Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934:

For the fiscal year ended December 31, 2015

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934:

For the transition period from _____ to _____

Commission file number 0-28685

VERTICAL COMPUTER SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 65-0393635 |

| (State of Incorporation) | (I.R.S. Employer Identification No) |

101 West Renner Road, Suite 300, Richardson, TX 75082

(Address of Principal Executive Offices)

Registrant’s telephone number: (972) 437-5200

Securities registered pursuant to section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to section 12(g) of the Act:

Common Stock, par value $0.00001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨ Nox

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such file. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained in this form, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or amendment to this Form 10-K. Yesx No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ¨ | Accelerated filer ¨ | ||

| Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes¨ Nox

Issuer’s revenues for fiscal year ended December 31, 2015: $ 4,263,635

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the registrant’s most recently completed second fiscal quarter: $37,896,769.

As of April 14, 2016, the issuer had 1,129,367,529 shares of common stock, par value $0.00001, issued and outstanding.

Documents incorporated by reference: None

VERTICAL COMPUTER SYSTEMS, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

| 1 |

Forward-Looking Statements and Associated Risks. This Report contains forward-looking statements. Such forward-looking statements include statements regarding, among other things, (a) our projected sales and profitability, (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans, (e) our anticipated needs for working capital, and (f) the benefits related to ownership of our common stock. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this Report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Report will in fact occur as projected.

Background

Vertical Computer Systems, Inc. (“Vertical”, “VCSY”, the “Company”, the “Registrant”, “we”, “our”, or “us”) was incorporated in the State of Delaware in March 1992. We operated as a non-reporting public shell company until October 1999, at which time we acquired all the outstanding capital stock of Externet World, Inc., an Internet service provider and became an operating entity. In April 2000, we acquired 100% of the outstanding common stock of Scientific Fuel Technology, Inc. (“SFT”), a company with no operations. Also in April 2000, we merged SFT into our company, as a consequence of which the outstanding shares of SFT were cancelled, Vertical became the surviving entity, and we assumed SFT’s reporting obligations pursuant to Rule 12g-3(a) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

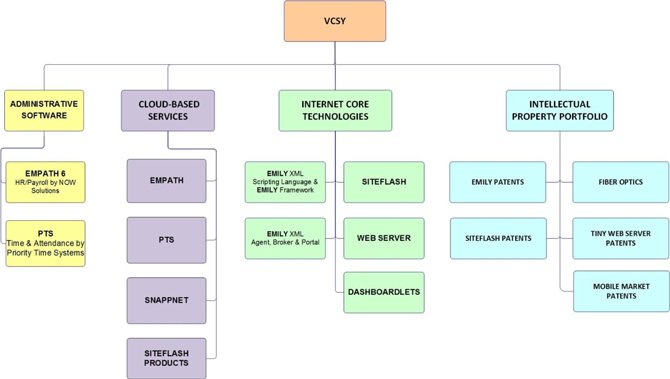

Business Overview

We are a global provider of application software, cloud-based and software services, Internet core technologies, and intellectual property assets through our distribution network with operations or sales in the United States, Canada and Brazil.

We attempt to acquire marketing or licensing rights for products which, in our belief, are best-of-breed, are profitable or on the path to profitability, are complementary to our other software offerings, and provide cross-product distribution channels. Our business model combines complementary and integrated software products, internet core technologies, and a multinational distribution system of partners, in order to create a distribution matrix that we believe is capable of penetrating multiple sectors through cross-promotion.

We developed a private communication platform based upon our patented technologies that we believe will change the nature of communication on the Internet by providing individuals with a true private communication channel as well as personal cloud capabilities.

VCSY’s platform eliminates the central server component in communications over the Internet and is based on the user having a web server on their mobile device, which may be synchronized with their tablet, PC or other hardware components (i.e. storage disks). VCSY’s platform is not a social media product, but rather a platform for users wanting to protect their data and information flow.

VCSY’s first application to be built upon that platform is Ploinks™, a personal private communication channel. Ploinks™ provides users with the ability to protect their data such as images, messages or videos, that protection being from both unwanted data transmissions and from third parties gaining ownership rights to their data. While users may still use all social media applications currently available, Ploinks™ provides a means to preserve and protect the part of the data they want to keep control of. Ploinks™ is currently in the beta-testing stage and we anticipate launching this product within the next few months.

| 2 |

Administrative Software

Our main administrative application software, emPath®, which is designed to handle complex payroll and human resources challenges, is developed, marketed and maintained by NOW Solutions. emPath® is natively Web-based, which means that the application can easily be accessed with a web browser. NOW Solutions, a 75% owned subsidiary, is selling emPath® in the United States and Canadian markets both as a software solution and a Software-as-a-Service (“SaaS”) offering, also known as Cloud-based offering. For a description of our cloud computing model for emPath®, please see the section entitled “Cloud-based services” below.

In 2010, we completed the workflow engine for emPath® and continued improvements for its cloud computing model. We also implemented our new strategy of developing certain HR/payroll related modules that can be sold separately from emPath® or bundled with emPath® as a comprehensive solution. These new features, when coupled with experience gained with the product by the Brazil-based development staff (over the past eight years), have substantially facilitated faster product development. In addition, we have significantly improved the scalability of emPath® to meet the needs of small businesses as well as very large enterprise clients.

Our continuous effort to improve our emPath® product and its cloud-based offering has allowed us to finalize and launch our new module-based initiative under which certain payroll/human resource modules can be marketed independently from emPath® or bundled into a comprehensive solution. A key objective of the module development initiative has been to enable new modules to be sold to a smaller customer base (companies with 25 to 500 employees) in a simple standardized version. This version will have full functionality and all the benefits of a total enterprise solution, while maintaining scalability in order to meet the needs of and to compete for the largest corporate customers and government entities, which often have complex payroll rules. We also have a global payroll initiative to launch emPath® internationally.

Our time and attendance software, PTS™, has been designed with the flexibility to meet the needs of a simple small business requirements as well as the most complex union-intensive clients through a rule-based time policy system coupled with a dashboardlet™ feature for presentations of information supporting numerous databases including Oracle, DB2 and SQL. For a description of this feature, please see the section entitled “Internet Core Technologies” below.

PTS™ will be marketed as a stand-alone best-of-breed solution through Priority Time Systems, Inc. (“Priority Time”) as well as an integrated module within emPath®, which we are marketing to emPath®’s existing customer base. Our initial marketing efforts are focused on the United States and Canadian markets.

| 3 |

SnAPPnet™ is currently marketed as a best-of-breed standalone solution through SnAPPnet, Inc. We are in the process of integrating this product with emPath® so it can also be sold to NOW Solutions’ customers as an emPath® module.

We have other administrative software in various stages of development which will be marketed through our subsidiaries including Priority Time, Vertical Healthcare Solutions, Inc. (“VHS”), and Taladin, Inc., (“Taladin”).

We believe that our administrative software solutions, which offer lower set-up fees and faster implementation times compared to competing products, provide customers with significant upfront cost savings and substantial increases in productivity for administration of everyday operations.

Cloud-based services

In addition to our standard software licensing model, where the software is deployed, hosted and maintained internally by the customer, we are offering customers with an alternate delivery method: software-as-a-service, or simply “cloud-based.” Cloud-based is a software delivery model where the company develops, operates, and hosts the application in data centers for use by its customers over the Internet.

