Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99-1 - XG SCIENCES INC | s102925_ex99-1.htm |

| EX-23.1 - EXHIBIT 23-1 - XG SCIENCES INC | s102925_ex23-1.htm |

| EX-10.37 - EXHIBIT 10-37 - XG SCIENCES INC | s102925_ex10-37.htm |

As Filed with the Securities and Exchange Commission on April 5, 2016 |

|

Registration No.333-209131 |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________

XG Sciences, INC.

(Exact name of registrant as specified in its charter)

|

Michigan |

|

2821 |

|

20-4998896 |

|

(State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer Identification |

3101 Grand Oak Drive

Lansing, MI 48911

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Philip L. Rose

Chief Executive Officer

XG Sciences, Inc.

3101 Grand Oak Drive

Lansing, MI 48911

Telephone: (517) 703-1110

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________

Copies to:

Clayton E. Parker, Esq.

Matthew Ogurick, Esq.

Camielle N. Green, Esq.

K&L Gates LLP

200 South Biscayne Boulevard, Suite 3900

Miami, Florida 33131-2399

Telephone: (305) 539-3306

Facsimile: (305) 358-7095

________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨ |

|

Accelerated filer ¨ |

|

Non-accelerated filer ¨ |

|

Smaller reporting company x |

|

|

|

|

|

(Do not check if a smaller reporting company) |

||

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

|

Amount to be Registered |

|

Proposed Maximum Offering Price Per Share(1) |

|

Proposed Maximum Aggregate Offering Price(1) |

|

Amount of Registration Fee |

||||

|

Primary Offering By XG Sciences, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, no par value per share |

|

3,000,000 |

|

$ |

8.00 |

|

$ |

24,000,000 |

|

$ |

2,417 |

|

|

Total: |

|

3,000,000 |

|

$ |

8.00 |

|

$ |

24,000,000 |

|

$ |

2,417 |

(2) |

____________

(1) Calculated in accordance with Rule 457(o) under the Securities Act of 1933.

(2) Previously paid.

The Registrant amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated April 5, 2016

3,000,000 shares of Common Stock of

XG SCIENCES, INC.

This is the initial public offering of common stock of XG Sciences, Inc., and no public market currently exists for the securities being offered. We are registering for sale a total of 3,000,000 shares of common stock at a fixed price of $8.00 per share to the general public in a self-underwritten, best efforts offering. We intend to engage the services of non-exclusive sales agents to assist us with selling the shares. If we engage such sales agents, we intend to pay a commission fee of up to 8%. For additional information please see the “Plan of Distribution”.

We estimate our total offering registration costs to be approximately $1,060,000 assuming we pay sales agents an 8% commission fee. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds (net of any sales agent commissions) from the sale of any of the offered shares.

The offering shall terminate on the earlier of (i) when the offering period ends (180 days from the effective date of this prospectus), (ii) the date when the sale of all 3,000,000 shares is completed, and (iii) when our Board of Directors decides that it is in the best interest of the Company to terminate the offering prior to the completion of the sale of all 3,000,000 shares registered under the Registration Statement of which this prospectus is part.

There has been no public market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not currently quoted on or traded on any exchange or on any over-the-counter market.

After this offering is completed, we intend to seek either (i) a listing of our common stock on a securities exchange registered with the Securities and Exchange Commission (SEC) under Section 6(a) of the Securities Exchange Act of 1934, as amended, such as the NASDAQ Capital Market or the New York Stock Exchange (NYSE), or (ii) the quotation of our common stock on the OTCQB or OTCQX marketplaces operated by OTC Markets Group, Inc. (any of the foregoing generally referred to as a “Qualified National Exchange” and the act of achieving such listing or quotation, generally referred to hereafter as a “Public Listing” in this prospectus). In order to achieve a Public Listing, we will have to meet certain initial listing qualifications of the Qualified National Exchange on which we are seeking the Public Listing. In addition, we will need to have market makers agree to make a market in our common stock and file a FINRA Form 15c211 with the SEC on our behalf before we can achieve a Public Listing, and we will also need to remain current in our quarterly and annual filings with the SEC.

There can be no assurance that our common stock will ever be quoted or traded on a Qualified National Exchange or that any market for our common stock will develop.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Please refer to discussions under “Prospectus Summary” on page 1 and “Risk Factors” on page 7 of how and when we may lose emerging growth company status and the various exemptions that are available to us.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” on page 7 of this prospectus and in the documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for certain risks and uncertainties you should consider.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

TABLE OF CONTENTS

|

|

1 |

|

|

|

5 |

|

|

|

7 |

|

|

|

19 |

|

|

|

19 |

|

|

|

20 |

|

|

|

21 |

|

|

|

22 |

|

|

|

24 |

|

|

|

25 |

|

|

|

26 |

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND |

|

27 |

|

|

39 |

|

|

|

60 |

|

|

|

70 |

|

|

|

73 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

76 |

|

|

79 |

|

|

|

89 |

|

|

|

91 |

|

|

|

91 |

|

|

|

91 |

|

|

|

F-1 |

|

|

|

F-31 |

|

|

|

II-1 |

|

|

|

II-9 |

|

|

|

II-9 |

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities in any state where the offer or solicitation is not permitted. The information contained in this prospectus is complete and accurate as of the date on the front cover of this prospectus, but information may have changed since that date. We are responsible for updating this prospectus to ensure that all material information is included and will update this prospectus to the extent required by law.

i

This prospectus of XG Sciences, Inc., a Michigan corporation (together with its sole subsidiary, the “Company”, “XG Sciences”, “XGS” or “we”, “us”, or “our”) is a part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (SEC). This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes beginning on page F-1 before making an investment decision.

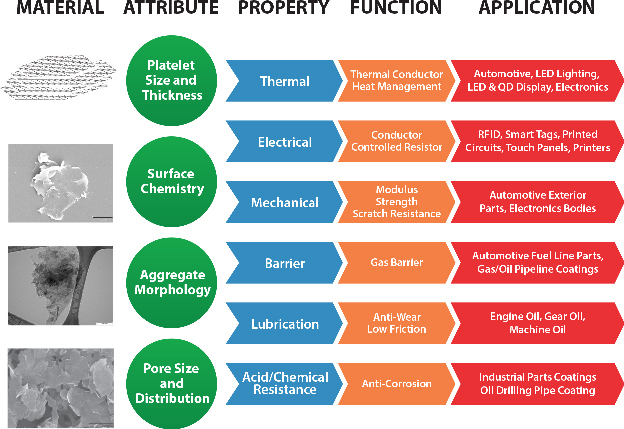

XG Sciences was formed in May 2006 for the purpose of commercializing certain technology to produce graphene nanoplatelets. First isolated and characterized in 2004, graphene is a single layer of carbon atoms configured in an atomic-scale honeycomb lattice. Among many noted properties, graphene is harder than diamonds, lighter than steel but significantly stronger, and conducts electricity better than copper. Graphene nanoplatelets are particles consisting of multiple layers of graphene. Graphene nanoplatelets have unique capabilities for energy storage, thermal conductivity, electrical conductivity, barrier properties, lubricity and the ability to impart strength when incorporated into plastics or other matrices.

