Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Limbach Holdings, Inc. | v437773_8k.htm |

|

Filed by 1347 Capital Corp. Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: 1347 Capital Corp. Commission File No. 001-36541 |

Exhibit 99.1 |

1347 Capital Corp. / Limbach Holdings LLC Investor Presentation April 2016

Forward Looking Statements Neither 1347 Capital Corp., Limbach nor any of their respective affiliates makes any representation or warranty as to the acc ura cy or completeness of the information contained in this presentation. The sole purpose of the presentation is to assist persons in deciding whether they wish to proceed with a further review of t he proposed transaction discussed herein and is not intended to be all - inclusive or to contain all the information that a person may desire in considering the proposed transaction discussed herein . I t is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction. This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transactions. This presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made exc ept by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended. This presentation includes “forward - looking statements.” 1347 Capital Corp.’s and Limbach’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “bu dget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements include, without limitation, 1347 Capital Corp.’s and Limbach’s expectations with respect to future performance and anticipated financial impacts of the proposed transaction, the satisfacti on of the closing conditions to the proposed transaction, and the timing of the completion of the proposed transaction. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ mater ially from the expected results. Most of these factors are outside 1347 Capital Corp.’s and Limbach’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurr en ce of any event, change or other circumstances that could give rise to the termination of the merger agreement for the business combination (the “Merger Agree men t”), (2) the outcome of any legal proceedings against Limbach or 1347 Capital Corp.; (3) the inability to complete the transaction contemplated by the Merger Agreement, including due to fail ure to obtain approval of the shareholders of 1347 Capital Corp. or other conditions to closing in the Merger Agreement; (4) delays in obtaining, adverse conditions contained in, or the inability to obt ain necessary regulatory approvals or complete regulator reviews required to complete the transactions contemplated by the Merger Agreement; (5) the risk that the proposed transaction disrupts curren t p lans and operations as a result of the announcement and consummation of the transaction described therein and herein; (6) the ability to recognize the anticipated benefits of the bu sin ess combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with suppliers and obtain adequate supply of products and retain its key employees; (7) costs related to the proposed business combination; (8) changes in applicable laws or regulations; (9) the possibility that t he combined company may be adversely affected by other economic, business, and/or competitive factors; and (10) other risks and uncertainties indicated from time to time in 1347 Capital Corp.’s filing s w ith the Securities and Exchange Commission. 1347 Capital Corp. cautions that the foregoing list of factors is not exclusive. 1347 Capital Corp. cautions readers not to p lac e undue reliance upon any forward - looking statements, which speak only as of the date made. 1347 Capital Corp. does not undertake or accept any obligation or undertaking to release publicly any updat es or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. 2

3 Investment Thesis: Historic Company in Industry Where SPACs Work Transaction Brief : 1347 Capital Corp . (“ 1347 ”) has signed a definitive agreement to merge with Limbach Holdings , LLC (“ Limbach ”) in a transaction valued at approximately $ 97 million Opportunity to invest in a nationally - recognized, industry leading company at an inflection point of growth within the non - residential construction market • Founded in 1901 , Limbach is the 12 th largest mechanical systems solutions firm in the U . S . * • Seasoned, proven leadership and infrastructure that is well - positioned to maximize value as a public company – Company has invested to build a national platform – Public equity structure will provide management with currency to grow the company through acquisition in a fragmented market • Favorable industry dynamics as the current upward leg of the construction cycle supports growth – High end niche player with a history of high - profile projects – Ample room for industry consolidation – smaller competitor deal multiples in the 3 x – 5 x EBITDA range • Attractive entry opportunity with strong forward visibility – 2015 revenue of $ 331 . 4 million with a projected $ 397 . 2 million for 2016 – Significant backlog coverage provides strong forward visibility for 2016 and 2017 – Discount to comps despite favorable growth profile – Prior E&C/SPAC mergers have been very successful * Source: Engineering News Record

