Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GREENWOOD HALL, INC. | s103053_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - GREENWOOD HALL, INC. | s103053_ex99-1.htm |

Exhibit 99.2

Helping Higher Education Transform & Prosper Investor Deck April 2016 Symbol: ELRN greenwoodhall.com

The information in this presentation may include “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . These include statements regarding Greenwood Hall’s business strategy as well as other statements that are not historical facts . Forward - looking statements also include but are not limited to those preceded or followed by the words "anticipates," "believes," "could," "estimates," "expects," "intends," "may," "plans," "projects," "should," “strategy,” "targets ," “path,” “on track,” “trends or trending,” and/or similar expressions . By their nature, forward - looking statements are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected . Readers are cautioned not to place undue reliance on these forward - looking statements . Except for any ongoing obligation to disclose material information as required by the United States federal securities laws, Greenwood Hall does not have any intention or obligation to publicly update or revise any forward - looking statements after Greenwood Hall distributes this document, whether to reflect any future events or circumstances or otherwise . For a discussion of potential risks and uncertainties, please refer to the risk factors listed in Greenwood Hall’s SEC filings . 2 Forward - Looking Statements

3 Greenwood Hall Snapshot ▪ Established technology - enabled solutions platform, serving higher education for over a decade ▪ Platform provides infrastructure, strategy , and people that help schools recruit, support, and create enduring relationships with students ▪ Recurring and subscription revenue from established institutional clients ▪ Highly coveted client relationships ▪ 35 - 40% revenue growth in EdTech offerings expected in FY2016 Higher education is experiencing disruptive change. C olleges must pivot to new markets, provide high - touch student support, and deliver ROI to their consumers. We provide turn - key solutions that provide real results in these areas

4 Investment Opportunity ▪ Solid reputation and 10 year operating track - record in Higher Education ▪ 1 of only 3 public companies in a sector with substantial investor interest. ▪ Strong sales momentum where PUBCO comps trade in excess of 6x revenue ▪ Focus on EdTech positions the Company strongly for growth ▪ Defined path to uplisting and trading liquidity ▪ Robust investment opportunity typically only found with early - stage companies

5 Recent Developments In FY16 Q216 Year - Over - Year Progress ▪ 26% Revenue Growth In EdTech Solutions ▪ 55% Reduction in SG&A Expense ▪ 35% Improvement in Adjusted EBITDA* New Major Contracts Added ▪ University of Oklahoma ▪ Concordia University ▪ Troy University ▪ San Juan College In FY - 2016, we have renewed or added 12 customer contracts that are expected to increase our EdTech revenue growth by 35 - 40%.

6 Financial Outlook For FY16 & FY17 EdTech Segment Revenue Growth ▪ 35 - 40% Topline Growth Anticipated This Fiscal Year ▪ Trending For Similar Growth In FY - 2017 Cost Savings & EBITDA ▪ Anticipates 30 - 35% Reduction In SG&A Overhead For Full Year FY - 2016 ▪ Trending Towards Adjusted EBITDA* For Full - Year FY - 2017 Management anticipates 35 - 40% year - over - year EdTech revenue growth in each of the the next two fiscal years. P rojects to be Adjusted EBITDA* positive in FY17. *Adjusted EBITDA, projections are Non - GAAP.

