Attached files

| file | filename |

|---|---|

| EX-10 - Max Sound Corp | jmjnote.htm |

| EX-10 - Max Sound Corp | iliadnote.htm |

| EX-10 - Max Sound Corp | toledonote.htm |

| EX-10 - Max Sound Corp | blackmountainnote.htm |

| EX-10 - Max Sound Corp | bayprivateequitynote.htm |

| EX-10 - Max Sound Corp | vecheryfamilytrustone.htm |

| EX-10 - Max Sound Corp | vecheryfamilytrusttwo.htm |

| EX-33 - CFO CERTIFICATION - Max Sound Corp | halperncertification10k2015.htm |

| EX-32 - COMNPANY CERTIFICATION - Max Sound Corp | companycertification10k2015.htm |

| EX-34 - CEO CERTIFICATION - Max Sound Corp | blaisurecertification10k2015.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to______.

Commission file number 000-51886

| MAX SOUND CORPORATION | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 26-3534190 | |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |

|

2902A Colorado Avenue Santa Monica, CA 90404 |

90404 | |

| (Address of principal executive offices) | (Zip Code) | |

| Registrant’s telephone number, including area code: 800-327-(MAXD) | ||

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.00001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o | |

|

Non-accelerated filer (Do not check if a smaller reporting company) |

o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The Aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of March 24, 2016 as approximately $3,821,090.

As of March 24, 2016, the registrant had 647,642,452 shares issued and outstanding.

Documents Incorporated by Reference:

None.

TABLE OF CONTENTS

| PART I | ||||||

| ITEM 1. | BUSINESS | 3 | ||||

| ITEM 1A. | RISK FACTORS | 8 | ||||

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 8 | ||||

| ITEM 2. | PROPERTIES | 8 | ||||

| ITEM 3. | LEGAL PROCEEDINGS | 8 | ||||

| ITEM 4. | MINE SAFETY DISCLOSURES | 8 |

| PART II | ||||||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 8 | ||||

| ITEM 6. | SELECTED FINANCIAL DATA | 6 | ||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 10 | ||||

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 17 | ||||

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 17 | ||||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 44 | ||||

| ITEM 9A. | CONTROLS AND PROCEDURES | 44 | ||||

| PART III | ||||||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 44 | ||||

| ITEM 11. | EXECUTIVE COMPENSATION | 45 | ||||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 47 | ||||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 47 | ||||

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 47 | ||||

| PART IV | ||||||

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 48 | ||||

| SIGNATURES | 49 |

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions.

Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to Max Sound Corporation, and “SEC” refers to the Securities and Exchange Commission.

PART I

ITEM 1. BUSINESS

Overview

Max Sound Corporation (“we,” “us,” “our,” or the “Company”) was incorporated in the State of Delaware on December 9, 2005 as 43010, Inc. to engage in any lawful corporate undertaking, including, but not limited to, locating and negotiating with a business entity for combination in the form of a merger, stock-for-stock exchange or stock-for-assets exchange. On October 7, 2008, pursuant to the terms of a stock purchase agreement, Mr. Greg Halpern purchased a total of 100,000 shares of our common stock from Michael Raleigh for an aggregate of $30,000 in cash. The total of 100,000 shares represents 100% of our issued and outstanding common stock at the time of the transfer. As a result, Mr. Halpern became our sole shareholder. As part of the acquisition, and pursuant to the Stock Purchase Agreement, Michael Raleigh, our then President, CEO, CFO, and Chairman resigned from all the positions he held in the company, and Mr. Halpern was appointed as our President, CEO CFO and Chairman. The original business model was developed by Mr. Halpern in September of 2008 and began when he joined the Company on October 7, 2008. In October 2008, we became a development stage company focused on creating an Internet search engine and networking web site.

From October 2008 until January 17, 2011, Mr. Halpern was our CEO, and during that time the Company was focused on developing their Internet search engine and networking web site. In January of 2010, the Company launched their Internet search engine and networking website. In 2011, the Company decided to abandon its social networking website. On May 11, 2010, the Company acquired the worldwide rights, title, and interest to all fields of use for MAX-D.

On January 17, 2011, Mr. Halpern resigned as the Company’s CEO and John Blaisure was appointed as CEO. In February of 2011, the Company elected to change its business operations and focus primarily on developing and launching the MAX-D technology. Our current website (www.maxsound.com) is used to showcase the MAX-D technology. On March 8, 2011, the Company changed its name to Max Sound Corporation, and its trading symbol on the OTC Bulletin Board to MAXD.

MAX Sound Corporation owns the worldwide rights to all fields of use to MAX-D HD Audio, which was invented by Lloyd Trammell, a top sound designer and audio engineer who helped develop and sell the first working Surround Sound System to Hughes Aircraft. Mr. Trammell, also developed MIDI for Korg and owns five patents in dimensional sound processing. We believe that MAX-D is to Audio what High Definition is to Video. MAX-D works by converting all audio files to their highest possible acoustically perfect equivalent without increasing files size or bandwidth usage.

On May 22, 2014, MAXD entered into a representation agreement with architect Eli Attia giving MAXD the exclusive rights to sue

violators of Eli Attia’s intellectual property rights. MAXD has since filed suit against Google, Inc., Flux Factory, and various executives of these companies for misappropriation of trade secrets.

No later than June 20, 2014, MAXD entered into a representation agreement with VSL Communications, Inc., making MAXD the exclusive agent to VSL to enforce all rights with respect to patented technology owned and controlled by VSL. In particular, the Company announced that it had acquired a worldwide license and representation rights to a patented video and data technology “Optimized Data Transmission System and Method” which enables end-user licensees to transport 100% of data bandwidth content in only 3% of the bandwidth with the identical lossless quality. Significantly, this represents thirty three times reduction associated with transport cost and the time it takes for the video or digital content to be viewed by an end-user. As described more fully in the Legal Proceedings Section, The Company has since filed suit against Google, Inc., YouTube, LLC, and On2 Technologies, Inc., alleging willful infringement of the patent.

On June 20, 2015, the Company entered into a license agreement with Santok LTD of United Kingdom (“Santok). The term of the agreement is three years. Santok will pay the Company a royalty fee of $1.50 for each licensed product. Santok guarantees to the Company a minimum total of 150,000 cumulative licensed product installation with a minimum total guaranteed value of $225,000 over the three years of the agreement. If the total royalty paid is less than the guaranteed value, Santok will pay the difference.

On July 13, 2015, the Company entered into a license agreement with Luna Mobile, Inc. of United States (“Luna). The term of the agreement is three years. Luna will pay the Company a royalty fee of $1.50 for each licensed product manufactured and sold.

