Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - inVentiv Group Holdings, Inc. | d156892dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 5, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

inVentiv Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 8742 | 01-0973593 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1 Van De Graaff Drive

Burlington, Massachusetts 01803

(800) 416-0555

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Eric R. Green, Esq.

General Counsel

1 Van De Graaff Drive

Burlington, Massachusetts 01803

(800) 416-0555

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Alexander D. Lynch, Esq. Heather L. Emmel, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 (Phone) (212) 310-8007 (Fax) |

Deanna L. Kirkpatrick, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 (Phone) (212) 701-5800 (Fax) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common stock, $0.01 par value per share |

$100,000,000 | $10,070.00 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) promulgated under the Securities Act. |

| (2) | Includes shares of common stock that may be issuable upon exercise of an option to purchase additional shares granted to the underwriters. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 5, 2016

Shares

inVentiv Group Holdings, Inc.

Common Stock

This is an initial public offering of shares of common stock of inVentiv Group Holdings, Inc. We are offering shares of common stock.

Prior to this offering, there has been no public market for our common stock. The initial public offering price of our common stock is expected to be between $ and $ per share. We intend to apply to list our common stock on the New York Stock Exchange (“NYSE”) or NASDAQ Global Market (“NASDAQ”) under the symbol “ .”

The underwriters have an option, for a period of 30 days from the date of this prospectus, to purchase a maximum of additional shares of our common stock at the initial public offering price, less the underwriting discount.

We will be a “controlled company” under the corporate governance rules for NYSE- or NASDAQ-listed companies and therefore we will be permitted to, and we intend to, elect not to comply with certain NYSE or NASDAQ corporate governance requirements. See “Management.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 15.

| Initial public offering price |

Underwriting discounts and commissions(1) |

Proceeds to us |

||||||||||

| Per Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses in connection with this offering. See “Underwriting.” |

Delivery of the shares of common stock will be made on or about , 2016.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Credit Suisse | Morgan Stanley |

| Goldman, Sachs & Co. | Jefferies | |

| Citigroup | BofA Merrill Lynch | Barclays | Wells Fargo Securities | |||

The date of this Prospectus is , 2016

Table of Contents

| ii | ||||

| ii | ||||

| 1 | ||||

| 15 | ||||

| 46 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

56 | |||

| 88 | ||||

| 101 | ||||

| 103 | ||||

| 110 | ||||

| 121 | ||||

| 123 | ||||

| 128 | ||||

| 131 | ||||

| 138 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders |

140 | |||

| 144 | ||||

| 150 | ||||

| 150 | ||||

| 150 | ||||

| F-1 |

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus, any amendment or supplement to this prospectus or any free-writing prospectus prepared by us or on our behalf or to which we have referred you. We do not, and the underwriters do not, take any responsibility for, and can provide no assurances as to, the reliability of any information that others provide to you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations and prospectus may have changed since that date.

Until , 2016 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: neither we or any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions related to this offering and the distribution of this prospectus outside of the United States.

Table of Contents

Some of the market and industry data contained in this prospectus are based on independent industry publications or other publicly available information. Although we believe that these independent publications and other publicly available information are reliable as of their respective dates, we have not verified the accuracy or completeness of the data presented from independent sources.

In addition, certain market and industry data contained in this prospectus are based on internal data, studies and management estimates, which are derived from information obtained from analysts’ reports, independent industry publications or publicly available sources, as well as our clients, partners, trade and business organizations and other contacts in the markets in which we operate, and also reflect our management’s understanding of industry conditions. In particular, our estimates of current commercialization spend and the growth rate of commercialization spend by biopharmaceutical companies through 2020 is based on the assumption that growth in selling, general and administrative (“SG&A”) expenses is indicative of growth in commercialization expenses, its largest component, over the same period. Although we believe that such information included in this prospectus is reliable as of their respective dates, such data, studies and estimates, particularly as they relate to market size, market growth, penetration, market share and our general expectations, involve important risks, uncertainties and assumptions and are subject to change based on various factors, including those discussed under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates and beliefs made by the independent parties and by us.

References in this prospectus to (i) our “top clients” are based upon such clients’ contribution to our 2015 net revenues and (ii) the “largest global biopharmaceutical companies” are based upon 2014 revenues within the biopharmaceutical industry.

inVentiv Health and the associated logo are some of our registered and unregistered trademarks. This prospectus also includes other registered and unregistered trademarks of ours. All other trademarks, tradenames and service marks appearing in this prospectus are the property of their respective owners.

Solely for convenience, certain trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights information appearing elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before investing. You should read this entire prospectus carefully, including the section entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto included elsewhere in this prospectus, before investing in our common stock. The terms “inVentiv,” “Company,” “we,” “us” and “our” refer to inVentiv Group Holdings, Inc. and its consolidated subsidiaries. Various financial terms, including “EBITDA,” “Adjusted EBITDA” and “Constant currency net revenues” are described under “—Summary Consolidated Financial and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Exchange Rate Fluctuations.”

Overview

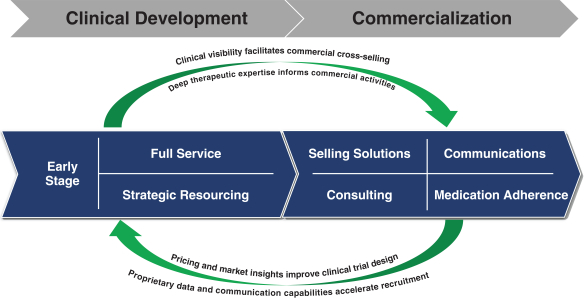

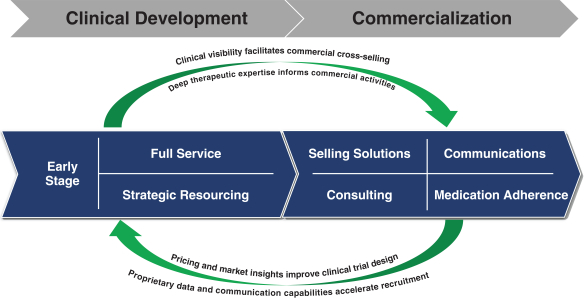

We are a leading global provider of outsourced clinical development and commercialization services to biopharmaceutical companies. We are the only provider delivering a full suite of services to enhance our clients’ ability to successfully develop, launch and market their products. We offer our services on both a standalone basis and as integrated solutions to support clinical development and commercialization. Our solutions are designed to drive greater efficiency and lower costs. We helped develop or commercialize over 80% of all new molecular entities approved by the Food and Drug Administration (“FDA”) and 70% of those approved by the European Medicines Agency (“EMA”) over the last five years through our innovative model. In 2015, we served more than 550 client organizations, including all 20 of the largest global biopharmaceutical companies, and have the ability to service clients in over 90 countries.

