Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - KEY ENERGY SERVICES INC | d178040dex314.htm |

| EX-31.3 - EX-31.3 - KEY ENERGY SERVICES INC | d178040dex313.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-08038

KEY ENERGY SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 04-2648081 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1301 McKinney Street

Suite 1800

Houston, Texas 77010

(Address of principal executive offices, including Zip Code)

(713) 651-4300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered | |

| Common Stock, $0.10 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Title of Class

None

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | þ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the common stock of the registrant held by non-affiliates as of June 30, 2015, based on the $1.80 per share closing price for the registrant’s common stock as quoted on the New York Stock Exchange on such date, was $240.5 million (for purposes of calculating these amounts, only directors, officers and beneficial owners of 10% or more of the outstanding common stock of the registrant have been deemed affiliates).

As of February 16, 2016, the number of outstanding shares of common stock of the registrant was 161,353,142.

Table of Contents

KEY ENERGY SERVICES, INC.

2015 ANNUAL REPORT ON FORM 10-K/A

| PART III | ||||||

| Item 10. |

4 | |||||

| Item 11. |

15 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

53 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

56 | ||||

| Item 14. |

57 | |||||

| Part IV | ||||||

| Item 15. |

59 | |||||

2

Table of Contents

EXPLANATORY NOTE

Key Energy Services, Inc. (the “Company” or “Key” or “We”) filed its Form 10-K for the year ended December 31, 2015 (the “2015 Form 10-K”) with the Securities and Exchange Commission (the “Commission”) on March 4, 2016. Pursuant to General Instruction G(3) to Form 10-K, the Company intended to incorporate by reference the information required by Part III of Form 10-K from our definitive proxy statement for the 2016 Annual Meeting of Shareholders (the “2016 Proxy Statement”) or to file by amendment. Because the 2016 Proxy Statement will not be filed with the Commission prior to 120 days after the end of the fiscal year covered by the 2015 Form 10-K, the Company is filing this Amendment No. 1 to the 2015 Form 10-K (the “Form 10-K/A”) to provide the additional information required by Part III of Form 10-K. This Form 10-K/A does not change the previously reported financial statements or any of the other disclosures contained in Part I, Part II or Part IV, other than to add new Exhibits 31.1 and 31.2 under Item 15(a)(3). Some of the information provided in this Form 10-K/A may be superseded by the information provided in the definitive 2016 Proxy Statement to be filed with the Commission. This report on Form 10-K/A is filed solely to provide the information required by Part III of Form 10-K, and it does not reflect events occurring or matters arising after the filing date of the 2015 Form 10-K.

3

Table of Contents

Item 10. Directors, Executive Officers and Corporate Governance

Board of Directors

Our Board is divided into three classes. One class is elected each year and members of each class hold office for three-year terms. Our bylaws provide that the number of directors constituting the Board will be determined by resolution of the Board. The Board has set the number of directors at ten. There are presently four Class I directors, three Class II directors and three Class III directors. Below are the name, age and certain other information of each member of our Board, including information each director has given us about all positions he or she holds, his or her principal occupation and business experience for the past five years and the names of other publicly held companies of which he or she currently serves as a director or has served as a director during the past five years. In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe that all of our directors exhibit high standards of integrity, honesty and ethical values.

Class I Directors (term expiring in 2016)

Kevin P. Collins, age 65, has been a member of the Board since March 1996 and currently serves as a member of the Board’s Audit Committee, Finance Committee and Special Committee. He has been Managing Member of The Old Hill Company LLC since 1997, a company he founded that provides corporate finance and management consulting services. From 1979 until 1991, he worked for various financial institutions. From 1992 to 1997, he served as a principal of JHP Enterprises, Ltd.; and from 1985 to 1992, he served as Senior Vice President of DG Investment Bank, Ltd., both of which were engaged in providing corporate finance and advisory services. Mr. Collins was a director of WellTech, Inc. from January 1994 until March 1996, when WellTech was merged into Key. From 2000 until 2010, Mr. Collins served as a director of the Penn Traffic Company. Mr. Collins was also a director of Applied Natural Gas Fuels, Inc. from November 2008 until October 2012 and Antioch Company LLC from February 2009 until November 2013. Mr. Collins is also a director of PowerSecure International, Inc. He holds BS and MBA degrees from the University of Minnesota. Mr. Collins is a CFA Charterholder. We believe Mr. Collins’ qualifications to serve on our Board include his extensive knowledge of Key and our industry, his analytical business background, his experience working on strategic transactions, as well as his lending and advisory experience with large financial institutions and his extensive experience serving on boards of directors, including his service on our and other companies’ audit committees.

W. Phillip Marcum, age 72, has been a member of the Board since March 1996 and currently serves as a member of the Board’s Compensation Committee and Corporate Governance and Nominating Committee. He was a director of WellTech, Inc. from January 1994 until March 1996, when WellTech was merged into Key. From October 1995 until March 1996, Mr. Marcum was the non-executive Chairman of the Board of WellTech. Previously, from January 1991 until April 2007, when he retired, he was Chairman of the Board, President and Chief Executive Officer of PowerSecure International, Inc. (formerly known as Metretek Technologies, Inc., and prior to that, known as Marcum Natural Gas Services, Inc.). Mr. Marcum also serves as Chairman of the Board of Advanced Emissions Solutions, Inc. (formerly known as ADA-ES), a Colorado based company. From 2012 to 2014, Mr. Marcum served as a director of Lilis Energy (formerly known as Recovery Energy, Inc.). He is presently a principal in Marcum Group. He holds a BBA from Texas Tech University. We believe Mr. Marcum’s qualifications to serve on our Board include his experience serving on other public companies’ boards of directors and his extensive business knowledge working with other public companies in the energy industry, including his founding and running of Marcum Natural Gas Services, Inc., which has since grown into a public company known as PowerSecure International, Inc.

William F. Owens, age 65, has been a member of the Board since January 2007 and currently serves as a member of the Board’s Audit Committee, Corporate Governance and Nominating Committee and Special Committee. He served as Governor of Colorado from 1999 to 2007 and as Colorado State Treasurer from 1995 to 1999. Before his public service, Mr. Owens was on the consulting staff at Touche Ross & Co. (now Deloitte & Touche, LLP) and served as Executive Director of the Colorado Petroleum Association, which represented more than 400 energy firms doing business in the Rocky Mountains region. Mr. Owens is a Senior Director at Greenberg Traurig, LLP, an international law firm. Currently, he is a Managing Director of Renew Strategies LLC, a Denver-based land and water development firm. Mr. Owens serves on the boards of Cloud Peak Energy Inc., Federal Signal Corporation and Bill Barrett Corporation and the Credit Bank of Moscow. From 2007 through 2012, he served on the board of FESCO, a Russian company listed on the Moscow exchange. He holds a BS from Stephen F. Austin State University. He is also a Senior Fellow at the University of Denver’s Institute for Public Policy Studies. We believe Mr. Owens’ qualifications to serve on our Board include his wide-ranging background and experience in business, public policy, management and energy.

