Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UMPQUA HOLDINGS CORP | umpqq120168-k.htm |

| EX-99.1 - PRESS RELEASE ANNOUNCING FIRST QUARTER 2016 FINANCIAL RESULTS - UMPQUA HOLDINGS CORP | umpqq12016ex991earningsrel.htm |

UMPQUA HOLDINGS CORPORATION 1st Quarter 2016 Earnings Conference Call Presentation April 21, 2016

2 Forward-looking Statements and Notes This presentation includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the SEC. You should not place undue reliance on forward- looking statements and we undertake no obligation to update any such statements. In this presentation we make forward- looking statements about credit discount accretion related to loans acquired from Sterling Financial Corporation, loan and lease growth and loan sales, and planned investments and results of new initiatives. Risks that could cause results to differ from forward-looking statements we make are set forth in our filings with the SEC and include, without limitation, prolonged low interest rate environment; unanticipated weakness in loan demand or loan pricing; deterioration in the economy; lack of strategic growth opportunities or our failure to execute on those opportunities; our inability to effectively manage problem credits; our ability to successfully develop and market new products and technology; changes in laws or regulations; and changes in general economic conditions.

Q1 2016 Highlights 3 > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation. Net earnings decreased, while operating earnings(1) remained flat: Net interest income decreased by $2.1 million, driven by one fewer day in the quarter and a 3 basis point decline in net interest margin Non-interest income decreased by $23.4 million, reflecting a charge of $20.6 million related to negative fair value adjustments to the mortgage servicing rights (“MSR”) asset and a charge of $1.8 million related to a decline in the fair value of debt capital market swap derivatives, both driven by the decline in long-term interest rates during the quarter. Excluding the impact of non-operating items(1), total non-interest income increased by $1.1 million, driven primarily by higher mortgage banking revenue Non-interest expense decreased by $1.9 million. Excluding the impact of non-operating items(1), total non-interest expense decreased by $2.1 million, driven by lower core expenses in most categories, partially offset by higher seasonal payroll taxes and a higher loss on other real estate owned Robust loan and deposit growth: Net loan and lease growth of $94.1 million, or 2% annualized, including $139.2 million of loan sales and $256.0 million of loans transferred to held for sale. Gross loan and lease growth (prior to the impact of loan sales and transfers) of $489.2 million, or 12% annualized Deposit growth of $455.8 million, or 10% annualized Loan to deposit ratio decreased to 93% Prudently managed capital: Book value per share increased by 1% sequentially to $17.62 per share and tangible book value per share(1) increased by 2% sequentially to $9.30 Estimated total risk-based capital ratio of 14.2% and estimated Tier 1 common to risk weighted assets ratio of 11.2% Paid quarterly cash dividend of $0.16 per common share; Repurchased 235,000 shares of common stock for $3.5 million

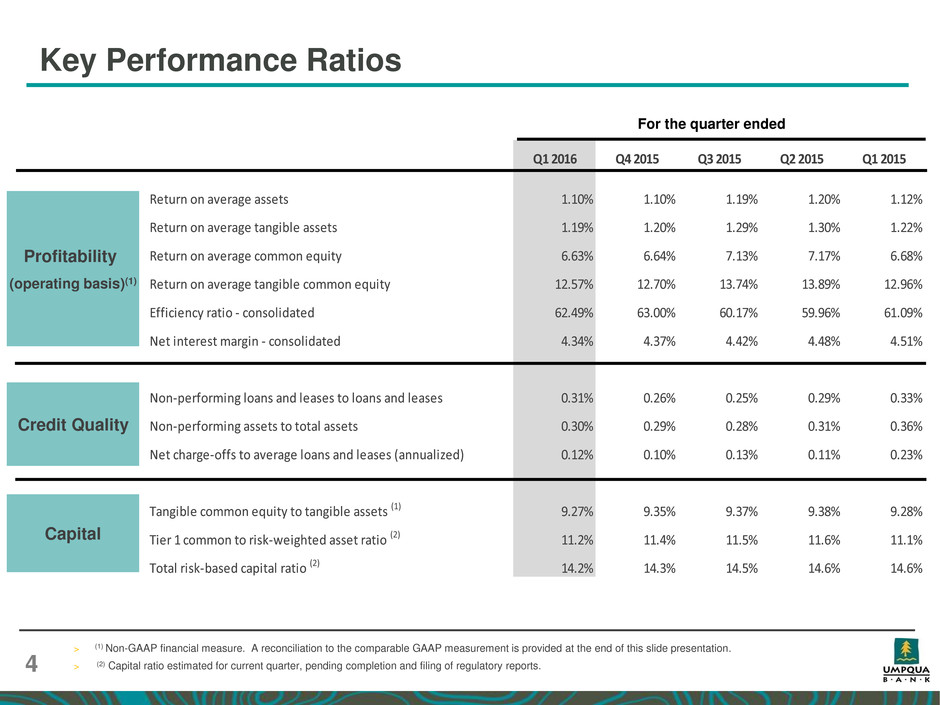

Q1 2016 Q4 2015 Q3 2015 Q2 2015 Q1 2015 Return on average assets 1.10% 1.10% 1.19% 1.20% 1.12% Return on average tangible assets 1.19% 1.20% 1.29% 1.30% 1.22% Return on average common equity 6.63% 6.64% 7.13% 7.17% 6.68% Return on average tangible common equity 12.57% 12.70% 13.74% 13.89% 12.96% Efficiency ratio - consolidated 62.49% 63.00% 60.17% 59.96% 61.09% Net interest margin - consolidated 4.34% 4.37% 4.42% 4.48% 4.51% Non-performing loans and leases to loans and leases 0.31% 0.26% 0.25% 0.29% 0.33% Non-performing assets to total assets 0.30% 0.29% 0.28% 0.31% 0.36% Net charge-offs to average loans and leases (annualized) 0.12% 0.10% 0.13% 0.11% 0.23% Tangible common equity to tangible assets (1) 9.27% 9.35% 9.37% 9.38% 9.28% Tier 1 common to risk-weighted asset ratio (2) 11.2% 11.4% 11.5% 11.6% 11.1% Total risk-based capital ratio (2) 14.2% 14.3% 14.5% 14.6% 14.6% Key Performance Ratios 4 > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. > (2) Capital ratio estimated for current quarter, pending completion and filing of regulatory reports. Profitability (operating basis)(1) Credit Quality Capital For the quarter ended

