UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 20, 2016

GREAT SOUTHERN BANCORP, INC.

(Exact name of Registrant as specified in its Charter)

|

Maryland

|

|

0-18082

|

|

43-1524856

|

|

(State or other jurisdiction of

incorporation) |

|

(Commission File No.)

|

|

(IRS Employer Identification

Number) |

|

1451 East Battlefield, Springfield, Missouri

|

65804

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (417) 887-4400

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure

Set forth below is presentation material of Great Southern Bancorp, Inc., the holding company for Great Southern Bank.

Loan Portfolio and Market Data March 31, 2016

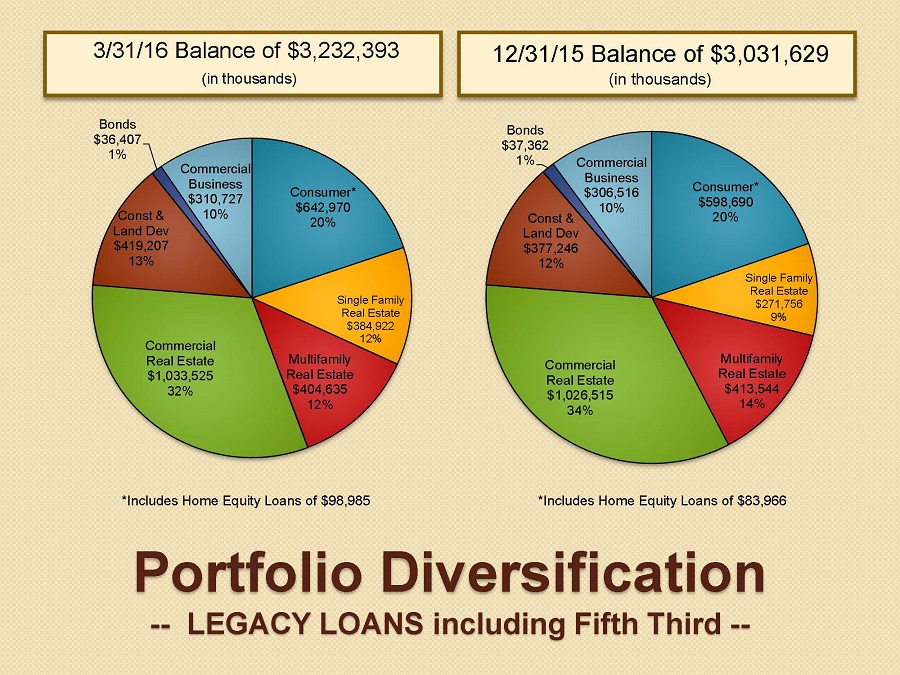

Portfolio Diversification-- LEGACY LOANS including Fifth Third -- 3/31/16 Balance of $3,232,393 (in thousands) *Includes Home Equity Loans of $98,985 *Includes Home Equity Loans of $83,966 12/31/15 Balance of $3,031,629(in thousands)

