Attached files

| file | filename |

|---|---|

| EX-5.1 - LEGAL OPINION LETTER - Road Marshall, Inc. | legalopinion.htm |

| EX-3.2 - BY-LAWS - Road Marshall, Inc. | bylaws_rm.htm |

| EX-3.1 - CERTIFICATE OF INCORPORATION - Road Marshall, Inc. | certofinc.htm |

| EX-10.2 - BOARD RESOLUTION - Road Marshall, Inc. | board_res.htm |

| EX-23.1 - CONSENT OF PCAOB - Road Marshall, Inc. | auditor_consent.htm |

| EX-10.1 - AGREEMENT-OFFERING EXPENSES - Road Marshall, Inc. | agreementforfunds.htm |

| EX-99.1 - SUBSCRIPTION AGREEMENT - Road Marshall, Inc. | subscription_sample.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

AMENDMENT NO. 4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

Road Marshall, Inc.

(Exact name of registrant as specified in its charter)

Date: April 4, 2016

| Delaware | 7371 | 00-0000000 |

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) | (IRS Employer Identification No.) |

|

194 Pandan Loop #05-08 Singapore 128383 |

Issuer's telephone number: +65 66848088

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Please send copies of all correspondence to:

V FINANCIAL GROUP, LLC

http://www.vfinancialgroup.com

780 Reservoir Avenue, #123

Cranston, RI 02910

TELEPHONE: (401) 440-9533

FAX: (401) 633-7300

Email: jeff@vfinancialgroup.com

(Name,

address, including zip code, and telephone number,

including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer |_| | Accelerated filer |_| |

| Non-accelerated filer |_| (Do not check if a smaller reporting company) | Smaller reporting company |X| |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share (1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee (2) |

Common Stock, $0.0001 par value |

7,250,000 | $0.005 | $36,250 | $3.65 |

| (1) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

PRELIMINARY PROSPECTUS

Road Marshall, Inc.

7,250,000 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

Prior to this Offering, no public market has existed for the common stock of Road Marshall, Inc. Upon completion of this Offering, we will attempt to have the shares quoted on the OTCQB operated by OTC Markets Group, Inc. There is no assurance that the Shares will ever be quoted on the OTCQB. To be quoted on the OTCQB, a market maker must apply to make a market in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares. As of the date of this registration statement it should be noted that our company is currently a shell company. We are not however, a blank check company.

In this public offering we, “Road Marshall, Inc.” are offering 5,000,000 shares of our common stock and our selling shareholders are offering 2,250,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. The offering is being made on a self-underwritten, “best efforts” basis. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our Chief Executive Officer, Engchoon Peh. Mr. Peh is deemed to be an underwriter of this offering. The selling shareholders are also deemed to be underwriters of this offering. There is uncertainty that we will be able to sell any of the 5,000,000 shares being offered herein by the Company. Mr. Peh will not receive any commissions or proceeds for selling the shares on our behalf. All of the shares being registered for sale by the Company will be sold at a fixed price of $0.005 per share for the duration of the Offering. Additionally, all of the shares offered by the selling shareholders will be sold at a fixed price of $0.005 for the duration of the Offering. Assuming all of the 5,000,000 shares being offered by the Company are sold, the Company will receive $25,000 in gross proceeds. Assuming 3,750,000 shares (75%) being offered by the Company are sold, the Company will receive $18,750 in net proceeds. Assuming 2,500,000 shares (50%) being offered by the Company are sold, the Company will receive $12,500 in net proceeds. Assuming 1,250,000 shares (25%) being offered by the Company are sold, the Company will receive $6,250 in net proceeds. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our company’s business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus, unless extended by our directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

In their audit report dated December 11, 2015, our auditors have expressed substantial doubt as to our ability to continue as a going concern.

Currently, our Chief Executive Officer Engchoon Peh and our Chief Operating Officer Zhencong Bai, together own approximately 64% of the voting power of our outstanding capital stock. After the offering, assuming all of their personal shares that are being registered herein and those shares being offered on behalf of the company are sold, both Mr. Peh and Mr. Bai will together have the ability to control approximately 50.33% of the voting power of our outstanding capital stock.

Currently, our officers and directors together own 100% of our outstanding voting stock. If all of the shares being registered herein are sold our officers and directors will collectively control 75.83% of our outstanding voting stock.

