Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Touchpoint Group Holdings Inc. | s102825_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Touchpoint Group Holdings Inc. | s102825_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Touchpoint Group Holdings Inc. | s102825_ex31-2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2015.

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-10822

One Horizon Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 46-3561419 | |||

| (State or other jurisdiction of | (I.R.S. Employer | |||

| incorporation or organization) | Identification No.) | |||

| T1-017

Tierney Building, University of Limerick, Limerick, Ireland. |

||||

| N/A | ||||

| (Address of principal executive offices) | (Zip Code) |

+353-61-518477

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name

of each exchange on which registered | |

| n/a | n/a |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.0001

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company þ |

| (Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the 22,406,634 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $ 70.58 million as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $3.15 per share, as reported on Nasdaq.

As of March 21, 2016, 35,045,423 shares of the registrant’s common stock, par value $0.0001, were outstanding.

TABLE OF CONTENTS

Introductory Note

Unless otherwise noted, references to the “Company” in this Report include One Horizon Group, Inc. and all of its subsidiaries.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

The statements made in this Report, and in other materials that the Company has filed or may file with the Securities and Exchange Commission, in each case that are not historical facts, contain “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, and other variations or comparable terminology as well as any statements regarding the evaluation of strategic alternatives. These forward-looking statements are based on the current plans and expectations of management, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Among these risks and uncertainties are the competition we face; our ability to adapt to rapid changes in the market for voice and messaging services; our ability to retain customers and attract new customers; our ability to establish and expand strategic alliances; governmental regulation and related actions and taxes in our international operations; increased market and competitive risks, including currency restrictions, in our international operations; risks related to the acquisition or integration of future businesses or joint ventures; our ability to obtain or maintain relevant intellectual property rights; intellectual property and other litigation that may be brought against us; failure to protect our trademarks and internally developed software; security breaches and other compromises of information security; our dependence on third party facilities, equipment, systems and services; system disruptions or flaws in our technology and systems; uncertainties relating to regulation of VoIP services; liability under anti-corruption laws; results of regulatory inquiries into our business practices; fraudulent use of our name or services; our ability to maintain data security; our dependence upon key personnel; our dependence on our customers' existing broadband connections; differences between our service and traditional phone services; our ability to obtain additional financing if required; our early history of net losses and our ability to maintain consistent profitability in the future. These and other matters the Company discusses in this Report, or in the documents it incorporates by reference into this Report, may cause actual results to differ from those the Company describes. The Company assumes no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

| 2 |

One Horizon Group, Inc. and its Subsidiaries (the “Company”) is the inventor of the patented SmartPacketTM Voice over Internet Protocol (“VoIP”) platform. Our software is designed to capitalize on numerous industry trends, including the rapid adoption of smartphones, the adoption of cloud based Internet services, the migration towards all IP voice networks and the expansion of enterprise bring-your-own-device to work programs.

The Company designs, develops and sells white label SmartPackettm software and services to large Tier-1 telecommunications operators. Our licensees deliver an operator-branded mobile Internet communication solution to smartphones including VoIP, multi-media messaging, video, and mobile advertising; and the Business to Business (“B2B”) business. Current licensees include some of the world’s largest operators such as Singapore Telecommunications, Philippines Smart Communication and Indonesia Smartfren Tbk.

The SmartPacket™ platform, significantly improves the efficiency by which voice signals are transmitted from smartphones over the Internet resulting in a 10X reduction in mobile bandwidth and battery usage required to transmit a smartphone VoIP call. This is of commercial interest to operators that wish to have a high quality VoIP call on congested metropolitan networks and on legacy 2G and 3G cellular networks.

By leveraging its SmartPacketTM solution, the Company is also a VoIP as a Service (“VaaS”) cloud communications leader for hosted smartphone VoIP that run globally on the Microsoft Azure cloud. The Company sells its software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector; and the “VaaS” business. Our existing licensees come from around the world including USA, China, United Kingdom, Singapore, Canada and Hong Kong.

Based on the SmartPacketTM solution, the Company is the sole owner and operator its own branded retail smartphone VoIP, messaging and advertising service in the People’s Republic of China called AishuoTM; the “Aishuo” business. Since its inception in the second quarter of 2015 Aishuo has been downloaded over 12 million times in 2015 and has doubled its revenues for the last 3 consecutive quarters of 2015. Aishuo offers subscribers very competitive telephone call rates and a virtual number rental service plus lots of innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a free VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Our business model is focused on winning new B2B Tier-1 telecommunications operators, winning new VaaS subscribers and driving Aishuo retail revenues. We are also commercially focused on expanding sales of new and existing licensed products and services to existing customers, and renewing subscriptions and software support agreements. We target customers of all sizes and across a broad range of industries.

We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, Ireland, the United Kingdom, China, India, Russia, Singapore, Hong Kong and Latin America.

History and Background

| (1) | Share Exchange |

On November 30, 2012, the Company (then known as Intelligent Communication Enterprise Corporation, referred herein below as “ICE Corp.”), and One Horizon Group PLC, a public limited company incorporated in the United Kingdom (“One Horizon UK”), consummated a share exchange (the “Share Exchange”), pursuant to which ICE Corp. acquired One Horizon UK stock from its then existing shareholders in exchange for 17,853,476,138 shares of ICE Corp.’s common stock. Upon completion of this transaction, the shareholders of One Horizon UK controlled approximately 96% of the outstanding stock of ICE Corp. and One Horizon UK became a subsidiary of ICE Corp. The transaction has been accounted for as a reverse acquisition, whereby ICE Corp. is the legal acquirer and One Horizon UK is the legal acquiree and accounting acquirer. On December 27, 2012, the Company changed its name to One Horizon Group, Inc.

| (2) | History of ICE Corp before the Share Exchange |

ICE Corp was incorporated in Pennsylvania in 1972 as Coratomic, Inc. It changed its name to Biocontrol Technology, Inc. in 1986; BICO, Inc. in 2000; Mobiclear Inc. in 2006; and Intelligent Communication Enterprise Corporation in 2009.

Prior to the Share Exchange, ICE Corp had two operational businesses: Modizo, and Global Integrated Media Limited (GIM). The Modizo business consisted of a celebrity blogging application, while the GIM business consisted of custom publishing, advertising design, brand building, media representation, website design and development and market research programs. These operations had employees and expenses, and generated gross revenue of roughly $205,000 for the nine months ended September 30, 2012. As the GIM and Modizo businesses did not fit within the Company’s business plan after the Share Exchange, both operational businesses were sold on December 31, 2012 for the return of 70,000 shares of the Company’s common stock held by the purchaser, which had a fair value of $420,000.

| 3 |

| (3) | One Horizon UK |

One Horizon UK, was incorporated in the United Kingdom on March 8, 2004. Prior to the Share Exchange, the consolidated financial statements of One Horizon UK for its fiscal years ended June 30, 2012 and 2011 consisted of two main business segments: (1) the Horizon Globex business segment including One Horizon UK and two of its subsidiaries, Abbey Technology and Horizon Globex; and (2) the Satcom Global business segment. However, the Satcom Global business was sold on October 25, 2012 as it became unprofitable. On the same day, Abbey Technology sold certain satellite billing software utilized in the Satcom Global business to the same purchaser. The entire purchase price for the software was paid by means of an offset against amounts owed by Abbey Technology and its affiliates to Satcom Global FZE, an entity acquired by the purchaser in connection with the purchase of the Satcom Global business.