A cloud-based service is a cost-effective, reliable and secure way for businesses to obtain the same benefits of commercially licensed, internally operated software, without the associated complexity and high start-up costs of deploying the software in-house or the need to dedicate IT people on staff to monitor and upgrade such a system.

After completing the testing of its emPath® cloud-based model to ensure a robust and competitive solution, NOW Solutions began selling that offering to existing and new clients. This delivery model provides a highly reliable, secure and scalable infrastructure, enabling us not only to continue servicing and expanding our current market of mid to large sized customers but also to increase our market reach by offering a solution to smaller sized customers, which otherwise may not be able to afford an in-house solution.

As an expanded product and as a result of our initial sales to customers with complex payroll, NOW Solutions has created a tailored cloud-based offering which provides these types of customers the cost benefits of a cloud computing model while meeting their complex requirements. We are also continuing to upgrade emPath® for our cloud computing offering utilizing emPath®’s powerful payroll component to provide private label contracting as well as distribution opportunities through existing payroll providers in their local markets.

PTS™, our time and attendance software, will also be offered as a cloud-based solution, as both a standalone product (through Priority Time and VHS) and an integrated module with emPath® (through NOW Solutions).

SnAPPnet™, a physician credentialing application, is currently offered as a cloud-based solution. We are in the process of developing a registered nurse module of SnAPPnet™. In addition, we are adding some key new features to the software application as well as doing a design review to meet other potential markets for credentialing and markets in need of automated fillable forms. We are marketing SnAPPnet™ directly to hospitals and plan to offer it through VHS to physicians in the United States and to NOW Solutions’ existing customer base.

In addition, we have converted our SiteFlash™ product to offer it in a cloud-based configuration. We intend to concentrate our initial marketing efforts for internal development projects connected with our private communication platform and its applications. For a description of SiteFlash™, please see the section entitled “Internet Core Technologies” below.

Software Services

In addition to the application software and cloud-based services, we offer a full range of software services that include professional services, maintenance, custom maintenance and managed services.

Internet Core Technologies

Internet core technologies provide the software foundation to support internet-based platforms for the delivery of individual software products that can be sold independently or combined with other software products for rapid deployment of all software products throughout our distribution system. We continue to develop specialized software applications that can be utilized in new products.

| 4 |

Our first patented internet core technology is SiteFlash™. The SiteFlash™ technology utilizes XML and publishes content on the Web, enabling the user to build and efficiently operate websites with the unique ability to separate form, function, and content. SiteFlash™ uses an advanced component-based structure to separate, parse, and store the various components of even the most complex web pages, permitting these components to be named, organized, filed and eventually redeployed onto the web pages of a website. Once all of the components of a web page are converted into “objects,” they can be grouped, as required by the user, into the three main types of web page components: content, form and function. Content includes text, pictures or multimedia. Form includes graphics and website colors, layout and design. Function includes the activities performed by or actions executed on the website. In this way, each element of a website created using SiteFlash™ is interchangeable with any other similar element, and these elements may be grouped together in almost any combination to create complex websites. This separation of form, function, and content also allows for the rapid creation of affiliated websites. SiteFlash™ architectural concepts enable integration with existing technological components within many organizations. Additional key features of SiteFlash™’s are its affiliation/syndication capability, its multi-lingual capability, and its multi-modal framework (enabling use on any output device, including wireless devices such as smart phones, as well as cellular phones and other devices with Internet capability).

SiteFlash™ can be offered as a stand-alone product and also as a technology platform for products targeted at specific vertical markets. The SiteFlash™ technology focuses on content management, e-commerce, and workflow and has led to the development of three additional software application products: ResponseFlash™, NewsFlash™ and AffiliateFlash™. In addition to a cloud-based offering, we are in the process of using SiteFlash™ as an internal component, along with some other company technology, in a new application which will be called the Physicians Bridge, and be marketed through VHS.

The second patented Internet core technology we have developed is the Emily™ XML scripting language, a Markup Language Executive (MLE), which is Java compatible. XML is a flexible way to create common information formats and share both the format and the data on the World Wide Web, intranets, and elsewhere. The Emily™ Framework was developed to be an engineering package comparable to other Web development tools, such as Allaire Cold Fusion™ or Microsoft FrontPage™. The primary component of the Emily™ Framework is the Emily XML scripting language, a programming language that runs on Windows™, Linux and several UNIX platforms. The Emily™ Framework is used to create Web-based applications that communicate via XML and HTTP. HTTP is the set of rules for exchanging files (text, graphic images, sound, video, and other multimedia files) on the Web.

The third patented Internet core technology we have developed is the combination of three components: the Emily™ XML Broker, the Emily™ XML Agent and the Emily™ XML Portal. This technology has been featured as an alternative to Web Services in the 4th Edition of the XML Handbook, by Dr. Charles Goldfarb, considered the father of XML and inventor of all markup languages. We are upgrading this technology for use in a new application we are developing simultaneously.

The fourth Internet core technology is based on a web server technology that was licensed to the Company. This technology was acquired with the intent to modify it and use it, along with the Emily™ technology, five other patent-pending applications and our SiteFlash™ patents, as a basis to create a core private communication platform. In 2016, using this communication platform, we plan to launch, through our subsidiary, Ploinks, Inc, a personal private mobile communications channel, known as Ploinks™. Ploinks™, version 1.7 is currently in the process of beta testing.

In addition, in the summer of 2010, we elected to utilize a new software development platform which we used for PTS™ and also created “dashboardletsTM” (a proprietary tool for business intelligence) allowing the scalability to meet large and/or complex customer requirements. In addition, this development platform will be used to develop other modules for our software solutions and to support SnAPPnet™ and certain portions of emPath®.

Intellectual Property Assets

Our SiteFlash technology is a System and Method for Generating Web sites in an Arbitrary Object Framework. This unique ability is patented under U.S. Patent No. 6,826,744 and continuation patent U.S. Patent No. 7,716,629 as well as a continuation patent (U.S. Patent No. 8,949,780) of U.S. Patent No. 7,716,629.

Our Emily™ core technology is the basis for a “Web-based collaborative data collection system”, which allows a disparate and distributed database to be viewed and updated as if it was a single large database. This unique ability is patented under U.S. Patent No. 7,076,521.

Our Emily™ XML scripting language, coupled with other Company technology, is the basis for development of mobile applications. This unique ability is patented under U.S. Patent No. 8,578,266.

| 5 |

Our patent for a “System and Method Running a Web Server on a Mobile Internet Device,” which is part of our Mobile Framework (the “MLE Framework") and covers the Tiny Web Server, which is also a component of our MLE Framework. This unique ability is patented under U.S. Patent No. 9,112,832.

Our fiber optic patent is an invention for “Transmission of Images Over a Single Filament of Fiber Optic Cable” under U.S Patent No. 6718103.

Finally, we have other mobile technologies, which are patent-pending.

