Attached files

| file | filename |

|---|---|

| EX-3.2 - EXHIBIT 3.2 - Fenix Parts, Inc. | fenx-20151231ex32.htm |

| EX-32 - EXHIBIT 32 - Fenix Parts, Inc. | fenx-20151231xex32.htm |

| EX-23 - EXHIBIT 23 - Fenix Parts, Inc. | fenx-20151231xex23.htm |

| EX-10.3 - EXHIBIT 10.3 - Fenix Parts, Inc. | fenx-20151231xex103.htm |

| EX-10.5 - EXHIBIT 10.5 - Fenix Parts, Inc. | fenx-20151231xex105.htm |

| EX-10.6 - EXHIBIT 10.6 - Fenix Parts, Inc. | fenx-20151231xex106.htm |

| EX-31.1 - EXHIBIT 31.1 - Fenix Parts, Inc. | fenx-20151231xex311.htm |

| EX-10.7 - EXHIBIT 10.7 - Fenix Parts, Inc. | fenx-20151231xex107.htm |

| EX-31.2 - EXHIBIT 31.2 - Fenix Parts, Inc. | fenx-20151231xex312.htm |

| EX-10.8 - EXHIBIT 10.8 - Fenix Parts, Inc. | fenx-20151231xex108.htm |

| EX-21.1 - EXHIBIT 21.1 - Fenix Parts, Inc. | fenx-20151231xex211.htm |

| EX-10.4 - EXHIBIT 10.4 - Fenix Parts, Inc. | fenx-20151231xex104.htm |

| EX-10.2 - EXHIBIT 10.2 - Fenix Parts, Inc. | fenx-20151231xex102.htm |

| EX-10.57 - EXHIBIT 10.57 - Fenix Parts, Inc. | fenx-20151231xex1057.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________

FORM 10-K

_______________________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 001-37382

_______________________________________

FENIX PARTS, INC.

(Exact name of Registrant as specified in its charter)

_______________________________________

Delaware | 46-4421625 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. ID) | |

One Westbrook Corporate Center, Suite 920 Westchester, Illinois | 60154 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 708-407-7200

_______________________________________

Title of Each Class | Name of each exchange on which registered | |

Common Stock, par value $.001 per share | NASDAQ Global Market | |

Securities registered pursuant to Section 12(g) of the Act: None

________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2015, the aggregate market value of common stock outstanding held by stockholders who were not affiliates of the registrant was approximately $100 million (based on the closing sale price on the NASDAQ Global Market on such date).

The number of outstanding shares of the registrant's common stock as of April 14, 2016 was 19,926,868.

Documents Incorporated by Reference

Portions of the registrant's proxy statement for the 2016 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days after the registrant’s fiscal year ended December 31, 2015, are incorporated by reference in Part III of this Form 10-K .

TABLE OF CONTENTS

Page No. | ||

3

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “trends,” “plans,” “estimates,” “projects” or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions. All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. These forward-looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from expected or projected results, performance or achievements expressed or implied by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors, and, of course, it is impossible to anticipate all factors that could affect our actual results. Some of these risks, uncertainties, and other factors are set forth elsewhere in this Annual Report on Form 10-K and in other documents we have filed with the SEC and include, among other things:

• | Our relatively short operating history and our ability to successfully integrate into one entity our operating subsidiaries ("Subsidiaries"), and those subsidiaries we may acquire; |

• | Our ability to successfully locate and acquire additional businesses that provide recycled OEM automotive products and our ability to successfully integrate acquired companies with our business; |

• | Our success in managing internal growth; |

• | Variations in the number of vehicles sold, vehicle accident rates, miles driven and the age of vehicles in accidents; |

• | Competition from vehicle replacement part companies, including but not limited to those that provide recycled parts; |

• | Our ability to maintain our relationships with auto body shops, insurers, other customers and with auction companies from which we purchase our salvage vehicles; |

• | Our compliance and our Subsidiaries' past compliance with environmental laws and regulations and federal, state and local operating and permitting requirements; |

• | The known environmental liabilities at our Toronto, Ontario facility associated with groundwater and surface water contamination as a result of historical releases and a petroleum hydrocarbon spill in November 2010; |

• | Potential for significant impairment of goodwill and intangibles; |

• | Fluctuations in the prices of scrap metal and other metals; |

• | Changes in the exchange rate for the Canadian Dollar |

• | Changes in the national, provincial or state laws and regulations affecting our business; |

• | Disruptions in the information technology systems on which our business relies; |

• | Our ability to satisfy our debt obligations and to operate in compliance with our financing agreements; |

• | Material weaknesses in our internal control over financial reporting; and |

• | Other factors discussed under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”. |

Given these risks and uncertainties, you are cautioned not to place undue reliance on our forward-looking statements. Projections and other forward-looking statements included in this filing have been prepared based on assumptions, which we believe to be reasonable, but not in accordance with GAAP or any guidelines of the SEC. Actual results may vary, perhaps materially. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Any such forward-looking statements, whether made in this Annual Report on Form 10-K or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed above. For further discussion of these and other factors that could impact our future results, performance or transactions, please carefully read “Risk Factors.”

4

ITEM 1. BUSINESS

As used in this Annual Report on Form 10-K, references to “Fenix” refer to Fenix Parts, Inc. solely, and references to the “Company,” “our”, “we”, “us” and similar terms refer to Fenix Parts, Inc., together with our Subsidiaries, as defined below.

OVERVIEW

We are in the business of auto recycling, which is the recovery and resale of original equipment manufacturer (“OEM”) parts, components and systems, (referred to as “products”) such as engines, transmissions, radiators, trunks, lamps and seats reclaimed from damaged, totaled or low value vehicles. We purchase our vehicles primarily at auto salvage auctions. Upon receipt of vehicles, we inventory and then dismantle the vehicles and sell the recycled components. Our customers include collision repair shops (body shops), mechanical repair shops, auto dealerships and individual retail customers. We also generate a portion of our revenue from the sale as scrap of the unusable parts and materials, from the sale of used cars and motorcycles, the sale of aftermarket parts, and from the sale of extended warranty contracts.

We provide customers with high quality recycled OEM products, extensive inventory and product availability, responsive customer service and fast delivery. We operate a hub and spoke distribution network allowing us to efficiently move products among our locations and expedite delivery to our customers. We distribute a variety of products to collision and mechanical repair shops, including recycled OEM products, as well as aftermarket, refurbished and remanufactured parts. Collectively, we refer to these products as alternative parts because they are not new OEM products.

