Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - AMERICAN BATTERY METALS CORP | orplt_ex311.htm |

| EX-32.1 - CERTIFICATION - AMERICAN BATTERY METALS CORP | orplt_ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2015 ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________

x

COMMISSION FILE NUMBER 333-199690

OROPLATA RESOURCES, INC. |

(Exact name of registrant as specified in its charter) |

NEVADA |

| 33-1227980 |

State or other jurisdiction of incorporation or organization |

| (I.R.S. Employer Identification No.) |

|

|

|

#5 Calle Gregorio de Lora, Puerto Plata, Dominican Republic |

|

|

(Address of principal executive offices) |

| (Zip Code) |

Registrant's telephone number, including area code (809) 970-2373

Securities registered pursuant to Section 12(b) of the Act: NONE.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 Par Value Per Share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K/A or any amendment to this Form 10-K/A. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller reporting company) |

|

| |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). x Yes ¨ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $45,000 as of December 11, 2015, based on the registered resale of securities on Form S-1/A effective October 16, 2013 at a price of $0.003 per share.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date. As of December 11, 2015, the Registrant had 40,000,000 shares of common stock outstanding.

OROPLATA RESOURCES, INC.

ANNUAL REPORT ON FORM 10-K/A

FOR THE YEAR ENDED SEPTEMBER 30, 2015

TABLE OF CONTENTS

|

| PAGE |

| ||

|

|

|

| ||

PART I |

|

|

| ||

|

|

|

|

|

|

ITEM 1. | BUSINESS. |

|

| 3 |

|

|

|

|

|

|

|

ITEM 1A. | RISK FACTORS. |

|

| 4 |

|

|

|

|

|

|

|

ITEM 2. | PROPERTIES. |

|

| 5 |

|

|

|

|

|

|

|

ITEM 3. | LEGAL PROCEEDINGS. |

|

| 17 |

|

|

|

|

|

|

|

ITEM 4. | MINE SAFETY DISCLOSURES. |

|

| 17 |

|

|

|

|

|

|

|

PART II |

|

|

| ||

|

|

|

|

|

|

ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

|

| 18 |

|

|

|

|

|

|

|

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

|

| 20 |

|

|

|

|

|

|

|

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

|

| 26 |

|

|

|

|

|

|

|

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

|

| 38 |

|

|

|

|

|

|

|

ITEM 9A. | CONTROLS AND PROCEDURES. |

|

| 38 |

|

|

|

|

|

|

|

ITEM 9B | OTHER INFORMATION |

|

| 40 |

|

|

|

|

|

|

|

ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. |

|

| 41 |

|

|

|

|

|

|

|

ITEM 11. | EXECUTIVE COMPENSATION. |

|

| 44 |

|

|

|

|

|

|

|

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

|

| 44 |

|

|

|

|

|

|

|

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

|

| 49 |

|

|

|

|

|

|

|

ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES. |

|

| 50 |

|

|

|

|

|

|

|

ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES. |

|

| 51 |

|

|

|

|

|

|

|

SIGNATURES |

|

| 52 |

| |

| 2 |

PART I

This Form 10-K/A, particularly in the sections titled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Form 10-K/A, including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "believe," "may," "might," "objective," "estimate," "continue," "anticipate," "intend," "should," "plan," "expect," "predict," "potential," or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of risks, and uncertainties.

These risks are not exhaustive. Other sections of this Form 10-K/A may include additional factors that could adversely impact our business and financial performance. These statements reflect our current views with respect to future events and are based on assumptions and subject to risk and uncertainties. Moreover, we operate in a very competitive and rapidly-changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K/A to conform these statements to actual results or to changes in our expectations.

As used in this Annual Report, the terms "we," "us," "our," "Oroplata," and the "Company" means Oroplata

Resources, Inc., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

Overview of Our Business

Oroplata Resources, Inc. was incorporated on October 6, 2011 under the laws of the State of Nevada. Our principal office is located at #5 Calle Gregorio de Lora, Puerto Plata, Dominican Republic and our registered agent's office is located at 123 West Nye Lane, Suite 129, Carson City, Nevada 89706. Our telephone number is 809-970-2373 and our e-mail address is "getup84@hotmail.com".

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of—

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

| 3 |

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a 'large accelerated filer', as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A(a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

Our Company is a start-up, exploration mining company formed to explore mineral properties in the Dominican Republic or elsewhere in the world which, hopefully, will contain gold and other precious minerals.

The Company purchased, through its wholly-owned subsidiary, Oroplata Exploraciones E Ingenieria, Orexi, S.R.L (herein known as "Oroplata Exploraciones") a 100% interest in the Leomary Gold Claim ("Leomary") consisting of 4,500 mining hectors (approximately 11,100 acres) located in the province of Monseñor Nouelan, municipality of Bonao. On September 1, 2014 the Director of Mining for the Dominion Republic cancelled the Leomary Gold Claim resulting in the Company no longer having any mineral rights to the Leomary. The Company has identified and acquired the mineral rights to a claim located in the Dominican Republic called Mogollon Gold Claim.

Oroplata has not earned any revenues to date and we do not anticipate earning revenues until such time as we have undertaken sufficient exploration work to identify an ore body. Exploration work will take a number of years and there is no certainty we will ever reach a production stage. Our Company is considered to be in the exploration stage due to not having done exploration work which would result in a development decision.

Our director has advanced $81,650 by way of paying on behalf of the Company certain expenses relating to office and past exploration work on the former Leomary mineral claim as well as providing additional funds for working capital.

As at September 30, 2015, we had $9,946 in cash on hand and current liabilities of $101,666 resulting in a negative working capital position of $(90,720).

From our inception on October 6, 2011 through to September 30, 2015, we raised $80,000 in capital in a private placement by issuing 40,000,000 shares of common stock at the price of $0.002 per share to our former sole director. Subsequent to September 30, 2015 we have raised no further funds other than advances from our director for payment of certain Company expenses.

We have one wholly-owned subsidiary called Oroplata Exploraciones E Ingenieria, Orexi, S.R.L which was incorporated under the laws of the Dominican Republic on January 10, 2012.

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Act of 1934 and are not required to provide the information under this item.

| 4 |

ITEM 2. PROPERTIES.

