Attached files

| file | filename |

|---|---|

| 8-K - CIRRUS LOGIC, INC. 8-K - CIRRUS LOGIC, INC. | a51328155.htm |

| EX-99.1 - EXHIBIT 99.1 - CIRRUS LOGIC, INC. | a51328155ex99_1.htm |

Exhibit 99.2

April 26, 2016 Letter

to Shareholders Q4 FY16 FYFY13 CIRRUS LOGIC, INC. 800 WEST SIXTH STREET,

AUSTIN, TEXAS 78701

April 26, 2016 Dear

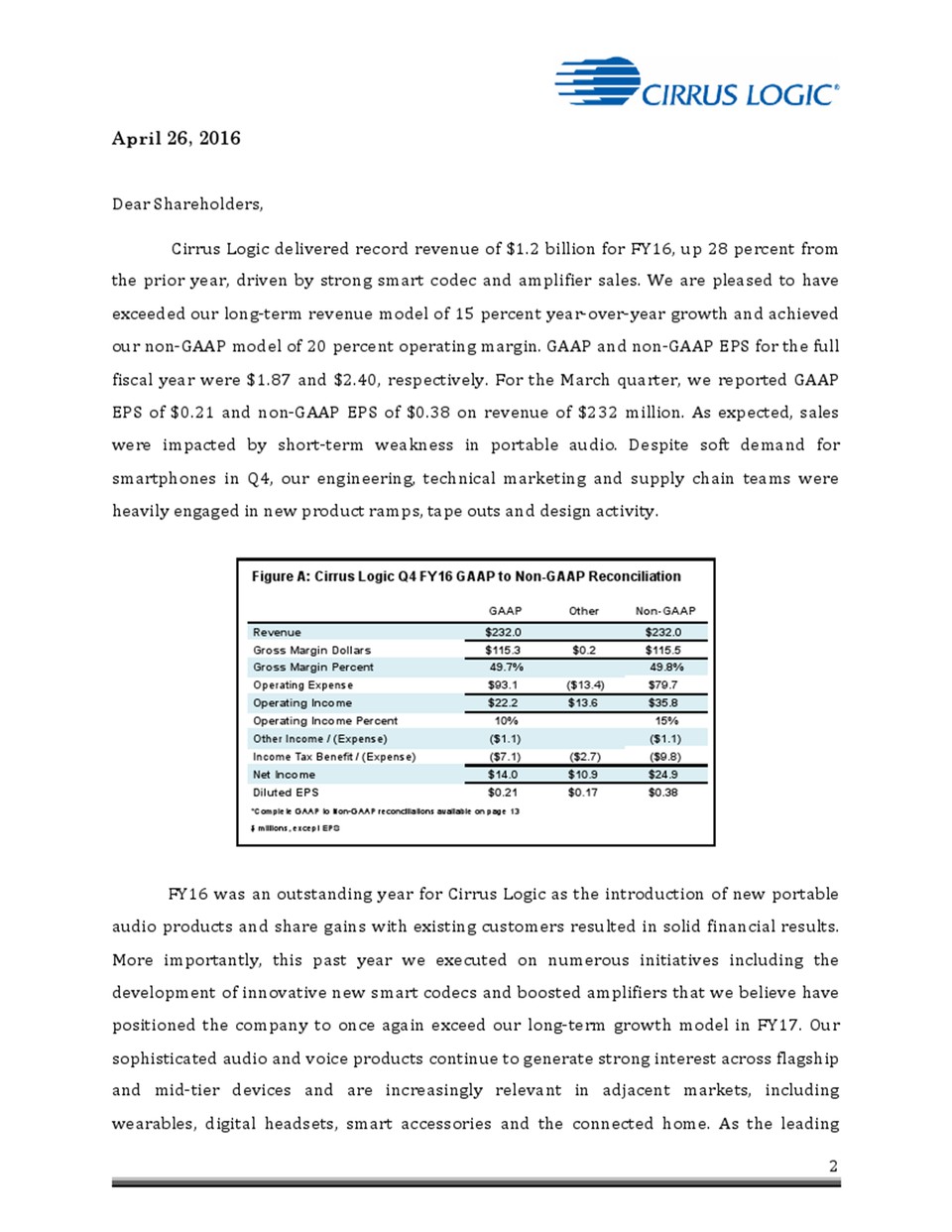

Shareholders, Cirrus Logic delivered record revenue of $1.2 billion for

FY16, up 28 percent from the prior year, driven by strong smart codec

and amplifier sales. We are pleased to have exceeded our long-term

revenue model of 15 percent year-over-year growth and achieved our

non-GAAP model of 20 percent operating margin. GAAP and non-GAAP EPS for

the full fiscal year were $1.87 and $2.40, respectively. For the March

quarter, we reported GAAP EPS of $0.21 and non-GAAP EPS of $0.38 on

revenue of $232 million. As expected, sales were impacted by short-term

weakness in portable audio. Despite soft demand for smartphones in Q4,

our engineering, technical marketing and supply chain teams were heavily

engaged in new product ramps, tape outs and design activity. GAAP Other

Non-GAAP Revenue $232.0 $232.0 Gross Margin Dollars $115.3 $0.2

$115.5 Gross Margin Percent 49.7% 49.8% Operating Expense $93.1

($13.4) $79.7 Operating Income $22.2 $13.6 $35.8 Operating Income

Percent 10% 15% Other Income / (Expense) ($1.1) ($1.1) Income

Tax Benefit / (Expense) ($7.1) ($2.7) ($9.8) Net Income $14.0 $10.9

$24.9 Diluted EPS $0.21 $0.17 $0.38 FY16 was an outstanding year for

Cirrus Logic as the introduction of new portable audio products and

share gains with existing customers resulted in solid financial results.

