Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Encompass Health Corp | hlsq18-k33116.htm |

| EX-99.1 - EXHIBIT 99.1 - Encompass Health Corp | hlsearningsrelease33116.htm |

First Quarter 2016 Earnings Call April 27, 2016 SUPPLEMENTAL SLIDES

2 The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect our current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, repurchases of securities, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2015, the form 10-Q for the quarter ended March 31, 2016, when filed, and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated April 26, 2016, to which the following supplemental slides are attached as Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements

3 Table of Contents Q1 2016 Summary................................................................................................................................................. 4-5 Inpatient Rehabilitation Segment ........................................................................................................................... 6-7 Home Health & Hospice Segment ......................................................................................................................... 8-9 Earnings per Share ................................................................................................................................................ 10-11 Adjusted Free Cash Flow....................................................................................................................................... 12 Guidance................................................................................................................................................................ 13-14 Appendix ................................................................................................................................................................ 15 Map of Locations.................................................................................................................................................... 16 Expansion Activity .................................................................................................................................................. 17 Business Outlook: Revenue Assumptions ............................................................................................................ 18 Adjusted Free Cash Flow and Tax Assumptions.................................................................................................... 19 Free Cash Flow Priorities....................................................................................................................................... 20 Debt Schedule and Maturity Profile ....................................................................................................................... 21-22 New-Store/Same-Store IRF Growth ...................................................................................................................... 23 Payment Sources (Percent of Revenues).............................................................................................................. 24 Inpatient Rehabilitation Operational and Labor Metrics ......................................................................................... 25 Home Health & Hospice Operational Metrics ........................................................................................................ 26 Share Information .................................................................................................................................................. 27 Segment Operating Results................................................................................................................................... 28-29 Reconciliations to GAAP........................................................................................................................................ 30-36 End Notes .............................................................................................................................................................. 37-38

4 Q1 2016 Summary (Q1 2016 vs. Q1 2015) Growth (In Millions) Q1 2016 Q1 2015 Dollars Percent HealthSouth Consolidated Net operating revenues $ 909.8 $ 740.6 $ 169.2 22.8% Adjusted EBITDA* $ 192.1 $ 156.1 $ 36.0 23.1% Inpatient Rehabilitation Segment Net operating revenues $ 749.2 $ 630.3 $ 118.9 18.9% Adjusted EBITDA* $ 196.9 $ 164.4 $ 32.5 19.8% Home Health and Hospice Segment Net operating revenues $ 160.6 $ 110.3 $ 50.3 45.6% Adjusted EBITDA* $ 22.6 $ 16.9 $ 5.7 33.7% Major takeaways: u Strong revenue, volume, and Adjusted EBITDA growth in both segments Ÿ 17% discharge growth for IRFs (same-store = 2.8%) Ÿ 56.1% admissions growth for home health (same-store = 12.6%) u Adjusted EPS grew 19.6% to $0.61 per diluted share ($0.51 per diluted share in Q1 2015). u Adjusted free cash flow grew 63.1% to $129.5 million ($79.4 million in Q1 2015). *Reconciliation to GAAP provided on pages 30-33

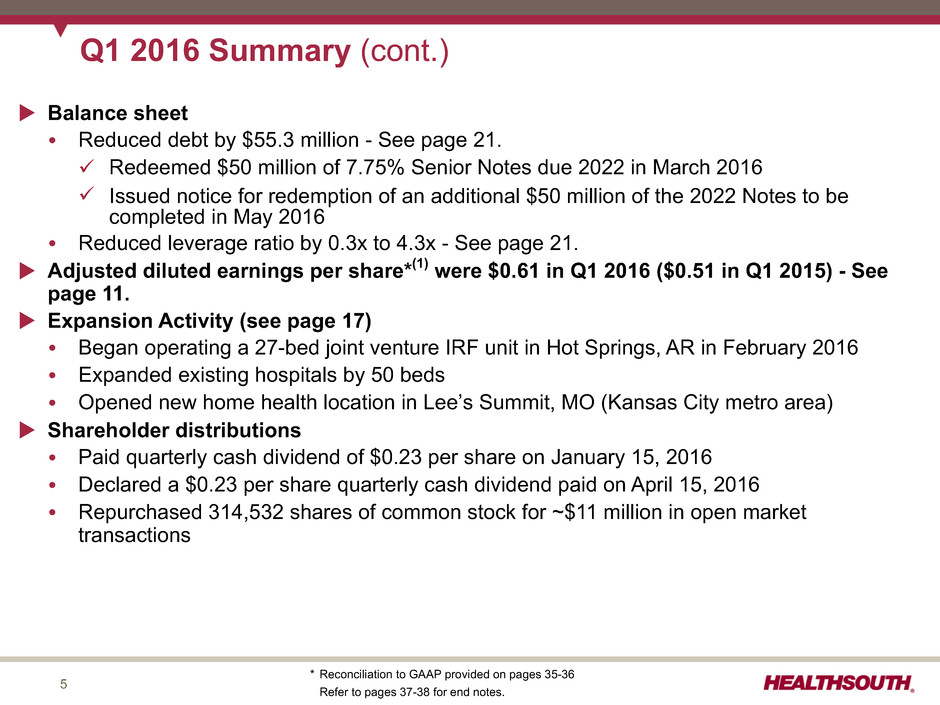

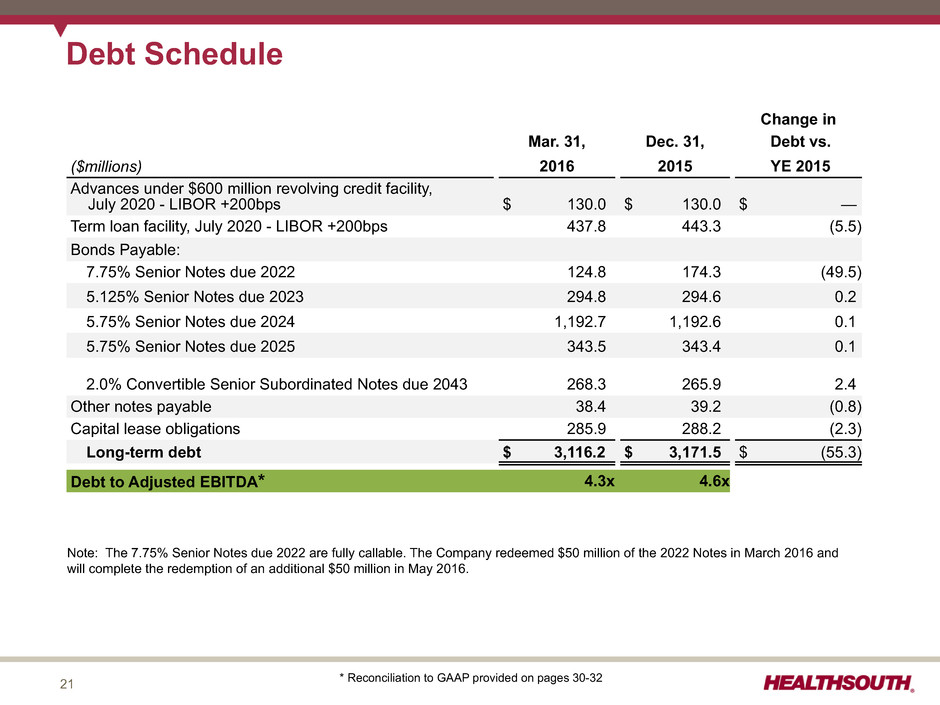

5 Q1 2016 Summary (cont.) u Balance sheet Ÿ Reduced debt by $55.3 million - See page 21. ü Redeemed $50 million of 7.75% Senior Notes due 2022 in March 2016 ü Issued notice for redemption of an additional $50 million of the 2022 Notes to be completed in May 2016 Ÿ Reduced leverage ratio by 0.3x to 4.3x - See page 21. u Adjusted diluted earnings per share*(1) were $0.61 in Q1 2016 ($0.51 in Q1 2015) - See page 11. u Expansion Activity (see page 17) Ÿ Began operating a 27-bed joint venture IRF unit in Hot Springs, AR in February 2016 Ÿ Expanded existing hospitals by 50 beds Ÿ Opened new home health location in Lee’s Summit, MO (Kansas City metro area) u Shareholder distributions Ÿ Paid quarterly cash dividend of $0.23 per share on January 15, 2016 Ÿ Declared a $0.23 per share quarterly cash dividend paid on April 15, 2016 Ÿ Repurchased 314,532 shares of common stock for ~$11 million in open market transactions * Reconciliation to GAAP provided on pages 35-36 Refer to pages 37-38 for end notes.

