Attached files

| file | filename |

|---|---|

| EX-10.25 - EXHIBIT 10.25 - SquareTwo Financial Corp | ex-1025amendmentno7toloana.htm |

| EX-31.1 - EXHIBIT 31.1 - SquareTwo Financial Corp | ye2015ex311ceocertification.htm |

| EX-31.2 - EXHIBIT 31.2 - SquareTwo Financial Corp | ye2015ex312cfocertification.htm |

| EX-32.1 - EXHIBIT 32.1 - SquareTwo Financial Corp | ye2015ex321soxcertification.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

________________________________________________________________

FORM 10-K

________________________________________________________________

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 333-170734

_____________________________________________

SquareTwo Financial Corporation

(Exact name of Registrant as Specified in Its Charter)

_____________________________________________

Delaware | 84-1261849 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

4340 South Monaco Street, Second Floor | ||

Denver, Colorado | 80237 | |

(Address of Principal Executive Offices) | (Zip Code) | |

303-296-3345

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | None | |

Securities registered pursuant to Section 12(g) of the Act: | None | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No o

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No o

(Note: The registrant is a voluntary filer of reports under Section 13 or 15(d) of the Securities Exchange Act of 1934; the registrant has filed during the preceding 12 months all reports that it would have been required to file by Section 13 or 15(d) of the Securities Exchange Act of 1934 if the registrant had been subject to one of such Sections.)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | |

Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes o No x

As of April 25, 2016, 1,000 shares of the registrant’s common stock, par value $0.001 per share, were outstanding.

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was zero.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

Page | ||

i

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K, particularly statements found in "Risk Factors," "Business," and "Management's Discussion and Analysis of Financial Condition and Results of Operations," may constitute "forward-looking statements" within the meaning of the U.S. federal securities laws. Forward-looking statements generally can be identified by the use of terminology such as "may," "will," "should," "expect," "intend," "estimate," "anticipate," "plan," "foresee," "predict," "believe," "potential" or "continue" or, in each case, their negative or other variations or similar expressions. These statements are intended to take advantage of the "safe harbor" provisions of the U.S. federal securities laws, including the Private Securities Litigation Reform Act of 1995 ("PSLRA"). These forward-looking statements include all statements that do not relate solely to historical facts.

We caution you that these forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. We believe these statements to be reasonable when made, based on information currently available to us. However, actual outcomes and results may differ materially from what is expressed or forecasted in these forward-looking statements. As a result, these statements speak only as of the date they were made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In view of such uncertainties, investors should not place undue reliance on our forward-looking statements.

Such forward-looking statements involve known and unknown risks, including, but not limited to, those identified in "Risk Factors" along with changes in general economic, business and labor conditions. More information regarding such risks and other risks can be found under the headings "Risk Factors," "Business," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and other sections of this Annual Report on Form 10-K. Such risk factors should not be construed as exhaustive and should be read with the other cautionary statements in this Annual Report on Form 10-K. New risks and uncertainties may emerge in the future. It is not possible for us to predict all of such risks or uncertainties, nor can we assess the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in forward-looking statements. Risks related to our business, among others, could cause actual results to differ materially from those described in the forward-looking statements. Such risks include those related to:

• our ability to continue as a going concern;

• our ability to extend or refinance our debt obligations as they come due, including without limitation our senior revolving credit facility maturing in April 2016 and our Senior Second Lien Notes maturing in April 2017;

• global political and financial instability, the availability of credit, the supply of money and interest rates;

• our concentration of suppliers, customers and branch offices;

• increased competition, growth and cyclicality of our industry;

• heavy reliance on intellectual property and information technology assets;

• the restrictive elements of our financing arrangements and our ability to comply with such arrangements more generally;

• our reliance on management and its ability to control, among other things, growth;

• our reliance on the legal system and practicing attorneys;

• our exposure to current or future governmental or regulatory actions;

• negative perceptions of the debt collection industry;

• unique current or future accounting methods;

• the interests of our controlling equity holder; and

• the difficulty of realizing the value of the collateral.

1

PART I

Item 1. Business.

Our Company

SquareTwo Financial Corporation is a Delaware corporation that was organized in February 1994 and is headquartered in Denver, Colorado. On August 5, 2005, CA Holding, Inc. acquired 100% of the outstanding stock of SquareTwo Financial Corporation and its subsidiaries (the “Acquisition”). We are a leading purchaser of charged-off consumer and commercial receivables in the accounts receivable management industry. Unless otherwise indicated, the terms (i) “SquareTwo,” “we,” “our,” “us” and the “Company” refer to SquareTwo Financial Corporation and all of its restricted subsidiaries on a consolidated basis, (ii) “SquareTwo Financial Corporation” refers to SquareTwo Financial Corporation and not to its parent company or any of its subsidiaries, and (iii) “Parent” refers to CA Holding, Inc. and not to any of its subsidiaries.

Our primary business is the acquisition, management and collection of charged-off consumer and commercial accounts receivable that we purchase from financial institutions, finance and leasing companies, and other issuers in the United States (U.S.) and Canada. Charged-off accounts receivable, which we refer to as "charged-off receivables" or "accounts," are defaulted accounts receivable that credit issuers have charged-off as bad debt, but that remain subject to collection. We refer to a group of accounts as a "portfolio," and, once purchased, we refer to our owned charged-off receivables as our "purchases" or "purchased debt." We believe that we are one of the largest purchasers of "fresh" charged-off credit card and consumer loan receivables in the U.S. Fresh charged-off credit card and consumer loan receivables are generally 180-210 days past due at the time of sale and typically have not been subject to previous collection attempts by a third-party collection agency. The act of charging off an account is an action required by banking regulations and is an accounting action that does not release the obligor on the account from his/her responsibility to pay amounts due on the account. Because the credit issuer was unable to collect the charged-off receivables that we purchase, we are able to acquire these portfolios at a substantial discount to their face value.

Our business model leverages our analytic expertise, technology platform, and in the U.S., a unique combination of SquareTwo-owned call centers operating under the d/b/a name Fresh View Solutions (“Fresh View”), one independently owned collections agency exclusively dedicated to SquareTwo, and a network of regional law offices, also referred to as “branch offices,” exclusively dedicated to SquareTwo. We refer to our U.S. operating business model as the “Closed Loop Network” as all newly acquired customer accounts are managed within our centralized, proprietary technology platform called eAGLE, regardless of where an account is in its lifecycle. This integrated account management system and the Closed Loop Network allow us to achieve the highest level of information security and data accuracy, as well as to strive to provide a uniform customer experience during every stage of collections regardless of location. We utilize non-exclusive law firms to liquidate legacy customer commitments, for collections on accounts where legal judgments and payment plans had been established prior to the formation of our Closed Loop Network. Lastly, in Canada, where we exclusively service our Canadian customers, we utilize a company-owned call center as well as third-party non-legal and legal collection firms.

Our focus throughout the recovery process is on the customer, and helping the customer resolve their outstanding financial commitments, while ensuring that those customers who demonstrate a significant ability to pay their contractual obligations actually satisfy their obligations. In accordance with our commitment to customer service, respect, and operational excellence, we are dedicated to treating customers fairly and ethically and maintaining stringent compliance standards, which we believe allows us to liquidate more effectively.

From 1999, our first full year of purchasing debt, to December 31, 2015, we have invested approximately $2.7 billion in the acquisition of charged-off receivables, representing over $39.0 billion in face value of accounts. From 1999 to December 31, 2015, we have grown our business from $8.7 million to $353.1 million of annual cash proceeds on owned charged-off receivables, representing a compound annual growth rate of approximately 26%.

