Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Vectrus, Inc. | vectrusform8-kapril2016ame.htm |

EXECUTION VERSION [[3582406]] AMENDMENT NO. 1 dated as of April 19, 2016 (this “Amendment”), to the CREDIT AGREEMENT dated as of September 17, 2014 (as amended, supplemented or otherwise modified from time to time, the “Credit Agreement”), among VECTRUS, INC., an Indiana corporation, VECTRUS SYSTEMS CORPORATION, (formerly known as Exelis Systems Corporation), a Delaware corporation (the “Borrower”), the LENDERS and ISSUING BANKS party thereto and JPMORGAN CHASE BANK, N.A., as Administrative Agent (the “Administrative Agent”). Capitalized terms used in this Amendment but not otherwise defined shall have the meanings assigned to such terms in the Credit Agreement. WHEREAS pursuant to the Credit Agreement, the Lenders and the Issuing Banks have agreed to extend credit to the Borrower on the terms and subject to the conditions set forth therein; WHEREAS the Borrower has requested that certain provisions of the Credit Agreement be amended as set forth herein; and WHEREAS the undersigned Lenders, constituting the Required Lenders, are willing to amend such provisions of the Credit Agreement, in each case on the terms and subject to the conditions set forth herein. NOW, THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, and subject to the conditions set forth herein, the parties hereto hereby agree as follows: SECTION 1. Amendments to Section 1.01. Section 1.01 of the Credit Agreement is hereby amended as follows: (a) The definition of the term “Available Amount” in Section 1.01 of the Credit Agreement is hereby amended as follows: (i) by adding the following parenthetical at the end of clause (a)(i) of such definition: (provided that any increase in the Available Amount pursuant to this clause (i) shall not be used to make any Restricted Payment unless, concurrently with the making of such Restricted Payment, the Borrower prepays Term Borrowings in an aggregate principal amount equal to such Restricted Payment) (ii) by adding the following text immediately following the text “prepayments required” in clause (b)(i) of such definition: Exhibit 10.1

2 [[3582406]] (for purposes of clarity, without giving effect to the right to decline in Section 2.11(e)) (iii) by adding the following sentence at the end of such definition: For purposes of determining the Available Amount at any time, any amount invested, loaned or advanced under Section 6.04(r) or prepaid under Section 6.08(b)(v) shall be deemed to have first decreased that portion of the Available Amount at such time that is comprised of the amounts referenced in clauses (a)(i) and (a)(iii) above before decreasing that portion of the Available Amount at such time that is comprised of the amounts referenced in clauses (a)(ii) and (a)(iv) above. (b) The definition of the term “Defaulting Lender” in Section 1.01 of the Credit Agreement is hereby amended by inserting the words “or of a Bail-In Action” after the words “Bankruptcy Event” at the end of clause (d) of such definition. (c) The definition of the term “Specified ECF Percentage” in Section 1.01 of the Credit Agreement is hereby amended by replacing in its entirety such definition with the following text: “Specified ECF Percentage” means, with respect to any fiscal year of Holdings, (a) if the Total Leverage Ratio as of the last day of such fiscal year is greater than 2.50 to 1.00, 50%, (b) if the Total Leverage Ratio as of the last day of such fiscal year is greater than 2.00 to 1.00 but less than or equal to 2.50 to 1.00, 25%, and (c) if the Total Leverage Ratio as of the last day of such fiscal year is less than or equal to 2.00 to 1.00, 0%. (d) The following definitions are hereby added in the appropriate alphabetical order to Section 1.01 of the Credit Agreement: “Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an EEA Financial Institution. “Bail-In Legislation” means, with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law for such EEA Member Country from time to time which is described in the EU Bail- In Legislation Schedule. “EEA Financial Institution” means (a) any institution established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition or (c) any institution established in an EEA Member Country which is a subsidiary of an