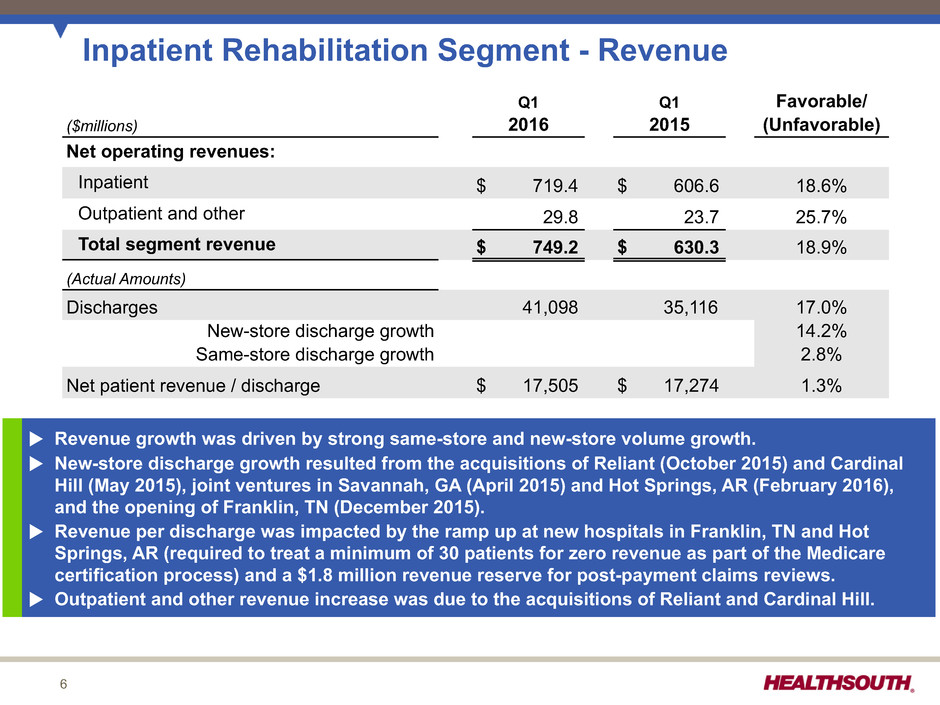

6 Inpatient Rehabilitation Segment - Revenue Q1 Q1 Favorable/ ($millions) 2016 2015 (Unfavorable) Net operating revenues: Inpatient $ 719.4 $ 606.6 18.6% Outpatient and other 29.8 23.7 25.7% Total segment revenue $ 749.2 $ 630.3 18.9% (Actual Amounts) Discharges 41,098 35,116 17.0% New-store discharge growth 14.2% Same-store discharge growth 2.8% Net patient revenue / discharge $ 17,505 $ 17,274 1.3% u Revenue growth was driven by strong same-store and new-store volume growth. u New-store discharge growth resulted from the acquisitions of Reliant (October 2015) and Cardinal Hill (May 2015), joint ventures in Savannah, GA (April 2015) and Hot Springs, AR (February 2016), and the opening of Franklin, TN (December 2015). u Revenue per discharge was impacted by the ramp up at new hospitals in Franklin, TN and Hot Springs, AR (required to treat a minimum of 30 patients for zero revenue as part of the Medicare certification process) and a $1.8 million revenue reserve for post-payment claims reviews. u Outpatient and other revenue increase was due to the acquisitions of Reliant and Cardinal Hill.

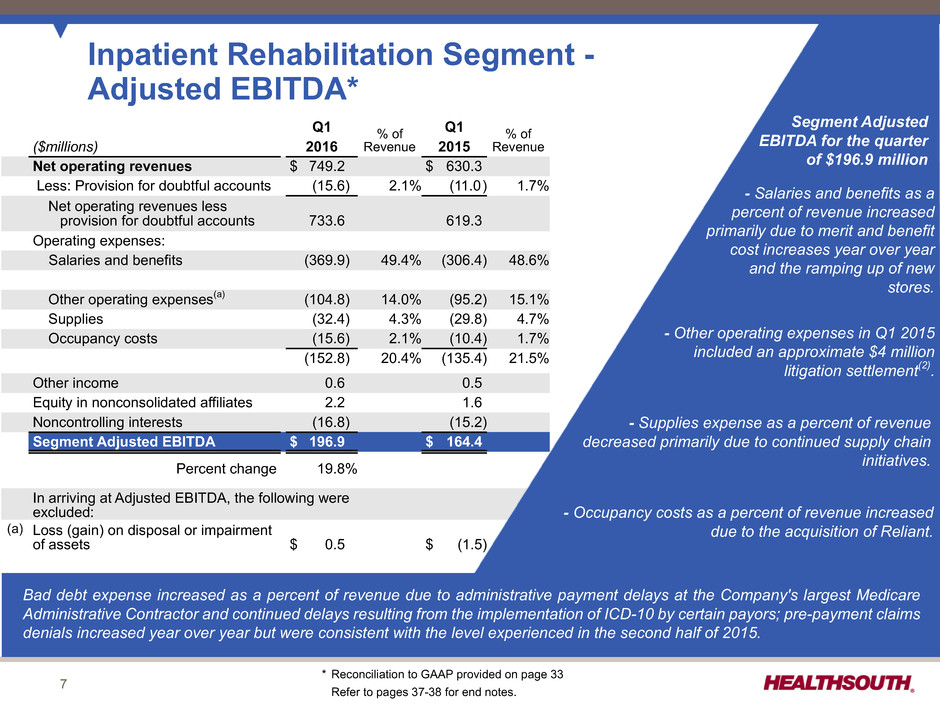

7 Inpatient Rehabilitation Segment - Adjusted EBITDA* Q1 % of Revenue Q1 % of Revenue($millions) 2016 2015 Net operating revenues $ 749.2 $ 630.3 Less: Provision for doubtful accounts (15.6) 2.1% (11.0) 1.7% Net operating revenues less provision for doubtful accounts 733.6 619.3 Operating expenses: Salaries and benefits (369.9) 49.4% (306.4) 48.6% Other operating expenses(a) (104.8) 14.0% (95.2) 15.1% Supplies (32.4) 4.3% (29.8) 4.7% Occupancy costs (15.6) 2.1% (10.4) 1.7% (152.8) 20.4% (135.4) 21.5% Other income 0.6 0.5 Equity in nonconsolidated affiliates 2.2 1.6 Noncontrolling interests (16.8) (15.2) Segment Adjusted EBITDA $ 196.9 $ 164.4 Percent change 19.8% In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal or impairment of assets $ 0.5 $ (1.5) Segment Adjusted EBITDA for the quarter of $196.9 million - Supplies expense as a percent of revenue decreased primarily due to continued supply chain initiatives. - Salaries and benefits as a percent of revenue increased primarily due to merit and benefit cost increases year over year and the ramping up of new stores. - Other operating expenses in Q1 2015 included an approximate $4 million litigation settlement(2). - Occupancy costs as a percent of revenue increased due to the acquisition of Reliant. Bad debt expense increased as a percent of revenue due to administrative payment delays at the Company's largest Medicare Administrative Contractor and continued delays resulting from the implementation of ICD-10 by certain payors; pre-payment claims denials increased year over year but were consistent with the level experienced in the second half of 2015. * Reconciliation to GAAP provided on page 33 Refer to pages 37-38 for end notes.

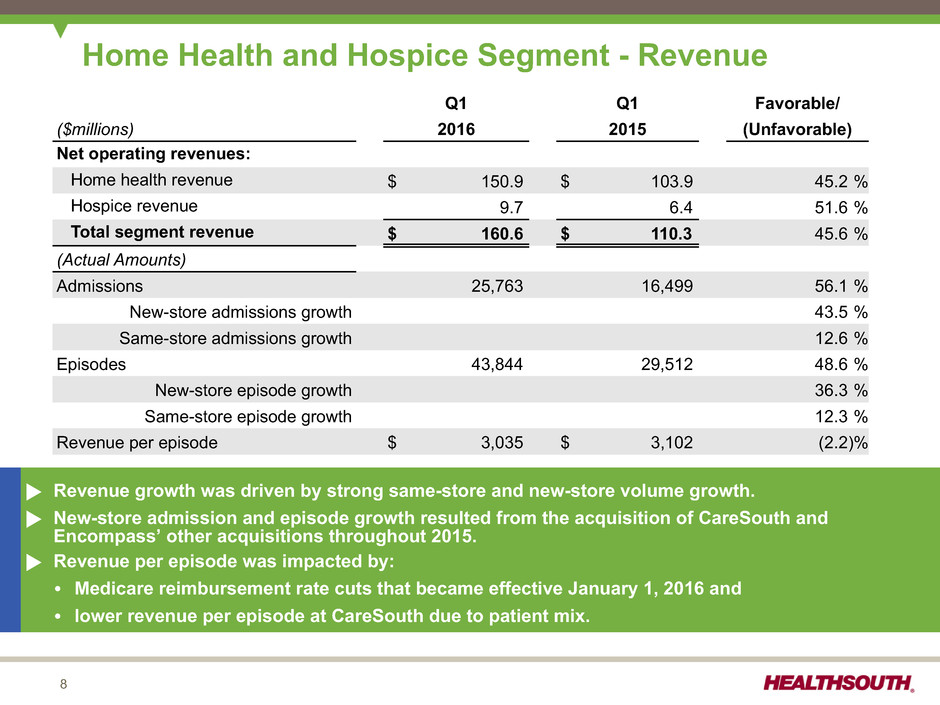

8 Home Health and Hospice Segment - Revenue Q1 Q1 Favorable/ ($millions) 2016 2015 (Unfavorable) Net operating revenues: Home health revenue $ 150.9 $ 103.9 45.2 % Hospice revenue 9.7 6.4 51.6 % Total segment revenue $ 160.6 $ 110.3 45.6 % (Actual Amounts) Admissions 25,763 16,499 56.1 % New-store admissions growth 43.5 % Same-store admissions growth 12.6 % Episodes 43,844 29,512 48.6 % New-store episode growth 36.3 % Same-store episode growth 12.3 % Revenue per episode $ 3,035 $ 3,102 (2.2)% u Revenue growth was driven by strong same-store and new-store volume growth. u New-store admission and episode growth resulted from the acquisition of CareSouth and Encompass’ other acquisitions throughout 2015. u Revenue per episode was impacted by: Ÿ Medicare reimbursement rate cuts that became effective January 1, 2016 and Ÿ lower revenue per episode at CareSouth due to patient mix.