4

Table of Contents

Lynn R. Coleman, age 76, has been a member of the Board since October 2007 and currently serves as a member of the Board’s Compensation Committee, Corporate Governance and Nominating Committee, Finance Committee and Special Committee. As a partner in the law firm of Skadden, Arps, Slate, Meagher and Flom LLP (“Skadden”), Mr. Coleman founded and led the firm’s energy practice for 20 years. He retired from the Skadden partnership in 2007. Prior to joining Skadden, Mr. Coleman served as the General Counsel of the U.S. Department of Energy and later as Deputy Secretary. From March 2008 through April 2010, Mr. Coleman served on the Supervisory Board of Lyondell Basell Industries, a large chemical company with operations in the U.S. and abroad. In May 2008, he also was appointed to the board of directors (non-executive Chair) of Total Holdings USA, Inc., a U.S. subsidiary of a large international oil company. In June 2010, Mr. Coleman was appointed to the board of directors of Defense Group Inc., a privately-owned corporation involved in defense and national security contracts, headquartered in Vienna, Virginia. In December 2012, Mr. Coleman was appointed to the board of directors of Standard Solar, Inc., a privately held corporation involved in development and installation of solar systems at the residential, commercial and municipal level. In 2007 and 2008, he was a lecturer at the University of Virginia School of Law, offering a seminar on energy and environmental law. He has also been appointed adjunct professor at the University of Texas School of Law offering a similar seminar. He holds an LLB degree from the University of Texas and a BA from Abilene Christian College. We believe Mr. Coleman’s qualifications to serve on our Board include his extensive experience practicing law in the energy industry, including his 20 years as a senior partner and leader of the energy practice at a prominent global law firm. He has wide ranging experience with energy transactions, litigation, government policy and regulation, in the U.S. and other countries. He has also served as managing partner and in similar management positions over other large groups of attorneys. His responsibilities in this capacity included decisions concerning strategic planning, hiring, partnership advancement, attorney evaluations, direction of work of other attorneys and management of client relationships.

Class II Directors (term expiring in 2017)

William D. Fertig, age 59, has been a member of the Board since April 2000 and currently serves as Chair of the Finance Committee and is a member of the Board’s Compensation Committee, Corporate Governance and Nominating Committee and Executive Committee. He has been Co-Chairman and Chief Investment Officer of Context Capital Management, an investment advisory firm, since 2002. He serves as trustee for ProFunds and ProShares. From 1990 through April 2002, Mr. Fertig was a Principal and a Senior Managing Director of McMahan Securities, a broker dealer firm specializing in convertible, high-yield and derivative securities. Mr. Fertig previously served in various senior capacities at Drexel Burnham Lambert and Credit Suisse First Boston from 1980 through 1990. He holds a BS from Allegheny College and an MBA from the Stern Business School of New York University. We believe Mr. Fertig’s qualifications to serve on our Board include his investment and market expertise.

Robert K. Reeves, age 58, has been a member of the Board since October 2007 and currently serves as Chair of the Compensation Committee and is a member of the Board’s Corporate Governance and Nominating Committee, Special Committee and Executive Committee. He is Executive Vice President, Law and Chief Administrative Officer of Anadarko Petroleum Corporation, an independent oil and gas exploration and production company. From 2007 to November 2015, Mr. Reeves served as Executive Vice President, General Counsel and Chief Administrative Officer of Anadarko. From 2004 to February 2007, Mr. Reeves served as Senior Vice President, Corporate Affairs & Law and Chief Governance Officer of Anadarko. Prior to joining Anadarko, he served as Executive Vice President, Administration and General Counsel of North Sea New Ventures from 2003 to 2004, and as Executive Vice President, General Counsel and Secretary of Ocean Energy, Inc. and its predecessor companies from 1997 to 2003, both energy exploration and production companies. Since 2008, Mr. Reeves also serves as a director of Western Gas Holdings, LLC, a subsidiary of Anadarko and general partner of Western Gas Partners, LP. Since 2012, Mr. Reeves has also served as a director of Western Gas Equity Holdings, LLC, a subsidiary of Anadarko and general partner of Western Gas Equity Partners, LP. He holds a BA and JD from Louisiana State University. We believe Mr. Reeves’ qualifications to serve on our Board include his experience in both legal and business matters as well as his upstream exploration and production experience.

Mark H. Rosenberg, age 54, has been a member of the Board since May 2013 and currently serves as the Chairman of the Board and Chair of the Executive Committee and is a member of the Board’s Compensation Committee, Corporate Governance and Nominating Committee and Finance Committee. Since 2002, he has been a Principal and since 2012 he has been a Principal and Chief Operating Officer with MHR Fund Management LLC, an owner of greater than 10% of the Company’s common stock. From 2000 to 2001, Mr. Rosenberg was Vice President with CRT Capital Group LLC in Greenwich, CT. From 1991 to 2000, Mr. Rosenberg was President of Rosemark Management, Inc., manager of a portfolio of investments and operating businesses. From 2012 to 2015, Mr. Rosenberg served as a director and a member of the Audit Committee and Compensation Committee of Northern Offshore Ltd. Previously, Mr. Rosenberg served on the boards of Ben Arnold Beverage Company of South Carolina until 2012 and Medical Nutrition USA, Inc. until its sale in 2010. Mr. Rosenberg graduated from the Wharton School, University of Pennsylvania and holds a BS in Economics. We believe Mr. Rosenberg’s qualifications to serve on our Board include his investment and market expertise.

5

Table of Contents

Class III Directors (term expiring in 2018)

Robert W. Drummond, age 55, is President and Chief Executive Officer. Mr. Drummond joined Key in June 2015 as President and Chief Operating Officer and has been a member of the Board of Directors since November 2015 and is a member of the Executive Committee and currently serves as Chair of the Equity Award Committee. Prior to joining Key, Mr. Drummond provided executive leadership as President North America for Schlumberger Limited, where, he had a distinguished, thirty-one year career where he held positions of Vice President of General Manager US Land, Vice President of Global Sales, Vice President General Manager US Gulf of Mexico, and President North American Offshore and Alaska. Mr. Drummond also serves on the Board of Directors of the National Ocean Industries Association and serves on the Board of Directors for the Petroleum Equipment Suppliers Association. In the past, he has served on the Board of Directors as Houston Offshore Energy Center, Greater Houston Partnership, and as Advisory Board Member of the University of Houston Global Energy Management Institute. Mr. Drummond received a Bachelor of Science, Mineral/Petroleum Engineering from the University of Alabama in 1982 and currently sits on their College of Engineering Leadership Board.

Ralph S. Michael, III, age 61, our former Lead Director, has been a member of the Board since March 2003 and currently serves as Chair of the Corporate Governance and Nominating Committee and is a member of the Board’s Audit Committee, Executive Committee, Finance Committee and Special Committee. He has served as Executive Vice President and Group Regional President of Fifth Third Bank since July 2015, and has served as President and Chief Executive Officer of Fifth Third Bank, Cincinnati Region, since December 2010. Mr. Michael was President and Chief Operating Officer of the Ohio Casualty Insurance Company from July 2005 until its sale in August 2007. From 2004 through July 2005, Mr. Michael served as Executive Vice President and Manager of West Commercial Banking for U.S. Bank, National Association (“U.S. Bank”) and then as Executive Vice President and Manager of Private Asset Management for U.S. Bank. He also served as President of U.S. Bank Oregon from 2003 to 2005. From 2001 to 2002, he served as Executive Vice President and Group Executive of PNC Financial Services Group, with responsibility for PNC Advisors, PNC Capital Markets and PNC Leasing. He is a director of AK Steel Corporation, Arlington Asset Investment Corporation, Cincinnati Bengals, Inc., CSAA Insurance Group and Xavier University. Previously, he served as a director for Integrated Alarm Services Group, Inc. from 2003 to 2007, for Ohio Casualty Corporation from 2002 to 2005 and FBR & Co. from 2010 until 2013. He holds a BA from Stanford University and an MBA from the Graduate School of Management of the University of California Los Angeles. We believe Mr. Michael’s qualifications to serve on our Board include the broad business and finance background obtained through his more than 30 years experience working in financial services, much of which has been in executive management positions, as well as his extensive experience as a corporate board member, including his service on our and other companies’ audit committees, all of which have designated him as an “audit committee financial expert.”