Currently, our Chief Executive Officer Engchoon Peh owns 3,750,000 shares of restricted common stock and 50,000 shares of preferred stock. Every one share of preferred stock is equivalent to the voting rights of 100 shares of common stock.

Currently, our Chief Operating Officer Zhencong Bai owns 2,250,000 shares of restricted common stock and 50,000 shares of preferred stock. Every one share of preferred stock is equivalent to the voting rights of 100 shares of common stock.

*Engchoon Peh will be selling shares of common stock on behalf of the Company simultaneously to selling shares of his own personal stock from his own account. A conflict of interest may arise between Mr. Peh’s interest in selling shares for his own account and in selling shares on the Company’s behalf. Regarding the sale of Mr. Peh’s shares, they will be sold at a fixed price of $0.005 for the duration of the offering.

The Company estimates the costs of this offering at $40,000. All expenses incurred in this offering are being paid for by Engchoon Peh, our Chief Executive Officer. There has been no public trading market for the common stock of Road Marshall, Inc.

The proceeds from the sale of the securities will be placed directly into the Company’s account; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the prospectus. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 5.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

The date of this prospectus is __________________.

- 1 -

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For the duration of this offering all dealers and or sellers that effect transactions in these securities, whether or not participating in this offering, are required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

This offering will terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 7,250,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering.

In this Prospectus, ‘‘Road Marshall,’’ the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to Road Marshall, Inc., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending September 30th. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 5, and the financial statements, before making an investment decision.

The Company

Road Marshall, Inc., a Delaware corporation (“the Company”) was incorporated under the laws of the State of Delaware on September 17, 2015.

