Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INVESTOR RELATIONS PRESENTATION - CORE MOLDING TECHNOLOGIES INC | a8-kinvestorpresentation.htm |

CREATIVE • RELIABLE • COMPOSITES INVESTOR PRESENTATION APRIL 2016

FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURERS This presentation, our remarks, and answers to questions contain historical information and forward-looking statements within the meaning of the federal securities laws. As a general matter, forward-looking statements are those focused upon future plans, objectives or performance as opposed to historical items and include statements of anticipated events or trends and expectations and beliefs relating to matters not historical in nature. Such forward-looking statements involve known and unknown risks and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. These uncertainties and factors could cause our actual results to differ materially from those matters expressed in or implied by such forward-looking statements. We do not undertake any obligation to update any forward-looking statements to reflect the impact of circumstances or events that may arise after the date of such forward-looking statements. We believe that the following factors, among others, could affect our future performance and cause actual results to differ materially from those expressed or implied by forward-looking statements made in this presentation: business conditions in the plastics, transportation, marine and commercial product industries (including slowdown in demand for truck production); federal and state regulations (including engine emission regulations); general economic, social and political environments in the countries in which we operate; safety and security conditions in Mexico; dependence upon certain major customers as the primary source of our sales revenues; our efforts to expand our customer base; the ability to develop new and innovative products and to diversify markets, materials and processes and increase operational enhancements; the actions of competitors, customers, and suppliers; failure of our suppliers to perform their obligations; the availability of raw materials; inflationary pressures; new technologies; regulatory matters; labor relations; our loss or inability to attract and retain key personnel; the ability to successfully identify, evaluate and manage potential acquisitions and to benefit from and properly integrate any completed acquisitions; federal, state and local environmental laws and regulations; the availability of capital; our ability to provide on-time delivery to customers, which may require additional shipping expenses to ensure on-time delivery or otherwise result in late fees; risk of cancellation or rescheduling of orders; management’s decision to pursue new products or businesses which involve additional costs, risks or capital expenditures; and other risks identified from time-to-time in our public documents on file with the Securities and Exchange Commission (“SEC”), including those described in our Annual Report on Form 10-K for the year ended December 31, 2015 as well as our other filings with the SEC. This presentation, our remarks, and answers to questions include references to earnings before interest, taxes, depreciation and amortization (“EBITDA”), which is a non-GAAP financial measure. EBITDA is reconciled to net income, its most directly comparable GAAP measure, in the financial table included in the Appendix to this presentation. We believe that this additional information and the reconciliation we provide may be useful to help evaluate our operations. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP-results. CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 2

COMPANY OVERVIEW • NYSE MKT: CMT • Headquarters: Columbus, OH • Over 1M square feet of manufacturing space in the US & Mexico • Incorporated: 1996 • Employees: ~ 1,500 • Market cap*: $87M • Shares outstanding: 7.6M • TTM (12/31/15) revenues of $199M, EBITDA of $24.5M, and net income of $12M • TTM P/E* of 7.18x • P/BV* of 0.97x CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 3 Leading manufacturer of specialized plastic products • Compound and molded fiber reinforced plastics (FRP) • Industry-leading range of production processes • Supply 2,000,000 parts and assemblies per year • Leading market share in heavy-duty truck market (1) • High quality blue-chip customer base (1) Based on management’s estimates and other quantitative and qualitative factors *As of 4/8/16

STRONG FINANCIAL METRICS AND GROWTH POTENTIAL RECORD SALES AND EPS in 2015 STABLE GROSS MARGINS across truck cycles NEW PROGRAMS starting in 2016 expected to partially offset anticipated downcycle in truck market March 2015 acquisition BROADENED PRODUCT OFFERING & MARKETS STRONG BALANCE SHEET WITH FINANCIAL FLEXIBILITY to support growth CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 4

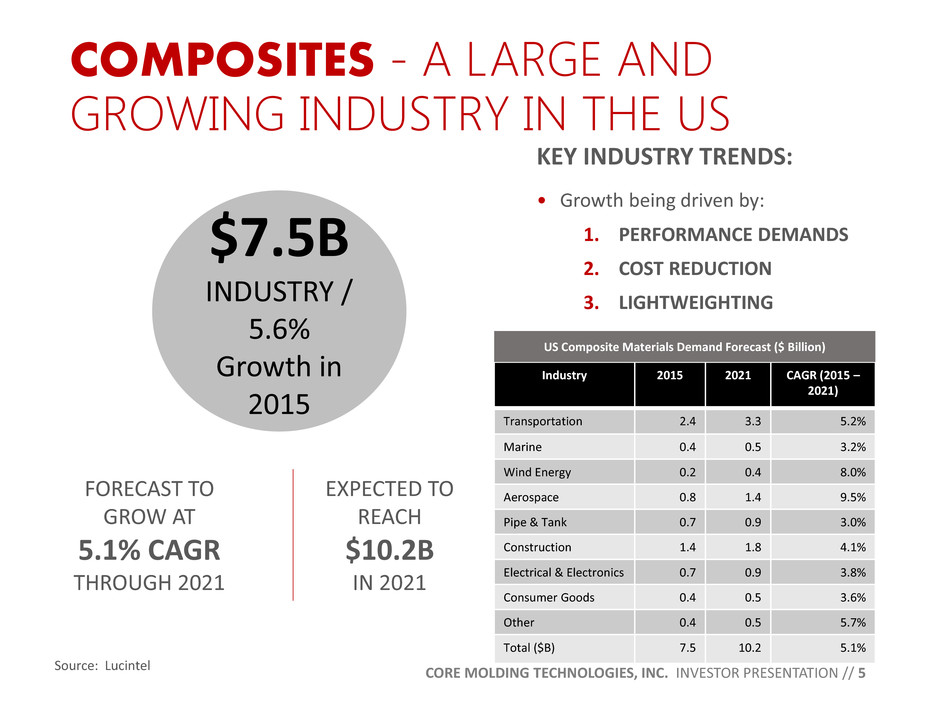

COMPOSITES - A LARGE AND GROWING INDUSTRY IN THE US FORECAST TO GROW AT 5.1% CAGR THROUGH 2021 CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 5 KEY INDUSTRY TRENDS: • Growth being driven by: 1. PERFORMANCE DEMANDS 2. COST REDUCTION 3. LIGHTWEIGHTING $7.5B INDUSTRY / 5.6% Growth in 2015 EXPECTED TO REACH $10.2B IN 2021 Source: Lucintel Industry 2015 2021 CAGR (2015 – 2021) Transportation 2.4 3.3 5.2% Marine 0.4 0.5 3.2% Wind Energy 0.2 0.4 8.0% Aerospace 0.8 1.4 9.5% Pipe & Tank 0.7 0.9 3.0% Construction 1.4 1.8 4.1% Electrical & Electronics 0.7 0.9 3.8% Consumer Goods 0.4 0.5 3.6% Other 0.4 0.5 5.7% Total ($B) 7.5 10.2 5.1% US Composite Materials Demand Forecast ($ Billion)