9 Q1 % of Revenue Q1 % of Revenue($millions) 2016 2015 Net operating revenues $ 160.6 $ 110.3 Less: Provision for doubtful accounts (0.9) 0.6% (0.6) 0.5% Net operating revenues less provision for doubtful accounts 159.7 109.7 Operating expenses: Cost of services (78.4) 48.8% (53.4) 48.4% Support and overhead costs(a) (57.0) 35.5% (38.1) 34.5% (135.4) 84.3% (91.5) 83.0% Equity in net income of nonconsolidated affiliates 0.2 — Noncontrolling interests (1.9) (1.3) Segment Adjusted EBITDA $ 22.6 $ 16.9 Percent change 33.7% In arriving at Adjusted EBITDA, the following was excluded: (a) Gain on disposal or impairment of assets (0.3) — Home Health and Hospice Segment - Adjusted EBITDA* Segment Adjusted EBITDA for the quarter of $22.6 million. - Cost of services increased as a percent of net operating revenues primarily due to lower average revenue per episode and merit and benefit cost increases. * Reconciliation to GAAP provided on pages 29-31 * Reconciliation to GAAP provided on page 33 - Support and overhead costs increased as a percent of net operating revenues primarily due to lower average revenue per episode and expenses related to the integration of CareSouth.

10 Earnings per Share - As Reported Q1 (In Millions, Except Per Share Data) 2016 2015 Inpatient rehabilitation segment Adjusted EBITDA $ 196.9 $ 164.4 Home health and hospice segment Adjusted EBITDA 22.6 16.9 General and administrative expenses (27.4) (25.2) Consolidated Adjusted EBITDA 192.1 156.1 Interest expense and amortization of debt discounts and fees (44.6) (31.8) Depreciation and amortization (42.4) (31.9) Stock-based compensation expense (4.5) (9.4) Other, including noncash (loss) gain on disposal or impairment of assets (0.2) 1.5 100.4 84.5 Certain unusual and nonrecurring items: Government, class action, and related settlements — (8.0) Loss on early extinguishment of debt (2.4) (1.2) Professional fees - accounting, tax, and legal (0.2) (2.2) Pre-tax income 97.8 73.1 Income tax expense(3) (39.7) (30.3) Income from continuing operations* $ 58.1 $ 42.8 Interest and amortization on 2.0% Convertible Senior Subordinated Notes (net of tax)(4) 2.4 2.3 Diluted shares (see page 27) 99.4 101.1 Diluted earnings per share*(4) $ 0.61 $ 0.44 u Earnings per share for the first quarter of 2016 were impacted by: Ÿ Higher interest expense related to the financing of the Reliant and CareSouth acquisitions Ÿ Higher depreciation and amortization resulting from acquisitions and capital investments Ÿ Lower stock-based compensation expense due to the mark-to-market adjustment for stock appreciation rights(5) and decreased stock awards resulting from 2015’s performance under the long-term incentive plan Ÿ Loss on early extinguishment of debt associated with the $50 million redemption of the 7.75% Senior Notes due 2022 in Q1 2016 Ÿ Lower share count resulting from stock repurchases in Q4 2015 and Q1 2016 u Earnings per share for the first quarter of 2015 included ~$11 million, or $0.07 per share, for certain nonrecurring items, including the General Medicine settlement. * Earnings per share are determined using income from continuing operations attributable to HealthSouth. Refer to pages 37-38 for end notes.

11 Q1 2016 2015 Earnings per share, as reported $ 0.61 $ 0.44 Adjustments, net of tax: Government, class action, and related settlements — 0.05 Professional fees — accounting, tax, and legal — 0.01 Mark-to-market adjustment for stock appreciation rights(5) (0.01) — Loss on early extinguishment of debt 0.01 0.01 Adjusted earnings per share* $ 0.61 $ 0.51 Adjusted Earnings per Share(1) * Adjusted EPS may not sum due to rounding. See complete calculations of adjusted earnings per share on pages 35-36. Refer to pages 37-38 for end notes. Adjusted earnings per share removes the impact of certain unusual and nonrecurring items from the earnings per share calculation.

12 Adjusted Free Cash Flow 3 Mos. 2015 Adjusted EBITDA Cash Interest Expense Cash Tax Payments, Net of Refunds Working Capital and Other Maintenance Capital Expenditures Preferred Dividends Adjusted Free Cash Flow 3 Mos. 2016 $79.4 $36.0 ($12.6) $2.4 $22.1 $0.6 $1.6 $129.5 Adjusted Free Cash Flow*(6) * Reconciliation to GAAP provided on page 34 Refer to pages 37-38 for end notes. u Adjusted free cash flow grew 63.1% primarily as a result of increased Adjusted EBITDA. u Cash interest expense increased due to the financing of the Reliant and CareSouth acquisitions. u The decrease in working capital was mainly attributable to the timing of payroll-related liabilities as well as a year-over-year decrease in payroll tax withholdings related to the vesting of employee restricted stock awards. u Quarterly free cash flow for the remainder of 2016 will be impacted by the timing of income tax payments and maintenance capital expenditures, as well as working capital changes.

13 Adjusted EBITDA Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth Revised Guidance Net Operating Revenues Initial 2016 Full-Year Guidance Revised 2016 Full-Year Guidance Net Operating Revenues $3,580 million to $3,680 million Adjusted EBITDA $770 million to $790 million Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth $2.37 to $2.49 Projected Growth Over 2015 $3,550 million to $3,650 million $765 million to $785 million $2.32 to $2.44 13% to 16% 13% to 16% 5% to 11% +$30 million +$5 million +$0.05 per share

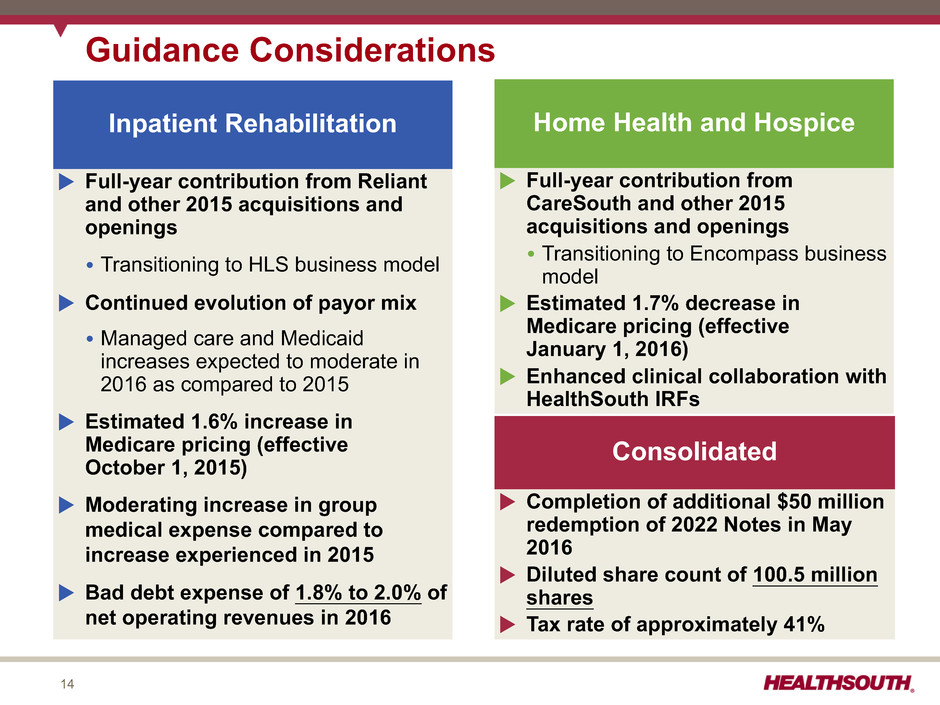

14 Inpatient Rehabilitation u Full-year contribution from Reliant and other 2015 acquisitions and openings Ÿ Transitioning to HLS business model u Continued evolution of payor mix Ÿ Managed care and Medicaid increases expected to moderate in 2016 as compared to 2015 u Estimated 1.6% increase in Medicare pricing (effective October 1, 2015) u Moderating increase in group medical expense compared to increase experienced in 2015 u Bad debt expense of 1.8% to 2.0% of net operating revenues in 2016 Guidance Considerations Home Health and Hospice u Full-year contribution from CareSouth and other 2015 acquisitions and openings Ÿ Transitioning to Encompass business model u Estimated 1.7% decrease in Medicare pricing (effective January 1, 2016) u Enhanced clinical collaboration with HealthSouth IRFs Consolidated u Completion of additional $50 million redemption of 2022 Notes in May 2016 u Diluted share count of 100.5 million shares u Tax rate of approximately 41%

