Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - PREMIER BIOMEDICAL INC | biei_ex311.htm |

| EX-31.2 - CERTIFICATION - PREMIER BIOMEDICAL INC | biei_ex312.htm |

| EX-32.1 - CERTIFICATION - PREMIER BIOMEDICAL INC | biei_ex321.htm |

| EX-32.2 - CERTIFICATION - PREMIER BIOMEDICAL INC | biei_ex322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_____________ to _____________.

Commission file number 000-54563

Premier Biomedical, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada |

| 27-2635666 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. mployer Identification No.) |

|

|

|

P.O. Box 31374 El Paso, TX |

| 79930 |

(Address of principal executive offices) |

| (Zip Code) |

Registrant's telephone number, including area code (814) 786-8849

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.00001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10 K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. $9,269,548 based on the closing price of $0.12 on June 30, 2015. The voting stock held by non-affiliates on March 14, 2016 consisted of 77,246,236 shares of common stock.

Applicable Only to Registrants Involved in Bankruptcy Proceedings During the Preceding Five Years:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

(Applicable Only to Corporate Registrants)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date. As of March 14, 2016, there were 89,579,908 shares of common stock, par value $0.001, issued and outstanding.

Documents Incorporated by Reference

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

PREMIER BIOMEDICAL, INC.

FORM 10-K ANNUAL REPORT

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

PART I | |||||

|

|

|

| ||

ITEM 1 – | BUSINESS |

|

| 3 |

|

ITEM 1A – | RISK FACTORS |

|

| 19 |

|

ITEM 1B – | UNRESOLVED STAFF COMMENTS |

|

| 31 |

|

ITEM 2 – | PROPERTIES |

|

| 31 |

|

ITEM 3 – | LEGAL PROCEEDINGS |

|

| 31 |

|

ITEM 4 – | MINE SAFETY DISCLOSURES |

|

| 31 |

|

|

|

|

|

| |

PART II | |||||

|

|

|

|

| |

ITEM 5 – | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

|

| 32 |

|

ITEM 6 – | SELECTED FINANCIAL DATA |

|

| 34 |

|

ITEM 7 – | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

| 34 |

|

ITEM 7A – | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

| 43 |

|

ITEM 8 – | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

|

| 43 |

|

ITEM 9 – | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

| 44 |

|

ITEM 9A – | CONTROLS AND PROCEDURES |

|

| 44 |

|

ITEM 9B – | OTHER INFORMATION |

|

| 46 |

|

|

|

|

|

| |

PART III | |||||

|

|

|

|

| |

ITEM 10 – | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

|

| 47 |

|

ITEM 11 – | EXECUTIVE COMPENSATION |

|

| 50 |

|

ITEM 12 – | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

| 53 |

|

ITEM 13 – | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

| 55 |

|

ITEM 14 – | PRINCIPAL ACCOUNTING FEES AND SERVICES |

|

| 58 |

|

|

|

|

|

| |

PART IV | |||||

|

|

|

|

| |

ITEM 15 – | EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

|

| 59 |

|

| 2 |

PART I

Cautionary Statement Regarding Forward Looking Statements

This Annual Report includes forward looking statements within the meaning of the Securities Exchange Act of 1934 (the "Exchange Act"). These statements are based on management's beliefs and assumptions, and on information currently available to management. Forward looking statements include the information concerning possible or assumed future results of operations of the Company set forth under the heading "Management's Discussion and Analysis of Financial Condition or Plan of Operation." Forward looking statements also include statements in which words such as "expect," "anticipate," "intend," "plan," "believe," "estimate," "consider" or similar expressions are used.

Forward looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions. The Company's future results and shareholder values may differ materially from those expressed in these forward looking statements. Readers are cautioned not to put undue reliance on any forward looking statements.

ITEM 1 – BUSINESS

Corporate History

We were incorporated on May 10, 2010 in the State of Nevada.

Overview

We are a research-based company that intends to discover and develop medical treatments for humans, specifically targeting the treatment of:

- Cancer | - Fibromyalgia |

- Multiple Sclerosis (MS) | - Traumatic Brain Injury (TBI) |

- Neuropathic Pain | - Alzheimer's Disease (AD) |

- Amyotrophic Lateral Sclerosis (ALS/Lou Gehrig's Disease) | - Blood Sepsis and Viremia |

We have a two-fold corporate focus:

One is to target Cancer, Alzheimer's disease, ALS, Blood Sepsis, Leukemia, and other life-threatening cancers, and to do this we intend to develop our proprietary Sequential-Dialysis Technique. The methodology involved in this technique is largely unexplored and has been described by scientists as the "wild west" of modern medicine. Consequently, our first entry into the therapeutics market for medications that work against cancer, Multiple Sclerosis, infectious diseases, Alzheimer's disease, strokes and traumatic brain injury carries significant obstacles before reaching the opportunities of a $700 billion industry.

| 3 |

The other is the development of our proprietary drug candidate Feldetrex™, a potential treatment for Multiple Sclerosis, Fibromyalgia, Neuropathic Pain and Traumatic Brain Injury. The formulation used in the current Feldetrex™ will be individually tailored to the various illnesses we intend to target, with each formulation being given a unique proprietary brand name. The annual market size of MS treatment is $500 million and the annual market size for all proposed Feldetrex™ market segments is $16 billion.

To overcome the significant obstacles inherent to the development of our Sequential-Dialysis Technique and Feldetrex™ candidate drug, we are seeking to partner with prestigious institutions and pharmaceutical companies with the substantial infrastructure and resource capacity to perform experimentation and to engage in product development in an inexpensive and efficient manner.

SEQUENTIAL-DIALYSIS TECHNIQUE

Our proprietary Sequential-Dialysis Technique is a methodology for the removal of those molecules which are harmful and responsible for causing diseases. A significant disappointment in the practice of modern medicine is that the capabilities do exist to eliminate the presence of most illnesses, including life-threatening diseases such as AIDS and cancer, but with a caveat that the process of treatment comes with catastrophic side effects that can and often do kill the patient.

Our development is that the innovative Sequential-Dialysis Methodology is done extracorporeally (outside the body). This is a truly unique and innovative method for alleviating disease.

We believe that this methodology can be used for the prevention of cancer metastasis, for directly attacking the causation of intractable seizures, for preventing the death of anterior motor neurons in ALS, for preventing the cause of the neuropathological changes in Alzheimer's disease and Traumatic Brain Injury and for eradicating the causations of infectious diseases, and our intention is that the effectiveness of this technique will be demonstrated and supported in future clinical studies.