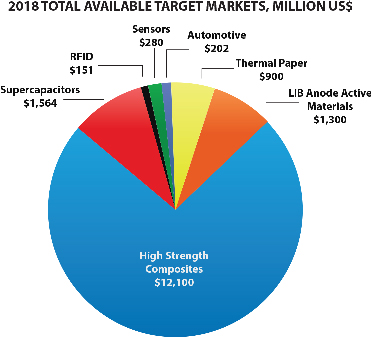

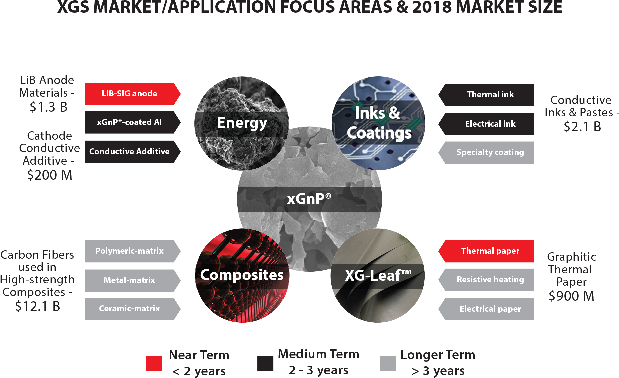

We believe the unique properties of graphene and graphene nanoplatelets will enable numerous new product applications and the market for such products will quickly grow to be a significant market opportunity. Our business model is to design, manufacture and sell advanced materials we call xGnP® graphene nanoplatelets and value-added products based on these nanoplatelets. We currently have hundreds of customers trialing our products for numerous applications, including, but not limited to lithium ion batteries, supercapacitors, thermal shielding and heat transfer, inks and coatings, printed electronics, construction materials, composites, and military uses.

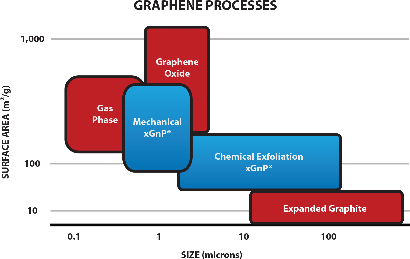

We target our xGnP® nanoplatelets for use in a range of large and growing end-use markets. Our proprietary manufacturing processes allow us to produce nanoplatelets with varying performance characteristics that can be tuned to specific end-use applications based on customer requirements. We currently offer three commercial “grades” of bulk materials, each of which is available in various particle sizes, which allows for surface areas ranging from 50 to 800 square meters of surface area per gram of material depending on the product. Other grades may be made available, depending on the needs for specific applications. In addition, we sell our material in the form of pre-dispersed mixtures with water, alcohol, or other organic solvents and resins. We also formulate xGnP® nanoplatelets into value-added products and formulations that further enhance the value we deliver to our customers. We have also licensed some of our base manufacturing technology to other companies and we consider technology licensing a component of our business model.

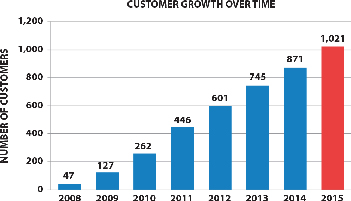

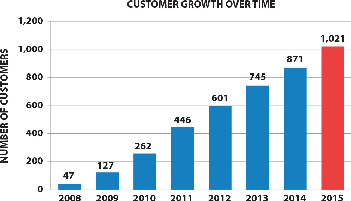

We sell products to customers around the world and have sold materials to over 1,000 customers (entities that have purchased our materials) in 47 countries since 2008. Some of these customers are research organizations and some are commercial organizations. Because graphene is a new material, our customers are developing new uses for our products and purchase them in quantities consistent with development purposes. A few of our customers have indicated to us that they have introduced commercial products that use our materials, but our customers are under no obligation to report to us on the usage of our materials. Our customers have included well-known automotive and OEM suppliers around the world (Ford, Johnson Controls, Magna, Honda Engineering) world-scale lithium ion battery manufacturers in the US, South Korea and China (Samsung SDI, LG Chem, Lishen, A123) and diverse specialty material companies (3M, BASF, Henkel, Dow Chemical, Dupont) as well as many others. We also work closely with our licensees, POSCO and Cabot Corporation (“Cabot”), who further extend our technology through their customer network. Ultimately, we expect to benefit in terms of royalties on sales of xGnP® produced and sold by our licensees.

|

|

|

|

|

|

1

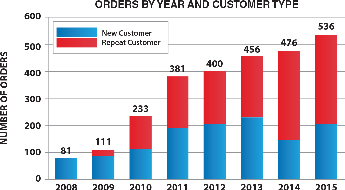

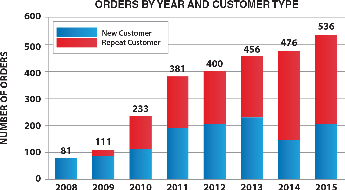

The above graphs show total orders and customers based on actual purchases of our materials and do not include free samples or materials used in joint development programs. The average order size in 2014 was $2,175 and in 2015 was $600, which indicates these orders were for materials that were not yet incorporated into large-volume commercial products. However, six customers have informed us of their intent to begin commercializing products using our products during 2016. As a result, we expect to begin shipping significantly greater quantities of our products in 2016. Based on the status of current discussions with such customers, we believe that we will begin to scale up revenue as 2016 progresses and that we will be able to book approximately $5-10 million of revenue in 2016.

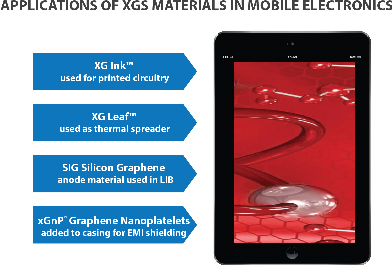

In addition to graphene nanoplatelets, we also offer a sheet product, called XG Leaf®, to customers for a variety of thermal spreading and other applications. XG Leaf® is ideally suited for use in thermal management in cell phones, tablets and PC’s. As these devices continue to adopt faster electronics, higher data management capabilities, brighter displays with ever increasing definition, they generate more and more heat. Managing that heat is a key requirement for the portable electronics market and our XG Leaf® product line is well suited to address the need. In a press release dated March 3, 2015, Gartner, Inc., a leading research organization, estimated the 2014 global cell phone market at 1.88 billion units. Every cell phone has some form of thermal management system, and we believe many of the new smart phones being developed can benefit from the performance advantages we are able to achieve with XG Leaf®. In August 2015, International Data Corporation (IDC) in their Worldwide Quarterly Tablet Tracker, estimated the global shipment of tablets in 2015 at 212 million units. Thus, we believe our XG Leaf® product line is well positioned to address a very large and rapidly growing market.

According to Prismark Partners, LLC, a leading electronics industry consulting firm specializing in advanced materials, the 2014 market for finished graphitic heat spreaders as sold to the OEM and EMS companies with adhesive, PET, and/or copper backing for selected portable applications was $600 million, and is expected to reach $900 million in 2018. The market is currently in a significant expansion period driven by the demand for portable devices.

