Attached files

| file | filename |

|---|---|

| EX-31.1 - OnePower Systems Ltd. | ex31-1.htm |

| EX-32.1 - OnePower Systems Ltd. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended February 29, 2016

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission file number: 333-185176

ONEPOWER SYSTEMS LTD.

(Exact name of registrant as specified in its charter)

| Nevada | N/A | |

| State

or other jurisdiction of incorporation or organization |

(I.R.S.

Employer Identification No.) |

Ain El-Mraisseh

73 Bliss Street, Qoreitem Bldg, 3rd floor

Beirut-Lebanon

(Address of principal executive offices) (Zip Code)

1-866-906-7983

Registrant’s telephone number, including area code

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

17,454,545 shares of common stock are issued and outstanding as of April 11, 2016.

OnePower Systems Ltd

Condensed Financial Statements

February 29, 2016

| PAGES | |

| CONDENSED BALANCE SHEETS | 3 |

| CONDENSED STATEMENTS OF OPERATIONS | 4 |

| CONDENSED STATEMENT OF STOCKHOLDERS’ DEFICIT | 5 |

| CONDENSED STATEMENTS OF CASH FLOWS | 6 |

| NOTES TO FINANCIAL STATEMENTS | 7-9 |

| 2 |

ONEPOWER SYSTEMS LTD.

(Unaudited)

| February 29,2016 | November 30, 2015 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 1,545 | $ | 5,134 | ||||

| Total Assets | $ | 1,545 | $ | 5,134 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and accrued liabilities | $ | 3,573 | $ | 5,538 | ||||

| Notes payable , related party (Note 6) | 20,000 | 20,000 | ||||||

| Notes payable, unrelated (Note 6) | 35,000 | 35,000 | ||||||

| Total Current Liabilities | 58,573 | 60,538 | ||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Common stock Par value:$0.001 Authorized 200,000,000 shares; issued and outstanding 17,454,545 shares at February 29, 2016 and November 30, 2014 | 17,455 | 17,455 | ||||||

| Additional paid in capital | 24,545 | 24,545 | ||||||

| Accumulated deficit stage | (99,028 | ) | (97,404 | ) | ||||

| Total Stockholders’ Deficit | (57,028 | ) | (55,404 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 1,545 | $ | 5,134 | ||||

The accompanying notes are an integral part of the financial statements.

| 3 |

ONEPOWER SYSTEMS LTD.

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| For the three | For the three | |||||||

| months ended | months ended | |||||||

| February 29, 2016 | February 28, 2015 | |||||||

| REVENUES | $ | - | $ | - | ||||

| EXPENSES | ||||||||

| General and administrative expenses | 1,624 | 4,996 | ||||||

| Net loss and comprehensive loss | $ | (1,624 | ) | $ | (4,996 | ) | ||

| Loss per share of common stock | ||||||||

| Basic and diluted | $ | (0.00 | ) | $ | (0.00 | ) | ||

| Weighted average shares of common stock | ||||||||

| Basic and diluted | 17,454,545 | 17,454,545 | ||||||

The accompanying notes are an integral part of the financial statements.

| 4 |

ONEPOWER SYSTEMS LTD

CONDENSED STATEMENT OF STOCKHOLDER’S DEFICIT

(Unaudited)

| Additional | ||||||||||||||||||||

| Common Stock | Paid-in | Accumulated | ||||||||||||||||||

| Share(s) | Amount | Capital | Deficit | Total | ||||||||||||||||

| Balance, November 30, 2013 | 17,454,545 | $ | 17,455 | $ | 24,545 | $ | (61,490 | ) | $ | (19,490 | ) | |||||||||

| Net loss for the period | - | - | - | (16,895 | ) | (16,895 | ) | |||||||||||||

| Balance, November 30, 2014 | 17,454,545 | 17,455 | 24,545 | (78,385 | ) | (36,385 | ) | |||||||||||||

| Net loss for the period | - | - | - | (19,019 | ) | (19,019 | ) | |||||||||||||

| Balance, November 30, 2015 | 17,454,545 | 17,455 | $ | 24,545 | (97,404 | ) | (55,404 | ) | ||||||||||||

| Net loss for the period | - | - | - | (1,624 | ) | (1,624 | ) | |||||||||||||

| Balance, February 29, 2016 | 17,454,545 | $ | 17,455 | $ | 24,545 | $ | (99,028 | ) | $ | (57,028 | ) | |||||||||