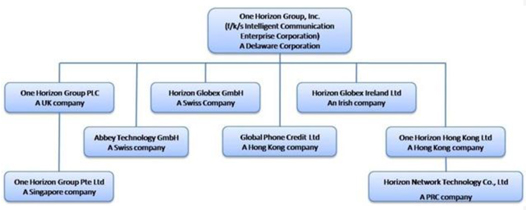

| (4) | Current Shareholding Structure of the Company |

Global Phone Credit Ltd, incorporated in Hong Kong on December 15, 2012, is a wholly subsidiary of the Company. One Horizon Group Pte Ltd, incorporated in Singapore on November 28, 2012, is a wholly owned subsidiary of One Horizon UK. One Horizon Hong Kong Ltd is a wholly-owned subsidiary of the Company, and was formed in 2012. One Horizon Hong Kong Ltd currently holds the Company’s 100% equity interest in Horizon Network Technology Co., Ltd., a subsidiary incorporated in China during 2013. The previous minority partner, ZTESoft withdrew and agreed to forfeit its shares.

Horizon Globex Ireland Ltd, an Irish company incorporated on August 7, 2013, is a wholly owned subsidiary of the Company.

In addition to the subsidiaries listed above, Suzhou Aishuo Network Information Co., Ltd (“Suzhou Aishuo”) is a limited liability company, organized in China and controlled by us via various contractual arrangements. Suzhou Aishuo is treated as one of our subsidiaries for financial reporting purpose in accordance with generally accepted accounting principles in the United States (“GAAP”).

(5) Reverse Stock Split, Change of Domicile and Change of Fiscal Year

On August 29, 2013, our 1-for-600 reverse stock split became effective for purposes of the securities markets. As a result of the reverse stock split, our issued and outstanding shares of common stock decreased from approximately 18.9 billion pre-reverse stock split shares to approximately 31.5 million post-reverse stock split shares.

On February 13, 2013, we changed the Company's fiscal year end from June 30 to December 31. As a result of this change, the Company filed transition report on Form 10-KT on May 13, 2013 to include the financial information for the six-month transition period from July 1, 2012 to December 31, 2012 (the "Transition Period").

| 4 |

Recent Developments

Business Operation

In February 2015, we announced the rollout of our platform in China, brand named Aishuo (http://www.ai-shuo.cn/). This rollout entails multiple strategies including advertisements, search engine optimization, press releases, event marketing, business-traveler direct marketing, as well as on and off-line promotions and leveraging the brand new One Horizon Sponsored-Call platform. Based on the SmartPacketTM solution, the Company is the sole owner and operator of this retail smartphone VoIP, messaging and advertising service in the People’s Republic of China.

Since its commercial availability in the second quarter of 2015, Aishuo has been downloaded over 12 million times in 2015 and has doubled its revenues for the last 3 consecutive quarters of 2015. Aishuo offers subscribers very competitive telephone call rates and a virtual number rental service plus lots of innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Aishuo is operated by, Suzhou Aishuo Network Information Co., Ltd. a Chinese company controlled by the Company, headquartered in Nanjing, China with 15 staff including customer care, R&D, sales and marketing.

| 5 |

Figure 1. Aishuo Retail

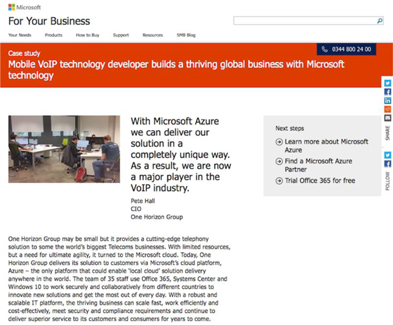

In December 2015, we announced the rollout of our VoIP as a Service “VaaS” platform on the Microsoft Azure cloud. The Company sells its software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector. The Company was showcased by Microsoft Corp. for its Azure technology (https://www.microsoft.com/en-gb/smb/customer-success-stories/building-a-global-business)

Figure 2. VaaS Hosted Offering

| 6 |

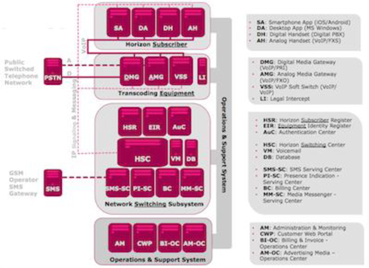

Figure 3. Cloud-based Secure, Fault Tolerant and Low Latency Architecture

Figure 4. Microsoft Showcases One Horizon Group Inc.

Our B2B platform is being used by a pre-paid VoIP Smartphone application launched by different carriers respectively, some of which are listed as follows:

| · | Smart Communications, Inc, (“Smart”). Smart is the Philippines' leading wireless services provider with 57.3 million subscribers on its GSM network as of June 2013. |

| 7 |

| · | Singapore Telecommunications (“Singtel”). Singtel is the Singapore’s leading wireless services provider with a combined mobile subscriber base of 500 million customers from its own operations and regional associates in 25 countries at end of March 2014. |

| · | PT Smartfren Telecom Tbk (“Smartfren”). Smartfren is a wireless service provider based in indonesia, with a combined mobile subscriber base of 12.5 million on its CDMA network as of October 2013. |

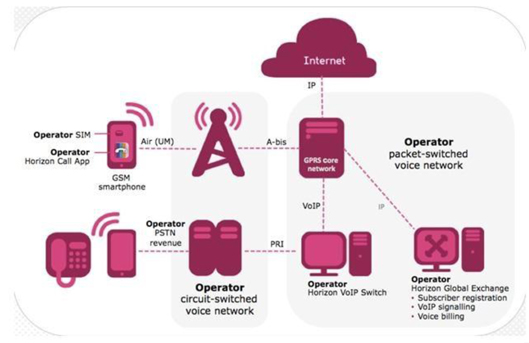

Figure 1. Horizon B2B Operator Core Network

On December 18, 2015, we formed a new Latin America company to facilitate our expansion into the region.

In August 2015, a Chinese based Satellite operator, KeyIdea, commenced the launch of its mobile Voice over IP solution targeting its VSAT customers in China. We expect this revenue share based co-operation to contribute to our revenues as the rollout of the numerous KeyIdeas earth stations and customer increases in the next few years.

In September 2015, a US based operator, Roam Frii, commenced the launch of its mobile Voice over IP solution targeting free Wi-Fi mobile hotspots throughout New York City. We expect this revenue share based co-operation to contribute to our revenues as the rollout of the numerous New York based Wi-Fi solutions increases in the next few years.

On November 30, 2015, we were awarded our patent for our bandwidth efficient mobile voice over Internet Protocol ("VoIP") platform.

In the second quarter of 2015 (the first quarter since the commercial launch of Aishuo) the Company recorded approximately $7,000 of revenue. In the three months ending September 30, 2015, the revenue from Aishuo grew to approximately $16,000 for the quarter. In the final quarter of 2015 the revenue had grown to over $30,000 in the quarter. The management expect this trend in revenue growth to continue as the Chinese user base grows.

| 8 |

During the three months ended September 30, 2015, Aishuo was released on Apple's iTunes App store with support for mobile In App Purchases and we signed a commercial license with Nanjing Lin Ren Communications, a smartphone manufacturer to pre-install the Aishuo smartphone App on the handsets prior to leaving the factory.