Arlene M. Yocum, age 58, has been a member of the Board since October 2007. She is the Chair of our Audit Committee and is currently serving as Chair of the Special Committee and is a member of the Board’s Finance Committee and Executive Committee. Ms. Yocum has been Executive Vice President, Managing Executive of Client Sales and Service for PNC’s Asset Management Group since 2003. Prior to that, she served as an Executive Vice President of PNC’s Institutional Investment Group from 2000 to 2003. Ms. Yocum was a director of Protection One, Inc until 2010. She holds a BA from Dickinson College and a JD from Villanova School of Law. We believe Ms. Yocum’s qualifications to serve on our Board include her extensive business experience, including her investment and finance expertise and her designation as an “audit committee financial expert,” as well as her knowledge of legal matters by virtue of her training as an attorney.

General

This section describes our principal corporate governance guidelines and practices. Complete copies of our Corporate Governance Guidelines, committee charters and codes of business conduct described below are available on our website at www.keyenergy.com. You can also request a copy of any of these documents by writing to: Investor Relations, Key Energy Services, Inc., 1301 McKinney Street, Suite 1800, Houston, Texas 77010. Our Board strongly believes that good corporate governance is important to ensure that Key is managed for the long-term benefit of our stockholders.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that address significant issues of corporate governance and set forth the procedures by which the Board carries out its responsibilities. Among the areas addressed by the Corporate Governance Guidelines are director qualifications and responsibilities, Board committee responsibilities, holdover directors, director compensation and tenure, director orientation and continuing education, access to management and independent advisors, succession planning and management development, and Board and committee performance evaluations. The

6

Table of Contents

Corporate Governance and Nominating Committee (the “CGN Committee”) is responsible for assessing and periodically reviewing the adequacy of these guidelines and recommending proposed changes to the Board, as appropriate. The Corporate Governance Guidelines are posted on our website at www.keyenergy.com. We will provide these guidelines in print, free of charge, to stockholders who request them.

Director Independence

Under applicable rules of the NYSE, a director will only qualify as “independent” if our Board affirmatively determines that he or she has no direct or indirect material relationship with Key. In addition, all members of the Audit Committee, Compensation Committee and CGN Committee are required to meet the applicable independence requirements set forth in the rules of the NYSE and the SEC.

The Board has determined that, except for Mr. Drummond, who serves as our President and Chief Executive Officer (“CEO”), each of our current directors are independent within the meaning of the foregoing rules. The Board considered Mr. Reeves’ position as an executive officer of one of our customers, Anadarko Petroleum Corporation (“Anadarko”), and determined that the relationship between Anadarko and Key does not affect Mr. Reeves’ independence. The Board considered the employment by Key of Mr. Reeves’ son-in-law, West P. Gotcher, and determined that the relationship between Mr. Reeves’ son-in-law and Key does not affect Mr. Reeves’ independence. For additional information regarding the relationships of Mr. Reeves, see the discussion below under the heading “Certain Relationships and Related Party Transactions.”

Board Leadership Structure

We separated the Chairman and CEO roles in August of 2015 and the Board appointed Mark H. Rosenberg as its independent, non-executive Chairman. Our Board consists of Mr. Rosenberg, the Chairman, and nine other directors. Our Corporate Governance Guidelines provide that non-employee directors will meet in executive session on a regular basis without management present. The Chairman presides at all meetings of the Board, as well as executive sessions of non-employee directors and, in consultation with the CEO, non-employee directors and management, establishes the agenda for each Board meeting. The Board has also delegated certain matters to its certain committees, each of which is chaired by an independent director with the exception of the Equity Award Committee. Mr. Drummond, as the Company’s President, CEO and Director, works in concert with the rest of our majority-independent Board to oversee the execution of the Company’s strategy.

Director Nomination Process

In considering whether to recommend a particular candidate for inclusion in the Board’s slate of recommended director nominees, our CGN Committee applies the criteria set forth in the guidelines contained in the Selection Process for New Director Candidates, which are available in the “Corporate Governance” section of our website, www.keyenergy.com. These criteria include the candidate’s integrity, business acumen, a commitment to understand our business and industry, experience, conflicts of interest and ability to act in the interests of all stockholders. The CGN Committee does not assign specific weights to particular criteria, and no particular criterion is a prerequisite for each prospective nominee. Any director nominee made by the CGN Committee must be highly qualified with respect to some or all of these criteria.

Our Board believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow it to fulfill its responsibilities. Although there is no formal diversity policy, the Selection Process for New Director Candidates tasks the CGN Committee with recommending director candidates who will assist in achieving this mix of Board members having diverse professional backgrounds and a broad spectrum of knowledge, experience and capability. At least once a year, the CGN Committee reviews the size and structure of the Board and its committees, including recommendations on Board committee structure and responsibilities.

In accordance with NYSE requirements, the CGN Committee also oversees an annual performance evaluation process for the Board, the Audit Committee, the Compensation Committee, the CGN Committee and the Finance Committee. In this process, anonymous responses from directors on a number of topics, including matters related to experience of Board and committee members, are discussed in executive sessions at Board and committee meetings. Although the effectiveness of the policy to consider diversity of director nominees has not been separately assessed, it is within the general subject matter covered in the CGN Committee’s annual assessment and review of Board and committee structure and responsibilities, as well as within the Board and committee annual performance evaluation process.

7

Table of Contents

Any stockholder entitled to vote for the election of directors may propose candidates for consideration for nomination for election to the Board. The CGN Committee will evaluate candidates proposed by stockholders in compliance with the guidelines contained in the Selection Process for New Director Candidates in the same manner as other candidates. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then the candidate’s name will be included on our proxy card for the next annual meeting. Stockholders also have the right under our bylaws to directly nominate director candidates, without any action or recommendation on the part of the CGN Committee or the Board. Candidates nominated by stockholders in accordance with procedures set forth in our bylaws will not be included on our proxy card for the next annual meeting.

Board Role in Risk Oversight

The Board’s role in the risk oversight process includes receiving regular reports from members of senior management on areas of material risk to Key, including operational, financial, legal and regulatory, and strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate “risk owner” within the organization to enable it to understand our risk identification, risk management and risk mitigation strategies. When a committee receives the report, the chair of the relevant committee reports on the discussion to the full Board during the committee reports portion of the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. In addition, as part of its charter, the Audit Committee regularly reviews and discusses with management, our internal auditors and our independent registered public accounting firm, Key’s policies relating to risk assessment and risk management. The Compensation Committee also specifically reviews and discusses risks that relate to compensation policies and practices. During 2015, we continued to engage in a comprehensive enterprise risk management process by evaluating our existing and emerging risk exposures and then implementing appropriate design plans to manage such risks. The Board reviews this process with management on a quarterly basis.

Board Meetings and Attendance

The Board held 13 meetings either in person or by telephone conference during 2015. Non-employee directors meet regularly in executive session. Additionally, management frequently discusses matters with the directors on an informal basis. Each director attended, either in person or by telephone conference, at least 96% of the Board and committee meetings held while serving as a director or committee member in 2015. The Company expects the directors to attend annual meetings of stockholders. All of the Company’s directors attending the 2015 annual meeting of stockholders, and we expect substantially all of our directors to attend the 2016 annual meeting.

