Attached files

| file | filename |

|---|---|

| EX-3.3 - EXHIBIT 3.3 - Global 2.0 | ex33.htm |

| EX-3.1 - EXHIBIT 3.1 - Global 2.0 | ex31.htm |

| EX-21 - EXHIBIT 21 - Global 2.0 | ex21.htm |

| EX-32.2 - EXHIBIT 32.2 - Global 2.0 | ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Global 2.0 | ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Global 2.0 | ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Global 2.0 | ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended: December 31, 2015

|

OR

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

|

Commission file number: 000-51697

|

|

Global 2.0 Corporation

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

|

81-0927556

|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

2705 Garnet Avenue, Suite 2A

San Diego, California

|

|

92109

|

|

|

|

(Address of principal executive offices)

|

|

(Postal Code)

|

|

Registrant's telephone number, including area code: (858) 847-9090

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, Par Value of $0.001 Per Share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ X ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10K or any amendment to this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer o Accelerated Filer o

Non-Accelerated Filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ☐

On December 28, 2015, the initial business day for the registrant's, 673,071_shares of its Common Stock, $0.001 par value per share (its only class of voting or non-voting common equity) were held by non-affiliates of the registrant. The market value of those shares was $0.00 based on the last sale price of $0.00 per share of the Common Stock on that date. For this purpose, shares of Common Stock beneficially owned by each executive officer and director of the registrant and each beneficial owner of 10% or more of the Common Stock outstanding have been excluded because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of April 6, 2016, there were 3,595,117 shares of the registrant's common stock, par value $0.001, issued and outstanding and 200 shares of Series A preferred stock, par value $0.002, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

Global 2.0 Corporation

FORM 10-K ANNUAL REPORT

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

|

||

CERTIFICATIONS

|

|

||||

|

Exhibit 31

|

Management certification

|

|

||

|

Exhibit 32

|

Sarbanes-Oxley Act

|

|

||

Forward Looking Statements — Cautionary Language

Certain statements made in these documents and in other written or oral statements made by Global 2.0 Corporation or on Global 2.0 Corporation's behalf are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words like: "believe", "anticipate", "expect", "estimate", "project", "will", "shall" and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in our businesses, prospective products, future performance or financial results. Global 2.0 Corporation claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from the results contained in the forward-looking statements. Risks and uncertainties that may cause actual results to vary materially, some of which are described in this filing. The risks included herein are not exhaustive. This annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC include additional factors which could impact Global 2.0 Corporation's business and financial performance. Moreover, Global 2.0 Corporation operates in a rapidly changing and competitive environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the impact of all risk factors on Global 2.0 Corporation's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Global 2.0 Corporation disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of the report.

As used in this annual report, "we", "us", "our", "Global 2.0", "Global 2.0 Holdings" "Company" or "our company" refers to Global 2.0 Corporation and all of its subsidiaries.

Except for historical information contained herein, the following discussion contains forward-looking statements that involve risks and uncertainties. Such forward-looking statements include, but are not limited to, statements regarding future events and the Company's plans and expectations. Actual results could differ materially from those discussed herein. Factors that could cause or contribute to such differences include, but are not limited to, those discussed elsewhere in this Form 10-K or incorporated herein by reference, including those set forth in Management's Discussion and Analysis of Financial Condition and Results of Operations.

Overview

Our company, Global 2.0 Corporation (formally referred to as Global Seafood Acquisition Corporation prior to the Merger Agreement as discussed in Corporate History below) is engaged in the Procurement and Distribution of Seafood internationally. [The predecessor company, Bridgetech Holdings International, Inc. was a company focused primarily on the business of facilitating the transfer of medical drugs, devices and diagnostics from the United States to China and other international locations. This business ceased all operation in 2008.]

Other than as set out in this quarterly report and any prior reports, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Corporate History

The entity that is the original predecessor of our company, originally named "Huggie Heart, Inc.," was incorporated in Delaware on June 4, 1991. In November 2002, this entity acquired Parentech, Inc., a Delaware corporation, and changed our name to "Parentech, Inc.". Effective May 18, 2015, the original predecessor changed their name to "Global Seafood Holdings Corporation." On December 28, 2015, through the Merger Agreement described below, we became "Global 2.0 Corporation".

Global 2.0 Corporation was incorporated on December 28, 2015 as a Delaware corporation under Delaware General Corporation Laws ("Delaware Act"). On the day of Global 2.0 Corporation incorporation, it became a Holding Company pursuant to Section 251(g) of the Delaware Act under an Agreement and Plan of Merger (the "Merger Agreement") with Global Seafood Holding Corporation ("GSHC") and BGTH Pre Inc. ("Merger Corp.") dated the same date (the "Reorganization"). Under the Merger Agreement, GSHC merged into Merger Corp. and ceased to exist, wherein the Merger Corp. became and is the survivor and successor under Section 251(g) of the Delaware Act, having acquired all GSHC's assets, rights and liabilities as the constituent or resulting corporation. Global 2.0 Corporation became the parent and the Holding Company of Merger Corp. under the Reorganization which was in compliance with Section 251(g) of the Delaware Act and Section 368(a)(1)(B) of the Internal Revenue Code of 1986, as amended.

Upon consummation of the Reorganization, each issued and outstanding equity of the former GSHC was transmuted into and exchanged for an identical equity structure from Global 2.0 Corporation (on a share-for-share basis) having the same designations, rights, powers and preferences, and qualifications, limitations and restrictions. Upon consummation, Global 2.0 Corporation, is the issuer since the former GSHC equity structure was transmuted pursuant to Section 251(g) into the current issued and outstanding equities of Global 2.0 Corporation.

The Reorganization was exempt from the registration requirements of the Securities Act of 1933 ("Act") as there was no "offer" or "sale" as defined in Section 2(3) of the Act so as to invoke the requirements of Rule 145 also under the Act.. Global 2.0 Corporation, as the issuer, was given a new CUSIP and tax identification number. Pursuant to Rule 144(d)(3)(ix) of the Act, the holding periods for the issued equities of Global 2.0 Corporation are the same and "tack" of the original holding periods of the equities transmuted from the former GSHC. Upon consummation of the Merger Agreement, GSHC's common stock was deemed to be registered under Section 12(b) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12g-3(a) promulgated thereunder. For purposes of Rule 12g-3(a), GSHC is the successor issuer to Global 2.0 Corporation. Subsequent to the completion of the Reorganization, the ownership by Global 2.0 Corporation in Merger Corp was canceled and the shares evidencing ownership in Merger Corp were returned and canceled.

Global 2.0 Corporation no longer has any interest or ownership in Merger Corp as the Board of Directors are now conducting all of their operations through Global 2.0 Corporation and subsidiaries.

Global 2.0 Corp.

A Holding Company pursuant to Section 251(g) of the Delaware Act

2015 was an extremely turbulent for the Seafood Industry, as seen by the $5 Billion drop in turnover by the World's 100 Largest Seafood Companies [undercurrent news 10/6/15]. This 'perfect storm' can be attributed to Currency fluctuations (the dollar strengthened a good deal vs. several heavy Seafood Producing currencies including Chile's ; Indonesia's ; the Philippian's ; and Viet Nam's; Political Issues (the Russian Embargo); a renewed focus on illegal and unregulated fishing, (primarily Thailand); the carryover effect of several large bankruptcy filings in 2013-2015, resulting from overpriced acquisitions and the expensive debt that enabled them to be completed[Undercurrent news 10/6/15].

