Attached files

| file | filename |

|---|---|

| EX-31.1 - Image Chain Group Limited, Inc. | ex31-1.htm |

| EX-32.2 - Image Chain Group Limited, Inc. | ex32-2.htm |

| EX-31.2 - Image Chain Group Limited, Inc. | ex31-2.htm |

| EX-32.1 - Image Chain Group Limited, Inc. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to _____________

Commission file number: 000-55326

| IMAGE CHAIN GROUP LIMITED, INC. | ||

| (Exact name of registrant as specified in its charter) |

| Nevada | 46-4333787 | |

| (State

or other jurisdiction of incorporation or organization) |

IRS

Employer (Identification No.) |

| Unit 07, 15F Convention Plaza Office Tower 1 Harbour Rd., | ||

| Wanchai, Hong Kong, China | N/A | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (852) 3188-2700

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act:

Common Stock, $.001 par value

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] | |

| (Do not check if a smaller reporting company) | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2015 was approximately $27 million based on the closing price on June 30, 2015.

The number of shares of common stock, par value $0.001 (the “Common Stock”), outstanding as of April 6, 2016 is 395,000,000.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| 2 |

COMPANY HISTORY AND RECENT DEVELOPMENT

Image Chain Group Limited, Inc. (formerly Have Gun Will Travel Entertainment, Inc.) (“ICGL”, “we”, “us” or the “Company”) was incorporated under the laws of Nevada on December 18, 2013. From inception through the date of the Share Exchange as defined below, we were an emerging forward-thinking full-service television pre-production company dedicated to the creation of original concepts and programming with a bold and innovative edge in the reality television space for sale, option and licensure to independent producers, cable television networks, syndication companies, and other entities. On June 11, 2015, the Company amended its Articles of Incorporation with the State of Nevada in order to change its name to Image Chain Group Limited, Inc. and to increase the authorized shares of common stock from 70,000,000 to 400,000,000 (the “Amendments”). The name change was undertaken in order to more closely align with the operations of the Company’s wholly-owned subsidiary, Fortune Delight Holdings Group Ltd (“FDHG”). The increase in authorized shares was undertaken to allow the Company to utilize the newly available shares to raise capital. The board of directors and the stockholders of the Company approved the Amendments on May 8, 2015.

On May 5, 2015, ICGL entered into a share exchange agreement (the “Exchange Agreement”) with FDHG and Wu Jun Rui, on behalf of himself and certain other individuals who are to receive shares of ICGL pursuant to the Exchange Agreement (the “Shareholders”). On the terms and subject to the conditions set forth in the Exchange Agreement, on May 5, 2015, Wu Jun Rui transferred all 50,000 shares of FDHG common stock, consisting of all of the issued and outstanding shares of FDHG, to ICGL in exchange for the issuance to the shareholders of 59,620,000 shares of the Company’s common stock, par value $.001 per share and 5,000,000 shares of the Company’s preferred stock, par value $.001 per share.

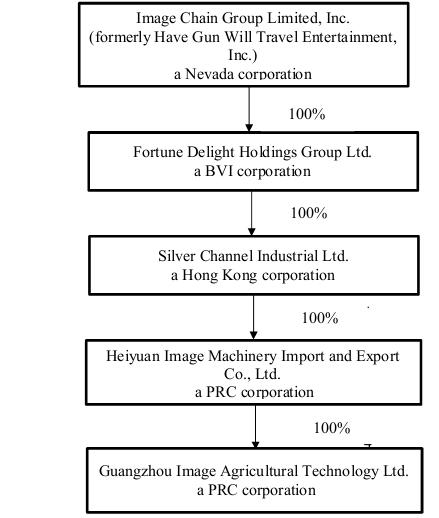

As a result of the closing of the Exchange Agreement, FDHG became the Company’s wholly owned subsidiary. FDHD is the parent company of Silver Channel Industrial Ltd., a Hong Kong company. Heyuan Image Machinery Import and Export Co., Ltd., a P.R.C. company, is the wholly-owned subsidiary of Silver Channel Industrial Ltd. Guangzhou Image Agricultural Technology Ltd., a Guangzhou company, is the wholly-owned subsidiary of Heyuan Image Machinery Import and Export Co., Ltd. Guangzhou Image Agricultural Technology Ltd. owns 100% of the capital stock of Yunnan Image Tea Industrial Ltd. (“Yunnan Image”) Through the aforementioned companies, ICGL has altered its business plan so that it have developed his branded tea named Image Tea. ICGL, through its subsidiaries, is appointed to operate a tea garden in Yunnan. Upon consummation of the transaction contemplated in the Exchange Agreement, ICGL issued 59,620,000 shares of its common stock and 5,000,000 shares of its preferred stock, as applicable, to the Shareholders, as directed by Wu Jun Rui.

CORPORATE STRUCTURE

| 3 |

The Company, through its wholly owned operating subsidiaries is in the business of promoting and distributing its owned branded teas that are grown, harvested, cured, and package in the People’s Republic of China (“PRC”). The Company’s headquarters is Guangzhou, Guangdong Province, PRC. Currently, the Company products are sold in the PRC for domestic consumption.

Fortune Delight Holdings Group Ltd is an investment holding company incorporated on January 8, 2015 and is domiciled in the British Virgin Islands.

Silver Channel Industrial Limited (“Silver Channel”), a limited company incorporated, registered, and domiciled in Hong Kong is a wholly owned trading company. The Company was incorporated on May 4, 2007. The Company acquired Silver Channel on March 24, 2015. Silver Channel since its incorporation has not engaged in in operations. Silver Channel has HKD 2 registered and paid up capital.

Heiyuan Image Equipment Import Export Co., Ltd (“Heiyuan Image”) is a wholly foreign owned enterprise (“WFOE”) limited company registered in Heiyuan City, Guangdong Province, PRC. Heiyuan Image was incorporated on January 28, 2011. The Company was dormant during the years ended December 31, 2014 and 2013. Heiyuan Image is wholly owned by Silver Channel.

Guangzhou Image Agricultural Technology Co., Ltd (“Guangzhou Image”) is a limited company registered in Guangzhou City, Guangdong Province, PRC. Guangzhou Image was incorporated on August 18, 2014. Guangzhou Image has not yet engaged in operating activities since its incorporation. Guangzhou Image is wholly owned by Heiyuan Image. Guangzhou Image has registered capital of RMB 10.0 million of which 0 has been paid up.

Yunnan Image Tea Industry Co., Ltd (“Yunnan Image” or “Yunnan Image”) is a limited company registered in Xishuangbana, Yunnan Province, PRC on August 23, 2013. Yunnan Image is the primary operating entity to carry out the Company’s core business activities of selling and marketing its own branded teas. Yunnan Image is a wholly owned by Guangzhou Image. .

OUR PRODUCTS, SERVICES AND CUSTOMERS

The Company primarily carries out its core business activities of selling and marketing its own branded teas through the operation of Yunnan Image, which is a dedicated Puer tea trader in the PRC. With the contracted tea cultivation bases, production facilities, established brand and extensive sales network, Yunnan Image has developed an integrated business model in year 2014 – Tea Manor Program (membership program) which provides the bespoke tea packaging, tourism and tea cultural center.

