Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TRIMAS CORP | trs_03312016xexhibit991.htm |

| 8-K - 8-K - TRIMAS CORP | trs_03312016x8k.htm |

First Quarter 2016 Earnings Presentation April 28, 2016

Forward-Looking Statement Forward-Looking Statement Any “forward-looking” statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including, but not limited to, those relating to the Company’s business, financial condition or future results, involve risks and uncertainties, including, but not limited to, risks and uncertainties with respect to: the Company's leverage; liabilities imposed by the Company's debt instruments; market demand; competitive factors; supply constraints; material and energy costs; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; technology factors; litigation; government and regulatory actions; the Company's accounting policies; future trends; general economic and currency conditions; various conditions specific to the Company's business and industry; the Company’s ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; the Company’s ability to attain the Financial Improvement Plan targeted savings and free cash flow amounts; future prospects of the Company; and other risks that are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2015. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements. Non-GAAP Financial Measures In this presentation, certain non-GAAP financial measures may be used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found at the end of this presentation or in the earnings releases available on the Company’s website. Additional information is available at www.trimascorp.com under the “Investors” section. 2

Agenda • Opening Remarks • Financial Highlights • Segment Highlights • Outlook and Summary • Questions and Answers • Appendix 3

Opening Remarks • First quarter sales of approximately $203 million – external headwinds continued – Organic initiatives and acquisition growth were more than offset by the impact of lower oil prices, lower aerospace distributor sales and unfavorable currency exchange – Sequential sales improvement in three out of four segments • Achieved Q1 EPS(1) of $0.27 – top of previously provided guidance range • Margin improvement in Packaging and Engineered Components offset by declines in Aerospace and Energy, as compared to first quarter 2015 • Aerospace experienced short-term production and acquisition integration costs and inefficiencies • Completed majority of the cost actions related to the $22 million Financial Improvement Plan – helped mitigate impact of continued top-line pressure 4 Overall earnings in quarter as expected; encouraged by results in three out of four segments, as well as reduced corporate costs. (1) Defined as diluted earnings per share from continuing operations, excluding “Special Items.” “Special Items” are provided in the Appendix.

External Headwinds and Tailwinds Headwinds • Macroeconomic conditions ‒ Low industrial activity levels ‒ Interest rate environment • Low oil and commodity prices ‒ Drilling and well completion activity ‒ Capex deferrals and reductions ‒ Resin and specialty steel prices • Inventory reductions at distributors ‒ Large aerospace distributors ‒ Overall supply chain reductions • Strength of U.S. dollar – Translation and transaction impacts – Exports in Engineered Components – Imports more competitive 5 Tailwinds • Commercial aircraft build rates and backlog – expect slight increase in 2016, with greater growth in 2017 • Asia still growing, albeit at lower rates – Uncertainty around China • Consumer spend remains solid – outpacing economic conditions No significant change – focused on execution to mitigate headwinds.

Key Business Initiatives 6 Initiatives remain consistent to achieve profitable growth and increased margins – balancing short and long-term objectives. • Packaging – Build out global marketing and sales force to align with end markets and customers – Add lower-cost capacity to support global customers and growth – Accelerate new product development with technology center in Asia • Aerospace – Improve throughput and production efficiencies to increase sales and margins – Achieve growth and cost synergies from acquisitions, including integration of new machined components facility • Energy – Hired Marc Roberts to lead business and drive improved performance – Leverage benefits of business restructuring and capitalize on end market opportunities • Engineered Components – Expand long-term cylinder capacity to capitalize on North American market position – Continue to “right size” the oil field engine and compressor business to reflect current market demand

Financial Highlights

First Quarter Summary • Q1 sales declined 9.5% as compared to Q1 2015 – weakness in the oil-related and industrial end markets, and unfavorable currency exchange more than offset organic initiatives and the results of a recent acquisition • Q1 operating profit dollars and margin percentage decreased as the impact of reduced sales and the related lower fixed cost absorption more than offset the positive impact of the Financial Improvement Plan, reductions in corporate expense and productivity initiatives • Income and diluted EPS both decreased due to lower operating profit • Total debt decreased as compared to Q1 2015 – used the cash distribution from Horizon Global in conjunction with the spin-off of the Cequent businesses to reduce outstanding borrowings 8 (1) “Special Items” for each period are provided in the Appendix. (2) Free Cash Flow is defined as Net Cash Provided by Operating Activities of Continuing Operations, excluding the cash impact of the Financial Improvement Plan, less Capital Expenditures. (Dollars in millions, except per share amounts) Unaudited, excluding Special Items(1) ( fro m co ntinuing o perat io ns) Q1 2016 Q1 2015 Variance Revenue $202.9 $224.1 -9.5% Op ting profit $21.8 $25.5 -14.3% Operating profit margin 10.8% 11.4% -60 bps Income $12.4 $13.8 -10.5% Diluted EPS $0.27 $0.31 -12.9% Free Cash Flow (2) ($5.9) ($1.8) n/m Total debt $437.9 $663.8 -34.0% Achieved EPS as planned, despite external top-line pressures and Aerospace inefficiencies.