4 Transaction Rationale: Why it Makes Sense for Both Sides • SPAC raised $ 46 million with a goal of repeating management’s past merger / spin - out successes • Sought scalable company with an enterprise value of between $ 80 - $ 200 million • Strong business with a long - history in engineering and construction that has grown organically into a fully integrated business systems service provider • Vintage portfolio company of FdG Associates for over 14 years • Sees public markets as a tool to leverage industry tailwinds and strategic M&A “Win / Win” • SPAC structure allows investors an opportunity to take an institutional size position at favorable multiples / minimal risk with the potential for upside • 1347 provides a strong partner that will work with management throughout its growth phase • Limbach is an ideal growth platform with an existing infrastructure that provides a platform where use of capital can be immediately additive • Other SPACs in E&C Industry have been successful for investors • Management is seasoned and prepared to grow a public company both organically and through M&A

Prior SPAC – E&C Company Mergers Have Been Very Successful • Hill International (HIL) • Merger took place in Q2 of 2006 • Enterprise value at June 30, 2006 was estimated at ~$98 million • Current Enterprise Value of $294 million • 10 year CAGR of 11.6% • Primoris Corp (PRIM) • Merger took place in Q3 of 2008 • Enterprise value at July 31, 2008 was estimated at ~$154 million • Current Enterprise Value of $1,303 million • 8 year CAGR of 30.6% $98 mln $294 mln $154 mln $1,303 mln 5

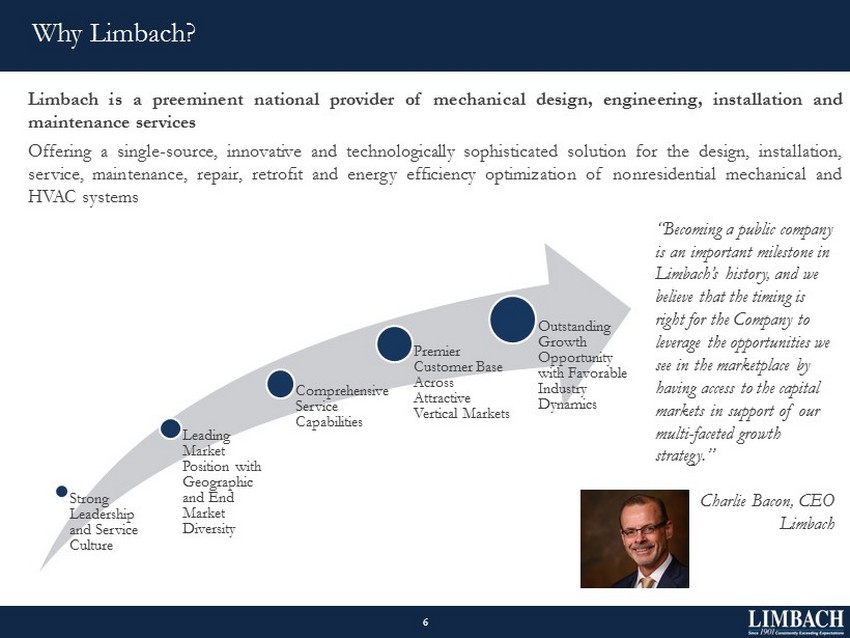

Why Limbach ? 6 Limbach is a preeminent national provider of mechanical design, engineering, installation and maintenance services Offering a single - source, innovative and technologically sophisticated solution for the design, installation, service, maintenance, repair, retrofit and energy efficiency optimization of nonresidential mechanical and HVAC systems Strong Leadership and Service Culture Leading Market Position with Geographic and End Market Diversity Comprehensive Service Capabilities Premier Customer Base Across Attractive Vertical Markets Outstanding Growth Opportunity with Favorable Industry Dynamics “Becoming a public company is an important milestone in Limbach’s history, and we believe that the timing is right for the Company to leverage the opportunities we see in the marketplace by having access to the capital markets in support of our multi - faceted growth strategy.” Charlie Bacon, CEO Limbach