Appendix

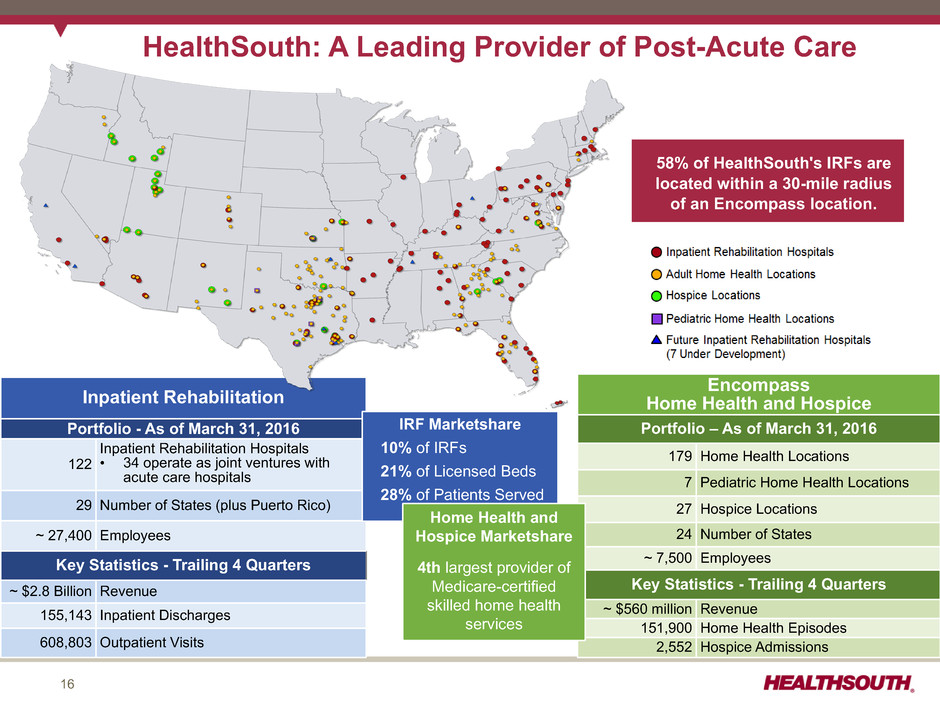

16 HealthSouth: A Leading Provider of Post-Acute Care 58% of HealthSouth's IRFs are located within a 30-mile radius of an Encompass location. Inpatient Rehabilitation Portfolio - As of March 31, 2016 122 Inpatient Rehabilitation Hospitals • 34 operate as joint ventures with acute care hospitals 29 Number of States (plus Puerto Rico) ~ 27,400 Employees Key Statistics - Trailing 4 Quarters ~ $2.8 Billion Revenue 155,143 Inpatient Discharges 608,803 Outpatient Visits Encompass Home Health and Hospice Portfolio – As of March 31, 2016 179 Home Health Locations 7 Pediatric Home Health Locations 27 Hospice Locations 24 Number of States ~ 7,500 Employees Key Statistics - Trailing 4 Quarters ~ $560 million Revenue 151,900 Home Health Episodes 2,552 Hospice Admissions IRF Marketshare 10% of IRFs 21% of Licensed Beds 28% of Patients Served Home Health and Hospice Marketshare 4th largest provider of Medicare-certified skilled home health services

17 Expansion Activity Inpatient Rehabilitation Facilities # of New Beds 2016 2017 2018 De Novo: Modesto, CA 50 — — Pearland, TX — 40 — Murrieta, CA — — 50 Joint Ventures: Hot Springs, AR 40 — — Broken Arrow, OK — 40 — Bryan, TX 49 — — Westerville, OH — 60 — Jackson, TN — 48 — Bed Expansions, net* 110 100 100 249 288 150 Home Health and Hospice # of locations December 31, 2015 213 Acquisitions — De Novo 1 Merged / Closed Locations (1) March 31, 2016 213 * Net bed expansions in each year may change due to the timing of certain regulatory approvals and/or construction delays. u Opened one home health location in Lee’s Summit, MO (Kansas City metro area) u Closed one legacy HealthSouth home health agency in Sea Pines, FL u Began operating 27-bed IRF unit in Hot Springs, AR in February 2016 Ÿ joint venture with CHI St. Vincent Hot Springs Ÿ will relocate unit to new 40-bed hospital when construction is completed (expected Q3 2016) u Expanded existing hospitals by 50 beds Ÿ 40 beds in Cincinnati, OH Ÿ 10 beds in Johnson City, TN (Quillen)

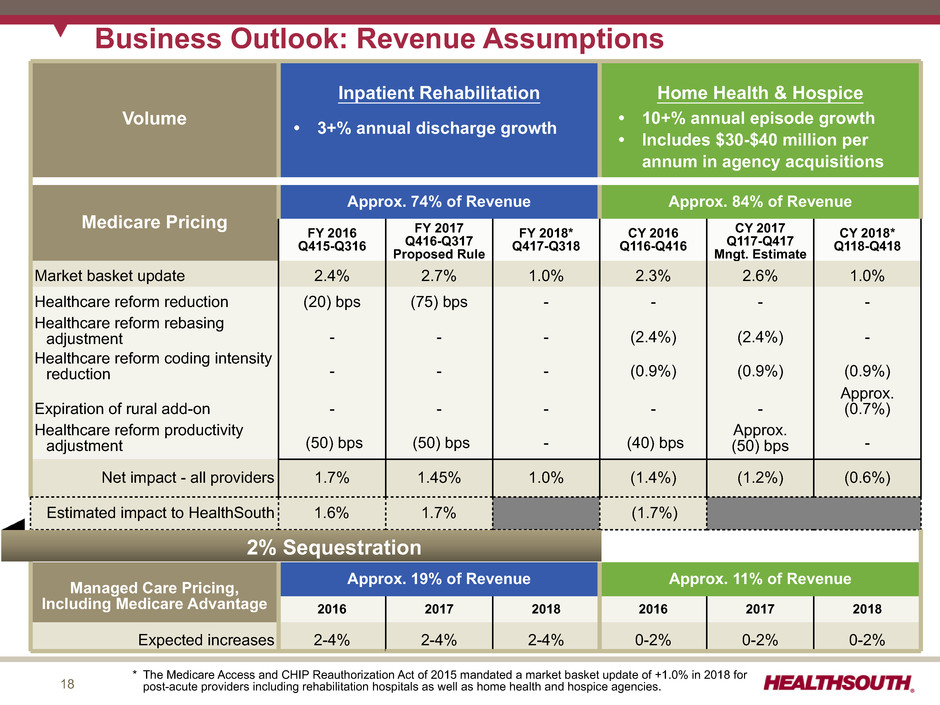

18 • 10% to15% annual episode growth • Includes $35-$40 million per annum in agency acquisitions Volume Inpatient Rehabilitation Home Health & Hospice Medicare Pricing Approx. 74% of Revenue Approx. 84% of Revenue FY 2016 Q415-Q316 FY 2017 Q416-Q317 Proposed Rule FY 2018* Q417-Q318 CY 2016 Q116-Q416 CY 2017 Q117-Q417 Mngt. Estimate CY 2018* Q118-Q418 Market basket update 2.4% 2.7% 1.0% 2.3% 2.6% 1.0% Healthcare reform reduction (20) bps (75) bps - - - - Healthcare reform rebasing adjustment - - - (2.4%) (2.4%) - Healthcare reform coding intensity reduction - - - (0.9%) (0.9%) (0.9%) Expiration of rural add-on - - - - - Approx. (0.7%) Healthcare reform productivity adjustment (50) bps (50) bps - (40) bps Approx. (50) bps - Net impact - all providers 1.7% 1.45% 1.0% (1.4%) (1.2%) (0.6%) Estimated impact to HealthSouth 1.6% 1.7% (1.7%) Managed Care Pricing, Including Medicare Advantage Approx. 19% of Revenue Approx. 11% of Revenue 2016 2017 2018 2016 2017 2018 Expected increases 2-4% 2-4% 2-4% 0-2% 0-2% 0-2% Business Outlook: Revenue Assumptions 2% Sequestration • 3+% annual discharge growth • 10+% annual episode growth• Includes $30-$40 million per annum in agency acquisitions * The Medicare Access and CHIP Reauthorization Act of 2015 mandated a market basket update of +1.0% in 2018 for post-acute providers including rehabilitation hospitals as well as home health and hospice agencies.

19 Adjusted Free Cash Flow*(6) and Tax Assumptions Certain Cash Flow Items (millions) Q1 2016 Actual 2016 Assumptions 2015 Actual • Cash interest expense (net of amortization of debt discounts and fees) $41.1 $165 to $175 $128.6 • Cash payments for taxes, net of refunds $0.7 $20 to $40 $9.4 • Working Capital and Other $3.0 $60 to $80 $69.2 • Maintenance CAPEX $17.7 $95 to $110 $83.1 • Dividends paid on preferred stock(7) $— $— $3.1 • Adjusted Free Cash Flow $129.5 $360 to $445 $389.0 GAAP Tax Considerations: • Gross federal NOL of ~$183 million as of March 31, 2016 • Remaining valuation allowance of ~$28 million related to state NOLS * Reconciliation to GAAP provided on page 34 Refer to pages 37-38 for end notes. Quarterly free cash flow for the remainder of 2016 will be impacted by the timing of income tax payments and maintenance capital expenditures, as well as changes in working capital.

