Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Braemar Hotels & Resorts Inc. | as20160331-8k.htm |

| EX-99.1 - PRESS RELEASE - Braemar Hotels & Resorts Inc. | as20160331-ex99_1.htm |

Exhibit 99.2

Management Track RecordMarch 2016

2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC.This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Prime, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.Important InformationAshford Hospitality Prime, Inc. ("Ashford Prime") plans to file with the SEC and furnish to its stockholders a Proxy Statement in connection with its 2016 Annual Meeting, and advises its stockholders to read the Proxy Statement relating to the 2016 Annual Meeting when it becomes available, because it will contain important information. Stockholders may obtain a free copy of the Proxy Statement and other documents (when available) that Ashford Prime files with the SEC at the SEC's website at www.sec.gov. The Proxy Statement and these other documents may also be obtained for free from Ashford Prime by directing a request to Ashford Hospitality Prime, Inc., Attn: Investor Relations, 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254 or by calling (972) 490-9600.Certain Information Concerning ParticipantsAshford Prime, its directors and named executive officers may be deemed to be participants in the solicitation of Ashford Prime's stockholders in connection with its 2016 Annual Meeting. Stockholders may obtain information regarding the names, affiliations and interests of such individuals in Ashford Prime's proxy statement dated April 17, 2015, which is filed with the SEC. To the extent holdings of Ashford Prime's securities have changed since the amounts printed in the proxy statement, dated April 17, 2015, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Certain Disclosures

Substantial depth of hospitality experienceHighly aligned with the interests of all shareholdersCommitment to long term value creation for stakeholdersBest-in-class asset management teamAffiliate property manager Remington adds significant valueIn-depth hospitality operations experience and knowledge allows management to identify property-level value-add opportunities Management has been involved in almost $20 billion of deal and capital markets activity in the hospitality industry since 2003 aloneUnique strategies employed by management have been very successful Summary 3 Renaissance TampaTampa, FL Management Expertise & Alignment Operational Expertise Capital Markets Expertise

Management Expertise & Alignment 4 Renaissance TampaTampa, FL Chicago Sofitel WaterTowerChicago, IL Ritz-Carlton St. ThomasSt. Thomas, BVI

Management Team with Deep Experience 5 Aggregate 140+ Years of Relevant Industry Experience 27 years of hospitality experience13 years with Ashford (14 years with Ashford predecessor)Cornell School of Hotel Administration BSCornell S.C. Johnson MBA Montgomery J. BennettChief Executive Officer & Chairman of the Board 20 years of hospitality experience13 years with AshfordStanford BA, MBA10 years with Goldman Sachs Douglas A. KesslerPresident 24 years of hospitality experience13 years with Ashford (11 years with Ashford predecessor)University of North Texas BS, University of Houston JD David A. BrooksChief Operating Officer, General Counsel 16 years of hospitality experience13 years with AshfordSouthern Methodist University BBA3 years with ClubCorpCFA charterholder Deric S. Eubanks, CFAChief Financial Officer 10 years of hospitality experience5 years with Ashford (5 years with Ashford predecessor)Oklahoma State University BS5 years with Stephens Investment Bank Jeremy J. WelterEVP of Asset Management 31 years of hospitality experience13 years with Ashford (18 years with Ashford predecessor)Pepperdine University BS, University of Houston MS, CPA Mark L. NunneleyChief Accounting Officer 11 years of hospitality experience11 years with AshfordPrinceton University AB3 years of M&A experience at Dresser Inc. & Merrill Lynch J. Robison HaysChief Strategy Officer

Highly Aligned With the Interests of All Shareholders 6 Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHOSource: Company filings* Insider ownership for Ashford Prime includes direct & indirect interests & interests of related parties Ashford Prime’s management team consisting of seven executives is the most highly-aligned management team among peers with respect to insider ownershipA substantial amount of management’s net worth is in Ashford Prime stock, thus they are highly incentivized to maximize shareholder value