EPS(1) Bridge from Q1 2015 to Q1 2016 9 (1) Excludes the impact of “Special Items.” For a detailed reconciliation, excluding “Special Items,” please see the Appendix. • Significant year-over-year impact related to lower oil production activity and aerospace distributor inventory reductions • Cost savings actions (including the Financial Improvement Plan) helping offset external headwinds • Executing plan to remedy short-term production and integration inefficiencies in Aerospace • Corporate spend reduced following the Cequent spin-off and in response to macroeconomic challenges Offsetting the majority of the external headwinds; continue to execute on margin enhancement plans. $0.31 $0.27 2015 Q1 EPS (1) Energy-facing business volume Aerospace volume and product mix Aerospace manufacturing & integration inefficiencies FIP and pre-FIP cost savings actions Corporate cash costs Interest, taxes and other 2016 Q1 EPS (1) (For illustrative purposes)

Segment Highlights

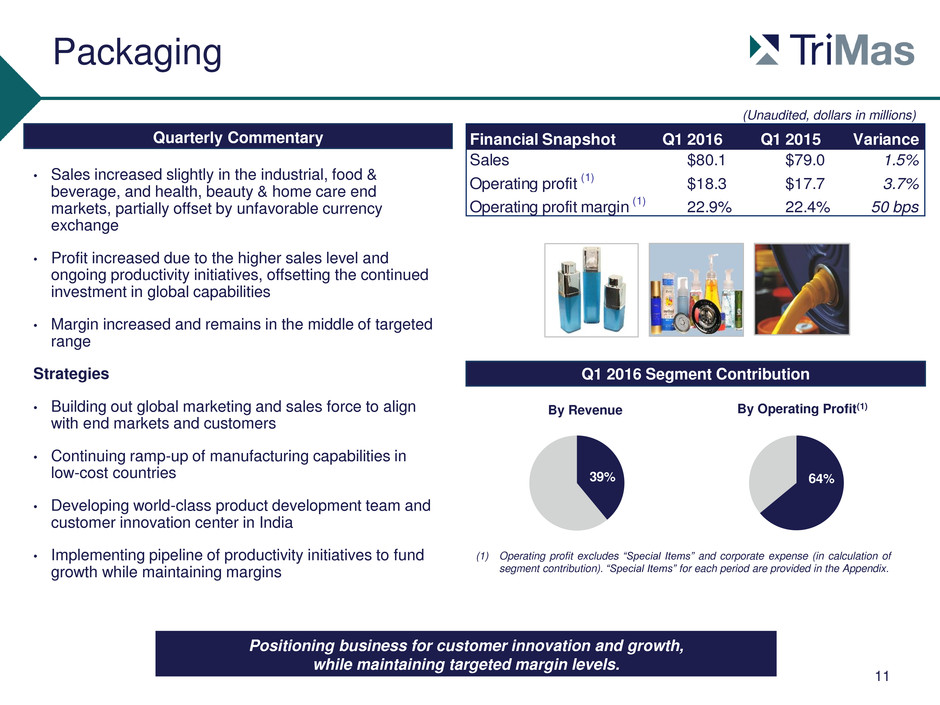

Packaging 11 • Sales increased slightly in the industrial, food & beverage, and health, beauty & home care end markets, partially offset by unfavorable currency exchange • Profit increased due to the higher sales level and ongoing productivity initiatives, offsetting the continued investment in global capabilities • Margin increased and remains in the middle of targeted range Strategies • Building out global marketing and sales force to align with end markets and customers • Continuing ramp-up of manufacturing capabilities in low-cost countries • Developing world-class product development team and customer innovation center in India • Implementing pipeline of productivity initiatives to fund growth while maintaining margins Quarterly Commentary (Unaudited, dollars in millions) (1) Operating profit excludes “Special Items” and corporate expense (in calculation of segment contribution). “Special Items” for each period are provided in the Appendix. Q1 2016 Segment Contribution 39% By Revenue 64% By Operating Profit(1) Positioning business for customer innovation and growth, while maintaining targeted margin levels. Financial Snapshot Q1 2016 Q1 2015 Variance Sales $80.1 $79.0 1.5% Operating profit (1) $18.3 $17.7 3.7% Operating profit margin (1) 22.9% 22.4% 50 bps