Products

Yunnan Image currently provides eight sub-varieties of refined Puer teas and private label member tea as well as loose packed teas. Yunnan Image has a team of certified tea tasters, who use organoleptic means to judge and appraise the characteristics and qualities of its raw teas and grade them according to their external appearance and innate quality (such as aroma, taste, tea colour and appearance of tea remainings). Furthermore, the tea tasters choose the top-grade Puer raw teas and blend them in various proportions to make premium refined Puer tea with the signature characteristics of Yunnan Image’s brand.

Production and Delivery

Yunnan Image, through Fuhai Tea Factory, under the sole agent agreement, entered into the Contracting Agreements with the relevant village committees, pursuant to which, the Yunnan Image agreed to purchase from the relevant village committees the use rights of the tea trees and plantations at a fixed rate and the land use rights at an annual fee for the entire contracting period in respect of the 5000 mu Ecological Forest Lands.

Yunnan Image’s sole contracted cultivation base is located in Xi Shuang Ban Na, Yunan Province, PRC. With its terroir including a cool climate, adequate rainfall, high frequency of cloud and mist, fertile soil, suitable acidity of soil, moderate sunshine and long day-time, all of which help the accumulation of the products of photosynthesis, Yunan is a well-known location for growing quality Puer and is the source of origin of Puer. Yunnan Image’s directors consider that the strategic selection of the cultivation bases has a significant bearing on the level of productivity and the quality of tea leaves.

| 4 |

Yunnan Image takes pride in the ability to efficiently distribute the finished tea leaves to the wholesalers, retail shops and members. Yunnan Image is able to distribute the products to the retail shops and members within 5 to 11 days upon receipt of orders.

Distribution

For the sale of raw teas, the Yunnan Image has 200 wholesalers approximately. Yunnan Image has entered into framework agreements with all of them for the sale of its raw teas. The Yunnan Image also sells its private label teas and refined teas to the members through the Tea Manor Program throughout the year.

COMPETITIVE STRENGTHS

We believe that the Yunnan Image’s historical success and future prospects are underpinned by a combination of competitive strengths including:

Strategically located cultivation bases

The Yunnan Image’s contracted tea cultivation bases comprise the 5000 mu Ecological Forest Lands, which are all strategically located in Xi Shuang Ban Na, Yunan Province, PRC. The we believe that since tea leaves is the most important raw materials of Yunnan Image, the cultivation bases enable the Yunnan Image to exercise better control over quality from the initial stage of plantation and this competitive advantage distinguishes the Yunnan Image from its competitors which do not have their sole contracted cultivation bases for tea plants. We also consider that the strategic location of the cultivation bases in Xi Shuang Ban Na, Yunan, a well-known location for growing high quality of Puer and the source of origin of Puer, has a significant bearing on the Yunnan Image’s level of productivity and the quality of its tea leaves, which distinguishes the Yunnan Image from its competitors.

Proven integrated Tea Manor Program

The Yunnan Image implemented an integrated business model in which the Yunnan Image provides Tea Culture Education as well as Tea Tasting Sharing to the member in order to distinguish the quality of tea from other competitors.

The Program also provide direct sales and marketing channel.

Sales, Marketing and Distribution Strategy

Yunnan Image adopts a two-prong strategy in the sales of its tea products to focus not only on the production and sales of raw teas, but also on the development of its branded tea business by implementing tea manor program to promote its Image Tea brand.

Yunnan Image sells a majority of its raw teas on a wholesale basis, and sells on a retail basis its refined Banzhang Puer under its Image Tea brand. Some of the Yunnan Image’s refined teas are also sold with a private label to our members.

MARKET CONDITIONS

According to IBISWorld’s Tea Production market research report on the “Tea Production in China” published in June 2015, the tea production industry has rapidly increased its share of China’s beverage market over the past decade, from 7.0% of total domestic beverage volume in 2000 to 26.0% in 2013. Over the past five years, industry revenue has been increasing at an annualized rate of 13.3% to an expected $19.5 billion in 2015. There are about 256 enterprises operating in the industry, with 67,961 workers.

According to EuroMonitor International’s analysis published in February 2016, tea is expected to post steady volume and value growth over 2015-2020, supported by stable demand in a traditional tea-drinking country.

COMPETITION

The Chinese tea market in which the Company operates could be considered as highly competitive and fragmented, and the competition is expected to continually increase. Many of the Company’s competitors sell products that are similar to the Company’s products, and the Company’s ability to compete against them is significantly dependent on its ability to distinguish its products from those of its competitors and demonstrate product quality.

| 5 |

GOVERNMENT AND INDUSTRY REGULATION

Our products are subject to central government regulation as well as provincial government regulation the provinces our products are sold to. Business and product licenses must be obtained through application to the central, provincial and local governments. We have obtained our business licenses to operate domestically under the laws and regulations of the PRC. We obtained business licenses to conduct businesses, including an operating license to sell packaged foods such as Puer tea and other tea products. Business, company and product registrations are certified on a regular basis and we must comply with the laws and regulations of the PRC, provincial and local governments and industry agencies.

In accordance with PRC laws and regulations, we are required to comply with applicable hygiene and food safety standards in relation to our production processes. Failure to pass these inspections, or the loss of or failure to renew our licenses and permits, could require us to temporarily or permanently suspend some or all of our production activities, which could disrupt our operations and adversely affect our business.

EMPLOYEES

As of the date of this report, we have 42 employees. We believe that we maintain good relationships with our employees, and have not experienced any strikes or shutdowns and have not been involved in any labor disputes.

Item 1A. Risk Factors

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, we are not required to provide the risk factors.

Item 1B. Unresolved Staff Comments

None.

Our corporate headquarters are located at Unit 07, 15F Convention Plaza Office Tower 1 Harbour Rd., Wanchai, Hong Kong, China, where we lease approximately 1900 square feet of office space under a lease that will expire on May 15, 2016. Our monthly lease payment for this office space is approximately $14,500.00.

Our servers are primarily maintained in China. We believe the leased premise is sufficient to meet the immediate needs of our business..

As of the date of this annual report, we are not a party to any legal proceedings that could have a material adverse effect on the Company’s business, financial condition or operating results. Further, to the Company’s knowledge no such proceedings have been threatened against the Company.

Item 4. Mine Safety Disclosures.

Not applicable

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issue Purchases of Equity Securities.

Market Information

Our common stock is quoted on the OTC Markets (“OTCQB”) under the symbol “ICGL”.

