Attached files

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

0-21777

(Commission File Number)

GOLDEN QUEEN MINING CO. LTD.

(Name of registrant in its charter)

| British Columbia, Canada | Not Applicable | |

| (State or other jurisdiction | (IRS Employer | |

| of incorporation or organization) | Identification No.) | |

| 2300 – 1066 Vancouver, British Columbia, Canada | V6E 3X2 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: (778) 373-1557

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under section 12(g) of the Exchange Act: Common shares without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $49,157,488 as at June 30, 2015.

Indicate the number of shares outstanding of each of the registrant’s classes of common equity, as of the latest practicable date: 99,928,683 common shares as at March 30, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K, which Proxy Statement is to be filed within 120 days after the end of the registrant's fiscal year ended December 31, 2015. If the definitive Proxy Statement cannot be filed on or before the 120 day period, the issuer may instead file an amendment to this Form 10-K disclosing the information with respect to Items 10 through 14.

Form 10-K

Table of Contents

References to the “Company”, “Golden Queen”, “we”, “us”, “our” and words of similar meaning refer to Golden Queen Mining Co. Ltd. The U.S. dollar (“$") is used in this Form 10-K and quantities are reported in Imperial units with Metric units in brackets.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-K and the documents incorporated by reference herein constitute forward-looking information and forward-looking statements within the meaning section 27A of the Securities Act of 1933 (as amended), section 21E of the Securities Exchange Act of 1934 (as amended), the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation (collectively “forward-looking statements”). The use of any of the words “anticipate”, “continue”, “estimate”, “expect”, “may”, “will”, “projected”, “propose”, “should”, “believe”, “intend”, “subject to” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct. Such forward-looking statements included in this Form 10-K and the documents incorporated herein by reference should not be unduly relied upon. References in this Form 10-K are to December 31, 2015, unless another date is stated, or in the case of documents incorporated herein by reference, are as of the dates of such documents.

In particular, this Form 10-K and the documents incorporated herein by reference contain forward-looking statements pertaining to the following:

| · | business strategy, strength and focus; |

| · | geological estimates in respect of mineral resources and reserves on the Project; |

| · | projections of market prices and costs and the related sensitivity of distributions; |

| · | supply and demand for precious metals; |

| · | expectations regarding the ability to generate income through operations; |

| · | expectations with respect to the Company’s future working capital position; |

| · | treatment under government regulatory regimes and tax laws; |

| · | anticipated gold and silver revenues; |

| · | estimated costs of anticipated production, sales and costs of sales; |

| · | anticipated mining operations proceeding as planned; and |

| · | the Company’s and GQM LLC’s capital expenditure programs. |

With respect to forward-looking statements contained in this Form 10-K and the documents incorporated by reference herein, assumptions have been made regarding, among other things:

| · | recovery rates from gold and silver production; |

| · | the impact of environmental regulations on our operations; |

| · | future gold and silver prices; |

| · | the Company’s and GQM LLC’s ability to retain qualified staff; |

| · | the impact of any changes in the laws of the United States or the State of California; |

| · | the ability of GQM LLC to maintain its existing and future permits in good standing; |

| · | the ability of GQM LLC to retain its mining rights under agreements with landholders, whether currently in place or may in the future be in place; |

| · | the regulatory framework governing royalties, taxes and environmental matters in the United States; |

| · | future capital expenditures, if any, required to be made by the Company and GQM LLC and the Company’s ability to fund its pro rata capital commitments to the GQM LLC joint venture; |

| · | the Company’s ability to repay or refinance current debt; and |

| · | the ability of the Company to maintain its current ownership level in GQM LLC. |

| 2 |

Actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and elsewhere in this Form 10-K and in the documents incorporated by reference:

| · | uncertainties in access to future funding for repayment of debt or any future capital requirements of the Project or future acquisitions; |

| · | unexpected liabilities or changes in the cost of operations, including costs of extracting and delivering gold and silver dore to a refinery, that affect potential profitability of the Project; |

| · | operating hazards and risks inherent in mineral exploration and mining; |

| · | volatility in global equities, commodities, foreign exchange, market price of gold and silver and a lack of market liquidity; |

| · | changes to the political environment, laws or regulations, or more stringent enforcement of current laws or regulations in the United States or California; |

| · | ability of GQM LLC to obtain and maintain licenses, access rights or permits, required for current and future planned operations; |

| · | unexpected and uninsurable risks that may arise; |

| · | risks associated with any future hedging activities; and, |

| · | the other factors discussed under Item 1A. Risk Factors. |

Readers are cautioned that the foregoing lists of factors are not exhaustive. The forward-looking statements contained in this Form 10-K and documents incorporated by reference herein are expressly qualified by this cautionary statement. Except as required under applicable securities laws, the Company does not undertake or assume any obligation to publicly update or revise any forward-looking statements.

CAUTIONARY NOTE REGARDING U.S. INVESTORS

The Company uses Canadian Institute of Mining, Metallurgy and Petroleum definitions for the terms “proven reserves”, “probable reserves”, “measured resources”, “indicated resources” and “inferred resources”. U.S. investors are cautioned that while these terms are recognized and required by Canadian regulations, including National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), the U.S. Securities and Exchange Commission (“SEC”) does not recognize them.

Canadian mining disclosure standards, including NI 43-101, differ significantly from the requirements of the SEC and SEC Guide 7, and reserve and resource information contained or incorporated by reference in this Form 10-K and in the documents incorporated by reference herein may not be comparable to similar information disclosed by companies reporting under U.S. standards. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of pre-feasibility or feasibility studies. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource estimate is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves in compliance with NI 43-101 may not qualify as “reserves” under SEC standards.

Accordingly, information contained in this Form 10-K and the documents incorporated herein by reference contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. See Item 1A. Risk Factors.

| 3 |

In addition, financial information in this Form 10-K and the Company’s financial statements is presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The Company’s financial statements have been prepared in accordance with U.S. GAAP, and are subject to Public Company Accounting Oversight Board (United States), (“PCAOB”). The Company prepares its financial statements in U.S. dollars.

We estimate and report our resources and we will estimate and report our reserves according to the definitions set forth in NI 43-101. We will modify and reconcile the reserves as appropriate to conform to SEC Industry Guide 7 for reporting in the U.S. The definitions for each reporting standard are presented below with supplementary explanation and descriptions of the parallels and differences.