Aerospace 12 • Sales decreased due to lower demand from larger distribution customers, as well lower sales to OE customers due to production constraints ‒ Partially offset by the sales related to the acquisition of Parker Hannifin’s machined components facility in Q4 2015 • Margin declined due to lower sales and related operating leverage, a less favorable product mix, and short-term production and acquisition integration costs and inefficiencies Strategies • Executing plan to improve production efficiencies and address integration costs to enhance margins • Upgrading ERP system applications across Aerospace platform • Developing and qualifying new highly-engineered products; qualifying existing products for new applications or new customers • Leveraging one aerospace platform to better serve customers and enhance margins (Unaudited, dollars in millions) Q1 2016 Segment Contribution 20% By Revenue 12% By Operating Profit(1) Quarterly Commentary Immediate focus on sales and margin improvement. (1) Operating profit excludes “Special Items” and corporate expense (in calculation of segment contribution). “Special Items” for each period are provided in the Appendix. Financial Snapshot Q1 2016 Q1 2015 Variance Sales $40.5 $45.7 -11.5% Operating profit (1) $3.5 $8.9 -60.2% Operating profit margin (1) 8.7% 19.4% -1070 bps

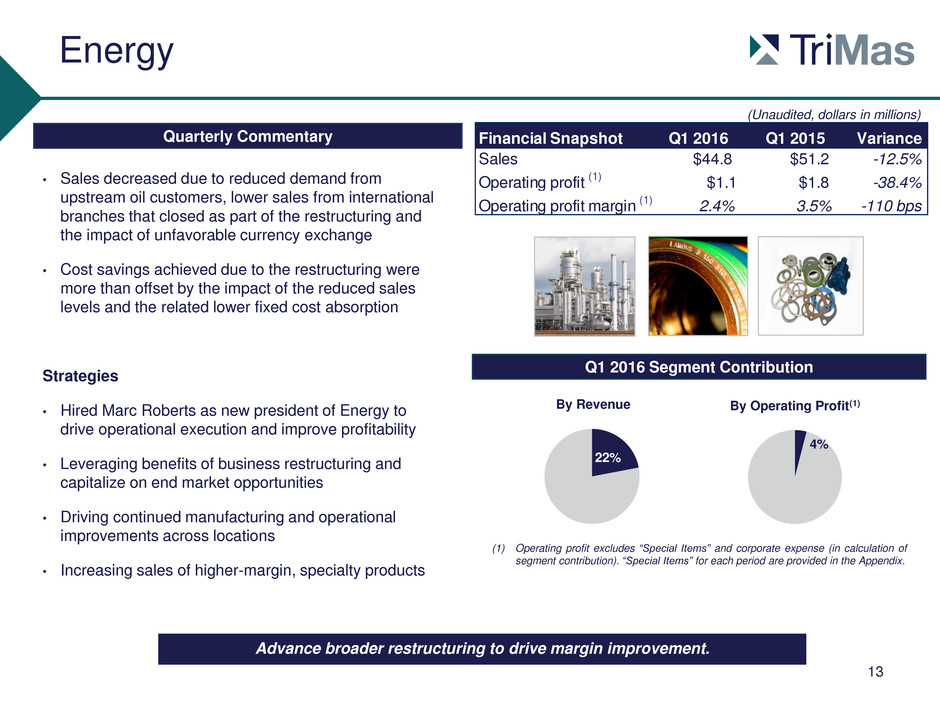

Energy 13 • Sales decreased due to reduced demand from upstream oil customers, lower sales from international branches that closed as part of the restructuring and the impact of unfavorable currency exchange • Cost savings achieved due to the restructuring were more than offset by the impact of the reduced sales levels and the related lower fixed cost absorption Strategies • Hired Marc Roberts as new president of Energy to drive operational execution and improve profitability • Leveraging benefits of business restructuring and capitalize on end market opportunities • Driving continued manufacturing and operational improvements across locations • Increasing sales of higher-margin, specialty products (Unaudited, dollars in millions) Q1 2016 Segment Contribution 22% By Revenue 4% By Operating Profit(1) Quarterly Commentary Advance broader restructuring to drive margin improvement. (1) Operating profit excludes “Special Items” and corporate expense (in calculation of segment contribution). “Special Items” for each period are provided in the Appendix. Financial Snapshot Q1 2016 Q1 2015 Variance Sales $44.8 $51.2 -12.5% Operating profit (1) $1.1 $1.8 -38.4% Operating profit margin (1) 2.4% 3.5% -110 bps

Engineered Components 14 • Engine and compressor sales decreased nearly 60% as a result of lower oil prices – remained approximately breakeven by reducing cost structure • Cylinder sales declined due to weaker industrial end markets and lower export sales due to stronger U.S. dollar • Margin increased as a result of cost reductions and ongoing productivity initiatives Strategies • Implemented cost reduction actions to mitigate top-line pressures and remain breakeven in engine business • Adding incremental cylinder capabilities and longer- term capacity • Expanding engine and compressor product lines to diversify and reduce end-market cyclicality (Unaudited, dollars in millions) Q1 2016 Segment Contribution 19% By Revenue 20% By Operating Profit(1) Quarterly Commentary Focused on mitigating top-line pressures by reducing costs and increasing efficiencies. (1) Operating profit excludes “Special Items” and corporate expense (in calculation of segment contribution). “Special Items” for each period are provided in the Appendix. Financial Snapshot Q1 2016 Q1 2015 Variance Sales $37.5 $48.3 -22.3% Operating profit (1) $5.7 $6.1 -5.3% Operating profit margin (1) 15.3% 12.5% 280 bps