In addition to the developments in the rollout of Aishuo smartphone app brand in mainland China, we have commenced our penetration into the Latin American market by signing a Horizon license contract with a regional operator. We consider Latin America a huge and growing market for mobile apps as Latin America growth is forecast to be in line with the global average and is also forecasting very significant VoIP revenues growing to $12.8bn by 2018 according to Vision Gain VoIP Market Forecast (https://www.visiongain.com/Report/1107/The-Voice-Over-Internet-Protocol-(VoIP)-Market-2013-2018).

Offering and Market Related

On August 10, 2015, in connection with an Underwriting Agreement dated August 4, 2015 (the “Underwriting Agreement”) with Aegis Capital Corp. (“Aegis”), as representative of the several underwriters named therein (the “Underwriters”), we closed a firm commitment underwritten public offering of 1,714,286 shares of Common Stock, and warrants to purchase up to an aggregate of 857,143 shares of Common Stock at a combined offering price of $1.75 per share and accompanying Warrant. Pursuant to the Underwriting Agreement, the Underwriters exercised an option to purchase 151,928 additional shares of Common Stock and 75,964 additional warrants. The net proceeds from the offering were approximately $2.89 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The warrants offered have a per share exercise price of $2.50 (subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock and also upon any distributions of assets, including cash, stock or other property to our stockholders), are exercisable immediately and will expire three years from the date of issuance. Subject to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.

On December 22, 2014, we closed a private placement of $3,500,000 in reliance upon the exemption from securities registration afforded by Regulation S (“Regulation S”) as promulgated under the Securities Act of 1933, as amended (the “December 2014 Offering”). In connection with the December 2014 Offering, we issued to an investor a convertible debenture that is convertible into 1,555,556 shares of common stock, par value $0.0001 per share (the “Common Stock”), Class C Warrant (the “Class C Warrant(s)”) to purchase 388,889 shares of Common Stock and Class D Warrant (the “Class D Warrant”) to purchase 388,889 shares of Common Stock, and Performance Warrants (the “Performance Warrant(s)”) to purchase up to 450,000 shares of Common Stock based on our annual reported subscriber numbers, twenty four (24) months after the closing, as is reflected in our Annual Report on Form 10-K for the year ending December 31, 2016 (the “ 2016 Form 10-K ”), if we fail to achieve 15.0 million subscribers at that time. In addition, the placement agent in the offering received placement agent warrant, Class C Warrant and Class D Warrant to purchase 62,222, 15,556 and 15,556 shares of Common Stock, respectively; and a cash fee of $280,000.

In July 2014, we closed a private placement of $1,000,000 for a total of 10 units at a purchase price of $100,000 per unit, each consisting of, (i) 17,094 shares of our Series A Redeemable Convertible Preferred Stock, par value $0.0001 per share ( the “Series A Preferred Stock”), initially convertible into 17,094 shares of Common Stock, and (ii) 10,000 Class B Warrants ( the “Class B Warrant(s)”), each exercisable to purchase 1 share of Common Stock at an exercise price of $4.00 per share (the “July 2014 Offering”). The July 2014 Offering was completed in reliance upon the exemption from securities registration afforded by Regulation S.

Our common stock commenced trading on the NASDAQ Capital Market on July 9, 2014 under the same ticker symbol "OHGI".

| 9 |

Industry

Rapid Growth in Global Mobile Voice over IP Service Market

We aim to deliver our patented smartphone software to the ever expanding mobile Voice over IP (“mVoIP”) user. There are over 1.9 billion smartphones now in circulation and, by 2018, we expect the number of users will grow to 2.56 billion, or one-third of all people worldwide (Source: http://www.emarketer.com/Article/2-Billion-Consumers-Worldwide-Smartphones-by-2016/1011694). Each new smartphone represents an opportunity for us to deliver our innovative mobile VoIP, Messaging over IP and Advertising over IP solution in whatever mobile app brand is attractive to the end user throughout the globe.

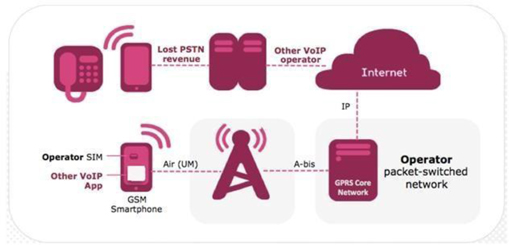

By partnering with national carriers and delivering our solution as a licensed service to regional mobile operators, we leverage the power of their brand and join them to fight back against already lost revenues, or potential revenue loss, to network bandwidth-intensive Over The Top (“OTT”) VoIP apps; such as Skype in the USA or Line in Japan and so on.

In the past mobile operators relied upon blocking VoIP on their networks but they have realized that this is no longer a viable option. They must embrace innovations in VoIP software, especially on the smartphone, from businesses like ours. Not only can we offer a multi-media, multi-faceted software solution to smartphones, but we are the only company that offers a package that aids the operators in the rollout, expansion, maintenance and upgrade of their mobile network in metro and rural areas to cater for smartphones.

From the beginning of the first smartphones in 2008, our software was specifically targeted to be a disruptive technology, which was and has been explicitly designed, and patented, to work on congested wireless Internet connections; the absolute fundamental basis of mobile phones in 2016 and beyond.

As more and more smartphones come online, each one places a significantly higher load on the existing cellular infrastructure; as smartphone users now use smartphone to check for emails, surf the Internet, check the weather, read the news, etc. while in the past, all a mobile phone did was calling and Short Messaging (SMS). In order for carriers to keep up with the explosive growth of smartphones and their increased network consumption they are in need of any possible tool to assist them in managing their network and maintaining relevance on the users’ device.

We offer operators a mobile VoIP call that has ten (10) times less bandwidth than a standard telephone call over GSM or legacy mobile VoIP solutions such as Session Initiation Protocol (“SIP”). This gives operators a higher quality call on busy and legacy networks such as 2G, 3G and congested metro-based 4G using less bandwidth; meaning more bang for their “spectrum buck”. We will not replace traditional calls nor prevent the delivery of newer call types such as Voice over LTE (“VoLTE”) etc., but we give operators yet another tool in their arsenal to deliver the best quality voice, for the best value, for their diversified customer bases.

| 10 |

Our Technology

Our Technology

We have a very detailed knowledge of these wireless data network issues and have invented a totally new solution to successfully deliver a high quality voice call over a wireless Internet connection. Our solution is designed specifically to address such issues as call latency (i.e. delay) and network jitter (i.e. lost data) in a way that achieves a much higher likelihood of a voice packet (i.e. tiny piece of recorded voice) arriving in time and not being lost or delayed. Our awareness of these problems led us to develop a completely new algorithm for sending and receiving (and ordering) voice packets so as to reduce the likelihood of packet loss due to congestion, which we call SmartPacket™; and to the end user this just means near HD audio at a fraction of the cellular consumption.

| 11 |

SmartPacket™ Technology

The core of the Horizon solution is our truly innovative, and patented, SmartPacket™ technology. This enables VoIP from only 2 kilobytes/second (kbps) compared to around 8kbps and upwards from other VoIP platforms available today. This industry-leading solution has been developed in-house and is fully compatible with digital telecommunications standards. This technology is capable of interconnecting any phone system over IP - on mobile, fixed and satellite networks. Our SmartPacket™ technology is not based on legacy SIP (Session Initiation Protocol) or RTP (Real-time Transport Protocol). Rather, the Horizon signaling protocol is much simpler and benchmark testing has shown that it consumes significantly less bandwidth for the same audio quality score. Our SmartPacket™ technology is the world’s most bandwidth efficient IP communication platform designed for mobile communications. The technology optimizes voice flow, delivery and playback and delivers excellent call quality, reduced delays and drops. As a further illustration, the technology is considerably more efficient in the way it handles silence. Traditional VoIP calls send the same amount of data in both directions, regardless of whether or not someone is speaking. SmartPacket™ technology is designed to detect silence and send tiny “indications of silence”, rather than the silence itself. This massively reduces the amount of data transmitted, lowers the load on the cellular infrastructure which, in turn, means that more data can get through. This results in higher audio quality and a better user experience.