The table below sets forth the high and low closing prices of the Company’s Common Stock during the periods indicated s reported by the NASDAQ Markets. The Company’s Common Stock was initially quoted on the OTCQB on January 3, 2015.

| Bid Price | ||||||||

| HIGH | LOW | |||||||

| First Quarter ended March 31, 2016 | ||||||||

| Period ended April 12, 2016 | $ | 9.90 | $ | 8.00 | ||||

| FISCAL YEAR 2015: | 9.50 | $ | 7.75 | |||||

| Fourth Quarter ended December 31, 2015 | $ | 9.00 | $ | 6.99 | ||||

| Third Quarter ended September 30, 2015 | $ | 8.00 | $ | 5.00 | ||||

| Second Quarter ended June 30, 2015 | $ | 6.25 | $ | 0.55 | ||||

| First Quarter ended March 31, 2015 | $ | 6.25 | $ | 0.01 | ||||

| FISCAL YEAR 2014: | ||||||||

| Fourth Quarter ended December 31, 2014 | $ | n/a | $ | n/a | ||||

| Third Quarter ended September 30, 2014 | $ | n/a | $ | n/a | ||||

| Second Quarter ended June 30, 2014 | $ | n/a | $ | n/a | ||||

| First Quarter ended March 31, 2014 | $ | n/a | $ | n/a | ||||

| 6 |

Holders

As of the date of this report there were approximately 223 holders of record of Company common stock. This does not include an indeterminate number of persons who hold our Common Stock in brokerage accounts and otherwise in “street name.”

Dividends

Holders of common stock are entitled to receive such dividends as may be declared by the Company’s Board of Directors. The Company did not declare or pay dividends during its fiscal year ended December 31, 2015 or 2014.

To the extent ICGL has any earnings, it will likely retain earnings to expand corporate operations and not use such earnings to pay dividends.

Transfer Agent and Registrar

The transfer agent and registrar for ICGL’s common stock is Manhattan Transfer Registrar Co., 531 Cardens Court, Erie CO 80516, telephone 631-928-7655.

Repurchases of Our Securities

None.

Recent Sales of Unregistered Securities

None.

Item 6. Selected Financial Data.

ICGL is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and is not required to provide the information under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statements

This Annual Report on Form 10-K (“Annual Report”) may contain “forward-looking statements,” as that term is used in federal securities laws, about Image Chain Group Limited, Inc.’s financial condition, results of operations and business. These statements include, among others:

| ● | statements concerning the potential benefits that Image Chain Group Limited, Inc. (“ICGL,” “we,” “our,” “us,” the “Company,” “management”) may experience from its business activities and certain transactions it contemplates or has completed; and | |

| ● | statements of ICGL’s expectations, beliefs, future plans and strategies, anticipated developments and other matters that are not historical facts. These statements may be made expressly in this Annual Report. You can find many of these statements by looking for words such as “believes,” “expects,” “anticipates,” “estimates,” “opines,” or similar expressions used in this Annual Report. These forward-looking statements are subject to numerous assumptions, risks and uncertainties that may cause ICGL’s actual results to be materially different from any future results expressed or implied by ICGL in those statements. The most important facts that could prevent ICGL from achieving its stated goals include, but are not limited to, the following: |

| (a) | volatility or decline of ICGL’s stock price; | |

| (b) | potential fluctuation of quarterly results; | |

| (c) | failure of ICGL to earn revenues or profits; | |

| (d) | inadequate capital to continue or expand its business, and inability to raise additional capital or financing to implement its business plans; |

| 7 |

| (e) | decline in demand for ICGL’s products and services; | |

| (f) | rapid adverse changes in markets; | |

| (g) | litigation with or legal claims and allegations by outside parties against ICGL, including but not limited to challenges to ICGL’s intellectual property rights; | |

| (h) | insufficient revenues to cover operating costs; |

There is no assurance that ICGL will be profitable, ICGL may not be able to successfully develop, manage or market its products and services, ICGL may not be able to attract or retain qualified executives and personnel, ICGL may not be able to obtain customers for its products or services, additional dilution in outstanding stock ownership may be incurred due to the issuance of more shares, warrants and stock options, or the exercise of outstanding warrants and stock options, and other risks inherent in ICGL’s businesses.

Because the statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. ICGL cautions you not to place undue reliance on the statements, which speak only as of the date of this Annual Report. The cautionary statements contained or referred to in this section should be considered in connection with any subsequent written or oral forward-looking statements that ICGL or persons acting on its behalf may issue. ICGL does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this Annual Report, or to reflect the occurrence of unanticipated events.

Overview

Image Chain Group Limited, Inc. (formerly Have Gun Will Travel Entertainment, Inc.) (“ICGL” or the “Company”) was incorporated under the laws of Nevada on December 18, 2013. From inception through the date of the Exchange Agreement as defined below, the Company was an emerging forward-thinking full-service television pre-production company dedicated to the creation of original concepts and programming with a bold and innovative edge in the reality television space for sale, option and licensure to independent producers, cable television networks, syndication companies, and other entities.

On May 5, 2015, ICGL entered into a share exchange agreement (the “Exchange Agreement”) with Fortune Delight Holdings Group Ltd., a British Virgin Islands corporation (“FDHG”) and Wu Jun Rui, on behalf of himself and certain other individuals who are to receive shares of ICGL (“Shareholders”) pursuant to the Exchange Agreement. On the terms and subject to the conditions set forth in the Exchange Agreement, on May 5, 2015, Wu Jun Rui transferred all 50,000 shares of FDHG common stock, consisting of all of the issued and outstanding shares of FDHG to ICGL. In exchange for the transfer of such securities by Wu Jun Rui, ICGL issued, to the Shareholders, 59,620,000 shares of the Company’s common stock, par value $.001 per share and 5,000,000 shares of the Company’s preferred stock, par value $.001 per share.

As a result of the closing of the Share Exchange Agreement, FDHG became the Company’s wholly owned subsidiary. FDHG is the parent company of Silver Channel Industrial Ltd., a Hong Kong company, which, in turn, holds 100% equity interest of Heyuan Image Machinery Import and Export Co., Ltd., a PRC corporation (“Heyuan Image”). Heyuan Image, through Guangzhou Image Agricultural Technology Ltd., a PRC corporation, owns 100% of Yunnan Image Tea Industrial Ltd. (“Yunnan Image”). ICGL, through its wholly-owned operating subsidiaries, is in the business of promoting and distributing its owned branded teas that are grown, harvested, cured, and packaged in the People’s Republic of China (“PRC”).

On June 11, 2015, the Company changed its name to Image Chain Group Limited, Inc. in order to more closely align with its current business.

Results of Operations

Fiscal year Ended December 31, 2015 Compared to Fiscal year Ended December 31, 2014

The Company recognized $1,386,968 in sales revenues for the fiscal year ended December 31, 2015, as compared to $0 for the fiscal year ended December 31, 2014. The material change in the amount of sales revenue is a result of the Company’s commencement of the operation in the business of promoting and distributing its own brand teas in 2015.

For the fiscal year ended December 31, 2015, the Company recognized cost of sales of $941,748 as compared to $0 for the same period in 2014. The Company initially began delivering the tea products during the period; accordingly, the cost of sales increased significantly.

Gross profit was $445,220 for the fiscal year ended December 31, 2015 as compared to gross loss of $0 for the same period in 2014.