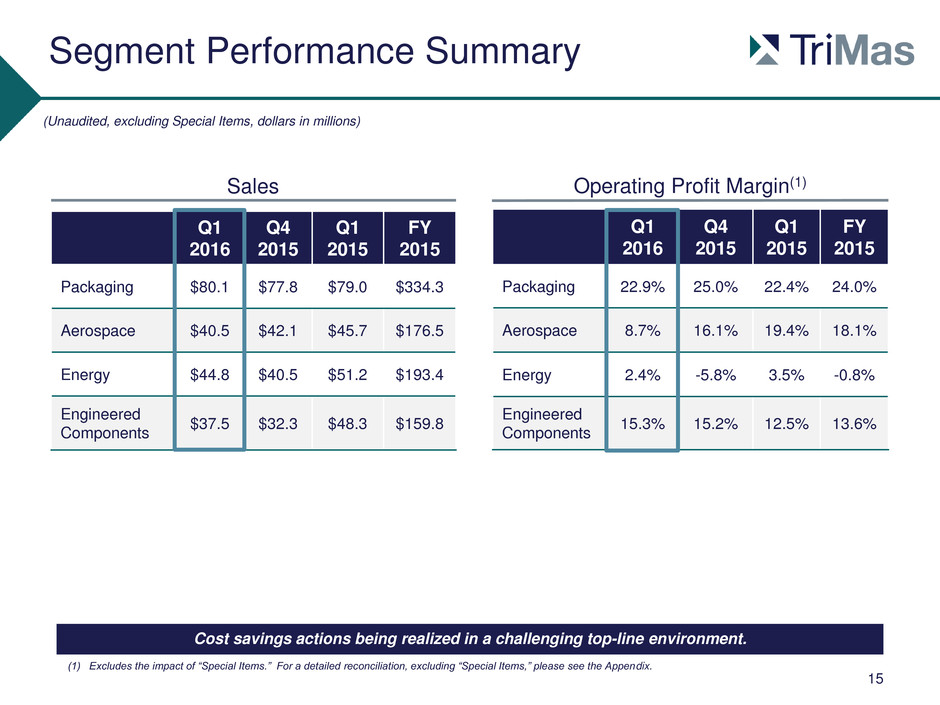

Segment Performance Summary 15 (Unaudited, excluding Special Items, dollars in millions) Sales Operating Profit Margin(1) (1) Excludes the impact of “Special Items.” For a detailed reconciliation, excluding “Special Items,” please see the Appendix. Q1 2016 Q4 2015 Q1 2015 FY 2015 Packaging $80.1 $77.8 $79.0 $334.3 Aerospace $40.5 $42.1 $45.7 $176.5 Energy $44.8 $40.5 $51.2 $193.4 Engineered Components $37.5 $32.3 $48.3 $159.8 Q1 2016 Q4 2015 Q1 2015 FY 2015 Packaging 22.9% 25.0% 22.4% 24.0% Aerospace 8.7% 16.1% 19.4% 18.1% Energy 2.4% -5.8% 3.5% -0.8% Engineered Components 15.3% 15.2% 12.5% 13.6% Cost savings actions being realized in a challenging top-line environment.

Outlook and Summary

Updated FY 2016 Segment Assumptions 17 Sales Growth(1) Operating Profit Margin(2) Full Year 2016 Commentary Packaging 4% – 8% 22% – 24% • Organic growth driven primarily by new products and increased share in emerging markets • Expected growth primarily in specialty dispensing products • Continuous pipeline of productivity initiatives to fund growth while maintaining margins Aerospace 9% – 11% 16% – 18% • Short-term production and integration costs and inefficiencies have impacted Q1 sales and profitability – sales and margin expected to increase throughout the year • Steady OE build rates and share gains expected to boost top-line • Q4 2015 acquisition of Parker Hannifin facility will add to growth • Major distributors expected to continue to reduce inventory levels Energy (10%) – (15%) 3% – 6% • Sales impacted by reduced downstream channel spending and exiting lower margin business • Improve margin level by continued restructuring of footprint and supply chain, cost-out actions and operational efficiencies Engineered Components (7%) – (10%) 13% – 15% • Industrial market slowdown expected to continue to impact cylinder sales – sales expected to be relatively flat • Maintain cylinder business margins through productivity initiatives • Continue to mitigate engine-related top-line pressure to breakeven – entered Q1 2015 with backlog resulting in higher sales, as compared to expected Q1 2016 sales levels Encouraging start to 2016 in three out of the four segments; decreased Aerospace margin assumption based on Q1 performance – executing plan to improve. (1) 2016 revenue growth versus 2015. (2) Defined as operating profit margin, excluding “Special Items.”

