Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - NorthStar Asset Management Group Inc. | nsamtownsend8-ka4152016.htm |

| EX-23.1 - EXHIBIT 23.1 - NorthStar Asset Management Group Inc. | exhibit231nsam04142016cons.htm |

| EX-99.2 - EXHIBIT 99.2 - NorthStar Asset Management Group Inc. | exhibit992nsamproformafor1.htm |

A U D I T E D C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S Townsend Holdings LLC and Subsidiaries (A limited liability company) As of December 31, 2015 and 2014 and Years Ended December 31, 2015, 2014 and 2013 With Report of Independent Auditors Exhibi t 99 .1

Townsend Holdings LLC and Subsidiaries (A limited liability company) Audited Consolidated Financial Statements Years Ended December 31, 2015, 2014 and 2013 Contents Report of Independent Auditors.......................................................................................................1 Audited Consolidated Financial Statements Consolidated Statements of Financial Condition .............................................................................2 Consolidated Statements of Income.................................................................................................3 Consolidated Statements of Comprehensive Income ......................................................................4 Consolidated Statements of Changes in Members’ Equity .............................................................5 Consolidated Statements of Cash Flows ..........................................................................................6 Notes to Consolidated Financial Statements....................................................................................7

1604-1900979 Report of Independent Auditors To the Members of Townsend Holdings LLC and Subsidiaries We have audited the accompanying consolidated financial statements of Townsend Holdings LLC and Subsidiaries, which comprise the consolidated statements of financial condition as of December 31, 2015 and 2014, and the related consolidated statements of income, comprehensive income, changes in members’ equity and cash flows for each of the three years in the period ended December 31, 2015, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in conformity with U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Townsend Holdings LLC and Subsidiaries at December 31, 2015 and 2014, and the consolidated results of their operations and their cash flows for each of the three years in the period ended December 31, 2015 in conformity with U.S. generally accepted accounting principles. April 14, 2016

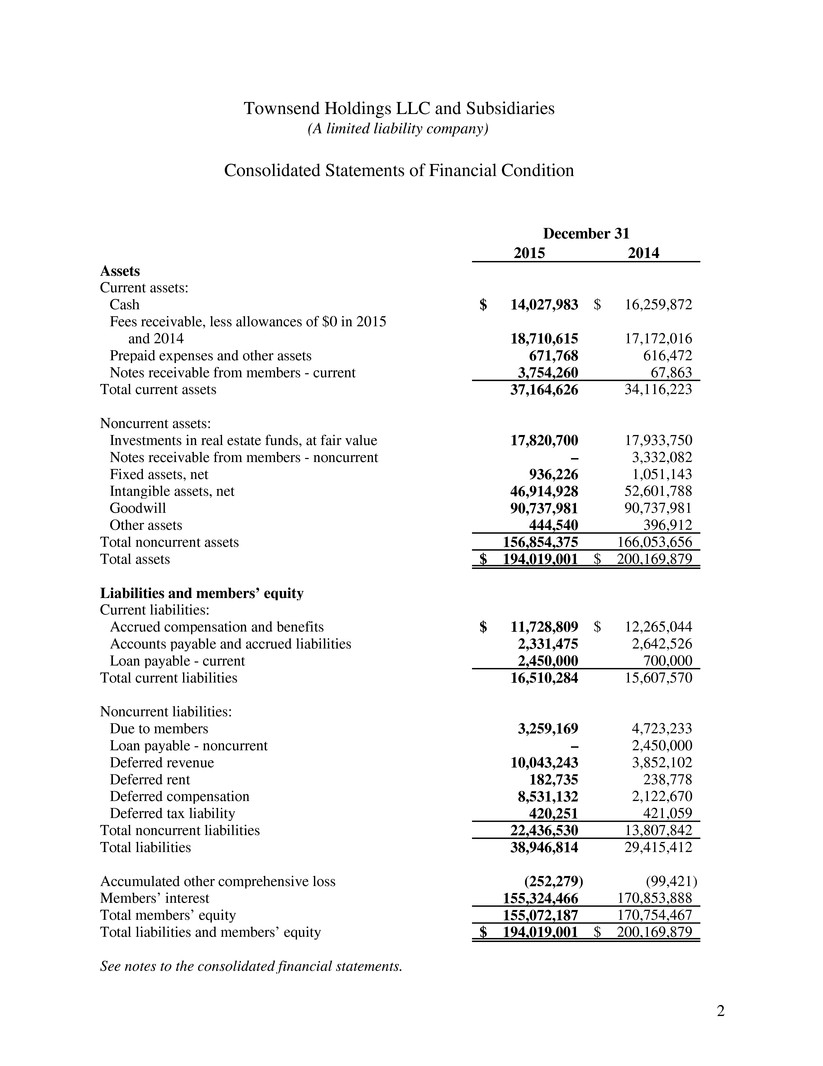

2 2015 2014 Assets Current assets: Cash 14,027,983$ 16,259,872$ Fees receivable, less allowances of $0 in 2015 and 2014 18,710,615 17,172,016 Prepaid expenses and other assets 671,768 616,472 Notes receivable from members - current 3,754,260 67,863 Total current assets 37,164,626 34,116,223 Noncurrent assets: Investments in real estate funds, at fair value 17,820,700 17,933,750 Notes receivable from members - noncurrent – 3,332,082 Fixed assets, net 936,226 1,051,143 Intangible assets, net 46,914,928 52,601,788 Goodwill 90,737,981 90,737,981 Other assets 444,540 396,912 Total noncurrent assets 156,854,375 166,053,656 Total assets 194,019,001$ 200,169,879$ Liabilities and members’ equity Current liabilities: Accrued compensation and benefits 11,728,809$ 12,265,044$ Accounts payable and accrued liabilities 2,331,475 2,642,526 Loan payable - current 2,450,000 700,000 Total current liabilities 16,510,284 15,607,570 Noncurrent liabilities: Due to members 3,259,169 4,723,233 Loan payable - noncurrent – 2,450,000 Deferred revenue 10,043,243 3,852,102 Deferred rent 182,735 238,778 Deferred compensation 8,531,132 2,122,670 Deferred tax liability 420,251 421,059 Total noncurrent liabilities 22,436,530 13,807,842 Total liabilities 38,946,814 29,415,412 Accumulated other comprehensive loss (252,279) (99,421) Members’ interest 155,324,466 170,853,888 Total members’ equity 155,072,187 170,754,467 Total liabilities and members’ equity 194,019,001$ 200,169,879$ See notes to the consolidated financial statements. December 31 Townsend Holdings LLC and Subsidiaries (A limited liability company) Consolidated Statements of Financial Condition

3 2015 2014 2013 Revenues: Management and advisory fees 57,440,494$ 50,783,518$ 49,930,663$ Incentive fees and carried interest 5,846,457 11,404,317 1,989,481 Other income including reimbursable expenses 2,667,788 3,251,076 2,528,574 Total revenues 65,954,739 65,438,911 54,448,718 Expenses: Compensation, benefits and related costs 35,769,562 28,735,023 20,243,522 Occupancy 1,679,228 1,490,103 1,294,488 Professional fees and information services 2,923,979 3,470,387 3,639,905 Travel and entertainment and marketing 1,543,987 1,654,671 1,316,464 Depreciation and amortization 6,010,393 5,942,515 5,879,759 Technology, telephone and communications 437,374 438,809 335,342 Reimbursable expenses from funds 2,660,700 3,251,076 2,478,574 Other operating and administrative 1,571,957 1,098,355 1,277,703 Total expenses 52,597,180 46,080,939 36,465,757 Other income (expense): Net change in unrealized gains on investments 1,977,782 3,701,854 4,255,227 Interest and other income 202,703 68,123 – Earn-out expense – (10,800,000) – Total other income (expense) 2,180,485 (7,030,023) 4,255,227 Net income 15,538,044$ 12,327,949$ 22,238,188$ See notes to the consolidated financial statements. Years Ended December 31 Townsend Holdings LLC and Subsidiaries (A limited liability company) Consolidated Statements of Income

4 2015 2014 2013 Net income $ 15,538,044 $ 12,327,949 $ 22,238,188 Other comprehensive (loss) income related to foreign currency translation (152,858) (321,021) 200,507 Total comprehensive income 15,385,186$ 12,006,928$ 22,438,695$ See notes to the consolidated financial statements. Years Ended December 31 Townsend Holdings LLC and Subsidiaries (A limited liability company) Consolidated Statements of Comprehensive Income