This 'Perfect Storm' set a unique landscape on which to execute a Roll-up Strategy and build a vertically integrated International Seafood enterprise. Through the acquisition of established companies, now in need of a safe harbor to join and providing an immediate desk for displaced talent from companies that completely imploded, the Company has positioned itself to acquire assets at a substantial discount to the premium normally expected for acquisitions and is some cases, a discount to today's market values.

Background - Global Seafood Holdings Corporation, (GSHC), Global Seafood International, Inc. and Global 2.0 Corporation.

On August 1, 2014, Global Seafood Holdings Corporation was established as a wholly owned subsidiary to develop and pursue a strategy to participate in the international seafood industry, taking advantage of the current consolidation going on in the overall food industry.

In January of 2015, Global Seafood Holdings Corporation began to develop a new seafood business opportunity in Chile.

Chilean Aquaculture

Chilean aquaculture began in experimentation in the early 1970's. Industrial level production began in the late 1970's, grew through the 1980's & 1990's until it represented 34% of the world's production by 2003. In 2005, Chile expected to export $1.5 billion worth of fresh-packed salmon, with 40 percent of it coming to the United States.

In 2007, Chile's salmon industry faced the worst crisis in its history. The virus, infectious salmon anemia ("ISA"), was first reported at a Chilean salmon farm owned by a Norwegian company. It quickly spread through southern Chile, wracking a fishing business that had become one of the country's biggest exporters during the past 15 years. The Chilean industry suffered more than $2 billion in losses and saw its production of Atlantic salmon fall by half and subsequently laid off 26,000 workers. In 2007, Salmon reached its highest point, exporting about 76,500,000 tons. Following the outbreak, in 2010, the figures dropped substantially to 30,317,339 tons. [Undercurrent News 10.6.15]

The solution was a massive Antibiotic/Anti-parasitic program initiated by the largest farms and producers in 2009. Mortality rates dropped from a high of 25% to an average of 15.2% in 2014. Chilean salmon farms use on average 700 grams of antibiotics per metric ton of harvested salmon compared to less than 10 grams in Norway.

In mid-2014, the negative impact of Chilean salmon industry's use of the antibiotic oxytetracycline, (put into the feed to fight against the persistent and widespread disease) began surfacing when agencies started to report increasing evidence that resistance had built up in salmon, with the result that the antibiotic was no longer working effectively. Of equal concern, the resistance buildup to oxytetracycline is particularly problematic since the World Health Organization lists the antibiotic as being 'highly important' to use for human health, to fight infections due to chlamydia and brucella. Algal Scientific called it the 'biggest example of egregious use in aquaculture'.

In May 2015, Walmart said it was immediately transitioning to 100% 'antibiotic free' Salmon. Chilean salmon has disappeared from Costco stores as they started selling Norwegian salmon labeled 'raised without antibiotics'. It will inevitably take several 5-10 years to reverse the damage to the industry.

[Undercurrent News June 11, 2015].

Some of the best investment opportunities come after the 'bubble' bursts. We believe that what differentiates our vision and skill set is our strength to begin looking for opportunities when indicators turn bleak and our ability to recognize the viable collateral damage worth pursuing when the 'burst' happens.

Collateral damage is defined as the unexpected harm to things that are incidental to the damaging event, having not been the cause of/nor the intended target of the results.

In the Chilean salmon business, the collateral damage is found in the area south of the Strait of Magellan, known for being prime conditions for salmon farming due to the frigid temperatures. This area is considered Antarctic waters, isolated from the warmer productive areas further north that have been heavily hit by

the ISA virus and now it is dealing with business fall out due to the extensive use of antibiotics. This region does not require antibiotics; however, it has been seriously caught up in the severe reduction in global sales, because it is a salmon product from Chile.

Having not participated in the original wave of investments developing the Chilean salmon industry and fortunately missing the billion dollar losses resulting from the ISA virus and subsequent second round of losses from the antibiotic quagmire, this opportunity, ideally tailored to Global Seafood, was presented to us in February 2015. We believe that Chilean salmon represents a tremendous opportunity for our Company to expand horizontally.

On July 1st, 2015, the first order for products under Global Seafood exceeding 60,000 lbs. and was immediately sold at a profit. During the initial six-month test to assess the opportunity and understand the nuances of the salmon industry, the Company generated $843,245 in revenues, with gross profits before expenses of approximately $125,000.

On December 12, 2015, Global Seafood Holdings Corporation ceased taking orders and all accounts were subsequently settled.

On December 14, 2015, business operations were established and conducted under Global 2.0 (and Global Seafood International, Inc. as a wholly owned subsidiary) to pursue opportunities in the Seafood business. As discussed above, Global 2.0 was formalized on December 28, 2015.

Going forward, the company has conducted business under Global Seafood International, Inc., a wholly owned subsidiary of Global 2.0.

Opportunities that have arisen from the consolidation with the Food Industry/Specifically Seafood

One can debate the reason the Food Industry is consolidating, but not the ripple effect…

| · | At the Brand/Production Level: Hillshire Brands to buy Pinnacle Foods for $6.6 Billion |

| · | In July of 2015, the merger between Kraft and Heinz was completed. |

| · | In September of 2015, the merger between AB InBev and SABMiller was announced. |

| · | At the Distribution Level: US Foods attempted to buy Sysco in 2015, which would have created a $65 billion entity. The Offer was rescinded … |

| · | At the Retail Level: Albertsons acquired Safeway for $9 billion |

An industry experiences a consolidation as it matures and sales/revenues can't be increased in the foreseeable future by adding new customers. To keep and support earnings momentum, (and avoid price discounting), larger companies acquire their competition.