More importantly, this past year we executed on numerous initiatives

including the development of innovative new smart codecs and boosted

amplifiers that we believe have positioned the company to once again

exceed our long-term growth model in FY17. Our sophisticated audio and

voice products continue to generate strong interest across flagship and

mid-tier devices and are increasingly relevant in adjacent markets,

including wearables, digital headsets, smart accessories and the

connected home. As the leading 2

Revenue and Gross

Margins We

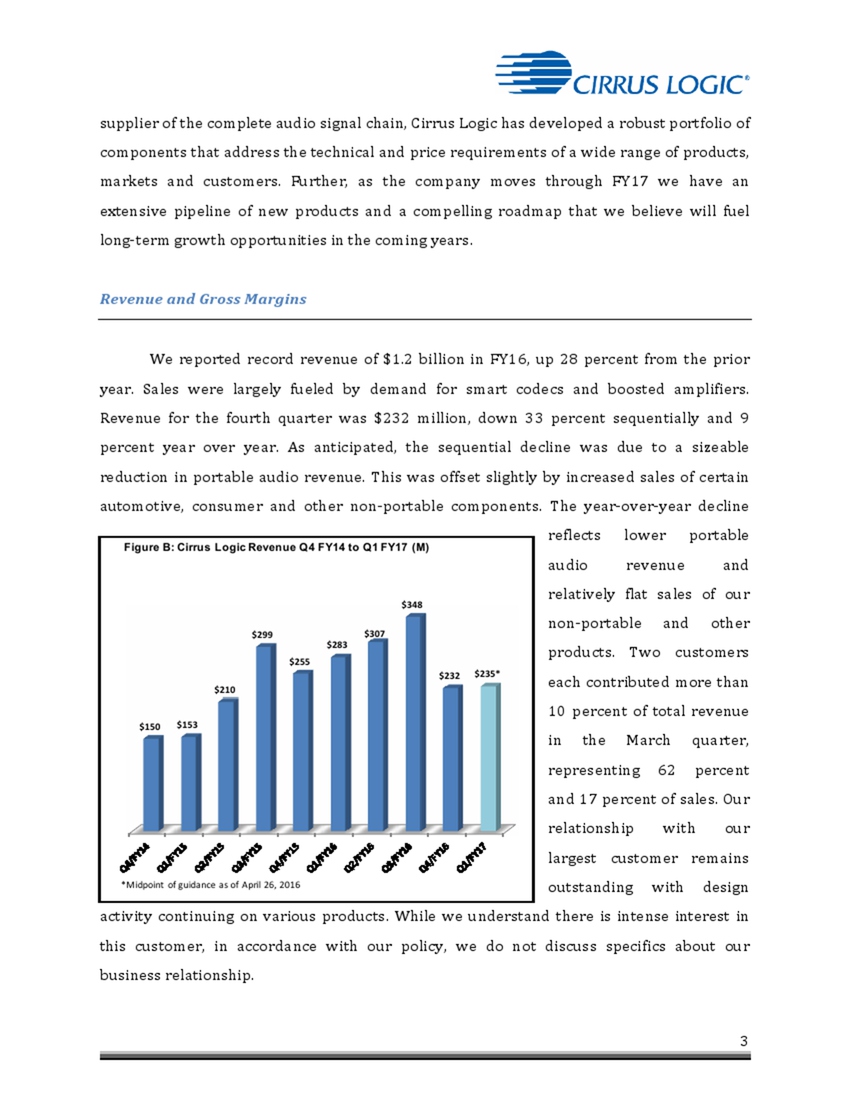

reported record revenue of $1.2 billion in FY16, up 28 percent from the

prior year. Sales were largely fueled by demand for smart codecs and

boosted amplifiers. Revenue for the fourth quarter was $232 million,

down 33 percent sequentially and 9 percent year over year. As

anticipated, the sequential decline was due to a sizeable reduction in

portable audio revenue. This was offset slightly by increased sales of

certain automotive, consumer and other non-portable components. The

year-over-year decline reflects lower portable audio revenue and

relatively flat sales of our non-portable and other products. Two

customers each contributed more than 10 percent of total revenue in the

March quarter, representing 62 percent and 17 percent of sales. Our

relationship with our largest customer remains outstanding with design

activity continuing on various products. While we understand there is

intense interest in this customer, in accordance with our policy, we do

not discuss specifics about our business relationship.