NI 43-101 Definitions

indicated mineral resource – an indicated mineral resource is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be established with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

inferred mineral resource – an inferred mineral resource is a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

mineral reserve – a mineral reserve is economically mineable part of an indicated or measured mineral resource as demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, metallurgy, processing, economic factors and other relevant factors that demonstrate, at the time of reporting, that economic exploitation can be justified. A mineral reserve includes diluting materials and allowance for losses that may occur when the material is mined. Mineral reserves are sub-divided in order of increasing confidence into probable and proven categories.

mineral resource – a mineral resource is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic exploitation. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral resources are sub-divided, in order of increasing geological confidence, into inferred, indicated and measured categories.

Qualified Person – a qualified person is an individual who (a) is an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geoscience, or engineering, relating to mineral exploration or mining; (b) has at least five years of experience in mineral exploration, mine development or operation, or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice; (c) has experience relevant to the subject matter of the mineral project and the technical report; (d) is in good standing with a professional association; and (e) in the case of a professional association in a foreign jurisdiction, has a membership designation that (i) requires attainment of a position of responsibility in their profession that requires the exercise of independent judgment; and (ii) requires A. a favourable confidential peer evaluation of the individual’s character, professional judgement, experience, and ethical fitness; or B. a recommendation for membership by at least two peers, and demonstrated prominence or expertise in the field of mineral exploration or mining.

| 4 |

SEC Industry Guide 7 Definitions:

exploration stage – an exploration stage prospect is one which is not in either the development or production stage.

development stage – a development stage project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

mineralized material – mineralized material is material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

production stage – a production stage project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

reserve – a reserve is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined.

Additional definitions for terms currently or previously used in the Company’s Annual Reports filed on Form 10-K:

Advance minimum royalty - Payment made before the start of commercial production under a mining lease agreement with landholders.

Ag – The chemical symbol for silver.

Au – The chemical symbol for gold.

Block model – The representation of geologic units using three-dimensional blocks of pre-determined sizes.

CIM – Canadian Institute of Mining, Metallurgy and Petroleum.

Cut-off grade – When determining economically viable mineral reserves, the lowest grade of mineralized material that qualifies as ore, i.e. that can be mined at a profit.

Diamond drill – A type of rotary drill in which the cutting is done by abrasion rather than by percussion. The drill cuts a core of rock which is recovered in long cylindrical sections.

Fault - A fracture in the earth’s crust caused by tectonic forces with displacement along the fracture.

Feasibility study – A study or group of studies that determine the economic viability of a given mineral occurrence.

g/t or gpt – Grams per metric tonne.

Grade – A term used to assign metal value to resources and reserves, such as gram per tonne (g/t) or troy ounces per ton (oz/ton). Grades are reported both in Imperial and Metric units in this Form 10-K.

Gravity – A methodology using instrumentation allowing the accurate measuring of the difference between densities of various geological units in situ.

Heap leaching – A process which uses dilute sodium-cyanide solutions to percolate through run-of-mine or crushed ore heaped on lined pad to dissolve gold and/or silver.

| 5 |

Mineral – A naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form.

Mineralization – A natural occurrence in rocks or soil of one or more metal yielding minerals.

Mineral deposit – A mineralized body, which has been intersected by a sufficient number of drill holes or by underground workings to give an estimate of grade(s) of metal(s) and thus to warrant further exploration or development. A mineral deposit does not qualify as a commercially viable mineral deposit with reserves under standards set by the U.S. Securities and Exchange Commission until a final, comprehensive, economic, technical and legal feasibility study has been completed.

Mining – The process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

National Instrument 43-101 or NI 43-101 – Canadian standards of disclosure for mineral projects.

NSR – A net smelter returns royalty, which is customarily calculated by subtracting from gross revenues a deduction for calculated mill recoveries, transport costs of any concentrates to a smelter, treatment and refining charges, and other deductions at the smelter and multiplying that result by the prescribed rate.

Open pit – Surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body.

Ore - A natural aggregate of one or more minerals which, at a specified time and place, may be mined and processed and the product(s) sold at a profit or from which some part may be profitably separated.

Preliminary feasibility study and pre-feasibility study – As defined in NI 43-101, each mean a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of a mineral resource may be classified as a mineral reserve.

Porphyry or porphyritic – An igneous rock characterized by visible crystals in a fine–grained matrix.

Quartz – a mineral composed of silicon dioxide, SiO2 (silica).

Reclamation – The process by which lands disturbed as a result of mining activity are modified to support beneficial land use. Reclamation activity may include the removal of buildings, equipment, machinery and other physical remnants of mining, closure of tailings storage facilities, leach pads and other mine features, and contouring, covering and re-vegetation of waste rock and other disturbed areas.

SEC Industry Guide 7 – U.S. reporting guidelines that apply to registrants engaged or to be engaged in significant mining operations.

Strike – The direction, or bearing from true north, of a vein or rock formation measured on a horizontal surface.

Vein – a thin, sheet like crosscutting body of hydrothermal mineralization, principally quartz.

| 6 |

General Development of Business

The Company was incorporated under the laws of the Province of British Columbia, Canada in November 1985 and has been exploring and developing the Soledad Mountain mining Project (the “Project”) located just south of Mojave in Kern County in southern California since that time.

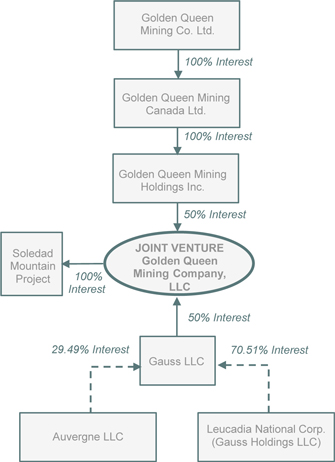

The Company acquired its initial interest in the Project in 1985 and has since added to its landholdings and interests in the area. Exploration and evaluation work on the Project was done, until September 10, 2014, by Golden Queen Mining Co., Inc. (“GQM Inc.”), a California corporation wholly-owned by the Company. GQM Inc. was converted into a limited liability company, Golden Queen Mining Company, LLC (“GQM LLC”) on September 10, 2014 in preparation for the formation of a joint venture (the “Joint Venture”) between a newly formed entity, Golden Queen Mining Holdings, Inc. (“GQM Holdings”), a wholly owned subsidiary of the Company, and Gauss LLC (“Gauss”). Gauss is an investment entity formed for the purpose of the Joint Venture, and is 70.51% owned by Leucadia National Corporation and 29.49% owned by members of the Clay family, a controlling shareholder group of the Company. See Project Financing - Joint Venture Transaction below for further details on the Joint Venture. In February 2015, the Company incorporated Golden Queen Mining Canada Ltd. (“GQM Canada”), a wholly-owned British Columbia subsidiary, to hold the Company’s interest in GQM Holdings.