2016 Quarterly Earnings Expansion Drivers • Packaging customers’ planned new product launches • Aerospace sales growth and improved profitability as a result of increased production throughput to meet OE demand levels • Aerospace execution on integration and margin improvement plans • Energy leverages restructuring benefits • Partially offset by: – An increase in corporate costs due to timing of planned third party spending and full impact of March 2016 equity grants – The expected impact in Q4 of historically lower demand levels and related leverage in several businesses 18 Plans in place to expand earnings throughout 2016. (As compared to Q1 2016)

Updated FY 2016 Outlook Reaffirming Full Year Outlook (as of 4/28/16)(1) Comments Sales Growth (2%) – 2% • Continued global macroeconomic and industrial end market weakness • Currency not expected to be a significant driver year-over- year – except strong USD dampens export sales and facilitates foreign import competition • Organic growth driven by Packaging and Aerospace • Expect ~1% growth from existing acquisition • Oil-related activity expected to remain weak, with energy- facing businesses’ sales consistent with Q1 2016 levels Earnings Per Share, diluted(2) $1.35 – $1.45 • Savings from Financial Improvement Plan expected to help mitigate impact of weak end markets • Expect Aerospace margin pressures to be offset by other segments and lower corporate costs • Productivity and margin programs drive EPS growth • Leverage from the restructured Energy footprint expected to be muted by expected sales decline Free Cash Flow(3) $60 – $70 million • Managing working capital and capital expenditures consistent with environment, while still funding growth programs • Target ~ 100% of net income (1) Original guidance provided on 2/25/16. (2) Defined as diluted earnings per share from continuing operations, excluding “Special Items.” (3) Free Cash Flow is defined as Net Cash Provided by Operating Activities of Continuing Operations, excluding the cash impact of “Special Items,” less Capital Expenditures. 19 Reaffirming full year 2016 outlook. From Continuing Operations

Summary • Mitigate impact of external headwinds via Financial Improvement Plan – continue to evaluate end markets and costs • Grow higher-margin Packaging and Aerospace platforms – continue to invest and leverage – Focus on achieving Aerospace’s near-term operational improvements and longer- term growth and profitability goals • Drive improved profitability from restructured Energy business • Improve cash flow conversion and ROIC • Drive continuous productivity pipeline • On-going evaluation of business portfolio mix 20 Focused on execution for remainder of 2016 and beyond.