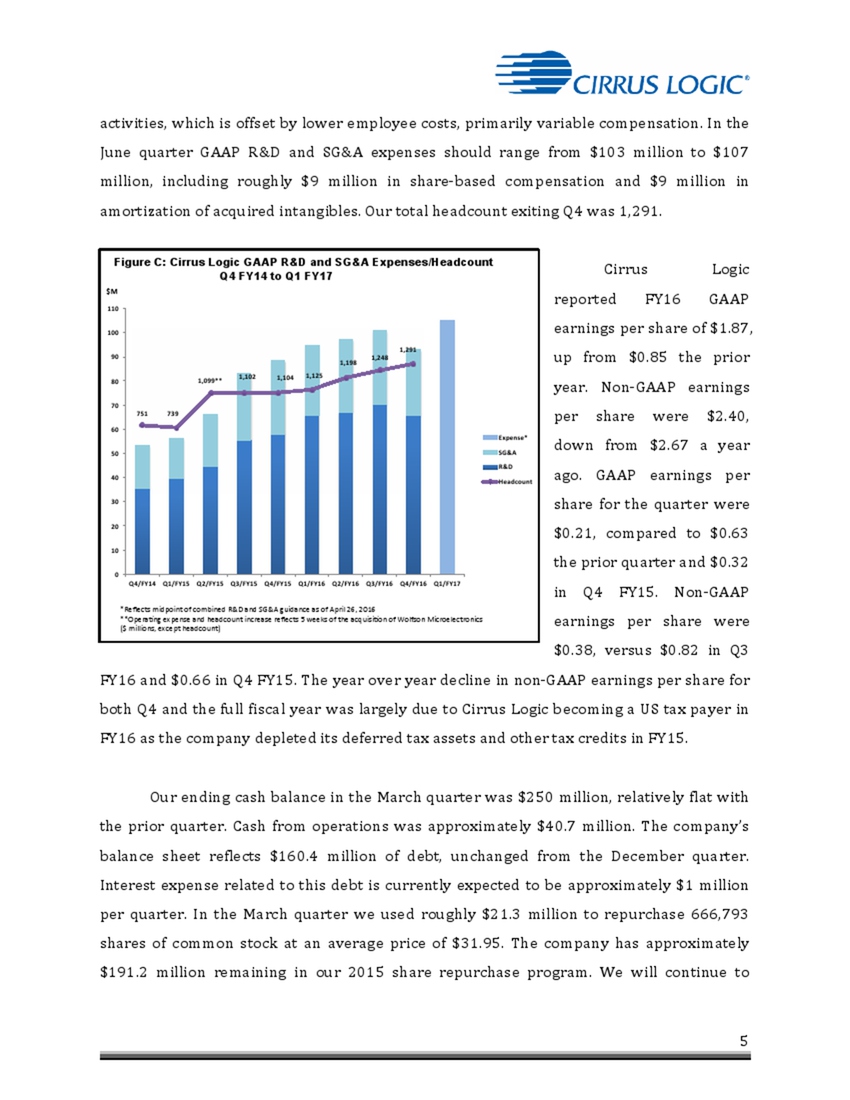

In the June quarter, we anticipate revenue will range from $220 million to $250 million, representing a one percent increase sequentially and a 17 percent decline year over year at the midpoint. Guidance for the quarter reflects continued short-term weakness in portable audio. As we look to FY17 overall, we continue to foresee strong growth, particularly in the second half of the year, driven by new product introductions and share expansion with existing and new customers. FY16 gross margins were 47.5 percent GAAP and 47.6 percent non-GAAP. For the March quarter, GAAP and non-GAAP gross margin were 49.7 percent and 49.8 percent, respectively. We exceeded Q4 gross margin guidance largely due to a lower contribution of revenue derived from portable audio products. In the June quarter, gross margin should range from 47 percent to 49 percent, as the product mix remains relatively consistent with the prior quarter. Operating Profit, Earnings and Cash Cirrus Logic delivered GAAP operating margin of 15 percent in FY16, up from 12 percent the previous year. On a non-GAAP basis, operating margin was 20 percent, which is consistent with FY15 and our long-term model. GAAP and non-GAAP operating expenses for the fiscal year were $374.6 million and $325.3 million, respectively. Operating expenses in FY15 were $317 million GAAP and $253.2 million non-GAAP. Some of the main factors of the year-over-year increase include a substantial uptick in headcount, higher product development costs and a full year of expenses associated with the acquisition of Wolfson Microelectronics in FY15. Operating margin in the March quarter was approximately 10 percent GAAP and 15 percent on a non-GAAP basis. GAAP operating expenses were $93.1 million and non-GAAP operating expenses were $79.7 million. GAAP operating expenses include approximately $8.6 million in share-based compensation and $8.4 million in amortization of acquired intangibles, which was partially offset by a $3.7 million benefit associated with the write-off of a long-term contractual obligation. The sequential decline is primarily due to lower employee costs. The uptick in operating expenses on a year-over-year basis is largely associated with increased headcount and product development activities, which is offset by lower employee costs, primarily variable compensation. In the June quarter GAAP R&D and SG&A expenses should range from $103 million to $107 million, including roughly $9 million in share-based compensation and $9 million in amortization of acquired intangibles. Our total headcount exiting Q4 was 1,291.

Cirrus Logic reported FY16

GAAP earnings per share of $1.87, up from $0.85 the prior year. Non-GAAP

earnings per share were $2.40, down from $2.67 a year ago. GAAP earnings

per share for the quarter were $0.21, compared to $0.63 the prior

quarter and $0.32 in Q4 FY15. Non-GAAP earnings per share were $0.38,

versus $0.82 in Q3 FY16 and $0.66 in Q4 FY15. The year over year decline

in non-GAAP earnings per share for both Q4 and the full fiscal year was

largely due to Cirrus Logic becoming a US tax payer in FY16 as the

company depleted its deferred tax assets and other tax credits in FY15.

Our ending cash balance in the March quarter was $250 million,

relatively flat with the prior quarter. Cash from operations was

approximately $40.7 million. The company’s balance sheet reflects $160.4

million of debt, unchanged from the December quarter. Interest expense

related to this debt is currently expected to be approximately $1

million per quarter. In the March quarter we used roughly $21.3 million

to repurchase 666,793 shares of common stock at an average price of

$31.95. The company has approximately $191.2 million remaining in our

2015 share repurchase program. We will continue to evaluate potential

uses of cash including acquisitions, the repurchase of shares and

repayment of debt.