We focus on the large and rapidly growing outsourcing component of the estimated $250 billion biopharmaceutical clinical development and commercialization market. Our services cover the entire biopharmaceutical development and commercialization continuum spanning from first-in-human clinical trials to the ongoing commercialization of mature products. Our services are designed to enhance our clients’ revenues and profitability, increase the likelihood of success of their clinical programs and commercial efforts and accelerate the execution of their projects in order to shorten the time from “lab to life.”

Our Clinical business is a leading global contract research organization (“CRO”) that is therapeutically-focused and provides a wide range of capabilities, including Phase I (early stage) and Phase II–IV clinical development, delivered on a project (full service) or functional (strategic resourcing) basis. Our services are designed to accelerate our clients’ pursuit of regulatory approval. We provide our services through teams that possess operational and scientific expertise in a broad range of therapeutic areas with a particular focus in high growth areas such as oncology, neuroscience, pain and respiratory. Our Commercial business is a contract commercial organization (“CCO”), the biopharmaceutical industry’s only provider of a full suite of complementary commercialization services, including selling solutions, communications, consulting and medication adherence. We believe this unique CCO model provides a competitive advantage by integrating strategic, creative and operational expertise enhanced by the deep therapeutic expertise from our Clinical business to help optimize performance, reduce risk and expedite delivery of innovative products.

We have over 14,000 employees globally, including more than 750 M.D.s and Ph.D.s, and offer clients a differentiated set of solutions designed to enhance operational and financial efficiencies across the clinical development and commercialization continuum. Our Clinical and Commercial segments inform and enhance one another, and the flexibility of our model allows us to provide additional services over time as the needs of our clients evolve.

1

Table of Contents

The creation of our comprehensive and integrated approach to serve the biopharmaceutical development and commercialization continuum began in 2010 with our acquisition by our sponsor, Thomas H. Lee Partners, L.P. (“THL”). We have made substantial investments, strategic acquisitions and operational changes to expand and strengthen our clinical development and commercial service offerings, geographic presence, human capital, systems and infrastructure to better serve our clients. These strategic and operational initiatives included:

| • | Completion and integration of 10 strategic acquisitions, including three CROs, to offer a full suite of services on a global basis; |

| • | Enhancement of therapeutic area focus with particular expertise in oncology, neuroscience, pain and respiratory; |

| • | Integration and rationalization of legacy commercial acquisitions and separately-operated brands into the biopharmaceutical industry’s only CCO providing a full suite of complementary commercialization services; |

| • | Expansion of our geographic capabilities in Japan, India, Western Europe, Latin America and China; |

| • | Evolution of our selling solutions capabilities into a market-leading strategic offering with expertise in helping clients launch and market complex biopharmaceutical products; and |

| • | Recruitment of Michael A. Bell, our Chairman and CEO who has extensive experience across the healthcare delivery continuum and who has managed and grown sophisticated global service organizations. |

These initiatives have helped us create a leading biopharmaceutical outsourcing business with an unmatched ability to provide a full suite of integrated services to meet our clients’ needs. Each of our top 10 clients and 24 of our top 25 clients utilized services from both our Clinical and Commercial segments in 2015. The following financial metrics are reflective of our improved performance from 2014 to 2015:

| • | Net revenues increased 10.4% on an as-reported basis (13.0% on a constant currency basis) to $1,994.3 million. |

| • | Clinical segment net revenues increased 8.9% to $947.9 million (47.2% of total net revenues). |

| • | Commercial segment net revenues increased 12.3% to $1,059.9 million (52.8% of total net revenues). |

| • | Adjusted EBITDA increased 33.9% to $275.9 million. |

| • | Adjusted EBITDA as a percentage of net revenues increased to 13.8% from 11.4%. |

2

Table of Contents

We incurred losses from continuing operations of $150.6 million and $180.6 million for the year ended December 31, 2015 and 2014, respectively. See “—Summary Consolidated Financial and Operating Data” for a discussion of Adjusted EBITDA and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Exchange Rate Fluctuations” for a discussion of constant currency net revenues.

Our Markets

Global demand for biopharmaceutical products is expected to continue to increase in both developed and emerging markets, driven by expanding access to care, increasing life expectancy and the growing prevalence of chronic conditions. Growing regulatory requirements, pricing and reimbursement challenges, a need to replenish product pipelines and a shift to more targeted and personalized medicines are driving higher costs and complexities and increasing pressures on biopharmaceutical companies. Additionally, advancements in science are driving new therapies (such as gene therapies, stem cells and biologics) that necessitate more complex clinical development and commercialization services. Faced with these pressures, biopharmaceutical companies are increasingly seeking to improve the efficiencies and effectiveness of their clinical development and commercialization activities by outsourcing these services throughout the entire product lifecycle. In particular, the following trends are expected to increase demand for outsourced clinical development and commercialization services:

| • | Growth in R&D Spending. We estimate the total research and development (“R&D”) spending in the biopharmaceutical industry was approximately $140 billion in 2015. Potential outsourcing development spending accounted for approximately 70%, or $100 billion, and is estimated to grow approximately 4% annually through 2020. |

| • | Increased Product Commercialization Spending. We estimate that spending related to product commercialization in the biopharmaceutical industry exceeded $150 billion in 2015 and will grow at approximately 2% to 3% annually through 2020. |

| • | Expansion in the Use of Outsourcing Services. We estimate that total clinical development outsourcing to CROs in 2015 was approximately 30% of total potential outsourcing development spending, representing an approximately $30 billion market. This market is expected to achieve approximately 40% penetration, or approximately $55 billion of spending, by 2020. Because the market for product commercialization services is more diverse, it is difficult to estimate the current amount of outsourced product commercialization services and the expected growth in such services. However, we estimate that less than 15% of product commercialization expenditures are currently being outsourced. As business models continue to evolve in the healthcare sector, we believe that the rate of commercial outsourcing could follow a similar path to the clinical development market. |

| • | Increased Complexity in Clinical Development and Commercialization. Significant unmet medical needs and scientific advancements are driving biopharmaceutical companies to seek to discover, develop and commercialize new, increasingly complex treatments. As an illustration, the average number of clinical endpoints required for a Phase III study increased 86% from 2002 to 2012. |

These trends represent significant opportunities in both of our segments:

| • | Clinical Segment. Our Clinical segment provides a full suite of services spanning Phases I-IV of clinical development, allowing us to respond to our clients’ needs throughout the development continuum. We expect the continued need for cost efficiency and increased speed to market across expanding product pipelines to benefit outsourced providers, particularly those with global scale and therapeutic expertise. We estimate that total R&D spending in the biopharmaceutical industry was approximately $140 billion in 2015, of which we estimate that potential outsourcing development spending was approximately $100 |