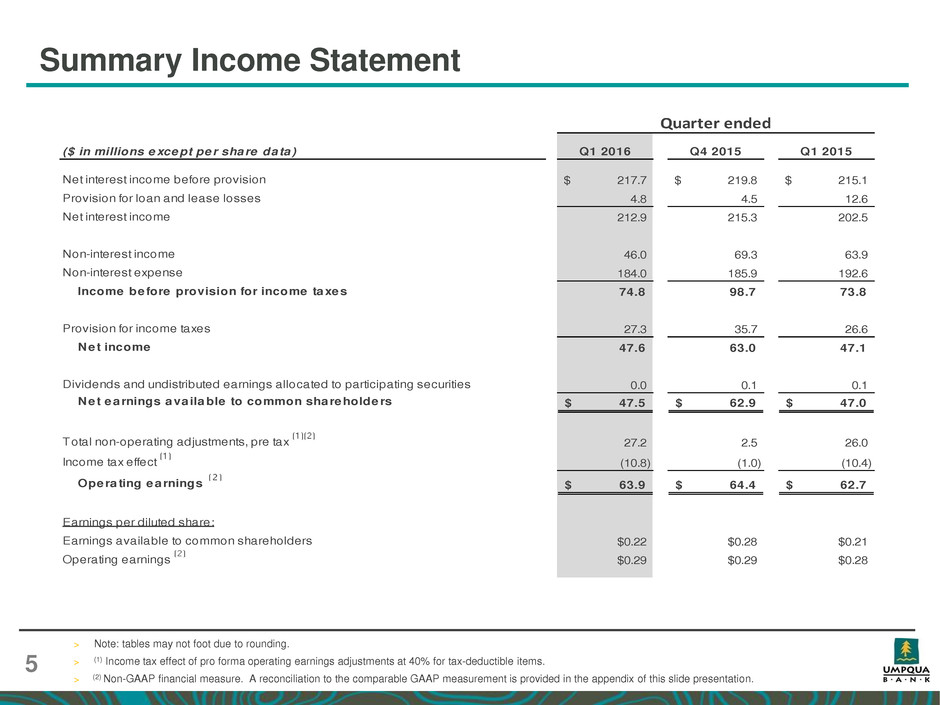

Summary Income Statement 5 > Note: tables may not foot due to rounding. > (1) Income tax effect of pro forma operating earnings adjustments at 40% for tax-deductible items. > (2) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation. ($ in millions except per share da ta ) Q1 2016 Q4 2015 Q1 2015 Net interest income before provision 217.7$ 219.8$ 215.1$ Provision for loan and lease losses 4.8 4.5 12.6 Net interest income 212.9 215.3 202.5 Non-interest income 46.0 69.3 63.9 Non-interest expense 184.0 185.9 192.6 Income be fore provision for income taxes 74.8 98.7 73.8 Provision for income taxes 27.3 35.7 26.6 Ne t income 47.6 63.0 47.1 Dividends and undistributed earnings allocated to participating securities 0.0 0.1 0.1 Ne t earnings ava ilable to common shareholders 47.5$ 62.9$ 47.0$ Total non-operating adjustments, pre tax 27.2 2.5 26.0 Income tax effect (10.8) (1.0) (10.4) Opera ting earnings 63.9$ 64.4$ 62.7$ Earnings per diluted share: Earnings available to common shareholders $0.22 $0.28 $0.21 Operating earnings $0.29 $0.29 $0.28 Quarter ended