20 Free Cash Flow Priorities (In Millions) Q1 2016 2016 2015 Actuals Assumptions Actuals IRF bed expansions $4.1 $20 to $30 $20.8 New IRF’s - De novos 17.3 70 to 90 47.8 - Acquisitions — 0 to 20 786.2 New home health and hospice acquisitions — 30 to 40 200.2 $21.4 $120 to $180 $1,055.0 Q1 2016 2016 2015 Actuals Assumptions Actuals Debt redemptions (borrowings), net $55.3 $TBD $(1,060.3) Leased property purchases — TBD — Cash dividends on common stock(8) 21.3 85 77.2 Common stock repurchases 12.9 TBD 45.3 $89.5 $TBD $(937.8) Shareholder Distributions Growth in Core Business Debt Reduction Highest Priorit y 2022 senior notes are fully callable: • Redeemed $50 million in March 2016 • ~$126 million remaining as of March 31, 2016 • will complete additional $50 million redemption in May 2016 Current quarterly cash dividend of $0.23 per common share ~$149 million authorization remaining as of March 31, 2016 Note: 2015 amount for debt borrowings included ~$208 million related to the Reliant hospitals' capital lease obligations. See the debt schedule on page 21. Refer to pages 37-38 for end notes.

21 Debt Schedule Change in Mar. 31, Dec. 31, Debt vs. ($millions) 2016 2015 YE 2015 Advances under $600 million revolving credit facility, July 2020 - LIBOR +200bps $ 130.0 $ 130.0 $ — Term loan facility, July 2020 - LIBOR +200bps 437.8 443.3 (5.5) Bonds Payable: 7.75% Senior Notes due 2022 124.8 174.3 (49.5) 5.125% Senior Notes due 2023 294.8 294.6 0.2 5.75% Senior Notes due 2024 1,192.7 1,192.6 0.1 5.75% Senior Notes due 2025 343.5 343.4 0.1 2.0% Convertible Senior Subordinated Notes due 2043 268.3 265.9 2.4 Other notes payable 38.4 39.2 (0.8) Capital lease obligations 285.9 288.2 (2.3) Long-term debt $ 3,116.2 $ 3,171.5 $ (55.3) Debt to Adjusted EBITDA* 4.3x 4.6x * Reconciliation to GAAP provided on pages 30-32 Note: The 7.75% Senior Notes due 2022 are fully callable. The Company redeemed $50 million of the 2022 Notes in March 2016 and will complete the redemption of an additional $50 million in May 2016.

22 2015 2019 2020 2020 2021 2022 2023 2024 2025 2043 $350 Senior Notes 5.75% $1,200 Senior Notes 5.75% $320 Conv. Sr. Sub. Notes 2.0% $300 Senior Notes 5.125% $130 Drawn + $35 reserved for LC’s Holders have a put option in 2020 As of March 31, 2016* Debt Maturity Profile - Face Value ($ in millions) $435 Available $126 Senior Notes 7.75% Callable beginning November 2017 HealthSouth is positioned with a cost-efficient, flexible capital structure. Callable beginning March 2018 Revolver Revolver Capacity $440 Term Loans Became callable in September 2015 Callable beginning September 2020 * This chart does not include ~$286 million of capital lease obligations or ~$38 million of other notes payable. See the debt schedule on page 21. The Company will complete the redemption of $50 million of its 7.75% Senior Notes due 2022 in May 2016. • Expect to fund using cash on hand and capacity under revolving credit facility • Q2 2016 loss on early extinguishment of debt of ~$2 million • Estimated cash interest savings of ~ $2 million in 2016

23 25.0 20.0 15.0 10.0 5.0 0.0 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 New-Store/Same-Store IRF Growth Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Fairlawn(9) 0.6% 1.9% 1.9% 2.0% 1.1% St. Vincent’s(10) 1.2% 1.3% New Store 0.7% 1.7% 2.5% 2.5% 2.0% 1.0% —% 0.6% 1.8% 4.4% 5.7% 15.6% 14.2% Same Store 2.2% 3.3% 3.2% 1.3% 0.4% 1.4% 1.9% 2.2% 2.9% 2.8% 3.9% 3.0% 2.8% Total by Qtr. 4.1% 6.3% 5.7% 3.8% 2.4% 3.0% 3.8% 4.7% 6.7% 8.3% 9.6% 18.6% 17.0% Total by Year 5.0% 3.5% 10.9% Same-Store Year(11) 2.5% 1.3% 3.2% Same-Store Year UDS(12) (0.7)% (0.2)% 1.3% Altamonte Springs, FL (50 beds) Johnson City, TN (26 beds) Newnan, GA (50 beds) Middletown, DE (34 beds) Augusta, GA (58 beds) Littleton, CO (40 beds) Stuart, FL (34 beds) Refer to page 37-38 for end notes. Reliant (857 beds) Franklin, TN (40 beds) Lexington, KY (158 beds) Savannah, GA (50 beds) Hot Springs, AR (27 beds)

24 Payment Sources (Percent of Revenues) Inpatient Rehabilitation Segment Home Health and Hospice Segment Consolidated Q1 Q1 Q1 Full Year 2016 2015 2016 2015 2016 2015 2015 Medicare 73.8% 73.5% 83.5% 83.8% 75.4% 74.9% 74.9% Medicare Advantage 7.6% 8.3% 8.7% 7.3% 7.8% 8.2% 7.9% Managed care 11.0% 11.2% 2.7% 3.1% 9.5% 10.0% 9.8% Medicaid 3.0% 2.0% 4.9% 5.6% 3.4% 2.6% 3.0% Other third-party payors 1.6% 1.7% —% 0.1% 1.4% 1.5% 1.7% Workers’ compensation 1.1% 1.1% —% —% 0.9% 0.9% 0.9% Patients 0.6% 0.8% 0.1% 0.1% 0.5% 0.7% 0.6% Other income 1.3% 1.4% 0.1% —% 1.1% 1.2% 1.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

25 Inpatient Rehabilitation Operational and Labor Metrics Q1 Q4 Q3 Q2 Q1 Full Year 2016 2015 2015 2015 2015 2015 (In Millions) Net patient revenue-inpatient $ 719.4 $ 696.8 $ 625.1 $ 618.7 $ 606.6 $ 2,547.2 Net patient revenue-outpatient and other revenues 29.8 29.1 26.5 26.6 23.7 105.9 Net operating revenues $ 749.2 $ 725.9 $ 651.6 $ 645.3 $ 630.3 $ 2,653.1 Discharges(13) 41,098 40,891 36,746 36,408 35,116 149,161 Net patient revenue per discharge $ 17,505 $ 17,040 $ 17,011 $ 16,994 $ 17,274 $ 17,077 Outpatient visits 162,649 163,119 138,121 144,914 131,353 577,507 Average length of stay 12.9 12.6 12.9 13.0 13.3 12.9 Occupancy % 68.9% 66.4% 69.6% 70.4% 72.8% 62.8% # of licensed beds 8,481 8,404 7,422 7,374 7,100 8,404 Occupied beds 5,843 5,580 5,166 5,191 5,169 5,278 Full-time equivalents (FTEs)(14) 19,352 19,136 17,782 17,601 17,002 17,880 Contract labor 194 152 141 118 116 132 Total FTE and contract labor 19,546 19,288 17,923 17,719 17,118 18,012 EPOB(15) 3.35 3.46 3.47 3.41 3.31 3.41 Refer to pages 37-38 for end notes.