3

Table of Contents

| billion. Based on our estimates, approximately 30% of potential outsourcing development spending in our market was outsourced in 2015. We estimate that the amount of outsourced clinical services will experience a compound annual growth rate (“CAGR”) in the high single digits from 2015 through 2020 as a result of growth in R&D spending by biopharmaceutical companies and the increased outsourcing of this spending. |

| • | Commercial Segment. Our Commercial segment addresses the needs of clients in support of and following product approval and links clinical development to healthcare delivery. The services we provide to address this market include selling solutions, communications, consulting and medication adherence. Because the market served by our Commercial segment is diverse, it is difficult to estimate the current amount of outsourced product commercialization services and the expected growth in such services. However, we estimate that total spending by biopharmaceutical companies related to commercialization of their products exceeded $150 billion in 2015 and less than 15% of these expenditures are currently being outsourced and that the outsourcing of these services is in the early stages of penetration. Growth for the outsourced commercial services market will be driven primarily by two factors: increased spending on commercialization services overall and increased outsourcing penetration within the market. |

Our Competitive Strengths

We address a large and growing market and believe we are well-positioned to continue expanding our market share. Our key competitive strengths include the following:

A global leader in biopharmaceutical outsourcing with differentiated positioning. We serve more than 550 client organizations, including all 20 of the largest global biopharmaceutical companies, and have the ability to service clients in over 90 countries. Over 80% of all new molecular entities approved by the FDA and 70% of those approved by the EMA over the last five years have been developed or commercialized with our support. We believe our scale, global reach and breadth of services, coupled with our deep industry expertise and experience, enable us to offer the solutions our clients need as they navigate an increasingly complex and evolving market. We believe our clients are seeking to consolidate their outsourcing to large global providers like us to address the changing industry dynamics. The breadth of our global clinical and commercial services should position us well to capitalize on this evolving environment and penetrate both existing and new clients.

Adding value across the biopharmaceutical product lifecycle. Our broad suite of services allows us to deliver customized solutions and provide value to biopharmaceutical companies and other key constituents across the healthcare delivery system. We leverage new and existing knowledge capital and proprietary data assets across our offerings to help biopharmaceutical clients optimize execution and reduce costs throughout the product lifecycle. The following are notable examples of these capabilities:

| • | Superior clinical trial design: We leverage our expanding clinical and commercial knowledge capital to inform and enhance clinical trial design in order to facilitate shorter and more efficient trials intended to improve the likelihood of regulatory and subsequent commercial success. |

| • | Enhanced site selection and patient recruitment: We utilize proprietary data assets, behavioral insights, social media and communications capabilities to enhance the speed and success of site selection and patient recruitment. |

| • | Proactive pre-launch reimbursement and formulary management: We bridge the gap between clinical development and commercialization by utilizing our diverse capabilities and communicating clinical benefits to payers and pharmacy benefit managers (“PBMs”) to help optimize reimbursement and patient access. |

| • | Highly effective commercial product launch capabilities: We help our clients navigate the complexities of launching a product by orchestrating interconnected work streams to develop and execute an effective product launch strategy. |

4

Table of Contents

| • | Proprietary programs to improve medication adherence: We have the ability to reach over 175 million patients through multi-channel medication adherence programs designed to mitigate costs related to non-adherence, which are estimated by the Centers for Disease Control and Prevention to exceed $100 billion annually. |

| • | Efficient project ramp-up: We scale clinical or commercial projects rapidly and effectively through our recruiting, training, and deployment capabilities, leveraging over 150 dedicated recruiting personnel and our proprietary database of over 650,000 industry professionals. |

Diversified operating model including deepening relationships with blue-chip client base. We are diversified across our leading Clinical (47% of 2015 net revenues) and Commercial (53% of 2015 net revenues) segments. We have a large and expanding client base, extensive range of services, geographic scope and an ability to provide solutions at nearly every stage of the product lifecycle. We have a loyal client base of over 550 client organizations, including all 20 of the largest global biopharmaceutical companies as well as a significant number of high-growth, small and mid-sized biopharmaceutical companies. Our top five clients accounted for approximately 37% of net revenues in the year ended December 31, 2015, with our largest client accounting for approximately 10% of our net revenues. All of our top 25 clients are diversified across multiple projects, compounds or service offerings. We have strong and growing relationships with our top clients. All of our top 20 clients have been clients since 2010 and many of these clients had long-standing relationships with the companies we have acquired.

Deep and aligned therapeutic expertise. We provide our clients highly-differentiated, specialized teams in both our Clinical and Commercial segments, with operational and scientific expertise in a range of therapeutic areas such as oncology, neuroscience, pain and respiratory. These core, high-growth therapeutic areas constituted 66% of our Clinical segment backlog as of December 31, 2015. We have strategically organized our business around therapeutic area expertise and serve some of the fastest growing areas in the market. Our deep understanding of these therapeutic areas extends throughout our business, allowing our clients to benefit from this knowledge base throughout our full suite of services. We believe our specialized therapeutic expertise in our Commercial segment is unique in our industry and becoming increasingly important to our clients as therapies become more complex and targeted. Our experienced medical and scientific professionals, including more than 750 M.D.s and Ph.D.s, apply innovative insights and science to clinical trials as well as to the commercialization of products.

Attractive financial profile with strong organic growth and operating leverage. We have achieved robust operating and financial performance over the past few years while increasing the scale and breadth of our service offerings. For the year ended December 31, 2015, our net revenues and Adjusted EBITDA grew 10% and 34%, respectively, all of which has been organic. Over the same period, we grew our market share in both Clinical and Commercial segments, as evidenced by growth in net revenues of 9% and 12%, respectively. The momentum in our Clinical segment is further reflected in the 11% growth in our Clinical backlog from December 31, 2014 to December 31, 2015 and 12% growth in net new business awards during the year ended December 31, 2015. Adjusted EBITDA as a percentage of net revenues increased to 13.8% from 11.4%. This margin expansion has been aided by a series of strategic investments and initiatives intended to both build out and rationalize our infrastructure. Examples of these include: (i) shifting selected support services to lower-cost geographies, (ii) centralizing administrative functions and (iii) optimizing our technology spend. We believe our outstanding financial profile and strong operating momentum position us for continued market share gains across both of our segments.

Highly experienced and committed management team. We are led by a dedicated executive management team, averaging 29 years of relevant experience, with extensive experience with biopharmaceutical companies, payers and health systems. Our team has been responsible for executing on our strategy, growing our client base and driving our significant growth in net revenues and Adjusted EBITDA over the past three years. This management team contributes to a company-wide culture of collaboration focused on delivering services and solutions that meet or exceed the quality standards demanded by clients, physicians, patients and regulatory authorities.

