Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GUGGENHEIM CREDIT INCOME FUND 2016 T | ccif2016tform8-k330162015o.htm |

EXHIBIT 99.1

CAREY CREDIT INCOME FUND 2016 T

FOURTH QUARTER AND YEAR END 2015 OVERVIEW

Carey Credit Income Fund (“CCIF”) is a non-traded business development company (“BDC”) that invests primarily in large, privately negotiated loans to private middle market U.S. companies. CCIF is the master fund which pools investor capital raised through its feeder fund offerings, such as the current offering Carey Credit Income Fund 2016 T (“CCIF 2016 T”). CCIF and CCIF 2016 T are managed by affiliates of W. P. Carey Inc. and Guggenheim Partners, LLC and are designed to provide investors with current income, capital preservation, and, to a lesser extent, capital appreciation. CCIF and CCIF 2016 T share the same investment objectives and strategies, and all portfolio investments are made by CCIF, the master fund.

Details about CCIF's and CCIF 2016 T's fourth quarter and year end 2015 portfolio and operating results are contained in this overview. This overview should be read in conjunction with the CCIF Form 10-K and the CCIF 2016 T Form 10-K, as filed with the U.S. Securities and Exchange Commission on March 15, 2016 and March 16, 2016, respectively.

CCIF 2016 T Year End 2015 Highlights

• | CCIF 2016 T's initial registration statement was declared effective by the Securities and Exchange Commission on July 24, 2015. CCIF 2016 T commenced investment operations on October 8, 2015. |

• | From July 24, 2015 through December 31, 2015, CCIF 2016 T raised gross proceeds of $2.4 million. |

• | During the fourth quarter ended December 31, 2015, CCIF 2016 T paid fully covered distributions of $0.15 per share. |

• | For the period from July 24, 2015 to December 31, 2015, CCIF 2016 T's total investment return was -1.85%1. The reason for this decline was primarily due to the unrealized losses in CCIF's commodity-sensitive assets and the corresponding unrealized losses with respect to the value of CCIF 2016 T's ownership of CCIF. |

• | CCIF's portfolio investments at fair value totaled $78.2 million as of December 31, 2015 and consisted of 38 debt investments and one attached equity investment in 32 portfolio companies. |

• | On December 17, 2015, CCIF entered into a senior-secured term loan credit facility with JPMorgan Chase Bank, NA for an aggregate principal commitment amount of up to $175 million. The interest rate under the credit facility is based on three month LIBOR plus 2.65%. |

(1) | Total investment return is a measure of total return for shareholders, assuming the purchase of the Company’s Common Share at the beginning of the period and the reinvestment of all distributions declared during the period. More specifically, total investment return is based on (i) the purchase of one Common Share at the net offering price on the first day of the period, (ii) the sale at the net asset value per Common Share on the last day of the period, of (A) one Common Share plus (B) any fractional Common Shares issued in connection with the reinvestment of distributions, and (iii) distributions payable relating to one Common Share, if any, on the last day of the period. The total investment return calculation assumes that (i) cash distributions are reinvested in accordance with the Company’s distribution reinvestment plan and (ii) the fractional Common Shares issued pursuant to the distribution reinvestment plan are issued at the then net offering price per Common Share on each distribution payment date. Since there is no public market for the Company’s Common Shares, then the terminal sales price per Common Share is assumed to be equal to net asset value per Common Share on the last day of the period presented. Total investment return is not annualized. The Company’s performance changes over time and currently may be different than that shown above. Past performance is no guarantee of future results. |

1

Business Environment

During the latter half of 2015, credit markets faced challenges, many of which originated in commodity-sensitive sectors. The sell-off that began with commodity-sensitive credits slowly spilled over into other sectors as technical forces, including mutual fund and Exchange-Traded Fund ("ETF") outflows, weighed heavily on the credit markets. The average loan price, according to the S&P/LSTA Leveraged Loan Index, a primary measure of senior debt covering the U.S. leveraged loan market, declined from $96.58 as of June 30, 2015 to $91.26 as of December 31, 2015, or -5.5%. Similarly, the average high yield bond price, as measured by the Bank of America Merrill Lynch High Yield Index, a primary measure of subordinated debt, declined from $98.21 to $88.82 during the same period, or -9.8%.

In addition to the downward pricing pressure in the credit markets, total returns were also affected by the recent impact of commodity price declines and the spillover effect into other sectors. From April of 2015, when CCIF commenced investment activity, through December 31, 2015, the S&P/LSTA Leveraged Loan Index, posted a total return of -2.79% compared to the Bank of America Merrill Lynch High Yield Index which posted a return of -7.08%. While the total return of these indices has declined due to pricing pressure, we continue to believe that defaults will remain largely contained to commodity related sectors and that other non-commodity sensitive sectors will continue to have strong current income fundamentals.