Description of Our Business

Max Sound (MAX-D) is engaged in activities to sell and license products and services based on its patent-pending MAX-D HD Audio Technology for sound recording and playback that dramatically improves the listener’s experience. The MAXD-D HD Audio Technology delivers high definition audio without increasing file size.

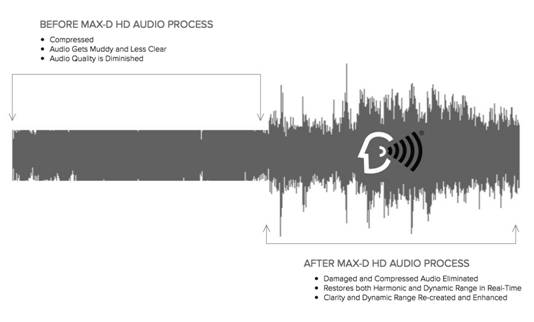

The Company is marketing MAX-D on the basis that it is to audio what HD is to video. MAX-D technology improves all types of audio; moreover, it is intended to be particularly valuable in improving the ever-growing use of compressed audio and video as used in mp3 files, iPods, internet, and satellite/terrestrial broadcasting. For example, a listener using a portable mp3 player with MAX-D will experience sound quality that is comparable to the original CD before it was converted into an mp3 file. In another example, cell phone users using a cell phone equipped with MAX-D will hear the other person's voice as if they are speaking directly in front of them. The Company believes that the MAX-D HD is better for a consumers hearing than today’s highly compressed audio and anticipate that continued research and development will support the Company’s position. In numerous consumer audio tests, MAXD-D HD sounded better to consumers than high resolution WAV files. Importantly, MAX-D HD remains one tenth the size of a WAV file, and in the Company’s opinion offers more clarity, dimension, articulation and impact in every range of the audio spectrum to the listener The Company’s current business model is to license the technology to content creators, manufacturers, and network broadcasters. The Company’s patent-pending technology stands customer ready today. The Company’s market pursuits include motion picture, music recording, video game, broadcasting, internet video and audio, automobile infotainment systems and consumer electronics.

The Company has a small and efficient staff of 10, including employees and sub-contractors, which has established business relationships with the leading companies in the Smartphone, Tablet, Chip, Music and Consumer Retail business. The Company is now executing its “Go To Market” strategy and sales programs as a first market mover solving the degraded compressed audio issues plaguing the audio currently being consumed. These companies dominate the multi-media and electronics technology arena providing audio delivery across all channels of the exploding smartphone tablet device phenomenon.

Qualcomm

The Company continues to pursue and renew its license with Qualcomm that enables our MAX-D technology to be on Qualcomm’s Snapdragon DSP. The license agreement is automatically renewable for one-year periods unless terminated by either party with 30 days prior written notice. By residing on the Qualcomm Snapdragon DSP, the MAX-D HD Audio Technology will have the ability to control and convert to HD Audio up to 8 audio processes simultaneously. This will include Cellular Voice transmission and termination, streaming video, streaming audio and all content stored on the device in memory. Qualcomm currently has a significant portion of the entire global chip market for all smartphones and tablets and they believe their growth rate mirrors the industry. We anticipate a strong adoption from the OEMs licensing the MAX-D technology. Now that MAX-D is part of the Snapdragon Chip, we believe MAX-D can be successfully deployed on the chip, and will have the ability to be offered to Qualcomm’s OEM’s on potentially hundreds of millions of devices every quarter.

Since the Company’s debut at the Qualcomm Upling conference in San Diego, we remain engaged with some of the largest OEM’s in the smart phone device market. Our sales and marketing team are continuing in advanced high-level strategic meetings with industry leaders in

the chip manufacturing and device hardware sectors. The Company is operating under several NDA’s and R&D Test Agreements with today’s most well known industry to implement and license the MAX-D HD onto their platforms.

About MAX-D:

The MAX-D software improves the sound heard from any device. Consumers have unknowingly sacrificed better audio quality for portable convenience and MAX-D rectifies this problem by:

analyzing what content is missing from the compressed audio signal; dynamically resynthesizing lost harmonics and natural sound fields in real time; maximizing the output potential of any device without increasing original file size; and without requiring consumers or OEM’s to change equipment or infrastructure.

MAX-D Benefits:Increases dynamic range, eliminates destructive effects of audio compression with no increase in file size or transmission bandwidth; High-resolution audio reproduction with an omni-directional sound field using only two speakers; “Real” three-dimensional sound field, versus artificial sound field created by competing technologies; and More realistic “live performance” quality of all recordings with optimal dynamic range, bass response and overall clarity

MAX-D Markets:

MAX-D can be used in a variety of venues and applications that provide audio capability, as categorized below:

· MOBILE - Communication | Voice – Data | Entertainment

· ENTERTAINMENT - Music | Movies | Audiobooks | Streaming Content | Live Events

· MULTI-MEDIA - Computing | Gaming

· CONSUMER - Home Theater | Portable Audio Players | Live Concert Sound | Automotive

We intend to license the MAX-D technology to creators of film, music, broadcast, and gaming content and selling them the service of applying the MAX-D technology to their end product. MAX-D is fully compatible with existing playback technology. We believe that no current competitor can provide the level of sound quality and end user experience that MAX-D delivers. MAX-D technology is ready for these markets now. We also intend to license the technology to manufacturers of consumer electronics products such as portable mp3 players, TV’s, Set Top Boxes, Car Stereo, Home Theatre, Smartphones and Tablets.

The Company is making positive inroads in the motion picture industry. Many of the post-production facilities are now requesting a MAX-D HD Box. The Max-D HD box is a small Windows-based computer that allows audio engineers to apply our patent pending MAX-D HD Audio technology to protect the original audio quality as it is compressed and distributed downstream throughout the internet in all compressed formats. We now have internal testing boxes completed, and anticipate delivering the first boxes to several markets in Q3 2016, and one of the top post film production houses is now engaged with us negotiating their first feature film deal to employ MAX-D HD Audio.

MAX-D Revenue Model:

The Company expects to derive its revenue through the licensing of its MAX-D technology. The Company is negotiating the licensing of its HD Audio Technology onto hardware and software across the primary vertical markets in Entertainment, Multi-media and Mobile Communications technology.

In 2015, the Company nearly tripled its Mobile App user base (with no dedicated marketing budget being employed –until we expect later in 2016). We currently have over 200,000 subscribers on the free version of our HD Audio App for MP3’s on Android andApple which supports iPhones and iPads.

In addition, the Company anticipates a Q2 2016 launch of a new streaming capable freemium app. This app which would offer millions of consumers a Max-D HD Audio experience with several revenue producing subscription add-ons and upgrades.