5

Table of Contents

Growth Strategy

Our goal is to generate profitable revenue growth in both of our segments and to increase margins through operational efficiency initiatives. The key elements of our growth strategy include:

Leverage our market leadership position in large and attractive markets. Our Clinical and Commercial segments are benefiting from specific industry trends that are expected to drive attractive growth through 2020. We estimate that the amount of outsourced clinical services will experience a CAGR in the high single digits from 2015 through 2020. As business models continue to evolve in the healthcare sector, we believe that the rate of commercial outsourcing could follow a similar path to the clinical development market. Global demand for biopharmaceutical products continues to increase, driven by expanding access to care, increasing life expectancy and the growing prevalence of chronic conditions in both developed and emerging markets. Higher costs and increased complexity are driving our clients to seek efficiency and expertise through outsourcing services. We intend to capitalize on these trends by continuing to provide the services our clients need.

Increase market share through our unmatched service offering and scale. We believe we are uniquely positioned to meet our clients’ evolving needs as the only provider of a full suite of services through the clinical development and commercialization continuum. Our size and scale enable us to provide solutions designed to accelerate our clients’ clinical or commercial projects effectively, thereby driving speed and cost efficiencies. Our ability to engage clients at the early phases of clinical trials with respect to commercial insights allows them to make more informed decisions on clinical trial design and strategies, a key differentiator from our competitors. We intend to leverage our differentiated service offerings to increase our share of the growing market for outsourced clinical and commercialization services.

Drive acceleration of commercial outsourcing. There is increasing demand for the outsourcing of many aspects of commercialization that have been traditionally handled internally by biopharmaceutical companies. Specialized knowledge and expertise, along with efficient cost and productivity management, are increasingly required for the successful launch and commercialization of new complex products. We have continuously expanded and invested in our commercial outsourcing capabilities and we intend to leverage our extensive knowledge, experience and unmatched offerings to drive expansion of the commercial outsourcing opportunity with new and existing clients.

Increase profitability by leveraging our scalable infrastructure. We have focused on creating an organization built for operational flexibility to efficiently provide services to address our clients’ needs. As we succeed in winning new business, we believe our significant degree of operating leverage will allow us to drive incremental margin expansion. Over the last few years, we have streamlined our organizational structure and made progress to optimize the efficiency of our operations. We have centralized and outsourced administrative functions and integrated and rationalized our technology systems to better serve our clients and improve our efficiency. We intend to leverage our improvements and continue to execute on internal efficiency initiatives to increase profitability.

Increase cross-selling with existing clients. We believe that we have substantial opportunities to expand the reach of our services that we provide to our existing clients. As only 53 of our top 100 clients utilized services from our Clinical and Commercial segments in 2015, we believe there is significant potential to sell additional services to our existing client base. In addition, a number of our largest clients that use both clinical and commercial services do not use each of them to the same extent and we are targeting these clients to expand the use of our services within the less utilized segment. Given our past success in expanding the scope of services provided to current clients, we intend to further expand our business with our existing clients by cross-selling additional clinical and commercial services. For example, for the year ended December 31, 2015, each of our top 10 clients in each segment utilized, on average, approximately 40% fewer services (as measured by net revenues) from the other segment. As part of our cross-selling efforts, we market the potential operational and economic efficiencies that clients can achieve by using more of our services throughout the product lifecycle.

6

Table of Contents

Capitalize on client and geographic growth opportunities. We intend to target segments of the biopharmaceutical market in which we are underpenetrated. Specifically, we plan to actively seek to expand our market share among small and mid-sized biopharmaceutical companies, as they frequently lack the robust infrastructures and service capabilities of larger clients. Additionally, we have developed a global platform with a presence in all of the major biopharmaceutical markets in the world with the ability to service clients in over 90 countries and we intend to further expand our business outside of the United States. We are focused on replicating our success in the U.S. market to other major biopharmaceutical markets around the world. We have demonstrated our capabilities for geographic expansion in Japan, the world’s second largest biopharmaceutical market, where we grew from less than 10 employees at the beginning of 2009 to approximately 700 employees at the end of 2015. In Western Europe, we principally see the opportunity to expand our commercial services with our existing clients in North America. We may also selectively identify and acquire complementary businesses to enhance our services, capabilities and geographic presence.

Our Principal Stockholders

Thomas H. Lee Partners, L.P. is one of the world’s oldest and most experienced private equity firms. Since the firm’s founding in 1974, THL has raised over $20 billion of equity capital and invested in more than 130 portfolio companies with an aggregate value of over $150 billion. THL invests in growth-oriented businesses, headquartered primarily in North America, across three sectors: Business & Financial Services, Consumer & Healthcare, and Media & Information Services. THL strives to build great companies of lasting value and generate superior investment returns.

Tax Receivables Agreement

Prior to the completion of this offering, we plan to enter into a tax receivables agreement (“TRA”) that generally provides the right to receive future payments from us to our current (pre-offering) stockholders and certain equity award holders (collectively, the “Existing Stockholders”) of 85% of the amount of income tax savings, if any, that we and our subsidiaries realize as a result of the utilization of certain tax assets attributable to periods prior to our initial public offering (the “Pre-IPO Tax Assets”). Based on current tax laws and assuming that we and our subsidiaries earn sufficient taxable income to realize the full tax benefits subject to the TRA, we expect that future payments under the TRA relating to the Pre-IPO Tax Assets could aggregate to between $ million and $ million. See “Certain Relationships and Related Party Transactions—Tax Receivables Agreement” and “Risk Factors.”

Risks Affecting Our Business

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” before making a decision to invest in our common stock. If any of these risks actually occurs, our business, results of operations, financial condition or prospects could be materially and adversely affected. In such case, the trading price of our common stock would likely decline and you may lose some or all of your investment. Below is a summary of some of the principal risks we believe we face:

| • | Our projects may be delayed, reduced in scope or terminated for reasons beyond our control. |

| • | The relationship of our backlog, book-to-bill ratio and net new awards to net revenues and operating results varies over time. |

| • | We may underprice our contracts, overrun our cost estimates or fail to receive approval for or experience delays in change orders. |

| • | We may be unable to achieve operational efficiencies or grow revenues faster than expenses. |

| • | Our relationships with existing or potential clients who are in competition with each other may adversely impact the degree to which other clients or potential clients use our services. |

7

Table of Contents

| • | We may be unable to recruit suitable willing investigators and patients for clinical trials. |

| • | Our insurance may not cover all of our indemnification obligations and other liabilities associated with our operations. |

| • | We could lose our access to certain data assets, which could impair our ability to provide certain of our services. |

| • | Some of our services involve direct interaction with clinical trial subjects or volunteers and operation of early stage (Phase I and IIa) clinical facilities, which could create potential liability. |

| • | We may be adversely affected by client concentration or concentration in therapeutic areas in which we conduct clinical trials. |

| • | We may be unable to successfully develop and market new services or enter new markets. |

| • | We may be unable to manage our growth effectively. |

| • | We may be impacted by actions of regulators, government regulation and recent and future healthcare reform initiatives. |

| • | We are subject to international economic, political and other risks. |

| • | We have a history of net losses and may not achieve profitability in the future. |

| • | We may be impacted by declines in outsourcing expenditures by companies in the biopharmaceutical industry. |

| • | We have a substantial amount of indebtedness. |

| • | We are controlled by THL, whose interests may be different from those of our public stockholders. |

| • | Upon the listing of our shares on the NYSE or NASDAQ, we will be a “controlled company” within the meaning of the NYSE or NASDAQ rules. As a result, our stockholders will not have certain corporate governance protections concerning the independence of our board of directors (the “Board”) that would otherwise apply to us. |

The above list is not exhaustive. Before you invest in our common stock, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors” immediately following this prospectus summary.

