Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PRESS RELEASE - BOYD GAMING CORP | exhibit991-pressrelease.htm |

| 8-K - 8-K - BOYD GAMING CORP | boyd8-kapril212016.htm |

BOYD GAMING’S ACQUISITION OF ALIANTE CASINO + HOTEL + SPA APRIL 2016

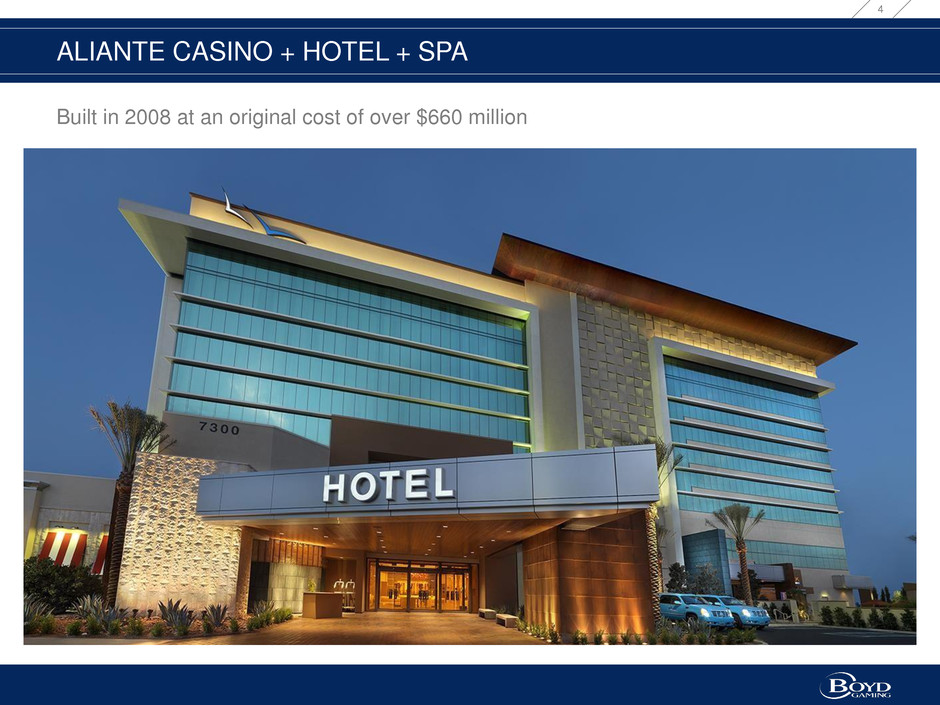

TRANSACTION OVERVIEW Aliante Casino + Hotel + Spa • Built in 2008 at an original cost of over $660 million • Initial entry into the North Las Vegas market • Positioned to benefit from significant future development in northern part of Las Vegas valley Total net purchase price: $380 million • Approximately $8.0 million of year one synergies plus operational improvements • Combination of synergies, operational improvements and market growth expected to generate EBITDA of more than $40.0 million in three to five years • Generates free cash flow and is EPS accretive in first full year Cash on Hand Third Quarter 2016; subject to customary closing conditions and required regulatory approvals 2 ACQUISITION TRANSACTION VALUE FINANCING EXPECTED CLOSING

STRATEGIC RATIONALE • High quality asset • Originally built at a cost of over $660 million • Full suite of premium amenities that align with our non-gaming investment strategy • Las Vegas economy strengthening and positioned for continued growth • North Las Vegas projected to have significant growth in jobs and housing • Aliante ideally located to capture growth in the northern part of the Las Vegas valley • Access to new customers in a market where we have limited exposure today • Benefits from participation in brand and segment wide promotions • B Connected program to drive increased loyalty of existing customers • Approximately $8.0 million of year one cost synergies plus operational improvement opportunities • Significant long-term revenue and EBITDA growth opportunities 3 PREMIUM ASSET HIGH GROWTH MARKET REVENUE ENHANCEMENTS COST SYNERGIES & FUTURE GROWTH

ALIANTE CASINO + HOTEL + SPA Built in 2008 at an original cost of over $660 million 4