For the fiscal year ended December 31, 2015, the Company recorded operating expenses totaling $6,619,954 which was comprised of selling, general and administrative expenses, and impairment of goodwill. The Company’s operating expenses was mainly attributable to the salary and wages. For the fiscal year ended December 31, 2014, our operating expenses were $298,204, which consisted of basic general and administrative expenses. Our increase in operating expenses is primarily due to the Company’s commencement of the operation in 2015.

As a result of the factors discussed above, the Company’s net loss was $6,167,071 for the fiscal year ended December 31, 2015, as compared to a net loss of $297,994 during the fiscal year ended December 31, 2014.

| 8 |

Liquidity and Capital Resources

The Company’s cash and cash equivalents were $78,753 at December 31, 2015, as compared to $70,107 at December 31, 2014. The increase in cash was due to the issuance of new shares. As of December 31, 2015, the Company had current assets of $3,985,108 and current liabilities of 2,886,137, respectively, compared to $800,570 and $1,610,654 as of December 31, 2014. Net working capital of was $1,098,971 at December 31, 2015 as compared to net capital deficit of $ 810,084 at December 31, 2014. The Company’s net working capital increased primarily from an increase in inventories and other receivables and partly offset by an increase in customer advance.

Net cash used in operating activities amounted to $2,393,706 for the fiscal year ended December 31, 2015, as compared to $16,766 for the fiscal year ended December 31, 2014. The substantial change in cash used in operating activities was primarily due to the commencement of our operations in the business of promoting and distributing its own brand teas in 2015.

There was net cash of $213,813 used in investing activities for the fiscal year ended December 31, 2015 and $82,710 of net cash used in investing activities in the fiscal year ended December 31, 2014. Cash used in investing activities was for purchase of property plant and equipment.

There was net cash of $2,577,764 provided by financing activities for the fiscal year ended December 31, 2015 and $0 for the fiscal year ended December 31, 2014. This increase was due to the sale and issuance of restricted shares by the Company to certain investors in a private placement in 2015.

On an on-going basis, we may take steps to identify and plan our needs for liquidity and capital resources, to fund our operations and day to day business operations. Our future capital expenditures will include, among others, expanding our product portfolio, large scale long term marketing campaigns, and making acquisitions as deemed appropriate.

Based on our current plans for the next 12 months, we anticipate that the sales of the Company’s tea products will be the primary organic source of funds for future operating activities in 2016. However, to fund continued expansion of our operation and extend our reach to broader markets, and to acquire additional entities, as we may deem appropriate, we may raise capital through public or private offerings. There is no assurance that we will be able to obtain such funding on acceptable terms, if at all.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported in the financial statements, including the notes thereto, and related disclosures of commitments and contingencies, if any. We consider our critical accounting policies to be those that require the more significant judgments and estimates in the preparation of financial statements, including the following:

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, trade receivables, prepaid expenses, payables and accrued expenses, Fair value estimates are made at a specific point in time, based on relevant market information about the financial instrument. These estimates are subjective in nature and involve uncertainties and matters of significant judgment and therefore cannot be determined with precision. We consider the carrying values of our financial instruments in the consolidated financial statements to approximate fair value, due to their short-term nature.

Property and Equipment

Property and equipment are recorded at cost, less accumulated depreciation. Depreciation is provided for using straight-line methods over the estimated useful lives of the respective assets, usually three to seven years.

| 9 |

Valuation of Long-Lived Assets

We periodically evaluate long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. If the estimated future cash flows (undiscounted and without interest charges) from the use of an asset were less than the carrying value, a write-down would be recorded to reduce the related asset to its estimated fair value. We do not believe that there has been any impairment to long-lived assets as of December 31, 2015 and 2014.

Recent Accounting Pronouncements

(See “Recent Accounting Pronouncements” in Note 2 of Notes to the Financial Statements.)

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

ICGL is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and is not required to provide the information under this item.

| 10 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

IMAGE CHAIN GROUP LIMITED, INC.

audited Consolidated Financial statements

AS OF December 31, 2015 AND 2014

(STATED IN U.S. DOLLARS)

IMAGE CHAIN GROUP LIMITED, INC.

| 11 |

REPORT OF REGISTERED INDEPENDENT PUBLIC ACCOUNTING FIRM

| To: | The Board of Directors and Stockholders of |

| Image Chain Group Limited, Inc. |

We have audited the accompanying consolidated balance sheets of Image Chain Group Limited, Inc. as of December 31, 2015 and 2014 and the related consolidated statements of income and comprehensive income, stockholders’ equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Image Chain Group Limited, Inc. as of December 31, 2015 and 2014 and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company had incurred substantial losses in previous years and has a working capital deficit, which raises substantial doubt about its ability to continue as a going concern. Management’s plans in regards to these matters are also described in Note 3. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| WWC, P.C. | |

| San Mateo, California | WWC, P.C. |

| April 14, 2016 | Certified Public Accountants |

| F-1 |

IMAGE CHAIN GROUP LIMITED, INC.

AUDITED CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2015 AND 2014

| December 31, 2015 | December 31, 2014 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 78,753 | $ | 70,107 | ||||

| Accounts receivable, net | 10,389 | 12,819 | ||||||

| Advanced to suppliers | 680,178 | 513,122 | ||||||

| Inventories | 447,972 | 36,075 | ||||||

| Other deposits | 48,920 | 1,242 | ||||||

| Other receivables, net | 2,468,538 | 167,205 | ||||||

| Related party receivable | 250,303 | - | ||||||

| Prepaid tax | 55 | - | ||||||

| Total current assets | $ | 3,985,108 | $ | 800,570 | ||||

| Non-current assets | ||||||||

| Property, plant and equipment, net | 232,180 | 51,180 | ||||||

| Goodwill | - | 323,493 | ||||||

| TOTAL ASSETS | $ | 4,217,288 | $ | 1,175,243 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| Current liabilities | ||||||||

| Accounts payable | 491,643 | 486,950 | ||||||

| Tax payable | 1,730 | 331 | ||||||

| Other payables | 372,374 | 469,448 | ||||||

| Accrued liabilities | 387,927 | 1,006 | ||||||

| Related party payable | 68,665 | 1,675 | ||||||

| Customer advance | 1,563,798 | 651,244 | ||||||

| TOTAL LIABILITIES | $ | 2,886,137 | $ | 1,610,654 | ||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred Stock, $0.001 par value, 5,000,000 shares authorized, issued and outstanding as of December 31, 2015 and 2014, respectively | 5,000 | 5,000 | ||||||

| Common stock, US$0.001 par value, 400,000,000 shares authorized, 395,000,000 and 70,000,000 shares issued and outstanding as of December 31, 2015 and 2014, respectively | 395,000 | 70,000 | ||||||

| Additional paid in capital | 49,563,863 | - | ||||||

| Subscription receivable | (41,991,202 | ) | - | |||||

| Accumulated deficit | (6,718,613 | ) | (551,542 | ) | ||||

| Accumulated other comprehensive income | 77,103 | 41,131 | ||||||

| TOTAL STOCKHOLDERS’ EQUITY | 1,331,151 | (435,411 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 4,217,288 | $ | 1,175,243 | ||||