Transaction Overview (continued) 7 Compelling Valuation Motivation for Transaction • Vintage portfolio company of FdG Associates • Going public provides tax - efficient currency for future acquisitions • Improved access to capital markets • Improved stature within the industry as a NASDAQ - listed public company Other Key Terms • In the event 1347 shareholder redemptions range from $ 3 million to $ 26 million, the following sources of financing are available : • Limbach unitholders to receive up to $ 10 million in additional shares of 1347 in lieu of cash consideration at closing (i . e . , consideration of up to $ 25 million in stock instead of $ 15 million), and up to 667 , 667 warrants, each exercisable for one share • Affiliates of 1347 to fund up to $10 million in newly - issued convertible preferred stock • $ 12.50 conversion price / 8% initial dividend • Excess cash from Limbach’s balance sheet • Post - merger, the board will be comprised of 7 members ; four Limbach representatives including Mr . Bacon, two 1347 Capital representatives, and one jointly selected independent member to be appointed upon closing • Limbach’s 2015 and 2016 E EBITDA multiple of 8 . 5 x and 7 . 0 x , respectively compare very favorably to its publicly - traded peers which are currently trading at 9 . 8 x and 8 . 4 x EBITDA • The transaction is structured such that Limbach will maintain low levels of leverage and a strong balance sheet positioning the company for future growth; in addition the company will take advantage of tax benefits arising from the transaction Strong Management Team • Limbach’s management team, led by CEO Charles Bacon, is unusually strong and deep for a small - cap business • Well - configured to meet the demands of SEC compliance • Established a coast - to - coast management and organizational infrastructure with the capability of seamlessly integrating acquisition candidates

Transaction Overview 8 Transaction Overview & Transaction Consideration Transaction Sources/Uses Waterfall • 1347 Capital Corp . (“ 1347 ”) has signed a definitive agreement to merge with Limbach Holdings, LLC (“Limbach”) in a transaction valued at approximately $ 97 million • Founded in 1901 , Limbach is the 12 th largest mechanical systems solutions firm in the United States as determined by Engineering News Record • Limbach’s current equityholders will receive an aggregate of $ 60 million of consideration for their interests in Limbach, consisting of cash, stock and warrants • The cash/stock/warrant mix will vary based on the number of 1347 shareholders that exercise their redemption rights • Cash consideration will range from $ 35 – $ 45 million and equity consideration (shares of 1347 valued at $ 10 . 00 each) will range from $ 15 – $ 25 million • 1347 expects to raise approximately $ 40 million in new debt financing in connection with the transaction • The combined entity expects to be listed on NASDAQ post - transaction under the ticker LMB • The transaction is expected to close in June or July 2016 Redemption % 0.0% 13.0% 23.9% 34.8% 45.7% 56.5% Sources Limbach cash (12/31/15) $6,107 $6,107 $6,107 $6,107 $6,107 $6,107 SPAC cash $46,000 $40,000 $35,000 $30,000 $25,000 $20,000 Convertible preferred stock $0 $1,500 $4,000 $6,500 $9,000 $10,000 New debt $40,000 $40,000 $40,000 $40,000 $40,000 $40,000 Equity rollover $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 Additional equity rollover $0 $1,500 $4,000 $6,500 $9,000 $10,000 Total sources $107,107 $104,107 $104,107 $104,107 $104,107 $101,107 Uses Cash to Limbach unitholders $45,000 $43,500 $41,000 $38,500 $36,000 $35,000 Repay existing debt $33,655 $33,655 $33,655 $33,655 $33,655 $33,655 Equity to unitholders $15,000 $16,500 $19,000 $21,500 $24,000 $25,000 Estimated deal costs $5,500 $5,500 $5,500 $5,500 $5,500 $5,500 Excess cash to balance sheet $7,952 $4,952 $4,952 $4,952 $4,952 $1,952 Total uses $107,107 $104,107 $104,107 $104,107 $104,107 $101,107 $ in 000s

Transaction Valuation 9 Valuation At Close (1) Implied Multiples At Close Ownership at Close (1) Public Shares 64% 1347 Sponsor 17% Pre - Merger Limbach Unit - Holders 19% 1 Assumes no 1347 shareholder redemptions 2 Does not include warrants 3 Does not reflect pro forma public company expenses (estimated at approximately $750,000 annually) Implied Multiples Est. EBITDA At Closing 2015 EV/EBITDA $13,180,000 8.5x 2016 EV/EBITDA $16,000,000 7.0x At Closing Transaction Valuation Total Shares Outstanding 7,958,000 $ Per Share $10.00 Equity Value $79,580,000 Limbach Debt $40,000,000 Limbach Cash $7,952,000 Enterprise Value $111,628,000