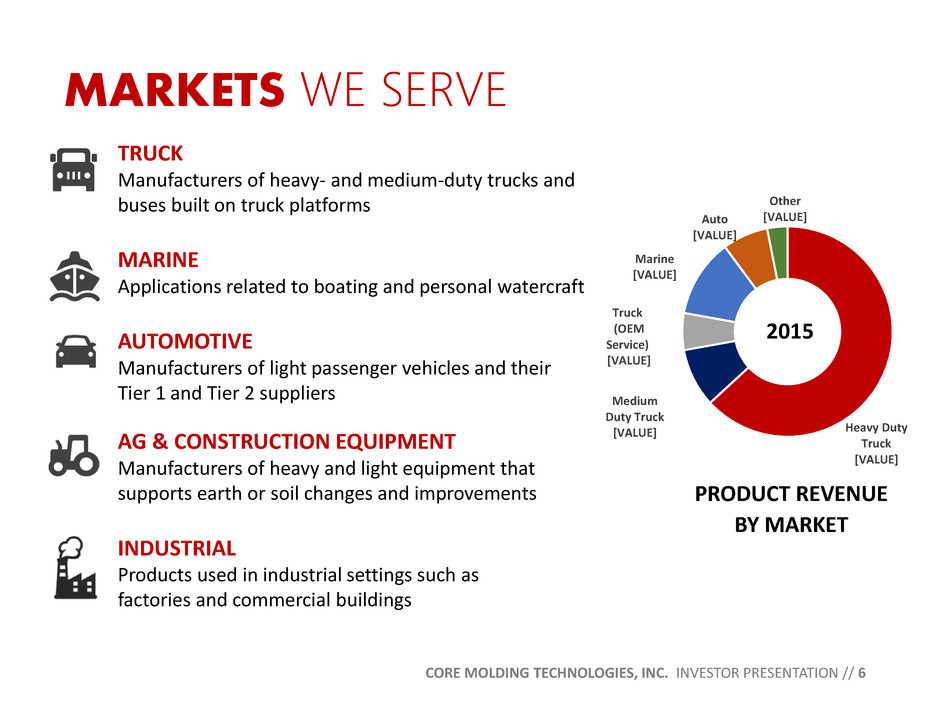

MARKETS WE SERVE CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 6 TRUCK Manufacturers of heavy- and medium-duty trucks and buses built on truck platforms MARINE Applications related to boating and personal watercraft AUTOMOTIVE Manufacturers of light passenger vehicles and their Tier 1 and Tier 2 suppliers AG & CONSTRUCTION EQUIPMENT Manufacturers of heavy and light equipment that supports earth or soil changes and improvements INDUSTRIAL Products used in industrial settings such as factories and commercial buildings PRODUCT REVENUE BY MARKET 2015 Heavy Duty Truck [VALUE] Medium Duty Truck [VALUE] Truck (OEM Service) [VALUE] Marine [VALUE] Auto [VALUE] Other [VALUE]

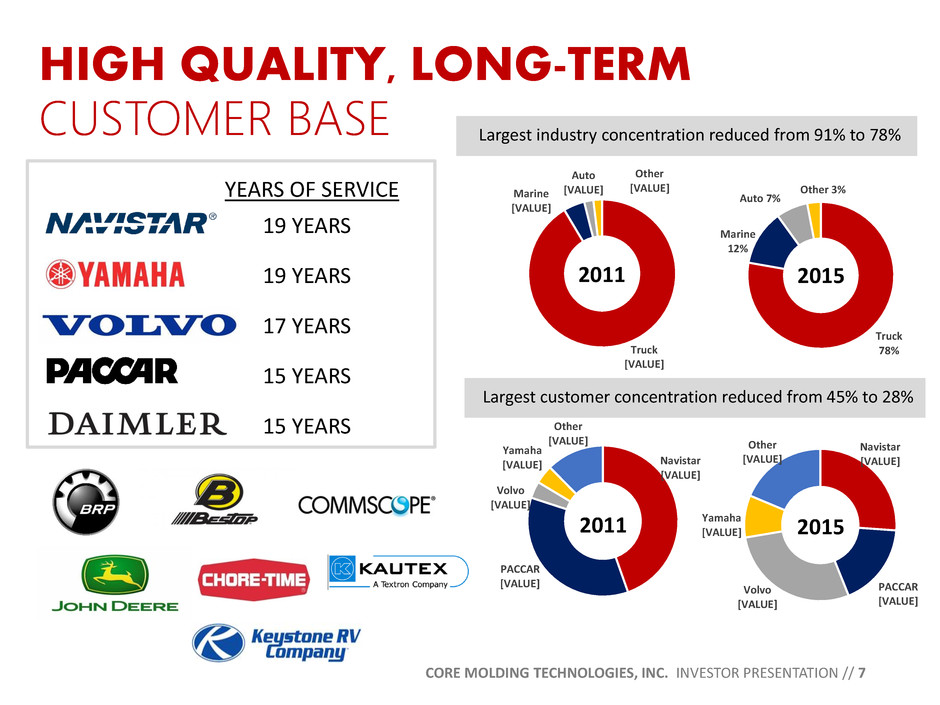

HIGH QUALITY, LONG-TERM CUSTOMER BASE CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 7 Largest industry concentration reduced from 91% to 78% Largest customer concentration reduced from 45% to 28% YEARS OF SERVICE 19 YEARS 19 YEARS 17 YEARS 15 YEARS 15 YEARS Navistar [VALUE] PACCAR [VALUE] Volvo [VALUE] Yamaha [VALUE] Other [VALUE] Navistar [VALUE] PACCAR [VALUE] Volvo [VALUE] Yamaha [VALUE] Other [VALUE] 2011 2015 Truck [VALUE] Marine [VALUE] Auto [VALUE] Other [VALUE] Truck 78% Marine 12% Auto 7% Other 3% 2011 2015

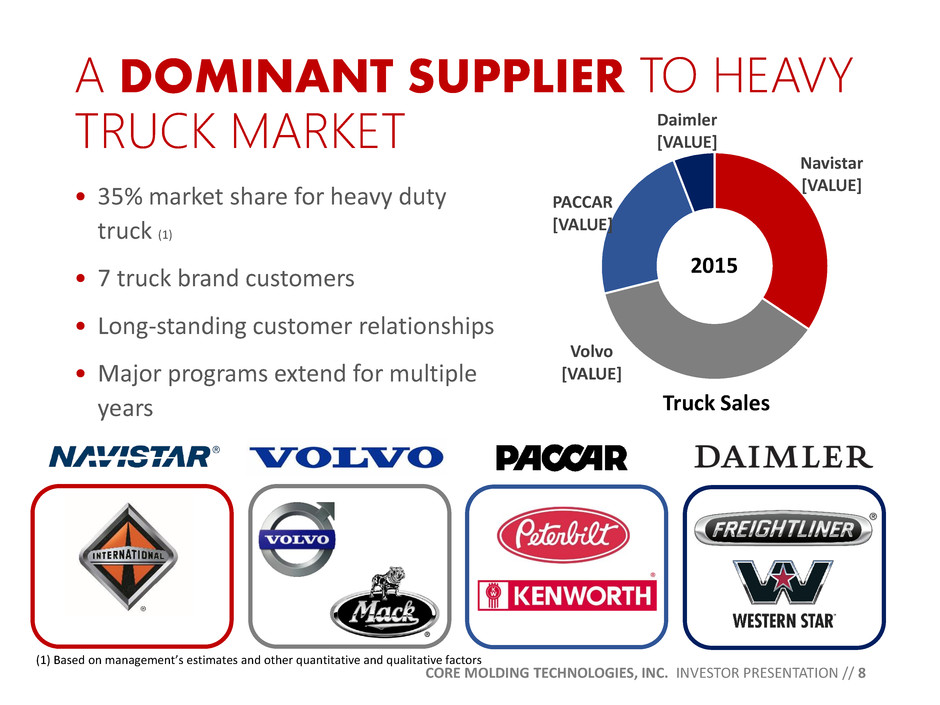

A DOMINANT SUPPLIER TO HEAVY TRUCK MARKET • 35% market share for heavy duty truck (1) • 7 truck brand customers • Long-standing customer relationships • Major programs extend for multiple years CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 8 Navistar [VALUE] Volvo [VALUE] PACCAR [VALUE] Daimler [VALUE] 2015 Truck Sales (1) Based on management’s estimates and other quantitative and qualitative factors