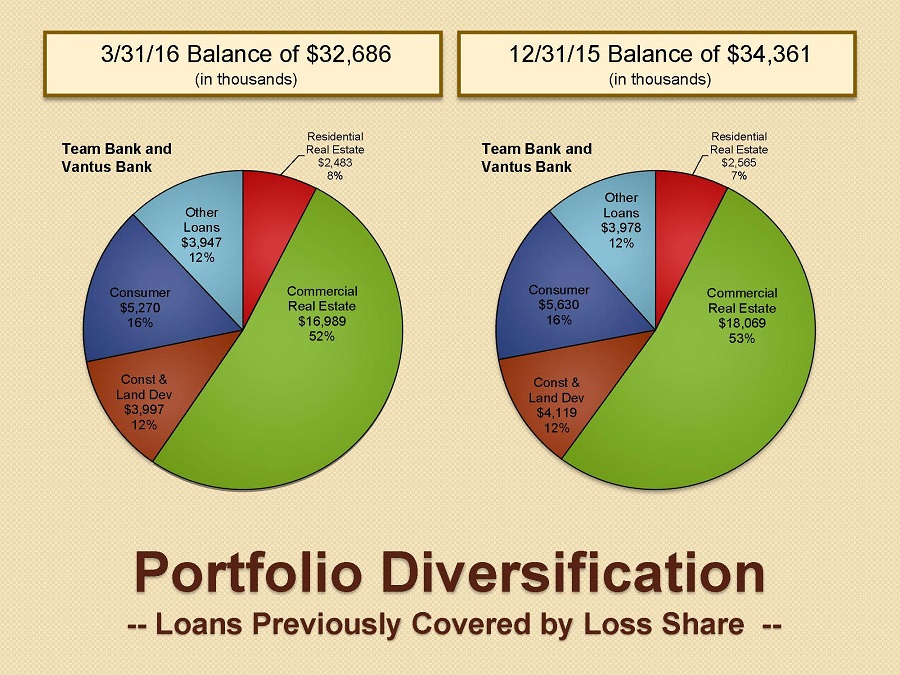

Portfolio Diversification -- Loans Previously Covered by Loss Share -- 3/31/16 Balance of $32,686(in thousands) 12/31/15 Balance of $34,361(in thousands)

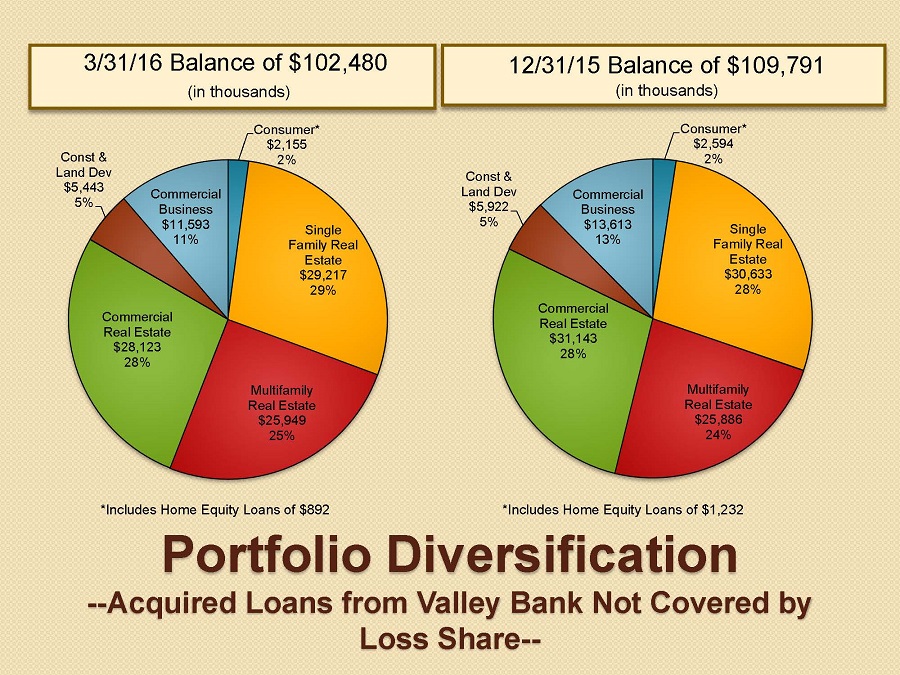

Portfolio Diversification--Acquired Loans from Valley Bank Not Covered by Loss Share-- 12/31/15 Balance of $109,791(in thousands) 3/31/16 Balance of $102,480 (in thousands) *Includes Home Equity Loans of $892 *Includes Home Equity Loans of $1,232