History

Fenix was founded on January 2, 2014 to acquire and combine companies in the automobile recycling and resale industry. Fenix Parts Canada, Inc. (“Fenix Canada”), a wholly-owned subsidiary of Fenix, was established on September 24, 2014 primarily to facilitate the acquisition and combination of companies in the automobile recycling and resale industry in Canada. Through November 2014, Fenix and Fenix Canada entered into Combination Agreements to acquire (in transactions referred to as the “Combinations”) eleven corporate entities that operate eight businesses (the “Founding Companies”), contingent upon, among other things, the closing of an initial public offering (“IPO”). On May 19, 2015, Fenix completed the IPO and closed on the Combinations with the Founding Companies, including those Founding Companies that are designated as accounting co-predecessors, Don’s Automotive Mall, Inc., Gary’s U-Pull It, Inc., and Horseheads Automotive Recycling, Inc. (collectively, the “Beagell Group”); and Standard Auto Wreckers Inc., End of Life Vehicles Inc., Goldy Metals Incorporated, and Goldy Metals (Ottawa) Incorporated (collectively, “Standard”). The aggregate consideration paid by Fenix in the Combinations (the "Combination Consideration") is detailed in Note 3, Business Combinations, to the consolidated financial statements in this document. Fenix raised the cash portion of the Combination Consideration in its IPO as well as from additional funding from indebtedness. The operations of the Founding Companies are reflected in the consolidated statements of operations from the date of acquisition on May 19, 2015 to December 31, 2015. During the third quarter and fourth quarter of 2015, Fenix acquired three additional automobile recycling companies ("Subsequent Acquisitions"). Our Founding Companies and Subsequent Acquisitions represent our operating subsidiaries ("Subsidiaries"). These are also reflected in the consolidated statements of operations from their respective dates of acquisition to December 31, 2015.

Products

The recycled OEM products that we sell include mechanical parts used to repair or replace worn or damaged components, such as engines and transmissions, and collision repair parts used to repair vehicles typically involved in a collision, such as door assemblies, trunk lids, lights, fenders and other products. These products are “insurance quality,” which means of a quality that is acceptable for use in a repair paid for by an insurance company. Many consumers and repair facilities use recycled OEM products because they are less expensive than new OEM products and are perceived to be of higher quality and fit than products made by non-OEM manufacturers, known as aftermarket products. Recycled OEM products often are sold as assemblies, which shorten repair times and help reduce labor costs. In addition, insurance companies are increasingly influencing repair facilities to use recycled OEM products as a lower cost alternative to new OEM products.

Typically, damaged, totaled or low value vehicles acquired by insurance companies are resold through auto salvage auctions. Some insurance companies mandate that recycled OEM products be no older than the vehicle they are used to repair; thus, the majority of the vehicles we acquire are not more than ten years old. We employ software-based inventory management systems to determine what vehicles to purchase and at what price, based upon our estimation of the demand for the products on the vehicle, the prices we can obtain for those products and the final scrap value of the vehicle.

5

Customers

Our customers include collision and mechanical repair shops, auto dealerships and individual retail customers. Competition for sales is based primarily on product availability, delivery times and price. Our ability to deliver insurance quality recycled OEM products on a same or next day basis is a critical service requirement of our customers. Customers can find and purchase our parts in many ways including searching our websites, by telephone (speaking with one of our sales professionals) or in-person at one of our fulfillment centers. We apply a coordinated regional approach to our inventory management and distribution activities, which allows us to increase the availability of our products and efficiently meet demand within the markets we serve. In 2015, we sold products to more than 12,000 customers. For the year ended December 31, 2015, there were no significant customers that accounted for more than 10% of total revenues.

Industry

The Auto Care Association (“ACA”) estimates that the U.S. automotive aftermarket was approximately $255 billion in 2015. We operate in the U.S. collision and mechanical repair products market, a subset of the U.S. automotive aftermarket. According to ACA, the U.S. collision and mechanical repair products market was approximately $63 billion in 2015.

The automotive recycling industry is highly fragmented, with few multi-facility operators. According to the Automotive Recyclers Association (“ARA”), there are an estimated 9,000 vehicle recycling facilities in the United States and Canada. We believe that there is only one direct competitor with more than 1% market share within the automotive recycling industry. We believe this competitor has less than 10% market share.

The automotive recycling industry obtains its insurance quality recycled OEM products from damaged, totaled or low value vehicles purchased at salvage auctions. In 2015, there were over 300 salvage auctions in the U.S. and Canada at which over 2.5 million damaged, totaled or low value vehicles were sold on behalf of automobile insurance companies and other sellers to licensed buyers, such as the Company.

The industry’s direct customers are collision and mechanical repair shops that use recycled OEM products in vehicle repairs. The industry also indirectly serves insurance companies as they pay for the majority of repairs to insured vehicles and thus have significant influence over the repair process. As insurance companies seek more cost effective repair solutions, collision repair shops are utilizing more recycled OEM products due to their attractive value proposition. Presently, many major U.S. insurance companies are encouraging collision repair shops to reduce costs, thus influencing them to utilize recycled OEM products in the repair of damaged vehicles.

In addition, automotive recycling is considered environmentally responsible, as more than 85% by weight of the materials from processed vehicles are typically reclaimed or recycled. We also believe that many environmentally conscious consumers will prefer a recycled product and over time government regulation will continue to favor environmentally friendly solutions.

Competition

Buyers of vehicle replacement products have the option to purchase from primarily five sources: new products produced by OEM's; new products produced by companies other than the OEMs, which are commonly referred to as aftermarket products; recycled OEM products produced by automobile recyclers obtained from salvage vehicles; used automotive products that have been refurbished; and used automotive products that have been remanufactured. We view all suppliers of vehicle replacement products as our competitors. While we compete with all parts suppliers, there are few automobile recyclers with regional distribution networks like Fenix’s that can reach the majority of customers within the optimum delivery time. We have begun to distinguish ourselves from other suppliers primarily through our broad recycled OEM product selection, which encompasses popular and hard-to-find items or products, our distribution network, and stock management systems, as well as through our service. We compete on the basis of product breadth and depth, rapid and dependable delivery, marketing initiatives, support services, and price.

COMPETITIVE STRENGTHS

Favorable Industry Dynamics

We believe that demand for recycled OEM products is highly stable and marked by consistent long-term growth due to a number of favorable trends, including the number of vehicles on the road (commonly referred to as the “car parc”), the increasing miles driven and the number and age of drivers. Additionally, we believe the utilization of recycled OEM products over the last decade has continued to increase given the inherent favorable pricing and product availability of recycled OEM products relative to other replacement products.

6

Competitive Market Position

We believe that we operate the second largest network of automotive recycling companies in the eastern region of North America (U.S. and Canada) with twelve full-service and four self-service recycling locations, two of which are co-located at existing full-service facilities. We believe the strength of our regional network, our customer relationships and our extensive inventory of insurance quality recycled OEM automotive products give us a competitive advantage and create high barriers to entry.

Extensive Inventory and Distribution Platform with Broad Customer Reach

Our extensive inventory of insurance quality recycled OEM automotive products and our distribution infrastructure give us the ability to help our customers reduce repair cycle time by delivering our products typically the same or next day. In order to increase the availability of our products, we maintain an extensive inventory and have developed a coordinated regional approach to inventory management and distribution. Our network enables us to reach three of the ten largest cities in North America by population. This customer base exceeds 12,000 customers with no one customer accounting for more than 3% of our consolidated revenue in 2015.