Mogollon Mineral Property

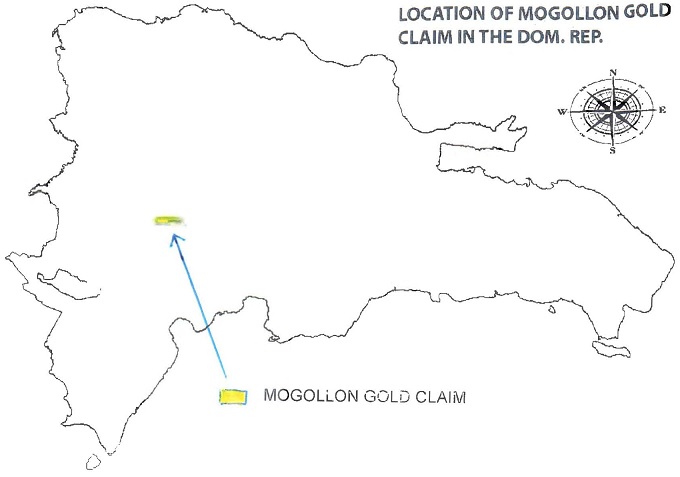

The Claim called "MOGOLLON" is located in the province of San Juan, municipality of Juan De Herera and an assortment of other small municipalities such as San Juan de la Maguana and Bohechio and near the villages of Solorin, El Toro Lado and La Cienaga. The coordinates to the Mogollon are shown in the following s chedule of relevant information below. The claim has easy access due to having paved roads and paths crossing the Mogollon.

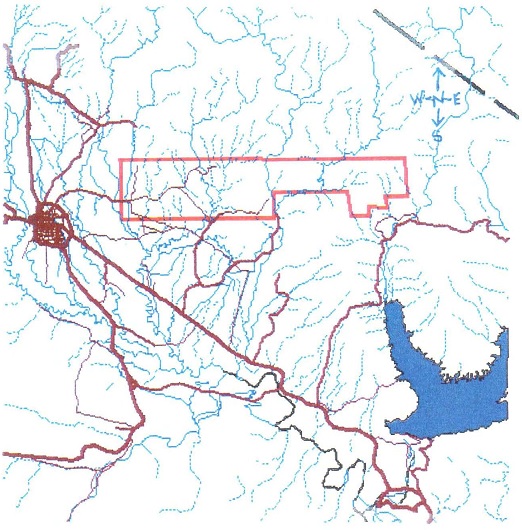

The above map was prepared by Francisco Garcia in Marc h 2016.

| 5 |

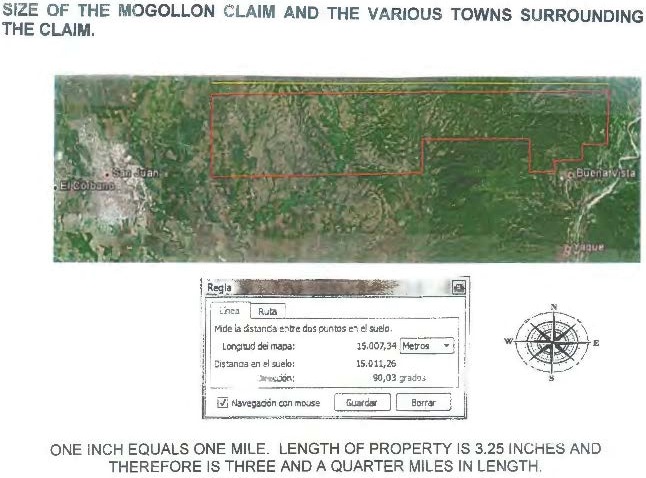

The following map shows the size of the Mogollon claim. One inch equals one mile.

The towns surrounding the Mogollon are Yaque, Buena Vista, San Juan and El Corbano.

Oroplata is required to maintain the Mogollon in good standing with the Ministry of Mines by undertaking exploration work on the claim and complying with the requirements occasionally set forth by the General Directorade of Mines.

Our professional geologist , Mr. Francisco Antonio Jerez Garcia, has visited the Mogollon mineral claim on several occasions.

| 6 |

Our sole officer and director, Mr. Ruben Ricardo Vasquez, has not yet visited the Mog ollon claim but once exploration takes place he will definitely visit the claim but for how many days at this time is unknown .

Oroplata has only the rights to the minerals on the Mogollon.

There are no agreements with anyone regarding the Mogollon claim and there are no royalties attached to the ownership of the mineral claims on the Mogollon . A list of land owners is shown of page 8.

There is a good access by the west part of the claim as it has roads and paths that cross the concession.

Process of Acquiring the Mineral Rights to the Mogollon Claim .

In the Dominican Republic, the following process is required in obtaining the m ineral rights to the Mogollon claim.

| - | Filing of an application involves two publications in a Dominican newspaper and the annual payment of fees of $100 – already paid. | |

| - | All mining titles are to be delivered to a Dominican Republic company. Exploration titles may also be delivered to individuals or a foreign company, with certain exceptions (e.g. government employees or their immediate relatives and foreign governments). | |

| - | Resolutions granting mineral title are issued by the Secretaría de Estado de Industria y Comercio (currently Ministry of Industry and Commerce) following a favorable recommendation by the Dirección General de Minería. | |

| - | A company may have exploration and mining titles over a maximum of 30,000 hectares. An exploration title is valid for 3 years and may be followed by two one year extensions. At the end of the 5 year period, the owner of the title applies for an exploitation permit, or a new round of exploration permitting may be started at the discretion of the mining department. | |

| - | An agreement must be reached with surface rights owners (formal or informal) for each phase of exploration work. If mining is envisioned, land must be bought. A procedure exists in which government mediation is used to resolve disagreements, and this process may ultimately end in expropriation at a fair price. | |

| - | Legal descriptions of exploration and mining concessions are based on polar co ordinates relative to a surveyed monument. The monument location is defined in UTM co ordinates, NAD27 datum. The concession boundaries are not marked or surveyed. |

The Mogollon claim is a mining concession which is lode but at the present time is exploration but will apply within the next few years for an exploitation concession. The claim is a state mining claim where only government permits are required.

| 7 |

The following schedule give s the relevant information relating to the location and size of the Mogollon claim.

Name of Claim: | MOGOLLON Gold Claim |

File Number: | S9-187 |

Date of acquiring Leomary | July 2014 |

Topographic Sheet No. | 6175 – IV |

Scale: | 1:50,000 |

Boundaries per UTM cooridnates: | 2081000M. North and2084000M. North and between coordinates 269000M. East and 284000M. East. |

Concession Unit: | 4,200 Hectares |

Registered Owner: | Oroplata Exploraciones E Ingenieria, Orexi S.R.L. |

There were no previous operators on the Mogollon claim but the land owners are as follows:

| 1. | Pedro Pérez | |

| 2. | Juan Bautista | |

| 3. | César Morales | |

| 4. | Carlos Diplan | |

| 5. | Saturnino Berroa | |

| 6. | Carlos Castro | |

| 7. | Manuel Sánchez | |

| 8. | Víctor Tejeda | |

| 9. | Manuel Bautista | |

| 10. | Inocencio Gálvez | |

| 11. | Manuel Berroa | |

| 12. | Escolástico Mercedes |

| 8 |

Tireo Formation

The geological unit of greater extent and power in the Central Dominican Cordillera is the Tireo Formation, which consists of a sequence of volcaniclastic and sedimentary rocks of more than 4000 m thick, interbedded with volcanic flows intruded by plutonic and hypabyssal rocks. The first references that allude to the Tireo Formation are due to a geologist in his report in 1966 mentioning them. Based on chemical analysis of volcanic rocks, a subsequent geologist in 1991 divided the unit into a lower and upper Tireo Group, suggesting as source material detrital material to the Siete Cabezas Formation essentially.

