, 12, 13 and 14) of the Original Filing that was previously omitted from the Original Filing.

General Instruction G(3) to Form 10-K allows such omitted information to be filed as an amendment to the Annual Report on Form 10-K or incorporated by reference from the Company’s definitive proxy statement which involves the election of directors not later than 120 days after the end of the fiscal year covered by the Annual Report on Form 10-K. Because the Company’s definitive proxy statement for the next annual meeting of stockholders will not be filed with the SEC within 120 days of the end of the fiscal year ended December 31, 2015 , the information required by Part III of Form 10-K cannot be incorporated by reference and, therefore, must be filed as an amendment to the Original Filing.

Except as described above, no other information in the Original Filing is being modified or amended by this Amendment, and unless indicated otherwise, this Amendment does not reflect events occurring after February 25, 2016, which is the filing date of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and our filings made with the SEC on or subsequent to February 25, 2016. Unless otherwise stated, all information set forth in this Amendment is as of April 25, 2016. The Original Filing and this Amendment are referred to collectively herein as the “Annual Report.”

3

TABLE OF CONTENTS

PART III. | |

PART IV. | |

4

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Executive Officers and Directors

The following table sets forth information with respect to our current executive officers and directors. There are no family relationships among any of our executive officers or directors.

Name | Age | Position(s) | |||

Jerome S. Griffith | 58 | Chief Executive Officer and President, and Director | |||

Michael J. Mardy | 67 | Chief Financial Officer and Executive Vice President, and Director | |||

Peter L. Gray | 48 | Executive Vice President, General Counsel and Secretary | |||

Steven M. Hurwitz | 59 | Senior Vice President—Product Development, Manufacturing and Sourcing | |||

David J. Riley | 45 | Chief Accounting Officer and Senior Vice President, Finance | |||

Claire M. Bennett | 50 | Director | |||

Christopher J.L. Fielding | 34 | Director | |||

Joseph R. Gromek | 69 | Non-Executive Chairman of the Board | |||

Thomas H. Johnson | 66 | Director | |||

Alexander W. Smith | 63 | Director | |||

Biographical and certain other information concerning our executive officers and directors is set forth below:

Jerome S. Griffith has served as our Chief Executive Officer and President and as a director since April 2009. From 2002 to February 2009, he was employed at Esprit Holdings Limited, a global fashion brand, where he was promoted to Chief Operating Officer and appointed to the Board in 2004, then promoted to President of Esprit North and South America in 2006. From 1999 to 2002, he worked as an executive vice president at Tommy Hilfiger, an apparel and retail company. From 1998 to 1999, he worked as the president of retail at the J. Peterman Company, a catalog-based apparel and retail company. From 1989 through 1998, he worked in various positions at Gap, Inc., a retailer of clothing, accessories, and personal care products. Mr. Griffith is a member of the Board of Directors of Vince Holdings, Inc., an apparel company and a member of the Supervisory Board of the Tom Tailor Group, an apparel company.

Mr. Griffith’s qualifications to serve on our Board include the experience described above, including his experience as a senior executive of a major global consumer products company and his proven track record of innovation and driving international growth and expansion.

Michael J. Mardy has served as our Chief Financial Officer and Executive Vice President since July 2003 and a director since November 2011. Prior to joining Tumi, from 1996 to 2002, he served as Executive Vice President, Finance and Administration of Keystone Foods LLC, a processor and distributor. From 1982 to 1996, he served as Senior Vice President, Chief Financial Officer and in various other finance positions at Nabisco Biscuit Company, a snack food and consumer products company. Mr. Mardy previously served on the Board of Directors of Keurig Green Mountain, Inc. Mr. Mardy serves on the Board of Trustees of the Eden Institute for Autism.

Mr. Mardy’s qualifications to serve on our Board include his extensive financial and accounting expertise (including his membership in the American Institute of Certified Public Accountants and the Financial Executive Institute), the experience he has gained through service on the board of other public companies, his consumer products experience in prior management positions and his overall leadership skills as a senior executive.

Peter L. Gray has served as our Executive Vice President, General Counsel and Secretary since December 2013. Mr. Gray was employed by ModusLink Global Solutions, Inc. (formerly CMGI, Inc.), a supply chain business process management company, from June 1999 to October 2013. Beginning in March 2002, he was ModusLink’s Executive Vice President and General Counsel, additionally becoming its Secretary in December 2005 and its Chief Administrative Officer in June 2012. Prior to joining ModusLink, Mr. Gray was Assistant General Counsel at Cambridge Technology Partners (Massachusetts), Inc., and a junior partner at Hale and Dorr LLP.

5

Steven M. Hurwitz has served as our Senior Vice President-Product Development, Manufacturing and Sourcing since 2006 and is responsible for managing our global supply chain. Prior to joining Tumi, from 1982 to 2000 and 2004 to 2006, Mr. Hurwitz served in various positions, including Vice President, Group Manufacturing-Accessories, at Liz Claiborne, Inc., a retailer of apparel and accessories. From 2002 to 2004, he was President-Accessories Division of the Betesh Group, a designer and manufacturer of accessories, bedding and electronic storage products. Prior to joining Betesh Group, Mr. Hurwitz was President-Ladies Group at Amerex Apparel Group, Inc., a designer and manufacturer of outerwear and sportswear.

David J. Riley has served as Chief Accounting Officer since February 2015, and as Senior Vice President, Finance since July 2014. Mr. Riley was Chief Executive Officer of The Gladius Group, Inc., a professional services firm specializing in chief financial officer and executive services, from November 2012 to June 2014. From 2000 to July 2012, Mr. Riley was employed in various financial and executive capacities by ModusLink Global Solutions, Inc. (formerly CMGI, Inc.), a supply chain business process management company, where his positions included Vice President, Finance, from April 2003 to June 2006, Chief Financial Officer from June 2006 to April 2007, Executive Vice President, Corporate Development from May 2007 to July 2012, and Business Unit President and CEO of Tech for Less, LLC (a subsidiary of ModusLink) from February 2011 to November 2011. Mr. Riley began his career with the accounting firm, Ernst & Young, LLP, and he is a Certified Public Accountant.

Claire M. Bennett has been a director since January 2013. Ms. Bennett has been Executive Vice President, Global Travel & Lifestyle Services of American Express Company, a global service company that provides charge and credit payment card products and travel-related services, from February 2012 to the present. Prior to her current position, Ms. Bennett served as Senior Vice President, Global Advertising and Brand Management for American Express then Executive Vice President of Cardmember Benefits, as well as General Manager of U.S. Consumer Travel Network for American Express. Before joining American Express in 2006, Ms. Bennett held various marketing and general management positions with Dell Inc. Prior to joining Dell, Ms. Bennett held various positions in brand management, strategic planning, and finance/accounting at The Quaker Oats Company (now PepsiCo, Inc.). Ms. Bennett was previously a member of the Board of Directors of Vente Privée USA, a joint venture members-only shopping destination in partnership with American Express. She is a current member of several travel industry and partner advisory boards, including The World Travel and Tourism Council Ms. Bennett was previously a member of the Board of Directors of Pong Research Corporation, a mobile device technology company and a member of the Association of National Advertisers, a non-profit organization.

Ms. Bennett was appointed to serve on our Board of Directors because of her more than 20 years of marketing and finance experience.

Christopher J.L. Fielding has been a director since December 2013. He is a Partner of Charme Capital Partners which he joined in September 2015 with a focus on European private equity investment. Previously, from September 2006 to September 2015, he was a Principal of Doughty Hanson & Co. Managers Limited (“Doughty Hanson”). Before joining Doughty Hanson, Mr. Fielding worked in the London office of Citigroup on mergers, acquisitions, and securities offerings. He also served in the British Army as a platoon commander in the Grenadier Guards. Mr. Fielding has a degree in Classics from Oxford University.