The accompanying notes are an integral part of the financial statements.

| 5 |

ONEPOWER SYSTEMS LTD.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

| For the three | For the three | |||||||

| months ended | months ended | |||||||

| February 29, 2015 | February 28, 2014 | |||||||

| Cash Flows (used in) Operating Activities | ||||||||

| Net loss | $ | (1,624 | ) | $ | (4,996 | ) | ||

| Adjustments to reconcile net income to net cash (used in) operating activities | ||||||||

| Accounts payable and accrued liabilities | (1,965 | ) | 4,000 | |||||

| Net Cash (used in) Operating Activities | (3,589 | ) | (996 | ) | ||||

| Net Cash from Investing Activities | - | - | ||||||

| Cash Flows from Financing Activities Proceeds of convertible notes payable | - | - | ||||||

| Net Cash provided by Financing Activities | - | - | ||||||

| Decrease in cash | (3,589 | ) | (996 | ) | ||||

| Cash at beginning of period | 5,134 | 4,746 | ||||||

| Cash at end of period | $ | 1,545 | $ | 3,750 | ||||

| Supplemental Information and Non-Monetary Transaction | ||||||||

| Interest Paid | $ | - | $ | - | ||||

| Taxes Paid | $ | - | $ | - | ||||

The accompanying notes are an integral part of the financial statements.

| 6 |

ONEPOWER SYSTEMS LTD.

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2016

| 1. | Interim Reporting |

While the information presented in the accompanying interim three months financial statements is unaudited, it includes all adjustments, which are, in the opinion of management, necessary to present fairly the financial position, results of operations and cash flows for the interim periods presented in accordance with accounting principles generally accepted in the United States of America. These interim financial statements follow the same accounting policies and methods of their application as the Company’s November 30, 2015 annual financial statements. All adjustments are of a normal recurring nature. It is suggested that these interim financial statements be read in conjunction with the Company’s November 30, 2015 annual financial statements.

Operating results for the three months ended February 29, 2016 are not necessarily indicative of the results that can be expected for the year ended November 30, 2016.

| 2. | Organization and nature of operations |

OnePower Systems Ltd. (“the Company”) was incorporated in the State of Nevada, USA on August 28, 2009. The Company is in its early development stage since its formation and has not realized any revenues from its planned operations. The Company is engaged in the development of electronic bill delivery and payment systems that will enable vendors the abilities to present bills and receive payments electronically.

The Company has chosen a November 30 year end.

| 3. | Going concern uncertainties |

These financial statements have been prepared in conformity with generally accepted accounting principles in the United States, which contemplate continuation of the Company as a going concern. However, the Company has limited operations and has sustained operating losses resulting in a deficit. In view of these matters, operating as a going concern is dependent upon the Company’s ability to meet its financing requirements, and the success of its future operations.

The Company has accumulated a deficit of $99,028 since inception, has yet to achieve profitable operations and further losses are anticipated in the development of its business. The Company’s ability to continue as a going concern is in substantial doubt and is dependent upon obtaining additional financing and/or achieving a sustainable profitable level of operations. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. The Company may seek additional equity as necessary and it expects to raise funds through private or public equity investment in order to support existing operations and expand the range of its business. There is no assurance that such additional funds will be available for the Company on acceptable terms, if at all.

| 4. | Summary of principal accounting policies |

A summary of the significant accounting policies applied in the presentation of the accompanying financial statements follows:

Basis of presentation

The accompanying financial statements are stated in US dollars and have been prepared in accordance with generally accepted accounting principles in the United States of America.

| 7 |

ONEPOWER SYSTEMS LTD.