Dynamic Vehicle Procurement Process

A critical component of our success and growth is our ability to identify and value the products that can be recycled from a salvage vehicle. We have developed a scalable, data-driven approach, utilizing real-time sales and inventory information, which allows us to procure vehicles in a cost-efficient manner, optimize the dismantling process and profitably sell these products to our customers.

Deep Industry Expertise

We benefit from the industry expertise and deep customer relationships that have been established at the Subsidiaries over the course of their history as standalone businesses. Our key management personnel at most of the Subsidiaries have served an average of 20 years in the automotive recycling industry and many have held senior leadership positions in key industry trade groups, such as the ARA.

Experienced Management Team

Our senior management has significant experience operating and growing automotive and logistics-based businesses. Prior to joining Fenix, our Chief Executive Officer, Kent Robertson, held several senior leadership positions at Stericycle, Inc. (“Stericycle”), a national reverse logistics and regulated waste management company. Mr. Robertson had more than 20 years of experience managing multi-line decentralized distribution and services businesses at Stericycle and at American Medical Disposal, Inc., a company he co-founded in 1990, which was acquired by Stericycle in 2001. Under Mr. Robertson’s leadership, Stericycle successfully acquired and integrated over 70 acquisitions. Our Chief Financial Officer, Scott Pettit, has significant automotive industry, public company, acquisition and integration experience, including serving from 2001 to 2007 as the Chief Financial Officer of Insurance Auto Auctions, Inc. Our Executive Vice President, David Gold, was the President and is the former co-owner of Standard Auto Wreckers, Inc., one of our Subsidiaries. A third-generation automobile recycler, Mr. Gold has over 20 years’ experience in our industry and is the President-elect of the ARA. Our Chief Operating Officer, Art Golden, has nearly 30 years' experience in various leadership roles, including; logistics, planning, warehousing, and field operations. Prior to joining Fenix, Mr. Golden served for 22 years at Stericycle most recently as Area Director of Operations, where he was responsible for overseeing operations in the northeastern region of the U.S. Our Executive Vice President, Supply Chain, John Blaseos, has over 16 years' experience in continuous improvement and supply chain. Most recently with Stericycle, Mr. Blaseos will lead vehicle purchasing, transportation and logistics, pricing and process improvement.

Attractive Financial Model

We believe our highly variable cost structure, low requirements for capital expenditures (in 2015, our maintenance capital expenditures were less than 1% of revenues) and the stability of the collision and mechanical repair products market combine to give our business the potential to deliver strong results through a variety of business cycles. We believe that these factors will allow us to produce significant free cash flow and enable us to continue to fund our growth.

Organizational Structure

We operate on a decentralized basis with an emphasis on regional and local market execution supported by corporate coordination. Local management teams operate the businesses and leverage their relationships with customers and suppliers. At the same time, certain administrative functions are centralized on a regional and, in certain circumstances, a national basis, including but not limited to corporate strategy and acquisitions, accounting and related functions, marketing, human resources, information technology and systems support and environmental compliance.

7

STRATEGY

We believe that execution of our business strategies will allow us to grow our business and enhance shareholder value:

Enhance and Build our Network through Acquisitions

The acquisition of other OEM automotive products recycling businesses is a key element of our strategy. This will increase our customer base, grow our distribution network and expand our inventory and warehouse capacity. There are currently an estimated 9,000 facilities in the automotive recycling industry, and we believe an ample number of attractive acquisition candidates. Since our initial public offering and the acquisition of the Founding Companies, we have acquired three businesses operating in geographic areas that fit within our strategic growth plan. We use a disciplined approach to identify and evaluate acquisition candidates and intend to pursue acquisitions to increase customer and route density within our network and expand into new geographic markets.

Organically Grow Market Share and Unit Volume

We have identified initiatives to increase vehicle processing throughput, inventory and product availability, thereby growing revenue, volume and market share. These initiatives include:

• | Expand Dismantling Capacity. We operate 67 dismantling bays within our full-service auto recycling facilities. We plan to add dismantling bays within our current facility structure to support inventory demand with minimal capital expense or regulatory involvement. We can also add shifts to increase dismantling utilization. We believe these initiatives will help us increase dismantling capacity and productivity, thereby increasing inventory and product availability. |

• | Develop an Integrated Technology Platform. We currently utilize third-party software solutions to support our business. We believe this software is sufficient for our current needs, but we are working to implement an integrated technology platform to support our future growth. We believe that any associated cost would be offset through improvements in salvage vehicle procurement, production management, part pricing, inventory management, marketing, sales, logistics and compliance. |

• | Enhance Sales Force Effectiveness. We maintain our sales specialists in their local markets to preserve high levels of service and existing customer relationships. We continue to provide our sales force with enhanced training and additional resources to reach new markets and customers. |

• | Expand our Logistics Capacity. We continue to expand our logistics capacity to meet the delivery expectations of our customers (typically the same or next day). We may invest in additional infrastructure, including trucks, employees or transfer hubs, to expand in existing markets and into adjacent markets. |

Increase our Margins and Enhance Operating Efficiencies

We have identified certain best practices among our Subsidiaries that improve salvage vehicle procurement and dismantling, enhance product delivery and maximize the value of end-of-life vehicles. We have begun to implement these best practices across our network to improve our operating margins and those of any subsequently acquired businesses. Further, we believe an integrated operating platform within geographic areas creates opportunities for economies of scale as we grow.

INTELLECTUAL PROPERTY

We own various trade names as a result of the acquisitions of the Subsidiaries. We do not believe that our business is materially dependent on any single or group of related trade names.

EMPLOYEES

As of December 31, 2015, the Company had approximately 651 employees at our recycled parts facilities and approximately 14 employees at our corporate headquarters. We enjoy good relations with our employees and are not party to any labor management agreement.

RELATED PARTIES

Please refer to Note 10, Related Party Transactions, to the consolidated financial statements in this document for information about our related parties and corresponding transactions with them. Additionally, see the more detailed information relating to this subject under the caption “Certain Relationships and Related Transactions” in our definitive Proxy Statement to be distributed in connection with our 2016 Annual Meeting of Shareholders.

8

FACILITIES

We lease an office building in Westchester, Illinois, which serves as our corporate headquarters. This facility will meet our growth requirements for the foreseeable future.