Market Segments

Our current products address the following market segments:

| MARKET | PRODUCT | OWNERSHIP/LICENSOR | LICENSEE | |||

| Human Resources and Payroll | emPath® | NOW Solutions | VHS (a), Taladin (b) | |||

| Government Sector- Emergency Response | ResponseFlash™ | Vertical | GIS (b) | |||

| Software development units | Emily™ | Vertical | VHS(a) | |||

| Content Management Framework | SiteFlash™ | Vertical | Unifocus(c) | |||

| Time and Attendance | PTS™ | Priority Time | VHS (a), NOW Solutions (d) | |||

| Healthcare Credentialing | SnAPPnet™ | SnAPPnet, Inc. | VHS (a) , NOW Solutions (d) | |||

| Private communication | Ploinks™ | Vertical | Ploinks, Inc.(e) |

| (a) | Physician market (including medical clinics but not including hospitals) |

| (b) | Government market |

| (c) | Hospitality market (including hotels, fast food chains, theme parks, restaurant chains, but not including casinos) |

| (d) | Clients of NOW Solutions |

| (e) | Personal private communications channel for individual consumers |

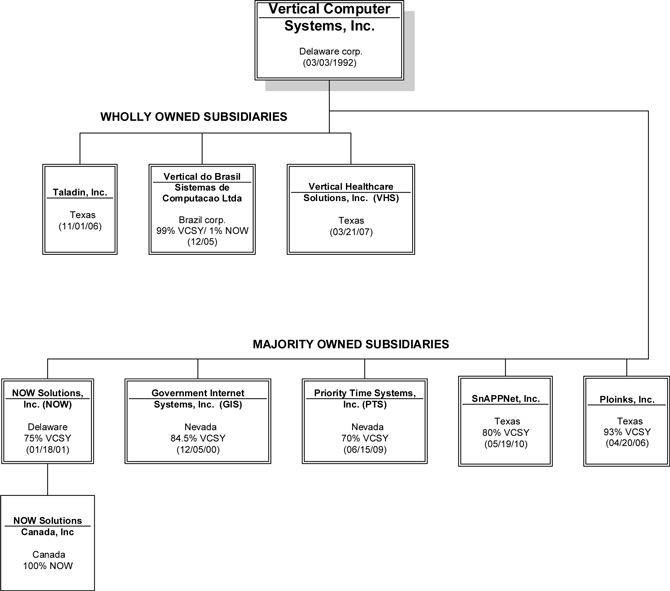

Business Operations and Units

Our business operations are grouped into the following units: NOW Solutions, Ploinks, Inc., Taladin, VHS, Priority Time Systems, SnAPPnet, Inc., GIS, Vertical do Brasil, and other subsidiaries with minimal or no activity and other limited interests. Each of these divisions is discussed below.

| 6 |

NOW Solutions, Inc.

NOW Solutions, a Delaware corporation, is a 75% owned subsidiary of the Company. NOW Solutions specializes in end-to-end, fully integrated human resources and payroll solutions. NOW Solutions has clients in the United States and Canada ranging from private businesses to government agencies, who typically employ 500 or more employees. NOW Solutions currently markets emPath®, a payroll and human resources and payroll solution. emPath® meets the needs for clients who have complex payroll where they may have employees from different unions, multiple locations in different states (U.S.) and provinces (Canada), and intricate compensation structures. We believe that the competitive advantage of emPath® is its speed of implementation through a formula-builder technology, which provides customers with rapid customization of payroll rules and calculations without the need for any programming expertise. NOW Solutions’ product suite is targeted to address the needs of management in today’s dynamic business environment and gives organizations a user-friendly, flexible, multi-lingual (i.e., English, Canadian French, Spanish, Portuguese, and Chinese) software solution, without the multi-million dollar implementation and support budgets typically required to use the payroll and HR products of major competitors.

| 7 |

NOW Solutions has converted some of its existing customers to its cloud-based model and is in the process of developing methods to introduce its cloud-based offering (supporting MS SQL, Oracle and DB2 databases) through distributors in the United States. During the conversion of one of our large complex customers and in discussions with other similar complex customers, we determined that there was a critical need and opportunity in providing a solution we are labeling “tailored cloud-based”, which can fulfill our customers’ unique requirements while giving them the benefits of a cloud-based offering.

Additionally, NOW Solutions has embarked on a strategy of developing and licensing HR products complementary to its existing suite of products that can be sold separately or integrated as emPath® modules, which has been greatly facilitated by emPath®’s Web Services integration. PTS™ is the first product to be integrated within the emPath® solution. NOW Solutions is currently finalizing the integration of PTS™ with emPath®. The second product is SnAPPnet™, which is in the in the process of being upgraded to expand the utility of the product beyond traditional credentialing software so that it can be used by HR departments of NOW Solutions’ existing customer to create and administer fillable forms routinely used for employees.

NOW Solutions has also finalized its business plan to expand into the global payroll market, utilizing its existing expertise gained from offering a comprehensive payroll/HR solution to customers with employees throughout the United States and Canada.

The revenue model of NOW Solutions is based upon five components: licensing and renewable annual maintenance fees, cloud-based fees, professional consulting services, and managed services. Under the cloud-based delivery model, NOW Solutions typically collects monthly fees.

For the 12 months ended December 31, 2015, NOW Solutions had approximately $415,456 of total assets, revenues of approximately $4,186,363 and net income of approximately $857,120.

Taladin, Inc.

Taladin, a Texas corporation, is a wholly-owned subsidiary of the Company. Taladin is being positioned to be the parent company for NOW Solutions, Priority Time and SnAPPnet in order to coordinate the Company’s business administrative software product lines as well as its marketing efforts.

For the 12 months ended December 31, 2015, Taladin had no material assets, no revenues and a net loss of approximately $15,649.

Ploinks, Inc.

Ploinks, Inc., a Texas corporation (formerly OptVision Research, Inc.), is a 93% owned subsidiary of the Company.

Vertical has licensed its private communication platform to Ploinks, Inc., for use by consumers as a personal private communication channel. The Ploinks™ application is currently in beta-testing and we anticipate launching this product within the next few months.

For the 12 months ended December 31, 2015, Ploinks, Inc. had no material assets, no revenues and no expenses.

Vertical Healthcare Solutions, Inc.

VHS, a Texas corporation, is a wholly-owned subsidiary of the Company. VHS will market a new platform called the “Physicians Bridge”, which will be the basis for marketing applications to physicians utilizing other Vertical technologies and products which were licensed for the physician market by Vertical to VHS in 2010. Vertical will license its communication platform to VHS to be utilized as a communication channel between physicians as well as a communication channel between physicians and patients.

For the 12 months ended December 31, 2015, VHS had no material assets, no material revenues, and a net loss of approximately $141,031.

Priority Time Systems, Inc.

Priority Time, a Nevada corporation, is an 80% owned subsidiary of the Company. On June 15, 2009, we purchased 90% of the common stock of Priority Time from a shareholder of Priority Time. In addition, we entered into a shareholder agreement with the selling shareholder of Priority Time whereby we have the option to purchase the remaining 10% of the common shares of Priority Time stock at any time after 3 years from the date of our purchase of our 90% interest. The shareholder agreement also provides for the licensing terms of Priority Time products to our other subsidiaries.

| 8 |

Priority Time has been developing PTS™, a time and attendance product that will be offered as both a standalone product and as an integrated module within emPath®. In late spring 2010, we elected to stop development of PTS™ in its then-current form and switched to a new development platform. That new platform allowed us to create a cloud-based solution that utilizes a rule-based system, which will better meet the needs of NOW Solutions’ most complex customers and more easily create a time and attendance product for vertical markets (i.e. medical, government, casinos, and hospitality).

PTS™ was developed to meet the unique and complex requirements of NOW Solutions’ customers, particularly for the medical and government markets, who provided us with specifications for an ideal time and attendance program. The most critical need of complex customers was robust flexibility which led to the creation, from the ground up, of a rule-based time and attendance application, allowing users to make for immediate changes within the application while also providing a state-of-the-art reporting ability to senior executives. The result also led to a new development platform as well as another application called “dashboardletsTM.” PTS™ will be commercially available once a major emPath® update is completed and its integration with emPath® finalized.