MAX-D Embedded Chip Solution: The MAX-D Embedded Chip technology is being designed to restore the natural sound field, causing compressed audio to sound like the original audio at playback time in any device. The audio does not have to be pre-processed or encoded. The Chip is being designed to be imbedded into TV Receivers, Digital Projection TVs, LCD TVs, Plasma TVs, Component DVD Players/Recorders, DVD Recorders, Set-Top Boxes, Personal Video Recorders (PVRs), Direct Broadcast Satellite (DBS) Receivers, Personal Computers, Satellite Radio Receivers, Mobile Video Devices, Domestic Factory Installed Auto Sound, Camcorders, MP3 Players, Electronic Gaming Hardware, Wireless Telephones, Cell Phones, and Personal Digital Assistants (PDAs).

MAX-D Dynamic Software Module: Max Sound has delivered and is working to implement an application programming interface (“API”) for all Internet applications to process all audio/video content streamed or downloaded by consumers. Viable target candidates within the next 24 months include streaming movie and music services. Companies selling downloaded MP3’s are also expected to find immense value in our technology due to their dominance in web-based audio and video. This Module is a lossless dynamic process requiring no destructive encoding or decoding and needs no additional hardware or critical monitoring stage after processing. In addition, no specialized decoder is necessary on any audio system.

Technology

MAX-D is a unique approach to processing sound, based on the physics of acoustics rather than electronics. Remarkably simple to deploy, MAX-D is a new technology that dramatically raises the standard for sound quality, with no corresponding increase in file size or transmission channel bandwidth. This is accomplished by processing audio with our proprietary, patent-pending process. This embedded and duplicating format either remains the same, or can be converted to whatever format the user desires, while retaining unparalleled fidelity and dynamic range.

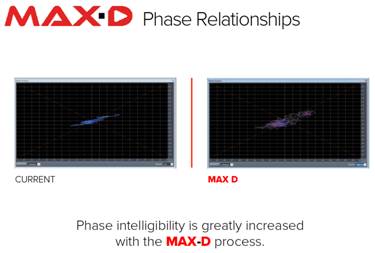

MAX-D restores the original recorded acoustical space in any listening environment. MAX-D is the only technology that both aligns phase and corrects phase distortion in a completed recording. MAX-D supplies missing audio content by adding acoustics and frequency response lost in the original recording or in the compression and transmission processes. MAX-D corrects and optimizes harmonic content and low frequency responses, greatly enhancing acoustic accuracy and we believe reduces ear fatigue.

MAX-D integrates time, phase, harmonics, dynamics, and sub-harmonic region optimizations in a fully dynamic fashion. MAX-D is a lossless dynamic process, requiring no destructive encoding/decoding process, or any specialized decoder at all. MAX-D needs no additional hardware or critical monitoring stage after processing. The end result is that every aspect of audio processed with MAX-D - voice, instrument, or special effects - sounds refreshingly clear, realistic, and natural. The MAX-D HD Audio Technology creates an optimum sound field throughout every listening environment – from the corners of a theater; on your living room couch; to the back seat of your car.

MAX-D HD Audio Technology requires no equipment changeover and can be embedded into any product (e.g. speakers, headphones, mobile devices), or online content delivery systems (e.g. streaming, cable, video games) to provide better sounding audio.

Market

MAX-D products and services are designed and intended to solve problems and add value to audio components of several separate industries, including consumer electronics, motion picture, broadcasting, video game, recording, cell phone, internet, and VOIP applications.

The Company is now positioned to pursue the following expansion strategies:

· Re-launch MAX-D audio on the Qualcomm Snapdragon DSP, which stands to make MAX-D audio available on potentially hundreds of millions of devices that can be licensed OEMs around the world.

· Grow the MAX-D HD Audio Apps user base and begin selling a paid version of the App.

· Deploy MAX-D APIs for use in streaming online Video/Audio and stand-alone Audio services.

Competition

The Company’s management believes there are no current competitors capable of delivering the high quality of audio products and services produced by the company. Although other companies, like DTS or Dolby, have technologies that enhance sound; we do not believe these technologies negatively affect the Company because the MAX-D process can enhance the other audio company’s technology.

We believe we will be considered friendly competition in the future for three reasons; (1) we believe that MAX-D technology delivers the best sound quality available today, (2) MAX-D does not require any additional equipment; and (3) MAX-D makes any competition’s audio processes sound better.

Intellectual Property

Max-D and HD Audio technologies and designs are Patent Pending and Trademarked. On February 8, 2011, the words “Max Sound” were issued to the Company by the U.S. Patent and Trademark office under Serial Number 85050705, and the words “HD Audio” are pending under Serial Number 85232456 for the following applications: Computer application software for mobile phones, namely, software for HD audio; Computer hardware and software systems for delivery of improved HD audio; Computer hardware for communicating audio, video and data between computers via a global computer network, wide-area computer networks, and peer-to-peer computer networks; Computer software for manipulating digital audio information for use in audio media applications; Computer software to control and improve computer and audio equipment sound quality; Digital materials, namely, CD's, DVD's, MP3's, streaming media, movies, videos, music, concerts, news, pre-recorded video, downloadable audio and video and high definition audio and video featuring improved HD audio; Digital media, namely, pre-recorded DVDs, downloadable audio and video recordings, and CDs featuring and promoting improved HD audio; Digital media, namely, pre-recorded video cassettes, digital video discs, digital versatile discs, downloadable audio and video recordings, DVDs, and high definition digital discs featuring improved HD audio; Digital media, namely, CD's, DVD's, MP3's, movies, videos, music, concerts, news, pre-recorded video, downloadable and streaming audio and video and high definition audio and video featuring improved HD audio; Downloadable MP3 files, MP3 recordings, on-line discussion boards, webcasts, webinars and podcasts featuring music, audio books in the field of entertainment and general subjects, and news broadcasts; Software to control and improve audio equipment sound quality; Sound recordings featuring improved HD audio.

The Company is in the process of filing 17 additional patents for its technology.

Research and Development

The Company throughout 2015 has continued to focus on research and development initiatives concerning the MAX-D HD Audio Technologies now that the Company is entering into the licensing phase. The Company is working with strategic partners who are now integrating or assisting with the development of the Company’s application on their respective platforms. The Company’s development team is concentrating on enhancing the existing MAX-D HD, and is also developing additional API interfaces to include32 and 64 bit options. The MAX-D API can be deployed across all streaming platforms along with most audio/video web-based services including audio hardware such as speakers and audio receivers including car smart head units. In 2014, the Company completed testing for industry the MAX-D HD Audio boxes and the MAXD –D Accurate Voice. Significantly, in 2015 the Company achieved breakthroughs in the software development of MAX-D HD for Android OS, Windows OS, Apple OS, a universal MAX-D APIand development activities relating to the build-out for the Company’s App for Windows Linux and IOS, as well as the MAX-D’s 300 KB API.