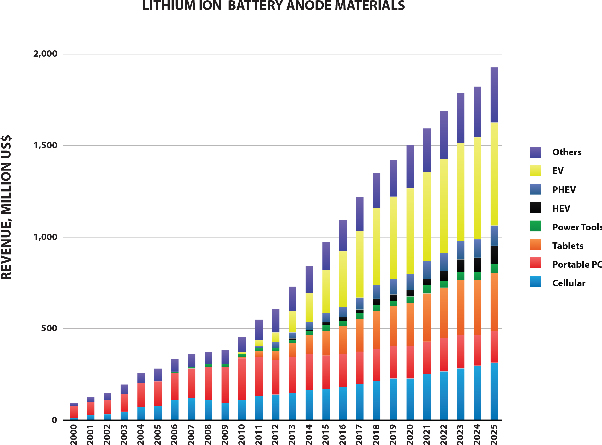

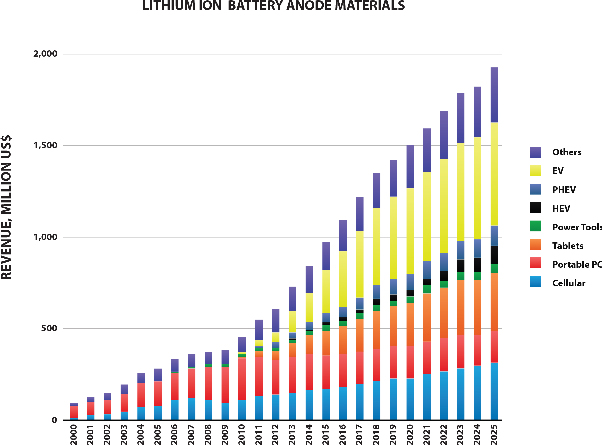

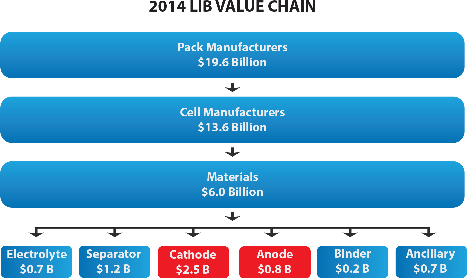

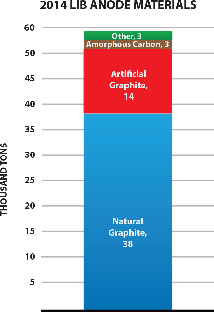

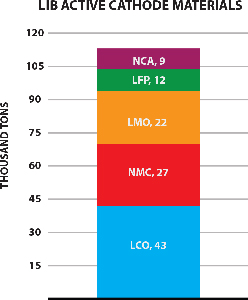

We also offer a specially formulated silicon-graphene composite material (also referred to as “SiG” in this prospectus) for use in lithium-ion battery anodes. SiG targets the never-ending need for higher battery capacity and longer life. In several customer trials, our SiG material has demonstrated the potential to increase battery energy storage capacity by 3-5x what is currently available with conventional lithium ion batteries today. The market for materials used in lithium ion battery anodes is large and growing as shown in the figure below (Avicenne Energy, “The Rechargeable Battery Market, 2014–2025”, July 2015). We believe our ability to address next generation anode materials represents a significant opportunity for us.

2

We also offer specially-formulated inks and coatings for electrical and thermal applications that are showing promise in diverse customer applications such as advanced packaging, electrostatic dissipation and thermal management.

These three product areas — custom XG Leaf® sheets, our SiG anode materials, and custom inks/coatings — comprise the set of core value-added product groups on which we are focusing our internal development resources. The following are examples of commercial and development uses of our products (See also exhibit 99.1 for our Summary Customer Pipeline):

• Construction company demonstrating less than one weight percent of our product in construction material composites improves flexural strength by more than 30%, and

• Large oil and lubricant supplier showing gear and friction improvements when incorporated into industrial and automotive greases, and

• Engineering design firm for automotive manufacturers found 20% reduction in operating temperature and in thermal uniformity when XG Leaf® replaces standard cooling fins in lithium ion battery packs’, and

• Auto manufacturer showing increased tensile and flexural strength and reduced weight in automotive composites, and

• Battery manufacturers demonstrating improved cycle life and energy storage when used as additives in lead acid batteries.

Some of our proprietary manufacturing processes were developed at Michigan State University (MSU) and licensed to us in 2006. We licensed four U.S. patents and patent applications from MSU. However, over time, our scientists and engineers have made many further discoveries and inventions that are embodied in the form of ten additional patent applications, and numerous trade secrets. Our general IP strategy is to keep as trade secrets those manufacturing processes that are difficult to enforce should they be disclosed and to seek patent coverage for other manufacturing processes, materials derived from those processes, unique combinations of materials and end uses of materials containing graphene nanoplatelets. We believe that the combination of our rights under the MSU license, patents and patent applications, and our trade secrets create a strong intellectual property position.

We have developed and scaled-up capacity for two manufacturing processes — one based on chemical intercalation of graphite and subsequent exfoliation and classification; and the second based on a high-shear mechanical process. In March 2012, we took possession of a production facility under terms of a long-term lease and moved our headquarters to this new location. Initial production commenced in this facility in September 2012. Currently, this facility is capable of producing approximately 30 – 50 tons per year of intercalated materials (depending on product mix) if operated on a continuous basis. We also operate a separate production facility in leased manufacturing space which is used for the production of certain specialty materials. This facility is capable of producing approximately 30 – 60 tons per year of materials (depending on product mix) if operated on a continuous basis. We believe these manufacturing facilities will be sufficient to meet demands for the majority of our bulk materials for a number of years, with suitable additions of capital equipment as warranted. However, additional manufacturing capabilities for certain value-added products and certain bulk materials remain to be developed and will likely require the acquisition of additional facilities. In particular, the production processes for XG Leaf® and our silicon-graphene electrode materials and our conductive inks will require additional capital and additional facilities to meet expected future customer demand.

Many of the Company’s products are new products that have not yet been fully developed and for which manufacturing operations have not yet been fully scaled. This means that investors are subject to the risks incident to the creation and development of multiple new products and their associated manufacturing processes. As of the date of this prospectus, we have not yet demonstrated sales of products at a level capable of covering our fixed expenses. Although we expect to begin to significantly scale revenue in 2016, we have not yet demonstrated the capability to produce sufficient materials to generate the ongoing revenues necessary to sustain our operations in the long-term. For additional information please see “Risk Factors”.

Developing, manufacturing and selling nanomaterials in commercially-viable quantities requires substantial funding. Since inception, we have raised approximately $32 million of capital through the issuance of equity and equity-linked securities and through licensing fees. Notable investors in the Company include Samsung Ventures, Hanwha Chemical Corporation, POSCO Corporation, and the Aspen Advanced Opportunity Fund.

Since our inception we have incurred annual losses every year and have accumulated a deficit from operations of $(43,371,368) through December 31, 2015. As of December 31, 2015 our total stockholder’s deficit was $(4,071,624). On December 31, 2015, we

3

issued and sold non-convertible promissory notes (“December Notes”) which mature on June 30, 2016 and warrants (“December Warrants”) to purchase 20,625 shares of our common stock having a strike price of $8.00 and a five year term to several existing stockholders (the “December Placement”) for proceeds to the Company of $550,000. As a result, as of December 31, 2015, we had cash on hand of $1,060,224.

However, as of the date of this prospectus, we have cash on hand that is only sufficient to fund our operations through the end of April 2016. We also believe that we will need approximately $4.8 million to sustain us for the next 12 months. The Company’s financial projections show that the Company may need to raise an additional $15,000,000 or more before it is capable of achieving sustainable cash flow from operations. We intend that the primary means for raising such funds will be through this offering. However, there is no assurance that the Company will be able to raise these funds or that the terms and conditions of future financing will be workable or acceptable for the Company and its stockholders.