Questions and Answers

Appendix

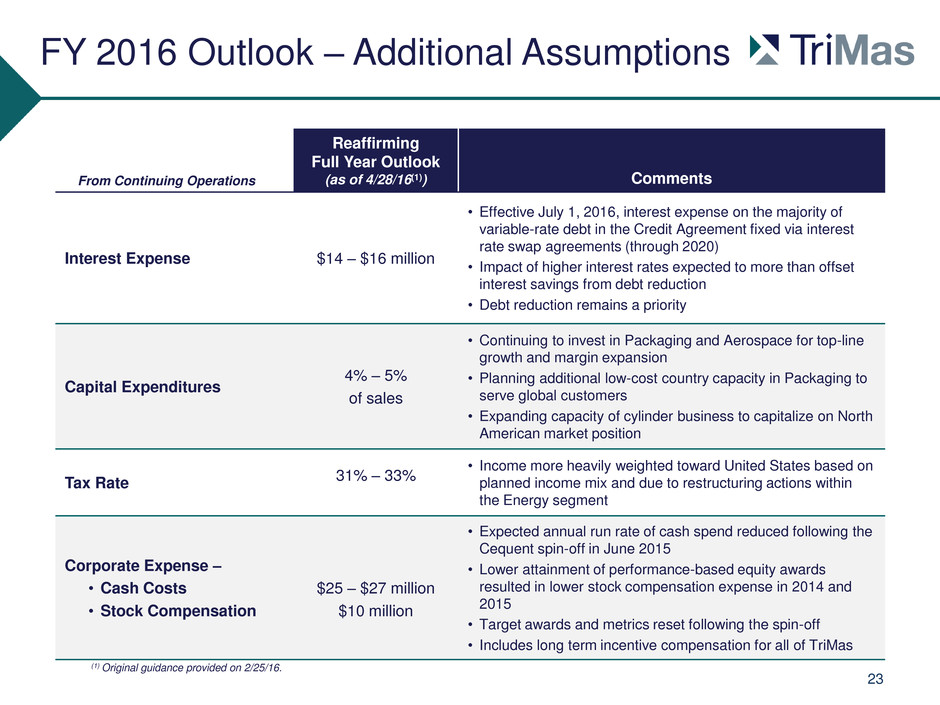

FY 2016 Outlook – Additional Assumptions Reaffirming Full Year Outlook (as of 4/28/16(1)) Comments Interest Expense $14 – $16 million • Effective July 1, 2016, interest expense on the majority of variable-rate debt in the Credit Agreement fixed via interest rate swap agreements (through 2020) • Impact of higher interest rates expected to more than offset interest savings from debt reduction • Debt reduction remains a priority Capital Expenditures 4% – 5% of sales • Continuing to invest in Packaging and Aerospace for top-line growth and margin expansion • Planning additional low-cost country capacity in Packaging to serve global customers • Expanding capacity of cylinder business to capitalize on North American market position Tax Rate 31% – 33% • Income more heavily weighted toward United States based on planned income mix and due to restructuring actions within the Energy segment Corporate Expense – • Cash Costs • Stock Compensation $25 – $27 million $10 million • Expected annual run rate of cash spend reduced following the Cequent spin-off in June 2015 • Lower attainment of performance-based equity awards resulted in lower stock compensation expense in 2014 and 2015 • Target awards and metrics reset following the spin-off • Includes long term incentive compensation for all of TriMas 23 From Continuing Operations (1) Original guidance provided on 2/25/16.

Condensed Consolidated Balance Sheet 24 (Dollars in thousands) March 31, December 31, 2016 2015 (unaudited) Assets Current assets: Cash and cash equivalents............................................................ 25,420$ 19,450$ Receivables, net........................................................................... 131,630 121,990 Inventories.................................................................................... 167,320 167,370 Prepaid expenses and other current assets..................................... 10,070 17,810 Total current assets................................................................... 334,440 326,620 Property and equipment, net.............................................................. 179,670 181,130 Goodwill........................................................................................... 379,250 378,920 Other intangibles, net........................................................................ 268,720 273,870 Other assets.................................................................................... 9,500 9,760 Total assets.............................................................................. 1,171,580$ 1,170,300$ Liabilities and Shareholders' Equity Current liabilities: Current maturities, long-term debt................................................... 13,840$ 13,850$ Accounts payable......................................................................... 75,050 88,420 Accrued liabilities.......................................................................... 41,940 50,480 Total current liabilities................................................................ 130,830 152,750 Long-term debt, net........................................................................... 424,010 405,780 Deferred income taxes...................................................................... 9,100 11,260 Other long-term liabilities................................................................... 56,920 53,320 Total liabilities........................................................................... 620,860 623,110 Total shareholders' equity........................................................... 550,720 547,190 Total liabilities and shareholders' equity....................................... 1,171,580$ 1,170,300$

Consolidated Statement of Operations 25 Three months ended 2016 2015 Net sales................................................................................................. 202,880$ 224,130$ Cost of sales............................................................................................ (146,960) (161,210) Gross profit........................................................................................... 55,920 62,920 Selling, general and administrative expenses............................................... (39,470) (39,900) Operating profit..................................................................................... 16,450 23,020 Other expense, net: Interest expense................................................................................... (3,440) (3,450) Other expense, net................................................................................ (60) (1,320) Other expense, net............................................................................ (3,500) (4,770) Income from continuing operations before income tax expense...................... 12,950 18,250 Income tax expense.................................................................................. (4,650) (6,310) Income from continuing operations.............................................................. 8,300 11,940 Income from discontinued operations, net of tax........................................... - 2,040 Net income............................................................................................... 8,300 13,980 Earnings per share - basic: Continuing operations............................................................................ 0.18$ 0.26$ Discontinued operations......................................................................... - 0.05 Net income per share............................................................................ 0.18$ 0.31$ Weighted average common shares - basic 45,278,990 44,997,961 Earnings per share - diluted: Continuing operations............................................................................ 0.18$ 0.26$ Discontinued operations......................................................................... - 0.05 Net income per share............................................................................ 0.18$ 0.31$ Weighted average common shares - diluted 45,654,816 45,400,843 March 31, (Unaudited, dollars in thousands, except for per share amounts)