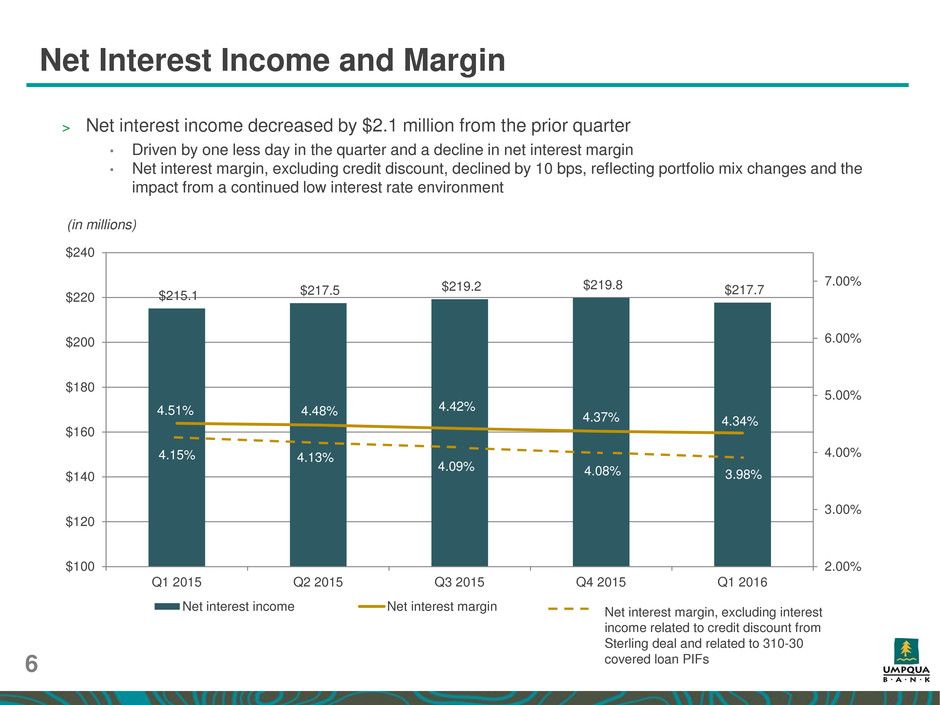

Net Interest Income and Margin 6 $215.1 $217.5 $219.2 $219.8 $217.7 4.51% 4.48% 4.42% 4.37% 4.34% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% $100 $120 $140 $160 $180 $200 $220 $240 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Net interest income Net interest margin > Net interest income decreased by $2.1 million from the prior quarter • Driven by one less day in the quarter and a decline in net interest margin • Net interest margin, excluding credit discount, declined by 10 bps, reflecting portfolio mix changes and the impact from a continued low interest rate environment (in millions) Net interest margin, excluding interest income related to credit discount from Sterling deal and related to 310-30 covered loan PIFs 4.15% 4.13% 4.09% 4.08% 3.98%

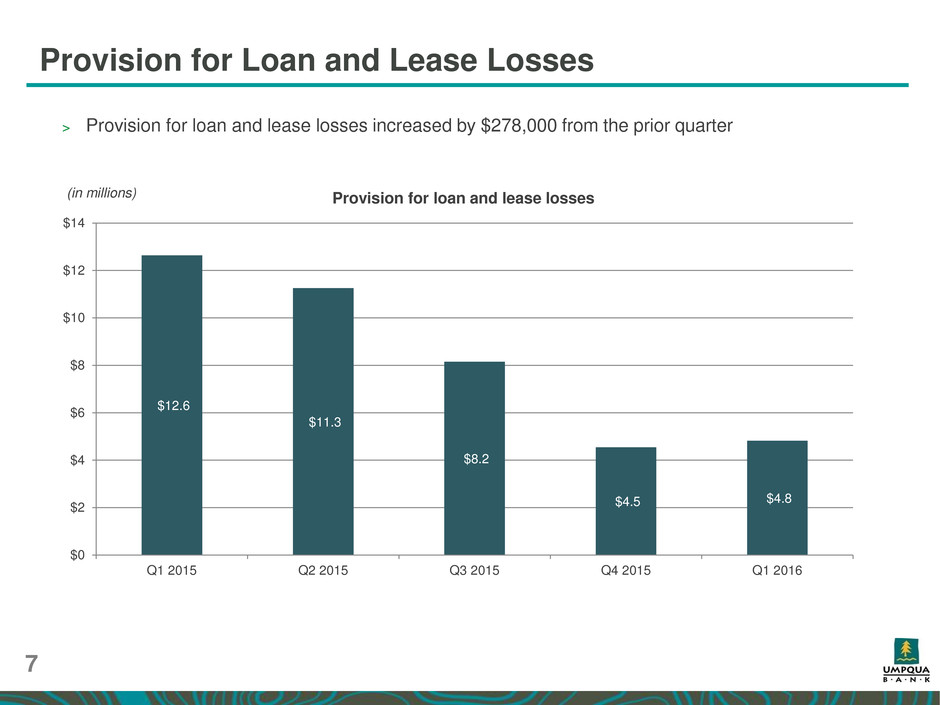

Provision for Loan and Lease Losses 7 > Provision for loan and lease losses increased by $278,000 from the prior quarter $12.6 $11.3 $8.2 $4.5 $4.8 $0 $2 $4 $6 $8 $10 $12 $14 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Provision for loan and lease losses (in millions)