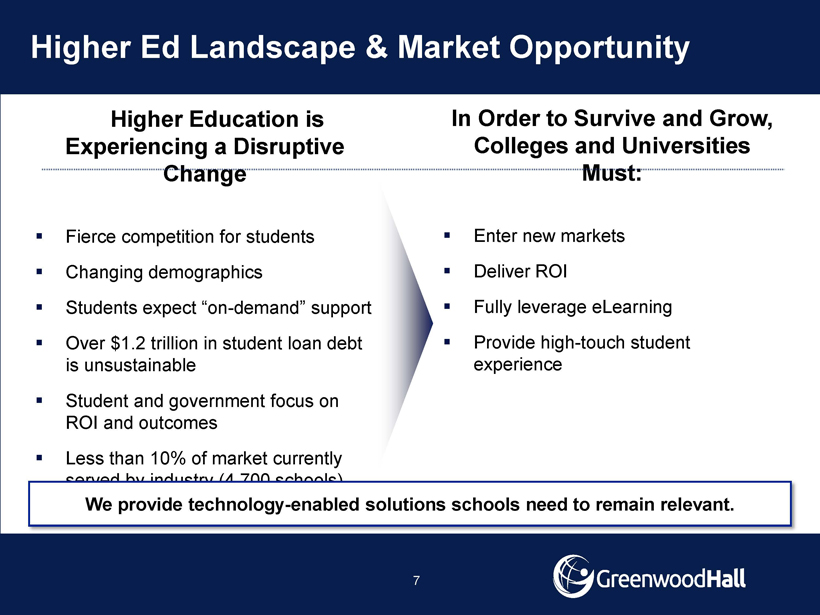

7 Higher Ed Landscape & Market Opportunity In Order to Survive and Grow, Colleges and Universities Must: ▪ Enter new markets ▪ Deliver ROI ▪ Fully leverage eLearning ▪ Provide high - touch student experience Higher Education is Experiencing a Disruptive Change ▪ Fierce competition for students ▪ Changing demographics ▪ Students expect “on - demand” support ▪ Over $1.2 trillion in student loan debt is unsustainable ▪ Student and government focus on ROI and outcomes ▪ Less than 10% of market currently served by industry (4,700 schools) We provide technology - enabled solutions schools need to remain relevant.

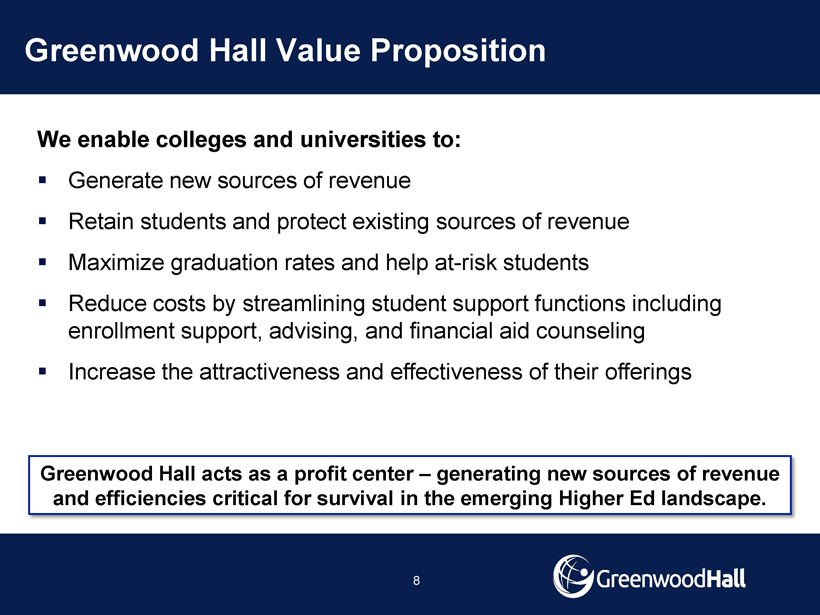

8 Greenwood Hall Value Proposition We enable colleges and universities to: ▪ Generate new sources of revenue ▪ Retain students and protect existing sources of revenue ▪ Maximize graduation rates and help at - risk students ▪ Reduce costs by streamlining student support functions including enrollment support, advising, and financial aid counseling ▪ Increase the attractiveness and effectiveness of their offerings Greenwood Hall acts as a profit center – generating new sources of revenue and efficiencies critical for survival in the emerging Higher Ed landscape.