As a result of the December Placement, the conversion price of our Series A Preferred Stock was adjusted to $6.40 per share. In addition, pursuant to the Certificate of Designation for the Series B Preferred Stock, holders of Series B Units received the right to exchange Series B Units (consisting of one share of Series B Preferred Stock with a liquidation preference of $16.00 per share and warrants to purchase shares of common stock at an exercise price of $16.00 per share, also referred to herein as the “Series B warrants”) into any future equity or equity-linked securities sold by the Company until December 31, 2017. Thus, as a result of this offering, holders of the Series B Units will have the right to exchange each Series B Unit for two shares of common stock, and the Series B Preferred Stock and the Series B warrants which constitute the exchanged Series B Unit will be cancelled (the “Series B Exchange Rights”).

Pursuant to the Certificates of Designation for the Series A and Series B Preferred Stock, all then-outstanding shares of Series A and Series B Preferred Stock, respectively, will automatically convert into shares of common stock upon the listing of the Company’s common stock on a Qualified National Exchange (a securities exchange registered with the SEC under Section 6(a) of the Securities Exchange Act of 1934, as amended (Exchange Act), such as the NASDAQ Capital Market or the New York Stock Exchange, or (ii) the quotation of our common stock on the OTCQB or OTCQX marketplaces operated by OTC Markets Group, Inc. (OTC Markets), and the act of achieving such listing or quotation, generally referred to hereafter as a “Public Listing” in this prospectus). As a result, there will only be one class of equity securities outstanding — common stock — after the Company achieves a Public Listing. Prior to any such listing, the Series A and Series B Preferred Stock may be voluntarily converted into shares of common stock at their respective then-current conversion rates (current rate for the Series A Preferred Stock is 1.875 for 1, current rate for Series B Preferred Stock is 1 for 1).

Although holders of Series B Units have no obligation to do so, we expect that most, if not all, of such holders will exchange their Series B Units into common stock pursuant to their Series B Exchange Rights, because each share of Series B Preferred Stock otherwise issued as part of the Series B Units and not exchanged would automatically convert into only one share of common stock upon the listing of the Company’s common stock on a Qualified National Exchange at the current rate, or may voluntarily convert prior to any such listing at such rate (See “Description of Securities — Series B Units”).

In order to achieve a Public Listing, we will have to meet certain initial listing qualifications of the Qualified National Exchange on which we are seeking the Public Listing. In addition, we will need to have market makers agree to make a market in our common stock and file a FINRA Form 15c211 with the SEC on our behalf before we can achieve a Public Listing, and we will also need to remain current in our quarterly and annual filings with the SEC. We cannot make any assurances that our common stock will ever be quoted or traded on Qualified National Exchange or that any market for our common stock will develop.

As of the date of this prospectus, we had 22 full-time employees. Employees include the following four senior managers that report to the CEO: a Vice President of Operations, a Vice President of Energy Markets, a Vice President of Research & Development, and a Controller. The Company employs a total of 6 full-time scientists and technicians in its R&D group, including the Vice President of Research & Development.

4

|

Common stock to be offered by the Company |

|

|

|

|

|

|

Common stock issued and outstanding before the offering(1) |

|

|

|

|

|

|

|

Offering price |

|

$8.00 per share |

|

|

|

|

|

Duration of offering |

|

This offering shall commence on the effective date of this prospectus and terminate on the earlier of (i) 180 days from the effective date of this prospectus, (ii) the date when the sale of all 3,000,000 shares is completed, and (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior the completion of the sale of all 3,000,000 shares registered under the Registration Statement of which this prospectus is part. |

|

|

|

|

Common stock issued and outstanding after the offering after giving effect to the sale of 3,000,000 shares by the Company(1) |

|

|

|

|

|

|

|

Pro forma common stock issued and outstanding after the offering after giving effect to the sale of 3,000,000 shares by the Company assuming the conversion of all issued and issuable shares of Series A and Series B Preferred Stock(2) |

|

|

|

|

|

|

|

Ticker Symbol and Market for our common stock |

|

|

|

|

|

|

|

|

|

After this offering is completed, we intend to seek either (i) a listing of our common stock on a securities exchange registered with the SEC under Section 6(a) of the Exchange Act, such as the NASDAQ Capital Market or NYSE, or (ii) the quotation of our common stock on the OTCQB or OTCQX marketplaces operated by OTC Markets Group, Inc. (each of the foregoing, a “Qualified National Exchange”). In order to achieve such a Public Listing, we will have to meet certain initial listing qualifications of such Qualified National Exchange on which we are seeking the Public Listing. In addition, we will need to have market makers agree to make a market in our common stock and file a FINRA Form 15c211 with the SEC on our behalf before we can achieve a Public Listing. No market maker has agreed to file such application. We will also need to remain current in our quarterly and annual filings with the SEC to achieve and maintain a Public Listing. There can be no assurance that our common stock will ever be quoted on Qualified National Exchange or that any market for our common stock will develop. |

|

|

|

|

|

Offering

use of |

|

|

|

|

|

|

5

|

Subscriptions |

|

All subscriptions, once accepted by us, are irrevocable. |

|

|

|

|

|

Risk Factors |

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 7. |

|

|

|

|

|

Dividend policy |

|

We do not intend to pay dividends on our common stock. We plan to retain any earnings for use in the operation of our business and to fund future growth. |

____________

| (1) | Includes the actual number of shares outstanding as of March 31, 2016 and, for the avoidance of doubt, does not include the conversion or exchange of any preferred shares or the exercise of any options or warrants. |

| (2) | This figure includes (a) 836,544 shares of common stock currently outstanding as of March 31, 2016, (b) the issuance of 3,376,299 shares of common stock upon conversion of all 1,800,696 shares of Series A Preferred Stock currently outstanding at the current Series A Conversion Rate (see “Description of Securities — Series A Convertible Preferred Stock”), (c) the issuance of 2,011,347 shares upon the conversion of 1,072,720 shares of Series A Preferred Stock (at the Series A Conversion Rate) issued upon the exercise of 1,072,720 warrants to purchase Series A Preferred Stock (the “Series A warrants”) and (d) the issuance of 539,974 shares of common stock upon the voluntary exchange of all 269,987 Series B Units (consisting of 269,987 shares of Series B Preferred Stock and warrants to purchase 224,897 shares of common stock) (see also “Description of Securities — Series B Units”). |

There is no assurance that we will raise the full $24,000,000 anticipated from the sale by the Company of 3,000,000 shares, and there is no guarantee that we will receive any proceeds from the offering. We may sell only a small portion or none of the offered shares.

Emerging Growth Company

In April 2012, the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, was enacted. Section 107 of the JOBS Act provides that an “emerging growth company,” or EGC, can take advantage of the extended transition period for complying with new or revised accounting standards. Thus, an EGC can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

We are in the process of evaluating the benefits of relying on other exemptions and reduced reporting requirements under the JOBS Act. Subject to certain conditions, as an EGC, we intend to rely on certain of these exemptions, including exemptions from the requirement to provide an auditor’s attestation report on our system of internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act and from any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements, known as the auditor discussion and analysis. We will remain an EGC until the earlier of: the last day of the fiscal year in which we have total annual gross revenues of $1.0 billion or more; the last day of the fiscal year following the fifth anniversary of the date of the completion of this offering; the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

Corporate Information

The Company was incorporated in Michigan on May 23, 2006 and is organized as a “C” corporation under the applicable laws of the United States and State of Michigan. Our headquarters and principal executive offices are located at 3101 Grand Oak Drive, Lansing, Michigan, 48911 and our telephone number is (517) 703-1110. Our website address is http://www.xgsciences.com, although the information contained in, or that can be accessed through, our website is not part of this prospectus.