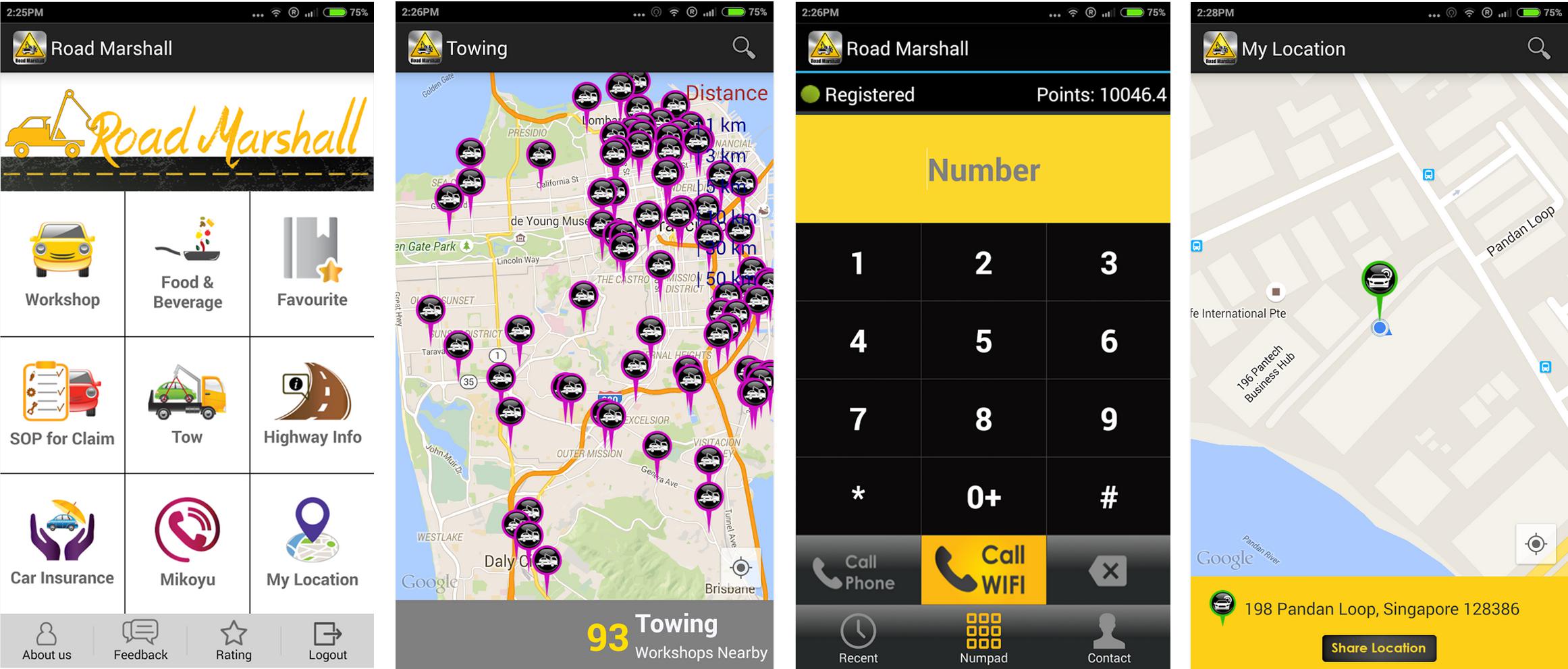

Road Marshall, Inc. is a technology company engaged in the development of a mobile application for iOS and Android devices.

The Company’s executive offices are located at 194 Pandan Loop #05-08 Singapore 128383.

Our activities have been limited to developing our business and financial plans. At present we have not yet begun generating revenue and have experienced a net loss of $9,910. Our application, Road Marshall, has been downloaded five times.

*Rule 405 of the Securities Act defines the term “shell company” as a registrant, other than an asset-backed issuer, that has:

(1) No or nominal operations; and

(2) Either:

(i) No or nominal assets;

(ii) Assets consisting solely of cash and cash equivalents; or

(iii) Assets consisting of any amount of cash and cash equivalents and nominal other assets.

For purposes of this definition, the determination of a registrant’s assets (including cash and cash equivalents) is based solely on the amount of assets that would be reflected on the registrant’s balance sheet prepared in accordance with generally accepted accounting principles on the date of that determination. The Company has no or nominal operations and has assets consisting solely of cash and cash equivalents and is, therefore, a shell company as defined under Rule 405.

-The Company’s shell company status results in the following consequences:

-The Company is ineligible to file a registration of securities using Form S-8; and

-Rule 144 is unavailable for transfers of our securities until we have ceased to be a shell company, are subject to the reporting requirements of the Exchange Act; we have filed Exchange Reports for 12 months and a minimum of one year has elapsed since the filing of Form 10 information on Form 8-K changing our status from a shell company to a non-shell company.

*There is the possibility, due to our status as a shell company, we may be unable to fully fulfill or carry out our intended business operations and that you may lose your entire investment if this should occur. There are a substantial number of steps that need to be taken to fulfill our business plan.

We believe we need to raise $25,000 to execute our business plan over the next 12 months. The funds raised in this offering, even assuming we sell all the shares being offered, may be insufficient to carry out our intended business operations. Road Marshall, Inc. is a company with the intent to become one of the, if not the primary, leading publicly traded iOS and Android application development and promotion companies in the industry. Our proprietary application,which is fully developed but not yet being marketed, is called Road Marshall. Road Marshall is an application which will be invaluable to its users in the event of car trouble and should revolutionize the way tow truck companies are found within the United States, and eventually around the world. The Company intends to monetize the mobile application through third party advertisements. Our application is described in further detail in our business information section beginning on page 15.

We will receive proceeds from the sale of 5,000,000 shares of our common stock and intend to use the proceeds from this offering to further develop and market our mobile application known as “Road Marshall.” There is uncertainty that we will be able to sell any of the 5,000,000 shares being offered herein by the Company. The expenses of this offering, including the preparation of this prospectus and the filing of this registration statement, estimated at $40,000, are being paid for by the Company’s Chief Executive Officer, Engchoon Peh. The maximum proceeds to us from this offering ($25,000) will satisfy our basic subsistence level, cash requirements for up to 12 months. 75% of the possible proceeds from the offering by the company ($18,750) will satisfy our basic, subsistence level cash requirements for up to 9 months, while 50% of the proceeds ($12,500) will sustain us for up to 6 months, and 25% of the proceeds ($6,250) will sustain us for up to 3 months. Our budgetary allocations may vary, however, depending upon the percentage of proceeds that we obtain from this offering. For example, we may determine that it is more beneficial to allocate funds toward securing potential financing and business opportunities in the short terms rather than to conserve funds to satisfy continuous disclosure requirements for a longer period. During the 12 months following the completion of this offering, we intend to continue our current business plan and increase operations relating to the development and marketing of our mobile application.