We have twelve full-service recycling facilities, concentrated in the Northeastern and Southeastern United States and Southeastern Canada. These locations include Bayville, NJ, Binghamton, NY, Forest City, NC, Greensboro, NC, Niagara Falls, NY, Pennsburg, PA, Rahway, NJ, Ottawa, Ontario, Port Hope, Ontario, Queensbury, NY, Watertown, NY, and Jacksonville, FL. Our full-service recycling facilities have a total of 67 bays for dismantling of vehicles and approximately 567,000 square feet of indoor warehouse space and approximately 235 acres of total storage. Our facilities employ state-of-the art environmental systems for removing fluids prior to dismantling. We have four self-service locations, two of which are co-located with full-service facilities. Our self-service locations are in Binghamton, NY, Elmira, NY, Ottawa, Ontario and Scarborough, Ontario. At these locations, we allow retail customers to directly dismantle, recover and purchase recycled OEM products. Our self-service recycling facilities have approximately 62,000 square feet of indoor storage space and are situated on approximately 46 acres.

9

ITEM 1A. RISK FACTORS

Risks Relating to Our Business

We have limited combined operating history, and there are risks associated with the acquisition of our Subsidiaries that could adversely affect the results of our operations.

We were founded in January 2014, and we combined with each of our Founding Companies simultaneously with, and as a condition to, the sale of the shares in our initial public offering in May 2015. Since that time, we have acquired three additional subsidiaries. While we have operated as a combined business with the Subsidiaries since each of their acquisitions, there can be no assurance that we will be able to fully integrate the operations of our Subsidiaries successfully or to institute the necessary systems and procedures, including accounting and financial reporting systems, to manage the combined enterprise on a profitable basis and to report the results of operations of the combined entities on a timely basis. In addition, there can be no assurance that our management team will be able to successfully manage the combined entity and effectively implement our operating or growth strategies. Our success will depend on management’s ability to integrate our current Subsidiaries and any companies we may acquire in the future into one organization. Our inability to successfully integrate the companies we acquire and to coordinate and integrate certain operational, administrative, financial and information technology systems would have a material adverse effect on our financial condition and results of operations.

If our efforts to locate and attract desirable companies in the business of providing recycled OEM automotive products are not successful or if we are unable to acquire desirable companies on commercially reasonable terms, our growth prospects will be adversely affected.

One of our principal growth strategies is to increase our revenue through the acquisition of additional businesses within our industry. We face competition in our pursuit to acquire additional businesses, which limits the number of available companies for sale and may lead to higher acquisition prices. When we identify desirable companies, their owners may not be willing to sell their companies at all or on terms that we have determined to be commercially reasonable. If our efforts to locate and acquire desirable companies are not successful, our growth prospects will be adversely affected.

Our ability to acquire additional businesses may require financing that we are unable to obtain or to obtain on acceptable terms.

The timing, size and success of our acquisition efforts and the associated capital commitments cannot be readily predicted. We have used and intend to continue to use our cash and common stock as consideration for future acquisitions of companies. If our common stock does not maintain a sufficient market value or potential acquisition candidates are unwilling to accept common stock as part of the consideration for the sale of their businesses, we may be required to utilize more of our cash resources, including obtaining additional capital through our existing line of credit or through alternative financing. However, there can be no assurance that our line of credit will have available or adequate capacity to support our acquisition strategy or we will be able to obtain financing if and when it is needed or that it will be available on terms that we deem acceptable. Under our credit facility, permitted acquisitions are subject to bank review and our meeting certain financial ratios, after giving effect to such acquisition. We believe that our cash and cash equivalents, cash provided by operating activities and funds available from bank borrowings are not likely to be sufficient for future acquisitions, and that we may need to raise additional funds through public or private financing, or other arrangements. There can be no assurance that additional funding, or refinancing of our credit facility, if needed, will be available on terms attractive to us, or at all. Furthermore, any additional equity financing may be dilutive to stockholders, and debt financing, if available, may be costly and involve further restrictive covenants. Failure to raise capital if and when needed could have a material adverse impact on our acquisition strategy and on our business, operating results, and financial condition.

We may not be able to successfully integrate future acquisitions or generate sufficient revenues from future acquisitions, which could cause our business to suffer.

Assuming that we are able to finance the acquisition of a company or a division of a company, there can be no assurance that we will be able to profitably manage such business or successfully integrate such business without substantial costs, delays or other operational or financial problems. There can be no assurance that the businesses we may acquire in the future will achieve anticipated revenues and earnings. Additionally:

• | the key personnel of an acquired business may decide not to work for us; |

• | changes in management at an acquired business may impair its relationships with employees and customers; |

• | we may be unable to maintain uniform standards, controls, procedures and policies among acquired businesses; |

10

• | we may be held liable for environmental risks and liabilities as a result of our acquisitions, some of which we may not have discovered during our due diligence; |

• | our ongoing business may be disrupted or receive insufficient management attention; and |

• | we may not be able to realize the cost savings or other financial benefits we anticipated. |

Some or all of these factors could have a material adverse effect on our business, financial condition and results of operations.

If we are not able to manage our internal growth, the results of our operations will be adversely affected.

We will attempt to grow our revenues through internal growth as well as through acquisitions. There can be no assurance that our systems, procedures and controls will be adequate to support our operations as they expand. Any future growth will also impose significant additional responsibilities on members of experienced management. Furthermore, as we grow, our ability to increase productivity and profitability will be limited by our ability to employ, train and retain skilled personnel to handle critical tasks within our operations and provide services to our customers and partners. There can be no assurance that we will be able to maintain an adequate skilled labor force necessary to operate efficiently or that our labor expenses will not increase as a result of a shortage in the supply of skilled personnel. To the extent that we are unable to manage our growth efficiently and effectively, or are unable to attract and retain skilled personnel, our financial condition and results of operations will be materially adversely affected.

If the number of vehicles involved in accidents declines or the number of cars being repaired declines, our business could suffer.

Our business depends on vehicle accidents and mechanical failures for both the demand for repairs using our products and the supply of recycled, remanufactured and refurbished parts. The number and/or severity of accidents and mechanical failures is influenced by factors including, but not limited to, the number of vehicles on the road, the number of miles driven, the ages of drivers, the occurrence and severity of certain weather conditions, the congestion of traffic, the use of cellular telephones and other electronic equipment by drivers, the use of alcohol and drugs by drivers, the effectiveness and extent of adoption of accident avoidance systems in newer vehicles, the reliability of new OEM parts, and the condition of roadways. Increases in fuel prices may cause the number of vehicles on the road, the number of miles driven, and the need for mechanical repairs and maintenance to decline, as motorists seek alternative transportation options. Mild weather conditions, particularly during winter months, tend to result in a decrease in vehicle accidents. Additionally, a number of states and municipalities have adopted, or are considering adopting, legislation banning the use of handheld cellular telephones or other electronic devices while driving, and such restrictions could lead to a decline in accidents.

Systems designed to help drivers avoid accidents, including but not limited to impact warning or avoidance systems, lane and vehicle recognition systems and driverless vehicle guidance systems are becoming more prevalent and more technologically sophisticated. To the extent manufacturers install or are mandated by law to install accident avoidance systems in their vehicles, the number and severity of accidents could decrease, which could have a material adverse effect on our business.

We depend upon the services of our management team.

