Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - HOPE BANCORP INC | exhibit311-201510ka2.htm |

| EX-31.2 - EXHIBIT 31.2 - HOPE BANCORP INC | exhibit312-201510ka2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________

FORM 10-K/A

Amendment No. 2

_______________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

Commission File # 000-50245

________________________________________

BBCN BANCORP, INC.

(Exact name of registrant as specified in its charter)

_________________________________________

Delaware | 95-4849715 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

3731 Wilshire Boulevard

Suite 1000

Los Angeles, California 90010

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (213) 639-1700

Securities registered pursuant to Section 12(b) of the Act:

Title of Class | Name of Exchange on Which Registered |

Common Stock, par value $0.001 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

_________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller Reporting Company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the Common Stock held by non-affiliates of the Registrant based upon the closing sale price of the Common Stock as of the last business day of the Registrant’s most recently completed second fiscal quarter, June 30, 2015, as reported on the NASDAQ Global Select Market, was approximately $1,176,550,460.

Number of shares outstanding of the Registrant’s Common Stock as of February 22, 2016: 79,566,356

TABLE OF CONTENTS | ||

Page | ||

Explanatory Note | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Explanatory Note

This Amendment No. 2 on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K of BBCN Bancorp, Inc. (the “Company,” “BBCN,” “we,” “us” or “our”) for the year ended December 31, 2015, originally filed with the Securities and Exchange Commission (the “SEC”) on March 4, 2016 (the “Original Annual Report”) and previously amended on Form 10-K/A and filed with the SEC on April 20, 2016 (the “Prior Amendment”). This Amendment amends Part III, Items 10 through 14 of the Original Annual Report, as amended by the Prior Amendment, to include information previously omitted from the Original Annual Report, as amended by the Prior Amendment, in reliance on General Instruction G(3) to Form 10-K. General Instruction G(3) to Form 10-K provides that registrants may incorporate by reference certain information from a definitive proxy statement which involves the election of directors if such definitive proxy statement is filed with the SEC within 120 days after the end of the fiscal year. The Company does not anticipate that its definitive proxy statement involving the election of directors will be filed before April 29, 2016 (i.e., within 120 days after the end of the Company’s 2015 fiscal year). Accordingly, Part III of the Original Annual Report is hereby amended and restated as set forth below. The information included herein as required by Part III, Items 10 through 14 of Form 10-K is more limited than what is required to be included in the definitive proxy statement to be filed in connection with our annual meeting of stockholders. Accordingly, the definitive proxy statement to be filed at a later date may include additional information related to the topics herein and additional information not required by Part III, Items 10 through 14 of Form 10-K. In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officers and principal financial officer are filed as exhibits to this Amendment under Item 15 of Part IV hereof.

Except as specifically set forth in the Prior Amendment and this Amendment, no attempt has been made to modify or update other disclosures presented in the Original Annual Report. The disclosures in this Amendment continue to speak as of the date of the Original Annual Report, and do not reflect events occurring after the filing of the Original Annual Report. Accordingly, this Amendment should be read in conjunction with our other filings made with the SEC subsequent to the filing of the Original Annual Report and any other amendments to those filings.

Forward-Looking Information

Certain statements in this Annual Report on Form 10-K/A constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements relate to, among other things, expectations regarding the business environment in which we operate, projections of future performance, perceived opportunities in the market and statements regarding our pending merger with Wilshire Bancorp, Inc., and our business strategies, objectives and vision. Forward-looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “may” or similar expressions. With respect to any such forward-looking statements BBCN Bancorp, Inc. claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. Our actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward-looking statements. The risks and uncertainties include: inability to consummate our proposed merger with Wilshire on the terms we have proposed; failure to realize the benefits from the merger with Wilshire we currently expect if the merger is consummated; deterioration in economic conditions in our areas of operation; interest rate risk associated with volatile interest rates and related asset-liability matching risk; liquidity risks; risk of significant non-earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; and regulatory risks associated with current and future regulations. For a more detailed discussion of factors that might cause such a difference, see Item 1A, “Risk Factors” of the Original Annual Report which is incorporated herein by reference. BBCN Bancorp, Inc. does not undertake, and specifically disclaims any obligation, to update any forward looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

PART III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Director Qualifications and Experience

The following is a brief description of our current directors. The age and other information provided in each director’s biography are as of February 29, 2016.

Jinho Doo, age 60, has served as a director of BBCN Bancorp and BBCN Bank since October 29, 2014. He is currently Chief Executive Officer of New York City-based Key Capital Management, LLC, where he manages a hedge fund. From 2007 to 2012, Mr. Doo was Chief Executive Officer of JSD Investment Advisory Services, LLC, based in Los Angeles, during which time he provided investment advisory services to Korean-American community banks and foreign exchange consulting services to financial institutions. Previously, Mr. Doo was a Managing Director at DaeYu Investment Management Co, LTD, in Seoul, Korea and served as Director, Head of Korean Desk, Bonds Division at BZW Asia Hong Kong, an affiliate of Barclays Capital, in Hong Kong. Mr. Doo began his professional career in 1982 as a foreign exchange trader at Standard Chartered Bank, Seoul Branch, and in 1988 joined Los Angeles-based Hanmi Bank, from which he retired in 1996 as Vice President and Manager of the Investment and Accounting department. Mr. Doo earned his B.A. in Portuguese with a minor in Economics from Hankuk University of Foreign Studies in Seoul, Korea and his M.S. in Finance from Texas A&M University in College Station, Texas.

Director Qualification Highlights | Committee Membership | |

■ Capital markets knowledge and experience ■ Financial statement expertise ■ Asset liability management | ■ Audit Committee (financial expert) ■ Asset/Liability Committee ■ Strategic & Business Planning Committee | |

Jin Chul Jhung, age 72, has served as a director of BBCN Bancorp and BBCN Bank since 2011. Mr. Jhung served as a director of Center Bank for 13 years and of Center Financial Corporation since its formation in 2000 until the merger of equals with Nara Bancorp, Inc. and Nara Bank. Mr. Jhung served as Chairman of the Board of Center Financial Corporation and Center Bank from 2009 to 2010. He has owned and operated Royal Imex, Inc., an import and wholesale business in the United States for more than 34 years. Mr. Jhung also serves as Chairman or Director of various Korean-American community organizations including as President of the Overseas Korean Traders Association, Chairman of the first and fifth World Korean Business Conventions, and as Director of the Centennial Committee of Korean Immigration to the United States. He has received numerous awards and commendations from many civic and governmental agencies such as the Export Industry Official Commendation from the Korea Industry and Commerce Minister. On December 8, 2010, Mr. Jhung was presented with a presidential merit award by the Korean government. Mr. Jhung received a B.S. degree in Business Administration from Korea University in Seoul, Korea, as well as an Honorary Ph.D. degree from Dongseo University in Busan, Korea.