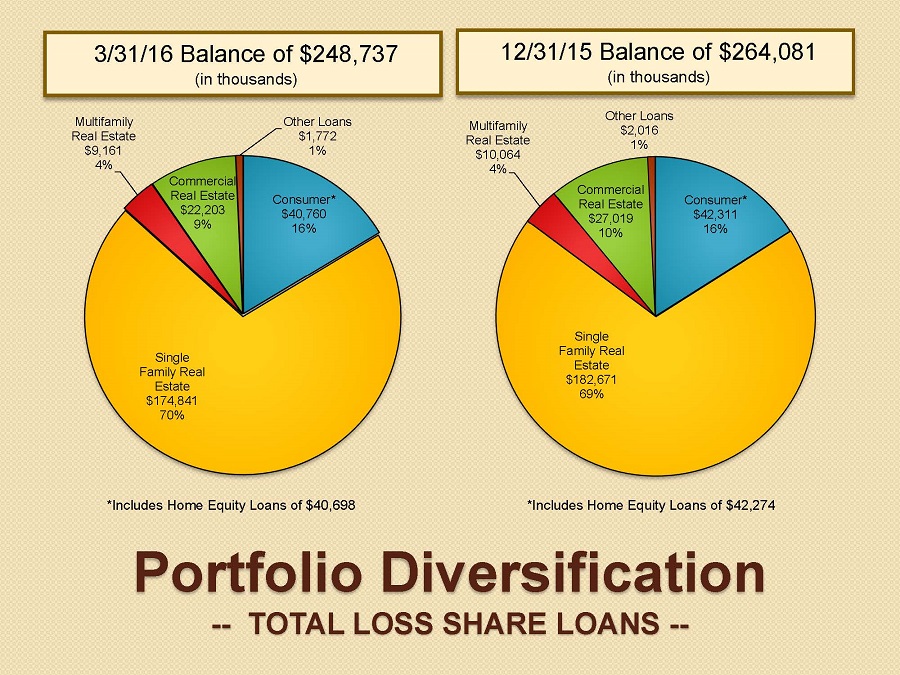

Portfolio Diversification-- TOTAL LOSS SHARE LOANS -- 3/31/16 Balance of $248,737(in thousands) *Includes Home Equity Loans of $40,698 *Includes Home Equity Loans of $42,274 12/31/15 Balance of $264,081(in thousands)

Portfolio by Region-- LEGACY LOANS Including Fifth Third -- 3/31/16 Balance of $3,232,393 (in thousands) 12/31/15 Balance of $3,031,629(in thousands)

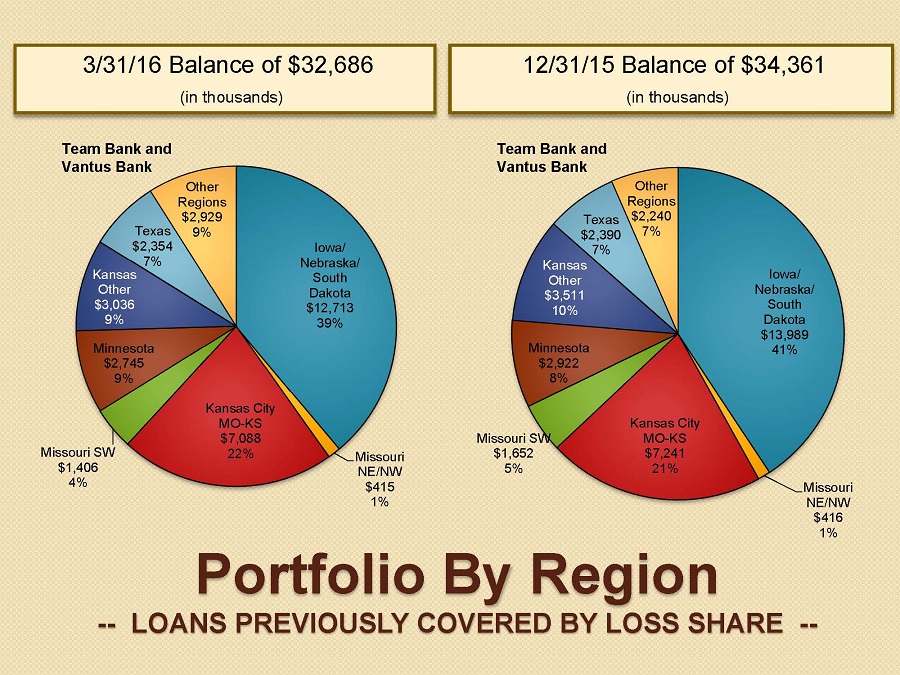

Portfolio By Region-- LOANS PREVIOUSLY COVERED BY LOSS SHARE -- 12/31/15 Balance of $34,361 (in thousands) 3/31/16 Balance of $32,686 (in thousands)

