Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - ULTRATECH INC | d165342dex311.htm |

| EX-31.2 - EX-31.2 - ULTRATECH INC | d165342dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-22248

ULTRATECH, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3169580 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 3050 Zanker Road, San Jose, California | 95134 | |

| (Address of principal executive offices) | (Zip Code) | |

(408) 321-8835

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 par value per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant, as of July 3, 2015, was approximately $179,858,176 (based upon the closing price for shares of the registrant’s common stock as reported by the NASDAQ Global Select Market on that date, the last trading date of the registrant’s most recently completed second quarter). Shares of common stock held by each officer, director and holder of 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 31, 2016, the Registrant had 26,709,639 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 filed with the Securities and Exchange Commission on February 26, 2016 are incorporated by reference into Part III and Part IV of this Annual Report on Form 10-K.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, originally filed on February 26, 2016 (the “Original Filing”). The Registrant is amending the Original Filing with respect to the following:

(1) the Registrant is refiling Part III to include the information required by Items 10, 11, 12, 13 and 14 of Part III within the period required by General Instruction G(3) to Form 10-K.

(2) the Registrant is amending and restating the exhibit index in Item 15. Exhibits, Financial Statement Schedules for the purpose of including the Registrant’s Description of its 2015 Management Incentive Compensation Plan, and to remove a disclosure referencing the Registrant’s Description of its 2012 Management Incentive Compensation Plan.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by the registrant’s principal executive officer and principal financial officer are filed as exhibits to this Amendment. Except as described above, no other changes have been made to the Original Filing.

Table of Contents

| 1 | ||||

| Item 10. Directors, Executive Officers and Corporate Governance |

1 | |||

| 4 | ||||

| 25 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

28 | |||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

As of December 31, 2015, the directors of Ultratech were as follows (ages and board committee assignments are as of April 15, 2016):

| Name |

Age | Position with the Company | ||

| Arthur W. Zafiropoulo |

77 | Chairman of the Board of Directors, Chief Executive Officer and President | ||

| Michael Child (2)(3)(4) |

61 | Director | ||

| Joel F. Gemunder (3) |

76 | Director | ||

| Nicholas Konidaris (1)(2) |

71 | Director | ||

| Dennis R. Raney (1)(2)(4) |

73 | Director | ||

| Henri Richard (2)(3)(4) |

57 | Director | ||

| Rick Timmins (1)(3) |

63 | Director |

| (1) | Member of the Audit Committee |

| (2) | Member of the Nominating and Corporate Governance Committee |

| (3) | Member of the Compensation Committee |

| (4) | Member of Business Development Committee |

Each director was elected to a one year term at the Company’s 2015 annual meeting of stockholders.

Arthur W. Zafiropoulo founded Ultratech in September 1992 to acquire certain assets and liabilities of the Ultratech Stepper Division (the “Predecessor”) of General Signal Technology Corporation (“General Signal”) and, since March 1993, has served as Chief Executive Officer and Chairman of the Board of Directors. Additionally, Mr. Zafiropoulo served as President of Ultratech from March 1993 to March 1996, from May 1997 until April 1999 and from April 2001 to January 2004. Since October 2006, he resumed the responsibilities of President and Chief Operating Officer. Between September 1990 and March 1993, he was President of the Predecessor. From February 1989 to September 1990, Mr. Zafiropoulo was President of General Signal’s Semiconductor Equipment Group International, a semiconductor equipment company. From August 1980 to February 1989, Mr. Zafiropoulo was President and Chief Executive Officer of Drytek, Inc., a plasma dry-etch company that he founded in August 1980, and which was later sold to General Signal in 1986. From July 1987 to September 1989, Mr. Zafiropoulo was also President of Kayex, a semiconductor equipment manufacturer, which was a unit of General Signal. From July 2001 to July 2002, Mr. Zafiropoulo served as Vice Chairman of Semiconductor Equipment and Materials International (“SEMI”), an international trade association representing the semiconductor, flat panel display equipment and materials industry. From July 2002 to June 2003, Mr. Zafiropoulo served as Chairman of SEMI, and Mr. Zafiropoulo has been on the board of directors of SEMI since July 1995. In December 2007, Mr. Zafiropoulo was elected as Director Emeritus of SEMI. On January 1, 2013, Mr. Zafiropoulo began serving as a member of the Board of Trustees at Northeastern University. Among other qualifications, Mr. Zafiropoulo brings extensive knowledge of and experience in the semiconductor and semiconductor capital equipment industries and businesses and his deep personal knowledge and commitment to the Company as the Company’s founder and Chief Executive Officer, as well as his personal leadership and management skills, to the Company’s Board of Directors.

Michael Child was appointed to the Company’s Board of Directors in April 2012. Mr. Child has been employed by TA Associates, Inc., a private equity firm, since 1982 where he currently serves as a Senior Advisor. Mr. Child served as a Managing Director of TA Associates from 1987 through 2010. Since September 2000, Mr. Child has served on the board of directors of IPG Photonics, which designs and manufactures high performance fiber lasers and amplifiers, and he currently serves as a member of its audit committee and as a member of its nominating and corporate governance committee. Since June 2010, Mr. Child has served on the board of directors of Finisar Corporation, a computer network equipment company, and he has served on the audit committee of Finisar since August 2010 and as chairman of the compensation committee since June 2011. He also served on the board of directors of Eagle Test Systems, a manufacturer of high performance automated test equipment for the semiconductor industry, from 2003 until November 2008 when it was acquired by Teradyne, Inc. Mr. Child holds a B.S. in Electrical Engineering from the University of California at Davis and an M.B.A. from the Stanford Graduate School of Business. Mr. Child has more than 25 years’ experience investing in and acquiring technology and technology-related companies and has served on the boards of directors of numerous public and private companies, including companies in the semiconductor industries. This broad financial and industry experience enables Mr. Child to make a valuable contribution to the board. He also brings significant knowledge regarding the Company and its operations from his previous years of service on the Company’s Board of Directors between 1993 and 1997.

Joel F. Gemunder has been a director of the Company since October 1997. Mr. Gemunder was President and a member of the board of directors of Omnicare, Inc., a pharmacy services provider, between 1981 and July 2010, and was Chief Executive Officer of Omnicare between 2001 and July 2010. Mr. Gemunder has also served as a member of the board of directors of Chemed Corporation since 1997, a company operating in two segments: VITAS Group and the Roto-Rooter Group. VITAS offers hospice services for patients with severe and life-limiting illnesses. Roto-Rooter operates in the sewer, drain and pipe cleaning, HVAC services and plumbing repair business and the HVAC and appliance repair and maintenance business. Mr. Gemunder has also served as the Vice Chairman of the Advisory Board of Healthedge Partners, a private equity firm since 2013. Among other things, Mr. Gemunder brings extensive experience as a public company chief executive officer and board member, as well as a valuable and different perspective due to his experience outside high-technology industries, to the Company’s Board of Directors.