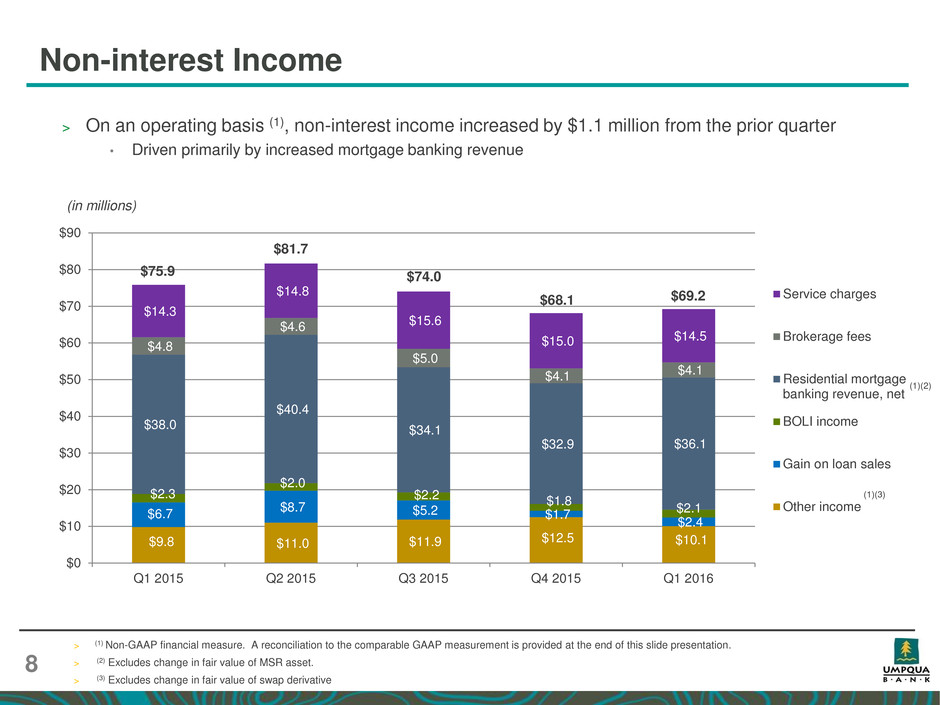

$9.8 $11.0 $11.9 $12.5 $10.1 $6.7 $8.7 $5.2 $1.7 $2.4 $2.3 $2.0 $2.2 $1.8 $2.1 $38.0 $40.4 $34.1 $32.9 $36.1 $4.8 $4.6 $5.0 $4.1 $4.1 $14.3 $14.8 $15.6 $15.0 $14.5 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Service charges Brokerage fees Residential mortgage banking revenue, net BOLI income Gain on loan sales Other income Non-interest Income 8 > On an operating basis (1), non-interest income increased by $1.1 million from the prior quarter • Driven primarily by increased mortgage banking revenue (in millions) $75.9 (1)(2) $81.7 $74.0 $68.1 $69.2 (1)(3) > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. > (2) Excludes change in fair value of MSR asset. > (3) Excludes change in fair value of swap derivative

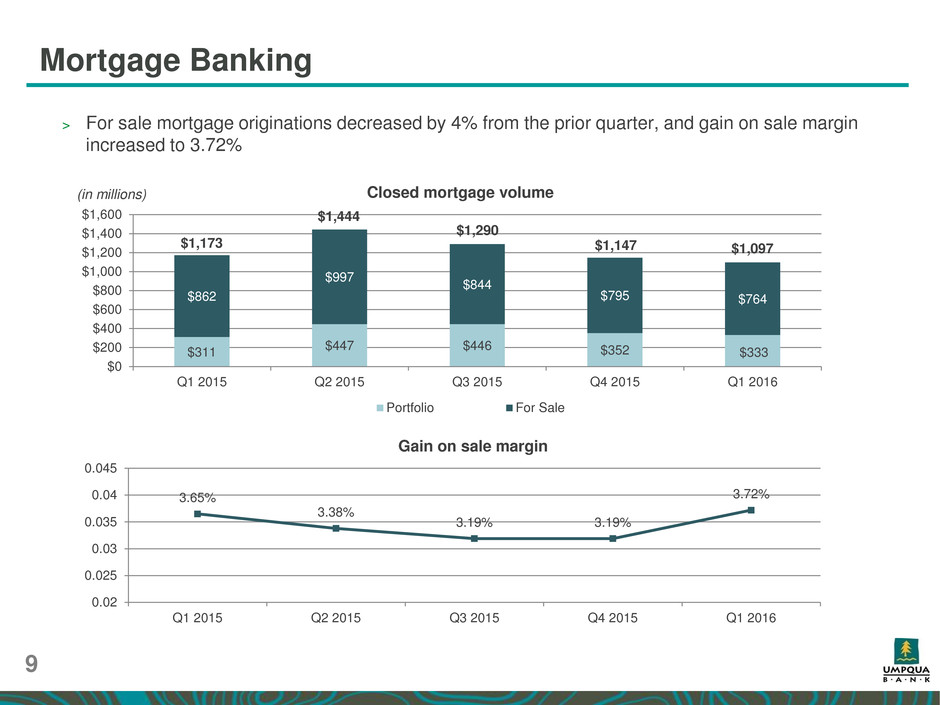

> For sale mortgage originations decreased by 4% from the prior quarter, and gain on sale margin increased to 3.72% 9 $311 $447 $446 $352 $333 $862 $997 $844 $795 $764 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Closed mortgage volume Portfolio For Sale (in millions) Mortgage Banking 3.65% 3.38% 3.19% 3.19% 3.72% 0.02 0.025 0.03 0.035 0.04 0.045 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Gain on sale margin $1,173 $1,444 $1,290 $1,147 $1,097