Employees

As of December 31, 2015, we had 10 employees, of which all were full-time. Since that time, the Company had reduced its overhead and staff by 6 employees.

Anticipated Milestones for the Next Twelve Months

For the next twelve months, our most important goal is to become cash flow positive by growing Max Sound HD Audio sales through licensing and recurring revenue streams. Our goal is to have this growth improve our stock value and investor liquidity. We expect our financial requirements to increase with the additional expenses needed to promote the MAX-D HD Audio Technology. We plan to fund these additional expenses by equity loans from our existing lines of credit and we are also considering various private funding opportunities until such time that our revenue stream is adequate enough to provide the necessary funds.

Over the next twelve months, our focus will be on achieving and implementing the following:

· The marketing of the MAX-D Android and Windows APP for tablets and smartphones in addition to an APP that will run on the Apple OS into the direct consumer market. This includes the ability to upgrade to a paid version and stream content through the MAX-D Apps.

· MAX-D is in the Qualcomm Snapdragon DSP through the Hexagon program. We will seek adoption of the MAX-D HD Audio Technology by Qualcomm’s OEMs.

· Deployment of Max Sound HD Audio appliances for key industry engineers and internet streaming companies allowing them to broadcast in MAX-D.

Long-Term Goals

· Increase Max Sound’s customer base substantially producing large consumer adoption and branding.

· Make a financial return on the investments of the last year, with increased sales and reduction of indirect costs, to become cash flow positive and then profitable in 2016.

· Increased adoption by industry leaders and differentiated as a deliverer of game-changing audio technology.

Where You Can Find More Information

We are a publicly reporting company under the Exchange Act and are required to file periodic reports with the Securities and Exchange Commission. The public may read and copy any materials we file with the Commission at the SEC's Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission and state the address of that site (http://www.sec.gov). In addition, you can obtain all of the current filings at our Internet website at www.maxsound.com.

ITEM 1A. RISK FACTORS

Not applicable for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable for smaller reporting companies.

ITEM 2. PROPERTIES.

Office Arrangements and Operational Activities

In November 2010, we leased our MAX-D post-production facility at 2902A Colorado Ave., Santa Monica, CA, 90404. The lease is for two years with one-year renewable options. In February 2016 the Company terminated its month-to-month lease at this address.

ITEM 3. LEGAL PROCEEDINGS.

See NOTE 8 titled LITIGATION for information on Legal Proceedings.

No assurance can be given as to the ultimate outcome of these actions or its effect on the Company.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our shares of common stock are traded on the OTC Bulletin Board under the symbol “MAXD.” The following table sets forth, for the period indicated, the high and low bid quotations for the Company’s common stock. These quotations represent inter-dealer quotations, without adjustment for retail markup, markdown or commission, and may not represent actual transactions.

Price

| High | Low | |||||||

| 2014 | ||||||||

| First quarter | $ | .22 | $ | .09 | ||||

| Second quarter | $ | .18 | $ | .08 | ||||

| Third quarter | $ | .28 | $ | .08 | ||||

| Fourth quarter | $ | .13 | $ | .08 | ||||

| 2015 | ||||||||

| First quarter | $ | .07 | $ | .02 | ||||

| Second quarter | $ | .10 | $ | .03 | ||||

| Third quarter | $ | .04 | $ | .02 | ||||

| Fourth quarter | $ | .05 | $ | .01 |

Holders

As of December 31, 2015, in accordance with our transfer agent records, we had 2272 record holders of our Common Stock. This number excludes individual stockholders holding stock under nominee security position listings.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Securities Authorized For Issuance Under Equity Compensation Plans.

None.

Stock Option Grants

See NOTE 6 - STOCKHOLDERS’ EQUITY, Section 2(c)

Recent Sales of Unregistered Securities

Note Conversions

See NOTE 3 - DEBT

Compensation-based Issuances

See NOTE 7 - COMMITMENTS

The Company determined that the securities described above were issued in transactions that were exempt from the registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereunder. This determination was based on the non-public manner in which we offered the securities and on the representations of the recipients of the securities, which included, in pertinent part, that they were “accredited investors” within the meaning of Rule 501 of Regulation D promulgated under the Securities Act, that they were acquiring such securities for investment purposes for their own account and not with a view toward resale or distribution, and that they understood such securities may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following plan of operation provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto. This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Overview

We were incorporated in the State of Delaware as of December 9, 2005 as 43010, Inc. to engage in any lawful corporate undertaking, including, but not limited to, locating and negotiating with a business entity for combination in the form of a merger, stock-for-stock exchange or stock-for-assets exchange. On October 7, 2008, pursuant to the terms of a stock purchase agreement, Mr. Greg Halpern purchased a total of 100,000 shares of our common stock from Michael Raleigh for an aggregate of $30,000 in cash. The total of 100,000 shares represents 100% of our issued and outstanding common stock at the time of the transfer. As a result, Mr. Halpern became our sole shareholder. As part of the acquisition, and pursuant to the Stock Purchase Agreement, Michael Raleigh, our then President, CEO, CFO, and Chairman resigned from all the positions he held in the company, and Mr. Halpern was appointed as our President, CEO CFO and Chairman. The current business model was developed by Mr. Halpern in September of 2008 and began when he joined the company on October 7, 2008. In October 2008, we became a development stage company focused on creating an Internet search engine and networking web site.

In May of 2010, we acquired the world-wide rights to all fields of use for Max Sound HD Audio Technology. In November of 2010, we opened our post-production facility for Max Sound HD Audio in Santa Monica California. In February of 2012, after several successful demonstrations to multi-media industry company executives, we decided to shift the focus of the Company to the marketing of the Max Sound HD Audio Technology and commenced the name change from So Act Network, Inc. to Max Sound Corporation and the symbol from SOAN to MAXD.

On December 3, 2012, the Company completed the purchase of the assets of Liquid Spins, Inc., a Colorado corporation (“Liquid Spins”). Pursuant to the Asset Purchase Agreement, the assets of Liquid Spins were exchanged for 24,752,475 shares of common stock of the Company (the “Shares”), equal to $10,000,000 and a purchase price of $.404 per share. The assets of Liquid Spins purchased included: record label distribution agreements; Liquid Spins technology inventory; independent arts programs; retail contracts for music distribution; physical inventory and office equipment; design and retail ready concepts; brand value; records; publishing catalog; and web assets. During 2015, the Company reviewed the intangible asset for impairment and determined that certain items had been impaired due to obsolescence. As a result of this review, the Company recorded an impairment loss of $15,703,617 that is recorded as impairment loss on intangible asset.