1

Table of Contents

Nicholas Konidaris has served as a director of the Company since July 2000. Since April 2014, Mr. Konidaris has served as President and Chief Executive Officer of OmniGuide, Inc. (“OmniGuide”), a privately held company and a leader in advanced surgical solutions focusing on minimally invasive surgeries. From January 2004 until February 2014, Mr. Konidaris has served as President, Chief Executive Officer and as a director of Electro Scientific Industries, Inc., a global supplier of manufacturing equipment to increase productivity for customers in the consumer electronics, semiconductor, passive components and LED markets. From July 1999 to January 2004, Mr. Konidaris served as President and Chief Executive Officer of Advantest America, Corp., a holding company of Advantest America, Inc., which is a manufacturer of testers and handlers. From July 1997 to January 2004, Mr. Konidaris also served as Chairman of the Board, President and Chief Executive Officer of Advantest America, Inc. Mr. Konidaris has served on the board of directors of OmniGuide since 2006, and served as a member of its audit committee until March 2014. Mr. Konidaris also served as a member of the board of directors of AISI, Inc., a privately held company, from 2008 to 2010. Mr. Konidaris holds a diploma in EE from the National Technical University of Athens and a Master of Science in Management from MIT Sloan. Since 2011, Mr. Konidaris has served on the MIT Sloan North American Executive Board. Among other things, Mr. Konidaris brings his extensive experience as a public company chief executive officer and board member in the semiconductor industry to the Company’s Board of Directors.

Dennis R. Raney has served as a director of the Company since April 2003. Mr. Raney has served as Managing Director of PrimeMark Advisors, a real estate consulting firm, since November 2008. Mr. Raney served as Principal of Liberty-Greenfield, LLP, a company that advised clients on real estate issues that have significant financial or operational consequences to their business, from May 2005 until the company was wound up in November 2008. Mr. Raney served as Chief Financial Officer of eONE Global, LP, a company that identifies, develops and operates emerging electronic payment systems and related technologies that address e-commerce challenges, from July 2001 to June 2003. From March 1998 to July 2001, Mr. Raney served as Chief Financial Officer and Executive Vice President of Novell, Inc., a producer of network software. From January 1997 to December 1997, Mr. Raney served as Chief Financial Officer and Executive Vice President of QAD, Inc., a provider of enterprise resource planning software. Mr. Raney served as the chief financial officer of Bristol Myers Squibb Pharmaceutical Group from October 1993 to January 1996. Mr. Raney also served as a director of EasyLink Services Corporation (“EasyLink”), a provider of information exchange services, from March 2003 until August 2007, and served as chair of the audit committee of EasyLink’s board of directors from June 2004 until August 2007. In addition, between February 2004 and October 2008 when it was acquired by DG Fast Channel, Mr. Raney served as a director of Enliven Corporation (formerly ViewPoint Corporation), a provider of visual application development, content assembly and delivery technology, and as chair of the audit committee of Enliven’s board of directors. Mr. Raney served as a director, and as chair of the audit committee of the board of directors, of Infiniti Solutions, a provider of semiconductor testing, assembly and prototyping services, between July 2004 and September 2008. Mr. Raney served as a director of Equinix, a provider of data center and internet exchange services from April 2003 to June 2005, and served as chair of the audit committee of Equinix’s board of directors during that time. From July 2002 to June 2003, Mr. Raney served as a director of ProBusiness Services, Inc., which was acquired by Automatic Data Processing, Inc. in June 2003. Mr. Raney also served as a director and audit committee member of Redleaf, Inc., a technology operating company that provides services and capital for pre-seed state technology companies, from April 1999 to June 2003. Mr. Raney previously served as a director and audit committee member of W.R. Hambrecht & Company, an investment banking firm, from March 1999 to July 2001 and served as a director and audit committee member of ADAC Laboratories, a company that designs, develops, manufactures, sells and services electronic medical imaging and information systems, from March 1999 to March 2001. Mr. Raney holds a B.S. degree in chemical engineering from the South Dakota School of Mines & Technology and an MBA from the University of Chicago. Among other things, Mr. Raney brings extensive finance experience in both high-technology and other industries as well as related international experience, including extensive board and audit committee service and service as a public company chief financial officer, to the Company’s Board of Directors.

Henri Richard has served as a director of the Company since April 2006. Since April 2013, Mr. Richard has served as Senior Vice President of Worldwide OEM and Enterprise Sales at SanDisk Corporation. From September 2007 until April 2013, Mr. Richard has served as Senior Vice President, Chief Sales and Marketing Officer at Freescale Semiconductor, Inc. (“Freescale”). Prior to joining Freescale in September 2007, Mr. Richard was Executive Vice President, Chief Sales and Marketing Officer at Advanced Micro Devices, Inc. (“AMD”), where his duties included oversight of the company’s global field sales and support organization, corporate marketing, and go-to-market activities for all AMD customer segments, including commercial, consumer and innovative solutions groups, and the company’s 50x15 digital inclusion initiative. Mr. Richard joined AMD in April 2002 as Group Vice President, Worldwide Sales. He was promoted to Senior Vice President in May 2003 and was appointed as Executive Vice President and Chief Sales and Marketing Officer in February 2004. Prior to joining AMD, Mr. Richard was Executive Vice President of Worldwide Field Operations at WebGain, Inc., a privately held provider of Java software for Fortune 500 companies. Before WebGain, he was vice president of Worldwide Sales and Support for IBM’s Technology Group. Mr. Richard has also held senior executive positions with several notable companies in the United States and Europe, including tenures as President of the Computer Products Group at Bell Microproducts, Executive Vice President at Karma International, and Vice President at Seagate Technology/Conner Peripherals. Among other things, Mr. Richard brings extensive experience as an executive officer in the semiconductor industry, in particular in the areas of sales and marketing and market analysis, to the Company’s Board of Directors.

2

Table of Contents

Rick Timmins has served as a director of the Company since August 2000. Since April 2009, Mr. Timmins has served as a Venture Partner and investor with G-51 Capital, a seed-stage venture capital firm that invests in the software, hardware, internet, and clean technology sectors. From January 1996 until April 2008, Mr. Timmins served as Vice-President of Finance for Cisco Systems, Inc. From January 2011 to November 2012, Mr. Timmins served as a member of the board of directors of IRIS International, Inc., a company that designs, develops, manufactures and markets in-vitro diagnostic products, consumables and supplies for urinalysis and body fluids. Mr. Timmins serves as a member of the audit committee of IRIS International. Since April, 2010 Mr. Timmins has served as a member of the board of directors of privately held company Socialware, a company that provides a social middleware platform. In January, 2011 Mr. Timmins joined the board of directors of the privately held company, Nexersys, which provides personal fitness exercise equipment. Mr. Timmins served as a member of the board of directors of Transmeta Corporation, a developer of computing, microprocessing and semiconductor technologies, from May 2003 until January 2009, and was the chairman of the audit committee of Transmeta’s board of directors between May 2003 and January 2009. He also served as a member of the board of directors of Treaty Oak Bancorp, Inc., a local community bank in Austin, Texas from December 2008 to February 2011. Mr. Timmins holds a B.S. degree in accounting and finance from the University of Arizona and an M.B.A. degree from St. Edward’s University. Among other things, Mr. Timmins brings extensive finance experience as well as technology industry experience to the Company’s Board of Directors.

Information concerning our executive officers is incorporated by reference from Part I of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 filed with the Securities and Exchange Commission on February 26, 2016.

There are no family relationships between any directors or executive officers.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers and any persons who are the beneficial owners of more than ten percent (10%) of the Company’s common stock to file reports of ownership and changes in ownership with the SEC. Such directors, officers and greater than ten percent (10%) beneficial stockholders are required by Securities and Exchange Commission regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms received by it and written representations from reporting persons for the 2015 fiscal year, the Company believes that all of the Company’s executive officers, directors and greater than ten percent (10%) beneficial stockholders complied with all applicable Section 16(a) filing requirements for the 2015 fiscal year.