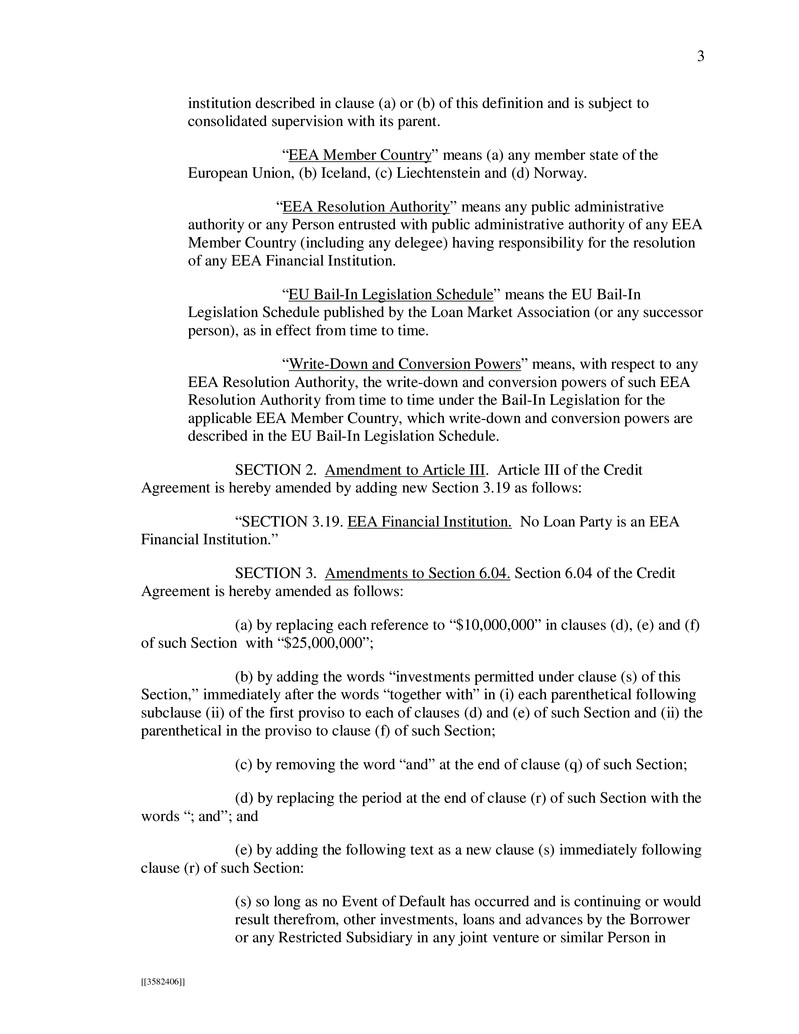

3 [[3582406]] institution described in clause (a) or (b) of this definition and is subject to consolidated supervision with its parent. “EEA Member Country” means (a) any member state of the European Union, (b) Iceland, (c) Liechtenstein and (d) Norway. “EEA Resolution Authority” means any public administrative authority or any Person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution. “EU Bail-In Legislation Schedule” means the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor person), as in effect from time to time. “Write-Down and Conversion Powers” means, with respect to any EEA Resolution Authority, the write-down and conversion powers of such EEA Resolution Authority from time to time under the Bail-In Legislation for the applicable EEA Member Country, which write-down and conversion powers are described in the EU Bail-In Legislation Schedule. SECTION 2. Amendment to Article III. Article III of the Credit Agreement is hereby amended by adding new Section 3.19 as follows: “SECTION 3.19. EEA Financial Institution. No Loan Party is an EEA Financial Institution.” SECTION 3. Amendments to Section 6.04. Section 6.04 of the Credit Agreement is hereby amended as follows: (a) by replacing each reference to “$10,000,000” in clauses (d), (e) and (f) of such Section with “$25,000,000”; (b) by adding the words “investments permitted under clause (s) of this Section,” immediately after the words “together with” in (i) each parenthetical following subclause (ii) of the first proviso to each of clauses (d) and (e) of such Section and (ii) the parenthetical in the proviso to clause (f) of such Section; (c) by removing the word “and” at the end of clause (q) of such Section; (d) by replacing the period at the end of clause (r) of such Section with the words “; and”; and (e) by adding the following text as a new clause (s) immediately following clause (r) of such Section: (s) so long as no Event of Default has occurred and is continuing or would result therefrom, other investments, loans and advances by the Borrower or any Restricted Subsidiary in any joint venture or similar Person in

