Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST MID BANCSHARES, INC. | form8k-042616.htm |

| EX-2.1 - EXHIBIT 2.1 - AGREEMENT AND PLAN OF MERGER - FIRST MID BANCSHARES, INC. | ex21_042616.htm |

| EX-99.1 - EXHIBIT 99.1 - PRESS RELEASE - FIRST MID BANCSHARES, INC. | ex991_042616.htm |

April 26, 2016 R 9 G 79 B 164 R 188 G 149 B 84 Announces the Acquisition of

2 This document may contain certain forward-looking statements, such as discussions of First Mid and First Clover Leaf’s pricing and fee trends, credit quality and outlook, liquidity, new business results, expansion plans, anticipated expenses and planned schedules. First Mid and First Clover Leaf intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1955. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of First Mid and First Clover Leaf, are identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar expressions. Actual results could differ materially from the results indicated by these statements because the realization of those results is subject to many risks and uncertainties, including, among other things, the possibility that any of the anticipated benefits of the proposed transactions between First Mid and First Clover Leaf will not be realized or will not be realized within the expected time period; the risk that integration of the operations of First Clover Leaf with First Mid will be materially delayed or will be more costly or difficult than expected; the inability to complete the proposed transactions due to the failure to obtain the required stockholder approvals; the failure to satisfy other conditions to completion of the proposed transactions, including receipt of required regulatory and other approvals; the failure of the proposed transactions to close for any other reason; the effect of the announcement of the transaction on customer relationships and operating results; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in interest rates; general economic conditions and those in the market areas of First Mid and First Clover Leaf; legislative/regulatory changes; monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; the quality or composition of First Mid’s and First Clover Leaf’s loan or investment portfolios and the valuation of those investment portfolios; success in raising capital by First Mid and First Clover Leaf; demand for loan products; deposit flows; competition, demand for financial services in the market areas of First Mid and First Clover Leaf; and accounting principles, policies and guidelines. Additional information concerning First Mid and First Clover Leaf, including additional factors and risks that could materially affect First Mid’s and First Clover Leaf’s financial results, are included in First Mid’s and First Clover Leaf’s filings with the SEC, including their Annual Reports on Form 10-K. Forward-looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the SEC, we do not undertake any obligation to update or review any forward-looking information, whether as a result of new information, future events or otherwise. Special Note Concerning Forward-Looking Statements

3 Proxy Statement / Prospectus This material is not a substitute for the proxy statement/prospectus that First Mid and First Clover Leaf will file with the Securities and Exchange Commission. Investors in First Mid or First Clover Leaf are urged to read the proxy statement/prospectus, which will contain important information, including detailed risk factors, when it becomes available. The proxy statement/prospectus and other documents which will be filed by First Mid and First Clover Leaf with the Securities and Exchange Commission will be available free of charge at the Securities and Exchange Commission’s website, www.sec.gov, or by directing a request when such a filing is made to First Mid-Illinois Bancshares, P.O. Box 499, Mattoon, IL 61938, Attention: Secretary; or to First Clover Leaf Financial Corp., P.O. Box 540, Edwardsville, IL 62025, Attention: Secretary. A final proxy statement/prospectus will be mailed to the stockholders of each of First Mid and First Clover Leaf. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction Special Note Concerning Proxy Statements Proxy Solicitation First Mid and First Clover Leaf, and certain of their respective directors, executive officers and other members of management and employees are participants in the solicitation of proxies in connection with the proposed transactions. Information about the directors and executive officers of First Mid is set forth in the proxy statement for its 2016 annual meeting of stockholders. Information about the directors and executive officers of First Clover Leaf is set forth in its proxy statement for its 2015 annual meeting of stockholders. Investors may obtain additional information regarding the interests of such participants in the proposed transactions by reading the proxy statement/prospectus for such proposed transactions when it becomes available.