Our Benchmark Testing: Horizon vs G.729

G.729 is a type of audio compression that is typically used throughout the world for mobile VoIP. Our testing has shown that Horizon is up to 10 times more efficient, depending on which one of our voice compression settings is selected by the user.

| Codec | "Talking" bandwidth | "Listening" bandwidth | IP headers | Total call data | Minutes per MB | |||||||||||||||

| Horizon Q1 | 1.9kbps | 0kbps | 2.46kbps | 4.36kbps | 32.03 | |||||||||||||||

| Horizon Q2 | 3.5kbps | 0kbps | 2.46kbps | 5.96kbps | 23.44 | |||||||||||||||

| Horizon Q3 | 5.5kbps | 0kbps | 2.46kbps | 7.96kbps | 17.56 | |||||||||||||||

| G.729 | 8kbps | 8kbps | 32kbps | 48kbps | 2.91 | |||||||||||||||

Proprietary

The Horizon Platform has been developed entirely in-house, patented, and is fully compatible with digital telecommunications standards. It is capable of interconnecting any phone system over IP – on mobile, fixed and satellite networks.

The Horizon Platform was initially developed for the burgeoning smartphone market and the challenging mobile VoIP over satellite market by Abbey Technology to make the best use of the limited wireless bandwidth available and to minimize the amount of data consumed.

We further developed the Horizon Platform for the broader telecommunications market on Apple’s iOS, Google’s Android and a Windows PC client focusing on the mobile Internet sector. This sector also benefits from our optimized mobile VoIP as it allows voice calls over new and legacy cellular telecom data networks. With the explosive growth in smartphone sales and increased usage of mobile data services, mobile operators face the challenge of dealing with increasingly congested networks, more dropped calls and rising levels of churn. Since the wireless spectrum is a finite resource, it is not always possible, or can be cost prohibitive, to increase network capacity. For these reasons, we believe that the demand for solutions to optimize the use of IP bandwidth will inevitably increase.

| 12 |

Our Strategy

We have developed a mobile application template called “Horizon Call,” that enables highly bandwidth-efficient VoIP calls over a smartphone using a 2G/EDGE, 3G, 4G/LTE, WiFi or Satellite connection. Our Horizon Call application is currently available for the iPhone and for Android handsets and we use it to showcase all of our functions, features, our call quality and the level of software innovation that we can brand for our potential clients.

Unlike the majority of mobile VoIP applications, Horizon Call creates a white-label business-to-business solution for mobile operators. Telecommunications operators are able to license from us, brand with us and deploy with us a completely new “white-labeled” solution so that they can optimize their highly pressurized mobile internet bandwidth and deliver innovation that in turn brings them new smartphone users. The operators decide how to integrate our application within their portfolio, how to offer it commercially and can customize it according to their own branding. Our solution helps them to manage increased traffic volumes while combating the competitive threat to their voice telephony revenues from other mobile VoIP applications by giving its mobile data customers a more efficient mobile VoIP solution that adds value to their mobile data network.

We are positioning ourselves as an operator-enabler by licensing our technology to mobile operators in a manner that can be fully customized to the needs of their subscribers. As shown below, operators are able to offer our platform to deliver branded smartphone applications to their existing customers to reduce lost Voice/Text revenue and minimize customer churn.

| 13 |

By offering Horizon Call to their existing customer base, our customers can offer innovative data-based voice and data services that are different from the existing Over The Top (“OTT”) data applications running on their networks. OTT refers to voice and messaging services that are delivered by a third party to an end user’s smartphone, leaving the mobile network provider responsible only for transporting internet data packets and not the value-added content. The Horizon Call voice services allow mobile operators’ customers to make VoIP calls under mobile operators’ call plans, thereby allowing mobile operators to capture value-added content, including voice calls, text messaging, voice messaging, group messaging, multimedia messaging, and advertising, that would have otherwise gone to the providers of other OTT services.

Horizon Call runs on both smartphone and tablet devices and, as networks become more congested, software services such as Horizon Call become ever more relevant. We believe that although more network capacity will eventually come on stream with 4G/LTE, it, like all other highways, will quickly become congested and this is why we believe that Horizon Call is ideally placed to add value to mobile data networks.

Incumbent mobile operators are suffering a reduction in revenue per user due to the OTT software services on mobile devices. These OTT applications, such as Skype and Line, can negatively impact mobile operators’ traditional revenue streams of voice and SMS (short message service). As shown below, the Horizon Platform positions the Company to enable mobile operators to operate their own OTT solution branded in their image allowing use on all mobile data networks.

| 14 |

In addition to delivering new data services to their existing customers, mobile operators can offer their brand of Horizon Call on any other operators’ handsets. Because the Horizon Call application can be installed on the smartphone from the Internet, the potential customer base for the operators’ data application surpasses the customer base that they can reach through traditional mobile phone SIM card distribution. We believe that this service innovation, coupled with the fact that the Horizon Call application can also use existing mobile operator pre-paid credit redemption and distribution services, presents a very compelling service against OTT services.

We believe that emerging markets represent a key opportunity for Horizon Call because these are significant markets with high population densities, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones. More than one-quarter of the world’s population will use smartphones in 2015, and by 2018, over 2.56 billion or one-third of all people worldwide will be smartphone users. Asia-Pacific will account for over half of all smartphone users in 2015, estimated at 951.5 M users. Globally, China is the largest smartphone market with an estimated 574.2 M handsets. These factors will put increased pressure on mobile operators to manage their network availability.

In this context, where necessary, we have created our own brand in China, called Aishuo, formed a number of strategic ventures with local partners in regions of various emerging markets to seize upon this opportunity.

In 2013 through our subsidiary One Horizon Hong Kong Ltd, we invested $1.5 million for a 75% equity stake in, Horizon Network Technology Co., Ltd (“HNT”), while, ZTE Corporation, held a 25% equity stake in HNT. In 2015 ZTE Corporation allowed OHGI to take 100% ownership of HNT by forfeiting their minority shareholding.

| 15 |

Aishuo in China

To address the explosive growth in China, One Horizon is launching an own-brand smartphone VoIP service, called Aishuo. To date, we have over 15 million downloads of the Aishuo smartphone App and have successfully installed servers throughout China. Our Aishuo app interconnects to the WeChat Wallet, AliPay and UnionPay credit card and micro-payments services in China to facilitate payments. We have also uploaded the App to the biggest smartphone App stores in China including Baidu, Tencent and Qihoo. The smart phone app will be able to provide various optimized internet value added services to its mobile subscribers including but not limited to voice and social media services such as text, picture, video and geo-location messaging. These value added services are made possible through the creation of a "Virtual SIM" and One Horizon's proprietary communication software, an industry first. Combined with One Horizon's location aware mobile advertising services, the Aishuo branded smart phone app is expected to drive multiple revenue streams from the supply of its value-added services. The service has attracted over 15 million downloads in its first year of operation and expects to achieve industry average revenues per user (ARPU) for similar social media apps for its subscribers.