Through our Sequential-Dialysis Technique, we ultimately hope to provide a cure for cancer if not only to dramatically extend the lives of suffering patients. Our initial focus is on lab and animal tests. Clinical trials, as required, will be undertaken subsequently.

| 4 |

CANCER

Description of Illness

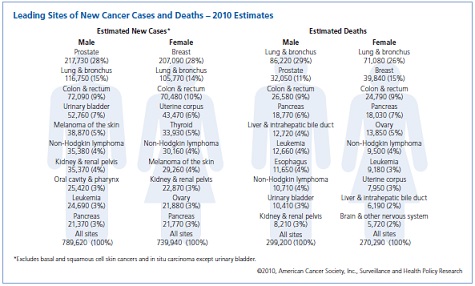

Cancer is a class of diseases in which a group of cells display 1) uncontrolled growth beyond the normal limits of cell reproduction, 2) invasion and destruction of adjacent tissues, and sometimes 3) metastasis or spread to other locations in the body via lymph or blood. These three properties of malignant cancers differentiate them from benign tumors which are self-limited and do not invade or metastasize. Most cancers form a tumor, but some, like leukemia, do not.1

Cancer may affect people at all ages but the risk for most varieties of cancer increases with age. In the United States, cancer accounts for nearly 1 in 4 deaths. According to the American Cancer Society about 577,190 Americans will die of Cancer this year, making the death toll a staggering 1,500 people per day.2 Globally and on average, 7.5 million people die of Cancer every year. There are about 12.7 million people living with cancer in the United States.3

Nearly all cancers are caused by abnormalities in the genetic material of the transformed cells. These abnormalities may be due to the effect of carcinogens, such as tobacco smoke, radiation, chemicals, or infectious agents. Other cancer-promoting genetic abnormalities may be randomly acquired through errors in DNA replication, or are inherited, and thus are present in all cells from birth. The heritability of cancers is usually affected by complex interactions between carcinogens and the host's genome. New aspects of the genetics of cancer pathogenesis, such as DNA methylation and microRNAs are increasingly recognized as important.

____________________

| 1 | http://www.news-medical.net/health/What-is-Cancer.aspx |

| 2 | http://www.cancer.org/acs/groups/content/@epidemiologysurveilance/documents/document/acspc-031941.pdf |

| 3 | http://costprojections.cancer.gov/ |

| 5 |

Conventional Method of Treatment

Cancer can be treated today by surgery, chemotherapy, radiation, immunotherapy, monoclonal antibody therapy, or other methods. The choice of therapy depends upon the location and grade of the tumor and the stage of the disease, as well as the general state of the patient. A number of experimental cancer treatments are also under development. Complete removal of the cancer without damage to the rest of the body is the goal of treatment. Sometimes this can be accomplished by surgery, but the propensity of cancers to invade adjacent tissue or to spread to distant sites by microscopic metastasis often limits its effectiveness. The effectiveness of chemotherapy is often limited by toxicity to other tissues in the body. Radiation damages normal tissue.4

Potential for Sequential Dialysis Technique

We intend to develop a methodology for treating cancer which is completely different from the standard treatments of chemotherapy and radiation therapy that are now being utilized. Due to the fact that all presently known treatments directly inject chemotherapeutic agents into the body of a patient and/or directly irradiate the patient, there is a very high level of adverse side effects, such as kidney failure, encephalopathy, neuropathy, heart toxicity, and other severe morbidities.

We intend to develop our intellectual property applications for utilizing a proprietary methodology in which the cancer patient's blood or other bodily fluid is utilized to remove metastatic cancer cells or other disease causing antigens. This is accomplished by sequentially dialyzing the patient's blood or other bodily fluid extracorporeally. The method will utilize designer antibodies to physically remove the pathophysiologic basis of the disease. For example, in sepsis there will be the physical attachment and removal of bacteria. In cancer treatment, there will be the physical attachment and then physical removal of metastasizing cancer cells. There will also be the physical attachment, and removal of those proteins which allow cancer to metastasize successfully and then thrive-such as angiogenic proteins. To date there has been no specific clinical evidence to support a conclusion that this treatment is effective for premetastatic or metastatic cancers. We hope to demonstrate this in future lab and animal experiments. Through this process, the cancer can be targeted through a number of innovative techniques being developed by the Company. |

|

|

This extracorporeal sequential dialysis methodology for cancer treatment has an enormous potentiality for decreasing the side effects of chemotherapy and radiation treatment in cancer patients. Our methodology may also increase the efficacy of cancer treatment by allowing for much higher dosages of anti-neoplastic agents to be used through this extracorporeal methodology. Due to the fact that this methodology completely avoids exposure of the patient's body to these anti-cancer agents, dosages that cannot be normally tolerated can now be utilized in fighting the cancer.

____________________

| 4 | http://www.kfshrcj.org/NR/rdonlyres/AC6F2108-37CB-4C32-999B-B292ED658481/2846/CancerTreatment.pdf |

| 6 |

ALZHEIMER'S DISEASE

Description of Illness

Alzheimer's disease is a dementing illness, which induces a progressive impairment of intellectual functioning, including a loss of short term memory. There is also a progressive impairment in executive functioning with occasional psychiatric manifestations such as depression and delirium. Delirium is characterized by an acute confusion. Oftentimes patients have language impairment and apraxia—an inability to perform previously learned tasks. Patients also often times show agnosia, an inability to recognize objects, and patients have a loss of visual-spatial abilities, for example oftentimes becoming lost in familiar surroundings. Occasionally hallucinations occur in severe forms of Alzheimer's disease.

Alzheimer's disease comes from neuropathic changes in the brain which includes the accumulation of neurofibrillary tangles and amyloid plaques in the cortex of the brain.5 Neurofibrillary tangles are composed of Tau proteins, which are deposited within the neurons of the brain. Thus, Tau proteins are the causation of Alzheimer's disease and other Tauopathies such as Pick's Disease, Tuberous Sclerosis and certain forms of Parkinson's disease.

A report by the Alzheimer's Association examining the current trajectory of Alzheimer's disease shows that the number of Americans age 65 and older who have Alzheimer's disease will increase from 5.1 million in 2010 to 13.5 million by mid-century. The report entitled "Changing the Trajectory of Alzheimer's Disease: A National Imperative" shows that "in the absence of disease-modifying treatments, the cumulative cost of care for people with Alzheimer's from 2010 to 2050 will exceed $20 trillion, in today's dollars. Total costs of care for individuals with Alzheimer's disease by all payers will soar from $172 billion in 2010 to more than $1 trillion in 2050." During this time, the Medicare costs of Alzheimer's disease will soar 600% to $627 billion and the Medicaid costs of Alzheimer's disease will soar 400% to $178 billion.6

Conventional Method of Treatment

Presently, there is no cure for Alzheimer's disease. Treatments exist but only target the symptoms of Alzheimer's disease without targeting the underlying progression of the disease. Consequently the projected future life span of an individual diagnosed with Alzheimer's disease is 5 to 7 years.7

Potential for Sequential-Dialysis Technique

We believe that our proprietary Sequential-Dialysis Technique can be used to prevent the onset of Alzheimer's disease. This would be done by removing the proteins responsible for the pathologic changes in the brain, namely the protein Tau; thus, preventing the cause of the neuropathic changes that cause Alzheimer's disease. The Tau protein will be removed from the cerebral spinal fluid in which it resides utilizing a designer antibody (an antibody genetically engineered for a specific purpose) which will allow for the efficacious removal of the protein. We hope to demonstrate this in future lab and animal experiments. We believe that our Sequential-Dialysis Technique can also be used in this fashion to treat Traumatic Brain Injury.

____________________

| 5 | McPhee, Stephen J. Current Medical Diagnosis & Treatment. 47th ed. New York: McGraw Hill, 2008. Print. |

| 6 | http://www.alz.org/documents_custom/FINAL_Trajectory_Report_Release-EMB_5-11-10.pdf |

| 7 | http://www.webmd.com/alzheimers/news/20100413/formula-predicts-alzheimers-longevity |

| 7 |

ALS

Description of Illness

Amyotrophic Lateral Sclerosis (ALS) is a progressive neurodegenerative disease that affects nerve cells in the brain and spinal cord. While the cause of ALS is uncertain, the process of ALS is known to occur as motor neurons in affected patients progressively degenerate until death. As motor neurons degenerate, they can no longer send impulses to muscle fibers that normally result in muscle movement. Eventually, the motor neurons die and the ability of the brain to initiate and control muscle movements is lost. With voluntary muscle action progressively affected, patients in the later stages of the disease become totally paralyzed.8

ALS has been frequently referred to as Lou Gehrig's disease, after the famous New York Yankees baseball player diagnosed with the disease in 1939.