ALIANTE CASINO + HOTEL + SPA AAA Four Diamond Hotel 5

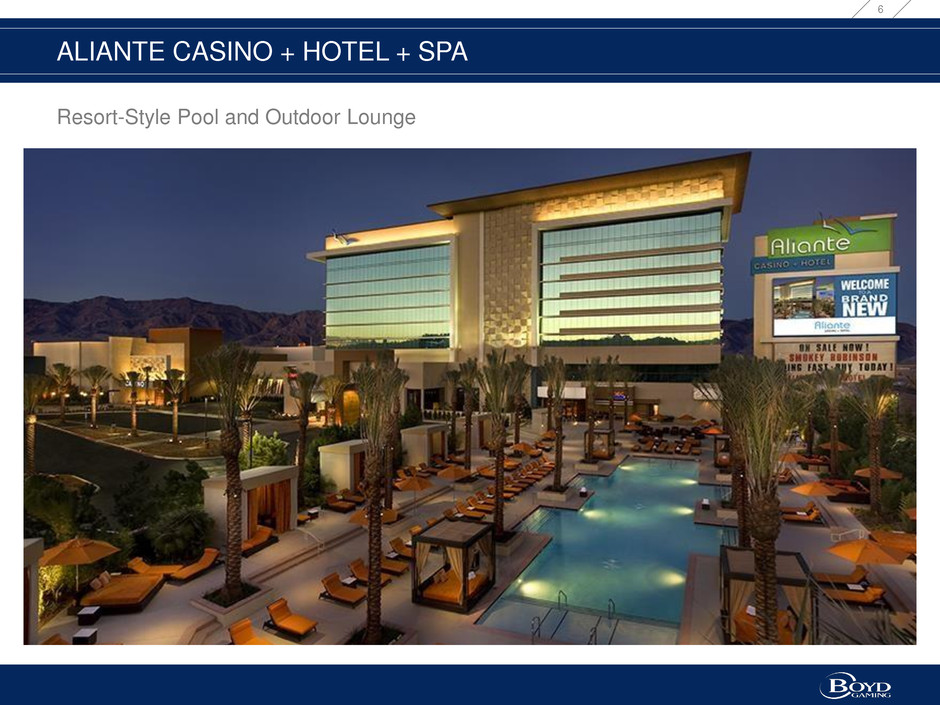

ALIANTE CASINO + HOTEL + SPA Resort-Style Pool and Outdoor Lounge 6

ALIANTE CASINO + HOTEL + SPA Modern and Attractive Food & Beverage Offerings Consistent with Our Non-Gaming Strategy 7

ALIANTE CASINO + HOTEL + SPA High Quality Entertainment and Meeting Venues 8

ALIANTE CASINO + HOTEL + SPA Well Designed and Equipped Casino Including Slots, Tables, Race & Sports and Bingo 9

ALIANTE CASINO + HOTEL + SPA • 82,000-sq. ft. gaming floor that offers 1,837 slots, 30 table games and a 200-seat bingo room • 202-room hotel (including suites) • Covered and surface parking lot offering 4,800 parking spaces • Diversified restaurant offerings, including five signature restaurants • Ultra-modern, 170-seat race and sports book with sports bar and viewing patio • 16-screen movie theater complex • 650-seat showroom • 14,000 sq. ft. of event and banquet space, including four ballrooms and six meeting/conference rooms • Luxury spa and massage area • Expansive, resort-style pool and outdoor lounge area with cabanas • Modern fitness center 10

1.8 1.9 2.0 2.1 2.2 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Mi lli on s THE LAS VEGAS LOCALS MARKET 11 Population growth ranks among the top in the country 3rd of the Top 30 US Metros Source: Clark County Comprehensive Planning; U.S. Census M ill io n s

750,000 770,000 790,000 810,000 830,000 850,000 870,000 890,000 910,000 930,000 950,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 THE LAS VEGAS LOCALS MARKET 12 Total employment has recovered to pre-recession highs in 2016 Source: U.S. Bureau of Labor Statistics, Data to March 2016