Marketing

Our marketing objective is to become a broadly adopted solution in the regions of the world with large concentrations of smartphone users and high network congestion. We aim at becoming the preferred solution for carriers who wish to deploy branded VoIP solutions that enable them to minimize revenue erosion, reduce churn, increase the effective capacity of their network infrastructure and improve user experience. We employ an integrated multi-channel approach to marketing, whereby we evaluate and focus our efforts on selling through telecommunications companies to enable them to provide the Horizon Platform to their customers. We routinely evaluate our marketing efforts and try to reallocate budgets to identify more effective media mixes.

We conduct marketing research to gain consumer insights into brand, product, and service performance, and utilize those findings to improve our messaging and media plans. Market research is also leveraged in the areas of testing, retention marketing, and product marketing to ensure that we bring compelling products and services to market.

Sales

Direct Sales. Our primary sales channel for the products and services of Horizon Platform is the sale of Horizon Platforms to Tier 1 and Tier 2 telecommunications companies to enable them to provide the product and services to their customers. We continue our efforts to develop new customers globally but particularly in Asia and Latin America.

Strategic Ventures. In addition to our direct sales channel, we also offer increased sales through our strategic venture channel. In this context, as mentioned above, we are working towards forming a number of strategic ventures in areas where regulatory issues require local representation.

Target Markets. The markets for our primary and joint venture channels will have high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones.

Competition

The Company’s direct competitors for its technology primarily consist of systems integrators that combine various elements of SIP (Session Initiation Protocol) dialers and media gateways. Other dial-back solutions exist but they are not IP-based. Because SIP dialers and media gateways currently are unable to provide a low bandwidth solution, they do not currently compete with the Company’s technology in those markets in which their high bandwidth needs are unsupported by the existing cellular networks. They do, however, compete in those markets where the cellular networks are accessible by those SIP dialers and gateways.

The Company licenses the Horizon Platform to mobile operators, who in turn may offer the application to their end-user subscribers. The Company’s principal competitors for the mobile operators’ end-users are Skype, Viber, WeChat, and WhatsApp. Having a mobile operator’s subscriber opt to use the operator’s (branded) Horizon Call service instead of existing OTT services means that the mobile operator will gain market share of some of the OTT voice and messaging traffic. We are currently unaware of any other companies that seek to license VoIP technology directly to mobile operators.

| 16 |

One of the Company’s key competitive advantages is that it is not a threat to mobile operators. Rather, the Company’s Horizon Platform is a tool that can be used by mobile operators to compete against the OTT provider’s applications that are running on their networks. Through the Horizon Platform, mobile operators are able to compete directly with OTT services that, by their design, divert voice and messaging services away from mobile operators. The solution is delivered completely and is easy to install and operate. This means that a mobile operator has a turnkey mobile voice and messaging solution to deploy to its customer (i.e., the end-user).

The turnkey Horizon software platform and the Horizon SmartPacket™ technology give us a competitive advantage by managing credit, routing, rating, security, performance, billing and monitoring. Horizon SmartPacket™ is the world’s lowest bandwidth voice compression and transmission protocol and is 100% developed and owned by the Company. Though other software companies can offer part of this solution space, we believe none offers it in such a complete and integrated fashion as we do. We believe it will take a substantial number of years to copy/replicate the Horizon Platform in its entirety, by which time we believe the Horizon Platform will have improved and further distanced itself from potential competition.

Intellectual Property

Our strategy with respect to our intellectual property is to patent our core software concepts wherever possible. The Company’s current software patent has been approved in the United States and is pending in other jurisdictions around the world. Our patent strategy serves to protects the Horizon Platform and the central processing service of the Horizon Platform.

The Company endeavors to protect its internally developed systems and technologies. All of our software is developed “in-house,” and then licensed to our customers. We take steps, including by contracts, to ensure that any changes, modifications or additions to the Horizon Platform requested by our customers remain the sole intellectual property of the Company.

Research and Development and Software Products

The Company has spent approximately $1.1 million on capitalizable research and development in the fiscal year 2015.

During 2015, we expanded our Irish software development team, our QA team and our graphics team with the addition of 5 new employees in our office at the Nexus Innovation Center on the campus of the University of Limerick.

Throughout 2015 we continued with our focus on innovation and our research and development teams (“R&D”) brought us a brand new call handoff solution. Applying this new call handoff solution, a call that is in progress on Wi-Fi will automatically transfer to 2G/3G/4G when Wi-Fi signal becomes too weak. Vice versa when a call is in progress over 2G/3G/4G and a known Wi-Fi signal is detected, the call will automatically transfer to a stronger signal. Whilst others have partially solved this issue of radio-handoff, the Horizon solution works for all handset types on Android and on Apple's iOS and we believe that this will open up other mobile VoIP opportunities.

R&D also delivered the only service in the world with a combo multi-installation App joined to a shared/peer landline or mobile. Using these features, especially for business, an App will ring on multiple devices at the same time not only on a smartphone and tablet but also ring a land line, mobile, and remote office etc. In this case, an end user can choose the most convenient way to answer a call. Whilst our competitors have partially solved this issue of simultaneous ringing with just the App, we have solved this for all phone types and we believe that this will open up other mobile VoIP opportunities for the Company.

Our R&D also focused on further enhancing our VoIP technology to detect and tune optimized voice quality on Xiaomi phones. Xiaomi is China's biggest selling smartphone vendor (source: IDC http://www.idc.com/getdoc.jsp?containerId=prHK25437515). We plan to continue our R&D focus on optimizing our application and service on Xiaomi smartphones given the expansion of the Xiaomi brand in China, India and South East Asia in order to keep the Aishuo App as the top performing retail VoIP service across the other top four brands in China's smartphone marketplace including Samsung, Lenovo, Huawei and Coolpad.

Furthermore, the R&D team delivered a brand new mobile VoIP app Voicemail concept and Ringback Tune concept. The new Voicemail solution means that when subscribers rent telephone numbers on Horizon, they will automatically have the facility of a personalized Voicemail service for them when they are busy or out of Internet coverage. Voicemails can be left by the calling party, optimized for efficient delivery and delivered to the App as audio messages. The user does not have to go through the cumbersome steps of dialing into a messaging service, our App delivers the voicemail directly to the App, complete with caller ID of the caller. The new Ringback Tune solution allows the App user to record, usually fun, audio track to be played to the person calling them while their phone is ringing. Ringback is sold on a monthly basis by mobile operators throughout Asia and our new method for doing this in our technology means that further service revenues can be derived by our licensee by offering new and fun features within our mobile Apps.

Further and deeper integration with the Google Wallet and Apple In-App Purchase solutions was also carried out by our R&D teams. Both of these payment service solutions were released in the second quarter of 2015 and provided more payment options to our B2B and B2C subscribers. And we continue to research the ever changing realm of on-line payment services for our customers by getting our In App Payment service for iTunes deployed for use in mainland China for Aishuo and our new KeyIdeas and LinRen licensees.

