Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment Number 1

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

CU BANCORP

(Exact name of registrant as specified in its charter)

Commission File Number 001-35683

| California | 90-0779788 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 818 W. 7th Street, Suite 220 Los Angeles, California |

90017 | |

| (Address of principal executive offices) | (Zip Code) | |

(818) 257-7700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(g) of the Act:

None

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, no par value, The NASDAQ Stock Market, LLC

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant Section 13 or 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, if definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated Filer | x | |||

| Non-Accelerated Filer | ¨ | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $342 million based upon the closing price of shares of the registrant’s Common Stock, no par value, as reported by The NASDAQ Stock Market, LLC.

The number of shares outstanding of the registrant’s common stock (no par value) at the close of business on April 28, 2016 was 17,432,966.

Table of Contents

EXPLANATORY NOTE

This amendment on the Annual Report on Form 10-K/A (the “Form 10-K/A”) amends CU Bancorp’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the Securities and Exchange Commission (“SEC”) on March 14, 2016. This Form 10-K/A includes the previously incorporated by reference material from the Proxy Statement which was not filed within 120 days of year end. Except for Items 10, 11, 12, 13 and 14 of Part III no other information in this Form 10-K/A is being amended.

Table of Contents

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

3 | |||

| 17 | ||||

| 41 | ||||

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

44 | |||

| 45 | ||||

| 46 |

Table of Contents

Forward Looking Statements

In addition to the historical information, this Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “1933 Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “1934 Act”). Those sections of the 1933 Act and 1934 Act provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their financial performance so long as they provide meaningful, cautionary statements identifying important factors that could cause actual results to differ significantly from projected results.

The Company’s forward-looking statements include descriptions of plans or objectives of management for future operations, products or services, and forecasts of its revenues, earnings or other measures of economic performance. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “assume,” “plan,” “predict,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.”

We make forward-looking statements as set forth above and regarding projected sources of funds, availability of acquisition and growth opportunities, dividends, adequacy of our allowance for loan and lease losses and provision for loan and lease losses, our loan portfolio and subsequent charge-offs. Forward-looking statements involve substantial risks and uncertainties, many of which are difficult to predict and are generally beyond our control. There are many factors that could cause actual results to differ materially from those contemplated by these forward-looking statements. Risks and uncertainties that could cause our financial performance to differ materially from our goals, plans, expectations and projections expressed in forward-looking statements include those set forth in our filings with the SEC, Item 1A of this Annual Report on Form 10-K, and the following:

| • | Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, high unemployment rates and overall slowdowns in economic growth. |

| • | Loss of customer checking and money-market account deposits as customers pursue other, higher-yield investments. |

| • | Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits. |

| • | Competitive market pricing factors. |

| • | Deterioration in economic conditions that could result in increased loan losses. |

| • | Risks associated with concentrations in real estate related loans. |

| • | Risks associated with concentrations in deposits. |

| • | Market interest rate volatility. |

| • | Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans. |

| • | Changes in the speed of loan prepayments, loan origination and sale volumes, loan loss provisions, charge offs or actual loan losses. |

| • | Compression of our net interest margin. |

| • | Stability of funding sources and continued availability of borrowings. |

| • | Changes in legal or regulatory requirements or the results of regulatory examinations that could restrict growth. |

| • | The inability of our internal disclosure controls and procedures to prevent or detect all errors or fraudulent acts. |

| • | Inability of our framework to manage risks associated with our business, including operational risk and credit risk, to mitigate all risk or loss to us. |

| • | Our ability to keep pace with technological changes, including our ability to identify and address cyber-security risks such as data security breaches, “denial of service” attacks, “hacking” and identity theft. |

1

Table of Contents

| • | The effects of man-made and natural disasters, including earthquakes, floods, droughts, brush fires, tornadoes and hurricanes. |

| • | Our ability to recruit and retain key management and staff. |

| • | Availability of, and competition for acquisition opportunities. |

| • | Risks associated with merger and acquisition integration. |

| • | Significant decline in the market value of the Company that could result in an impairment of goodwill. |

| • | Regulatory limits on the Bank’s ability to pay dividends to the Company. |

| • | The uncertainty of obtaining regulatory approval for various merger and acquisition opportunities. |

| • | New accounting pronouncements. |

| • | The impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) and related rules and regulations on the Company’s business operations and competitiveness. |

| • | Our ability to comply with applicable capital and liquidity requirements (including the finalized Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms. |

| • | The effects of any damage to our reputation resulting from developments related to any of the items identified above. |

For a more detailed discussion of some of the risk factors, see the section entitled “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2015.

Forward-looking statements speak only as of the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made or to reflect the occurrence of unanticipated events. You should consider any forward looking statements in light of this explanation, and we caution you about relying on forward-looking statements.

2

Table of Contents

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

The Bylaws of the CU Bancorp (the “Company” or “CUB”) provide that the number of directors shall not be less than nine or more than seventeen until changed by an amendment to the Articles of Incorporation or the Bylaws, leaving the board of directors with the authority to fix the exact number of directors within that range. The board of directors last fixed the exact number of directors at twelve.

Directors are elected annually for a term ending on the next annual shareholders’ meeting date.

The board of directors has determined that all of the current directors on the board, except for Mr. Rainer, Mr. Horton and Mr. Cosgrove, are “independent,” as that term is defined by the rules and regulations of The NASDAQ Stock Market. These nine independent directors comprise a majority of the board of directors.

The following table lists the names and certain information as of April 15, 2016 regarding CUB’s directors. All the named individuals serve as directors of CU Bancorp and its subsidiary California United Bank.

| Name |

Age |

Position with CUB |

Year First Appointed or | |||

| Roberto E. Barragan | 55 | Director | 2004 | |||

| Charles Beauregard | 68 | Director | 2014 | |||

| Kenneth J. Cosgrove | 68 | Vice Chairman California United Bank | 2012 | |||

| David Holman | 67 | Director (Lead) | 2014 | |||

| K. Brian Horton | 56 | Director and President | 2014 | |||

| Eric S. Kentor | 57 | Director | 2014 | |||

| Jeffrey Leitzinger, Ph.D. | 61 | Director | 2014 | |||

| David I. Rainer | 59 | Chairman, President and Chief Executive Officer | 2004 | |||

| Roy A. Salter | 59 | Director | 2004 | |||

| Daniel F. Selleck | 60 | Director | 2004 | |||

| Charles H. Sweetman | 73 | Director | 2004 | |||

| Kaveh Varjavand* | 53 | Director | 2015 |

| * | Appointed by the board for a term commencing September 1, 2015 |

CUB’s directors serve one-year terms. None of the directors or executive officers was selected pursuant to any arrangement or understanding, other than with the directors and executive officers of CUB acting within their capacities as such. There are no family relationships between the directors and executive officers of CUB. None of the directors or executive officers of CUB serve as directors of any company which has a class of securities registered under, or which are subject to the periodic reporting requirements of, the Securities Exchange Act of 1934, as amended, or any investment company registered under the Investment Company Act of 1940. None of the directors or executive officers of CUB have been involved in any legal proceedings during the past ten years that are material to an evaluation of the ability or integrity of any director or executive officer of CUB. No specific term limits have been set by the board of directors for individual directors. However, the board has adopted guidelines which set out expected term limits based on the age of individual directors. It is expected that a director shall not be renominated or stand for election after his/her 73rd birthday or his/her 75th birthday as to board members serving on April 25, 2013. Directors are allowed to complete their current term if their 73rd or 75th birthday, as applicable, falls within the term. Exceptions to this policy can be approved by the board of directors.