In the studied area, the cartographic units that are differentiated from base to top in Tireo Formation are: massive volcaniclastic rocks or laminated with interbedded subordinate lava and limestone, massive andesitic flows and interbedded with volcaniclastic terms, and limestone pleated in white, red and gray tones. On the Formation volcaniclastic proximal facies change essentially NW SE volcano-sedimentary facies and distal. The Tireo Formation is calcalkaline chemistry, representing its position in the Central Cordillera axis of magmatic activity linked to bow II stadium Superior Cretaceous-Eocene (AICC).

BIOCHEMICAL CHARACTERISTICS OF UNITS OF THE CENTRAL DOMINICAN MOUNTAINS

Igneous rocks that form the Dominican Cordillera Central are variably deformed, metamorphosed, retrograded and altered. These processes have led to the formation of new minerals such as amphibole, epidote, chlorite, white mica, albite and Fe-Ti oxides. Therefore, the geochemical interpretation of these rocks must be careful as to have undergone a metamorphism and / or alteration should be considered potential elements such as Sr, Rb, K, Na and Ba mobility. However, Zr, Nb, Th, Hf, Y, Ti, Cr and REE elements are relatively immobile and can be used to evaluate the magmatic affinities of rocks belonging to the various units that make up the Central Cordillera. Their geochemical characterization will allow establishing relationships between the different units and discriminating the possible tectonomagmátic build environment.

GEOLOGY

The mineralization of greater economic interest in the Dominican Republic corresponds to massive sulphide ores of hydrothermal replacements and laterite concentrations. The massive sulphides are preferentially located in the Maimon Formation and formations Los Ranchos, Duarte, Tireo and Peralvillo. In the Maimon Formation have been identified several Prospects Massive Sulphide mineralization such as: Cerro Maimon, Loma Barbuito and Loma Pesada.

The epithermal mineralization are preferably in the Formations Los Ranchos and Tireo, where you can highlight the tank sulphides Pueblo Viejo (Au, Ag, Zn) the deposit of Managua (Au, Ag) Deposits and Centenario (Au) and Candelones (Au).

| 9 |

The case of Pueblo Viejo is very particular, if the hypothesis that relates to Maar is true, the chances of a similar system there are very limited. If the situation is that proposed by a geologist in 2000 in which the epithermal system associated with massive sulfide and acidic domes is correct, then there are more chances of finding similar systems.

The assessment of areas with mining potential of metallic minerals is related to geodynamic processes developed in Hispaniola, in origin related to plate tectonics. The evolution of the Caribbean Plate presents different episodes of continuous transformation; this evolution is also lithological with input from volcanic material and intrusion of plutons and subsequent metamorphic process.

During these developmental periods areas affected include those between Hispaniola island arc formation in the Upper Jurassic and Cretaceous to Eocene, although there is evidence of Quaternary volcanism without major contributions of metallic ores.

The most representative tectonic events are associated with the contribution of volcanic rocks and large primary guidelines where this feature is in line with its geotectonic framework that is particularly favorable to the formation of various types of mineralization, many with great importance and economic significance. The global metallogenic analysis match the extraordinary fertility of the fields of island arc for the genesis of mineral deposits, especially regarding major types, such as hydrothermal volcanogenic massive sulfide (VHMS), epithermal, including porphyry copper deposits.

Other than obtaining the mineral rights to the Mogollon claim and having the geologist prepare a report on the claim no exploration work has been undertaken to date.

The state of the current exploration program and its results will depend upon the exploration work performed as set forth in the schedule under the heading of "Past and Future Exploration Expenses" .

To obtain positive results in the exploration program, efforts were directed to develop a mining project exploitation of metallic minerals, to meet the current needs of the international market.

The Company has not undertaken any exploration on the Mogollon concession but it is expected to do so before the end of 2016.

The conditions that must be met to retain the Mogollon claim are that Oroplata must pay approximately $12,000 in exploration work on or before April 30 th of this year and an additional $100 to obtain a Certificate from the Ministry of Mines. The latter amount has been paid but Oroplata has not yet received the Certificate. The Company has requested an extension of 45 days prior to having to complete the exporation program and should receive a response from the Ministry of Mines prior to the end of April. Normally the extension is granted. It has not undertaken yet the exploration work on the Mogollon. Oroplata is responsible for paying all the above noted fees.

Within the immediate 45 days there are no detailed plans to conduct exploration on the Mogollon claim. Subsequent to that date the Company will be required to conduct exploration work on the Mogollon or lose the rights to the minerals thereon.

Presently the Company does not have the available funds to undertake the initial exploration program on the Mogollon unless its sole director is prepared to advance the initial funds, the Company undertakes a private place by offering its shares in the market or has the director guarantee a line of credit with a financial institute. None of these options has been considered at this time.

| 10 |

Compliance with Government Regulations – Essentials of Mining Laws

In the Dominican Republic the laws relating to mineral exploration and development are contained under the "Mining Law of the Dominican Republic – Law No. 146". The important components of the mining law are as follows:

| - | Filing of an application involves two publications in a Dominican newspaper and the annual payment of fees. | |

| - | All mining titles are to be delivered to a Dominican Republic company. Exploration titles may also be delivered to individuals or a foreign company, with certain exceptions (e.g. government employees or their immediate relatives and foreign governments). | |

| - | Resolutions granting mineral title are issued by the Secretaría de Estado de Industria y Comercio (currently Ministry of Industry and Commerce) following a favorable recommendation by the Dirección General de Minería. | |

| - | A company may have exploration and mining titles over a maximum of 30,000 hectares. An exploration title is valid for 3 years and may be followed by two one year extensions. At the end of the 5 year period, the owner of the title applies for an exploitation permit, or a new round of exploration permitting may be started at the discretion of the mining department. | |

| - | An agreement must be reached with surface rights owners (formal or informal) for each phase of exploration work. If mining is envisioned, land must be bought. A procedure exists in which government mediation is used to resolve disagreements, and this process may ultimately end in expropriation at a fair price. | |

| - | Legal descriptions of exploration and mining concessions are based on polar co ordinates relative to a surveyed monument. The monument location is defined in UTM co ordinates, NAD27 datum. The concession boundaries are not marked or surveyed. |