Annually, about 5,600 people are diagnosed with ALS in the United States. The projected future life span of a diagnosed patient is two to five years. It is projected that of the current US population, 300,000 people will die of ALS before a cure is found.

The financial cost to families of persons with ALS is exceedingly high. In the advanced stages, care can cost up to $200,000 a year. Entire savings of relatives of patients are quickly depleted because of the extraordinary cost involved in the care of ALS patients.9

|

|

|

Conventional Method of Treatment

There is currently no cure or treatment that halts or reverses ALS. However, there is one FDA approved drug, Riluzole, which modestly slows the progression of ALS.

Potential for Sequential-Dialysis Technique

Numerous medical studies have proven that the causation of ALS is an over excitation of the anterior motor neurons in the spinal cord. Our Sequential-Dialysis Technique method removes those excitatory neural transmitters that cause the death of those cells. The method will utilize designer antibodies to physically remove excitatory neurotransmitters such as glutamate from cerebrospinal fluid. We hope to demonstrate this methodology in future lab and animal experiments. Thus, we hope to prevent the development of ALS; thereby, giving hope to patients of a currently unconquerable disease.

____________________

| 8 | http://www.alsa.org/als/what.cfm |

| 9 | http://www.focusonals.com/alsfacts.htm |

| 8 |

BLOOD SEPSIS AND VIREMIA

Description of Illness

Blood Sepsis, also known as Blood Poisoning, is an infection of the blood stream. Sepsis is caused when toxin releasing bacteria, such as Staphylococcus, enter the blood. Blood Sepsis is a particularly devastating disease due to the domino-effect of organ shutdown which causes multiple organ failure. Blood Sepsis causes a whole body inflammatory state called Systemic Inflammatory Response Syndrome (SIRS).

Blood Sepsis first results in the shutdown of kidneys; thus patients require standard dialysis immediately to prevent death. As the disease progresses, vital signs collapse—the foremost of these being blood pressure. Subsequently, symptoms of Sepsis include elevated temperature, elevated heart rate, respiratory collapse, further organ failures, altered mental status and cardiac failure.

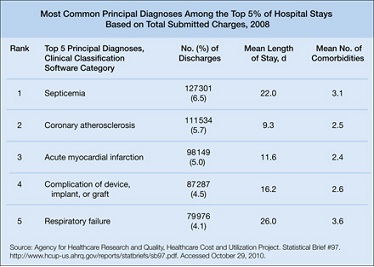

Septicemia is a major cause of death in the United States and puts people in the intensive care unit at a very high rate. Only about 1-2% of all hospitalizations in the United States are attributed to Septicemia, though Septicemia accounts for as much as 25% of bed-utilization in intensive-care units. |

|

|

Conventional Method of Treatment

The traditional therapy of Blood Sepsis (bacteremia) relies on intravenous treatment using multiple antibiotics. However, in intensive care units, even with today's treatment, approximately 35% of patients with severe sepsis and 60% of patients with septic shock die within 30 days.

Septicemia is of particular concern because of the exceedingly high cost of treatment for Septicemia patients. A typical stay in the intensive care unit costs $10,000 per day with testing. Consequently, the treatment of Blood Sepsis is one of the most costly expenditures for hospitals in America.

Potential for Sequential-Dialysis Technique

We hope to conquer Blood Sepsis and Viremia (a disease having symptoms similar to Sepsis but caused by virus) by using our proprietary Sequential-Dialysis Technique. If proven successful, this technique would dialyze the toxin producing bacteria out of the blood by using antibodies; thus saving countless lives while also providing significant cost savings to hospitals around the country. The method will utilize designer antibodies to physically remove the toxin producing bacteria out of the blood. The designer antibodies will attach to the toxin producing bacteria or virus, and then the antibody-antigen compound will be efficaciously dialyzed out of the blood extracorporeally. We hope to demonstrate this methodology in future lab and animal experiments.

| 9 |

FELDETREX™

Although a combination of generic medications, we have a U.S. Patent (No. 8,865,733) on our Feldetrex™ candidate drug. In this way, Feldetrex™ is similar to ViagraÒ, which was a proprietary cardiac drug prior to its current use and ownership by Pfizer. Consequently, we have one pending patent application for our Feldetrex™ candidate drug—intending to increase our Feldetrex™ related patent applications to three in the near future.

Feldetrex™ may serve as an additional medication utilized by physicians for the treatment of Multiple Sclerosis, Fibromyalgia, or Traumatic Brain Injury, and is designed to decrease symptomatology in those conditions. Feldetrex™ will not compete against our proprietary Sequential-Dialysis Technique in the market to treat Traumatic Brain Injury, but rather the two will work conjunctively.

Feldetrex™ utilizes a low dosage of Naltrexone which has been shown in multiple medical articles, in the medical literature, to increase endogenous enkephalins10 (endogenous enkephalins are pain-relieving pentapeptides produced in the body, located in the pituitary gland, brain, and GI tract. Axon terminals that release enkephalins are concentrated in the posterior horn of the gray matter of the spinal cord, in the central part of the thalamus, and in the amygdala of the limbic system of the cerebrum. Endogenous Enkephalins function as neurotransmitters that inhibit neurotransmitters in the pathway for pain perception, thereby reducing the emotional as well as the physical impact of pain). We have not independently conducted medical or laboratory tests to show the mechanism of action of this medication. While Naltrexone in high dosages acts as an opioid antagonist, it inhibits opiate receptors. Naltrexone in low dosages causes a compensatory upregulation (increase in the number of receptors) of native endorphins and enkephalins, which last beyond the effects of the Naltrexone itself. We believe that this means, paradoxically, that a daily dose of low dose Naltrexone can be used to chronically increase endorphin and enkephalin levels. We believe that by utilizing a low dosage, Naltrexone has a unique ability to increase enkephalins and other neurotransmitters in the brainstem of patients.

____________________

| 10 | A. | Bowling, Allen C.. "Low-dose naltrexone (LDN) The "411" on LDN" National Multiple Sclerosis Society. http://www.nationalmssociety.org/multimedia-library/momentum-magazine/back-issues/momentum-spring-09/index.aspx. Retrieved 6 July 2011. |

| B. | Bourdette, Dennis. "Spotlight on Low Dose Naltrexone (LDN)". US Department of Veteran Affairs. http://www.va.gov/MS/articles/Spotlight_on_Low_Dose_Naltrexone_LDN.asp. Retrieved 5 July 2011. | |

| C. | Giesser, Barbara S. (2010). Primer on Multiple Sclerosis. New York: Oxford University Press US. pp. 377. ISBN 978-0-19-536928-1. | |

| D. | Moore, Elaine A. 1948. The promise of low dose naltrexone therapy: potential benefits in cancer, autoimmune, neurological and infectious disorders. Elaine A. Moore and Samantha Wilkinson. ISBN 978-0-7864-3715-3. | |

| A. | Moore, Elaine A. 1948. The promise of low dose naltrexone therapy: potential benefits in cancer, autoimmune, neurological and infectious disorders. Elaine A. Moore and Samantha Wilkinson. ISBN 978-0-7864-3715-3 | |

| B. | Crain SM, Shen K-F (1995). Ultra-low concentrations of naloxone selectively antagonize excitatory effects of morphine on sensory neurons, thereby increasing its antinociceptive potency and attenuating tolerance/dependence during chronic cotreatment. Proc Natl Acad Sci USA 92: 10540–10544. | |

| C. | Powell KJ, Abul-Husn NS, Jhamandas A, Olmstead MC, Beninger RJ, et al. (2002). Paradoxical effects of the opioid antagonist naltrexone on morphine analgesia, tolerance, and reward in rats. J Pharmacol Exp Ther 300: 588–596. | |

| D. | Wang H-Y, Friedman E, Olmstead MC, Burns LH (2005). Ultra-low-dose naloxone suppresses opioid tolerance, dependence and associated changes in Mu opioid receptor-G protein coupling and Gβγ signaling. Neuroscience 135: 247–261 |

| 10 |

MULTIPLE SCLEROSIS

Description of Illness

Multiple Sclerosis (MS) is a devastating inflammatory neurologic disease in which white matter, known as myelin, is damaged—causing episodic or neurological symptoms. The destruction of myelin inhibits communications between the nerves in the brain.