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2016

| 4. | Summary of principal accounting policies (continued) |

Recently issued accounting pronouncements

The Company adopts new pronouncements relating to generally accepted accounting principles applicable to the Company as they are issued, which may be in advance of their effective date. Management does not believe that any pronouncement not yet effective but recently issued by the FASB (including its Emerging Issues Task Force), the AICPA or the SEC would, if adopted, have a material effect on the accompanying financial statements.

| 5. | Common stock |

The Company has not issued any stock options or warrants during the periods ended February 29, 2016 and February 28, 2015, or since inception

There were no non-cash transactions during the periods ended February 29, 2016 and February 28, 2015.

| 6. | Convertible Notes Payable |

The Company has five convertible notes payable. The notes are non-interest bearing, unsecured and payable on demand. At any time prior to repayment any portion of the entire note may be converted into common stock at the discretion of the holder on the basis of $0.055 of debt to 1 share. The effect that conversion would have on earnings per share has not been disclosed due to the current anti-dilutive effect.

The common stock of the Company has been issued at $0.055 per share for operations. The conversion rate of $0.055 creates a zero conversion benefit at current stock prices. Therefore, no beneficial conversion factor has been recorded.

| Notes payable as of February 29, and February 28 | February 29, 2016 | November 30, 2015 | ||||||

| Issued to a related party | ||||||||

| Convertible promissory note payable, dated November 9, 2012 non-interest bearing, due on demand | $ | 10,000 | $ | 10,000 | ||||

| Convertible promissory note payable, dated April 26, 2013 non-interest bearing, due on demand | 10,000 | 10,000 | ||||||

| Notes payable to related party | $ | 20,000 | $ | 20,000 | ||||

| 8 |

ONEPOWER SYSTEMS LTD.

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2016

| Notes payable Issued to unrelated parties | February 29, 2016 | November 30, 2015 | ||||||

| Convertible promissory note payable, dated March 28, 2014 non-interest bearing, due on demand | $ | 20,000 | $ | 20,000 | ||||

| Convertible promissory note payable, dated June 26, 2015 non-interest bearing, due on demand | 10,000 | 10,000 | ||||||

| Convertible promissory note payable, dated November 11, 2015 non-interest bearing, due on demand | 5,000 | 5,000 | ||||||

| Notes payable to unrelated parties | $ | 35,000 | $ | 35,000 | ||||

| 9 |

FORWARD LOOKING STATEMENTS

Statements made in this Form 10-Q that are not historical or current facts are “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 (the “Act”) and Section 21E of the Securities Exchange Act of 1934. These statements often can be identified by the use of terms such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “approximate” or “continue,” or the negative thereof. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

GENERAL

OnePower Systems Ltd. was incorporated under the laws of the State of Nevada, U.S. on August 28, 2009. Our registration statement on Form S-1 was filed with the Securities and Exchange Commission was declared effective on May 21, 2013.

OnePower is a startup company, with its operations located in Lebanon, engaged in the development of an electronic bill delivery and payment system (the “OP SYSTEM”) that is intended to provide Middle Eastern utility companies with the ability to present bills and receive payment electronically. OnePower is a “shell” company as defined by the SEC as a result of only having nominal operations and nominal assets. OnePower is an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. OnePower’s mission is to become the leading provider of electronic bill delivery and payment services for all business-to-consumer transactions within the utility industry.

RESULTS OF OPERATIONS

Our financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation. We expect we will require additional capital to meet our long term operating requirements. We expect to raise additional capital through, among other things, the sale of equity or debt securities.

Three-month Period Ended February 29, 2016 Compared to the Three-month Period Ended February 28, 2015.

Our net loss for the three-month period ended February 29, 2016 was $1,624 (2015: $4,996), which consisted of general and administration expenses. We did not generate any revenue during either three-month period in fiscal 2016 or 2015. The increase in expenses in the current fiscal year relate to accounting, audit, and legal fees that we have incurred in connection with the filing of our statements on Form 10-K with the Securities & Exchange Commission.