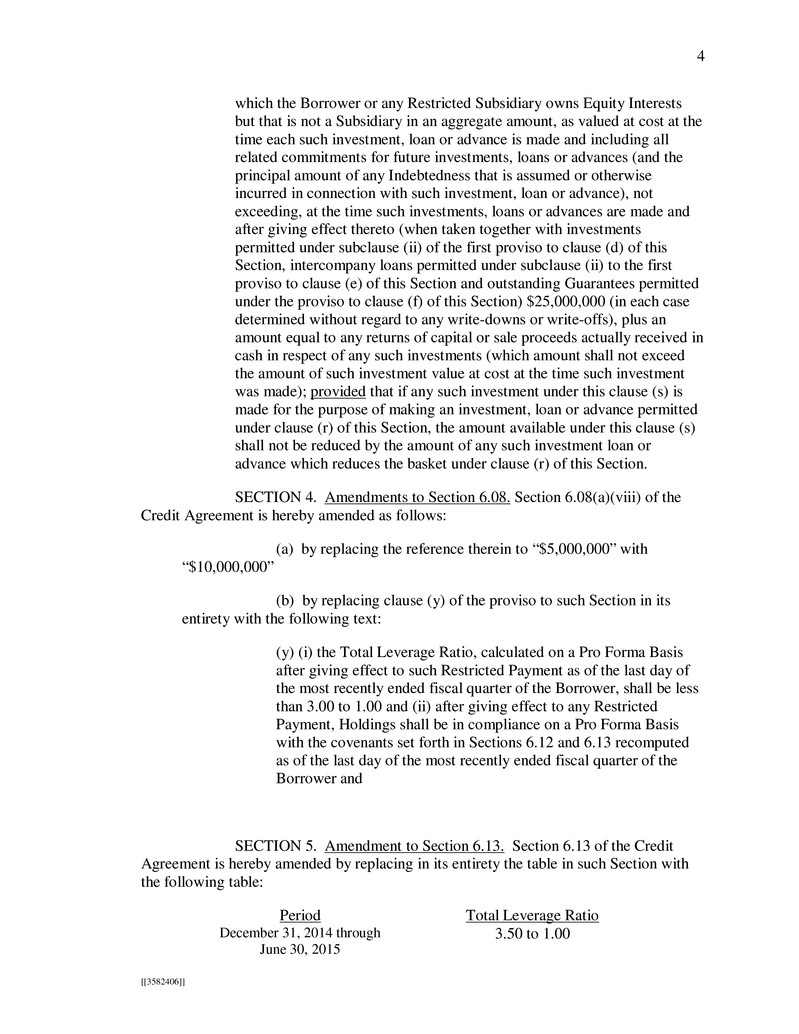

4 [[3582406]] which the Borrower or any Restricted Subsidiary owns Equity Interests but that is not a Subsidiary in an aggregate amount, as valued at cost at the time each such investment, loan or advance is made and including all related commitments for future investments, loans or advances (and the principal amount of any Indebtedness that is assumed or otherwise incurred in connection with such investment, loan or advance), not exceeding, at the time such investments, loans or advances are made and after giving effect thereto (when taken together with investments permitted under subclause (ii) of the first proviso to clause (d) of this Section, intercompany loans permitted under subclause (ii) to the first proviso to clause (e) of this Section and outstanding Guarantees permitted under the proviso to clause (f) of this Section) $25,000,000 (in each case determined without regard to any write-downs or write-offs), plus an amount equal to any returns of capital or sale proceeds actually received in cash in respect of any such investments (which amount shall not exceed the amount of such investment value at cost at the time such investment was made); provided that if any such investment under this clause (s) is made for the purpose of making an investment, loan or advance permitted under clause (r) of this Section, the amount available under this clause (s) shall not be reduced by the amount of any such investment loan or advance which reduces the basket under clause (r) of this Section. SECTION 4. Amendments to Section 6.08. Section 6.08(a)(viii) of the Credit Agreement is hereby amended as follows: (a) by replacing the reference therein to “$5,000,000” with “$10,000,000” (b) by replacing clause (y) of the proviso to such Section in its entirety with the following text: (y) (i) the Total Leverage Ratio, calculated on a Pro Forma Basis after giving effect to such Restricted Payment as of the last day of the most recently ended fiscal quarter of the Borrower, shall be less than 3.00 to 1.00 and (ii) after giving effect to any Restricted Payment, Holdings shall be in compliance on a Pro Forma Basis with the covenants set forth in Sections 6.12 and 6.13 recomputed as of the last day of the most recently ended fiscal quarter of the Borrower and SECTION 5. Amendment to Section 6.13. Section 6.13 of the Credit Agreement is hereby amended by replacing in its entirety the table in such Section with the following table: Period Total Leverage Ratio December 31, 2014 through June 30, 2015 3.50 to 1.00