Symptoms of Multiple Sclerosis include extreme fatigue, numbness, weakness, difficulty with eyesight, spasticity, speech problems, and problems with coordination. Multiple Sclerosis has its greatest incidence in young adults and patients are usually diagnosed at less than 55 years of age at the onset of the illness.

The cause of Multiple Sclerosis is unknown, although the disease is believed to be an autoimmune problem triggered by a virus—meaning that the patient's immune cells attack and destroy the patient's myelin. In the United States, there are approximately 400,000 patients diagnosed with MS and approximately 200 new patients are diagnosed every week.11 Globally, Multiple Sclerosis is believed to effect 2.1 million people, mostly of European origin.

Conventional Method of Treatment

'ABC' drugs Avonex, Beta-Seron, Copaxone are used to treat Multiple Sclerosis but have been shown to barely beat out placebos in efficacy and are not approved in England for government subsidy. The drug Tysavri was deemed dangerous and was taken off the market for over a year.

Another treatment of MS is high dose steroids; though, this treatment simply decreases symptoms without curing MS.

Potential for Feldetrex™

Our proprietary Feldetrex™ candidate drug will not compete with typical treatment methods for Multiple Sclerosis, but rather, is simply an add-on drug to increase the effectiveness of treatment.

____________________

| 11 | http://www.nationalmssociety.org/about-multiple-sclerosis/what-we-know-about-ms/who-gets-ms/index.aspx |

| 11 |

FIBROMYALGIA

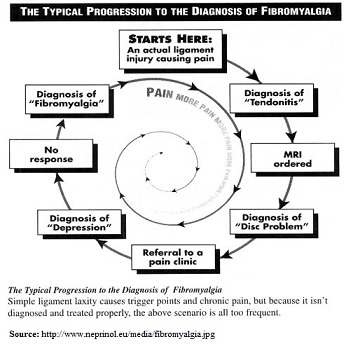

Description of Illness

Fibromyalgia is a common illness affecting approximately 2% of the general population, most common amongst women 20 to 50 years of age. Approximately five million Americans suffer from the debilitating illness. The cause of Fibromyalgia is officially unknown and diagnosis of Fibromyalgia is a 'diagnosis of exclusion'—meaning that Fibromyalgia is diagnosed as an illness after Rheumatoid Arthritis and Lupus have been ruled out with a blood test.

Patients with Fibromyalgia suffer from debilitating fatigue, numbness, headaches, and chronic widespread musculoskeletal pain with multiple tender points. Fibromyalgia is a chronic condition lasting 6 months to many years. Patients commonly complain of chronic aching, pain, stiffness, sleep difficulty, headaches, and irritable bowel syndrome. Consequently, approximately 25% of patients with Fibromyalgia are work disabled. The direct and indirect costs of Fibromyalgia are, on average, $5,945 per patient.12 |

|

|

Conventional Method of Treatment

Lyrica (Pregabalin) is the only FDA approved medication for the treatment of Fibromyalgia. However, Lyrica oftentimes has side effects of dizziness, drowsiness and dry mouth. Rarely, Lyrica can cause suicidal ideation and severe agitation.

Potential for Feldetrex™

Our Feldetrex™ candidate drug will not compete with currently existing treatments of Fibromyalgia, but, rather, would be an add-on-drug to increase the effectiveness of treatment.

____________________

| 12 | http://www.cdc.gov/arthritis/basics/fibromyalgia.htm |

| 12 |

TRAUMATIC BRAIN INJURY

Description of Illness

Traumatic Brain Injury (TBI) occurs when an external force traumatically injures the brain. TBI is a major cause of death and disability worldwide, especially in children and young adults. Causes of TBI include falls, vehicle accidents, and violence. Three separate processes of Traumatic Brain Injury work to injure the brain: 1) bruising (bleeding), 2) tearing, and 3) swelling. Brain trauma can be caused by a direct impact or by acceleration alone. In addition to the damage caused at the moment of injury, brain trauma causes 'secondary injury', a variety of events that take place in the minutes and days following the injury. These processes, which include alterations in the cerebral blood flow and the pressure within the skull contribute substantially to the damage from the initial injury. |

|

|

Each year, an estimated two million TBI-related deaths, hospitalizations, and emergency department visits occur in the United States. Of these patients, 56,000 die and 300,000 are hospitalized. 1.7 million patients are treated and released from an emergency department.13

Conventional Method of Treatment

The present treatment methodology for Traumatic Brain Injury is centered on the treatment of symptoms. There are currently no treatments that target the underlying pathology of Traumatic Brain Injury.

Currently used medications used to treat Traumatic Brain Injury, such as narcotics and antidepressants, have many side effects including addiction, arrhythmia, liver and kidney damage, abdominal problems, nausea, and vomiting.

Potential for Feldetrex™

Our proprietary Feldetrex™ candidate drug has a mechanism of action via a manipulation of central nervous system neurotransmitters, which involves the cerebral cortex, limbic system, and spinothalamic tracts. Feldetrex™ utilizes a low dosage of Naltrexone which has been shown in multiple medical articles, in the medical literature, to increase endogenous enkephalins. We have not independently conducted medical or laboratory tests to show the mechanism of action of this medication.

____________________

| 13 | http://www.caregiver.org/caregiver/jsp/content_node.jsp?nodeid=441 |

| 13 |

Development Plans

Central Nervous System Disorders

Feldetrex™

Feldetrex™, our candidate drug, is a treatment for decreasing the morbidity of Multiple Sclerosis patients. Multiple Sclerosis is a chronic, progressive illness that affects the nerves in the brain, spinal cord, and other parts of the central nervous system. Multiple Sclerosis affects over 400,000 people in the United States and may affect 2.5 million people worldwide. The licensor under our License Agreements has two pending provisional patent applications with variations featuring oral and/or possibly transdermal medication applications. We intend to compare the efficacy of Feldetrex™ to the standard injectable medications currently utilized to treat Multiple Sclerosis, such as Betaseron (Interferon beta-1b), Avonex (Interferon beta-1a), and Copaxone (Glatiramer acetate). Additionally, we plan on utilizing Feldetrex™ in peer reviewed medical studies at major medical centers to ascertain the efficacy of Feldetrex™ in symbiotically increasing the efficacy of the standard FDA approved Multiple Sclerosis injection drugs.

Feldetrex™ Development Plans

We don't have the financial ability to conduct the necessary clinical trials for FDA approval of our Feldetrex™ product candidate. We intend to enter into agreements with larger pharmaceutical companies as collaboration partners, in part to help cover the cost of such processes.