Mr. Fielding was elected to serve on our Board because of his affiliation with Doughty Hanson, his financial expertise and his experience working with companies controlled by private equity sponsors. Mr. Fielding serves as a director pursuant to a director nomination agreement among the Company and certain funds managed by Doughty Hanson.

Joseph R. Gromek has been a director since April 2012 and was appointed non-executive Chairman in December 2013. From April 2003 to February 2012, Mr. Gromek served as President and Chief Executive Officer and as a director of The Warnaco Group, Inc., a global apparel company. From 1996 to 2002, Mr. Gromek served as President and Chief Executive Officer of Brooks Brothers, Inc., a clothing retailer. Over the last 25 years, Mr. Gromek has held senior management positions with Saks Fifth Avenue, Limited Brands, Inc. and AnnTaylor Stores Corporation. Mr. Gromek is a member of the Board of Directors of Wolverine World Wide, Inc., a footwear and apparel company, The Children’s Place Retail Stores, Inc., a children’s specialty apparel retailer and Guess?, Inc., a global apparel and accessories company. Mr. Gromek also serves on the Board of Directors of Ronald McDonald House, Stanley M. Proctor Company and J. McLaughlin, as a member of the Board of Governors of the Parsons School of Design, as a member of the Board of Trustees of the Trevor Day School and as Chairman of the Board of the New School. He was previously a member of the Advisory Board of the Fashion Institute of Technology.

Mr. Gromek was elected to serve on our Board of Directors because of his extensive experience and strong track record as an executive in the retail industry and his public board governance experience.

6

Thomas H. Johnson has been a director since April 2012. Mr. Johnson has been Managing Partner of THJ Investments, L.P., a private investment firm, from November 2005 to the present. Since 2008, he has also served as Chief Executive Officer of The Taffrail Group, LLC, a private strategic advisory firm. Mr. Johnson served as Chairman and Chief Executive Officer of Chesapeake Corporation, a specialty packaging manufacturer, from August 1997 to November 2005. From 1989 until 1997, Mr. Johnson served as President and Chief Executive Officer of Riverwood International, an integrated packaging and forest products company. From 1976 to 1989, Mr. Johnson served in various leadership positions with Mead Corporation, a paper products company, including President, Paperboard Division; President, Coated Board Division; Director, Strategic Planning and Corporate Development; and as an executive of Mead Consumer Products Division. Mr. Johnson has served as a director of GenOn Energy, Inc., a wholesale generator of electricity, and is currently a director of Coca-Cola Enterprises, Inc., an independent Coca-Cola bottler and distributor of bottle and can refreshments, with operations primarily in Europe, and Universal Corporation, a leaf tobacco merchant and processor.

Mr. Johnson was elected to serve on our Board of Directors because of his extensive international management experience. Mr. Johnson’s service on the boards and audit committees of other public companies also provides our Board with financial, operational and strategic expertise.

Alexander W. Smith has been a director since December 2013. Since joining Pier 1 Imports in February 2007, he has served as its President and Chief Executive Officer and on its Board of Directors. Mr. Smith has over 30 years of retail and international branding experience. Prior to joining Pier 1 Imports, Mr. Smith served as Group President of the TJX Companies, Inc., where he oversaw the operations and development of Home Goods, Marshalls, and TJ Maxx plus a number of corporate functions. He was instrumental in the development of the TK Maxx stores in Great Britain and oversaw international operations. From 2007 to 2011, Mr. Smith also served as a director of Papa John’s International, Inc., including as chairman of its compensation committee and as a member of its audit committee. He has a bachelor’s degree in biological sciences from the University of East Anglia.

Mr. Smith was elected to serve on our Board because of the depth of his experience in the fields of international retailing operations and brand management, and because of his public company experience as an executive and director.

Certain Arrangements

In connection with our April 2012 initial public offering (“IPO”), we entered into a director nomination agreement with Doughty Hanson & Co IV Nominees One Limited, Doughty Hanson & Co IV Nominees Two Limited, Doughty Hanson & Co IV Nominees Three Limited, Doughty Hanson & Co IV Nominees Four Limited and Officers Nominees Limited or, together with their permitted transferees, the Doughty Hanson Funds, that provides for the right of the Doughty Hanson Funds to nominate individuals to our Board of Directors. So long as the Doughty Hanson Funds own 10% or more of our outstanding common stock, the Doughty Hanson Funds will have the right (but not have the obligation) to nominate two individuals to our Board of Directors, and so long as the Doughty Hanson Funds own 3% or more but less than 10% of our outstanding common stock, the Doughty Hanson Funds have the right (but not have the obligation) to nominate one individual to our Board of Directors. Subject to limited exceptions, we will include these nominees in the slate of nominees recommended to our stockholders for election as directors. In the event the Doughty Hanson Funds have nominated less than the total number of designees that the Doughty Hanson Funds are entitled to nominate pursuant to the director nomination agreement, then the Doughty Hanson Funds have the right, at any time, to nominate such additional designee(s) to which it is entitled, in which case, the members of our Board of Directors will take all necessary corporate action to increase the size of our Board as required to enable the Doughty Hanson Funds to so nominate such additional designees and designate such additional designees nominated by the Doughty Hanson Funds to fill such newly created vacancies. As of March 21, 2016, the Doughty Hanson Funds owned 13.4% of our outstanding common stock. Christopher J. L. Fielding was appointed to the Board effective December 9, 2013 as a Doughty Hanson Funds nominee under the nomination agreement and remains a Doughty Hanson nominee.

Pursuant to our employment agreement with Mr. Griffith, originally entered into on December 22, 2008, and amended and restated on March 11, 2015, we agreed to nominate Mr. Griffith to our Board of Directors.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Our Audit Committee assists our Board of Directors in its oversight of the integrity of our financial statements, our independent registered public accounting firm’s qualifications and independence and the performance of our independent registered public accounting firm. The Audit Committee: reviews the audit plans and findings of our independent registered public accounting firm and our internal audit and risk review staff, as

7

well as the results of regulatory examinations, and tracks management’s corrective action plans where necessary; reviews our financial statements, including any significant financial items and changes in accounting policies, with our senior management and independent registered public accounting firm; reviews our financial risk and control procedures, compliance programs and significant tax, legal and regulatory matters; and has the sole discretion to appoint annually our independent registered public accounting firm, evaluate its independence and performance and set clear hiring policies for employees or former employees of the independent registered public accounting firm.

The Audit Committee held six meetings during 2015. Our Audit Committee is currently composed of three members, Ms. Bennett, Mr. Johnson (chairperson) and Mr. Smith. Our Board of Directors has determined that Mr. Johnson is qualified as an “audit committee financial expert” within the meaning of SEC regulations. All of the members of the Audit Committee are financially literate and have accounting or related financial management expertise within the meaning of the NYSE rules. Our Board of Directors has determined that Ms. Bennett and Messrs. Johnson and Smith meet the definition of an “independent” director under each of the NYSE listing standards and Rule 10A-3 of the Exchange Act.

Compensation Committee

Our Compensation Committee reviews and recommends policies relating to compensation and benefits of our officers and employees. The Compensation Committee reviews and approves corporate goals and objectives relevant to compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives, and recommends the compensation of these officers based on such evaluations. The Compensation Committee also administers the issuance of stock options and other awards under our equity compensation plans and prepares the Compensation Committee report required by SEC rules to be included in our annual report or proxy statement. The current members of our Compensation Committee are Mr. Fielding, Mr. Gromek (chairperson) and Mr. Johnson, each of whom qualifies as an “independent” director as defined under the applicable rules and regulations of the SEC and the NYSE.

The Compensation Committee held seven meetings during 2015.