Our success depends, in part, upon the continuing contributions of our executive officers and key employees at the management level. This includes, in part, continuing efforts from many of the executives and managers of the current Subsidiaries, whose reputations and client relationships have contributed significantly to the success of those companies. Although we have employment and noncompetition agreements with certain of our key executive officers and managers, there is no guarantee that they will not leave. The loss of the services of any of our executive officers or managers, or our failure to attract other executive officers or managers could have a material adverse effect on our business or our business prospects. If we lose the services of any of our key employees at the operating or regional level, we may not be able to replace them with similarly qualified personnel, which could harm our business.

We face intense competition from local, regional, national and internet-based automotive products providers, and this competition could negatively affect our business.

The recycled vehicle replacement parts and automotive recycling industries are highly competitive and are served by local owner-operated companies, several large regional companies and internet-based parts providers. Additionally, in certain regions of the country where we operate, local automotive recycling companies have formed cooperative inventory sharing programs. We currently participate in certain of these programs, but may elect not to in the future, and as a public company, we may not qualify to participate in certain of them. One such cooperative disqualified us from participation because our Subsidiaries were no longer independently owned. We could also face additional competition in the future from others entering the market, such as OEMs,

11

insurance companies, new parts producers other than OEMs, sometimes referred to as “aftermarket” suppliers, and industry consolidators. Some of our current and potential competitors may have more operational expertise and greater financial, technical, manufacturing, distribution and other resources, longer operating histories, lower cost structures and better key relationships in the insurance and automotive industries. As a result, they may be able to provide products that we are unable to supply, sell their products at lower costs or serve customers we are unable to serve.

If we fail to maintain or adequately replace our relationships with auto body shops, insurers and other customers, through which we make a significant portion of our revenue, our revenue will be adversely affected.

The majority of our products and services are sold to collision repair shops, also known as body shops, and mechanical repair shops. Additionally, we indirectly rely on insurance companies to help drive demand, as insurance companies are increasingly influencing repair facilities to use recycled OEM products as a lower cost alternative to new OEM products. We also generate a portion of our revenue from scrap sales to metal recyclers. If we are not able to continue our current or similar arrangements with these body shops, mechanical repair shops, insurers and scrap metal recyclers, the volume of our sales, revenue and profitability will be materially adversely affected.

An adverse change in our relationships with auction companies could increase our expenses and hurt our relationships with our customers.

Our inventory primarily consists of vehicles offered at salvage auctions operated by companies that own auction facilities in numerous locations across the U.S. We do not typically have contracts with these auction companies. A small number of companies control a large percentage of the salvage auction market in the U.S. and Canada. We acquire substantially all of our salvage autos from two of these auction companies. If either of these companies prohibited us from participating in its auctions, began competing with us, or significantly raised its fees, our business could be adversely affected through higher costs or the resulting potential inability to service our customers. Moreover, we face competition in the purchase of vehicles from direct competitors, rebuilders, exporters and others.

We are subject to environmental regulations and incur costs relating to environmental matters.

Our operations, both in the U.S. and Canada, are subject to national, state, provincial and local environmental, health and safety laws and regulations governing, among other things:

• | the emission and discharge of wastes, chemicals, contaminants and other hazardous materials into the ground, air, or water; |

• | the exposure to hazardous materials; and |

• | the generation, handling, storage, use, treatment, identification, reporting, record-keeping, transportation and disposal of industrial by-products, waste water, storm water, solid and hazardous wastes, petroleum products and hazardous materials. |

We are in the process of implementing environmental management systems that are designed to facilitate and support our compliance with these requirements and to address current outstanding environmental and operating permit issues. However, if we violate or fail to comply with these laws or regulations we could be fined or otherwise sanctioned by regulators.

Contamination resulting from vehicle recycling processes can include air, soil, surface water and ground water contamination from the release, storage, transportation, or disposal of motor oil, gasoline, or other petroleum products, antifreeze, transmission fluid, waste solvents, chlorofluorocarbons from air conditioners, other hazardous materials, or metals such as aluminum, cadmium, chromium, lead and mercury. Contamination can migrate on-site or off-site which can increase the risk and the amount of any potential liability.

In connection with the acquisition of our current Subsidiaries and other future acquisitions, we may assume the liabilities of the companies we acquire. Contamination at properties owned or operated by the Subsidiaries or companies we acquire in the future may result in liability for us under environmental laws and regulations for the full amount of assessment and remediation-related costs, including those for the investigation and cleanup of contaminated soil, surface water and ground water, building contamination, and impacts to human health, and damages to natural resources. Under certain environmental laws, including but not limited to the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, we and our directors and officers could be held responsible for all of the costs relating to any contamination at, or migrating to or from, the Subsidiaries’ or any newly acquired company’s past or present facilities and at third-party waste disposal sites. These laws often impose liability even if the owner or operator did not know of, or was not responsible for causing, any such contamination. The costs of complying

12

with environmental laws and regulations and any claims concerning noncompliance or liability with respect to contamination in the future could have a material adverse effect on our financial condition or operating results.

Environmental laws are complex, change frequently and have tended to become more stringent over time. Significant capital and operating costs may be incurred at any time to keep our operations in compliance with environmental, health and safety laws and regulations. If it is not economical to make those expenditures, or if we violate any of these laws and regulations, it may be necessary to restrict or modify our operations, which could have a material adverse effect on our business, financial condition and results of operations.

One of our Subsidiaries is the subject of environmental claims.

Groundwater and surface water contamination has been detected at the facility in Toronto, Ontario that we acquired as lessee when we acquired the assets of Goldy Metals Incorporated ("GMI"), as a result of historical releases and a petroleum hydrocarbon spill in November 2010. Since November 2010, the Ontario Ministry of the Environment issued a series of regulatory orders under Ontario’s Environmental Protection Act that required the owner of GMI to investigate and remediate all areas that were contaminated by the spill and to take protective and remedial actions related to its property and operations as well as adjacent areas. We believe GMI has been and is taking necessary steps to remediate the surface water and groundwater contamination. Furthermore, we did not assume this liability and GMI, its shareholder and certain affiliates have agreed to indemnify us for a period of three years from the date of Combination against any liability that may be imposed on us as a result of this contamination. However, as the successor to GMI’s business and lessee of the facility, we may become legally responsible for this liability, and we and our directors and officers may be responsible under national and provincial laws and regulations for the assessment, delineation, control, clean-up, remediation, monitoring and verification of, or as a result of, any environmental contamination at that site and any affected off-site areas. The owner of GMI and certain of its affiliates have agreed, pursuant to the Combination Agreements, to continue to be responsible for the costs of an additional storm water management, control and discharge system following the completion of the Combinations. However, there can be no assurance that the owner of GMI or its affiliates will perform their obligations under such agreements and their failure to perform would require us to undertake these environmental obligations.

The site and operations in Toronto have been operating since the 1960s. During the last decade, the surrounding parkland and agricultural area, as well as the site itself, have been designated part of a new federal urban park. Accordingly, there has been continual governmental, quasi-governmental, and non-governmental body environmental oversight and intervention, including various enforcement initiatives. We anticipate that this will continue.