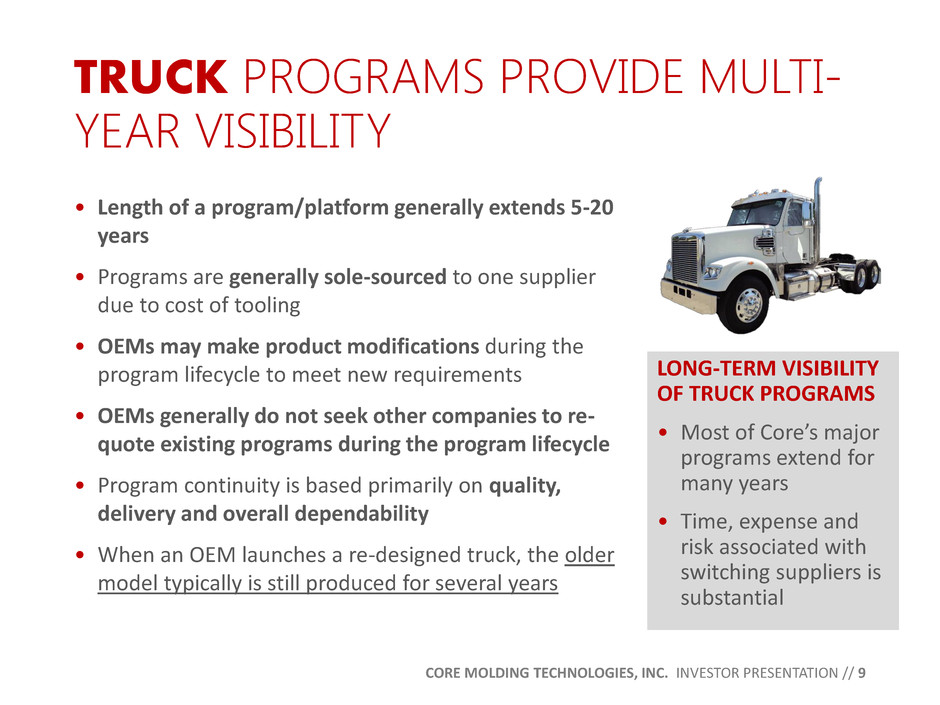

TRUCK PROGRAMS PROVIDE MULTI- YEAR VISIBILITY • Length of a program/platform generally extends 5-20 years • Programs are generally sole-sourced to one supplier due to cost of tooling • OEMs may make product modifications during the program lifecycle to meet new requirements • OEMs generally do not seek other companies to re- quote existing programs during the program lifecycle • Program continuity is based primarily on quality, delivery and overall dependability • When an OEM launches a re-designed truck, the older model typically is still produced for several years CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 9 LONG-TERM VISIBILITY OF TRUCK PROGRAMS • Most of Core’s major programs extend for many years • Time, expense and risk associated with switching suppliers is substantial

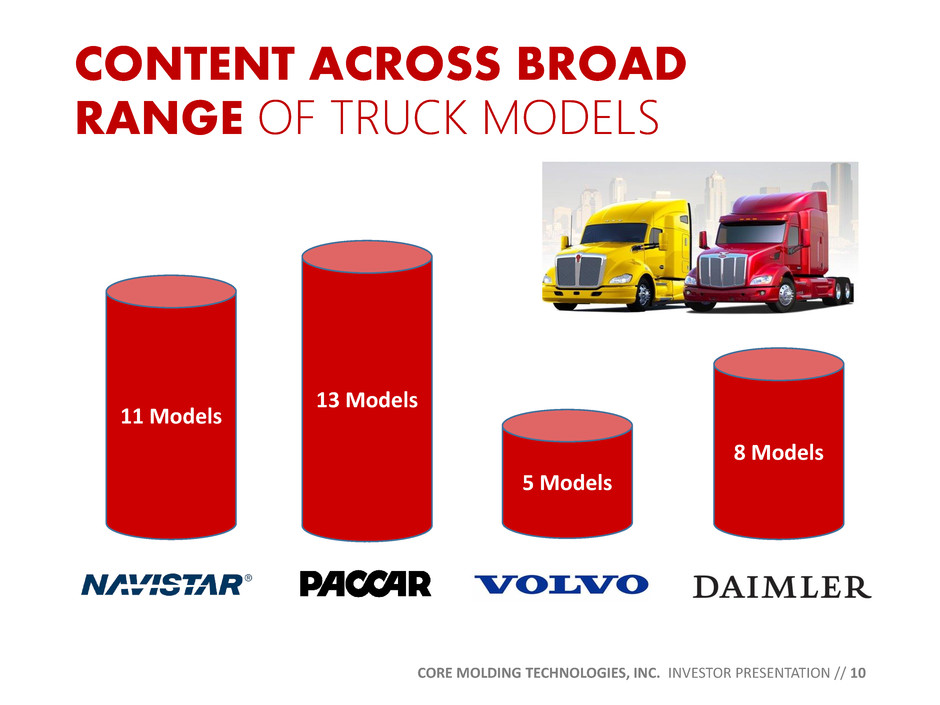

CONTENT ACROSS BROAD RANGE OF TRUCK MODELS CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 10 11 Models 13 Models 5 Models 8 Models

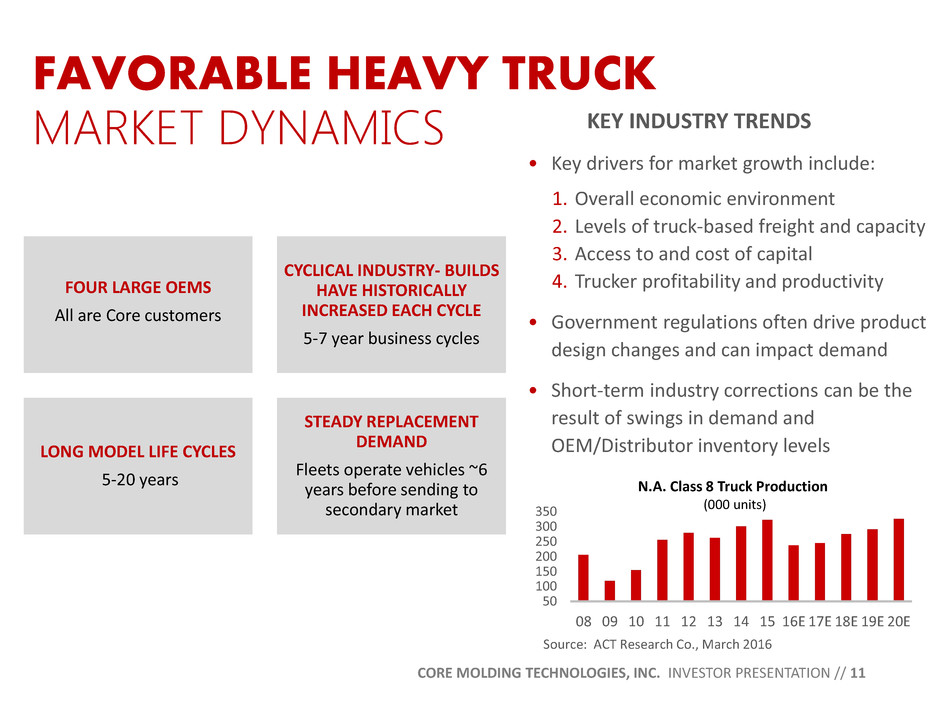

FAVORABLE HEAVY TRUCK MARKET DYNAMICS CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 11 FOUR LARGE OEMS All are Core customers CYCLICAL INDUSTRY- BUILDS HAVE HISTORICALLY INCREASED EACH CYCLE 5-7 year business cycles LONG MODEL LIFE CYCLES 5-20 years STEADY REPLACEMENT DEMAND Fleets operate vehicles ~6 years before sending to secondary market KEY INDUSTRY TRENDS • Key drivers for market growth include: 1. Overall economic environment 2. Levels of truck-based freight and capacity 3. Access to and cost of capital 4. Trucker profitability and productivity • Government regulations often drive product design changes and can impact demand • Short-term industry corrections can be the result of swings in demand and OEM/Distributor inventory levels 50 100 150 200 250 300 350 08 09 10 11 12 13 14 15 16E 17E 18E 19E 20E N.A. Class 8 Truck Production (000 units) Source: ACT Research Co., March 2016