At the conclusion of the studies involving Feldetrex™, we plan to publish the results in established medical journals and subsequently contact the large pharmaceutical firms for a possible sale or license of the rights to conduct clinical trials, manufacture, and distribute Feldetrex™.

Infectious Diseases

The licensor under our License Agreements has filed a provisional patent application for the dialyzation of blood from a patient who is dying from septicemia. Septicemia is a rapidly fatal condition in which bacteria have infected the bloodstream of a patient. These patients subsequently suffer from rapid renal failure, encephalopathy, and heart failure unless the septicemia is quickly reversed. Each year approximately 200,000 Americans die from septicemia.14 The traditional treatment of septicemia has been intravenous antibiotics, which have limited efficacy and are highly toxic.

Our method of treatment is to use an extracorporeal methodology of blood dialysis in which the bacteria-infected blood is sterilized through a proprietary methodology of dialyzation in which the blood is placed into contact with antibiotics within the dialysis lumen for a specified period, which subsequently kills the bacterial pathogen with a sequential removal of the antibiotic in order to negate any toxicity to the treated patient. We anticipate that this method could be utilized in place of the standard methodology or could be utilized as an adjunctive treatment for intensive care unit patients.

____________________

14 | Longo, Dan (2011). Harrison's principles of internal medicine. (18th ed.). New York: McGraw-Hill. p. Chapter 271. |

| 14 |

Development Plans

Initial concept experimentations began in 2012. After proof of concept experimentations, we intend to implement a clinical hospital/doctor test plan for patients using the same contacts developed in the studies described above for Feldetrex™. We anticipate that these studies will be initiated after successful laboratory testing no earlier than 2014. Actual clinical trials with patients, conducted in conjunction with our collaboration partners, may continue for many years. We plan to contact the large medical firms, such as Johnson and Johnson, Pfizer, and Eli Lilly, to attempt to sell the rights to use our technology and conduct the anticipated clinical trials, beginning as early as mid-to-late 2014.

Oncology

The licensor under our License Agreements is currently developing applications for utilizing a proprietary methodology in which the cancer patient's blood is utilized to remove metastatic cancer cells. This is accomplished by dialyzing the patient's blood extracorporeally, and, through our proprietary methodology, placing the cancer cells in contact with anti-neoplastic agents within the lumen of the dialysis apparatus. We believe this extracorporeal methodology for cancer treatment has an enormous potentiality for decreasing the side effects of chemotherapy and irradiation treatment in cancer patients. Our methodology may also increase the efficacy of cancer treatment by allowing for much higher dosages of anti-neoplastic agents to be used through this extracorporeal methodology. Because this method completely avoids exposure of the patient's corpus to these anti-cancer agents, we believe dosages that cannot be normally tolerated can now be utilized in fighting the cancer.

Development Plans

We initiated laboratory tests to prove our cancer-fighting technology in late 2012. In 2013, we completed two breast oncology studies to test the effectiveness of a treatment proposed by Premier Biomedical, Inc. on small mice populations. Premier Biomedical, Inc. believes that the results of these studies will be published in a scientific journal in January 2014, although the results will ultimately be published at the discretion of the University of Texas at El Paso. We plan to undertake additional studies at a university/hospital during 2014. We estimate the cost for each of these studies to be between $300,000 and $500,000, including actual testing with cancer patients, which we anticipate funding from additional capital raises. At the anticipated successful conclusion of these studies, we plan to contact the large pharmaceutical/medical devices firms, such as Johnson & Johnson, Boston Scientific, Medtronics, Pfizer, and E. I. Lilly, to attempt to negotiate a partnership and/or sale of the technology.

Research and Development

Innovation by our research and development operations is very important to our success. Our goal is to discover, develop and bring to market innovative products and treatments that address major unmet medical needs, including initially, Multiple Sclerosis, Septicemia, and Cancer. We expect this goal to be supported by substantial research and development investments.

We plan on conducting research internally and may also through contracts with third parties, through collaborations with universities and biotechnology companies and in cooperation with pharmaceutical firms. We may also seek out promising compounds and innovative technologies developed by third parties to incorporate into our discovery or development methods and procedures or projects, as well as our future product lines, through acquisition, licensing or other arrangements.

| 15 |

In addition to discovering and developing new products, methods and procedures of treatment and treatments, we expect our research operations to add value to our existing products and methods and procedures of treatment in development by improving their effectiveness and by discovering new uses for them.

Marketing

Currently, we manage our marketing responsibilities internally. We intend to seek a partnership with and/or sale of our product candidates/technologies to large pharmaceutical and/or medical devices firms. These firms have the ability to effectively promote our product candidates to healthcare providers and patients. Through their marketing organizations, they can explain the approved uses, benefits and risks of our product candidates to healthcare providers, such as doctors, nurse practitioners, physician assistants, pharmacists, hospitals, Pharmacy Benefit Managers (PBMs), Managed Care Organizations (MCOs), employers and government agencies. They also market directly to consumers in the U.S. through direct-to-consumer advertising that communicates the approved uses, benefits, and risks of our product candidates while continuing to motivate people to have meaningful conversations with their doctors. In addition, they sponsor general advertising to educate the public on disease awareness, important public health issues, and patient assistance programs.

The large pharmaceutical/medical devices firms principally sell their products to wholesalers, but they also sell directly to retailers, hospitals, clinics, government agencies and pharmacies and also work with MCOs, PBMs, employers and other appropriate healthcare providers to assist them with disease management, patient education and other tools that help their medical treatment routines.

Patents and Intellectual Property Rights

We have licensed three U.S. patents: Sequential Extracorporeal Treatment of Bodily Fluids, U.S. Patent No. 9,216,386 and Utilization of Stents for the Treatment of Blood Borne Carcinomas, U.S. Patent No. 8,758,287 (both from Marv Enterprises, LLC), and Medication and Treatment for Disease, U.S. Patent No. 8,865,733 (from Altman Enterprises, LLC), in the areas of cancer, sepsis, and multiple sclerosis. We expect these patents to cover the medical treatments discussed above for Multiple Sclerosis, Blood Sepsis, and Cancer and be effective until 2029. Marv and Altman have licensed these technologies to us pursuant to the terms of the License Agreements. Because our license agreements cover the patents and "all applications of the United States and foreign countries that claim priority to the above PCT applications, including any non-provisionals, continuations, continuations-in-part, divisions, reissues, re-examinations or extensions thereof," we anticipate that other technologies that derive from these patents will also belong to us and are covered by the license agreements.

Patents extend for twenty years from the date of patent filing. The actual protection afforded by a patent, which can vary from country to country, depends upon the type of patent, the scope of its coverage and the availability of legal remedies in the country.

| 16 |

Dr. Felder is the owner of the Feldetrex mark, and has also licensed this to us pursuant to the terms of the License Agreements.

We expect our patent and related rights to be of material importance to our business.

Competition

Our business is conducted in an intensely competitive and often highly regulated market. Our treatments face competition in the form of branded drugs, generic drugs and the currently practiced treatments for Multiple Sclerosis, Blood Sepsis, and Cancer. The principal forms of competition include efficacy, safety, ease of use, and cost effectiveness. Where possible, companies compete on the basis of the unique features of their products, such as greater efficacy, better patient ease of use or fewer side effects. A lower overall cost of therapy is also an important factor. Products that demonstrate fewer therapeutic advantages must compete for inclusion based primarily on price. Though the means of competition vary among product categories, demonstrating the value of our medications and procedures will be a critical factor for our success.