Director Qualification Highlights | Committee Membership | |

■ Knowledge of import and wholesale businesses ■ Deep understanding of core commercial banking customer needs ■ Community knowledge and relations | ■ Board Risk & Compliance Committee ■ Director Loan Committee ■ Strategic & Business Planning Committee | |

5

Kevin S. Kim, age 58, is Chairman, President and Chief Executive Officer of BBCN Bancorp and President and Chief Executive Officer of BBCN Bank. He has been President and Chief Executive Officer of BBCN Bancorp since March 2013 and of BBCN Bank since April 2014. He has been Chairman of the Board of BBCN Bancorp since May 2012 and served as Chairman of the Board of BBCN Bank from December 2011 through June 2014. Formerly a director of Center Financial Corporation and Center Bank from 2008 until the merger of equals with Nara Bancorp, Inc. and Nara Bank completed on November 30, 2011, Mr. Kim was the lead negotiator from Center resulting in the creation of BBCN. Prior to joining BBCN as the President and Chief Executive Officer, Mr. Kim practiced law for 18 years, focusing on corporate and business transactions, tax planning, and real estate transactions. Mr. Kim began his professional career as a Certified Public Accountant working for approximately 10 years at Arthur Andersen LLP and KPMG LLP. Mr. Kim serves on the board of directors of United Way of Greater Los Angeles. He received a B.A. degree with a major in English and a minor in International Trade from Hankuk University of Foreign Studies in Seoul, Korea, an M.B.A. degree from the Anderson School of Management, the University of California, Los Angeles, and a J.D. degree from Loyola Law School in California. Mr. Kim is a graduate of the ABA Stonier Graduate School of Banking, University of Pennsylvania, and earned the Wharton Leadership Certificate from The Wharton School Aresty Institute of Executive Education.

Director Qualification Highlights | Committee Membership | |

■ Legal and public accounting background and expertise ■ Leadership of BBCN Bank ■ Community knowledge and relations | ■ Executive Committee ■ Strategic & Business Planning Committee | |

Peter Y.S. Kim, age 67, has served as a director of BBCN Bancorp and BBCN Bank since 2011. He served as a director of Center Bank for 13 years and of Center Financial Corporation from its formation in 2000 to its merger with Nara Bancorp, Inc. For more than 31 years, he has owned and operated Harbor Express, Inc., Gold Point Transportation, Bridge Warehouse, Inc. and 3Plus Logistics, each of which are trucking transportation and warehousing businesses in the United States. While sponsoring many scholarship programs in the Korean-American community in Los Angeles, he also serves as an advisory board member of the Korean Studies Institute of the University of Southern California. He received a B.S. degree in Business Administration from Sogang University in Seoul, Korea.

Director Qualification Highlights | Committee Membership | |

■ Extensive experience leading global businesses in highly regulated industry ■ Risk management and corporate governance experience ■ Community knowledge and relations | ■ Nomination & Governance Committee ■ Human Resource & Compensation Committee ■ Executive Committee ■ Director Loan Committee | |

Sang Hoon Kim, age 74, has been a member of the BBCN Bancorp and BBCN Bank boards since 2011. He was one of the founding directors of Center Bank and Center Financial Corporation and continuously served as a director of Center Bank for 26 years and of Center Financial Corporation for 11 years, until the latter’s merger into Nara Bancorp, Inc.. He served as Chairman and Chief Executive Officer of Tmecca.com, an on-line provider of professional books and magazines, from 2001 until he retired in 2006, and was active in various importing and manufacturing businesses in the Los Angeles area for nearly 40 years. Mr. Kim moved to the United States in 1967 and established Jaycee Co., an importer of wigs and other hair products. In 1979, he established Protrend, Ltd., thereby entering the women’s garment import and manufacturing industry, and pioneering the successful sale of these imported products to higher-end department stores. Mr. Kim then expanded into the men’s garment import and manufacturing business in 1988 by establishing Greg and Peters, Inc., and after several decades of involvement in the wig and garment industries, he expanded into the online professional publication business referenced above, from which he retired in 2006. Mr. Kim was twice the recipient of the presidential award of the Republic of Korea recognizing his contributions to foreign exports and trade. Mr. Kim received a B.S. degree in Economics from Korea University in Seoul, Korea.

Director Qualification Highlights | Committee Membership | |

■ Extensive experience in establishing successful business ventures in the trade and manufacturing industries ■ Deep understanding of core commercial customer banking needs ■ Community knowledge and relations | ■ Nomination & Governance Committee ■ Director Loan Committee ■ Strategic & Business Planning Committee | |

6

Chung Hyun Lee, age 74, has been a member of the BBCN Bancorp and BBCN Bank boards since 2011. He was one of the founding directors of Center Bank and Center Financial Corporation and continuously served as a director of Center Bank for 26 years and of Center Financial Corporation for 11 years, until the merger of equals with Nara Bancorp, Inc. and Nara Bank. He owned and operated cosmetics importing businesses in the United States for 35 years and retired from his position as President of NuArt International, Inc. in October 2010. He received a B.S. degree in Industrial Engineering from Hanyang University in Seoul, Korea, as well as a Masters in Industrial Engineering from the University of Southern California. Mr. Lee is active in the broader Korean-American community in Southern California and currently serves as a Director of the Overseas Korean Trade Association as well as a Director of the Korean Chamber of Commerce in Los Angeles. He also has served in the past as Vice Chairman of the Korean Chamber of Commerce in Los Angeles, President of the South Bay Lions Club, Chairman of the Korean American Inter-Cultural Foundation, and Director of the Korean Federation of Los Angeles.

Director Qualification Highlights | Committee Membership | |

■ Extensive experience leading international businesses ■ Strategic planning and operations ■ Community knowledge and relations | ■ Director Loan Committee, Chair ■ Board Risk & Compliance Committee ■ Asset/Liability Committee | |

William J. Lewis, age 72, has served as a director of BBCN Bancorp and BBCN Bank since September 15, 2014. He most recently served as Executive Vice President and Chief Credit Officer of Pasadena-based East West Bank, during which period the bank grew from approximately $3 billion to approximately $24 billion. Prior to joining East West Bank, he served as Executive Vice President and Chief Credit Officer at PriVest Bank, based in Costa Mesa, California, from 1998 until it was acquired by American Security Bank in 2002. From 1994 to 1998, he served in the same capacity at Eldorado Bank based in Tustin, California. Previously, Mr. Lewis was Senior Vice President and Chief Credit Officer for Los Angeles based Sanwa Bank. He began his banking career in 1969 at First Interstate Bank in Los Angeles where he held various branch and credit management positions during his 13-year tenure with the bank. Mr. Lewis earned his B.B.A. in Industrial Administration from the University of New Mexico and his M.B.A. from Golden Gate University. He also completed the Executive Leadership Program at USC Marshall School of Business.

Director Qualification Highlights | Committee Membership | |

■ Leadership experience at publicly held, growth oriented financial institutions ■ Extensive banking and operational experience ■ Credit management background | ■ Asset/Liability Committee, Chair ■ Director Loan Committee ■ Board Risk & Compliance Committee ■ Audit Committee | |

David P. Malone, age 65, has been a director of BBCN Bancorp and BBCN Bank since May 20, 2014 and was appointed Chairman of the Board of the Bank effective June 26, 2014. Prior to joining the board of directors, Mr. Malone completed a 15-year tenure at Community Bank in Pasadena, California, where he served as Chairman in 2013, President and Chief Executive Officer from 2008 to 2013, and Chief Operating Officer and Chief Financial Officer from 1998 to 2008. Under Mr. Malone’s leadership, Community Bank grew into one of the leading financial institutions in Southern California, with more than $3 billion in assets and 17 offices across five counties. While at Community Bank, Mr. Malone was responsible for transforming the company into a relationship-oriented community bank, developing a high performing sales culture, introducing new business lines, and expanding the bank’s geographical footprint. Mr. Malone’s efforts helped Community Bank achieve consistent profitability throughout the last recession, generate five consecutive years of balance sheet growth and post record profitability in his last two years as President and Chief Executive Officer. During his professional career, Mr. Malone also served as Executive Vice President and Chief Financial Officer for both Metrobank and Merchant Bank of California. He began his professional career as a Certified Public Accountant with Arthur Andersen, where he later served as a Senior Manager, providing strategic and operational consulting services to financial institutions in the Western United States. Mr. Malone earned a B.S. degree in Accounting from California State University, Northridge.