R&D also delivered an in app Sticker solution this year. Stickers are small cartoonlike figures used in smartphone text-chat conversations to show emotions. They are hugely popular in Asia and generate significant revenues for those companies that have such services in place. We intend to license the core Sticker service to our operators and also to launch a complete Sticker purchase service in the Aishuo app in China.

R&D delivered a brand new concept in mobile advertising called a Gift Center. Our technology can now deliver small gifts of free calls etc. to our loyal users when they invite others to join, use our app on a regular basis etc. Bringing a feeling of loyalty to a smartphone app is key to retaining the customer and reducing churn.

| 17 |

Employees

As of December 31, 2015, we had 29 employees, all of whom were full-time employees.

Not applicable.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

We do not currently own any real property. In March 2016, we leased the following offices:

| Location | Approximate size | Approximate monthly rent | ||||

| Ireland | 840 sqft | $ | 1,700 | |||

| China | 1,900 sqft | $ | 1,400 | |||

| UK | 120 sqft | $ | 1,400 | |||

| Switzerland | 300 sqft | $ | 900 | |||

| Singapore | 100 sqft | $ | 1,000 | |||

Executive Offices

Our offices are located at T1-017 Tierney Building, University of Limerick, Limerick, Ireland.

We are not a party to any material legal proceedings and no material legal proceedings have been threatened by us or, to the best of our knowledge, against us except the following:

In 2012, we sold certain former subsidiaries engaged in provision of satellite service in 2012 to Broadband Satellite Services (“BSS”), a company incorporated under laws of England and Wales. Horizon Globex, a company incorporated in Switzerland and a subsidiary of us, had provided these subsidiary companies with software and IT services. In connection with its acquisition of our former subsidiary companies, BSS entered into three agreements with Horizon Globex pursuant to which BSS continued to use Horizon Globex to supply software and IT services. Notwithstanding the fact that Horizon Globex has provided such ongoing software and IT services, BSS has failed to pay our fees pursuant to the agreements. As a result, on December 23, 2014, we initiated legal proceedings in the High Court, Queens Bench Division, Commercial Court No. 2014 folio 1560 against BSS in the United Kingdom to collect such fees in the amount of $640,000. Subsequently, BSS asserted counter claims in the amount of $5.8 million, alleging among other claims, civil fraud in connection with the sale of subsidiary companies. Based on the timing of these claims, which were never raised until we filed our action against BSS, it is our position that these claims are specious and represent nothing more than an attempt to improve BSS's negotiating position with regard to our legitimate claims against it. As a result, we plan to continue to carry out our claims against BSS to the fullest extent possible and to defend BSS's counter-claims vigorously. We note further that several of BSS's counter claims may be time barred by applicable sections of the contracts and plan to assert the same as an affirmative defense to such counter claim. Notwithstanding our views with regard to our claims against BSS and BSS's counterclaims, litigation is by its nature unpredictable and therefore we cannot guarantee with certainty the outcome of our dispute with BSS.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 18 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the NASDAQ Capital Market under the symbol OHGI. Prior to July 9, 2014, our common stock was quoted on the OTCBB under the symbol OHGI. Prior to January 31, 2013, our common stock was quoted under the symbol ICMC.

The following table sets forth the high and low bid information, as reported by Nasdaq on its website, www.nasdaq.com, for our common stock for each quarterly period in 2015, 2014 and 2013. The information reflects inter-dealer prices reflecting a reverse split on a 1 for 600 basis effective August 29, 2013, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Low | High | |||||||

| Fiscal year ending December 31, 2015: | ||||||||

| Quarter ended December 31 | $ | 0.90 | $ | 1.62 | ||||

| Quarter ended September 30 | 1.11 | 3.34 | ||||||

| Quarter ended June 30 | 1.03 | 5.84 | ||||||

| Quarter ended March 31 | 1.21 | 3.92 | ||||||

| Fiscal year ending December 31, 2014: | ||||||||

| Quarter ended December 31 | $ | 1.91 | $ | 3.20 | ||||

| Quarter ended September 30 | 1.55 | 4.85 | ||||||

| Quarter ended June 30 | 3.50 | 5.91 | ||||||

| Quarter ended March 31 | 4.00 | 6.50 | ||||||

| Fiscal year ended December 31, 2013: | ||||||||

| Quarter ended December 31 | $ | 3.75 | $ | 6.75 | ||||

| Quarter ended September 30 | 6.50 | 6.75 | ||||||

| Quarter ending June 30 | 6.00 | 11.40 | ||||||

| Quarter ended March 31 | 3.60 | 21.60 | ||||||

As of March 22, 2016, the closing bid price of the common stock was $0.92 and we had approximately 198 record holders of our common stock. This number excludes any estimate by us of the number of beneficial owners of shares held in street name, the accuracy of which cannot be guaranteed.

We issued 116,760 warrants with an exercise price of $0.86 per share to an investor in 2012. In February 2013 Offering, we issued 403,225 Class A Warrant with an exercise price of $5.94 per share to purchase 403,225 shares of Common Stock to an investor as part of the $6.0 million subscription agreement signed. In July 2014 Offering, we issued 170,940 shares of Series A Preferred Stock convertible into 170,940 shares of Common Stock, 100,000 Class B Warrants to purchase up to 100,000 shares of Common Stock at a price of $4.00 per share; and we also issued 25,000 shares of Common Stock to the placement agent. In connection with and as a consideration to the closing of the July 2014 offering, we reduced the exercise price of Class A Warrants issued in the February 2013 Offering from $5.94 to $4.25 per share and increased the amount of shares issuable upon exercise of Class A warrants from 403,225 to 1,209,675. In December 2014 Offering, we issued a convertible debenture that is convertible into 1,555,556 shares of Common Stock, Class C Warrant to purchase 388,889 shares of Common Stock, Class D Warrant to purchase 388,889 shares of Common Stock and Performance Warrant to purchase up to 450,000 shares of Common Stock. In addition, the placement agent in the December 2014 Offering received a placement agent warrant, Class C Warrant and Class D Warrant to purchase 62,222, 15,556 and 15,556 shares of Common Stock respectively. On August 10, 2015, in connection with an Underwriting Agreement dated August 4, 2015 (the “Underwriting Agreement”) with Aegis Capital Corp. (“Aegis”), as representative of the several underwriters named therein (the “Underwriters”), the Company closed a firm commitment underwritten public offering of 1,714,286 shares of Common Stock, and warrants to purchase up to an aggregate of 857,143 shares of Common Stock at a combined offering price of $1.75 per share and accompany warrant. Pursuant to the Underwriting Agreement, the Underwriters exercised an option to purchase 151,928 additional shares of Common Stock and 75,964 additional warrants.

Effective August 11, 1993, the SEC adopted Rule 15g-9, which established the definition of a "penny stock," for purposes relevant to the Company, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) that the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must (i) obtain financial information and investment experience and objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form, (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) states that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Disclosure also has to be made about the risks of investing in penny stock in both public offerings and in secondary trading, and about commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

| 19 |

Dividend Policy

The payment of cash dividends by us is within the discretion of our board of directors and depends in part upon our earnings levels, capital requirements, financial condition, any restrictive loan covenants, and other factors our board considers relevant. Since the share exchange in 2012, we have not declared or paid any dividends on our common stock and we do not anticipate paying such dividends in the foreseeable future. We intend to retain earnings, if any, to finance our operations and expansion.