The Province of Ontario has filed a civil lawsuit against GMI and the owner of the land on which the Toronto, Ontario facility is located claiming damages of Canadian Dollars ("CAD") $10.5 million plus pre- and post-judgment interest and court costs, for alleged historical and spill-related contamination as well as for alleged property encroachment damage. The lawsuit is currently in the pre-discovery stage. We did not assume this liability, and GMI, its owner and certain affiliates have agreed to indemnify us, subject to certain limits as defined in the Combination agreements, for a period of three years from the date of Combination against any liability that may be imposed on us as a result of this liability. However, we may become legally responsible for this liability as the successor to GMI’s business and lessee of the facility. We cannot assure you that we will not become responsible for this liability, or that GMI and its owner or their affiliates will have the capacity to indemnify us in the event we become responsible for this liability in whole or in part. Our responsibility for this liability in whole or in significant part could have a material adverse effect on our results of operations and financial position.

Prior to the Combinations, GMI was also charged by the Province of Ontario for causing or permitting an oil spill in Toronto which allegedly impaired a nearby creek. This matter was settled through a guilty plea on consent, with GMI paying a penalty of CAD $94,000. A future charge and conviction under the same or other environmental statute in Ontario could result in the imposition of a minimum fine of CAD $100,000 per day plus a 25% surcharge, up to a maximum of CAD $10 million. We did not assume this liability, and GMI, its owner and certain affiliates have agreed to indemnify us for a period of three years from the date of Combination against any liability that may be imposed on us as a result of this liability. However, we may become legally responsible for this liability as the successor to GMI’s business and lessee of the facility. We cannot assure you that we will not become responsible for this liability, or that GMI, and its shareholder or their affiliates will have the capacity to indemnify us in the event we become responsible for this liability in whole or in part. Our responsibility for this liability in whole or in significant part could have a material adverse effect on our results of operations and financial position.

GMI is also the subject of further regulatory orders relating to sedimentation monitoring and control in the creek, rehabilitating the creek area that was diverted in 2011 as well as assessing, preventing, treating and controlling off-site groundwater and surface water discharges. To address these orders, GMI intends to implement a new surface water control, management and discharge system.

13

Governmental agencies may refuse to grant or renew our operating licenses and environmental and other permits.

Our current Subsidiaries and future subsidiaries must receive certain licenses and permits from state and local governments to conduct their operations, including but not limited to permits required by environmental laws. We may face unexpected delays in obtaining the necessary permits and approvals required by environmental and other laws in connection with our facilities. If we violate or fail to obtain or comply with any permits required by environmental or other laws, we could be fined or otherwise sanctioned by regulators. Furthermore, when we develop or acquire a new facility, we must seek the approval of state and local units of government and satisfy applicable siting laws and regulations. Governmental agencies often resist the establishment of an automotive recycling facility in their communities. There can be no assurance that future approvals or transfers will be granted. In addition, there can be no assurance that we will be able to maintain and renew the licenses and permits we and our Subsidiaries currently hold.

We have a large amount of goodwill as a result of the acquisition of our Subsidiaries, and if such goodwill becomes impaired, our earnings would be adversely affected.

As of December 31, 2015, we had recorded goodwill of $76.8 million. Goodwill represents the excess of the amount we pay for our acquisitions over the fair value of the acquired net assets. We have substantial goodwill related to our acquisitions of our Subsidiaries. As we implement our business acquisition strategy, we will be required to account for similar premiums paid on future acquisitions in the same manner. We do not amortize acquired goodwill but instead we test it for impairment on an annual basis in the fourth quarter and between annual tests if events and circumstances indicate that it is more likely than not that the fair value of our one reporting unit is less than its carrying value. The goodwill impairment test is based upon a fair value approach comparing fair value of our reporting unit to its carrying value, which as of our annual measurement date of October 1, 2015 was an 8.5% margin; we, accordingly, concluded that we did not incur any impairment. Further, there were no events or indicators of goodwill impairment as of year-end that would call into question the analysis as of October 1, 2015.

Testing for impairment of goodwill involves an estimation of the fair value of our net assets and involves a high degree of judgment and subjectivity. There are numerous risks that may cause the fair value of a reporting unit to fall below its carrying amount, which could lead to the measurement and recognition of goodwill impairment. These risks include, but are not limited to, adverse changes in the business climate, a sustained decline in our market capitalization, significant negative variances between actual and expected results, and lowered expectations of future financial results. Significant judgments inherent in these analyses include assumptions about appropriate sales growth rates, weighted average cost of capital (“WACC”) and the amount of expected future net cash flows. The judgments and assumptions used in the estimate of fair value are generally consistent with the projections and assumptions that are used in current operating plans. Such assumptions are subject to change as a result of changing economic and competitive conditions. The determination of fair value is highly sensitive to differences between estimated and actual cash flows and changes in the related discount rate used to evaluate the fair value of the reporting unit where the goodwill resides. Based on the discounted cash flow valuation at October 1, 2015, a 1% increase in the WACC, terminal growth rate decrease by 0.5%, shortfall against budgeted revenue and gross profit in excess of 2% or changes in other significant variables in the future could potentially result in impairment. If we have any significant impairment to our goodwill, it would have a material adverse effect on our reported financial results for the period in which the charge is taken. Further, the factors leading to the impairment could result in a decrease in the market price of our common stock. For further information regarding the impairment testing done in 2015, see Note 12, Goodwill, to the consolidated financial statements in this document.

Our annual and quarterly performance may fluctuate.

Our revenue, cost of salvage vehicles and operating results have fluctuated on a quarterly and annual basis in the past and on a consolidated basis have fluctuated and can be expected to continue to fluctuate in the future as a result of a number of factors, some of which are beyond our control. Future factors that may affect our operating results include, but are not limited to, the following:

• | fluctuations in the market value of salvage and used vehicles; |

• | the availability of salvage vehicles at an attractive price; |

• | variations in vehicle accident rates; |

• | changes in state or federal laws or regulations affecting our business; |

• | our ability to successfully integrate in a timely manner and manage our acquisitions; |

• | severity of weather and seasonality of weather patterns; |

14

• | the amount and timing of operating costs and capital expenditures relating to the maintenance and expansion of our business, operations and infrastructure; and |

• | declines in asset values, including but not limited to Goodwill impairment. |

• | declines in scrap metal prices |

• | declines in the value of the Canadian Dollar relative to the US dollar. |

Due to the foregoing factors, our operating results in one or more future periods can be expected to fluctuate and period-to-period comparisons of our results of operations should not be relied upon as indications of future performance. These fluctuations in our operating results may cause our results to fall below the expectations of public market analysts and investors, which could cause our stock price to decline.

Fluctuations in the prices of metals could adversely affect our financial results.