Director Qualification Highlights | Committee Membership | |

■ Leadership experience at growth oriented financial institutions ■ Extensive banking and operational experience ■ Financial statement expertise | ■ Board Risk & Compliance Committee, Chair ■ Nomination & Governance Committee ■ Human Resource & Compensation Committee ■ Asset/Liability Committee ■ Audit Committee ■ Executive Committee; Chair | |

7

Gary E. Peterson, age 62, has served as a director of BBCN Bancorp and BBCN Bank since October 29, 2014. He is founder of IMAG Consulting Services LLC, a consulting and advisory firm specializing in regulatory compliance, as well as anti-money laundering (“AML”), Bank Secrecy Act (“BSA”) and wholesale and retail banking compliance, and a frequent industry speaker related to these topics. With more than three decades of experience providing counsel and oversight to U.S.-based and global financial institutions, Mr. Peterson was recruited in 2010 by HSBC North America to head up a major expansion and remediation of the company’s anti-money laundering efforts and subsequently appointed as Senior Executive Vice President and Chief Compliance Officer in 2012, responsible for managing the activities of AML, general banking compliance and securities compliance staff in the U.S. He returned in early 2014 as President of IMAG Consulting Services LLC. Mr. Peterson also advises on strategic planning initiatives relating to the compliance, technology and risk aspects of acquisitions, mergers and new product and service launches. Prior to forming IMAG Consulting Services LLC, Mr. Peterson was Senior Vice President, Chief of Staff, General Counsel and Head of Compliance of Midland Bank PLC from 1985-1992 and was responsible for legal, regulatory and compliance oversight over retail, corporate and commercial banking, treasury and capital markets, wealth management services, securities, asset management and investment banking businesses. Upon HSBC’s acquisition of Midland, he became Regional Compliance Director, Western Hemisphere, and Secretary of its U.S. bank holding company. Mr. Peterson began his professional career as an associate at the law firm of Fellner and Rovins in New York City. He is a summa cum laude graduate of Lehigh University in Bethlehem, Pennsylvania, and earned his J.D. from the School of Law of Case Western Reserve University in Cleveland, Ohio. Mr. Peterson is a member of the New York State bar.

Director Qualification Highlights | Committee Membership | |

■ Recent operational banking experience ■ Extensive risk and compliance background, including BSA and AML ■ Knowledge of regulatory environment | ■ Board Risk & Compliance Committee ■ Audit Committee ■ Strategic & Business Planning Committee | |

Scott Yoon-Suk Whang, age 70, has been a director of BBCN Bancorp and BBCN Bank since 2007. Mr. Whang previously served in the capacities of Vice-Chairman of BBCN Bancorp from May 2012 through June 2014, and Lead Independent Director of BBCN Bancorp and BBCN Bank from March 2013 to June 2014. Mr. Whang was the lead negotiator from Nara resulting in the creation of BBCN upon the merger of equals of Nara Bancorp, Inc. and Center Financial Corporation. He is a goal-oriented entrepreneur who has started three successful companies over the past 20 years. Mr. Whang currently serves as President and CEO of Orange Circle Studios, a company he founded in 2008. In 1985, he founded Codra Enterprises, a provider of new product development and manufacturing outsourcing services to the gift and stationery industry, and served as its Chairman until December 2007. In 1990, Mr. Whang also founded Avalanche Publishing, Inc., one of the leading publishers of various gift and stationery products serving large national retailers, as well as office chains and specialty gift stores, and served as the CEO until he negotiated the sale of the company in 2006. Previously, Mr. Whang held various management positions with Daewoo Corporation, where he began his career in the early 1970s until he resigned from the position as President of the western division of Daewoo International (USA) in 1985. In 2006, Mr. Whang was chosen as entrepreneur of the year by the Korean American Chamber of Commerce in recognition of his success in the mainstream publishing industry and as an exemplary minority entrepreneur. Mr. Whang graduated from the College of Business Administration at Seoul National University with a B.A. degree in International Economy.

Director Qualification Highlights | Committee Membership | |

■ Extensive entrepreneurial and M&A experience ■ Strategic planning, management and operations experience ■ Community knowledge and relations | ■ Human Resource & Compensation Committee, Chair ■ Nomination & Governance Committee ■ Strategic & Business Planning Committee ■ Executive Committee | |

8

Dale S. Zuehls, age 65, was appointed to the boards of directors of BBCN Bancorp and BBCN Bank effective March 20, 2014. A principal of specialty accounting and consulting firm Zuehls, Legaspi & Company, Dr. Zuehls has more than 40 years of experience in the areas of complex auditing, accounting, forensic accounting, complex tax issues, performance measurement and related consulting matters. In addition to being a Certified Public Accountant, Dr. Zuehls has a Ph.D. in accounting and holds a law degree. He is also Certified in Financial Forensics and Accredited in Business Valuations by the American Institute of Certified Public Accountants, and is a member of the American Certified Fraud Examiners. Previously, Dr. Zuehls held various leadership positions at KPMG and Arthur Andersen & Co., two of the largest public accounting firms. A recognized expert in complex accounting matters, Dr. Zuehls has taught in Ph.D. and Masters’ programs at Southern California-based universities and has held seminars on various accounting and tax issues. He serves on the Audit Committee of the largest research foundation at California State University, Los Angeles. Dr. Zuehls earned his B.S. degree in accounting at California State University, Los Angeles, his M.A. and Ph.D. degrees from Stafford University in England, and his J.D. degree from Southwestern University School of Law, Los Angeles.

Director Qualification Highlights | Committee Membership | |

■ Extensive audit, accounting, performance measurement and legal experience ■ Financial statement expertise ■ Risk management and corporate governance e knowledge and experience | ■ Audit Committee, Chair (financial expert) ■ Human Resource & Compensation Committee ■ Nomination & Governance Committee ■ Strategic & Business Planning Committee ■ Executive Committee | |

Director Nomination Process

As specified in its charter, the Nomination and Governance Committee is appointed by the board of directors of the Company to assist the board of directors in identifying qualified individuals to become members of the board of directors, consistent with criteria approved by the board of directors, and to recommend to the board of directors the director nominees for the annual meetings of stockholders. The Nomination and Governance Committee will utilize the same standards for evaluating director candidates recommended by stockholders as it does for candidates proposed by the board of directors or members thereof.

The Nomination and Governance Committee considers many factors in nominating individuals to serve on the board of directors, including the following:

• | diversity of professional disciplines and backgrounds; | |

• | experience in business, finance and/or administration; | |

• | familiarity with national and international business matters; | |

• | familiarity and experience with the commercial banking industry; | |

• | personal prominence and reputation, and the ability to enhance the reputation of the Bank; | |

• | time available to devote to the work of the board of directors and one or more of its committees; | |

• | specific qualifications that complement and enhance the overall core competencies of the board of directors and/or the specific committees to which they may be assigned; | |

• | activities and associations of each candidate to ensure that there is no legal impediment, conflict of interest, or other consideration that might hinder or prevent service on the board of directors; | |

• | interests of the stockholders as a whole; | |

• | independence determination; | |

9

• | the age of a nominee; and | |

• | the extent to which a nominee may add diversity to the board of directors. | |

The Company’s Corporate Governance Guidelines require all directors who are age seventy-five or older at the time of an annual meeting to retire.