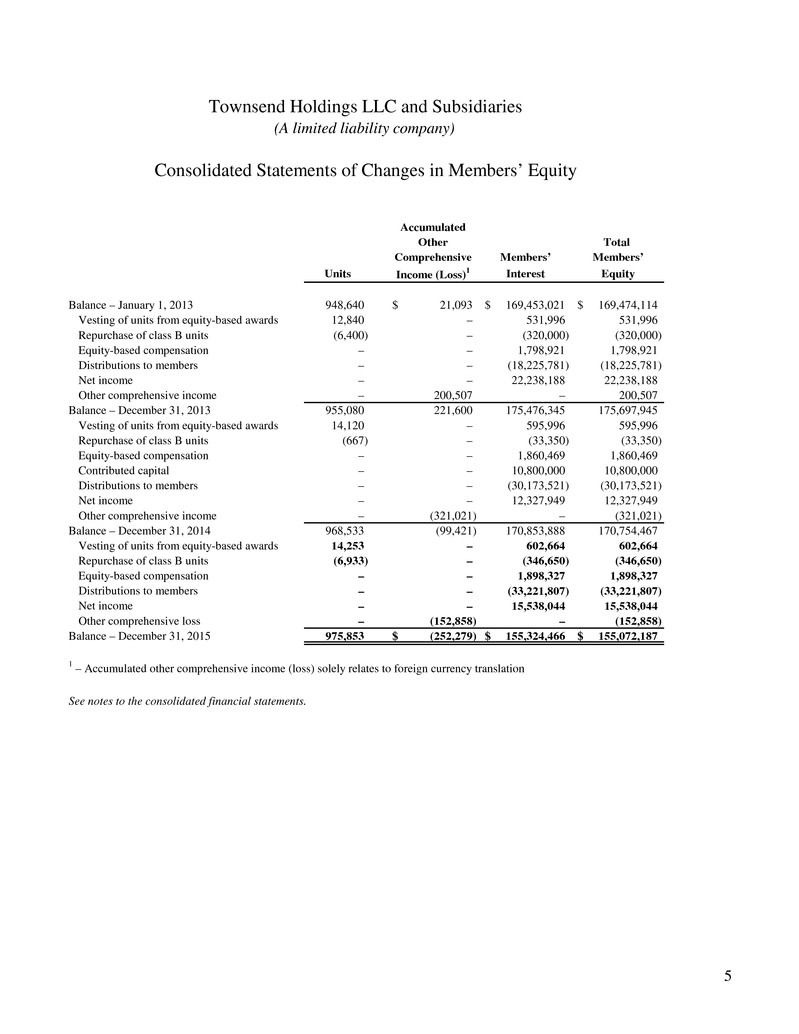

5 Accumulated Other Total Comprehensive Members’ Members’ Units Income (Loss)1 Interest Equity Balance – January 1, 2013 948,640 21,093$ 169,453,021$ 169,474,114$ Vesting of units from equity-based awards 12,840 – 531,996 531,996 Repurchase of class B units (6,400) – (320,000) (320,000) Equity-based compensation – – 1,798,921 1,798,921 Distributions to members – – (18,225,781) (18,225,781) Net income – – 22,238,188 22,238,188 Other comprehensive income – 200,507 – 200,507 Balance – December 31, 2013 955,080 221,600 175,476,345 175,697,945 Vesting of units from equity-based awards 14,120 – 595,996 595,996 Repurchase of class B units (667) – (33,350) (33,350) Equity-based compensation – – 1,860,469 1,860,469 Contributed capital – – 10,800,000 10,800,000 Distributions to members – – (30,173,521) (30,173,521) Net income – – 12,327,949 12,327,949 Other comprehensive income – (321,021) – (321,021) Balance – December 31, 2014 968,533 (99,421) 170,853,888 170,754,467 Vesting of units from equity-based awards 14,253 – 602,664 602,664 Repurchase of class B units (6,933) – (346,650) (346,650) Equity-based compensation – – 1,898,327 1,898,327 Distributions to members – – (33,221,807) (33,221,807) Net income – – 15,538,044 15,538,044 Other comprehensive loss – (152,858) – (152,858) Balance – December 31, 2015 975,853 (252,279)$ 155,324,466$ 155,072,187$ See notes to the consolidated financial statements. Townsend Holdings LLC and Subsidiaries (A limited liability company) Consolidated Statements of Changes in Members’ Equity 1 – Accumulated other comprehensive income (loss) solely relates to foreign currency translation

6 2015 2014 2013 Operating activities Net income 15,538,044$ 12,327,949$ 22,238,188$ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 323,533 238,902 174,061 Amortization of intangibles 5,686,860 5,703,613 5,705,698 Deferred income tax (benefit) expense (808) 27,101 103,051 Equity based compensation 1,898,327 1,860,469 1,798,921 Earn-out expense – 10,800,000 – Loss on disposal of fixed assets 202,911 – – Net change in unrealized gains on investments (1,977,782) (3,701,854) (4,255,227) Distributions from investments in real estate funds 4,700,621 2,227,077 1,879,694 Changes in operating assets and liabilities: Fees receivable (1,538,599) (494,045) (1,811,198) Due from affiliates – 666,341 – Prepaid expenses and other assets (102,924) (183,821) (93,245) Accrued compensation and benefits (536,235) 5,875,780 1,649,119 Accounts payable and accrued liabilities (323,426) (437,636) 669,625 Due to members (1,464,064) (691,735) – Due to affiliates – (666,341) – Deferred revenue 6,191,141 2,228,276 1,444,493 Deferred compensation and other 6,608,433 476,487 619,494 Foreign currency remeasurement (52,870) (132,780) – Net cash provided by operating activities 35,153,162 36,123,783 30,122,674 Investing activities Contributions to investments in real estate funds (3,904,935) (4,250,270) (5,188,442) Distributions from investments in real estate funds 1,295,146 2,889,212 37,378 Notes to members (335,562) (3,500,000) – Payment received on notes to members 289,547 100,055 – Purchases of fixed assets (405,262) (611,705) (439,660) Net cash used in investing activities (3,061,066) (5,372,708) (5,590,724) Financing activities Proceeds from loan payable – 3,500,000 – Principal payments on loan payable (700,000) (350,000) – Contributions for reissuance of treasury units 38,350 33,350 320,000 Repurchase of treasury units (346,650) (33,350) (320,000) Distributions to members (33,221,807) (30,173,521) (18,225,781) Net cash used in financing activities (34,230,107) (27,023,521) (18,225,781) Effect of foreign exchange rate changes on cash (93,878) (177,378) – Net (decrease) increase in cash (2,231,889) 3,550,176 6,306,169 Cash at beginning of year 16,259,872 12,709,696 6,403,527 Cash at end of year 14,027,983$ 16,259,872$ 12,709,696$ Supplemental disclosure of non-cash activities Investing activities - Notes to members $ (308,300) $ – $ – Financing activities - Contributions for reissuance of treasury units 308,300 – – Supplemental disclosure of cash flow information Income taxes paid during the year $ 240,678 $ 409,790 $ 419,061 See notes to the consolidated financial statements. Years Ended December 31 Townsend Holdings LLC and Subsidiaries (A limited liability company) Consolidated Statements of Cash Flows