Taxes and Inventory The

FY16 GAAP tax expense was $52.4 million, resulting in an effective tax

rate of 29.8 percent. GAAP tax expense for the March quarter was $7.1

million, resulting in an effective tax rate of 33.6 percent. Non-GAAP

tax expense for the fiscal year and quarter were $68.4 million and $9.8

million, respectively. Non-GAAP effective tax rates for the fiscal year

and quarter were 30.2 percent and 28.2 percent, respectively. Non-GAAP

tax expense reflects the effect of higher non-GAAP income in various

jurisdictions. Moving forward, we expect a growing portion of our income

will be generated offshore; accordingly, our worldwide effective tax

rate in FY17 should range from 27 percent to 29 percent. Q4 inventory

was $142 million, up slightly from the prior quarter. Inventory is

expected to increase in the first half of the fiscal year as we ramp new

products ahead of anticipated customer demand in the back half of the

year. Company

Strategy FY16

was a tremendous year for Cirrus Logic. We delivered record revenue,

exceeded our long-term model of 15 percent growth and achieved our

non-GAAP operating margin model of 20 percent. We significantly enhanced

our product portfolio with new smart codecs, amplifiers and MEMS

microphones and diversified our customer base. Despite weaker than

anticipated demand for smartphones in the second half of the year, the

desire by OEMs to bring to market products with compelling audio and

voice technology that enables a differentiated user experience gained

momentum across flagship and mid-tier devices. We are pleased with our

accomplishments in FY16 as we increased our share with existing

customers and OEMs three through ten, made progress driving key flagship

features into mid-tier devices and introduced innovative products,

including those targeting the wearable and smart accessory market. We

remain keenly focused on a wide range of strategic initiatives in FY17,

that we believe are essential for future growth and will strengthen our

position as a market leader. As we move into FY17 the company

anticipates strong revenue growth fueled by share gains with existing

customers, progress in digital headsets and a substantial increase in

amplifier sales. We have a robust pipeline of smart codec, amplifier and

MEMS microphone products in advanced process nodes that we expect will

be launched over the next several quarters, which we believe will

generate meaningful revenue opportunities with both existing and new

customers.

range of strategic

initiatives in FY17, that we believe are essential for future growth and

will strengthen our position as a market leader. As we move into FY17

the company anticipates strong revenue growth fueled by share gains with

existing customers, progress in digital headsets and a substantial

increase in amplifier sales. We have a robust pipeline of smart codec,

amplifier and MEMS microphone products in advanced process nodes that we

expect to launch over the next several quarters and we believe will

generate meaningful revenue opportunities with both existing and new

customers. Cirrus Logic’s strategy of providing a comprehensive

portfolio of the very best hardware, software and associated signal

processing algorithms has enabled the company to increase content and

share with key customers in both flagship and mid-tier devices. We have

experienced success with this approach across numerous OEMs, including

our third largest handset customer, where we have greatly expanded our

presence. As an early adopter of cutting edge audio and voice technology

in the Android ecosystem, this customer’s desire for a differentiated

user experience is expected to drive new opportunities for content

expansion going forward. Further, we expect to continue to gain traction

in the broader Android market over the next several years as OEMs strive

to bring to market devices with advanced audio and voice features in

this increasingly competitive environment. During the quarter, we ramped

a new flagship multi-core smart codec with a key customer. Additionally,

we began shipping our first complete signal chain win with microphones,

a new mid-tier smart codec and a new boosted amplifier at another

tier-one smartphone customer. Chip design activity was also robust in Q4

as we taped out a new flagship high performance codec, a HiFi headphone

DAC, a boosted amplifier and worked to finalize the design of a next

generation mid-tier smart codec. With a wide range of products in the

market and an extensive roadmap that includes smart codecs, amplifiers

and microphones, Cirrus Logic is uniquely positioned to address the

technical and cost needs of the various tiers and geographies across the

complete audio signal chain, providing us numerous opportunities to

increase total content with our customers. Amplifiers continue to be one

of our most successful product lines with units increasing 32 percent

year over year in FY16. In FY17, we expect this business to

meaningfully contribute to

our growth as we gain share at several customers. Demand continues to

accelerate across flagship and mid-tier devices as OEMs push for louder,

higher quality sound in thinner industrial designs with limited physical

space allocated to speakers. We are pleased with our progress in the

March quarter as we began shipments of a new boosted amplifier with a

key smartphone customer. Based on our design momentum, we are optimistic

about our ability to continue to grow this business with both new and

existing customers over the next several years, particularly in Android

applications where we have experienced limited penetration historically.

Going forward, we plan to continue to invest heavily in best in class

hardware at advanced process nodes and the associated software,

including speaker protection and linearization, that we believe will

provide a competitive advantage and drive long-term success of this

product line. The digital headset market is in the early stages of

development as OEMs increasingly look to introduce new compelling

accessories targeting mobile phones. This is fueling a transition from

the traditional analog interface to digitally connected products within

the one billion-unit global headset and headphone market. With a

platform of ultra-low power, high performance products optimized for a

full range of digital headsets, Cirrus Logic is poised to capitalize on

this rapidly growing segment. At the high end, our disruptive headphone

smart codec provides high-fidelity audio playback and advanced features

such as adaptive active noise cancelling (ANC) across all form factors,

including non-sealed earbuds. While unit volumes at the high end are

relatively small and dominated by non-adaptive ANC headsets, we believe

our adaptive solution will increase the size of the addressable market.

Our technology enables OEMs to provide a user experience across all form

factors similar to that of a $200 to $300 ANC headset available today

but at a significantly lower price for the consumer. While we are

pleased with our design activity and customer feedback regarding our ANC

headsets, we are also excited with the momentum we are experiencing in

the substantially larger mainstream digital headset market. As the

analog technology shifts toward digital solutions over the next few

years even the most basic headset will require an interface device and

conversion circuitry. Our mainstream components are designed for this

type of application where we deliver a cost-effective high-fidelity

audio experience. Cirrus Logic has a diverse platform of products that

will enable customers to

develop digital headsets across a broad spectrum of specifications and

price points, dramatically increasing our served available market.