Board Committees

The Board has established six standing committees—Audit Committee, Compensation Committee, Equity Award Committee, CGN Committee, Executive Committee and Finance Committee. Current copies of the charters of each of the Audit, Compensation, CGN and Finance Committees are posted in the “Corporate Governance” section of our website, www.keyenergy.com.

The Board has determined that all of the members of each of the Board’s standing committees, other than the Executive Committee and Equity Award Committee, are independent under the NYSE rules, including, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended.

Audit Committee

The responsibilities of the Audit Committee include the following:

| • | appointing, evaluating, approving the services provided by and the compensation of, and assessing the independence of, our independent registered public accounting firm; |

| • | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of certain reports from such firm; |

| • | reviewing with the internal auditors and our independent registered public accounting firm the overall scope and plans for audits, and reviewing with the independent registered public accounting firm any audit problems or difficulties and management’s response; |

8

Table of Contents

| • | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| • | reviewing and discussing with management and the independent registered public accounting firm our system of internal controls, financial and critical accounting practices and policies relating to risk assessment and risk management; |

| • | reviewing the effectiveness of our system for monitoring compliance with laws and regulations; and |

| • | preparing the Audit Committee report required by SEC rules (which is included under the heading “Report of the Audit Committee” below). |

The current members of our Audit Committee are Ms. Yocum and Messrs. Collins, Michael and Owens. Ms. Yocum is the chair of the Audit Committee. All members of the Audit Committee meet the financial literacy standard required by the NYSE rules and at least one member qualifies as having accounting or related financial management expertise under the NYSE rules. In addition, as required by the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring that each public company disclose whether or not its audit committee has an “audit committee financial expert” as a member. An “audit committee financial expert” is defined as a person who, based on his or her experience, satisfies all of the following attributes:

| • | an understanding of generally accepted accounting principles and financial statements; |

| • | an ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; |

| • | experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and level of complexity of issues that can reasonably be expected to be raised by Key’s financial statements, or experience actively supervising one or more persons engaged in such activities; |

| • | an understanding of internal control over financial reporting; and |

| • | an understanding of audit committee functions. |

The Board has determined that Ms. Yocum and Mr. Michael satisfy the definition of “audit committee financial expert,” and has designated each of Ms. Yocum and Mr. Michael as an “audit committee financial expert.” In addition, the Board has determined that all members of the Audit Committee are independent under the listing standards of the NYSE and the rules of the SEC.

The Audit Committee held eight meetings in 2015. In addition, members of the Audit Committee speak regularly with our independent registered public accounting firm and separately with the members of management to discuss any matters that the Audit Committee or these individuals believe should be discussed, including any significant issues or disagreements concerning our accounting practices or financial statements. For further information, see “Report of the Audit Committee” below.

The Audit Committee has the authority to retain legal, accounting or other experts that it determines to be necessary or appropriate to carry out its duties. We will provide the appropriate funding, as determined by the Audit Committee, for the payment of compensation to our independent registered public accounting firm and to any legal, accounting or other experts retained by the Audit Committee and for the payment of the Audit Committee’s ordinary administrative expenses necessary and appropriate for carrying out the duties of the Audit Committee.

The Audit Committee charter provides that no member of the Audit Committee may simultaneously serve on the audit committees of more than three public companies (including our Audit Committee) unless the Board has determined that such simultaneous service would not impair his or her ability to effectively serve on our Audit Committee. Currently, no member of the Audit Committee serves on the audit committees of more than three public companies.

9

Table of Contents

The charter of our Audit Committee can be accessed on the “Corporate Governance” section of our website, www.keyenergy.com.

Compensation Committee

The Compensation Committee has responsibility for establishing, implementing and continually monitoring adherence with our compensation philosophy. The responsibilities of the Compensation Committee include the following:

| • | reviewing and approving corporate goals and objectives relevant to the compensation of the CEO; |

| • | evaluating the CEO’s performance in light of corporate goals and objectives and, together with the other independent directors (as directed by the Board), determining and approving the CEO’s compensation level based on this evaluation; |

| • | reviewing and approving the compensation of senior executive officers other than the CEO; |

| • | reviewing and approving any incentive-compensation plans or equity-based plans; |

| • | overseeing the activities of the individuals and committees responsible for administering incentive-compensation plans or equity-based plans, including the 401(k) plan, and discharging any responsibilities imposed on the Compensation Committee by any of these plans; |

| • | approving any new equity compensation plan or any material change to an existing plan where stockholder approval has not been obtained; |

| • | in consultation with management, overseeing regulatory compliance with respect to compensation matters, including overseeing Key’s policies on structuring compensation programs to preserve tax deductibility; |

| • | making recommendations to the Board with respect to any severance or similar termination payments proposed to be made to any current or former senior executive officer or member of senior management of Key; |

| • | reviewing and recommending director compensation to the Board; |

| • | reviewing any potential conflicts of interest of our compensation consultant; |

| • | preparing an annual report of the Compensation Committee on executive compensation for inclusion in Key’s annual proxy statement or annual report in accordance with applicable SEC rules and regulations; and |

| • | reviewing and approving the Compensation Disclosure and Analysis for inclusion in Key’s annual proxy statement or annual report in accordance with applicable SEC rules and regulations. |

The current members of the Compensation Committee are Messrs. Reeves, Fertig, Marcum, Coleman and Rosenberg, all of whom are independent, non-employee members of the Board. Mr. Coleman is not eligible for re-election and therefore will retire as a member of the Board of Directors and a member of the Compensation Committee upon the end of his term in 2016. The Compensation Committee does not intend to replace him at this time. Mr. Reeves is the chair of the Compensation Committee. No Compensation Committee member participates in any of our employee compensation programs other than the Key Energy Services, Inc. 2014 Equity and Cash Incentive Plan. The Compensation Committee held ten meetings in 2015.

The Compensation Committee has the sole authority to select, retain, terminate and approve the fees and other retention terms of special counsel or other experts or consultants, as it deems appropriate in order to carry out its responsibilities, without seeking approval of the Board or management. With respect to compensation consultants retained to assist in the evaluation of director, CEO or executive officer compensation, this authority is vested solely in the Compensation Committee.

The charter of our Compensation Committee can be accessed in the “Corporate Governance” section of our website, www.keyenergy.com.

10

Table of Contents

Equity Award Committee

Mr. Alario served as the chair and sole member of the Equity Award Committee through March 4, 2016. Mr. Drummond is currently the chair and sole member of the Equity Award Committee. Subject to certain exceptions and limitations, the Compensation Committee has delegated to the Equity Award Committee the ability to grant equity awards under our equity incentive plans to those employees who are not executive officers, usually in connection with new hires and promotions. During 2015, the Compensation Committee authorized the Equity Award Committee to make grants up to an aggregate of 150,000 stock options or shares of restricted stock and restricted stock units to eligible employees under the annual approval authority for twelve months starting on January 29, 2015, but no more than 20,000 shares per grant or in the aggregate to any single employee during a twelve-month period. In addition, on that same date, the Compensation Committee approved restricted stock, restricted stock units and performance unit grants to non-executive officer employees up to an aggregate amount, and authorized the Equity Award Committee to determine the individual grant amounts to each employee in its reasonable discretion in consultation with management. For 2016, the Compensation Committee reset this Equity Award Committee’s authority to make grants up to an aggregate of 150,000 shares of restricted stock and restricted stock units to eligible employees under the annual approval authority for twelve months starting on January 28, 2016. Reports of equity grants made by the Equity Award Committee are included in the materials presented at the Compensation Committee’s regularly scheduled meetings.