The following is the business experience of the members of CUB’s current board of directors:

Roberto E. Barragan. Mr. Barragan currently is President of the Valley Economic Development Center, Inc. (“VEDC”). He has served in various capacities with the VEDC since 1995. The VEDC is a 501(c)3 community based private non-profit corporation which offers training, consulting, technical assistance and

3

Table of Contents

financing to small- and medium-sized businesses. He was a founder of the Pacoima Development Federal Credit Union. Mr. Barragan is an expert on the needs of small businesses within CUB’s communities and assists significantly in the Community Reinvestment Act efforts of CUB. Mr. Barragan serves as the Community Reinvestment Act “CRA” board Liaison, between the Bank’s CRA committee and the board of directors. Mr. Barragan is an expert on the needs of small businesses within the Company’s communities as well as lending, community development and government programs designed to assist in small business lending. His experience and community contacts provide him with the knowledge to assist significantly in the Community Reinvestment Act and small business lending efforts of California United Bank.

Charles P. Beauregard. Mr. Beauregard has served as a director of the Company since November 30, 2014, following the merger of 1st Enterprise Bank with and into California United Bank. He was a director of 1st Enterprise Bank since its incorporation in 2006 and served as Chairman of the Director’s Loan Committee at 1st Enterprise as well as a member of the Compensation Committee, the Strategic and Capital Planning Committee, and the Governance Committee. Mr. Beauregard is a retired bank executive with over 30 years of commercial banking experience. Mr. Beauregard was formerly chief credit officer for Wells Fargo Bank’s Trust and Private Bank Group. Mr. Beauregard provides the benefit of his lengthy experience in the financial services industry and a bank director to the Company.

Kenneth J. Cosgrove. Mr. Cosgrove was previously the Chairman and Chief Executive Officer of Premier Commercial Bancorp and Premier Commercial Bank, N.A. and had served in that position since the formation. He has over 40 years of banking experience. He is currently also a member of the board of directors of the holding company for Pacific Coast Bankers Bank as well as Pacific Coast Bankers Bank, a bankers’ bank in San Francisco, CA and serves as the Chairman of the board. Mr. Cosgrove as a former independent banker has extensive knowledge of the community banking industry and the Southern California banking market as well as SBA lending.

David C. Holman. Mr. Holman is the Company’s lead independent director and has served in that position since March 2015. He was previously the Chairman of the board of directors of 1st Enterprise Bank, serving since incorporation of 1st Enterprise since in February 2006 and was also a private investor throughout that period. He was Chairman of both the Strategic and Capital Planning Committee and the Nominating and Governance Committee, and a member of the Compliance and Compensation Committees of 1st Enterprise. Mr. Holman was formerly a senior executive at First Interstate Bank in Los Angeles and has been actively involved in the commercial banking industry for 40 years in California as a banker or investor. As a former banker and chairman of the board of a community bank, Mr. Holman brings experience in banking and corporate governance to the Company.

K. Brian Horton is President and a director of CU Bancorp and California United Bank. He previously served as the President and a director of 1st Enterprise since February 2006. Previously, he served as Division President of Mellon 1st Business Bank, from September 2004 to June 2005, and in various management positions at Mellon 1st Business Bank (and its predecessor, 1st Business Bank) from 1988 through June 2005, including Executive Vice President from 2003 to 2004, and Regional Vice President for the Orange County Regional Office from 1997 to 2003. Mr. Horton provides the board with his banking and market expertise as well as additional insight into the Company’s loan and other business production activities.

Eric S. Kentor. Mr. Kentor is an attorney, independent business consultant and private investor working primarily with companies in the medical technology and clean tech, or “green” sectors. From 1995, until its purchase by Medtronic in 2001, Kentor served as Senior Vice President, General Counsel, and Corporate Secretary and as a permanent member of the Executive Management Committee at MiniMed Inc. The company was a world leader in the design, development, manufacture and marketing of advanced systems for the treatment of diabetes. Prior to MiniMed, Kentor served as Vice President of Legal Services for Health Net, California’s second-largest health maintenance organization, as well as Executive Counsel for its parent corporation. Previously, Kentor was a partner at the law firm of McDermott, Will & Emery. Kentor has also served as a director of both private and public companies, including Endocare, Inc., a publicly traded medical device company where he served as a director until the company was acquired in 2009. As an attorney experienced in corporate governance, Mr. Kentor provides legal and corporate governance expertise as well as experience as an executive officer and director of public companies.

4

Table of Contents

Jeffrey J. Leitzinger, Ph.D. previously served as a director of 1st Enterprise since its incorporation in 2006. He was a member of the ALCO Committee, the Nominating and Governance Committee, and the Strategic and Capital Planning Committee. Dr. Leitzinger has been President and Chief Executive Officer of Econ One Research, Inc. in Los Angeles since 1997, and has been an economic consultant for over 30 years. Dr. Leitzinger is an economic expert and assists the Company in this area, including expertise in asset-liability management as well as community banking.

David I. Rainer. Mr. Rainer is Chairman of the board of directors and the Chief Executive Officer of CU Bancorp and California United Bank. He was previously California State President for US Bank and Executive Vice President of Commercial Banking for US Bank, in which capacity he led the commercial banking operations for US Bank in the Western United States, from Colorado to California. In February 1999, Mr. Rainer became President and Chief Executive Officer of Santa Monica Bank which was acquired by US Bank in November 1999. From 1992 to 1999, Mr. Rainer was an executive officer of California United Bank (not related to the current California United Bank), and its successor Pacific Century Bank, N.A., and served as Executive Vice President and then director, President and Chief Executive Officer. Mr. Rainer is a member of the board of directors of the Federal Reserve Bank of San Francisco, Los Angeles Branch. As the Company’s Chief Executive, Mr. Rainer provides the board with essential information about the Company and management activities as well as leading initiatives intended to promote and enhance shareholder value.

Roy A. Salter. Mr. Salter is an independent consultant. He was formerly the Senior Managing Director of FTI, LLC. Previously he was a Founding Principal of The Salter Group based in the Los Angeles Office where he co-managed the firm’s overall practice and project management efforts. The Salter Group was a leading independent financial and strategic advisory firm specializing in providing business and intangible asset valuations, financial opinions, financial and strategic analysis, forecasting, and transaction support covering a broad spectrum of industries and situations to both middle market and Fortune 500 companies and capital market constituents. The Salter Group combined with FTI in 2012. Mr. Salter brings financial analysis and valuation expertise to the board as well as a background in bank marketing.