Monty J. Bennett was named the hotel industry’s “Top-Performing CEO of the Year” for 2011 by HVS Executive Search, as he offered the best value to AHT shareholders based on HVS’s pay-for-performance model2013 finalist for ALIS Single Asset Transaction of the Year for AHT’s purchase of the 142-room Pier House Resort & Spa for $90 million from The Jacobs Group2011 finalist for ALIS Merger & Acquisition of the Year for AHT’s joint venture with Prudential Financial Inc. that acquired the hotel portfolio of Highland Hospitality Corp. Awarded the 2015 Marriott Renovation Excellence Award for AHP’s repositioning of Courtyard Philadelphia DowntownAwarded the 2015 Marriott Full-Service Renovation Excellence Award for AHT’s conversion of the Marriott Beverly Hills Award-Winning Management Team 7

Operational Expertise 8 Renaissance TampaTampa, FL Chicago Sofitel WaterTowerChicago, IL Marriott SeattleSeattle, WA

Hospitality REITs require very hands-on asset management and it’s crucial that management has a very thorough understanding of operations in order to oversee property managersThe depth of management’s 140+ years of hospitality experience provides shareholders with exceptional operational expertiseBest-in-class asset management team, as evidenced by highest EBITDA flows and margin change by AHT over the past nine years versus peers Remington also provides an advantage, as it outperforms other property managers, can better preserve cash flow going into a downturn, and can enhance acquisition returns Management looks at each property to identify opportunities and implement value-add strategiesAshford Prime gives shareholders the unique opportunity to invest alongside an industry-leading management team with tremendous hotel operating experience and expertiseSeveral upcoming slides include hands-on case studies involving AHP properties, demonstrating the impact of our asset management and operational know-how Strong Operational Expertise 9

Asset Management Expertise 10 Peers include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RHP, RLJ, SHO, and APLESource: Company filings AHT has the highest average hotel EBITDA flows among its peers over the past 9 years

Asset Management Expertise 11 Renaissance TampaTampa, FL Peers include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RHP, RLJ, SHO, and APLESource: Company filings AHT has the highest average EBITDA margin change among its peers over the past 9 years

Remington Outperformance - Profitability 12 Renaissance TampaTampa, FL Marriott SeattleSeattle, WA Superior management of downside risk and cash flow loss Remington has outperformed in EBITDA flow-through 7 out of the last 8 years NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to Non-Remington managed hotels owned by Ashford Trust and Ashford Prime

Ordinary asset management results Extraordinary Ashford asset management results Asset Management Expertise – Highland Takeover 13 The takeover of the Highland portfolio demonstrates how a superior asset management team can drive performanceAHT took over the Highland portfolio in March 2011 (see slide 27 for additional background)The portfolio is a high-quality, geographically diversified portfolio of 28 hotels, mainly comprised of upper-upscale Marriott and Hilton-branded hotels Hotel EBITDA Flow-Through

Asset Management Expertise – Marriott Seattle 14 Seattle Marriott Waterfront – Seattle, WA Segment Jul-Aug 2012 Jul-Aug 2013 Jul-Aug 2014 Jul-Aug 2015 ADR Premium Retail $ 327.49 $ 354.85 $ 411.14 $ 449.95 Regular Retail $ 281.73 $ 309.96 $ 348.03 $ 371.66 Difference $ 45.76 $ 44.90 $ 63.10 $ 78.29 Premium Rooms Identified 23 corner rooms with views of the water to transition to premium Corner King roomsTotal number of premium rooms is 200, 56% of the total room inventoryCorner King rooms can sell at $100 above regular retail during peak summer seasonFewer regular retail rooms make it easier to fence out special corporate rates during peak timesSell premium rooms in advance, leading to higher regular retail rates after premium rooms sell outUse length-of-stay restrictions on regular retail to encourage booking premium rooms Implementation Summary: 300 bps RevPAR index gain since 2011

Asset Management Expertise – Capital Hilton 15 The Capital Hilton – Washington, DC Installed Upsell program, driving $250,000 of incremental revenueDaily focus on pricing in order to drive retail transient penetration to historical high; retail RPI up 19% TTMWeekly reviews of group position, leading to 5% TTM group RPI growthUpgraded Director of Revenue Management in Q1 2015 Implemented Revenue Strategies: The Capital Hilton – Washington, DC +370 bps growth

Asset Management Expertise – Marriott Plano Legacy 16 Strong RPI growth despite opening of Hilton Granite Park in Sep. 2014Installed Sr. RM in Q1 20142014 & 2015 Business Transient Pricing Strategy led to premium increases with key accountsRenovated meeting space in 2014Monthly review with Area & Group Sales Offices to grow group RPI Implemented Revenue Strategies: Marriott Plano Legacy – Plano, TX Marriott Plano Legacy – Plano, TX +1,640 bps growth Hilton Granite Park Opening (1.2 miles from Marriott Plano)