The combination of our historical and future recovery efforts is expected to result in cumulative gross cash proceeds of approximately 2.2x our invested dollars since our first purchase in 1998. Based on our proprietary analytical models, which utilize historical and current account level data as well as economic, pricing and collection trends, we expect that our U.S. owned charged-off receivables as of December 31, 2015 of $7.1 billion (active face value) will generate approximately $482.6 million in gross cash proceeds. We refer to this as estimated remaining proceeds ("ERP"). We expect to receive approximately 78% of these proceeds within the next 36 months starting January 1, 2016. In addition, we expect our Canadian owned charged-off receivables of $1.9 billion (active face value) to generate approximately $74.0 million in additional ERP. Therefore, the total ERP for both our U.S. and Canadian owned charged-off receivables was $556.6 million as of December 31, 2015. This compares to total ERP of $654.9 million as of December 31, 2014 and $840.9 million as of December 31, 2013.

2

These expectations are based on historical data as well as assumptions about future collection rates and consumer behavior. We cannot guarantee that we will achieve such proceeds.

Our U.S. Closed Loop Network

Recovery efforts on all newly acquired U.S. purchased debt are managed by the Closed Loop Network discussed in the preceding section. Historically, our branch offices were the primary channel for recovery work on our behalf, but during 2014, we expanded our asset recovery options in the U.S. by opening a company-owned call center dedicated to consumer collections. Newly acquired accounts are placed for collection with our Fresh View call centers, where our call center employees are compensated based on their ability to meet our stringent compliance and operating standards. Legal recovery operations, if necessary, continue to progress through our dedicated branch office legal channel.

Fresh View enables us to satisfy a wide array of our bank clients’ needs while helping SquareTwo remain a leader in compliance. Regardless of where in our Closed Loop Network we place an account, either with Fresh View or with one of our branch offices, all customer account information and collection activity is managed within eAGLE, our proprietary integrated account management system, and in accordance with a standardized set of comprehensive policies and operational procedures, which we refer to as our “Compliance Management System.” This ensures that regardless of the chosen recovery option, we strive to provide a uniform customer experience. In addition, our Closed Loop Network business model creates valuable operating efficiencies and synergies, which we believe will translate to improved financial performance in the future.

Once accounts are designated for legal recovery efforts, they are placed into the network of legal branch offices. The branch offices perform recovery work exclusively on our behalf and utilize our account management system in accordance with specified contractual arrangements. Effective June 1, 2015, the Company entered into new business agreements with its branch offices replacing the previous contractual arrangements that were subject to franchise law. The new legal framework removed the legal requirements of franchise law in multiple jurisdictions and enables the Company more control and flexibility in how we manage the branch offices. These contractual agreements have a term of three years and provide the branch offices with a license to use our proprietary collection and account management software; however, SquareTwo no longer charges royalty fees as a percentage of each dollar collected.

We are under no obligation to provide accounts to any branch office. We pay these offices a service fee, which varies based upon the amount collected as well as their performance against certain of our operational incentives. We have historically allocated accounts to our branch offices based on capacity, geographic coverage, and their performance against our return expectations and adherence to operational and compliance requirements. In addition, branches are required to meet our stringent compliance standards to continue to be a part of our Closed Loop Network.

Subsidiary Entities

We operate our domestic charged-off receivables management business through a series of subsidiary entities, including CACH, LLC, CACV of Colorado, LLC, CACH of NJ, LLC, CACV of New Jersey, LLC, SquareTwo Financial Services Corporation (d/b/a Fresh View Solutions), Orsa, LLC, Candeo, LLC and Autus, LLC. Charged-off consumer receivables acquired by certain of the aforementioned subsidiaries are placed for collections within our Closed Loop Network.

We operate our Canadian business through a Canadian subsidiary, SquareTwo Financial Canada Corporation ("SquareTwo Canada"). Acting through its subsidiaries, SquareTwo Canada exclusively purchases Canadian consumer credit charged-off receivables. SquareTwo Canada utilizes a company-owned call center and third-party non-legal and legal collection firms to pursue recovery on the accounts it owns and manages. Our Canadian business accounted for 18.8% of our total Adjusted EBITDA and 14.0% of our total revenues for the year ended December 31, 2015 and represented 13.4% of our total assets as of December 31, 2015.

We have two operating segments: Domestic and Canada, which we consider to be our reporting segments in accordance with U.S. generally accepted accounting principles ("GAAP"). Included in the domestic operating segment are our consumer, commercial and other business lines. Consistent with how our board of directors (the "Board of Directors") and the leadership team review the Company's strategy and performance, the following description of our business operations focuses on the Company as a whole. Additional information on our operating segments is contained in the "Management's Discussion and Analysis of Financial Condition and Results of Operations" section under the heading “Segment Performance Summary” as well as in Note 13 to the consolidated financial statements.

3

Operations

Our operations can generally be categorized around two primary business processes: (i) underwriting and purchasing and (ii) management of collections and other cash proceeds on purchased debt.

Underwriting and Purchasing

The success of our business depends heavily on our ability to find charged-off receivables for purchase, evaluate these assets accurately and acquire them at the appropriate pricing. We have a dedicated Business Development team that generates acquisition opportunities. Historically, we have purchased charged-off receivables from seven of the ten largest U.S. credit card issuers identified in The Nilson Report, which is a leading source of news and proprietary research on the payment system industry. In addition to our relationships with the largest U.S. credit card issuers, we have extensive relationships with marketplace lenders or financial technology companies, also known as "FinTechs", super-regional and regional banks and other credit issuers. Potential purchasing opportunities are reviewed in detail by our Decision Science department, which is responsible for creating forecasted cash flows for each purchase using our proprietary statistical models and our experience with similar purchases. These models and related assumptions are reviewed by our investment committee, which includes members of our senior leadership team and representatives from each key business function, to determine the appropriate purchase price for the available portfolios. We target purchases that meet return thresholds determined by our investment committee. In times of increased pricing in the market, we may accept a lower return, while still maintaining our yield-based purchasing strategy. In addition to the relationships described above, we are actively engaged in the development of business opportunities in purchasing other forms of charged-off domestic and Canadian receivables.

The majority of our purchasing opportunities are sourced through limited auctions where the original credit issuer is generally interested in dealing with a small group of parties that have proven long-term operational and financial history. We also evaluate one-off negotiated deals and broader auction sales depending on the type of charged-off receivable and process desired by the seller. Our Business Development team spends substantial time seeking to develop new business relationships among financial institutions which have not historically sold their charged-off consumer and commercial accounts.

The following table summarizes our investment activity in purchased debt for the years ended December 31, 2015, 2014, and 2013 by type of charged-off receivable:

December 31, | |||||||||||||||||||

Purchased Debt, Cost ($ in thousands) | 2015 | 2014 | 2013 | Totals | % of Total | ||||||||||||||

Credit Card/Consumer Loan - Fresh | $ | 52,093 | $ | 101,102 | $ | 197,420 | $ | 350,615 | 72.6 | % | |||||||||

Credit Card/Consumer Loan - Non-Fresh | 19,989 | 14,346 | 40,912 | 75,247 | 15.6 | % | |||||||||||||

Other(1) | 26,165 | 11,299 | 19,778 | 57,242 | 11.8 | % | |||||||||||||

Purchased Debt - Total | $ | 98,247 | $ | 126,747 | $ | 258,110 | $ | 483,104 | 100.0 | % | |||||||||

(1) Other includes commercial, student loan and other purchased debt assets.

In any period, we acquire charged-off receivables that can vary dramatically in age, type, quality, and ultimately collectability. Because of this variation, we may pay significantly different prices for our charged-off receivables within any period and from period to period. In addition, market forces can drive prices up or down. Regardless of the price paid for charged-off receivables, we target a required rate of return for each of our purchases based on the unique qualities of each portfolio. Our purchasing strategy in a given period is based predominantly on expected returns at pricing which we believe will be successful in the market compared to the risks we perceive on potential impacts to collectability.