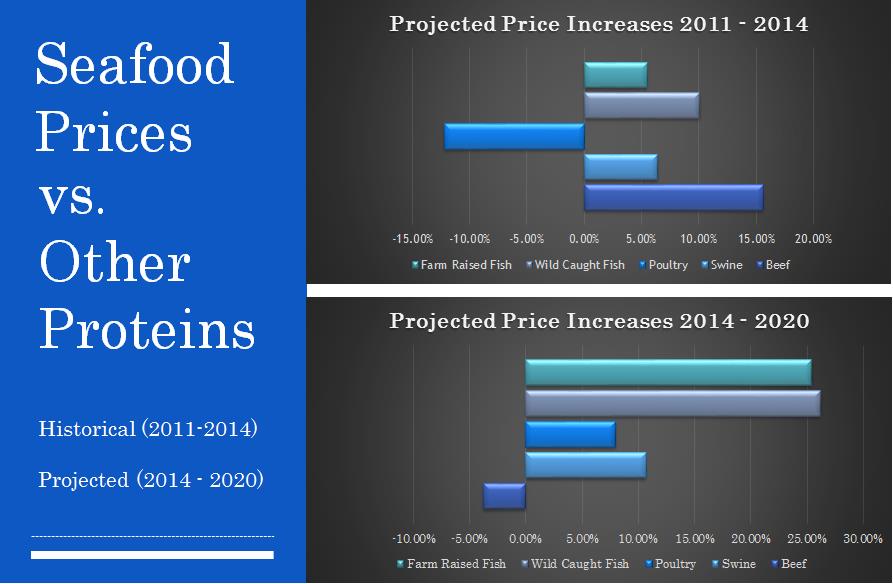

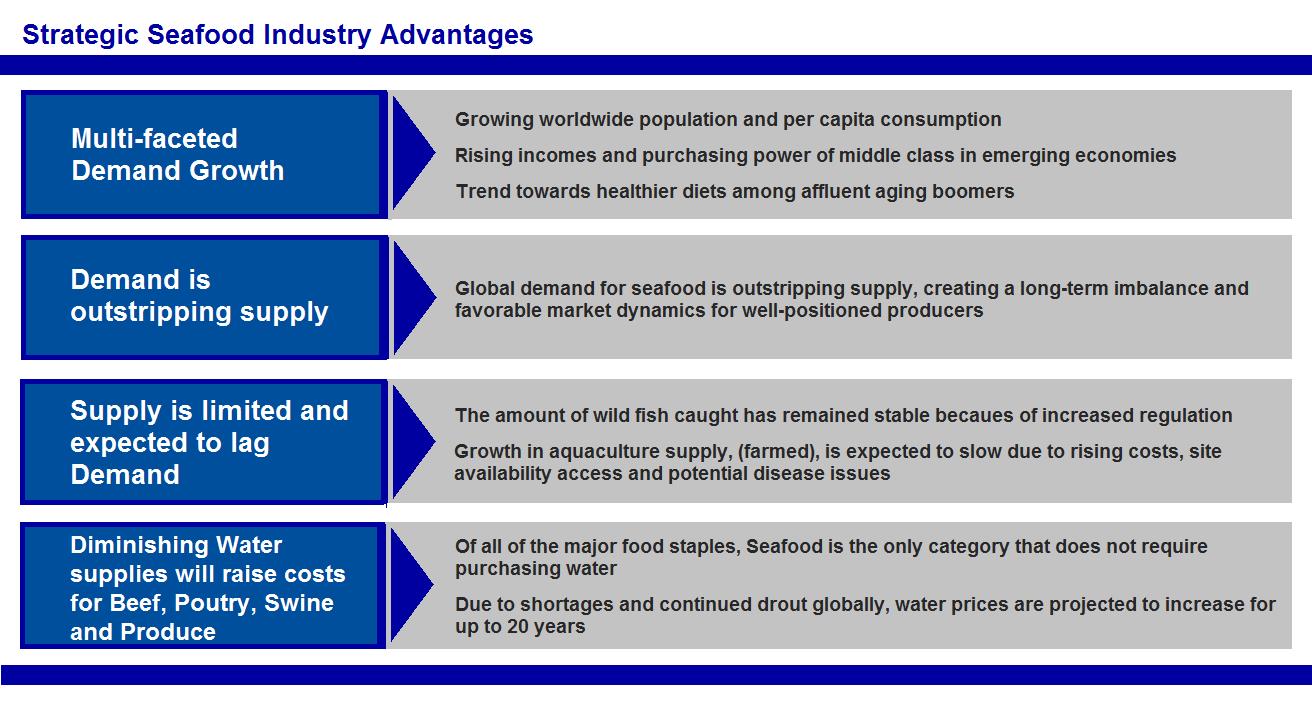

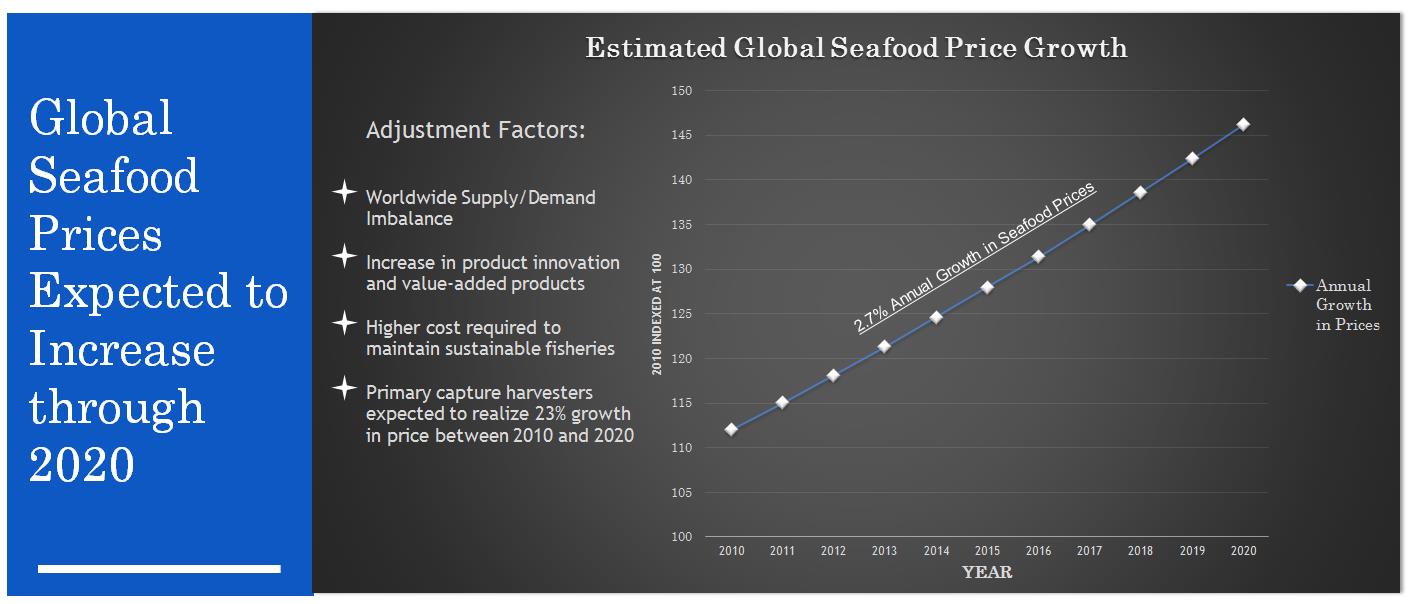

Why Seafood vs. Beef; Poultry; Swine or Produce?

The Seafood Industry: Background and the important role of Vertical Integration.

The Seafood Industry is Diverse and Fragmented with an estimated $400 Billion in Annual Revenues globally. Historically, Companies have specialized in a single seafood species segments within the Value chain. [FAO (Food Outlook Global Market Analysis) 2014. The State of World Fisheries and Aquaculture 2014.] The Industry is broken down into three main segments with a fourth rapidly emerging:

| v | Harvesting |

| · | Commercial Fishing |

| · | Aquaculture Production (Farming vs. Wild Catch) |

| v | Processing |

| · | Primary – cleaning; sorting; freezing; filleting and packaging |

| · | Secondary – creation of processed products for ready meals or meal components |

| v | Distribution |

| · | Wholesale – U.S. Foods/Sysco Distributors |

| · | Retail – Supermarkets; Specialty Seafood Stores |

| · | In-Trade – Hotels; Restaurants & Institutional |

| v | Emerging Fourth Segment - Fish Feed – as Aquaculture continues to grow, the Fish Feed sub-category is expected to produce annual growth of 11.7%. [OECD (The Organization for Economic Co-operation and Development) and FAO Secretariats.] |

The Vision for Global 2.0: Utilizing a public entity, become one of the limited number of remaining 'buyers' in the growing number of motivated sellers in the small-middle tier entities.