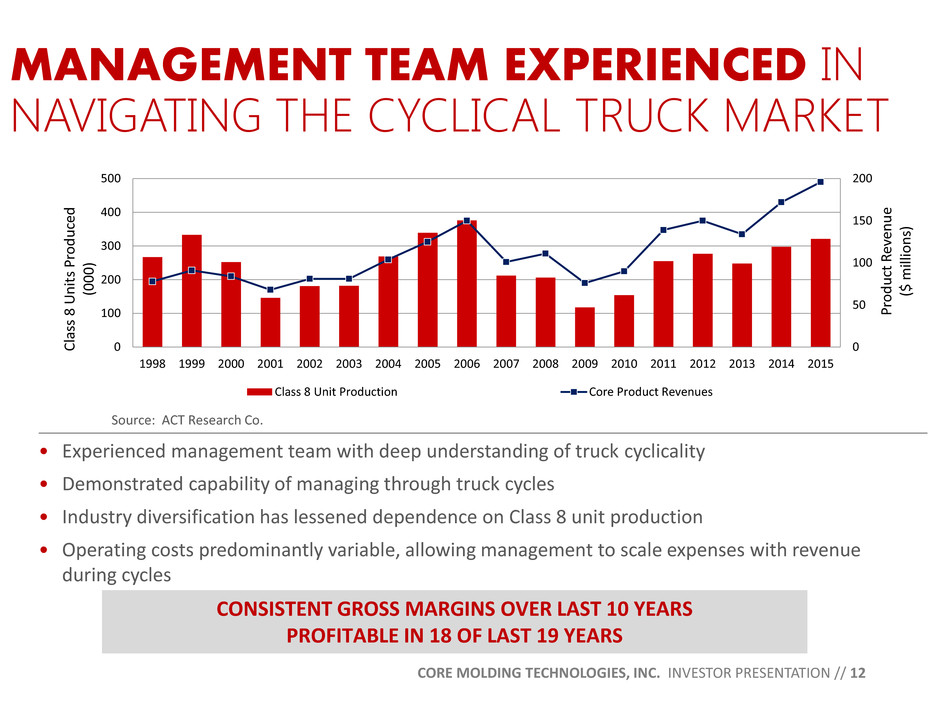

MANAGEMENT TEAM EXPERIENCED IN NAVIGATING THE CYCLICAL TRUCK MARKET CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 12 • Experienced management team with deep understanding of truck cyclicality • Demonstrated capability of managing through truck cycles • Industry diversification has lessened dependence on Class 8 unit production • Operating costs predominantly variable, allowing management to scale expenses with revenue during cycles CONSISTENT GROSS MARGINS OVER LAST 10 YEARS PROFITABLE IN 18 OF LAST 19 YEARS 0 50 100 150 200 0 100 200 300 400 500 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 P ro d u ct R ev en u e ($ milli o n s) Cla ss 8 Uni ts P ro d u ce d (0 0 0 ) Class 8 Unit Production Core Product Revenues Source: ACT Research Co.

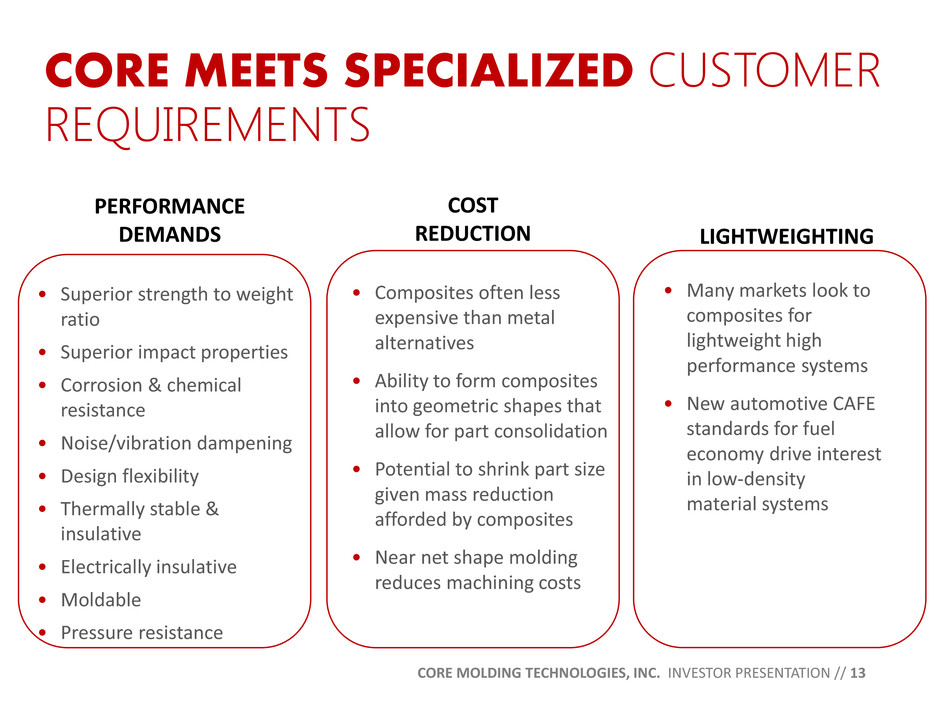

CORE MEETS SPECIALIZED CUSTOMER REQUIREMENTS CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 13 PERFORMANCE DEMANDS COST REDUCTION LIGHTWEIGHTING • Composites often less expensive than metal alternatives • Ability to form composites into geometric shapes that allow for part consolidation • Potential to shrink part size given mass reduction afforded by composites • Near net shape molding reduces machining costs • Many markets look to composites for lightweight high performance systems • New automotive CAFE standards for fuel economy drive interest in low-density material systems • Superior strength to weight ratio • Superior impact properties • Corrosion & chemical resistance • Noise/vibration dampening • Design flexibility • Thermally stable & insulative • Electrically insulative • Moldable • Pressure resistance Region

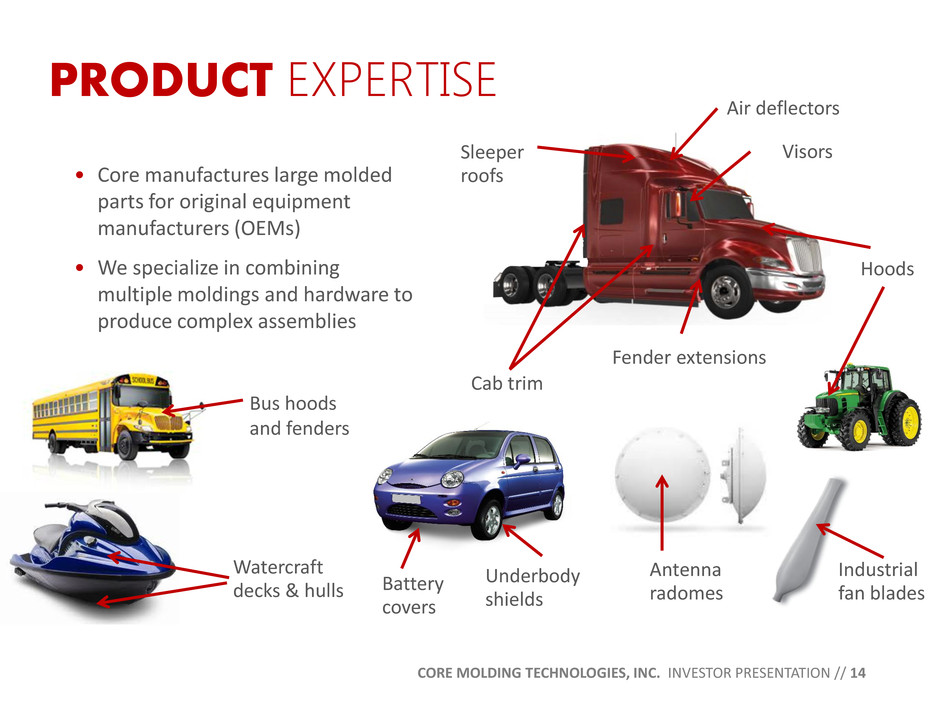

PRODUCT EXPERTISE • Core manufactures large molded parts for original equipment manufacturers (OEMs) • We specialize in combining multiple moldings and hardware to produce complex assemblies CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 14 Sleeper roofs Air deflectors Visors Hoods Fender extensions Cab trim Bus hoods and fenders Watercraft decks & hulls Battery covers Underbody shields Antenna radomes Industrial fan blades