0% 2% 4% 6% 8% 10% 12% 14% 16% '10 '11 '12 '13 '14 '15 '16 THE LAS VEGAS LOCALS MARKET 13 Unemployment fell below 6 percent in 2016 Source: U.S. Bureau of Labor Statistics, Data to February 2016

THE LAS VEGAS LOCALS MARKET 14 Tourism continues to expand 33 34 35 36 37 38 39 40 41 42 43 '06'07'08'09'10'11'12'13'14'15 Mi lli on s Visitor volume reaches new heights Convention travel is growing Hotel occupancy rates are rising 74% 76% 78% 80% 82% 84% 86% 88% 90% 92% '06'07'08'09'10'11'12'13'14'15 0 1 2 3 4 5 6 7 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Mi lli on s

THE LAS VEGAS LOCALS MARKET The Site Selectors Guild awarded the Governor’s Office of Economic Development with The Excellence in Economic Development Award for three key wins. Beyond tourism: Nevada is recognized for its economic development wins 15

BROADENING OUR LAS VEGAS FOOTPRINT TO THE HIGH GROWTH MARKET OF NORTH LAS VEGAS 16

190,000 195,000 200,000 205,000 210,000 215,000 220,000 225,000 230,000 235,000 240,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Population NORTH LAS VEGAS MARKET 17 The North Las Vegas market is positioned to yield significant population growth Source: Clark County Comprehensive Planning Population

80,000 85,000 90,000 95,000 100,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Employment NORTH LAS VEGAS MARKET 18 The North Las Vegas market is positioned to yield the highest level of growth in the Las Vegas Valley Source: United States Bureau of Labor Statistics Employment

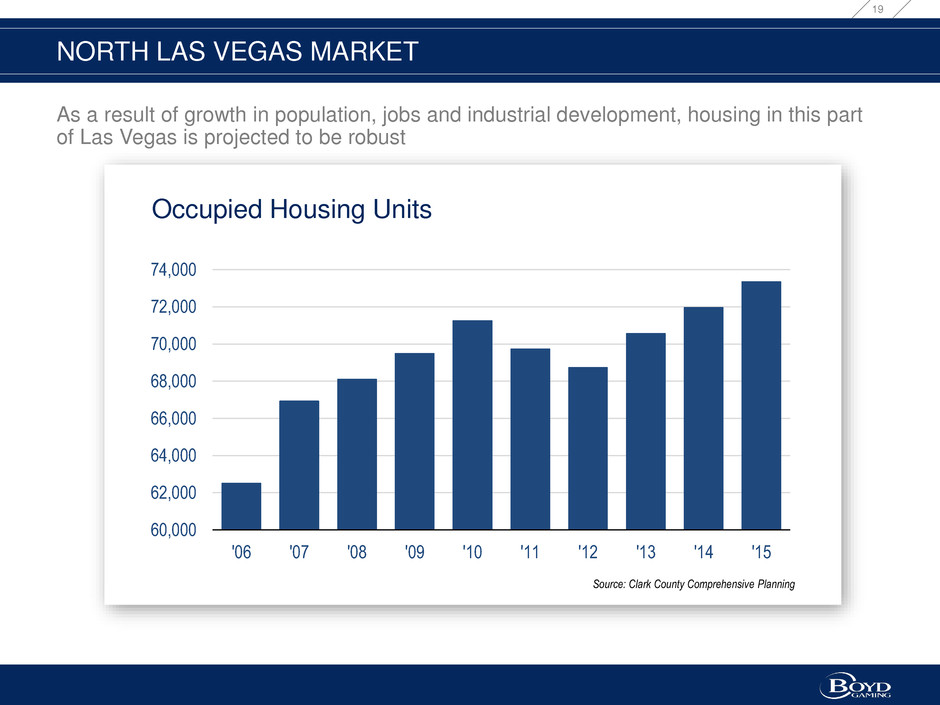

60,000 62,000 64,000 66,000 68,000 70,000 72,000 74,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Occupied Housing Units NORTH LAS VEGAS MARKET 19 As a result of growth in population, jobs and industrial development, housing in this part of Las Vegas is projected to be robust Source: Clark County Comprehensive Planning Occupied Housing Units