The Company has entered into agreements with a few technology companies’ to use our HD Audio solution, and is in negotiations with several other multi-media companies that we believe will utilize our HD Audio solution in the future.

Videos and news relating to the Company is available on the company website at maxd.audio.com. The MAX-D Technology Highlights Video summarizes the HD Audio™ process and shows the need for high definition (HD) Audio in several key vertical markets. The video explains MAX-D as what we believe to be the only dynamic HD Audio™ that is being offered to various markets.

Plan of Operation

We began our operations on October 8, 2008, when we purchased the Form 10 Company from the previous owners. Since that date and through 2014, we have conducted financings to raise initial start-up money for the building of our internet search engine and social networking website and to start our operations. In 2011, the Company shifted the focus of its business operations from their social networking website to the marketing of the Max Sound HD Audio Technology.

The Company believes that Max Sound HD Audio Technology is a game changer for several vertical markets whose demand will create revenue opportunities in 2016.

We expect our financial requirements to increase with the additional expenses needed to market and promote the MAX-D HD Audio Technology. We plan to fund these additional expenses through financings and through loans from our stockholders and/or officers based on existing lines of credit and we are also considering various private funding opportunities until such time that our revenue stream is adequate enough to provide the necessary funds.

Results of Operations

For the year ended December 31, 2015 and for the year ended December 31, 2014.

General and Administrative Expenses: Our general and administrative expenses were $3,014,325 for the year ended December 31, 2015 and $3,090,128 for the year ended December 31, 2014, representing a decrease of 75,803, or approximately 2.45%, as a result of decrease in the general operation of the Company included added personnel, product development and marketing of our Max Sound Technology.

Consulting Fees: Our consulting fees were $437,113 for the year ended December 31, 2015 and $505,597 for the year ended December 31, 2014, representing a decrease of $68,484, or approximately 14%. The Company has decreased the use of consultants to assist the Company.

Professional Fees: Our professional fees were $1,091,709 for the year ended December 31, 2015 and $1,025,241 for the year ended December 31, 2014, representing an increase of $64,968 or approximately 6%, as a result of ongoing litigation.

Compensation: Our compensation expenses were $946,596 for the year ended December 31, 2015 and $1,004,800 for the year ended December 31, 2014, representing a decrease of $58,204, or approximately 6%, as a result of our expensing of monthly compensation to our management and employees.

Net Loss: Our net loss for the year ended December 31, 2015 was $26,158,686, compared to net loss of $9,863,929 for the year ended December 31, 2014. While the operational expenses in marketing our Max Sound technology decreased from the same period of last year, the overall amount of our net loss substantially increased as a result of an increase in the change in the fair value of embedded derivative liability associated with the convertible debt and the impairment of the intangible asset..

Liquidity and Capital Resources

Revenues for the year ended December 31, 2015 and 2014, were $0 and $2,491, respectively. We have an accumulated deficit of $63,295,031 for the period from December 9, 2005 (inception) to December 31, 2015, and have negative cash flow from operations of $3,682,458 for the year ended December 31, 2015.

Our financial statements have been presented on the basis that it is a going concern, which contemplates the realization of revenues from our subscriber base and the satisfaction of liabilities in the normal course of business. We have incurred losses from inception. These factors raise substantial doubt about our ability to continue as a going concern.

From our inception through December 31, 2015, our primary source of funds has been the proceeds of private offerings of our common stock, private financing, and loans from stockholders. Our need to obtain capital from outside investors is expected to continue until we are able to achieve profitable operations, if ever. There is no assurance that management will be successful in fulfilling all or any elements of its plans.

Below is a summary of our capital-raising activities for the year ended December 31, 2015:

On October 7, 2015, the Company entered into a convertible note up to$1,000,000. The note matures on October 7, 2016 and bears an interest charge of 8%. The conversion price equals the “Variable Conversion Price”, which is 65% of the three lowest trading prices for the common stock during the three (3) trading day period prior to the conversion. The holder of the note has a right to convert all or any part of the outstanding unpaid principal amount into shares of common stock after six months. The Company received $1,000,000 of proceeds on October 13, 2015.

On October 7, 2015, the Company entered into a convertible note up to $115,500. The note matures on February 27, 2016 and bears an interest charge of 8%. The conversion price equals the “Variable Conversion Price”, which is 65% of the lowest two trading prices for the common stock during the ten (10) trading day period prior to the conversion. The holder of the note has a right to convert all or any part of the outstanding unpaid principal amount into shares of common stock after six months. The Company received $100,000 on October 8, 2015.

On October 21, 2015, the Company entered into an agreement whereby the Company will issue up to $110,250. The note matures on March 17, 2016 and bears an interest charge of 8%. The conversion price equals the “Variable Conversion Price”, which is 65% of the lowest trading prices for the common stock during the ten (10) trading day period prior to the conversion. The holder of the note has a right to convert all or any part of the outstanding unpaid principal amount into shares of common stock after six months. The Company received $33,000 of proceeds on October 21, 2015.

On October 26, 2015, the Company entered into an agreement whereby the Company will issue up to $1,000,000. The note matures on October 26, 2016 and bears an interest charge of 8%. The conversion price equals the “Variable Conversion Price”, which is 65% of the three lowest trading prices for the common stock during the three (3) trading day period prior to the conversion. The holder of the note has a right to convert all or any part of the outstanding unpaid principal amount into shares of common stock after six months. The Company received $1,000,000 of proceeds on October 28, 2015.

On October 31, 2015, the Company entered into a convertible note up to $218,325. The Company received $200,000 of proceeds less and $5,000 in legal costs and $13,325 in original issue discount. The note matures on October 31, 2016 and bears an interest charge of 8%. The conversion price equals the “Variable Conversion Price”, which is 65% of the lowest trading prices for the common stock during the ten (10) trading day period including the day the conversion notice is received. The holder of the note has a right to convert all or any part of the outstanding unpaid principal amount into shares of common stock after six months.

On November 11, 2015, the Company entered into a convertible, whereby the Company will issue up to $111,111 in a convertible note. The Company received $100,000 of proceeds less $11,111 in original issue discount. The note matures on November 30, 2016 and bears a onetime interest charge of 5% after 90 days. The conversion price equals the “Variable Conversion Price”, which is 70% of the “Market Price”, which is the average of the lowest three (3) trading prices for the common stock during the fifteen (15) trading day period prior to the conversion. The holder of the note has a right to convert all or any part of the outstanding an unpaid principal amount into shares of common stock after six months.