See Notes to Financial Statements and Accountants’ Report

| F-2 |

IMAGE CHAIN GROUP LIMITED, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME

FOR THE years ENDED DEcember 31, 2015 AND 2014

| For the years ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| Sales, net | $ | 1,386,968 | $ | - | ||||

| Cost of sales | 941,748 | - | ||||||

| Gross profit | 445,220 | - | ||||||

| Operating expenses: | ||||||||

| Selling, general and administrative expenses | 6,296,461 | 298,204 | ||||||

| Impairment loss on goodwill | 323,493 | - | ||||||

| Total operating expenses | 6,619,954 | 298,204 | ||||||

| Loss from operations | (6,174,734 | ) | (298,204 | ) | ||||

| Other income (expense): | ||||||||

| Interest income | 155 | 550 | ||||||

| Other (expense) income, net | 7,508 | (340 | ) | |||||

| 7,663 | 210 | |||||||

| Loss before income taxes | (6,167,071 | ) | (297,994 | ) | ||||

| Provision for income tax | - | - | ||||||

| Net loss | $ | (6,167,071 | ) | $ | (297,994 | ) | ||

| Other comprehensive income: | ||||||||

| Foreign currency translation adjustment | 35,972 | $ | 42,766 | |||||

| Comprehensive loss | $ | (6,131,099 | ) | $ | (255,228 | ) | ||

| Net loss per share | ||||||||

| Basic | $ | (0.03 | ) | $ | (0.00 | ) | ||

| Diluted | (0.03 | ) | (0.00 | ) | ||||

| Weighted average number of common shares outstanding | ||||||||

| Basic | 207,091,563 | 70,000,000 | ||||||

| Diluted | 207,091,563 | 70,000,000 | ||||||

| F-3 |

IMAGE CHAIN GROUP LIMITED, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE years ended december 31, 2015 and 2014

| For the years ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| CASH FLOWS USED IN OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (6,167,071 | ) | $ | (297,994 | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 30,385 | 5,925 | ||||||

| Impairment loss on goodwill | 323,493 | - | ||||||

| Stock compensation expense | 4,681,819 | - | ||||||

| Commission expenses | 638,077 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 2,430 | (12,819 | ) | |||||

| Advance to suppliers | (167,056 | ) | (505,196 | ) | ||||

| Inventories | (411,897 | ) | (36,075 | ) | ||||

| Other deposit | (47,678 | ) | 422 | |||||

| Other receivable | (2,301,333 | ) | 149,822 | |||||

| Related party receivable | (250,303 | ) | - | |||||

| Accounts payable, taxes and other payable | (91,037 | ) | 29,190 | |||||

| Accrued liabilities | 386,921 | (1,007 | ) | |||||

| Related party payable | 66,990 | (278 | ) | |||||

| Customer advanced | 912,554 | 651,244 | ||||||

| Net cash used in operating activities | (2,393,706 | ) | (16,766 | ) | ||||

| CASH FLOWS USED IN FROM INVESTING ACTIVITIES | ||||||||

| Net cash outflow on acquisition of a subsidiary | - | (26,189 | ) | |||||

| Purchase of property, plant and equipment | (213,813 | ) | (56,521 | ) | ||||

| Net cash used in investing activities | (213,813 | ) | (82,710 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from stock issuance | 2,577,764 | - | ||||||

| Net cash provided by financing activities | 2,577,764 | - | ||||||

| Effect of exchange rate changes on cash and cash equivalents | 38,401 | 42,767 | ||||||

| Net increase in cash and cash equivalents | 8,646 | (56,709 | ) | |||||

| Cash and cash equivalents, beginning balance | 70,107 | 126,816 | ||||||

| Cash and cash equivalents, ending balance | $ | 78,753 | $ | 70,107 | ||||

| SUPPLEMENTAL DISCLOSURES: | ||||||||

| Interest received | $ | 155 | $ | 550 | ||||

| Interest paid | $ | - | $ | - | ||||

| Income tax paid | $ | - | $ | - | ||||

| F-4 |

IMAGE CHAIN GROUP LIMITED, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

(STATED IN US DOLLARS)

| Number of Preferred Stock | Preferred Stock | Number of Common Stock | Common Stock | Subscription receivable | Additional paid in capital | Accumulated deficit | Accumulated other comprehensive income | Total | ||||||||||||||||||||||||||||

| Balance, January 1, 2014 | - | - | 10,380,000 | 10,380 | - | (10,380 | ) | - | - | |||||||||||||||||||||||||||

| Recapitalization as a result of share exchange agreement with FDHG and Wu Jun Rui | 5,000,000 | 5,000 | 59,620,000 | 59,620 | - | - | (243,168 | ) | (1,635 | ) | (180,183 | ) | ||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (297,994 | ) | - | (297,994 | ) | |||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | - | - | 42,766 | 42,766 | |||||||||||||||||||||||||||

| Balance, December 31, 2014 | 5,000,000 | 5,000 | 70,000,000 | 70,000 | - | - | (551,542 | ) | 41,131 | (435,411 | ) | |||||||||||||||||||||||||

| Balance, January 1, 2015 | 5,000,000 | 5,000 | 70,000,000 | 70,000 | - | - | (551,542 | ) | 41,131 | (435,411 | ) | |||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (6,167,071 | ) | - | (6,167,071 | ) | |||||||||||||||||||||||||

| Issuance of common stock for cash | - | - | 58,575,000 | 58,575 | - | 3,157,267 | - | - | 3,215,842 | |||||||||||||||||||||||||||

| Issuance of share based compensation | - | - | 62,975,000 | 62,975 | - | 4,618,844 | - | - | 4,681,819 | |||||||||||||||||||||||||||

| Share allotment | - | - | 203,450,000 | 203,450 | (41,991,202 | ) | 41,787,752 | - | - | - | ||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | - | 35,972 | 35,972 | ||||||||||||||||||||||||||||

| Balance, December 31, 2015 | 5,000,000 | 5,000 | 395,000,000 | 395,000 | (41,991,202 | ) | 49,563,863 | (6,718,613 | ) | 77,103 | 1,331,151 | |||||||||||||||||||||||||

| F-5 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES |

Business

Image Chain Group Limited, Inc. (formerly Have Gun Will Travel Entertainment, Inc.) (“ICGL” or the “Company”) was incorporated under the laws of Nevada on December 18, 2013. From inception through the date of the Share Exchange as defined below, the Company was an emerging forward-thinking full-service television pre-production company dedicated to the creation of original concepts and programming with a bold and innovative edge in the reality television space for sale, option and licensure to independent producers, cable television networks, syndication companies, and other entities. On June 11, 2015, the Company amended its Articles of Incorporation with the State of Nevada in order to change its name to Image Chain Group Limited, Inc. and to increase the authorized shares of common stock from 70,000,000 to 400,000,000 (the “Amendments”). The name change was undertaken in order to more closely align with the operations of the Company’s wholly-owned subsidiary, Fortune Delight Holdings Group Ltd (“FDHG”). The increase in authorized shares was undertaken to allow the Company to utilize the newly available shares to raise capital. The board of directors and the stockholders of the Company approved the Amendments on May 8, 2015.