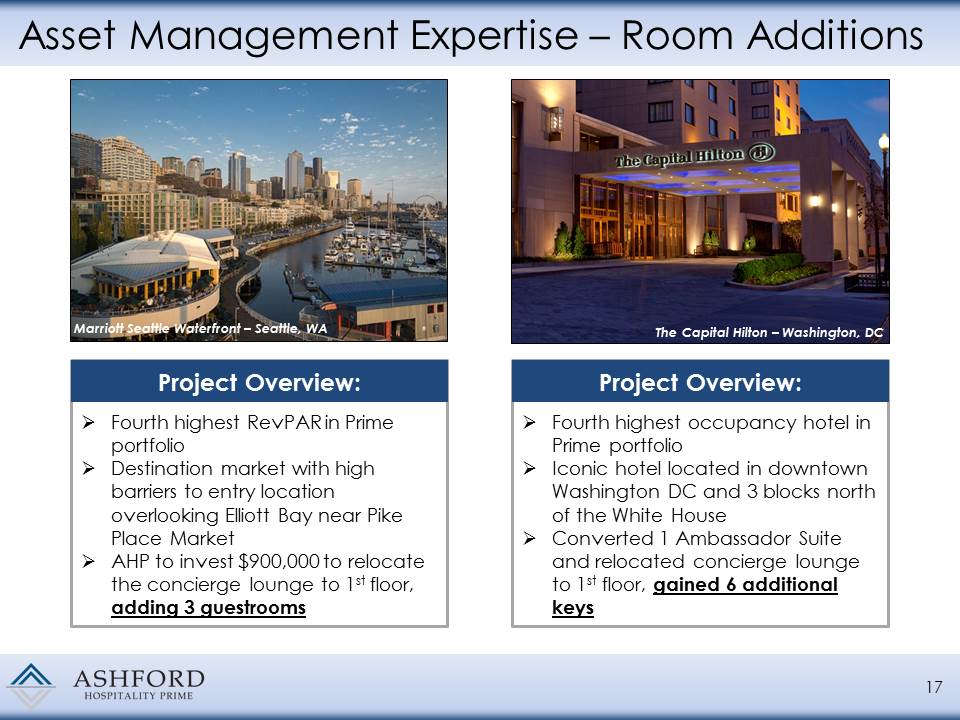

Asset Management Expertise – Room Additions 17 Fourth highest occupancy hotel in Prime portfolioIconic hotel located in downtown Washington DC and 3 blocks north of the White HouseConverted 1 Ambassador Suite and relocated concierge lounge to 1st floor, gained 6 additional keys Project Overview: Fourth highest RevPAR in Prime portfolio Destination market with high barriers to entry location overlooking Elliott Bay near Pike Place MarketAHP to invest $900,000 to relocate the concierge lounge to 1st floor, adding 3 guestrooms Project Overview: Marriott Seattle Waterfront – Seattle, WA The Capital Hilton – Washington, DC