Daniel F. Selleck. Mr. Selleck is President of the Westlake Village-based Selleck Development Group, Inc. which specializes in the development and acquisition of commercial properties. That company has completed the development of more than 4 million square feet of property, with a value approximating $1.2 billion, including the development of the former General Motors Assembly Plant in Van Nuys, California. Selleck Development Group, Inc. has also recently completed the development of “The Shoppes at Westlake Village”, a $40 million Shopping Center located in Westlake Village, California. As a real estate expert, Mr. Selleck provides his expertise to CUB’s Directors’ Loan Committee and provides expertise in real estate lending and structure.

Charles H. Sweetman. Mr. Sweetman is a managing partner of Sweetman Properties, LLC, a commercial income property company located in Palm Desert, California and also is the President and Chief Executive Officer of Sweetman Group, Inc. a property management and consulting firm. Mr. Sweetman provides strong entrepreneurial experience to the board as well as significant business development skills. He is a member of the Compensation, Nominating and Corporate Governance Committee. Mr. Sweetman provides leadership experience and entrepreneurial experience in founding and managing small-to-medium size businesses which is one of the Company’s target markets.

Kaveh Varjavand. Mr. Varjavand is an accounting and financial professional with 28 years of experience in the financial services industry, including 18 years in public accounting, during which 14 of which he was a managing partner. Mr. Varjavand is the founder and president of AARCS (Accounting, Audit, and Reporting Consulting Services), established in 2013, which provides consulting services to community banks in the areas of financial reporting, risk assessment, regulatory compliance, governance and credit risk management, among others. From 2006 to 2013, he was the Partner-in-Charge of the Southern California Financial Services Group at

5

Table of Contents

Moss Adams LLP, where he was responsible for all aspects of practice development related to financial services clients in Southern California. In 1990 Varjavand joined the audit staff at KPMG LLP, and served there as an audit partner from 1999 to 2006. He left KPMG for four years from 1994 to 1998 to work in the banking industry: from 1994 to 1997 he served as Vice President, Corporate Planning & Internal Asset Review, at Coast Federal Bank, an $8 billion savings bank; from 1997 to 1998, he served as First Vice President, Planning & Analysis at California Federal Bank, a $60 billion savings bank. He is a member of the American Institute of Certified Public Accountants and the California Society of Certified Public Accountants. Mr. Varjavand earned a bachelor’s degree in accounting with a minor in economics from the University of Kentucky. He has been a licensed certified public accountant since 1992.

Executive Officers

The following sets forth the names and certain information as of April 15, 2016 with respect to CUB’s executive officers (except for Mr. Rainer and Mr. Horton whose information is included above):

| Name |

Age |

Position with CUB |

Year First | |||

| Anne A. Williams | 58 | Director – California United Bank, Executive Vice President, Chief | 2005 | |||

| Operating Officer / Chief Credit Officer | ||||||

| Karen A. Schoenbaum | 53 | Executive Vice President and Chief Financial Officer | 2009 | |||

| Anita Y. Wolman | 64 | Executive Vice President, Chief Administrative Officer, General Counsel & Corporate Secretary1 | 2009 |

| 1 | Ms. Wolman was previously Senior Vice President Legal/Compliance and had served in that capacity since 2005. |

Anne A. Williams, Director, Executive Vice President, Chief Operating Officer and Chief Credit Officer of California United Bank has served in this capacity since January 2009 and October 2004, respectively. She is also Chief Operating Officer and Chief Credit Officer of CUB and has served in these capacities since April 2008 and October 2004, respectively. Ms. Williams is also a member of the board of directors of California United Bank. Prior to joining us, Ms. Williams served as Senior Vice President and Credit Risk Manager for US Bank’s Commercial Banking Market for the State of California. Ms. Williams was previously the Executive Vice President and Chief Credit Officer of Santa Monica Bank, which was acquired by US Bank in November 1999. Prior to joining Santa Monica Bank, Ms. Williams was the Executive Vice President and Chief Credit Officer at California United Bank (and its successor, Pacific Century Bank, N.A.) from 1992 to 1999.

Karen A. Schoenbaum, Executive Vice President and Chief Financial Officer has served as CUB’s Executive Vice President and Chief Financial Officer since October 2009. Prior to joining CUB, Ms. Schoenbaum was Executive Vice President and Interim Chief Financial Officer of Premier Business Bank in Los Angeles. She previously served as Executive Vice President and Chief Financial Officer of California National Bank from 2001 to 2008, where she was responsible for the financial and regulatory reporting, accounting, treasury, asset and liability management, general services and corporate real estate departments. From 1997, Ms. Schoenbaum was Executive Vice President, Chief Financial Officer and Chief Information Officer of Pacific Century Bank, N.A. a subsidiary of Bank of Hawaii Corporation.

Anita Y. Wolman, Executive Vice President, Chief Administrative Officer, General Counsel & Corporate Secretary was appointed Chief Administrative Officer in 2013 and Executive Vice President & General Counsel in January 2009. She previously was Senior Vice President Legal/Compliance beginning in 2005. Prior to joining CUB, Ms. Wolman was Senior Vice President, General Counsel & Corporate Secretary of California Commerce Bank (Citibank/Banamex USA). Earlier Ms. Wolman was Executive Vice President, General Counsel & Corporate Secretary of Pacific Century Bank, N.A. a subsidiary of Bank of Hawaii Corporation and its predecessor California United Bank.

There are no family relationships between any Director and an Executive Officer or among any Directors.

6

Table of Contents

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership of, and transactions in, the Company’s equity securities with the SEC. Such directors, executive officers and 10% stockholders are also required to furnish the Company with copies of all Section 16(a) reports that they file. Based solely on a review of the copies of such reports received by the Company, and on written representations from certain reporting persons, the Company believes that all Section 16(a) filing requirements applicable to its directors, executive officers and 10% stockholders were complied with during 2015 with the exception of a total of three (3) filings for Mr. Rainer and Mses. Williams and Wolman, respectively, which, due to an administrative error, were 4 days delinquent and related to the number of shares of restricted stock not delivered to the recipient upon vesting, in order for the recipient to satisfy his or her tax withholding obligations in connection with the vesting.

7

Table of Contents

CORPORATE GOVERNANCE PRINCIPLES AND CODE OF ETHICS

The board of directors is committed to good business practices, transparency in financial reporting and the highest level of corporate governance. In response to this, the board has adopted formally the following Corporate Governance Guidelines:

Corporate Governance Guidelines

Our corporate governance guidelines provide for, among other things:

| • | A board consisting of a majority of independent directors; |

| • | A lead independent director; |

| • | Periodic executive sessions of non-management directors; |

| • | An Audit and Risk Committee and a Compensation, Nominating and Corporate Governance Committee consisting entirely of independent directors; |

| • | Annual Performance Evaluation of the board; |

| • | Director education and orientation; and |

| • | Ethical conduct of directors and adherence to a duty of loyalty to the Bank. |

In connection with our ongoing review of corporate governance and best practices, in March 2015, the board appointed David Holman to the newly created position of Lead Independent Director. Mr. Holman was previously the Chairman of the board of 1st Enterprise Bank and additionally brings many years of banking experience to this position. As Lead Director he calls and chairs meetings of the independent and non-management directors, act as a liaison between the independent directors, other members of the board and management, and assists as necessary on board agendas to assure that all stakeholders’ interests are represented appropriately. In the absence of the Chairman, the Lead Director will chair meetings of the board of directors.