6

THE SECURITIES BEING OFFERED INVOLVE A HIGH DEGREE OF RISK AND, THEREFORE, SHOULD BE CONSIDERED EXTREMELY SPECULATIVE. THEY SHOULD NOT BE PURCHASED BY PERSONS WHO CANNOT AFFORD THE POSSIBILITY OF THE LOSS OF THEIR ENTIRE INVESTMENT. PROSPECTIVE INVESTORS SHOULD READ THE ENTIRE PROSPECTUS, INCLUDING ALL EXHIBITS, AND CAREFULLY CONSIDER, AMONG OTHER FACTORS, THE FOLLOWING RISK FACTORS.

Risks Relating to Our Business and Industry

We are a young company with a limited operating history, making it difficult for you to evaluate our business and your investment.

XG Sciences, Inc. was incorporated on May 23, 2006. We have not yet demonstrated sales of products at a level capable of covering our fixed expenses. Since inception, we have not demonstrated the capability to produce sufficient materials to generate the ongoing revenues necessary to sustain our operations in the long-term. Nor have we demonstrated the ability to generate sufficient sales to sustain the business. There can be no assurance that the Company will ever produce a profit.

Many of the Company’s products represent new products that have not yet been fully developed and for which manufacturing operations have not yet been fully scaled. This means that investors are subject to all the risks incident to the creation and development of multiple new products and their associated manufacturing processes, and each investor should be prepared to withstand a complete loss of their investment.

Because we are subject to these uncertainties, there may be risks that management has failed to anticipate and you may have a difficult time evaluating our business and your investment in our Company. Our ability to become profitable depends primarily on our ability to successfully commercialize our products in the future. Even if we successfully develop and market our products, we may not generate sufficient or sustainable revenue to achieve or sustain profitability, which could cause us to cease operations and you will lose all of your investment.

We have no sustainable base of products approved for commercial use by our customers, have never generated significant product revenues and may never achieve sufficient revenues for profitable operations, which could cause us to cease operations.

XG Sciences primarily sells bulk materials or products made with these materials to other companies for incorporation into their products. To date, there has been no significant incorporation of our materials or products into customer products that are released for commercial sale. Because there is no demonstrated history of commercial success for our products, it is possible that such commercial success may never happen and that we will never achieve the level of revenues necessary to sustain our business.

We will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms, which could have a materially adverse effect on our business.

Developing, manufacturing and selling nanomaterials in commercially-viable quantities requires substantial funding. On December 31, 2015, the Company issued and sold promissory notes and warrants to several existing investors in a private placement (the December Notes and December Warrants) for proceeds to the Company of $550,000. As a result, as of December 31, 2015, we had cash on hand of approximately $1.1 million. However, as of the date of this prospectus, we have cash on hand that is only sufficient to fund our operations through the end of April 2016. We also believe that we will need approximately $4.8 million to sustain us for the next twelve months. The Company’s financial projections show that the Company may need to raise an additional $15,000,000 or more before it is capable of achieving sustainable cash flow from operations. We intend that the primary means for raising such funds will be through this offering. The Company can make no assurance that it will be able to raise these funds or that the terms and conditions of future financing will be workable or acceptable for the Company and its stockholders. In the event that the Company is not able to raise substantial additional funds in the future on terms that are acceptable or adjust its business model accordingly, the Company may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

If we are unable to continue as a going concern, our securities will have little or no value.

The report of our independent registered public accounting firm that accompanies our consolidated financial statements for the year ended December 31, 2015 contains a going concern qualification in which such firm expressed substantial doubt

7

about our ability to continue as a going concern. We currently anticipate that our cash and cash equivalents will be sufficient to fund our operations through the end of April 2016, without raising additional capital. Our continuation as a going concern is dependent upon continued financial support from our shareholders, the ability of us to obtain necessary equity and/or debt financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding our ability to continue as a going concern. We cannot make any assurances that additional financings will be available to us and, if available, completed on a timely basis, on acceptable terms or at all. If we are unable to complete an equity or debt offering, or otherwise obtain sufficient financing when and if needed, it would negatively impact our business and operations, which would likely cause the price of our common stock to decline. It could also lead to the reduction or suspension of our operations and ultimately force us to cease our operations.

We have limited experience in the higher volume manufacturing that will be required to support profitable operations, and the risks associated with scaling to larger production quantities may be substantial.

We have limited experience manufacturing our products. We have established small-scale commercial or pilot-scale production facilities for our bulk powders, XG Leaf® and SiG materials, but these facilities do not have the existing production capacity to produce sufficient quantities of materials for us to reach sustainable sales levels. In order to develop the capacity to produce much higher volumes, it will be necessary to produce multiples of existing processes or engineer new production processes in some cases. There is no guarantee that we will be able to economically scale-up our production processes to the levels required. If we are unable to scale-up our production processes and facilities to support sustainable sales levels, the Company may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

Projection of fixed monthly expenses and operating losses for the near future means that investors may not earn a return on their investment or may lose all of their investment.

Because of the nature of the Company’s business, the Company projects considerable fixed expenses that lead to projected monthly deficits for the near future. Fixed manufacturing expenses to maintain production facilities, compensation expenses for scientists and other critical personnel, and ongoing rent and utilities amount to several hundred thousand dollars per month, and the Company believes that such expenses are required as a precursor to significant customer sales. However, there can be no assurance that monthly sales will ever reach a sufficient level to cover the cost of ongoing monthly expenses. If sufficient regular monthly sales are not generated to cover these fixed expenses, we will continue to experience monthly profit deficits which, if not eliminated, will require continuing new investment in the Company. If monthly deficits continue beyond levels that investors find tolerable, we may not be able to raise additional funds may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

We have a long and complex sales cycle and have not demonstrated the ability to operate successfully in this environment.

It has been our experience since our inception that the average sales cycle for our products can range from one to seven years from the time a customer begins testing our products until the time that they could be successfully used in a commercial product. The product introduction timing will vary based on the target market, with automotive uses typically being toward the long end and consumer electronics toward the shorter end. We have not demonstrated a track record of success in completing customer development projects, which makes it difficult for you to evaluate the likelihood of our future success. The sales and development cycle for our products is subject to customer budgetary constraints, internal acceptance procedures, competitive product assessments, scientific and development resource allocations, and other factors beyond our control. If we are not able to successfully accommodate these factors to enable customer development success, we will be unable to achieve sufficient sales to reach profitability. In this case, the Company may not be able to raise additional funds and may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

We could be adversely affected by our exposure to customer concentration risk.

We are subject to customer concentration risk as a result of our reliance on a relatively small number of customers for a significant portion of our revenues. For 2015 we had one customer (one of our Asian distributors) whose purchases accounted for 9% of total product revenues. In 2014 we had another customer that represented 69% of total product revenues. Due to the nature of our business and the relatively large size of many of the applications our customers are developing, we anticipate that we will be dependent on a relatively small number of customers for the majority of our revenues for the next several years. It is possible that only one or two customers could place orders sufficient to utilize most or all of our existing manufacturing capacity.