Nominations, other than those made by or at the direction of the board of directors or by the Nomination and Governance Committee, may only be made pursuant to timely notice in writing to the Secretary of the Company. To be timely, a stockholder’s notice must be received at the principal executive offices of the Company (i) in the case of an annual meeting of the stockholders, not less than 100 days, nor more than 120 days, prior to the anniversary of the immediately preceding annual meeting of the stockholders; provided, however, that in the event that the date of the annual meeting of stockholders is more than 30 days before or after such anniversary date, notice by the stockholder to be timely must be so received not later than the close of business on the tenth day following the earlier of the date on which notice or public announcement of the date of the annual meeting of stockholders was first given or made by the Company, and (ii) in the case of a special meeting of the stockholders called for the purpose of electing directors, not later than the close of business on the tenth day following the earlier of the date on which notice or public announcement of the date of the special meeting was first given or made by the Company.

A stockholder’s written nomination notice to the Secretary of the Company must set forth: (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Company that are beneficially owned by the person and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Section 14(a) of the Exchange Act and the rules and regulations of the SEC promulgated thereunder; and (b) as to the stockholder giving the notice, (i) the name and record address of the stockholder and (ii) the class and number of shares of capital stock of the Company that are beneficially owned by the stockholder. The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company. No person nominated by a stockholder shall be eligible for election as a director of the Company unless nominated in accordance with the procedures for the same, which are set forth in full in the Company’s bylaws. The chairman of the meeting shall, if the facts warrant, determine that a nomination was not made in accordance with the applicable procedures, and, if he should so determine, he shall so declare at the meeting, and the defective nomination shall be disregarded.

The board of directors will submit to the stockholders for their vote at the 2016 annual meeting of stockholders a slate of directors comprised of nine nominees to serve until the close of the proposed merger with Wilshire Bancorp, Inc. or, if the merger is not completed, until the next annual meeting of stockholders and until their successors are elected and have been qualified. If the merger is consummated, the nine nominees of the BBCN board of directors, together with seven nominees of Wilshire Bancorp, Inc.’s board of directors, will be appointed to serve on the surviving corporation’s board of directors immediately upon effectiveness of the merger.

BBCN’s director nominees are:

Jinho Doo | Chung Hyun Lee | Gary E. Peterson | ||

Jin Chul Jhung | William J. Lewis | Scott Yoon-Suk Whang | ||

Kevin S. Kim | David P. Malone | Dale S. Zuehls | ||

The nominees for director consist of all of the directors of BBCN who were previously elected by the stockholders at the Company’s 2015 annual meeting of stockholders, other than former directors Kiho Choi and C.K. (Chuck) Hong, each of whom resigned from the BBCN board of directors, effective as of January 21, 2016, and directors Sang Hoon Kim and Peter Y.S. Kim, who will be retiring from the board of directors concurrent with the Company’s 2016 annual meeting of stockholders.

Corporate Governance

In performing its role, our board of directors is guided by our Corporate Governance Guidelines, which establish a framework for the governance of our board of directors and the management of the Company. We believe that sound and prudent corporate governance is essential to the integrity of our Company. Our board of directors oversees the Company’s corporate governance and takes seriously its responsibility to promote the best interests of our stockholders, employees, customers and the communities that we

10

serve. Good corporate governance is the basis for our decision-making and control processes and enhances the relationships we have with all of our stakeholders.

The Corporate Governance Guidelines were adopted by our board of directors and reflect regulatory requirements and broadly recognized best governance practices, including the Nasdaq Stock Market corporate governance continued listing standards. The Corporate Governance Guidelines are reviewed regularly and updated as appropriate, but at a minimum on an annual basis. The full text of the Corporate Governance Guidelines can be found on our website at www.BBCNbank.com, in the Corporate Governance section under the About menu. By including the foregoing website address link, we do not intend to, and shall not be deemed to, incorporate by reference any material contained therein.

In addition, the Company has adopted a Director Code of Ethics and Business Conduct that applies to all directors, as well as Code of Ethics and Business Conduct which applies to all officers and employees, both of which are in the Corporate Governance section of our website. If the Company makes any substantive amendments to the director or employee versions of the Code of Ethics and Business Conduct or grants waiver from a material provision of the Code of Ethics and Business Conduct to any director or executive officer, it is the Company’s policy to promptly disclose the nature of the amendment or waiver.

Board Leadership Structure

Our board of directors is committed to having a sound governance structure that promotes the best interest of all Company stockholders. Our leadership structure includes the following principles:

• | Yearly Elections. We believe that yearly elections hold the directors accountable to our stockholders, as each director is subject to re-nomination and re-election each year. | |

• | Independent Oversight. All of our directors are independent, except for Kevin S. Kim, Chairman, President and Chief Executive Officer of the Company. Our board of directors has affirmatively determined that the other 10 directors are independent under SEC and Nasdaq Stock Market corporate governance rules, as applicable. | |

• | Chairman of the Board. The Chairman of the Board is appointed annually by our board of directors. Kevin S. Kim has served in the capacity of Chairman since May 31, 2012 and his responsibilities include, among others, presiding at and calling board and stockholder meetings and preparing meeting schedules, agendas and materials in collaboration with the Lead Independent Director. | |

• | Lead Independent Director. In the case where the Chairman of the Board is not deemed to be independent, we believe an independent director should be designated to serve in a lead capacity as a liaison between the independent directors and the Chairman. Dale S. Zuehls was appointed Lead Independent Director effective June 26, 2014 and his responsibilities include, among others, coordinating the evaluation process of and providing feedback to the Chairman related to his performance, in collaboration with the Chair of the Human Resources and Compensation Committee, and presiding over executive sessions of independent directors, which are held regularly after each scheduled in-person board meeting. | |

We believe our board structure serves the interests of the stockholders by balancing the practicalities of running the Company with the need for director accountability.

Section 16(a) Beneficial Ownership Reporting Compliance

Under Section 16(a) of the Exchange Act, our executive officers and directors, and persons who own more than 10% of the Company’s common stock, are required to file reports of ownership and changes in ownership with the SEC. The SEC requires executive officers, directors and greater than 10% beneficial owners to furnish to us copies of all Section 16(a) forms they file. Based solely on our review of these reports and of certifications furnished to us, we believe that during the fiscal year ended December 31, 2015, all executive officers, directors and greater than 10% beneficial owners complied with all applicable Section 16(a) filing requirements.

Board Diversity

Our board of directors does not have a formal written policy with regard to the consideration of diversity in identifying director nominees. Our Nomination and Governance Committee Charter, however, requires the Nomination and Governance Committee to review the qualifications of candidates to our board of directors. This assessment includes the consideration of the following factors, among others:

11

• | Personal and professional ethics and integrity, including personal prominence and reputation, and ability to enhance the reputation of the Company; | |

• | Diversity among the existing board members, specific business experience and competence, including an assessment of whether the candidate has experience in, and possesses an understanding of, business issues applicable to the success of the banking industry; | |

• | Financial acumen, including whether the candidate, through education or experience, has an understanding of financial statement matters and the preparation and analysis of financial statements; | |

• | Professional and personal accomplishments, including involvement in civic and charitable activities; | |

• | Educational background; and | |

• | Whether the candidate has expressed a willingness to devote sufficient time to carrying out his duties and responsibilities effectively and is committed to service on the board of directors. | |

As currently comprised, our board of directors is a group of individuals who are drawn from various market sectors and industry groups with a presence in the Company’s markets, as well as a wealth of banking experience. Board members are individuals with knowledge and experience who serve and represent the communities we serve. Current board representation provides backgrounds in accounting, auditing, banking, Internet marketing, retail and wholesale, printing, transportation/trucking, international trade and IT solutions. The expertise of these individuals covers accounting, audit and financial reporting, corporate management, strategic planning, business acquisitions, bank risk and compliance, enterprise risk management, IT operations, corporate governance, credit review and administration, marketing, international operations, and retail and small business operations. The Nomination and Governance Committee believes that the backgrounds and qualifications of the directors, considered as a group, provide a significant composite mix of experience, knowledge and abilities, as discussed above, which will allow our board of directors to fulfill its responsibilities and fiduciary duties. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis.