CODE OF ETHICS

We have adopted a Code of Ethics for our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have posted this Code of Ethics on our website located at www.ultratech.com. Any future amendments to and waivers of this Code of Ethics will also be posted on our website.

AUDIT COMMITTEE

The Audit Committee of the Board of Directors (the “Audit Committee”) currently consists of three (3) directors, Messrs. Konidaris, Raney and Timmins. The Audit Committee is responsible for overseeing the integrity of the Company’s financial statements and the appointment, compensation, qualifications, independence and performance of the Company’s independent auditors, as well as compliance with related legal and regulatory requirements and performance of the Company’s accounting practices and internal controls. The Board of Directors has determined that each current member of the Audit Committee is “independent” as that term is defined in Rule 10A-3 under the Securities Exchange Act of 1934 and an “independent director” as that term is defined in Rule 5605 of The NASDAQ Stock Market’s Marketplace Rules. In addition, the Board of Directors has determined that each of Messrs. Konidaris, Raney, and Timmins is an “Audit Committee Financial Expert” as that term is defined by Item 407 of Securities and Exchange Commission Regulation S-K.

3

Table of Contents

| Item 11. | Executive Compensation |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) describes the material elements of our executive compensation program, the compensation decisions made under the program and the factors considered in making those decisions for the Company’s executive officers named in the Summary Compensation Table of this Proxy Statement (each, an “NEO”) for 2015. This CD&A also contains certain forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. Future compensation programs that we adopt may, however, differ from those currently planned or in place.

Executive Summary

The Company’s overarching compensation goal is to reward executive officers in a manner that supports a strong pay-for-performance philosophy while maintaining an overall level of compensation that the Company believes is fair, reasonable and responsible. Highlights of the Company’s executive compensation program, including key changes made for fiscal years 2015 and 2016 based on input received from the Company’s stockholders, include the following:

| • | Our annual bonus program is rigorous and based on pre-established metrics. The Compensation Committee believes the performance goals established under the Company’s annual bonus program were challenging and required the Company to perform at a high level for bonuses to be paid at target. As in 2014, the Company did not achieve the target performance levels in 2015, and the named executive officers’ annual bonuses were 51.1% of the target bonus level. In addition, in order to encourage retention, one-half of each NEO’s final bonus amount remains subject to time-based vesting requirements. Additional bonuses, based on the Company’s relative stock price performance relative to a peer group of companies considered for this purpose, were also paid for 2015. |

| • | Maximum payouts under our incentives are capped. We capped the maximum potential bonus for the operating income metric under our 2015 annual bonus program, and we capped the maximum potential bonus for both the operating income and revenue metrics under our 2016 annual bonus program. Maximum potential payouts under our long-term incentive awards for 2015, discussed below, are also capped. |

| • | Long-term incentive awards for our NEOs for 2015 were dependent upon stock price goals that have not yet been attained. We restructured our long-term incentive awards for 2015 to be dependent upon significant stock price appreciation; no portion of the awards vests based solely on the passage of time without performance. The named executive officers’ long-term incentives granted in 2015 are cash bonus opportunities that will be payable if the Company’s stock price achieves specified levels of significant appreciation over the Company’s stock price on the grant date of the awards. The potential payout is 50% of the executive’s target amount for a 30% increase in stock price by December 31, 2017 and a potential payout of the full target amount for a 60% increase in stock price by December 31, 2017. If a stock price goal is achieved, one-fourth of the applicable amount is paid out immediately on attainment of the goal, and the remainder is subject to a three-year vesting requirement. In certain circumstances, the awards could also pay out in connection with a change in control of the Company on or before December 31, 2019. Thus, the awards provide additional incentives to create value for stockholders and to continue in service with the Company. The applicable stock price goals have not yet been attained and no new long-term incentives have been awarded to the NEOs for 2016. |

| • | NEO salaries and target annual incentives remain flat. Our NEOs did not receive a base salary increase or target annual incentive increase for 2015 and have not received a base salary or target annual incentive increase for 2016. |

| • | We maintain stock ownership guidelines with a 10x guideline level of ownership for our Chief Executive Officer. The Company maintains stock ownership guidelines under which the named executive officers are expected to own specified levels of the Company’s stock. In 2016, the Company increased the guideline level of stock ownership for our Chief Executive Officer from six times base salary to ten times base salary and increased the guideline level of stock ownership for each member of the Board of Directors who is not employed by the Company or one of our subsidiaries (a “non-employee director”) from five times to six times the director’s base annual cash retainer for service on the Board of Directors. |

| • | We maintain anti-hedging and anti-pledging policies. The Company adopted anti-hedging and anti-pledging policies with respect to the Company’s stock. |

| • | We adopted a clawback policy. In April 2016, the Company adopted a “clawback” policy which allows the Company to recover amounts awarded under our incentive programs in connection with a restatement of the Company’s financial statements due to noncompliance with applicable securities laws. |

4

Table of Contents

| • | We updated our peer group of companies. The Compensation Committee, with advice from its independent compensation consultant, engaged in a comprehensive review of the peer group of companies considered in reviewing the Company’s executive compensation program for 2016 and adopted a new peer group of companies identified below. |

Stockholder Engagement and Response to our 2015 Say-on-Pay Vote. The Compensation Committee values input from the Company’s stockholders regarding the Company’s executive compensation program. At each annual meeting, we hold a non-binding advisory vote to approve the compensation of our NEOs, which is commonly referred to as a “Say-on-Pay” vote. The Compensation Committee was disappointed with the voting results for the Say-on-Pay vote at our 2015 annual meeting of stockholders. In 2015, the Company also engaged with and solicited input on our executive compensation program and related issues from various stockholders of the Company. At the start of 2015, the Compensation Committee redesigned the Company’s long-term incentive awards for 2015 as noted above to directly link the payment of the awards to significant levels of stock price appreciation. The Company did not grant other long-term incentives to our NEOs in 2015, and has not granted new long-term incentive awards to our NEOs in 2016 because the long-term incentives granted in 2015 remain outstanding and the applicable levels of stock price appreciation have not been attained. The Compensation Committee capped maximum bonus amounts for both financial measures used under our 2016 annual bonus program. The Compensation Committee determined that our NEOs would not receive base salary or target bonus increases for 2015 or for 2016. Based on concerns expressed by certain stockholder advisory groups regarding the composition of the peer group of companies considered by the Compensation Committee in reviewing the Company’s executive compensation program, the Compensation Committee, with advice from its independent compensation consultant, engaged in 2015 in a comprehensive review of the peer group of companies considered in reviewing the Company’s executive compensation program and adopted a new peer group of companies that were considered in the Compensation Committee’s review of the executive compensation program for 2016. The Company also maintains stock ownership guidelines, and anti-hedging and anti-pledging policies with respect to the Company’s stock, and adopted a “clawback” policy in 2016, all as discussed in more detail below.