For the 12 months ended December 31, 2015, Priority Time had no material assets, no material revenues and a net loss of approximately $3,153.

SnAPPnet, Inc.

SnAPPnet, Inc., a Texas corporation, is an 80% owned subsidiary of the Company. On May 21, 2010, SnAPPnet, Inc. purchased substantially all the assets of Pelican Applications, LLC (“Pelican”) in exchange for $5,335 cash, 100,000 shares of Series B Convertible Preferred Stock of VHS, and other contingent consideration. The assets acquired included a software application product known as SnAPPnet™ which is currently used for physician credentialing, as well as Pelican’s entire customer base. We intend to utilize the SnAPPnet™ software to expand its offering to physicians, and to adapt the software to meet the needs of NOW Solutions’ hospital clients who may need a credentialing product for nurses.

Specifications are being finalized to rewrite SnAPPnet™ core application to utilize our new administrative development platform, including our proprietary dashboardlets™.

For the 12 months ended December 31, 2015, SnAPPnet, Inc. had assets of approximately $8,626, revenues of approximately $77,272 and a net loss of approximately $32,319.

Government Internet Systems, Inc.

GIS, a Nevada corporation is our 84.5% owned subsidiary. Vertical licensed ResponseFlash™ to GIS in order to market and distribute this technology to government entities (excluding state universities and schools) in the United States. We are in the process of reviewing the marketing objectives and products for GIS.

For the 12 months ended December 31, 2015, GIS had no assets, no material revenue and net loss of approximately $ 10,209.

Vertical do Brasil

Our 100% owned subsidiary, Vertical do Brasil, a Brasilian company, houses a software development team that performs services on behalf of the Company and its subsidiaries.

For the 12 months ended December 31, 2015, Vertical do Brasil had assets of approximately $3,057, no revenues and net loss of approximately $80,143.

The following corporations are inactive:

Vertical Internet Solutions, Inc.

VIS, a California corporation, is a wholly-owned subsidiary of the Company. VIS is inactive and we currently have no plans regarding this subsidiary.

For the 12 months ended December 31, 2015, VIS had no material assets, no material revenue and no expenses.

| 9 |

EnFacet, Inc.

EnFacet, a Texas corporation, is a wholly-owned subsidiary of the Company. EnFacet is inactive and we currently have no plans regarding this subsidiary.

For the 12 months ended December 31, 2015, EnFacet had no material assets, no material revenue and no expenses.

Globalfare.com

Globalfare, a Nevada corporation, is a wholly-owned subsidiary of the Company. Globalfare is inactive and we currently have no plans regarding this subsidiary.

For the 12 months ended December 31, 2015, Globalfare had no assets, no material revenue and no expenses.

Pointmail.com, Inc.

Pointmail, a California corporation, is a wholly-owned subsidiary of the Company. Pointmail is inactive and we currently have no plans regarding this subsidiary.

For the 12 months ended December 31, 2015, Pointmail had no assets, no revenues and no expenses.

Competition

We face substantial competition from software and hardware vendors, system integrators, and multinational corporations focused upon information technology and security.

In the realm of application software, NOW Solutions’ competitors include Oracle, Lawson, Cyborg /Hewitt, Kronos, DLGL, Ultimate and SAP. Our cloud-based emPath® competes with ADP, Ceridian, Ultimate Software and Quicken. However, while NOW Solutions competes with these companies, our payroll product is utilized by our many of our customers in conjunction with many of these companies’ other modules.

Priority Time’s competitors include Kronos, NOVAtime Technology, Asure Software, Insperity (formerly known as Administaff), and Qqest Software Systems.

SnAPPnet, Inc. competes with several small and mid-sized competitors in the healthcare credentialing business sector. SnAPPnet’s competitors include EchoApps (Heathline Systems), Win/Staff PRO-FILE (Win/Staff), Medkinetics Pro (Medkinetics), IntelliAppsSE (Intellisoft Group, Inc.), OneAPP (Sy.Med) and CACTUS Software.

Our primary competitors have longer operating histories, greater name recognition, larger customer bases and significantly greater financial, technical and marketing resources than we do. However, we have a number of large complex clients including cities and counties in the United States that have been users of our Payroll/HRMS software for many years (10 -25 years) and are highly referenceable. We cannot guarantee that we will be able to compete successfully against current or future competitors or that competitive pressure will not have a material and adverse effect on our financial position, results of operations and cash flows.

Our ability to compete will also depend upon our ability to continually improve our products and services, the enhancements we develop, the quality of our customer service, and the ease of use, performance, price and reliability of our products and services.

We believe, however, that we possess certain competitive advantages for the following reasons:

| 1. | We have a number of proprietary patented technologies that can be utilized in our offerings. |

| 2. | NOW Solutions has an outstanding customer support department that has supported large complex entities for a number of years, and many of these large entities are leaders in their respective industries. |

| 3. | emPath®’s inherent strengths include its formula builder, the use of one single database (where competing products may use two or more), and a strong, highly identifiable customer base it can reference. |

| 4. | emPath® is built on a state-of-the-art Microsoft.net platform, allowing for rapid software development and interoperability with other software packages. |

| 10 |

| 5. | Our new development platform, including the dashboardlet™ feature; will provide a consistent business intelligence tool across our products’ line. |

| 6. | We can cross-promote applications between companies. |

| 7. | emPath® supports a global platform with one database for both payroll and HR and an international clients’ base beyond the U.S. and Canada. |

| 8. | Our new private communication platform coupled with our specialized Emily™ scripting language, offers a structure for the development of applications geared towards the mobile market. |

Strategic Overview

The Company’s product portfolio reflects a number of unique characteristics and advantages that have been developed or acquired over time. At present, we are actively pursuing the strategy of (a) further developing the technologies owned by the Company and our subsidiaries and (b) combining all the technologies owned by the Company and our subsidiaries into viable product offerings.

The key components of our strategy are to:

| 1. | Leverage our strong, profitable subsidiary, NOW Solutions, that has a highly-referenceable client base, including companies that are leaders in their industries and have been users of emPath® and its predecessor product for over 25 years for their payroll and human resource needs. |

| 2. | Develop a portfolio of patented technologies that can be licensed to third parties or utilized internally to strengthen our existing and projected product offerings. |

| 3. | Build a network of compatible partners and acquisition or licensing of products that complement our existing offerings. |

| 4. | Maximize the unique features of our new software development platform to launch our new PTS™ and SnAPPnet™ products as well as other products to NOW Solutions’ customer base and, at the same time, have those customers assist us in development of product specifications for their own vertical markets. |

| 5. | Build and integrate new commercially viable products utilizing our patented technology and other administration software. |

| 6. | Expand the reach of emPath® internationally beyond the U.S. and Canada utilizing non-competitive local distributors in foreign countries. |

| 7. | Develop proprietary applications on our private communication platform and, with licensing agreements, provide a structure whereby third-party applications can be developed upon that platform to be then distributed. |

The software development leg of our strategy is two-fold. The first is to further enhance our existing solutions and develop new products in order to better compete with the large ERP providers like SAP and Oracle by providing complex best-of-breed alternative offerings that are more cost effective solutions. The second is to continue developing our intellectual property internally for mass market, best-of-breed solutions offered as cloud-based solutions that incorporate the advantages of our complex solutions. In each such instance, the software development leg of our strategy will be augmented by exploring solutions that can be linked to federal and state government programs for cost savings.