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements Years Ended December 31, 2015, 2014 and 2013 7 1. Organization and Nature of Operations Townsend Holdings LLC (the Company) was organized as a limited liability company under the laws of the State of Delaware and commenced operations on August 22, 2011 with its sole member being The Townsend Group Inc. (Townsend). In November 2011 Townsend sold 700,000 Class B units in the Company to Townsend Acquisition LLC (TA) (the Purchase). The Company is a boutique real estate investment advisory firm, registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended. Townsend was founded in 1983. The Company’s headquarters are located in Cleveland, Ohio with additional offices located in San Francisco, California; London, United Kingdom and Hong Kong, China. The Company provides both non-discretionary advisory and discretionary investment management services to clients across the globe. The Company provides services primarily to institutional clients, although the Company also maintains some private client relationships. The Company’s services include advisory, segregated mandates and commingled fund arrangements. 2. Significant Accounting Policies Basis of Presentation The accompanying consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP). The following is a summary of the significant accounting and reporting policies: Use of Estimates The preparation of the Consolidated Financial Statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the Consolidated Financial Statements and the reported amounts of revenues and expenses during the periods in the Consolidated Financial Statements and accompanying notes. Actual results could differ from those estimates and such differences could be material.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 8 2. Significant Accounting Policies (continued) Consolidation Policy The Company consolidates all wholly owned operating subsidiaries, which include Townsend Group Europe, Ltd. and Townsend Group Asia, Ltd and the single member limited liability companies that act as a general partner to certain funds that the Company manages. All significant inter-entity transactions and balances have been eliminated. In addition, the Company consolidates: 1) affiliated funds and co-investment entities, for which a subsidiary of the Company is the sole general partner and the presumption of control by the general partner has not been overcome and 2) variable interest entities (VIEs), for which the Company is deemed to be the primary beneficiary. For entities that are determined to be VIEs, the Company consolidates those entities where it is deemed to be the primary beneficiary. As substantially all of the funds managed by the Company qualify for the deferral under ASU 2010-10, Amendments to Statement 167 for Certain Investment Funds, the primary beneficiary of the funds the Company manages that are determined to be VIEs is the party that absorbs a majority of the VIEs’ expected losses or receives a majority of the expected residual returns as a result of holding variable interest. An entity is determined to be the primary beneficiary if it holds a controlling financial interest. A controlling financial interest is defined as (a) the power to direct the activities of a VIE that most significantly impact the entity’s business and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. The consolidation rules require an analysis to (a) determine whether an entity in which the Company holds a variable interest is a VIE and (b) whether the Company’s involvement, through holding interests directly or indirectly in the entity or contractually through other variable interests (e.g., management and performance related fees), would give it a controlling financial interest. In evaluating whether the Company is the primary beneficiary, the Company evaluates its economic interests in the entity held either directly or indirectly by the Company. The consolidation analysis is generally performed qualitatively. This analysis, which requires judgment, is performed at each reporting date.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 9 2. Significant Accounting Policies (continued) At December 31, 2015, the Company held variable interests in a VIE which was not consolidated because the Company was not the primary beneficiary. The Company’s involvement with such entity was in the form of indirect equity interests. At December 31, 2014, the Company had no variable interests in any VIEs. At December 31, 2013, the Company held variable interests in a VIE which was not consolidated because the Company was not the primary beneficiary. The Company’s involvement with such entity was in the form of direct equity interests and management fee arrangements. The maximum exposure to loss represents the loss of management fees receivable relating to the unconsolidated VIE, which was $27,267 at December 31, 2013. The limited partnership agreement of this VIE entity was amended and at December 31, 2014 the entity is no longer considered a VIE. Revenue Recognition Revenues primarily consist of management and advisory fees and performance fees. Fees are generally billed one quarter in arrears. There are generally no advance collections. Management and Advisory Fees Management and advisory fees are comprised of amounts derived from investment advisory services, segregated mandates, commingled funds revenue and transactional fees. The Company typically earns advisory fees from clients at a fixed annual retainer. The Company earns management fees from clients and limited partners of funds in each of its managed funds, at a fixed percentage of assets under management, net asset value, total assets, committed capital, invested capital or, in some cases, a fixed fee. All management and advisory fees are based on contractual terms specified in the underlying investment advisory agreements. Transaction-based fees are recognized when (a) there is evidence of an arrangement with a client, (b) agreed-upon services have been provided, (c) fees are fixed or determinable and (d) collection is reasonably assured. As revenue from management fees is based on contractual fee arrangements applied to capital under management, significant changes in the value of the capital under management could materially affect future revenue.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 10 2. Significant Accounting Policies (continued) Management and advisory fees for the years ended were as follows: Years Ended December 31 2015 2014 2013 Investment advisory revenue $ 13,246,167 $ 12,502,176 $ 11,656,834 Segregated mandates revenue 30,741,503 27,996,835 27,666,078 Commingled funds revenue 13,452,824 10,284,507 10,607,751 Total $ 57,440,494 $ 50,783,518 $ 49,930,663 Incentive Fees Incentive fees and carried interest are realized when an underlying investment is disposed of and the cumulative returns are in excess of the preferred return. Revenue is not recognized on incentive fees subject to contingent repayment until all of the related contingencies have been resolved. Carried Interest As the member of the general partner of certain investment funds, the Company may receive carried interest cash distributions from the funds in accordance with distribution provisions of the fund agreements. The Company may, from time to time, be required to return all or a portion of such distributions to the limited partners in the event the limited partners do not achieve a return as specified in the various fund agreements (Clawback). Therefore, the Company records carried interest distributions subject to such clawback provisions as a deferred revenue liability on its Consolidated Statements of Financial Condition.

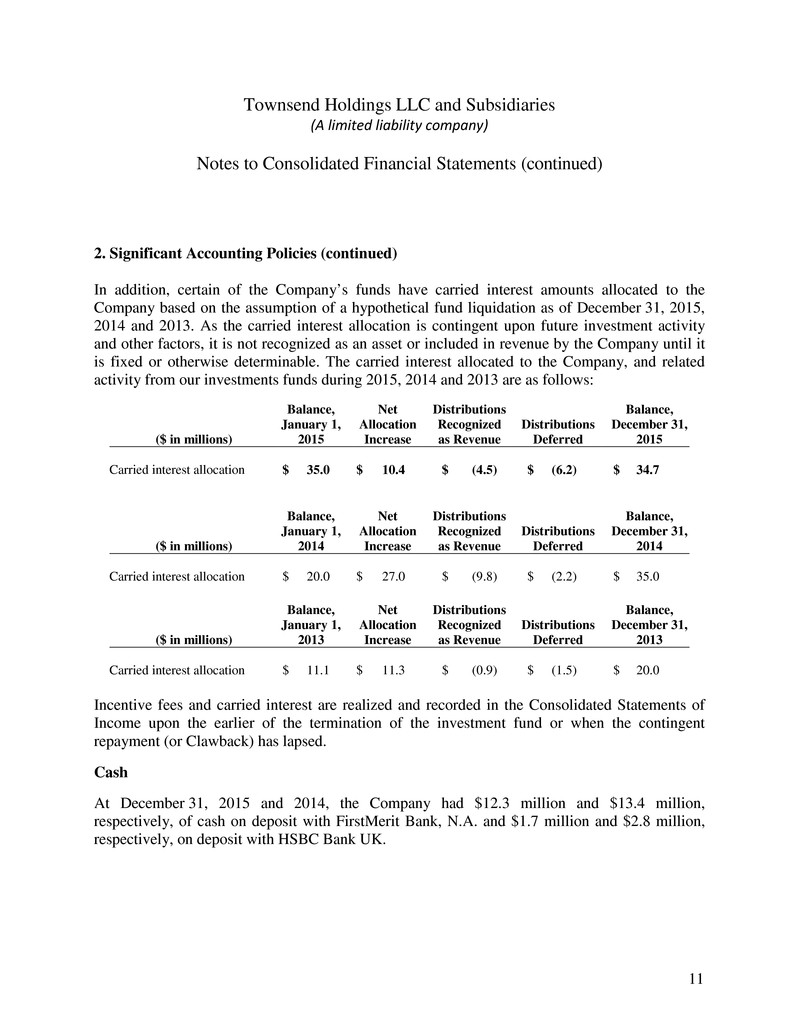

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 11 2. Significant Accounting Policies (continued) In addition, certain of the Company’s funds have carried interest amounts allocated to the Company based on the assumption of a hypothetical fund liquidation as of December 31, 2015, 2014 and 2013. As the carried interest allocation is contingent upon future investment activity and other factors, it is not recognized as an asset or included in revenue by the Company until it is fixed or otherwise determinable. The carried interest allocated to the Company, and related activity from our investments funds during 2015, 2014 and 2013 are as follows: ($ in millions) Balance, January 1, 2015 Net Allocation Increase Distributions Recognized as Revenue Distributions Deferred Balance, December 31, 2015 Carried interest allocation $ 35.0 $ 10.4 $ (4.5) $ (6.2) $ 34.7 ($ in millions) Balance, January 1, 2014 Net Allocation Increase Distributions Recognized as Revenue Distributions Deferred Balance, December 31, 2014 Carried interest allocation $ 20.0 $ 27.0 $ (9.8) $ (2.2) $ 35.0 ($ in millions) Balance, January 1, 2013 Net Allocation Increase Distributions Recognized as Revenue Distributions Deferred Balance, December 31, 2013 Carried interest allocation $ 11.1 $ 11.3 $ (0.9) $ (1.5) $ 20.0 Incentive fees and carried interest are realized and recorded in the Consolidated Statements of Income upon the earlier of the termination of the investment fund or when the contingent repayment (or Clawback) has lapsed. Cash At December 31, 2015 and 2014, the Company had $12.3 million and $13.4 million, respectively, of cash on deposit with FirstMerit Bank, N.A. and $1.7 million and $2.8 million, respectively, on deposit with HSBC Bank UK.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 12 2. Significant Accounting Policies (continued) Fees Receivable Fees receivable includes management fees receivable from underlying funds in the commingled funds business and advisory fees receivables. These are periodically assessed for collectability. The Company is generally successful in recovering substantially all of the outstanding fees receivable; however, the Company’s policy is to identify and reserve for specific collectability concerns based on customers’ financial condition and payment history. Amounts determined to be uncollectible are charged directly to other operating and administrative expenses in the Consolidated Statements of Income. The amount charged to operations included $0.3 million for the year ended December 31, 2015. There were no amounts charged to operations in 2014 and 2013. Fees receivable are not subject to interest. Due From/To Due Affiliates At December 31, 2013, the due from/due to affiliates accounts consisted entirely of a receivable from a co-invested fund and an offsetting payable to Townsend for $666,341, related to the capital funding of a co-invested fund. These funds were received from the co-invested fund and paid to Townsend in 2014. No amounts remain outstanding at December 31, 2015 and 2014. Fixed Assets Fixed assets, which are comprised of computer equipment, furniture and fixtures, and leasehold improvements, are stated at historical cost, less accumulated depreciation. Computers, software, and furniture and fixtures are depreciated on a straight-line basis for a period ranging between three to five years. Leasehold improvements are amortized on a straight-line basis over the lesser of the lease term or the useful life of the related premises. Expenditures for repairs and maintenance are expensed as incurred.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 13 2. Significant Accounting Policies (continued) At December 31, 2015 and 2014, the fixed assets were as follows: 2015 2014 Leasehold improvements $ 524,594 $ 496,989 Furniture and fixtures 510,846 581,606 Computer equipment 460,929 459,527 Construction in process 82,202 - Subtotal 1,578,571 1,538,122 Less accumulated depreciation (642,345) (486,979) Fixed assets, net $ 936,226 $ 1,051,143 Intangible Assets The expected useful lives of definite-lived acquired intangibles are analyzed each period and determined based on an analysis of the historical and projected attrition rates of existing clients, and other factors that may influence the expected future economic benefit the Company will derive from the relationships. The Company tests for the possible impairment of definite-lived intangible assets whenever events or changes in circumstances indicate that the carrying amount of the asset is not recoverable. If such indicators exist, the Company compares the estimated future undiscounted cash flows related to the asset to the carrying value of the asset. If the carrying value is greater than the undiscounted cash flow amount, an impairment charge is recorded in the Consolidated Statements of Income for amounts necessary to reduce the carrying value of the asset to fair value.