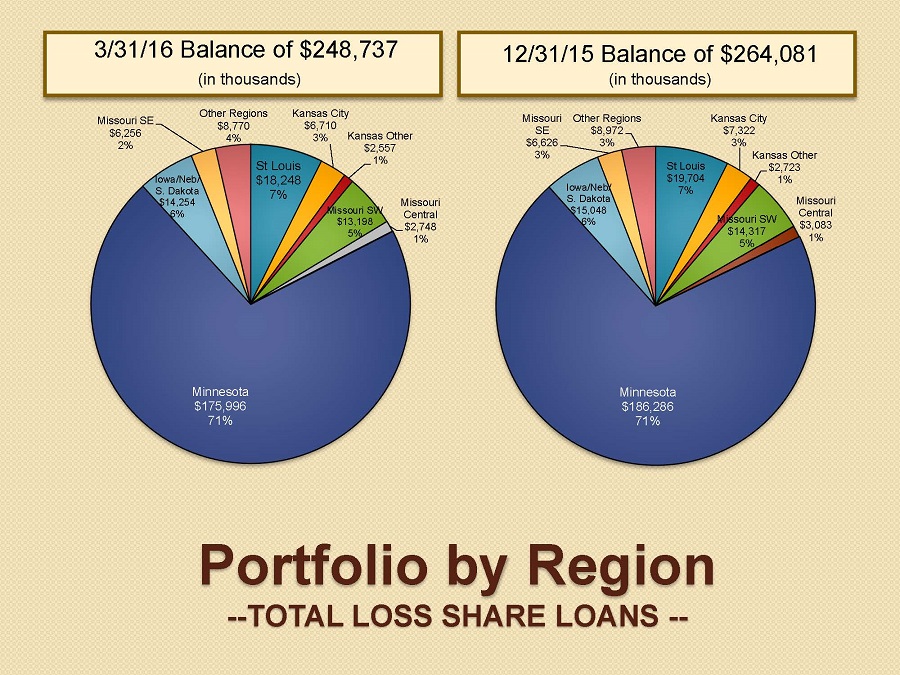

Portfolio by Region--TOTAL LOSS SHARE LOANS -- 3/31/16 Balance of $248,737 (in thousands) 12/31/15 Balance of $264,081(in thousands)

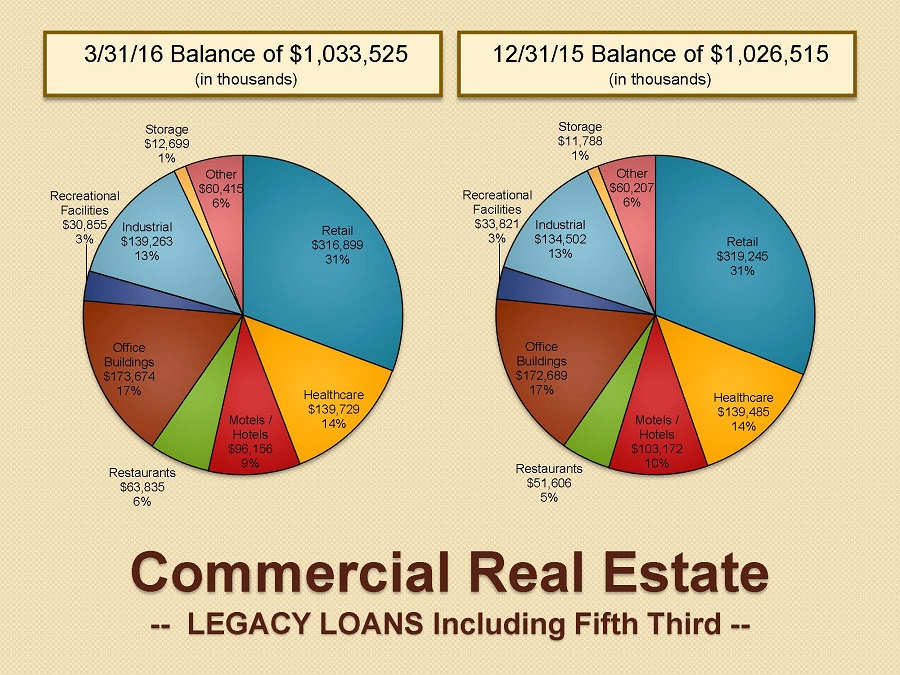

Commercial Real Estate-- LEGACY LOANS Including Fifth Third -- 3/31/16 Balance of $1,033,525(in thousands) 12/31/15 Balance of $1,026,515(in thousands)