To the extent permitted by applicable law and the provisions of the 2012 Long-Term Incentive Plan, as amended, on an annual basis the Compensation Committee approves a pool of shares (expressed as a dollar value amount) with respect to which it delegates authority to Mr. Griffith and Mr. Mardy to grant stock options and restricted stock units to non-executive employees within certain limits, including a prohibition on making grants to direct reports and per person limits, which authority is generally used to facilitate making new hire grants and to recognize promotions or reward special accomplishments and achievements. The Compensation Committee also approves a pool of shares (expressed as a dollar value amount) for annual grants of stock options and restricted stock units to non-executive employees, and thereafter Mr. Griffith and Mr. Mardy are authorized to determine the amounts and recipients of the annual awards (which are made on the third trading day after the public release of annual financial results), subject to certain limitations established by the Compensation Committee. With respect to restricted stock unit awards, Mr. Griffith and Mr. Mardy act as the members of the Restricted Stock and Restricted Stock Unit Committee of the Board of Directors, to which this authority is delegated.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for making recommendations to our Board of Directors regarding candidates for directorships and the size and composition of our Board. In addition, the Nominating and Corporate Governance Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to our Board concerning governance matters. The current members of our Nominating and Corporate Governance Committee are Ms. Bennett, Mr. Gromek and Mr. Smith (chairperson), each of whom qualifies as an “independent” director as defined under the applicable rules and regulations of the SEC and the NYSE.

The Nominating and Corporate Governance Committee held four meetings during 2015.

Stockholder Nominations

During the fourth quarter of fiscal year 2015, we made no material changes to the procedures by which stockholders may recommend nominees to our Board of Directors, as described in our most recent proxy statement.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act, requires our directors and executive officers and persons who own more than 10% of the issued and outstanding shares of our common stock to file reports of initial ownership of common stock and other equity securities and subsequent changes in that ownership with the SEC and the NYSE. Based solely on a review of such reports and

8

written representations from the directors and executive officers, the Company believes that all such filing requirements were met during 2015.

Corporate Governance Guidelines, Code of Business Conduct and Code of Ethics

Our Board of Directors has adopted Corporate Governance Guidelines, which set forth a governance framework within which our Board of Directors, assisted by committees thereof, directs the affairs of the Company. The Corporate Governance Guidelines address, among other things, the composition and functions of the Board of Directors, director independence, compensation of directors, management succession and review, committees of the Board of Directors and selection of new directors.

We have a Code of Business Conduct and Ethics, which is applicable to all employees of the Company. We have a separate Code of Ethics for Principal Executive and Senior Financial Officers, which contains provisions specifically applicable to our principal executive officer, principal financial officer, principal accounting officer and controller (or persons performing similar functions).

The Corporate Governance Guidelines, the Code of Business Conduct and Ethics and the Code of Ethics for Principal Executive and Senior Financial Officers are available on the Investor Relations page of our website (www.tumi.com). Any amendments to these codes, or any waivers of their requirements, will be disclosed on our website. Information on, or accessible through, our website is not part of this Annual Report.

9

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

In administering 2015 compensation and evaluating the named executive officers and their performance, the Board of Directors and Compensation Committee considered the financial and nonfinancial dynamics of operating in the global and premium retail industry, the importance of rewarding and retaining talented, experienced executive officers to continue to guide the Company, and the alignment of executive compensation programs with stockholders’ interests.

2015 Financial Performance

• | Net sales increased 4% to $548 million in 2015 (or 7% to $563 million on a constant currency basis*) from $527 million in 2014. | |

• | Gross profit increased 7% to $327 million in 2015 from $306 million in 2014. | |

• | Operating income increased 4% to $96.9 million in 2015 (or 8% to $101 million on a constant currency basis*) from $93.4 million in 2014. | |

2015 Nonfinancial Performance

• | Continued to expand our global presence. | |

• | Broadened our product base with women’s and accessories, out fastest growing segments. | |

• | Redesigned and launched our new website, www.tumi.com. | |

• | Bolstered our standing as a global premium travel lifestyle brand. | |

• | Demonstrated broad-based growth, stemming from our industry-leading product innovation, impactful marketing programs, channel penetration, and growth in existing and new markets. | |

Stockholder Alignment

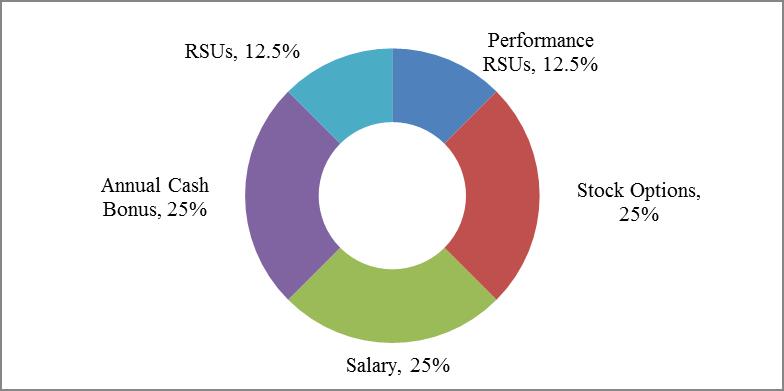

• | Stockholder alignment was supported and motivated by Tumi's strong equity mix in the compensation of the CEO and other Tumi executives. | |

• | Tumi's CEO alignment with stockholders is reinforced by the CEO's stock ownership levels, as shown on the Beneficial Ownership table included in this Proxy Statement, and pay mix, depicted below, through which 62.5% is performance-based and 50% is equity-based. | |

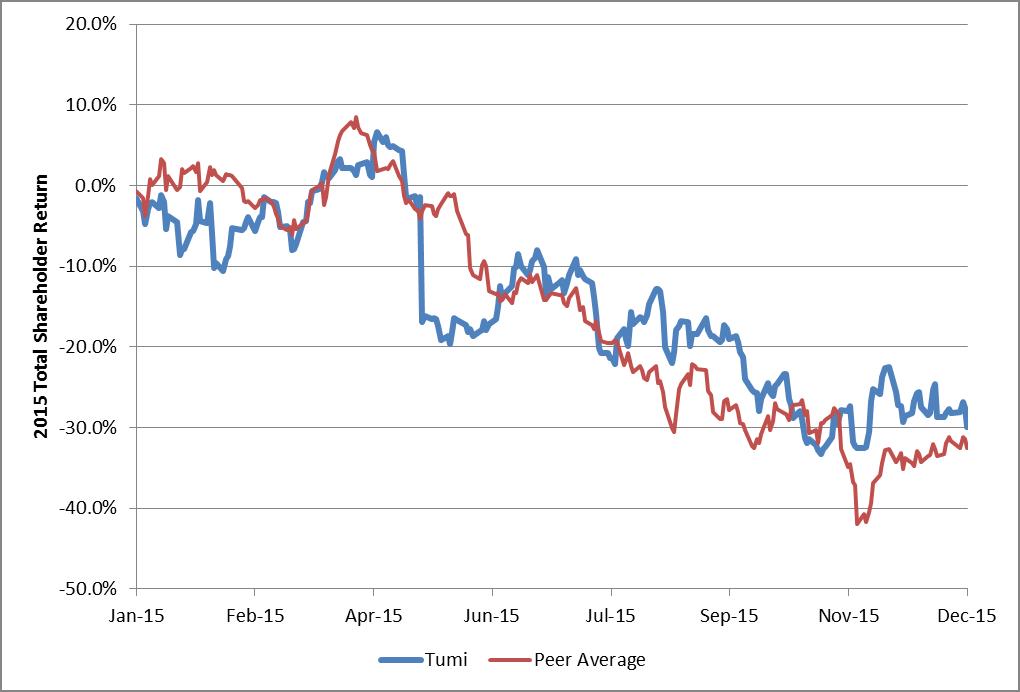

• | Tumi's 2015 total shareholder return ("TSR") (-29.9%) is closely aligned with the median TSR of Tumi’s peers (-30.3%). As illustrated in the graph below, Tumi’s 2015 TSR is highly correlated with its peers, which suggests the macroeconomic factors impacting Tumi’s performance in 2015 had a similar impact on our peers. | |

• | Over a three-year period, Tumi’s TSR (-7.3%), is also closely aligned with the median of Tumi’s peers (-8.0%) measured over the same period. | |

_____________________

* See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation— Key Performance Indicators" in the Original Filing for a discussion of "constant currency" performance measures and reconciliation to the closest GAAP measures.