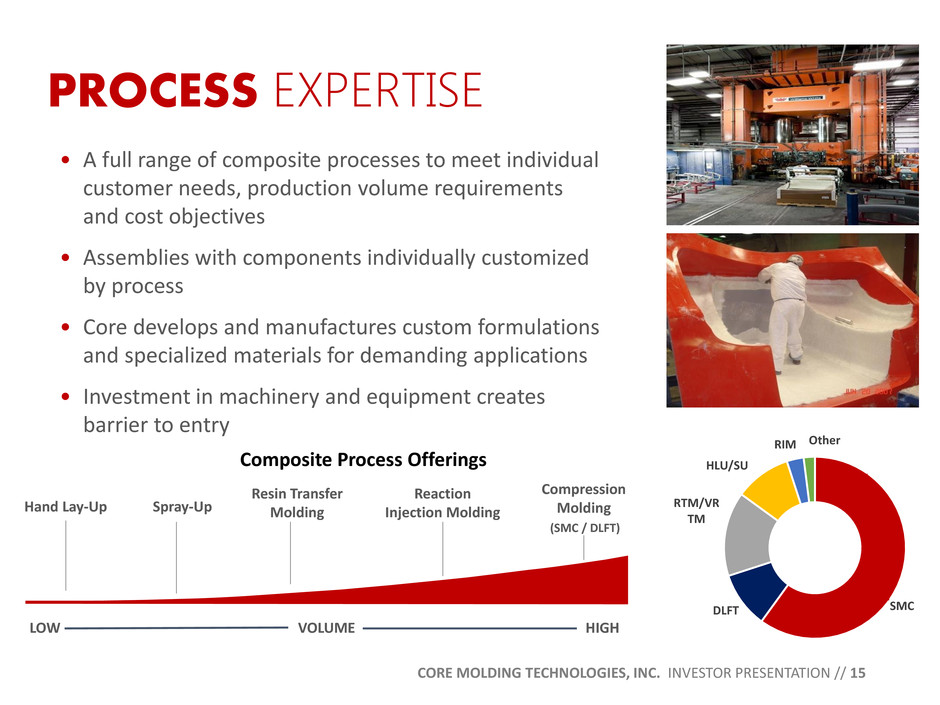

PROCESS EXPERTISE • A full range of composite processes to meet individual customer needs, production volume requirements and cost objectives • Assemblies with components individually customized by process • Core develops and manufactures custom formulations and specialized materials for demanding applications • Investment in machinery and equipment creates barrier to entry CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 15 Composite Process Offerings SMC DLFT RTM/VR TM HLU/SU RIM Other VOLUME HIGH LOW Hand Lay-Up Spray-Up Resin Transfer Molding Reaction Injection Molding Compression Molding (SMC / DLFT)

MATERIALS EXPERTISE • Skilled at developing custom materials to meet specific customer performance requirements • Fully-resourced with on-staff materials scientists and external cooperative development partnerships • Lightweighting sheet molding compound (SMC) formulations demanded by the transportation industry • Specialized materials for high strength, UV and chemical exposure applications • Custom development of both thermoset (high temperature) and thermoplastic (high recyclability) resin configurations • Completion of second SMC line in 2014 approximately doubled SMC production capacity CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 16 COMPREHENSIVE SUITE OF LIGHTWEIGHTING SMC FORMULATIONS • Featherlite® • FeatherliteXL® • Airilite® • Econolite® • Mirilite™

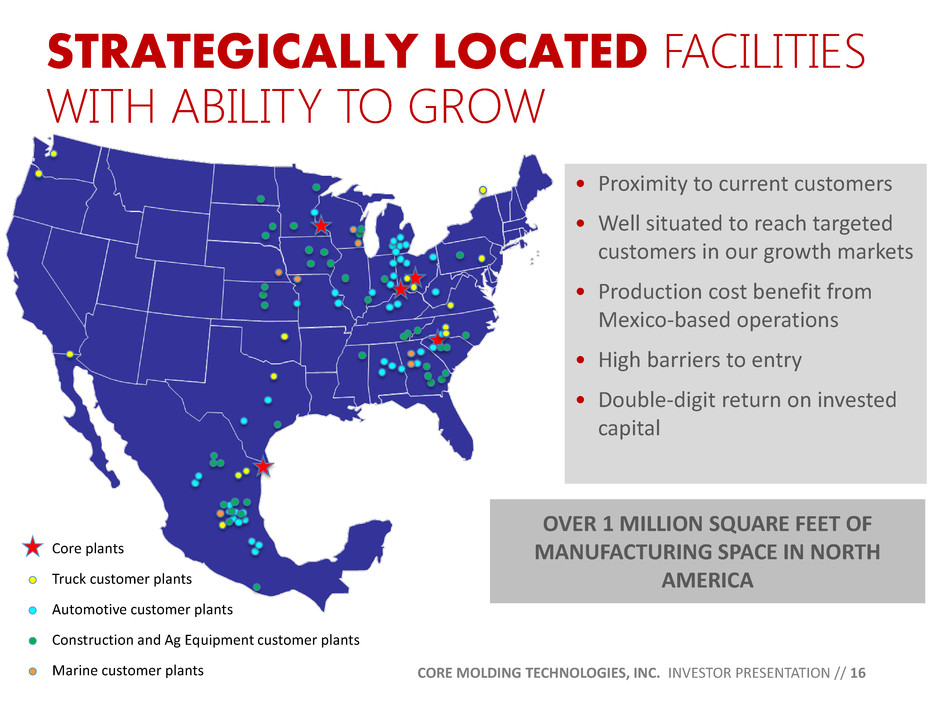

STRATEGICALLY LOCATED FACILITIES WITH ABILITY TO GROW • Proximity to current customers • Well situated to reach targeted customers in our growth markets • Production cost benefit from Mexico-based operations • High barriers to entry • Double-digit return on invested capital Core plants Automotive customer plants Construction and Ag Equipment customer plants Truck customer plants Marine customer plants OVER 1 MILLION SQUARE FEET OF MANUFACTURING SPACE IN NORTH AMERICA CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 16

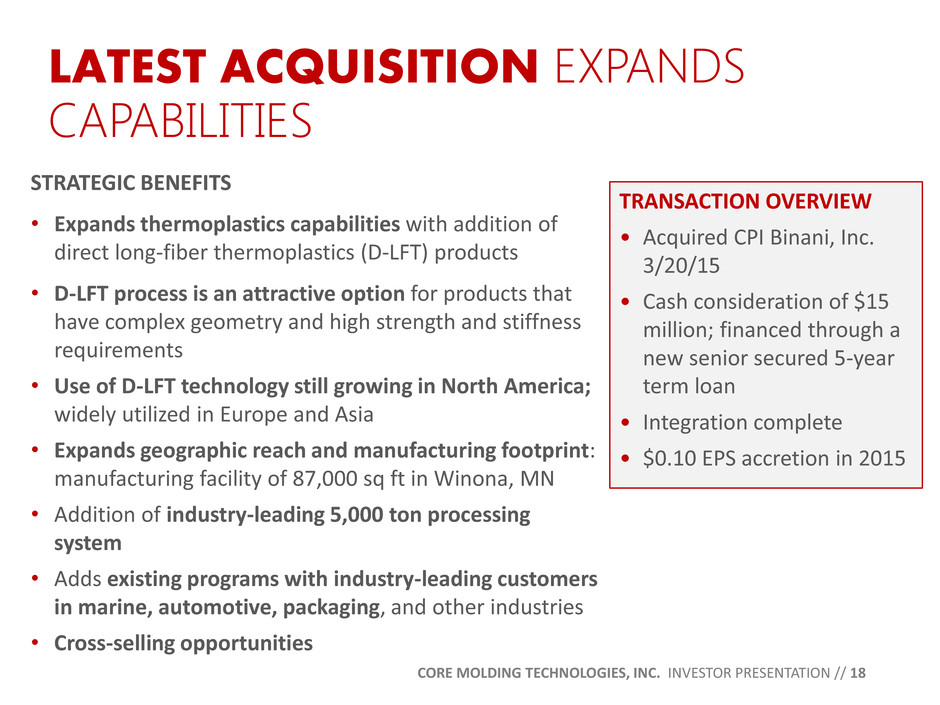

TRANSACTION OVERVIEW • Acquired CPI Binani, Inc. 3/20/15 • Cash consideration of $15 million; financed through a new senior secured 5-year term loan • Integration complete • $0.10 EPS accretion in 2015 LATEST ACQUISITION EXPANDS CAPABILITIES STRATEGIC BENEFITS • Expands thermoplastics capabilities with addition of direct long-fiber thermoplastics (D-LFT) products • D-LFT process is an attractive option for products that have complex geometry and high strength and stiffness requirements • Use of D-LFT technology still growing in North America; widely utilized in Europe and Asia • Expands geographic reach and manufacturing footprint: manufacturing facility of 87,000 sq ft in Winona, MN • Addition of industry-leading 5,000 ton processing system • Adds existing programs with industry-leading customers in marine, automotive, packaging, and other industries • Cross-selling opportunities CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 18