Our Corporate Information

We were incorporated in Delaware in May 2010. Our corporate headquarters is located at 1 Van De Graaff Drive, Burlington, MA 01803. Our telephone number is (800) 416-0555. Our website is www.inventivhealth.com. The information on our website is not deemed to be part of this prospectus, and you should not rely on it in connection with your decision whether or not to invest in our common stock.

8

Table of Contents

The Offering

| Issuer |

inVentiv Group Holdings, Inc. |

| Common stock offered by us |

shares of common stock. |

| Common stock to be outstanding immediately after this offering |

shares of common stock ( shares if the underwriters’ option to purchase additional shares is exercised in full). |

| Option to purchase additional shares |

The underwriters have an option to purchase a maximum of additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We estimate that the net proceeds from the sale of our common stock in this offering, after deducting the underwriting discount and estimated offering expenses payable by us, will be approximately $ ($ if the underwriters exercise in full their option to purchase additional shares) based on an assumed initial public offering price of $ per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus). |

| We intend to use these net proceeds to repay certain of our outstanding indebtedness and for general corporate purposes. See “Use of Proceeds.” |

| Dividend policy |

We do not intend to pay dividends on our common stock for the foreseeable future. However, we may change this policy in the future. Present and future agreements may also limit our ability to pay dividends. See “Dividend Policy.” |

| Voting rights |

Each share of our common stock will entitle its holder to one vote on all matters to be voted on by stockholders generally. See “Description of Capital Stock.” |

| Listing |

We intend to apply to have our common stock listed on the NYSE or NASDAQ under the symbol “ ”. |

| Risk factors |

Investing in our common stock involves a high degree of risk. See the “Risk Factors” section beginning on page 15 of this prospectus for a discussion of factors you should carefully consider before deciding to purchase shares of our common stock. |

9

Table of Contents

Unless otherwise indicated, the number of shares of common stock to be outstanding after this offering is based on shares of common stock outstanding as of , 2016 and all information in this prospectus:

| • | assumes no exercise of the underwriters’ option to purchase additional shares; |

| • | excludes shares of our common stock issuable upon the exercise of options to purchase shares of our common stock, which have a weighted average exercise price of $ per share; |

| • | excludes shares of our common stock issuable upon the vesting of restricted stock units; |

| • | assumes an initial public offering price of $ per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus); |

| • | excludes an aggregate of shares of our common stock that will be available for future equity awards under the inVentiv Group Holdings, Inc. 2016 Equity Incentive Plan (the “2016 Plan”); |

| • | gives effect to a -for- stock split of our common stock that will occur prior to the consummation of this offering; and |

| • | gives effect to our amended and restated certificate of incorporation and our amended and restated bylaws, which will be in effect immediately prior to the consummation of this offering. |

10

Table of Contents

Summary Consolidated Financial and Operating Data

The following table summarizes our consolidated financial data and other data for the periods and at the dates indicated. We derived the consolidated statement of operations data for the years ended December 31, 2015, 2014 and 2013 and the consolidated balance sheet data as of December 31, 2015 from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected for any future period.

The following information should be read together with the information under the headings “Selected Historical Financial Data,” “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| (in millions, except share and per share data) | 2015 | 2014 | 2013 | |||||||||

| Statement of Operations Data: |

||||||||||||

| Net revenues |

$ | 1,994.3 | $ | 1,806.4 | $ | 1,644.6 | ||||||

| Reimbursed out-of-pocket expenses |

327.0 | 266.8 | 259.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenues |

2,321.3 | 2,073.2 | 1,904.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating expenses: |

||||||||||||

| Cost of revenues |

1,326.8 | 1,203.6 | 1,084.8 | |||||||||

| Reimbursable out-of-pocket expenses |

327.0 | 266.8 | 259.9 | |||||||||

| Selling, general and administrative expenses |

525.2 | 529.4 | 538.3 | |||||||||

| Proceeds from purchase price finalization |

— | — | (14.2 | ) | ||||||||

| Impairment of goodwill |

34.0 | 15.8 | 36.9 | |||||||||

| Impairment of long-lived assets |

35.2 | 8.2 | 2.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

2,248.2 | 2,023.8 | 1,907.7 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income (loss) |

73.1 | 49.4 | (3.2 | ) | ||||||||

| Loss on extinguishment of debt and refinancing costs |

— | (10.1 | ) | (0.8 | ) | |||||||

| Interest expense |

(228.3 | ) | (217.4 | ) | (209.3 | ) | ||||||

| Interest income |

0.1 | 0.4 | 0.1 | |||||||||

| Other income |

11.3 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income tax (provision) benefit and income (loss) from equity investments |

(143.8 | ) | (177.7 | ) | (213.2 | ) | ||||||

| Income tax (provision) benefit |

(5.6 | ) | (2.5 | ) | (3.0 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income (loss) from equity investments |

(149.4 | ) | (180.2 | ) | (216.2 | ) | ||||||

| Income (loss) from equity investments |

(1.2 | ) | (0.4 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from continuing operations |

(150.6 | ) | (180.6 | ) | (216.2 | ) | ||||||

| Net income (loss) from discontinued operations, net of tax |

— | (8.2 | ) | (20.2 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net Income (loss) |

(150.6 | ) | (188.8 | ) | (236.4 | ) | ||||||

| Less: Net (income) loss attributable to the noncontrolling interest |

(0.9 | ) | (0.8 | ) | (1.2 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) attributable to inVentiv Group Holdings, Inc. |

$ | (151.5 | ) | $ | (189.6 | ) | $ | (237.6 | ) | |||

|

|

|

|

|

|

|

|||||||

11

Table of Contents

| Year Ended December 31, | ||||||||||||

| (in millions, except share and per share data) | 2015 | 2014 | 2013 | |||||||||

| Earnings per share attributable to inVentiv Group Holdings, Inc. |

||||||||||||

| Basic and diluted:(1) |

||||||||||||

| Income (loss) from continuing operations |

$ | (28.04 | ) | $ | (33.59 | ) | $ | (40.23 | ) | |||

| Income (loss) from discontinued operations |

— | (1.51 | ) | (3.75 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) per share attributable to inVentiv Group Holdings, Inc. |