During a consolidation market, which management contends began in the seafood industry several years ago and continues to get stronger, the size of the potential buyers group shrinks but the supply of inventory at the small and medium size business categories for sale actually grows, creating, in our opinion, a very inefficient 'Buyer's Market'. Management's vision is to utilize our status as a public entity to attract those smaller and medium entities, who are coming to grips with their rapidly diminishing ability to compete in light of the current seafood industry consolidation, necessitating pursuit of some kind of alliance or merger opportunity just to survive. Effecting this model, we anticipate becoming one of the limited number of remaining 'buyers' among the growing number of motivated sellers in the small-middle tier operators.

Strategic Timing:

Implementing a '2nd Wave Strategy' to affect an Industry roll-up:

Investing tends to be a game of 'Follow the Leader'; hence Bubble's and Bursts. New trends get over-invested normally due to supply and demand. A concept is solid, but the new industry is not ready for a dearth of cash; so poorly conceived and executed projects get funded in the crowd and eventually fail. The bubbles will end only when the greater fool becomes the greatest fool who pays the top price for the overvalued asset and can no longer find another buyer to pay for it at a higher price.

Some of the best investment opportunities come after the 'Bubble' bursts; as speculative money moves on and legitimate projects have a difficult time finding growth capital.

As an industry grows through various stages, sometimes the best skill is the ability to wait until the crowd moves on!

Strategic investments can be identified during each stage/cycle as an industry develops;

| 1. | Origination: A 'Hot' new Product/Category is introduced |

| 2. | Market Development/Expansion/Penetration: if demand is validated, competitors emerge; discounting is established; The successful entrants will pursue revenue growth with Product Line/Brand extension; |

| 3. | Market Capacity: Eventually, markets mature; margins erode; oversupply of Parts/Materials may occur; and Finished Goods Inventories exceed demand; weaker Brands Exit Market and then Consolidation. |

… But the best risk/reward opportunities come during Consolidation. When Industries Consolidate there will always be Change; Disruption and Opportunities. Industry consolidation forces movement. Companies can't stand still because the market itself changes. It becomes simple economics... shop when there are more sellers than buyers. It is a byproduct opportunity that comes with an Industry Consolidation.

Look at it similar to waiting to do your holiday gift shopping beginning Dec. 26th, (the 'After Christmas Sales'); that period directly after Christmas where retailers are trying to keep sales going via discounting and promotions. Since the primary purchase stimulator is over, (gift giving), the size of the group still looking to make purchases is significantly smaller. It is actually a complete reverse in the shopping equation as retailers are now looking to sell off what's remaining to those who are not motivated by delivering a gift on time but solely by price.

In an Industry Consolidation market; the size of the potential buyers group does shrink, but the supply of inventory at the Small and Medium size business categories for sale actually grows, creating a very inefficient 'Buyer's Market'.

This occurs because of three irreversible changes that take effect as a result of Consolidation:

Size: Initially, a few Key Large target companies will be purchased at a substantial premium in order to create size quickly. The New combined entity will continue to make acquisitions but the target size requirement will get larger as smaller 'bites' can no longer have any significant effect on economies of scale; revenues and profits. Immediately after the initial purchases, it stops being feasible for the new Large Companies to pursue Small and Middle market acquisition opportunities. They can't justify the allocating the resources for acquisitions that will not have a discernable effect on revenues and their bottom line.

Margins: Since Consolidation is often the result of markets maturing experiencing fewer growth opportunities, additional profits are now pursued by taking advantage of economies of scale by expanding a company's footprint:

| · | By acquiring competitors, (effectively reducing supply choices for their customers), they minimize discounting; stabilize the market; and can slowly begin to increase prices. |

| · | As the major sources continue to grow in size, so does their purchasing power, putting pressure on component suppliers to reduce their prices, lured by the attraction of higher volumes or simply staying viable. |

Dynamics: To achieve the expected cost savings and economies of scale, the new combined entity will eliminate infrastructure duplications. This can be accomplished by reducing the number of resources they purchase from per category; which will enable a reduction in the buying staff and their support system. To stay viable, suppliers will be expected to grow in both size and vertical integration. Those suppliers that survive the cuts, will be expected to handle larger volumes; additional categories; covering more territories; at lower price points. (Example: four resources for product X might require oversight by a staff of eight, but encouraging one source to grow in capacity and selection could reduce that staff number to four.)

This 2nd Wave Strategy could also be called 'The art of buying undervalued businesses in sectors others are desperate to escape'.

Buy Low/Sell High, but always be in the Market: In almost every market, opportunity moves from the Buy side to the Sell side and back again. By positioning Global Seafood A.C. as one of the only remaining 'Ready Buyers' to vulnerable and displaced Small and Medium size entities, the Company will maintain its 'Buy Low' strategy. At the same time, each acquisition dramatically increases revenues, gradually attracting the attention of the remaining large entities. At some level, the Company will move from 'acquirer' to 'potential target', potentially attracting bidding wars and premium offers that the few available targets in the size range enjoy.

On the Buy Side: Under normal circumstances, to gain control of a target, acquirers must pay its shareholders a premium over the current market value. Although premiums can vary widely, the average ones for corporate control have been fairly stable: almost 30 percent of the pre-offer price of the target's equity. For targets pursued by multiple acquirers, the premium rises dramatically, creating the so-called winner's curse. If several companies evaluate a given target and all identify roughly the same potential synergies, the pursuer that overestimates them most will offer the highest price. Since it is based on an overestimation of the value to be created, the winner pays too much—and is ultimately a loser.

Instead of competing for the largest acquisition targets attracting premium prices, Global Seafood will focus its purchases among the remaining entities that are now too small to be of interest to the largest buyers and no longer viable as a stand-alone entity competing in the overall market.

| · | These are the historically solid businesses that in all likelihood not able to continue to complete and survive with what is left in the marketplace. With owners in their 60's and 70's with either no family members wanting to, or capable of, taking over the business, they now discover there are few buyers looking to cash out their lifetime of work. |

| · | The challenge for smaller companies is that retailers only want to stock a certain number of brands on their shelves. Access to retail shelf space and management succession issues are all making it more difficult for small independent companies to complete with the bigger players. |

| · | With few if any alternatives, these pieces will sell at discounts to historical values before the consolidation began and be very flexible with regards to terms and accepting the majority of the price in paper. |

The acquisitions made in the small to medium size of a category tend to be completed at smaller premiums. Private companies get valued substantially lower because there is no public market where, which adds value because of the liquidity factor. Private acquisitions often stem from the seller's desire to get out rather than the buyer's desire for a purchase.

Increase the Company's Market Value:

Growth by rolling up middle tier companies, enables the acquisition company to consistently deliver increased EBITDA, even if growth slows in the overall market.

The Value Arbitrage; if a public company trading at 20x earnings buys a small private company for 5x earnings, the earnings of the latter automatically trade at 20x as part of the whole entity. When the public company reports earnings the first time after making the acquisition, the tranche of its earnings from the acquisition naturally trades at the same multiple as the whole entity, 20x instead of 5x, completing the arbitrage.

Maintaining a Buy/Sell Position in the Market

Keeping the acquisition window limited to the Small and Medium size target companies give Global Seafood the unique flexibility to be a Strategic Buyer and Seller… at the same time.

With each additional acquisition, the Company grows closer to the size of a Top Tier. At some level of revenues, the Company becomes an attractive target. Having grown without getting saddled with expensive long term debt, the Company will be easier to finance for a buyer. If purchase premiums rise to a high enough level, selling becomes a very positive exit strategy.