On November 23, 2015, the Company entered into a convertible note up to $110,000. The Company received $100,000 of proceeds less and $10,000 in original issue discount. The note matures on November 23, 2017 and bears an interest charge of 8%. The conversion price equals the “Variable Conversion Price”, which is 65% of the lowest trading prices for the common stock during the ten (10) trading day period prior to the conversion. The holder of the note has a right to convert all or any part of the outstanding unpaid principal amount into shares of common stock after six months.

On November 30, 2015, the Company entered into a convertible note up to $143,889. The Company received $125,000 of proceeds less and $5,000 in legal costs and $13,889 in original issue discount. The note matures on November 30, 2016 and bears an interest charge of 8%. The conversion price equals the “Variable Conversion Price”, which is 65% of the lowest two trading prices for the common stock during the ten (10) trading day period prior to the conversion. The holder of the note has a right to convert all or any part of the outstanding unpaid principal amount into shares of common stock after six months.

During the years ended December 31, 2015 and December 31, 2014, the Company issued convertible notes totaling $4,601,852 and $3,028,418, respectively. The Convertible notes issued for year ended December 31, 2015 and year ended December 31, 2014 consist of the following terms:

| Year ended | Year ended | |||||||||

| December 31, 2015 | December 31, 2014 | |||||||||

| Amount of | Amount of | |||||||||

| Principal Raised | Principal Raised | |||||||||

| Interest Rate | 0% - 10% | 2.5% - 10% | ||||||||

| Default interest rate | 14% - 22% | 14% - 22% | ||||||||

| Maturity | February 26, 2015 - November 23, 2017 | February 26, 2015 - June 18, 2016 | ||||||||

| Conversion terms 1 | 65% of the “Market Price”, which is the average of the lowest three (3) trading prices for the common stock during the ten (10) trading day period prior to the conversion. | 2,104,000 | 253,500 | |||||||

| Conversion terms 2 | 65% of the “Market Price”, which is the lowest trading prices for the common stock during the ten (10) trading day period prior to the conversion. | 420,410 | 1,006,500 | |||||||

| Conversion terms 3 | 70% of the “Market Price”, which is the average of the lowest three (3) trading prices for the common stock during the fifteen (15) trading day period prior to the conversion. | 111,111 | — | |||||||

| Conversion terms 4 | 70% of the “Market Price”, which is the average of the lowest three (3) trading prices for the common stock during the twenty (20) trading day period prior to the conversion. | — | 79,886 | |||||||

| Conversion terms 5 | 75% of the “Market Price”, which is the average of the lowest three (3) trading prices for the common stock during the ten (10) trading day period prior to the conversion. | 787,778 | 1,553,332 | |||||||

| Conversion terms 6 | 60% of the “Market Price”, which is the lowest trading prices for the common stock during the fifteen (15) trading day period prior to the conversion. | 35,000 | — | |||||||

| Conversion terms 7 | Conversion at $0.10 per share | 135,200 | 135,200 | |||||||

| Conversion terms 8 | 60% of the “Market Price”, which is the lowest trading prices for the common stock during the ten (10) trading day period prior to the conversion. | 282,000 | — | |||||||

| Conversion terms 9 | 65% of the “Market Price”, which is the two lowest trading prices for the common stock during the ten (10) trading day period prior to the conversion. | 390,778 | — | |||||||

| Conversion terms 10 | 65% of the “Market Price”, which is the two lowest trading prices for the common stock during the fifteen (15) trading day period prior to the conversion. | 150,250 | — | |||||||

| Conversion terms 11 | 65% of the “Market Price”, which is the lowest trading prices for the common stock during the fifteen (15) trading day period prior to the conversion. | 218,325 | — | |||||||

| Convertible Debt | 4,634,852 | 3,028,418 | ||||||||

| Less: Debt Discount | (2,658,213 | ) | (1,691,065 | ) | ||||||

| Convertible Debt - net | $ | 1,976,639 | $ | 1,337,353 |

Unregistered Sales of Equity Securities and Use of Proceeds.

Below is a summary of our capital-raising activities for the three months ended December 31, 2015 and underlying terms:

On December 29, 2015, the Company entered into a conversion agreement with JSJ Investments, Inc. relating to a convertible promissory note dated June 22, 2015 with the original principal amount of $150,000 for 5,482,456 shares based on a conversion price of $0.009 per share (See Note 6).

On October 23, 2015, the Company entered into a conversion agreement with Union Capital, LLC relating to a convertible promissory note dated April 21, 2015 with the original principal amount of $110,250 for 8,957,146 shares based on a conversion price of $0.013 per share (See Note 6).

On December 22, 2015, the Company entered into a conversion agreement with Union Capital, LLC relating to a convertible promissory note dated April 21, 2015 with the original principal amount of $110,250 for 922,503 shares based on a conversion price of $0.011 per share (See Note 6).

On December 29, 2015, the Company entered into a conversion agreement with Union Capital, LLC relating to a convertible promissory note dated April 21, 2015 with the original principal amount of $110,250 for 951,862 shares based on a conversion price of $0.011 per share (See Note 6).

On October 22, 2015, the Company entered into a conversion agreement with Horberg Enterprises Limited Partnership relating to a convertible promissory note dated August 21, 2015 with the original principal amount of $250,000 for 1,183,432 shares based on a conversion price of $0.013 per share (See Note 6).

On October 26, 2015, the Company entered into a conversion agreement with Rock Capital relating to a convertible promissory note dated August 25, 2015 with the original principal amount of $36,750 for 2,100,000 shares based on a conversion price of $0.013 per share (See Note 6).

On October 7, 2015, the Company entered into a conversion agreement with Toledo Advisors, LLC relating to a convertible promissory note dated February 27, 2015, with the original principal amount of $115,500 for 2,274,107 shares based on a conversion price of $0.013 per share (See Note 6).

On October 8, 2015, the Company entered into a conversion agreement with Toledo Advisors, LLC relating to a convertible promissory note dated February 27, 2015, with the original principal amount of $115,500 for 396,510 shares based on a conversion price of $0.013 per share (See Note 6).

On October 14, 2015, the Company entered into a conversion agreement with Toledo Advisors, LLC relating to a convertible promissory note dated February 27, 2015, with the original principal amount of $115,500 for 1,586,042 shares based on a conversion price of $0.013 per share (See Note 6).

On October 15, 2015, the Company entered into a conversion agreement with Toledo Advisors, LLC relating to a convertible promissory note dated February 27, 2015, with the original principal amount of $115,500 for 2,379,064 shares based on a conversion price of $0.013 per share (See Note 6).

On October 20, 2015, the Company entered into a conversion agreement with Toledo Advisors, LLC relating to a convertible promissory note dated February 27, 2015, with the original principal amount of $115,500 for 1,586,042 shares based on a conversion price of $0.013 per share (See Note 6).