- 2 -

In their audit report dated December 11, 2015, our auditors have expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Because our Chief Executive Officer Engchoon Peh may be unwilling or unable to loan or advance any additional capital to us, we believe that if we do not raise additional capital within 12 months of the effective date of this registration statement, we may be adversely effected and may have to curtail operations or continue operations at a limited level that is financially suitable for the Company.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

Our Offering

We have authorized capital stock consisting of 500,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). We have 15,000,000 shares of Common Stock and 100,000 shares of Preferred Stock issued and outstanding. Through this offering we will register a total of 7,250,000 shares. These shares represent 5,000,000 additional shares of common stock to be issued by us and 2,250,000 shares of common stock by our selling stockholders. We may endeavor to sell all 5,000,000 shares of common stock after this registration becomes effective. Upon effectiveness of this Registration Statement, the selling stockholders may also sell their own shares. The price at which we, the company, offer these shares is at a fixed price of $0.005 per share for the duration of the offering. The selling stockholders will also sell shares at a fixed price of $0.005 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of our common stock but we will not receive any proceeds from the selling stockholders.

*The primary offering on behalf of the company is separate from the secondary offering of the selling stockholders in that the proceeds from the shares of stock sold by the selling stockholder’s will go directly to them, not the company. The same idea applies if the company approaches or is approached by investors who then subsequently decide to invest with the company. Those proceeds would then go to the company. Whomever the investors decide to purchase the shares from will be the beneficiary of the proceeds. None of the proceeds from the selling stockholder’s will be utilized or given to the company. Mr. Peh will clarify for investors at the time of purchase whether the proceeds are going to the company or directly to himself.

*Mr. Peh will be able to sell his shares at any time during the duration of this offering. Regarding the sale of Mr. Peh’s shares, they will be sold at a fixed price of $0.005 for the duration of the offering.

*Mr. Peh will be selling shares of common stock on behalf of the Company simultaneously to selling shares of his own personal stock from his own account. A conflict of interest may arise between Mr. Peh’s interest in selling shares for his own account and in selling shares on the Company’s behalf. Please note that at this time Mr. Peh intends to sell the Company’s shares prior to selling his own shares, although he is under no obligation to do so. Mr. Peh will decide whether shares are being sold by the Company or by Mr. Peh himself.

*We will notify investors by filing an information statement that will be available for public viewing on the SEC Edgar Database of any such extension of the offering.

| Securities being offered by the Company | 5,000,000 shares of common stock, at a fixed price of $0.005 offered by us in a direct offering. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

|

| Securities being offered by the Selling Stockholders | 2,250,000 shares of common stock, at a fixed price of $0.005 offered by selling stockholders in a resale offering. As previously mentioned this fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. |

| Offering price per share | We and the selling shareholders will sell the shares at a fixed price per share of $0.005 for the duration of this Offering. |

| Number of shares of common stock outstanding before the offering of common stock | 15,000,000 common shares are currently issued and outstanding. |

| Number of shares of common stock outstanding after the offering of common stock | 20,000,000 common shares will be issued and outstanding if we sell all of the shares we are offering. |

| The minimum number of shares to be sold in this offering |

None. |

| Market for the common shares | There is no public market for the common shares. The price per share is $0.005. |

| We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop. | |

| The offering price for the shares will remain at $0.005 per share for the duration of the offering. |

- 3 -

| Use of Proceeds | We intend to use the gross proceeds to us for working capital, marketing and further development of our mobile application “Road Marshall.” |

| Termination of the Offering | This offering will terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 7,250,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. |

| Terms of the Offering | Our Chief Executive Officer, Engchoon Peh will sell the 5,000,000 shares of common stock on behalf of the company, upon effectiveness of this registration statement, on a BEST EFFORTS basis. |

| Subscriptions: | All subscriptions once accepted by us are irrevocable.

|

| Registration Costs | We estimate our total offering registration costs to be approximately $40,000.

|

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

After the offering, assuming all of their personal shares that are being registered herein and those shares being offered on behalf of the company are sold, both Mr. Peh and Mr. Bai will together have the ability to control approximately 50.33% of the voting power of our outstanding capital stock.

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

- 4 -

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Company and Our Industry

We have a limited operating history.

We have a limited operating history and do not have a meaningful historical record of sales and revenues nor do we have an established business track record. While we believe that we have the opportunity to be successful in the mobile application industry, there can be no assurance that we will be successful in accomplishing our business initiatives, or that we will be able to achieve any significant levels of revenues or net income, from our mobile application, “Road Marshall.”