10

Pay for Performance Alignment

• | Tumi set challenging annual incentive goals in 2015. Despite achieving record profit levels, the annual cash bonus paid out at 49% of target. | |

• | Tumi's commitment to pay for performance alignment begins with the CEO, whose 2015 target total direct compensation included 62.5% pay at risk. Other than salary and time-based restricted stock units (RSUs), all other 2015 compensation components were at risk: annual cash bonus, stock options, and performance-based restricted stock units (PRSUs). | |

CEO Pay Mix

11

• | The 2015 total compensation for the other named executive officers covered in this document also has a strong emphasis on equity: | |

Type of Compensation | % of Target Compensation |

Base Salary | 45% to 49% |

Annual Cash Bonus | 19% to 23% |

Stock Options | 15% to 17% |

Performance-based RSUs | 7% to 8% |

Time-based RSUs | 7% to 8% |

Investor Support

• | At its annual meeting held in May 2015 (the "2015 Annual Meeting") 98% of the shares present and voting approved the compensation of the named executive officers on an advisory basis, known as “say on pay.” | |

Overview

The following Compensation Discussion and Analysis (“CD&A”) provides information regarding the objectives and components of our compensation philosophy, policies and practices with respect to the compensation of our named executive officers. Our named executive officers for the year ended December 31, 2015 were:

• | Jerome S. Griffith, Chief Executive Officer and President; | |

• | Michael J. Mardy, Chief Financial Officer and Executive Vice President; | |

• | Steven M. Hurwitz, Senior Vice President—Product Development, Manufacturing and Sourcing; | |

• | Peter L. Gray, Executive Vice President, General Counsel and Secretary; | |

• | Adam Levy, Former President, Retail; and | |

• | David J. Riley, Senior Vice President, Finance and Chief Accounting Officer | |

The Compensation Committee of our Board of Directors (the “Compensation Committee”) has overall responsibility for the compensation program for our named executive officers. Members of the Compensation Committee are appointed by our Board of Directors, and our Compensation Committee consists entirely of independent directors, as defined under the applicable rules and regulations of the SEC, the NYSE and the Internal Revenue Service. Procedurally, the Compensation Committee reviews all matters of executive compensation and recommends such matters for approval by all of the independent members of the Board of Directors who are both “non-employee directors” for the purposes of Section 16 under the Exchange Act and “outside directors” for purposes of Section 162(m) of the Internal Revenue Code. All references in this CD&A to the Board of Directors refer to such independent members of the Board.

12

Key 2015 Compensation Activities

• | Reviewed executive pay benchmarking against peer group, where data was available, and retail industry for each of the named executive officers and concluded that compensation approximated the median for the group as a whole. | ||

• | Established and reviewed peer group incentive design characteristics. | ||

• | The 2015 bonus plan, consistent with the design implemented in 2014, was based on pre-established financial metrics, namely operating income and net revenue growth, with specific threshold, target, and stretch goals established for each metric. | ||

• | The 2015 long-term incentive vehicles were stock options, performance-based restricted stock units and, as a new feature for 2015, time-based restricted stock units. The performance-based restricted stock unit design, as discussed below, measures a pre-established metric over a multi-year period against specific threshold, target, and stretch goals. | ||

• | Both the bonus plan and long-term incentives were designed and established to align stockholders’ and management’s interest, and to provide retentive value. | ||

• | Modified employment and change in control agreements. Key changes made include: | ||

○ | Removing the 280G gross-up provision from the Chief Executive Officer's employment agreement. | ||

○ | Enhancing severance provisions for the named executive officers, in line with market practices, in the event of termination before and after a change in control. | ||

All of the modifications are discussed in more detail under “Employment Arrangements with Named Executive Officers” and “Potential Payment upon Termination or Change in Control" elsewhere in this Annual Report.

• | Adopted stock ownership guidelines including: | ||

○ | Six times base salary for Chief Executive Officer | ||

○ | Three times base salary for Chief Financial Officer | ||

○ | One and one half times base salary for other executive officers, including the named executive officers | ||

○ | Three times annual cash retainer for non-employee members of the Board of Directors | ||

We strive to follow best practices in our executive compensation program. Key features of this program are set forth below:

What We Do | ||

Ÿ | We pay for performance | |

Ÿ | We consider peer groups in establishing compensation | |

Ÿ | We schedule and price stock option and restricted stock unit grants to promote transparency and consistency | |

Ÿ | We have double-trigger equity vesting in the event of a change in control | |

Ÿ | We have a conservative compensation risk profile | |

Ÿ | We retain an independent compensation consultant | |

What We Don’t Do | ||

Ÿ | We do not pay dividend equivalents on stock options or performance shares | |

Ÿ | We do not allow share recycling | |

Ÿ | We do not allow repricing underwater stock options (including cash outs) | |

Ÿ | We do not allow hedging, pledging or short sales of Company stock | |

Ÿ | We do not allow our shares to be held in margin accounts | |

Ÿ | We do not pay tax gross-ups | |

13

Compensation Philosophy and Objectives

Tumi’s compensation philosophy is to provide competitive salaries and incentives to achieve superior financial performance. Our executive compensation program is designed to meet the following objectives:

• | Attract and retain executive officers who contribute to our success; | |

• | Align compensation with our business mission, strategy and goals; | |

• | Align the interests of our executive officers with the interests of our stockholders; and | |

• | Motivate and reward high levels of performance. | |

These objectives collectively seek to link compensation to our overall financial performance, which helps to ensure that the interests of our named executive officers are aligned with the interests of our stockholders. These objectives serve as guiding principles in our compensation program design.

Components of Executive Compensation

The principal components of compensation for our named executive officers for 2015 consisted of base salary, an annual cash bonus, long-term incentive compensation and other benefits, as further described in the table below:

Pay Element | What the Pay Element Rewards | Purpose of the Pay Element |

Base Salary | Core responsibilities, years of service with the Company and experience in similar positions at other companies | Provide a regular and stable source of income to named executive officers |

Annual Cash Bonus | The Company achieving specific corporate business objectives over which the named executive officers have reasonable control or influence | Focus named executive officers on specific annual goals that contribute to the Company's long-term success Provide annual performance-based cash compensation Align participants on important annual performance metrics |

Long-term Incentive Compensation | Focusing on long-term corporate business objectives Focusing on driving long-term stockholder value Continuing employment with the Company during the vesting period | More closely align named executive officers' interests with stockholders' interests Reward named executive officers for building stockholder value Encourage long-term investment in the Company and strategy development by the named executive officers Retain named executive officers |

Other Benefits | In the case of health and welfare benefits that are offered to all full-time employees, providing support to named executive officers and their families throughout various stages of their careers with the Company Core responsibilities, years of service with the Company and experience in similar positions at other companies | Attract and retain named executive officers with appropriate health and welfare benefits Limited perquisites to convey additional value in connection with performing job duties |

Determining the Amount of Each Component of Compensation

Overview

The amount of each component of our compensation program is determined on an annual basis by our Board of Directors, after receiving a recommendation by the Compensation Committee, taking into consideration compensation programs of comparable companies and the competitive market for our named executive officers and general economic factors. In 2015, as in prior years, our approach has been to provide named executive officers with a base salary and an annual cash bonus opportunity and long-term incentive compensation that were generally competitive with the level of those elements paid for comparable positions at comparable companies.

14

After the year is over, our Compensation Committee reviews the performance of the named executive officers to determine the achievement of annual incentive compensation targets and to assess the overall functioning of our compensation plans against our goals.