As a result of the changes made in connection with the Joint Venture and the incorporation of GQM Canada, the names, place of formation and ownership of the Company’s subsidiaries and the Project as at March 30, 2016 are as follows:

| 7 |

The registered office of the Company is located at 1200 - 750 West Pender Street, Vancouver, BC, Canada V6C 2T8 and its executive offices are located at 2300 – 1066 West Hastings Street, Vancouver, BC, Canada, V6E 3X2. The California office of GQM LLC is located at 15772 K Street, Mojave, California, 93501.

Significant Developments in 2015

Project Update

The Company engaged Mine Development Associates (“MDA”) in late 2014 to update the Project's geological model from first principles and to provide an updated mineral resource estimate. In late 2014, the Company also engaged Norwest Corporation (“Norwest”) and Kappes, Cassiday & Associates (“KCA”) to update the reserve estimates and prepare a feasibility study and economic analysis based upon current information. The updated mineral resource and reserve estimates and results of the feasibility study were disclosed in a news release on February 10, 2015. In support of the updated mineral resource and reserve estimates, the Company filed a technical report pursuant to National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) titled “Soledad Mountain Technical Report and Updated Feasibility Study” with an effective date of February 25, 2015 (the “Technical Report”) on the System for Electronic Document Analysis and Retrieval (“SEDAR”) on February 27, 2015 and with the U.S. Securities And Exchange Commission (“SEC”) on March 2, 2015. The Technical Report was prepared by Carl E. Defilippi of KCA, Sean Ennis of Norwest, Michael M. Gustin of MDA and Peter Ronning of New Caledonian Geological Consulting, each of whom are Qualified Persons and independent of the Company pursuant to NI 43-101. See Item 2. Properties below for detailed information regarding the Technical Report and the Project.

Major construction projects completed in 2015, include the Phase 1, stage 1 heap leach pad, the crushing-screening plant and Merrill-Crowe plant, Assay lab, workshop & warehouse, roads and access ramps, power and water supply, conveying and stacking system. The Company acquired mobile mining and support equipment required for the commencement of mining operations and has been stock-piling ore from pre-production mining. In addition the Company conducted an infill drilling program in 2015 as part of its pre-production mine planning.

Commissioning of the crushing-screening plant started in the fourth quarter of 2015 and the first gold pour occurred on March 1, 2016. Commercial production is anticipated to commence later in 2016.

There are a number of risks associated with the Project and readers are urged to consider these risks and possible other risks, in order to obtain an understanding of the Project (see Item 1A. Risk Factors below).

Joint Venture with Gauss LLC

The Company owns a 50% interest in GQM LLC pursuant to the terms of a joint venture agreement, dated September 15, 2014, entered into between GQM Holdings and Gauss (the “JV Agreement”). The JV Agreement provides, inter alia, details of how GQM LLC will be managed and the obligations of each of the parties in connection with further funding requirements. GQM LLC is managed by a board of managers comprising an equal number of representatives of each of Gauss and GQM Holdings. The current representatives of GQM Holdings on the board of managers are Guy Le Bel, Bryan A. Coates and Thomas Clay. The current officers of GQM LLC are Robert C. Walish, Jr. as Chief Executive Officer and Andrée St-Germain as Chief Financial Officer.

The JV Agreement also provides for future funding requirements, if needed, and dilution of member interests on a straight line basis in the event any member does not equally fund a capital contribution. During 2015, Gauss and GQM Holdings each made a capital contribution to GQM LLC in the amount of $12.5 million, for a total contribution of $25 million. Following the capital contribution, each of Gauss and GQM Holdings retained a 50% ownership interest in GQM LLC. The funds contributed are expected to be sufficient for GQM LLC to commence commercial production and maintain operations until the Project is cash flow positive. However, should additional capital funds be required in the future, the JV partners may be called upon to contribute additional capital.

| 8 |

Following closing of the Joint Venture Transaction, Golden Queen has been treating GQM LLC as a variable interest entity (“VIE”), with Golden Queen considered to be the primary beneficiary. A VIE is an entity in which the investor, Golden Queen, holds a controlling interest, or in this case, is a primary beneficiary, that is not based on the majority of the voting rights. As a result, Golden Queen continues to reflect 100% of the financial results of GQM LLC in its consolidated financial statements, along with a non-controlling interest representing Gauss’ 50% interest in GQM LLC.

Financing – Loans

On June 8, 2015, the Company amended the December Loan to extend the maturity to December 8, 2016 and increased the principal amount from $12,500,000 to $37,500,000 (the “June 2015 Loan”). The Company also issued 10,000,000 common share purchase warrants exercisable for a period of five years expiring June 8, 2020. The common share purchase warrants have an exercise price of $0.95. All other terms remained the same as the December Loan. The Company also incurred a financing fee to secure the loan in the amount of $1,500,000, all of which was paid on June 8, 2015. The Company agreed to pay the legal fees incurred by the lenders relating to this instrument, which amounted to $46,408. The legal fees were expensed as the transaction met the definition of a debt extinguishment. The terms of the registration rights remains unchanged as does the Company’s assessment of the likelihood of the registration rights being exercised. As such, as of December 31, 2015, no accrual has been made for the potential costs related to the registration rights.

On October 1, 2015 and January 1, 2016, the Company chose to exercise its right to pay quarterly interest on the June 2015 Loan in kind by adding interest owed to the principal balance.

Financial Information by Segment and Geographic Area

The Company has a single reportable operating segment, and all mining operations and assets are located in the United States. See Item 6. Selected Financial Data, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and the attached financial statements for all financial information.

Competitive Conditions

The Company and GQM LLC compete with other mining companies in the recruitment and retention of qualified managerial and technical employees, for supplies and equipment, as well as for capital. As a result of this competition in the mining industry, some of which is with large established mining companies with substantial capabilities and with greater financial and technical resources than ours, we may be unable to effectively develop and operate the Project or obtain financing on terms we consider acceptable.