The board has adopted a Code of Ethics that applies to the Bank’s principal executive officer, principal financial officer, controller and principal accounting officer, or persons performing similar functions, as well as Principles of Business Conduct & Ethics that apply to its directors, officers and employees. A copy is available on the Company’s website at www.cunb.com or by contacting Anita Wolman, Corporate Secretary, at 15821 Ventura Boulevard, Suite 100, Encino, CA 91436. A copy will be provided without charge.

We also have an Insider Trading Policy which prohibits Directors and Senior Officers from the purchase or sale of puts, calls, options or other derivative securities based on the Company’s securities. Corporate Governance Guidelines also prohibit Directors and Named Executive Officers from pledging their Company securities in connection with margin accounts or other borrowing arrangements. Variations of the pledging prohibitions may be approved by the CNCG Committee for limited transactions specifically involving exercise of stock options held by Directors as of July 30, 2015.

Board Leadership Structure

The board and the CNCG Committee have determined that given the quality of leadership, shareholder relationships and other mitigating matters peculiar to Mr. Rainer and the Company at this stage of its growth, it is appropriate for Mr. Rainer to serve as both Chief Executive Officer and Chairman of the board. In 2014, Mr. Horton was named to serve as President of the Company, thereby separating the jobs of CEO and President. In further recognition of the combined Chairman/CEO structure, in 2015 the board of directors named Mr. Holman to

8

Table of Contents

a newly created position of Lead Independent Director to call and chair meetings of the independent and non-management directors, act as a liaison between the independent directors, other members of the board and management and assist on board agendas and in other matters to assure that all stakeholder’s interests are represented appropriately. Through the Lead Independent Director, the Company aims to foster an appropriate level of separation between the levels of leadership in the Company. Leadership is also provided through the respective chairs of the board’s various committees. The board believes it is critical for both the CEO and the President to serve on the board of directors.

Director Resignation Policy

As part of its Corporate Governance Guidelines, the CU Bancorp board of directors has adopted a “Director Resignation Policy.” This policy provides that at any shareholder meeting at which directors are subject to an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election will then be required to tender a letter of resignation to the Chairman of the board for consideration by the board’s Compensation, Nominating and Corporate Governance Committee which will thereafter recommend to the CU Bancorp board of directors the action to be taken with respect to such offer of resignation. The CU Bancorp board of directors will act no later than 90 days following the date of the shareholder meeting with respect to each such letter of resignation and will notify the director concerned of its decision and promptly publicly disclose such decision. Any director who tenders his or her resignation pursuant to this provision will not participate in any board or committee action regarding whether to accept his or her resignation offer.

Director and Executive Officer Share Ownership Policy

The Board has always taken the position that all Directors and Named Executive Officers should own a meaningful amount of Company common stock to foster alignment with the interests of the shareholders. In August 2015, the board of directors adopted a formal Stock Ownership Policy which sets out minimum ownership guidelines as follows:

| Participant |

Value of Shares Owned | |

| Chief Executive Officer | 3x Base Salary | |

| President | 2x Base Salary | |

| Other Named Executive Officers | 1x Base Salary | |

| Non-Employee Directors | 3x Annual Cash Retainer | |

Participants may satisfy the ownership guidelines with: i) shares owned directly; ii) shares owned indirectly; iii) vested restricted stock or iv) unvested restricted stock/units subject only to time based requirements. Unexercised options and unvested performance-contingent shares/units are not counted toward meeting the ownership guidelines. These requirements are reviewed annually as of December 31. If a participant is not in compliance with the Stock Ownership Policy at any such determination date, the participant must retain 100% of all shares of CU Bancorp common stock held as of such date and no less than 50% of the net shares received as a result of the exercise, vesting or payment of any Company equity awards granted to the Participant. Participants not in compliance with the minimum ownership guidelines will receive written notification that the Retention Ratio described above will apply until the Participant provides written notification and documentation indicating that he or she has come into compliance with the Stock Ownership Policy. Because a Participant must retain a percentage of net shares acquired from CUNB equity awards until the Participant satisfies the specified guideline level of ownership, there is no minimum time period required to achieve the guideline level of ownership, and the Board recognizes that a newly-elected or appointed Director or Executive Officer may require a period of time to accumulate a sufficient number of shares to attain the designated minimum ownership level.

9

Table of Contents

At December 31, 2015 all directors and executive officers were in compliance with this policy with the exception of Kaveh Varjavand who joined the board effective September 1, 2015. As a recently-appointed Board member, Mr. Varjavand is working toward ownership of the requisite number of shares in accordance with the Company’s ownership policy.

THE BOARD OF DIRECTORS AND COMMITTEES OF THE COMPANY

The board of directors of the Company oversees its business and monitors the performance of management. In accordance with corporate governance principles, our board of directors does not involve itself in day-to-day operations. The directors keep themselves informed through, among other things, discussions with the Chief Executive Officer, other key executives and our principal outside advisors (legal counsel, outside auditors, and other consultants), by reading reports and other materials that the Company sends them and by participating in board and committee meetings.

During 2015, the board of directors of CU Bancorp held twelve meetings. During 2015, no director of the Company attended less than 75% of all board meetings and the meetings of any committee of the boards on which he or she served.

In 2015, the board of directors had the following committees: Audit and Risk Committee; Compensation, Nominating and Corporate Governance Committee, and Executive Committee. In addition California United Bank maintained a board of directors Loan Committee. The Audit and Risk Committee and the Compensation, Nominating and Corporate Governance Committee both consisted solely of independent directors.

Members of the board of directors also serve as liaisons to management committees related to Community Reinvestment Act (“CRA”) matters and Asset Liability management (ALCO).

Attendance at Annual Meetings

It is the policy of the board that directors are expected to attend each Annual Meeting of Shareholders. Such attendance allows for direct interaction with shareholders. All of the Company’s directors attended the Company’s 2015 Meeting of Shareholders.

Executive Sessions

Executive sessions of non-management directors are held by the board on an “as needed” basis and at least four times annually. Prior to March 2015, the executive sessions of non-management directors were chaired by the Vice Chairman of the board, when there was one, or in his or her absence, a director chosen by the non-management directors. In March 2015 the board appointed David Holman as the Lead Independent Director. In that role he or in his absence, a director chosen by the independent directors chairs meetings of the independent directors. In 2015, the non-management directors met four times.

Reporting of Complaints/Concerns Regarding Accounting or Auditing Matters

The Company’s board of directors has adopted procedures for receiving and responding to complaints or concerns regarding accounting and auditing matters. These procedures were designed to provide a channel of communication for employees and others who have complaints or concerns regarding accounting or auditing matters involving the Company. Employee concerns may be communicated in a confidential or anonymous manner to the Audit and Risk Committee of the board. The Audit and Risk Committee Chairman will make a determination on the level of inquiry, investigation or disposal of the complaint. All complaints are discussed with the Company’s senior management, as appropriate, and monitored by the Audit and Risk Committee for handling, investigation and final disposition. The Chairman of the Audit and Risk Committee will report the status and disposition of all complaints to the board of directors. No complaints were received during 2015.