10 Investment Details – Why Limbach ? • Non - residential construction expected to continue rebounding from post - recession low which occurred in 2011 * • Projected growth rates for the 2015 - 2020 period show positive trends in all sub - verticals * • Architectural billing index trending over 50 on a consistent basis which indicates increase in billings Favorable Market Dynamics • Outstanding reputation for quality and innovation in complex projects, with geographic and end market diversity • History of high profile projects involving some of the most recognizable buildings in the United States • Established relationships with industry - leading general contractors and construction managers Premium Brand Name • By leading with advanced engineering capabilities through our “LEDS” division, Limbach adds significant value for our clients • Capabilities from the concept/engineering phase all the way through service and maintenance create a “one stop shop” offering for our customers • Incorporation of technology applications such as use of 3D models for pre - fabrication Differentiated Strategy • Continue growing our service business which provides fast - growing sustainable revenue with long - term visibility • Addition/expansion of complementary specialty services such as electrical and fire protection in order to enhance Limbach’s “one stop shop” offering • Targeted M&A to expand Limbach’s geographic coverage into attractive regional markets Focused Growth Plan * Source: FMI's 2016 Construction Outlook First Quarter Report

Favorable Market Dynamics

Strong signs of market recovery = Ample opportunities to drive growth Non - Residential Construction Put - in - Place ($ in billions) Source: Data for 1994 - 2009 per FMI's 2011 U.S. Markets Construction Overview; data for 2010 and later per FMI's 2016 Construction Outlook First Quarter Report. 12 Non - Residential Construction – Large Market with Tailwinds $201 $228 $253 $276 $296 $315 $342 $347 $319 $309 $324 $346 $390 $463 $498 $432 $348 $337 $355 $360 $389 $450 $483 $510 $533 $560 $598 $0 $100 $200 $300 $400 $500 $600 $700

Growth forecasted across multiple markets Improving Industry Outlook Construction Forecasts Source: FMI's 2016 Construction Outlook First Quarter Report. • Architectural Billing Index trending over 50 on a consistent basis which indicates increase in billings • Strong activity in core end - markets along with key customers like Disney (Amusement and Recreation) and HCA (Healthcare) • FMI Construction Outlook projects total nonresidential building construction to grow nearly 6% annually to over $597.8 billion in 2020 based on construction put in place Indicators and Outlook Change from Prior Year % Change 2014 Actual 2015 Actual 2015A - 2020F CAGR Total Nonresidential Buildings 8% 16% 6% Amusement and Recreation 9% 24% 3% Commercial 18% 7% 5% Education 1% 7% 5% Healthcare (6)% 4% 6% Lodging 20% 31% 7% Manufacturing 14% 44% 7% Office 21% 22% 6% Public Safety (1%) (5%) 3% Transportation 6% 7% 7% 13

Premium Brand Name

Depth of Limbach’s Leadership Team 15 Experienced Management Team Assembled to Lead Limbach During its Expansion Chief Executive Officer EVP, Chief Operating Officer EVP, Chief Financial Officer EVP, Maintenance & Service Director of Human Relations SVP, Chief Learning Officer President, Engineering & Design Services General Counsel SVP, National Sales & Marketing Officer President, Harper Average Years at Limbach 12 28 1 10 18 24 18 10 1 6 13 Years in Industry 34 28 28 35 18 24 34 23 35 12 27

Limbach – Long and Proud History 16 Founded in 1901 by Frank Limbach, a talented metal craftsman, who created a one - person roofing and sheet metal company in Pittsburgh, PA, with little but his own integrity and skill Limbach - the “1 st Choice” of customers as a specialty contractor and service firm in the United States Limbach – At a Glance Corporate Headquarters Pittsburgh, PA Employees approx. 1,300 www.limbachinc.com Limbach is well equipped to handle the needs of the manufacturing sector, which is the fastest projected growth sector among non - residential construction . Industrial facilities and manufacturing plants (such as GM Powertrain, presented above) present unique requirements in terms of HVAC, controls and energy management Limbach serves as the mechanical contractor for Pittsburgh Civic Arena (above), the world’s first retractable roof facility, followed by the Louisiana Superdome, Pontiac Silverdome, the Georgia Dome, and currently in design phase for the new Red Wings Arena From parking garages, to train maintenance facilities, to airports, transportation represents a rapidly growing market for Limbach . Major clients include the Washington Metropolitan Area Mass Transit Authority and the LAX Airport, where Limbach is currently working on the massive Tom Bradley International Terminal .