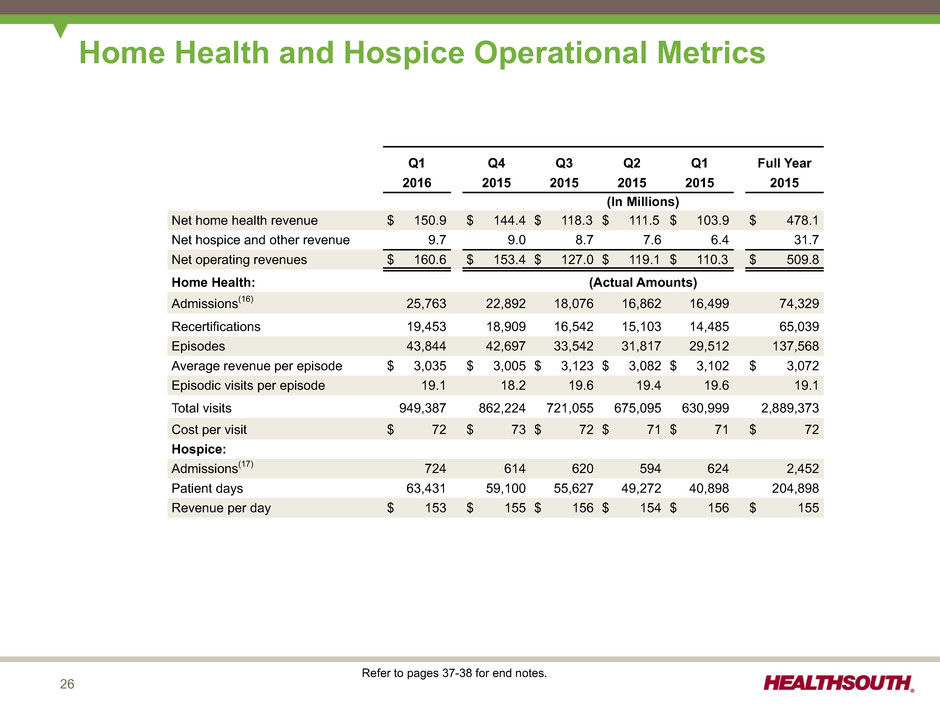

26 Home Health and Hospice Operational Metrics Q1 Q4 Q3 Q2 Q1 Full Year 2016 2015 2015 2015 2015 2015 (In Millions) Net home health revenue $ 150.9 $ 144.4 $ 118.3 $ 111.5 $ 103.9 $ 478.1 Net hospice and other revenue 9.7 9.0 8.7 7.6 6.4 31.7 Net operating revenues $ 160.6 $ 153.4 $ 127.0 $ 119.1 $ 110.3 $ 509.8 Home Health: (Actual Amounts) Admissions(16) 25,763 22,892 18,076 16,862 16,499 74,329 Recertifications 19,453 18,909 16,542 15,103 14,485 65,039 Episodes 43,844 42,697 33,542 31,817 29,512 137,568 Average revenue per episode $ 3,035 $ 3,005 $ 3,123 $ 3,082 $ 3,102 $ 3,072 Episodic visits per episode 19.1 18.2 19.6 19.4 19.6 19.1 Total visits 949,387 862,224 721,055 675,095 630,999 2,889,373 Cost per visit $ 72 $ 73 $ 72 $ 71 $ 71 $ 72 Hospice: Admissions(17) 724 614 620 594 624 2,452 Patient days 63,431 59,100 55,627 49,272 40,898 204,898 Revenue per day $ 153 $ 155 $ 156 $ 154 $ 156 $ 155 Refer to pages 37-38 for end notes.

27 Share Information Weighted Average for the Period Q1 Full Year (Millions) 2016 2015 2015 2014 2013 Basic shares outstanding(7) 89.5 87.1 89.4 86.8 88.1 Convertible perpetual preferred stock(7)(18) — 3.2 1.0 3.2 10.5 Convertible senior subordinated notes(18) 8.4 8.2 8.3 8.2 1.0 Restricted stock awards, dilutive stock options, restricted stock units, and common stock warrants(19) 1.5 2.6 2.3 2.5 2.5 Diluted shares outstanding 99.4 101.1 101.0 100.7 102.1 End of Period Q1 Full Year (Millions) 2016 2015 2015 2014 2013 Basic shares outstanding(7) 89.4 87.2 89.3 86.6 86.8 Approx. Approx. Date Conversion Rate Conversion Price Convertible senior subordinated notes(18) 04/01/16 26.6011 $37.59 Refer to pages 37-38 for end notes.

28 Segment Operating Results Q1 2016 Q1 2015 IRF Home Health and Hospice Reclasses HealthSouthConsolidated IRF Home Health and Hospice Reclasses HealthSouthConsolidated Net operating revenues $ 749.2 $ 160.6 $ — $ 909.8 $ 630.3 $ 110.3 $ — $ 740.6 Less: Provision for doubtful accounts (15.6) (0.9) — (16.5) (11.0) (0.6) — (11.6) 733.6 159.7 — 893.3 619.3 109.7 — 729.0 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (369.9) — (116.2) (486.1) (306.4) — (78.7) (385.1) Other operating expenses(a) (104.8) — (14.2) (119.0) (95.2) — (9.5) (104.7) Supplies (32.4) — (2.6) (35.0) (29.8) — (1.6) (31.4) Occupancy (15.6) — (2.4) (18.0) (10.4) — (1.7) (12.1) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (78.4) 78.4 — — (53.4) 53.4 — Support and overhead costs — (57.0) 57.0 — — (38.1) 38.1 — (522.7) (135.4) — (658.1) (441.8) (91.5) — (533.3) Other income 0.6 — — 0.6 0.5 — — 0.5 Equity in net income of nonconsolidated affiliates 2.2 0.2 — 2.4 1.6 — — 1.6 Noncontrolling interest (16.8) (1.9) — (18.7) (15.2) (1.3) — (16.5) Segment Adjusted EBITDA $ 196.9 $ 22.6 $ — 219.5 $ 164.4 $ 16.9 $ — 181.3 General and administrative expenses(b) (27.4) (25.2) Adjusted EBITDA $ 192.1 $ 156.1 Reconciliation to GAAP provided on pages 30-33 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal or impairment of assets $ 0.5 $ (0.3) $ — $ 0.2 $ (1.5) $ — $ — $ (1.5) (b) Stock-based compensation — — — 4.5 — — — 9.4

29 Segment Operating Results Year Ended December 31, 2015 IRF Home Health and Hospice Reclasses HealthSouth Consolidated Net operating revenues $ 2,653.1 $ 509.8 $ — $ 3,162.9 Less: Provision for doubtful accounts (44.7) (2.5) — (47.2) 2,608.4 507.3 — 3,115.7 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (1,310.6) — (360.2) (1,670.8) Other operating expenses(a) (387.7) — (41.8) (429.5) Supplies (120.9) — (7.8) (128.7) Occupancy (46.2) — (7.7) (53.9) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (244.8) 244.8 — Support and overhead costs — (172.7) 172.7 — (1,865.4) (417.5) — (2,282.9) Other income 2.3 — — 2.3 Equity in net income of nonconsolidated affiliates 8.6 0.1 — 8.7 Noncontrolling interest (62.9) (6.8) — (69.7) Segment Adjusted EBITDA $ 691.0 $ 83.1 $ — 774.1 General and administrative expenses(b)(c) (94.8) Gain related to SCA equity interest 3.2 Adjusted EBITDA $ 682.5 Reconciliation to GAAP provided on pages 30-33 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal or impairment of assets $ 2.8 $ (0.2) $ — $ 2.6 (b) Stock-based compensation expense — — — 26.2 (c) Transaction costs — — — 12.3

30 Reconciliation of Net Income to Adjusted EBITDA(20) 2016 Q1 (in millions, except per share data) Total Per Share Net Income $ 76.7 Loss from disc ops, net of tax, attributable to HealthSouth 0.1 Net income attributable to noncontrolling interests (18.7) Income from continuing operations attributable to HealthSouth* 58.1 $ 0.61 Gov’t, class action, and related settlements — Pro fees - acct, tax, and legal 0.2 Provision for income tax expense 39.7 Interest expense and amortization of debt discounts and fees 44.6 Depreciation and amortization 42.4 Loss on early extinguishment of debt 2.4 Other, including net noncash loss on disposal or impairment of assets 0.2 Stock-based compensation expense 4.5 Adjusted EBITDA $ 192.1 Weighted average common shares outstanding: Basic 89.5 Diluted 99.4 * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. Refer to pages 37-38 for end notes.