Growing Client List of Prestigious Institutions 9

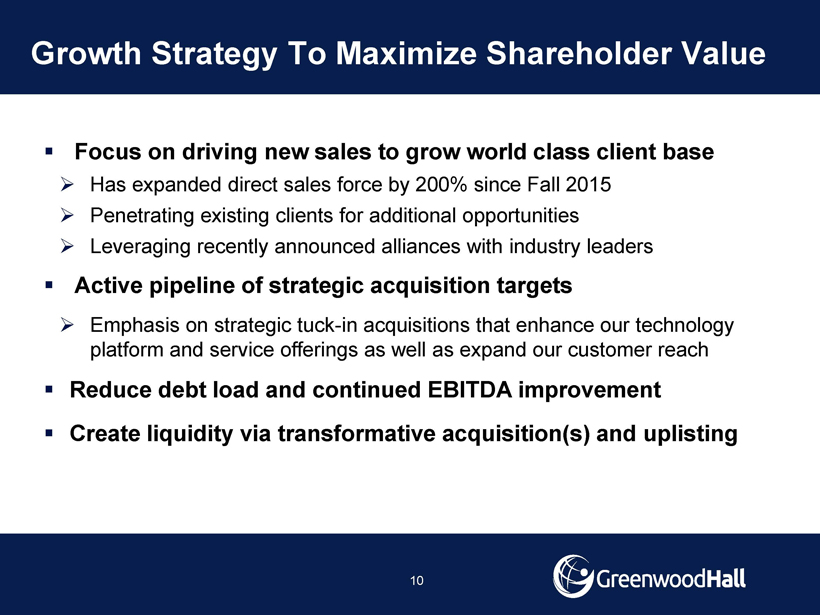

10 Growth Strategy To Maximize Shareholder Value ▪ Focus on driving new sales to grow world class client base » Has expanded direct sales force by 200% since Fall 2015 » Penetrating existing clients for additional opportunities » Leveraging recently announced alliances with industry leaders ▪ Active pipeline of strategic acquisition targets » Emphasis on strategic tuck - in acquisitions that enhance our technology platform and service offerings as well as expand our customer reach ▪ Reduce debt load and continued EBITDA improvement ▪ Create liquidity via transformative acquisition(s) and uplisting

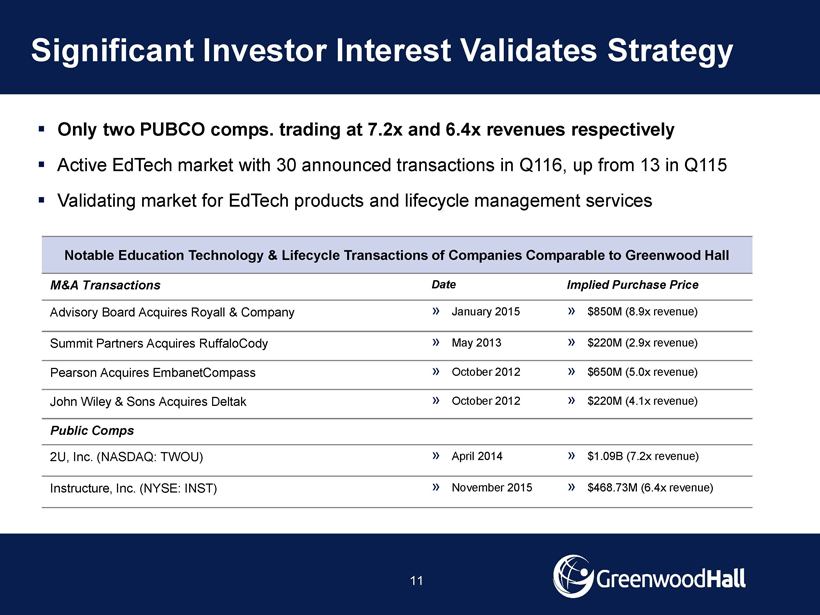

11 ▪ Only two PUBCO comps. trading at 7.2x and 6.4x revenues respectively ▪ Active EdTech market with 30 announced transactions in Q116, up from 13 in Q115 ▪ Validating market for EdTech products and lifecycle management services Notable Education Technology & Lifecycle Transactions of Companies Comparable to Greenwood Hall M&A Transactions Date Implied Purchase Price Advisory Board Acquires Royall & Company » January 2015 » $850M (8.9x revenue) Summit Partners Acquires RuffaloCody » May 2013 » $220M (2.9x revenue) Pearson Acquires EmbanetCompass » October 2012 » $650M (5.0x revenue) John Wiley & Sons Acquires Deltak » October 2012 » $220M (4.1x revenue) Public Comps 2U, Inc. (NASDAQ: TWOU) » April 2014 » $1.09B (7.2x revenue) Instructure, Inc. (NYSE: INST) » November 2015 » $468.73 M (6.4x revenue) Significant Investor Interest Validates Strategy