8

In this case, there would be a risk of significant loss of future revenues if one or more of these customers were to stop ordering our materials, which could in turn have a material adverse effect on our business and on your investment.

Our revenues often fluctuate significantly based on one-off orders from customers or from the recognition of grant revenues which vary from period-to-period, which may materially impact our financial results from period to period.

Because of the potential for large revenue swings from one-time large orders or grants it may be difficult to accurately forecast the needs for inventory, working capital, and other financial resources from period-to-period. Such orders would require a significant short-term increase in our production capacity and would require the financial resources to add staff and support the associated working capital. If such large one-time orders were not handled smoothly, customer confidence in us as a viable supplier could be reduced and we might not succeed in capturing the additional larger orders that may be reflected in our business plan.

We operate in an advanced technology arena where hypothesized properties and benefits of our products may not be achieved in practice, or in which technological change may alter the attractiveness of our products.

Because there is no sustained history of successful use of our products in commercial applications, there is no assurance that broad successful commercial applications may be technically feasible. Most, if not all, of the scientific and engineering data related to our products has been generated in our own laboratories or in laboratory environments at our customers or third-parties, like universities and national laboratories. It is well known that laboratory data is not always representative of commercial applications.

Likewise, we operate in a market that is subject to rapid technological change. Part of our business strategy is to monitor such change and take steps to remain technologically current, but there is no assurance that such strategy will be successful. If the Company is not able to adapt to new advances in materials sciences, or if unforeseen technologies or materials emerge that are not compatible with our products and services or that could replace our products and services, our revenues and business prospects would likely be adversely affected. Such an occurrence may have severe consequences, including the potential for our investors to lose all of their investment.

Competitors that are larger and better funded may cause the Company to be unsuccessful in selling its products.

The Company operates in a market that is expected to have significant competition in the future. Global research is being conducted by substantially larger companies who have greater financial, personnel, technical, and marketing resources. There can be no assurance that the Company’s strategy of offering better materials based on the Company’s proprietary exfoliated graphite nanoplatelets will be able to compete with other companies, many of whom will have significantly greater resources, on a continuing basis. In the event that we cannot compete successfully, the Company may be forced to cease operations and investors may lose some or all of their investment.

Because of our small size and limited operating history, we are dependent on key employees.

The Company’s operations and development are dependent upon the experience and knowledge of Philip L. Rose, our Chief Executive Officer, Dr. Liya Wang, Vice President of Research & Development, Robert Privette, Vice President of Energy Markets, Scott Murray, Vice President of Operations, and Dr. Hiroyuki Fukushima, Technical Director. If the services of any of these individuals should become unavailable, the Company’s business operations might be adversely affected. If several of these individuals became unavailable at the same time, the ability of the Company to continue normal business operations might be adversely affected to the extent that revenue or profits could be diminished and you could lose all or a significant amount of your investment.

Our success depends in part on our ability to protect our intellectual property rights, and our inability to enforce these rights could have a material adverse effect on our competitive position.

We rely on the patent, trademark, copyright and trade-secret laws of the United States and the countries where we do business to protect our intellectual property rights. We may be unable to prevent third parties from using our intellectual property without our authorization. The unauthorized use of our intellectual property could reduce any competitive advantage we have developed, reduce our market share or otherwise harm our business. In the event of unauthorized use of our intellectual property, litigation to protect or enforce our rights could be costly, and we may not prevail.

9

Many of our technologies are not covered by any patent or patent application, and our issued and pending U.S. and non-U.S. patents may not provide us with any competitive advantage and could be challenged by third parties. Our inability to secure issuance of our pending patent applications may limit our ability to protect the intellectual property rights these pending patent applications were intended to cover. Our competitors may attempt to design around our patents to avoid liability for infringement and, if successful, our competitors could adversely affect our market share. Furthermore, the expiration of our patents may lead to increased competition.

Our pending trademark applications may not be approved by the responsible governmental authorities and, even if these trademark applications are granted, third parties may seek to oppose or otherwise challenge these trademark applications. A failure to obtain trademark registrations in the United States and in other countries could limit our ability to protect our products and their associated trademarks and impede our marketing efforts in those jurisdictions.

In addition, effective patent, trademark, copyright and trade secret protection may be unavailable or limited in some foreign countries. In some countries, we do not apply for patent, trademark or copyright protection. We also rely on unpatented proprietary manufacturing expertise, continuing technological innovation and other trade secrets to develop and maintain our competitive position. Although we generally enter into confidentiality agreements with our employees and third parties to protect our intellectual property, these confidentiality agreements are limited in duration and could be breached, and may not provide meaningful protection of our trade secrets or proprietary manufacturing expertise. Adequate remedies may not be available if there is an unauthorized use or disclosure of our trade secrets and manufacturing expertise. In addition, others may obtain knowledge about our trade secrets through independent development or by legal means. The failure to protect our processes, apparatuses, technology, trade secrets and proprietary manufacturing expertise, methods and compounds could have a material adverse effect on our business by jeopardizing critical intellectual property.

Where a product formulation or process is kept as a trade secret, third parties may independently develop or invent and patent products or processes identical to our trade-secret products or processes. This could have an adverse impact on our ability to make and sell products or use such processes and could potentially result in costly litigation in which we might not prevail.

We could face intellectual property infringement claims that could result in significant legal costs and damages and impede our ability to produce key products, which could have a material adverse effect on our business, financial condition and results of operations.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Any failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial frauds. Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting, and the standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. If we cannot assess our internal control over financial reporting as effective, investor confidence and share value may be negatively impacted.

In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting, or disclosure of our independent registered public accounting firm’s report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

Future adverse regulations could affect the viability of the business.

The Company’s bulk products have been approved for sale in the United States by the U.S. Environmental Protection Agency after a detailed review of our products and production processes for our H, M and C grade materials. In most cases, as far as we are aware, there are no current regulations elsewhere in the world that prevent or prohibit the sale of the Company’s products. Nevertheless, the sale of nano-materials is a subject of regulatory discussion and review in many countries around the world. In some cases, there is a discussion of potential testing requirements for toxicity or other health effects of nano-materials before they can be sold in certain jurisdictions. If such regulations are enacted in the future, the Company’s business could be adversely

10

affected because of the requirement for expensive and time-consuming tests or other regulatory compliance. There can be no assurance that future regulations might not severely limit or even prevent the sale of the Company’s products in major markets, in which case the Company’s financial prospects might be severely limited, causing investors to lose some or all of their investment.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses and will divert time and attention away from revenue generating activities.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities, which could have an adverse effect on our business.

Risks Relating To Our Common Stock

There is a risk of dilution of your percentage ownership of common stock in the Company.

In addition to the shares which we may sell pursuant to this offering, the Company has the right to raise additional capital or incur borrowings from third parties to finance its business. The Company may also implement public or private mergers, business combinations, business acquisitions and similar transactions pursuant to which it would issue substantial additional capital stock to outside parties, causing substantial dilution in the ownership of the Company by its existing stockholders. Subject to certain exceptions (See “Management — Shareholder Side Letter”), our Board of Directors has the authority, without the consent of any of the stockholders, to cause the Company to issue more shares of common stock and/or preferred stock at such price and on such terms and conditions as are determined by the Board in its sole discretion.