Attractive Vertical Markets – Specialty Niche with Brand Recognition Focus on large and growing markets that require specialized technical capabilities and solutions Limbach is a desired partner for leading general contractors and construction managers Commercial Healthcare OSU Cancer Center Transportation LAX Bradley Terminal Sports New Red Wings Arena Higher Education Harvard Cultural Hospitality Four Seasons Resort Entertainment Disney – Mine Train Ride Liberty Mutual 17 Broad Art Museum

Outstanding Construction and Service Relationships 18

Limbach – Wide Geographic Reach With Room to Expand Employees Size Bonding 1,300 + Top 12 $600 million W ESTERN P ENNSYLVANIA E ASTERN P ENNSYLVANIA S OUTHERN C ALIFORNIA M ICHIGAN O HIO N EW J ERSEY N EW E NGLAND M ID - A TLANTIC O RLANDO T AMPA 19 The Company has a broad geographic footprint operating from 14 offices in New England, the Mid - Atlantic, the Southeast, the Midwest and California

Differentiated Strategy

Limbach – Value Proposition 21 • High - touch Engineering Expertise – Professional Engineers to challenge the design team and bring additional ideas • Strong Direct Relationships – Leading general contractors and construction managers – Building owners • Utilization of Technology to Maximize Service Offerings / Energy Savings – Offsite fabrication offer tremendous benefits to the overall project . – Increased project safety, higher productivity, enhanced quality control, better fit and sequencing, and minimization of waste

Full Mechanical Capabilities Building Information Modeling Off - Site / Pre - fabrication 24/7 Service Engineering Commissioning Energy Modeling Construction and Installation Conceptual Estimating Operations and Maintenance 22

The Importance of Mechanical Systems • HVAC systems are critical to building function and comprise the largest component of building investment, operating expenses and energy use • Energy efficiency programs can reduce overall building energy costs by as much as 30 % , with proper operations and maintenance accounting for annual operating cost savings of 5 % to 20 % MEP Systems 60% Office Equipment 4% Lighting 20% Other 16% HVAC 32% Lighting 25% Electronics 8% Other 36% MEP Systems 30% Repair & Maintenance 23% Cleaning 18% Security 8% Management & Admin 10% Grounds 3% Source: BOMA, U.S. Energy Information Administration, ASHRAE. Initial Investment – CapEx Life Cycle Investment - OpEx Commercial Building Energy Use Mechanical Energy Efficiency Focus 23 Mechanical systems are the most critical systems within a facility Full service providers with scale, technical design and engineering capabilities are scarce Limbach Opportunity Limbach Opportunity

Pre - Construction Design and Engineering 24 • With more than 27 Professional Engineers on staff, Limbach Engineering and Design Services (“LEDS”) is a provider of turnkey mechanical design and engineering services throughout the Limbach organization • LEDS provides the Company with a significant competitive advantage few other mechanical contractors offer ‒ Pre - construction evaluation of engineering designs to identify cost saving and schedule opportunities ‒ Identification of mechanical system design errors and inefficiencies, as well as potential trade conflicts impacting constructability ‒ Cooperative process with general contractors and construction managers allows for improved bottom - line value for the client while creating durable partnerships for Limbach Pre - Construction engagement serves to reduce risk and reduce cost, positioning Limbach as a value - added partner Building Information Modeling (BIM) Engineering Energy Modeling Conceptual Estimating

Construction and Installation Services 25 • Limbach’s extensive fabrication and installation capabilities are tailored to the unique attributes of each local market ‒ Strength of local labor relationships ‒ Comparative economics and relative risk of in - house fabrication and trade self - performance versus subcontracting ‒ Demands of customers and facility owners for single - source solutions • When possible, the Company seeks opportunities to pre - fabricate piping, plumbing and electrical assemblies offsite to improve productivity and to reduce labor costs, or in certain cases to package mechanical, electrical and plumbing services (“MEP”) into a turnkey offering • Notwithstanding differentiation at the local level, the Company seeks to implement universal and consistent protocols with respect to risk management and operational excellence Off - Site / Pre - fabrication Commissioning Construction and Installation