FDHG, through its wholly-owned operating subsidiaries, is in the business of promoting and distributing its own branded teas that are grown, harvested, cured, and packaged in the People’s Republic of China (“PRC”). The Company’s headquarters is located in Guangzhou, Guangdong Province, PRC. Currently, the Company’s products are sold in the PRC for domestic consumption.

Share Exchange

On May 5, 2015, ICGL entered into a share exchange agreement (the “Exchange Agreement”) with FDHG and Wu Jun Rui, on behalf of himself and certain other individuals who were to receive shares of ICGL pursuant to the Exchange Agreement (the “Shareholders”). On the terms and subject to the conditions set forth in the Exchange Agreement, on May 5, 2015, Wu Jun Rui transferred all 50,000 shares of FDHG common stock, consisting of all of the issued and outstanding shares of FDHG, to ICGL in exchange for the issuance to the shareholders of 59,620,000 shares of the Company’s common stock, par value $.001 per share and 5,000,000 shares of the Company’s preferred stock, par value $.001 per share. The preferred stock is not convertible nor mandatorily redeemable; it does not pay dividends or carrying any voting rights but is entitled to liquidation preference.

As a result of the closing of the Exchange Agreement, FDHG became the Company’s wholly owned subsidiary. FDHG is an investment holding company incorporated and domiciled in the British Virgin Islands. FDHG wholly owns Silver Channel Industrial Limited, a limited company incorporated, registered, and domiciled in Hong Kong.

The securities purchase agreement transaction is referred to hereafter as the “reverse-merger transaction.” The share exchange transaction has been accounted for as a recapitalization of ICGL where ICGL (the legal acquirer) is considered the accounting acquiree and FDGH (the legal acquiree) is considered the accounting acquirer. As a result of this transaction, ICGL is deemed to be a continuation of the business of FDDG.

Accordingly, the accompanying consolidated financial statements are those of the accounting acquirer, FDGH. The historical stockholders’ equity of the accounting acquirer prior to the share exchange has been retroactively restated as if the share exchange transaction occurred as of the beginning of the first period presented.

| F-6 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Organization History of Silver Channel Industrial Limited and its subsidiaries

On January 28, 2011, Silver Channel incorporated Heyuan Image Equipment Import Export Co., Ltd. (“Heyuan Image”) as a wholly foreign owned enterprise (“WFOE”) registered in Heyuan City, Guangdong Province, PRC. Heyuan Image was dormant for the year ended December 31, 2015 and 2014. Heyuan Image is wholly owned by Silver Channel. Heyuan Image has a registered capital of HKD 4,000,000 of which HKD 3,380,000 has been paid up.

On August 18, 2014, the Company, through its subsidiary Heyuan Image, acquired 100% equity of Guangzhou Image Agricultural Technology Co., Ltd. (“Guangzhou Image”). Guangzhou Image is a limited liability company registered in Guangzhou City, Guangdong Province, PRC. Guangzhou Image has not yet engaged in operating activities since its incorporation. Guangzhou Image is wholly owned by Heyuan Image. Guangzhou Image has a registered capital of RMB 10 million of which is still outstanding.

On February 16, 2015, Guangzhou Image entered into an equity transfer agreement with all the shareholders of Yunnan Image Tea Industry Co., Ltd. (“Yunnan Image”). Guangzhou Image paid RMB 3,000,000 to all the shareholders of Yunnan Image for 100% equity interest in Yunnan Image. Yunnan Image is a limited liability company registered in Xishuangbanna, Yunnan Province PRC. Yunnan Image was incorporated on August 23, 2013. Yunnan Image is the primary operating entity to carry out the Company’s core business activities of selling and marketing its own branded teas. Yunnan Image is wholly-owned by Guangzhou Image. Yunnan Image has a registered capital of RMB 3 million. The capital has been paid up in its entirety.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Method of Accounting |

The Company maintains its general ledger and journals with the accrual method of accounting for financial reporting purposes. The financial statements and notes are representations of management. Accounting policies adopted by the Company conform to generally accepted accounting principles in the United States of America and have been consistently applied in the presentation of financial statements.

| (b) | Basis of Presentation |

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”).

| (c) | Principles of Consolidation |

The consolidated financial statements include the accounts of the Company, its subsidiaries for which the Company is the primary beneficiary. All significant inter-company accounts and transactions have been eliminated. The consolidated financial statements include 100% of assets, liabilities, and net income or loss of those wholly-owned subsidiaries.

As of December 31, 2015, the detailed identities of the consolidating subsidiaries are as follows:

| Name of company | Place of incorporation | Attributable equity interest% | Registered capital | |||||||

| Fortune Delight Holdings Group Limited | British Virgin Islands | 100 | % | $ | 50,000 | |||||

| Silver Channel Industrial Limited | Hong Kong | 100 | % | - | ||||||

| Heyuan Image Equipment Import Export Co., Ltd. | P.R.C. | 100 | % | 515,849 | ||||||

| Guangzhou Image Agricultural Technology Co., Ltd. | P.R.C. | 100 | % | 1,636,902 | ||||||

| Yunnan Image Tea Industry Co., Ltd. | P.R.C. | 100 | % | 491,071 | ||||||

| (d) | Economic and Political Risks |

The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic, legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, restriction on international remittances, and rates and methods of taxation, among other things.

| F-7 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| (e) | Use of Estimates |

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting years. These accounts and estimates include, but are not limited to, the estimation on useful lives of property, plant and equipment. Actual results could differ from those estimates.

| (f) | Cash and Cash Equivalents |

Cash and cash equivalents include cash in hand and cash in time deposits, certificates of deposit and all highly liquid debt instruments with original maturities of three months or less. As of December 31, 2015, cash and cash equivalents were mainly denominated in RMB and were placed with banks in the PRC. These cash and cash equivalents may not be freely convertible into foreign currencies and the remittance of these funds out of the PRC may be subjected to exchange control restrictions imposed by the PRC government.

| (g) | Accounts Receivable |

The Company maintains allowances for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these allowances. Terms of sales vary. Allowances are recorded primarily on a specific identification basis.

As of December 31, 2015, no provision for allowance for doubtful accounts was provided.

| (h) | Other receivables |

Other receivables are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An allowance for doubtful accounts is made when recovery of the full amount is doubtful.

| (i) | Inventories |

Inventories are stated at the lower of cost or market value. Cost is computed using the first-in, first-out method and includes all costs of purchase and other costs incurred in bringing the inventories to their present location and condition. Market value is determined by reference to the sales proceeds of items sold in the ordinary course of business or estimates based on prevailing market conditions.

| (j) | Property, plant and equipment |

Property and equipment are stated at cost. Expenditures for maintenance and repairs are charged to earnings as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method for substantially all assets with estimated lives of:

| Building | 20 years | |

| Computer | 3 years | |

| Motor vehicles | 4 years |

| F-8 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| (k) | Accounting for Impairment of Long-Lived Assets |

The Company adopts Accounting Standards Codification (“ASC”) 360, “Accounting for the Impairment or Disposal of Long-Live Assets”, which addresses financial accounting and reporting for the impairment or disposal of long-lived assets. The Company periodically evaluates the carrying value of long-lived assets to be held and used in accordance with ASC 360 which requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets.