4 Transaction Rationale • Comprehensive due diligence process and thorough loan review completed • Conservative credit mark – more than 150% of NPAs • Similar cultures will help facilitate a successful integration process • Creates a $2.8 billion Midwest community banking franchise • Consistent earnings and the ability to enhance future EPS • Greater penetration into the attractive St. Louis metro east market with the ability to leverage existing operations for greater efficiencies • Opportunity to expand wealth management, trust and insurance businesses • Accretive to EPS in first full year • Tangible book value dilution earn back of 4 years • Operating synergies result in readily achievable cost savings, phased in over two years • Pricing multiples in line with other recent transactions for banks similar in size and geography to FCLF Strategic Rationale Financially Attractive Low Risk Integration

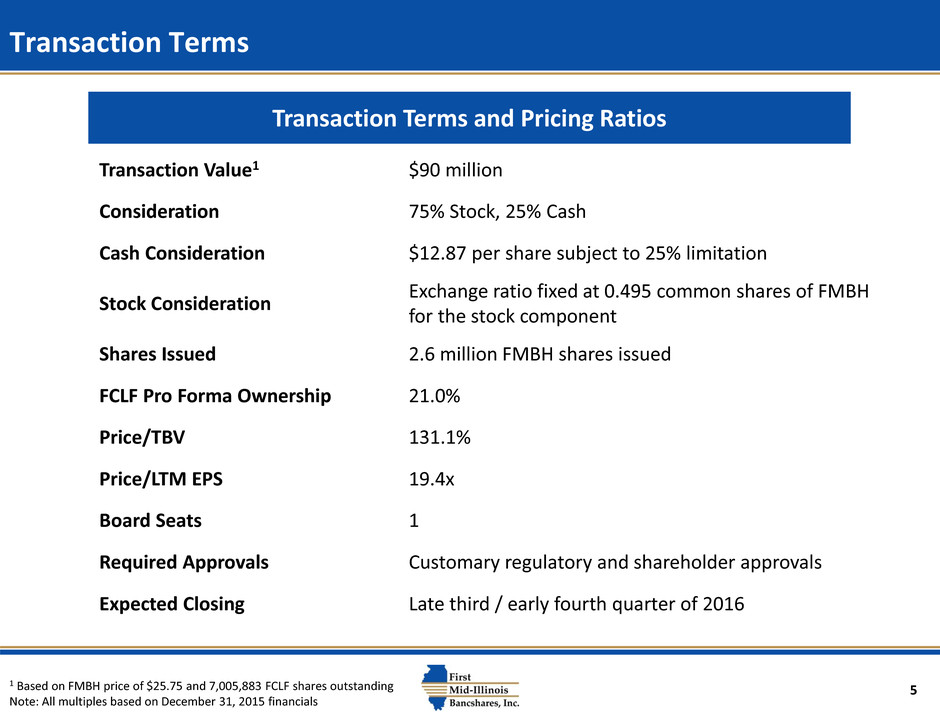

5 Transaction Terms Transaction Value1 $90 million Consideration 75% Stock, 25% Cash Cash Consideration $12.87 per share subject to 25% limitation Stock Consideration Exchange ratio fixed at 0.495 common shares of FMBH for the stock component Shares Issued 2.6 million FMBH shares issued FCLF Pro Forma Ownership 21.0% Price/TBV 131.1% Price/LTM EPS 19.4x Board Seats 1 Required Approvals Customary regulatory and shareholder approvals Expected Closing Late third / early fourth quarter of 2016 Transaction Terms and Pricing Ratios 1 Based on FMBH price of $25.75 and 7,005,883 FCLF shares outstanding Note: All multiples based on December 31, 2015 financials

6 Transaction Assumptions Cost Saves, Purchase Marks and Other Assumptions Estimated Cost Savings: 20% of FCLF LTM non-interest expense over the first 12 months, increasing to 27.5% in the years thereafter Revenue Synergies: None assumed; however, opportunities exist in wealth management, trust and insurance businesses Transaction Expenses: $7.6 million, pretax Core Deposit Intangible: $6.4 million Credit Marks: 2.7% aggregate mark on loans and 35.5% on OREO Capital Contingency: None