During the quarter, we remained heavily engaged in design activity with

several leading Android and aftermarket accessory OEMs. We also launched

our MFi Headset Development Kit, a reference design platform that helps

OEMs quickly develop Lightning-based digital headsets. More

importantly, while digital headsets are expected to contribute

meaningfully to revenue in FY17, we believe our long-term opportunities

in this market are extensive as more and more analog headsets transition

to digital over the next five years. We are extremely proud of our

progress this past year and are delighted as we move into FY17 as

content expansion and new product introductions are expected to fuel

strong year-over-year growth. We believe the company is well positioned

to expand share with new and existing mobile customers and continue to

leverage the audio and voice solutions we developed for mobile into

emerging markets such as wearables, virtual reality headsets, the

connected home and voice biometrics. With a robust portfolio of

compelling components and a solid pipeline of new products launching

over the next several years, we are extremely excited about our outlook

for the future. Summary and Guidance For the June quarter we expect the

following results:•Revenue to range between $220 million and $250

million; • GAAP gross margin to be between 47 percent and 49 percent;

and • Combined GAAP R&D and SG&A expenses to range between $103 million

and $107 million, including approximately $9 million in share-based

compensation expense and $9 million in amortization of acquired

intangibles.In summary, FY16 was a fantastic year for Cirrus Logic as

sales of our smart codecs and amplifiers drove revenue up 28 percent

year over year. Building on the market trends of this past year, demand

for innovative audio and voice products across the signal chain

continues to gain momentum. With a diverse product portfolio and extensive roadmap that addresses the technology and price requirements of flagship and mid-tier devices in the mobile, smart accessory, wearable and connected home markets, Cirrus Logic is poised to deliver strong annual revenue growth above our long-term model in FY17. Sincerely, Jason Rhode Thurman Case President and Chief Executive Officer Chief Financial Officer Conference Call Q&A Session Cirrus Logic will host a live Q&A session at 5 p.m. EST today to answer questions related to its financial results and business outlook. Participants may listen to the conference call on the Cirrus Logic website. Participants who would like to submit a question to be addressed during the call are requested to email investor.relations@cirrus.com. A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion, or by calling (404) 537-3406, or toll-free at (855) 859-2056 (Access Code: 77072356). Use of Non-GAAP Financial Information To supplement Cirrus Logic's financial statements presented on a GAAP basis, Cirrus has provided non-GAAP financial information, including gross margins, operating expenses, net income, operating profit and income, tax expenses, effective tax rate and diluted earnings per share. A reconciliation of the adjustments to GAAP results is included in the tables below. Non-GAAP financial information is not

meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and comparative

purposes. In addition, certain non-GAAP financial information is used

internally by management to evaluate and manage the company. The

non-GAAP financial information used by Cirrus Logic may differ from that

used by other companies. These non-GAAP measures should be considered in

addition to, and not as a substitute for, the results prepared in

accordance with GAAP. Safe Harbor Statement Except for historical

information contained herein, the matters set forth in this news release

contain forward-looking statements, including expectations for growth

and product ramps in the first quarter 2017 and beyond, our estimates of

effective tax rates, fiscal year 2017 revenue, gross margin, combined

research and development and selling, general and administrative expense

levels, share-based compensation expense and amortization of acquired

intangibles. In some cases, forward-looking statements are identified by

words such as “expect,” “anticipate,” “foresee,” “target,” “project,”

“believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations

of these types of words and similar expressions. In addition, any

statements that refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are forward-looking

statements. These forward-looking statements are based on our current

expectations, estimates and assumptions and are subject to certain risks

and uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the

following: the level of orders and shipments during the first quarter of

fiscal year 2017, customer cancellations of orders, or the failure to

place orders consistent with forecasts, along with the timing and

success of future product ramps; and the risk factors listed in our Form

10-K for the year ended March 28, 2015, and in our other filings with

the Securities and Exchange Commission, which are available at

www.sec.gov. The foregoing information concerning our business outlook

represents our outlook as of the date of this news release, and we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new developments or otherwise. Cirrus

Logic and Cirrus are registered trademarks of Cirrus Logic, Inc.,

Android is a registered trademark of Google, Inc. and Lightning is a

registered trademark of Apple Inc. All other company or product names

noted herein may be trademarks of their respective holders. Summary

financial data follows:

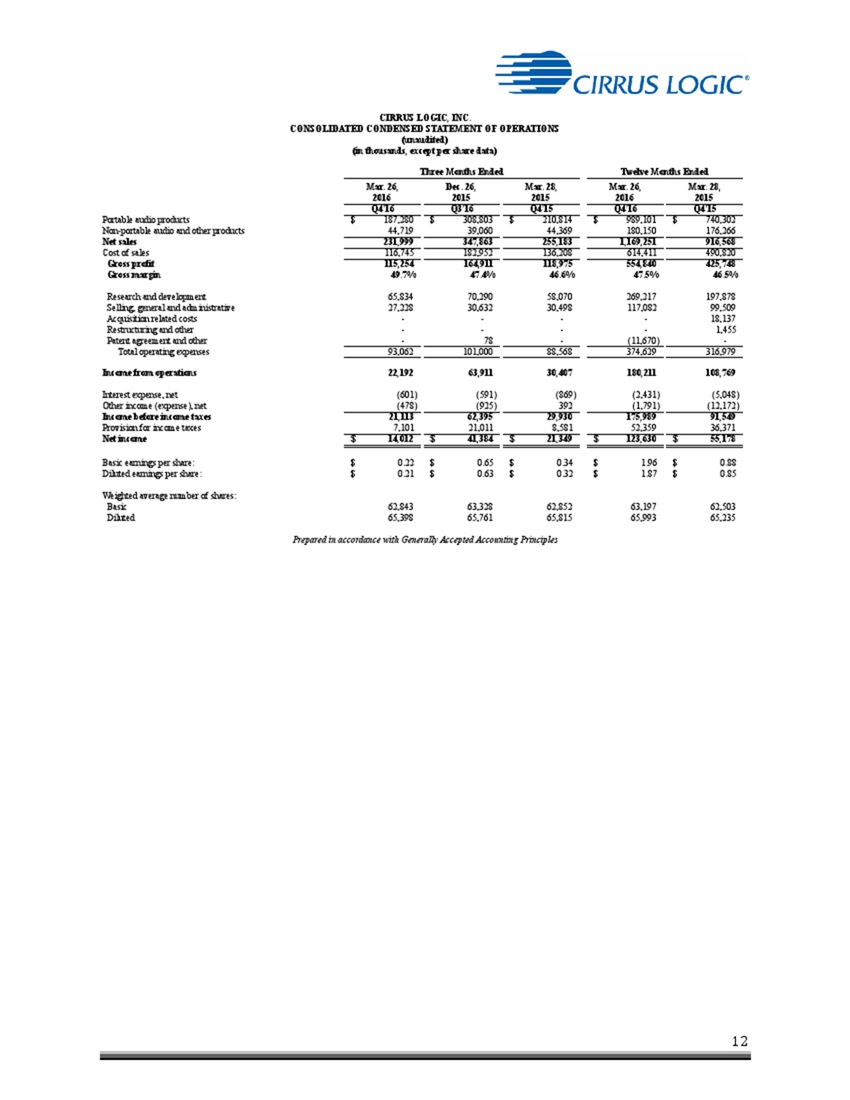

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in thousands, except per share data) Three Months Ended Twelve Months Ended Mar. 26, Dec. 26, Mar. 28, Mar. 26, Mar. 28, 2016 2015 2015 2016 2015 Q4'16 Q3'16 Q4'15 Q4'16 Q4'15 Portable audio products $ 187,280 $ 308,803 $ 210,814 $ 989,101 $ 740,302 Non-portable audio and other products 44,719 39,060 44,369 180,150 176,266 Net sales 231,999 347,863 255,183 1,169,251 916,568 Cost of sales 116,745 182,952 136,208 614,411 490,820 Gross profit 115,254 164,911 118,975 554,840 425,748 Gross margin 49.7% 47.4% 46.6% 47.5% 46.5% Research and development 65,834 70,290 58,070 269,217 197,878 Selling, general and administrative 27,228 30,632 30,498 117,082 99,509 Acquisition related costs - - - - 18,137 Restructuring and other - - - - 1,455 Patent agreement and other - 78 - (11,670) - Total operating expenses 93,062 101,000 88,568 374,629 316,979 Income from operations 22,192 63,911 30,407 180,211 108,769 Interest expense, net (601) (591) (869)(2,431) (5,048) Other income (expense), net (478) (925) 392 (1,791)(12,172) Income before income taxes 21,113 62,39 29,930 175,989 91,549 Provision for income taxes 7,101 21,011 8,581 52,359 36,371 Net income $ 14,012 $ 41,384 $ 21,349 $ 123,630 $ 55,178 Basic earnings per share: $ 0.22 $ 0.65 $ 0.34 $ 1.96 $ 0.88 Diluted earnings per share: $ 0.21 $ 0.63 $ 0.32 $ 1.87 $ 0.85 Weighted average number of shares: Basic 62,843 63,328 62,852 63,197 62,503 Diluted 65,398 65,761 65,815 65,993 65,235 Prepared in accordance with Generally Accepted Accounting Principles