The sale of the shares being offered by us hereunder, as well as the shares of common stock issuable upon the exercise of options and warrants, the shares issuable upon conversion of Series A Preferred Stock (including the shares of Series A Preferred Stock issuable upon the exercise of warrants), shares issuable upon conversion of Series B Preferred Stock, shares issuable upon the voluntary exchange of the Series B Units, and the issuance of additional shares of capital stock by the Company will dilute your ownership percentage in the Company and could impair our ability to raise capital in the future through the sale of equity securities.

Certain stockholders who are also officers and directors of the Company may have significant control over our management, which may not be in your best interests.

As of March 31, 2016, the directors, or the entities they represent, and executive officers of the Company owned approximately 69.5% of the voting stock of the Company. Certain of these executives and directors, or the companies they represent, converted secured convertible notes into an additional 1,456,126 shares of Series A Preferred Stock on December 31, 2015.

Additionally, our existing stockholders are a party to that certain Shareholder Agreement, which was amended on February 26, 2016. Although shareholders purchasing shares in this offering will not be subject to the Shareholders’ Agreement, certain provisions of such Shareholders’ Agreement may impact the governance of the Company. Pursuant to the Shareholders’ Agreement, (a) so long as AAOF or its affiliates own 10% of more of the aggregate outstanding Shareholder Stock (as defined in the Shareholder Agreement), (i) the size of the Board of Directors shall be set at seven individuals (provided, however, that the number of directors on the Board of Directors may be increased or decreased with the prior written consent of AAOF and shareholders (including AAOF) who in the aggregate then own Shareholder Stock representing a majority of the then issued and outstanding voting stock of the Company), (ii) one person nominated by AAOF shall be elected to the Board of Directors, (iii) two members of the Board of Directors, other than those nominated by AAOF, POSCO or Hanwha Chemical, shall qualify as independent Directors; (b) so long as POSCO owns 10% of more of the aggregate outstanding Shareholder Stock, one person nominated by POSCO shall be elected to the Board of Directors (POSCO does not currently own 10% or more of the aggregate outstanding Shareholder Stock and therefore does not maintain a seat on our Board of Directors); and (c) so long as Hanwha Chemical owns 10% of more of the aggregate outstanding Shareholder Stock, one person nominated by Hanwha Chemical shall be elected to the Board of Directors. (Hanwha does not currently own 10% or more of the aggregate outstanding Shareholder Stock and therefore does not maintain a seat on our Board of Directors).

The Shareholder Agreement contains certain restrictions on transfer. Pursuant to the Shareholder Agreement, the Company has a first right of first refusal with respect to certain stock transfers. In the event that the Company does not exercise this right, each non-transferring shareholder shall have the right to purchase its pro rata share of the transferring shareholder’s stock. Subject

11

to certain exclusions, each shareholder and holder of convertible notes who is a signatory to the Shareholders Agreement has a preemptive right to purchase his, her or its pro rata share of the Company’s common stock in subsequent offerings. The Shareholders Agreement also contains a right of co-sale and bring-along rights where a shareholder or shareholders owning more than 50% of the Company’s common stock on a fully diluted basis may cause other shareholders to tender their shares to a third party purchaser.

Under the Shareholders Agreement, shareholders may not, while such person is a shareholder, directly or indirectly, either alone or in association with others, in any other capacity: (i) conduct, become engaged or interested in, any business that competes, directly or indirectly, with the business of the Company or any of its affiliates worldwide; (ii) solicit, divert or take away or attempt to solicit, divert or take away, directly or indirectly, any of the Company’s or its affiliates current, prior, or prospective customers: or (iii) solicit or attempt to solicit any person who is employed or engaged to perform services by the Company or its affiliates to leave his or her employment or engagement with Company or its Affiliates. After such shareholder ceases to be a shareholder, the former shareholder may not for a period of three (3) years from the date of sale, directly or indirectly, either alone or in association with others, for himself or herself or in any other capacity: (i) conduct, become engaged in, or interested in, any business that competes, directly or indirectly, with the business of the Company or any of its affiliates worldwide; (ii) solicit, divert or take away or attempt to solicit, divert or take away, directly or indirectly, any of the Company’s or its affiliates current, prior, or prospective customers; or (iii) solicit or attempt to solicit any person who is employed or engaged to perform services by the Company or its affiliates to leave his or her employment or engagement with Company or its affiliates. These restrictions on competition and solicitation will not be violated, however, by a shareholder’s passive ownership of up to 2% of a class of outstanding publicly traded shares of a corporation that is listed or quoted on a national securities exchange including any such corporation that competes with the business of the Company.

On February 26, 2016, the Shareholders Agreement was amended (the “Amendment to Shareholders Agreement”) to provide that holders of Excluded Stock are not subject to the terms of the Shareholders Agreement. Excluded Stock means shares of common stock that are subject to a registration statement that has been filed with the SEC and has been declared effective. The Amendment to Shareholders Agreement takes effect when a majority of the Board of Directors and shareholders holding at least 60% of the voting power of all shares of Shareholder Stock have consented to the amendment to the Shareholders Agreement, and a registration statement registering the shares of common stock has been filed with the SEC and declared effective. The Amendment to the Shareholders Agreement further clarifies that preemptive rights shall not apply to Excluded Stock, and amends the termination date of the Shareholders Agreement. Specifically, the Shareholder Agreement has been amended to provide that it continues in effect until (i) the date of the closing of a public offering of common stock pursuant to a registration statement filed with the SEC that is declared effective in which the Company receives gross proceeds of at least $10,000,000, on which date it shall terminate in its entirety, unless the Shareholder Agreement is earlier terminated in accordance with its terms, or (ii) the date on which the Company’s common stock is listed on the NASDAQ Stock Market of the New York Stock Exchange. As a result, in the event that the Company is unable to raise at least $10,000,000 in this offering, the Shareholder Agreement will continue to remain in effect and certain of our larger shareholders will be entitled to continue to exercise their rights under such Shareholders Agreement, but purchasers of shares of common stock under this registration statement, if it is made effective, will not be required to adopt the Shareholders Agreement.

Furthermore, in conjunction with a financing from Samsung Ventures on January 15, 2014, we and our existing stockholders entered into a voting agreement with Samsung Ventures whereby for so long as Samsung Ventures owns 10% or more of the aggregate outstanding common stock of XGS (assuming Full Conversion, but excluding any shares of common stock issuable upon the exercise of any warrants held by Samsung Ventures), each stockholder made a party thereto shall vote all of his, her or its voting securities from time to time in whatever manner is necessary to ensure that at each annual or special meeting of the stockholders at which an election of Directors is held or pursuant to any written consent of the stockholders, one person nominated by Samsung Ventures is elected to our Board as a Director. The rights granted to Samsung Ventures under a voting agreement are effective until the first to occur of (1) the date on which the Minimum Ownership Requirement is no longer satisfied, (2) the date on which the Shareholder Agreement (which is described above) is terminated for any reason and (3) the date that Samsung Ventures agrees in writing to terminate the Agreement.

As a result, such entities have a significant influence on the affairs and management of the Company, as well as on all matters requiring stockholder approval, including electing and removing members of the Company’s Board of Directors, causing the Company to engage in transactions with affiliated entities, causing or restricting the sale or merger of the Company, and certain other matters. Such concentration of ownership and control could have the effect of delaying, deferring or preventing a change in control of the Company even when such a change of control would be in the best interests of the Company’s stockholders.