4

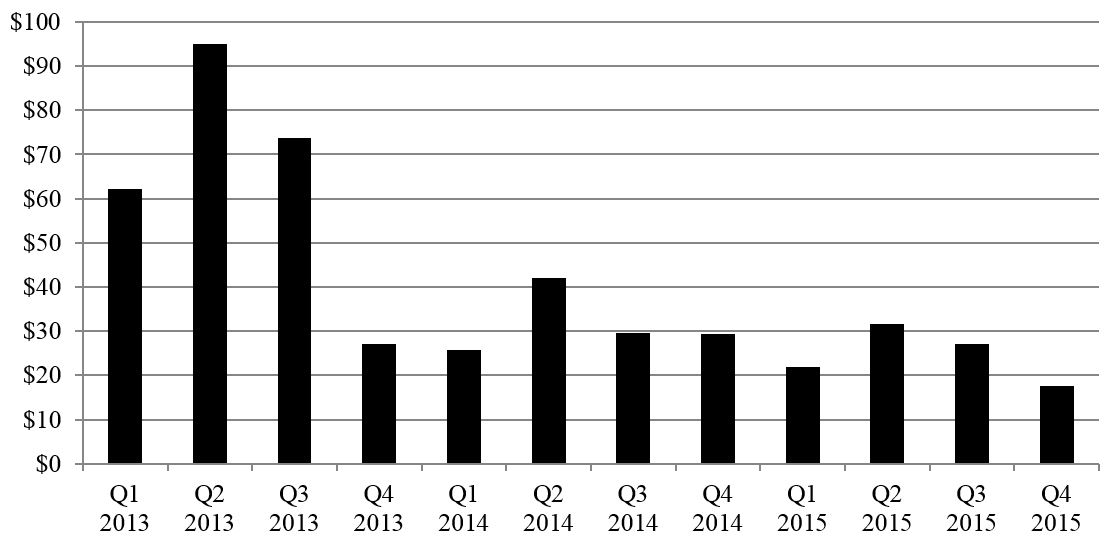

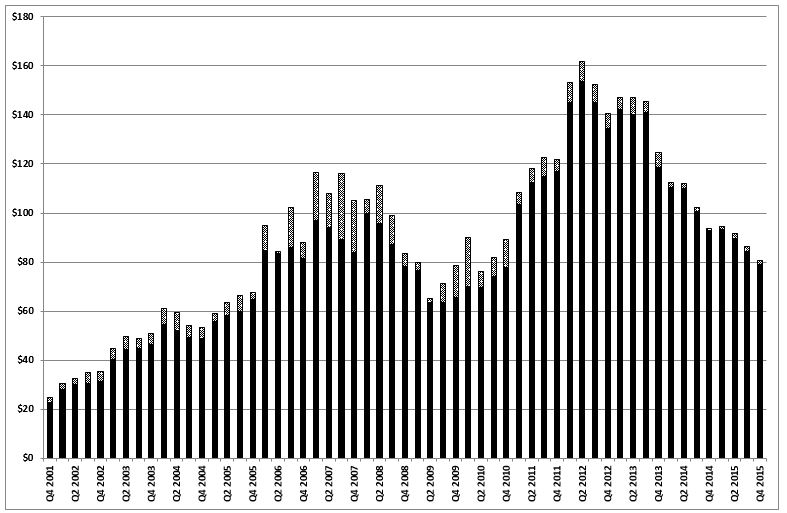

The following chart outlines our quarterly investment pace in the years ended December 31, 2015, 2014, and 2013:

Quarterly Purchased Debt, Cost ($ in millions)

Cash Proceeds on Purchased Debt

A key driver to our performance, and one of the primary metrics monitored by our management team, is cash proceeds received from our purchased debt. This measurement, and our focus on cash proceeds, is important because proceeds drive our business operations. Included in cash proceeds are non-legal collections, legal collections, the recovery of certain legal costs previously paid by us (which we refer to as “court cost recoveries”), bankruptcy proceeds, and returns of non-conforming accounts (which we refer to as “recourse”). These incoming cash flow streams and their respective relationships to the collection life cycle are described further below.

Non-Legal Collections. Once we acquire a portfolio, we pursue collections on a non-legal basis, which means collection activities other than initiating lawsuits or other legal action. Non-legal collections offer the most cost-effective means for the company to realize cash proceeds. In the year ended December 31, 2015, approximately $118.1 million, or 38.1%, of our total domestic cash proceeds on owned accounts was generated through telephone and letter campaigns initiated through the non-legal collection channel. This compares with approximately $162.8 million, or 43.2%, in the year ended December 31, 2014 and approximately $281.6 million, or 54.6%, in the year ended December 31, 2013. In the U.S., we pursue non-legal collections either through Fresh View or through one of our exclusive regional branch offices. Historically, our branch offices were the primary channel for recovery work on our behalf. During 2014, we expanded our asset recovery options in the U.S by opening a company-owned call center dedicated to consumer collections. Since the opening of our Fresh View consumer call center, newly acquired accounts are placed for collection exclusively within Fresh View. However, certain of the accounts that had previously been placed into our branch office network for non-legal collections are still being pursued by the respective branch office. Our call center employees are compensated based on their ability to meet our stringent compliance and operating standards. In Canada, we also utilize a combination of a company-owned call center and third-party non-legal and legal collection firms to pursue recovery on our Canadian accounts.

If an account remains uncollected after its initial placement into the non-legal channel, we will evaluate moving that account to a legal collection effort. Our strong preference is to assist customers in resolving their financial commitments without filing a lawsuit, however in some cases, court processes must commence in order to collect monies owed under the contracts we have purchased. Our Operations team and our Law and Regulatory Affairs team work closely with Fresh View call center management and our branch offices to ensure that the correct customers receive appropriate oral and written communications and our work standards and policies are followed, to optimize recovery efforts and to help respond to changes in the collections environment or regulatory landscape.

5

Legal Collections. While our preference is not to file suit, in the instance that a customer's apparent financial resources indicate they have the ability but not the willingness to pay, legal action may be pursued. In addition to determining legal eligibility based on applicable statutes or jurisdictional requirements, we systematically exclude a number of otherwise legally eligible accounts such as customers that have made or committed themselves to at least a partial payment. In the year ended December 31, 2015, approximately $186.0 million or 59.9%, of our total domestic cash proceeds on owned accounts was generated through legal collection efforts, which includes collections in the legal channel received prior to the initiation of legal action. This compares with approximately $207.9 million, or 55.2%, in the year ended December 31, 2014 and approximately $212.8 million, or 41.3%, in the year ended December 31, 2013. While overall legal collections have decreased over the past three years, they have increased as a percentage of our total domestic cash proceeds which is a direct result of our domestic portfolio aging as we have purchased less during the years 2014 and 2015 than in years prior. As our portfolio becomes weighted more heavily towards older portfolios, legal collections increase as a percentage of total domestic cash proceeds and this aging is reflected in ERP.

Once an account is designated for suit in the U.S., we place it with a branch office within the Closed Loop Network, which has the capability of bringing suit in the location of the customer. We pay our branch offices for their collection efforts based on their performance subject to compliance with our numerous operating and regulatory standards. In addition to these collection fees, we typically pay court costs and related fees on accounts placed for legal collection. If such fees are ultimately recovered, they are referred to as court cost recoveries and are included in legal collections. Our legal collection efforts over time have led to the development of a significant number of awarded judgments on our owned accounts, which we believe will help generate future cash flows. In Canada, when appropriate, we utilize third party law firms to assist with our legal collection efforts.

Recourse and Bankruptcy Proceeds. Under the terms of our purchase contracts, we typically have recourse, or the right to return, certain accounts to the seller within a designated time period from the purchase date should the account not meet certain agreed upon requirements, including the accounts of customers who were deceased or bankrupt at the time of purchase. If a customer enters into bankruptcy after our contractual recourse period, we utilize Fresh View to collect any proceeds as a result of the court driven bankruptcy process. Since 2013, account sales have no longer been part of our core liquidation strategy.