The documents and requirements a company would be required to file in order to obtain a license for mining exploration are as follows:

| 1. | Name, nationality, address, profession, identification number of the applicant or their agent or the holder of a corresponding special power. |

| 2. | Name of the claim or concession. |

| 3. | Location, indicating: province, municipality, section or village. |

| 4. | Description of the starting point that will be necessary within or on the perimeter of the claim, determining the direction and distance of same reference point. These points should be located at a distance of not less than 150 feet, or within 1,500 feet. The point must be visible from one another. The point of reference should be related to three or more visual in direction of topographical characteristic points of the area. |

| 5. | The amount of mining hectares indicating the boundaries and the amount limited by law. |

| 6. | Three or more personal references about the moral, technical and economic capacity of the applicant. |

| 7. | Name of adjoining claims or concessions if any. |

| 11 |

| 8. | Name(s) of (the) owner(s) or occupant(s) of (the) field(s) if any. |

| 9. | The plans and drawings of an exploration area must be submitted at scales from 1:5,000 to 1:20,000, in original. |

| 10. | A copy of the topographic map at 1:5,000 scale, indicating the geological location of the concession area, specifying number, series and corresponding map edition. |

| 11. | Two (2) receipt payments to Internal Revenue Office for ten Dominican Pesos. |

Past and Future Exploration Expenditures

The total cost incurred to date is $ 5 ,000 in obtaining the mineral rights to the Mogollon claim and in obtaining a geological report thereon. The geologist has estimated the future exploration program will cost $62,117 as indicated below.

Item Units |

| Number and Cost |

|

| Total Cost USD |

| |

|

|

|

|

|

| ||

Salaries: |

|

|

|

|

|

| |

Supervising Geologist |

| 17 days @ $750/day |

|

|

| 12,750 |

|

Geological Assistant |

| 17 days @ $360/day |

|

|

| 6,120 |

|

|

|

|

|

|

|

| |

Transportation |

| 1,000 km @ $0.75/km |

|

|

| 750 |

|

Camp cost/Lodging |

| 17 days @ $90/day |

|

|

| 1,530 |

|

|

|

|

|

|

|

| |

Compilation |

|

|

|

|

|

|

|

Data and digitizing |

| 11 Days @ $150/day |

|

|

| 1,650 |

|

Drill hole interp & modeling |

| 14 days @ $400/day |

|

|

| 5,600 |

|

Structural consultant |

| 14 days @ $200/day |

|

|

| 2,800 |

|

|

|

|

|

|

|

| |

Soil Geochemistry |

|

|

|

|

|

|

|

Diamond Drilling (initial test holes) |

| 490 m @ $43/m |

|

|

| 21,070 |

|

Assay of Drill core |

| 120 samples @ $35/sample |

|

|

| 4,200 |

|

|

|

|

|

|

|

| |

SUBTOTAL |

|

|

|

|

|

|

|

|

|

|

|

| 56,470 |

| |

Contingency |

| 10% |

|

| 5,647 |

| |

|

|

|

|

|

|

| |

TOTAL USD |

|

|

|

|

| 62,117 |

|

| 12 |

At the present time the Company does not have the available funds to complete the above noted exploration program.

The Mogollon claim is without known reserves and the proposed program is exploratory in nature.

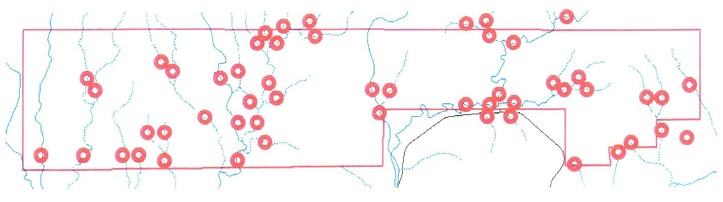

The following represents the sampling points on the Mogollon which the geologist recommends taking various soil and rock samples.

The geological justification for exploring the Mogollon claim is that the Dominican Republic over the years has resulted in numerous gold producing properties as well as copper properties. Even though gold prices per ounce and copper prices are low compared to prior years, management feels that if these metal strengthen over the next several years and if an ore deposit is found on the Mogollon, the Company might be able to proceed to extracting minerals from the Mogollon. There is no assurance that any ore deposits of commercial quality will be found on the Mogollon.

The geologist who will be conducting the proposed exploration work on the Mogollon is Francisco Garcia. He graduated from the Instituto Tecnico del Cibao Oriental – ITECO in the Province of Sanchez Ramirez and obtained a degree of Engineer of Geology and Mines in 1991 and Master's of Science in 1994 from the same university. In 1996 he worked for M&M Minerals and in 1998 he was employed by Minera Hispaniola, SA where he was involved in exploration and drilling. He worked there until 2002 when he was employed by Placer Dome Dominicana and in 2003 and 2004 worked as a geologist for Cementos Cibao and in 2005 until 2010 was employed by Cemex Dominicana in planning selective mining, crushing and stacking of ore. From 2010 to the present time he has been a self-employed geologist.

| 13 |

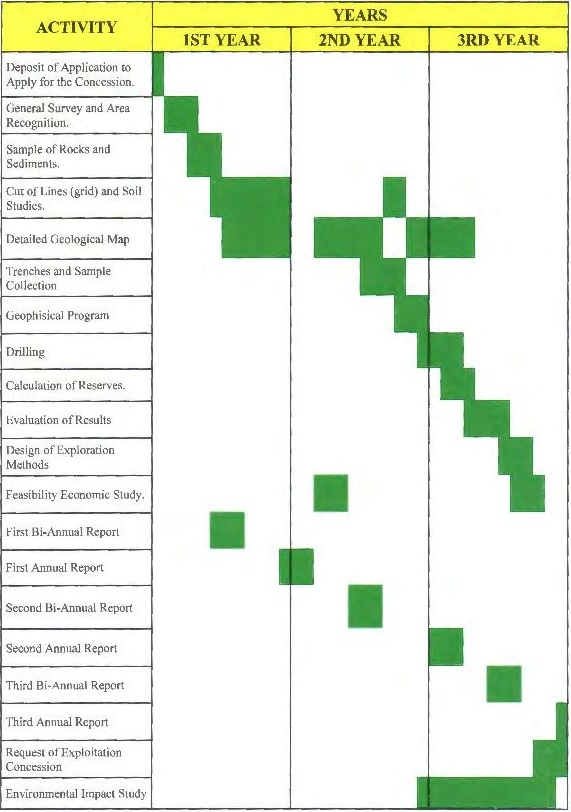

EXPLORATION TIME TABLE

Francisco Garcia has estimated the first year's budget will be $62,117 but until the first year is completed it is difficult for him to estimate future years' budgets in a dollar amount due to not knowing how successful the first year's exploration will be. The following schedule shows the type of work which will be done each year if the first year's exploration program is successful.

| 14 |

Environmental Permits

Important components of environmental law in the Dominican Republic are:

- | An environmental permit is not necessary to conduct geological mapping, stream sediment, sampling, line cutting or geophysical surveys. | |

|

|

|

| - | A letter of no objection (Carta de no objección) from the Ministry of Environment is all that is required for trenching and initial drilling, as long as access routes need not be constructed. This letter is based on a brief technical description submitted by the company. |

|

|

|

| - | Additional drilling and the construction of any access roads warrant an environmental license that is valid for one year. A report must be filed by the company and must include technical and financial aspects that take into account remediation costs. |

|

|

|

| - | At the feasibility stage, an environmental impact study must be submitted and approved by the government. Such a study could cost as high as $100,000. |

With the Leomary concession being cancelled by the Director of Mines for the Dominican Republic, the Company has had to replace the Leomary with the Mogollon claim. In addition to losing the Leomary concession the Company's sole officer and director, Hilario Sosa passed away in late August of 2014 after a short illness. The shareholders appointed Ruben Ricardo Vasquez as it new sole director and officer. Therefore, the Company's address has been changed to Calle Gregorio de Lora, #5, Puerto Plata, Dominican Republic. This is the private residence of Mr. Vasquez who is our sole officer and director. At the present time Oroplata does not require its own office space due to having no employees, other than Mr. Vasquez, but will consider renting office space once our exploration and staff requirements demand it.