Committees of the Board

The Company’s board of directors has four standing committees, including the Audit Committee, Nomination and Governance Committee, Human Resources and Compensation Committee and Asset/Liability Committee.

During 2015, there were 9 regular and 3 special meetings of the Company board of directors. All of the current directors attended at least 75% of the aggregate total number of meetings of our board of directors and the committees on which they served during their periods of service in 2015, with the exception of Peter Y.S. Kim.

Audit Committee

The Audit Committee is appointed by our board of directors to assist our board of directors in overseeing the Company’s accounting and reporting practices, audits of financial statements, and to assist our board of directors in monitoring the integrity of the Company’s financial statements, compliance with legal and regulatory related audit and accounting matters, including the Sarbanes-Oxley Act of 2002, qualifications and independence of the Company’s independent auditors, and the performance of the Company’s internal audit function and independent auditors. The Audit Committee operates under a charter adopted by our board of directors a copy of which can be found in the Corporate Governance section of our website at www.BBCNbank.com. By including the foregoing website address link, we do not intend to, and shall not be deemed to, incorporate by reference any material contained therein.

The current members of the Audit Committee include directors Dale S. Zuehls (Chair), Jinho Doo and Gary E. Peterson. Each of the members of the Audit Committee is “independent” as defined by our policy, the listing standards for the Nasdaq Stock Market and SEC Rule 10a-3. Our board of directors has determined that Dale S. Zuehls and Jinho Doo each satisfy the requirements established by the SEC for qualification as an “audit committee financial expert.” The Audit Committee held sixteen meetings in 2015.

12

Nomination and Governance Committee

The Nomination and Governance Committee is appointed by our board of directors to assist our board of directors in identifying qualified individuals to become board members, consistent with criteria approved by our board of directors, to determine the composition of our board of directors and to recommend to our board of directors the director nominees for each annual meeting. The Nomination and Governance Committee is also responsible for assuring that an appropriate governance structure is established and maintained and for conducting an annual assessment of our board of directors’ performance and effectiveness. The Nomination and Governance Committee operates under a charter adopted by our board of directors, a copy of which can be found in the Corporate Governance section of our website at www.BBCNbank.com. By including the foregoing website address link, we do not intend to, and shall not be deemed to, incorporate by reference any material contained therein.

The current members of the Nomination and Governance Committee include directors Peter Y.S. Kim (Chair), Sang Hoon Kim, David P. Malone, Scott Yoon-Suk Whang and Dale S. Zuehls. Each of the members of the Nomination and Governance Committee is “independent” as defined by our policy and the listing standards of the Nasdaq Stock Market. The Nomination and Governance Committee held four meetings in 2015.

Human Resources and Compensation Committee

The Human Resources and Compensation Committee (also referred to as the “Compensation Committee”) is appointed by our board of directors to assist our board of directors in establishing the overall compensation of our Chief Executive Officer and executive officers who have the title of “Executive Vice President” or above. The Compensation Committee is also responsible for considering and making recommendations to our board of directors concerning compensation, benefit plans, and implementation of sound personnel policies and practices.

The Compensation Committee monitors the performance of our executive officers in relation to applicable corporate goals and strategies, and seeks to ensure that compensation and benefits are at levels that enable us to attract and retain high quality employees, are consistent with our strategic goals, are internally equitable and are consistent with all regulatory requirements. The Compensation Committee operates under a charter adopted by our board of directors, a copy of which can be found in the Corporate Governance section of our website at www.BBCNbank.com. By including the foregoing website address link, we do not intend to, and shall not be deemed to, incorporate by reference any material contained therein.

The current members of the Compensation Committee include directors Scott Yoon-Suk Whang (Chair), Peter Y.S. Kim, David P. Malone and Dale S. Zuehls. Each of the members of the Compensation Committee is “independent” as defined by our policy and the listing standards of the Nasdaq Stock Market.

The Compensation Committee meets at least four times a year and also holds special meetings and telephonic meetings to discuss extraordinary items, such as the hiring or dismissal of employees at the Executive Vice President level or above. For fiscal year 2015, the Compensation Committee met a total of nine times. The Chair of the Compensation Committee regularly reports to our board of directors on the Compensation Committee’s actions and recommendations. The Compensation Committee has authority to retain outside counsel, compensation consultants and other advisors to assist as needed.

Additional information regarding the Compensation Committee is provided below under the caption “Compensation Discussion and Analysis-Roles and Responsibilities of Human Resources and Compensation Committee.”

Asset/Liability Committee

The Asset/Liability Committee is appointed by our board of directors to assist our board of directors in assessing the adequacy and monitoring the implementation of the Bank’s and the Company’s Asset/Liability Management Policy (the “ALM Policy”) and related procedures. The ALM Policy includes specific policies and procedures relating to (i) interest rate risk, (ii) market/investment risk, (iii) liquidity risk, (iv) credit risk, and (v) capital risk. The Asset/Liability Committee oversees the implementation of processes for managing the Bank’s interest rate, liquidity, and similar market risks relating to the Bank’s balance sheet and associated activities, including the adoption from time to time of risk limits and capital levels. The Asset/Liability Committee operates under a charter adopted by our board of directors, a copy of which can be found in the Corporate Governance section of our website at www.BBCNbank.com. By including the foregoing website address link, we do not intend to, and shall not be deemed to, incorporate by reference any material contained therein.

The current members of the Asset/Liability Committee include directors William J. Lewis (Chair), Jinho Doo, Chung Hyun Lee and David P. Malone. Each of the members of the Asset/Liability Committee is “independent” as defined by our policy and the listing standards of the Nasdaq Stock Market. The Asset/Liability Committee held four meetings in 2015.

13

Board Communication

A formal process for stockholder communications with our board of directors is posted in the corporate governance section of the Company’s website at www.BBCNbank.com. By including the foregoing website address link, we do not intend to, and shall not be deemed to, incorporate by reference any material contained therein. Interested parties may communicate with the Company’s board of directors as follows:

By writing to: | By email to: | |

BBCN Bancorp, Inc. 3731 Wilshire Blvd., Suite 1000 Los Angeles, CA 90010 Attn: Lead Independent Director | LeadIndependentDirector@BBCNbank.com | |

Any communication sent must state the number of shares owned by the stockholder sending the communication. The Lead Independent Director will review each communication and forward the communication to our board of directors or to any individual director to whom the communication is addressed unless the communication is unduly hostile, threatening or similarly inappropriate, in which case, the Lead Independent Director may disregard the communication. Every effort is made to ensure that the views of stockholders are heard by our board of directors or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner.

Equity Ownership Guidelines

We believe the ownership of our Company’s stock by our directors ensures a strong alignment of the interests of our board of directors with that of its stockholders. As stated in the Company’s Corporate Governance Guidelines, each independent director of our board of directors must own at least two times the value of their annual director cash compensation in Company common stock within three years of their appointment. The requirements of these provisions may be met by the vesting of performance units, the exercise of stock options or the purchase of our Company’s common stock in the open market.

Hedging and Pledging Prohibition

The Company’s Insider Trading Policy, as amended and approved by our board of directors on February 19, 2015, explicitly prohibits directors and employees from engaging in hedging transactions involving the Company’s stock. Directors and employees are further prohibited from pledging their securities in the Company as collateral for a loan, and the Company’s stock may not be held in margin accounts. Exceptions to the pledging prohibition may be granted by the Company’s Legal Department in cases where the director or employee clearly demonstrates the financial capacity to repay the loan without resort to the pledged securities.