$ | (28.04 | ) | $ | (35.10 | ) | $ | (43.98 | ) | |||

|

|

|

|

|

|

|

|||||||

| Weighted average number of shares outstanding- basic and diluted |

5,402,377 | 5,402,377 | 5,402,017 | |||||||||

|

|

|

|

|

|

|

|||||||

| Selected statement of cash flows data: |

||||||||||||

| Net cash provided by (used in) continuing operations: |

||||||||||||

| Operating activities |

$ | 106.7 | $ | (46.0 | ) | $ | 22.6 | |||||

| Investing activities |

(5.2 | ) | (23.4 | ) | (24.3 | ) | ||||||

| Financing activities |

(34.7 | ) | 25.5 | (1.3 | ) | |||||||

| Other financial data: |

||||||||||||

| Segment net revenues: |

||||||||||||

| Clinical |

$ | 947.9 | $ | 870.3 | $ | 865.1 | ||||||

| Commercial |

1,059.9 | 943.7 | 784.1 | |||||||||

| Intersegment eliminations |

(13.5 | ) | (7.6 | ) | (4.6 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 1,994.3 | $ | 1,806.4 | $ | 1,644.6 | ||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA(2): |

||||||||||||

| Clinical |

$ | 139.3 | $ | 99.6 | $ | 93.4 | ||||||

| Commercial |

176.0 | 135.5 | 118.7 | |||||||||

| Corporate and other |

(39.4 | ) | (29.1 | ) | (43.8 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 275.9 | $ | 206.0 | $ | 168.3 | ||||||

|

|

|

|

|

|

|

|||||||

| Capital expenditures |

$ | 39.3 | $ | 33.1 | $ | 35.7 | ||||||

| As of December 31, 2015 | ||||||||

| (in millions) | Actual | As Adjusted(3) | ||||||

| Selected balance sheet data: |

||||||||

| Cash and cash equivalents |

$ | 121.3 | $ | |||||

| Total assets |

2,152.7 | |||||||

| Total debt |

2,170.5 | |||||||

| Total liabilities |

2,923.8 | |||||||

| Total stockholders’ deficit |

(771.1 | ) | ||||||

| (1) | Basic and diluted loss per share is computed by dividing the net loss available to common stockholders by the weighted-average number of shares of common stock outstanding during the period. |

| (2) | We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). To supplement this information, we have included the following supplemental non-GAAP financial measures in this prospectus: EBITDA and Adjusted EBITDA. |

EBITDA is defined as income before interest expense, loss on extinguishment of debt and refinancing costs, income tax provision, depreciation and amortization, equity investment income and other income.

Adjusted EBITDA is defined as EBITDA adjusted to exclude certain items (e.g., the impact of impairment losses, acquisition accounting, acquisition expenses, management fees and stock-based compensation) and to include the impact of our acquisition of Catalina Health Resource, LLC (“Catalina Health”), a provider of

12

Table of Contents

tailored, direct-to-patient medication adherence programs, in October 2013. Adjusted EBITDA is a key metric that management uses to assess the performance of our operations and is calculated in a manner consistent with the terms of the instruments governing our indebtedness. We believe that Adjusted EBITDA provides additional relevant information to our investors to compare performance from period to period by excluding certain items that we believe are not representative of our core business.

EBITDA and Adjusted EBITDA are not defined under GAAP, are not measures of net income, operating income or any other performance measure derived in accordance with GAAP, and are subject to important limitations. Our use of the terms EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies in our industry and are not measures of performance calculated in accordance with GAAP. EBITDA and Adjusted EBITDA have important limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our financial performance as reported under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP as measures of operating performance or as alternatives to cash flow from operating activities as measures of our liquidity. For example, EBITDA and Adjusted EBITDA, among other things:

| • | exclude certain tax payments that may represent a reduction in cash available to us; |

| • | exclude certain non-recurring cash charges; |

| • | do not reflect any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the future; |

| • | do not reflect changes in, or cash requirements for, our working capital needs; and |

| • | do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt. |

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA and Adjusted EBITDA only for supplemental purposes.

A reconciliation of income (loss) from continuing operations, the most directly comparable GAAP measure, to EBITDA and from EBITDA to Adjusted EBITDA for the periods indicated is as follows:

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| (in millions) | ||||||||||||

| Income (loss) from continuing operations |

$ | (150.6 | ) | $ | (180.6 | ) | $ | (216.2 | ) | |||

| Income tax provision (benefit) |

5.6 | 2.5 | 3.0 | |||||||||

| Interest expense, net |

228.2 | 217.0 | 209.2 | |||||||||

| Loss on extinguishment of debt and refinancing costs |

— | 10.1 | 0.8 | |||||||||

| Equity investment income |

1.2 | 0.4 | — | |||||||||

| Other income |

(11.3 | ) | — | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Operating income (loss) |

73.1 | 49.4 | (3.2 | ) | ||||||||

| Depreciation and amortization |

95.2 | 107.3 | 106.0 | |||||||||

|

|

|

|

|

|

|

|||||||

13

Table of Contents

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| (in millions) | ||||||||||||

| EBITDA |

$ | 168.3 | $ | 156.7 | $ | 102.8 | ||||||

|

|

|

|

|

|

|

|||||||

| Impairment loss(a) |

69.2 | 24.0 | 38.9 | |||||||||

| Stock-based compensation(b) |

4.3 | 0.6 | (0.9 | ) | ||||||||

| Impact of acquisition accounting adjustments(c) |

1.8 | (4.3 | ) | 2.1 | ||||||||

| Management fees(d) |

2.7 | 2.5 | 2.8 | |||||||||

| Foreign currency transaction (gains) losses(e) |

0.5 | 0.4 | — | |||||||||

| Impact of unrestricted subsidiaries, net of addback(f) |

3.0 | 4.6 | 3.7 | |||||||||

| Acquisition and financing expense(g) |

1.4 | 0.3 | 2.1 | |||||||||

| Severance(h) |

10.8 | 13.8 | 12.3 | |||||||||

| Restructuring costs(i) |

9.4 | 9.5 | 10.8 | |||||||||

| Purchase price finalization(j) |

— | — | (14.2 | ) | ||||||||

| Other(k) |

4.5 | (2.1 | ) | 7.9 | ||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 275.9 | $ | 206.0 | $ | 168.3 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | Represents non-cash losses associated with the impairment of goodwill, intangible assets and other long-lived assets. |

| (b) | Represents non-cash compensation charges. |

| (c) | Represents non-cash adjustments resulting from the revaluation of certain items such as deferred revenue and deferred rent recognized in connection with our prior acquisitions. |