Consolidated Statement of Cash Flow (Unaudited, dollars in thousands) 26 2016 2015 Cash Flows from Operating Activities: Net income.............................................................................................................................. 8,300$ 13,980$ Income from discontinued operations......................................................................................... - 2,040 Income from continuing operations............................................................................................. 8,300 11,940 Adjustments to reconcile net income to net cash used for operating activities: Loss on dispositions of property and equipment...................................................................... 590 100 Depreciation......................................................................................................................... 5,940 5,080 Amortization of intangible assets........................................................................................... 5,100 5,360 Amortization of debt issue costs............................................................................................ 340 510 Deferred income taxes.......................................................................................................... (20) 280 Non-cash compensation expense.......................................................................................... 1,970 1,980 Tax effect from stock based compensation............................................................................. 620 (200) Increase in receivables.......................................................................................................... (11,210) (7,310) (Increase) decrease in inventories.......................................................................................... 330 (1,930) (Increase) decrease in prepaid expenses and other assets....................................................... 7,700 (2,280) Decrease in accounts payable and accrued liabilities............................................................... (23,660) (7,980) Other, net............................................................................................................................ 660 (1,690) Net cash provided by (used for) operating activities of continuing operations........................... (3,340) 3,860 Net cash used for operating activities of discontinued operations........................................... - (27,130) Net cash used for operating activities.............................................................................. (3,340) (23,270) Cash Flows from Investing Activities: Capital expenditures............................................................................................................. (5,980) (5,690) Net proceeds from disposition of property and equipment......................................................... 120 520 Net cash used for investing activities of continuing operations............................................... (5,860) (5,170) Net cash used for investing activities of discontinued operations............................................ - (2,200) Net cash used for investing activities............................................................................... (5,860) (7,370) Cash Flows from Financing Activities: Repayments of borrowings on term loan facilities..................................................................... (3,470) (5,860) Proceeds from borrowings on revolving credit and accounts receivable facilities.......................... 117,130 289,440 Repayments of borrowings on revolving credit and accounts receivable facilities......................... (97,220) (245,880) Payments for deferred purchase price..................................................................................... - (5,400) Shares surrendered upon vesting of options and restricted stock awards to cover tax obligations…...…………………………………………………………………………………….……… (650) (2,560) Proceeds from exercise of stock options................................................................................ - 430 Tax effect from stock based compensation............................................................................. (620) 200 Net cash provided by financing activities of continuing operations.......................................... 15,170 30,370 Net cash used for financing activities of discontinued operations........................................... - (420) Net cash provided by financing activities.......................................................................... 15,170 29,950 Cash and Cash Equivalents: Net increase (decrease) for the period.................................................................................... 5,970 (690) At beginning of period........................................................................................................... 19,450 24,420 At end of period................................................................................................................ 25,420$ 23,730$ Supplemental disclosure of cash flow information: Cash paid for interest........................................................................................................ 2,980$ 4,710$ Cash paid for taxes........................................................................................................... 1,780$ 8,340$ March 31, Three months ended

Three months ended 2016 2015 Packaging Net sales................................................................................................................................................ 80,110$ 78,960$ Operating profit........................................................................................................................................ 17,840$ 17,510$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs........................................................................................... 470$ 150$ Excluding Special Items, operating profit would have been................................................................... 18,310$ 17,660$ Aerospace Net sales................................................................................................................................................ 40,500$ 45,740$ Operating profit........................................................................................................................................ 3,460$ 8,080$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs........................................................................................... 70$ 790$ Excluding Special Items, operating profit would have been................................................................... 3,530$ 8,870$ Energy Net sales................................................................................................................................................ 44,750$ 51,160$ Operating profit (loss)............................................................................................................................... (3,610)$ 340$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs........................................................................................... 4,700$ 1,430$ Excluding Special Items, operating profit would have been................................................................... 1,090$ 1,770$ Engineered Components Net sales................................................................................................................................................ 37,520$ 48,270$ Operating profit........................................................................................................................................ 5,580$ 5,970$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs........................................................................................... 150$ 80$ Excluding Special Items, operating profit would have been................................................................... 5,730$ 6,050$ Corporate expenses Operating loss......................................................................................................................................... (6,820)$ (8,880)$ Total Continuing Operations Net sales................................................................................................................................................ 202,880$ 224,130$ Operating profit........................................................................................................................................ 16,450$ 23,020$ Total Special Items to consider in evaluating operating profit........................................................................ 5,390$ 2,450$ Excluding Special Items, operating profit would have been................................................................... 21,840$ 25,470$ March 31, Company and Business Segment Financial Information 27 (Unaudited, dollars in thousands, from continuing operations)

Additional Information Regarding Special Items Impacting Reported GAAP Financial Measures 28 (Unaudited, dollars in thousands, except for per share amounts) Three months ended March 31, 2016 2015 Income from continuing operations, as reported.............................................................................................................. 8,300$ 11,940$ After-tax impact of Special Items to consider in evaluating quality of income from continuing operations: Severance and business restructuring costs....................................................................................................................... 4,090 1,900 Excluding Special Items, income from continuing operations would have been........................................................... 12,390$ 13,840$ Three months ended March 31, 2016 2015 Diluted earnings per share from continuing operations, as reported................................................................................ 0.18$ 0.26$ After-tax impact of Special Items to consider in evaluating quality of EPS from continuing operations: Severance and business restructuring costs....................................................................................................................... 0.09 0.05 Excluding Special Items, EPS from continuing operations would have been................................................................ 0.27$ 0.31$ Weighted-average shares outstanding ......................................................................................................................... 45,654,816 45,400,843 2016 2015 Operating profit from continuing operations (excluding Special Items)……………………….……….................................... 21,840$ 25,470$ Corporate expenses (excluding Special Items)…………………………………………................................................................ 6,820 8,880 Segment operating profit (excluding Special Items)………………….................................................................................. 28,660$ 34,350$ Segment operating profit margin (excluding Special Items)…...……................................................................................ 14.1% 15.3% 2016 2015 Net cash provided by (used for) operating activities of continuing operations.............................................................................. (3,340)$ 3,860$ Add: Cash impact of Financial Improvement Plan.................................................................................................................... 3,440 - Cash Flows from operating activities excluding Special Items.................................................................................................. 100 3,860 Less: Capital expenditures of continuing operations................................................................................................................ (5,980) (5,690) Free Cash Flow from continuing operations............................................................................................................................ (5,880)$ (1,830)$ Three months ended March 31, March 31, Three months ended