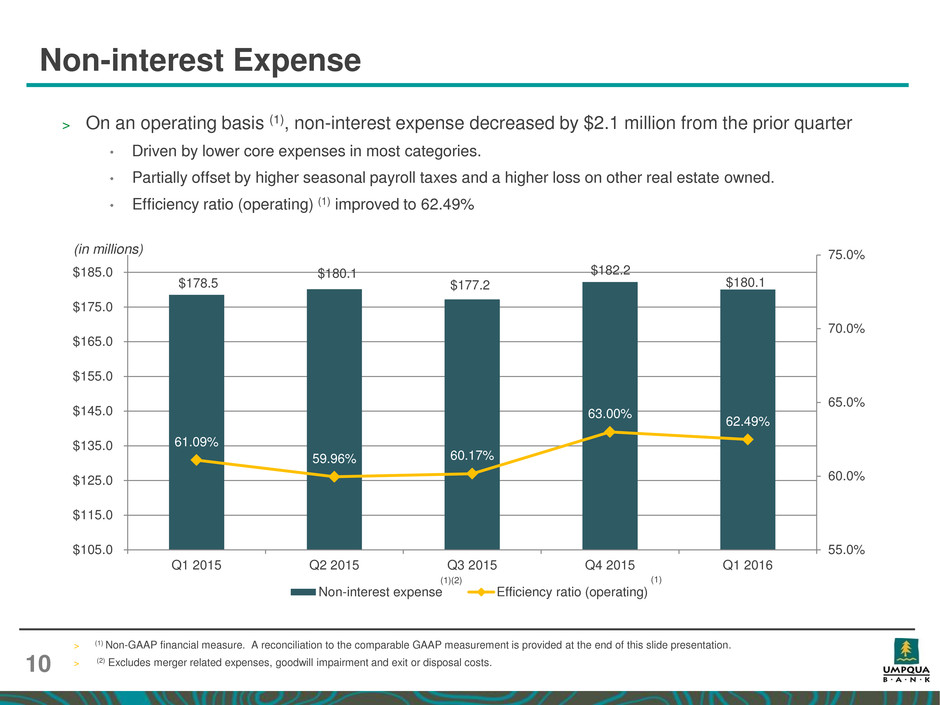

$178.5 $180.1 $177.2 $182.2 $180.1 61.09% 59.96% 60.17% 63.00% 62.49% 55.0% 60.0% 65.0% 70.0% 75.0% $105.0 $115.0 $125.0 $135.0 $145.0 $155.0 $165.0 $175.0 $185.0 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Non-interest expense Efficiency ratio (operating) Non-interest Expense 10 > On an operating basis (1), non-interest expense decreased by $2.1 million from the prior quarter • Driven by lower core expenses in most categories. • Partially offset by higher seasonal payroll taxes and a higher loss on other real estate owned. • Efficiency ratio (operating) (1) improved to 62.49% (in millions) > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. > (2) Excludes merger related expenses, goodwill impairment and exit or disposal costs. (1) (1)(2)