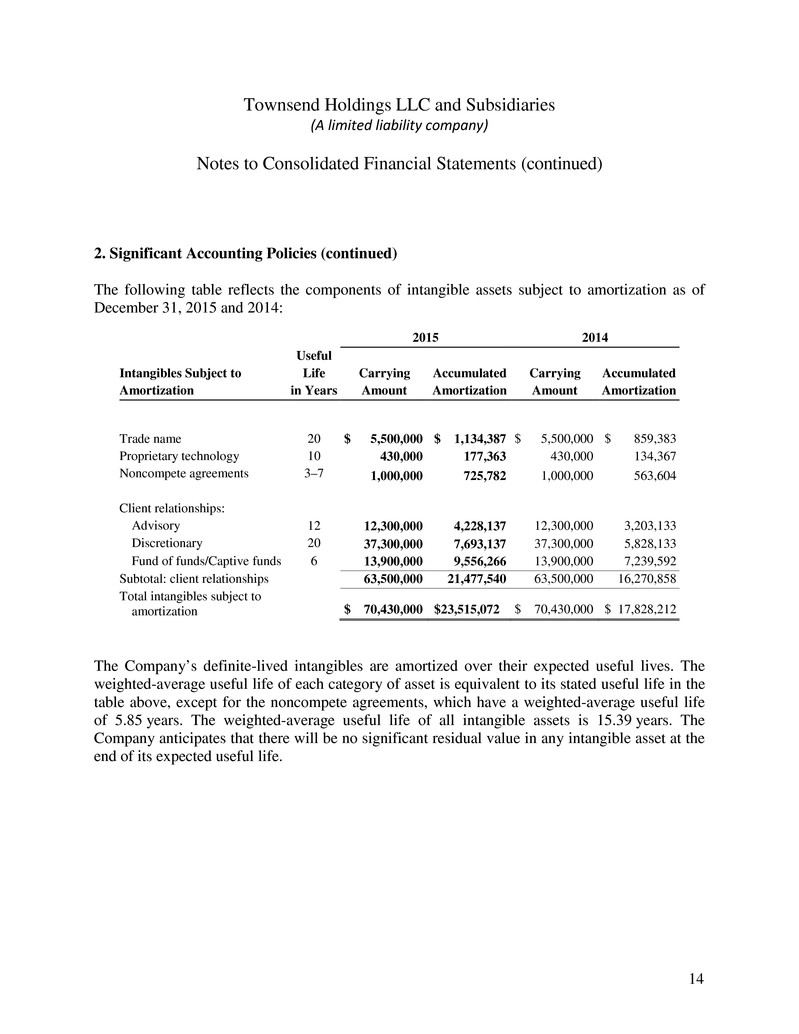

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 14 2. Significant Accounting Policies (continued) The following table reflects the components of intangible assets subject to amortization as of December 31, 2015 and 2014: 2015 2014 Intangibles Subject to Amortization Useful Life in Years Carrying Amount Accumulated Amortization Carrying Amount Accumulated Amortization Trade name 20 $ 5,500,000 $ 1,134,387 $ 5,500,000 $ 859,383 Proprietary technology 10 430,000 177,363 430,000 134,367 Noncompete agreements 3–7 1,000,000 725,782 1,000,000 563,604 Client relationships: Advisory 12 12,300,000 4,228,137 12,300,000 3,203,133 Discretionary 20 37,300,000 7,693,137 37,300,000 5,828,133 Fund of funds/Captive funds 6 13,900,000 9,556,266 13,900,000 7,239,592 Subtotal: client relationships 63,500,000 21,477,540 63,500,000 16,270,858 Total intangibles subject to amortization $ 70,430,000 $23,515,072 $ 70,430,000 $ 17,828,212 The Company’s definite-lived intangibles are amortized over their expected useful lives. The weighted-average useful life of each category of asset is equivalent to its stated useful life in the table above, except for the noncompete agreements, which have a weighted-average useful life of 5.85 years. The weighted-average useful life of all intangible assets is 15.39 years. The Company anticipates that there will be no significant residual value in any intangible asset at the end of its expected useful life.