Acquisitions in Discussion with Letters of Intent:

Blue Star Foods

The Management Team of Global 2.0 set out to build the company's strategy for growth around access to and the guidance of the management group at John Keeler & Co. d/b/a Blue Star Foods. The primary focus of Blue Star and current source of revenue is importing blue and red swimming crab meat primarily from Indonesia, Philippines and China and distributing it in the United States, Mexico, Canada, the Caribbean, United Kingdom, France, Singapore and Hong Kong under several brand names such as Blue Star, Seassentials, Oceanica, Pacifika and Harbor Banks. To that end, it planned to acquire and utilize the infrastructure as the central base from which to build. (John Keeler & Co., Ltd.' audited results submitted in the Company's DEF 14C Filing dated April 22, 2015, John Keeler & Co. reported 'Net revenues were approximately $49,246,767 in fiscal 2014 and Gross Profit increased to $6,913,676.)

On February 18, 2015, a Merger Agreement was executed between Global Seafood Holdings Corp, and John Keeler & Co., Inc., (subsequently amended on July 24, 2015), restructured for an initial purchase of nineteen percent (19%) of John Keeler & Co., Inc. and the option to purchase the remaining eighty-one percent (81%) on or before December 31, 2016. That option remained in Global Seafood Holdings Corp and a subsequent agreement with Global 2.0 had not been entered into as of Dec 31, 2015.

Philippian Manufacturing Facilities Acquisitions

On November 11, 2015, Global Seafood Holdings Corp entered into a non-binding Memorandum of Understanding to acquire the majority of the equity (not less than 95% of each entity) of two seafood packaging companies located in the Philippians, with represented historical revenues exceeding $15 million per year. The consideration for this negotiated transaction will be our restricted common shares and we expect to close on the acquisitions in stages beginning in 2016. That Memorandum of Understanding remains in Global Seafood Holdings Corp. and a subsequent agreement with Global 2.0 had not been entered into as of Dec 31, 2015.

Model Objectives and Exit Strategy

Focus on the Supply Side:

Vertical Integration: Moving forward, a successful roll-up strategy in the Seafood industry must include Vertical Integration as a core element to effectively drive revenues and profits. Building a business that incorporates ownership and control from Harvesting to Processing and Distribution can enable the Company to:

| · | Achieve operational synergies, cost reductions and higher margins |

| · | Maintain quality control as traceability of the end product has become a major emphasis for food safety |

| · | Establish faster distribution to customers and have the built in ability to adapt quickly to the changing demands of customers |

Improve the acquired company's performance: Improving the performance of the target company is one of the most common value-creating acquisition strategies. Put simply, you buy a company and radically reduce costs to improve margins and cash flows. In some cases, the acquirer may also take steps to accelerate revenue growth.

Size: The increase in size will also enable the Company to meet the expectations of the top customers who are looking for vendors who can deliver product in larger enough volumes to accommodate their growth and market coverage.

Margins: The aim of these deals is to take advantage of greater size, bring on more sophisticated management and reduce costs. Additional profits are now achieved by taking advantage of economies of scale from expanding a company's footprint. Larger companies have stronger negotiating clout; (example: more buying power to purchase goods in bulk). Fewer vendor choices can reduce discounting; stabilize margins and create the opportunity to and increase pricing.

Dynamics: To achieve the expected cost savings and economies of scale, the new combined entity will eliminate infrastructure duplications.

Ability to be more aggressive with key acquisition targets by minimizing overall debt: The best way to create value from an acquisition is to buy cheap—in other words, at a price below a company's intrinsic value. Such opportunities can be brief moments when Markets, for example, sometimes overreact to negative news, such as a unavoidable worldwide event, (weather, nature, political change) or the failure of a single product in a portfolio with many strong ones.

With the majority of the purchase price to be paid in securities, the Company can make superior offers to a potential acquisition because they are not reliant on finding additional capital for a higher offer.

Less Debt than competing companies of similar size, not only delivers stronger earnings with less constraints due to a heavy debt load. It also keeps 'dry powder' available when time is limited and flexibility is needed to take advantage of market dynamics, which may cause a short term drop in the cost of raw materials or speed up a sense of urgency to a potential target due to cash flow issues.

Accelerate market access for the new and existing companies' products; Often relatively small companies with innovative products have difficulty reaching the entire potential market for their products. By adding access to the existing customer base of the core company itself, new products can reach cost effective production levels and profitability sooner

Management

The biggest impediment that occurs transitioning from a company that has grown 'organically' to 'growth through acquisition/roll up' is the drain on existing management. Beginning a roll up strategy can be a daunting task to even the most experienced and savvy management team if acquisitions have never before been part of their corporate development plans.

In 2014, John Keeler, (the founder of John Keeler & Co. d/b/a Blue Star Foods), recognized the emerging consolidation within the Seafood Industry and began to explore growth opportunities. (Located in Miami, Florida, John Keeler & Co., Inc. has been in business since 1995. The primary focus of Blue Star and current source of revenue is importing blue and red swimming crab meat.

Keeler, utilizing the management expertise developed over the past nineteen years, recruited select professionals with extensive experience in Seafood procurement/distribution and implementing 'roll-up' strategies to round out the management team that would build Global 2.0, a new business strategy for a vertically integrated International Premium Seafood company that would focus on several categories of both 'shell' and 'fin' fish. Conducting business under the name of Global Seafood International, Inc., the Management team will utilize their respective reputation and skill sets to establish a universal footprint within the industry, (beyond the Crab Meat category).

Global 2.0's business model addresses the immediate/transitional requirements for its management team, as well as builds the necessary talent pool to run the entity long term as it grows exponentially.

John Keeler – Founding Partner of John Keeler & Co. d/b/a Blue Star Foods:

In 1995, Mr. Keeler started a seafood import company from scratch that has grown to become one of the leading Marketers of Imported Blue Swimming Crabmeat in the US. He has successfully built sales over the past 20 years to $36 million annually through 2013, without ever pursuing outside investment capital. Now recognized as a leader and innovator in the seafood industry, this US based operation delivered 2014 sales exceeding $50 million, primarily sourced from East Asia. Having not lost his passion for how he began, he still oversees operating facilities in the Philippines and Indonesia with production potential of close to 10 million lbs. annually.

Pedro Veganzones – Managing Director

Since 2001, Mr. Veganzones has held senior positions in the Chilean Seafood Industry, where he was personally responsible for the development of new relationships with some of the largest wholesale/retail seafood procurement companies in the US and Asia. His skills negotiating with clients and managing interdepartmental teams have proven key to increasing the value of companies through improved management strategies. His expertise includes fresh and frozen Salmon, Steelhead, Coho, Mussels and Crab products. Mr. Veganzones had risen to the position of National Sales Director, USA, prior to joining Global Seafood Holdings Corp in 2015 and establishing his founding role in Global 2.0.

Scott D. Landow – Founding Partner:

A serial entrepreneur with over 30 years' experience building and executing business plans in Investment Banking; Specialty Retail; Medical Equipment; Beverages & Sports Nutrition, successfully conducting business from the primarily from East Asia, U.S. to China, Japan, Korea and the Middle East. Mr. Landow specializes in building business strategies for emerging growth companies that have plateaued using their own momentum. He has been the CEO/Chairman of several public companies, typically in a 'transitional role' for a few years, aggregating and integrating new resources and managerial expertise to lead the next evolution and growth. For the past several years he has also been an Adjunct Professor of Entrepreneurship at California State University.

Employees

As of the date of this filing, we have no employees.