The ownership of our mobile application “Road Marshall” was transferred to us in its entirety not through a formal agreement, but through a board resolution signed by our officers and directors of whom were the previous owners of the mobile application.

Because there was no formal agreement regarding the transfer in ownership of our mobile application “Road Marshall” this may impair your ability to sell shares in our company. A potential buyer of our stock may negatively regard such action that we have taken regarding the exchange in ownership. Additionally, this may limit our own ability to attract investors, which would negatively impact the value of your shares of stock.

The mobile application industry is subject to rapid technological change and, to compete, we must continually enhance our mobile Apps and custom development services.

We must continue to enhance and improve the performance, functionality and reliability of our mobile application, Road Marshall. The mobile application industry is characterized by rapid technological change, changes in user requirements and preferences, frequent new product and services introductions embodying new technologies and the emergence of new industry standards and practices that could render our products and services obsolete. Our success will depend, in part, on our ability to both internally develop and license leading technologies to enhance our existing application, services that address the increasingly sophisticated and varied needs of our customers, and respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. The development of our technology and other proprietary technology involves significant technical and business risks. We may fail to use new technologies effectively or to adapt our proprietary technology and systems to customer requirements or emerging industry standards. If we are unable to adapt to changing market conditions, customer requirements or emerging industry standards, we may not be able to increase our revenue and expand our business.

Major network failures could have an adverse effect on our business.

Our technology infrastructure is critical to the performance of our application and customer satisfaction. Apps run on a complex distributed system, or what is commonly known as cloud computing. We will own, operate and maintain the primary elements of this system, but some elements of this system are operated by third parties that we do not control and which would require significant time to replace. We expect this dependence on third parties to continue. Major equipment failures, natural disasters, including severe weather, terrorist acts, acts of war, cyber-attacks or other breaches of network or information technology security that affect third-party networks, communications switches, routers, microwave links, cell sites or other third-party equipment on which we rely, could cause major network failures and/or unusually high network traffic demands that could have a material adverse effect on our operations or our ability to provide service to our customers. These events could disrupt our operations, require significant resources to resolve, result in a loss of customers or impair our ability to attract new customers, which in turn could have a material adverse effect on our business, prospects, results of operations and financial condition.

If we experience significant service interruptions, which could require significant resources to resolve, it could result in a loss of users or impair our ability to attract new users, which in turn could have a material adverse effect on our business, prospects, results of operations and financial condition.

In addition, with the growth of wireless data services, enterprise data interfaces and Internet-based or Internet Protocol-enabled applications, wireless networks and devices are exposed to a greater degree to third-party data or applications over which we have less direct control. As a result, the network infrastructure and information systems on which we rely, as well as our customers’ wireless devices, may be subject to a wider array of potential security risks, including viruses and other types of computer-based attacks, which could cause lapses in our service or adversely affect the ability of our customers to access our service. Such lapses could have a material adverse effect on our business, prospects, results of operations and financial condition.

Defects in our mobile app may adversely affect our business.

Tools, code, subroutines and processes contained within mobile apps may contain defects when introduced and also when updates and new versions are released. Our introduction of a mobile app with potential defects or quality problems may result in adverse publicity, product returns, reduced orders, uncollectible or delayed accounts receivable, product redevelopment costs, loss of or delay in market acceptance of our products or claims by customers or others against us. Such problems or claims may have a material and adverse effect on our business, prospects, financial condition and results of operations.

- 5 -

Technology is constantly undergoing significant changes and evolutions and it is imperative that we keep up with an ever changing technological landscape in order to ensure the continued use and viability of our application.

Our industry is categorized by rapid technological progression and ever increasing innovation. While we believe ourselves to currently offer the best mobile application relating to road side assistance to suit the unique needs of our users we will need to constantly work on improving our current assets (mobile application) in order to keep up with technological advances that will almost certainly occur. Should we fail to do so our business may be adversely affected.

Strong competition in the mobile application market could decrease our market share.

The mobile application industry is highly competitive. We compete with companies which may offer similar applications to our own. In addition, some of our competitors may have substantially greater name recognition and financial and other resources than we have, which may enable them to compete more effectively for the available market share. We also expect to face increased competition as a result of new entrants to the mobile application industry, including established and emerging companies which create and/or market mobile applications. We may not be able to compete successfully against current or future competitors and may face competitive pressures that could adversely affect our business or results of operations.