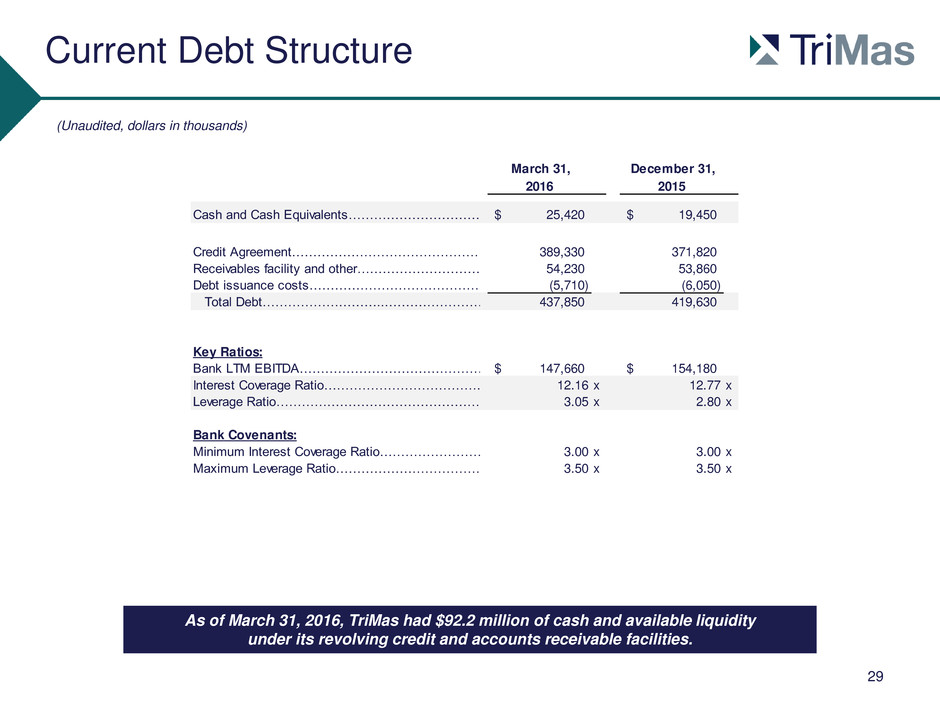

Current Debt Structure 29 (Unaudited, dollars in thousands) As of March 31, 2016, TriMas had $92.2 million of cash and available liquidity under its revolving credit and accounts receivable facilities. March 31, December 31, 2016 2015 Cash and Cash Equivalents……………………………..………………… 25,420$ 19,450$ Credit Agreement……………………………………….. 389,330 371,820 Receivables facility and other……………………………….. 54,230 53,860 Debt issuance costs…………………………………… (5,710) (6,050) Total Debt………………………...………………………...………………………… 437,850 419,630 Key Ratios: Bank LTM EBITDA……………………………………………………………………………….……………………………………… 147,660$ 154,180$ I terest Coverage Ratio………………………………………………………………… 12.16 x 12.77 x Leverage Ratio…………………………………………………………………... 3.05 x 2.80 x Bank Covenants: Minimum Interest Coverage Ratio………………………………………………………………… 3.00 x 3.00 x Maximum Leverage Ratio………………………………………………………………………………… 3.50 x 3.50 x

LTM Bank EBITDA as Defined in Credit Agreement 30 (Unaudited, dollars in thousands) (1) As defined in the Credit Agreement dated June 30, 2015. (39,080)$ Interest expense....................................................................................................................... 14,050 Income tax expense.................................................................................................................. 4,880 Depreciation and amortization.................................................................................................... 44,140 Extraordinary non-cash charges................................................................................................. 75,680 Non-cash compensation expense............................................................................................... 6,330 Other non-cash expenses or losses........................................................................................... 16,010 Non-recurring expenses or costs relating to cost saving projects .................................................. 15,000 Acquisition integration costs...................................................................................................... 1,900 Debt financing and extinguishment costs.................................................................................... 1,970 Permitted dispositions............................................................................................................... 6,780 147,660$ Net loss for the twelve months ended March 31, 2016..................................................................... Bank EBITDA - LTM Ended March 31, 2016 (1)…………………………………………………………………