Our operations generate scrap metal. After we dismantle a salvage vehicle for parts and after vehicles have been used in our self-service business, any remaining metal is sold to processors and brokers of metal and the remaining vehicle hulks are sold to scrap processors. In addition, we receive vehicles from various sources, which we sell at scrap metal market rates calculated on a per-ton basis. The price of scrap metal has historically fluctuated, sometimes significantly, due to market factors. In addition, buyers may stop purchasing metal entirely due to excess supply. To the extent that the price of metal decreases materially, our revenue from such sales will be adversely impacted and a write-down of our inventory value could be required. Despite our recent experience with declining purchase prices on vehicles as a result of reduced commodity prices, there can be no assurance that our vehicle purchasing costs will continue to decrease by a corresponding amount or at the same rate as the scrap metal prices decline, and there may be a delay between the scrap metal price reductions and any vehicle purchasing cost reductions.

We operate in Canada, which exposes us to foreign exchange and other risks.

We have operations in Canada. Our Canadian operations expose us to additional risks associated with international business, which has had an adverse effect on our business, results of operations, and financial condition. We collect revenues and incur costs at our Canadian operations in Canadian dollars. The significant decline in the value of the Canadian dollar against the U.S. dollar from 2014 to 2015 has had an adverse effect on our reported results of operations and financial condition in 2015, and could have a similar effect in the future. In addition to foreign exchange exposure, we are subject to foreign tax, foreign employment laws and regulations and other foreign and domestic laws.

If we experience problems with our fleet of trucks, our business could be harmed.

We operate a fleet of trucks throughout our network to deliver products to our customers and transfer hubs. We are subject to the risks associated with providing trucking services, including inclement weather, disruptions in the transportation infrastructure, availability and price of fuel, and liabilities arising from accidents to the extent we are not covered by insurance. In addition, our failure to deliver parts in a timely and accurate manner could harm our customer relationships and reputation, which could have a material adverse effect on our business.

We rely on information technology in critical areas of our operations, and a disruption relating to such technology could harm our business.

We rely on information technology for significant aspects of our business, including our financial reporting, accounting, accounts payable, payroll, procurement, inventory control, customer selling and billing, sales analysis, vehicle tracking and profitability reporting, as well as an electronic exchange system for identifying and locating parts at other selected recyclers and facilitating brokered sales to fill customer orders for items not in stock. Any disruption relating to our information systems and hardware could seriously harm our operations.

We may not be able to sell our products due to existing or new laws prohibiting or restricting the sale of recycled automotive products.

Some jurisdictions have enacted laws prohibiting or severely restricting the sale of certain recycled automotive products that we provide, such as airbags. Additional jurisdictions could enact similar laws or could prohibit additional automotive products we sell. Restrictions on the products we are able to sell could decrease our revenue and have an adverse effect on our business and operations.

15

Risks Relating to Our Common Stock and Financial Structure

Future sales of our common stock or other securities may depress our stock price.

We and our stockholders may sell shares of common stock or other equity, debt or instruments which constitute an element of our debt and equity (collectively, “securities”) in the future. We may also issue shares of common stock under our stock plan or in connection with future acquisitions. We cannot predict the size of future issuances of securities or the effect, if any, that future issuances and sales of shares of our common stock or other securities will have on the price of our common stock. Sales of substantial amounts of common stock (including shares issued in connection with an acquisition), the issuance of debt securities, or the perception that such sales or issuances could occur, may cause the price of our common stock to fall.

Our stock price could be volatile and could expose us to securities class action litigation.

The price of our common stock could be extremely volatile and may fluctuate substantially due to the following factors, some of which are beyond our control:

• | variations in our operating results; |

• | variations between our actual operating results and the expectations of securities analysts, investors and the financial community; |

• | announcements of developments affecting our business or expansion plans by us or others; and |

• | conditions and trends in the auto parts industry and the economy as a whole. |

In addition, stock market volatility has had a significant effect on the market prices of securities issued by many companies for reasons unrelated to the operating performance of these companies. Downturns in the stock market may cause the price of our common stock to decline. Additionally, the market price for our common stock has been in the past, and in the future may be, adversely affected by allegations made or reports issued by short sellers, analysts or others regarding our business model, our management or our financial accounting.

In the past, securities class action litigation often has been instituted against companies following periods of volatility in the market price of their securities. This type of litigation, if directed at us, could result in substantial costs and a diversion of management’s attention and resources.

We have a substantial amount of indebtedness, which could have a material adverse effect on our financial condition and our ability to obtain financing in the future and to execute our business strategy.

As of December 31, 2015, we had approximately $20.8 million of debt outstanding under our senior secured credit facility, consisting of $11.2 million under our revolving line of credit and $9.6 million under our term loan. We also have a letter of credit for $5.9 million secured under the facility. In addition, we have contingent consideration arrangements with the former owners of three acquired businesses that could result in substantial future cash obligations in 2016 and 2017 as described in Management's Discussion and Analysis of Financial Condition and Results of Operations - "Liquidity and Capital Resources" and as estimated and recorded in the accompanying consolidated balance sheet as of December 31, 2015. The credit facility contains operating restrictions and financial covenants that can restrict our business and limit our access to additional borrowings. Compliance under the financial covenants is measured each quarter and determines how much in additional borrowings, if any, are available to us. At December 31, 2015, we had approximately $4.7 million of additional borrowing capacity under the revolving facility - $2.9 million in U.S. Dollars and $2.4 million that can be drawn in Canadian Dollars. Our significant amount of debt, limited borrowing capacity and our debt service and contingent consideration obligations could limit our ability to satisfy our obligations, limit our ability to operate our business, execute our expansion strategy and impair our competitive position. Moreover, our failure to comply with the covenants and restrictions in our Credit Facility could result in an event of default, which would permit our lender to call for the immediate repayment of the entire amount we owe under our Credit Facility, among other remedies. The acceleration of our obligations under our Credit Facility would have a material adverse effect on our business.

16

We have assumed uncertain tax positions as part of the Combinations.

We assumed the uncertain tax positions of certain Founding Companies as part of the Combinations and have recorded reserves for these positions, including related interest and penalties, of approximately $5.7 million as of December 31, 2015. If the settlement of any unrecognized tax reserves is different than that accrued, it would impact our effective tax rate. Under certain conditions, payments made by us, including interest and penalties, for assumed uncertain tax positions are indemnified by the previous owners of the Subsidiaries for a period of three years from the Combinations and we have an indemnification receivable of $5.1 million recorded in the balance sheet as of December 31, 2015. If a reserved uncertain tax position results in an actual liability and we are unable to collect on or enforce the related indemnification provision or if the actual liability occurs after the three-year indemnity period has expired, there could be a material charge to our consolidated financial results and reduction of cash resources.

Our officers and directors and the stockholders and former equity interest holders of the Subsidiaries and their affiliates exercise significant control over us.