Board’s Role in Risk Oversight

Our board of directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives in the areas of strategy, operations, reporting, and compliance without exposing the organization to undue risk. Our board of directors recognizes that these objectives are important to improve and sustain long-term organizational performance and stockholder value. A fundamental part of risk management is not only identifying the risks our Company faces and implementing steps to manage those risks, but also determining what constitutes the appropriate level of risk based upon our Company’s activities.

Our board of directors participates in the Company’s annual enterprise risk management assessment, which is led by the Company’s Chief Risk Officer, Johann Minkyun You. In this process, risk is assessed throughout the Company by focusing on nine areas of risk, including risks relating to: credit, liquidity, interest rates, foreign exchange, operational, country, compliance/legal, strategic and reputation. Risks that simultaneously affect different parts of the Company are identified, and an interrelated response is made. Our board of directors provides ongoing oversight of enterprise-wide risks through a periodic enterprise risk assessment update.

While our board of directors has the ultimate oversight responsibility for the risk management process, various committees of our board of directors also have responsibility for risk management. In particular, the Board Risk and Compliance Committee assists our board of directors in fulfilling its oversight responsibility with respect to regulatory, compliance and operational risk and enterprise risk management issues that affect the Company and works closely with the Company’s legal and risk departments. The Audit Committee helps our board of directors monitor financial risk and internal controls from a risk-based perspective and oversees the annual audit plan. It also reviews reports from the Company’s internal audit department. The Director’s Loan Committee oversees credit risk by identifying, monitoring, and controlling repayment risk associated with the Bank’s lending activities. The Business

14

Development/Strategic Planning committee oversees risks associated with the planned short- and long-term direction of the Company and ensures ongoing board involvement with and oversight of the Company’s three-year strategic plan.

The Asset/Liability Committee oversees the implementation of an effective process for managing the Bank’s interest rate, liquidity, and similar market risks relating to the Bank’s balance sheet and associated activities.

In overseeing compensation, the Human Resource and Compensation Committee strives to design incentives that encourage a conservative level of risk-taking behavior consistent with the Company’s business strategy and in compliance with all laws and the Interagency Guidance on Incentive Compensation.

Finally, the Company’s Nomination and Governance Committee approves the code of conduct and business ethics policies relating to employees and directors, respectively. In addition, it conducts an annual assessment of corporate governance policies and potential risk associated with governance and related party matters.

Executive Officer Qualifications and Experience

The following is a brief description of our current executive officers. The age and other information provided in each executive officer’s biography are as of February 29, 2016.

Kevin S. Kim, 58. Mr. Kim is Chairman, President and Chief Executive Officer of BBCN Bancorp and President and Chief Executive Officer of BBCN Bank. He has been President and Chief Executive Officer of BBCN Bancorp since March 2013 and of BBCN Bank since April 2014. He has been Chairman of the Board of BBCN Bancorp since May 2012 and served as Chairman of the Board of BBCN Bank from December 2011 through June 2014. Formerly a director of Center Financial Corporation and Center Bank from 2008 until the merger of equals with Nara Bancorp, Inc. and Nara Bank completed on November 30, 2011, Mr. Kim was the lead negotiator from Center resulting in the creation of BBCN. Prior to joining BBCN as the President and Chief Executive Officer, Mr. Kim practiced law for 18 years, focusing on corporate and business transactions, tax planning, and real estate transactions. Mr. Kim began his professional career as a Certified Public Accountant working for approximately 10 years at Arthur Andersen LLP and KPMG LLP. Mr. Kim serves on the board of directors of United Way of Greater Los Angeles. He received a B.A. degree with a major in English and a minor in International Trade from Hankuk University of Foreign Studies in Seoul, Korea, an M.B.A. degree from the Anderson School of Management, the University of California, Los Angeles, and a J.D. degree from Loyola Law School in California. Mr. Kim is a graduate of the ABA Stonier Graduate School of Banking, University of Pennsylvania, and earned the Wharton Leadership Certificate from The Wharton School Aresty Institute of Executive Education.

Kyu S. Kim, 55. Ms. Kim, a 18-year veteran of BBCN Bank, was promoted to Senior Executive Vice President effective May 1, 2013 and was named Chief Operating Officer effective August 2, 2013. Previously, she served as Executive Vice President and Chief Commercial Banking Officer of BBCN Bank upon the merger of Nara Bank and Center Bank completed on November 30, 2011. Prior to the merger, Ms. Kim, who we credit with building former Nara Bank’s eastern region presence from the ground up, was the Executive Vice President and Eastern Regional Manager for Nara Bank from April 2008 through November 2011. Previously, she held the titles Senior Vice President and Eastern Regional Manager for Nara Bank from October 2005 through March 2008 and Deputy Regional Manager from July 2003 to September 2005. Ms. Kim also served as the Manhattan Branch Manager from February 2000 to September 2005 and Flushing Branch Manager from September 1998 to February 2000. Prior to joining Nara Bank, Ms. Kim was Vice President and Chief Credit Officer at the former Chicago-based Foster Bank from March 1990 to September 1997. Ms. Kim received her B.B.A. degree in Finance from the University of Wisconsin, Oshkosh. She completed the Graduate School of Banking at the University of Wisconsin, Madison and the ABA Stonier Graduate School of Banking at the University of Pennsylvania. Ms. Kim also earned the Wharton Leadership Certificate from The Wharton School Aresty Institute of Executive Education.

Douglas J. Goddard, 63. Mr. Goddard assumed the position of Executive Vice President and Chief Financial Officer of BBCN Bancorp and BBCN Bank on April 1, 2013, after having served as the Deputy Chief Financial Officer since the merger of Nara Bancorp, Inc. and Center Financial Corporation completed on November 30, 2011. Mr. Goddard has nearly 30 years of experience in financial management in the commercial banking sector. Prior to the merger, he served as Interim Chief Financial Officer of Center Financial Corporation beginning in June 2010. From 1997 through 2009, Mr. Goddard served as Executive Vice President and Chief Financial Officer of the former First Federal Bank of California, which was placed into receivership by the FDIC in December 2009. He also was involved in several other bank acquisitions in his prior positions at California United Bank and Pasadena-based Community Bank. Mr. Goddard began his professional career as an auditor in 1974 at KPMG LLP. A Certified Public Accountant, Mr. Goddard earned a B.A. degree in economics and accounting from Claremont McKenna College, where he graduated cum laude with departmental honors.

15

Daniel H. Kim, 49. Mr. Kim joined BBCN Bancorp as Executive Vice President and Chief Planning Officer effective November 25, 2013. Prior to joining BBCN Bancorp, he was the Executive Vice President, Chief Financial Officer and Corporate Secretary of the former Saehan Bancorp, Inc. and Saehan Bank. Having joined Saehan in September 2003, Mr. Kim directly supervised and provided oversight of numerous departments within the organization, including accounting/investment, central operations administration, human resources, IT, compliance and BSA requirements. From May 1997 to August 2003, Mr. Kim served as First Vice President and Manager of the accounting, corporate planning and investment departments of the former Pacific Union Bank, during which time he successfully consummated that bank’s initial public offering. Mr. Kim began his banking career in June 1991 at the former Center Bank, where he last served as Assistant Vice President and Accounting/Investment Officer. Mr. Kim earned a B.A. degree in economics/business from the University of California, Los Angeles.