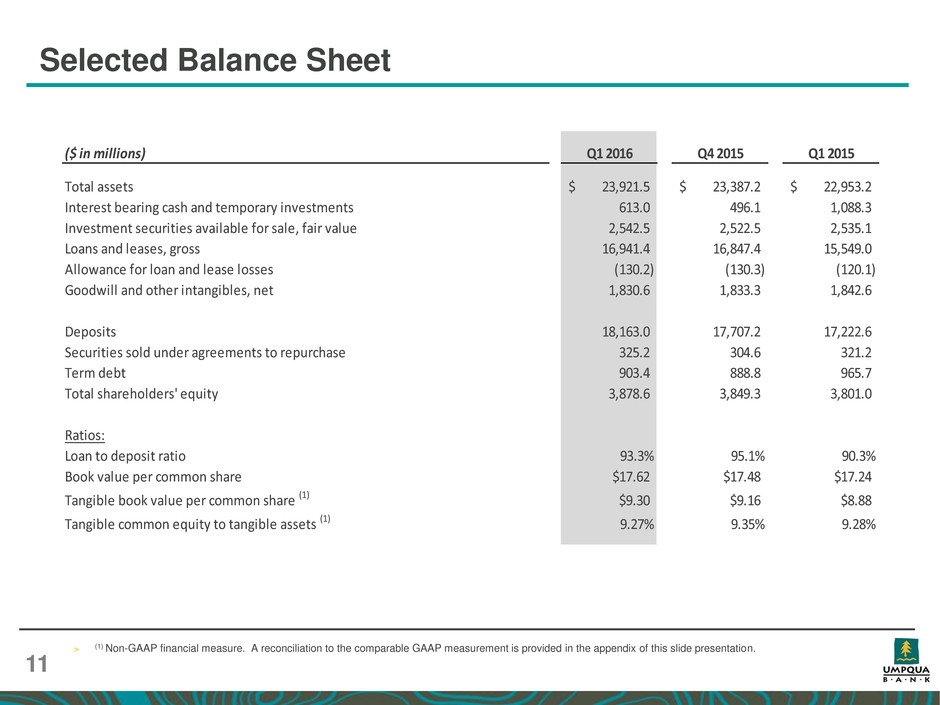

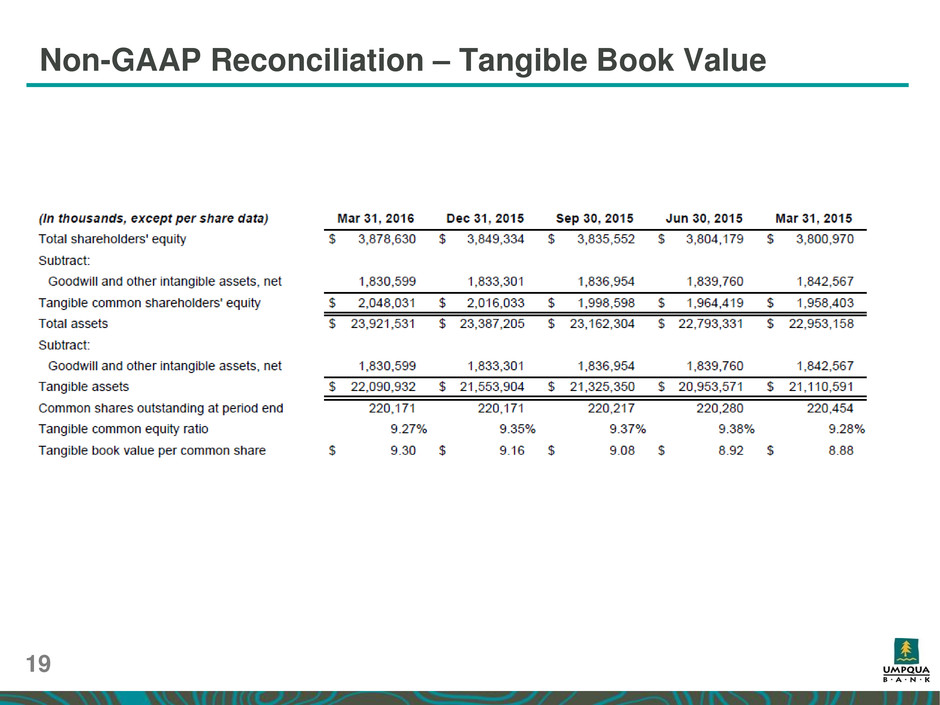

Selected Balance Sheet 11 ($ in millions) Q1 2016 Q4 2015 Q1 2015 Total assets 23,921.5$ 23,387.2$ 22,953.2$ Interest bearing cash and temporary investments 613.0 496.1 1,088.3 Investment securities available for sale, fair value 2,542.5 2,522.5 2,535.1 Loans and leases, gross 16,941.4 16,847.4 15,549.0 Allowance for loan and lease losses (130.2) (130.3) (120.1) Goodwill and other intangibles, net 1,830.6 1,833.3 1,842.6 Deposits 18,163.0 17,707.2 17,222.6 Securities sold under agreements to repurchase 325.2 304.6 321.2 Term debt 903.4 888.8 965.7 Total shareholders' equity 3,878.6 3,849.3 3,801.0 Ratios: Loan to deposit ratio 93.3% 95.1% 90.3% Book value per common share $17.62 $17.48 $17.24 Tangible book value per common share (1) $9.30 $9.16 $8.88 Tangible common equity to tangible assets (1) 9.27% 9.35% 9.28% > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation.

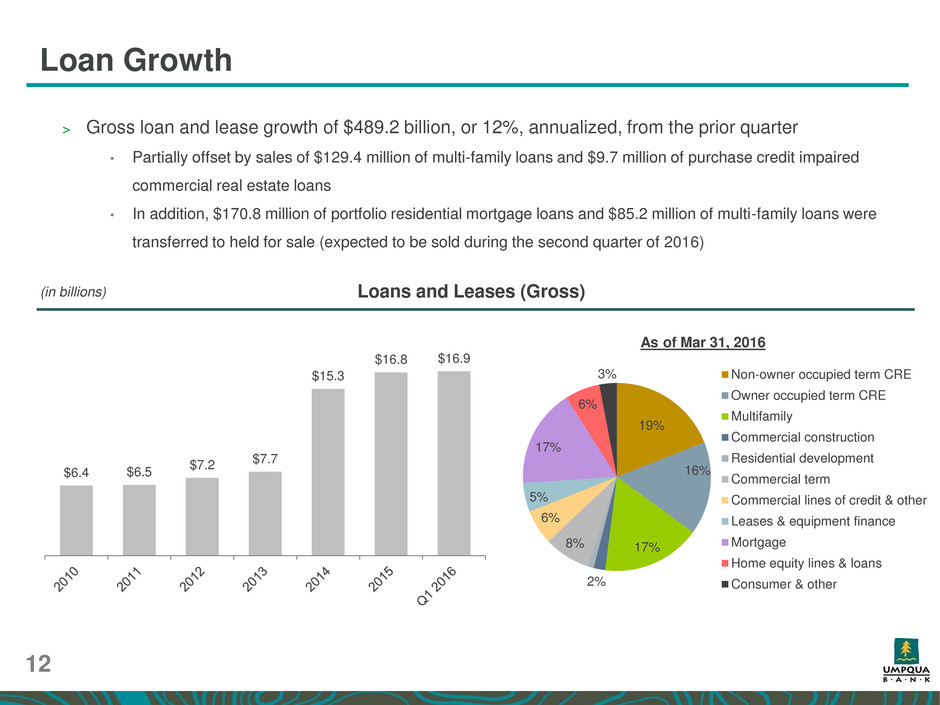

Loan Growth 12 Loans and Leases (Gross) $6.4 $6.5 $7.2 $7.7 $15.3 $16.8 $16.9 (in billions) 19% 16% 17% 2% 8% 6% 5% 17% 6% 3% Non-owner occupied term CRE Owner occupied term CRE Multifamily Commercial construction Residential development Commercial term Commercial lines of credit & other Leases & equipment finance Mortgage Home equity lines & loans Consumer & other As of Mar 31, 2016 > Gross loan and lease growth of $489.2 billion, or 12%, annualized, from the prior quarter • Partially offset by sales of $129.4 million of multi-family loans and $9.7 million of purchase credit impaired commercial real estate loans • In addition, $170.8 million of portfolio residential mortgage loans and $85.2 million of multi-family loans were transferred to held for sale (expected to be sold during the second quarter of 2016)