Research and Development

We have incurred $Nil in research and development expenditures over the last two fiscal years.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the twelve months.

WHERE YOU CAN FIND MORE INFORMATION

You are advised to read this Form 10-K in conjunction with other reports and documents that we file from time to time with the SEC. In particular, please read our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file from time to time. You may obtain copies of these reports directly from us or from the SEC at the SEC's Public Reference Room at 100 F. Street, N.E. Washington, D.C. 20549, and you may obtain information about obtaining access to the Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains information for electronic filers at its website http://www.sec.gov.

As a "smaller reporting company", we are not required to provide the information required by this Item.

As a "smaller reporting company", we are not required to provide the information required by this Item.

We are currently operating from 2705 Garnet Ave Suite 2a San Diego, CA 92109. Our office services and office space was provided without charge by the sole officer and director of our company through December 31, 2015. On February 1,2016 we entered into a sublease agreement for two offices located in Doral, Florida. Monthly rent is $782.44. We do not anticipate that we will require any additional premises in the foreseeable future.

We are currently not involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our company's or our company's subsidiaries' officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Not applicable.

ITEM 5. MARKET FOR REGISTANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUERS PURCHASES OF EQUITY SECURITIES.

Global Seafood Holdings Corp common stock was traded in the over-the-counter market, and quoted in the National Association of Securities Dealers Inter-dealer Quotation System ("Electronic Bulletin Board) www.otcmarkets.com under the symbol "BGTH." Global Seafood Holdings Corp. common stock ceased trading in the over-the-counter market on April 14, 2013. Global 2.0's common stock is not traded on any exchange.

Dividends

We may never pay any dividends to our shareholders. We did not declare any dividends for the year ended December 31, 2015. Our Board of Directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the Board of Directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the Board of Directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend.

Transfer Agent

Global 2.0 's Transfer Agent and Registrar for the common stock is Colonial Stock Transfer located in Salt Lake City, Utah.

Securities Authorized for Issuance Under Equity Compensation Plans

Global Seafood Holdings Corp had two stock option plans: the 2001 Stock Option Plan (the "2001 Plan") and the 2005 Stock Option Plan (the "2005 Plan"). There are currently no options outstanding under the 2001 Plan or the 2005 Plan. Both Plans are terminated and neither plan was carried forward into Global 2.0 Corporation.

|

Plan Category

|

Number of Securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

||||||||

|

(a)

|

(b)

|

(c)

|

|||||||||

|

Equity compensation plans approved by security holders

|

- 0 -

|

- 0 -

|

- 0 -

|

||||||||

|

Equity compensation plans not approved by security holders

|

- 0 -

|

- 0 -

|

- 0 -

|

||||||||

|

Total

|

- 0 -

|

- 0 -

|

_______

|

||||||||

Recent sales of unregistered securities

There were no sales of unregistered securities between the commencement of business for Global 2.0 Corporation and the date of this filing.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended December 31, 2015.

As a "smaller reporting company", we are not required to provide the information required by this Item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OR PLAN OF OPERATION.

The following is management's discussion and analysis of certain significant factors that have affected our financial position and operating results during the periods included in the accompanying consolidated financial statements, as well as information relating to the plans of our current management. This report includes forward-looking statements. Generally, the words "believes," "anticipates," "may," "will," "should," "expect," "intend," "estimate," "continue," and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, including the matters set forth in this report or other reports or documents we file with the Securities and Exchange Commission from time to time, which could cause actual results or outcomes to differ materially from those projected. Undue reliance should not be placed on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to update these forward-looking statements.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto and other financial information contained elsewhere in this Form 10-K

Critical Accounting Policies

Revenue Recognition

The Company recognizes revenues in accordance with FASB ASC Topic 605, "Revenue Recognition", and with the guidelines of the Securities and Exchange Commission ("SEC") Staff Accounting Bulletin ("SAB") No. 104 "Revenue Recognition".

Under SAB 104, four conditions must be met before revenue can be recognized: (i) there is persuasive evidence that an arrangement exists, (ii) delivery has occurred or service has been rendered, (iii) the price is fixed or determinable, and (iv) collection is reasonably assured.

The Company recognizes revenue on brokered product sales at the time when the product is shipped to the customer. The Company evaluates the criteria outlined in ASC Topic 605-45, Principal Agent Considerations, in determining whether it is appropriate to record the gross amount of product sales and related costs or the net amount earned as commissions. Since the Company is the primary obligor in the transaction, does take custody of the product, amounts earned are determined based on an amount per pound of fish sold, and the sales price is determined by the Company, revenue is recorded on a gross basis.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States ("GAAP") requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) the disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and (iii) the reported amount of net sales and expenses recognized during the periods presented. Adjustments made with respect to the use of estimates often relate to improved information not previously available. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of financial statements; accordingly, actual results could differ from these estimates.

These estimates and assumptions also affect the reported amounts of revenues, costs and expenses during the reporting period. Management evaluates these estimates and assumptions on a regular basis. Actual results could differ from those estimates.

Income Taxes

Deferred income taxes are provided based on the provisions of ASC Topic 740, "Accounting for Income Taxes", to reflect the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

The Company adopted the provisions of ASC Topic 740; "Accounting For Uncertainty In Income Taxes-An Interpretation Of ASC Topic 740 ("ASC Topic 740"). ASC Topic 740 contains a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates it is more likely than not, that the position will be sustained on audit, including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest amount, which is more than 50% likely of being realized upon ultimate settlement. The Company considers many factors when evaluating and estimating the Company's tax positions and tax benefits, which may require periodic adjustments. At December 31, 2013, the Company did not record any liabilities for uncertain tax positions.

RESULTS OF OPERATIONS

Global 2.0 began operations in December of 2015. For the period from December 28, 2015 through December 31, 2015, we generated revenues of $59,776, with cost of revenues at $38,425 for a gross profit of $21,351. Our operating expenses during this period were $26,947 resulting in a net loss of $5,596.

Liquidity and Capital Resources

As of December 31, 2015, we had cash of $500. and accounts receivable of $59,776. Our liabilities totaled $65,372.

We are dependent upon funds from private investors and the support of certain stockholders. Management is proposing to raise any necessary additional funds through loans and additional sales of its common stock. There is no assurance that we will be successful in raising additional capital. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.

Contractual Obligations

As a "smaller reporting company", we are not required to provide tabular disclosure obligations.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

As a "smaller reporting company", we are not required to provide the information required by this Item.