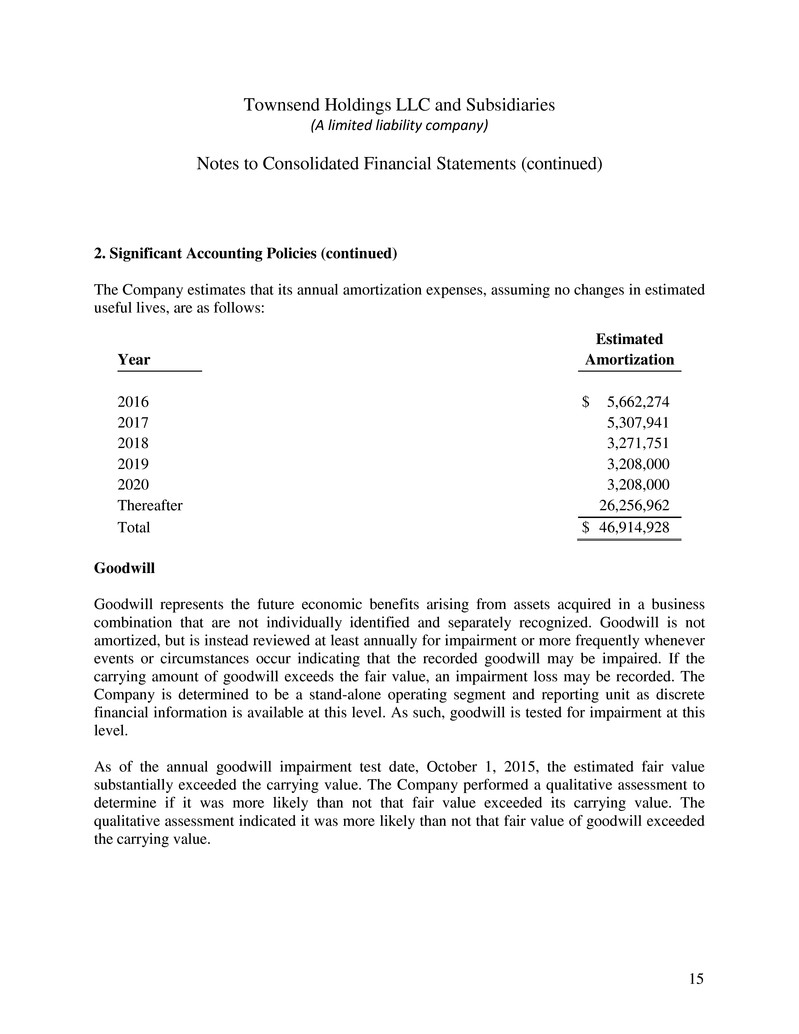

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 15 2. Significant Accounting Policies (continued) The Company estimates that its annual amortization expenses, assuming no changes in estimated useful lives, are as follows: Year Estimated Amortization 2016 $ 5,662,274 2017 5,307,941 2018 3,271,751 2019 3,208,000 2020 3,208,000 Thereafter 26,256,962 Total $ 46,914,928 Goodwill Goodwill represents the future economic benefits arising from assets acquired in a business combination that are not individually identified and separately recognized. Goodwill is not amortized, but is instead reviewed at least annually for impairment or more frequently whenever events or circumstances occur indicating that the recorded goodwill may be impaired. If the carrying amount of goodwill exceeds the fair value, an impairment loss may be recorded. The Company is determined to be a stand-alone operating segment and reporting unit as discrete financial information is available at this level. As such, goodwill is tested for impairment at this level. As of the annual goodwill impairment test date, October 1, 2015, the estimated fair value substantially exceeded the carrying value. The Company performed a qualitative assessment to determine if it was more likely than not that fair value exceeded its carrying value. The qualitative assessment indicated it was more likely than not that fair value of goodwill exceeded the carrying value.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 16 2. Significant Accounting Policies (continued) Accrued Compensation and Benefits Expenses Accrued compensation and benefits consisted of the following at December 31: 2015 2014 Discretionary bonus and profit sharing $ 11,464,665 $ 12,108,320 Employee 401(k) contributions 20,498 12,956 Other 243,646 143,768 Accrued compensation and benefits $ 11,728,809 $ 12,265,044 Due to Members Due to members consists entirely of amounts due to Townsend from fundings made to co-investment funds prior to the Purchase. Such amounts will be paid to Townsend only to the extent cash distributions are received from the co-investment funds. During 2015 and 2014, $1,464,064 and $691,735, respectively, were paid to members. No payments were made during 2013. Foreign Currency In the normal course of business, the Company or its subsidiaries may enter into transactions not denominated in their functional currency. Foreign exchange gains and losses arising on such transactions are recorded as other operating expenses in the Consolidated Statements of Income. Foreign exchange losses for the years ended December 31, 2015, 2014 and 2013 amounted to $59,243, $44,743 and $9,695, respectively. In addition, the Company consolidates entities that have a non-U.S. dollar functional currency. Non-U.S. dollar denominated assets and liabilities are translated to U.S. dollars at the exchange rate prevailing at the reporting date and income, expenses, gains and losses are translated at the average of the prevailing exchange rates for the period in which the transaction took place. Cumulative translation adjustments arising from the translation of non-U.S. dollar denominated operations are recorded in accumulated other comprehensive income.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 17 2. Significant Accounting Policies (continued) Other Income – Including Reimbursable Expenses The Company’s other income included $2.7 million, $3.3 million and $2.5 million for the years ended December 31, 2015, 2014 and 2013, respectively, of expenses that are reimbursable from clients or funds for which a subsidiary of the Company is the general partner. Compensation, Benefits and Related Costs Employee Compensation and Benefits consists of (a) compensation, comprising salary, discretionary bonus, and performance revenue based payment arrangements, (b) benefits paid and payable to employees, and (c) equity-based compensation associated with the grants of equity-based awards to employees. Equity-Based Compensation – Compensation cost relating to the issuance of equity-based awards to members and employees is measured at fair value at the grant date, taking into consideration expected forfeitures, and expensed over the vesting period on a straight-line basis. Equity-based awards that do not require future service are expensed immediately. Compensation and Benefits – Performance Fee – Performance fee compensation and benefits consists of participation in realized performance fees in accordance with certain profit sharing initiatives. Such compensation expense is incurred when the revenue from the fee-based performance is earned and collected. As revenue is not recognized on incentive income subject to contingent repayment until all of the related contingencies have been resolved, no associated performance fee compensation is recorded until all of the related contingencies have been resolved and are not paid until the fee is collected. Income and Other Taxes No federal income taxes have been provided on income or loss of the Company since the members are individually liable for the taxes on their share of the Company’s income or loss. However, the Company is subject to various taxes imposed within the states and local municipalities where it operates. As such, the Company recorded $138,882, $180,365 and

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 18 2. Significant Accounting Policies (continued) $288,388 of tax expense for the years ended December 31, 2015, 2014 and 2013, respectively, included within other operating and administrative expenses within the accompanying Consolidated Statements of Income. Certain subsidiaries of the Company are subject to income tax of the foreign countries in which they conduct business. The Company recorded $42,800 of foreign income tax benefit for the year ended December 31, 2015, and recorded $27,036 and $200,750 of foreign income tax expense for the years ended December 31, 2014 and 2013, respectively, in other operating and administrative expenses within the accompanying Consolidated Statements of Income. The Company also recorded deferred income tax benefit of $808 for the year ended December 31, 2015, and deferred income tax expense of $27,101 and $103,051 for the years ended December 31, 2014 and 2013, respectively, related to the book-to-tax differences of intangibles assets and goodwill. The Company’s operations in foreign countries have resulted in tax losses available indefinitely for offsetting against future taxable profits. The unutilized loss carry forwards generated deferred tax assets of approximately $427,000. The deferred tax assets are fully reserved at December 31, 2015. The Company recognizes the tax benefits of uncertain tax positions only if it is “more likely than not” that the tax position is sustainable assuming examination by tax authorities. The Company’s management has assessed the Company’s tax positions and has determined that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years, or expected to be taken in the Company’s 2015 returns. The Company is generally no longer subject to tax examinations by any tax authorities for years before 2012. The Company files tax returns as prescribed by the tax laws of the jurisdictions in which it operates and is treated as a partnership for U.S. Federal and state income tax purposes. In the normal course of business, the Company is subject to examination by U.S. Federal, various states, and other jurisdictions, where applicable; however, the Company is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Company’s policy is to classify interest and penalties associated with underpayment of taxes as income tax expense on its Consolidated Statements of Income. The Company did not pay any interest or penalties associated with the underpayment of any income taxes in 2015, 2014 or 2013.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 19 2. Significant Accounting Policies (continued) Recent accounting pronouncements In May 2014, the Financial Accounting Standards Board (FASB) issued a comprehensive new revenue recognition standard for contracts with customers that will supersede most current revenue recognition guidance. This standard contains principles that an entity will apply to determine the measurement of revenue and timing of when it is recognized. The entity will recognize revenue to reflect the transfer of goods or services to customers at an amount that the entity expects to be entitled to in exchange for those goods or services. In August 2015, FASB delayed the effective date of the new revenue standard by one year. In March 2016, FASB amended the principal-versus agent implementation guidance in the new revenue standard. The new standard is effective for the Company beginning after December 15, 2018. The Company is currently evaluating the impact on its consolidated financial statements upon the adoption of this new standard. In February 2015, the FASB issued an accounting standard update on consolidation. The standard eliminates the deferral under ASU 2010-10. The standard amends the evaluation of whether (1) fees paid to a decision maker or service provider represent a variable interest, (2) a limited partnership or similar entity has the characteristics of a VIE and (3) a reporting entity is the primary beneficiary of a VIE. The new standard is effective for the Company beginning January 1, 2017. The Company is currently evaluating the potential impact that this guidance will have on its consolidated financial statements. In May 2015, the FASB issued an accounting standard update that eliminated the requirement to categorize investments measured using the net asset value practical expedient in the fair value hierarchy. The new guidance is to be applied retrospectively and effective for fiscal years beginning after December 15, 2016. The Company does not expect a material impact to its consolidated financial statements. In February 2016, the FASB issued an accounting update that requires lessees to present right-of- use assets and lease liabilities on the balance sheet. The new guidance is to be applied using a modified retrospective approach at the beginning of the earliest comparative period in the financial statements and is effective for fiscal years beginning after December 15, 2019. The Company is currently evaluating the potential impact that this guidance will have on its consolidated financial statements.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 20 2. Significant Accounting Policies (continued) In March 2016, the FASB issued an accounting standard update which simplified several aspects for employee share-based payment transactions. The new guidance is effective for annual reporting periods beginning after December 15, 2017. The Company is currently evaluating the potential impact that this guidance will have on its consolidated financial statements. 3. Investments and Fair Value Measurements Investments in real estate funds reflect the fair value of the Company’s ownership interests (typically general partner interests) in the co-investment funds, net of carried interest, as the Company elected the fair value option for these investments which otherwise would have been accounted for using the equity method of accounting. The fair value of the investments are recorded in accordance with ASC 820, Fair Value Measurements. ASC 820 defines fair value as the amount that would be exchanged to sell an asset or transfer a liability in an orderly transfer between market participants at the measurement date. ASC 820 establishes a hierarchal disclosure framework which ranks the observability of market price inputs used in measuring financial instruments at fair value. The observability of inputs is impacted by a number of factors, including the type of financial instrument, the characteristics specific to the financial instrument and the state of the marketplace, including the existence and transparency of transactions between market participants. Financial instruments with readily available quoted prices, or for which fair value can be measured from quoted prices in active markets, will generally have a higher degree of market price observability and a lesser degree of judgment applied in determining fair value. Investments measured and reported at fair value are classified and disclosed based on the observability of inputs used in the determination of fair values, as follows: • Level I – inputs to the valuation methodology are quoted prices available in active markets for identical instruments as of the reporting date. • Level II – inputs to the valuation methodology are other than quoted prices in active markets, which are either directly or indirectly observable as of the reporting date. • Level III – inputs to the valuation methodology are unobservable and significant to overall fair value measurement. The inputs into the determination of fair value require significant management judgment or estimation.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 21 3. Investments and Fair Value Measurements (continued) In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the determination of which category within the fair value hierarchy is appropriate for any given financial instrument is based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument. The following table summarizes the Company’s investment in real estate funds measured at fair value on recurring basis by the above fair value hierarchy levels as of December 31, 2015: Fair Value of Assets as of December 31, 2015 ($ in millions) Level I Level II Level III Total Investments in real estate funds $ – $ – $ 17.8 $ 17.8 Total $ – $ – $ 17.8 $ 17.8 The following table summarizes the Company’s investment in real estate funds measured at fair value on recurring basis by the above fair value hierarchy levels as of December 31, 2014: Fair Value of Assets as of December 31, 2014 ($ in millions) Level I Level II Level III Total Investments in real estate funds $ – $ – $ 17.9 $ 17.9 Total $ – $ – $ 17.9 $ 17.9 The fair values of investments in real estate funds are estimated by utilizing the Company’s proportionate share of net asset values provided by the underlying real estate funds based on the most recent available information. The Company reviews the net asset values provided by the underlying real estate fund managers on an ongoing basis and compares these values to the audited financial statements. The terms of the investments preclude the ability to redeem the investments. Distributions from these investments will be received as the underlying assets in the funds are liquidated, the timing of which cannot be readily determined.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 22 3. Investments and Fair Value Measurements (continued) The changes in the Company’s investment in real estate funds measured at fair value for which the Company has used Level III inputs to determine fair value for the year ended December 31, 2015 are as follows: ($ in millions) Balance, January 1, 2015 Purchases Proceeds From Investments Net Change in Unrealized Gains on Investments Transfers In and Out of Level III Balance, December 31, 2015 Real estate funds $ 17.9 $ 3.9 $ (6.0) $ 2.0 $ – $ 17.8 Total investments $ 17.9 $ 3.9 $ (6.0) $ 2.0 $ – $ 17.8 The changes in the Company’s investment in real estate funds measured at fair value for which the Company has used Level III inputs to determine fair value for the year ended December 31, 2014 are as follows: ($ in millions) Balance, January 1, 2014 Purchases Proceeds From Investments Net Change in Unrealized Gains on Investments Transfers In and Out of Level III Balance, December 31, 2014 Real estate funds $ 15.1 $ 4.2 $ (5.1) $ 3.7 $ – $ 17.9 Total investments $ 15.1 $ 4.2 $ (5.1) $ 3.7 $ – $ 17.9 The total change in realized and unrealized gains for Level III investments are included as a component of net change in unrealized gains on investments in the accompanying Consolidated Statements of Income. 4. Concentrations of Credit Risk Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and receivables. The Company maintains cash with various financial institutions. These financial institutions can be located in cities in which the Company and its affiliates operate. The Company’s cash balances may from time to time exceed the depository insurance limits of the Federal Deposit Insurance Corporation (FDIC). The Company is subject to credit risk to the