The weighted average number of shares outstanding was 17,454,545 for the three-month period ended February 29, 2016 and 17,454,545 for the three-month period ended February 28, 2015.

| 10 |

LIQUIDITY AND CAPITAL RESOURCES

As at February 29, 2016, our current assets were $1,545 compared to $5,134 in current assets at November 30, 2015. As of February 29, 2016, our current liabilities were $58,573 compared to $60,538 at November 30, 2015. Current liabilities at February 29, 2016 were comprised of $55,000 in loans payable to our director and $5,538 in accounts payable.

Stockholders’ deficit increased from $55,404 as of November 30, 2015 to $57,028 as of February 29, 2016.

Cash Flows from Operating Activities

We have not generated positive cash flows from operating activities. For the three-month period ended February 29, 2016, net cash flows used in operating activities were $3,589 consisting of a net loss of $1,624, and $1,965 in accounts payable and accrued liabilities. For the three-month period ended February 28, 2015, net cash flows used in operating activities were $996 consisting of a net loss of $4,996, $4,000 in accounts payable.

Cash Flows from Financing Activities

We have financed our operations primarily from either the issuance of our shares of common stock or from director loans. For the three-month period ended February 29, 2016, we realized $nil in net cash. We did not generate any cash from financing activities in the comparative period in fiscal 2015.

PLAN OF OPERATION AND FUNDING

OnePower’s plan of operation for the next 12 months is to:

| 1. | develop a prototype version of the OP System; | |

| 2. | identify and establish a relationship with a utility company that can assist in the final stage of development of the OP System; | |

| 3. | develop its website and market the OP System to Middle Eastern utility companies; | |

| 4. | Rollout the OP System to targeted Middle Eastern utility companies and sign up a minimum of five Middle Eastern utility companies, as well as advertising through traditional radio and print media to create product awareness. |

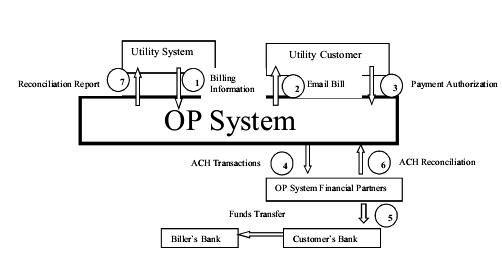

OnePower’s OP System is intended to offer a full service electronic bill presentment and payment solution for businesses with a recurring billing cycle. OP System is being designed to utilize data from a biller’s existing system and create an enhanced online version of a customer’s bill. In addition to electronic billing, The OP System is intended to strengthen direct marketing and customer care. The electronic bill is presented to a consumer as a bill from the biller, not from OnePower. This customized bill will be designed to contain promotions and information chosen by the biller that are accessible through successive mouse clicks.

The operations flow of this service is being designed to integrate smoothly with the biller’s existing workflow. The process involves the following steps:

| 1. | The utility sends billing information for the current cycle to OnePower in the utilities existing system format. | |

| 2. | OnePower software translates this billing information into its database. For each new bill, OnePower generates a customized electronic bill. The electronic bill is emailed to the customer. | |

| 3. | The customer receives the email, reviews, and approves payment by responding to the email. | |

| 4. | OnePower processes the responses, for each approved payment, an automated clearing house (ACE) transaction is submitted to OnePower’s bank. | |

| 5. | The transaction is processed within the ACE system. | |

| 6. | An execution report is returned to OnePower | |

| 7. | OnePower compiles the executed and fully funded transactions, and sends back a reconciliation report which integrates directly into the Middle Eastern utility companies system. |

| 11 |

Pricing

OnePower intends to utilize a combination of fixed and variable fees to charge companies for the use of the OnePower services. These fees may be flexible depending on the size of each customer.