GLOBAL 2.0 CORPORATION

| TABLE OF CONTENTS |

Page

|

|

| REPORTS OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

F-1

|

|

| FINANCIAL STATEMENTS: | ||

| Balance Sheet at December 31, 2015 | F-2 | |

|

Statement of Operations for the period from December 28, 2015 to December 31, 2015

|

F-3

|

|

|

Statement of Stockholders' Deficit for the period from December 28, 2015 to December 31, 2015

|

F-4

|

|

|

Statement of Cash Flows for the period from December 28, 2015 to December 31, 2015

|

F-5

|

|

| NOTES TO FINANCIAL STATEMENTS |

F-6

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Global 2.0 Corporation

San Diego, California

We have audited the accompanying consolidated balance sheet of Global 2.0 Corporation (the "Company") as of December 31, 2015, and the related consolidated statement of operations, stockholders' deficit and cash flows for the period from December 28, 2015 through December 31, 2015. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Global 2.0 Corporation as of December 31, 2015, and the results of its consolidated operations and its cash flows for the period from December 28, 2015 through December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has suffered losses from operation and has a working capital deficit as of December 31, 2015. These conditions raise significant doubt about the Company's ability to continue as a going concern. Management's plans in this regard are described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

April 6, 2016

|

GLOBAL 2.0 CORPORATION

|

||||

|

CONSOLIDATED BALANCE SHEET

|

||||

|

FOR THE PERIOD FROM DECEMBER 28, 2015 THROUGH DECEMBER 31, 2015

|

||||

|

December 31,

|

||||

|

2015

|

||||

|

ASSETS

|

||||

|

Cash

|

500

|

|||

|

Accounts Receivable

|

59,776

|

|||

|

TOTAL ASSETS

|

60,276

|

|||

|

LIABILITES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||

|

CURRENT LIABILITIES:

|

||||

|

Accounts payable and other accrued liabilities

|

65,372

|

|||

|

TOTAL LIABILITIES

|

65,372

|

|||

|

COMMITMENTS AND CONTINGENCIES

|

-

|

|||

|

STOCKHOLDERS' EQUITY (DEFICIT):

|

||||

|

Series A 8% cumulative convertible preferred stock, $.002 par value

|

||||

|

5,000,000 shares authorized, 200 issued and outstanding

|

-

|

|||

|

Series B convertible preferred stock, $.02 par value

|

||||

|

2,000,000 shares authorized, 0 issued and outstanding

|

-

|

|||

|

Common stock, $.001 par value, 100,000,000 shares authorized;

|

||||

|

3,595,117 shares issued and outstanding

|

3,595

|

|||

|

Additional paid-in capital

|

(3,095

|

)

|

||

|

Accumulated deficit

|

(5,596

|

)

|

||

|

Total stockholders' deficit

|

(5,096

|

)

|

||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT):

|

60,276

|

|||

|

The accompanying notes are an integral part of the consolidated financial statements.

|

||||

|

GLOBAL 2.0 CORPORATION

|

||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

||||

|

FOR THE PERIOD FROM DECEMBER 28, 2015 THROUGH DECEMBER 31, 2015

|

||||

|

For the Period Ended

|

||||

|

December 31,

|

||||

|

2015

|

||||

|

REVENUE

|

$

|

59,776

|

||

|

COST OF REVENUE

|

38,425

|

|||

|

GROSS PROFIT

|

21,351

|

|||

|

OPERATING EXPENSES:

|

||||

|

Selling, general and administrative expenses

|

26,947

|

|||

|

Total operating expenses

|

26,947

|

|||

|

OPERATING LOSS

|

(5,596

|

)

|

||

|

NET LOSS

|

$

|

(5,596

|

)

|

|

|

NET LOSS PER COMMON SHARE:

|

||||

|

Basic and Diluted

|

$

|

(0.00

|

)

|

|

|

WEIGHTED AVERAGE OF COMMON SHARES OUTSTANDING:

|

||||

|

Basic and Diluted

|

3,595,117

|

|||

|

The accompanying notes are an integral part of the consolidated financial statements.

|

||||

|

GLOBAL 2.0 CORPORATION

|

||||||||||||||||||||||||||||

|

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

|

||||||||||||||||||||||||||||

|

FOR THE PERIOD FROM DECEMBER 28, 2015 THROUGH DECEMBER 31, 2015

|

||||||||||||||||||||||||||||

|

Series A Preferred Stock

|

Common Stock

|

|||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Additional Paid-in Capital

|

AccumulateDeficit

|

Total

|

||||||||||||||||||||||

|

DECEMBER 28, 2015

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||

|

Capital Contribution

|

500

|

500

|

||||||||||||||||||||||||||

|

Founder Shares

|

200

|

-

|

3,595,117

|

3,595

|

(3,595

|

)

|

-

|

-

|

||||||||||||||||||||

|

Net Loss

|

-

|

-

|

-

|

-

|

-

|

(5,596

|

)

|

(5,596

|

)

|

|||||||||||||||||||

|

DECEMBER 31, 2015

|

200

|

-

|

3,595,117

|

3,595

|

(3,095

|

)

|

(5,596

|

)

|

(5,096

|

)

|

||||||||||||||||||

|

The accompanying notes are an integral part of the consolidated financial statements.

|

||||||||||||||||||||||||||||

|

GLOBAL 2.0 CORPORATION

|

||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

||||

|

FOR THE PERIOD FROM DECEMBER 28, 2015 THROUGH DECEMBER 31, 2015

|

||||

|

For the Period Ended

|

||||

|

December 31,

|

||||

|

2015

|

||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||

|

Net loss

|

$

|

(5,596

|

)

|

|

|

Adjustments to reconcile net loss to net cash

|

||||

|

from operating activities:

|

||||

|

Changes in operating assets and liabilities:

|

||||

|

Accounts receivable

|

(59,776

|

)

|

||

|

Accounts payable and other accrued liabilities

|

65,372

|

|||

|

Net cash used in operating activities

|

-

|

|||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||

|

Capital Contribution

|

500

|

|||

|

Net cash provided by financing activities

|

500

|

|||

|

NET CHANGE IN CASH

|

500

|

|||

|

CASH, BEGINNING OF PERIOD

|

-

|

|||

|

CASH, END OF PERIOD

|

$

|

500

|

||

|

NON CASH TRANSACTIONS:

|

||||

|

Founder Shares

|

$

|

(3,595

|

)

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

||||

|

Income taxes paid

|

$

|

-

|

||

|

Interest paid

|

$

|

-

|

||

|

The accompanying notes are an integral part of the consolidated financial statements.

|

||||

NOTE 1 – BUSINESS AND NATURE OF OPERATIONS

Global 2.0 Corporation (formally referred to as Global Seafood Acquisition Corporation prior to the Merger Agreement as discussed in Corporate History below) was incorporated on December 28, 2015 as a Delaware corporation and is engaged in the Procurement and Distribution of Seafood internationally. Global 2.0 Corporation, while formally incorporated on December 28, 2015, commenced business on December 14, 2015 and these financial statements reflect the pre-incorporation business. On the day of Global 2.0 Corporation incorporation it became a Holding Company pursuant to Section 251(g) of the Delaware Act under an Agreement and Plan of Merger (the "Merger Agreement") with Global Seafood Holding Corporation ("GSHC") and BGTH Pre Inc. ("Merger Corp.") dated the same date (the "Reorganization"). Under the Merger Agreement, GSHC merged into Merger Corp. and ceased to exist, wherein the Merger Corp. became and is the survivor and successor under Section 251(g) of the Delaware Act, having acquired all GSHC's assets, rights and liabilities as the constituent or resulting corporation. Global 2.0 Corporation became the parent and the Holding Company of Merger Corp. under the Reorganization which was in compliance with Section 251(g) of the Delaware Act and Section 368(a)(1)(B) of the Internal Revenue Code of 1986, as amended. Upon consummation of the Reorganization, each issued and outstanding equity of the former GSHC was transmuted into and exchanged for an identical equity structure from Global 2.0 Corporation (on a share-for-share basis) having the same designations, rights, powers and preferences, and qualifications, limitations and restrictions. Upon consummation, Global 2.0 Corporation, is the issuer since the former GSHC equity structure was transmuted pursuant to Section 251(g) into the current issued and outstanding equities of Global 2.0 Corporation. The Reorganization was exempt from the registration requirements of the Securities Act of 1933 ("Act") as there was no "offer" or "sale" as defined in Section 2(3) of the Act so as to invoke the requirements of Rule 145 also under the Act. Under the terms of the Merger Agreement, the shareholders and equity holders of the former GSHC have no appraisal rights or rights to a shareholder vote and consequently no investment decision was made by the shareholders. Global 2.0 Corporation, as the issuer, was given a new CUSIP and tax identification number. Pursuant to Rule 144(d)(3)(ix) of the Act, the holding periods for the issued equities of Global 2.0 Corporation are the same and "tack" of the original holding periods of the equities transmuted from the former GSHC. Upon consummation of the Merger Agreement, GSHC's common stock was deemed to be registered under Section 12(b) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12g-3(a) promulgated thereunder. For purposes of Rule 12g-3(a), GSHC is the successor issuer to Global 2.0 Corporation. Subsequent to the completion of the Reorganization, the ownership by Global 2.0 Corporation in Merger Corp was canceled and the shares evidencing ownership in Merger Corp were returned and canceled. Global 2.0 Corporation no longer has any interest or ownership in Merger Corp as the Board of Directors are now conducting all of their operations through Global 2.0 Corporation.