Oroplate owns no real estate as such but has an interest in the minerals on the Mogollon claim.

Competition

Oroplata is an exploration stage company which has to compete with other companies searching for minerals in the Dominican Republic or elsewhere in the world and seeking financing for the development of their specific properties. Often, if not in all cases, these other mineral companies are better financed, have properties which have had sufficient exploration work done on them to warrant a future investor to consider investing in their company rather than ours. There is only a limited number of investors willing to invest in a company which had no proven reserves and has just started its exploration work. These other mineral exploration companies might induce investors to consider their properties and not ours. Hence, any additional funds they receive will be directed to the future exploration work on their properties whereas our company might be strapped for funds and unable to do any worthwhile exploration work on the unidentified property it is presently seeking. We might never be able to compete against these other companies and hence never bring our new property into a stage where a production decision is to be made. In addition, we will have to compete with both large and small exploration companies for other resources we will need; professional geologists, transportation to and from the mineral claim, materials to set up a camp if required and supplies including drill rigs.

Oroplata's Main Product

Oroplata's main product will be the sale of gold that can be extracted from its Mogollon mineral claim once the claim has been explored. Since the Mogollon has yet to be explored by us, we have yet to find an ore body and therefore cannot sell any ore.

| 15 |

Exploration Facilities

There is no plant and equipment located on the Mogollon claim and none will be installed there until such time as Oroplata makes a decision as to whether or not to further develop and extract minerals from the Mogollon claim.

Source of Water and Power

There are plenty of natural rivers surrounding the Mogollon and a hydroelectric plant exists at about half a kilometer from the claim. There are potable water sources close to the claim and initial power can easily be produced by portable generators .

Natural Water Sources on the Mogollon Claim

The Company has no plans to construct a mill or smelter on the Mogollon mineral claim.

| 16 |

Other Mineral Properties

We are not contemplating any other mineral properties at this time.

Employees

Other than our sole director and officer we do not have any other employees. He devotes approximately 10 hours a month to our operations. Since he is not a professional geologist he will have to hire individuals who can assist in the Company's exploration activities and advise him of future exploration plans.

Research and Development Expenditures

Oroplata has not expended any money on research and development since its inception.

Patents and Trademarks

Oroplata does not have any patents or trademarks.

ITEM 3. LEGAL PROCEEDINGS.

We are not currently a party to any legal proceedings. There are no material proceedings to which our executive officer and director is a party adverse to us or has a material interest adverse to us. There are no legal actions, either pending or believed by management to happen, to which the Company is aware.

We are required by Section 78.090 of the Nevada Revised Statutes (the "NRS") to maintain a registered agent in the State of Nevada. Our registered agent for this purpose is American Corporate Enterprise, Inc. of 123 W. Nye Lane, Suite 129, Carson City, NV 89706. All legal process and any demand or notice authorized by law to be served upon us may be served upon our registered agent in the State of Nevada in the manner provided in NRS 14.020(2).

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

| 17 |

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

No Public Market for Common Stock

Our shares have recently been quoted on the OTC Bulletin Board ("OTCBB") under the symbol of ORRP.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a suitably written statement.

| 18 |

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, if our common stock becomes subject to the penny stock rules, stockholders may have difficulty selling those securities.

Rule 144 Shares

In general, under Rule 144, a person who is not an affiliate of a company and who is not deemed to have been an affiliate of a company at any time during the three months preceding a sale and who has beneficially owned shares of a company's common stock for at least six months would be entitled to sell them without restriction, subject to the continued availability of current public information about the company (which current public information requirement is eliminated after a one-year holding period). In addition, a person, who is an affiliate and beneficially owned shares of a company's common stock for at least six months, will be entitled to sell within any three month period a number of shares that does not exceed the greater of:

1. | One percent of the number of shares of the company's common stock then outstanding; or |

|

|

2. | The average weekly trading volume of the company's common stock during the four calendar weeks preceding the filing of a notice on form 144 with respect to the sale. |

However, Rule 144 is not available for securities initially issued by a company that has either no or nominal operations and no or nominal assets (a "shell company"), whether reporting or non-reporting, or a company that was at any time previously a shell company, unless the company:

· | has ceased to be a shell company; |

|

|

· | is subject to the Exchange Act reporting obligations; |

|

|

· | has filed all required Exchange Act reports during the preceding twelve months; and |

|

|

· | at least one year has elapsed from the time the company filed with the SEC current Form 10 type information reflecting its status as an entity that is not a shell company. |

"Shell Company Conditions"

At this time, we are considered a shell company. As a result, our major shareholder and director, being an affiliate, and any other person initially issued shares of our common stock, excluding those shares registered in our effective registration statement, will not be entitled to sell such shares until the Shell Company Conditions have been satisfied. Upon satisfaction of the Shell Company Conditions, such sales by our sole shareholder and director would be limited by the manner of sale provisions and notice requirements and to the availability of current public information about us as set forth above.

HOLDERS OF OUR COMMON STOCK

As of December 1, 2015, there were 41 registered holders of record of our common stock due to our previous sole director and officer, Mr. Hilario Sosa, selling 15,000,000 common shares under the Company's effective registration statement.

| 19 |

DIVIDENDS

Oroplata's Articles of Incorporation or Bylaws do not restrict it from declaring dividends. Nevertheless, the Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. | We would not be able to pay our debts as they become due in the usual course of business; or |

| 2. | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution. |

Oroplata has not declared any dividends since its inception and does not conceive that it will be declaring any dividends in the near future. Management plans to retain any excess funds in the Company for working capital and for further exploration on a future mineral claim.

Stock Options, Warrants and Rights

Oroplata does not have any outstanding stock options, warrants, rights or any other instrument which will allow the holders to convert into common shares of our Company.

RECENT SALES OF UNREGISTERED SECURITIES

None.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS.

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto included elsewhere in the Form 10-K. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this Form 10-K.