Monthly Subscription Fee

This fee is the per month subscription rate for OnePower service. This fee will be $5,000 per month. This is meant to cover the intangible but critical value added benefits of the service, including:

| ● | Facilitating customized bill presentment, marketing and promotion by working closely with the utility to help them develop and maximize this new medium of direct customer contact. | |

| ● | Setup costs for registering new consumers. | |

| ● | Analysis of billing data to enhance targeted marketing initiatives and customer profiles. | |

| ● | Online access to company and billing information through hosting web content thus providing better customer service and data access. | |

| ● | Advertising & Promotion - reduction of paper stuffers. |

Transaction Fee

The transaction fee will be assigned per bill processed. This will be $0.40 per transaction. This fee is meant to include the incremental value to the biller per transaction, including:

| ● | Accounts Receivables Reduction | |

| ● | Printing/Paper savings | |

| ● | Postage savings | |

| ● | Handling of paid bills, data entry | |

| ● | Check Processing Fees |

The implementation of the different phases of OnePower’s plan of operation will depend on how successful OnePower is in raising the required funds through equity or debt financing.

Phase 1 - Develop a prototype version of the OP System (5 months)

In Phase 1, OnePower plans to develop a prototype of its electronic bill delivery and payment system that is intended to provide Middle Eastern utility companies with the ability to present bills and receive payments electronically (the “OP System”).

The development of the OP System will consist of acquiring the required hardware and software to develop the prototype of the OP System. In addition, OnePower plans to hire or retain qualified technicians to develop the core technology of the OP System.

OnePower has budgeted $100,000 for this phase and expects it to take five months to complete, with completion expected within the first five months of OnePower’s plan of operation. This phase can be fully implemented with a minimum financing of $186,000. However, the implementation of this phase and the other phases of OnePower’s plan of operation will depend on whether OnePower can raise the required funds. As of February 29, 2016, OnePower had only raised $25,000 and has subsequently deregistered its offering. OnePower intends to finance the balance of its plan of operation through equity and debt financing.

| 12 |

Phase 2 – Identify and establish relationship with utility company (6 months)

In Phase 2, OnePower plans to identify specific Middle Eastern utility companies in which to establish a relationship in which the utility company will be a participant in the pilot program for the prototype version of the OP System, (2) to test the OP System, and (3) to establish credibility within the utility industry.

In this phase of its plan of operations, OnePower will identify a target utility company that will become a first adopter of the OP System for the purpose of testing the OP System. The relationship between OnePower and the target utility company will need to satisfy the following criteria:

| ● | The utility company must provide access to its systems and data files for the purpose of merging with the OP System. | |

| ● | The utility company must share personnel and industry knowledge with OnePower. | |

| ● | OnePower must provide a server and a site to test the OP System with the utility company’s system. | |

| ● | The utility company must have credibility in the utility industry. |

OnePower has budgeted $50,000 for this phase and expects it to take six months to complete, with completion expected within the first six months of OnePower’s plan of operation. Also, during this phase, OnePower will continue to develop its OP System. Phase 2 will overlap with Phase 1 and will be worked on simultaneously with Phase 1. This phase can be implemented with approximately $300,000.

Phase 3 – Market the OP System to Middle Eastern utility companies (6 months)

In Phase 3, OnePower plans to (1) implement its marketing and sales programs for the OP System (2) develop and populate its website (www.onepowersystems.com) with information regarding its business and the OP System, and (3) hire and train staff for its marketing and sales programs.

OnePower has budgeted $100,000 for this phase and expects it to take six months to complete, with completion expected within the last six months of OnePower’s plan of operation. Also, during this phase, OnePower will continue to (a) develop its OP System and (b) identify target Middle Eastern utility companies for partnerships to test the OP System. Phase 3 will overlap and will be worked on simultaneously with Phases 1 and 2. This phase can be implemented with approximately $400,000.

Phase 4 –Roll out the OP System (6 months)

In Phase 4, OnePower plans to (1) roll out the OP System to other Middle Eastern utility companies and (2) sign up five Middle Eastern utility companies as new customers.

In this phase of its plan of operations, OnePower intends to identify potential viable target Middle Eastern utility companies. Target Middle Eastern utility companies will be identified based on (a) areas with high Internet usage and (b) a large customer base with a potential for greater use of the OP System.

OnePower has budgeted $100,000 for this phase and expects it to take six months to complete, with completion expected within the last six months of OnePower’s plan of operation and will be an ongoing phase of OnePower’s plan of operation. This phase can be substantially implemented with approximately $500,000.