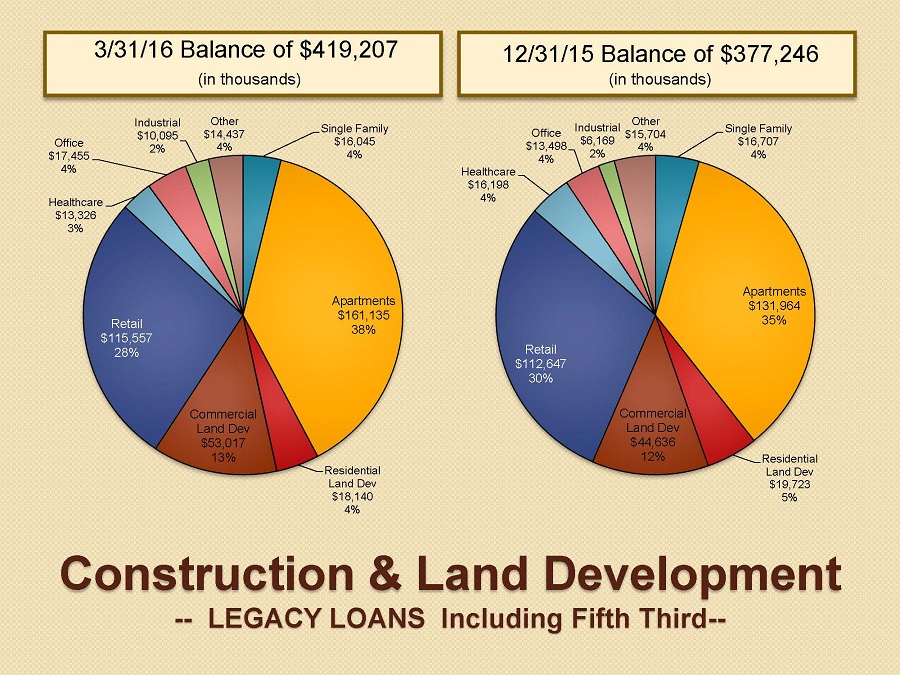

Construction & Land Development-- LEGACY LOANS Including Fifth Third-- 3/31/16 Balance of $419,207 (in thousands) 12/31/15 Balance of $377,246(in thousands)