Corporate Governance and Nominating Committee

The responsibilities of the CGN Committee include the following:

| • | identifying and recommending individuals to the Board for nomination as members of the Board and its committees, consistent with criteria approved by the Board; |

| • | developing and recommending to the Board corporate governance guidelines applicable to Key; and |

| • | overseeing the evaluation of the Board and management of Key. |

The CGN Committee consists entirely of independent directors, as that term is defined by applicable NYSE rules. The current members of the CGN Committee are Messrs. Michael, Fertig, Coleman, Marcum, Owens, Reeves and Rosenberg. Mr. Coleman is not eligible for re-election and therefore will retire as a member of the Board of Directors and a member of the Corporate Governance and Nominating Committee upon the end of his term in 2016. The Corporate Governance and Nominating Committee does not intend to replace him at this time. Mr. Michael is the chair of the CGN Committee. The CGN Committee held six meetings in 2015.

The CGN Committee has the authority and funding to retain counsel and other experts or consultants, including the sole authority to select, retain and terminate any search firm to be used to identify director candidates and to approve the search firm’s fees and other retention terms.

The charter of our CGN Committee can be accessed in the “Corporate Governance” section of our website, www.keyenergy.com.

Finance Committee

The Finance Committee was established August 21, 2015. The responsibilities of the Finance Committee include the following:

| • | Review and monitor the financial structure of the Company to determine that it is consistent with the Company’s requirements for growth and fiscally sound operation; |

| • | Review and approve for recommendation to the Board equity and debt offerings and other financings or refinancings to be undertaken by the Company and its subsidiaries and affiliates; |

| • | Review the actual and projected financial situation and capital needs of the Company as needed, on: (a) the capital structure of the Company, including among other matters, the respective level of debt and equity, the sources of financing and equity, and the Company’s financial ratios and credit rating policy; (b) any dividend policy; and (c) the issues and repurchase of Company stock; |

11

Table of Contents

| • | Review the Company’s activities with credit rating agencies; |

| • | Review the insurance principles and coverage of the Company and its subsidiaries, as well as financing risks, including those associated with currency and interest rates;. |

| • | Review, evaluate and approve for recommendation to the Board, the proposed terms of any credit facilities with lending or other institutions for corporate financings, general working capital purposes, or the establishment of any bank lines of credit and commercial paper programs; |

| • | Monitor on a periodic basis the Company’s key financial ratios, including any significant ratios or other financial covenants under the Company’s credit facilities; and |

| • | Review on a periodic basis the Company’s policy governing approval levels for capital expenditures and the Company’s financial plan to fund approved capital expenditures. |

The Finance Committee consists entirely of independent directors, as that term is defined by applicable NYSE rules. The current members of the Finance Committee are Messrs. Fertig (chair), Coleman, Collins, Michael, Rosenberg and Ms. Yocum. Mr. Coleman is not eligible for re-election and therefore will retire as a member of the Board of Directors and a member of the Finance Committee upon the end of his term in 2016. The Finance Committee does not intend to replace him at this time. The Finance Committee has the authority and funding to retain counsel and other experts or consultants, including the sole authority to select, retain, terminate and approve the fees and other retention terms of a financial consultant, independent legal counsel, and other financial advisors as it deems appropriate in order to carry out its responsibilities, without seeking approval of the Board or management. The Finance Committee held four meetings in 2015.

Executive Committee

The Executive Committee’s membership consists of the CEO and Chairman of the Board, the chair of each of the Audit Committee, Compensation Committee, CGN and Finance Committee. The Executive Committee only acts in place of the Board in situations where it may be impracticable to assemble the full Board to consider a matter on a timely basis. Any action by the Executive Committee will be promptly reported to the full Board. Currently, Messrs. Rosenberg, Drummond, Fertig, Michael and Reeves and Ms. Yocum serve on the Executive Committee. The Executive Committee held no meetings in 2015.

Other Committees

From time to time, the Board has established ad hoc or special committees to oversee certain Company projects or issues. During 2014, a Special Committee of directors consisting of Ms. Yocum (chair of the Special Committee) and Messrs. Michael, Collins, Owens, Coleman and Reeves was formed to investigate (i) possible violations of the FCPA involving business activities of our operations in Russia, (ii) an allegation involving our Mexico operations that, if true, could potentially constitute a violation of certain of our policies, including our Code of Business Conduct, the FCPA and other applicable laws, and (iii) a review of certain aspects of the Company’s Colombia operations, as well as our other international locations. Mr. Coleman is not eligible for re-election and therefore will retire as a member of the Board of Directors and a member of the Special Committee upon the end of his term in 2016. The Special Committee does not intend to replace him at this time. The Special Committee held twenty-six meetings in 2015.

Code of Business Conduct and Code of Business Conduct for Members of the Board of Directors

Our Code of Business Conduct applies to all of our employees, including our directors, CEO, Chief Financial Officer (“CFO”) and senior financial and accounting officers. Among other matters, the Code of Business Conduct establishes policies to deter wrongdoing and to promote both honest and ethical conduct, including ethical handling of actual or apparent conflicts of interest, compliance with applicable laws, rules and regulations, full, fair, accurate, timely and understandable disclosure in public communications and prompt internal reporting of violations of the Code of Business Conduct. We also have an Ethics Committee, composed of members of management, which administers our ethics and compliance program with respect to our employees. In addition, we provide an ethics line for reporting any violations on a confidential basis. Copies of our Code of Business Conduct are available in the “Corporate Governance” section of our website at www.keyenergy.com. We will post on our website all waivers to or amendments of our Code of Business Conduct and the Code of Business Conduct for Members of the Board of Directors that are required to be disclosed by applicable law and the NYSE listing standards.

12

Table of Contents

Executive Officers

Below are the names, ages and certain other information on each of our current executive officers, other than Mr. Drummond, whose information is provided above.

J. Marshall Dodson, age 45, Senior Vice President, Chief Financial Officer and Treasurer. Mr. Dodson was appointed Senior Vice President and Chief Financial Officer on March 25, 2013. Mr. Dodson joined Key as Vice President and Chief Accounting Officer on August 22, 2005 and served in that capacity until being appointed Vice President and Treasurer on June 8, 2009. From February 6, 2009, until Mr. Whichard’s election as Key’s new Chief Financial Officer on March 26, 2009, Mr. Dodson served in the additional capacity as interim principal financial officer. Prior to joining Key, Mr. Dodson served in various capacities at Dynegy, Inc., an electric energy production and services company, from 2002 to August 2005, most recently serving as Managing Director and Controller, Dynegy Generation since 2003. Mr. Dodson started his career with Arthur Andersen LLP in Houston, Texas in 1993, serving most recently as a senior manager prior to joining Dynegy, Inc. Mr. Dodson received a BBA from the University of Texas at Austin in 1993.