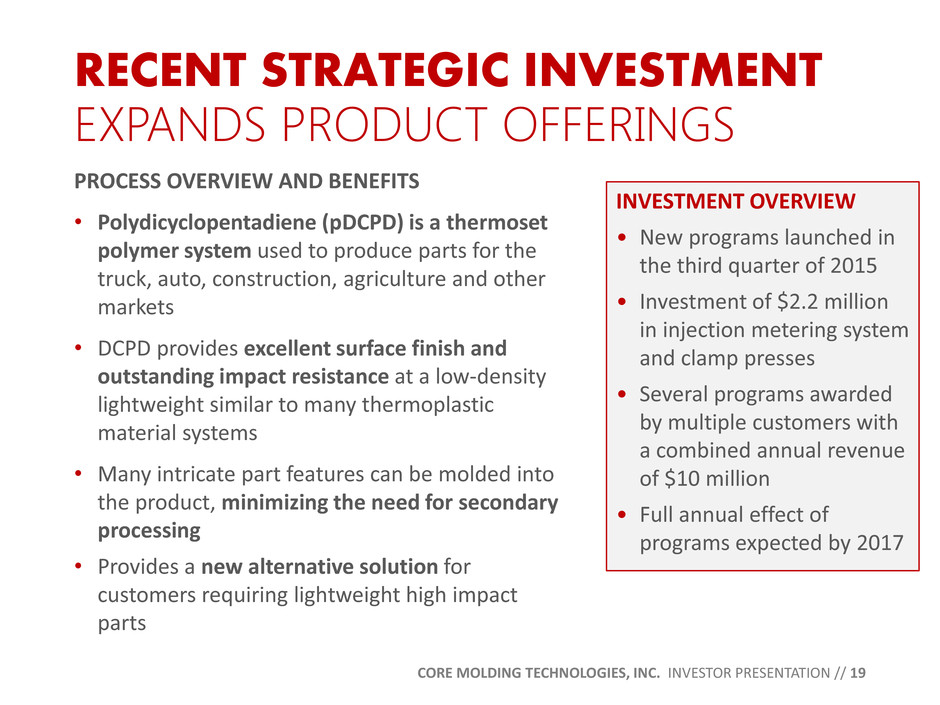

INVESTMENT OVERVIEW • New programs launched in the third quarter of 2015 • Investment of $2.2 million in injection metering system and clamp presses • Several programs awarded by multiple customers with a combined annual revenue of $10 million • Full annual effect of programs expected by 2017 RECENT STRATEGIC INVESTMENT EXPANDS PRODUCT OFFERINGS PROCESS OVERVIEW AND BENEFITS • Polydicyclopentadiene (pDCPD) is a thermoset polymer system used to produce parts for the truck, auto, construction, agriculture and other markets • DCPD provides excellent surface finish and outstanding impact resistance at a low-density lightweight similar to many thermoplastic material systems • Many intricate part features can be molded into the product, minimizing the need for secondary processing • Provides a new alternative solution for customers requiring lightweight high impact parts CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 19

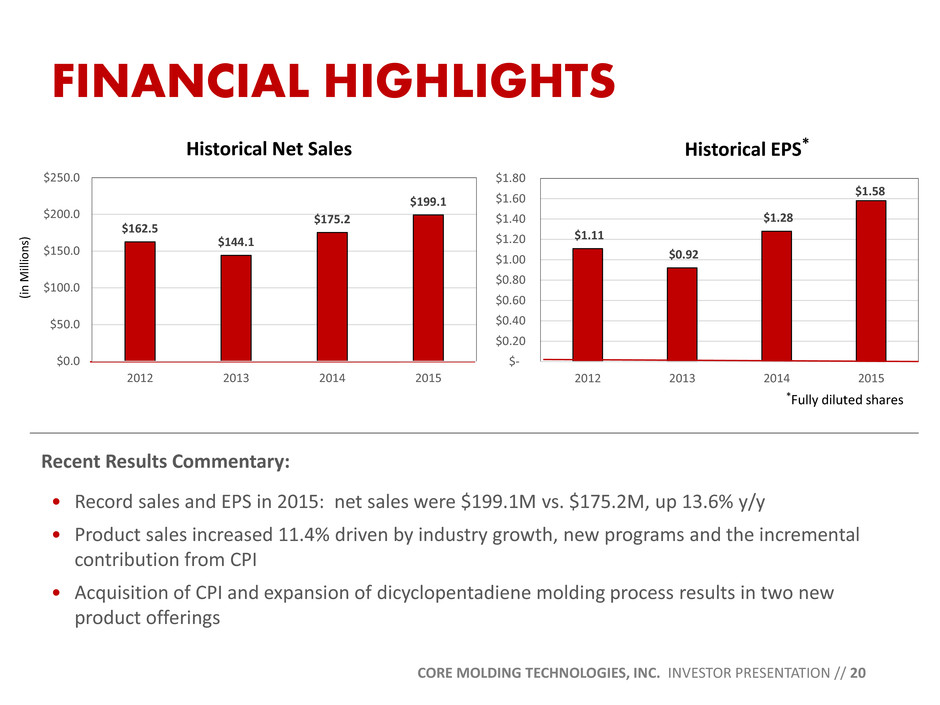

FINANCIAL HIGHLIGHTS CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 20 Historical Net Sales Historical EPS* Recent Results Commentary: $1.11 $0.92 $1.28 $1.58 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 2012 2013 2014 2015 $162.5 $144.1 $175.2 $199.1 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2012 2013 2014 2015 (in Mill io n s) • Record sales and EPS in 2015: net sales were $199.1M vs. $175.2M, up 13.6% y/y • Product sales increased 11.4% driven by industry growth, new programs and the incremental contribution from CPI • Acquisition of CPI and expansion of dicyclopentadiene molding process results in two new product offerings *Fully diluted shares

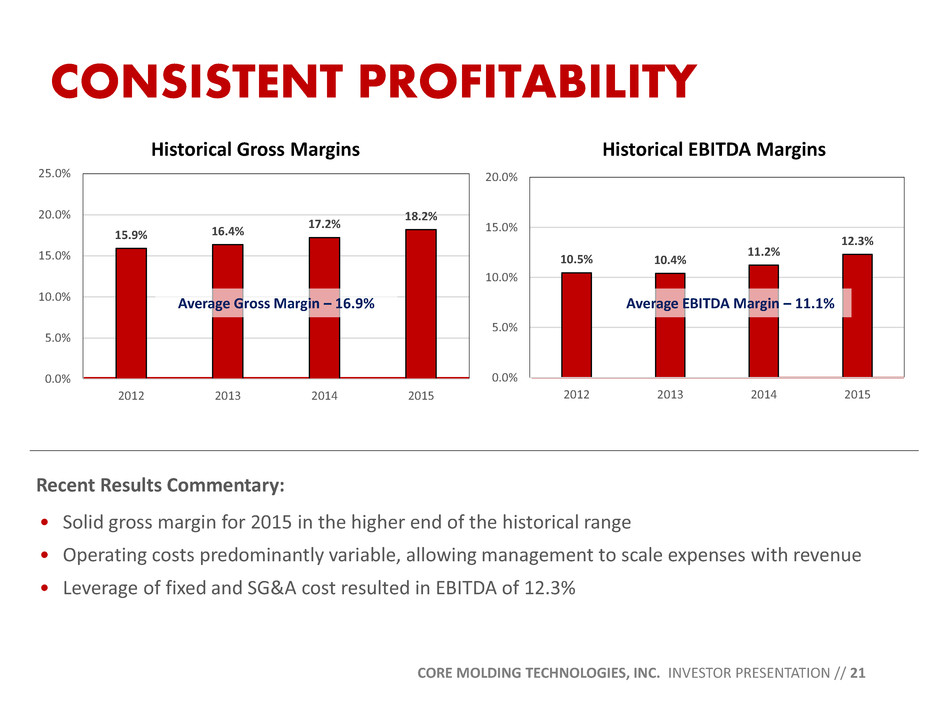

CONSISTENT PROFITABILITY CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 21 Historical Gross Margins Historical EBITDA Margins Recent Results Commentary: • Solid gross margin for 2015 in the higher end of the historical range • Operating costs predominantly variable, allowing management to scale expenses with revenue • Leverage of fixed and SG&A cost resulted in EBITDA of 12.3% 15.9% 16.4% 17.2% 18.2% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2012 2013 2014 2015 10.5% 10.4% 11.2% 12.3% 0.0% 5.0% 10.0% 15.0% 20.0% 2012 2013 2014 2015 Average Gross Margin – 16.9% Average EBITDA Margin – 11.1%