Our new mobile strategy is intended to make us a dominant player in the mobile space for the private communication sector that also serves as a complement to the social media market, as well as providing solutions in the healthcare and corporate markets. The goal is to become a provider with an all-in-one solution incorporating technology between a mobile device and different data storage units.

One key to the success of our strategies is to leverage our core capabilities, by entering into co-marketing agreements with other companies, particularly those who offer best-of-breed products that complement our product offerings. Our objective is to enter into distinct co-marketing agreements whereby each business unit will have a separate agreement with the co-marketing partner for its particular target market. To supplement this approach, our business units will enter into agreements with each other where they can more successfully cross-promote and market their respective products. We are also identifying complementary products from third parties which we can private label and sell as part of our existing product offering or separately.

| 11 |

Proprietary Rights

We rely upon a combination of patent, copyright, trademark, trade secret laws, and contract provisions and to protect our proprietary rights in our technologies, products and services. We distribute our products and services under agreements that grant users or customers a license to use our products and services and rely upon the protections afforded by the copyright laws to protect against the unauthorized reproduction of our products. In addition, we protect our trade secrets and other proprietary information through confidentiality agreements with employees, consultants and other business partners. emPath®, PTS™, SnAPPnet™, and PASS™ are protected by copyright and trademark.

Our patent portfolio consists of the following technologies and related products:

The USPTO granted us a patent (No. 6,718,103) for an invention for “Transmission of Images over a Single Filament Fiber Optic Cable” in April 2004. This patent is in a theoretical stage only and is intended to be used for transmitting images on fiber optics that might improve in orders of magnitude today’s capacity of fiber optics to transmit images and data.

The USPTO granted us a patent (No. 6,826,744) for an invention for “System and Method for Generating Web Sites in an Arbitrary Object Framework” on November 30, 2004. On May 11, 2010, we were granted a continuation patent (U.S. Patent No. 7,716,629) of U.S. Patent No. 6,826,744 by the USPTO. All pending new claims were granted in the continuation patent for U.S. Patent No. 7,716,629, which has increased the scope of the original patent by adding 32 new claims to the original 53 claims. On February 3, 2015, we were granted a continuation patent (U.S. Patent No. 8,949,780) of U.S. Patent No. 7,716,629. All pending new claims were granted in the continuation patent for U.S. Patent No. 8,949,780, which has increased the scope of the continuation patent and the original patent by adding 24 new claims.

Together, these patents are the foundation of our SiteFlash™ platform, and form the basis of the ResponseFlash™, NewsFlash™ and AffiliateFlash™ products.

The USPTO granted us a patent (No. 7,076,521) for an invention for a “Web-based collaborative data collection system” on July 11, 2006. This patent covers various aspects of the Emily™ XML Enabler Agent and the Emily™ XML Broker.

The USPTO granted us a patent (No. 8,578,266) for a “Method and Systems for automatically downloading and storing markup language documents into a folder based data structure” (formerly, a “Method and System for Providing a Framework for Processing Markup Language Documents”) on November 5, 2013. In March 2016, we received a Notice of Allowance for a continuation patent on this technology which provided notice that Claims 1-19 and 21 were allowed and which also amended claims 1, 14, and 21 as well as the title of the patent (to a “Method and Systems for automatically downloading and storing markup language documents into a folder based data structure”). This patent covers the Emily™ scripting language.

THE USPTO granted us a patent (No. 9,112,832) for a “System and Method Running a Web Server on a Mobile Internet Device.” This patent is incorporated into our Mobile Framework (the “MLE Framework") and covers the Tiny Web Server, which is also a component of our MLE Framework.

We also have several patent-pending software technologies and licensed software:

In 2011, we filed two provisional applications for patents relating to our patent application filed in 2010 and these have been replaced with non-provisional patent applications which were filed in 2012, which are still pending.

In 2013, we filed six patent applications (including provisional patent applications).

In 2014, we filed two provisional patent applications, which have been replaced with non-provisional patent applications and filed in 2015. These patent applications are still pending.

The Company acquired rights for U.S. Patent No. 8,903,371 (cellular telephone system and method), which was issued on December 2, 2014 under an assignment from Luiz Valdetaro, a co-inventor who is also an employee and the Chief Technology Officer of the Company.

| 12 |

Although we intend to protect our intellectual property rights as described above, there can be no assurance that these measures will be successful. Policing unauthorized use of our products and services is difficult and the steps taken may not prevent the misappropriation of our technology intellectual property rights. In addition, effective patent, trademark, trade secret and copyright protection may be unavailable or limited in certain foreign countries. We seek to protect the source code of some of our products as trade secrets and as unpublished copyright works. Source code for certain products has been or will be published in order to obtain patent protection or to register copyright in such source code. We believe that our products, trademarks and other proprietary rights do not infringe on the proprietary rights of third parties. There can be no assurance that third parties will not assert infringement claims against us in the future with respect to current or future features or content of services or products or, if so asserted that any such claims will not result in litigation or require us to enter into royalty arrangements.

Regulatory Environment; Public Policy

In the United States and most countries in which we conduct our operations, we are generally not regulated other than pursuant to laws applicable to businesses in general and value-added services specifically. In some countries, we are subject to specific laws regulating the availability of certain material related to, or to the obtaining of, personal information. Adverse developments in the legal or regulatory environment relating to the interactive online services and Internet industry in the United States, Canada, Europe, Asia, Latin America or elsewhere could have a material adverse effect on our business, financial condition and operating results. A number of legislative and regulatory proposals from various international bodies and foreign and domestic governments in the areas of telecommunications regulation, particularly related to the infrastructures on which the Internet rests, access charges, encryption standards and related export controls, content regulation, consumer protection, advertising, intellectual property, privacy, electronic commerce, and taxation, tariff and other trade barriers, among others, have been adopted or are now under consideration. We are unable at this time to predict which, if any, of the proposals under consideration may be adopted and, with respect to proposals that have been or will be adopted, whether they will have a beneficial or an adverse effect on our business, financial condition and operating results.

Employees

As of April 14, 2016, we had 21 full-time and 5 part-time employees (21 are employed in the United States and 5 in Canada), and 2 full time consultants. We are not a party to any collective bargaining agreements.

Risk Factors Related to Our Business, Operating Results and Financial Condition

We are subject to various risks that may materially harm our business, financial condition and results of operations. You should carefully consider the risks and uncertainties described below and the other information in this filing before deciding to purchase our common stock. If any of these risks or uncertainties actually occurs, our business, financial condition or operating results could be materially harmed. In that case, the trading price of our common stock could decline and you could lose all or part of your investment.

We Have Historically Incurred Losses and May Continue to Do So in the Future.

We had a net loss of $2,495,612 and $1,450,822 for the years ended December 31, 2015 and 2014, respectively, and have historically incurred losses. Accordingly, we have and may continue to experience significant liquidity and cash flow problems because our operations are not profitable. No assurances can be given that we will be successful in reaching or maintaining profitable operations.

We Have Been Subject to a Going Concern Opinion from Our Independent Auditors, Which Means That We May Not Be Able to Continue Operations Unless We Obtain Additional Funding.