Description of Equity Compensation Plans Approved by Shareholders

Prior to the Share Exchange, One Horizon UK had authorized securities for issuance under equity compensation plans that have not been approved by the stockholders, but none under equity compensation plans that were approved by the stockholders. The following table shows the aggregate amount of securities authorized for issuance under all equity compensation plans as of December 31, 2015:

Number

of securities to be issued upon exercise of outstanding options, | Weighted- | Number

of | ||||||||||

| Equity compensation plans approved by security holders | 944,000 | $ | 2.48 | 4,056,000 | ||||||||

The securities referenced in the table above reflect stock options granted and approved by security holders pursuant to the 2013 plan. In addition share options were issued to employees under previous unapproved plans, 291,900 of such options are fully vested and 291,900 of such options vest on December 31, 2015. 291,900 of such options are expiring in 2020; and 291,900 are expiring in 2022. The number of options in the table above reflect a conversion that occurred in connection with the Share Exchange, whereby the number of options (to purchase One Horizon UK shares) held by each employee was increased by 175.14 times and the exercise price was decreased by the option exercise price divided by 175.14, and additionally reflect a 1-for-600 reverse stock split effected as of August 6, 2013.

Recent Sales of Unregistered Equity Securities

Information regarding any equity securities we have sold during the periods covered by this Report that were not registered under the Securities Act of 1933, as amended, are included in a previously filed Quarterly Report on Form 10-Q or in a Current Report on Form 8-K except the following:

Repurchases of Equity Securities

We have not repurchased any equity securities during the periods covered by this Report.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

| 20 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our audited condensed consolidated financial statements and notes for the fiscal years ended December 31, 2015 and 2014. The following discussion and analysis contains forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking statements. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

See “Cautionary Note Concerning Forward-Looking Statements.”

Overview

Our operations include the licensing of software to telecommunications operators and the development of software application platforms that optimize mobile voice, instant messaging and advertising communications over the Internet. Our proprietary software techniques use internet bandwidth more efficiently than other technologies that are unable to provide a low-bandwidth solution. The Horizon Platform is a bandwidth-efficient Voice over Internet Protocol platform for smartphones and also provides optimized data applications including messaging and mobile advertising. We license our software solutions to telecommunications network operators and service providers in the mobile, fixed line and satellite communications markets. We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, the United Kingdom, China, India, Singapore and Hong Kong.

We have developed a mobile application, “Horizon Call,” which enables highly bandwidth-efficient VoIP calls over a smartphone using a 2G/EDGE, 3G, 4G/LTE, WiFi or WiMax connection. Our Horizon Call application is currently available for iPhones and for Android handsets.

Unlike other mobile VoIP applications, Horizon Call creates a business-to-business solution for mobile operators. It is a software solution that telecommunications operators license, brand and deploy. Mobile operators decide how to integrate Horizon Call within their portfolio and how to offer it commercially. Horizon Call can be customized according to each mobile operators’ own branding. It helps them to manage rising traffic volumes while combating the competitive threat to their voice telephony revenues from other mobile VoIP applications by giving its mobile data customers a more efficient mobile VoIP solution that adds value to their mobile data network.

We believe that emerging markets represent a key opportunity for Horizon Call because there are significant markets with high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones. These factors will put increased pressure on mobile operators to manage their network availability.

In this context, the Company has entered into some strategic relationships with local partners in certain regions to seize upon this opportunity. As of the date of this report, we have formed strategic relationships in India, Russia and Latin America.

We expect to form strategic relationships when local regulations prevent us from accessing a particular market directly.

We plan to fund our expansion through debt financing, cash from operations and potential equity financing. However, we may not be able to obtain additional financing at acceptable terms, or at all, and, as a result, our ability to continue to improve and expand our software products and to expand our business could be adversely affected.

| 21 |

Recent Developments

Business Operation

In February 2015, we announced the rollout of our platform in China, brand named, Aishuo. The Aishuo platform provides VoIP services, a Value Added Virtual SIM solution delivered through a PRC entity controlled by us via various contractual arrangements, Suzhou Aishuo. The Aishuo product has been delivered to the major stores in Chinese App marketplace including Baidu’s 91.com and Baidu.com, the Tencent App store MyApp.com, 360 Qihoo store 360.cn and the ever growing Xiaomi store mi.com. The Aishuo smartphone app is expected to drive multiple revenue streams from the supply of its value-added services including the rental of Chinese telephone phone numbers linked to the app, low cost local and international calling plans and sponsorship from advertisers. Subscribers can top up their app credit from the biggest online payment services in China including AliPay (from Alibaba), Union Pay, PayPal and Tenent’s WeChat payment service.

Since its commercial availability in the second quarter of 2015, Aishuo has been downloaded over 12 million times in 2015 and has doubled its revenues for the last 3 consecutive quarters of 2015.

In August 2015, a Chinese based Satellite operator, KeyIdea, commenced the launch of its mobile Voice over IP solution targeting its VSAT customers in China. We expect this revenue share based co-operation to contribute to our revenues as the rollout of the numerous KeyIdeas earth stations and customer increases in the next few years.

In September 2015, a US based operator, Roam Frii, commenced the launch of its mobile Voice over IP solution targeting free Wi-Fi mobile hotspots throughout New York City. We expect this revenue share based co-operation to contribute to our revenues as the rollout of the numerous New York based Wi-Fi solutions increases in the next few years.

On November 30, 2015, we were awarded our USA patent for our bandwidth efficient mobile voice over Internet Protocol ("VoIP") platform. The Company has patent applications pending in Hong Kong, China, India, Europe and Eurasia/Russia.

In December 2015, we announced the rollout of our VoIP as a Service “VaaS” platform on the Microsoft Azure cloud. The Company sells its software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector. The Company was showcased by Microsoft Corp. for its Azure technology (https://www.microsoft.com/en-gb/smb/customer-success-stories/building-a-global-business)

In addition to the developments in the rollout of Aishuo smartphone app brand in mainland China, we have commenced our penetration into the Latin American market by signing a Horizon license contract with a regional operator. We consider Latin America a huge and growing market for mobile apps as Latin America growth is forecast to be in line with the global average and is also forecasting very significant VoIP revenues growing to $12.8bn by 2018 according to Vision Gain VoIP Market Forecast (https://www.visiongain.com/Report/1107/The-Voice-Over-Internet-Protocol-(VoIP)-Market-2013-2018). On December 18, 2015, we formed a new Latin America company to facilitate our expansion into the region.