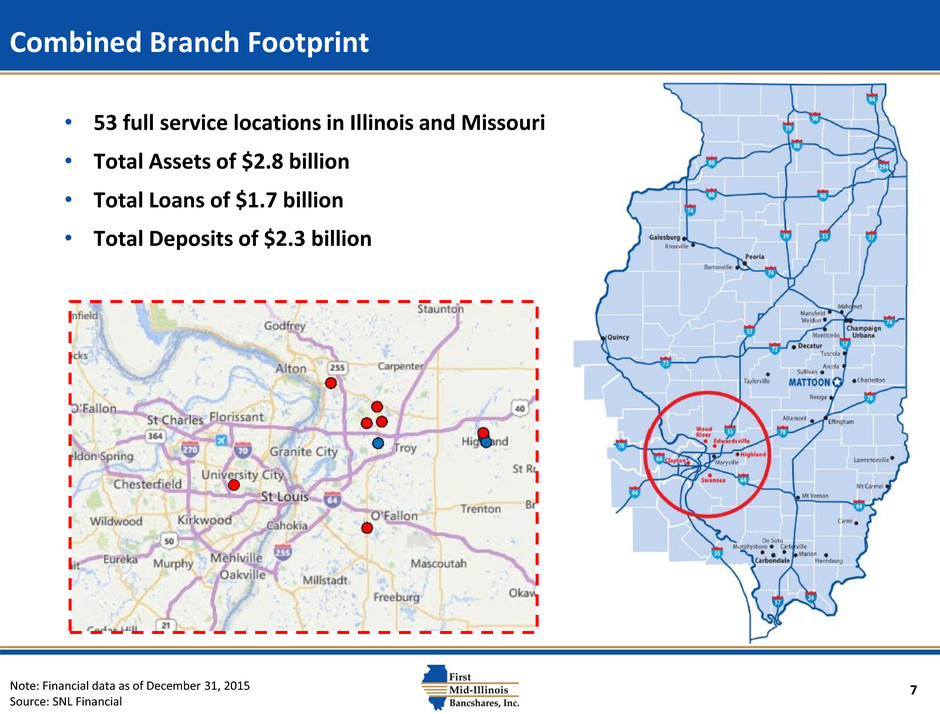

7 Combined Branch Footprint Note: Financial data as of December 31, 2015 Source: SNL Financial • 53 full service locations in Illinois and Missouri • Total Assets of $2.8 billion • Total Loans of $1.7 billion • Total Deposits of $2.3 billion

8 Source: Bureau of Labor Statistics, St. Louis Chamber of Commerce A commercial and industrial hub with a diverse economy based on manufacturing and services • 19th largest metropolitan area in the U.S. • Population of approximately 3 million residents • Economic engine of the region with over 1.3 million jobs • Primary economic drivers include trade, transportation & utilities, education & health services, professional & business services, and manufacturing • Midwest innovation and high tech center with significant private equity inflows of over $1 billion in recent years • Median household income of approximately $58k • Home to more than 30 universities and colleges including Washington University, St. Louis University and the University of Missouri - St. Louis 9 Fortune 500 Companies HQ in St. Louis Greater Access to the St. Louis Market

9 Pro Forma Deposit Market Share Branch Franchise: • Pro forma institution moves to top 25 in deposit market share in the St. Louis market and top 3 in Madison County, IL • FMBH acquires more than $70 million of non-interest bearing deposits • FCLF’s total cost of deposits was 0.44% as of the quarter ended December 31, 2015 Note: All deposit data as of June 30, 2015 Source: SNL Financial Saint Louis, MO-IL MSA June '15 Total Market # of Deposits Share Rank Institution Branches ($000) (%) 14 UMB Financial Corp. 16 $1,227,550 1.4 15 Bank of Montreal 16 $1,214,118 1.4 16 First Busey Corp. 13 $1,162,928 1.3 17 Central Banco. Inc. 15 $1,144,071 1.3 18 First Co Bancorp Inc. 19 $1,011,322 1.1 19 Midland States Bancorp Inc. 20 $930,570 1.0 20 Reliance Bancshares Inc. 21 $853,788 1.0 21 CBX Corp. 8 $696,396 0.8 22 Jefferson County Bancshares Inc. 17 $695,032 0.8 23 Royal Bancshares Inc. 11 $577,189 0.6 24 Cass Information Systems Inc. 4 $572,243 0.6 Pro Forma Entity 10 $542,724 0.6 25 Great Southern Bancorp Inc. 21 $491,312 0.6 26 First Illinois Bancorp Inc. 12 $490,965 0.6 27 First Clover Leaf Financial Corp. 7 480,453 0.5 85 First Mid-Illinois Bancshares Inc. 3 62,271 0.1 Market Total 919 $89,903,290 100.0 Madison County, IL June '15 Total Market # of Deposits Share Rank Institution Branches ($000) (%) 1 Banc Ed Corp. 14 $1,147,074 24.4 % 2 First Co Bancorp Inc. 9 $554,861 11.8 Pro Forma Entity 8 $533,291 11.4 3 First Clover Leaf Financial Corp. 5 471,020 10.0 4 U.S. Bancorp 14 $462,092 9.9 5 R gions Financial Corp. 12 $419,264 8.9 6 Liberty Bancshares Inc. 4 $253,594 5.4 7 First Staunto Bancshares Inc. 6 $202,980 4.3 8 CBX Corp. 2 $169,953 3.6 9 UMB Fina ial Corp. 2 $128,425 2.7 10 Bank of America Corp. 1 $94,974 2.0 11 Collinsville Building and Loan Association2 $88,093 1.9 12 Associated Banc-Corp 2 $77,530 1.7 13 Home Federal Savings and Loan Association2 $75,774 1.6 14 Country Bancorp Inc. 3 $68,157 1.5 17 First Mid-Illi ois Bancshares Inc. 3 62,271 1.3 Market Total 98 $4,693,318 100.0