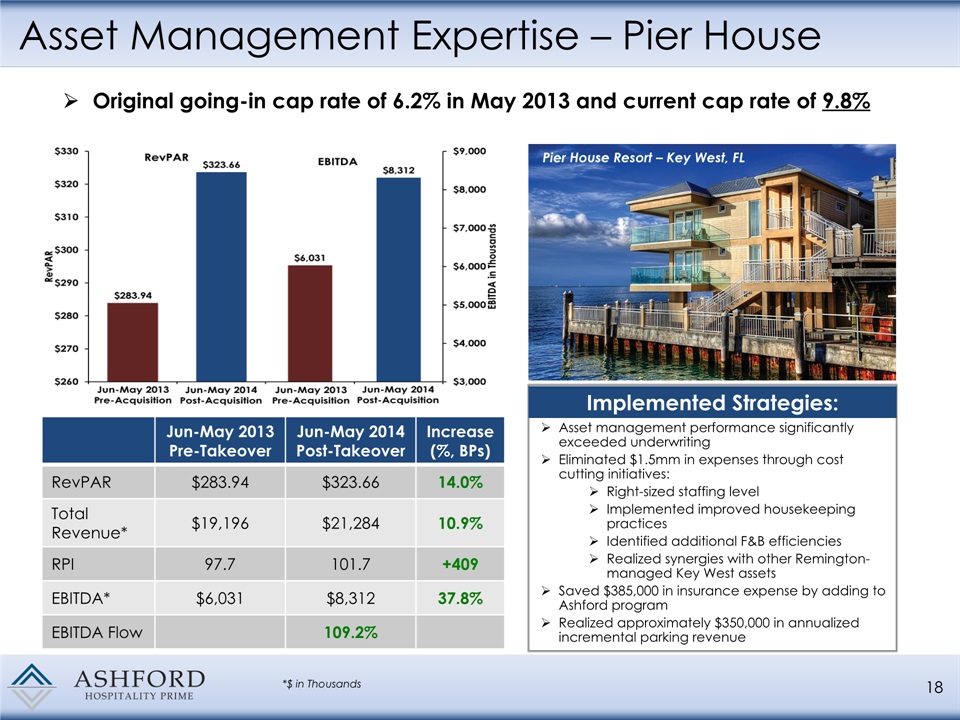

Asset Management Expertise – Pier House 18 Asset management performance significantly exceeded underwritingEliminated $1.5mm in expenses through cost cutting initiatives: Right-sized staffing levelImplemented improved housekeeping practicesIdentified additional F&B efficienciesRealized synergies with other Remington-managed Key West assetsSaved $385,000 in insurance expense by adding to Ashford programRealized approximately $350,000 in annualized incremental parking revenue Implemented Strategies: Pier House Resort – Key West, FL Jun-May 2013 Pre-Takeover Jun-May 2014Post-Takeover Increase (%, BPs) RevPAR $283.94 $323.66 14.0% Total Revenue* $19,196 $21,284 10.9% RPI 97.7 101.7 +409 EBITDA* $6,031 $8,312 37.8% EBITDA Flow 109.2% *$ in Thousands Original going-in cap rate of 6.2% in May 2013 and current cap rate of 9.8%

Asset Management Expertise – Courtyard San Francisco 19 Courtyard San Francisco has historically underperformed compared to the rest of AHP’s select portfolio in ADR indexA one point increase in RevPAR index equals $171,000 in EBITDARepositioning hotel with $14.5mm extensive guestrooms and lobby renovation starting Q4 2016Custom guestrooms renovation (including king showers) will better position hotel to capture higher rated group and transient business Opportunities: Courtyard San Francisco – San Francisco, CA Opportunity Opportunity Select*, excluding CY San Francisco CY San Francisco Select*, excluding CY San Francisco CY San Francisco CY Philadelphia Renovation Impact *Ashford Prime-owned select service properties

Asset Management Expertise – Bardessono 20 Bardessono – Yountville, CA Acquired by AHP in July 20152015 RevPAR of $56462 keys, 1,350 sq. ft. of meeting spaceLocated in Yountville, CA the “Culinary Capital of Napa Valley”High barrier to entry marketEasily accessible to the major markets in Northern CaliforniaOne of only three LEED Platinum certified hotels in the U.S., only hotel in California Hotel Overview: Opportunity to add 2 to 3 luxury villas to attract ultra-luxury guestsCost control opportunitiesImplementation of Remington revenue initiativesRevPAR up 5.9%, EBITDA Margin up 460 bps, & EBITDA flow-through of 83% in the 4th quarter (1st full quarter of ownership) Opportunities: Bardessono – Yountville, CA

Asset Management Expertise – Ritz St. Thomas 21 The Ritz-Carlton St. Thomas Acquired by AHP in December 2015180 keys, 10,000 sq. ft. of meeting spaceAcquisition completed at favorable metrics of 7.2x TTM EBITDA and 10% TTM NOI cap rateLocated in St. Thomas in the stunning U.S. Virgin Islands with high barriers to entry30 oceanfront acres along Great BayRecognized in the 2015 U.S. News & World Report's Best Hotel Rankings Hotel Overview: Significant upside after recently completed extensive $22 million renovation of guest rooms and public spaceAdditional growth opportunities include ability to expand the resort further through additional keys and villas Opportunities: Great Bay ViewThe Ritz-Carlton St. Thomas

Capital Markets Expertise 22 Renaissance TampaTampa, FL Chicago Sofitel WaterTowerChicago, IL Pier House ResortKey West, FL