On October 22, 2015, the Company entered into a conversion agreement with Toledo Advisors, LLC relating to a convertible promissory note dated February 27, 2015, with the original principal amount of $115,500 for 3,232,736 shares based on a conversion price of $0.013 per share (See Note 6)

On October 6, 2015, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated March 11, 2015 with the original principal amount of $166,667 for 2,000,000 shares based on a conversion price of $0.013 per share (See Note 6).

On October 14, 2015, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated March 11, 2015 with the original principal amount of $166,667 for 4,900,000 shares based on a conversion price of $0.013 per share (See Note 6).

On December 9, 2015, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated March 11, 2015 with the original principal amount of $166,667 for 3,114,503 shares based on a conversion price of $0.014 per share (See Note 6).

On October 8, 2015, the Company entered into a conversion agreement with Adar Bays, LLC relating to a convertible promissory note dated March 17, 2015, with the original principal amount of $110,250 for 793,021 shares based on a conversion price of $0.013 per share (See Note 6)

On October 14, 2015, the Company entered into a conversion agreement with Adar Bays, LLC relating to a convertible promissory note dated March 17, 2015, with the original principal amount of $110,250 for 1,171,417 shares based on a conversion price of $0.013 per share (See Note 6)

On December 1, 2015, the Company entered into a conversion agreement with Adar Bays, LLC relating to a convertible promissory note dated March 17, 2015, with the original principal amount of $110,250 for 449,843 shares based on a conversion price of $0.011 per share (See Note 6)

On December 30, 2015, the Company entered into a conversion agreement with Adar Bays, LLC relating to a convertible promissory note dated March 17, 2015, with the original principal amount of $110,250 for 778,968 shares based on a conversion price of $0.010 per share (See Note 6)

On October 13, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 2,407,898 shares based on a conversion price of $0.012 per share (See Note 6).

On October 21, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 3,971,721 shares based on a conversion price of $0.013 per share (See Note 6).

On October 29, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 1,931,123 shares based on a conversion price of $0.016 per share (See Note 6).

On November 9, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 1,748,252 shares based on a conversion price of $0.017 per share (See Note 6).

On November 23, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 1,644,376 shares based on a conversion price of $0.018 per share (See Note 6).

On November 30, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 2,021,427 shares based on a conversion price of $0.015 per share (See Note 6).

On December 15, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 2,683,363 shares based on a conversion price of $0.015 per share (See Note 6).

On December 23, 2015, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated August 13, 2014 with the original principal amount of $282,778 for 2,758,367 shares based on a conversion price of $0.015 per share (See Note 6).

On December 31, 2015, the Company entered into a conversion agreement with Rock Capital relating to a convertible promissory note dated February 25, 2015 with the original principal amount of $36,750 for 2,047,764 shares based on a conversion price of $0.033 per share (See Note 6).

All 10 Form exhibits previously exhibited associated with all Company 10 Form filings are incorporated herein.

Loans and Advances

We have entered into three Credit Line Agreements with Greg Halpern. The first two were for $100,000 each and matured and expired in 2011. The third Credit Line Agreement issued by Mr. Halpern in March 2010 is for an additional $500,000 and matured and expired in 2012. All three agreements accrue interest at the prime rate as of the date of issuance. The prime rate of interest is the rate of interest that major banks charge their most creditworthy customers. For the purposes of these agreements, we shall determine the prime rate by using the prime rate reported by the Wall Street Journal on the date funds are extended to the Company. Based on the prime rate as of the date of issuance, the prime rate shall be 3.25%. On September 26, 2013, we entered into a Credit Line Agreement with Mr. Halpern for $1,000,000 that will mature and expire on or before the second anniversary of September 26, 2015. Interest will accrue on each advance at an annual rate of 4%. As of December 31, 2013, the Company owed $0 in principal and $0 in accrued interest related to these loans and lines of credit. We believe that the $1,000,000 line of credit issued will not be sufficient to cover the additional expense arising from maintenance of our regulatory filings with the SEC, and the marketing of our technology over the next twelve months, thus the Company will continue to pursue additional financing and/or additional funding in 2016 to continue marketing the Max Sound HD Audio Technology aggressively to Multi-Media Industry Users of Audio and Audio with Video products.

In 2015, the Company has received from Mr. Halpern additional net advances on the established lines of credit in the amount of $264,000 of which it has repaid $536,000. As of December 31, 2015, the balance including accrued interest on the line of credit is $473. This further demonstrates our Chairman’s ongoing commitment to continue financing the Company’s needs. While the Company expects to have ongoing needs for additional financing, the amount of those needs are not clearly established as the Company moves forward.

During the year ended December 31, 2015, the principal stockholder was repaid $536,000. As of December 31, 2015, the line of credit balance including accrued interest totaled $473.

On September 17, 2015, the Company received $170,000 from a related party. Pursuant to the terms of the note, the note is bearing an original issuance discount in the amount of $10,000 and is due on or before October 31, 2015. As of December 31, 2015, the balance of the note is $0, and was fully repaid.

In the event that we are unable to obtain additional financing and/or funding or Mr. Halpern either fails to extend us more financing, declines to loan additional cash, declines to fund the line of credit, or declines to defer his salary payments, we will no longer be able to

continue to operate and will have to cease operations unless we begin to generate sufficient revenue to cover our costs.

Recent Accounting Pronouncements

All other newly issued accounting pronouncements but not yet effective have been deemed either immaterial or not applicable.

Critical Accounting Policies and Estimates

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (“GAAP”). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Use of Estimates:

In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates.

Revenue Recognition:

Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable and collectability is assured. We had $0 and $2,491 in revenue for the years months ended December 31, 2015and 2014, respectively.

Stock-Based Compensation:

In December 2004, the FASB issued FASB Accounting Standards Codification No. 718, Compensation – Stock Compensation. Under FASB Accounting Standards Codification No. 718, companies are required to measure the compensation costs of share-based compensation arrangements based on the grant-date fair value and recognize the costs in the financial statements over the period during which employees are required to provide services. Share-based compensation arrangements include stock options, restricted share plans, performance-based awards, share appreciation rights and employee share purchase plans. As such, compensation cost is measured on the date of grant at their fair value. Such compensation amounts, if any, are amortized over the respective vesting periods of the option grant. The Company applies this statement prospectively.