The long-lived assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. It is reasonably possible that these assets could become impaired as a result of technology or other industry changes. Recoverability of assets to be held and used is determined by comparing the carrying amount of an asset to future net undiscounted cash flows to be generated by the assets.

If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell. During the reporting periods, there was no impairment loss.

| (l) | Customer advance |

Customer advance was received from customers in connection with orders of products to be delivered in future periods.

| (m) | Revenue Recognition |

The Company’s revenue recognition policies are in compliance with Staff Accounting Bulletin (“SAB”) 104, included in the Codification as ASC 605, Revenue Recognition. Sales revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectability is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue.

The Company does not allow its customers to return products. The Company’s customers can exchange products only if they are damaged in transportation.

Revenue reported is net of value added tax.

| (n) | Cost of Sales |

The Company’s cost of sales is comprised of the inbound acquisition cost of packaged finished goods for resale, inbound shipping, value added tax and business taxes recognized upon sales of goods.

| (o) | Selling Expenses |

Selling expenses are comprised of salaries for the sales force, client entertainment, commissions, advertising, and travel and lodging expenses.

| (p) | General & Administrative Expenses |

General and administrative expenses include executive compensation, general overhead such as the finance department and administrative staff, depreciation, office rental and utilities.

| F-9 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| (q) | Foreign Currency Translation |

The Company maintains its financial statements in the functional currencies on Chinese Renminbi (RMB) and Hong Kong Dollars (“HKD”). Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchanges rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income for the respective periods.

For financial reporting purposes, the financial statements of the Company, which are prepared using the functional currency, have been translated into United States dollars. Assets and liabilities are translated at the exchange rates at the balance sheet dates and revenue and expenses are translated at the average exchange rates and stockholders’ equity is translated at historical exchange rates. Translation adjustments are not included in determining net loss but are included in foreign exchange adjustment to other comprehensive loss, a component of stockholders’ equity.

| Exchange Rates | 12/31/2015 | 12/31/2014 | ||||||

| Year end RMB : US$ exchange rate | 6.4907 | 6.1385 | ||||||

| Average year RMB : US$ exchange rate | 6.2175 | 6.1432 | ||||||

| Year end HKD : US$ exchange rate | 7.7504 | 7.7574 | ||||||

| Average year HKD : US$ exchange rate | 7.7521 | 7.7544 | ||||||

RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US$ at the rates used in translation. The HKD is freely convertible into other foreign currencies.

| (r) | Income Taxes |

The Company adopts SFAS No. 109, Accounting for Income Taxes, included in the Codification as ASC 740, Income Taxes, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

On January 1, 2007, The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes (“FIN 48”), included in the Codification as ASC 740, Income Taxes. The topic addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures.

| F-10 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| (s) | Statutory Reserve |

Statutory reserve refers to the amount appropriated from the net income in accordance with PRC laws or regulations, which can be used to recover losses and increase capital, as approved, and, are to be used to expand production or operations. PRC laws prescribe that an enterprise operating at a profit, must appropriate, on an annual basis, from its earnings, an amount to the statutory reserve to be used for future company development. Such an appropriation is made until the reserve reaches a maximum equal to 50% of the enterprise’s registered capital.

| (t) | Fair Value of Financial Instruments |

For certain of the Company’s financial instruments, including cash and equivalents, accounts and other receivables, accounts and other payables, accrued liabilities and short-term debt, the carrying amounts approximate their fair values due to their short maturities. ASC Topic 820, “Fair Value Measurements and Disclosures,” requires disclosure of the fair value of financial instruments held by the Company. ASC Topic 825, “Financial Instruments,” defines fair value, and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. The carrying amounts reported in the balance sheets for receivables and current liabilities each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The three levels of valuation hierarchy are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices for identical assets or liabilities in active markets. | |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. | |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The Company analyzes all financial instruments with features of both liabilities and equity under ASC 480, “Distinguishing Liabilities from Equity,” and ASC 815.

The Company’s financial instruments include cash and equivalents, accounts receivable, and accounts payable. Cash and cash equivalents consist deposits financial institutions with original maturities of three months or less. Management estimates the carrying amounts of the non-related party financial instruments approximate their fair values due to their short-term nature.

The following is table of the Company’s financial instruments:

As of December 31, 2015:

| Carrying amount | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Estimated fair value | |||||||||||||

| Financial assets | ||||||||||||||||

| Carried at (amortized) cost: | ||||||||||||||||

| Cash and cash equivalents | $ | 78,753 | $ | - | $ | - | $ | 78,753 | ||||||||

As of December 31, 2014:

| Carrying amount | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Estimated fair value | |||||||||||||

| Financial assets | ||||||||||||||||

| Carried at (amortized) cost: | ||||||||||||||||

| Cash and cash equivalents | $ | 70,107 | $ | - | $ | - | $ | 70,107 | ||||||||

| F-11 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| (u) | Other Comprehensive Income |

The Company’s functional currency is the Renminbi (“RMB”). For financial reporting purposes, RMB were translated into United States Dollars (“USD” or “$”) as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated other comprehensive income”. Gains and losses resulting from foreign currency transactions are included in income.

The Company uses FASB ASC Topic 220, “Reporting Comprehensive Income”. Comprehensive loss is comprised of net loss and all changes to the statements of stockholders’ equity, except for changes in paid-in capital and distributions to stockholders due to investments by stockholders.

| (v) | Business combination |

Business combinations are accounted for under the acquisition method of accounting in accordance with ASC 805, Business Combinations. Under the acquisition method the acquiring entity in a business combination recognizes 100 percent of the acquired assets and assumed liabilities, regardless of the percentage owned, at their estimated fair values as of the date of acquisition. Any excess of the purchase price over the fair value of net assets and other identifiable intangible assets acquired is recorded as goodwill. To the extent the fair value of net assets acquired, including other identifiable assets, exceed the purchase price, a bargain purchase gain is recognized. Assets acquired and liabilities assumed from contingencies must also be recognized at fair value, if the fair value can be determined during the measurement period. Results of operations of an acquired business are included in the statement of earnings from the date of acquisition. Acquisition-related costs, including conversion and restructuring charges, are expensed as incurred.