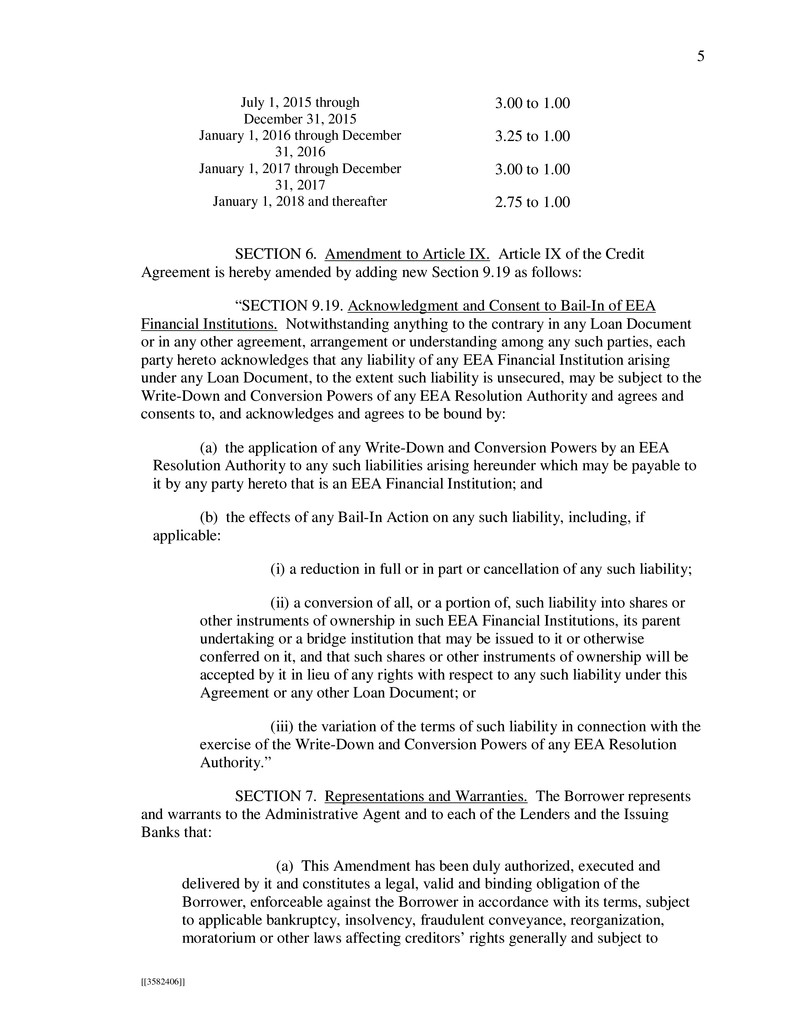

5 [[3582406]] July 1, 2015 through December 31, 2015 3.00 to 1.00 January 1, 2016 through December 31, 2016 3.25 to 1.00 January 1, 2017 through December 31, 2017 3.00 to 1.00 January 1, 2018 and thereafter 2.75 to 1.00 SECTION 6. Amendment to Article IX. Article IX of the Credit Agreement is hereby amended by adding new Section 9.19 as follows: “SECTION 9.19. Acknowledgment and Consent to Bail-In of EEA Financial Institutions. Notwithstanding anything to the contrary in any Loan Document or in any other agreement, arrangement or understanding among any such parties, each party hereto acknowledges that any liability of any EEA Financial Institution arising under any Loan Document, to the extent such liability is unsecured, may be subject to the Write-Down and Conversion Powers of any EEA Resolution Authority and agrees and consents to, and acknowledges and agrees to be bound by: (a) the application of any Write-Down and Conversion Powers by an EEA Resolution Authority to any such liabilities arising hereunder which may be payable to it by any party hereto that is an EEA Financial Institution; and (b) the effects of any Bail-In Action on any such liability, including, if applicable: (i) a reduction in full or in part or cancellation of any such liability; (ii) a conversion of all, or a portion of, such liability into shares or other instruments of ownership in such EEA Financial Institutions, its parent undertaking or a bridge institution that may be issued to it or otherwise conferred on it, and that such shares or other instruments of ownership will be accepted by it in lieu of any rights with respect to any such liability under this Agreement or any other Loan Document; or (iii) the variation of the terms of such liability in connection with the exercise of the Write-Down and Conversion Powers of any EEA Resolution Authority.” SECTION 7. Representations and Warranties. The Borrower represents and warrants to the Administrative Agent and to each of the Lenders and the Issuing Banks that: (a) This Amendment has been duly authorized, executed and delivered by it and constitutes a legal, valid and binding obligation of the Borrower, enforceable against the Borrower in accordance with its terms, subject to applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to