• The Company’s service and maintenance operations are fundamental to the full - lifecycle service offering ‒ Higher margin, recurring revenue business model driven by contractual maintenance base ‒ Substantial “pull - through” spot, small project, and negotiated emergency and expansion work • Over the last several years, the Company has made substantial investments in accelerating the growth of the service business in select branch locations Service, Operations and Maintenance 26 24/7 Service Operations and Maintenance • Expanding this capability throughout the entire organization is an initiative that management believes is critical to maximizing the Company’s core capabilities, and which complements the fabrication and installation business ‒ Relationships direct to facility owners ‒ Diversification of revenue streams ‒ Meaningfully higher gross margins

Annuity Streams: Maintenance 27 • Limbach’s contractual maintenance base has increased steadily in response to recent investments in sales people, training and business development efforts • Growth in the maintenance base has driven a greater increase in pull - through special project and construction revenue which generates comparatively higher gross margins than stand - alone construction projects $7.1 $7.2 $7.5 $8.3 $9.1 $10.0 $17.2 $26.0 $26.5 $31.6 $40.9 $47.7 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 2010 2011 2012 2013 2014 2015B Maintenance Base Pull-Through Revenue $50.0 $39.9 $24.3 $34.0 $33.2 $57.7 ($ in millions)

Focused Growth Plan

Ideally positioned to expand service capabilities and take share as the market recovers and demand for technically complex and energy efficient buildings grows Core Growth Plan • Establish Limbach as a national platform through expansion into adjacent geographic areas • Complementary strategic acquisitions • Proven greenfield office expansion into satellite markets of existing branches • Grow recurring, high margin maintenance services platform • Leverage 2012 b uilding automation partnership with Siemens • Further expand MEP pilot from Mid - Atlantic to other locations to further differentiate Limbach from competitors • Target of c ontrolling 25% - 50% of a building’s construction costs • Further expand presence in existing markets • Further penetrate key customer relationships with higher - end services • Strategic selling • Leverage engineering and BIM capabilities • Maximize prefabrication to dramatically reduce field construction cost • Continue rapid growth of maintenance/service segment Geographic Expansion Integrated Services Gain Market Share 29

Significant greenfield expansion Geographic Expansion - Florida Provides A Roadmap For Success 30 • Limbach , through its open shop Harper Limbach subsidiary, has operated profitably in Central Florida for over two decades through its principal location in the Orlando market ‒ Solid track record of managing risk and exceeding budget ‒ Strong and leverageable customer base • Several years ago, Limbach opened a satellite location in Tampa, and quickly developed a consistently profitable business • In light of the positive growth trends in the Southeast market generally and in the Florida market in particular, Harper Limbach has embarked upon a multi - year expansion plan to establish a presence in southeast and northeast Florida • Management believes that the Florida operation is scalable over time, first across the major in - state markets and ultimately into neighboring states

Limbach’s access to capital will enable pursuit of unique acquisition opportunities that can integrate ideally into its geographic / service expansion model Strategic Acquisitions Attractive Acquisition Environment Geography Integrated MEP Platform • Highly fragmented industry dominated by small, single location businesses and mid - sized regional firms (typically family owned / operated) • Few large competitors – only a few firms with revenues over $500 million • Significant consolidation opportunities for businesses with scale and capable management teams • Geographic opportunities » Target mechanical businesses in adjacent markets • Expand service offering » Target electrical and fire protection businesses within existing footprint » Build full MEP offering, controlling 50% of a building’s construction cost, plus full maintenance opportunity W ESTERN PA E ASTERN PA S OUTHERN C ALIFORNIA M ICHIGAN O HIO N EW J ERSEY N EW E NGLAND M ID - A TLANTIC O RLANDO T AMPA Mechanical Electrical Fire Protection 31

Conclusion • Strong established brand and recognized industry leader – top 12 firm • Full - service capabilities, technical expertise, strong customer relationships • Significant investments in scalable and sophisticated operating platform and people • Multiple avenues for organic and acquisition - driven growth • Well - positioned to flourish as markets recover • Strong and growing service and maintenance business proving annuity income stream • Dedicated and talented team with desire to build a $1+ billion business • Market recovery in process – pipeline is larger than ever and backlog is back to pre - recessionary levels (historical high as of March 31, 2016) • Fragmented market with competitive advantages for firms with scale and financial strength; opportunity to take market share • Growing demand for energy efficiency in buildings favors full - service mechanical firms • Significant opportunities for strategic acquisitions • Public company status helpful for acquisitions and access to growth capital Limbach is the Ideal Growth Platform Attractive Market Opportunity Ownership Transition 32