Oroplata is a start-up, exploration stage company. Oroplata has a limited operating history and has not yet generated or realized any revenues from its activities. It has lost the rights to the minerals on the Leomary claim which for several years it undertook exploration work thereon. Nevertheless, it has identified another mineral claim in the Dominican Republic called Mogollon Gold Claim which it is presently considering doing exploration work on it.

Oroplata's auditors have issued a going concern opinion. This means that its auditors believe there is substantial doubt that it can continue as an on-going business for the next twelve months unless it obtains additional capital to pay for its operations. This is because it has not generated any revenues and no revenues are anticipated until it begins removing and selling minerals, if ever. Accordingly, it must raise cash from sources other than the sale of minerals found on its future unidentified mineral claim. That cash must be raised from other sources. Oroplata's only other source for cash at this time is investment by others in Oroplata, advances from its current sole director or institutional financing. Oroplata must raise cash to implement its planned exploration program and stay in business.

Overview of Oroplata

Oroplata was incorporated under the laws of the State of Nevada on October 6, 2011 for the purpose of acquiring rights to mineral properties with the eventual objective of being a producing mineral company, if and when it ever occurs. On January 10, 2012 Oroplata incorporated a wholly-owned subsidiary under the laws of the Dominican Republic named "Oroplata Exploraciones E Ingenieria, Orexi, SRL" in order to hold the mineral rights to a claim named "Leomary Gold Claim". In order to determine what mineralization was present on the Leomary the Company hired Ismael Martinez, Professional Geologist, to undertake an exploration program on the Leomary at a cost of $25,800. The exploration program centered mainly on obtaining soil, sediment and rock samples from various areas within the claim to determine what minerals were present. Based on the results on these initial findings Oroplata undertook a further exploration program during the summer of 2013 to identify mineralization in other parts of the Leomary and to resample the previous high grade samples. This additional exploration work was completed at the end of August 2013. Unfortunately the Company lost the rights to any mineral on the Leomary.

| 20 |

Results of Operations

Revenue from Operations

Oroplata has not realized any revenue from its exploration activities on either the Leomary or the Mogollon and it is extremely doubtful that the new mineral property, being the Mogollon, will be able to produce any revenue for many years. Without an ore reserve Oroplata cannot seek substantial investors to further fund the Company so that production can be achieved. Not until commercial production is realized will Oroplata have any chance of recognizing any form of revenue.

Sources of Funds

To date the source of funds obtained by Oroplata is through the sale of 40,000,000 common shares to our former director and officer, Mr. Hilario Sosa, for a total consideration of $80,000. Prior to his untimely death, Mr. Sosa advanced $25,000 as a non-interest bearing loan payable on demand. No formal agreement between the Company and Mr. Sosa was entered into regarding these funds. These funds were used to undertake the next stage of the sampling program and provide a small amount of working capital. Oroplata will require additional funds over the next year and will either obtain further funds from its new sole director and officer, undertake a private placement or borrowing from institute lenders. The latter will be difficult for Oroplata to do until it is able to prove that the Mogollon claim has some merit.

Financial Activities since Inception

The following summarizes the financial activities of Oroplate since its inception and gives a breakdown of the expenses which are grouped in the attached financial statements herein.

Activities from October 6, 2011 (date of inception) to September 30, 2015 with comparison to inception to September 30, 2014 – consolidated figures:

Description |

| Ref |

| Sept 30, 2015 |

|

| % |

|

| Sept. 30, 2014 |

|

| % |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Accounting |

| i |

| $ | 49,220 |

|

|

| 28.83 |

|

| $ | 29,580 |

|

|

| 22.29 |

|

Exploration expenses |

| ii |

|

| 63,618 |

|

|

| 37.26 |

|

|

| 52,918 |

|

|

| 39.87 |

|

Filing fees |

| iii |

|

| 12,767 |

|

|

| 7.48 |

|

|

| 8,978 |

|

|

| 6.76 |

|

Impairment on mineral claim rights |

| iv |

|

| 13,000 |

|

|

| 7.61 |

|

|

| 13,000 |

|

|

| 9.79 |

|

Incorporation costs |

| v |

|

| 3,275 |

|

|

| 1.92 |

|

|

| 3,275 |

|

|

| 2.47 |

|

Legal |

| vi |

|

| 16,978 |

|

|

| 9.94 |

|

|

| 15,678 |

|

|

| 11.81 |

|

Office |

|

|

|

| 2,959 |

|

|

| 1.74 |

|

|

| 1,751 |

|

|

| 1.32 |

|

Transfer agent's fees |

| vii |

|

| 2,596 |

|

|

| 1.53 |

|

|

| 1,745 |

|

|

| 1.32 |

|

Travel |

| viii |

|

| 6,307 |

|

|

| 3.69 |

|

|

| 5,807 |

|

|

| 4.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total expenses |

|

|

| $ | 170.720 |

|

|

| 100.00 |

|

| $ | 132,732 |

|

|

| 100.00 |

|

| 21 |

| i. | The amount recorded in September 30, 2015 represents the fees charged by the accountant for the preparation of the financial statement as at September 30, 2014, for examination by the Company's independent accountants and the review of the financial statements for the three months ended December 31, 2014, six months ended March 31, 2015 and the nine months ended June 30, 2015. | |

| ii. | The exploration work relates to the Mogollon claim which was acquired during the year and a geological report written on it. The Director of Mines cancelled Oroplata's interest in the mineral on the Leomary during the prior year. The majority of exploration work was done on the Leomary during the prior years. | |

| iii. | Represent the cost of filing the various Form 10-Qs and 10-K with the SEC during the year, in having certain corporate documents apostilles for the Ministry of Mines in the Dominican Republic and the preparation of new format forms required by the Ministry of Mines relating to the Leomary. | |

| iv. | The cost to acquire the Leomary claim had been expensed in prior years. | |

| v. | The cost to incorporate both the parent and subsidiary in Nevada and the Dominican Republic. | |

| vi. | Fees paid to the lawyer in the Dominican Republic for incorporating the subsidiary, preparing documents for the Ministry of Mines and other services as required by the Company. In addition fees paid to an attorney for preparing an opinion on the tradeability of shares under Exhibit 5.1 to the Form S-1. | |

| vii. | Fees charged by Action Stock Transfer for issuance of share certificates, preparing and filing the Annual List of Officers, Directors, etc and issuance of Shareholders Report. | |

| vii. | Travel expense represents the cost of the Dominican Republic lawyer to travel between Puerto Plata and Santa Domingo in the Dominican Republic in order to record various documents with the Ministry of Mines. |

During the period from inception to September 30, 2015, Oroplata has an operating loss of $170,720 as compared to an operating loss of $132,732 for the same period ended September 30, 2014. The loss increased over the fiscal year ended September 30, 2015 by $37,988 compared with a loss for the fiscal year ended September 30, 2014 of $43,398.