Base salary

Our Compensation Committee reviews our named executive officers’ base salaries on an annual basis taking into consideration each individual’s responsibilities and experience, market and peer compensation levels and other discretionary factors deemed relevant by our Compensation Committee. Such other factors may include material changes in position or responsibilities, prior performance, overall corporate performance and competitive marketplace for executive talent. The Compensation Committee recommends any base salary adjustments to the Board of Directors for approval.

We believe our base salaries are set at levels that allow us to attract and retain executives in competitive markets. The level of base pay for each named executive officer in 2015 was determined with the goal of setting compensation for our named executive officers at approximately the 50th percentile relative to survey data. Base salary is evaluated at the beginning of the year, and if any changes are deemed appropriate, the adjustments are typically made at the mid-point of the year. Effective July 1, 2015, the salaries of our named executive officers were increased by approximately 3%, in light of the Compensation Committee’s review of benchmarking data (as discussed below) and general market conditions, as reviewed in early 2015. Mr. Griffith’s base salary remained unchanged, as the Compensation Committee viewed his base salary as competitive and in line with market and peer data which it had reviewed. Base salaries were, on average, 44% of the total target compensation of the named executive officers as a group (with Mr. Griffith’s salary comprising 25% of his total target compensation).

The base salaries as approved in 2015 (which took effect in July 2015) as compared with base salaries approved in 2014 (which took effect in July 2014) are set forth in the table below.

Name | 2014 Base Salary | 2015 Base Salary |

Jerome S. Griffith | $885,000 | $885,000 |

Michael J. Mardy | $473,800 | $488,014 |

Steven M. Hurwitz | $448,050 | $461,491 |

Peter L. Gray | $402,000 | $414,060 |

Adam Levy(1) | $427,450 | $440,273 |

David J. Riley | $280,000 | $288,400 |

(1) Mr. Levy resigned from the Company, effective September 3, 2015.

Annual cash bonus

Pursuant to the terms of their employment arrangements with us, each of Messrs. Griffith, Mardy, Hurwitz, Gray and Riley are eligible to earn a target annual bonus. For 2015, the target bonus amount for Messrs. Griffith, Mardy, Hurwitz, Gray and Riley was set at 100%, 50%, 45%, 45% and 40%, respectively, of each such individual’s base salary, at target performance. Mr. Levy’s target annual bonus was set at 45%, but due to his resignation he was not eligible to earn any bonus payment. Pursuant to the cash bonus plan, each executive could earn between zero and two times his targeted bonus amount. No minimum bonus payment was guaranteed for any of our named executive officers. The targeted bonus percentages for the named executive officers were unchanged from 2014, with the exception of Mr. Griffith. With respect to Mr. Griffith, the Committee and Board reviewed peer and market data in 2014 and concluded that his compensation was below the median with respect to bonus potential and long-term incentives. Consequently, in light of the competitive data reviewed by the Compensation Committee, Mr. Griffith’s bonus percentage for 2014 was set at 75% with the intent to increase it to 100% in 2015, which action was taken for 2015.

Our annual cash bonus program for 2015 was implemented pursuant to the Tumi Holdings, Inc. 2012 Long-Term Incentive Plan and performance was measured relative to two metrics, operating income and net sales growth. The influence of each metric was weighted, such that 70% of the bonus amount related to operating income and 30% of the bonus amount related to net sales growth. This bonus plan design was consistent with that developed for 2014 and was implemented to encourage management to achieve profitable growth.

Threshold, target and maximum levels of performance were established for each metric. The bonus program contemplated increasing levels of payout for performance at higher levels, with 50% payout relating to the threshold level, 100% payout relating to the target level and 200% payout relating to the maximum level, with a sliding scale between levels. If the threshold performance level was not attained, no bonus was to be paid with respect to such metric.

15

The performance required for the target level for each metric was set relative to the Company’s internal budget and goals for each metric. The threshold level was set at 85% of the target level, and the maximum level was set at 115% of the target level for net sales growth. For operating income, the threshold level was set at the level of performance achieved in 2014, indicating that the component would only begin to be earned when operating income performance equaled the 2014 level. The maximum level for operating income was set at 115% of target. A table summarizing the plan design, metrics, and performance levels, is set forth below:

Weight | Threshold (50% payout) | Target (100% payout) | Maximum (200% payout) | |

Operating Income | 70% | $93.4 million | $105.6 million | $121.4 million |

Net Sales Growth | 30% | $51 million | $60 million | $69 million |

At the time it set the targets, the Board believed that the metrics at the target level were attainable, yet challenging, as $105.6 million of operating income represented a 13% increase over 2014 operating income performance and $60 million of net sales growth represented an 11% increase over 2014 revenue performance.

For 2015, the Company achieved net sales growth of approximately $20.5 million or 4% over the 2014 level, which was below the threshold which had been established. Consequently, no portion of the bonus related to net sales growth was earned or paid.

For 2015, the Company achieved operating income of $96.9 million. In addition, the Compensation Committee and Board of Directors, as permitted by the Company’s 2012 Long-Term Incentive Plan, adjusted the achieved performance level to take into consideration certain unbudgeted business development related expenses incurred during 2015. Giving effect to these adjustments, operating income performance was measured at $98.3 million, which was in excess of the threshold amount, but less than the target amount. Applying a sliding scale between the threshold payment level of 50% and the target payment level of 100%, the operating performance yielded a 70% payout of the operating income metric. After applying the 70% weighting to the operating income performance level, a payout of 49% was earned by the named executive officers pursuant to the cash bonus plan. Neither the Compensation Committee nor the Board exercised any discretion with respect to the bonus amounts, which are set forth below.

____________________

Name | Target Cash Bonus for 2015 | Actual Bonus Earned in 2015 | Actual Bonus Earned as % of Target |

Jerome S. Griffith | $885,000 | $433,791 | 49% |

Michael J. Mardy | $244,007 | $119,602 | 49% |

Steven M. Hurwitz | $207,671 | $101,792 | 49% |

Peter L. Gray | $186,327 | $91,330 | 49% |

Adam Levy(1) | $198,123 | — | —% |

David J. Riley | $115,360 | $56,545 | 49% |

(1) | Mr. Levy resigned from the Company, effective September 3, 2015, and was ineligible to receive a bonus payment. |

Long-term incentive compensation

The Company uses equity awards, both time-based and performance-based, as its long-term incentive compensation vehicles. These are comprised of stock options, time-based restricted stock units (“RSUs”) and performance-based restricted stock units (“PRSUs”). RSUs were introduced into the Company’s compensation design in 2015, in order to provide retentive value. Awards are typically made in the first quarter of the fiscal year, on the third trading day after the release of financial results for the completed prior year, in connection with other annual compensation decisions. Awards may also be given from time to time during the year in recognition of exemplary achievement, promotions or other compensation adjustments.

In accordance with this practice, for 2015, the annual equity awards made to the named executive officers, were awarded and based on the value of the common stock on March 3, 2015, the third trading day after the public release of the Company’s financial results for 2014. The relative value of each of the equity awards, as a percent of total long-term incentive, were 50% stock options, 25% RSUs and 25% PRSUs.