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 23 4. Concentration of Credit Risk (continued) extent that the financial institutions are not able to fulfill their obligations to repay the amounts owed to the Company in excess of FDIC limits. The Company is exposed to credit risk related to revenues and fees receivables. For the years ended December 31, 2015, 2014 and 2013 one client’s management and advisory fees approximate 14.5%, 10.4% and 12.5%, respectively, of total management and advisory revenues. At December 31, 2015 and 2014, the largest single fee receivable was approximately 10.5% and 5.2%, respectively, of total outstanding receivables at those dates, respectively. The Company manages assets through its funds in more than 350 investment products across a range of real estate asset classes and investment styles in geographically distributed markets. The Company believes that its diversification across investment styles and geographic markets helps to mitigate the Company’s exposure to the risks created by changing market environments. 5. Employee Compensation and Benefit Plans The Company employs personnel in its San Francisco, California; London, United Kingdom; Hong Kong, China and Cleveland, Ohio offices. Employee compensation is primarily comprised of base pay, discretionary and incentive based bonuses, equity based compensation, health care benefits, retirement contributions (including 401(k) profit sharing) and payroll taxes. In 2015, the Company entered into Bonus Agreements with certain employees. Under these agreements the Company will pay an incentive-based compensatory cash bonus, calculated based on the Company’s annual performance and certain thresholds defined in the respective agreements. Included in employee compensation expense for the year ended December 31, 2015 is $1.5 million of expense related to these Bonus Agreements, of which $0.7 million is payable at December 31, 2015 and included in accrued compensation and benefits in the accompanying Consolidated Statements of Financial Condition. The employee compensation expense for the year ended December 31, 2015 includes bonus amounts based on the Company’s prior year performances. The Company sponsors a 401(k) Plan & Trust for San Francisco and Cleveland employees as a fully discretionary contribution plan. The Company generally contributes a fixed percentage of

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 24 5. Employee Compensation and Benefit Plans (continued) employee compensation on an annual basis, based upon the Company’s performance in the prior fiscal year. Upon completing three months of service and attaining the age of eighteen, employees may contribute to the 401(k) plan. The annual maximum amount as determined by the Internal Revenue Service, which was $18,000 for 2015 and $17,500 for 2014 and 2013, respectively. Included in employee compensation expense are discretionary employer contributions to the 401(k) plan of approximately $706,000, $639,000 and $521,000 for the years ended December 31, 2015, 2014 and 2013, respectively. In 2014, the Company established a group personal pension plan for employees in the London office. This is a defined contribution plan and the Company contributes a fixed percentage of the employees’ monthly compensation. Employees are eligible to participate the month following their initial employment with the Company. Certain employees in London have separate individual pension plans to which the Company contributes a fixed percentage of the employees’ monthly compensation. Included in employee compensation expense for the year ended December 31, 2015 and 2014 are discretionary employer contributions to these plans of approximately $193,000 and $280,000, respectively. The employee compensation expense for the year ended December 31, 2014 includes catch-up contributions for employee’ services prior to 2014. 6. Financing Arrangements On October 4, 2012, the Company entered into a credit and security agreement (the Credit Agreement), with FirstMerit Bank, N.A, under which the Company may borrow up to $3.0 million. The Credit Agreement is guaranteed by the business assets of the Company, including accounts receivable and fixed assets. Amounts under the Credit Agreement bear interest at LIBOR plus 2.65%. An annual fee of up to 0.25% is imposed by the bank on the unused borrowing capacity and is based on the total aggregate credit facility used. The Company paid fees of $7,604 in 2015 and 2014, respectively, and $7,916 in 2013 for unused commitments under the Credit Agreement. The Company had $3.0 million available under the Credit Agreement at December 31, 2015 and 2014 and there were no borrowings in 2015 or 2014.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 25 6. Financing Arrangements (continued) The Credit Agreement contains a number of customary covenants, including but not limited to restrictions on the Company’s ability to incur additional indebtedness, create liens or other encumbrances, sell assets, make certain payments, loans, advances or guarantees, and make capital expenditures. Significant financial covenants for the Credit Agreement include a minimum tangible net worth of $5.0 million. As of December 31, 2015 and 2014, the Company was in compliance with all covenants. In June 2015, the Credit Agreement was amended to extend the maturity date of the agreement to June 30, 2017. On September 4, 2014, the Company entered into a $3.5 million term loan with FirstMerit Bank, N.A. The proceeds from the loan were used to provide loans to certain members of the Company. The term loan is secured by the business assets of the Company, including the notes receivable from members. The loan bears interest at a variable rate of a 30-day LIBOR plus 2.75%. The interest rate on the loan at December 31, 2015 was 3.08%. Commencing September 30, 2014, quarterly principal payments of $175,000 and interest payments are required. Any accrued and unpaid interest and the remaining principal of the loan are due on maturity, September 4, 2019. The Company paid interest of $86,049 and $31,491 on the loan during the year ended December 31, 2015 and 2014, respectively. The outstanding balance on the loan at December 31, 2015 was $2,450,000. The fair value of the loan at December 31, 2015 and 2014 approximates cost. The loan was repaid in full in January 2016. The term loan contains various financial and non-financial covenants. Financial covenants include maintaining a minimum operating cash flow to total fixed charges ratio and maintaining total cash on hand in excess of total funded indebtedness. As of December 31, 2015, the Company was in compliance with all covenants. 7. Equity-Based Compensation The Company has granted equity-based compensation awards to certain individuals under the Townsend Holdings LLC 2011 Equity Plan (the Equity Plan). The Equity Plan allows for the granting of options, unit appreciation rights or other unit-based awards (i.e., units, restricted units) which may contain certain service or performance requirements. For all equity-based award programs, during the applicable vesting period, the units cannot be sold or transferred by the participants until after the vesting conditions have been satisfied.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 26 7. Equity-Based Compensation (continued) As of December 31, 2015, 2014 and 2013, there was approximately $1.1 million, $2.5 million and $3.5 million, respectively, of unrecognized compensation expense related to unvested option awards. The remaining expense is to be recognized over a weighted-average period of 2.74 years. As of December 31, 2015, 2014 and 2013, there was approximately $1.8 million, $1.5 million and $2.2 million, respectively, of unrecognized compensation expense related to restricted Class B unit awards (RSUs). The remaining expense is to be recognized over a remaining weighted- average period of 3.34 years. Total vested and unvested outstanding Class B units were 57,221, 47,000 and 31,200, respectively, at December 31, 2015, 2014 and 2013. All of the Company’s unvested equity-based awards are expected to vest. A summary of the Company’s unvested equity-based awards as of December 31, 2015, 2014 and 2013 and a summary of changes during 2015, 2014 and 2013 were as follows: Equity Settled Awards Unvested Units Options Weighted- Average Grant Date Fair Value RSU Weighted- Average Grant Date Fair Value Balance, January 1, 2013 48,600 $113.29 15,360 $128.80 Granted – 6,400 $124.41 Forfeited – – Vested (14,667) $133.02 (3,840) $128.80 Balance, December 31, 2013 33,933 $104.76 17,920 $127.23 Granted – 667 $81.84 Forfeited – – Vested (9,767) $112.70 (5,120) $158.22 Balance, December 31, 2014 24,166 $101.55 13,467 $113.20 Granted – 6,933 $136.10 Forfeited – – Vested (15,166) $91.28 (5,253) $126.98 Balance, December 31, 2015 9,000 $118.86 15,147 $118.91