Industry Overview

The accounts receivable management industry can best be explained by separately describing its (i) composition, practice, and size, (ii) market, (iii) regulation, and (iv) recent industry trends.

Composition, Practice, and Size

Receivables in the accounts receivable industry are classified as consumer and commercial obligations which consist of short- and intermediate-term credit extended to individuals and businesses. The unsecured consumer and commercial debt is segmented as revolving and non-revolving installment loan debt.

The U.S. accounts receivable management industry is comprised of a wide range of entities from very small local operating entities to large public corporations with national and international operations and includes the following types of operating entities: (i) contingency collection agencies, (ii) debt purchasers and (iii) collection law firms.

Contingency collection agencies work predominantly for issuers of credit on a fee per dollar collected basis and represent the largest segment (in terms of number of firms and annual collections) in the industry. Credit issuers use contingency collection agencies primarily to supplement their own internal recovery efforts. A contingency collection agency will typically receive placements of accounts for a pre-specified period of time, typically four to six months, during which they will have the opportunity to collect the accounts before they are recalled by the credit issuer and moved to a different agency or method of collection.

Historically, debt purchasers have ranged from large purchasers of debt that have their own collection platform, diversified portfolios, and international operations to contingency collection agencies that acquire additional purchased debt volume as a secondary business. Smaller purchasers of debt may acquire accounts specific to a particular asset class or geography or may represent a discrete group of investors that outsources all collections work. Due to increasing regulatory scrutiny over the accounts receivable industry, the number of debt purchasers that can meet stringent regulatory requirements has dramatically decreased, leaving large purchasers of debt as the primary debt purchasers in the U.S.

6

Debt purchasers often focus on different stages of delinquent or charged-off accounts. Credit card and consumer loan asset classes typically vary from fresh charge-offs to "quad" charge-offs (accounts that have been placed with three prior agencies at the time of sale). There are also active debt purchasing markets for other consumer receivables including charge-offs in the telecom, utility and healthcare markets which tend to consist of smaller average account balances than credit card charge-offs.

Collection law firms generally work for a combination of credit issuers and debt purchasers to pursue legal recoveries on accounts. These firms typically receive reimbursement for non-personnel costs associated with pursuing legal recoveries and are compensated on a fee per dollar collected basis. The placement of an account with a collection law firm typically lasts much longer than the placement of an account with a contingency agency as the legal recovery process can take several years.

While several national and regional networks of collection law firms have been developed, we believe our Closed Loop Network consisting of company owned call centers and a network of exclusive regional branch offices, all of which operate on our proprietary technology platform and in accordance with our Compliance Management System, is unique within the industry. Both the integrated account management technology platform and our Compliance Management System provide our call centers and branch offices with a holistic suite of tools to maximize liquidations while providing each customer with a best-in-class customer experience. In addition, unlike the typical collection law firm or collection agency, our agreements contain provisions which restrict the ability of the branch offices to collect debt for other providers.

Market

At a high-level, the supply of debt available for purchase in our markets is determined based on business and consumer reliance on credit, charge-off rates, changing regulatory requirements, and the originating financial institutions' strategy to sell charged-off receivables. Historically, business and consumer reliance on credit and the corresponding charge-off rates associated with that credit have moved in tandem with the broader economy, albeit sometimes on a lagged basis. However, the originating financial institutions' decision to sell can be impacted by multiple factors that do not always trend with the macro-economic environment. These factors have included (i) changing regulatory requirements associated with selling charged-off receivables, (ii) the benefits versus perceived risks to produce returns on their charged-off portfolio through collection efforts rather than selling, and (iii) the demand of the accounts receivable management industry to buy and corresponding market pricing. These factors and others can cause the supply of charged-off debt available to purchase to move in cycles that can be unpredictable.

The price of charged-off debt for sale is primarily dictated by the supply and quality of charged-off debt for sale. Similar to a commodity, supply and pricing for charged-off debt have an inverse relationship and can ebb and flow as the willingness of originating financial institutions to sell changes.

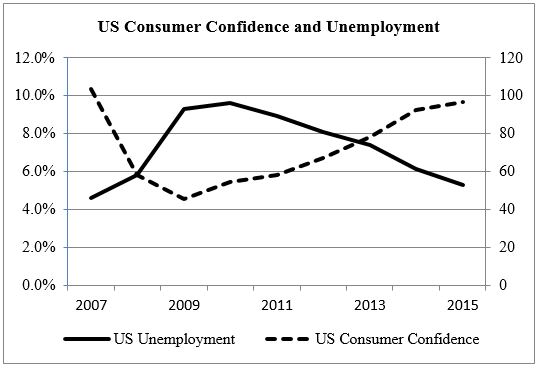

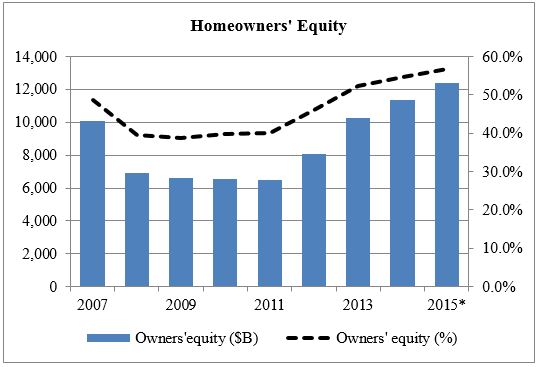

In addition to consumer credit quality impacts, collectability of charged-off accounts receivable is generally dictated by the ability to find the customer and the customer's willingness to pay. We believe that economic indicators such as unemployment rates, consumer confidence and home equity values are generally indicative of trends in the recoverability of charged-off receivables. These economic indicators have experienced positive trends over the last several years which we believe will be a long term positive for the accounts receivable management industry.

Source: Moody's Analytics Source: Federal Reserve. *Data through Q3 2015

7

Regulation

The industry is regulated by multiple regulatory bodies and rules. As a purchaser of charged-off receivables that relies on the efforts of our Closed Loop Network, we are impacted by federal, state and local laws that establish specific guidelines and procedures that debt collection account representatives must follow when collecting consumer accounts. Failure to comply with these laws could lead to fines or loss of licensure of our call centers or branch offices that could have a material and adverse effect on us. Court rulings in various jurisdictions also impact call centers and branch offices’ ability to collect our charged-off receivables.

Significant regulatory bodies, federal laws and regulations applicable to us, our call centers and our branch offices include the following:

Dodd-Frank Wall Street Reform and Consumer Protection Act. With the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) in 2010, the Consumer Financial Protection Bureau (“CFPB”) was established and initiated regulatory authority over certain entities in the industry starting in January 2013. The CFPB has jurisdiction over the debt purchasing, debt collection and credit issuance industries and will be allowed to pursue enforcement actions and issue regulations interpreting the Fair Debt Collection Practices Act ("FDCPA"). Late in 2013, the CFPB issued an Advance Notice of Proposed Rulemaking (the “ANPR”) pursuant to which it posed 162 questions addressing issues raised in the debt collection and purchasing markets. The expressed intention of the CFPB is to use the responses to the questions to guide it in the issuance of regulations governing these industries. The timing and content of these regulations and the impact of these regulations on the debt purchasing and debt collection industries remain uncertain.

FDCPA. The FDCPA was adopted in 1977 to provide the collection industry with guidance as to appropriate actions in the collection of consumer indebtedness and to provide protection to consumers from deceptive and abusive collection practices. While the FDCPA has been amended periodically, the basic structure of the law has remained unchanged since its enactment. Under Section 814(a) of the FDCPA, the Federal Trade Commission ("FTC") has the authority to investigate actions that may violate the FDCPA or that may be considered to be unfair or deceptive acts or practices forbidden by Section 5 of the FTC Act. The FTC does not have the authority to issue regulations interpreting the FDCPA but the FTC issues an annual written report to Congress with recommendations for legislative improvements to the FDCPA. Pursuant to Section 814(b)-(d) of the FDCPA, the CFPB has both rulemaking and enforcement authority with regard to the FDCPA’s provisions.