Environmental Regulation

Our current and planned operations are subject to state and federal environmental laws and regulations. Those laws and regulations provide strict standards for compliance, and potentially significant fines and penalties for non-compliance. These laws address emissions, waste discharge requirements, management of hazardous substances, protection of endangered species and reclamation of lands disturbed by mining. Compliance with environmental laws and regulations requires significant time and expense, and future changes to these laws and regulations may cause material changes or delays in the development of our Project or our future activities on site.

See Environmental Issues, Permits & Approvals below for a detailed description of the effects of federal, state and local environmental regulations and permitting on the Company, GQM LLC and the Project, as well as Item 1A. Risk Factors for a discussion of the related risks.

Employees

As of March 30, 2016, the Company had 130 employees. The Company works with an accounting firm, which is independent from our auditors, on a contract basis for the preparation of its consolidated financial statements, and engages various part-time consultants and contractors as needed for administrative services.

| 9 |

Available Information

We make available, free of charge, our annual report on Form 10-K, our quarterly reports on Form 10-Q and any amendments to those reports, on our website at www.goldenqueen.com. Our current reports on Form 8-K are available at the SEC’s website at www.sec.gov, or we will provide electronic copies of these filings free of charge upon request. Our website and the information on it is not intended to be, and is not incorporated into this Form 10-K. Additional information and filings related to the Company can be found at www.sec.gov and www.sedar.com.

The following is a discussion of distinctive or special characteristics of our operations and the industry in which we operate, which may have a material impact on, or constitutes risk factors in respect of, our future financial performance and in respect of an investment in the Company. These risk factors should be read in conjunction with disclosure on business and risks appearing in this Form 10-K.

Operational Risks

Mineral resource and reserve estimates are based on interpretation and assumptions, and the Project may yield lower production of gold and silver under actual operating conditions than is currently estimated. A material decrease in the quantity or grade of mineral resource or reserves from those estimates, will affect the economic viability of the Project or the Project’s return on capital

Unless otherwise indicated, mineral resource and reserve figures presented in this Annual Report on Form 10-K and in our filings with securities regulatory authorities, press releases and other public statements that may be made from time to time, are based upon estimates made by independent consulting geologists and mining engineers. Estimates can be imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling, which may prove to be unreliable. We cannot assure you that the estimates are accurate or that mineralized materials from the Project can be mined or processed profitably.

Assumptions about silver and gold market prices are subject to great uncertainty as those prices have fluctuated widely in the past. Declines in the market prices of silver and gold may render reserves containing relatively lower grades of ore uneconomic to exploit, and the Company may be required to reduce reserve estimates, discontinue development or mining at one or more of its properties or write down assets as impaired. Should GQM LLC encounter mineralization or geologic formations at the Project different from those predicted, it may adjust its reserve estimates and alter its mining plans. Either of these alternatives may adversely affect the Company’s actual production and financial condition, results of operations and cash flow.

As production at the Project proceeds, mineral resources and reserves may require adjustments or downward revisions. In addition, the grade of mineralized material ultimately mined, if any, may differ from that indicated by our 2015 updated feasibility study. Gold and silver recovered in small scale tests may not be duplicated on a production scale.

The mineral resource and reserve estimates contained in this Form 10-K have been determined and valued based on assumed future prices for gold and silver, cut-off grades and operating costs that may prove to be different than actual prices, grades and costs. Extended declines in prices for gold or silver may render such estimates uneconomic and result in reduced reported mineralization or adversely affect current determinations of commercial viability. Any material reductions in estimates of mineralization, or of the ability of GQM LLC to profitably extract gold and silver, could have a material adverse effect on our share price and the value of the Project.

The estimates of production rates, costs and financial results contained in the 2015 feasibility study and any future guidance of production rates offered by the Company depend on subjective factors and may not be realized in actual production and such estimates speak only as of their respective dates.

The 2015 feasibility study provides estimates and projections of future production, costs and financial results of the Project. In addition, the Company may in the future provide guidance on projected production rates of the Project. Any such information is forward-looking and depend on numerous assumptions, including assumptions about the availability, accessibility, sufficiency and quality of ore, the costs of production, the market prices of silver and gold, the ability to sustain and increase production levels, the sufficiency of its infrastructure, the performance of its personnel and equipment, its ability to maintain and obtain mining interests and permits and its compliance with existing and future laws and regulations. Actual results and experience may differ materially from these assumptions. Any such production cost, or financial results estimates speak only as of the date on which they are made, and the Company disclaims any intent or obligation to update such estimates, whether as a result of new information, future events or otherwise.

| 10 |

There are significant financial and operational risks associated with an operating mining project such as the project operated by GQM LLC

The financial results of GQM LLC is subject to risks associated with operating and maintaining mining operations on the Property, including:

| · | increases in our projected costs due to differences in grade of mineralized material, metallurgical performance or revisions to mine plans in response to the physical shape and location of mineralized materials as compared to our 2015 feasibility study estimates; |

| · | increases in the costs of commodities such as fuel and electricity, and other materials and supplies which would increase Project development and operating costs; |

| · | the ability to extract sufficient gold and silver from resources and reserves to support a profitable mining operation on the Property; |

| · | decreases in gold and silver prices; |

| · | compliance with approvals and permits for the Project; |

| · | potential opposition from environmental groups, other non-governmental organizations or local residents which may delay or prevent development of the Project or affect our future operations; |

| · | difficult surface conditions, unusual or unexpected geologic formations or failure of open pit slopes; |

| · | mechanical or equipment problems, industrial accidents or personal injury resulting in unanticipated cost and delays; |

| · | environmental hazards or pollution; |

| · | fire, flooding, earthquakes, cave-ins or periodic interruptions due to inclement weather; and |

| · | labor dispute. |

Any of these hazards and risks can materially and adversely affect, among other things, production quantities and rates, costs and expenditures, potential revenues and production dates. They may also result in damage to, or destruction of, production facilities, environmental damage, monetary losses and legal liability. The value of our interest in GQM LLC may decrease as a result, which would be expected to reduce the value of our common shares.