| (w) | Recent Accounting Pronouncements |

In February 2015, the FASB issued Accounting Standards Update ASU No. 2015-02, “Consolidation” (Topic 810). ASU 2015-02 changes the guidance with respect to the analysis that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. All legal entities are subject to reevaluation under the revised consolidation mode. ASU 2015-02 affects the following areas: (1) Limited partnerships and similar legal entities. (2) Evaluating fees paid to a decision maker or a service provider as a variable interest. (3) The effect of fee arrangements on the primary beneficiary determination. (4) The effect of related parties on the primary beneficiary determination. (5) Certain investment funds. ASU 2015-02 is effective for public business entities for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted, including adoption in an interim period. If an entity early adopts the guidance in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. A reporting entity may apply the amendments in this guidance using a modified retrospective approach by recording a cumulative-effect adjustment to equity as of the beginning of the fiscal year of adoption. A reporting entity also may apply the amendments retrospectively. The adoption of ASU 2015-02 is not expected to have any impact on the Company’s financial statements.

| F-12 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In April 2015, the FASB issued ASU No. 2015-03, “Simplifying the Presentation of Debt Issuance Costs”. The accounting guidance requires that debt issuance costs related to a recognized debt liability be reported on the Statements of Financial Condition as a direct deduction from the carrying amount of that debt liability. The guidance is effective for the Company retrospectively beginning in the first quarter of fiscal 2017 and early adoption is permitted. The adoption of this accounting guidance is not expected to have a material impact on the Company’s financial statements.

In July 2015, the FASB issued ASU 2015-11, “Inventory (Topic 330): Simplifying the Measurement of Inventory,” which applies to inventory that is measured using first-in, first-out (“FIFO”) or average cost. Under the updated guidance, an entity should measure inventory that is within scope at the lower of cost and net realizable value, which is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal and transportation. Subsequent measurement is unchanged for inventory that is measured using last-in, last-out (“LIFO”). This ASU is effective for annual and interim periods beginning after December 15, 2016, and should be applied prospectively with early adoption permitted at the beginning of an interim or annual reporting period. The adoption of this accounting guidance is not expected to have a material impact on the Company’s financial statements.

In September 2015, the FASB issued ASU 2015-16, the guidance eliminates the requirement to restate prior period financial statements for measurement period adjustments following a business combination. The new guidance requires that the cumulative impact of a measurement period adjustment (including the impact on prior periods) be recognized in the reporting period in which the adjustment is identified. The prior period impact of the adjustment should be either presented separately on the face of the income statement or disclosed in the notes. The Company is currently evaluating the impact the pronouncement will have on the Company’s consolidated financial statements.

In November 2015, the Financial Accounting Standards Board issued ASU No. 2015-17, “Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes”. The objective of this Update is to simplify the presentation of deferred income taxes. The amendments in this Update require that deferred assets and liabilities be classified as long-term on the balance sheet instead of separating the deferred taxes into current and noncurrent amounts. For a public entity, the amendments in this Update are effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. Early application is permitted for financial statements that have not been previously issued. The Company believes that this treatment of deferred taxes reduces the complexity of financial reporting while improving the usefulness of the information provided to users of the financial statements. As a result, the Company has elected to early adopt this Update prospectively as of December 31, 2015 and prior periods have not been retrospectively adjusted.

As of December 31, 2015, except for the above, there are no recently issued accounting standards not yet adopted that would have a material effect on the Company’s financial statements.

| (x) | Contingencies |

Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company’s management evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed.

Loss contingencies considered to be remote by management are generally not disclosed unless they involve guarantees, in which case the guarantee would be disclosed.

| F-13 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| 3. | GOING CONCERN UNCERTAINTIES |

These financial statements have been prepared assuming that Company will continue as a going concern, which contemplates the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future.

As of December 31, 2015, the Company had accumulated deficits of $6,164,373 due to the substantial losses in operation in the current year. Management’s plan to support the Company in operations and to maintain its business strategy is to raise funds through public and private offerings and to rely on officers and directors to perform essential functions with minimal compensation. If we do not raise all of the money we need from public or private offerings, we will have to find alternative sources, such as loans or advances from our officers, directors or others. Such additional financing may not become available on acceptable terms and there can be no assurance that any additional financing that the Company does obtain will be sufficient to meet its needs in the long term. Even if the Company is able to obtain additional financing, it may contain undue restrictions on our operations, in the case of debt financing, or cause substantial dilution for our stockholders, in the case of equity financing. If we require additional cash and cannot raise it, we will either have to suspend operations or cease business entirely.

The accompanying financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern.

| 4. | GOODWILL |

Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable assets acquired in a business combination. In accordance with FASB ASC Topic 350, “Goodwill and Other Intangible Assets”, goodwill is no longer subject to amortization. Rather, goodwill is subject to at least an annual assessment for impairment, applying a fair-value based test. Fair value is generally determined using a discounted cash flow analysis.

On February 16, 2015, the Company, through Guangzhou Image, entered into an equity transfer agreement to acquire 100% of Yunnan Image. As of December 31, 2014, the net assets of Yunnan Image were USD 166,022. The purchase consideration was USD 489,515 (equivalent to RMB 3,000,000), which resulted in goodwill of USD 323,493.

| December 31, 2015 | December 31, 2014 | |||||||

| Yunnan Image | $ | 323,493 | $ | 323,493 | ||||

| Less: Impairment loss | (323,493 | ) | - | |||||

| Total goodwill | $ | - | $ | 323,493 | ||||

The Company reviews the carrying value of the goodwill for impairment regularly. For the year ended December 31, 2015, the Company reviewed the carrying value of its goodwill and provided an impairment for such goodwill since the acquisition of Yunnan Image has not generated positive cash flow.

| F-14 |

IMAGE CHAIN GROUP LIMITED, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| 5. | OTHER RECEIVABLES |

| December 31, 2015 | December 31, 2014 | |||||||

| Other receivables | $ | 2,911,361 | $ | 625,055 | ||||

| Less: Allowance for doubtful accounts | (442,823 | ) | (457,850 | ) | ||||

| Other receivables, net | $ | 2,468,538 | $ | 167,205 | ||||

| 6. | INVENTORIES |

| December 31, 2015 | December 31, 2014 | |||||||

| Raw materials | $ | 169,397 | $ | - | ||||

| Packing materials | 14,344 | 36,075 | ||||||

| Finished goods | 264,231 | - | ||||||

| $ | 447,972 | $ | 36,075 | |||||

| 7. | PROPERTY, PLANT AND EQUIPMENT |

Property, plant and equipment consisted of the following:

| December 31, 2015 | December 31, 2014 | |||||||

| Building | $ | 19,561 | $ | 20,684 | ||||

| Motor vehicle | 230,188 | 32,416 | ||||||

| Plant and equipment | $ | 17,890 | $ | 4,005 | ||||

| 267,649 | 57,105 | |||||||

| Less: Accumulated depreciation | (35,459 | ) | (5,925 | ) | ||||

| $ | 232,180 | $ | 51,180 | |||||

Depreciation expense for the years ended December 31, 2015 and 2014 was $30,385 and $5,869, respectively.

| 8. | INCOME TAX |

The Company is subject to US Income taxes.

The Company’s subsidiary Fortune Delight Holdings Group Limited was incorporated in the British Virgin Islands. The British Virgin Islands is an income tax free jurisdiction.