Fair Credit Reporting Act/Fair and Accurate Credit Transaction Act of 2003. The Fair Credit Reporting Act and its amendment entitled the Fair and Accurate Credit Transaction Act of 2003 ("FACT Act") place requirements on providers of credit information regarding verification of the accuracy of information provided to credit reporting agencies and requires such information providers to investigate consumer disputes concerning the accuracy of such information. The FACT Act also requires certain conduct in the cases of identity theft or unauthorized use of a credit card and direct disputes with the creditor.

The Financial Privacy Rule. Promulgated under the Gramm-Leach-Bliley Act, this rule requires that financial institutions, including collection agencies, develop policies to protect the privacy of consumers' private financial information and provide notices to consumers advising them of their privacy policies. It also requires that if private personal information concerning a consumer is shared with another unrelated institution, the consumer must be given an opportunity to opt out of having such information shared. Since we do not share consumer information with non-related entities, except as required by law, or except as allowed in connection with the collection efforts of our call centers and branch offices, the customers of our owned and managed charged-off receivables are not entitled to any opt-out rights under this act. This rule is enforced by the CFPB. Consumers do not have a private cause of action for violations of the Gramm-Leach-Bliley Act.

The Safeguards Rule. Also promulgated under the Gramm-Leach-Bliley Act, this rule specifies that we, and our branch offices, must safeguard financial information of consumers and have a written security plan setting forth information technology safeguards and the ongoing monitoring of the storage and safeguarding of electronic information. Enforcement of the Safeguards Rule remains with the FTC.

Telephone Consumer Protection Act. In the process of collecting accounts, our call centers and branch offices may use automated dialers to place calls to consumers. This act and similar state laws place certain restrictions on telemarketers and users of automated dialing equipment that place telephone calls to consumers.

8

U.S. Bankruptcy Code. To prevent any collection activity with bankrupt customers by creditors and collection agencies, the U.S. Bankruptcy Code provides for an automatic stay, which prohibits certain contacts with consumers after the filing of bankruptcy petitions.

Additionally, there are state and local statutes and regulations comparable to the above federal laws and other state-and-local-specific licensing requirements that affect our operations and the operations of our call centers and branch offices. State laws may also limit interest rates and fees, methods of collections, as well as the timeframe in which judicial actions may be initiated to enforce the collection of consumer accounts. Failure to comply with current or future laws and regulations may result in the imposition of fines and/or restrictions or prohibitions on us, our call centers or our branch offices' ability to operate. Laws, administrative regulations and their future changes or interpretations may ultimately have a negative impact on our industry.

Recent Industry Trends

The following summarizes a number of recent trends which we believe are driving the U.S. accounts receivable management industry:

Increased Regulatory Oversight. Pursuant to Dodd-Frank, the CFPB was established and effective as of January 2, 2013, the CFPB has assumed direct regulatory oversight of the debt purchasing and collection industry including supervisory jurisdiction over large market participants, defined as having over $10 million in annual receipts. According to the FDPCA annual report issued by the CFPB in March 2015, this represents over 60 percent of the accounts receivable management industry. The CFPB has stated its main areas of focus for the industry are to ensure that industry participants are (i) providing adequate disclosures to consumers, (ii) providing accurate consumer information during the collection process, (iii) providing consumers with a complaint and resolution process, and (iv) communicating civilly and honestly with consumers.

These areas of focus are driving significant improvements within the industry that affect both accounts receivable management firms and the financial institutions that originate consumer debt. This has resulted in even stronger partnerships between the accounts receivable management firms and financial institutions that are able to satisfy the new requirements and focus areas of the CFPB and the industry as a whole.

As a large market participant, we have had ongoing interaction with the CFPB in regard to our policies and procedures and the experience that our customers receive in the context of collection interactions. In addition, we believe that the ongoing regulation of the industry will continue its impact resulting in (i) additional market participants exiting the industry and (ii) financial institutions being significantly more selective about the entities to which they sell charged-off accounts. Additionally, the CFPB has gathered and released certain data relating to consumer interactions with debt collectors and debt purchasers. The data indicates that our call centers and branch offices receive substantially fewer complaints than other large participants in the accounts receivable management industry.

In November 2013, the CFPB issued an ANPR to assist in the development of rules interpreting the laws which govern the purchase and collection of consumer obligations. As of December 31, 2015, no rules have been issued by the CFPB. While the timing and outcome of the rulemaking process is unclear, we believe that the certainty allowed by a clearer set of rules will benefit the Company, our branch offices, the industry and the customers with whom we interact on a daily basis.

In 2015, the CFPB concluded several high profile enforcement proceedings, which are of great interest to debt sale and debt market participants, by issuing consent orders (the "Consent Orders"). On July 8, 2015 the CFPB issued a Consent Order against Chase Bank USA, N.A. and Chase Bankcard Services, Inc. (“Chase”). On September 9, 2015, the CFPB filed Consent Orders against Encore Capital Group, Inc. (“Encore”) and Portfolio Recovery Associates, LLC (“PRA”). On December 28, 2015 the CFPB and Frederick J. Hanna & Associates, P.C. (“Hanna”) filed a stipulated final judgment and order settling the pending lawsuit between them. By their terms in the Consent Orders, the Encore, PRA and Hanna matters apply to consumer debts - those incurred primarily for personal, family or household purposes. No implementation timeframe was announced in the PRA and Encore Consent Orders, although select provisions apply to their post-Consent Order purchases. The Hanna stipulated final judgment required that Hanna comply with the judgment’s provisions within 90 days of entry.

Although not formal rules or law, the Consent Orders telegraph what the CFPB believes is required under the FDCPA and Dodd-Frank, as they exist today. CFPB Director Richard Cordray stated in a September 9, 2015 press release regarding the Encore and PRA Consent Orders, “industry members who sell, buy and collect debt would be well served by carefully reviewing these orders." It is anticipated that the CFPB will propose formal rules in accord with the principles and requirements set forth in the Consent Orders.

9

On November 4, 2015, the FTC announced a major new law enforcement initiative targeting deceptive and abusive debt collection practices titled “Operation Collection Protection”. The initiative is a nationwide effort the FTC is coordinating with the Department of Justice, the CFPB and more than 45 state and local enforcement agencies and regulators. FTC Chairwoman Edith Ramirez stated that Operation Collection Protection will conduct a comprehensive review of debt collection industry practices and will target corporate entities as well as individuals.

Industry Consolidation and Increased Barriers to Entry. With the establishment of the CFPB, there has been a dramatic increase in the emphasis on compliance, data security, and consumer protection by both large financial institutions and the largest U.S. debt purchasers. As a result, we believe large issuers of credit will rarely sell accounts directly to smaller debt purchasers, and their strategy to sell to larger debt purchasers has and may continue to fluctuate as they work to improve their own compliance, data security, and consumer protection standards.

Since the announcements by the Office of the Comptroller of the Currency in August 2014 requiring banking institutions to (i) engage in substantial due diligence of those entities that purchase debt and (ii) follow specific guidelines in order to sell charged-off receivables, large purchasers have incurred substantial expenses to improve and align their compliance, data security, and consumer protection standards with large financial institutions. While the Office of the Comptroller of the Currency does not have direct jurisdiction over debt purchasers, it is influential in our industry because of the jurisdiction it possesses over the banks who sell accounts to debt purchasers. We believe these changes create a significant market advantage to larger purchasers and will serve as a barrier for smaller debt purchasers to interact directly with financial institutions.

We believe smaller debt purchasers still may source accounts through other debt purchasers or portfolio brokers. However, the costs of meeting regulatory requirements associated with heightened industry standards for compliance, data security, and consumer protection has and may result in continued consolidation or elimination of certain smaller debt purchasers. We also believe that the enhanced regulatory requirements will also serve as a barrier to entry to new, significant debt purchasers.