10

Table of Contents

Shareholder Communications with the Board

Shareholders wishing to communicate with the board of directors as a whole, or with an individual director, may do so by e-mail from the Bank’s or the Company’s website, www.cunb.com, or by writing to the following address:

CU Bancorp

15821 Ventura Boulevard, Suite 110

Encino, California 91436

Attention: Corporate Secretary

Any communications directed to the Corporate Secretary will be forwarded to the entire board of directors, unless the Chairman of the board reasonably believes communication with the entire board of directors is not appropriate or necessary or unless the communication is addressed solely to a specific committee or to an individual director.

Audit and Risk Committee and Board of Directors Risk Management

Board’s Role in Risk Oversight

The board has active involvement and responsibility for overseeing risk management of the Company arising out of its operations and business strategy and understanding of what level of risk is appropriate for the Company. The board monitors, reviews and reacts to material enterprise risks identified by management. The board receives specific oral and written reports from officers with oversight responsibility for particular risks within the Company. Executive management reports include reporting on financial, credit, liquidity, interest rate, capital, operational, legal and regulatory compliance and reputation risks and the Company’s degree of exposure to those risks. The board helps ensure that management is properly focused on risk by, among other things, reviewing and discussing the performance of senior management and business line leaders. While the board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the board also have responsibility for risk management. The Company has adopted, and the board has approved, a comprehensive set of policies designed to address areas of risk in the Company which management has implemented and disseminated throughout the Company and which are reviewed regularly.

Audit and Risk Management Committee Oversight

The Company has a separately designated standing Audit and Risk Committee established in accordance with applicable regulatory and NASDAQ requirements. The Audit and Risk Committee also serves as the Audit and Risk Committee of California United Bank. The Audit and Risk Committee Charter adopted by the board sets out the responsibilities, authority and specific duties of the Audit and Risk Committee. The Audit and Risk Committee must consist of at least three members, each of whom are non-management (independent) directors and each of whom must meet the independence and expertise requirements of the NASDAQ, the Sarbanes-Oxley Act of 2002 and rules promulgated thereunder, and other applicable rules and regulations. At least one member must have accounting or related financial management expertise and qualify as a “financial expert”, as defined under the regulations of the SEC. Pursuant to the Audit and Risk Committee Charter, the Audit and Risk Committee has the following primary duties and responsibilities:

| • | oversight of the quality and integrity of regulatory and financial accounting, financial statements, financial reporting processes and systems of internal accounting and financial controls; |

| • | oversight of the quality of compliance risk management and enterprise risk management; |

11

Table of Contents

| • | oversight of the Company’s compliance with legal and regulatory requirements; |

| • | oversight of the annual independent audit of the Company’s financial statements and internal controls over financial, accounting, regulatory and legal compliance and conformity with the Company’s Principles of Business Conduct and Ethics; |

| • | engagement of the independent registered public accounting firm and evaluation of the qualifications, independence and performance of the independent registered public accounting firm; |

| • | approval of all audit and non-audit services permitted to be provided by the independent registered public accountants (other than those services that meet the requirements of any de minimus exception established by law or regulation); |

| • | oversight and retention of internal audit and/or outsourced internal audit services, as well as review of the performance of the internal auditors and review of all internal audit reports and follow up on citations, comments and recommendations; and |

| • | Preparation of an annual report substantially in compliance with the rules of the SEC with regard to companies subject to the Sarbanes-Oxley Act, to be included in the Company’s annual proxy statement, if applicable. |

The Audit Committee Charter is available on the Company’s website at www.cubancorp.com.

The Audit and Risk Committee is primarily responsible for overseeing the risk management function at the Company, on behalf of the board. The Company’s Risk Manager reports directly to the Audit and Risk Committee. Both the Bank’s Bank Secrecy Act and Compliance Officers also have direct reporting lines to the Audit and Risk Committee. The Audit and Risk Committee directs and employs third parties to conduct periodic reviews and monitoring of compliance efforts with a special focus on those areas that expose the Company to compliance risk. Among the purposes of the periodic monitoring is to ensure adherence to established policy and procedures. All reviews are reported to the Audit and Risk Committee, which regularly reports to the board of directors. The Audit and Risk Committee regularly meets with various members of management and receives reports on risk management and the processes in place to monitor and control such risk.

The Audit and Risk Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities and has direct access to the independent auditors, as well as to anyone in our organization. The Audit and Risk Committee has the ability to retain special legal or accounting experts, or such other consultants, advisors or experts it deems necessary in the performance of its duties and shall receive appropriate funding from the Company for payment of compensation to any such persons. The Audit and Risk Committee works closely with management and the Company’s independent registered public accounting firm. At December 31, 2015, the Audit and Risk Committee consisted of Messrs. Varjavand (Chairman), Beauregard, Kentor, Leitzinger and Salter, each of whom was “independent” as defined by the rules and regulations of the NASDAQ Stock Market. For additional information regarding the background and relevant experience of Messrs. Varjavand, Beauregard, Kentor, Leitzinger and Salter, please see the biographies of directors under the section entitled “Directors”, above.

The board of directors has also determined that Mr. Varjavand, who serves as the Chairman of the Audit and Risk Committee, has: (i) an understanding of generally accepted accounting principles and financial statements; (ii) an ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) an experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by our financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal control over financial reporting; and (v) an understanding of audit committee functions and is therefore qualified as an “audit committee financial expert”, is “financially sophisticated” and is “independent” as those terms are

12

Table of Contents

defined by the applicable rules and regulations of the Securities and Exchange Commission and the NASDAQ Stock Market. The designation of a person as an audit committee financial expert does not result in the person being deemed an expert for any purpose, including under Section 11 of the Securities Act of 1933. The designation does not impose on the person any duties, obligations or liability greater than those imposed on any other audit committee member or any other director and does not affect the duties, obligations or liability of any other member of the Audit Committee or board of directors.

The Audit and Risk Committee held 8 regular and 2 special meetings during 2015. The Audit Committee regularly meets without members of management present.

Compensation, Nominating and Corporate Governance Committee and Bank Loan Committee Oversight

In addition to the Audit and Risk Committee, other committees of the board of directors of the Company and California United Bank consider the risks within their area of responsibility. For example, the Compensation, Nominating and Corporate Governance Committee reviews the risks that may be implicated by the Company’s executive and other compensation programs. For a discussion of that Committee’s review of executive officer compensation plans and employee incentive plans and the risks associated with these plans. See “Executive Compensation – Risk of Compensation Programs,” herein. The Bank’s Loan Committee reviews credit risk, portfolio quality and trends, as well as the results of and external credit review. The Compensation, Nominating and Corporate Governance Committee recommends director candidates with appropriate experience and skills who will set the proper tone for the Company’s risk profile and provide competent oversight over our material risks.

Audit and Risk Committee Report

The following report of the Audit and Risk Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of CU Bancorp’s other filings under the Securities Act or under the Exchange Act, except to the extent CU Bancorp specifically incorporates this report by reference.