If we are the subject of an intellectual property infringement claim, the cost of participating in any litigation could cause us to go out of business.

There has been, and we believe that there will continue to be, significant litigation and demands for licenses in our industry regarding patent and other intellectual property rights. Although we anticipate having a valid defense to any allegation that our current products, production methods and other activities infringe the valid and enforceable intellectual property rights of any third parties, we cannot be certain that a third party will not challenge our position in the future. Other parties may own patent rights that we might infringe upon with our products or other activities, and our competitors or other patent holders may assert that our products, and the methods we employ, are covered by their patents. These parties could bring claims against us that would cause us to incur substantial litigation expenses and, if successful, may require us to pay substantial damages. Some of our potential competitors may be better able to sustain the costs of complex patent litigation and, depending on the circumstances, we could be forced to stop or delay our research, development, manufacturing or sales activities. Any of these costs could cause us to go out of business.

We operate in a highly competitive market with rapid technological change, and we may not have the resources needed to compete successfully.

The mobile application industry is a highly competitive market that is characterized by rapid changes in our users’ technological requirements, expectations and evolving market standards. Competitors vary in size and organization from individuals with the capability to produce applications to startups to established corporations and software companies. Each of these competitors may develop applications or other technologies that are superior to the application we are offering. We may not have the resources necessary to acquire or compete with technologies being developed by our competitors, which may render our application less competitive or obsolete.

- 6 -

Our current success and future growth depend on the continued acceptance of the Internet and the corresponding growth in mobile application usage.

Our business, to a large extent, relies on the Internet for its success. A number of factors could inhibit the continued acceptance of the Internet and adversely affect our profitability, including:

• Inadequate Internet infrastructure;

• Security and privacy concerns; and

• The unavailability of cost-effective Internet service and other technological factors.

If Internet use decreases, or if the number of mobile application users does not increase, our business may not grow as planned.

Government regulations relating to the Internet could increase our cost of doing business, affect our ability to grow or otherwise have a material adverse effect on our business.

The increasing popularity and use of the Internet and mobile applications has led, and may lead, to the adoption of new laws and regulatory practices in the United States or foreign countries and to new interpretations of existing laws and regulations. These new laws and interpretations may relate to issues such as online privacy, copyrights, trademarks and service marks, sales taxes, fair business practices and the requirement that online education institutions qualify to do business as foreign corporations or be licensed in one or more jurisdictions where they have no physical location or other presence. New laws, regulations or interpretations related to doing business over the Internet could increase our costs and materially and adversely affect our enrollments, revenues and results of operations.

Our success depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lose their services.

Our future success heavily depends upon the continued services of our senior executives and other key employees. If one or more of our senior executives or key employees are unable or unwilling to continue in their present positions, it could disrupt our business operations, and we may not be able to replace them easily or at all. In addition, competition for senior executives and key personnel in our industry is intense, and we may be unable to retain our senior executives and key personnel or attract and retain new senior executives and key personnel in the future, in which case our business may be severely disrupted.

There is a conflict of interest that exists due to the fact that our Officers and Directors have outside obligations in which they serve other positions.

Because our Officers and Directors serve other outside positions they are only able to focus on advancing our business operations part time. Each of our Officers and Directors currently devotes between 10-20 hours per week in regards to our operations. It should be noted however, that the amount of time our Officers and Director’s may allocate to our business activities may increase or decrease in the future. We can not accurately predict however, if this will occur for certain or what exact events will cause our Officers and Directors to allocate more time or less time to our operations.

Our mobile application generates and processes a large amount of data, and the improper use or disclosure of such data could harm our reputation as well as have a material adverse effect on our business and prospects.

Our mobile application generates and processes a large quantity of data. We face risks inherent in handling large volumes of data and in protecting the security of such data. This includes protecting the data in and hosted on our system, including against attacks on our system by outside parties or fraudulent behavior by our employees; addressing concerns related to privacy and sharing, safety, security and other factors; and complying with applicable laws, rules and regulations relating to the collection, use, disclosure or security of personal information, including any requests from regulatory and government authorities relating to such data. Any systems failure or security breach or lapse that results in the release of user data could harm our reputation and brand and, consequently, our business, in addition to exposing us to potential legal liability.