10 Pro Forma Loan Portfolio FMBH FCLF Pro Forma Composition Composition Composition Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total Constr & Dev 39,209 3.1% Constr & Dev 19,593 4.6% Constr & Dev 58,802 3.4% 1-4 Family Residential 194,669 15.2% 1-4 Family Residential 120,506 28.2% 1-4 Family Residential 315,175 18.4% Home Equity 36,902 2.9% Home Equity 11,329 2.7% Home Equity 48,231 2.8% Owner - Occ CRE 209,092 16.3% Owner - Occ CRE 78,433 18.3% Owner - Occ CRE 287,525 16.8% Other CRE 200,080 15.6% Other CRE 65,578 15.3% Other CRE 265,658 15.5% Multifamily 45,740 3.6% Multifamily 35,225 8.2% Multifamily 80,965 4.7% Commercial & Industrial 305,060 23.8% Commercial & Industrial 65,045 15.2% Commercial & Industrial 370,105 21.7% Consr & Other 251,137 19.6% Consr & Other 31,752 7.4% Consr & Other 282,889 16.5% Total Loans $1,281,889 100.0% Total Loans $427,429 100.0% Total Loans $1,709,350 100.0% C&D 3.1% 1-4 Fam 15.2% HELOC 2.9% OwnOcc CRE 16.3% Other CRE 15.6% Multifam 3.6% C&I 23.8% Consr & Other 19.6% C&D 4.6% 1-4 Fam 28.2% HELOC 2.7% OwnOcc CRE 18.3% Other CRE 15.3% Multifam 8.2% C&I 15.2% Consr & Other 7.4% C&D 3.4% 1-4 Fam 18.4% HELOC 2.8% OwnOcc CRE 16.8% Other CRE 15.5%Multifam 4.7% C&I 21.7% Consr & Other 16.5% Note: Regulatory data shown; purchase accounting adjustments not included Source: SNL Financial

11 Pro Forma Deposit Composition FMBH FCLF Pro Forma Composition Composition Composition Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total Non Interest Bearing 342,636 19.8% Non Interest Bearing 69,296 13.0% Non Interest Bearing 411,932 18.2% OW & Other Trans 490,838 28.3 OW & Other Trans 157,241 29.5 OW & Other Trans 648,079 28.6 MMDA & Sav 655,656 37.8% MMDA & Sav 173,449 32.5% MMDA & Sav 829,105 36.6% Time Deposits < $100k 154,582 8.9 Time Deposits < $100k 65,465 12.3 Time Deposits < $100k 220,047 9.7 Ti e Deposits > $100k 88,856 5.1% Ti e Deposits > $100k 67,707 12.7% Ti e Deposits > $100k 156,563 6.9% Total Deposits $1,732,568 100.0 Total Deposits $533,158 100.0 Total Deposits $2,265,726 100.0 Non Int. Bearing 19.8% NOW Accts 28.3% MMDA & Sav 37.8% Retail Time 8.9% Jumbo Time 5.1% Non Int. Bearing 13.0% NOW Accts 29.5% MMDA & Sav 32.5% Retail Time 12.3% Jumbo Time 12.7% Non Int. Bearing 18.2% NOW Accts 28.6% MMDA & Sav 36.6% R ta l Time 9.7% Jumbo Time 6.9% Note: Regulatory data shown; purchase accounting adjustments not included Source: SNL Financial

12 Summary • Creates $2.8 billion Midwest community banking franchise • Drives future earnings growth and shareholder value • Significantly increases FMBH’s presence in the St. Louis metro east market with the ability to leverage existing operations • Pro forma institution is stronger, more diversified and remains well- capitalized • Increases liquidity in FMBH shares • Enhances FMBH’s ability to serve larger customers