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 27 7. Equity-Based Compensation (continued) Restricted Stock Units The Company’s Board of Directors can make additional awards under the Equity Plan without restriction. The fair value at the date of grant is expensed on a straight-line basis over the applicable service periods. Dividends declared on unvested units during the vesting period are paid to the holders in cash. During 2015, 2014 and 2013, 6,933, 667 and 6,400 options, respectively, were exercised and reclassed in the above table to Restricted Stock Units due to the 5-year service period required once exercised. At December 31, 2015, 2014 and 2013, 15,147, 13,467 and 17,920, respectively, unvested RSUs were outstanding. The Company recorded non-cash stock-based compensation expense of $536,976, $528,048 and $494,580 for the years ended December 31, 2015, 2014 and 2013, respectively. Options on Restricted Stock Units The Company granted an executive the option to purchase up to 14,000 units of the Company’s Class B Units on November 18, 2011, which have 5-year vesting restrictions. Units acquired through the exercise of options will be re-acquired by the Company from primary investors, resulting in no change in the number of outstanding units. The weighted-average strike price of the options is $50.00. The options shall vest with the right to acquire up to the number of Class B Units (each an option tranche) on each of the subsequent seven anniversaries of the grant date (each such date, a tranche vesting date) provided that the grantee shall forfeit all remaining option tranches upon separation. Following the tranche vesting date, the option tranche that vests at such time may be exercised by the grantee at any time prior to February 1 of the calendar year following the calendar year of the applicable tranche vesting date (each an option tranche exercise date). If an option tranche is not exercised prior to the applicable option tranche exercise date, such option tranche shall immediately expire and the grantee shall have no further rights to acquire any of the Class B units subject to that option tranche. In March 2015, January 2014 and January 2013, the executive exercised the 767, 677 and 1,400 options from the third, second and first anniversary vesting at the $50.00 exercise price. Effective September 30, 2013 (Modified Date), the Company’s Board of Directors approved an amendment to the executive’s vesting schedule to accelerate 5,000 shares (split evenly from the

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 28 7. Equity-Based Compensation (continued) then remaining tranches) to be exercised immediately. On September 30, 2015 (Second Modified Date), the Company’s Board of Directors again approved an amendment to accelerate the executive’s vesting schedule to accelerate 6,166 shares from the remaining tranches. Those 6,166 and 5,000 shares were exercised effective October 1, 2015 and 2013, respectively at the $50.00 exercise price and are subject to the 5-year vesting restrictions. The executive financed the transaction with non-recourse interest bearing notes from affiliates for 100% and 90% of the transaction price for the 2015 and 2013 purchases, respectively. The fair value of options granted was estimated using the Black-Scholes option pricing model. In accordance with ASC 718, when the 6,166 and 5,000 options were modified to accelerate vesting, there was an incremental increase in the fair value of the options of $673,259 and $305,664, respectively, which is being recognized on a straight-line basis as compensation cost over the 5-year RSU vesting period. At December 31, 2015 there were no unvested options on unvested RSUs. At December 31, 2014 and 2013, respectively, 6,166 and 6,933 unvested options on unvested RSUs were outstanding pursuant to this option grant. 767 and 667 options on unvested RSUs vested and were exercisable at December 31, 2014 and 2013, respectively. The weighted-average contractual term of exercisable options at December 31, 2014 and 2013 was one month. In connection with the grant of these options on unvested RSUs, the Company recorded non-cash stock-based compensation expense of $215,184, $186,254 and $158,169 for the years ended December 31, 2015, 2014 and 2013, respectively. On November 18, 2011, certain executives were allowed to purchase 45,000 Class B units and to finance such transactions with non-recourse interest-bearing notes from affiliates for 90% of the transaction price. The balance of these notes at December 31, 2015, 2014 and 2013 was $0.5 million, $1.1 million and $1.8 million, respectively. These have been accounted for as options given the terms of the transaction. The options have a term of nine years and are subject to annual cliff vesting at 20% per year for five years. The weighted-average exercise price of the options is $44.44 per unit. In connection with the grant of these options on unvested RSUs, the Company recorded noncash stock-based compensation expense of $1,146,168 for the years ended December 31, 2015, 2014 and 2013. The fair value of the options granted was estimated using Monte Carlo simulations. The weighted-average grant date fair value of options outstanding at December 31, 2015, 2014 and 2013 was $118.91, $113.20 and $127.35, respectively.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 29 7. Equity-Based Compensation (continued) Incentive Units On August 26, 2013, the Company granted awards of 40,000 Class B Income and 40,000 Capital Incentive Units (collectively, Incentive Units) to certain officers and employees. The Incentive Units issued are considered liability awards in accordance with ASC 718. The Incentive Units are subject to vesting based on employment at the Company. The Income Units are paid to the holders as they vest above specified thresholds at time of grant. Upon a defined liquidity event, the Income Units will cease to be in effect and the Capital Units will remain and are subject to specific thresholds. In 2015 the vesting schedule for the Capital Units was amended. The Capital Units vest over 7 consecutive annual installments of 12.5% and the last installment of 25% in the 7th year. Vesting of 10,000 units commences August 26, 2013 and vesting of the remaining 5,000 and 25,000 units begins November 18, 2013 and December 31, 2013, respectively. In 2015, the Income Units portion of the Incentive Units were cancelled. The Company replaced those cancelled Income Units with a Bonus Agreement based on the Company exceeding an EBIDA threshold. The Company recognized an expense in 2015 of $1,497,694 included in compensation, benefits, and related costs in the accompanying Consolidated Statements of Income based on exceeding those EBIDA hurdles. The Bonus Agreement is an annual calculation based on a fixed percentage that exceeds a fixed EBIDA threshold. Prior to being cancelled, the fair value of the Income Units granted was estimated using a discounted cash flow analysis taking into consideration the Company’s excess operating cash and the expected distributions to the Income Units determined from their respective participation thresholds. The weighted-average fair value of Income Units outstanding at December 31, 2014 and 2013 was $0.76 and $2.41, respectively. 10,000 Income Units for one executive vested at two-thirds in 2013 and the remaining one-third in 2014. The other 30,000 Income Units vest one- third immediately with another one-third for each of the next two years. The Company recognized $41,003 of income and $71,303 of compensation expense in 2014 and 2013, respectively. In 2015, when the Income Units were cancelled, the Company recognized $30,300 of income to remove the remaining liability. The fair value of the Capital Units granted was estimated using Monte Carlo simulations. The weighted-average fair value of Capital Units outstanding at December 31, 2015, 2014 and 2013 was $262.00, $80.00 and $95.60, respectively. The Company is expensing the awards over seven