David W. Kim, 50. Mr. Kim currently serves as Executive Vice President, Chief Operations Administrator and General Counsel of BBCN Bank. With more than 20 years of experience in the banking industry, he joined the Bank effective April 1, 2014 as Executive Vice President, Chief Administrative Officer and General Counsel. Prior to BBCN, Mr. Kim joined United Central Bank in 2011 as part of a turnaround team, where he served as Executive Vice President, Chief Operating Officer and General Counsel. From 2010 to 2011, Mr. Kim was Executive Vice President and Chief Credit Officer of Commonwealth Business Bank. Prior to that, he was Senior Vice President, Chief Operating Officer and General Counsel of Wilshire State Bank from 2005 to 2010. Mr. Kim began his career in the Korean-American banking industry in 1995 at Hanmi Bank, where he served as Senior Vice President, Chief Administrative Officer and General Counsel. Previously, Mr. Kim was with Chase Bank in New York and the International Monetary Fund in Washington, D.C. Mr. Kim received a B.S. degree in economics and public policy from Indiana University and a J.D. degree from George Washington University Law School.

Jason K. Kim, 49. Mr. Kim was appointed Executive Vice President and Chief Lending Officer of BBCN Bank effective December 1, 2011 and is responsible for the SBA, equipment lease finance, credit card and residential mortgage departments. Prior to the merger of equals creating BBCN, he served as Chief Credit Officer of Center Bank since April 2007 and was promoted to Executive Vice President in December 2010. A 23-year veteran of the Bank, Mr. Kim served as Senior Vice President and Manager of Center Bank’s SBA Department from 1991 to 2007. Under his tenure, Center Bank’s SBA Department was recognized for having maintained the highest asset quality among more than 800 lenders across the nation, leading to the Company’s receipt of the “Lender of the Year Award” by the U.S. Small Business Administration in 2006. Mr. Kim graduated from the University of California, Los Angeles with a B.A. degree in economics.

Mark H. Lee, 53. Mr. Lee has served as Executive Vice President and Chief Credit Officer of BBCN Bank since May 2009. Previously, Mr. Lee was Senior Vice President and Deputy Chief Credit Officer at East West Bank from May 2007 to April 2009, and prior to that he was the Manager of the Commercial Business Credit department. Prior to his work at East West Bank, Mr. Lee served in various lending and credit capacities starting in 1990 at California Bank and Trust, Center Bank and Sanwa Bank California. Mr. Lee earned his B.S. degree in biochemistry from Pacific Union College and his M.B.A. degree in corporate finance from the Marshall School of Business, University of Southern California.

Brian E. Van Dyk, 53. Mr. Van Dyk was appointed Executive Vice President and Chief Information Officer of BBCN Bank effective December 1, 2011 and has more than 30 years of experience in the information technology sector. Previously, Mr. Van Dyk worked as an integration, IT conversion and vendor management consultant for RLR Management Consulting, Inc. from February 2006 to November 2011, and as President of the Premier Division of Aurum Technology Inc. (and Fidelity Information Systems) from December 1999 to October 2005. Prior to his work at Aurum Technology, Mr. Van Dyk served in various software development and management positions with Electronic Data Systems from 1984 to 1999. Mr. Van Dyk earned his B.S. degree in business finance from Montana State University.

Johann Minkyun You, 51. Mr. You was appointed Executive Vice President and Chief Risk Officer of BBCN Bank effective March 3, 2014, and is responsible for all areas of risk, compliance and BSA management. Previously, Mr. You was employed by HSBC USA where he served in roles of increasing responsibility from June 2011 through January 2014. Most recently, he was Senior Vice President and Head of Enterprise Compliance Risk, responsible for compliance risk strategy, risk assessment, risk reporting, compliance risk systems and compliance issue management. From June 2006 to June 2011, Mr. You was Director and Head Consultant at IMAG Consulting Services LLC, where he spearheaded numerous operational, regulatory and risk-based projects for large global financial institutions. Mr. You earned a B.S. degree in accounting from the University of Binghamton and is a Certified Anti-Money Laundering Specialist.

16

Item 11. Executive Compensation.

Who are the Named Executive Officers?

The Named Executive Officers, whom we also refer to as NEOs, are (i) each person who served as our Chief Executive Officer for any period of time during 2015; (ii) each person who served as our Chief Financial Officer for any period of time during 2015; and (iii) each of the other three most highly compensated executive officers employed by us as of December 31, 2015, whose total compensation for services rendered to us in all capacities during 2015 exceeded $100,000, along with any former executive officer who would have been so included on the basis of his/her 2015 compensation if he had remained an employee at year end. For 2015, the NEOs are Kevin S. Kim, Douglas J. Goddard, Kyu S. Kim, Johann Minkyun You and Mark H. Lee, as well as our former Senior Executive Vice President and Chief Administrative Officer Cha Y. Park, who retired from the Company effective December 22, 2015.

Human Resources and Compensation Committee Report

The following report does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filings by the Company under the Securities Act of 1933, as amended, or the Securities and Exchange Act of 1934, as amended, except to the extent we may specifically incorporate the information contained in this report by reference thereto.

The Human Resources and Compensation Committee (“Compensation Committee”) has reviewed and discussed the Compensation Discussion and Analysis (“CD&A”) included in this report with management and, based on such review and discussions, has recommended to the board of directors that the CD&A be included in this report.

Respectfully submitted by the members of the Compensation Committee.

SCOTT YOON-SUK WHANG (Chair)

PETER Y.S. KIM

DAVID P. MALONE

DALE S. ZUEHLS

Date: February 24, 2016

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) provides information about our executive compensation program, the factors that were considered in making compensation decisions for our Named Executive Officers (“NEOs”) and how we have modified our programs to meet the Company’s needs in the future. The compensation decisions that pertain to the NEOs listed in the table below were made by the Compensation Committee.

Name | Title | |

Kevin S. Kim | Chairman, President & Chief Executive Officer | |

Douglas J. Goddard | Executive Vice President & Chief Financial Officer | |

Kyu S. Kim | Senior Executive Vice President & Chief Operating Officer | |

Johann Minkyun You | Executive Vice President & Chief Risk Officer | |

Mark H. Lee | Executive Vice President & Chief Credit Officer | |

Cha Y. Park | Former Senior Executive Vice President & Chief Administrative Officer | |

17

Executive Summary

2015 Financial and Strategic Business Performance

BBCN continued to fortify its foundation for sustainable growth in 2015, marked by strong profitability, robust loan origination volumes, disciplined cost management and positive asset quality trends, as demonstrated by the following achievements:

• | Net income increased 4% to $92.3 million, or $1.16 per diluted common share | ||

• | Return on average assets of 1.25% | ||

• | Return on average equity of 10.11% | ||

• | Efficiency ratio of 48.43% | ||

• | $1.69 billion in new loans, representing a 27% increase over origination volumes in the prior year | ||

• | 12.3% growth in total loans | ||

• | 11.4% growth in total deposits | ||

• | 12.0% decline in nonaccrual loans and 9.1% decline in classified loans, with declines driven by payoffs and loan upgrades | ||

• | Total stockholder return of 23% | ||

In addition to the strong progress made to date in transforming BBCN to a more diversified financial institution, the Company embarked on a new journey with the announcement of a merger of equals with Wilshire Bancorp, creating the only super regional Korean-American bank in the United States. The combined entity will enjoy a significantly stronger competitive position, with unrivaled leadership among our niche peers and unparalleled opportunity to cross-sell a comprehensive offering of products and services-further improving upon the value proposition BBCN is providing to its customers, employees and stockholders.