Jeffrey S. Skelly, age 58, Senior Vice President, Operations. Mr. Skelly joined Key as its Senior Vice President, Rig Services effective on June 21, 2010. He has served in various roles for Key, including Senior Vice President of Rig Services, Fluid Management Services and Operations Support. Mr. Skelly’s previous role was that of Chief Operating Officer at GEODynamics, a technology company focused on perforating systems and solutions, from November 2007 to January 2010. Previously, he was President for Expro Group’s Western Hemisphere Operations from January 2005 to June 2007. Mr. Skelly has also served in several roles at Halliburton including Global Manufacturing Operations Manager, Global Product Manager for Logging and Perforating, and Regional Manager of Wireline and Testing for the Middle East. Mr. Skelly began his career in the oil and gas services business after earning a B.S. Degrees in Civil Engineering and Ocean Engineering from Florida Institute of Technology. After college, he joined Schlumberger Limited (Schlumberger N.V.) (“Schlumberger”) and held various domestic and international positions at Schlumberger over the next 15 years including Field Engineer, Technical Manager, Field Service Manager, District Manager, Area Operations Manager, and Sales Manager.

Scott P. Miller, age 37, Senior Vice President of Operational Services and Chief Administrative Officer. Mr. Miller joined the Company in May, 2006 serving in various leadership roles in Supply Chain Management, Enterprise Projects, Fluid Management Services and Strategy before accepting the role of Vice President and Chief Information Officer in March of 2013. Mr. Miller was promoted to his current position effective January 1, 2016. Prior to joining Key, Mr. Miller served in various financial and supply chain roles at Dynegy, Inc. and Capital One. Mr. Miller received a Bachelors of Science in Management of Information Systems from Louisiana State University and a Master of Business Administration from the University of Houston.

Katherine I. Hargis, age 45, Vice President, Chief Legal Officer and Secretary. Ms. Hargis joined Key in July 2013 as Associate General Counsel, Corporate and Transactional & Assistant Secretary and was promoted to Vice President, Associate General Counsel & Assistant Secretary in November 2015 and was promoted to her current position as Vice President, Chief Legal Officer and Secretary on January 1, 2016. Prior to joining Key she served as the Vice President, General Counsel and Corporate Secretary for U.S. Concrete, Inc., a publicly held Company providing ready-mixed concrete and aggregates, from June 2012 through July 2013, and as its Deputy General Counsel & Corporate Secretary from December 2011 through June 2012, and as its Assistant General Counsel from December 2006 through December 2011. From February 2006 through December 2006, Ms. Hargis served as an attorney with King & Spalding LLP. From August 2002 through February 2006, Ms. Hargis served as an attorney for Andrews Kurth LLP. Ms. Hargis received her B.S. in Administration of Justice from Arizona State University in 1999 and her J.D. from Tulane University in 2002.

Mark A. Cox, age 56, Vice President and Controller. Mr. Cox was appointed as Vice President and Controller on March 20, 2012, and serves as principal accounting officer. Mr. Cox joined Key as Vice President, Tax in October 2009. Prior to joining Key, he served from December 2008 to September 2009 as Chief Financial Officer for Recon International, a privately-held company providing construction services to military and private organizations in Afghanistan. From August 1990 through November 2008, Mr. Cox held a variety of positions with BJ Services Company, including Director of Tax, Middle East Region Controller and Assistant Corporate Controller. He also worked in the tax practice of Arthur Andersen LLP from 1986 to 1990. Mr. Cox is a CPA and received a Bachelor of Accountancy degree from Houston Baptist University in 1986.

13

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and persons who beneficially own more than 10% of a registered class of our equity securities, to file initial reports of ownership on Form 3 and changes in ownership on Forms 4 or 5 with the SEC. Such officers, directors and 10% stockholders also are required by SEC rules to furnish Key with copies of all Section 16(a) reports they file. Based solely on its review of the copies of such forms furnished or available to us, we believe that our directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements for the fiscal year ended December 31, 2015. In making these statements, we have relied upon an examination of the copies of Forms 3, 4 and 5, and amendments thereto, and the written representations of our directors, executive officers and 10% stockholders.

14

Table of Contents

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

This section of the Form 10-KA describes and analyzes our executive compensation philosophy and program in the context of the compensation paid to our Named Executive Officers for 2015. Throughout this Form 10-KA, the individuals who served as our Principal Executive Officer and Principal Financial Officer during fiscal year 2015, and each of our other most highly compensated executive officers that are required to be in our executive compensation disclosures in fiscal year 2015 are referred to as the “Named Executive Officers” or “NEOs.” Our 2015 NEOs and their titles during the 2015 calendar year are listed below, which may not reflect their current status with our company:

| • | Richard J. Alario, Chief Executive Officer; |

| • | Robert Drummond, President and Chief Operating Officer from June 22, 2015 through March 4, 2016 (currently our President and Chief Executive Officer); |

| • | J. Marshall Dodson, our Senior Vice President, Chief Financial Officer and Treasurer; |

| • | Jeffrey S. Skelly, our Senior Vice President of Operations; |

| • | Kim B. Clarke, our Senior Vice President, Administration and Chief People Officer; and |

| • | Kimberly R. Frye, our Senior Vice President, General Counsel and Secretary. |

Effective March 5, 2016, Mr. Alario retired from the Company and no longer served as our Chief Executive Officer and Mr. Drummond was promoted to Chief Executive Officer. Effective March 31, 2016, Ms. Clarke terminated her employment with the Company and no longer served as the Company’s Senior Vice President, Administration and Chief People Officer. Ms. Frye, who served as our Senior Vice President, General Counsel and Secretary for a portion of 2015 was no longer with the Company at the end of the 2015 fiscal year, but was still considered an NEO for the 2015 year under the SEC’s disclosure rules.

In this Compensation Discussion and Analysis, we first provide an executive summary of our actions and results from 2015 related to executive compensation. We next explain the factors affecting our compensation decisions, results from 2015 and changes for the 2016 executive compensation program. We will also explain our principles that guide our Compensation Committee’s executive compensation decisions, including the compensation philosophy. We encourage you to read the entirety of the executive compensation discussion.

Executive Summary

Pay for Performance Philosophy

We are committed to providing value to our shareholders. We believe that our executive compensation program fairly and appropriately compensates our executive officers. The core principle of our executive compensation philosophy is to pay for performance in ways that we believe will motivate our executives to develop and execute strategies that deliver performance improvements over the short and long term. Accordingly, our executive compensation program is heavily weighted toward “at-risk” performance-based compensation. We have three principal elements of total direct compensation: base salary, annual incentive compensation and long-term incentive compensation. These elements provide our compensation committee with a platform to reinforce our pay-for-performance philosophy while addressing our business needs and goals with appropriate flexibility.

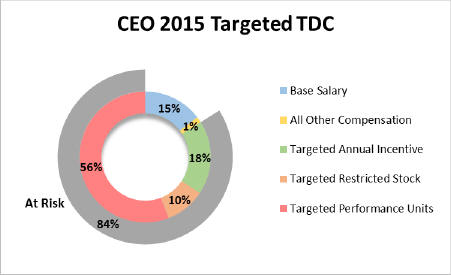

To illustrate our pay for performance philosophy, the following charts set forth each element as a proportion of the total direct compensation (“TDC”) that the CEO and the other NEOs were targeted to receive for 2015. For the CEO, 84% of his TDC was at-risk, performance based and not guaranteed.

15

Table of Contents

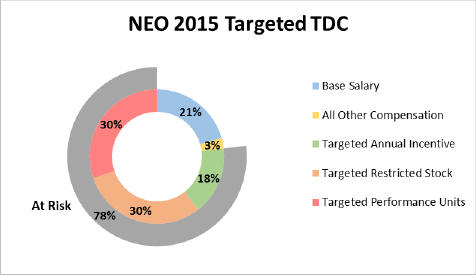

For the other NEOs, on average, 78% of their TDC was at-risk, performance based and not guaranteed.