As we expand our operations, the laws, rules and regulations of other jurisdictions may impose more stringent or conflicting requirements and penalties, compliance with which could require significant resources and costs. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any regulatory requirements or privacy protection-related laws, rules and regulations could result in proceedings or actions against us by governmental entities or others. These proceedings or actions may subject us to significant penalties and negative publicity, require us to change our business practices, increase our costs and severely disrupt our business.

The success of our business depends on our ability to maintain and enhance our reputation and brand.

We believe that our reputation in the mobile application industry is of significant importance to the success of our business. A well recognized brand is critical to increasing our customer base and, in turn, increasing our revenue. Since the mobile application industry is highly competitive, our ability to remain competitive depends to a large extent on our ability to maintain and enhance our reputation and brand, which could be difficult and expensive. To maintain and enhance our reputation and brand, we need to successfully manage many aspects of our business, such as cost-effective marketing campaigns to increase brand recognition and awareness in a highly competitive market; our ability to deliver our online platform and to ensure that it is seen as continually valuable within the mobile application industry.

We will conduct various marketing and brand promotion activities. We cannot assure you, however, that these activities will be successful and achieve the brand promotion goals we expect. If we fail to maintain and enhance our reputation and brand, or if we incur excessive expenses in our efforts to do so, our business, financial conditions and results of operations could be adversely affected.

- 7 -

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision. If we cannot provide reliable financial reports, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly and result in a loss of some or all of your investment.

Due to the fact that our directors and officers reside outside the United States our shareholders may have difficulties effecting service of process against them.

The difficulties shareholders could face when attempting to effect service of process against our foreign officers and directors include, but are not limited to, the following:

| - | Effecting service of process within the United States; |

| - | Enforcing judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal securities laws against the officers; |

| - | Enforcing judgments of U.S. courts based on the civil liability provisions of the U.S. federal securities laws in foreign courts against your officers; and |

| - | Bringing an original action in foreign courts to enforce liabilities based on the U.S. federal securities laws against your officers. |

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

• General Economic Conditions;

• The number users utilizing our mobile application;

• Our ability to retain, grow our business and attract new clients;

• Administrative Costs;

• Advertising and other marketing costs;

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Currently, our Chief Executive Officer Engchoon Peh and our Chief Operating Officer Zhencong Bai, together own approximately 40% of the voting power of our outstanding capital common stock. Additionally, Engchoon Peh and Zhencong Bai each beneficially owns or has the right to vote on an additional 50,000 shares of outstanding preferred stock As a result, they have a substantial voting power in all matters submitted to our stockholders for approval. Additionally, our officers and directors together as a group own 100% of our outstanding voting stock. If all of the shares being registered herein are sold our officers and directors will collectively control 75.83% of our outstanding voting stock. As a group our officers and directors have substantial voting power in all matters including:

• Election of our board of directors;

• Removal of any of our directors;

• Amendment of our Certificate of Incorporation or bylaws;

• Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

As a result of their ownership and positions, all of our officers and directors substantially influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by any of our officers and or directors could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Our officers’ and directors’ stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

At present we rely heavily upon Mr. Peh for additional capital in order to fund our development.

Engchoon Peh has informally agreed to advance funds “on a need be basis” to allow us to pay for filing fees, and professional fees that we may incur. At present, with our application fully developed, we do not believe we will require substantial additional financing from Mr. Peh, however without additional funding we will be unable to grow and market our business in the manner we intend to. Our business operations cannot progress further without additional financing, and Mr. Peh may not be willing to provide it to us if we are unable to raise the $25,000 we are seeking in this offering. In the event that we cannot raise the money we seek, we may be forced to halt or suspend our proposed marketing and business activities and our application may not have the capability to begin generating profits which could result in a loss of all or part of your investment in our company.

- 8 -

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

As we are a publicly reporting company, we will continue to incur significant costs in staying current with reporting requirements. Our management will be required to devote substantial time to compliance initiatives. Additionally, the lack of an internal audit group may result in material misstatements to our financial statements and ability to provide accurate financial information to our shareholders.

Our management and other personnel will need to devote a substantial amount of time to compliance initiatives to maintain reporting status. Moreover, these rules and regulations, which are necessary to remain as an SEC reporting Company, will be costly as an external third party consultant(s), attorney, or firm, may have to assist in some regard to following the applicable rules and regulations for each filing on behalf of the company.

