Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - DOVER Corp | a20160331-10xq.htm |

| EX-32 - EXHIBIT 32 - DOVER Corp | a2016033110-qexhibit32.htm |

| EX-10.2 - EXHIBIT 10.2 - DOVER Corp | a2016033110-qexhibit102.htm |

| EX-31.1 - EXHIBIT 31.1 - DOVER Corp | a2016033110-qexhibit311.htm |

| EX-10.1 - EXHIBIT 10.1 - DOVER Corp | a2016033110-qexhibit101.htm |

| EX-10.4 - EXHIBIT 10.4 - DOVER Corp | a2016033110-qexhibit104.htm |

| EX-31.2 - EXHIBIT 31.2 - DOVER Corp | a2016033110-qexhibit312.htm |

Exhibit 10.3

Performance Share Award

DATE: February 11, 2016

TO: «Name»

Here are the details for your Performance Share Award:

Your business unit - | «Company» |

The Performance Period is the three-year period - | 2016 - 2018 |

Your target Performance Share Award at the 100% level - | « # of Shares» Shares |

The actual Performance Shares to be paid to you, if any, will be derived from the Performance Share Payout Table included in this Award agreement.

Your Performance Share Award is subject to all the terms and provisions of the Dover Corporation ("Dover") 2012 Equity and Cash Incentive Plan ("Plan"), which terms and provisions are expressly incorporated into and made a part of the Award as if set forth in full herein. Capitalized terms used but not defined herein have the meanings ascribed to them in the Plan.A copy of the Plan can be found at www.dovercorporation.com, in the Investor Information area, under SEC Filings, in the Proxy Statement filed on March 19, 2012, Appendix A.

In addition, your Performance Share Award is subject to the following:

1. Within two and one-half months following the end of the Performance Period, Dover will issue you Common Stock if your business unit has reached certain levels of internal total shareholder return (“iTSR”), as set forth in the Performance Share Payout Table, and the other conditions of your Performance Share Award are satisfied.

2. A summary of the definition of iTSR, for your business unit is set forth in the Definition of iTSR.

3. The aggregate maximum payout for each business unit (determined after applying the individual payment limitation noted in the next sentence, if applicable) in respect of all Performance Share Awards for a specific performance period shall not exceed the product of (i) 1.75%, times (ii) the sum of the business unit’s change in entity value plus free cash flow (as such terms are defined in the Definition of iTSR) for that Performance Period. In no event will the performance payout to any one individual exceed 500,000 shares of Common Stock for the Performance Period.

4. As a condition of receiving your Performance Share Award, you agree to be bound by the terms and conditions of the Dover Corporation Anti-hedging and Anti-pledging Policy and by any Clawback Policy to be adopted by Dover, as such policies may be in effect from time to time. The Anti-hedging and Anti-pledging Policy prohibits hedging or pledging any Dover equity securities held by you or certain designees, whether such Dover securities are, or have been, acquired under the Plan, another compensation plan sponsored by Dover, or otherwise. Please review the Anti-hedging and Anti-pledging Policy to make sure that you are in compliance. You may obtain a copy of the current version of the Anti-hedging, Anti-pledging, and any Clawback Policy to be adopted by Dover, by contacting the Benefits Department at 630-541-1540.

5. For Non-US Employees, your Performance Share Award is subject to the terms and conditions of the Addendum for Non-US Employees.

6. Your Performance Share Award is not transferrable by you other than by will or the laws of descent and distribution and in accordance with the applicable terms and conditions of the Plan.

7. Dover reserves the right to amend, modify, or terminate the Plan at any time in their discretion without notice.

Performance Share Payout Table

iTSR for Performance Period | Payout (% of target) |

<6% | 0% |

6% | 25% |

9% | 100% |

17% | 300% |

>24% | 400% |

The payout formula will be applied on a sliding scale between 0% and 400% based on the business unit’s iTSR for the Performance Period.

---------------------------------------------------------------------------------------------------------------------------------------

Definition of iTSR

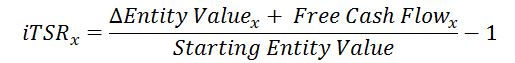

Conceptual formula for iTSR calculation:

Explanation of iTSR formula:

Change in entity value is nine times the change in EBITDA values, comparing the full base year to the full final year of the performance period. The base year iTSR is the minimum value of an Operating Company, to which the 9X multiple is applied to calculate an EV. The base year iTSR is calculated using the highest of the following:

(i) | Base-Year EBITDA |

(ii) | 10% of Base-Year Sales |

(iii) | 90% of Prior-to-Base-Year iTSR Base |

Free cash flow is the cash flow generated by your business unit, including your business unit’s operating profit plus depreciation, amortization and proceeds from dispositions, less taxes and investments made for future growth (capital spending, working capital and acquisitions) and adjusted for other non-recurring items.

EBITDA is pre-tax income adjusted for non-operating and non-recurring items plus depreciation and amortization.

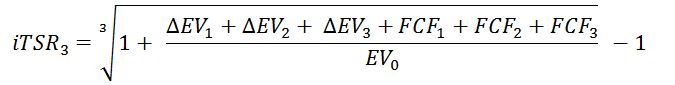

Mathematical formula for Cash 3 Year iTSR Performance Plan payout:

for Transfers/Promotions

The following rules will apply to you if you are transferred from one Dover business unit to another Dover business unit. These rules apply to all Performance Share payments you may be entitled to under this and any other Performance Share Award under the Plan you may have, as if part of your original Award.

(i) For the first Performance Share payment date that occurs after your transfer, any Performance Share payment that may be due will be based on the performance of your old business unit.

(ii)For the second Performance Share payment date that occurs after your transfer, any Performance Share payment that may be due will be based on the performance of either your old business unit or your new business unit, whichever results in the higher payment to you.

(iii)For the third Performance Share payment date that occurs after your transfer, any Performance Share payment that may be due will be based on the performance of your new business unit.

(iv)Any Performance Share payment under an Award made at one business unit that becomes payable after you transfer to another business unit will still be based on that Award’s original share amount.

For purposes of these rules your old business unit is the business unit indicated on your Award. Your new business unit is the business unit where you are employed on the payment date.