NOTE 2 –SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies of the Company is presented to assist in understanding the Company's financial statements. The financial statements and notes are representations of the Company's management, which is responsible for their integrity and objectivity. These accounting policies conform to GAAP and have been consistently applied in the preparation of the financial statements.

Principal of Consolidation:

Our consolidated financial statements include the accounts of Global 2.0 Corporation and its subsidiary: Global Seafood International, Inc. All inter-company balance has been eliminated.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States ("GAAP") requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) the disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and (iii) the reported amount of net sales and expenses recognized during the periods presented. Adjustments made with respect to the use of estimates often relate to improved information not previously available. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of financial statements; accordingly, actual results could differ from these estimates.

Management evaluates these estimates and assumptions on a regular basis. Actual results could differ from those estimates.

Cash Equivalents:

Cash equivalents are represented by operating accounts or money market accounts maintained with insured financial institutions, including all highly-liquid investments with maturities of three months or less when purchased to be cash equivalents. The Company had no cash equivalents as of December 31, 2015

Revenue Recognition

The Company recognizes revenues in accordance with FASB ASC Topic 605, "Revenue Recognition", and with the guidelines of the Securities and Exchange Commission ("SEC") Staff Accounting Bulletin ("SAB") No. 104 "Revenue Recognition".

For the year ended December 31, 2015, Company's revenues earned from sale of products included 96% of the Company's total revenues from one customer.

Under SAB 104, four conditions must be met before revenue can be recognized: (i) there is persuasive evidence that an arrangement exists, (ii) delivery has occurred or service has been rendered, (iii) the price is fixed or determinable, and (iv) collection is reasonably assured.

The Company recognizes revenue on brokered product sales at the time when the product is shipped to the customer. The Company evaluates the criteria outlined in ASC Topic 605-45, Principal Agent Considerations, in determining whether it is appropriate to record the gross amount of product sales and related costs or the net amount earned as commissions. Since the Company is the primary obligor in the transaction, does take custody of the product, amounts earned are determined based on an amount per pound of fish sold, and the sales price is determined by the Company, revenue is recorded on a gross basis.

Accounts Receivable

The Company records trade receivables when revenue is recognized. When appropriate, the Company will record an allowance for doubtful accounts, which is primarily determined by review of specific trade receivables. Those accounts that are doubtful of collection are included in the allowance. These provisions are reviewed to determine the adequacy of the allowance for doubtful accounts. Trade receivables are charged off when there is certainty as to their being uncollectible. Trade receivables are considered delinquent when payment has not been made within contract terms. At December 31, 2015, the Company had no allowance for doubtful accounts.

Income Taxes

The Company accounts for income taxes under an asset and liability approach. This process involves calculating the temporary and permanent differences between the carrying amounts of the assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The temporary differences result in deferred tax assets and liabilities, which would be recorded on the Company's balance sheets in accordance with ASC 740, which established financial accounting and reporting standards for the effect of income taxes. The Company must assess the likelihood that its deferred tax assets will be recovered from future taxable income and, to the extent the Company believes that recovery is not likely, the Company must establish a valuation allowance. Changes in the Company's valuation allowance in a period are recorded through the income tax provision on the consolidated statements of operations.

From the date of its inception the Company adopted ASC 740-10-30. ASC 740-10 clarifies the accounting for uncertainty in income taxes recognized in an entity's financial statements and prescribes a recognition threshold and measurement attributes for financial statement disclosure of tax positions taken or expected to be taken on a tax return. Under ASC 740-10, the impact of an uncertain income tax position on the income tax return must be recognized at the largest amount that is more-likely-than-not to be sustained upon audit by the relevant taxing authority. An uncertain income tax position will not be recognized if it has less than a 50% likelihood of being sustained. Additionally, ASC 740-10 provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. As a result of the implementation of ASC 740-10, the Company recognized no material adjustment in the liability for unrecognized income tax benefits.

Fair Value of Financial Instruments

The Company applies the provisions of accounting guidance, FASB Topic ASC 820 that requires all entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet, for which it is practicable to estimate fair value, and defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties. As of December 31, 2015, the fair value of cash, and accounts receivable approximated carrying value due to the short maturity of the instruments, quoted market prices or interest rates which fluctuate with market rates.

Related Parties:

A party is considered to be related to the Company if the party directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests is also a related party.

We are currently operating from 2705 Garnet Ave Suite 2a San Diego, CA 92109. Our office services and office space was provided without charge by the sole officer and director of our company through December 31, 2015

Recent Accounting Pronouncements

The Company's management does not believe that any recently issued effective pronouncements, or pronouncements issued but not yet effective, if adopted, would have a material effect on the accompanying financial statements.

NOTE 3 – GOING CONCERN

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying financial statements during the period from December 28, 2015 through December 31, 2015, the Company incurred a net loss of $5,596, had assets totaling $60,276, and liabilities of $65,372. These factors raise substantial doubt about the Company's ability to continue as a going concern.

The Company's existence is dependent upon management's ability to develop profitable operations and to obtain additional funding sources. There can be no assurance that the Company's financing efforts or revenue stream will result in profitable operations. The accompanying statements do not include any adjustments that might result should the Company.

NOTE 4 – EARNINGS PER SHARE

FASB ASC Topic 260, Earnings Per Share, requires a reconciliation of the numerator and denominator of the basic and diluted earnings (loss) per share (EPS) computations.

Basic earnings (loss) per share are computed by dividing net earnings available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. In periods where losses are reported, the weighted-average number of common stock outstanding excludes common stock equivalents, because their inclusion would be anti-dilutive.

The total number of potential additional dilutive warrants outstanding for all periods presented was none since the Company had net losses for all periods presented and had no additional potential common shares that have an anti-dilutive effect.

The following table sets forth the computation of basic and diluted net income per share:

|

December 31, 2015

|

||||

|

Net loss attributable to the common stockholders

|

$

|

5,596

|

||

|

Basic weighted average outstanding shares of common stock

|

3,595,117

|

|||

|

Dilutive effect of options and warrants

|

-

|

|||

|

Diluted weighted average common stock and common stock equivalents

|

3,595,117

|

|||

|

Loss per share:

|

||||

|

Basic and diluted

|

$

|

0.00

|

||

NOTE 5 – Equity