The report of our independent registered public accounting firm included an explanatory paragraph in connection with our financial statements for the years ended December 31, 2015 and 2014. This paragraph states that our recurring net losses, negative working capital and accumulated deficit, the substantial funds used in our operations and the need to raise additional funds to accomplish our objectives raise substantial doubt about our ability to continue as a going concern. Our ability to develop our business plan and to continue as a going concern depends upon our ability to raise capital, to succeed in the licensing of our intellectual property and to achieve improved operating results. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| 13 |

Our Ability to Continue as a Going Concern Is Dependent on Our Ability to Raise Additional Funds and to Establish Profitable Operations.

The accompanying consolidated financial statements for the years ended December 31, 2015 and 2014 have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

The carrying amounts of assets and liabilities presented in the financial statements do not purport to represent realizable or settlement values. We have suffered significant recurring operating losses, used substantial funds in our operations, and need to raise additional funds to accomplish our objectives. Stockholders’ deficit at December 31, 2015 was $26.9 million. Additionally, at December 31, 2015, we had negative working capital of approximately $17.6 million (although it includes deferred revenue of approximately $1.7 million) and have defaulted on substantially all of our debt obligations. These conditions raise substantial doubt about our ability to continue as a going concern.

Our Success Depends On Our Ability to Generate Sufficient Revenues to Pay for the Expenses of Our Operations.

We believe that our success will depend upon our ability to generate revenues from our SiteFlash™ and Emily™ technology products through licensing and development of commercially viable products, as well as increased revenues from NOW Solutions’ products and services as well as the successful launch of our new products by our subsidiaries (such as SnAPPnet™, and PTS™, Emily™ and web server applications), none of which can be assured. Our ability to generate revenues is subject to substantial uncertainty and our inability to generate sufficient revenues to support our operations and debt repayment could require us to curtail or suspend operations. Such an event would likely result in a decline in our stock price.

Our Success Depends On Our Ability to Obtain Additional Capital.

We have funding that is expected to be sufficient to fund our present operations for three months. However, we will need significant additional funding in order to complete our business plan objectives. Accordingly, we will have to rely upon additional external financing sources to meet our cash requirements. Management will continue to seek additional funding in the form of equity or debt to meet our cash requirements. Other than common or preferred stock in our subsidiaries, we do not have any common stock available to issue to raise money. However, there is no guarantee we will raise sufficient capital to execute our business plan. In the event that we are unable to raise sufficient capital, our business plan will have to be substantially modified and operations curtailed or suspended.

We Have a Working Capital Deficit, Which Means That Our Current Assets on December 31, 2015 Were Not Sufficient to Satisfy Our Current Liabilities on That Date.

We had a working capital deficit of approximately $17.6 million at December 31, 2015, which means that our current liabilities exceeded our current assets by approximately $17.6 million (although it includes deferred revenue of approximately $1.7 million). Current assets are assets that are expected to be converted into cash within one year and, therefore, may be used to pay current liabilities as they become due. Our working capital deficit means that our current assets on December 31, 2015 were not sufficient to satisfy all of our current liabilities on that date.

Our Operating Results May Fluctuate Because of a Number of Factors, Many of Which Are Outside of Our Control.

Our operating results may fluctuate significantly as a result of variety of factors, many of which are outside of our control. These factors include, among others, the following:

| · | the demand for our SiteFlash™ and Emily™ technologies; |

| · | the demand for administrative software products and services: emPath®; PTS™, and SnAPPnet™ |

| · | introduction of new products and services by us and our competitors; |

| · | costs incurred with respect to acquisitions; |

| · | price competition or pricing changes in the industry; |

| · | technical difficulties or system failures; |

| · | general economic conditions and economic conditions specific to the Internet and Internet media; and |

| · | the licensing of our intellectual property. |

| 14 |

We Face Product Development Risks Due to Rapid Changes in Our Industry. Failure to Keep Pace with These Changes Could Harm Our Business and Financial Results.

The markets for our products are characterized by rapid technological developments, continually-evolving industry trends and standards and ongoing changes in customer requirements. Our success depends on our ability to timely and effectively keep pace with these developments.

Keeping Pace with Industry Changes.

We must enhance and expand our product offerings to reflect industry trends, new technologies and new operating environments as they become increasingly important to customer deployments. We must continue to expand our business models beyond traditional software licensing and subscription models, including, by way of example, use of cloud based offering as an increasingly important method and business model for the delivery of applications. We must also continuously work to ensure that our products meet changing industry certifications and standards. Failure to keep pace with any changes that are important to our customers could cause us to lose customers and could have a negative impact on our business and financial results.

Impact of Product Development Delays or Competitive Announcements.

Our ability to adapt to changes can be hampered by product development delays. We may experience delays in product development as we have at times in the past. Complex products like ours may contain undetected errors or version compatibility problems, particularly when first released, which could delay or adversely impact market acceptance. We may also experience delays or unforeseen costs associated with integrating products we acquire with products we develop because we may be unfamiliar with errors or compatibility issues of products we did not develop ourselves. We may choose not to deliver a partially-developed product, thereby increasing our development costs without a corresponding benefit. This could negatively impact our business.

Our Failure to Maintain and Increase Acceptance of Our Cloud-Offerings Would Inhibit Our Growth Or Cause a Significant Decline in Our Revenues.

Our future success depends on maintaining and increasing acceptance of our Cloud-based offering, particularly, of emPath® and PTS™. Any decrease in the demand for these products would have a material adverse effect on our business, operating results and financial condition and would place a significant strain on our management and operations.

If We Are Unable to Make Periodic Updates for Our Products Concerning Changes in Tax Laws and Other Regulations on a Timely Basis Acceptance of Our Products in the Market could Be Adversely Affected And Our Revenues Would Decline.

Products like emPath® are affected by changes in tax laws and regulations, and we must generally update such products on an annual or periodic basis to maintain their accuracy and competitiveness. We cannot be certain we will be able to release these updates on a timely basis in the future. Any failure to do so could have a material adverse effect on the acceptance of our products. Additionally, any significant changes in tax laws or regulations applicable to such products could require us to make significant investments in modifications of these products, leading to significant and unexpected costs.

Errors and Defects in Our Software Could Affect Sales of Our Products.

The software products we offer may contain undetected errors, defects, or failures when first introduced or as new versions are released. Testing of software products presents many challenges since it is difficult to anticipate and simulate the wide range of software computing environments in which our customers use these products. While we test our products extensively, from time-to- time, we have discovered errors or defects in our products. These defects and errors may result in any of the following:

| · | Delays in the release of our new products, versions and upgrades |

| · | Increased costs to fix such defects and errors, in turn leading to a strain on our software development resources |

| · | Design modifications of the product |

| · | A decrease in customer satisfaction with, our products and a decrease in sales, and a loss of existing and potential customers |

Even after our products are tested by us and by current and prospective customers, errors and defects may be discovered after the commercial release has commenced, which may result in loss of or delay in market acceptance which could have a material adverse impact upon our business, operating results and financial condition.

| 15 |

Our software products may be vulnerable to break-ins and similar disruptive problems; addressing these issues may be expensive and require a significant amount of our resources.

We have included security features in our products that are intended to protect the privacy and integrity of customer data. Despite the existence of these security features, our software products may be vulnerable to break-ins and similar disruptive problems. Addressing these evolving security issues may be expensive and require a significant amount of our resources.