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 30 7. Equity-Based Compensation (continued) years in accordance with their vesting schedules. The Company recognized $6,694,778, $513,687 and $225,341 of compensation expense in 2015, 2014 and 2013, respectively, included within compensation, benefits and related costs within the accompanying Consolidated Statements of Income. 8. Members’ Equity All capitalized terms herein, to the extent not defined, are defined in the Company’s operating agreement. The total units which the Company has authority to issue are determined by the Board of Directors from time to time and currently consist of an unlimited number of Class A units; 2,000,000 Class B units; 150,000 Income Incentive units and 150,000 Capital Incentive units. Class A units are issued only in connection with, and in amounts necessary to fund, the repurchase of residual units from management unit holders. There were no Class A units issued or outstanding during 2015, 2014 and 2013. On November 11, 2011, 1,000,000 Class B units were issued to Townsend in exchange for the contribution of substantially all of its assets and liabilities to the Company. In addition, on November 11, 2011, Townsend exchanged equity interests of the Company’s 10,000 Class B units in return for 1% of the members’ equity interests in Townsend. On November 18, 2011, Townsend sold 700,000 Class B units (the Purchase) to TA, representing a controlling financial interest in the Company. In addition, the Company redeemed from Townsend 64,200 Class B units to be assigned by the Company for equity based awards that were given to various grantees. The 64,200 units assigned by the Company as equity awards were awarded with vesting restrictions. The Company shall make distributions of the Company’s Excess Operating Cash as defined in the Company’s First Amended and Restated Limited Liability Company Agreement dated November 18, 2011, in the amount determined by the Company’s Board of Directors in its sole discretion and to the extent not prohibited under any agreement to which the Company or any Subsidiary is a party. Profit and loss is allocated to unit holders on a pro rata basis. During 2015, 2014 and 2013, the Company distributed $14.0 million, $18.2 million and $7.0 million, respectively, in Excess Operating Cash. Each member’s liability is limited by terms set forth in the Company’s operating agreement and other applicable laws.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 31 9. Related Parties and Key Company Terms Townsend is a minority holder of Class B units. Certain members of Townsend are also officers of the Company. To ensure that these officers continue to act in the Company’s best interests, these officers are incented by various employment and Earn-out agreements. Each agreement is tailored to the specific responsibilities of each officer and incorporates salary and bonus considerations. Offsetting liabilities to Townsend were established with respect to certain investment assets. These liabilities will be satisfied if and when payment is received by the Company in satisfaction of such receivables and/or return of such investment capital. In 2014, funds were received by the Company and paid to Townsend and there is no receivable and offsetting liability at December 31, 2015 and 2014. Offsetting liabilities remain for certain investment assets on the Consolidated Statements of Financial Condition at December 31, 2015 and 2014. Any cash received regarding the investment capital shall be transferred to Townsend. Once all liabilities related to the excluded assets are satisfied, the Company will be entitled to retain any additional cash returned from the excluded assets. In September 2014, the Company issued non-recourse promissory notes to certain members totaling $3.5 million. Additional non-recourse promissory notes totaling $0.6 million were issued to a certain member in September and October 2015. The notes are secured by a pledge of the Company’s Income Incentive Units and Capital Incentive Units and/or Class B Units held by the respective members. The notes have an interest rate of 6%. Payments of accrued interest and principal are required following the members receipt of their annual bonus payment from the Company and after any distributions of excess cash are received from the Company subject to certain other arrangements. All unpaid principal and interest are due on the earlier of the 10th anniversary of the respective promissory notes origination date or upon the members’ separation from the Company. The outstanding balance on the notes receivable at December 31, 2015 and 2014 is $3.8 million and $3.4 million, respectively. The fair value of the notes receivable at December 31, 2015 and 2014 approximates cost. For the years ended December 31, 2015 and 2014, the Company earned interest income of $0.2 million and $0.1 million, respectively, included in interest and other income within the accompanying Consolidated Statements of Income. As of December 31, 2015 and 2014, respectively, $0.1 million of this interest is included in other assets on the accompanying Consolidated Statements of Financial Condition. These notes were repaid in January 2016.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 32 9. Related Parties and Key Company Terms (continued) The Company provides management and administrative services to the real estate funds and their affiliates. In connection therewith, the Company receives from the real estate funds a quarterly management fee calculated at varying annual rates of the capital account balances and unfunded capital commitments of each applicable partner of the real estate funds. For the years ended December 31, 2015, 2014 and 2013, management fees earned from the related party real estate funds were $26.1 million, $18.9 million and $20.7 million, respectively. Approximately $7.5 million and $5.3 million of the management fees are receivable as of December 31, 2015 and 2014, respectively, and are included in fees receivable in the accompanying Consolidated Statements of Financial Condition. Incentive fees from real estate funds to which the Company provides management and administrative services of $4.5 million, $9.8 million and $0.9 million were realized and included within the accompanying Consolidated Statements of Income for the years ended December 31, 2015, 2014 and 2013, respectively. Under the terms of a participation agreement for one of the real estate funds, a percentage of the management fees earned by the Company are payable to an affiliated entity. For the years ended December 31, 2015, 2014 and 2013, these fees were $0.4 million, $0.5 million and $0.7 million, respectively, of which $0.1 million is payable at December 31, 2015 and 2014, respectively, and included in accounts payable and accrued liabilities in the accompanying Consolidated Statements of Financial Condition. On October 1, 2013, the Company entered into a non-exclusive sales and marketing support agreement with Aligned Manager Services LLC (Aligned), an affiliate of TA. In connection with this agreement, the Company agreed to pay a fee to Aligned for clients or investors they solicit to invest in the Company’s segregated mandates or investment products, with fees calculated as a percentage of revenues accrued by the Company related to such clients. In March 2014, this agreement was replaced with a new non-exclusive sales and marketing support agreement entered into between Aligned and the Company. Under the new agreement fees were calculated as a percentage of revenues accrued by the Company for clients and investors obtained through Aligned’s services. This agreement was amended and restated effective December 31, 2014 to provide fees for only segregated mandates. For the years ended December 31, 2015, 2014 and 2013, fees of approximately $0, $45,000 and $146,000, respectively, were expensed and are included within professional fees and information services expense within the accompanying Consolidated Statements of Income. There were no fees outstanding at December 31, 2015 and 2014, respectively. This agreement was terminated as of January 29, 2016.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 33 10. Guarantees, Commitments and Contingencies In the normal course of business, the Company enters into contracts which provide a variety of representations and warranties, and which provide a variety of indemnifications. Such contracts include those with certain service providers. The Company’s maximum exposure under these arrangements is unknown as it would involve future claims that may be made against the Company; however, based on the Company’s experience, the risk of loss is remote and no such claims or losses pursuant to these contracts are expected to occur. As such, the Company has not accrued for any liabilities in connection with such indemnifications. The Company had commitments to co-invest approximately 1% of total capital in certain funds. At December 31, 2015 and 2014, outstanding commitments totaled $9.8 million and $8.1 million, respectively. Upon the liquidation of certain real estate funds, if the aggregate, cumulative distributions to the Company exceed a certain percentage of the total distributions of net investment gains and losses to partners, then the Company will be obligated to return the excess amount. The Company would also be required to return a Clawback amount to the partners upon liquidation if total distributions to the partners did not provide the partners with a certain percentage of cumulative, non-compounded annual rate of return on realized capital and costs, as defined in the various partnership agreements. In accordance with Company policy, amounts distributed subject to Clawback are recognized as deferred revenue until all the Clawback provisions have been satisfied. At December 31, 2015 and 2014, $10.0 million and $3.9 million, respectively, was recognized as deferred revenue due to Clawback provisions within the accompanying Consolidated Statements of Financial Condition. As part of the Purchase, the purchase consideration included an earn-out (the Earn-out), which represented contingent consideration. The Earn-out required TA to pay additional cash proceeds in an aggregate amount ranging from $0 to a maximum of $15.0 million providing certain earnings targets are met. On December 6, 2013, the Earn-out was amended to require a maximum earn-out payment of $15.0 million if a Revenue Target of $46.0 million for 2013 was achieved. At December 31, 2013, it was determined that the Revenue Target was achieved for the year ended December 31, 2013. The fair value of the contingent payment obligation is included the Statement of Financial Condition of TA. In 2014, TA paid the Earn-out. Upon payment of the Earn-out by TA, the Company recognized a $10.8 million increase to contributed capital and a charge to earnings for the excess of the payment amount over the amount reflected in the purchase accounting.

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 34 10. Guarantees, Commitments and Contingencies (continued) In October 2015, the Company entered into a Securities Purchase Agreement (NSAM Purchase) with NorthStar Asset Management Group Inc. (NSAM) and certain other parties, pursuant to which NSAM would acquire a controlling interest in the Company. In connection with this agreement the Company entered into Closing Bonus Agreements with certain employees. Under these Closing Bonus Agreements the Employees are entitled to cash bonus agreements if they continue employment at the Company through the closing of the NSAM Purchase. The Closing Bonus Agreements were amended and restated in January 2016. Upon the close of the NSAM Purchase on January 29, 2016, closing bonuses of $13.6 million were paid to employees under these Closing Bonus Agreements. See Note 5 for information about certain contingent liabilities related to employee compensation and benefit plans. Operating Leases Operating leases primarily consist of rental of office space in San Francisco, California; Hong Kong, China; London, United Kingdom and Cleveland, Ohio with termination dates ranging from July 2017 to August 2020. Occupancy lease agreements, in addition to base rentals, provide for rent and operating expense escalations resulting from increased assessments for real estate taxes and other charges. Occupancy expenses related to operating leases are recorded on a straight-line basis. Expenses for the Company’s operating leases totaled $1,302,170, $1,168,739 and $1,057,108 for the years ended December 31, 2015, 2014 and 2013, respectively, and are included in occupancy and other operating and administrative expenses in the accompanying Consolidated Statements of Income. As of December 31, 2015, future lease commitments under these leases are as follows: 2016 $ 1,418,631 2017 1,263,454 2018 896,244 2019 873,356 2020 183,872 Total minimum payments required $4,635,557

Townsend Holdings LLC and Subsidiaries (A limited liability company) Notes to Consolidated Financial Statements (continued) 35 11. Regulated Entity The Company has a subsidiary that is based in London, United Kingdom, that is subject to the capital requirements of the U.K. Financial Conduct Authority. This entity has continuously operated in excess of its regulatory capital requirements. 12. Subsequent Events Subsequent events have been evaluated from January 1, 2016 through April 14, 2016, the date the Consolidated Financial Statements of the Company were issued. On January 29, 2016, Thunder Investor T-II, LLC, a subsidiary of NSAM, acquired 857,769 Class B units (an approximate 84% interest) in the Company for approximately $383.0 million, subject to post-closing adjustments. In January and February 2016, the Company made excess cash distributions totaling $9.1 million to the members.