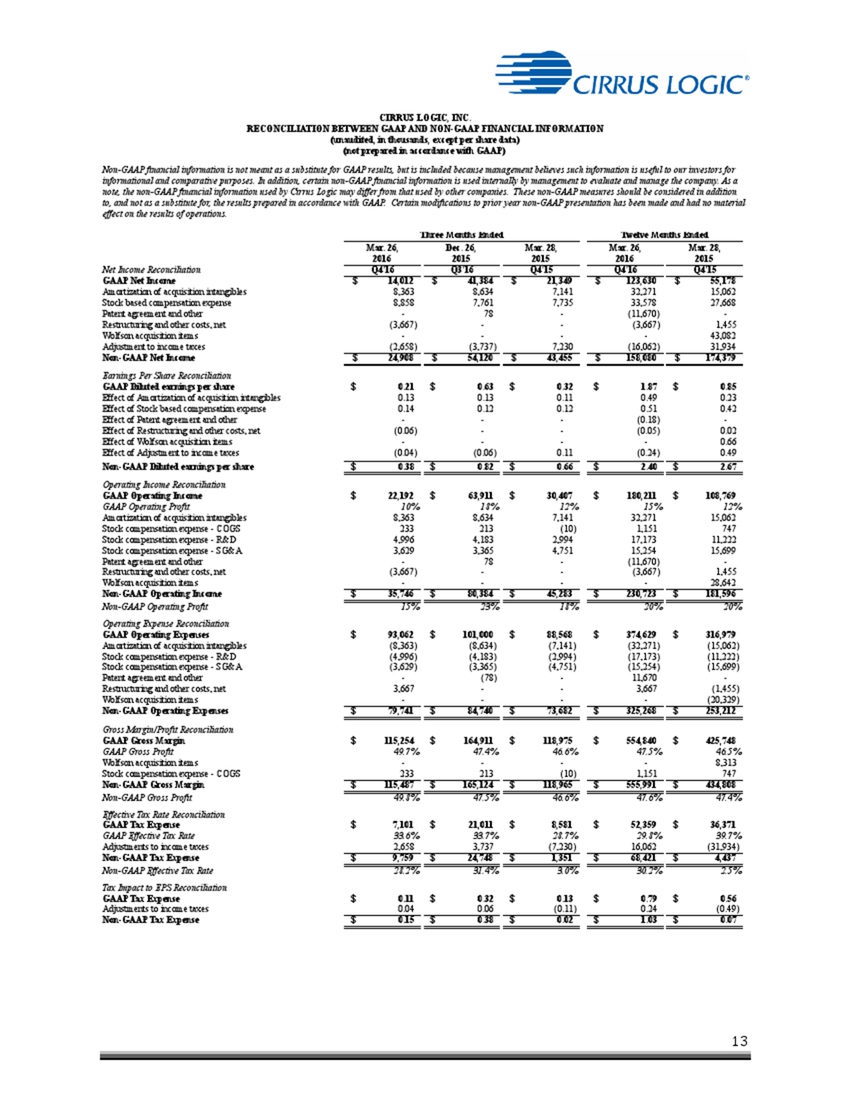

CIRRUS LOGIC, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

(unaudited, in thousands, except per share data) (not prepared in

accordance with GAAP) Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes

such information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage the

company. As a note, the non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These non-GAAP

measures should be considered in addition to, and not as a substitute

for, the results prepared in accordance with GAAP. Certain

modifications to prior year non-GAAP presentation has been made and had

no material effect on the results of operations. Three Months Ended

Twelve Months Ended Mar. 26, Dec. 26, Mar. 28, Mar. 26, Mar. 28, 2016

2015 2015 2016 2015 Net Income Reconciliation Q4'16 Q3'16 Q4'15 Q4'16

Q4'15 GAAP Net Income $ 14,012 $ 41,384 $ 21,349 $ 123,630 $ 55,178

Amortization of acquisition intangibles 8,363 8,634 7,141 32,271 15,062

Stock based compensation expense 8,858 7,761 7,735 33,578 27,668 Patent

agreement and other - 78 - (11,670) - Restructuring and other costs,

net (3,667) - - (3,667) 1,455 Wolfson acquisition items - - - -

43,082 Adjustment to income

taxes (2,658) (3,737) 7,230 (16,062) 31,934 Non-GAAP Net Income

Earnings Per Share Reconciliation $ 24,908 $ 54,120 $ 43,455 $ 158,080 $

174,379 GAAP Diluted earnings per share $ 0.21 $ 0.63 $ 0.32 $ 1.87 $

0.85 Effect of Amortization of acquisition intangibles 0.13 0.13 0.11

0.49 0.23 Effect of Stock based compensation expense 0.14 0.12 0.12 0.51

0.42 Effect of Patent agreement and other - - - (0.18) -

Effect of Restructuring and other costs, net (0.06) - - (0.05) 0.02

Effect of Wolfson acquisition items - - - - 0.66 Effect of

Adjustment to income taxes (0.04) (0.06) 0.11 (0.24) 0.49 Non-GAAP

Diluted earnings per share Operating Income Reconciliation GAAP

Operating Income $ 0.38 $ $ 22,192 $ 0.82 $ 63,911 $ 0.66 $ 30,407 $

2.40 $ 180,211 $ 2.67 108,769 GAAP Operating Profit 10% 18% 12% 15%

12% Amortization of acquisition intangibles 8,363 8,634 7,141 32,271

15,062 Stock compensation expense – COGS 233 213 (10) 1,151 747 Stock

compensation expense - R&D 4,996 4,183 2,994 17,173 11,222 Stock

compensation expense - SG&A 3,629 3,365 4,751 15,254 15,699 Patent

agreement and other - 78 - (11,670) - Restructuring and other costs, net

(3,667) - - (3,667) 1,455 Wolfson acquisition items - - - - 28,642

Non-GAAP Operating Income $ 35,746 $ 80,384 $ 45,283 $ 230,723 $ 181,596

Non-GAAP Operating Profit 15% 23% 18% 20% 20% Operating Expense

Reconciliation GAAP Operating Expenses $ 93,062 $ 101,000 $ 88,568 $

374,629 $ 316,979 Amortization of acquisition intangibles (8,363)

(8,634) (7,141) (32,271) (15,062) Stock compensation expense -

R&D (4,996) (4,183) (2,994) (17,173) (11,222) Stock compensation expense

- SG&A (3,629) (3,365) (4,751) (15,254) (15,699) Patent agreement and

other - (78) - 11,670 - Restructuring and other costs, net 3,667 - -

3,667 (1,455) Wolfson acquisition items - - - - (20,329) Non-GAAP

Operating Expenses $ 79,741 $ 84,740 $ 73,682 $ 325,268 $ 253,212 Gross

Margin/Profit Reconciliation GAAP Gross Margin $ 115,254 $ 164,911 $

118,975 $ 554,840 $ 425,748 GAAP Gross Profit 49.7% 47.4% 46.6% 47.5%

46.5% Wolfson acquisition items - - - - 8,313 Stock compensation expense

- COGS 233 213 (10) 1,151 747 Non-GAAP Gross Margin $ 115,487 $ 165,124

$ 118,965 $ 555,991 $ 434,808 Non-GAAP Gross Profit Effective Tax Rate

Reconciliation 49.8% 47.5% 46.6% 47.6% 47.4% GAAP Tax Expense $

7,101 $ 21,011 $ 8,581 $ 52,359 $ 36,371 GAAP Effective Tax Rate 33.6%

33.7% 28.7% 29.8% 39.7% Adjustments to income taxes 2,658 3,737 (7,230)