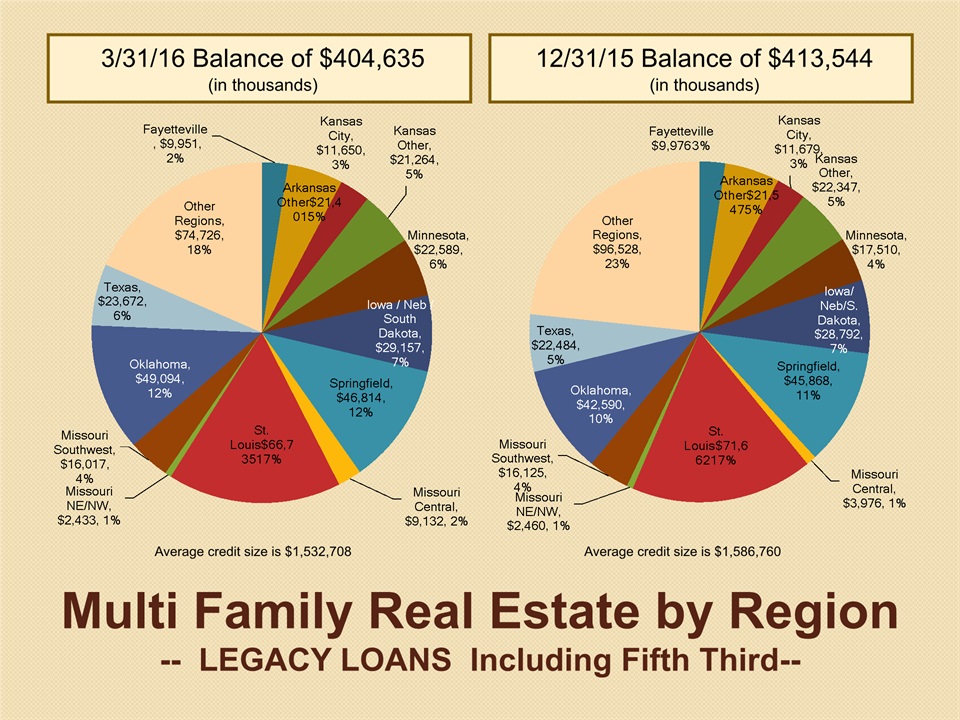

Multi Family Real Estate by Region-- LEGACY LOANS Including Fifth Third-- 3/31/16 Balance of $404,635(in thousands) 12/31/15 Balance of $413,544(in thousands) Average credit size is $1,532,708 Average credit size is $1,586,760

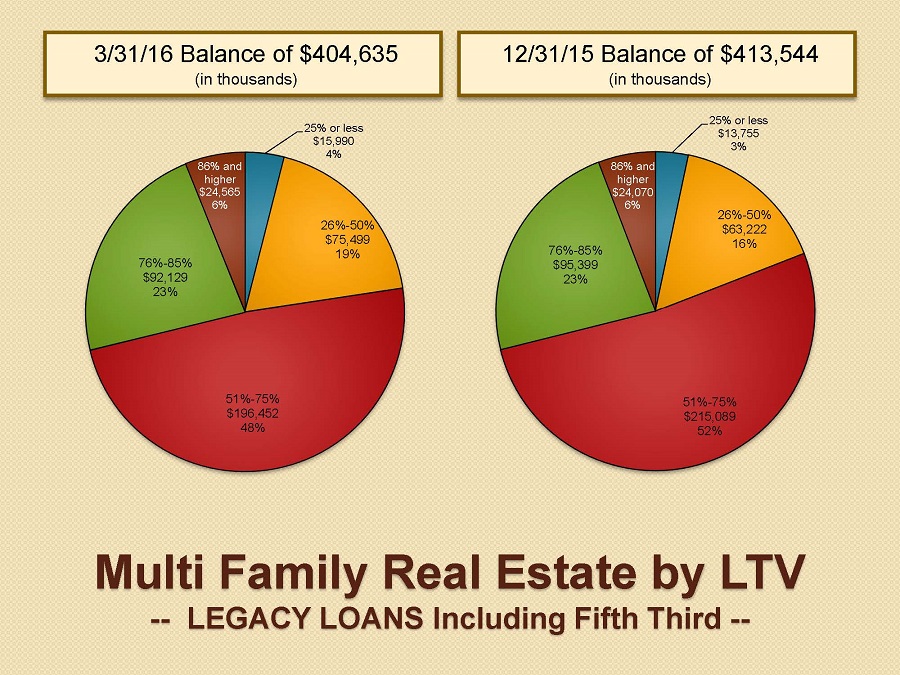

Multi Family Real Estate by LTV-- LEGACY LOANS Including Fifth Third -- 3/31/16 Balance of $404,635(in thousands) 12/31/15 Balance of $413,544(in thousands)