We expect that working capital requirements will continue to be funded through a combination of our existing funds and further issuances of securities. Our working capital requirements are expected to increase in line with the growth of our business.

Existing working capital, further advances and debt instruments, and anticipated cash flow are expected to be adequate to fund our operations over the next three months. We have no lines of credit or other bank financing arrangements. Generally, we have financed operations to date through the proceeds of the private placement of equity and debt instruments. In connection with our business plan, management anticipates additional increases in operating expenses and capital expenditures relating to: (i) acquisition of inventory; (ii) developmental expenses associated with a start-up business; and (iii) marketing expenses. We intend to finance these expenses with further issuances of securities and director loans. Thereafter, we expect we will need to raise additional capital and generate revenues to meet long-term operating requirements. Additional issuances of equity or convertible debt securities will result in dilution to our current shareholders. Further, such securities might have rights, preferences or privileges senior to our common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of prospective new business endeavors or opportunities, which could significantly and materially restrict our business operations. We will have to raise additional funds in the next twelve months in order to sustain and expand our operations. We currently do not have a specific plan of how we will obtain such funding; however, we anticipate that additional funding will be in the form of equity financing from the sale of our common stock. We have and will continue to seek to obtain short-term loans from our directors, although no future arrangement for additional loans has been made. We do not have any agreements with our directors concerning these loans. We do not have any arrangements in place for any future equity financing.

| 13 |

OFF-BALANCE SHEET ARRANGEMENTS

As of the date of this report, we do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

GOING CONCERN

The independent auditors’ report accompanying our November 30, 2015 financial statements contained an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. The financial statements have been prepared “assuming that we will continue as a going concern,” which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

No report required.

ITEM 4. CONTROLS AND PROCEDURES

Our management is responsible for establishing and maintaining a system of disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act) that is designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive officer or officers and principal financial officer or officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

An evaluation was conducted under the supervision and with the participation of our management of the effectiveness of the design and operation of our disclosure controls and procedures as of February 29, 2016. Based on that evaluation, our management concluded that our disclosure controls and procedures were effective as of such date to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms. Such officer also confirmed that there was no change in our internal control over financial reporting during the three-month period ended February 29, 2016 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

| 14 |

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Quarterly Report, no director, officer or affiliate is (i) a party adverse to us in any legal proceeding, or (ii) has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

During the quarter of the fiscal year covered by this report, (i) OnePower did not modify the instruments defining the rights of its shareholders, (ii) no rights of any shareholders were limited or qualified by any other class of securities, and (iii) OnePower did not sell any unregistered equity securities.

On May 21, 2013, the Securities and Exchange Commission declared OnePower’s Form S-1 Registration Statement effective, file number 333-185176, which permitted OnePower to offer up to 10,000,000 shares of common stock at $0.055 per share. There was no underwriter involved in this public offering. OnePower accepted one subscription agreement for a total of $25,000 for the issuance of 454,545 common shares to date.

On September 23, 2013, the Securities and Exchange Commission declared OnePower’s post-effective amendment #1 of its Form S-1 Registration Statement effective, file number 333-185176, which deregistered the 9,545,455 shares of common stock that remained unsold as of that date. The offering period for the public offering expired on September 23, 2013.

OnePower has used the proceeds to pay for some of the expenses of the Form S-1 offering including legal, accounting, and transfer agent fees

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

No report required.

ITEM 4. MINE SAFETY DISCLOSURES

None.

ITEM 5. OTHER INFORMATION

No report required.

ITEM 6. EXHIBITS

Exhibits:

| 31.1 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to Section 302(a) of the Sarbanes-Oxley Act |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer Under Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act. |

| 101 | Interactive data files pursuant to Rule 405 of Regulation S-T. |

| 15 |

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ONEPOWER SYSTEMS LTD. | ||

| Dated: April 20, 2016 | By: | /s/ Soha Hamdan |

| Soha Hamdan, President and Chief Executive | ||

| Officer and Chief Financial Officer | ||

| 16 |