Our competitors include large worldwide research-based drug companies, smaller research companies with more limited therapeutic focus, and generic drug manufacturers. We compete with other companies that manufacture and sell products that treat similar diseases as our major medications and procedures.

Environment

Our business may be subject to a variety of federal, state and local environmental protection measures. We intend to comply in all material respects with applicable environmental laws and regulations.

Regulation

We expect our business to be subject to varying degrees of governmental regulation in the United States and any other countries in which our operations are conducted. In the United States, regulation by various federal and state agencies has long been focused primarily on product safety, efficacy, manufacturing, advertising, labeling and safety reporting. The exercise of broad regulatory powers by the FDA continues to result in increases in the amounts of testing and documentation required for FDA clearance of new drugs and devices and a corresponding increase in the expense of product introduction. Likewise, the approval process with the FDA is estimated to take approximately seven (7) years from the time it is started. Similar trends are also evident in major markets outside of the United States.

| 17 |

Clinical trials are a set of procedures in medical research conducted to allow safety (or more specifically, information about adverse drug reactions and adverse effects of other treatments) and efficacy data to be collected for health interventions (e.g., drugs, diagnostics, devices, therapy protocols). These trials can take place only after satisfactory information has been gathered on the quality of the non-clinical safety, and Health Authority/Ethics Committee approval is granted in the country where the trial is taking place.

Depending on the type of product and the stage of its development, investigators enroll healthy volunteers and/or patients into small pilot studies initially, followed by larger scale studies in patients that often compare the new product with the currently prescribed treatment. As positive safety and efficacy data are gathered, the number of patients is typically increased. Clinical trials can vary in size from a single center in one country to multicenter trials in multiple countries.

Due to the sizable cost a full series of clinical trials may incur, the burden of paying for all the necessary people and services is usually borne by the sponsor who may be a governmental organization, a pharmaceutical, or biotechnology company. Since the diversity of roles may exceed resources of the sponsor, often a clinical trial is managed by an outsourced partner such as a contract research organization or a clinical trials unit in the academic sector.

The regulatory agencies under whose purview we intend to operate have administrative powers that may subject us to such actions as product withdrawals, recalls, seizure of products and other civil and criminal sanctions.

Because we intend to seek a partnership with and/or sale of our product candidates/technologies to large pharmaceutical and/or medical devices firms, we anticipate that a larger pharmaceutical company will undertake to navigate the regulatory pathway, including conducting clinical trials, for a product such as Feldetrex™.

Employees

As of the date hereof, we do not have any employees other than our two officers and four additional directors that work on a part-time basis. Our officers and directors will continue to work for us for the foreseeable future. We anticipate hiring appropriate personnel on an as-needed basis, and utilizing the services of independent contractors as needed.

| 18 |

ITEM 1A. – RISK FACTORS.

As a smaller reporting company we are not required to provide a statement of risk factors. Nonetheless, we are voluntarily providing risk factors herein.

Any investment in our common stock involves a high degree of risk. You should consider carefully the following information, together with the other information contained in this Annual Report, before you decide to buy our common stock. If one or more of the following events actually occurs, our business will suffer, and as a result our financial condition or results of operations will be adversely affected. In this case, the market price, if any, of our common stock could decline, and you could lose all or part of your investment in our common stock.

We are developing medical treatments for Alzheimer's disease, multiple sclerosis, amyotrophic lateral sclerosis, fibromyalgia, traumatic brain injury, blood sepsis and virema, and cancer. We face risks in developing our product candidates and services and eventually bringing them to market. We also face risks that our business model may become obsolete. The following risks are material risks that we face. If any of these risks occur, our business, our ability to achieve revenues, our operating results and our financial condition could be seriously harmed.

Risk Factors Related to the Business of the Company

We have a limited operating history and our financial results are uncertain.

We have a limited history and face many of the risks inherent to a new business. As a result of our limited operating history, it is difficult to accurately forecast our potential revenue. We were incorporated in Nevada in 2010. Our revenue and income potential is unproven and our business model is still emerging. Therefore, there can be no assurance that we will provide a return on investment in the future. An investor in our common stock must consider the challenges, risks and uncertainties frequently encountered in the establishment of new technologies, products and processes in emerging markets and evolving industries. These challenges include our ability to:

· execute our business model; · create brand recognition; · manage growth in our operations; · create a customer base in a cost-effective manner; · retain customers; · access additional capital when required; and · attract and retain key personnel.

There can be no assurance that our business model will be successful or that it will successfully address these and other challenges, risks and uncertainties.

We will need additional funding in the future, and if we are unable to raise capital when needed, we may be forced to delay, reduce or eliminate our product candidate development programs, commercial efforts, or sales efforts.

Developing products and methods and procedures of treatment and marketing developed products is costly. We will need to raise substantial additional capital in the future in order to execute our business plan and help us and our collaboration partners fund the development and commercialization of our product candidates.

| 19 |

In 2015, we raised funds primarily through convertible debt financing, and in 2014, we raised funds through a public equity offering. We may need to finance future cash needs through public or private equity offerings, debt financings or strategic collaboration and licensing arrangements. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience additional dilution, and debt financing, if available, may involve restrictive covenants and may result in high interest expense. If we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our product candidates, processes and technologies or our development projects or to grant licenses on terms that are not favorable to us. We cannot be certain that additional funding will be available on acceptable terms, or at all. If adequate funds are not available from the foregoing sources, we may consider additional strategic financing options, including sales of assets, or we may be required to delay, reduce the scope of, or eliminate one or more of our research or development programs or curtail some of our commercialization efforts of our operations. We may seek to access the public or private equity markets whenever conditions are favorable, even if we do not have an immediate need for additional capital.

We do not own our technologies, they are owned by, and licensed from, two entities that are under the control of the Chairman of our Board of Directors.

We do not currently own the technologies necessary to conduct our operations. The patents necessary to pursue our intended business plan are under the control of our Chairman of the Board of Directors. As consideration for the two licenses, we agreed to (i) pay a royalty of five percent (5%) of any sales of products using the technology, with no minimum royalty and (ii) reimburse the licensor for any costs incurred in pursuing its proprietary rights in the licensed technology and pay any costs incurred for maintaining or obtaining the licensors' proprietary rights in the licensed technology in the U.S. and in extending the intellectual property to other countries around the world. The licensor has the sole discretion to select other countries into which exclusive rights in the licensed technology may be pursued, and if we decline to pay those expenses, then the licensor may pay said expenses and our licensed rights in those countries will revert to the licensor. The license agreements contain provisions that require us to indemnify the licensor for any claims, including costs of litigation, brought against them related to the licenses, and require us to maintain insurance that may be burdensome. In the event of a breach of our obligations under the license agreements, the licensors are entitled to various damages and remedies, up to and including termination of said license agreements. The licensors are entities under the control of Dr. Mitchell S. Felder, the Chairman of our Board of Directors. While Dr. Felder is one of our Company's founders and the Chairman of our Board of Directors, there can be no assurance that he will extend the offer to license these technologies to us in the future as currently contemplated.

We do not intend to take our FeldetrexÒ product candidate past the development stage, but instead intend to enter into collaboration agreements with collaboration partners. If we are unable to enter into an agreement with collaboration partners, our FeldetrexÒ product candidate cannot be marketed, and it will not generate revenue for us.