There are operational risks for which insurance coverage is not available at affordable rates or at all, and the occurrence of any material adverse event for which there is no insurance coverage may decrease financial performance of GQM LLC, or may impede or prevent ongoing operations

GQM LLC currently maintains insurance within ranges of coverage consistent with industry practice in relation to some of these risks, but there are certain risks against which GQM LLC cannot insure, or against which GQM LLC cannot maintain insurance at affordable premiums. Insurance against environmental risks (including pollution or other hazards resulting from the disposal of waste products generated from production activities) is not generally available to GQM LLC. If subjected to environmental liabilities, the costs incurred would reduce funds available for other purposes, and GQM LLC may have to suspend operations or undertake costly interim compliance measures to address environmental issues. Any such events would be expected to have a significant detrimental impact on the value of our interest in GQM LLC and our common stock.

Silver and gold mining involves significant production and operational risks

Silver and gold mining involves significant production and operational risks, including those related to uncertain mineral exploration success, unexpected geological or mining conditions, the difficulty of development of new deposits, unfavorable climate conditions, equipment or service failures, unavailability of or delays in installing and commissioning plants and equipment, import or customs delays and other general operating risks.

| 11 |

Commencement of mining can reveal mineralization or geologic formations, including higher than expected content of other minerals that can be difficult to separate from silver, which can result in unexpectedly low recovery rates. Problems may also arise due to the quality or failure of locally obtained equipment or interruptions to services (such as power, water, fuel or transport or processing capacity) or technical capital expenditure to achieve expected recoveries. Many of these production and operational risks are beyond the Company’s control. Delays in commencing successful mining activities at new or expanded mines, disruptions in production and low recovery rates could have adverse effects on the Company’s financial condition, results of operations and cash flows.

Land reclamation requirements for our properties may be burdensome and expensive

Reclamation requirements are imposed on GQM LLC in order to minimize long term effects of land disturbance, and this includes a requirement to re-establish pre-disturbance land forms.

In order to carry out reclamation obligations imposed on GQM LLC in connection with development activities, GQM LLC must allocate financial resources that might otherwise be spent on further exploration and development. GQM LLC has set up and plans to set up a provision for our reclamation obligations on the Project, as appropriate, but this provision may not be adequate. If GQM LLC is required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Sale of Aggregate

We have not included contributions from the sale of aggregate in the 2015 feasibility study cash flow projections. However, aggregate sales over a period of thirty years are important for the Project as it will permit GQM LLC to meet its closure and reclamation requirements. If no sale of waste rock as aggregate is ever achieved, the initial mine life is expected to be reduced.

The mining industry is intensely competitive

As a result of competition in the mining industry, some of which is with large established mining companies with substantial capabilities and with greater financial and technical resources than ours, GQM LLC may be unable to effectively develop the Project or obtain financing on terms we consider acceptable.

We compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for qualified employees, GQM LLC’s production of minerals from the Project may be slowed down or suspended. We also compete with other mining companies for capital. If we are unable to raise sufficient capital, our interest in GQM LLC may be diluted.

Legal and Regulatory Risks

We are subject to significant governmental regulations, which affect our operations and costs of conducting our business

GQM LLC’s current and future operations are and will be governed by laws and regulations, including, among others, those relating to:

| · | mineral property production and reclamation; |

| · | taxes and fees; |

| · | labor standards, and occupational health and safety; and |

| · | environmental standards for waste disposal, treatment and use of toxic substances, land use and environmental protection. |

Companies engaged in production activities often experience increased costs and delays as a result of the need to comply with applicable laws, regulations, and permits. Failure to comply with these may result in enforcement actions, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. GQM LLC may be required to compensate those suffering loss or damage by reason of our activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits.

| 12 |

Existing and possible future laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation, could have a material adverse impact on GQM LLC’s business and cause increases in capital expenditures or require abandonment or delays in development of the Project, all of which would be expected to reduce the value of our interest in the GQM LLC.

| 13 |

GQM LLC’s activities are subject to California state and federal environmental laws and regulations that may increase the costs of doing business and restrict operations

GQM LLC’s current and planned operations are subject to state and federal environmental laws and regulations. Those laws and regulations provide strict standards for compliance, and potentially significant fines and penalties for non-compliance. These laws address air emissions, waste discharge requirements, management of hazardous substances, protection of endangered species and reclamation of lands disturbed by mining. Compliance with environmental laws and regulations requires significant time and expense, and future changes to these laws and regulations may cause material changes or delays in the production of minerals from the Project or future activities.

U.S. Federal Laws: The Comprehensive Environmental, Response, Compensation, and Liability Act (CERCLA), and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, demands for reimbursement for government incurred cleanup costs, or natural resource damages, or for neighbouring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (RCRA), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

The Clean Air Act, as amended, and comparable state statutes, restrict the emission of air pollutants from many sources, including mining and processing activities. GQM LLC’s mining operations may produce air emissions, including fugitive dust and other air pollutants from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment, which are subject to review, monitoring and/or control requirements under the Clean Air Act and comparable state air quality laws. New facilities may be required to obtain permits before work can begin, and existing facilities may be required to incur capital costs in order to remain in compliance. In addition, permitting rules may impose limitations on GQM LLC’s production levels or result in additional capital expenditures in order to comply with the rules. The Clean Air Act and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized emissions of pollutants.

The Clean Water Act (CWA), and comparable state statutes, impose restrictions and controls on the discharge of pollutants into waters of the United States, or to the surface or ground waters of the state. The CWA regulates storm water runoff from mining facilities and requires a storm water discharge permit for certain activities. Such a permit requires the regulated facility to monitor and sample storm water run-off from its operations. The CWA and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges of pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release. Violation of these regulations and/or contamination of groundwater by mining related activities may result in fines, penalties, and remediation costs, among other sanctions and liabilities under state laws. In addition, third party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages, and bodily injury.