The Audit and Risk Committee oversees CU Bancorp’s financial reporting process on behalf of the board of directors. The Audit and Risk Committee consists of five (5) members of the board of directors, each of whom is independent under the NASDAQ listing standards, SEC Rules and other regulations applicable to audit committees. In fulfilling its oversight responsibilities, the Audit and Risk Committee approved the engagement and retention of RSM US LLP as CU Bancorp’s independent registered public accountants, reviewed and discussed with management and the external auditors the audited financial statements included in CU Bancorp’s Annual Report on Form 10-K filed with the Securities and Exchange Commission and the unaudited financial statements included in CU Bancorp’s Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. RSM US LLP has served as the Company’s (or prior to that California United Bank’s) independent registered accounting firm since 2005 and reports directly to the Audit and Risk Committee. In selecting RSM US LLP as the Company’s independent registered accounting firm for 2015, the Audit and Risk Committee considered a number of factors including:

| • | The professional qualifications of RSM US LLP’s lead audit partner and other members of the audit team participating in the engagement, |

| • | RSM US LLP’s independence, |

| • | RSM US LLP’s depth of understanding of the Company’s business, accounting policies and practices and internal control over financial reporting, |

| • | The appropriateness of RSM US LLP’s fees for audit services (on both an absolute basis and as compared to peer companies/firms; and |

| • | The results of management’s and the Audit and Risk Committee’s annual evaluations of the qualifications, performance and independence of RSM US LLP. |

13

Table of Contents

In accordance with SEC rules and RSM US LLP’s policies, audit partners are subject to rotation requirements to limit the number of consecutive years an individual partner may provide service to us. For lead and concurring audit partners, the maximum number of consecutive years of service in that capacity is five (5) years. We select the Company’s lead audit partner pursuant to this rotation policy following meetings between the Chairman of the Audit and Risk Committee and the candidate or candidates for that role, as well as discussion by the full Committee and with management.

The Audit and Risk Committee operates pursuant to a written charter that was most recently ratified in September 2015. A copy of the Audit and Risk Committee’s Charter may be obtained on CU Bancorp’s website at www.cubancorp.com under the section entitled “Corporate Governance.” The Audit and Risk Committee also oversees the performance of CU Bancorp’s internal audit function, including outsourcing of that function and review of reports.

Management is responsible for CU Bancorp’s financial reporting process including its system of internal controls, and for the preparation of financial statements in accordance with generally accepted accounting principles. CU Bancorp’s independent registered public accountants are responsible for auditing those financial statements.

The Audit and Risk Committee’s responsibility is to monitor and review these processes and procedures. The members of the Audit and Risk Committee are not professionally engaged in the practice of accounting or auditing. The Audit and Risk Committee has relied on the information provided and on the representations made by management regarding the effectiveness of internal controls over financial reporting, that the financial statements have been prepared with integrity and objectivity and that these financial statements have been prepared in conformity with generally accepted accounting principles. The Audit and Risk Committee also relies on the opinions of the independent registered public accountants on the financial statements and the effectiveness of internal controls over financial reporting. The Audit and Risk Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, its consultations and discussions with management and the independent registered public accountants do not assure that CU Bancorp’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of CU Bancorp’s financial statements has been carried out in accordance with generally accepted auditing standards or that CU Bancorp’s independent registered public accountants are in fact “independent.”

In addition to approving the engagement and retention of the independent registered public accountants, the Audit and Risk Committee reviewed, met and discussed with the independent registered public accountants the matters required to be discussed by the statements on Auditing Standards (SAS) No. 16, as amended (Communication with Audit Committees) as adopted by the Public Company Accounting Oversight Board in Rule 3200T. These discussions included the clarity of the disclosures made therein, the underlying estimates and assumptions used in the financial reporting, and the reasonableness of the significant judgments and management decisions made in developing the financial statements. In addition, the Audit and Risk Committee received the written disclosures and the letter from the independent registered public accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accountants’ communications with the Audit and Risk Committee concerning independence, and has discussed with the independent registered public accountants their independence.

The Audit and Risk Committee has reviewed management’s report on its assessment of the effectiveness of internal control over financial reporting as of December 31, 2015 and the independent registered public accounting firm’s opinion on the effectiveness of CU Bancorp’s internal control over financial reporting prepared in accordance with the Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”) and discussed these reports and opinions with management and the independent registered public accounting firm prior to CU Bancorp’s filing of its Annual Report on Form 10-K for the year ended December 31, 2015. As an “emerging growth company”, CU Bancorp is not required to obtain an assessment of the effectiveness of CU Bancorp’s internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002.

14

Table of Contents

The Audit and Risk Committee also met and discussed with the independent registered public accountants issues related to the overall scope and objectives of the audit, CU Bancorp’s internal controls and critical accounting policies, and the specific results of the audit. Management was present at all or some part of each of these meetings. The Audit and Risk Committee also met with the independent registered public accountants without management. Lastly, the Audit and Risk Committee met with management and discussed the engagement of RSM US LLP as CU Bancorp’s independent registered public accountants.

During 2015, the Audit and Risk Committee met in open session and executive session with appropriate internal auditors or entities providing similar services, and RSM US LLP to discuss the results of their examinations, observations and recommendations regarding financial reporting practices, the effectiveness of CU Bancorp’s internal controls and significant risks affecting CU Bancorp.

The Audit and Risk Committee also monitors and retains the Company’s outsourced internal audit program which is intended to objectively review and evaluate the adequacy, effectiveness and quality of the Company’s system of internal controls related to the reliability and integrity of its financial information and the safeguarding of its assets. The Risk Manager reports directly to the Audit and Risk Committee with regard to the internal audit function.

Pursuant to the reports and discussions described above, and subject to the limitations on the role and responsibility of the Audit and Risk Committee referred to above and in the Audit and Risk Committee’s charter, the Audit and Risk Committee recommended to the board of directors that the audited consolidated financial statements of CU Bancorp for 2015 be included in the Annual Report on Form 10-K for the fiscal year 2015 for filing with the SEC.

Respectfully submitted by the members of the Audit and Risk Committee:

Kaveh Varjavand, Chairman

Charles Beauregard

Eric Kentor

Jeffrey Leitzinger, Ph.D.

Roy Salter

April 5, 2016

The Audit and Risk Committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this joint proxy statement/prospectus into any filing under the Securities Act or the Exchange Act, and shall not otherwise be deemed filed under these Acts.

Compensation, Nominating and Corporate Governance Committee

The Company has a separately designated Compensation, Nominating and Corporate Governance Committee (the “CNCG Committee”), which consists entirely of independent directors as defined by the rules and regulations of the SEC and the NASDAQ Stock Market. The CNCG Committee acts for both CU Bancorp and California United Bank. The members of the Compensation, Nominating and Corporate Governance Committee as of December 31, 2015 were Directors Kentor (Chairman), Barragan, Holman, Selleck, and Sweetman. Each member of the CNCG Committee is an independent director as defined by the requirements of the SEC and NASDAQ Stock Market.

The CNCG Committee has three areas of responsibility. The CNCG Committee is responsible for: (i) ensuring that compensation and benefits policies and programs for executive management and the board of directors of the Company comply with applicable law and stock exchange listing requirements, and are devised and maintained to provide and retain for the Company a high executive level of management and corporate governance competence; (ii) determining the nominees to the board of directors and their qualifications and

15

Table of Contents

reviewing performance of the board of directors and committees of the board of directors annually; and (iii) ensuring compliance with the Sarbanes Oxley Act of 2002 relative to corporate governance and such other laws and regulations as may be applicable with regard thereto.