CEO Reported Pay vs. Realized Pay

Realized Compensation Reflects Alignment with Stockholders

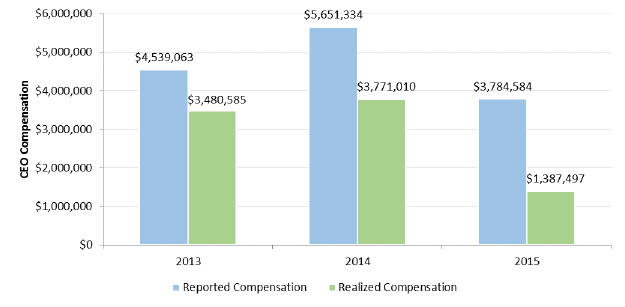

At the Company, a substantial portion of the compensation granted by the Compensation Committee to the CEO and reported in the “Summary Compensation Table” represents an incentive for future performance, not current cash compensation. This demonstrates the linkage between compensation and performance results. The table below sets forth the difference between pay shown in the “Summary Compensation Table” (“Reported Compensation”) and the actual pay realized by the CEO for fiscal years 2015, 2014, and 2013:

| Year of Compensation |

Total Reported Compensation |

Total Realized Compensation |

Realized Compensation vs. Reported Compensation |

Realized Compensation as a Percentage of Reported Compensation | ||||

| 2015 | $3,784,584 | $1,387,497 | –$2,397,087 | 37% | ||||

| 2014 | $5,651,334 | $3,771,010 | –$1,880,325 | 67% | ||||

| 2013 | $4,539,063 | $3,480,585 | –$1,058,478 | 77% |

16

Table of Contents

Realized compensation is different than reported compensation as disclosed in the “Summary Compensation Table” below.

Reported Compensation—the total compensation based on the current reporting rules for the “Summary Compensation Table” to be disclosed by a Company. Reported compensation includes the “grant date fair value” of equity awards (i.e. restricted stock and performance shares), rather than the annual expense value for accounting purposes. The “grant date fair value” is also calculated without any consideration to the risk of forfeitures with the award.

Realized Compensation—the total compensation actually received by the executive during the fiscal year, including base salary, the current bonus cash payout, market value of previously granted restricted stock that vested in the current year, market value of previously awarded performance shares vesting in the current year (assuming performance was achieved), and all other compensation amounts realized in the current year. This excludes the value of newly awarded/unvested restricted stock and performance share grants, change in pension value, and other amounts that will not actually be received until a future date. Realized compensation as a percentage of reported compensation has decreased 40% since 2013.

A realized compensation analysis measures the value of long-term compensation as it is earned rather than the value at the time of the grant. Because Key is ultimately focused on the interests of the shareholder, the realized compensation of the executive team, particularly the CEO, is linked to the performance of the Company’s total shareholder return and other performance metrics as described in the summary of compensation components below. The chart below details the performance of total shareholder return (“TSR”) over the past three years in comparison to reported compensation and to the compensation that was actually realized by the CEO in order to show that, based on our compensation philosophy, the compensation plans align realized pay with shareholder return:

Note: The total shareholder return (“TSR”) is the value of the stock performance between January 1st and year end. The realized long-term incentive values included the Realized TDC for the chart above include the restricted stock shares and the performance shares vested in each of the years at the year end stock price.

Executive Compensation Principles

As discussed in greater detail in this Compensation Discussion & Analysis, we believe that our compensation practices align the interests of our CEO and other executives to that of our stockholders, to drive performance. An overview of the practices we have implemented to drive this behavior and improve performance is highlighted below.

17

Table of Contents

We Pay for Performance.

| • | 84% of our CEO’s (and 78% on average for our other NEOs) total direct compensation is “at-risk, performance based, and not guaranteed.” |

| • | CEO long-term incentive awards revised to target at 85% performance based, up from 50% in 2014. |

| • | CEO and NEO long-term incentive award levels were reduced by 30% in 2015 versus 2014 to account for the drop in stock price at the time of the 2015 grant. |

| • | NEO’s long-term incentive awards revised to target at 50% performance based, up from 20% in 2014. |

| • | We reduced our CEO’s base salary by 10% and our NEO’s base salaries by 7%, effective February 22, 2015. |

| • | We set clear financial goals to determine bonus payments. |

| • | We use negative discretion in determining the awards made under our bonus plan. |

| • | We use negative discretion in determining the awards under our long-term incentive plan. |

| • | We provide minimal perquisites to our executive officers. |

We Follow Compensation Best Practices.

| • | Performance based long term compensation is subject to a three year performance period, up from one year performance period in prior grants. |

| • | All incentive-based compensation is subject to a clawback policy. |

| • | All equity grants, including performance- based grants are subject to “clawback” and “detrimental activities” provisions under certain circumstances. |

| • | We pay our cash incentive plan on an annual basis with pre-established criteria. |

| • | We prohibit hedging transactions and short sales by our executive officers and directors. |

| • | We do not permit the repricing of underwater stock options. |

| • | Our equity incentive plans do not allow for share recycling, other than forfeitures or cancellations. |

| • | We have minimum vesting requirements of three years for all equity-based awards to our executive officers. |

| • | We have equity ownership guidelines for our executive officers and directors: 6x base salary for CEO, 3x for NEO, 3x annual cash retainer for outside directors. |

| • | We evaluate share utilization to ensure burn rate and shareholder value dilution is within peer and industry norms. |

| • | We eliminated excise tax gross-ups for any employment agreements negotiated in the future. |

| • | We do not provide automatic change of control cash payments; after a change of control, there must be an involuntary termination of the executive (a “double-trigger”) in order for severance to be paid. |

| • | We limit our severance multiples to not greater than 3.0 times. |

| • | All new restricted stock grants provide for double trigger equity vesting after a change of control. |

We Follow Corporate Governance Best Practices.

| • | Our Compensation Committee is comprised of only independent directors. |

| • | We seek to mitigate undue risk associated with compensation, including caps, retention provisions, multiple performance targets and robust checks and balances to ensure employees do not take on unnecessary financial, safety or environmental risks. |

| • | Our Compensation Committee engages an independent compensation consultant, and meets with the consultant in executive session. |

| • | We regularly review the executive’s compensation with the peer group, which is also analyzed to ensure it is appropriate. |

| • | We revised the 2015 peer group to more closely represent the Company’s size. |

2015 Market and Industry Context

Our core businesses depend on our customers’ willingness to make expenditures to produce, develop and explore for oil and natural gas. Industry conditions are influenced by a number of factors, such as the domestic and international supply and demand for oil and natural gas, domestic and international economic conditions, political instability in oil producing countries and merger, acquisition and divestiture activity among E&P companies.

In a drastic turn of events, oil prices dropped roughly 35% during year over year and dropped approximately 58% from September 31, 2014 to December 31, 2015; declining to a low of $38.17 a barrel by December 31, 2015. This has been one of the fastest and longest oil price declines in history. As a result, customer demand as measured by the Baker Hughes land drilling rig count declined sharply as exploration and production companies cut capital expenditures.

18

Table of Contents

Layered on top of the market dynamics, in addition to the substantial time spent by management during the course of the year, the Company incurred costs of approximately $31.0 million for 2015 and $74.7 million to date, in connection with the Special Committee investigations described above, which in turn created uncertainty for investors as to the ongoing costs and ultimate resolution of the investigation.