Executive Compensation Policies. We maintain a number of executive compensation and related policies that we believe represent best practices. These policies include:

| • Minimum Stock Ownership Guidelines for Executives |

• No Repricing of Underwater Stock Options Without Stockholder Approval | |

| • Minimum Stock Ownership Guidelines for Non-Employee Directors |

• Independent Compensation Consultant | |

| • Anti-Hedging Policy |

• Succession Planning | |

| • Anti-Pledging Policy |

• Regular Stockholder Engagement | |

| • Clawback Policy |

||

Compensation Philosophy and Components for Executive Officers. The Compensation Committee has designed the various elements comprising the compensation packages of the Company’s executive officers to achieve the following objectives:

| • | attract, retain, motivate and engage executives with superior leadership and management capabilities, |

| • | provide an overall level of compensation to each executive officer which is externally competitive, internally equitable and performance-driven, and |

| • | ensure that total compensation levels are reflective of the Company’s financial performance and provide the executive officers with the opportunity to earn above-market total compensation for exceptional business performance. |

Each executive officer’s compensation package typically consists of three key elements: (i) a base salary, (ii) an annual cash bonus opportunity tied solely to the Company’s attainment of pre-established financial objectives, and (iii) long-term incentive awards. Typically, long-term incentives are granted in the form of stock option grants and restricted stock unit awards, although the long-term incentives for the named executive officers for 2015 were granted as cash-based awards that vest based on the Company’s stock price attaining pre-established levels of significant stock price appreciation. In each case, long-term incentives are designed to align and strengthen the mutuality of interests between the Company’s executive officers and its stockholders.

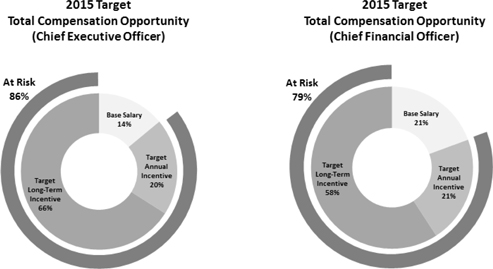

The Compensation Committee believes that a majority of each NEO’s total compensation opportunity (consisting of base salary, target annual incentive opportunity and, for 2015, target value of long-term incentives awarded in that year) should be “at risk.” For 2015, approximately 88% of Mr. Zafiropoulo’s total compensation opportunity, and approximately 79% of Mr. Wright’s total compensation opportunity, was “at risk” (consisting of their respective target annual incentive opportunities and the target value of their respective long-term incentives awarded in 2015). Annual incentives and the long-term incentives awarded in 2015 were “at risk” because the final incentive awards are based on Company performance. Indeed, as evidence of the rigor of our performance-based compensation philosophy, the 2015 annual incentives paid out at significantly less than targeted levels and no portion of the long-term incentives granted in 2015 (which are dependent upon stock price appreciation) has vested.

5

Table of Contents

Determining Compensation Levels for Executive Officers. In determining the appropriate level for each element of compensation, the Compensation Committee takes into account the Company’s financial performance and operating results and the executive officer’s duties and responsibilities. As described below, the Compensation Committee also considers executive compensation data for a peer group of companies as background information for its compensation decisions. However, the Compensation Committee does not specifically “benchmark” compensation at a particular level as compared with these other companies. Instead, the Compensation Committee refers to the peer group compensation data as one data point regarding competitive pay levels. Except as otherwise noted in this CD&A, the Compensation Committee’s executive compensation determinations are subjective and the result of the Compensation Committee’s business judgment, which is informed by the experiences of the members of the Compensation Committee, the analysis and input from, and peer group data provided by, the Compensation Committee’s independent executive compensation consultant, as well as the Compensation Committee’s assessment of overall compensation trends and trends specific to the Company’s industry.

In setting the compensation levels for Messrs. Zafiropoulo and Wright, the Compensation Committee has taken into account its determination that Messrs. Zafiropoulo and Wright have duties and responsibilities that extend beyond those of their counterparts at peer group companies and believes that their compensation levels continue to be appropriate in light of their many years of service, experience, duties and responsibilities, and commitment to the Company.

Compensation Consultants. In setting executive officer compensation for 2015, the Compensation Committee continued to utilize Compensia as its independent consulting firm. Compensia reports directly to the Compensation Committee and not to management. Compensia has not provided any services to the Company other than to the Compensation Committee, and receives compensation from the Company only for services provided to the Compensation Committee. The Compensation Committee assessed the independence of Compensia pursuant to SEC rules and concluded that the work of Compensia has not raised any conflict of interest and that Compensia is independent from the Company.

Comparative Framework. To assist the Compensation Committee in determining whether the various elements of the Company’s executive officer compensation package remain competitive at their targeted levels, the Compensation Committee’s independent compensation consultant provides competitive market data and advice to the Compensation Committee from time to time on the Company’s executive compensation programs and policies. The Compensation Committee uses such data to conduct periodic reviews of the compensation levels in effect for executive officer positions at a peer group of companies. The peer group is selected by the Compensation Committee with the assistance of its compensation consultant and consists of companies in the high-tech and precision manufacturing industries deemed to be comparable with the Company. For 2015, the companies which comprised the comparative peer group were as follows:

| Advanced Energy Industries, Inc. |

GSI Group Inc. | |

| ATMI, Inc. |

Kulicke and Soffa Industries, Inc. | |

| Axcelis Technologies, Inc. |

Mattson Technology, Inc. | |

| Brooks Automation, Inc. |

MKS Instruments, Inc. | |

| Coherent, Inc. |

Veeco Instruments Inc. | |

| Cymer, Inc. |

||

6

Table of Contents

The Compensation Committee, with input from its independent compensation consultant and based on concerns expressed by certain stockholder advisory groups regarding the composition of the peer group, engaged in a comprehensive review of the peer group and in 2015 adopted a new peer group of companies that were considered in the Compensation Committee’s review of the executive compensation program for 2016. The Compensation Committee determined that the peer group of companies adopted for this purpose should generally consist of publicly-traded US-based companies that the Compensation Committee considered similar applying the following target criteria:

| • | Industry: semiconductor equipment industry, including companies that develop, manufacture and market photolithography, laser thermal processing and inspection equipment; |

| • | Primary financial metric: revenue between 0.4 to 2.5 times the Company’s revenue; and |

| • | Secondary financial metric: market capitalization between 0.25 to 4.0 times the Company’s market capitalization (with the broader range, relative to revenue, intended to address stock price volatility and help ensure a sufficient sample size). |

As a result of this process, the peer group selected by the Compensation Committee to review the Company’s executive compensation program for 2016 consisted of the following companies:

| Axcelis Technologies, Inc. |

Mattson Technology, Inc. | |

| Cascade Microtech, Inc. |

Nanometrics Incorporated | |

| Cohu, Inc. |

PDF Solutions, Inc. | |

| Electro Scientific Industries, Inc. |

Rudolph Technologies, Inc. | |

| FormFactor, Inc. |

Veeco Instruments Inc. | |

| GSI Group Inc. |

Xcerra Corporation | |

Elements of Compensation. Each of the three major elements comprising the compensation package for executive officers (salary, target annual bonus and long-term incentive awards) for 2015 was designed to achieve one or more of the Company’s overall objectives of setting a competitive level of compensation, tying compensation to the attainment of one or more of the Company’s strategic business objectives and subjecting a substantial portion of the executive officer’s compensation to the Company’s financial success as measured in terms of the Company’s stock price performance. The following sections describe each component in more detail.

Salary. The Compensation Committee reviews the base salary level of each executive officer in January each year, with any salary adjustments for the year to be effective as of January 1 of that year. The base salary for each named executive officer is determined on the basis of his level of responsibility and experience. The Compensation Committee believes that base salary should provide a level of economic security and stability from year to year and not be dependent to any material extent on the Company’s financial performance. In addition, Messrs. Zafiropoulo and Wright have existing employment agreements with the Company which set a minimum level of annual base salary, subject to periodic upward adjustment at the discretion of the Compensation Committee. For 2015, no adjustments were made to the base salary levels of Messrs. Zafiropoulo and Wright and their base salary levels remained at $575,000 and $350,000, respectively, which the Compensation Committee believed was competitive based on the peer group data for comparable positions, taking their experience, years of service, and duties and responsibilities into account.