Breakdown of Expenses between the Parent and Subsidiary Companies

|

| Oroplata Resouces Inc. |

| Oroplata Exploraciones |

|

| ||||||||||||||

|

| [parent company] |

|

| [subsidiary company] |

|

| |||||||||||||

Description |

| Sept. 30, |

|

| Sept. 30, |

|

| Sept. 30, |

|

| Sept. 30, |

|

| From inception to Sept. 30, 2015 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Accounting |

| $ | 19,640 |

|

| $ | 16,440 |

|

| $ | - |

|

| $ | - |

|

| $ | 49,220 |

|

Exploration expenses |

|

| - |

|

|

| - |

|

|

| 10,700 |

|

|

| 5,824 |

|

|

| 63,618 |

|

Filing fees |

|

| 3,639 |

|

|

| 4,750 |

|

|

| 150 |

|

|

| 2,700 |

|

|

| 12,767 |

|

Impairment of mineral claim rights |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 13,000 |

|

Incorporation costs |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 3,275 |

|

Legal |

|

| - |

|

|

| 503 |

|

|

| 1,300 |

|

|

| 8,425 |

|

|

| 16,978 |

|

Office |

|

| 737 |

|

|

| 795 |

|

|

| 470 |

|

|

| - |

|

|

| 2,959 |

|

Transfer agent |

|

| 852 |

|

|

| 1,745 |

|

|

| - |

|

|

| - |

|

|

| 2,596 |

|

Travel |

|

| - |

|

|

| - |

|

|

| 500 |

|

|

| 2,216 |

|

|

| 6,307 |

|

Total expenses |

| $ | 24,868 |

|

| $ | 24,233 |

|

| $ | 13,120 |

|

| $ | 19,165 |

|

| $ | 170,720 |

|

The parent company provides the funds to its subsidiary in order that any expenses associated with its mineral claims could be paid by it. This was done via the intercompany account.

| 22 |

Activities for the year ended September 30, 2015

With the loss of the Leomary the Company acquired a new mineral claim called Mogollon located in the Dominican Republic. With the acquisition our new mineral property the Company will require funds to proceed. Unless our director is willing to advance the required funds, at this point in time he has not committed himself to advance further funds, the Company will have sell treasury shares in a private placement to interested investors. This might be difficult since the market for natural resources and their costs are extremely low at the present time. Many investors might not be willing to invest in a start up situation where they might have to wait years before they realize a profit. If this funding is not available when needed the Company will not be able to undertake any future exploration program and might, after twelve months, have to cease operations.

Liquidity and Capital Resources

As of September 30, 2015, Oroplata had cash of $9,946 and a negative working capital position of $(90,720) as compared to cash of $22,248 and a negative working capital position of $(52,732) at September 30, 2014.

Cash Requirement over the Next Twelve Months

The following represents management's estimates of the cash Oroplata will require to meet its current obligations and provide working capital for the next twelve months.

Description |

| Amount |

|

| Particulars Regarding Funds Needed | |

|

|

|

|

| ||

Accounting and audit |

| $ | 17,640 |

|

| See schedule below |

Exploration – Mogollon |

|

| 12,000 |

|

| Estimate of cost of exploration |

Filing fees |

|

| 2,500 |

|

| Annual filing with State of Nevada and Edgar fees for filing with the SEC |

Legal |

|

| 2,500 |

|

| Fees to lawyer in the Dominican Republic. |

Office |

|

| 1,500 |

|

| Fax, photocopying and office supplies |

Travel |

|

| 1,000 |

|

| For the lawyer to travel to Santa Domingo |

Transfer agent |

|

| 1,000 |

|

| Issuance of shares and annual fee |

|

|

|

|

|

| |

Total cash required before the following |

|

| 38,140 |

|

|

|

|

|

|

|

|

| |

Less: Cash on hand |

|

| (9,946 | ) |

| Cash as of September 30, 2015 |

|

|

|

|

|

| |

Cash Requirements |

| $ | 27,194 |

|

|

|

Accounting and audit

Period |

| Accountant (i) |

|

| Independent Accountant |

|

| Total |

| |||

|

|

|

|

|

|

|

|

| ||||

September 30, 2015 |

| $ | 1,785 |

|

| $ | 4,500 |

|

| $ | 6,285 |

|

December 31, 2015 |

|

| 1,785 |

|

|

| 2,000 |

|

|

| 3,785 |

|

March 31, 2016 |

|

| 1,785 |

|

|

| 2,000 |

|

|

| 3,785 |

|

June 30, 2016 |

|

| 1,785 |

|

|

| 2,000 |

|

|

| 3,785 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total estimated fees |

| $ | 7,140 |

|

| $ | 10,500 |

|

| $ | 17,640 |

|

| (i) | Accountant engaged to prepare the financial statements for either an examination as of the year-end or a review each quarter by the independent accountants. |

| 23 |

Exploration expenses

| (ii) | Represents the estimated cost of an initial exploration program on Mogollon claim. Oroplata does not have the funds to meet its estimated expenses over the next twelve months. Oroplata has the following options in order to raise the needed funds; |

| 1. | Advances from Mr. Vasquez which at the present time he is not prepared to consider; | |

| 2. | Obtaining funds from a financial institution personally guaranteed by Mr. Vasquez; or | |

| 3. | Selling additional shares under a private placement from Treasury. |

At the present time none of these options have been considered by Mr. Vasquez.

Off-Balance Sheet Arrangements

None.

Trends

From Oroplata's date of inception it has been an exploration company which has produced no revenue and maybe will not be able to produce revenue. To the knowledge of its management Oroplata is unaware of any trends or past and future events which will have a material effect upon it, its income and business, both in the long and short term.

Critical Accounting Policies and Estimates

In presenting Oroplata's financial statements in conformity with U.S. generally accepting accounting principles, or GAAP, Oroplata is required to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, costs and expenses and related disclosures.

Some of the estimates and assumptions Oroplata is required to make relate to matters that are inherently uncertain as they pertain to future events. Oroplata bases these estimates and assumptions on historical experience or on various other factors that it believes to be reasonable and appropriate under the circumstances. On an ongoing basis, Oroplata reconsiders and evaluates its estimates and assumptions. Actual results may differ significantly from these estimates.

Oroplata believes that the critical accounting policies listed below involve its more significant judgments, assumptions and estimates and, therefore, could have the greatest potential impact on its financial statements. In addition, Oroplata believes that a discussion of these policies is necessary to understand and evaluate the financial statements contained in this Form 10-K.

Estimates and Assumptions

Management uses estimates and assumptions in preparing financial statements in accordance with general accepted accounting principles. Those estimates and assumptions affect the reported amounts of the assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing these financial statements.