| (d) | Represents the annual sponsor management fee paid pursuant to our management services agreement with THL (the “THL Management Agreement”) described in “Certain Relationships and Related Party Transactions—Management Services Agreements.” The THL Management Agreement will be terminated in connection with this offering. |

| (e) | Represents the net gain or loss resulting from currency remeasurements. |

| (f) | Represents loss from continuing operations of certain foreign subsidiaries that are treated as investments until they reach sustained profitability. |

| (g) | Represents legal and advisory fees incurred in connection with our acquisitions that do not relate to and are not indicative of our core on-going operations. |

| (h) | Represents employee termination costs. |

| (i) | Represents costs in connection with facility closures, relocations, integrations and business optimization. |

| (j) | Represents the final purchase price adjustment recorded in the second quarter of 2013 related to the acquisition of United Health Group’s clinical development business (the “i3 Acquisition”). |

| (k) | Represents third party costs for tax services, franchise taxes and certain non-cash items and one-time costs from third party advisors and gives effect to the results of Catalina Health prior to the closing of the acquisition in the fourth quarter of 2013. |

For a segment-level reconciliation of income (loss) from continuing operations, the most directly comparable GAAP measure, to EBITDA and from EBITDA to Adjusted EBITDA for the periods indicated, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Additional Segment Data.”

| (3) | As adjusted information gives effect to the application of the net proceeds received by us from the offering as described under “Use of Proceeds.” |

14

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before purchasing our common stock. If any of the following risks occur, our business, results of operations or financial condition could be materially and adversely affected. In that case, the trading price of our common stock could decline and you may lose some or all of your investment.

Risks Related to Our Business

Our projects may be delayed, reduced in scope or terminated for reasons beyond our control, which could adversely affect our business, results of operations and financial condition.

Many of our projects, including those in our backlog, may be delayed, reduced in scope or terminated upon short notice (generally 30 to 90 days) without cause. As a result, delays, reductions in scope and cancellations may occur for a variety of reasons that are beyond our control, including:

| • | delays in, or the failure to obtain, required regulatory approvals; |

| • | actions by regulatory authorities; |

| • | the failure of products to satisfy safety requirements or efficiency criteria; |

| • | unexpected or undesired results of the products; |

| • | insufficient patient enrollment; |

| • | insufficient investigator recruitment; |

| • | the client’s lack of available financing, budgetary limits or changing priorities; |

| • | production problems resulting in shortages of the product being tested; |

| • | the client’s decision to terminate the development or commercialization of a product or to end a particular project; |

| • | shift of business to a competitor or internal resources; and |

| • | withdrawal of a product following launch. |

In addition, many of our biopharmaceutical selling solutions service contracts provide our clients with the opportunity to internalize the resources provided under the contract and terminate all or a portion of the services we provide under the contract and our clients may also decide to shift their business to a competitor.

As a result, contract terminations, cancellations, delays and modifications are a regular part of our business. For example, our full service offering within our Clinical segment has been, and may continue to be, negatively impacted by project delays. In addition, project start delays, downsizings and cancellations, particularly within our selling solutions and communications offerings, which are part of our Commercial segment, have impacted our results. The loss, reduction in scope or delay of a large project or of multiple projects could have a material adverse effect on our business, results of operations and financial condition. In addition, we might not realize the full benefits of our backlog if our clients cancel, delay or reduce their commitments to us.

In the event of termination, our contracts may provide reimbursement for the costs of winding down the terminated project as well as fees earned by us up to the time of the termination. These fees may not be sufficient for us to maintain our margins and, as a result, terminations may result in lower operating margins. In addition, cancellation of a clinical trial may result in the unwillingness or inability of our client to satisfy certain associated accounts receivable. We may also be legally or ethically bound to compete or wind down the trial at our own expense. Any of these factors may in turn have a material adverse effect on our business, results of operations and financial condition.

15

Table of Contents

The relationship of backlog, book-to-bill ratio and net new awards to net revenues and operating results varies over time.

Backlog represents future net revenues from work not yet completed or performed under signed contracts, letters of intent or pre-contract commitments that are supported by written communications. Once work begins on a project, net revenues are recognized over the duration of the project. Projects may be terminated or delayed by the client or delayed by regulatory authorities for reasons beyond our control. To the extent projects are delayed, our revenue recognition could be affected. In the event that a client cancels a contract, we typically would be entitled to receive payment for all services performed up to the cancellation date and subsequent client-authorized services related to terminating the canceled project. Typically, however, we have no contractual right to the full amount of the net revenues reflected in our backlog in the event of a contract cancellation. The duration of the projects included in our backlog, and the related revenue recognition, range from a few weeks to many years.

Our backlog at December 31, 2015 was $3,465.4 million compared to backlog of $2,616.0 million at December 31, 2014. Although an increase in backlog will generally result in an increase in net revenues to be recognized over time (depending on the level of cancellations), an increase in backlog at a particular point in time does not necessarily correspond directly to an increase in net revenues during a particular period. The extent to which contracts in backlog will result in future net revenues depends on many factors, including, but not limited, to delivery against projected project schedules, the need for scope changes (change orders), contract cancellations and the nature, duration, size and complexity of the projects, each of which can vary significantly from time to time. Our $3,465.4 million of backlog at December 31, 2015 included approximately $1,973.0 million of backlog that we do not expect to generate net revenues in 2016, compared to our $2,616.0 million of backlog at December 31, 2014, which included approximately $1,310.8 million of backlog that we did not expect to generate net revenues in 2015. While we believe backlog for our Clinical segment can be a useful component of predicting future performance given the multi-year nature of most of the contracts, the majority of our service offerings in our Commercial segment have short term contracts and, as a result, we do not believe backlog is as meaningful a metric and we do not use it as a key metric in managing the Commercial segment. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—How we Assess our Performance—Backlog, Book-to-Bill Ratio and Net New Awards.”

We also consider net new business awards and book-to-bill ratio in our Clinical segment in assessing our performance. Net new business awards represent the value of future net revenues for services awarded during the period under signed contracts, letters of intent or pre-contract commitments that are supported by written communications that are expected to commence within the next twelve months, net of cancellations of prior awards. Book-to-bill ratio is a ratio calculated by dividing net new business awards by net revenues in a particular period. For the year ended December 31, 2015, our Clinical segment recorded net new business awards of $1,145.3 million and book-to-bill ratio of 1.21x.

The rate at which our backlog converts to net revenues, and the relationship of our book-to-bill ratio and net new business awards to net revenues and operating results, may vary over time for a variety of reasons. The revenue recognition on larger, more global projects could be slower than on smaller, less global projects for a variety of reasons, including, but not limited to, an extended period of negotiation between the time the project is awarded to us and the actual execution of the contract, as well as an increased timeframe for obtaining the necessary regulatory approvals. Additionally, the increased complexity of clinical trials and the need to enroll precise patient populations could extend the length of clinical trials causing revenues to be recognized over a longer period of time. Further, delayed projects will remain in backlog, unless and until otherwise canceled by the client, and will not generate net revenues at the rate originally expected. As a result, the relationship of backlog to realized net revenues and future operating results may vary over time, and may not be indicative of our future net revenues or operating results, and we may not realize the anticipated future net revenues reflected in our backlog, and book-to-bill ratio or net new business awards.