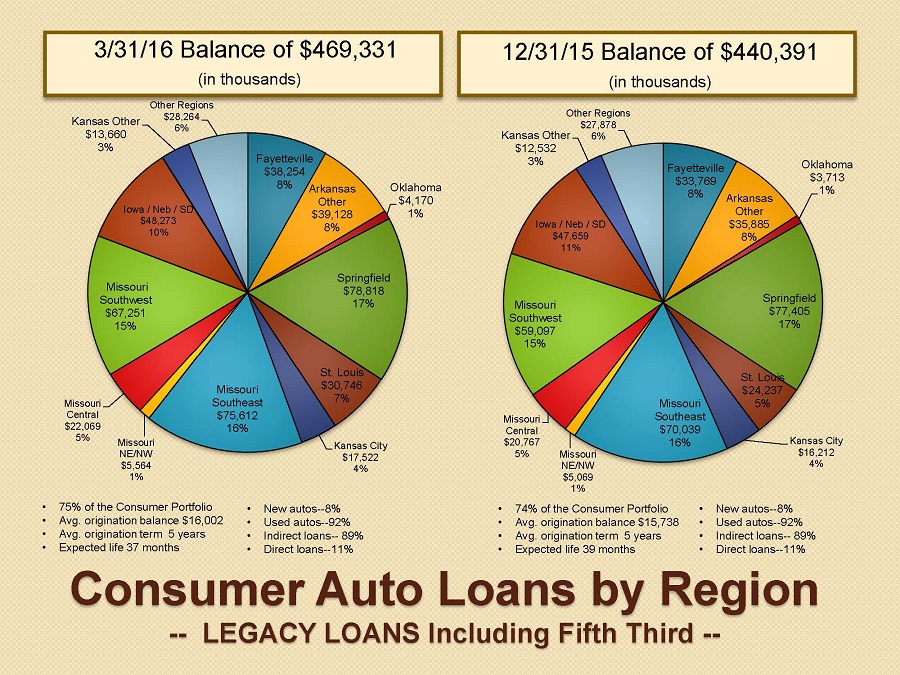

Consumer Auto Loans by Region-- LEGACY LOANS Including Fifth Third -- 3/31/16 Balance of $469,331 (in thousands) 12/31/15 Balance of $440,391(in thousands) 75% of the Consumer PortfolioAvg. origination balance $16,002Avg. origination term 5 yearsExpected life 37 months New autos--8% Used autos--92% Indirect loans-- 89%Direct loans--11% 74% of the Consumer PortfolioAvg. origination balance $15,738Avg. origination term 5 yearsExpected life 39 months New autos--8% Used autos--92% Indirect loans-- 89%Direct loans--11%

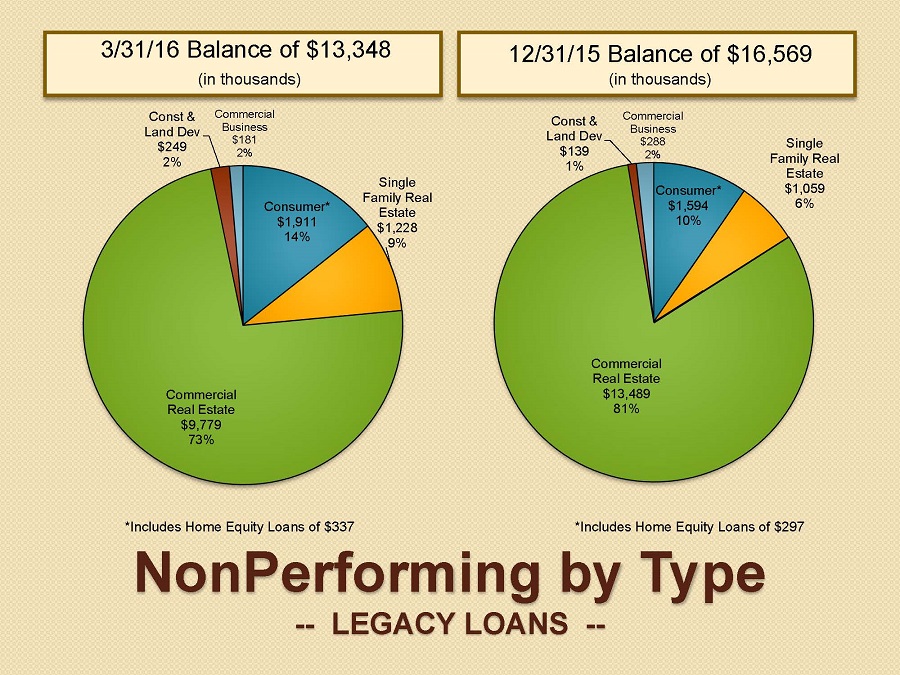

NonPerforming by Type-- LEGACY LOANS -- 3/31/16 Balance of $13,348 (in thousands) *Includes Home Equity Loans of $337 *Includes Home Equity Loans of $297 12/31/15 Balance of $16,569(in thousands)

NonPerforming by Region-- LEGACY LOANS -- 3/31/16 Balance of $13,348 (in thousands) 12/31/15 Balance of $16,569(in thousands)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| GREAT SOUTHERN BANCORP, INC. | |||

|

Date April 20, 2016

|

By:

|

/s/ Joseph W. Turner | |

| Joseph W. Turner | |||

| President and Chief Executive Officer | |||

14