Our B2B platform is currently being used by a pre-paid Smartphone VoIP application launched by different carriers respectively, some of which are listed as follows:

| · | Smart Communications, Inc, (“Smart”), the Philippines' leading wireless services provider with 57.3 million subscribers on its GSM network as of end-June 2013. |

| · | Singapore Telecommunications (“Singtel”), the Singapore’s leading wireless services provider with a combined mobile subscriber base of 500 million customers from its own operations and regional associates in 25 countries at end of March 2014. |

| · | PT Smartfren Telecom Tbk (“Smartfren”), Smartfren is a wireless service provider with a combined mobile subscriber base of 12.5 million on its CDMA network as of October 2013. |

Offering and Market Related

On August 10, 2015, in connection with an Underwriting Agreement dated August 4, 2015 (the “Underwriting Agreement”) with Aegis Capital Corp. (“Aegis”), as representative of the several underwriters named therein (the “Underwriters”), we closed a firm commitment underwritten public offering of 1,714,286 shares of Common Stock, and warrants to purchase up to an aggregate of 857,143 shares of Common Stock at a combined offering price of $1.75 per share and accompanying Warrant. Pursuant to the Underwriting Agreement, the Underwriters exercised an option to purchase 151,928 additional shares of Common Stock and 75,964 additional warrants. The net proceeds from the offering were approximately $2.89 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The warrants offered have a per share exercise price of $2.50 (subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock and also upon any distributions of assets, including cash, stock or other property to our stockholder), are exercisable immediately and will expire three years from the date of issuance. Subject to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.

| 22 |

Corporate Governance

In 2015 the management decided to improve the internal GAAP experience by appointing external consultants with GAAP and public company reporting experience. The external consultants commenced work in July 2015.

Research & Development

The Company has spent approximately $1.1 million on capitalizable research and development in the fiscal year 2015.

During 2015, we continue to expand our Irish software development team with the addition of new senior software developers at our software research and development office at the Nexus Innovation Center on the campus of the University of Limerick.

| 23 |

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States, or GAAP. Our significant accounting policies are described in notes accompanying the consolidated financial statements. The preparation of the consolidated financial statements requires our management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, expenses, and related disclosure of contingent assets and liabilities. Estimates are based on information available as of the date of the financial statements, and accordingly, actual results in future periods could differ from these estimates. Significant judgments and estimates used in the preparation of the consolidated financial statements apply critical accounting policies described in the notes to our consolidated financial statements.

We consider our recognition of revenues, accounting for the consolidation of operations, accounting for stock-based compensation, accounting for intangible assets and related impairment analyses, the allowance for doubtful accounts and accounting for equity transactions, to be most critical in understanding the judgments that are involved in the preparation of our consolidated financial statements.

Additionally, we consider certain judgments and estimates to be significant, including those relating to the timing of revenue recognition from the sales of perpetual licenses to certain Tier 1 and Tier 2 telecom entities, those relating to the determination of vendor specific objective evidence (“VSOE”) for purposes of revenue recognition, allowance for doubtful accounts, useful lives for amortization of intangibles, determination of future cash flows associated with impairment testing of long-lived assets, determination of the fair value of stock options and other assessments of fair value. We base our estimates on historical experience, current conditions and on other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates and assumptions.

Together with our critical accounting policies set out above, our significant accounting policies are summarized in Note 2 of our audited financial statements as of December 31, 2015.

Revenue Recognition

The Company recognizes revenue when it is realized or realizable and earned. The Company establishes persuasive evidence of a sales arrangement for each type of revenue transaction based on a signed contract with the customer and that delivery has occurred or services have been rendered, price is fixed and determinable, and collectability is reasonably assured.

| ● | Software and licenses – revenue from sales of perpetual licenses to telecom entities is recognized at the date of invoices raised for installments due under the agreement, unless payment terms exceed one year, as described below, presuming all other relevant revenue recognition criteria are met. Revenue from sales of perpetual licenses to other entities is recognized over the agreed collection period. |

| ● | Revenue for user licenses purchased by customers is recognized when the user license is delivered except as set out below. |

| ● | Revenue for maintenance services is recognized over the period of delivery of the services except as set out below. |

| ● | Effective as of October 1, 2014, the Company amended certain existing customer contracts with respect to the terms under which those customers would pay the Company for perpetual licenses, user licenses and maintenance services provided by the Company. Existing customer contracts required payments for maintenance services to be made based on contractually specified fixed amounts, which were billed regularly through September 2014. Through that date the Company recorded revenue for licenses and maintenance services when those licenses and services were billed. Revenue for user licenses was recorded as earned and revenue for maintenance services was recorded based on a fixed annual fee, billed quarterly. The Company has modified the payment terms under certain of those existing customer contracts by entering into Revenue Sharing agreements with those customers. Under the terms of these Revenue Sharing agreements, future payments will be due from the customer when that customer has generated revenue from its customers who subscribe to use the Horizon products and services. Effective October 1, 2014 revenue will be recorded by the Company when it invoices the customer for the revenue share due to the Company. Certain customers who entered into revenue sharing arrangements had outstanding balances due to the Company as of September 30, 2014, which balances were included in accounts receivable at that date. Payments received after September 30, 2014, from those customers under revenue sharing agreements have been applied to the customer’s existing accounts receivable balances first. For those customers having balances due at September 30, 2014, revenue related to perpetual and user licenses and maintenance services will be recorded only after existing accounts receivable balances are fully collected. |

| ● | Revenues from Aishuo retail sales are recognized when the PSTN calls and texts are made |

Where the Company has entered into a Revenue Share with the customer then all future revenue from granting of user licenses and for maintenance services will be recognized when the Company has delivered user licenses and is entitled to invoice.

We enter into arrangements in which a customer purchases a combination of software licenses, maintenance services and post-contract customer support (“PCS”). As a result, judgment is sometimes required to determine the appropriate accounting, including how the price should be allocated among the deliverable elements if there are multiple elements. PCS may include rights to upgrades, when and if available, support, updates and enhancements. When vendor specific objective evidence (“VSOE”) of fair value exists for all elements in a multiple element arrangement, revenue is allocated to each element based on the relative fair value of each of the elements. VSOE of fair value is established by the price charged when the same element is sold separately. Accordingly, the judgments involved in assessing the fair values of various elements of an agreement can impact the recognition of revenue in each period. Changes in the allocation of the sales price between deliverables might impact the timing of revenue recognition, but would not change the total revenue recognized on the contract. When elements such as software and services are contained in a single arrangement, or in related arrangements with the same customer, we allocate revenue to each element based on its relative fair value, provided that such element meets the criteria for treatment as a separate unit of accounting. In the absence of fair value for a delivered element, revenue is first allocated to the fair value of the undelivered elements and then allocated to the residual delivered elements. In the absence of fair value for an undelivered element, the arrangement is accounted for as a single unit of accounting, resulting in a delay of revenue recognition for the delivered elements until the undelivered elements are fulfilled. No sales arrangements to date include undelivered elements for which VSOE does not exist.

For purposes of revenue recognition for perpetual licenses, the Company considers payment terms exceeding one year as a presumption that the fee in the transaction is not fixed and determinable. This presumption however, may be overcome if persuasive evidence demonstrates that the Company has a business practice of extending payment terms and has been successful in collecting under the original terms, without providing any concessions. In doing so, the Company considers if the arrangement is sufficiently similar to historical arrangements in terms of similar customers and products is assessing whether there is evidence of a history of successful collection.

In order to determine the company’s historical experience is based on sufficiently similar arrangements, the Company considers the various factor including the types of customers and products, product life cycle, elements Included in the arrangement, length of payment terms and economics of license arrangement.

| 24 |

If the presumption cannot be overcome due to a lack of such evidence, revenue should be recognized as payments become due, assuming all other revenue recognition criteria has been met.

Results of Operations

The following table sets forth information from our statements of operations for the year ended December 31, 2015 and 2014.