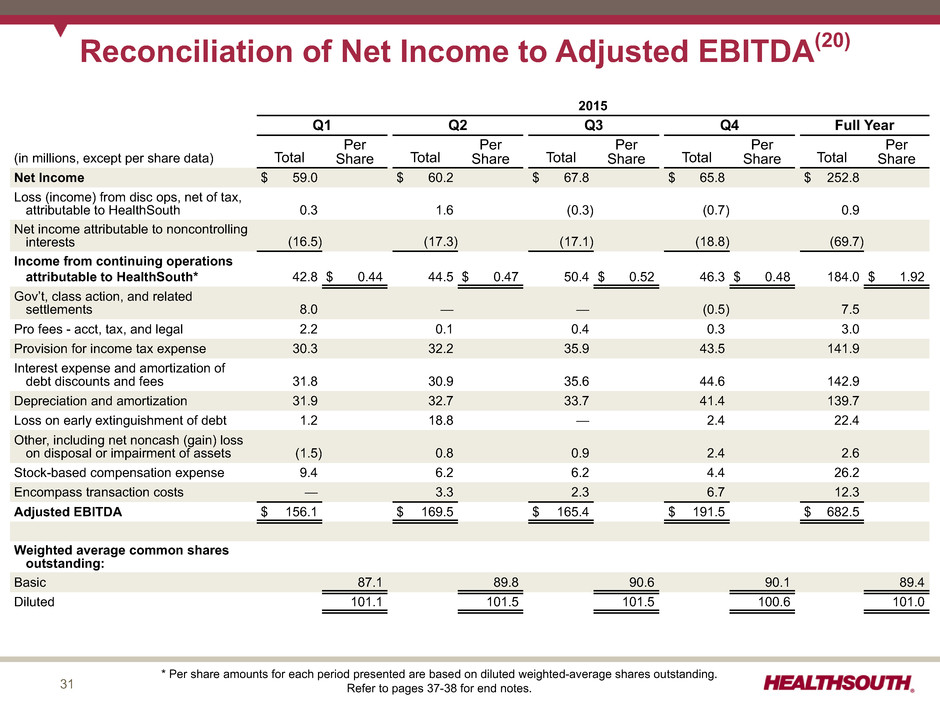

31 Reconciliation of Net Income to Adjusted EBITDA(20) 2015 Q1 Q2 Q3 Q4 Full Year (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 59.0 $ 60.2 $ 67.8 $ 65.8 $ 252.8 Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.3 1.6 (0.3) (0.7) 0.9 Net income attributable to noncontrolling interests (16.5) (17.3) (17.1) (18.8) (69.7) Income from continuing operations attributable to HealthSouth* 42.8 $ 0.44 44.5 $ 0.47 50.4 $ 0.52 46.3 $ 0.48 184.0 $ 1.92 Gov’t, class action, and related settlements 8.0 — — (0.5) 7.5 Pro fees - acct, tax, and legal 2.2 0.1 0.4 0.3 3.0 Provision for income tax expense 30.3 32.2 35.9 43.5 141.9 Interest expense and amortization of debt discounts and fees 31.8 30.9 35.6 44.6 142.9 Depreciation and amortization 31.9 32.7 33.7 41.4 139.7 Loss on early extinguishment of debt 1.2 18.8 — 2.4 22.4 Other, including net noncash (gain) loss on disposal or impairment of assets (1.5) 0.8 0.9 2.4 2.6 Stock-based compensation expense 9.4 6.2 6.2 4.4 26.2 Encompass transaction costs — 3.3 2.3 6.7 12.3 Adjusted EBITDA $ 156.1 $ 169.5 $ 165.4 $ 191.5 $ 682.5 Weighted average common shares outstanding: Basic 87.1 89.8 90.6 90.1 89.4 Diluted 101.1 101.5 101.5 100.6 101.0 * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. Refer to pages 37-38 for end notes.

32 Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA Q1 Full Year (Millions) 2016 2015 2015 Net cash provided by operating activities $ 159.7 $ 102.0 $ 484.8 Provision for doubtful accounts (16.5) (11.6) (47.2) Professional fees—accounting, tax, and legal 0.2 2.2 3.0 Interest expense and amortization of debt discounts and fees 44.6 31.8 142.9 Equity in net income of nonconsolidated affiliates 2.4 1.6 8.7 Net income attributable to noncontrolling interests in continuing operations (18.7) (16.5) (69.7) Amortization of debt-related items (3.4) (3.3) (14.3) Distributions from nonconsolidated affiliates (1.7) (1.9) (7.7) Current portion of income tax expense 5.0 3.5 14.8 Change in assets and liabilities 18.3 56.0 147.1 Net premium paid on bond issuance/redemption 1.9 (8.0) 3.9 Cash used in operating activities of discontinued operations 0.2 0.1 0.7 Reliant/CareSouth transaction costs — — 12.3 Encompass transaction costs — — — Other 0.1 0.2 3.2 Adjusted EBITDA $ 192.1 $ 156.1 $ 682.5

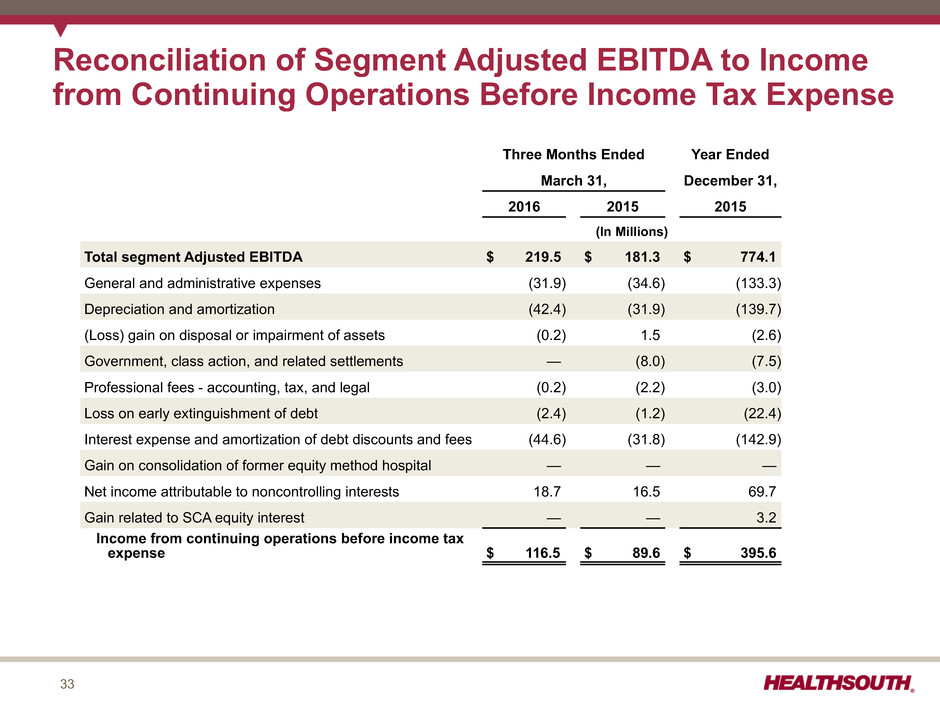

33 Reconciliation of Segment Adjusted EBITDA to Income from Continuing Operations Before Income Tax Expense Three Months Ended Year Ended March 31, December 31, 2016 2015 2015 (In Millions) Total segment Adjusted EBITDA $ 219.5 $ 181.3 $ 774.1 General and administrative expenses (31.9) (34.6) (133.3) Depreciation and amortization (42.4) (31.9) (139.7) (Loss) gain on disposal or impairment of assets (0.2) 1.5 (2.6) Government, class action, and related settlements — (8.0) (7.5) Professional fees - accounting, tax, and legal (0.2) (2.2) (3.0) Loss on early extinguishment of debt (2.4) (1.2) (22.4) Interest expense and amortization of debt discounts and fees (44.6) (31.8) (142.9) Gain on consolidation of former equity method hospital — — — Net income attributable to noncontrolling interests 18.7 16.5 69.7 Gain related to SCA equity interest — — 3.2 Income from continuing operations before income tax expense $ 116.5 $ 89.6 $ 395.6

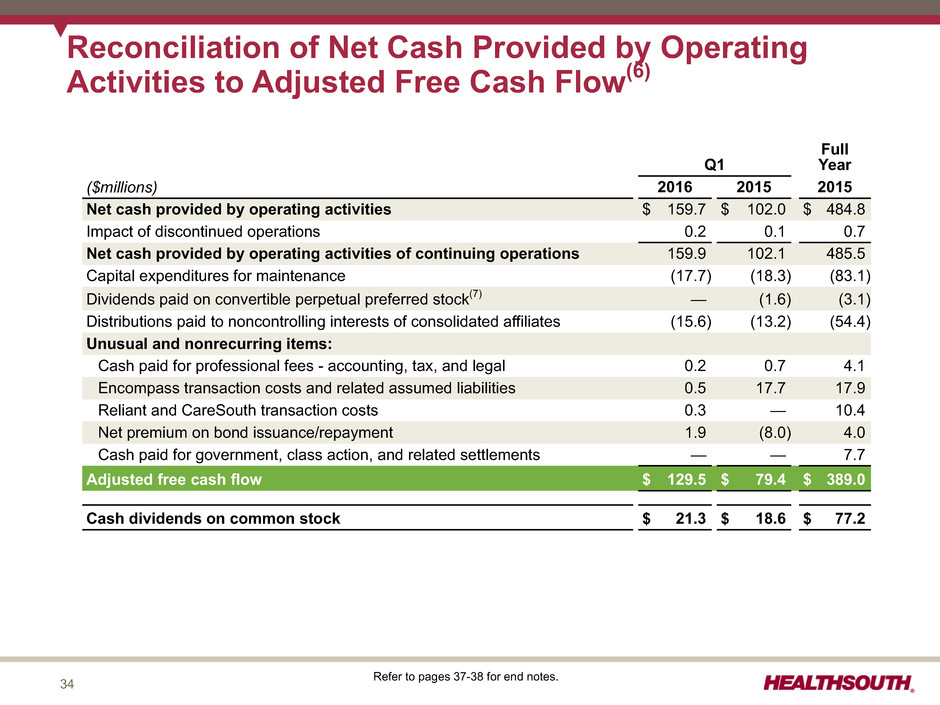

34 Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow(6) Q1 Full Year ($millions) 2016 2015 2015 Net cash provided by operating activities $ 159.7 $ 102.0 $ 484.8 Impact of discontinued operations 0.2 0.1 0.7 Net cash provided by operating activities of continuing operations 159.9 102.1 485.5 Capital expenditures for maintenance (17.7) (18.3) (83.1) Dividends paid on convertible perpetual preferred stock(7) — (1.6) (3.1) Distributions paid to noncontrolling interests of consolidated affiliates (15.6) (13.2) (54.4) Unusual and nonrecurring items: Cash paid for professional fees - accounting, tax, and legal 0.2 0.7 4.1 Encompass transaction costs and related assumed liabilities 0.5 17.7 17.9 Reliant and CareSouth transaction costs 0.3 — 10.4 Net premium on bond issuance/repayment 1.9 (8.0) 4.0 Cash paid for government, class action, and related settlements — — 7.7 Adjusted free cash flow $ 129.5 $ 79.4 $ 389.0 Cash dividends on common stock $ 21.3 $ 18.6 $ 77.2 Refer to pages 37-38 for end notes.