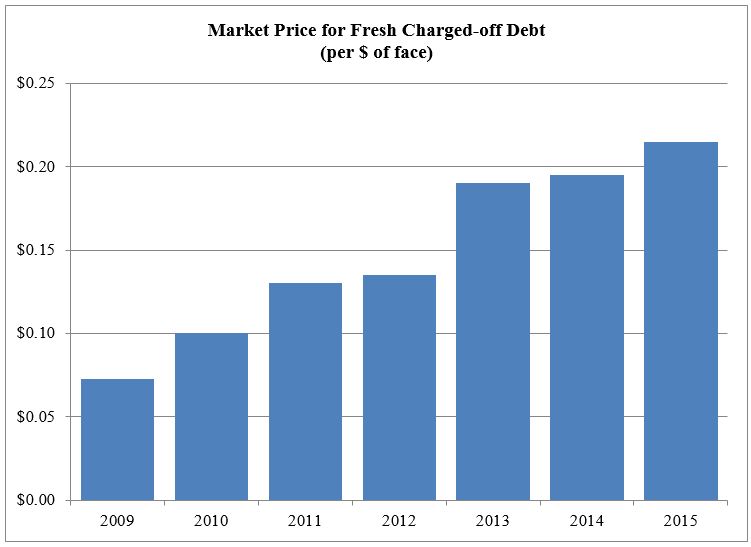

Changes in Quality and Supply of Charged-Off Debt. As a result of the housing and credit crises that occurred during the 2005 - 2008 period, most large financial institutions significantly tightened their underwriting standards for revolving consumer debt. This resulted in sustained higher quality of borrowers' credit in the consumer loan and credit card market. As some of those borrowers charged-off in the following years, pricing of charged-off debt increased steadily between 2009 and 2013. We attribute the majority of pricing increases from 2010 to 2012 to the resulting increase in quality of charged-off assets being offered for sale from large financial institutions. However, during 2013, prices continued to increase steadily throughout the year while the quality of charged-off assets reached a plateau in the second half of 2013. Pricing increases in late 2013 and 2014 were driven primarily by a decrease in larger financial institutions’ willingness to sell charged-off debt as they improved compliance, data security, and consumer protection standards to meet more stringent regulatory requirements. During 2015, a few of the large financial institutions were still absent from the debt sales market as they continued to build out the necessary infrastructure to sell charged-off debt in accordance with current regulatory requirements. As a result, pricing remained elevated during 2015.

10

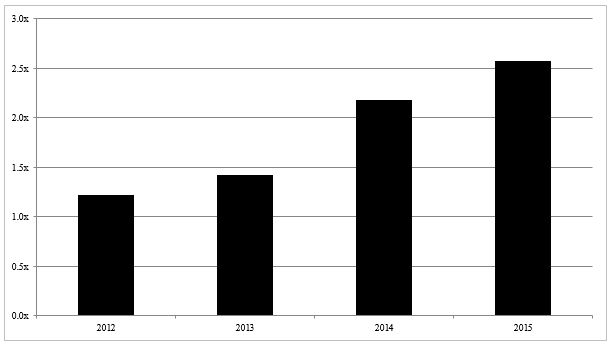

The following graph depicts the market prices of fresh charged-off receivables from 2009 through 2015:

Source: January 2016 Charge-Off Portfolio Sales: Market Overview from Garnet Capital Advisors

Our Competitive Strengths

We believe that we possess the following competitive strengths that differentiate us from our competitors:

Customer Satisfaction. We believe that our success fundamentally depends on providing a positive customer experience within the context of a collection interaction. Therefore, we strive to treat each customer fairly, while also requiring that those customers who are able to make payments satisfy their validly incurred obligations to the maximum extent reasonably possible. We believe that treating customers fairly, honestly, and with respect improves overall collection performance, and is critical to long-term business success. We believe two equally important components are needed to create customer satisfaction: (i) strict compliance to state and federal regulations and (ii) a comprehensive and dynamic strategy that establishes a culture of customer service. Full compliance lays the basic foundation for a customer experience; regulatory oversight provides specific guardrails that guide every customer interaction. Creating customer satisfaction requires providing a high level of customer service. Consequently, we believe that conducting business through our call centers and branch offices that are committed to following consistent policies, programs, and business tools within the framework of our Compliance Management System will offer us a competitive advantage. We continually invest in ongoing improvement, oversight, and auditing of all areas of compliance, and dedicate ourselves to creating a culture focused on consistently providing a positive customer experience.

U.S. Closed Loop Network. Our Closed Loop Network consists of both Fresh View call centers and our network of exclusive regional branch offices, all of which use our proprietary systems in the collection of customer obligations. We believe that this model is unique to the accounts receivable management industry. Regardless of whether we commence collections through Fresh View or place an account with one of our branch offices, all customer account information and collection activity is contained and managed within our proprietary integrated account management system, and in accordance with SquareTwo’s Compliance Management System. This ensures that regardless of the chosen recovery option, we strive to provide a uniform customer experience.

Proprietary Technology Platform. We have developed and will continue to advance a sophisticated software, computing and network architecture to support the acquisition, management and collection activities of our charged-off receivables within our Closed Loop Network of call centers and branch offices. In partnership with Oracle®, we have developed and will continue to enhance our proprietary eAGLE technology platform, which we feel provides our call centers and branch offices with the data necessary to optimize collections. Each of our call centers and branch offices conduct all collection activities through eAGLE leveraging identical real-time account level data regardless of location. As account level data is affected by activity performed at our corporate headquarters, our call centers and branch offices see this account level

11

activity in real-time. We believe this creates a significant competitive advantage as our industry competitors outsource various collection activities resulting in less control and delayed account updates for customers.

In addition to the advantages described above, this integrated account management system tracks multiple collection and operational metrics at the collector and account levels and delivers results in real time, providing us with immediate and comprehensive data on the performance of our call centers and branch offices. This enables us to better allocate charged-off receivables among our locations based on their relative performance and adherence to our strict compliance requirements. The depth of our historical databases and current performance metrics enables us to perform sophisticated analyses on potential debt purchasing opportunities that help us to achieve our target returns. The quantity and quality of the account and collector level information captured and reported by our systems is also critical to our ability to effectively manage the collection efforts and compliance standards on our charged-off receivables. As we evolve our proprietary technological system, we will continue to provide each individual collector with enhanced insights into the appropriate collection strategies, while also using the system to guide collectors in the use of appropriate customer handling techniques and account resolution.

Disciplined and Proprietary Underwriting Process. We adhere to a disciplined underwriting process, which we believe allows us to price purchasing opportunities at levels that meet our targeted return thresholds. Our underwriting process centers around our proprietary analytical models, which utilize historical data collected over our 20 years in the industry and incorporate current account-level data, as well as information regarding current economic, pricing and collection trends. Our models use multiple internally and externally generated variables, including credit bureau attributes, customer data, and asset class information to provide comprehensive measures of value and potential collection rates at the individual account level. Since inception, our disciplined purchasing process has allowed us to achieve strong expected cash on cash returns on our purchased debt of 2.2x on a gross basis, and typically results in 100% of our initial cash investment being returned within 12-24 months on a gross basis.

Strong Relationships with Major Credit Issuers. We have developed strong, long-standing relationships with a number of leading consumer credit, business credit, and student loan issuers that, we believe, view us as an important part of their charged-off receivables recovery strategy. We believe that credit issuers value our unique Closed Loop Network model, which ensures integrity of customer data and enhances our focus on compliance and ethical collection practices.