The Sale and Support of Software Products and the Performance of Related Services by Us Entail the Risk of Product or Service Liability Claims, Which Could Significantly Affect Our Financial Results.

Customers use our products in connection with the preparation and filing of tax returns and other regulatory reports. If any of our products contain errors that produce inaccurate results upon which users rely, or cause users to misfile or fail to file required information, we could be subject to liability claims from users. Our Cloud-based usage licenses and maintenance renewal agreements with our customers typically contain provisions intended to limit our liability to such claims, but such provisions may not be effective in doing so. These contractual limitations may not be legally enforceable and may not afford us with adequate protection against product liability claims in certain jurisdictions. If a successful claim for product or service liability was brought against us, this could result in substantial cost to us and divert management’s attention from our operations.

International Operations of Our Business Subject Us to Additional Risks in Those Foreign Countries.

Our international operations are subject to additional risks, which increase our exposure to foreign laws and regulations. Over time, our international operations may grow and increase their significance to our business. Sales to international customers subject our business to a number of risks, including foreign currency fluctuations, unexpected changes in regulatory requirements related to software, international political and economic instability, international tax laws, compliance with multiple, changing, and possibly conflicting governmental laws and regulations, and difficulty in staffing and managing foreign operations,. In addition, there may be weaker protection for our intellectual property abroad than in the United States, and we may have difficulties in enforcing such rights abroad. If we are not able to comply with foreign laws and regulations, which are often complex and subject to variation and unexpected changes, we could incur unexpected costs and potentially become involved in litigation. In addition, in the event sales to any of our customers outside of the United States are delayed or canceled because of any of the risks described above, our revenues may be negatively impacted.

Security and Privacy Breaches Could Adversely Impact Our Business.

For services such as our cloud-based offerings, we may electronically store personal information about our clients and their employees. We take security measures to protect against the unauthorized access and disclosure of such information. However, there is no guarantee the precautions we take will be successful in protecting against all security breaches that may result in unauthorized access to such information. If our security measures are breached or if our services are subject to attacks that degrade or deny the ability of our clients to access our services, we may incur significant financial, legal, and regulatory exposure.

Privacy Concerns Could Result in Changes of Regulations or Laws That Affect Our Business.

Personal privacy is a significant issue in the United States as well as in other countries where our customers operate. Consequently, we are subject to regulations concerning the use of personal information we collect. Changes to regulations or laws affecting privacy that apply to our business could impose additional costs and potential liability on us and could also limit our use and disclosure of such information. If we are required to change our business activities or revise or eliminate services, our business could be adversely affected.

We May Have Difficulty Managing Our Growth and Integrating Recently Acquired Companies.

Our recent growth through acquisitions and licensing of new solutions, coupled with our development efforts to create new commercially viable products and improve existing ones, has placed a significant strain on our managerial, operational, and financial resources. To manage our growth, we must continue to implement and improve our operational and financial systems and to expand, train, and manage our employee base. Any inability to manage growth effectively could have a material adverse effect on our business, operating results, and financial condition. Further, acquisition transactions are accompanied by a number of risks, including the following:

| · | the difficulty of assimilating the operations and personnel of the acquired companies; |

| · | the potential disruption of our ongoing business and distraction of management; |

| · | the difficulty of incorporating acquired technology or content and rights into our products and media properties; |

| · | the correct assessment of the relative percentages of in-process research and development expense which needs to be immediately written off as compared to the amount which must be amortized over the appropriate life of the asset; |

| 16 |

| · | the failure to successfully develop an acquired in-process technology resulting in the impairment of amounts currently capitalized as intangible assets; |

| · | unanticipated expenses related to technology integration; |

| · | the maintenance of uniform standards, controls, procedures and policies; |

| · | the impairment of relationships with employees and customers as a result of any integration of new personnel; and |

| · | the potential unknown liabilities associated with acquired businesses. |

We may not be successful in addressing these risks or any other problems encountered in connection with acquisitions. Our failure to address these risks could negatively affect our business operations through lost opportunities, revenues or profits, any of which would likely result in a lower stock price.

Our Success Depends On Our Ability to Protect Our Proprietary Technology.

Our success is dependent, in part, upon our ability to protect and leverage the value of proprietary technology, including our patented SiteFlash™ and Emily™, our patent-pending technologies and administrative software solutions like emPath®, PTS™, and SnAPPnet™, as well as our trade secrets, trade names, trademarks, service marks, domain names and other proprietary rights we either currently have or may have in the future. Given the uncertain application of existing trademark laws to the Internet and copyright laws to software development, there can be no assurance that existing laws will provide adequate protection for our technologies, sites or domain names. Policing unauthorized use of our technologies, content and other intellectual property rights entails significant expenses and could otherwise be difficult or impossible to do given the global nature of the Internet and our potential markets.

If Demand for Our Products Grow Quickly, We May Lack the Capacity Needed to Meet Demand or We May Be Required to Increase Our Capital Spending Significantly.

Our current plans may not be sufficient to meet our capacity needs for the foreseeable future or may not be implemented quickly enough to meet growing demand. Moreover, if we make significant capital expenditures to increase capacity and demand does not increase as we expect, these expenditures would adversely affect our profitability and return on capital.

Our Stock Price Has Historically Been Volatile, Which May Make It More Difficult for Shareholders to Resell Shares When They Choose To At Prices They Find Attractive.

The trading price of our common stock has been and may continue to be subject to wide fluctuations. The stock price may fluctuate in response to a number of events and factors, such as quarterly variations in operating results, announcements of technological innovations or new products and media properties by us or our competitors, changes in financial estimates and recommendations by securities analysts, the operating and stock price performance of other companies that investors may deem comparable, and news reports relating to trends in our markets. In addition, the stock market in general, and the market prices for Internet-related and technology-related companies in particular, have experienced extreme volatility that often has been unrelated to the operating performance of such companies. These broad market and industry fluctuations may adversely affect the price of our stock, regardless of our operating performance.

Our Common Stock Is Deemed To Be “Penny Stock,” Which May Make It More Difficult for Investors to Sell Their Shares Due To Suitability Requirements.

Our common stock is deemed to be “penny stock” as that term is defined in Rule 3a51-1 promulgated under the Exchange Act. Penny stocks are stocks:

| 1. | With a price of less than $5.00 per share; |

| 2. | That are not traded on a recognized national exchange; |

| 3. | Whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ listed stock must have a price of not less than $5.00 per share); or |

| 4. | In issuers with net tangible assets less than $2 million (if the issuer has been in continuous operation for at least three years) or $5 million (if in continuous operation for less than three years), or with average revenues of less than $6 million for the last three years. |

Broker/dealers dealing in penny stocks are required to provide potential investors with a document disclosing the risks of penny stocks. Moreover, broker/dealers are required to determine whether an investment in a penny stock is a suitable investment for a prospective investor. These requirements may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline.

| 17 |

The Company and NOW Solutions’ headquarters are currently located at 101 West Renner Road, Suite 300, Richardson, Texas, and comprise approximately 4,000 square feet. NOW Solutions has other offices at 6205 Airport Road, Building B, Suite 214, Mississauga, Ontario, Canada, which comprises 793 square feet, and Avenida N. Sra. De Copacabana, 895, Suite 901, Copacabana, Rio de Janeiro, Brazil, which comprises 1,200 square feet. All of these locations are leased from third parties and the premises are in good condition. We believe that our facilities are adequate for our present needs and near-term growth, and that additional facilities will be available at acceptable rates as we need them. Our other subsidiaries may be reached through our Richardson, Texas headquarters.