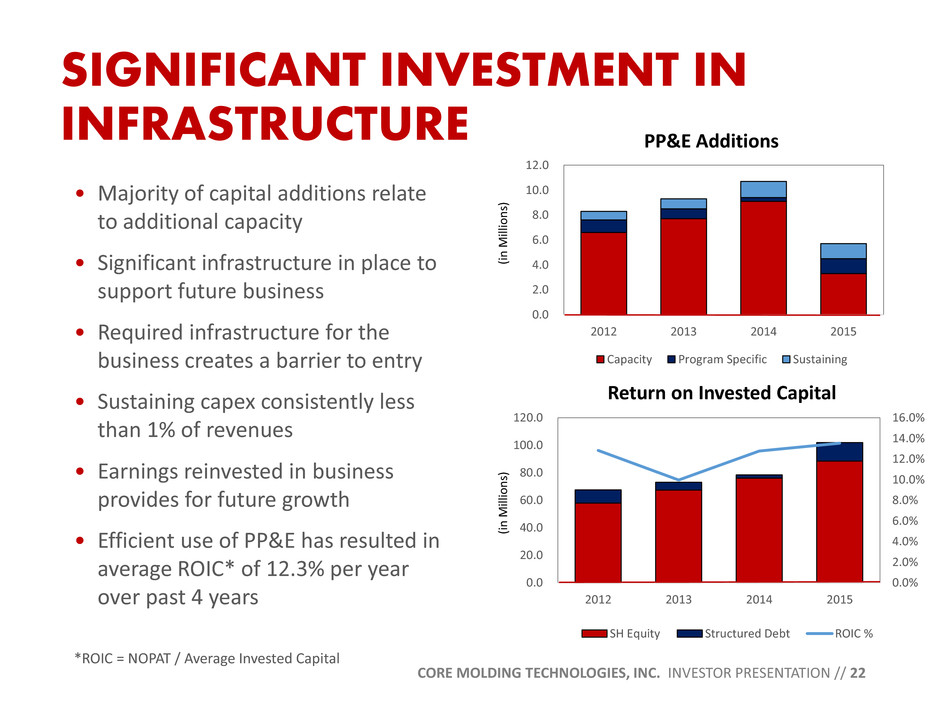

SIGNIFICANT INVESTMENT IN INFRASTRUCTURE • Majority of capital additions relate to additional capacity • Significant infrastructure in place to support future business • Required infrastructure for the business creates a barrier to entry • Sustaining capex consistently less than 1% of revenues • Earnings reinvested in business provides for future growth • Efficient use of PP&E has resulted in average ROIC* of 12.3% per year over past 4 years CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 22 0.0 2.0 4.0 6.0 8.0 10.0 12.0 2012 2013 2014 2015 Capacity Program Specific Sustaining PP&E Additions (in Mill io n s) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 0.0 20.0 40.0 60.0 80.0 100.0 120.0 2012 2013 2014 2015 SH Equity Structured Debt ROIC % (in Mill io n s) *ROIC = NOPAT / Average Invested Capital Return on Invested Capital

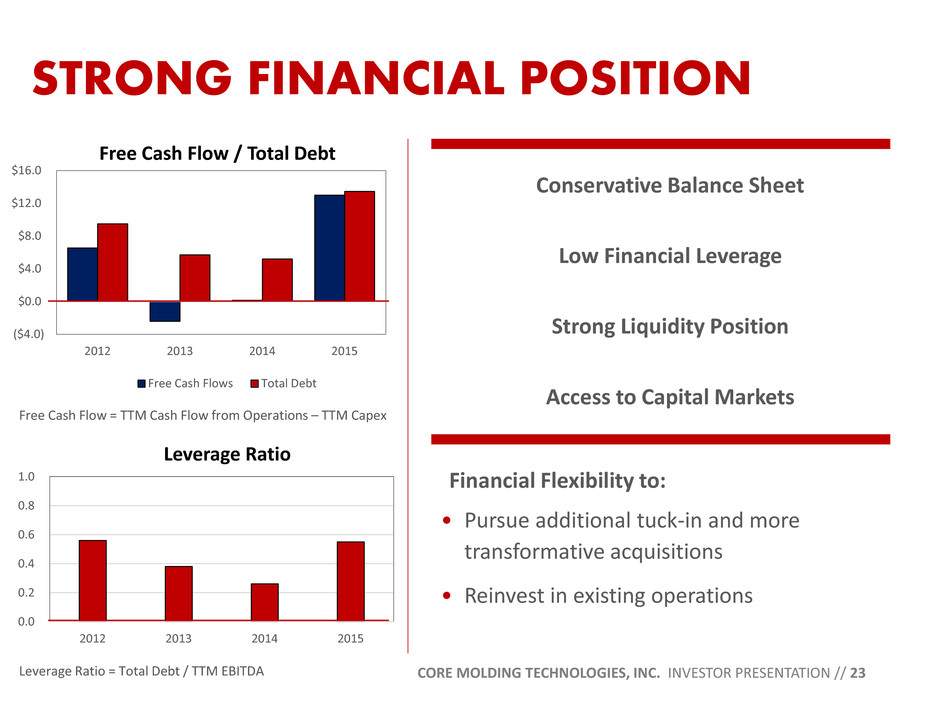

STRONG FINANCIAL POSITION Conservative Balance Sheet Low Financial Leverage Strong Liquidity Position Access to Capital Markets CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 23 • Pursue additional tuck-in and more transformative acquisitions • Reinvest in existing operations Financial Flexibility to: ($4.0) $0.0 $4.0 $8.0 $12.0 $16.0 2012 2013 2014 2015 Free Cash Flows Total Debt Free Cash Flow / Total Debt 0.0 0.2 0.4 0.6 0.8 1.0 2012 2013 2014 2015 Leverage Ratio Leverage Ratio = Total Debt / TTM EBITDA Free Cash Flow = TTM Cash Flow from Operations – TTM Capex

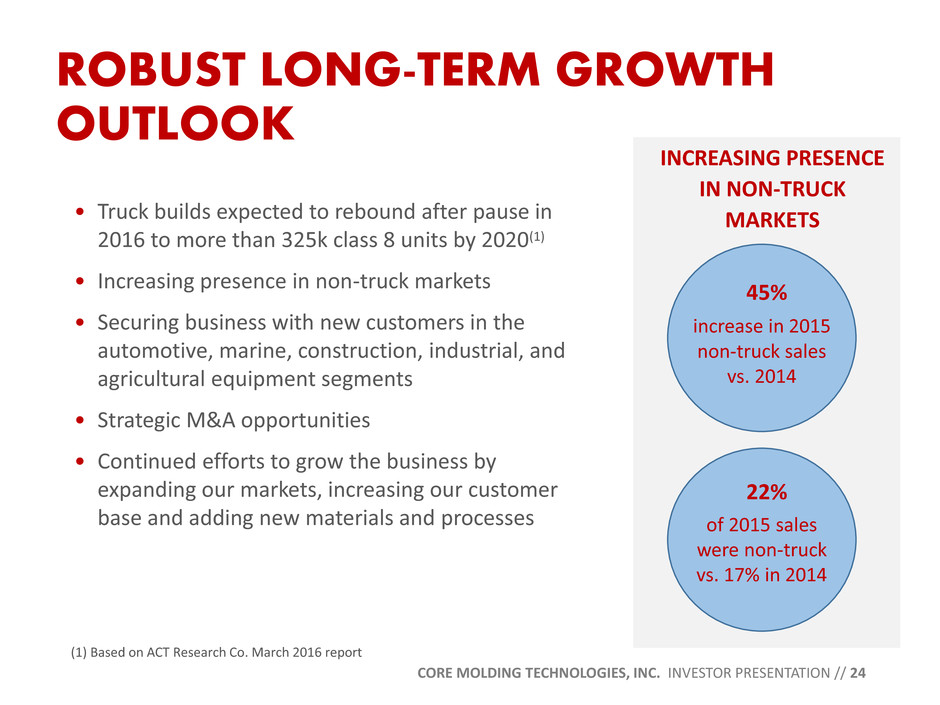

ROBUST LONG-TERM GROWTH OUTLOOK • Truck builds expected to rebound after pause in 2016 to more than 325k class 8 units by 2020(1) • Increasing presence in non-truck markets • Securing business with new customers in the automotive, marine, construction, industrial, and agricultural equipment segments • Strategic M&A opportunities • Continued efforts to grow the business by expanding our markets, increasing our customer base and adding new materials and processes CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 24 INCREASING PRESENCE IN NON-TRUCK MARKETS 45% 22% increase in 2015 non-truck sales vs. 2014 of 2015 sales were non-truck vs. 17% in 2014 (1) Based on ACT Research Co. March 2016 report