35 For the Three Months Ended March 31, 2016 Adjustments As Reported Professional Fees - Accounting, Tax, and Legal Mark-to- Market Adjustment for Stock Appreciation Rights Loss on Early Extinguishment of Debt As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA* $ 192.1 $ — $ — $ — $ 192.1 Depreciation and amortization (42.4) — — — (42.4) Professional fees - accounting, tax, and legal (0.2) 0.2 — — — Loss on early extinguishment of debt (2.4) — — 2.4 — Interest expense and amortization of debt discounts and fees (44.6) — — — (44.6) Stock-based compensation (4.5) — (2.4) — (6.9) Loss on disposal or impairment of assets (0.2) — — — (0.2) Income from continuing operations before income tax expense 97.8 0.2 (2.4) 2.4 98.0 Provision for income tax expense (39.7) (0.1) 1.0 (1.0) (39.8) Income from continuing operations attributable to HealthSouth $ 58.1 $ 0.1 $ (1.4) $ 1.4 $ 58.2 Add: Interest on convertible debt, net of tax 2.4 2.4 Numerator for diluted earnings per share $ 60.5 $ 60.6 Diluted earnings per share from continuing operations** $ 0.61 $ — $ (0.01) $ 0.01 $ 0.61 Diluted shares used in calculation 99.4 Adjusted EPS(1) - Q1 2016 * Reconciliation to GAAP provided on page 30; Refer to pages 37-38 for end notes. ** Adjusted EPS may not sum across due to rounding.

36 For the Three Months Ended March 31, 2015 Adjustments As Reported Government, Class Action, and Related Settlements Professional Fees - Accounting, Tax, and Legal Loss on Early Extinguishment of Debt As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA* $ 156.1 $ — $ — $ — $ 156.1 Depreciation and amortization (31.9) — — — (31.9) Government, class action, and related settlements (8.0) 8.0 — — — Professional fees - accounting, tax, and legal (2.2) — 2.2 — — Loss on early extinguishment of debt (1.2) — — 1.2 — Interest expense and amortization of debt discounts and fees (31.8) — — — (31.8) Stock-based compensation (9.4) — — — (9.4) Gain on disposal or impairment of assets 1.5 — — — 1.5 Income from continuing operations before income tax expense 73.1 8.0 2.2 1.2 84.5 Provision for income tax expense (30.3) (3.2) (0.9) (0.5) (34.9) Income from continuing operations attributable to HealthSouth $ 42.8 $ 4.8 $ 1.3 $ 0.7 $ 49.6 Add: Interest on convertible debt, net of tax 2.3 2.3 Numerator for diluted earnings per share $ 45.1 $ 51.9 Diluted earnings per share from continuing operations** $ 0.44 $ 0.05 $ 0.01 $ 0.01 $ 0.51 Diluted shares used in calculation 101.1 Adjusted EPS(1) - Q1 2015 * Reconciliation to GAAP provided on page 31; Refer to pages 37-38 for end notes. ** Adjusted EPS may not sum across due to rounding.

37 End Notes (1) HealthSouth is providing adjusted earnings per share from continuing operations attributable to HealthSouth (“adjusted earnings per share”), which is a non-GAAP measure. The Company believes the presentation of adjusted earnings per share provides useful additional information to investors because it provides better comparability of ongoing performance to prior periods given that it excludes the impact of government, class action, and related settlements, professional fees - accounting, tax, and legal, mark-to-market adjustments for stock appreciation rights, gains or losses related to hedging instruments, loss on early extinguishment of debt, adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims), items related to corporate and facility restructurings, and certain other items. It is reasonable to expect that one or more of these excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period and may not directly relate to the Company's ongoing operations. Accordingly, they can complicate comparisons of the Company's results of operations across periods and comparisons of the Company's results to those of other healthcare companies. Adjusted earnings per share should not be considered as a measure of financial performance under generally accepted accounting principles in the United States as the items excluded from it are significant components in understanding and assessing financial performance. Because adjusted earnings per share is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, it may not be comparable as presented to other similarly titled measures of other companies. (2) In the first quarter of 2015, the Company recorded a settlement related to sexual harassment and other claims brought by eight former employees against another former employee. The settlement was not covered by insurance and was included in “Other Operating Expenses.” (3) Current income tax expense was $5.0 million and $3.5 million for Q1 2016 and Q1 2015, respectively. (4) The interest and amortization related to the convertible senior subordinated notes must be added to income from continuing operations when calculating diluted earnings per share because the debt is assumed to have been converted and the applicable shares are included in the diluted share count. (5) In connection with the Encompass acquisition, the Company granted stock appreciation rights based on the common stock of HealthSouth Home Health Holdings, Inc. to certain members of Encompass management. The fair value of Holdings’ common stock is determined using the product of the trailing 12-month specified performance measure for Holdings and a specified median market price multiple based on a basket of public home health companies. The fair value of these stock appreciation rights will vary from period to period based on Encompass’ performance and the change in the multiple of the basket of public home health companies. (6) Definition of adjusted free cash flow is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, dividends paid on preferred stock, distributions to noncontrolling interests, and nonrecurring items. Common stock dividends are not included in the calculation of adjusted free cash flow. (7) In March 2006, the Company completed the sale of 400,000 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. In Q4 2013, the Company exchanged $320 million of newly issued 2.0% Convertible Senior Subordinated Notes due 2043 for 257,110 shares of its outstanding preferred stock. In April 2015, the Company exercised its rights to force conversion of all outstanding shares of preferred stock. On the conversion date, each outstanding share of preferred stock was converted into 33.9905 shares of common stock, resulting in the issuance of 3,271,415 shares of common stock. (8) On July 16, 2015, the board of directors approved a $0.02 per share, or 9.5%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.23 per common share. (9) HealthSouth acquired an additional 30% equity interest in Fairlawn Rehabilitation Hospital in Worcester, MA from its joint venture partner. This transaction increased HealthSouth’s ownership interest from 50% to 80% and resulted in a change in accounting for this hospital from the equity method to a consolidated entity effective June 1, 2014. (10) In Q3 2012, HealthSouth amended the joint venture agreement related to St. Vincent Rehabilitation Hospital in Sherwood, AR which resulted in a change in accounting for this hospital from the equity method to a consolidated entity. (11) Includes consolidated HealthSouth inpatient rehabilitation hospitals classified as same store during each time period.

38 End Notes, con’t. (12) Data provided by Uniform Data System for Medical Rehabilitation, a division of UB Foundation Activities, Inc., a data gathering and analysis organization for the rehabilitation industry; represents ~70% of industry, including HealthSouth sites (13) Represents discharges from HealthSouth’s 121 consolidated hospitals in Q1 2016; 120 consolidated hospitals in Q4 2015; 108 consolidated hospitals in Q3 2015 and Q2 2015; and 106 consolidated hospitals in Q1 2015 (14) Excludes approximately 430 full-time equivalents in Q1 2016 and approximately 400 full-time equivalents in the 2015 periods presented who are considered part of corporate overhead with their salaries and benefits included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals. (15) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. (16) Represents home health admissions from Encompass’ 184 consolidated locations in Q1 2016 and Q4 2015; 141 locations in Q3 2015, 139 locations in Q2 2015, and 143 locations in Q1 2015. (17) Represents hospice admissions from Encompass’ 27 locations in Q1 2016 and Q4 2015; 23 locations in Q3 2015; and 21 locations in Q2 2015 and Q1 2015. (18) In November 2013, the Company closed separate, privately negotiated exchanges in which it issued $320 million of 2.0% Convertible Senior Subordinated Notes due 2043 in exchange for 257,110 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. The Company recorded ~$249 million as debt and ~$71 million as equity. The convertible notes are convertible, at the option of the holders, at any time on or prior to the close of business on the business day immediately preceding December 1, 2043 into shares of the Company’s common stock and is subject to customary antidilution adjustments. The Company has the right to redeem the convertible notes before December 1, 2018 if the volume weighted-average price of the Company’s common stock is at least 120% of the conversion price ($45.70) of the convertible notes for a specified period. On or after December 1, 2018, the Company may, at its option, redeem all or any part of the convertible notes. In either case, the redemption price will be equal to 100% of the principal amount of the convertible notes to be redeemed, plus accrued and unpaid interest. (19) The agreement to settle the Company’s class action securities litigation received final court approval in January 2007. The 5.0 million shares of common stock and warrants to purchase ~8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) related to this settlement were issued on September 30, 2009. The 5.0 million common shares are included in the basic outstanding shares. The warrants were not included in the diluted share count prior to 2015 because the strike price has historically been above the market price. In Q1 2016 and Q1 2015, zero shares related to the warrants are included in the diluted share count due to antidilution based on the stock price. In full-year 2015, 80,814 shares related to the warrants are included in the diluted share count using the treasury stock method. (20) Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments set forth.