16,062 (31,934) Non-GAAP Tax Expense $ 9,759 $ 24,748 $ 1,351 $ 68,421 $

4,437 Non-GAAP Effective Tax Rate 28.2% 31.4% 3.0% 30.2% 2.5% Tax Impact

to EPS Reconciliation GAAP Tax Expense $ 0.11 $ 0.32 $ 0.13 $ 0.79 $

0.56 Adjustments to income taxes 0.04 0.06 (0.11) 0.24 (0.49)

Non-GAAP Tax Expense $ 0.15 $ 0.38 $ 0.02 $ 1.03 $ 0.07

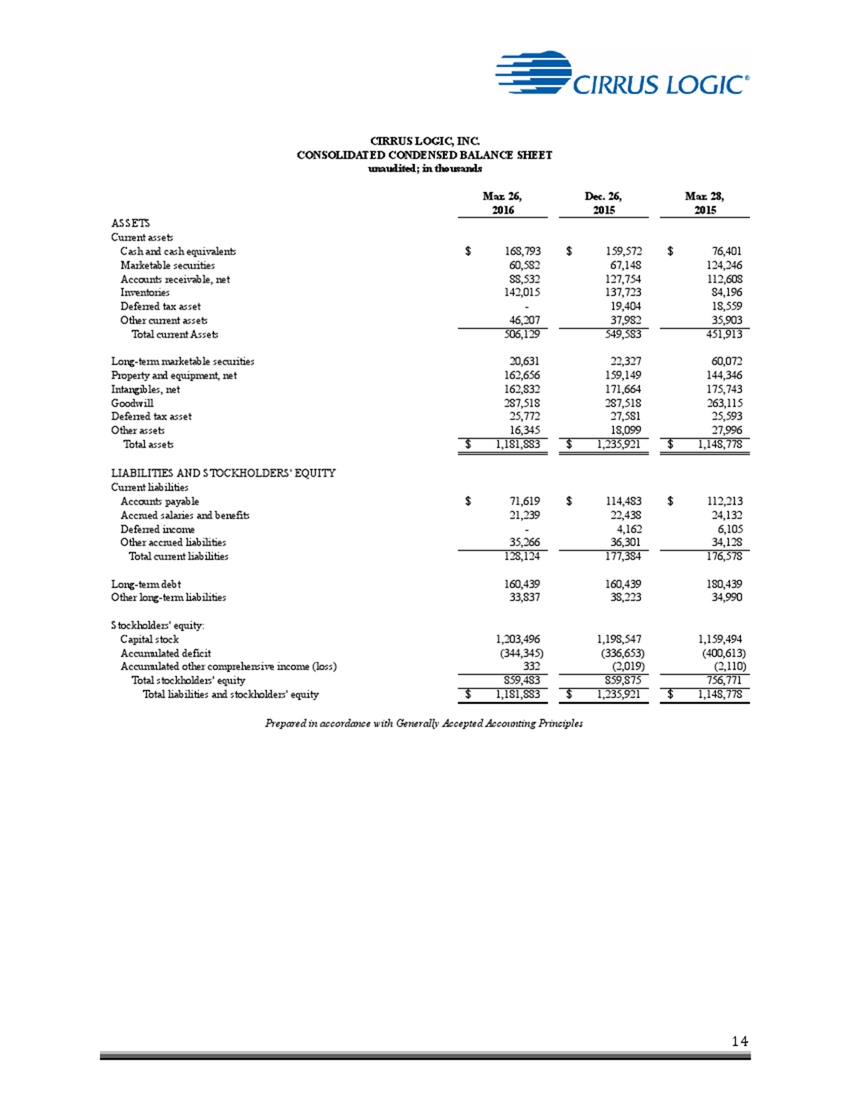

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED BALANCE SHEET unaudited; in thousands Mar. 26, 2016 Dec. 26, 2015 Mar. 28, 2015 ASSETS Current assets Cash and cash equivalents $ 168,793 $ 159,572 $ 76,401 Marketable securities 60,582 67,148 124,246 Accounts receivable, net 88,532 127,754 12,608 Inventories 142,015 137,723 84,196 Deferred tax asset - 19,404 18,559 Other current assets 46,207 37,982 35,903 Total current Assets 506,129 549,583 451,913 Long-term marketable securities 20,631 22,327 60,072 Property and equipment, net 162,656 159,149 144,346 Intangibles, net 162,832 71,664 175,743 Goodwill 287,518 287,518 263,115 Deferred tax asset 25,772 27,581 25,593 Other assets 16,345 18,099 27,996 Total assets $ 1,181,883 $ 1,235,921 $ 1,148,778 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable $ 71,619 $ 114,483 $ 112,213 Accrued salaries and benefits 21,239 22,438 24,132 Deferred income - 4,162 6,105 Other accrued liabilities 35,266 36,301 34,128 Total current liabilities 128,124 177,384 176,578 Long-term debt 160,439 160,439 180,439 Other long-term liabilities 33,837 38,223 34,990 Stockholders' equity: Capital stock 1,203,496 1,198,547 1,159,494 Accumulated deficit (344,345) (336,653) (400,613) Accumulated other comprehensive income (loss) 332 (2,019) (2,110) Total stockholders' equity 859,483 859,875 756,771 Total liabilities and stockholders' equity $ 1,181,883 $ 1,235,921 $ 1,148,778 Prepared in accordance with Generally Accepted Accounting Principles