NORTH LAS VEGAS MARKET 20 Las Vegas Locals gaming revenues continue to improve led by strong performance in North Las Vegas Source: Nevada Gaming Commission • On an LTM basis as of February 2016, the North Las Vegas Market outpaced the remainder of the Las Vegas Locals Market North Las Vegas Gaming Revenue Total Boulder Strip & Balance of County Gaming Revenue Growth % 5.35% 3.91%

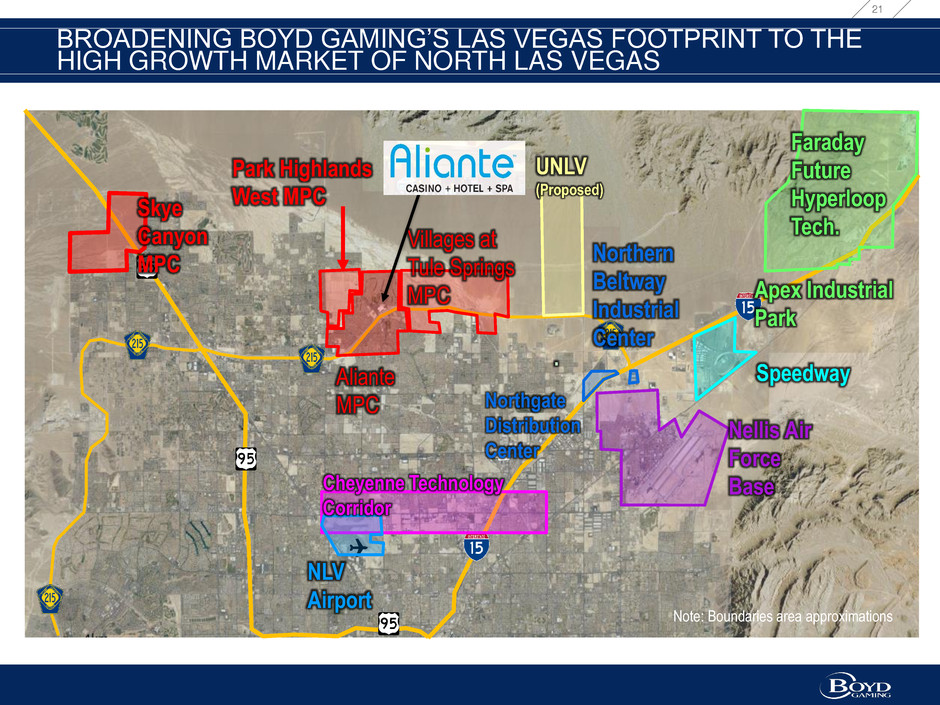

BROADENING BOYD GAMING’S LAS VEGAS FOOTPRINT TO THE HIGH GROWTH MARKET OF NORTH LAS VEGAS 21 North Las Vegas Market Housing Developments with a Projected 20,000 Homes are Currently Planned in North Las Vegas This is a start to a more comprehensive development map centered around Aliante SpeedwayAliante MPC Villages at Tule Springs MPC Park Highlands West MPCSkye Canyon MPC Note: Boundaries area approximations Apex Industrial Park Faraday Future Hyperloop Tech. UNLV (Proposed) NLV Airport Cheyenne Technology Corridor . Nellis Air Force Base Northgate Distribution Center Northern Beltway Industrial Center

NORTH LAS VEGAS MARKET 22 Perfectly Positioned within the Aliante Master Planned Community with ease of access from the I-215

NORTH LAS VEGAS MARKET GROWTH PROJECTS Apex Industrial Park • 2,000 acres of available industrial lots • Site of choice for Faraday Future, Hyperloop Technologies and parcels are being considered by other existing and start-up companies. • Conveniently positioned on the I-15 with ease of access to the US 93 and Union Pacific Railroad • Full build out expected to yield up to 50,000 direct jobs and contribute to the creation of over 120,000 total 23