Our Chief Executive Officer makes recommendations with respect to equity awards for each executive officer (other than himself) to the Compensation Committee. Our Board of Directors retains full discretion to set the grant amount. In determining the type and size of an award to an executive officer, our Board of Directors, in consultation with the

16

Compensation Committee, generally considers, among other things:

• | Company and individual performance; | |

• | the executive officer’s current and expected future contributions to the Company; | |

• | the effect of a potential award on total compensation and pay philosophy; and | |

• | internal pay equity relationships. | |

Stock Options

Stock options awarded by the Company in 2015 vest annually in three equal installments on each of the first three anniversaries of the date of grant, subject to continued service and the other terms and conditions set forth in the stock option agreement governing the terms of the grant. Because a financial gain from these options is only possible if the price of our common stock has increased and because these options vest over a three-year period, these grants are intended to encourage our executives to take actions that will increase the value of the Company by aligning the interests of management and stockholders over an extended time frame. The value of the stock option awards to each of the named executive officers in 2015 were as follows: Mr. Griffith - $885,000; Mr. Mardy - $175,000; Mr. Hurwitz - $140,000; Mr. Gray - $140,000; Mr. Levy - $140,000 and Mr. Riley - $100,000. These grant date values were then expressed as a number of stock options based on the Black-Scholes valuation of common stock on March 3, 2015. Each option has an exercise price of $23.25 per share, the closing price of the common stock on the date of grant. The following table sets forth the stock option awards to each of the named executive officers:

________________

Name | Number of Shares Underlying Stock Options |

Jerome S. Griffith | 87,106 |

Michael J. Mardy | 17,224 |

Steven M. Hurwitz | 13,779 |

Peter L. Gray | 13,779 |

Adam Levy(1) | 13,779 |

David J. Riley | 9,842 |

(1) | Award forfeited upon Mr. Levy’s resignation. |

RSUs

As mentioned above, in 2015 the Company modified its mix of equity awards to include a component of RSUs, in order to provide retentive value. The value of the RSU awards to each of the named executive officers were as follows: Mr. Griffith - $442,500, Mr. Mardy - $87,500, Mr. Hurwitz - $70,000, Mr. Gray - $70,000, Mr. Levy - $70,000, and Mr. Riley - $50,000. These values were then expressed as a number of RSUs, based on the value of the common stock on March 3, 2015. These awards vest annually over a three-year period.

The following table sets forth the RSU awards made to each of the named executive officers in 2015:

Name | Number of RSUs |

Jerome S. Griffith | 19,032 |

Michael J. Mardy | 3,763 |

Steven M. Hurwitz | 3,010 |

Peter L. Gray | 3,010 |

Adam Levy(1) | 3,010 |

David J. Riley | 2,150 |

(1) | Award forfeited upon Mr. Levy’s resignation. |

PRSUs

As it had in 2014, in 2015, the Company granted the named executive officers PRSUs in order to encourage the attainment of long-term financial goals and performance. Each named executive officer was awarded an amount of PRSUs (each representing the contingent right to receive one share of common stock) which will vest, if at all, at the conclusion of a

17

three-year period covering fiscal years 2015, 2016 and 2017 (the “Performance Period”). The Board established a performance budget related to the PRSUs, with one metric, earnings per share. The PRSUs may be earned, and become vested, in the event that a certain level of compound annual growth rate (CAGR) for earnings per share is achieved for the Performance Period. As in 2014, the Board chose this metric as it focuses the named executive officers on increasing earnings per share over a multi-year period and driving longer-term stockholder value. While the metric for the PRSUs differs from the metric used in the cash bonus plan, similar to the design utilized in the cash bonus plan, each named executive officer was awarded a targeted number of PRSUs and based on the earnings per share performance for the Performance Period, may earn in the range of 50% (for threshold performance), 100% (for target performance) and 200% (for maximum performance) of the targeted number of PRSUs. If the threshold level of CAGR for earnings per share is not achieved, no PRSUs will be earned and the PRSUs will expire. The targeted value of the PRSU awards to each of the named executive officers were as follows: Mr. Griffith - $442,500; Mr. Mardy - $87,500; Mr. Hurwitz - $70,000; Mr. Gray - $70,000; Mr. Levy - $70,000; and Mr. Riley - $50,000. These values were then expressed as a number of PRSUs, based on the value of the common stock on March 3, 2015. The table below depicts the plan and the number of PRSUs which may be earned by each of the named executive officers:

Name | Threshold | Target | Maximum |

Jerome S. Griffith | 9,516 | 19,032 | 38,064 |

Michael J. Mardy | 1,882 | 3,763 | 7,526 |

Steven M. Hurwitz | 1,505 | 3,010 | 6,020 |

Peter L. Gray | 1,505 | 3,010 | 6,020 |

Adam Levy(1) | 1,505 | 3,010 | 6,020 |

David J. Riley | 1,075 | 2,150 | 4,300 |

_______________

(1) | Award forfeited upon Mr. Levy’s resignation. |

Limited perquisites and other benefits

Historically, in light of our private equity ownership prior to our IPO, and our corporate culture, we use limited perquisites for our executives, and our executives receive other benefits in line with those offered to our employees generally. These benefits, such as our basic health benefits, 401(k) plan with matching contributions, life insurance, paid time off, matching charitable gifts program, tuition reimbursement and discounts on certain Tumi products, are intended to provide a stable array of support to our employees, and these core benefits are provided to all employees. Additionally, Messrs. Griffith, Mardy, Hurwitz, Gray and Riley receive (and Mr. Levy, during his employment, received) an automobile allowance.

Employment and Severance Arrangements

We have employment and other arrangements with each of our named executive officers which provide for "at-will" employment and define compensation and benefits payable to them in certain termination scenarios, giving them some certainty regarding their individual outcomes under these circumstances. Each such agreement includes provisions that (1) prohibit the executive from competing against us (or working for a competitor) during a specified period after the executive leaves the Company, and (2) provide severance payments upon the executive’s termination of employment by us for other than “Cause,” (and by the executive for "Good Reason" in the case of Mr. Griffith) both before and after a Change in Control or by the executive for "Good Reason" after a change in control. We believe the employment agreements are a necessary component of the compensation package provided to our named executive officers because: (1) the noncompetition provisions protect us from a competitive disadvantage if one of the named executive officers leaves the Company; and (2) the severance provisions serve as an effective recruiting and retention tool. Our Board of Directors approved these agreements and reviews them on an as-needed basis, based on market trends or on changes in our business environment. These agreements and arrangements were initially established with the named executive officers when they commenced employment with the Company, and in late 2014 and early 2015, the Compensation Committee began a detailed review of the agreements to address a tax gross-up provision contained in Mr. Griffith’s agreement and, with the assistance of our compensation consultant, reflect current market practice and terms, as many of these agreements were entered into five to ten years ago and while the Company was privately-held. In March 2015, the agreements were amended and restated and new agreements were provided to executives who previously held offer letters.

The terms of the employment agreements are described in more detail below under “Employment Arrangements with Named Executive Officers.” Additional information regarding the severance and change in control benefits provided under the employment agreements is provided below under “Potential Payments upon Termination or Change in Control.”

18

Role of Executives in Executive Compensation Decisions

Our Compensation Committee generally seeks input from Mr. Griffith when discussing the performance of and the compensation levels for the other named executive officers. Our Compensation Committee also works with Mr. Mardy in evaluating the financial, accounting, tax and retention implications of our various compensation programs. The Compensation Committee then makes recommendations regarding executive compensation to the Board of Directors, which includes Mr. Griffith and Mr. Mardy, for approval by the Board of Directors. Mr. Mardy and Mr. Griffith do not play any role in setting their own compensation, or in approving the compensation of the other named executive officers. Mr. Griffith makes recommendations to the Compensation Committee and the Board of Directors regarding the compensation of our other named executive officers.

Tumi believes that Mr. Griffith is in the best position to assess performance of our other named executive officers. However, decisions about individual compensation elements, including those related to Mr. Griffith, are ultimately recommended by the Compensation Committee and approved by the independent members of the Board using its judgment, focusing primarily on the executive officer’s performance and Tumi’s overall performance. The Compensation Committee routinely meets in executive session without management or Mr. Griffith present.

Other Compensation-Related Practices and Policies

Executive Officer Stock Ownership Guidelines

In 2015, we adopted stock ownership guidelines that require our Chief Executive Officer and President to own shares equal in value to six times his base salary, our Chief Financial Officer and Executive Vice President to own shares equal in value to three time his base salary and our other executive officers to hold shares equal in value to one and one half times each such executive officer’s base salary. Executives have five years to meet the guidelines, compliance is measured at the end of each calendar year and the value of shares of common stock owned, as well as in-the-money stock options, is considered when assessing compliance. At December 31, 2015, each of Mr. Griffith and Mr. Mardy met the guidelines.