2015 Stockholder Feedback and Program Changes

Each year, we carefully consider the results of our stockholder say-on-pay vote from the preceding year. At the May 2015 annual stockholders’ meeting, 45.8% of the votes cast supported our executive compensation decisions. We interpreted the results of our 2015 vote as a signal to expand our dialogue with stockholders to help us understand their perspectives on compensation and take steps to ensure that we make future changes to our program that are aligned with competitive practices and in the best interests of both our stockholders and executives.

Following are highlights of the changes we have either made or are in the process of making:

• | A more structured approach to Annual Cash Incentive Awards for the Chief Executive Officer. The Compensation Committee adopted an approach that uses a formulaic structure preferred by many of our investors. This program replaces the prior structure, which involved a greater degree of discretion. This new design structure is described further in the section titled “Elements of Compensation” below. | ||

• | A new independent compensation consultant. As part of our increased effort to continually improve to our compensation practices, the Compensation Committee engaged Pearl Meyer, an independent compensation consultant, in June 2015. The Committee directed Pearl Meyer to perform a comprehensive review of our executive compensation structure, its competitiveness relative to comparable banking organizations, and our related governance practices. Pearl Meyer provided the Committee with recommendations for potential changes to our practices going forward and the Committee is currently taking these recommendations under consideration. | ||

18

• | A new set of stockholder-friendly features. In early 2016, the Compensation Committee approved a formal clawback policy. In addition, a stock ownership guideline for our CEO was adopted and our guidelines for non-employee directors was enhanced to bolster our current compensation governance practices and further strengthen the alignment of stockholder and executive interests. | ||

• | Commitment to greater transparency and dialogue with stockholders. Beginning with this CD&A, we have made a commitment to explain more fully the Compensation Committee’s thought process as it relates to establishing executive compensation levels and design. We are also in the process of launching a more formalized stockholder outreach program to not only share more openly our rationale for executive compensation decisions, but to be just as intentional about listening to our stakeholders to obtain and understand their thoughts and concerns. | ||

19

Chief Executive Officer (“CEO”) Pay at a Glance

The independent members of the board of directors selected Kevin S. Kim to serve as President and CEO of BBCN Bancorp on March 7, 2013, and in April of 2014 expanded his responsibilities to include President and CEO of BBCN Bank, based on their belief that Mr. Kim was the leader BBCN needed to successfully guide the Company through its longer-term growth objective to be the premier Korean-American bank in the United States with total assets in excess of $10 billion. As such, the Company entered into a new employment agreement with Mr. Kim effective April 2014 that was designed to be commensurate with his significantly increased responsibilities and leadership role within the Company. The new employment agreement provided Mr. Kim with an initial annual base salary of $650,000, target annual cash incentive opportunity of 75% of his annual base salary, time-based vesting stock options and time-based vesting restricted stock. In entering into the new employment agreement with Mr. Kim, the Compensation Committee’s prior consultant reviewed the terms of the agreement, including the compensation components and found them to be within competitive practices of comparable banks. Previously, upon his appointment as President and CEO of the Bancorp, Mr. Kim was granted restricted stock units.

The Compensation Committee believes the time-based vesting equity awards, in particular, were critical to retaining Mr. Kim for the long term during a critical time in the Company’s growth and transition and aligning his interests with the long-term interests of our stockholders. The restricted stock awards were designed to be the primary retention vehicle, ensuring that Mr. Kim had immediate unvested equity, while the stock options were designed primarily to motivate and reward growth in the value of the Company. The nature of these equity awards were unique to the Company’s specific needs during the leadership transition and are not necessarily indicative of the Committee’s plans for future awards to Mr. Kim, which will be evaluated and developed during 2016. No equity awards were granted to Mr. Kim in 2015.

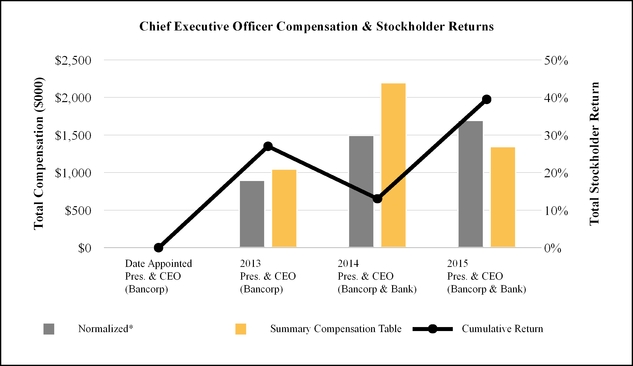

Because we view the 2013 and 2014 equity awards granted to Mr. Kim as special multi-year hire-on awards, the Committee’s assessment of his actual total annual compensation does not directly correlate with annual amounts disclosed in the Summary Compensation Table found below. Rather than inclusion of the awards at full market value on the date of grant (which results in significant swings between 2013, 2014 and 2015), the Compensation Committee evaluates his total annual compensation opportunity by including a normalized value of his hire-on awards, spreading the grant date fair market value over the intended service periods-the periods over which the hire-on awards vest. The chart below illustrates Mr. Kim’s “normalized” total compensation each year, relative to the cumulative total return to stockholders since his date of hire:

* | Reflects equity award values granted pursuant to Employment Agreement, normalized over intended service period (vesting period). |

20

2015 Compensation Decisions

The Compensation Committee made the following compensation decisions for fiscal 2015:

• | Base Salaries: Increased base salaries of NEOs consistent with Company-wide salary adjustment rates (ranging between 3% and 4%) | ||

• | Annual Cash Incentive Awards: The Compensation Committee awarded Mr. Kim 118% of his target award opportunity. The other NEOs received between 79% and 86% of their respective target award opportunities. For more information, please see the section titled “Elements of Compensation” below. | ||

• | Long-Term Equity Incentive Awards: The Compensation Committee did not grant any equity awards to any of the NEOs in 2015. | ||

• | Long-Term Cash Incentive Plan (“LTIP”): The Company met required performance targets and the Company contributed $50,000 and $30,000 to deferred compensation accounts of Kevin S. Kim and Kyu S. Kim, respectively, in accordance with the terms of their respective plans. | ||

Best Compensation Practices & Policies

Our executive compensation program is reinforced by the following best-practice governance standards which encourage prudent decision-making and prevent excessive risk-taking behaviors through the following processes, policies and practices:

• | Stock ownership policy | ||

• | Clawback policy | ||

• | No tax gross ups | ||

• | No automatic “single trigger” vesting upon a change of control | ||

• | New independent compensation consultant retained | ||

• | No excessive perquisites | ||

What Guides Our Executive Compensation Program

Compensation Philosophy and Objectives

We believe that the most effective executive compensation programs are those that align the interests of our executive officers with those of our stockholders. A properly structured compensation program will reinforce and support the development of a strong performance-oriented culture within the Company to achieve specific short and long-term strategic objectives while taking into consideration potential risk implications, such as not encouraging imprudent risk-taking that threatens the long-term value of the Company. Although we believe that a significant percentage of executive compensation should be based on the principles of pay for performance, we also recognize that we must have the ability to attract and retain highly talented executive officers by offering competitive base salaries.

The Company’s executive compensation programs are designed to provide:

• | levels of base salary that are competitive with companies in our peer group; | ||

• | annual cash incentive bonuses that are tied to our financial results, achievement of our yearly strategic goals and achievement of individual performance objectives; | ||

21

• | long-term incentive equity awards, that are designed to encourage executive officers to focus their efforts on building stockholder value by meeting longer-term financial and strategic goals; and | ||

• | long-term cash incentives that deliver opportunities for performance-based contributions to select executive officers’ deferred compensation accounts. | ||