Cash Bonuses.

Annual Bonus Program. In March 2015, the Compensation Committee established the Management Incentive Program (the “MIP”) for 2015 for the named executive officers. As was the case for the 2014 MIP, the cash bonus opportunity under the 2015 MIP was tied solely to the Company’s revenue and operating income levels for 2015. The target bonuses set under the 2015 MIP for the Company’s executive officers were the same as in effect under the 2014 MIP and were as follows: $862,500 for Mr. Zafiropoulo (150% of his annual base salary) and $350,000 for Mr. Wright (100% of his annual base salary).

7

Table of Contents

For each executive, sixty-five percent of the potential bonus opportunity was tied to a revenue target, and the remaining thirty-five percent was tied to an operating income target. The performance levels noted below were established for each metric to determine the bonus amount payable with respect to that metric. No qualitative performance factors, whether in the terms of Company or individual performance, were established under the 2015 MIP. Goal attainment is measured on a consolidated basis with the Company’s consolidated subsidiaries for financial reporting purposes, and with revenue and operating income determined in accordance with GAAP.

The potential bonus with respect to each performance measure, as a percentage of the portion of the total target bonus allocated to that metric, is set forth below for each specified level of goal attainment.

| Level of Attainment for Revenue Goal (65% of Target Bonus Opportunity) |

Payout Percentage | |||||||||

| Below Threshold: |

< | $ | 108,000,000 | 0 | % | |||||

| Threshold: |

$ | 108,000,000 | 50 | % | ||||||

| Tier I (Target): |

$ | 180,000,000 | 100 | % | ||||||

| Tier II: |

$ | 207,000,000 | 125 | % | ||||||

| Tier III: |

$ | 234,000,000 | 200 | % | ||||||

| Level of Attainment for Operating Income Goal (35% of Target Bonus Opportunity) |

Payout Percentage | |||||||||

| Below Threshold: |

< | $ | (6,500,000 | ) | 0 | % | ||||

| Threshold: |

$ | (6,500,000 | ) | 66 | % | |||||

| Tier I (Target): |

$ | (3,250,000 | ) | 100 | % | |||||

| Tier II: |

$ | 0 | 150 | % | ||||||

| Tier III: |

$ | 3,250,000 | 200 | % | ||||||

| Tier IV: |

$ | 6,500,000 | 250 | % | ||||||

| Tier V and Above: |

³ | $ | 9,750,000 | 300 | % | |||||

If both performance goals were attained at the threshold level, then each executive officer would be awarded approximately 56% of his target bonus for 2015 (applying the relative weightings for each goal and the threshold payout levels above). If both performance goals were attained at the target level (identified as Tier I in the tables above), then each executive would be awarded his full target bonus. If the actual level of attainment for either goal were between any two designated levels up to the highest tier level for that metric, the payout percentage for that goal would be interpolated on a straight line basis between those two levels. If the actual revenue level exceeded the Tier III level established for that goal, the payout percentage for the revenue goal would be adjusted upward in accordance with the same slope that exists between the Tier II and Tier III levels for that goal. The payout percentage for the operating income goal is capped at 300%. (The maximum potential bonus for both the operating income and revenue metrics under our 2016 annual bonus program are capped.)

In February 2016, the Compensation Committee determined that the Company’s revenue for 2015 was $149.176 million, and the Company’s operating loss for 2015 was $15.040 million. Accordingly, the Compensation Committee awarded each of Messrs. Zafiropoulo and Wright a bonus under the 2015 MIP equal to 51.1% of the executive’s target bonus as set forth below:

| Name |

Bonus Tied to Operating Income Goal |

Bonus Tied to Revenue Goal |

Total Bonus Amount | |||||||||

| Arthur W. Zafiropoulo |

$ | 0 | $ | 440,624 | $ | 440,624 | ||||||

| Bruce R. Wright |

$ | 0 | $ | 178,804 | $ | 178,804 | ||||||

One-half of the bonus amount was paid following the close of 2015, and in order to encourage retention the remainder is subject to vesting and will be payable on December 31, 2016, provided the executive continues to be employed with the Company through that date (subject to accelerated payment under the 2015 MIP in connection with certain terminations of employment or a change in control of the Company prior to that date).

Special Stockholder Return Bonuses for 2015. In February 2016, the Compensation Committee also approved special bonuses for Mr. Zafiropoulo and Mr. Wright in the amounts of $100,000 and $50,000, respectively, based on the Company’s relative stock price performance and increased market capitalization during 2015 and the contributions of these executives to that performance. For this purpose the Compensation Committee considered the following group of companies, which were broader than the Company’s peer group of companies considered for executive compensation purposes generally because the Compensation Committee felt that a broader peer group (including some companies with revenues and market capitalizations significantly larger than those of the

8

Table of Contents

Company) focused on the semiconductor equipment industry was appropriate when assessing relative levels of total stockholder return. The Company’s 2015 total stockholder return placed second in this group of companies:

| Applied Materials, Inc. |

Lam Research Corporation | |

| ASML Holding N.V. |

Mattson Technology, Inc. | |

| ASM International N.V. |

MKS Instruments, Inc. | |

| Axcelis Technologies, Inc. |

Nanometrics Incorporated | |

| Brooks Automation, Inc. |

Rudolph Technologies, Inc. | |

| Electro Scientific Industries, Inc. |

Teradyne, Inc. | |

| KLA-Tencor Corporation |

Ultra Clean Holdings, Inc. | |

| Kulicke and Soffa Industries, Inc. |

Veeco Instruments Inc. | |

Long-Term Incentives. Historically, the Company has structured its long-term incentive program for executive officers in the form of equity awards under its 1993 Stock Option/Stock Issuance Plan (the “1993 Plan”). The Company’s equity grant program has generally consisted of both stock options and restricted stock units (“RSUs”). The Company believes that both types of equity awards create important incentives for its executive officers. Stock options provide further incentives to deliver value for stockholders as the value of the option depends on appreciation in the Company’s stock price after the grant date. RSUs are equivalent to shares of the Company’s common stock and provide a more predictable value than options and can thus provide a greater retention incentive. The Compensation Committee believes that the equity awards made in 2014 and in prior years under its long-term incentive program provide the Company’s executive officers with a competitive equity compensation package based on market data compiled by its independent consultant and are also in line with the Compensation Committee’s pay-for-performance objectives. These awards are designed to align the interests of the executive officer with those of the Company’s stockholders and to provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business.

For 2015, however, the Compensation Committee determined to grant long-term incentive awards for the named executive officers that would be payable in cash if the Company’s stock price achieved pre-established targets. Structuring the awards in cash helped preserve the limited number of shares of the Company’s common stock available for new award grants under the 1993 Plan, and also facilitated the structure of the incentives so that a fixed amount would be payable upon attainment of pre-determined levels of significant stock price appreciation.

In structuring the award, the Compensation Committee determined that one-half of the executive’s target award amount would be eligible to vest if, for a period of 15 consecutive trading days ending on or before December 31, 2016, the closing price of the Company’s common stock exceeded $22.80 (which is approximately 130% of the average of the high and low trading prices for the Company’s common stock on the grant date of the award). The remaining one-half of the target award amount would be eligible to vest if, for a period of 15 consecutive trading days ending on or before December 31, 2016, the closing price of the Company’s common stock exceeded $28.05 (which is approximately 160% of the average of the high and low trading prices for the Company’s common stock on the grant date of the award). Except as described below, the award will be eligible to vest only if the executive’s employment with the Company continues through the date the applicable stock price target is achieved.