Focus on Fresh Charged-off Credit Card and Consumer Loan Receivables. We believe that we are one of the largest purchasers of fresh charged-off credit-card and consumer loan receivables in the U.S. Fresh charged-off receivables are generally 180-210 days past due at the time of sale and have typically not been subject to previous collection attempts by a third-party collection agency. Typically, fresh charged-off receivables have a more rapid collection cycle than charged-off receivables that have been subject to previous collection attempts by collection agencies. Additionally, our direct relationship with issuers of credit provides enhanced accuracy and control of customer data. We believe that our focus on fresh charged-off credit card and consumer loan receivables reduces the risk profile of our investments, increases our ability to maximize our cash-on-cash rates of return, and accelerates our ability to reinvest the capital we deploy. Additionally, we believe that fresh charged-off receivables provide a higher quality asset base and more predictable future cash flows than charged-off receivables that have been subject to prior third party collection attempts, further mitigating risks associated with the future cash flows from our owned debt portfolios. In the year ended December 31, 2015, approximately 41.1% of our aggregate purchases, based on purchase price, have been of U.S. fresh charged-off credit card and consumer loan receivables. This compares with approximately 70.7% in the year ended December 31, 2014 and approximately 71.7% in the year ended December 31, 2013. As noted above in the “Industry Overview" section under the "Recent Industry Trends" heading and the "Changes in Quality and Supply of Charged-Off Debt” sub-heading, the market price for fresh charged-off debt has risen substantially in the last few years, and our ability to acquire fresh charged-off credit card and consumer loan receivables, on economic terms or at all, has declined.

Continued Diversification. We continue to leverage internally developed best practices combined with external client relationships to diversify the revenue streams of the Company. Having built deep relationships with banks, commercial finance companies and other non-bank financial institutions, SquareTwo has expanded its focus to evaluate, purchase and liquidate portfolios comprised of Canadian receivables, small business loan and lease products, non-bank issued consumer loans, and private student loans that have been charged off by their owners. These diversification efforts provide significant opportunities for growth, balance and flexibility, which complement the Company's extensive history and success in the unsecured consumer credit marketplace. Our purchases of Canadian, commercial and private student loans were 48.4% and 25.3% of total purchases in the years ended December 31, 2015 and 2014, respectively.

12

Experienced Management Team. We have an experienced management team with considerable expertise in the financial services industry, including the credit card and charged-off receivables management sectors. The key members of our management team have on average over 20 years of experience in financial services and related industries, including previous leadership roles at Key National Finance, Bank of America, MBNA, and ING. We believe that the experience and expertise of our senior leadership team positions us to continue to successfully maintain and grow our core business. We have actively sought to complement internally developed management talent with externally recruited managers who bring new skill sets and perspectives to our company.

Our Strategy

Key components of our strategy include the following:

Customer Focus. We are committed to treating each customer fairly, while also requiring that those customers who are able to make payments satisfy their validly incurred obligations to the maximum extent possible. Inherent in our culture is the desire to work together with our customer as we believe that our success fundamentally depends on providing a positive customer experience within the context of a collection interaction. We believe this strategy creates the most beneficial solution for our customers to help resolve their validly incurred debts.

Inspire a Culture of Leadership by Living Our Core Values. We believe that our success depends upon both SquareTwo and its network of exclusive branch offices hiring, developing and retaining personnel of the highest quality who help create a culture of personal responsibility. In addition, we believe that this culture is sustained by the daily demonstration by our personnel of our five core values: Focus, Alignment, Accountability, Integrity and Trust. We believe that this commitment to clearly identify and implement these values at each location enables us to attract and retain the highest quality employees.

Pursue Systemic Operational and Compliance Excellence. We leverage our sophisticated proprietary technology and our operational and analytical models to properly analyze and liquidate our accounts via eAGLE. From refining our forecast models to determining appropriate acquisition prices for charged-off receivables, to developing the best methods to select accounts and the ideal collection procedures, our business strategies are data driven. Consequently, we make ongoing, significant investments in our processes and systems to ensure our data is available, accessible, accurate, and actionable. We maintain constant focus on building operational efficiencies to drive collections and build comprehensive programs to maximize our recoveries through new and existing liquidation strategies. Additionally, we continually enhance our internal controls and auditing capabilities within our Compliance Management System to ensure we are compliant, and that our data is secure across all areas of the organization. We leverage technological tools to manage our recovery and compliance efforts on our owned receivables. We have built comprehensive controls into our systems to help ensure compliance with applicable law and the highest level of data security at both the corporate and branch office levels, to protect the privacy of our customers. Finally, we believe that both our intense focus on the customer experience and our desire to lead the industry in compliance practices are competitive advantages.

Create an Outstanding Network of Call Centers and Exclusive Branch Offices. We believe that our unique Closed Loop Network model of company-owned call centers and our network of exclusive regional branch offices provides us with an integrated framework for collection performance, compliance achievement and customer satisfaction. As we continue to enhance policies, procedures and controls through each of our call centers and branch offices, we improve the customer experience that is essential to a successful liquidation of validly incurred contractual obligations. Our technological advances allow our call centers and branch offices to operate more efficiently by contacting only those customers who we believe have both the willingness and ability to make payments. They also provide ongoing reinforcement of the collection and compliance training that has been provided to those individuals interacting with our customers.

Deliver Solid Financial Results. Our focus is on delivering solid bottom line results. By adhering to our other core strategies, we strive to deliver sustainable growth and provide financial results that meet and exceed the expectations of our key stakeholders. To achieve this end, we continue to focus on buying assets at the analytically correct price and manage them in an efficient, cost-effective manner. We continue to expand our existing relationships into other related product lines, and diversify our acquisition efforts into other categories of charged-off receivables. These continued diversification efforts into parallel products and assets will assist us in meeting our long-term financial goals by quickly adapting to dynamic markets.

13

Our Owned Portfolios

As of December 31, 2015, our active owned charged-off receivables in the U.S. and Canada totaled $9.0 billion in face value and consisted of approximately 2.3 million accounts. The following table sets forth summary information on our active owned charged-off receivables as of December 31, 2015:

Account Type | # of Active Accts (in thousands) | Avg. Bal. per Acct. | Active Face Value(3) ($ in millions) | Active Face Value (% of Total) | Capital Deployed(1) ($ in millions) | Capital Deployed(1) (% of Total) | |||||||||||||||

Credit Card/Consumer Loan - Fresh | 1,303 | $ | 4,074 | $ | 5,308 | 59.0 | % | $ | 2,149 | 80.1 | % | ||||||||||

Credit Card/Consumer Loan - Non-Fresh | 927 | 3,010 | 2,790 | 31.0 | % | 367 | 13.6 | % | |||||||||||||

Other(2) | 48 | 18,729 | 899 | 10.0 | % | 166 | 6.2 | % | |||||||||||||

Total/Average | 2,278 | $ | 3,950 | $ | 8,997 | 100.0 | % | $ | 2,682 | 100.0 | % | ||||||||||

(1) Capital Deployed is an aggregate life-to-date total by account type. It is a representation of resource allocation and includes active and inactive accounts. Canadian Capital Deployed is converted using the historical end of month exchange rate in the month of purchase.

(2) Other includes commercial, student loan, and other purchased debt assets.

(3) Canadian Active Face is converted to U.S. dollars using the exchange rate as of December 31, 2015.

Account Management Model

Recovery efforts in the U.S. on all newly acquired debt are managed within our Closed Loop Network, a unique combination of call centers and a network of regional branch offices exclusively dedicated to SquareTwo. Historically, our branch offices were the primary channel for recovery work on our behalf, but during 2014, we expanded our asset recovery options in the U.S by opening a company-owned call center dedicated to consumer collections. Since the opening of our Fresh View consumer call center, newly acquired accounts are placed for collection exclusively within Fresh View. However, certain of the accounts that had previously been placed into our branch office network for non-legal collections are still being pursued by the respective branch office. Legal recovery operations will continue to progress as necessary through our dedicated network of regional branch offices.