This credit environment provides experienced credit managers, such as CCIF's Advisors, the opportunity to invest in new assets with attractive yields while remaining in senior positions of companies' capital structures. Specifically, we are seeing buying opportunities in sectors outside of commodities where there has been a technical sell-off yet fundamentals remain strong and credit risk remains low. Given that CCIF commenced its capital raising efforts in the midst of this evolving credit cycle, we believe CCIF has a significant competitive advantage compared to investors who have large legacy portfolios.

CCIF's Advisors have over 50 years of combined experience structuring, underwriting, and investing in corporate finance-focused credit. We believe that the current dislocation in the market creates additional attractive buying opportunities, which we intend to capitalize on utilizing their extensive sourcing capabilities and the breadth of their corporate credit platforms. Opportunities such as those presented by the current volatility in today's credit market serve to expand upon the already robust investment pipeline.

2

CCIF 2016 T Financial and Operating Highlights ($ in thousands except per share data)

For the three months ended | |||||||

December 31, 2015 | September 30, 2015 | ||||||

Total investment income | $ | 33 | $ | — | |||

Net investment income | $ | 8 | $ | — | |||

Net unrealized depreciation | $ | (78 | ) | $ | — | ||

Net decrease in net assets resulting from operations | $ | (70 | ) | $ | — | ||

Net assets | $ | 2,161 | $ | — | |||

Basic and diluted total investment income per Common Share | $ | 0.62 | $ | — | |||

Basic and diluted net investment income per Common Share | $ | 0.15 | $ | — | |||

Basic and diluted loss per Common Share | $ | (1.31 | ) | $ | — | ||

Net asset value per Common Share at end of quarter | $ | 8.68 | $ | — | |||

Investment Activity, Investment Performance, and Portfolio Update

CCIF commenced investment operations on April 2, 2015, and over the remainder of 2015 CCIF's gross investment commitments totaled approximately $102.2 million. Investment activity by each quarter since commencing operations, for the year ended December 31, 2015, is set forth below:

Portfolio Highlights ($ in thousands) | |||||||||||

Q2'15 | Q3'15 | Q4'15 | |||||||||

Gross Commitments | $ | 70,639 | $ | 14,292 | $ | 17,227 | |||||

Investments Sold or Repaid | $ | (156 | ) | $ | (10,787 | ) | $ | (7,506 | ) | ||

Total Fair Value of Investments | $ | 70,690 | $ | 70,825 | $ | 78,226 | |||||

Gross Portfolio Yield | 6.6 | % | 7.5 | % | 8.0 | % | |||||

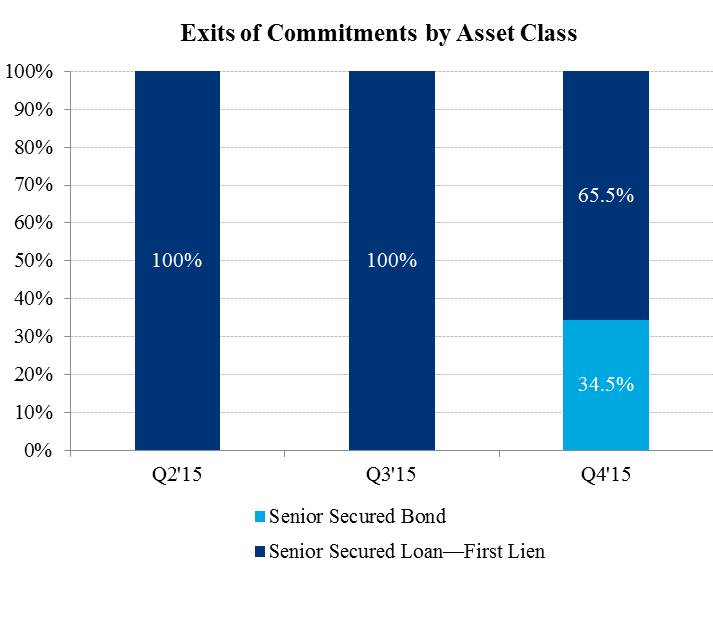

As of December 31, 2015, the portfolio consisted of $78.2 million of total investments at fair value (or $83.9 million of total investments at amortized cost), 96.0% of which consisted of investments in senior secured debt. We believe senior secured debt investments provide for downside protection that is particularly important given today's credit environment. Set forth below is the composition of the portfolio by asset class for each quarter end based on fair value:

3

Within the year ended December 31, 2015, initial investment activity was primarily concentrated in sourcing debt investments through primary issuance channels (56.2%) and the remainder was through secondary market channels (i.e. syndicated investments). Investment activity by quarter and by asset class for the year ended December 31, 2015 was as follows:

When commencing investment activity in April of 2015, we were focused on building a portfolio of high-quality, income-producing assets with favorable risk/reward characteristics. In order to efficiently ramp up the portfolio, initial investment activity in the period ending June 30, 2015 was geared towards sourcing broadly syndicated debt investments in the secondary market. By initially allocating capital to broadly syndicated loans that were more liquid in nature, we were then able to exit select lower yielding positions in the second half of 2015 and deploy that capital into assets with favorable spreads while maintaining high exposure to senior secured assets. As the selling pressure described above continued to weigh heavily on the credit markets, we began to see investment opportunities with similar risk profiles as those identified during the initial ramp up of the portfolio, but at lower costs and with higher returns. As seen in the chart below, CCIF's gross portfolio yield increased to 8.0% as of December 31, 2015 compared to 6.6% at the end of the second quarter of 2015. This demonstrates our ability to maintain our focus on senior positions in the capital structure of portfolio companies, and on participating in what we perceive to be the optimal risk-adjusted return profiles in the current market opportunity.

Set forth below are the weighted average effective yields as of each quarter end in the year ended December 31, 2015:

4

As of December 31, 2015, there were 32 portfolio companies in which CCIF held 38 debt investments and one equity investment. The weighted average portfolio company age was 33 years as of December 31, 2015. Furthermore, and aligned with our strategy of mitigating industry specific risk, the companies comprising the CCIF portfolio were diversified among 16 industries. Set forth below are the industry concentrations in CCIF's portfolio as of December 31, 2015 by fair value.

(*) | Portfolio companies in this category represent insurance brokers and are not classified as insurance companies. |

(**) | Industry classifications based upon Moody's standard industry classifications. |

CCIF's exposure to energy and commodity-sensitive sectors collectively represented 7.6% of the portfolio's fair value as of December 31, 2015. As of December 31, 2015, the $5.7 million of accumulated unrealized depreciation, approximately 77.6% was in part driven by the recent volatility in the global commodity price environment. That said, CCIF had no instances of non-accruals or default in the portfolio as of December 31, 2015, and losses attributable to commodity-sensitive assets, were all unrealized as of year end. Given today's environment, we believe it is prudent to limit the exposure to these sectors, and as we continue to raise and deploy capital, the current exposure will continue to decline as a percentage of the total portfolio.

The weighted average portfolio company EBITDA for CCIF portfolio companies as of the end of each quarter of investment activity are set forth below. As seen in the chart, the weighted average EBITDA for CCIF's portfolio companies decreased over the year ended December 31, 2015. This decrease is primarily due to the exit of select lower yielding investment positions, as described above, two of which were the largest issuers in terms of EBITDA as of September 30, 2015.

Also set forth below are the weighted average total leverage multiple and the portfolio weighted average interest rate coverage ratio of CCIF's portfolio companies.

5

(2) Weighted average EBITDA amounts are weighted based on the amortized cost of the portfolio company investments. EBITDA amounts are estimated from the most recent portfolio company financial statements, have not been independently verified by CCIF or its advisors, and may reflect a normalized or adjusted amount. Accordingly, CCIF nor its advisors makes no representation or warranty in respect of this information.

(3) Portfolio weighted average interest coverage ratio represents the portfolio company’s EBITDA as a multiple of interest expense. Portfolio company credit statistics are derived from the most recently available portfolio company financial statements, have not been independently verified by CCIF or its advisors, and may reflect a normalized or adjusted amount. Accordingly, CCIF nor its advisors makes no representation or warranty in respect of this information.

(4) This portfolio weighted average EBITDA, weighted average total leverage multiple, and interest coverage ratio data includes information solely in respect of portfolio companies in which CCIF has a debt investment (in each case, subject to the exclusions described in the following sentence). Excluded from the data above is information in respect to discrete projects in the project finance/power generation sector which includes Moxie Liberty LLC, Moxie Patriot LLC, and Panda Hummel LLC.

(5) EBITDA is a non-GAAP financial measure. For a particular portfolio company, EBITDA is generally defined as net income before net interest expense, income tax expense, depreciation and amortization. EBITDA amounts are estimated from the most recent portfolio company financial statements, have not been independently verified by CCIF or tis advisors, and may reflect a normalized or adjusted amount. Accordingly, CCIF nor its advisors makes no representation or warranty in respect of this information.