16

Table of Contents

Our financial results may be adversely affected if we underprice our contracts, overrun our cost estimates or fail to receive approval for or experience delays in change orders.

Most of our client contracts are either fee-for-service contracts or fixed-fee contracts. Our financial results have been, and our future financial results may be, adversely impacted if we initially underprice our contracts or otherwise overrun our cost estimates and are unable to successfully negotiate a change order. Change orders and other changes in scope typically occur when the scope of work we perform needs to be modified from that originally contemplated by our contract with the relevant client. Modifications can occur, for example, when there is a change in a key clinical trial assumption or parameter, commercialization strategy or a significant change in timing. Where we are not successful in including out-of-scope work into our current contracts, we bear the cost of the additional work. Even if we are successful in negotiating changes in scope, we cannot recognize additional revenues anticipated from changes in scope until appropriate documentation is received by us from the relevant client authorizing the change. However, if we incur additional expense in anticipation of receipt of that documentation, we must recognize the expense as incurred. Any of the foregoing could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our operating margins and profitability will be adversely affected if we are unable to achieve operational efficiencies or grow revenues faster than expenses.

We operate in a highly competitive environment and experience competitive pricing pressure. We have implemented initiatives to control our operating expenses, and we will continue to utilize these initiatives in the future with a view to offsetting any such pricing pressures and improving our operational efficiency. However, we cannot be certain that we will be able to achieve the efficiency gains necessary to maintain or grow our operating margins, or that the magnitude of growth in our revenues will be faster than the growth in our operating costs. If we are unable to grow our revenues at a faster rate than our operating costs, our operating margins will be adversely affected. Our initiatives and any future cost initiatives may also adversely affect us, as they may decrease employee morale or make it more difficult for us to meet operational requirements.

Our relationships with existing or potential clients who are in competition with each other may adversely impact the degree to which other clients or potential clients use our services, which may adversely affect our results of operations.

The biopharmaceutical industry is highly competitive, with biopharmaceutical companies each seeking to persuade payers, providers and patients that their products are better and more cost-effective than competing products marketed or being developed by competing firms. We regularly provide services to biopharmaceutical companies who compete with each other, and often with respect to competitive products, and we sometimes provide services to such clients regarding competing products in clinical development. Our existing or future relationships with our biopharmaceutical clients, particularly with respect to any given product that might compete directly with another client’s product, may therefore deter other biopharmaceutical clients from using our services or may result in our clients seeking to place limits on our ability to serve other biopharmaceutical companies. A loss of clients or reductions in the level of revenues from a client could have a material adverse effect on our business, results of operations and financial condition.

If we are unable to recruit suitable willing investigators and patients, there may be a material adverse effect on the results of operations of our Clinical segment and an adverse impact on our ability to attract new business.

The recruitment of investigators and patients for clinical trials is essential to our business. We contract with physicians located in hospitals, clinics and other such sites, who serve as investigators in conducting clinical trials to test new biopharmaceutical products on their patients. Investigators supervise administration of the investigational product to patients during the course of a clinical trial. Patients for clinical trials are generally from the communities in which the clinical trials are conducted. The availability of suitable patients for enrollment in studies is dependent upon many factors including the size of the patient population, the design of the study protocol, eligibility criteria, the referral practices of physicians, the perceived risks and benefits of the

17

Table of Contents

investigational product under study and the availability of alternative medication, including medication undergoing separate clinical trials. The expanding global nature of clinical trials increases the risks associated with attracting suitable investigators and patients, especially if these trials are conducted in regions where our resources or experience may be more limited. Insufficient patient enrollment or investigator recruitment may result in the termination or delay of a clinical trial, or may require us to expend additional funds to obtain access to more investigators and patients than planned which may, in turn, result in additional costs to us. Any of these factors could have a material adverse effect on the results of operations of our Clinical segment, and may also adversely affect our ability to attract new business.

Our insurance may not cover all of our indemnification obligations and other liabilities associated with our operations.

We maintain insurance designed to provide coverage for ordinary risks associated with our operations and our ordinary indemnification obligations. The coverage provided by such insurance may not be adequate for all claims we may make or may be contested by our insurance carriers. If our insurance is not adequate or available to pay liabilities associated with our operations, or if we are unable to purchase adequate insurance at reasonable rates in the future, our profitability may be adversely impacted.

We could lose our access to certain data assets, which could impair our ability to provide certain services.

Our services depend upon continued access to and receipt of data from internal and external sources, including clinical trial data and other data received from clients and strategic partners, and on our ability to utilize such data in our business. Potential security breaches by employees and others with or without permitted access to our systems pose a risk that such data may be exposed to unauthorized persons or to the public, or that such data may be corrupted, lost or otherwise rendered inaccessible. Such breaches could also arise from negligence or fraud on the part of third parties who store, transfer or process our data, or from cyber-attacks by computer programmers and hackers who may develop and deploy viruses, worms or other malicious software programs. In addition, we may lose access to such data for a variety of other reasons, including the loss of any clients or strategic partners through which such data is generated (including as a result of the perception that our systems are not secure), and disruptions or damage to our information systems.

Our ability to utilize such data generally is subject to limitations in agreements we have with certain of our clients and strategic partners, as well as applicable legal and regulatory restrictions. If we violate any such limitations or restrictions, our ability to utilize such data in our business may be adversely effected. Moreover, we may also become subject to increased legislative, regulatory or judicial restrictions or mandates on the collection, disclosure or use of such data, which could result in additional restrictions on our ability to utilize such data, in particular if such data is not collected in a way that allows us to use such data in our business.

Any of these factors would impact our ability to provide certain of our services and could have a material adverse effect on our reputation, our ability to attract clients, and on our business, results of operations and financial condition.

Some of our services involve direct interaction with clinical trial subjects or volunteers and operation of early stage (Phase I and IIa) clinical facilities, which could create potential liability that may adversely affect our business, results of operations and financial condition.

We operate facilities where early stage clinical trials are conducted, which ordinarily involve testing an investigational product on a limited number of individuals to evaluate a product’s basic safety and identify any side effects as well as, in some instances, early indications of efficacy. Failure to operate such a facility in accordance with applicable regulations could result in that facility being shut down, which could materially disrupt our operations. Regulations applicable to our early stage activities are subject to continuing evolution and change, which could result in the imposition of additional restrictions, create additional costs to us or otherwise

18

Table of Contents