The Endangered Species Act and comparable state laws are designed to protect critically imperiled species from extinction as a consequence of development. GQM LLC filed a response to statements made in a petition filed on January 31, 2014 with the United States Fish and Wildlife Service (USFWS), which petition sought to list the Mojave Shoulderband snail as a threatened or endangered species (see Item 3. Legal Proceedings in this report for additional information). In April 2014, USFWS concluded that there was no imminent threat to the snail that would cause them to believe an emergency listing was required, but that USFWS may address the petition in the future, subject to funding. Under the Endangered Species Act if the USFWS determines that the petition contains information that the species is imperiled, it then will proceed with a 90 day screening process to determine if the petition presents substantial information to support listing the subject species as endangered, and if such information exists, the USFWS has a further 12 month period to conduct a detailed assessment of the listing request to approve or deny the listing. The existence of any species listed as endangered under those laws, including as a result of the petition, on Project lands that are to be disturbed as part of the development and operation of the Project could increase the costs associated with the Project or require changes or limitations to the planned project development.

| 14 |

California Laws: At the state level, mining operations are also regulated by the California Department of Conservation, Office of Mine Reclamation. State law requires mine operators to hold a permit, which dictates operating controls and closure and post-closure requirements directed at protecting surface and ground water. In addition, state law requires operators to have an approved mine reclamation plan. Local ordinances require the operators to hold Conditional Use Permits. These permits mandate concurrent and post-mining reclamation of mines and require the posting of reclamation financial assurance sufficient to guarantee the cost of closure and reclamation. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, requiring changes to operating constraints, technical criteria, fees or financial assurance requirements.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on GQM LLC and its suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Given the current emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition and operating performance. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by GQM LLC or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain, and may include changes in rainfall and storm patterns and intensities, water shortages and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

Title to the Property may be subject to other claims, which could affect our property rights

There are risks that title to the Property may be challenged or impugned. The Property is located in California and may be subject to prior unrecorded agreements or transfers and title may be affected by undetected defects. There may be valid challenges to the title to the Property which, if successful, could affect development of the Project and/or operations. This is particularly the case in respect of those portions of the Property in which GQM LLC holds its interest solely through a lease with landholders, as such interests are substantially based on contract and have been subject to a number of assignments.

| 15 |

GQM LLC holds a number of unpatented mining claims created and maintained in accordance with the General Mining Law of 1872 (the “General Mining Law”). Unpatented lode mining claims and millsites are unique property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the federal laws and regulations under the General Mining Law. Also, unpatented mining claims may be subject to possible challenges by third parties or validity contests by the federal government. The validity of an unpatented mining claim or millsite, in terms of both its location and its maintenance, is dependent on strict compliance with a body of U.S. federal law. Should the federal government impose a royalty or additional tax burdens on the properties that lie within public lands, the resulting mining operations could be seriously impacted, depending upon the type and amount of the burden.

Legislation has been proposed in the past that could significantly affect the mining industry

Members of the United States Congress have repeatedly introduced bills which would supplant or alter the provisions of the United States General Mining Law. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to mine mineralized material on unpatented mining claims. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Although we cannot predict what legislated royalties might be, the enactment of these proposed bills could adversely affect GQM LLC’s potential to mine mineralized material on unpatented mining claims. Passage of such legislation could adversely affect our financial performance.

GQM LLC may incur increased construction costs if a 1997 project labor agreement is found to be enforceable

The Company filed a complaint with the National Labor Relations Board (the “NLRB”) against the Building and Construction Trades Council of Kern, Inyo, and Mono Counties (the “Union”) on May 23, 2014. Refer to Item 3. Legal Proceedings for complete details.

Financial Risks

Our financial statements contain a qualification as to our ability to continue as a going concern due primarily to the need to repay or refinance our current indebtedness due in December of 2016, which is not assured

Until such time as GQM LLC can economically produce and sell gold and silver from the Project and distribute cash to its members, we will continue to have no cash flow from our ownership interest in GQM LLC and will continue to incur an operating deficit. As at December 31, 2015, excluding any cash held by GQM LLC and inclusive of GQM Holdings, we had cash of approximately $6.1 million and current liabilities of approximately $37.1 million, including secured debt with a related party lender which is due in December of 2016. The ability of the Company to continue as a going concern requires that we obtain new financing to replace our current debt obligations or are able to refinance with the existing lenders. Our ability to obtain new financing is dependent on a number of factors including cash flow from operations that are distributed from GQM LLC to the Company, equity market conditions, the market for precious metals, and the willingness of other parties to lend the Company money.

| 16 |

The Company must meet any future cash contribution requirements if required under the terms of the JV Agreement with Gauss LLC, or face dilution of its ownership interest in the Project, which could impact our stock value and our ability to meet stock exchange listing requirements

We hold a 50% interest in the Project pursuant to the terms of the JV Agreement. If in the future there are unexpected costs that require additional capital contributions from us under the terms of the JV Agreement, we will need to raise additional funds in order to maintain our 50% interest in the Project, otherwise we will have our interest diluted to below 50% which will likely have an adverse impact on the price of our common shares. In addition, to the extent our ownership interest of GQM LLC remains our sole business and asset, if we are diluted below 50% ownership we could fail to meet the listing requirements of the TSX and be delisted from the TSX and unable to list on a suitable alternate stock exchange. In such an event the market for our securities would be limited to the US over-the-counter market and related quotation services, being currently the OTCQX in the case of the Company. The anticipated impact of such a delisting will be to reduce venues for trading in our securities, a reduction in available market information, a reduction in liquidity, a decrease in analyst coverage of our securities, and a decrease in our ability for us to obtain additional financing to fund our operations.

GQM LLC’s results of operations, cash flows and operating costs are highly dependent upon the market prices of silver and gold and other commodities, which are volatile and beyond the Company’s control.

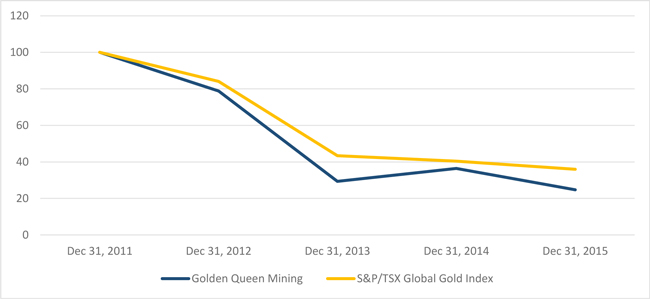

Silver and gold are exchange-traded commodities, and the volatility in gold and silver prices is illustrated by the following table, which sets forth, for the periods indicated (calendar year), the average annual market prices in U.S. dollars per ounce of gold and silver, based on the daily London P.M. fix, as shown in the table below:

| Mineral | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Gold | $ | 1,160.06 | $ | 1,265.78 | $ | 1,411.23 | $ | 1,668.98 | $ | 1,571.52 | ||||||||||

| Silver | $ | 15.68 | $ | 19.08 | $ | 23.79 | $ | 31.15 | $ | 35.12 | ||||||||||

Silver and gold prices are affected by many factors including U.S. dollar strength or weakness, prevailing interest rates and returns on other asset clauses, expectations regarding inflation, speculation, global currency values, governmental decisions regarding the disposal of precious metal stockpiles, global and regional demand and production, political and economic conditions and other factors. In addition, Exchange Traded Funds (“ETFs”), which have substantially facilitated the ability of large and small investors to buy and sell precious metals, have become significant holders of gold and silver. Factors that are generally understood to contribute to a decline in the prices of silver and gold include a strengthening of the U.S. dollar, net outflows from gold and silver ETFs, bullion sales by private and government holders and global economic conditions and/or fiscal policies that negatively impact large consumer markets.