12

We may, in the future, issue additional shares of common stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation, as amended, authorize the issuance of up to 25,000,000 shares of common stock and up to 8,000,000 shares of preferred stock. As of March 31, 2016, the Company had 836,544 shares of common stock, 1,800,696 shares of Series A Preferred Stock and 269,987 Series B Units (consisting of 269,987 shares of Series B Preferred Stock and warrants to purchase 224,897 shares of common stock) issued and outstanding. All issued and outstanding shares of Series B Preferred Stock are a part of the Series B Units.

Upon a Public Listing on a Qualified National Exchange, all Series A Preferred Stock then currently outstanding will automatically convert into shares of common stock at the then-current Series A Conversion Rate (current ratio is 1.875 for 1), which would result in the issuance of 3,376,299 shares of common stock assuming the conversion of 1,800,696 shares of Series A Preferred Stock. Series A Preferred Stock holders may also voluntarily convert at the then-current rate at any time prior to any such Public Listing on a Qualified National Exchange.

In addition, as a result of this offering, holders of Series B Units will have the right, at their discretion, to exchange each Series B Unit for two shares of common stock, which, if all Series B Units were exchanged, would result in the issuance of 539,974 shares of common stock (and the cancellation of the 269,987 shares of Series B Preferred Stock and the Series B warrants to purchase 224,897 shares of common stock at an exercise price of $16.00 per share which constitute the Series B Units).

If none of our Series B Unit holders exchange their Series B Units pursuant to their Series B Exchange Rights, then upon a Public Listing on a Qualified National Exchange, all shares of Series B Preferred Stock (all of which are a part of the Series B Units) then outstanding will automatically convert into shares of common stock at the then-current conversion ratio (current ratio is 1 for 1) which would result in the issuance of 269,987 shares of common stock assuming the conversion of 269,987 shares of common stock. Series B Preferred Stock holders may also voluntarily convert at the then-current rate at any time prior to any such Public Listing on a Qualified National Exchange.

As of March 31, 2016, the Company had also granted options to purchase up to 419,750 shares of common stock and had issued warrants to purchase up to (i) 267,122 shares of common stock (including the 224,897 shares underlying the Series B warrants which are a component of the Series B Units) and (ii) 1,072,720 shares of Series A Preferred Stock which, if exercised, would be convertible into shares of common stock at the then-current Series A Conversion Rate (at the current ratio of 1.875 shares for each share of Series A Preferred Stock, we would issue 2,011,347 shares of common stock). Therefore, we have committed to issue up to an additional 6,389,593 shares of common stock, which includes the issuance of (a) 3,376,299 shares upon conversion of all 1,800,696 shares Series A Preferred Stock currently outstanding at the Series A Conversion Rate, (b) 539,974 shares upon the exercise by all of the Series B Unit holders of their Series B Exchange Rights, (c) 2,011,347 shares upon the conversion of 1,072,720 shares of Series A Preferred Stock (at the current Series A Conversion Rate) which are issuable upon exercise of 1,072,720 Series A warrants, (c) 419,750 shares upon the exercise of options and (d) the issuance of 42,225 shares upon the exercise of warrants, and excludes, for the avoidance of doubt, shares issuable upon the exercise of the 224,897 Series B warrants which we assume will be cancelled upon the exchange of the Series B Units. If we issued all 6,389,593 shares, we would have, in addition to the 836,544 shares currently outstanding, 7,226,137 shares issued and outstanding, with 17,773,863 authorized shares available for future issuance and if we assume the sale of all 3,000,000 shares being offered hereunder, we would have 14,773,863 authorized shares available for future issuance. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, might have an adverse effect on any trading market for our common stock and could impair our ability to raise capital in the future through the sale of equity securities.

We have a large number of restricted shares outstanding, a portion of which may be sold under Rule 144, which may reduce the market price of our shares.

Of the 836,544 shares of common stock, the 1,800,696 outstanding shares of Series A Preferred Stock and the 269,987 Series B Units (consisting of 269,987 shares of Series B Preferred Stock and warrants to purchase 224,897 shares of common stock) issued and outstanding as of March 31, 2016, and assuming no warrants or stock options are converted or exercised, 1,201,168 shares were held by non-affiliates and 1,706,059 were held by affiliates of the Company, which 50,000 shares of common stock were held by affiliates and 786,544 shares of common stock were held by non-affiliates. All of such shares are deemed “restricted securities” within the meaning of Rule 144 as promulgated under the Securities Act.

Our Series A Preferred Stock may be voluntarily converted, or will automatically convert upon a Public Listing of our common shares on a Qualified National Exchange, into shares of common at the then-current Series A Conversion Rate (at the current ratio of 1.875 for 1, all shares of Series A Preferred Stock outstanding at December 31, 2015 would result in an issuance of 3,376,299 shares of common stock).

Furthermore, our Series B Preferred Stock may be voluntarily converted, or will automatically convert upon a Public Listing of our common shares on a Qualified National Exchange, into shares of common stock at the then-current Series B Conversion Rate (at the current ratio of 1 for 1, all shares of Series B Preferred Stock outstanding at December 31, 2015 would result in an issuance of 269,987 shares of common stock).

13

However, pursuant to the Series B Exchange Rights, holders of Series B Preferred Stock also have the right, prior to any Public Listing on a Qualified National Exchange of our common stock, at their discretion, to exchange each Series B Unit for two shares of common stock which, if all Series B Unit holders exercised such right, would result in the issuance of 539,974 shares of common stock (and the cancellation of the 269,987 shares of Series B Preferred Stock and 224,897 Series B warrants).

It is anticipated that all of the aforementioned “restricted securities” will be eligible for resale under Rule 144. In general, under Rule 144, subject to the satisfaction of certain other conditions, a person, who is not an affiliate (and who has not been an affiliate for a period of at least three months immediately preceding the sale) and who has beneficially owned restricted shares of our common stock for at least six months is permitted to sell such shares without restriction, provided that there is sufficient public information about us as contemplated by Rule 144. An affiliate who has beneficially owned restricted shares of our common stock for a period of at least one year may sell a number of shares equal to one percent of our issued and outstanding common stock approximately every three months.

The possibility that substantial amounts of our common stock may be sold under Rule 144 into the public market may adversely affect prevailing market prices for the common stock and could impair our ability to raise capital in the future through the sale of equity securities.

The Company is considered a smaller reporting company and is exempt from certain disclosure requirements, which could make our stock less attractive to potential investors.

Rule 12b-2 of the Exchange Act defines a “smaller reporting company” as an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

• Had a public float of less than $75 million as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or

• In the case of an initial registration statement under the Securities Act or Exchange Act for shares of its common equity, had a public float of less than $75 million as of a date within 30 days of the date of the filing of the registration statement, computed by multiplying the aggregate worldwide number of such shares held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of such shares included in the registration statement by the estimated public offering price of the shares; or

• In the case of an issuer whose public float as calculated under paragraph (1) or (2) of this definition was zero, had annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available.

As a “smaller reporting company” (in addition to and without regard to our status as an “emerging growth company”) we are not required and may not include a “Compensation Discussion and Analysis” section in our proxy statements; we provide only 3 years of business development information; provide fewer years of selected financial data; and have other “scaled” disclosure requirements that are less comprehensive than issuers that are not “smaller reporting companies” which could make our stock less attractive to potential investors, which could make it more difficult for you to sell your shares.