We do not intend to conduct clinical trials on our FeldetrexÒ product candidate. We instead intend to enter into one or more collaboration agreements with third parties to do so. However, we have not entered into any such agreements, or discussions for any such agreements, and we cannot guarantee that we will be successful in doing so. If we do not find a collaboration partner, the FeldetrexÒ product candidate cannot be marketed, and it will not generate any revenue for us.

| 20 |

The failure to generate revenue from our FeldetrexÒ product candidate will have a materially adverse effect on our overall revenues, profitability, and we may not be able to continue operations.

If an individual used any of our product candidates prior to their approval by the FDA or other regulatory authority, we face risks of unforeseen medical problems, and up to a complete ban on the sale of our product candidates.

The efficacy and safety of pharmaceutical products is established through a process of clinical testing under Federal Drug Administration ("FDA") oversight. No individual is authorized or should use any of our products outside of an established process of clinical testing and FDA approval and authorization. If an individual were to use one of our product candidates in such a manner, we cannot predict the potential medical harm to that individual. If such an event were to occur, the FDA or similar regulatory agency might impose a complete ban on the sale or use of our candidate products.

The FDA might not approve our product candidates for marketing and sale.

We intend to enter into agreements with larger pharmaceutical companies as collaboration partners, in part to help cover the cost of seeking regulatory approvals. We believe that FDA approval of some of our product candidates will need to undergo a full investigational new drug (IND) application with the FDA, including clinical trials. There can be no assurance that the FDA will approve our IND application or any other applications. Failure to obtain the necessary FDA approval will have a material negative affect on our operations. While we intend to license our FeldetrexÒ product to a larger pharmaceutical company, they in turn, may not be able to obtain the necessary approval to market and sale the product.

We may fail to deliver commercially successful new product candidates, methods and procedures of treatment, and treatments.

Our technology is at an early stage of research and development. As of the date hereof, we have partnered with the University of Texas at El Paso (UTEP), and protocol for animal testing procedures is being developed in conjunction with UTEP at this time. Subsequent clinical trials on human patients will be coordinated with our development partners in the near future. We have also entered into a Cooperative Research and Development Agreement (the "CRADA") with the Clinical Investigation Regulatory Office U.S. Army Medical Research and Material Command ("CIRO") for performing medical research, development, testing and evaluation. Pursuant to the CRADA, we will collaborate with the U.S. Army Medical Research Material Command at the William Beaumont Army Medical Center ("WBAMC") on the "Clearance of Specific Immunomodulators from Cerebrospinal Fluid via Selective Dialysis," and more specifically, targeting the prevention of suicidal ideation and clinical depression, and assisting in the creation of antibodies in order to obtain a decrease in the neuropathologic findings in traumatic brain injuries.

| 21 |

The development of commercially viable new products and methods and procedures of treatment, as well as the development of additional uses for existing products and methods and procedures of treatment, is critical to our ability to generate sales and/or sell the rights to manufacture and distribute our product and process candidates to another firm. Developing new products and methods and procedures of treatment is a costly, lengthy and uncertain process. A new product or process candidate can fail at any stage of the development or commercialization, and one or more late-stage product or process candidates could fail to receive regulatory approval.

New product and process candidates may appear promising in development, but after significant investment, fail to reach the market or have only limited commercial success. This, for example, could be as a result of efficacy or safety concerns, inability to obtain necessary regulatory approvals, difficulty or excessive costs to manufacture, erosion of patent term as a result of a lengthy development period, infringement of third-party patents or other intellectual property rights of others or inability to differentiate the product or process adequately from those with which it competes.

The commercialization of product and process candidates under development may not be profitable.

In order for the commercialization of our product candidates to be profitable, our product and process candidates must be cost-effective and economical to manufacture on a commercial scale. Furthermore, if our product candidates and methods and procedures of treatment do not achieve market acceptance, we may not be profitable. Subject to regulatory approval, we expect to incur significant development, sales and marketing expenses in connection with the commercialization of our new product and process candidates. Even if we receive additional financing, we may not be able to complete planned development and marketing of any or all of our product or process candidates. Our future profitability may depend on many factors, including, but not limited to:

· the terms and timing of any collaborative, licensing and other arrangements that we may establish; · the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; · the costs of establishing manufacturing and production, sales, marketing and distribution capabilities; and · the effect of competing technological and market developments.

Even if our collaboration partners receive regulatory approval for our product and process candidates, we may not earn significant revenues from such product or process candidates. With respect to the product and methods and procedures of treatment candidates in our development pipeline that are being developed by or in close conjunction with third parties, our ability to generate revenues from such product and process candidates will depend in large part on the efforts of such third parties. To the extent that our collaboration partners are not successful in commercializing our product or process candidates, our revenues will suffer, we will incur significant additional losses and the price of our common stock will be negatively affected.

| 22 |

We may engage in strategic transactions that fail to enhance stockholder value.

From time to time, we may consider possible strategic transactions, including the potential acquisitions or licensing of products or technologies or acquisition of companies, and other alternatives with the goal of maximizing stockholder value. We may never complete a strategic transaction, and in the event that we do complete a strategic transaction, implementation of such transactions may impair stockholder value or otherwise adversely affect our business. Any such transaction may require us to incur non-recurring or other charges and may pose significant integration challenges and/or management and business disruptions, any of which could harm our results of operation and business prospects.

Our business is heavily regulated by governmental authorities, and failure to comply with such regulation or changes in such regulations could negatively impact our financial results.

We must comply with a broad range of regulatory controls on the testing, approval, manufacturing and marketing of our product candidates, procedures and other treatments, particularly in the United States and countries of the European Union, that affect not only the cost of product development but also the time required to reach the market and the uncertainty of successfully doing so. Health authorities have increased their focus on safety when assessing the benefit risk/balance of drugs in the context of not only initial product approval but also in the context of approval of additional indications and review of information regarding marketed products. Stricter regulatory controls also heighten the risk of changes in product profile or withdrawal by regulators on the basis of post-approval concerns over product safety, which could reduce revenues and can result in product recalls and product liability lawsuits. There is also greater regulatory scrutiny, especially in the United States, on advertising and promotion and in particular on direct-to-consumer advertising.

The regulatory process is uncertain, can take many years, and requires the expenditure of substantial resources. In particular, proposed human pharmaceutical therapeutic product requirements set by the FDA in the United States, and similar health authorities in other countries, require substantial time and resources to satisfy. We may never obtain regulatory approval for our product and process candidates.

We may not be able to gain or sustain market acceptance for our services and product candidates.

Failure to establish a brand and presence in the marketplace on a timely basis could adversely affect our financial condition and results of operations. Moreover, there can be no assurance that we will successfully complete our development and introduction of new products or product enhancements, or methods and procedures of treatment or that any such product candidates or methods and procedures of treatment will achieve acceptance in the marketplace. We may also fail to develop and deploy new products and product enhancements on a timely basis.

| 23 |

The market for products, methods and procedures of treatment and services in the pharmaceuticals industry is highly competitive, and we may not be able to compete successfully.

We intend to operate in highly competitive markets. We will likely face competition both from proprietary products of large international manufacturers and producers of generic pharmaceuticals. Most of the competitors in the industry have longer operating histories and significantly greater financial, technical, marketing and other resources than us, and may be able to respond more quickly than we can to new or changing opportunities and customer requirements. Also, many competitors have greater name recognition and more extensive customer bases that they can leverage to gain market share. Such competitors are able to undertake more extensive promotional activities, adopt more aggressive pricing policies and offer more attractive terms to purchasers than we can.