The Compensation Committee established the following target award amount for each executive:

| Name |

Target Award Amount | |||

| Arthur W. Zafiropoulo |

$ | 2,800,000 | ||

| Bruce R. Wright |

$ | 1,000,000 | ||

If a stock price goal is met, twenty-five percent of the amount awarded to the executive will immediately vest and be paid, while the remaining seventy-five percent of that amount will be subject to additional time-based vesting requirements in order to encourage retention and will vest over a three-year period thereafter, subject to the executive’s continued service with the Company through the applicable vesting date. However, if the executive’s employment terminates due to an involuntary termination or due to his death or disability, any portion that is subject only to time-based vesting will fully vest and be paid on his termination of employment.

If a change in control of the Company occurs at any time on or before December 31, 2019 and the executive’s employment with the Company continues through the change in control (or his employment is involuntarily terminated in connection with the change in control) then: (1) any portion of the incentive that is subject only to time-based vesting will fully vest; and (2) if the consideration paid for a share of the Company’s common stock in the transaction is $22.80 or more and the executive had not yet earned the full amount of his target award opportunity based on stock price, the executive will be entitled to payment of an additional portion of such target award (determined by applying such per share consideration to the $22.80 and $28.05 goals above, and pro-rating the target award opportunity if such per share consideration falls between those goals) less any portion of the target award amount that had been earned based on stock price performance prior to the change in control. In no event will the amount paid under an award exceed the executive’s target award amount set forth above.

9

Table of Contents

Because these long-term cash awards will vest only if our stock price achieves the specified performance levels within a relatively short period of time following the grant date, the Compensation Committee believed they help further align the interests of the executives with those of our stockholders. In addition, the awards provide an additional retention incentive as the awards are scheduled to fully vest only if the executive remains with the Company not only through the achievement of the stock price goals, but also for an extended vesting period following the time the goals are achieved.

Because the applicable stock price goals had not yet been met but the Compensation Committee believed that the goals remained meaningful over the long-term, and that this incentive structure for Messrs. Zafiropoulo and Wright continued to be appropriate, performance-driven, and aligned with stockholder interests, in February 2016 the Compensation Committee extended the December 31, 2016 deadline to attain the goals to December 31, 2017. In light of that extension, the Compensation Committee has not granted new or additional long-term incentive awards to our NEOs in 2016.

Under applicable SEC rules, long-term incentives structured as cash awards are generally not reported in the Summary Compensation Table as compensation for the year in which the award is granted. Rather, these awards would be reported as compensation for the year in which the award is paid. Accordingly, any payment of these awards will be reflected in the Summary Compensation Table as compensation for the year in which the stock price goal is achieved (or, as to the portion of the award that is subject to additional time-based vesting requirements, as compensation for the year in which that portion vests and is paid).

Employment Agreements; Severance and Change in Control Benefits. The Company entered into employment agreements in 2008 with Messrs. Zafiropoulo and Wright that provide for severance benefits if the executive’s employment terminates in certain circumstances. A summary of the material terms of the employment agreements, including these severance benefits, may be found below in the section entitled “Employment Contracts, Termination of Employment and Change in Control Arrangements.”

The Company believes the severance benefits payable under the employment agreements are fair and reasonable in light of the many years of service Messrs. Zafiropoulo and Wright have rendered the Company and the level of dedication and commitment they have shown over those years. The agreements provide for a higher level of severance benefits if the executive’s employment terminates in connection with a change in control. The Company believes enhanced severance benefits are appropriate in these circumstances as they provide additional security for Messrs. Zafiropoulo and Wright at a time when their future with the Company may be uncertain and allow them to focus their attention on acquisition proposals that are in the best interests of the stockholders, without undue concern as to their own financial situation. The Company’s equity awards granted to the named executive officers prior to 2015 also include accelerated vesting upon a change in control. The Company believes that this benefit is appropriate because these awards were designed to provide the executives with an opportunity, if the stock price performed well, to accumulate wealth for their retirement years, and that the executives should therefore realize the full benefits of these awards if a change in control were to occur.

Executive Officer Perquisites. The employment agreements entered into in 2008 between the Company and Messrs. Zafiropoulo and Wright require the Company to provide them with certain retiree medical benefits and, for Mr. Zafiropoulo, a Company automobile for his use. For Mr. Zafiropoulo, these provisions were a continuation of benefits that he was entitled to under his 2003 employment agreement with the Company. Except for benefits that the Company is required to provide under the terms of their respective employment agreements, it is not the Company’s practice to provide its executive officers with significant perquisites.

Other Programs. The Company’s executive officers are eligible to participate in the Company’s 401(k) plan on the same basis as all other regular U.S. employees. The Company also maintains a non-qualified deferred compensation program for its executive officers and other key employees. Under that program, participants may elect to defer all or a portion of their salary or bonus each year, and the deferred sums will be credited with notional earnings (or losses) based on their investment elections. Such deferred compensation (as adjusted for such notional earnings or losses) will become payable following the participant’s termination of employment and may be paid in a lump sum or in installments based on the circumstances under which the termination event occurs and the prior distribution election made by the participant. The program is described in more detail below in the section entitled “Nonqualified Deferred Compensation.” The Company does not provide the executive officers with any defined benefit pension plan or supplemental executive retirement plan.

Compensation-Related Policies

Executive and Director Stock Ownership Policy. The Company maintains a policy under which the Company’s Chief Executive Officer is expected to acquire and hold shares of common stock of the Company with a value of at least ten times his base salary, the Company’s Chief Financial Officer is expected to acquire and hold shares of common stock of the Company with a value of at least two times his base salary, our other executive officers are expected to acquire and hold shares of common stock of the Company with a value of at least one times their base salary, and each of our non-employee directors is expected to acquire and hold shares of common stock of the Company with a value of at least six times the director’s base annual cash retainer for service on the Board of Directors. For these purposes, restricted stock and restricted stock unit awards that are subject only to time-based vesting are included in the executive’s ownership. However, shares subject to stock options that have not been exercised and shares subject to performance-based awards are not taken into account.

10

Table of Contents

Anti-Hedging and Anti-Pledging Policy. The Company’s insider trading policy prohibits executive officers and other employees, as well as members of the Board of Directors, from engaging in hedging transactions related to the Company’s common stock, or pledging or short-selling the Company’s common stock.

Clawback Policy. In April 2016, we adopted a clawback policy that allows our Board of Directors or Compensation Committee to require reimbursement or cancellation of awards or payments made under our cash and equity incentive programs to the Company’s officers in certain circumstances where the amount of the award or payment was determined based on the achievement of financial results that were subsequently the subject of an accounting restatement due to material noncompliance with applicable securities laws.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code disallows a tax deduction to publicly held companies for compensation paid to certain of their executive officers to the extent such compensation exceeds $1.0 million per covered officer in any year. The limitation applies only to compensation that is not considered to be “performance-based” under Section 162(m). Although the Compensation Committee considers the impact of Section 162(m) when developing and implementing executive compensation programs, the Compensation Committee believes that it is important and in the best interests of stockholders to preserve flexibility in designing compensation programs. Accordingly, the Compensation Committee retains discretion to approve compensation arrangements for executive officers that are not fully deductible. Further, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) and the regulations issued thereunder, no assurance can be given, notwithstanding the Compensation Committee’s efforts, that compensation intended to satisfy the requirements for deductibility under Section 162(m) does in fact do so.