In addition to its operational expertise, management also has an extensive track record of successful capital markets executionManagement’s unique understanding of the long-term cost of equity has allowed it to successfully navigate through several lodging cycles while minimizing riskManagement has created tremendous shareholder value by executing unique and creative strategiesManagement is responsible for almost $20 billion of deal and capital markets activity in the hospitality industry since 2003 aloneThe next several slides highlight this management team’s ability to create value and mitigate risk through both traditional and innovative capital markets strategies Deep Capital Markets Expertise 23

Extensive Capital Markets & Deal Expertise 24 Management’s deal and capital markets activity in the hospitality industry has totaled $19.4 billion since 2003 Source: AHT, AHP and AINC Company filings

The Ashford management team took advantage of the opportunity to buy back AHT stock at trough prices, while other public hospitality REIT management teams issued stock at these low prices, substantially diluting their shareholders Significant Value Creation – Share Buybacks 25 Source: SNL

Ashford management implemented a hedging strategy at AHT to protect cash flow prior to the Great Recession in 2008Management discovered a high correlation between RevPAR growth and changes in LIBORBased on this strong correlation, management swapped $1.8b of fixed-rate debt to floating-rate debt in order to cushion cash flow in the event of an industry downturnAdditionally, interest rate flooridors were purchased to provide more income should rates continue to drop, which they did Significant Value Creation – Hedges 26

Demonstrated understanding of debt capital market conditions and formed subordinated JV with institutional partnerIn January 2008, AHT formed a joint venture with Prudential Real Estate Investors ("PREI") in which contributions would be split 25% from AHT and 75% from PREIAHT acquired junior mezz position in former publicly traded Highland HospitalityIn February 2008, the AHT/PREI joint venture acquired a mezzanine loan (mezz 6 tranche) secured by JER Partners $2.2 billion Highland Hospitality portfolio AHT's 25% share of the investment was $17.5mAggressively protected capital investment as market conditions deterioratedIn July 2010, the JV acquired a mezz 4 tranche in this portfolio at a substantial discount (AHT invested $15m) in order to protect its investment and gain leverageWorked through consensual foreclosure and complex restructuring with 7 lenders to convert junior mezz position into equity ownershipIn March 2011, AHT contributed $150m and formed a new joint venture with PREI (72% AHT/ 28% PREI) to take ownership of the Highland portfolio through a consensual foreclosure for total consideration of $1.3bThe JV worked out a consensual restructuring with all lenders who provided $949m of financing and the JV assumed additional first mortgage financing of $146mResulted in conversion of 25% JV investment of $17.5 million in Mezz 6 position to 72% ownership of $1.7 billion* portfolioAt a market value of $1.7b*, AHTs equity interest in the joint venture is worth about $554m*, representing a $372m gain over the $182m invested, which equates to a 29% IRR over seven years and a 3.0x equity multipleAHT’s subsequently bought out PREI’s ownership interest to achieve 100% ownership 27 Significant Value Creation – Highland Portfolio Transaction History Highland Hospitality Portfolio:AHT converted a fully-subordinated minority junior mezz position deep in the capital stack to 72% ownership of a $1.7b* portfolio, creating $372m in shareholder value * Based on the total transaction value at the time of the buyout of PREI in March 2015

28 Significant Value Creation – Highland Portfolio The Ritz-Carlton – Atlanta, GA 29% IRR over 7 years3.0x equity multiple $554.3 $371.8Gain * Based on the total transaction value at the time of the buyout of PREI in March 2015 Highland Hospitality Portfolio:AHT converted a fully-subordinated minority junior mezz position deep in the capital stack to 72% ownership of a $1.7b* portfolio, creating $372m in shareholder value

Substantial depth of hospitality experienceHighly aligned with the interests of all shareholdersCommitment to long term value creation for stakeholdersBest-in-class asset management teamAffiliate property manager Remington adds significant valueIn-depth hospitality operations experience and knowledge allows management to identify property-level value-add opportunities Management has been involved in almost $20 billion of deal and capital markets activity in the hospitality industry since 2003 aloneUnique strategies employed by management have been very successful Summary 29 Renaissance TampaTampa, FL Management Expertise & Alignment Operational Expertise Capital Markets Expertise

Management Track RecordMarch 2016