NORTH LAS VEGAS MARKET GROWTH PROJECTS Faraday Future • Broke ground on April 13, 2016 • Purchased 3 parcels of land (14 acres) • Proposed full site to be 900 acres with an approximately $1 billion total investment • 3 Million Square Feet of Industrial Space • Up to 3,000 construction jobs • Estimated 4,500 direct permanent jobs and 9,000 indirect jobs 24

NORTH LAS VEGAS MARKET GROWTH PROJECTS Hyperloop Technologies • 20,000 square foot facility under construction • Two-Mile test track under construction • Initially investing over $121.6 million in facilities and equipment 25

NORTH LAS VEGAS MARKET GROWTH PROJECTS Other North Las Vegas Industrial Projects 26 Northgate Distribution Center Buildings 1&2 806,000 SF Lone Mountain Corporate Center 694,500 SF Prologis North 15 Freeway Distribution Center 410,600 SF Sunpoint Business Center 311,500 SF Prologis Cheyenne Distribution Center #3 163,800 SF

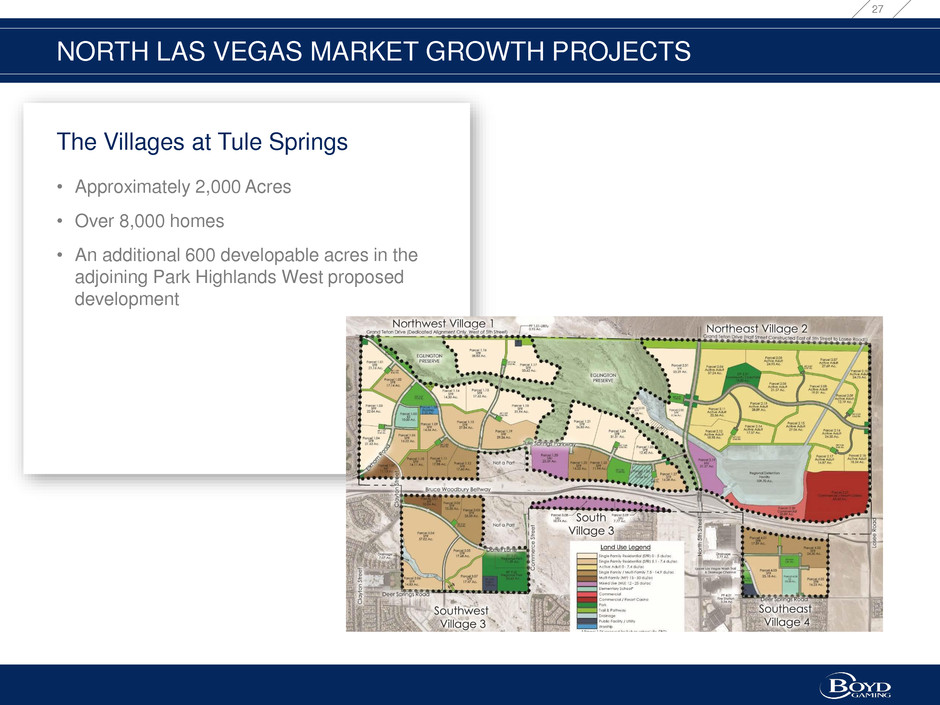

NORTH LAS VEGAS MARKET GROWTH PROJECTS The Villages at Tule Springs • Approximately 2,000 Acres • Over 8,000 homes • An additional 600 developable acres in the adjoining Park Highlands West proposed development 27

NORTH LAS VEGAS MARKET GROWTH PROJECTS Skye Canyon • Approximately 1,700 Acres • Over 9,000 homes 28

COST SYNERGIES 29 Approximately $8.0 million in first year synergy opportunities (in millions) Purchasing Synergies Shared Services Public Company Costs Insurance and other Year One Synergies $ 3.0 $ 2.5 $ 1.5 $ 1.0 _____ $ 8.0

(in millions) Net Revenue EBITDA Margin 2015 Actual 84.2$ 17.1$ 20.3% 2016 Pro Forma 92.4$ 30.0$ 32.5% IMPROVING PERFORMANCE 30 Multiyear revenue and EBITDA growth trends continue to accelerate Source: Company Filings, Management Projections Please refer to the Form 10-K SEC filing of ALST Casino Holdco, LLC for the year ended December 31, 2015 for reconciliations of non-GAAP measures to GAAP. Pro Forma estimates assume full year ownership and full year impact of synergies as if the acquisition closed on January 1, 2016.