Risk Assessment of Executive Officer Compensation

The Company believes the various components of the total compensation package of the executive officers, as discussed above, are appropriately balanced so as to avoid any excessive risk-taking by such individuals. First, the long-term equity awards granted prior to 2015, which are tied to the market price of the Company’s common stock and many of which remain outstanding, represent a significant component of our executive officers’ compensation over the past few years and promote a commonality of interest between the executive officers and the Company’s stockholders in sustaining and increasing stockholder value. As described above, a substantial portion of each executive officer’s compensation for 2015 was in the form of a long-term cash award tied to stock price appreciation and the creation of value for our stockholders. Because long-term incentive awards are typically made on an annual basis, the executive officers always have unvested awards outstanding that could decrease significantly in value if the Company’s business is not managed to achieve its long term goals. Second, under the Company’s annual bonus program, an individual target bonus amount is established for each executive officer, and the performance measures upon which the actual bonus amounts are determined are tied to strategic objectives intended to help sustain stockholder value. Payments based on performance goal attainment under the annual bonus program are also subject to a service-based vesting schedule so that a participant must remain with the Company for one or more years following the fiscal year in which the bonus is earned in order to receive his or her full payment for that performance period, thereby further encouraging long-term focus. For additional information, please see “Risk Assessment of Compensation Policies and Practices” below.

11

Table of Contents

Summary Compensation Information - Fiscal Years 2013-2015

The following table provides certain summary information concerning the compensation earned for services rendered in all capacities to the Company and its subsidiaries for the years ended December 31, 2015, 2014 and 2013, respectively, by the Company’s Chief Executive Officer and Chief Financial Officer. Each of the listed individuals shall be hereinafter referred to as a “named executive officer.” There were no other executive officers of the Company during the 2015 fiscal year.

| Name and Principal Position |

Year | Salary ($)(1) |

Bonus ($)(2) |

Stock Awards ($)(3) |

Option Awards ($)(4) |

Non-Equity Incentive Plan Compensation Earnings ($)(5) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(6) |

All Other Compensation ($)(7) |

Total ($) | |||||||||||||||||||||||||||

| Arthur W. Zafiropoulo, Chairman of the Board, Chief Executive Officer and President |

|

2015 2014 2013 |

|

|

575,000 596,116 518,053 |

|

|

100,000 — — |

|

|

— 1,168,250 2,707,000 |

|

|

— 1,057,518 — |

|

|

440,624 119,378 — |

|

|

— — — |

|

|

76,200 76,200 83,850 |

(8) (9) (10) |

|

1,191,824 3,017,462 3,308,903 |

| |||||||||

| Bruce R. Wright, Senior Vice President, Finance, Chief Financial Officer and Secretary |

|

2015 2014 2013 |

|

|

350,000 363,462 322,269 |

|

|

50,000 — — |

|

|

— 584,125 1,353,500 |

|

|

— 793,138 — |

|

|

178,804 48,443 — |

|

|

117 4,346 8,302 |

|

|

— — 7,650 |

(11) |

|

578,921 1,793,514 1,691,721 |

| |||||||||

| (1) | This column includes amounts deferred under the Company’s 401(k) Plan, a qualified deferred compensation plan under section 401(k) of the Internal Revenue Code, and the Company’s Executive Deferred Compensation Plan, a non-qualified deferred compensation program. |

| (2) | The amounts in this column represent special bonuses awarded to the named executive officers based on the Company’s stock price performance and increased market capitalization during 2015 as described in the “Compensation Discussion and Analysis” above |

| (3) | The amount indicated in the column for each fiscal year represents the aggregate grant-date fair value of the restricted stock unit awards made in that year. The grant-date fair value is in each instance calculated in accordance with Accounting Standards Codification (“ASC”) Topic 718, Compensation-Stock Compensation (“ASC Topic 718”), on the basis of the closing price of the Company’s common stock on the award date and does not take into account any estimated forfeitures related to service-vesting or performance-vesting conditions. For further information concerning such grant-date fair value, please see footnote 5 to the Company’s audited financial statements for the fiscal year ended December 31, 2015 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 26, 2016. |

| (4) | The amount indicated in the column for each fiscal year represents the aggregate grant-date fair value of the stock option grants made in that year, as calculated in accordance with ASC Topic 718, and does not take into account any estimated forfeitures related to service-vesting or performance-vesting conditions. The assumptions used in the calculation of such grant-date fair value are set forth in footnote 5 to the Company’s audited financial statements for the year ended December 31, 2015 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 26, 2016. |

| (5) | The amount shown for each fiscal year reflects the actual bonuses earned under the Management Incentive Plan (the “MIP”) in effect for that fiscal year. For the 2015 fiscal year, one-half of the reported bonus amount for the 2015 MIP was paid to the named executive officer following the close of the 2015 fiscal year, and the remaining portion of the reported bonus amount for the 2015 MIP is subject to vesting tied to the named executive officer’s continued service with the Company through December 31, 2016. For the 2014 fiscal year one-half of the reported bonus amount for the 2014 MIP was paid to the named executive officer following the close of the 2014 fiscal year, and the remaining portion of the reported bonus amount for the 2014 MIP is subject to an annual installment vesting schedule tied to the named executive officer’s continued service with the Company over an additional two year period that will end on December 31, 2016. For the 2013 fiscal year, no bonuses were earned under the Management Incentive Plan as the applicable performance goals were not achieved. |

12

Table of Contents

| (6) | The amounts in this column represent the notional gain for the applicable fiscal year with respect to the compensation deferred by the named executive officer under the Executive Deferred Compensation Plan. For further information regarding the Executive Deferred Compensation Plan, please see the section entitled “Nonqualified Deferred Compensation” below. |

| (7) | In the Company’s proxy statements for the past two years, the amounts reported in this column of the Summary Compensation Table for the 2013 and 2014 fiscal years included amounts accrued by the Company for that fiscal year with respect to the lifetime retiree health care coverage to which the named executive officer would be entitled following his termination of employment. The Company has determined that these accruals should not have been included in the Summary Compensation Table, and accordingly, the amounts reflected in this column for the 2013 and 2014 fiscal years have been adjusted to remove these accrued amounts. Corresponding adjustments have also been made to the total compensation column for these two fiscal years. For further information regarding such health care coverage, including the Company’s estimate of its costs to provide such coverage, please see the section entitled “Employment Contracts, Termination of Employment Agreements and Change in Control” below. |

| (8) | Represents $76,200 attributable to the costs to the Company for the non-business use of a Company car provided to Mr. Zafiropoulo. |

| (9) | Represents $76,200 attributable to the costs to the Company for the non-business use of a Company car provided to Mr. Zafiropoulo. |

| (10) | Represents (i) $76,200 attributable to the costs to the Company for the non-business use of a Company car provided to Mr. Zafiropoulo and (ii) $7,650 attributable to the matching contribution made by the Company to Mr. Zafiropoulo’s account in the Company’s 401(k) plan. |

| (11) | Represents $7,650 attributable to the matching contribution made by the Company to Mr. Wright’s account in the Company’s 401(k) plan. |

Grants of Plan-Based Awards - Fiscal 2015

The following table provides certain summary information concerning each grant of an award made to a named executive officer in the 2015 fiscal year under a compensation plan. We did not grant stock or option awards to our named executive officers in the 2015 fiscal year.