Significant product innovations, technical advances or the intensification of price competition by competitors could adversely affect our operating results. We cannot predict the timing or impact of competitive products or their potential impact on sales of our product candidates.

If any of our major product candidates or methods and procedures of treatment were to become subject to a problem such as unplanned loss of patent protection, unexpected side effects, regulatory proceedings, publicity affecting doctor or patient confidence or pressure from competitive products and methods and procedures of treatment, or if a new, more effective treatment should be introduced, the adverse impact on our revenues and operating results could be significant.

We are dependent on the services of key personnel and failure to attract qualified management could limit our growth and negatively impact our results of operations.

We are highly dependent on the principal members of our management and scientific staff and certain key consultants, including our Chief Executive Officer and the Chairman of our Board of Directors. We will continue to depend on operations management personnel with pharmaceutical and scientific industry experience. At this time, we do not know of the availability of such experienced management personnel or how much it may cost to attract and retain such personnel. The loss of the services of any member of senior management or the inability to hire experienced operations management personnel could have a material adverse effect on our financial condition and results of operations.

If physicians and patients do not accept our current or future product candidates or methods and procedures of treatment, we may be unable to generate significant additional revenue, if any.

The products and methods and procedures of treatment that we may develop or acquire in the future may fail to gain market acceptance among physicians, health care payors, patients and the medical community. Physicians may elect not to recommend these treatments for a variety of reasons, including:

· timing of market introduction of competitive drugs; · lower demonstrated clinical safety and efficacy compared to other drugs or treatments; · lack of cost-effectiveness; · lack of availability of reimbursement from managed care plans and other third-party payors; · lack of convenience or ease of administration; · prevalence and severity of adverse side effects; · other potential advantages of alternative treatment methods; and · ineffective marketing and distribution support.

| 24 |

If our product candidates and processes fail to achieve market acceptance, we would not be able to generate significant revenue.

We are exposed to the risk of liability claims, for which we may not have adequate insurance.

Since we participate in the pharmaceutical industry, we may be subject to liability claims by employees, customers, end users and third parties. We do not currently have product liability insurance. We intend to have proper insurance in place; however, there can be no assurance that any liability insurance we purchase will be adequate to cover claims asserted against us or that we will be able to maintain such insurance in the future. We intend to adopt prudent risk management programs to reduce these risks and potential liabilities; however, we have not taken any steps to create these programs and have no estimate as to the cost or time required to do so and there can be no assurance that such programs, if and when adopted, will fully protect us. We may not be able to put risk management programs in place, or obtain insurance, if we are unable to retain the necessary expertise and/or are unsuccessful in raising necessary capital in the future. Adverse rulings in any legal matters, proceedings and other matters could have a material adverse effect on our business.

Pre-clinical and clinical trials are conducted during the development of potential products and other treatments to determine their safety and efficacy for use by humans. Notwithstanding these efforts, when our treatments are introduced into the marketplace, unanticipated side effects may become evident. Manufacturing, marketing, selling and testing our product candidates under development or to be acquired or licensed, entails a risk of product liability claims. We could be subject to product liability claims in the event that our product candidates, processes, or products under development fail to perform as intended. Even unsuccessful claims could result in the expenditure of funds in litigation and the diversion of management time and resources, and could damage our reputation and impair the marketability of our product candidates and processes. While we plan to maintain liability insurance for product liability claims, we may not be able to obtain or maintain such insurance at a commercially reasonable cost. If a successful claim were made against us, and we don't have insurance or the amount of insurance was inadequate to cover the costs of defending against or paying such a claim or the damages payable by us, we would experience a material adverse effect on our business, financial condition and results of operations.

Other companies may claim that we have infringed upon their intellectual property or proprietary rights.

We do not believe that our product candidates and methods and procedures violate third-party intellectual property rights; however, we have not had an independent party conduct a study of possible patent infringements. Nevertheless, we cannot guarantee that claims relating to violation of such rights will not be asserted by third parties. If any of our product candidates or methods and procedures of treatment are found to violate third-party intellectual property rights, we may be required to expend significant funds to re-engineer or cause to be re-engineered one or more of those product candidates or methods and procedures of treatment to avoid infringement, or seek to obtain licenses from third parties to continue offering our product candidates or methods and procedures of treatment without substantial re-engineering, and such efforts may not be successful.

| 25 |

In addition, future patents may be issued to third parties upon which our product candidates and methods and procedures of treatment may infringe. We may incur substantial costs in defending against claims under any such patents. Furthermore, parties making such claims may be able to obtain injunctive or other equitable relief, which effectively could block our ability to further develop or commercialize some or all of our products or methods and procedures of treatment in the United States or abroad, and could result in the award of substantial damages against us. In the event of a claim of infringement, we may be required to obtain one or more licenses from third parties. There can be no assurance that we will be able to obtain such licenses at a reasonable cost, if at all. Defense of any lawsuit or failure to obtain any such license could be costly and have a material adverse effect on our business.

Our success depends on our ability to protect our proprietary technology.

Our success depends, to a significant degree, upon the protection of our proprietary technology, and that of any licensors. Legal fees and other expenses necessary to obtain and maintain appropriate patent protection could be material. Insufficient funding may inhibit our ability to obtain and maintain such protection. Additionally, if we must resort to legal proceedings to enforce our intellectual property rights, the proceedings could be burdensome and expensive, and could involve a high degree of risk to our proprietary rights if we are unsuccessful in, or cannot afford to pursue, such proceedings.

Our licensors have been granted three U.S. patents: Sequential Extracorporeal Treatment of Bodily Fluids, U.S. Patent No. 9,216,386; Utilization of Stents for the Treatment of Blood Borne Carcinomas, U.S. Patent No. 8,758,287; and Medication and Treatment for Disease, U.S. Patent No. 8,865,733, in the areas of cancer, sepsis, and multiple sclerosis. We expect these patents to cover the medical treatments for Multiple Sclerosis, Blood Sepsis, and Cancer and be effective until 2029. Our licensors have licensed these technologies to us pursuant to the terms of the license agreements. We anticipate that other technologies that derive from these patents will also belong to us and are covered by the license agreements. However, we have not conducted thorough prior art or novelty studies, but we are not aware of existing prior art that would prevent us from obtaining patents on our product candidates or methods and procedures of treatment. Prior art preventing us from obtaining broad patent protection is a possibility. Inability to obtain valid and enforceable patent protection would have a material negative impact on our business opportunities and success. Because the patent positions of pharmaceutical and biotechnology companies are highly uncertain and involve complex legal and factual questions, the patents may not be granted on our applications, and any future patents owned and licensed by us may not prevent other companies from developing competing products or ensure that others will not be issued patents that may prevent the sale of our products or require licensing and the payment of significant fees or royalties. Furthermore, to the extent that: (i) any of our future products or methods are not patentable; (ii) such products or methods infringe upon the patents of third parties; or (iii) our patents or future patents fail to give us an exclusive position in the subject matter to which such patents relate, our business will be adversely affected. We may be unable to avoid infringement of third-party patents and may have to obtain a license, or defend an infringement action and challenge the validity of such patents in court. A license may be unavailable on terms and conditions acceptable to us, if at all. Patent litigation is costly and time consuming, and we may be unable to prevail in any such patent litigation or devote sufficient resources to even pursue such litigation. If we do not obtain a license under such patents, are found liable for infringement and are not able to have such patents declared invalid, we may be liable for significant monetary damages, encounter significant delays in bringing products to market or may be precluded from participating in the manufacture, use or sale of products or methods of treatment requiring such licenses.

| 26 |