Because GQM LLC is expected to derive all of its revenues from sales of silver and gold, its results of operations and cash flows will fluctuate as the prices of these metals increase or decrease. A period of significant and sustained lower gold and silver prices would materially and adversely affect the results of operations and cash flows. Additionally, if market prices for silver and gold decline or remain at relatively low levels for a sustained period of time, GQM LLC may have to revise its operating plans, including reducing operating costs and capital expenditures, terminating or suspending mining operations at one or more of its properties and discontinuing certain exploration and development plans. GQM LLC may be unable to decrease its costs in an amount sufficient to offset reductions in revenues, and may incur losses.

Operating costs at the Project are also affected by the price of input commodities, such as fuel, electricity, labour, chemical reagents, explosives, steel and concrete. Prices for these input commodities are volatile and can fluctuate due to conditions that are difficult to predict, including global competition for resources, currency fluctuations, consumer or industrial demand and other factors. Continued volatility in the prices of commodities and other supplies the Company purchases could lead to higher costs, which would adversely affect results of operations and cash flows.

Investment Risks

Holders of common shares may suffer dilution as a result of any equity financing by us in order to reduce or repay current indebtedness

We require additional capital to repay our current indebtedness, and we may be required to seek funding, including through the issuance of equity based securities. We cannot predict the size or price of any future financing to raise capital, and any issuance of common shares or other instruments convertible into equity. Any additional issuances of common shares or securities convertible into, or exercisable or exchangeable for, common shares may ultimately result in dilution to the holders of common shares, dilution in any future earnings per share and a decrease in the market price of our common shares.

| 17 |

We have been reflecting 100% of the financial results of GQM LLC in our consolidated financial statements based on certain assumptions of management, which assumptions, if incorrect, may require us to account for the Joint Venture differently

Our financial statements are prepared on the basis that GQM LLC meets the requirements for accounting treatment as a variable interest entity with the Company being considered as the primary beneficiary. As a result, we continue to reflect 100% of the financial results of GQM LLC in our consolidated financial statements, along with a non-controlling interest held by Gauss LLC representing a 50% interest in GQM LLC. Although no individual investor holds a controlling financial interest in GQM LLC, GQM LLC is controlled by a related party group. Accordingly, one member of the group must be identified as the primary beneficiary. As the member of the related party group most closely associated with GQM LLC, Golden Queen has determined it is the primary beneficiary. Future changes in the capital or voting structure of GQM LLC could change that outcome. If this is the case, the presentation of the information in Golden Queen’s financial statements would change, which could be perceived negatively by investors, and could have an adverse effect on the market price of Golden Queen’s common shares.

There are differences in U.S. and Canadian practices for reporting mineral resources and reserves

We generally report mineral resources and reserves in accordance with Canadian practices. These practices differ from the practices used to report resource and reserve estimates in reports and other materials filed with the SEC.

It is Canadian practice to report measured, indicated and inferred mineral resources, which are generally not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations, however, the SEC only permits issuers to report “resources” as in place, tonnage and grade without reference to unit measures.

The Company’s future growth will depend upon its ability to develop new mines, either through exploration at existing properties or by acquisition from other mining companies.

Mines have limited lives based on proven and probable ore reserves. The Company’s ability to achieve significant additional growth in revenues and cash flows will depend upon success in further developing the Project and developing or acquiring new mining properties. Any strategies to further develop the Project or acquire new properties are inherently risky, and the Company cannot assure that it will be able to successfully develop existing or new mining properties or acquire additional properties on favorable economic terms or at all.

We believe that we may be a “passive foreign investment company” for the 2015 taxation year which would likely result in materially adverse United States federal income tax consequences for United States investors

We generally will be designated as a “passive foreign investment company” under the meaning of Section 1297 of the United States Internal Revenue Code of 1986, as amended (a “PFIC”) if, for a tax year, (a) 75% or more of our gross income for such year is “passive income” (generally, dividends, interest, rents, royalties, and gains from the disposition of assets producing passive income) or (b) if at least 50% or more of the value of our assets produce, or are held for the production of, passive income, based on the quarterly average of the fair market value of such assets. United States shareholders should be aware that we believe we were classified as a PFIC during our tax year ended December 31, 2015. If we are a PFIC for any taxable year during which a United States person holds our securities, it would likely result in materially adverse United States federal income tax consequences for such United States person. The potential consequences include, but are not limited to, re-characterization of gain from the sale of our securities as ordinary income and the imposition of an interest charge on such gain and on certain distributions received on our Common Shares. Certain elections may be available under U.S. tax rules to mitigate some of the adverse consequences of holding shares in a PFIC.

| 18 |

Two of our directors are ordinarily resident outside of the United States and accordingly it may be difficult to effect service of process on them, or to enforce any legal judgment against them

Two of our directors namely, Bryan A. Coates and Guy Le Bel are residents of Canada. Consequently, it may be difficult for U.S. investors to effect service of process within the U.S. upon these directors, or to realize in the U.S. upon judgments of U.S. courts predicated upon civil liabilities under the U.S. securities laws. A judgment of a U.S. court predicated solely upon such civil liabilities would probably be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether or not an original action could be brought successfully in Canada against any of such directors predicated solely upon such civil liabilities.

Our directors and officers may have conflicts of interest as a result of their relationships with other companies

Our directors and officers are, or may in the future be, directors, officers or shareholders of other companies that are similarly engaged in the business of acquiring, developing and exploiting natural resource properties. Consequently, there is a possibility that our directors and/or officers may be in a position of conflict in the future.