LONG TERM STRATEGIC OBJECTIVES CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 25 • Continue diversification of industry and customer base to reduce effect of truck cycles • Increase process and material offerings in order to provide customers with a broad range of solutions • Best in class operations and customer service to provide customers with the highest quality dependable service at a competitive price • Complete strategic acquisitions that diversify industry concentration and broaden process and material offerings Diversified manufacturer of organic polymer composites with an emphasis on serving OEMs

INVESTMENT HIGHLIGHTS • Extensive process expertise in large & growing industry; latest acquisition expands capabilities • A dominant supplier in principal end market •Multi-year programs and high barriers to entry • Wide range of service offerings providing customers with multiple alternatives • Multiple pathways to growth resulting from end market diversification and M&A opportunities • Solid financial position with minimal leverage and ample liquidity • Highly qualified and experienced management CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 26

CONTACT Company Representative Core Molding Technologies CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 27 Corporate Offices Core Molding Technologies 800 Manor Park Drive Columbus, OH 43228 Investor Relations Advisors The Equity Group Inc. Fred Buonocore, CFA Senior Vice President 212-836-9607 fbuonocore@equityny.com John Zimmer Chief Financial Officer 614-870-5604 jzimmer@coremt.com

APPENDIX CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 28

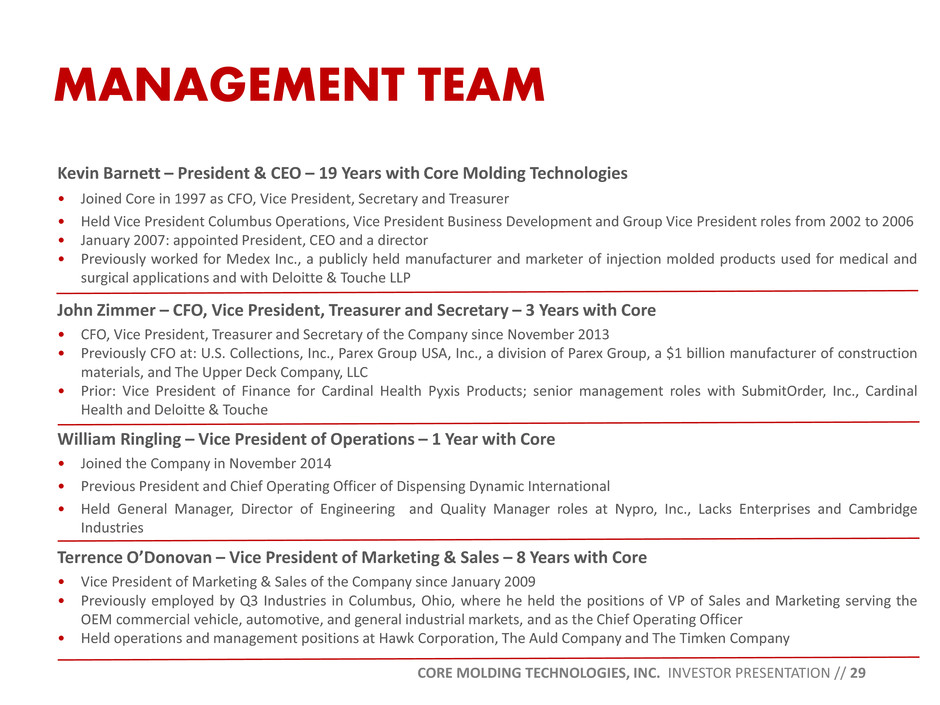

MANAGEMENT TEAM CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 29 Kevin Barnett – President & CEO – 19 Years with Core Molding Technologies • Joined Core in 1997 as CFO, Vice President, Secretary and Treasurer • Held Vice President Columbus Operations, Vice President Business Development and Group Vice President roles from 2002 to 2006 • January 2007: appointed President, CEO and a director • Previously worked for Medex Inc., a publicly held manufacturer and marketer of injection molded products used for medical and surgical applications and with Deloitte & Touche LLP John Zimmer – CFO, Vice President, Treasurer and Secretary – 3 Years with Core • CFO, Vice President, Treasurer and Secretary of the Company since November 2013 • Previously CFO at: U.S. Collections, Inc., Parex Group USA, Inc., a division of Parex Group, a $1 billion manufacturer of construction materials, and The Upper Deck Company, LLC • Prior: Vice President of Finance for Cardinal Health Pyxis Products; senior management roles with SubmitOrder, Inc., Cardinal Health and Deloitte & Touche William Ringling – Vice President of Operations – 1 Year with Core • Joined the Company in November 2014 • Previous President and Chief Operating Officer of Dispensing Dynamic International • Held General Manager, Director of Engineering and Quality Manager roles at Nypro, Inc., Lacks Enterprises and Cambridge Industries Terrence O’Donovan – Vice President of Marketing & Sales – 8 Years with Core • Vice President of Marketing & Sales of the Company since January 2009 • Previously employed by Q3 Industries in Columbus, Ohio, where he held the positions of VP of Sales and Marketing serving the OEM commercial vehicle, automotive, and general industrial markets, and as the Chief Operating Officer • Held operations and management positions at Hawk Corporation, The Auld Company and The Timken Company

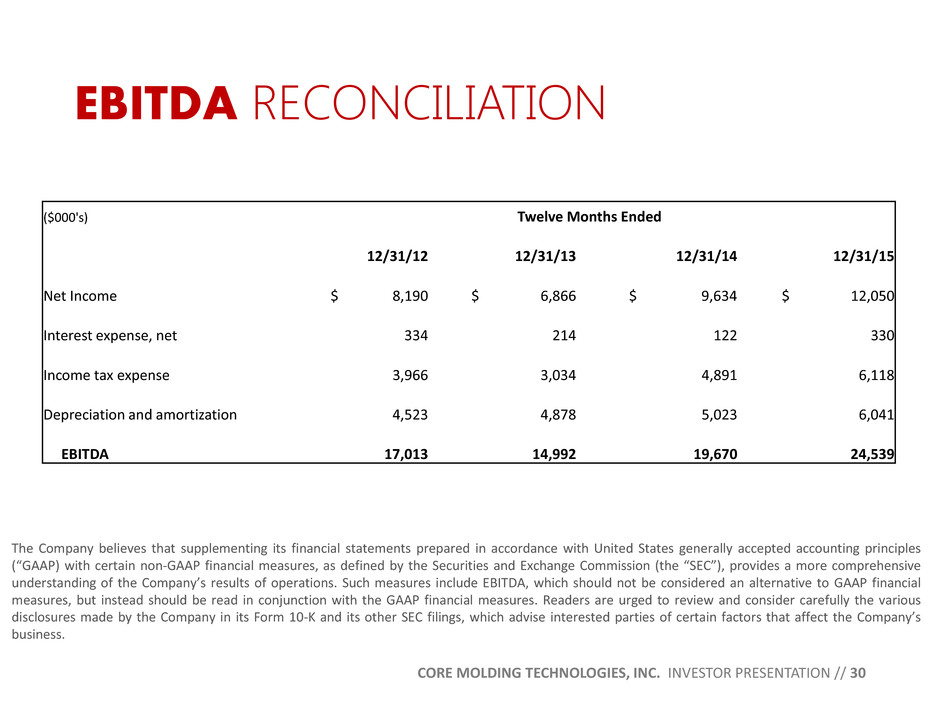

EBITDA RECONCILIATION CORE MOLDING TECHNOLOGIES, INC. INVESTOR PRESENTATION // 30 ($000's) Twelve Months Ended 12/31/12 12/31/13 12/31/14 12/31/15 Net Income $ 8,190 $ 6,866 $ 9,634 $ 12,050 Interest expense, net 334 214 122 330 Income tax expense 3,966 3,034 4,891 6,118 Depreciation and amortization 4,523 4,878 5,023 6,041 EBITDA 17,013 14,992 19,670 24,539 The Company believes that supplementing its financial statements prepared in accordance with United States generally accepted accounting principles (“GAAP) with certain non-GAAP financial measures, as defined by the Securities and Exchange Commission (the “SEC”), provides a more comprehensive understanding of the Company’s results of operations. Such measures include EBITDA, which should not be considered an alternative to GAAP financial measures, but instead should be read in conjunction with the GAAP financial measures. Readers are urged to review and consider carefully the various disclosures made by the Company in its Form 10-K and its other SEC filings, which advise interested parties of certain factors that affect the Company’s business.