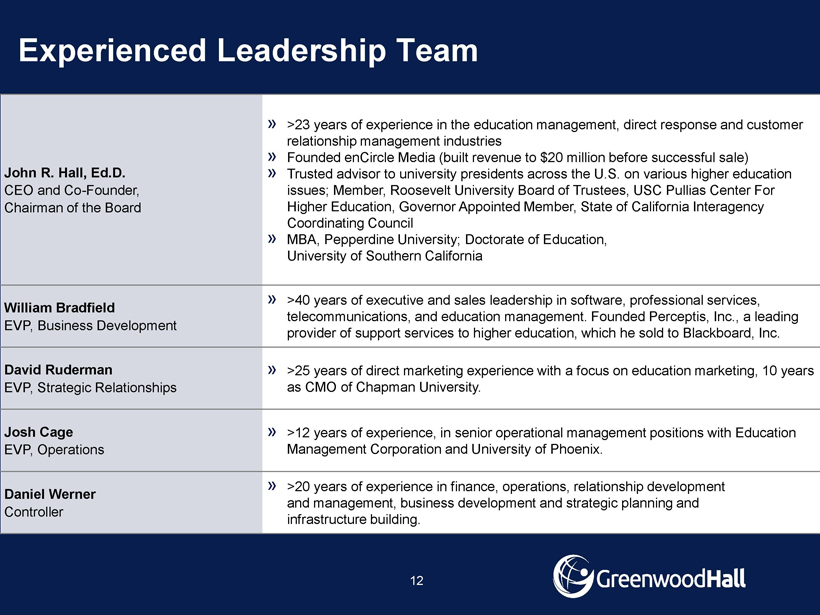

12 Experienced Leadership Team John R. Hall, Ed.D. CEO and Co - Founder, Chairman of the Board » >23 years of experience in the education management, direct response and customer relationship management industries » Founded enCircle Media (built revenue to $20 million before successful sale) » Trusted advisor to university presidents across the U.S. on various higher education issues; Member, Roosevelt University Board of Trustees, USC Pullias Center For Higher Education, Governor Appointed Member, State of California Interagency Coordinating Council » MBA, Pepperdine University; Doctorate of Education, University of Southern California William Bradfield EVP, Business Development » >40 years of executive and sales leadership in software, professional services, telecommunications, and education management. Founded Perceptis , Inc., a leading provider of support services to higher education, which he sold to Blackboard, Inc. David Ruderman EVP, Strategic Relationships » >25 years of direct marketing experience with a focus on education marketing, 10 years as CMO of Chapman University. Josh Cage EVP, Operations » >12 years of experience, in senior operational management positions with Education Management Corporation and University of Phoenix. Daniel Werner Controller » >20 years of experience in finance, operations, relationship development and management, business development and strategic planning and infrastructure building.