Specifically with regard to compensation, the CNCG Committee is charged with overview of the Company’s compensation matters. The CNCG Committee reviews and approves our compensation philosophy and evaluates and determines CEO and executive officer compensation. It also reviews and approves compensation programs, plans and awards, and is responsible for administration of short-term and long-term incentive plans and other stock or stock based plans. The CNCG Committee is responsible for oversight of regulatory compliance with respect to compensation matters. In order to carry out its duties, the CNCG Committee has the ability to retain advisors to be used to assist the CNCG Committee in its duties.

With regard to nomination and governance functions the CNCG Committee recommends director nominees and appropriate policies and procedures for governance matters. The CNCG Committee has the following specific responsibilities: (i) to make recommendations as to size of the board of directors or any committee; (ii) identify potential board members; (ii) review the performance of the board and its members and committees at least annually; (iii) review the Corporate Governance Guidelines at least annually; (iv) review compliance with corporate governance requirements under applicable law and regulations of stock exchanges; (v) review the Code of Ethical Conduct and Business Practices annually; and (vi) review all related party transactions, other than those which are directly reviewed by the board of directors.

Shareholders can obtain the CNCG Committee Charter upon request to: CU Bancorp, Corporate Secretary, 15821Ventura Boulevard, Suite 100, Encino CA 91436. The CNCG Committee met eleven (11) times during 2015.

16

Table of Contents

ITEM 11. EXECUTIVE COMPENSATION

Compensation, Nominating and Corporate Governance Committee Interlocks and Insider Participation

None of the Company’s executive officers serves on the CNCG Committee, or equivalent, of another entity, one of whose executive officers or board members served on our board of directors, and none of the members of the CNCG Committee serves or has served as an officer or employee of the Company.

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE COMPENSATION

This Compensation Discussion & Analysis (“CD&A”) describes our compensation practices for both CU Bancorp and California United Bank, and the executive compensation policies, decisions and actions of our CNCG Committee. We explain how the CNCG Committee determines compensation for our senior executives and its rationale for specific 2015 decisions. We also discuss numerous changes the CNCG Committee made to our program in 2015 to further advance its fundamental objective of aligning our executive compensation with the long-term interests of CU Bancorp shareholders. The Compensation Discussion and Analysis focuses specifically on compensation for our named executive officers (“NEOs”) which in 2015 included the following:

2015 Named Executive Officers

| Name |

Position | |

| David I. Rainer | Chairman, Chief Executive Officer | |

| Brian Horton | President | |

| Anne Williams | Executive Vice President, Chief Credit Officer, Chief Operating Officer | |

| Karen Schoenbaum | Executive Vice President, Chief Financial Officer | |

| Anita Wolman | Executive Vice President, Chief Administrative Officer, General Counsel |

EXECUTIVE SUMMARY

Summary and Corporate Governance

The CNCG Committee is composed entirely of independent directors and is responsible for reviewing and approving CU Bancorp’s overall compensation programs, plans and awards, including approving salaries, awarding bonuses and granting stock based compensation to the CU Bancorp NEOs and for formulating, implementing and administering CU Bancorp’s short-term and long-term incentive plans and other stock or stock-based plans. The CNCG Committee establishes the factors and criteria upon which the CU Bancorp NEOs’ compensation is based and how such compensation relates to CU Bancorp’s performance, general compensation policies, competitive realities and regulatory requirements. The CNCG Committee also provides recommendations regarding director compensation programs. The CNCG Committee also reviews CU Bancorp’s compensation plans for risk.

2015 Business Highlights

Following the merger of 1st Enterprise Bank with and into California United Bank effective November 30, 2014, the integration of the two banks and synergies of the merger were realized during 2015, as seen in both the improvement in California United Bank’s efficiency ratio and double-digit loan growth in every quarter of 2015. The execution by the management team of this strategic initiative resulted in a bank with an efficient low-cost funding platform with an average cost of deposits of 0.10% and an average deposit balance of $254 million per branch at year end 2015. Total assets at December 31, 2015 were $2.6 billion, a year-over-year increase of $370 million from December 31, 2014.

17

Table of Contents

In late 2014, K. Brian Horton, former President of 1st Enterprise, joined CU Bancorp as a director and as President of CU Bancorp and California United Bank. Four former members of the 1st Enterprise board of directors, David Holman, Brian Horton, Charles Beauregard, and Jeffrey Leitzinger, Ph.D., joined the CU Bancorp and California United Bank boards of directors, replacing retiring CU Bancorp Directors, Kenneth Bernstein and Robert Matranga. On September 1, 2015, Kaveh Varjavand joined CU Bancorp as a director of CU Bancorp and California United Bank and Chair and designated financial expert of the Audit & Risk Committee, replacing resigning CU Bancorp Director Lester Sussman.

For the year ended December 31, 2015, core net income (net income available to common shareholders adding back net merger expenses and net severance and retention expenses) was $20.6 million, representing an increase of $9.2 million or 80.7% from 2014. Net charge-offs for 2015 were $2 million resulting in a nonperforming asset ratio at December 31, 2015 of 0.09%, one of the lowest of publicly-held West Coast banks. The Company’s 2015 efficiency ratio was 61% with core operating efficiency ratio (core non-interest expense as a percent of net interest income plus non-interest income) of 60% down from 65% for 2014. Non-interest bearing demand deposits were 56% of total deposits once again representing over one-half of all deposits and resulting in a cost of funds of 0.12% in the 4th Quarter of 2015, down from 0.13% in the 4th Quarter of 2014. Total Loans were $1.8 billion, an increase of $208 million or 13% from 2014. Moreover, at year end 2015 the Company maintained its status as being well-capitalized, the highest regulatory category available.

It should be noted that the comparability of financial information for 2015 to 2014, is affected by the Company’s acquisition of 1st Enterprise effective November 30, 2014. Operating results for 2014 include the combined operations from December 1, 2014.

In 2015, CUNB stock price per share appreciated from $21.69 at January 1 to $25.36 at December 31, representing a 17% annualized increase in price per share. An initial investment in CUNB stock of $100 on December 31, 2010 would have been worth $205.34 at December 31, 2015.

2015 Compensation Program Highlights

As part of our commitment to continuously evaluate and improve the design of our executive compensation program with a view toward further aligning compensation with performance, in the first quarter of 2015, the CNCG Committee made fundamental modifications to the compensation structure for our NEOs with the following primary objectives:

| • | Strengthen the alignment of executive pay with our business and leadership strategies |

| • | Retain the key executive talent necessary to build on our past success and execute on our strategic objectives for the future, particularly in the period immediately following the transaction with 1st Enterprise |

| • | Emphasize accountability through prospective, measurable performance goals |

| • | Balance the need to encourage short-term profitability with the imperative to deliver long-term, sustainable results |

| • | Remain appropriately competitive as the Company continues to increase shareholder value through organic growth and execution of other selective growth opportunities |

These modifications were effective for the 2015 year and resulted in all incentive compensation for that year being performance based. Specific actions and changes are discussed below. As an “emerging growth company” under the “Jumpstart Our Business Startups Act” (“JOBS Act”), the Company is not subject to laws/regulations requiring an advisory vote to approve executive compensation at this time.