As of December 31, 2015, our executive officers and directors and the stockholders and former equity interest holders of the Subsidiaries and their immediate family members beneficially own, in the aggregate, approximately 26% of our outstanding common stock. As a result, these stockholders are able to exercise significant control over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, which could delay or prevent someone from acquiring or merging with us. These stockholders may have interests that are different from yours.

Provisions in our certificate of incorporation and bylaws, Delaware law and our loan documents could discourage a takeover that stockholders may consider favorable.

Our amended and restated certificate of incorporation and amended and restated bylaws may discourage, delay or prevent a merger or acquisition that a stockholder may consider favorable because they, among other things:

• | authorize our board of directors, without stockholder approval, to issue up to 100,000 shares of undesignated preferred stock; |

• | do not provide for cumulative voting in the election of directors; |

• | establish supermajority voting requirements in order to amend certain provisions in our certificate of incorporation; and |

• | prohibit stockholders from calling a special meeting of stockholders. |

As a Delaware corporation, we are also subject to the Delaware anti-takeover provisions contained in Section 203 of the Delaware General Corporation Law. Under Delaware law, a corporation may not engage in a business combination with any holder of 15% or more of its capital stock unless the holder has held the stock for three years or, among other things, the board of directors has approved the transaction. Our board of directors could rely on this provision to prevent or delay an acquisition of us. In addition, our credit agreement provides that a change of control is an event of default, which could impede an acquisition, takeover or other business combination involving us or discourage a potential acquirer from making a tender offer for our common stock, which, under certain circumstances, could reduce the price of our common stock.

We do not intend to pay dividends.

We have never declared or paid any cash dividends on our capital stock and do not intend to pay dividends in the foreseeable future. We intend to invest our future earnings, if any, to fund our growth. We cannot assure you that you will receive a return on your investment when you sell your shares or that you will not lose the entire amount of your investment.

Our internal controls have been determined to not be effective, and we may not succeed in establishing and maintaining effective internal controls, which may adversely affect investor confidence in our Company and, as a result, the value of our common stock.

Our independent registered public accounting firm identified material weaknesses in our internal control over financial reporting for all of our Subsidiaries and Fenix. In an effort to remediate deficiencies in our internal controls, we are in the process of adding personnel to our accounting staff, standardizing financial reporting policies and procedures and upgrading our internal accounting systems. In addition, we have implemented steps to establish a company-wide system of uniform account classifications, and are migrating all operations to common information systems. However, this is a significant task and an integral part of our integration

17

plan for acquired businesses. The integration is still in progress and may require substantial resources at significant cost over an extended period of time to complete. If we fail to establish and thereafter maintain effective controls over financial reporting, our ability to accurately report on our financial results on a timely basis will be adversely affected.

When we cease to be an “emerging growth company” as defined under the JOBS Act, our auditors will be required to express an opinion on the effectiveness of our internal controls. Additionally, our principal executive and financial officers of the Company will be required to certify in the Company's annual and quarterly filings (i) that such reports are accurate and complete and that we have established and maintained adequate internal control over financial reporting, or, (ii) if we have not established and maintained adequate internal controls, that such officers have disclosed to our auditors and our audit committee all significant deficiencies and material weaknesses in the design or operation of internal controls over financial reporting which are reasonably likely to adversely affect our ability to record, process, summarize and report financial information. If we are unable to certify that our internal control over financial reporting is effective, or if our auditors are unable to express an opinion on the effectiveness of our internal controls, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our common stock to decline.

The requirements of being a public company strain our resources, increase our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner.

As a public company with listed equity securities, we must comply with certain laws, regulations and requirements, including corporate governance provisions of the Sarbanes-Oxley Act, related regulations of the Securities and Exchange Commission (the “SEC”) and the requirements of the NASDAQ Global Market, with which we were not required to comply as a private company. Complying with these statutes, regulations and requirements occupies a significant amount of the time of our board of directors and management and results in significant costs and expenses, which will increase after we are no longer an emerging growth company under the JOBS Act. Among the actions we have taken or are in the process of taking are to:

• | institute comprehensive corporate governance and compliance functions; |

• | design, establish, evaluate and maintain a system of internal control over financial reporting in compliance with the requirements of Section 404(a) of the Sarbanes-Oxley Act and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board; |

• | comply with rules promulgated by the NASDAQ Global Market; |

• | prepare and distribute periodic public reports in compliance with our obligations under the federal securities laws; |

• | establish internal policies, such as those relating to disclosure controls and procedures and insider trading; |

• | involve and retain outside counsel and accountants in connection with these activities; and |

• | establish an investor relations function. |

Due to the historic decentralized cash basis financial reporting at the Subsidiaries, complex accounting required by the acquisitions of Subsidiaries and our lack of effective controls over financial reporting, we have incurred accounting and auditing fees that are very high for a public company of our size. In addition, these complexities have resulted in our inability to file two quarterly reports on Form 10-Q and a Form 10-K in a timely manner. Continued high accounting and auditing costs could have a material adverse effect on our financial condition, and continued late filing of routine securities filings could undermine investors’ confidence in our Company.

We are an emerging growth company and our reliance on the reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions and relief from various reporting requirements that are applicable to other public companies, but are not applicable to emerging growth companies. In particular, while we are an emerging growth company, we are not required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, we are subject to reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and we are not required to hold nonbinding advisory votes on executive compensation or shareholder approval of any golden parachute payments not previously approved. We have taken advantage of certain reduced disclosure obligations and may elect to take advantage of other reduced burdens in future filings. Investors may find our common stock less attractive when we rely on these exemptions and relief. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may decline and/or become more volatile.

18

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our properties are described in the Facilities section in Item 1 of this Annual Report on Form 10-K, and such description is incorporated by reference into this Item 2. Our properties are sufficient to meet our present needs, and we do not anticipate any difficulty in securing additional space to conduct operations or additional office space, as needed, on terms acceptable to us.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

19

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SHARES

Market

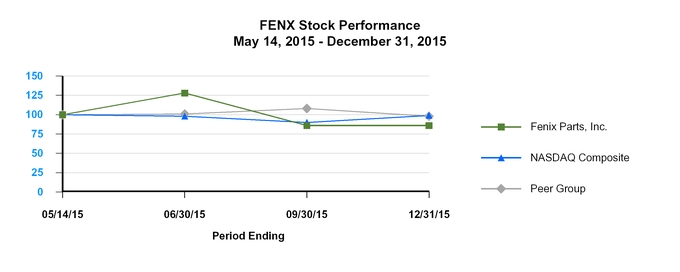

Our common shares have been traded since May 2015 on the NASDAQ Global Market ("NASDAQ"). The trading symbol is FENX.

Prices

The table below sets forth the high and low sales prices during each calendar quarter since May 14, 2015, the date the IPO closed.

2015 | High | Low | |||||

Fourth Quarter | $ | 8.50 | $ | 5.40 | |||

Third Quarter | $ | 10.94 | $ | 6.65 | |||

Second Quarter | $ | 11.92 | $ | 8.59 | |||

Dividends