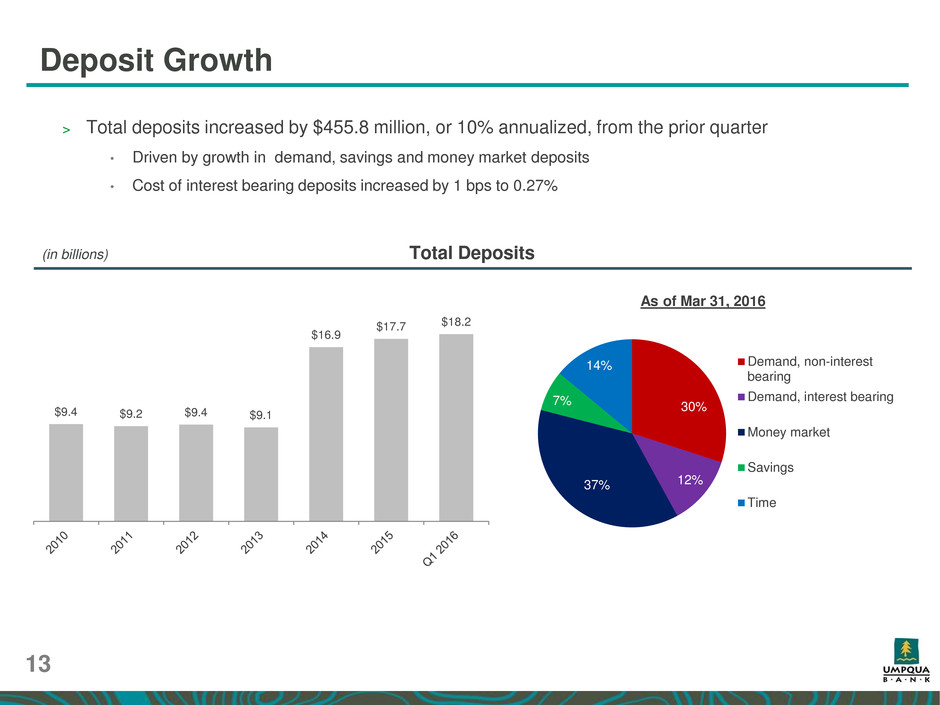

30% 12% 37% 7% 14% Demand, non-interest bearing Demand, interest bearing Money market Savings Time Deposit Growth $9.4 $9.2 $9.4 $9.1 $16.9 $17.7 $18.2 (in billions) Total Deposits As of Mar 31, 2016 > Total deposits increased by $455.8 million, or 10% annualized, from the prior quarter • Driven by growth in demand, savings and money market deposits • Cost of interest bearing deposits increased by 1 bps to 0.27% 13

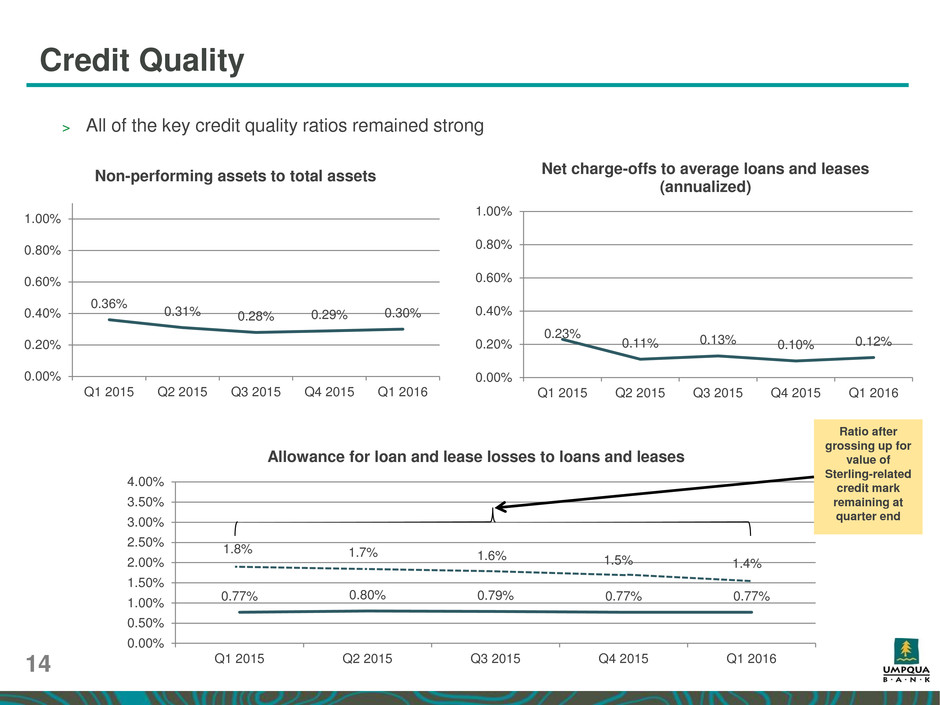

Credit Quality > All of the key credit quality ratios remained strong 0.77% 0.80% 0.79% 0.77% 0.77% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Allowance for loan and lease losses to loans and leases 0.36% 0.31% 0.28% 0.29% 0.30% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Non-performing assets to total assets 0.23% 0.11% 0.13% 0.10% 0.12% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Net charge-offs to average loans and leases (annualized) Ratio after grossing up for value of Sterling-related credit mark remaining at quarter end 1.8% 1.6% 1.7% 1.5% 1.4% 14