Revised Compensation Peer Group: In light of the scale and complexity of the Company following the 1st Enterprise acquisition and recent organic growth, and to better inform the CNCG Committee’s deliberations and decisions regarding our executive compensation program for 2015, the CNCG Committee worked with its independent consultant to develop a new compensation peer group.

18

Table of Contents

Adoption of Management Incentive Plan: In July 2014 the Company amended and restated its 2007 Equity and Incentive Plan (the “Equity and Incentive Plan”) to, among other items, provide for both performance-based cash and equity incentives which are intended to qualify for exceptions to the tax deductibility limitations of Internal Revenue Code Section 162(m). These amendments were approved by the Company’s shareholders in October 2014. For 2015 the Equity and Incentive Plan, as amended was the vehicle for providing cash and equity incentives to the Company’s NEO’s and the Committee anticipates that the Equity and Incentive Plan will be the principal vehicle for providing performance-based cash and equity incentives to NEO’s going forward. In March 2015 the CNCG Committee adopted an annual management incentive plan (the “MIP”) under and pursuant to the Equity and Incentive Plan, as the centerpiece of our performance-based executive compensation program for 2015. The MIP is designed to deliver both cash and equity based incentives contingent on the achievement of pre-established performance goals which the CNCG Committee believed would drive superior long-term performance for the Company and improve the alignment of executive pay with performance. Under the MIP, more than 50% of Mr. Rainer’s target total direct compensation for 2015 was performance based, as compared to 24% in 2014. For the other NEOs, more than 40% of target total direct compensation was directly tied to the achievement of pre-established goals, compared to roughly 23% in 2014.

Special One-Time Restricted Stock Awards: The CNCG Committee believes that retention of the current NEOs is critical to the future success of the Company. In order to better assure their retention, the CNCG Committee granted one-time special awards of restricted stock to Mr. Rainer, Ms. Williams, Ms. Schoenbaum, and Ms. Wolman in March 2015, similar in nature to the grant of restricted stock awarded to Mr. Horton upon his hire upon the close of the 1st Enterprise acquisition in 2014. These awards were structured with a vesting schedule designed to encourage retention over a particularly critical period for the Company following the 1st Enterprise acquisition and during which the Committee expects the Company may be well-positioned for continued growth. Accordingly, no portion of the grant vests until the 2-year anniversary date of the grant, and will fully vest over a four-year period. In considering these awards, the Committee noted that none of the NEO’s has an employment contract with the Company.

Further discussion about each of the above changes to the NEO compensation program in 2015 is set out in the section below titled “Our Executive Compensation Program in Detail.”

Our Compensation Governance Practices & Policies

Our pay practices emphasize good governance and market practice.

| We do |

We do not | |

| ü Place an emphasis on variable compensation, which includes annual cash incentive awards dependent on the achievement of short-term financial goals |

x Offer compensation-related tax gross ups | |

| ü Grant performance based equity awards |

x Provide significant perquisites | |

| ü Have stock ownership requirements for NEOs; all NEOs are expected and do hold a significant position in Company common stock |

x Allow hedging, and trading in derivatives of Company securities | |

| ü Have an executive compensation clawback as part of our incentive program to ensure accountability |

x Guarantee bonuses | |

| ü Have an independent compensation consultant advising the CNCG Committee |

x Offer employment agreements | |

19

Table of Contents

WHAT GUIDES OUR EXECUTIVE COMPENSATION PROGRAM

Our Compensation Philosophy

CU Bancorp’s compensation programs are designed, among other things, to emphasize the link between compensation and performance, taking into account competitive compensation levels in similar banks and in the markets where CU Bancorp competes for talent, as well as performance by the executive, their particular skills, background and expertise. The policies and underlying philosophy governing CU Bancorp’s compensation programs include the following:

| • | Aligning pay with performance. CU Bancorp provides a competitive salary to NEO’s based, in part, on median salary levels of similar positions as peer banks, combined with incentive opportunities that create “leveraged” compensation, providing the opportunity for market to above-market total compensation for outstanding company and individual performance. A meaningful portion of annual executive compensation is related to factors that can affect the financial performance of CU Bancorp, and is designed to incentivize and reward performance that is expected to drive shareholder value. |

| • | Creating shareholder value through incentive opportunities. The CNCG Committee believes that the long-term success of CU Bancorp and its ability to consistently increase shareholder value is dependent on its ability to attract and retain skilled executives, particularly retaining and incentivizing those currently in place who have proved their value. CU Bancorp’s compensation strategy encourages equity-based compensation to align the interests of our shareholders and our executives, as well as performance incentive awards that are designed to reward performance that we expect will result in increased shareholder value. |

| • | Attracting and retaining highly-experienced executives. We strive to employ exceptional performers with experience not typically found in peer community banks. Executives are generally expected to have backgrounds and experience in larger regional or national banks or other similar levels of experience for their particular area of emphasis. We expect our executives to be responsible for the development and success of the organization, client development and shareholder relationships. CU Bancorp executives may also hold multiple positions and responsibilities, which increases their value to the Company and may make comparisons to peers less meaningful. |

| • | Mitigating risk. CU Bancorp uses a combination of short-term and long-term compensation. The latter is impacted by CU Bancorp’s performance and mitigates the benefit to executives from exposing CU Bancorp to short-term risks, as the value of the long-term compensation, particularly equity grants, is substantially impacted by CU Bancorp’s long-term performance. |

Our philosophy is supported by the following principal elements of pay in our executive compensation program:

| Pay Element |

Form |

Purpose | ||

| Base Salary | Cash (Fixed) |

Provide a competitive level of pay that reflects the executive’s experience, role and responsibilities | ||

| Annual Incentives | Cash and Equity (Variable) |

Reward achievement of corporate performance goals for the most recently-completed fiscal year; equity has vesting period beyond recently-completed fiscal year | ||

| Long-Term Incentives | Equity (Variable) |

Drive financial performance that links to shareholder value creation and longer-term business strategies. | ||

NEOs are also eligible for other benefits, including salary continuation benefits and a qualified 401(k) Plan that provides participants with the opportunity to defer a portion of their compensation, up to tax code limitations, and may entitle NEOs to receive a company matching contribution. Modest ancillary benefits are also provided to executives by the Company. See below for more information.

20

Table of Contents

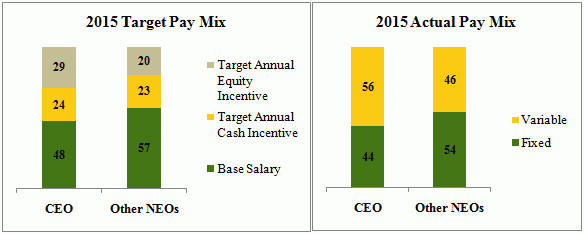

Pay Mix

While the Summary Compensation Table sets forth annual compensation data in accordance with SEC requirements, the CNCG Committee considers additional perspectives beyond this format when evaluating our compensation program. This allows us to better understand how our annual pay opportunities and mix of pay elements compare to our competitors, as well as how compensation actually earned (rather than theoretically achievable) aligns with our performance.