We currently do not have an internal audit group, and we will eventually need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to have effective internal controls for financial reporting. Additionally, due to the fact that our officers and Director, have limited experience as an officer or Director of a reporting company, such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders.

Moreover, if we are not able to comply with the requirements or regulations as an SEC reporting company, in any regard, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

- 9 -

Our Officers and Directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies.

Our Officers and Directors lack experience in, and with, the reporting and disclosure obligations of publicly-traded companies and with serving as an Officer and or Director of a publicly-traded company. Such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. Consequently, our operations, future earnings and ultimate financial success could suffer irreparable harm due to our Officers’ and Director’s ultimate lack of experience in our industry and with publicly-traded companies and their reporting requirements in general.

Risks Relating to the Company’s Securities

We may never have a public market for our common stock or may never trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTCQB. In addition, it is possible that such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may in the future issue additional shares of our common stock, which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 500,000,000 shares of common stock and 20,000,000 shares of preferred stock, of which 15,000,000 shares of common stock and 100,000 shares of preferred stock are issued and outstanding as of April 4, 2016. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 20,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. Currently, each one (1) share of Preferred Stock shall have voting rights held at all stockholders’ meetings for all purposes, including election of directors equal to one hundred (100) shares of common stock.

Our preferred Stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions. However, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

We do not currently intend to pay dividends on our common stock and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

Shareholders who hold unregistered shares of our common stock are subject to resale restrictions pursuant to Rule 144, due to our status as a “Shell Company.”

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, because we have no assets , we are still considered a “shell company” pursuant to Rule 144 and as such, sales of our securities pursuant to Rule 144 are not able to be made until we have ceased to be a “shell company” and we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “Form 10 information” (i.e., information similar to that which would be found in a Form 10 Registration Statement filing with the SEC has been filed with the Commission reflecting the Company’s status as a non-“shell company.” Because none of our non-registered securities can be sold pursuant to Rule 144, until one year after filing Form 10 like information with the SEC any non-registered securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until 12 months after we cease to be a “shell company” and have complied with the other requirements of Rule 144, as described above. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless.

- 10 -

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a reporting company we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

We do not currently have independent audit or compensation committees. As a result, our directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 is and will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will continue to incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $35,000 per year for the next few years and will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

State Securities Laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell Shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock cannot be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

Risks Relating to this Offering

Investors cannot withdraw funds once invested and will not receive a refund.

Investors do not have the right to withdraw invested funds. Subscription payments will be paid to Road Marshall, Inc. and held in our corporate bank account if the Subscription Agreements are in good order and the Company accepts the investor’s investment. Therefore, once an investment is made, investors will not have the use or right to return of such funds.

Engchoon Peh will be able to sell his shares at any time during the duration of this offering. This may pose a conflict of interest since he is also selling shares on behalf of the company in this offering. It is possible that this conflict of interest could affect the ultimate amount of funds raised by the Company. This could negatively affect your investment.

As previously mentioned Mr. Peh is going to be selling shares on behalf of the Company in this offering. Mr. Peh is also simultaneously having his shares registered for resale. This conflict of interest could divert Mr. Peh’s time and attention in selling shares on behalf of the Company since he will also be able to sell his own shares. Several factors that could result are less monies raised by the company, and less desire to purchase shares by investors to name a few negative consequences. Because of this your investment could be adversely affected.

- 11 -

Our Chief Executive Officer and Director, Engchoon Peh does not have any prior experience conducting a best effort offering, and our best effort offering does not require a minimum amount to be raised. As a result, we may not be able to raise enough funds to commence and sustain our business and our investors may lose their entire investment.

Mr. Peh does not have any experience conducting a best-efforts offering. Consequently, we may not be able to raise the funds needed to commence business operations. Also, the best efforts offering does not require a minimum amount to be raised. If we are not able to raise sufficient funds, we may not be able to fund our operations as planned, and our business will suffer and your investment may be materially adversely affected. Our inability to successfully conduct a best-efforts offering could be the basis of your losing your entire investment in us.

The trading in our shares will be regulated by the Securities and Exchange Commission Rule 15G-9 which established the definition of a “Penny Stock.”

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $4,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 ($300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and must deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase.

We are selling the shares of this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our Chief Executive Officer Engchoon Peh, who will receive no commissions. There is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares of our Company’s offering, we may have to seek alternative financing to implement our business plan.

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase in this offering.