How Key has Responded to Market Dynamics

As a result of the change in market conditions, management made several changes in the U.S. business to position Key for success in a market of declining demand and intense competition. These changes included:

| • | Reduction in corporate overhead; |

| • | Elimination of job positions; |

| • | Reduction in corporate salaries and wages; |

| • | Reduction in costs in field locations and field management; |

| • | Reduction in field salaries and wages; |

| • | Removing fixed assets and related costs; and |

| • | Requiring price reductions from our suppliers. |

In addition, we are proactively using our Key Value Added or KVA as our guidepost in pricing to ensure we are retaining cash flow positive work and maximizing the marginal dollars available to us in this market. KVA is not only a financial metric on which we measure ourselves, but, more important, it is a strategic analysis framework for decision making that we believe has meaningfully enhanced the institutional and commercial intelligence at Key. Please see below for a detailed discussion on KVA.

2015 Executive Compensation Highlights

2015 Investor Outreach

Following the results of our 2014 say-on-pay vote, our management team significantly increased our efforts to obtain feedback from our stockholders. Our goal in soliciting feedback was to provide information to our Compensation Committee to help the Committee (i) better understand our stockholders’ views on executive compensation, (2) be responsive to our stockholders’ views expressed in the 2014 say-on-pay vote, and (3) understand whether potential changes to our compensation programs would address concerns expressed by our stockholders. We contacted a significant majority of our largest investors after the 2014 annual meeting to get their further opinion on our compensation policies and practices. Our aggressive investor outreach efforts included the following:

| • | Outreach efforts to stockholders holding in the aggregate more than 50% of our outstanding stock; |

| • | In-depth meaningful discussions with holders representing approximately 35% of our outstanding stock (some stockholders declined our request to engage and some stockholders targeted in our comprehensive outreach effort have not yet responded); and |

| • | Examination of reports and analyses issued by and discussions with the principal proxy advisory services. |

Our CFO, Director of Investor Relations and Associate General Counsel- Corporate and Transactional led the outreach to interested investors. We believe the stockholders appreciated the outreach and the dialogue that resulted, and generally expressed a high level of satisfaction with our pay-for-performance approach and overall disclosure, but also provided some meaningful recommendations for the Compensation Committee to consider. We intend to continue this dialogue with our major stockholders.

As a result of the Compensation Committee’s ongoing efforts to ensure strong alignment between executive pay and Company performance, and in response to the feedback that we received from our major stockholders, as well as feedback from our compensation consultants, the Compensation Committee made the following key changes and decisions with respect to our executive compensation program:

19

Table of Contents

Negative Discretion Used in Determining 2015 Bonus Payout. We met the threshold goal for our 2015 financial performance goal. Nonetheless, the Compensation Committee exercised negative discretion in determining the bonus payout for the NEOs’ service in the 2015 calendar year except for with regard to Messrs. Drummond and Dodson. The Compensation Committee used positive discretion with regard to the individual portion of the cash bonus payments for both Messrs. Drummond and Dodson to recognize Mr. Drummond’s reorganizational and cost-cutting efforts and Mr. Dodson’s increased responsibilities in light of the Company’s current financial condition. The bonuses actually paid were well below the target bonus amount set for each NEO.

| Participant |

Bonus Paid |

Target Bonus Amount |

||||||

| Richard J. Alario |

$ | 150,000 | $ | 1,081,250 | ||||

| Robert Drummond |

$ | 200,000 | $ | 562,500 | ||||

| J. Marshall Dodson |

$ | 125,000 | $ | 300,000 | ||||

| Jeffrey S. Skelly |

$ | 125,000 | $ | 280,000 | ||||

| Kim B. Clarke |

$ | 70,000 | $ | 288,120 | ||||

| • | No bonus was paid to Ms. Frye as she was no longer employed at the end of the 2015 calendar year. |

| • | No Payments Made with Respect to Performance Units. The second tranche of performance units granted in 2014 did not meet the performance expectation. As a result, no payments were made with respect to any outstanding performance units in 2015. |

| • | NEO Salary Reductions. Effective February 22, 2015, the Compensation Committee reduced the CEO’s base salary by 10%, and the NEOs’ base salaries by 7%, resulting in base salaries at the 28th market percentile of the prior peer group. Mr. Drummond’s base salary was reduced by 10% upon his start date to the effect that he was offered an annual base salary of $625,000 subject to a temporary 10% base salary reduction resulting in an annual base salary of $562,500 commencing June 22, 2015. |

| • | Negative Discretion Used in Determining Long Term Incentive Awards to NEOs in 2015. In 2015, the Compensation Committee used negative discretion in awarding long-term incentives to its NEOs by reducing the value of shares awarded from $8,659,824 in 2014 to $6,401,696 in 2015 resulting in a 26% drop in total long-term incentive award value from 2014. |

| • | Negative Discretion Used in Determining Long Term Incentive Awards to NEOs in 2016. In 2016, the Compensation Committee again used negative discretion in awarding long-term incentives to its NEOs by reducing the value of shares awarded from $6,401,696 in 2015 to $2,386,757 in 2016 resulting in a 63% drop in total long-term incentive award value from 2015. |

| • | Director Fee Reductions. Effective January 1, 2015, the Compensation Committee reduced the director’s base cash retainers by 10%. |

| • | Performance Awards. The Compensation Committee adopted new performance unit award terms, including lengthening the performance period from two independent one year periods to one three year period, and eliminating opportunities for payout when total shareholder return (“TSR”) performance is below a sixth placement amongst the peer group. In addition, the Committee revised the CEO’s long-term incentive awards to target 85% performance based, up from 50% performance based in 2014 and revised the NEOs’ long-term incentive awards to target 50% performance based, up from 20% in 2014. |

| • | Restricted Stock Awards. The Compensation Committee approved a form of restricted stock award agreement that provides for double trigger equity vesting after a change of control. Shares granted using this form of award agreement will supersede any single trigger change of control provisions in any existing employment agreement, including for our CEO. |

20

Table of Contents

| • | Clawback Policy. In 2014, the Compensation Committee approved a clawback policy that requires the Board to review incentive compensation paid or awarded to the Company’s current and former executive officers in the event of a material misstatement of the Company’s financial results and to seek recoupment or forfeiture of any incentive-based compensation from executive officers who engaged in fraud or other misconduct that resulted in the restatement to the extent in excess of the amount that would have been paid or awarded to the officer under the Company’s restated financial statements. |

More details regarding our 2015 performance and executive compensation can be found below. We encourage you to read this section in conjunction with the advisory (nonbinding) vote with respect to the compensation of our NEOs described below. See “Compensation of Executive Officers— Summary Compensation Table” and other related compensation tables and narrative disclosure in the “Compensation of Executive Officers” section below.

Compensation Philosophy

Our compensation strategy is to support the successful attainment of our vision, values and business objectives. The primary goals of our compensation program are to attract and retain the talent we need to successfully manage the company, reward exceptional organizational and individual performance improvements, and accomplish these objectives at a reasonable total cost in relation to performance and market conditions.

The following compensation objectives are considered in setting the compensation components for our senior executives:

| • | Attracting and retaining key executives responsible not only for our continued growth and profitability, but also for ensuring proper corporate governance and carrying out the goals and plans of Key; |

| • | Motivating management to enhance long-term stockholder value and to align our executives’ interests with those of our stockholders; |

| • | Paying for performance by aligning a substantial portion of management’s compensation to measurable performance, including specific financial and operating goals; |

| • | Evaluating and rating performance relative to the existing market conditions during the measurement period; and |

| • | Setting compensation and incentive levels that reflect competitive market practices. |