Members of the Clay family own a substantial interest in Golden Queen and are represented on our board of directors, and thus may exert significant influence on our corporate affairs and actions, including those submitted to a shareholder vote

Thomas M. Clay, a director of the Company is a member of the Clay Group. The Clay Group also controls Auvergne, which holds a 29.49% interest in Gauss, the joint venture that holds a 50% interest in GQM LLC and half the Project. For so long as the Clay Group beneficially owns at least 25% of our common shares, at least one of Golden Queen’s representatives on the board of managers of the Joint Venture will be designated by Auvergne. Accordingly, the Clay Group has considerable influence on our corporate affairs and actions, including those submitted to a shareholder vote, and GQM LLC’s development and operation of the Project. The interests of the Clay family may be different from the interests of other investors.

Members of the Clay family have also provided the Company with a loan of $37.5 million, including approximately $18.75 million provided by an investment vehicle managed by Thomas M. Clay. The loan is guaranteed by GQM Holdings and secured by a pledge of the Company’s interest in GQM Canada, GQM Canada’s interest in GQM Holdings, and GQM Holdings’ 50% interest in GQM LLC. As a result, a default on the loan could result in the Company losing its interest in the Project, which would have a material adverse effect on our share price.

Our share price may be volatile and as a result you could lose all or part of your investment

In addition to volatility associated with equity markets in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common shares:

| · | Changes in the price for gold or silver; |

| · | delays, problems or increased costs in the production of minerals from the Project; |

| · | decline in demand for our common stock; |

| · | downward revisions in securities analysts’ estimates; |

| · | our ability to refinance or repay our current and future debt; |

| · | investor perception or our industry or prospects; and |

| · | general economic trends. |

Over the past few years, stock markets have experienced extreme price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common shares. As a result, you may be unable to resell your shares at a desired price.

| 19 |

Because our common shares trade at prices below $5.00 per share, and because we will not be listed on a national U.S. exchange, there are additional regulations imposed on U.S. broker-dealers trading in our shares that may make it more difficult for you to buy and resell our shares through a U.S. broker-dealer.

Because of U.S. rules that apply to shares with a market price of less than $5.00 per share, known as the “penny stock rules”, investors will find it more difficult to sell their securities in the U.S. through a U.S. broker dealer. The penny stock rules will probably apply to trades in our shares. These rules in most cases require a broker-dealer to deliver a standardized risk disclosure document to a potential purchaser of the securities, along with additional information including current bid and offer quotations, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer’s account, and to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction.

Item 1B. Unresolved Staff Comments

Not applicable.

Land Ownership and Mining Rights

The Company acquired its initial property interests in 1985 and has since acquired additional properties in the area. GQM LLC holds directly or controls via agreement a total of 33 patented lode mining claims, 160 unpatented lode mining claims, one patented millsite, 18 unpatented millsites, and holds directly or controls via agreement approximately 1,328 acres of fee land, which together make up the Property. The Property is located west of California State Highway 14 and lies largely south of Silver Queen Road covering all of Section 6 and portions of Sections 5, 7 and 8 in Township 10 North, Range 12 West; portions of Sections 1 and 12 in Township 10 North, Range 13 West; portions of Section 18 in Township 9 North, Range 12 West, and portions of Section 32 in Township 11 North, Range 12 West, all from the San Bernardino Baseline and Meridian. Some of the ancillary facilities required for a mining operation will be located in Section 6, T10N, R12W.

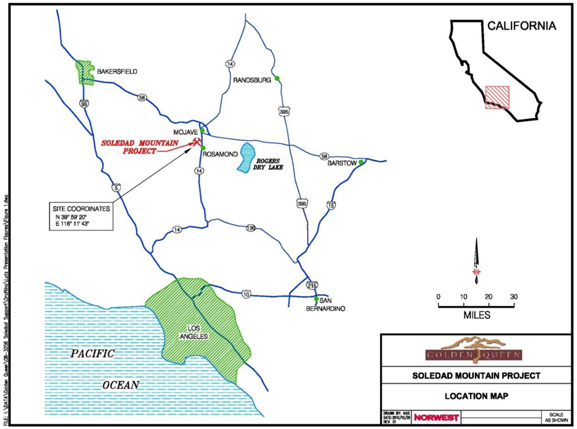

A Project location map is shown in Figure 1 below:

| 20 |

Figure 1

GQM LLC holds the properties either directly or under mining lease agreements with a number of individual landholders, two groups of landholders and three incorporated entities. The land required for the Project has therefore either been secured under one of the mining lease agreements or is controlled by GQM LLC through ownership of the land in fee or where GQM LLC owns or holds patented and unpatented mining claims or mill sites directly. The mining lease agreements were entered into from 1986 onwards. Refer to section Property Interests Are In Good Standing below for key information.

Fee land surrounding Section 6 is required for the construction of the ancillary facilities for a mining operation, for the construction of the heap leach pad and for construction of two pads for storing quality waste rock. The area that will be disturbed by the Project is a 912 acre block (369 hectare) within the total area of approximately 1,700 acres (689 hectares) owned, held or controlled by GQM LLC. GQM LLC also owns 7 residential properties with buildings north of Silver Queen Road.

GQM LLC continues to review purchases of additional land in the adjacent area.

Record of Survey and Royalty Map

The Company obtained Records of Survey for the Project on July 20, 2011 and March 31, 2014, which are recorded with Kern County under Document No. 211092035 Book 0027, Page 66, and Document No. 3318, Book 29, Page 30, respectively.

The basis for GQM LLC’s royalty map is now the Record of Survey and this has superseded all earlier versions of the royalty map.

| 21 |

Royalties

GQM LLC is required to make advance minimum royalty payments under the mining lease agreements. In some instances, GQM LLC will receive a credit for the advance minimum royalty payments when mining ore on particular properties after the start of commercial production. Most of the royalties are of the net smelter return type and are based on a sliding scale, with the percentage amount of the royalty depending upon the grade of ore mined and processed from the particular property to which the royalty relates. Weighted average royalty rates will range from a low of 1.0% to a high of 5.0% depending upon the area being mined and gold and silver prices. The agreements also typically provide for an additional royalty if non-mineral commodities, such as aggregates, are processed and sold.

Property Interests Are In Good Standing

A number of mining lease agreements expired in 2015 and GQM LLC is in ongoing negotiations with some landholders to extend mining lease agreements. This is not expected to impact GQM LLC’s operations.

Other mining leases have expiry dates ranging from 2016 to 2045. All mining leases contain an “evergreen” clause that becomes effective once the mine commences production.

Project Background

The Project is located approximately 5 miles (8 kilometres) south of Mojave in Kern County in southern California. See Figure 1, a Project location map above.

Geology