We are involved in the following ongoing legal matters:

On December 31, 2011, the Company and InfiniTek corporation (“InfiniTek”) entered into a settlement agreement to dismiss an action filed by the Company against InfiniTek in the Texas State District Court in Fort Worth, Texas, for breach of contract and other claims, a counter claim filed by InfiniTek against the Company for non-payment of amounts claimed the Company owed to InfiniTek, and an action filed by InfiniTek against the Company in California Superior Court in Riverside, California seeking damages for breach of contract and lost profit. Pursuant to the terms of the settlement agreement, Vertical agreed to pay InfiniTek $82,500 in three equal installments with the last payment due by or before August 5, 2012. Upon full payment, InfiniTek shall transfer and assign ownership of the NAVPath software developed by InfiniTek for use with NOW Solutions emPath® software application and Microsoft Dynamics NAV (formerly Navision) business solution platform. The amounts in dispute were included in our accounts payable and accrued liabilities and have been adjusted to the settlement amount of $82,500 at December 31, 2011. The Company has made $37,500 in payments due under the settlement agreement as of the date of this Report and each party is alleging the other party is in breach of the settlement agreement. We are currently seeking to resolve all disputes with InfiniTek.

On February 4, 2014, Victor Weber filed a lawsuit against Vertical, MRC and Richard Wade in the District Court of Clark County, Nevada for failure to make payment of the outstanding balance due under a $275,000 promissory note issued by Vertical to Mr. Weber. On July 24 2014, the court granted plaintiff’s motion for summary judgment against defendants. The judgment was filed on September 18, 2014. In June 2015, the Company and Mr. Weber entered into an agreement to pay off the $365,000 outstanding balance under the judgment, which included $275,000 in principal, accrued interest, attorney’s fees and court costs. Under the terms of the agreement, the Company issued 10,000,000 shares of its common stock with the Rule 144 restrictive legend to Mr. Weber at a fair market value of $250,000 in consideration of Mr. Weber’s forbearance in not taking any action to enforce the judgment. The Company also agreed to make payments of $100,000 by June 15, 2015 and $265,000 by July 15, 2015, or in the alternative, the Company had the option to issue another 10,000,000 shares of the Company’s common stock with the Rule 144 restrictive legend in lieu of making the $100,000 payment and issue an additional 15,000,000 shares of the Company’s common stock with the Rule 144 restrictive legend in lieu of making the $265,000 payment. On June 15, 2015, the Company issued 10,000,000 shares with the Rule 144 restrictive legend at a fair market value of $250,000 to Mr. Weber as repayment of a $100,000 payment resulting in a loss on extinguishment of $150,000. On July 15, 2015, the Company issued 15,000,000 shares with the Rule 144 restrictive legend at a fair market value of $408,000 to Mr. Weber as repayment of the $265,000 payment. Pursuant to the agreement, Mr. Weber filed disposition documents that the judgment has been satisfied and this matter is resolved.

On October 20, 2014, Michael T. Galvan and Michelle Bates (“Galvan & Bates”) filed a lawsuit in the Court of Chancery in the State of Delaware seeking to have the court compel the Company to hold a shareholder meeting for the purpose of electing all directors of the Company, designating the time and place of a meeting and other details reasonably necessary to hold such a meeting, attorney costs and fees (including reasonable attorney’s fees), and such other relief as the court deems proper. Galvan and Bates are stockholders of the Company. This case is styled Michael T. Galvan and Michelle Bates v. Vertical Computer Systems, Inc., No. 10234. The Company held an annual meeting of shareholders on February 25, 2015. This matter is resolved.

Item 4. Mine Safety Disclosures

Not applicable.

| 18 |

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Our common equity is traded on the OTC Markets and quoted on the OTCQB under the symbol “VCSY.” The OTCQB may also be referred to as “OTCMKTS” or “Other OTC”.

The following is the range of high and low closing bid prices of our stock, for the periods indicated below.

| High | Low | |||||||

| Quarter Ended December 31, 2015 | $ | 0,0475 | $ | 0.0121 | ||||

| Quarter Ended September 30, 2015 | $ | 0.0480 | $ | 0.0205 | ||||

| Quarter Ended June 30, 2015 | $ | 0.0370 | $ | 0.0226 | ||||

| Quarter Ended March 31, 2015 | $ | 0.0300 | $ | 0.0176 | ||||

| Quarter Ended December 31, 2014 | $ | 0.0198 | $ | 0.0095 | ||||

| Quarter Ended September 30, 2014 | $ | 0.0405 | $ | 0.0123 | ||||

| Quarter Ended June 30, 2014 | $ | 0.0750 | $ | 0.0250 | ||||

| Quarter Ended March 31, 2014 | $ | 0.0740 | $ | 0.0480 | ||||

The above quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Number of Holders

As of April 14, 2016, there were 1,877 holders of record of VCSY common stock.

Equity Securities Under Compensation Plans

| Equity Compensation Plan Information | ||||||||||||

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | - | - | - | |||||||||

| Equity compensation plans not approved by security holders | ||||||||||||

| Stock Options | - | - | - | |||||||||

| Warrants | - | - | - | |||||||||

| Unvested Restricted Stock Awards | 2,250,000 | $ | 0.0243 | - | ||||||||

| Total | 2,250,000 | $ | 0.0243 | - | ||||||||

| (1) | Other than individual agreements with employees, directors and third party consultants, we do not have any equity compensation plans (i.e., stock option plans or restricted stock plans) that have been approved by security holders. |

| 19 |

| (2) | No stock options were issued to employees or consultants during the year ended December 31, 2015. |

| (3) | No warrants to purchase common stock were issued to employees or consultants during the year ended December 31, 2015. |

| (4) | Of the 2,250,000 common shares of restricted stock that had not vested at December 31, 2015 and were issued in connection with individual restricted stock agreements executed in 2015 with employees of the Company and its subsidiaries, 400,000 have vested through April 14, 2016. |

Dividends

We have outstanding shares of Series A and Series C 4% Convertible Cumulative Preferred stock that accrue dividends (if such dividends are declared) at a rate of 4% on a semi-annual basis. The total dividends applicable to Series A and Series C Preferred Stock were $588,000 for each of the years ended December 31, 2015 and 2014. Our Board of Directors did not declare any dividends on our outstanding shares of Series A or Series C Preferred Stock during 2015 or 2014, nor has the Company paid any dividends on our outstanding shares of Series A or Series C Preferred Stock since 2001. We intend to retain future earnings, if any, to provide funds for use in the operation and expansion of our businesses. Accordingly, we do not anticipate paying cash dividends on any of our capital stock, including preferred stock, in the near future. For additional information concerning dividends, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7.

Unregistered Sales of Securities

During the last two years, we issued the following unregistered securities:

During the year ended December 31, 2014, 550,000 common shares granted to employees of the Company and a consultant of the Company vested. Stock compensation that was previously accrued totaling $10,226 was reclassified from accrued liabilities to stockholders’ equity associated with these shares vested.

During the year ended December 31, 2014, the Company granted 200,000 common shares to an employee of the Company. The shares vested immediately upon grant and the fair value of the shares was determined to be $3,200. The fair value was expensed in full during the year ended December 31, 2014.

In February 2015, the Company increased the number of its authorized shares of common stock to 2,000,000,000.