Insider Trading Policy

We have maintained an insider trading policy since our initial public offering. The policy applies to the officers and directors of the Company, as well as other individuals who have access to material non-public information. We believe the policy serves to provide a framework for compliance with securities laws and regulations, as well as make clear the behaviors which we believe are speculative and expose the individual and the Company to the risks of trading of stock when otherwise prohibited, or the appearance of impropriety. Accordingly, the policy explicitly prohibits hedging of shares, pledging of shares, short-selling, trading options, warrants, puts and calls or similar instruments on Company securities and holding shares of the Company’s common stock in margin accounts.

Tally Sheets

From time-to-time the Compensation Committee is provided a “tally sheet” report prepared by management for each named executive officer. The tally sheet includes, among other things, total annual compensation, the value of unexercised or unvested equity compensation awards, and amounts payable upon termination of employment under various circumstances, including following a change in control. The Compensation Committee uses tally sheets to provide additional perspective on the value the executives have accumulated from prior equity awards and the retentive value of such awards.

Use of Consultants and Other Advisors

The Compensation Committee has retained Pay Governance LLC to assist the Compensation Committee with its responsibilities related to the Company’s executive and Board of Director compensation programs. Pay Governance’s responsibilities to the Compensation Committee included providing:

• | Competitive market data and advice related to the Chief Executive Officer’s compensation level and incentive program; | |

• | A review of Company compensation levels, annual and long-term incentive program design (including performance objectives); and | |

• | Information on executive compensation philosophy considerations. | |

As part of the Company’s evaluation of Pay Governance, the Compensation Committee considered the following independence factors related to Pay Governance: (i) that no other services were provided to us by Pay Governance in 2015, (ii) the fees paid by the Company as a percentage of Pay Governance’s total revenue, (iii) policies or procedures of Pay Governance that are designed to prevent conflicts of interest, (iv) any business or personal relationships between Pay

19

Governance’s senior advisor for the Company and a member of the Compensation Committee, (v) any business or personal relationship of Pay Governance or its senior advisor for the Company and a Company executive and (vi) any Company stock owned by the senior advisor of Pay Governance. The Compensation Committee discussed these considerations and concluded that the work performed by Pay Governance and its senior advisor involved in the engagement did not raise any conflict of interest and that both are independent under the Compensation Committee’s charter and applicable SEC and NYSE-listed company rules.

Benchmarking

The Compensation Committee considers a number of factors in making compensation decisions. This includes the compensation practices of peer companies in the retail industry, which we refer to as the Custom Peer Group. These companies are chosen by the Compensation Committee after considering the recommendations of Pay Governance LLC and management. We developed our Custom Peer Group by considering competitors identified by industry, size, growth rate and equity analysts, as well as by internal resources, and companies who identify Tumi as a peer in their proxy disclosures. We believe these companies to have similarities to our business and reflect the market in which we compete for executive talent. The Compensation Committee reviews the composition of the Custom Peer Group at least annually, and considers additions or deletions. In late 2014 and early 2015, the Compensation Committee reviewed the Custom Peer Group then being considered by the Company and determined that due to one company (R.G. Barry) having gone private, and one company (Body Central) having a comparatively small market capitalization, those companies would be removed from the Custom Peer Group for 2015. The Committee sought to include additional companies to the Custom Peer Group to increase the sample size considered for comparison purposes. Following this review, the Committee added five companies to the Custom Peer Group: Chico’s FAS, Inc., G-III Apparel Group, Ltd., Kate Spade & Company, Restoration Hardware Holdings, Inc. and Vitamin Shoppe, Inc. Accordingly, the companies in the 2015 Custom Peer Group were:

• | Chico's FAS, Inc. | |

• | Francesca’s Holdings Corporation | |

• | G-III Apparel Group, Ltd. | |

• | Iconix Brand Group, Inc. | |

• | Kate Spade & Company | |

• | Movado Group, Inc. | |

• | Oxford Industries, Inc. | |

• | Perry Ellis International, Inc. | |

• | Restoration Hardware Holdings, Inc. | |

• | Tilly’s, Inc. | |

• | Vera Bradley, Inc. | |

• | Vince Holding Corp. | |

• | Vitamin Shoppe, Inc. | |

• | Zumiez Inc. | |

When making 2015 compensation decisions, in addition to the Custom Peer Group, the Compensation Committee also considered results from the HayGroup’s 2014 Luxury Retail survey and Towers Watson’s 2014 Top Management Compensation Survey Report - U.S.

The Compensation Committee attempts to set the compensation at levels that are competitive with the data sources listed above. The Compensation Committee generally seeks to set the compensation of our executive officers for salary, target bonus, and long-term incentives within a competitive range of the median. An executive’s actual compensation may vary from this amount based on individual performance, incentive payouts, and changes in our stock price. The Compensation Committee uses market data as a source of information but retains the flexibility to set target compensation at levels it deems appropriate for an individual or for a specific element of compensation.

Tax Considerations

Section 162(m) of the Code generally disallows a federal income tax deduction to public corporations for compensation greater than $1 million paid for any fiscal year to the corporation’s five named executive officers. Prior to our IPO in April 2012, our Board of Directors did not take the deductibility limit imposed by Section 162(m) into consideration in setting compensation. Our Compensation Committee has adopted a policy that states, where reasonably practicable, the Compensation Committee will seek to have the variable compensation paid to our named executive officers qualify for an

20

exemption from the deductibility limitations of Section 162(m). The Compensation Committee may, however, in its judgment, authorize compensation payments that do not consider the deductibility limit imposed by Section 162(m) when it believes, in its judgment, that such payments are appropriate to attract and retain executive talent. In addition, transition provisions under Section 162(m) applied for a period of three years following the consummation of our IPO in April 2012 to certain compensation arrangements that were entered into by the Company before it was publicly held.

Compensation Committee Interlocks and Insider Participation

During 2015, our Compensation Committee consisted of Messrs. Fielding, Gromek and Johnson. No member of the Compensation Committee has at any time in the last fiscal year been one of our officers or employees, and none has had any relationships with our Company of the type that is required to be disclosed under Item 404 of Regulation S-K.

None of our executive officers serves or has served as a member of the Board of Directors, Compensation Committee, or other Board committee performing equivalent functions, of any entity that has one or more executive officers who serves as one of our directors or on our Compensation Committee.

Report of the Compensation Committee

The information contained in this report shall not be deemed to be “soliciting material” or “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act or the Exchange Act.

The Compensation Committee of the Company has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Annual Report.

The Compensation Committee

Joseph R. Gromek (Chairperson)

Christopher J. L. Fielding

Thomas H. Johnson

21

Summary Compensation Table

The following table sets forth the cash and other compensation that we paid to our named executive officers, or that was otherwise earned by our named executive officers, for their services in all capacities during fiscal 2015, 2014 and 2013.