Mineral claim acquisition and exploration costs

The cost of acquiring mineral properties or claims is initially capitalized and then tested for recoverability whenever events or changes in circumstances indicate that its carrying amount may not be recoverable. Mineral exploration costs are expensed as incurred.

| 24 |

Income Taxes

Oroplata utilizes the liability method of accounting for income taxes. Under the liability method deferred tax assets and liabilities are determined based on differences between financial reporting and the tax bases of the assets and liabilities and are measured using the enacted tax rates and laws that will be in effect, when the differences are expected to be reversed. An allowance against deferred tax assets is recorded, when it is more likely than not, that such tax benefits will not be realized.

Recent Accounting Pronouncements

The Company reviews new accounting standards as issued. No new standards had any material effect on these financial statements, except for changes in reporting Development Stage Enterprises. The accounting pronouncements issued subsequent to the date of these financial statements that were considered significant by management were evaluated for the potential effect on these consolidated financial statements. Management does not believe any of the subsequent pronouncements will have a material effect on these consolidated financial statements as presented and does not anticipate the need for any future restatement of these consolidated financial statements because of the retro-active application of any accounting pronouncements issued subsequent to September 30, 2015 through the date these financial statements were issued.

On June 10, 2014 the FASB issued authoritative guidance which eliminates the concept of a development stage entity, which includes exploration stage. The incremental reporting requirements for presenting the development stage operations and cash flows since inception will no longer apply to exploration stage entities. The amendments related to the elimination of inception-to-date information and the other remaining disclosure requirements of Topic 915 are to be applied retrospectively and are effective for fiscal years beginning after December 15, 2014. The Company previously had been considered an exploration stage entity as its operations had not begun and has elected early adoption of this guidance effective with this filing.

Products and Gold

Until such a time that we explore and identify an ore body on the Mogollon claim we will have no minerals to sell. It will take many years to prove any minerals on the Mogollon claim and there may be no commercial minerals after we have completed an extensive exploration program.

Other Minerals

We have not undertaken sufficient exploration work to know what other minerals might be located on the Mogollon claim.

Foreign Currency

Our Company has conducted exploration activities in the Dominican Republic and has paid its expenses in United States Dollars.

| 25 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

| 1. | Reports of Independent Registered Public Accounting Firms; |

| ||

| 2. | Consolidated Balance Sheets as at September 30, 2015 and 2014; |

| ||

| 3. | Consolidated Statements of Operations for the years ended September 30, 2015 and 2014; |

| ||

| 4. | Consolidated Statement of Stockholders' Deficit for the years ended September 30, 2015 and 2014; |

| ||

| 5. | Consolidated Statements of Cash Flows for the years ended September 30, 2015 and 2014 |

| ||

| 6. | Notes to the Consolidated Financial Statements. |

| 26 |

Heaton & Company, PLLC

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors and Stockholders of

Oroplata Resources, Inc.

We have audited the accompanying balance sheet of Oroplata Resources, Inc. (the Company) as of September 30, 2015, and the related statements of operations, changes in stockholders' equity (deficit) and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States of America). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Oroplata Resources, Inc. as of September 30, 2015, and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has negative working capital and has not generated revenues to cover operating expenses. These factors, among others, raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to this matter are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Heaton & Company, PLLC

Farmington, Utah

December 11, 2015

| 27 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

Oroplata Resources, Inc.

We have audited the accompanying balance sheet of Oroplata Resources, Inc. as of September 30, 2014, and the related statement of operations, stockholders' deficiency, and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements as of and for the year ended September 30, 2013 were audited by other auditors who issued an unqualified opinion on December 24, 2013.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Oroplata Resources, Inc. at September 30, 2014, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the accompanying financial statements, the Company has significant net losses and cash flow deficiencies. Those conditions raise substantial doubt about the Company's ability to continue as a going concern. Management's plans regarding those matters are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ DKM Certified Public Accountants

DKM Certified Public Accountants

Clearwater, Florida

January 12, 2015

| 28 |

OROPLATA RESOURCES, INC.

Consolidated Balance Sheets

| September 30, |

|

| September 30, |

| |||

|

|

|

|

|

| |||

Assets |

|

|

|

|

|

| ||

|

|

|

|

|

| |||

Current Assets |

|

|

|

|

|

| ||

|

|

|

|

|

| |||

Cash |

| $ | 9,946 |

|

| $ | 22,248 |

|

Prepaid expense |

|

| 1,000 |

|

|

| - |

|

|

|

|

|

|

|

|

| |

Total Current assets |

|

| 10,946 |

|

|

| 22,248 |

|

|

|

|

|

|

|

|

| |

Total Assets |

| $ | 10,946 |

|

| $ | 22,248 |

|

|

|

|

|

|

|

|

| |

Liabilities and Stockholders' Deficit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 20,016 |

|

| $ | 13,969 |

|

Due to related parties |

|

| 81,650 |

|

|

| 61,011 |

|

|

|

|

|

|

|

|

| |

Total Current Liabilities |

|

| 101,666 |

|

|

| 74,980 |

|

|

|

|

|

|

|

|

| |

Stockholders' Deficit: |

|

|

|

|

|

|

|

|

Common stock 500,000,000 common stock authorized, $0.001 par value; 40,000,000 common shares issued and Outstanding |

|

| 40,000 |

|

|

| 40,000 |

|

Additional paid-in capital |

|

| 40,000 |

|

|

| 40,000 |

|

Retained deficit |

|

| (170,720 | ) |

|

| (132,732 | ) |

|

|

|

|

|

|

|

| |

Total Stockholders' Deficit |

|

| (90,720 | ) |

|

| (52,732 | ) |

|

|

|

|

|

|

|

| |

Total Liabilities and Stockholders' Deficit |

| $ | 10,946 |

|

| $ | 22,248 |

|

See accompanying notes to these consolidated financial statements

| 29 |

OROPLATA RESOURCES, INC.

Consolidated Statements of Operations

| For the year ended |

|

| For the year ended |

| |||

|

|

|

|

|

| |||

Revenue |

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

| |

Expenses |

|

|

|

|

|

|

|

|

Exploration costs |

|

| 10,700 |

|

|

| 5,824 |

|

General and Administrative expenses |

|

| 27,288 |

|

|

| 37,574 |

|

|

|

|

|

|

|

|

| |

Total expenses |

|

| 37,988 |

|

|

| 43,398 |

|

|

|

|

|

|

|

|

| |

Loss from operations |

| $ | (37,988 | ) |

| $ | (43,398 | ) |

|

|

|

|

|

|

|

| |

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

| |

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

|

| 40,000,000 |

|

|

| 40,000,000 |

|

See accompanying notes to these consolidated financial statements

| 30 |

OROPLATA RESOURCES, INC.

Consolidated Statement of Stockholders' Deficit

| Common |

|

| Stock |

|

| Additional |

|

| Retained |

|

| Total Stockholders' Deficit |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance, September 30, 2013 |

|

| 40,000,000 |

|

|

| 40,000 |

|

|

| 40,000 |