6 [[3582406]] general principles of equity, regardless of whether considered in a proceeding in equity or at law and an implied covenant of good faith and fair dealing. (b) The representations and warranties of each Loan Party set forth in the Loan Documents are true and correct in all material respects (or, in the case of representations and warranties qualified as to materiality, in all respects) on and as of the date hereof, except in the case of any representation and warranty that expressly relates to a prior date, in which case such representation and warranty is true and correct in all material respects (or in all respects, as applicable) as of such earlier date. (c) At the time of and immediately after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing. SECTION 8. Effectiveness. This Amendment shall become effective as of the date first above written (the “Amendment Effective Date”) when (a) the Administrative Agent shall have received counterparts of this Amendment that, when taken together, bear the signatures of the Borrower and the Required Lenders and (b) the Administrative Agent and the Lenders shall have received payment of all fees and expenses required to be paid or reimbursed by the Borrower or any other Loan Party under or in connection with this Amendment and any other Loan Document, including those fees and expenses set forth in Section 12 hereof. SECTION 9. Credit Agreement. Except as expressly set forth herein, this Amendment (a) shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Lenders, the Administrative Agent, the Borrower or any other Loan Party under the Credit Agreement or any other Loan Document and (b) shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall continue in full force and effect. Nothing herein shall be deemed to entitle the Borrower or any other Loan Party to any future consent to, or waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document in similar or different circumstances. After the date hereof, any reference in the Loan Documents to the Credit Agreement shall mean the Credit Agreement as modified hereby. This Amendment shall constitute a “Loan Document” for all purposes of the Credit Agreement and the other Loan Documents. SECTION 10. Applicable Law; Waiver of Jury Trial. (a) THIS AMENDMENT AND ANY CLAIM, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AMENDMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK.

7 [[3582406]] (b) EACH PARTY HERETO HEREBY AGREES AS SET FORTH IN SECTION 9.10 OF THE CREDIT AGREEMENT AS IF SUCH SECTION WERE SET FORTH IN FULL HEREIN. SECTION 11. Counterparts; Amendment. This Amendment may be executed in two or more counterparts, each of which shall constitute an original but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or electronic transmission shall be effective as delivery of a manually executed counterpart of this Amendment. This Amendment may not be amended nor may any provision hereof be waived except pursuant to a writing signed by the Borrower, the Administrative Agent and the Required Lenders. SECTION 12. Fees and Expenses. (a) The Borrower agrees to pay to the Administrative Agent, for the account of each Lender that consents to this Amendment by 5:00 p.m., New York City time, on April 15, 2016, an amendment fee (the “Amendment Fee”) in an amount equal to 0.125% of the sum of (i) the unused Revolving Commitments of such Lender, (ii) the outstanding Revolving Exposure of such Lender and (iii) the outstanding aggregate principal amount of Term Loans held by such Lender, in each case immediately prior to the effectiveness of this Amendment. The Amendment Fee will be paid in immediately available funds on, and subject to the occurrence of, the Amendment Effective Date and shall not be refundable. (b) The Borrower agrees to reimburse the Administrative Agent for its reasonable out-of-pocket expenses in connection with this Amendment to the extent required under Section 9.03 of the Credit Agreement. SECTION 13. Headings. The Section headings used herein are for convenience of reference only, are not part of this Amendment and are not to affect the construction of, or to be taken into consideration in interpreting, this Amendment. [Signature Pages Follow]