| Name |

Grant Date |

Potential Payouts Under Non-Equity Incentive Plan Awards |

All Other Stock Awards: Number of Shares of Stock or Units (#) |

All Other Option Awards: Number of Securities Underlying Options (#) |

Exercise or Base Price of Option Awards ($/Share) |

Grant Date Fair Value of Equity Awards ($) | ||||||||||||||||||||||

| (a) | (b) | Threshold ($)(c) |

Target ($)(d) |

Maximum ($)(e) |

(f) | (g) | (h) | (i) | ||||||||||||||||||||

| Arthur W. Zafiropoulo |

|

3/27/2015 3/27/2015 |

(1) (2) |

|

199,238 1,400,000 |

|

|

862,500 2,800,000 |

|

|

|

(1) (2) |

|

— — |

|

|

— — |

|

||||||||||

| Bruce R. Wright |

|

3/27/2015 3/27/2015 |

(1) (2) |

|

194,600 500,000 |

|

|

350,000 1,000,000 |

|

|

|

(1) (2) |

|

— — |

|

|

— — |

|

||||||||||

| (1) | Reflects the potential amounts payable under the Company’s 2015 MIP based on the Company’s attainment of revenue and operating income goals set at various levels for that year. Sixty-five percent (65%) of the target bonus amount for each named executive officer was allocated to the revenue performance metric, and thirty-five percent (35%) of the target bonus amount for each named executive officer was allocated to the operating income performance metric. If the Company’s revenue for the 2015 fiscal year exceeded the highest revenue performance target established for the plan, the bonus potential for the revenue goal would be increased on an extrapolated basis in accordance with the same slope that applies to the two highest performance levels. The bonus potential for the operating income goal is capped at 300% of the target bonus amount allocated to that metric. For purposes of the table, the potential bonus indicated for each level assumes that both performance goals were attained at the highest revenue and operating income performance targets established for the plan. For further information concerning such potential bonus amounts, please see the description of the 2015 MIP below. |

| (2) | Reflects the potential amounts payable pursuant to a long-term cash award granted to each named executive officer that will vest and be payable if the Company’s stock price exceeds certain targets established by the Compensation Committee, subject to the executive’s continued employment with the Company through the specified vesting dates. For further information concerning these awards, please see the description of the 2015 Long-Term Cash Awards below. |

13

Table of Contents

2015 Management Incentive Plan. Bonuses under the 2015 MIP were determined based on the Company’s revenue and operating income for the 2015 fiscal year against specified performance levels established by the Compensation Committee for each metric. Sixty-five percent (65%) of the target bonus for each named executive officer was allocated to the revenue performance goal, and the remaining thirty-five percent (35%) was allocated to the operating income performance goal. For each specified performance level, a designated percentage of the executive’s target bonus allocated to that metric would be payable (subject to the vesting requirement noted below). If the actual level of performance for a particular metric were below the threshold level for that metric, then no bonus amount would be payable with respect to that metric. If the actual level of performance were between any two designated levels up to the highest level for that metric, the potential bonus with respect to that goal would be interpolated on a straight line basis between those two levels. If the Company’s revenue for the 2015 fiscal year exceeded the highest revenue performance target established for the plan, the bonus potential for the revenue goal would be increased on an extrapolated basis in accordance with the same slope that applies to the two highest performance levels. The bonus potential for the operating income goal is capped at 300% of the target bonus amount allocated to that metric. Any bonus awarded under the 2015 Management Incentive Program would vest and be payable in two installments, with one-half of the bonus amount to be paid at the end of the 2016 and 2017 fiscal years, subject to the named executive officer’s continued service with the Company through the vesting date. Each bonus installment will be paid as it vests and will earn interest at a designated rate until paid. For more information regarding the 2015 MIP and the specific performance targets and payout levels, please see the section entitled “Elements of Compensation—Annual Cash Bonus” in the Company’s Compensation Discussion and Analysis.

2015 Long-Term Cash Awards. In March 2015, each named executive officer was granted an incentive award that will be payable in cash if the Company’s stock price meets or exceeds certain targets established by the Compensation Committee on or before December 31, 2016, subject to applicable time-based vesting requirements. The awards will also vest in certain circumstances if the applicable stock price target is attained in connection with a change in control of the Company that occurs prior to December 31, 2019. For more information regarding the 2015 Long-Term Cash Awards,” please see the section entitled “Elements of Compensation—Long-Term Incentives” in the Company’s Compensation Discussion and Analysis.

For information regarding the treatment of these awards upon certain terminations of the executive’s employment or a change in control of the Company, please see “Employment Contracts, Termination of Employment Agreements and Change of Control” below.

14

Table of Contents

Outstanding Equity Awards at Fiscal 2015 Year-End

The following table provides certain summary information concerning outstanding equity awards held by the named executive officers as of December 31, 2015.

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested(#) |

Market Value of Shares or Units of Stock That Have Not Vested ($)(1) |

||||||||||||||||||

| Arthur W. Zafiropoulo |

26,000 | (2) | $ | 515,320 | ||||||||||||||||||||

| 28,000 | (3) | $ | 554,960 | |||||||||||||||||||||

| 4,800 | (4) | $ | 95,136 | |||||||||||||||||||||

| 12,000 | 13,000 | (5) | $ | 17.30 | 10/26/2024 | |||||||||||||||||||

| 12,000 | 13,000 | (5) | $ | 24.10 | 7/20/2024 | |||||||||||||||||||

| 12,000 | 13,000 | (5) | $ | 26.75 | 4/27/2024 | |||||||||||||||||||

| 12,000 | 13,000 | (5) | $ | 25.31 | 2/2/2024 | |||||||||||||||||||

| 75,000 | — | $ | 9.66 | 2/3/2018 | ||||||||||||||||||||

| Bruce R. Wright |

13,000 | $ | 257,660 | |||||||||||||||||||||

| 14,000 | $ | 277,480 | ||||||||||||||||||||||

| 1,600 | $ | 31,712 | ||||||||||||||||||||||

| 9,000 | 9,750 | (5) | $ | 17.30 | 10/26/2024 | |||||||||||||||||||

| 9,000 | 9,750 | (5) | $ | 24.10 | 7/20/2024 | |||||||||||||||||||

| 9,000 | 9,750 | (5) | $ | 26.75 | 4/27/2024 | |||||||||||||||||||

| 9,000 | 9,750 | (5) | $ | 25.31 | 2/2/2024 | |||||||||||||||||||

| 25,599 | 1,067 | (6) | $ | 28.92 | 10/21/2022 | |||||||||||||||||||

| 25,601 | 1,066 | (6) | $ | 30.12 | 7/22/2022 | |||||||||||||||||||

| 25,000 | 1,066 | (6) | $ | 31.24 | 4/22/2022 | |||||||||||||||||||

| 25,000 | — | $ | 22.00 | 10/23/2021 | ||||||||||||||||||||

| 25,000 | — | $ | 27.75 | 7/24/2021 | ||||||||||||||||||||

| 25,000 | — | $ | 30.91 | 4/25/2021 | ||||||||||||||||||||

| 25,000 | — | $ | 22.53 | 1/30/2021 | ||||||||||||||||||||

| 25,000 | — | $ | 18.65 | 10/25/2020 | ||||||||||||||||||||

| 25,000 | — | $ | 18.92 | 7/25/2020 | ||||||||||||||||||||

| 25,000 | — | $ | 15.65 | 4/25/2020 | ||||||||||||||||||||

| 19,528 | — | $ | 12.25 | 2/7/2020 | ||||||||||||||||||||

| 4,800 | — | $ | 9.66 | 2/3/2018 | ||||||||||||||||||||