6

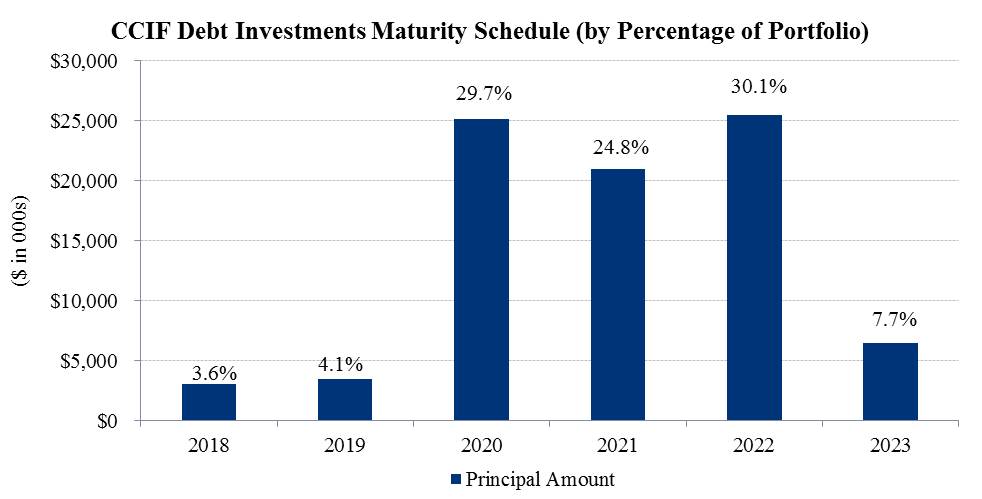

The following chart shows the maturity schedule of CCIF's debt investments based on principal amount as of December 31, 2015.

CCIF's public offerings, CCIF 2016 T and Carey Credit Income Fund — I, which have committed to seek liquidity events prior to December 31, 2021 and December 31, 2040, respectively, collectively represented less than 5% of the CCIF's total ownership as of December 31, 2015. The following chart shows the liquidity schedule of CCIF's current public offerings as of December 31, 2015 based on net assets of CCIF.

About W. P. Carey Inc.

Founded in 1973, W.P. Carey ("WPC") is a publicly-traded real estate investment trust (NYSE: WPC) that provides long-term sale-leaseback and build-to-suit financing for companies worldwide. WPC has expertise in credit and real estate underwriting, with more than 35 years of experience in evaluating credit and real estate investment opportunities. A capital provider to growing U.S. companies since its inception, WPC had an enterprise value of approximately $10.4 billion at December 31, 2015. In addition to its owned portfolio of diversified global real estate, WPC manages a series of non-traded publicly registered investment programs with assets under management of approximately $11.0 billion. WPC is subject to the information and reporting requirements of the Exchange Act. As a result, it files periodic reports and financial statements with the SEC, copies of which are available on the SEC's website at www.sec.gov.

For four decades, WPC has provided companies around the globe with capital to expand their businesses, make acquisitions, invest in research and development, or fund other corporate initiatives. Its corporate finance-focused credit and underwriting process is a constant that has been leveraged across a wide variety of companies and industries. WPC's investment process has largely focused on identifying companies with stable and improving credit profiles using a top-down and bottom-up approach, without relying on outside rating agencies. Credit-quality characteristics, capital structure, operating history, margin and ratio analysis, industry market share, and management team are all key considerations in evaluating and determining investment suitability of potential credits.

7

About Guggenheim Partners, LLC

Guggenheim Investments represents the investment management businesses of Guggenheim Partners and includes Guggenheim, an SEC-registered investment adviser. Guggenheim Partners is a privately-held, global financial services firm with over 2,500 employees and more than $240 billion in assets under management as of December 31, 2015. It produces customized solutions for its clients, which include institutions, governments and agencies, corporations, insurance companies, investment advisors, family offices, and individual investors.

Guggenheim Investments manages $198 billion in assets across fixed income, equity, and alternatives as of December 31, 2015. Its 250+ investment professionals perform research to understand market trends and identify undervalued opportunities in areas that are often complex and underfollowed. This approach to investment management has enabled Guggenheim to deliver long-term results to its clients.

Within Guggenheim Investments is the Guggenheim Corporate Credit Team, which is responsible for all corporate credit strategies and asset management of $68 billion. A unified credit platform is utilized for all strategies and is organized by industry as opposed to asset class, which increases its ability to uncover relative value opportunities and to identify and source opportunities. The scale of the platform, combined with the expertise across a wide range of industries and in-house legal resources, allows Guggenheim to be a solution provider to the market and maintain an active pipeline of investment opportunities.

Cautionary Statement Concerning Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Federal securities laws. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. CCIF and CCIF 2016 T undertake no obligation to update any forward-looking statements contained herein to conform the statements to actual results or changes in their expectations. A number of factors may cause CCIF’s and CCIF 2016 T's actual results, performance or achievement to differ materially from those anticipated. For further information on factors that could impact CCIF and CCIF 2016 T performance, please review CCIF’s and CCIF 2016 T's respective filings at the SEC website at www.sec.gov.

8