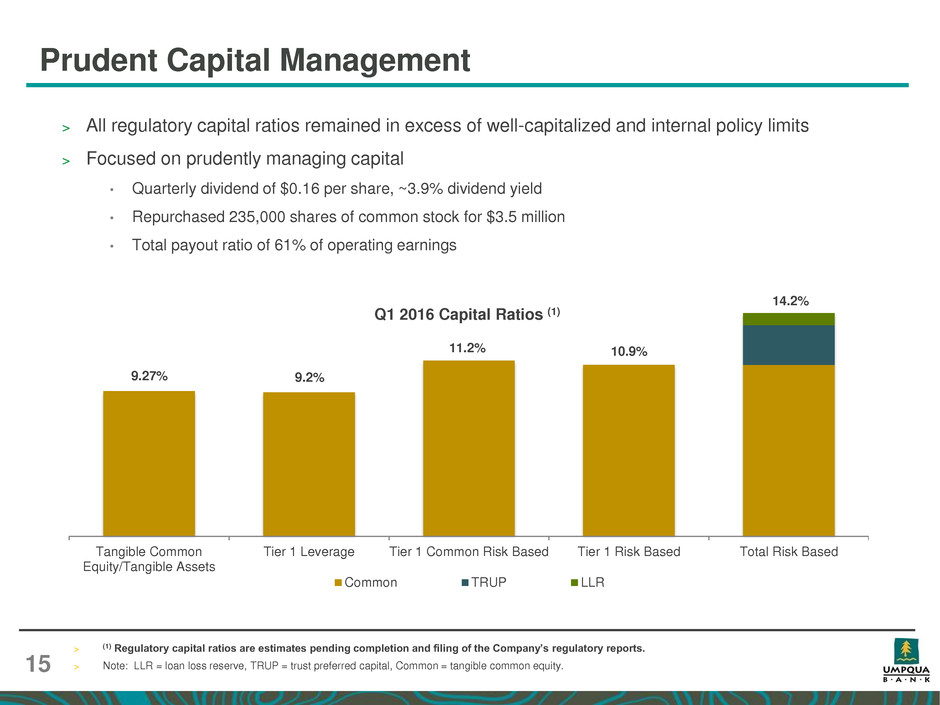

Prudent Capital Management 15 > All regulatory capital ratios remained in excess of well-capitalized and internal policy limits > Focused on prudently managing capital • Quarterly dividend of $0.16 per share, ~3.9% dividend yield • Repurchased 235,000 shares of common stock for $3.5 million • Total payout ratio of 61% of operating earnings Tangible Common Equity/Tangible Assets Tier 1 Leverage Tier 1 Common Risk Based Tier 1 Risk Based Total Risk Based Q1 2016 Capital Ratios (1) Common TRUP LLR 9.2% 11.2% 10.9% 14.2% 9.27% > (1) Regulatory capital ratios are estimates pending completion and filing of the Company’s regulatory reports. > Note: LLR = loan loss reserve, TRUP = trust preferred capital, Common = tangible common equity.

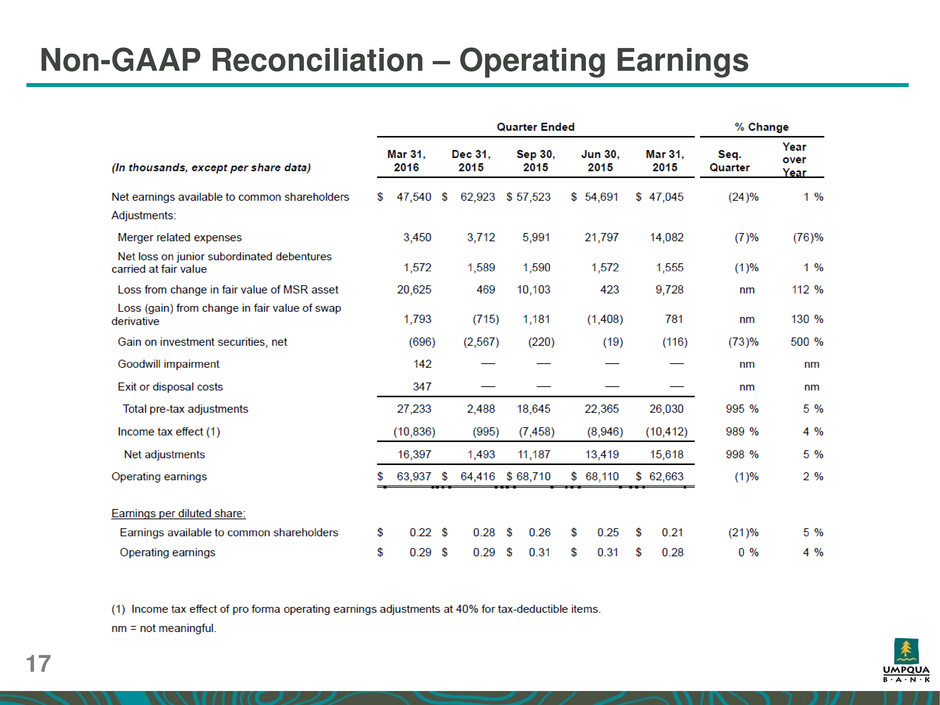

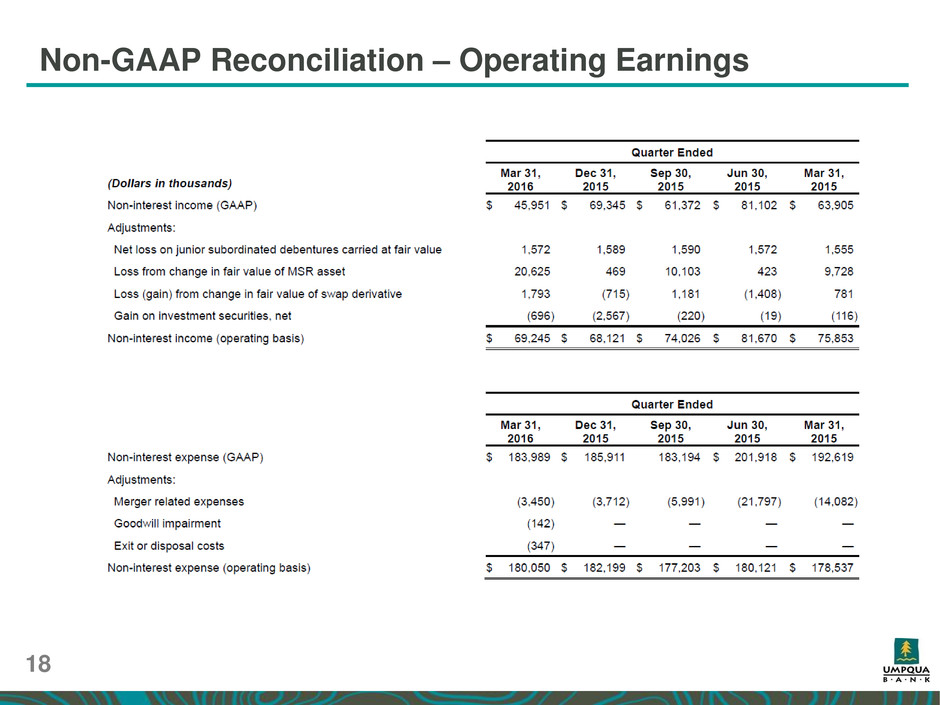

Appendix – Non-GAAP Reconciliation

Non-GAAP Reconciliation – Operating Earnings 17

Non-GAAP Reconciliation – Operating Earnings 18

Non-GAAP Reconciliation – Tangible Book Value 19

Thank you