STRATEGIC RATIONALE • High quality asset • Originally built at a cost of over $660 million • Full suite of premium amenities that align with our non-gaming investment strategy • Las Vegas economy strengthening and positioned for continued growth • North Las Vegas projected to have significant growth in jobs and housing • Aliante ideally located to capture growth in the northern part of the Las Vegas valley • Access to new customers in a market where we have limited exposure today • Benefits from participation in brand and segment wide promotions • B Connected program to drive increased loyalty of existing customers • Approximately $8.0 million of year one cost synergies plus operational improvement opportunities • Significant long-term revenue and EBITDA growth opportunities 31 PREMIUM ASSET HIGH GROWTH MARKET REVENUE ENHANCEMENTS COST SYNERGIES & FUTURE GROWTH

THANK YOU

Important information regarding forward-looking statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may contain words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” or the negative thereof or comparable terminology, and may include (without limitation) statements regarding the potential benefits to be achieved from the acquisition of the Aliante business, the potential long-term growth of Aliante and benefits from the development of the area in which Aliante is located, anticipated development projects in North Las Vegas, opportunities to increase revenue through the introduction of our B Connected loyalty program, as well as other revenue enhancements, anticipated synergies, free cash flow, that the transaction will be accretive to earnings, the timing for such benefits, timing for the closing of the transaction, the 2016 Forecast, 2016 Synergies and 2016 Pro Forma information, and any statements or assumptions underlying any of the foregoing. In addition, forward-looking statements include statements regarding improved revenue and financial performance and the discussion and charts on the slides titled “The Las Vegas Locals Market,” “North Las Vegas Market,” “North Las Vegas Market Growth Potential,” “Revenue Enhancement Opportunities”, “Cost Synergies”, “Improving Performance”, and “Strategic Rationale.” These forward-looking statements are based upon the current beliefs and expectations of management and involve certain risks and uncertainties, including (without limitation) the effects of intense competition that exists in the gaming industry, the effect of legislative changes, the effects of litigation, antitrust matters or the satisfaction or waiver of any of the closing conditions that could delay or prevent the acquisition of Aliante; and changes to the financial conditions of the parties, or the credit markets, or the economic conditions in the areas in which they operate. Additional factors are discussed in “Risk Factors” in Boyd Gaming’s Annual Report on Form 10-K for the year ended December 31, 2015, and in Boyd Gaming’s other current and periodic reports filed from time to time with the Securities and Exchange Commission. All forward-looking statements in this press release are made as of the date hereof, based on information available to Boyd Gaming as of the date hereof, and Boyd Gaming assumes no obligation to update any forward-looking statement. Non-GAAP Financial Measures Regulation G, "Conditions for Use of Non-GAAP Financial Measures," prescribes the conditions for use of non-GAAP financial information in public disclosures. We do not provide a reconciliation of forward-looking non-GAAP financial measures due to our inability to project special charges and certain expenses. FORWARD LOOKING STATEMENTS 33

Important disclosures regarding information contained within this document We obtained the industry, market and competitive position data throughout this presentation from (i) our own internal estimates and research of third party company websites and other sources, (ii) industry and general publications and research or (iii) studies and surveys conducted by third parties. Such sources generally do not guarantee the accuracy or completeness of included information. While we believe that the information included in this presentation from such publications, research, studies, surveys and websites is reliable, we have not independently verified data from these third-party sources. While we believe our internal estimates and research are reliable, neither such estimates and research nor such definitions have been verified by any independent source. This presentation also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this presentation may appear without the ® or TM symbols, but we do not intend our use or display of other companies’ trade names, trademarks or service marks with or without such symbols to imply relationships with, or endorsement or sponsorship of us by, these other companies. Disclosures 34