SquareTwo mandates specific expectations that both the call centers and the branch offices must meet. Success is contingent on both SquareTwo and our branch offices’ ability to hire, train and lead their teams in a manner which maximizes liquidation while maintaining adherence to policies and procedures relating to compliance and customer service.

We continue to make significant investments in both our call centers and our relationship with the branch offices. Corporate teams are exclusively dedicated to monitoring, auditing and evaluating all of our locations within the Closed Loop Network on an ongoing basis. However, we do not merely measure and observe; we have implemented financial penalties for failing to meet our customer experience expectations. The knowledge gained from our monitoring efforts provides us insight on how we then incentivize, train and support our call center management and employees and well as branch offices and their respective employees to achieve our mutual success. Members from our executive, operations, technology, legal and compliance teams make multiple on-site visits to each call center and branch office location each year. These efforts ensure we maintain a close and productive relationship with each and provide additional opportunities to ensure that our branch offices remain committed to and accountable for our expressed strategies.

Through our alignment with our network of branch offices, we have achieved symbiotic profitability. We rely on our branch offices to conduct collection efforts on our owned charged-off receivables, so we make thoughtful and deliberate investments in their long-term success and sustainability. A significant focus of our Company is providing our branch offices the resources, tools, and training to enable them to manage their businesses efficiently and to identify opportunities to improve their operations. We pay particular attention to providing training and feedback to offices surrounding the customer experience and our desire to have this experience remain a competitive advantage. The presentation of these materials is aimed at providing our branch offices with insights into best practices and the cause-and-effect relationships of each metric and its impact on overall performance. Additionally, our Operations team uses information available on our system to proactively address development opportunities with each branch office.

We also strive to incentivize our branch offices' liquidation performance of the accounts placed with them by using a variable fee structure. This operational practice aligns each branch office's profitability with that of SquareTwo, and should improve our branch office performance, as poorer performing offices are continually evaluated and possibly replaced. We make decisions about the need for each individual office in the context of current performance and business need for capacity.

14

We have created numerous and diverse channels of interaction to ensure we remain in constant communication with our branch offices. We conduct conference calls with all branch offices to discuss key business issues. We hold several conferences that serve as educational forums for our branch offices, including an annual Partner Summit where we present substantial training on operational, legal, and compliance issues. We also hold an annual Attorney Conference for our attorneys and compliance professionals. This conference typically includes significant content on regulatory trends, legal compliance and collection best practices, and other considerations pertinent to the legal collections process presented by third-party experts and SquareTwo personnel. In addition, we periodically invite each office’s senior leaders to meet with key members of our management team at our headquarters in Denver, Colorado.

Business Development and Purchasing Contracts

We have a dedicated Business Development team that consists of professionals who focus on sourcing charged-off and distressed receivable purchasing opportunities. This team actively maintains relationships with a significant majority of the leading issuers of domestic credit cards, commercial, and consumer loans in addition to relationships with a broad group of national and regional issuers of credit. Within this team, we have individuals who focus specifically on opportunities in the consumer, commercial, student loan and Canadian markets.

We are continuously improving the structure of our Business Development department as part of an effort to both broaden our relationships with institutions from which we have historically acquired charged-off receivables and to expand our active purchasing relationships with both national and regional financial institutions. Depending on whether an institution has historically sold its charged-off receivables, our sourcing efforts require different levels of education on our capabilities and the process of selling charged-off receivables. We believe the efforts of our Business Development team are important to enhancing our relationships with existing credit issuers and in forming effective partnerships with new credit issuers. In addition, we hold our Business Development team responsible for providing the executive management team with market insights, trends and competitive behavior.

We have developed longstanding relationships with a number of leading credit issuers including U.S. and Canadian credit card, consumer loan, student loan, and small business credit issuers. Historically, we have purchased assets from seven of the ten largest credit card issuers in the U.S. In aggregate, we have purchased from over 40 different issuers of credit over the last three years as of December 31, 2015.

When we acquire a portfolio of charged-off receivables, there are generally two types of arrangements that we utilize. While a majority of our purchases occur through short-term forward flow agreements that provide for a range of purchased volumes at predetermined pricing on a monthly basis, we actively manage the risk associated with fixed pricing under these agreements. These contracts typically cover six months or less and can be generally canceled by the Company at its discretion with 30-60 days’ notice. Finally, our purchased debt agreements contain specific criteria around the credit quality and characteristics of the accounts we purchase to protect us from receiving future assets that do not conform to the product we evaluated to establish pricing. In addition to purchases under our short-term forward flow agreements, we regularly acquire charged-off receivable portfolios through individually negotiated transactions at spot market prices.

Under the terms of our purchase contracts, we typically have recourse, or the right to return, certain accounts to the seller within a designated time period from the purchase date should the account not meet certain agreed upon requirements, including the accounts of customers who were deceased or bankrupt at the time of purchase. If a customer enters into bankruptcy after our contractual recourse period, we utilize Fresh View to collect any proceeds as a result of the court driven bankruptcy process. Since 2013, account sales have no longer been part of our core liquidation strategy.

Proprietary Technology and Analytics

Our proprietary debt distribution, portfolio management and collection system, eAGLE, is built on the latest Oracle® database, middleware and application framework technology to enhance performance, security, flexibility and scalability. The eAGLE platform is housed on Oracle's high performance database and application hardware platforms - ExaData and ExaLogic. This platform represents years of continuing development and investment over $35 million. Each of our U.S. call centers and branch offices conduct all collection activities through eAGLE. Controls have been added into eAGLE which provide significant insight into and control over the actions of the call centers and branch offices, ensuring continuous regulatory compliance. eAGLE is a user friendly tool that enables a new or seasoned collector to collect debt using the latest collection techniques and information repositories and provides the data that we believe is necessary to enhance collections. Our eAGLE platform is designed as an asset management system as well as a collections platform. The system monitors and evaluates the performance of our call centers and branch offices and their individual collectors. The system also provides standard operating metrics to enhance performance and visibility on a daily, weekly and monthly basis for the call centers and

15

branch offices. It allows us to track the data that we believe is necessary to efficiently allocate purchased debt to our call centers and branch offices based on state licensing requirements, historical collection success rates and other factors, and to move purchased debt within our branch offices (recalling and replacing accounts) to maximize performance. eAGLE is scalable, with the ability to expand our business operations while still maintaining rigorous internal controls, and it is built with architecture to provide flexibility for future operational and process changes that we may choose to implement. In addition to enabling an efficient, effective and continuously improving collection process, eAGLE was designed to capture data to help us better understand the market and debt performance, which further enhances our ability to acquire receivables. We believe that the eAGLE platform is a key competitive advantage for us relative to our primary competitors that utilize "off-the-shelf" or legacy platforms.

Our Decision Science team provides in-depth statistical analyses on the receivables we purchase to provide our management team with the data necessary to track and enhance performance at the call center and branch office level. These robust statistical models create accurate portfolio forecasts that, when combined with our reporting platform, provide the business leaders at our Company the data required to manage our business and to make decisions using real-time performance. The team has developed and implemented a structured projection model that generates portfolio-level cash flow expectations. The team also operates a grading model that utilizes multiple variables comprised of third party customer-level data, asset class information, and other details to determine internal account-level grades.

Risk Management, Compliance and Insurance

We operate in a regulated industry and have devoted significant resources to risk management and compliance. Our Office of Compliance, in conjunction with the Law and Regulatory Affairs department, is directly responsible for the design, management and implementation of our Compliance and Control Operational Framework. The Office of Compliance, under the direction of the Chief Compliance Officer, along with the Compliance Risk Committee ("CRC"), manages internal compliance and leads compliance within our Closed Loop Network. Once regulatory requirements are identified, the CRC identifies business processes, assesses risk and prioritization and reports those findings to the Office of Compliance. The Office of Compliance along with the CRC define specific policies, assign responsibilities to process owners, establish procedures and controls, engage in communication and training, monitor and test adherence to established compliance policies, and remediate deficiencies.