2015 SUMMARY COMPENSATION TABLE | ||||||||||||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1)(2) | Option Awards ($)(1)(3) | Non-Equity Incentive Plan Compensation ($)(4) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($)(5) | Total ($) | |||||||||

Jerome S. Griffith Chief Executive Officer and President | 2015 2014 2013 | 885,000 885,000 868,800 | - - - | 885,000 600,000 - | 885,000 600,000 500,000 | 433,791 282,114 331,875 | - - - | 32,116 22,400 22,200 | 3,120,907 2,389,514 1,722,875 | |||||||||

Michael J. Mardy Chief Financial Officer and Executive Vice President | 2015 2014 2013 | 480,907 466,900 450,000 | - - - | 175,000 175,000 - | 175,000 175,000 500,000 | 119,602 100,690 172,500 | - - - | 22,017 20,921 20,136 | 972,526 938,511 1,142,636 | |||||||||

Steven M. Hurwitz Senior Vice President—Product Development, Manufacturing and Sourcing | 2015 2014 2013 | 454,771 441,525 427,500 | - - - | 140,000 140,000 - | 140,000 140,000 400,000 | 101,792 85,696 146,813 | - - - | 20,871 20,081 19,501 | 857,434 827,302 993,814 | |||||||||

Peter L. Gray(6) Executive Vice President and General Counsel | 2015 2014 2013 | 408,030 396,000 29,918 | - - - | 140,000 140,000 - | 140,000 140,000 500,000 | 91,330 76,888 - | - - - | 23,001 21,995 - | 802,361 774,883 529,918 | |||||||||

Adam Levy(7) Former President, Retail | 2015 2014 2013 | 305,166 421,225 407,500 | - - - | 140,000 140,000 - | 140,000 140,000 400,000 | - 81,756 140,063 | - - - | 17,006 19,766 19,346 | 602,172 802,747 966,909 | |||||||||

David J. Riley(8) Chief Accounting Officer and Senior Vice President—Finance | 2015 | 284,200 | - | 100,000 | 100,000 | 56,545 | - | 16,960 | 557,705 | |||||||||

_________

(1) | The amounts shown in the “Stock Awards” and “Option Awards” columns represent the aggregate grant date fair value of awards computed in accordance with ASC 718, not the actual amounts that might be paid to or realized by the named executed officers. ASC 718 fair value amount as of the grant date for performance-based restricted stock units, restricted stock units and stock options generally is spread over the number of months of service required for the grant to vest. For information regarding the assumption used in determining the fair value of an award, please refer to Note 16 to Consolidated Financial Statements contained in our Annual Report on Form 10-K for fiscal 2015. An explanation of the vesting of options awards, restricted stock units and performance-based restricted stock units is discussed in the footnotes to the “Grants of Plan-Based Awards for Fiscal 2015” and “Outstanding Equity Awards at 2015 Fiscal Year End” tables below. |

(2) | Reflects the aggregate grant date fair value of awards computed in accordance with ASC 718 for restricted stock unit awards and performance-based restricted stock unit awards granted to the named executive officers. The fair value of these awards is based on the closing price of our common stock on the grant date and for the performance-based restricted stock unit awards is calculated at the target share payout level as of the grant date (March 3, 2015). The maximum grant date potential values for the 2015 performance-based restricted stock awards for Messrs. Griffith, Mardy, Hurwitz, Gray, Levy and Riley were $885,000, $175,000, $140,000, $140,000, $140,000 and $100,000, respectively. |

(3) | The fair value of each stock option award is estimated as of the date of grant using a Black-Scholes valuation model. Additional information regarding the assumptions used to estimate the fair value of all stock option awards is included in Note 16 to Consolidated Financial Statements contained in our Annual Report on Form 10-K for fiscal 2015. |

(4) | Represents the amount paid under our performance-based annual cash bonus program. See “Determining the Amount of Each Component of Compensation-Annual cash bonus” above for more details. |

(5) | All other compensation in 2015 consisted of: (a) a car allowance for the following individuals in the following amounts: Mr. Griffith-$12,000, Mr. Mardy-$9,000, Mr. Hurwitz-$9,000, Mr. Gray-$12,000, Mr. Levy-$6,000 and Mr. Riley-$6,000; (b) life insurance premiums paid on behalf of the following individuals in the following amounts: Mr. Griffith-$0, Mr. Mardy-$2,417, Mr. Hurwitz-$1,271, Mr. Gray-$401, Mr. Levy-$406 and Mr. Riley-$360; (c) 401(k) employer matching contributions for the following individuals in the following amounts: Mr. Griffith-$10,600, Mr. Mardy-$10,600, |

22

Mr. Hurwitz-$10,600, Mr. Gray-$10,600, Mr. Levy-$10,600 and Mr. Riley-$10,600; and (d) $9,516 of reimbursement of legal fees to Mr. Griffith in connection with the negotiation of Mr. Griffith’s amended and restated employment agreement.

(6) | Mr. Gray joined the Company in December 2013. |

(7) | Mr. Levy resigned from the Company in September 2015. |

(8) | Mr. Riley became an executive officer of the Company in February 2015. |

Grants of Plan-Based Awards for 2015

The following table sets forth information regarding grants of plan-based awards in fiscal 2015.

GRANTS OF PLAN-BASED AWARDS FOR FISCAL 2015 | |||||||||||||||||||||||||||

Name | Grant Date | Committee/Board Approval Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | All Other Option Awards: Number of Securities Underlying Options (#)(4) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards($)(5) | |||||||||||||||||||

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | ||||||||||||||||||||||

Jerome S. Griffith | (6) | (7) | 442,500 | 885,000 | 1,770,000 | ||||||||||||||||||||||

9,516 | 19,032 | 38,064 | 442,500 | ||||||||||||||||||||||||

19,032 | 442,500 | ||||||||||||||||||||||||||

87,106 | 23.25 | 885,000 | |||||||||||||||||||||||||

Michael J. Mardy | (6) | (7) | 122,004 | 244,007 | 488,014 | ||||||||||||||||||||||

1,882 | 3,763 | 7,526 | 87,500 | ||||||||||||||||||||||||

3,763 | 87,500 | ||||||||||||||||||||||||||

17,224 | 23.25 | 175,000 | |||||||||||||||||||||||||

Steven M. Hurwitz | (6) | (7) | 103,835 | 207,671 | 415,342 | ||||||||||||||||||||||

1,505 | 3,010 | 6,020 | 70,000 | ||||||||||||||||||||||||

3,010 | 70,000 | ||||||||||||||||||||||||||

13,779 | 23.25 | 140,000 | |||||||||||||||||||||||||

Peter L. Gray | (6) | (7) | 93,164 | 186,327 | 372,654 | ||||||||||||||||||||||

1,505 | 3,010 | 6,020 | 70,000 | ||||||||||||||||||||||||

3,010 | 70,000 | ||||||||||||||||||||||||||

13,779 | 23.25 | 140,000 | |||||||||||||||||||||||||

Adam Levy | (6) | (7) | 99,061 | 198,123 | 396,246 | ||||||||||||||||||||||

1,505 | 3,010 | 6,020 | 70,000 | ||||||||||||||||||||||||

3,010 | 70,000 | ||||||||||||||||||||||||||

13,779 | 23.25 | 140,000 | |||||||||||||||||||||||||

David J. Riley | (6) | (7) | 57,680 | 115,360 | 230,720 | ||||||||||||||||||||||

1,075 | 2,150 | 4,300 | 50,000 | ||||||||||||||||||||||||

2,150 | 50,000 | ||||||||||||||||||||||||||

9,842 | 23.25 | 100,000 | |||||||||||||||||||||||||

_________

(1) | Awards made under the Company’s performance-based cash bonus program. Actual amounts earned under the program are disclosed in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table. |

(2) | The amounts shown reflect number of PRSUs which may vest based on the satisfaction of performance criteria established by the Compensation Committee and Board of Directors. The threshold achievement represents 50% of target and maximum achievement represents 200% of target. Performance below the threshold level results in the PRSUs expiring with no vesting. The PRSUs vest, at target level, under certain circumstances. See “Potential Payments Upon Termination or Change in Control” below. See “Compensation Discussion and Analysis” for further discussion of the PRSUs and performance criteria. |

(3) | Restricted stock unit awards vest in three equal annual installments on each of the first three anniversaries of the date of grant, provided that the recipient remains employed by the Company or one of its subsidiaries on each such date. The vesting of the restricted stock units is accelerated under certain circumstances. See “Potential Payments Upon Termination or Change-in-Control.” |

23

(4) | Stock option awards vest in three equal annual installments on each of the first three anniversaries of the date of grant, provided that the recipient remains employed by the Company or one of its subsidiaries on each such date. The vesting and exercisability of the options is accelerated under certain circumstances. See “Potential Payments Upon Termination or Change in Control.” |

(5) | The grant date fair value of “All Other Option Awards” is computed based on a value per share of $10.16 on March 3, 2015, computed in accordance with ASC 718. |

(6) | The grant date for all equity awards was March 3, 2015. |