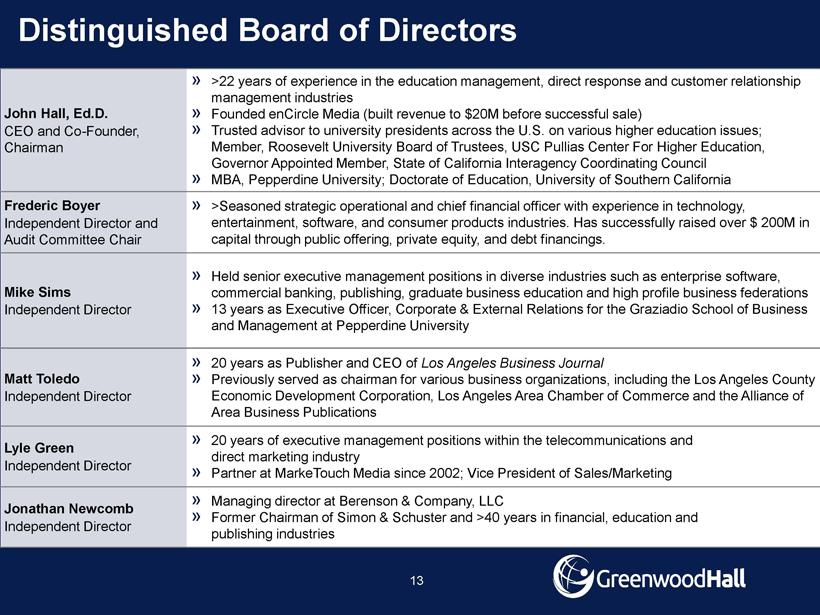

13 Distinguished Board of Directors John Hall, Ed.D. CEO and Co - Founder, Chairman » >22 years of experience in the education management, direct response and customer relationship management industries » Founded enCircle Media (built revenue to $20M before successful sale) » Trusted advisor to university presidents across the U.S. on various higher education issues; Member, Roosevelt University Board of Trustees, USC Pullias Center For Higher Education, Governor Appointed Member, State of California Interagency Coordinating Council » MBA, Pepperdine University; Doctorate of Education, University of Southern California Frederic Boyer Independent Director and Audit Committee Chair » >Seasoned strategic operational and chief financial officer with experience in technology, entertainment, software, and consumer products industries. Has successfully raised over $ 200M in capital through public offering, private equity, and debt financings. Mike Sims Independent Director » Held senior executive management positions in diverse industries such as enterprise software, commercial banking, publishing, graduate business education and high profile business federations » 13 years as Executive Officer, Corporate & External Relations for the Graziadio School of Business and Management at Pepperdine University Matt Toledo Independent Director » 20 years as Publisher and CEO of Los Angeles Business Journal » Previously served as chairman for various business organizations, including the Los Angeles County Economic Development Corporation, Los Angeles Area Chamber of Commerce and the Alliance of Area Business Publications Lyle Green Independent Director » 20 years of executive management positions within the telecommunications and direct marketing industry » Partner at MarkeTouch Media since 2002; Vice President of Sales/Marketing Jonathan Newcomb Independent Director » Managing director at Berenson & Company, LLC » Former Chairman of Simon & Schuster and >40 years in financial, education and publishing industries

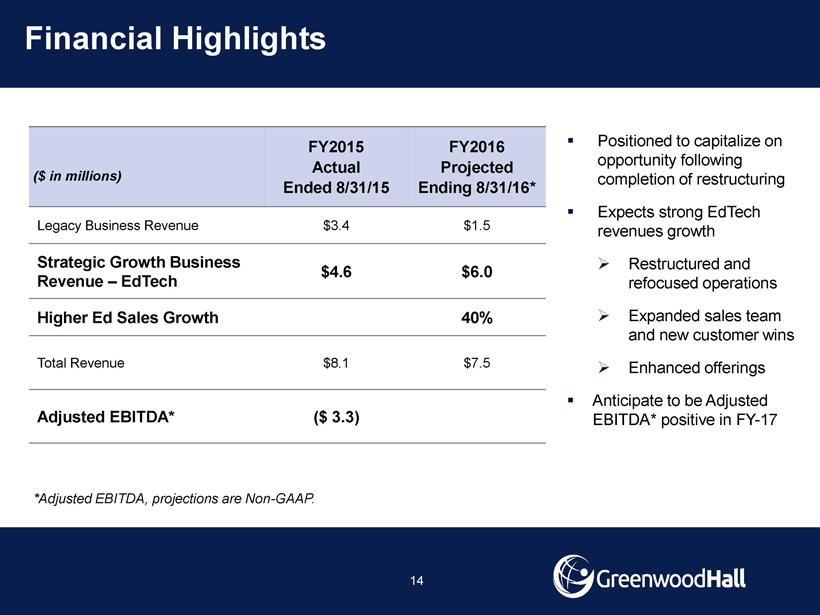

14 Financial Highlights ($ in millions) FY2015 Actual Ended 8/31/15 FY2016 Projected Ending 8/31/16* Legacy Business Revenue $3.4 $1.5 Strategic Growth Business Revenue – EdTech $4.6 $6.0 Higher Ed Sales Growth 40% Total Revenue $8.1 $7.5 Adjusted EBITDA* ($ 3.3) ▪ Positioned to capitalize on opportunity following completion of restructuring ▪ Expects strong EdTech revenues growth » Restructured and refocused operations » Expanded sales team and new customer wins » Enhanced offerings ▪ Anticipate to be Adjusted EBITDA* positive in FY - 17 *Adjusted EBITDA, projections are Non - GAAP.

15 A Defined Path to Uplisting & Trading Liquidity ▪ Drive high organic growth by leveraging disruption i n EdTech and our established i ndustry position ▪ Capitalize on opportunities to accelerate growth through strategic partnerships/investments and acquisitions ▪ Build on significant investor interest in sector to expand Wall Street presence and pursue NASDAQ u plisting

16 Key Investment Takeaways ▪ Disruption in Higher Ed creating significant demand for our EdTech solutions ▪ One of a few publicly traded companies in emerging, high - growth education technology sector ▪ Established business model and compelling value proposition ▪ Already experiencing strong revenue growth in EdTech ▪ Sector attracting significant investor interest ▪ Clear path to trading liquidity and planned NASDAQ uplisting

17 Company: John Hall, Ed.D . Chief Executive Officer Greenwood Hall, Inc. jhall@greenwoodhall.com Contact Information