Appendix – Financial Exhibits

Financial Performance 34 • Significant backlog coverage (94%) provides strong forward visibility for 2016 and 2017 • Excludes promised projects totaling ~$100 million which are awaiting final documentation and are expected to be booked over the coming quarter • Growth of recurring, higher margin maintenance services provides stability and improved profit mix • Continuing focus on operational improvements driving sustainable margin enhancements in coming years • Minimal maintenance capital expenditures, and growth capital investments limited to leasehold improvements and expansion of the service vehicle fleet and prefabrication operations

Financial Performance – Strong Backlog / EBITDA Growth Rate Historical Performance Comments • Strong forward visibility with large backlog and revenue coverage • Growth of recurring, higher margin maintenance services provides stability and improved profit mix • Competing on capabilities versus price as market recovers from cost - based decisions in prior years • Focus on operational improvements driving sustainable margin enhancements in coming years • Performance in 2016 expected to reflect continued strength in the market and improvements in execution 35 2016 Forecast • 2016 revenue estimates: $397.2 million • 2016 Adjusted EBITDA: $16.0 million* * Does not reflect estimated public company expenses (estimated at approximately $750,000) ($ in thousands) 2013 2014 2015 Revenue $327,781 $294,436 $331,350 Cost of Revenue 284,703 255,381 285,938 Gross Profit 43,078 39,055 45,412 SG&A 34,729 33,972 37,767 Operating Income 8,349 5,083 7,645 Gain (Loss) On Sale of PPE 5 37 (73) Interest Expense (3,051) (3,134) (3,200) Net Income $5,303 $1,986 $4,372 EBITDA Calculation Net Income $5,303 $1,986 $4,372 Depreciation 2,513 2,594 2,630 Interest Expense 3,051 3,134 3,200 Gain (Loss) On Sale of PPE 37 (73) Other Adjustments 1,546 1,325 3,051 Adjusted EBITDA $12,413 $9,076 $13,180 Operating Statistics Revenue Growth -10.2% 12.5% Gross Margin 13.1% 13.3% 13.7% Adjusted EBITDA Margin 3.8% 3.1% 4.0%

Balance Sheet Supports Large Scale Projects and Bonding Ability Historical Balance Sheet 36 ($ in thousands) 12/31/2014 12/31/2015 Cash $8,612 $6,107 Restricted Cash 63 63 Accounts receivable, not of allowance 73,858 85,357 Gross underbillings 12,896 20,745 Other current assets 1,748 1,799 Total Current Assets $97,177 $114,071 Property and equipment, net $12,023 $13,221 Other assets 70 37 Total Assets $109,270 $127,329 Short term debt $3,021 $2,698 Accounts payable 39,911 42,569 Gross overbillings 24,669 26,272 Accrued expenses and other 9,044 15,660 Total Current Liabilities $76,645 $87,199 Senior debt $7,542 $8,748 Subordinated debt 19,507 22,209 Other 1,615 964 Total Liabilities $105,309 $119,120 Member's Equity 3,961 8,209 Total Liabilities and Members' Equity $109,270 $127,329

Comparable Companies Analysis 37 Data as of April 21, 2016 Source: Capital IQ Limbach Comparable Companies Analysis ($ in millions except Share Price) April 21, April 21, April 21, LTM 2016 CY LTM 2016 CY LTM LTM 2016 CY Company 2016 2016 2016 Estimate Estimate Estimate Share Market Enterprise EV/ EV/ Net Price/ Price/ Price Cap Value EBITDA EBITDA EBITDA EBITDA Income Earnings Earnings Comfort Systems USA Inc. $33.18 $1,234 $1,208 $112.6 $128.3 10.7x 9.4x $49.4 25.5x 20.6x EMCOR Group Inc. $48.79 $2,960 $2,795 $362.1 $374.8 7.8x 7.5x $172.3 18.1x 17.0x Electra Ltd. $135.39 $485 $580 $56.9 N/A 8.0x N/A $36.9 12.7x N/A Integrated Electrical Services, Inc. $14.88 $320 $284 $23.5 N/A 12.6x N/A $19.0 17.3x N/A Mean 9.8x 8.4x 18.4x 18.8x Median 9.4x 8.4x 17.7x 18.8x