Equity instruments (“instruments”) issued to other than employees are recorded on the basis of the fair value of the instruments, as required by FASB Accounting Standards Codification No. 718. FASB Accounting Standards Codification No. 505, Equity Based Payments to Non-Employees defines the measurement date and recognition period for such instruments. In general, the measurement date is when either a (a) performance commitment, as defined, is reached or (b) the earlier of (i) the non-employee performance is complete or (ii) the instruments are vested. The measured value related to the instruments is recognized over a period based on the facts and circumstances of each particular grant as defined in the FASB Accounting Standards Codification.

Derivative Financial Instruments

Fair value accounting requires bifurcation of embedded derivative instruments such as conversion features in convertible debt or equity instruments, and measurement of their fair value for accounting purposes. In determining the appropriate fair value, the Company uses the Black-Scholes option-pricing model. In assessing the convertible debt instruments, management determines if the convertible debt host instrument is conventional convertible debt and further if there is a beneficial conversion feature requiring measurement. If the instrument is not considered conventional convertible debt, the Company will continue its evaluation process of these instruments as derivative financial instruments.

Once determined, derivative liabilities are adjusted to reflect fair value at each reporting period end, with any increase or decrease in the fair value being recorded in results of operations as an adjustment to fair value of derivatives. In addition, the fair value of freestanding derivative instruments such as warrants, are also valued using the Black-Scholes option-pricing model.

Impairment of Long-Lived Assets

The Company accounts for its long-lived assets in accordance with ASC Topic 360-10-05, Accounting for the Impairment or Disposal of Long-Lived Assets." ASC Topic 360-10-05 requires that long-lived assets, such as technology rights, be reviewed for impairment annually, or whenever events or changes in circumstances indicate that the historical cost carrying value of an asset may no longer be appropriate. The Company assesses recoverability of the carrying value of an asset by estimating the future net cash flows expected to result from the asset, including the eventual disposition. If the future net cash flows are less than the carrying value of an asset, an impairment loss is recorded equal to the difference between the asset's carrying value and fair value or disposable value. For the year ended December 31, 2015, the Company completed an impairment analysis on its' long-lived assets, their technology rights, and determined that no impairment was necessary.

ASC 350 prescribes a two-step process for impairment testing of goodwill and intangibles with indefinite lives, which is performed annually, as well as when an event triggering impairment may have occurred. ASC 350 also allows preparers to qualitatively assess goodwill impairment through a screening process which would permit companies to forgo Step 1 of their annual goodwill impairment process. This qualitative screening process will hereinafter be referred to as "Step 0". Goodwill and intangible assets deemed to have an indefinite life are tested for impairment on an annual basis, or earlier when events or changes in circumstances suggest the carrying amount may not be fully recoverable. The Company has elected to perform its annual assessment on $16,796,237 of intangible assets. For the year ended December 31, 2015, $15,703,616 impairment loss has been recorded due to a change in business model, this being significantly impacted by the impairment of Liquid Spins assets, as digital music sales are no longer relevant in today’s market.

The Company believes that the accounting estimate related to asset impairment is a "critical accounting estimate" because the impairment methodology is highly susceptible to change from period to period, because it requires management to make assumptions about future cash flows, and because the impact of recognizing impairment could have a significant effect on operations. Management's assumptions about future cash flows require significant judgment because actual business operations of marketing the technology rights is in its infancy stages and managements expects that their future operating levels to fluctuate. The analysis included assumptions that are based on annual business plans and other forecasted results which are used to reflect market-based estimates of the risks associated with the projected cash flows, based on the best information available as of the date of the impairment test. There can be no assurance that the estimates and assumptions used in the impairment tests will prove to be accurate predictions of the future. If the future adversely differs from management's best estimate of key economic assumptions, and if associated future cash flows materially decrease, the Company may be required to record impairment charges related to its indefinite life intangible asset.

Prior to February 2011, the Company's business operations were related to the development and launching of a social networking website. However, since February 2011, our business focus has been on the marketing of our Max Sound HD Audio Technology. Since 2011, was our initial year of marketing our technology, management considers past operational levels to be inconsistent with future operations mainly due to the shift in business focus. In our impairment testing, the Company made assumptions towards the income and expenses expected in the future including, but not limited to, determining the actual expenses incurred in the current year that were attributable to the new business focus in order to develop an annual cost benchmark, trends in the marketplace, feedback from current and past marketing activities, and assessments upon the useful life of the technology rights.

The Company's primary focus over the next three to five years will be centered on the marketing and implementation of their technology in order to take advantage of the current trends in the marketplace for users of their technology. In particular, the Company expects that expenses will increase significantly from year to year over the next five years, at which time in year six and beyond the year-to-year change will be a minimal increase. In addition, the Company expects minimal revenue over the next two years, while in year three to six the Company expects to realize significant year to year increases in revenue, at which time in year seven and beyond the year to year change will be a minimal increase.

As part of the impairment test, the Company reviewed its' initial useful life analysis, in reference to their technology, and updated this analysis with factors that existed at the time of the impairment testing and determined that nothing had occurred in the marketplace that would change their initial determination of the useful life of their technology. The analysis included researching known technological advances in the marketplace and determining if those advances which are similar to the Company's products would limit the useful life of the asset. The Company believes that the technological advances in the marketplace are geared to developing different playback devices and the implementation of technology that is similar to the Company's technology. Thus, the Company concluded that their technology rights continue to have an indefinite useful life. However, it is understood that technological advancements could happen in the future that would limit the useful life of their technology. If a technology was created in the future that would limit the useful life of the technology, the Company would be required to update their impairment testing to include a useful life determination of the technology and may be required to record impairment charges at some time in the future.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities”.

See NOTE 3 - SUBSEQUENT EVENTS

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are subject to certain market risks, including changes in interest rates and currency exchange rates. We have not undertaken any specific actions to limit those exposures.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

MAX SOUND CORPORATION

| PAGE | F - 2 | REPORT OF INDEPENDENT REGISTERED ACCOUNTING FIRM. | ||

| PAGE | F - 3 | BALANCE SHEETS AS OF DECEMBER 31, 2015 AND AS OF DECEMBER 31, 2014. | ||

| PAGE | F - 4 | STATEMENTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014 | ||

| PAGE | F - 5 | STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014. | ||

| PAGE | F - 6 | STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014. | ||

| PAGES | F - 7 | NOTES TO FINANCIAL STATEMENTS. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Max Sound Corporation

We have audited the accompanying balance sheet of Max Sound Corporation (the "Company”) as of December 31, 2015, and the related statements of operations, changes in stockholders’ deficit and cash flows for the year ended December 31, 2015. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company was not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2015, and the results of its operations, changes in stockholders’ deficit and its cash flows for the year ended December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, these conditions raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result should the Company be unable to continue as a going concern.

| /s/ Anton & Chia, LLP | |

|

Newport Beach, California

March 30, 2016 | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Max Sound Corporation